- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Traveling Internationally? Order Foreign Currency Before You Go

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Upon landing in a foreign country, expect a lot of lines. There’s immigration, passport control and customs inspection. But there’s one line you can — and absolutely should — skip: the airport currency exchange.

Not only does the airport currency exchange counter’s line cut into precious time abroad, but it’s typically a terrible money move. Airport currency exchange rates are among the worst you’ll find.

It’s not uncommon to see airport exchanges charging 14% more than the current International Monetary Fund (IMF) exchange rate. NerdWallet even found some premiums exceeding 17%. Some also charge additional fees on top of the poor exchange rate.

So what do you do if you need cash upon arrival to order a cab or tip the bellhop? Consider ordering foreign currency before you fly.

Most banks allow you to order foreign currencies, which you can typically pick up at a local branch before your trip. Some banks offer to ship currencies to you, and sometimes they don’t even charge extra for postage if you order a certain amount.

Plus, the exchange rate are usually quite good. For instance, at Bank of America, the exchange rates we checked in January 2024 average roughly 6% more than the IMF rates — and less than half of what the airport currency exchanges are charging.

Just check your own bank's exchange rate to ensure it's optimal before initiating the transaction.

» Learn more: The best travel credit cards right now

How to order foreign currency from your bank

While the exact process varies by bank, most major banks make it easy to order online.

Typically you can access the currency exchange webpage through your bank’s website or mobile app, or by phone. From there, you usually enter the currency you need, add the desired amount, select the pickup method and place your order.

While you can generally expect a solid exchange rate, use a trusted source such as Reuters or the International Monetary Fund to find current exchange rates and ensure you get a fair deal.

Additionally, understand all the fees involved. For example, Citi charges a $5 service fee for transactions under $1,000, though it’s waived for clients with premium bank accounts .

Or you might get charged a shipping fee. Bank of America’s standard shipping costs $7.50, but overnight shipping is $20. Sometimes you can avoid shipping fees by opting to pick up the cash at a local branch or by being a loyal customer. Bank of America Preferred Rewards program members get free standard shipping.

There’s also generally a minimum amount of foreign currency you can order ($100 or $200 is common) and a maximum ($10,000 within a 30-day period is common).

Other good ways to pay abroad

If it’s too late to order foreign currency from your bank, here are other ways to curtail currency fees :

Find an in-network ATM abroad

Major banks usually have branches abroad or partner with other banks to create a network. Using those ATMs often provides a decent exchange rate while eliminating out-of-network ATM fees.

If you end up using a non-network ATM, pay attention to ATM fees , which vary but usually run about $5 per transaction. Given that, consider limiting ATM debit transactions by withdrawing the amount you think you’ll need for the entire trip, or at least a large portion of it.

ATM availability is more common in some places than others. Macau has the highest number of ATMs per capita with 316 ATMs per 100,000 adults, based on 2021 data from the World Bank Group. Uruguay, Canada and Austria are other destinations with the most ATMs per capita.

But other countries tend to have far fewer. For example, Kenya had fewer than 7 ATMs per 100,000 adults and Nepal had only 20 ATMs per 100,000 adults, according to the same data.

Pay with a credit card that doesn’t charge foreign transaction fees

Depending on the card, you might get dinged with foreign transaction fees of 1%-3% when you make purchases at non-U.S. retailers abroad.

That’s why it’s wise to carry a no-foreign-transaction-fee credit card abroad.

on Chase's website

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠. .

Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel. .

Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening. .

» Learn more: The best no-foreign-transaction-fee cards

And more international merchants are taking plastic. This wider card acceptance and increased security are reasons travelers are ditching cash, according to the Visa Global Travel Intentions Study 2023, which polled more than 15,000 people in the Asian Pacific region between April and June 2023.

While this type of card won’t help you pay at cash-only businesses or get money for tips, it’s otherwise one of the smartest ways to pay internationally.

» Frequent travelers: Consider a multicurrency account

Try paying in cash dollars

If all else fails, offer to pay in U.S. dollars. In fact, some merchants or individuals accepting tips prefer it in certain countries. You might find vendors willing to give you an even better deal if you pay with U.S. dollars.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

- Home ›

- Exchange Rates ›

- Post Office

Post Office exchange rates

Today's latest Post Office travel money exchange rates, updated 4 minutes ago at 2:00am

The Post Office have 56 currencies in stock and ready to order now. Buy online and get your currency delivered securely to your door, or collect your order from one of over 11,000 Post Office Bureau de Change branches across the UK.

Jump to section:

- View today's latest Post Office rates

- Compare the Post Office's rates

Travel money order limits and fees

- Post Office reviews

Post Office travel money rates

These are the latest Post Office exchange rates available right now. You must buy or reserve your currency online to guarantee these rates or you may be given a lower rate in-store.

Compare the Post Office's exchange rates

We compare hundreds of exchange rates from dozens of currency suppliers across the UK. Select a currency below to see how the Post Office's rates compare against other providers. Bear in mind that exchange rates aren't the only important factor when it comes to getting the best deal; commission, card surcharges and delivery costs can all affect the final amount of currency you'll receive. You can see the full range of currency deals on offer right now on our travel money comparisons .

The Post Office have a minimum order value of £400 for in-store collection and £400 for home delivery. The maximum amount you can order is £2,500 for collection and £2,500 for delivery. Delivery is free for orders over £500, otherwise a £4.99 delivery charge will apply.

Latest Post Office reviews

Our users have rated the Post Office Poor in 682 reviews. Read more on our Post Office reviews page.

Mandy Price

I've had reason to phone the travel card money team about 4 times this week (my fault, not theirs). I've spoken to Matthew, Carolyn and Stephen in the Glasgow office and I wanted to say it's been a pleasure. They've sorted all my weird queries, bee [...]

Read the full review

Glad I read the reviews before I got a Travel money card. Wont be getting one now will just take cash with me.

POST OFFICE MONEY CARD Avoid this card nightmare This card was suggested in the post office, unaware the staff had no understanding what they were “selling” they were in fact miss selling. It was explained that with the card I could load curre [...]

The euro rate at the Post Office right now is 1.1302. You'll need to buy or reserve your euros online to guarantee this rate; the euro rate offered in your local branch may be lower if you don't order online beforehand.

On average, the Post Office's exchange rates are slightly lower than those offered by other high street brands such as Tesco and John Lewis . Many customers who buy their travel money with the Post Office do so because of the Post Office's brand name and convenient locations - there are over 11,000 Post Office Bureau de Change across the UK - but this convenience comes at a cost in the form of slightly lower exchange rates than those available elsewhere.

If you plan on buying your currency with the Post Office, the golden rule is to always reserve your currency online first so you get their online exchange rate. If you turn up and order over the counter at your local branch, you may be given a much lower rate. Ultimately, if you want the absolute best exchange rate on the market, better currency deals are usually available from other suppliers. Check out our travel money comparisons to find the best currency deals available right now.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

- Money Transfer

- Rate Alerts

Xe Currency Converter

Check live foreign currency exchange rates

Xe Live Exchange Rates

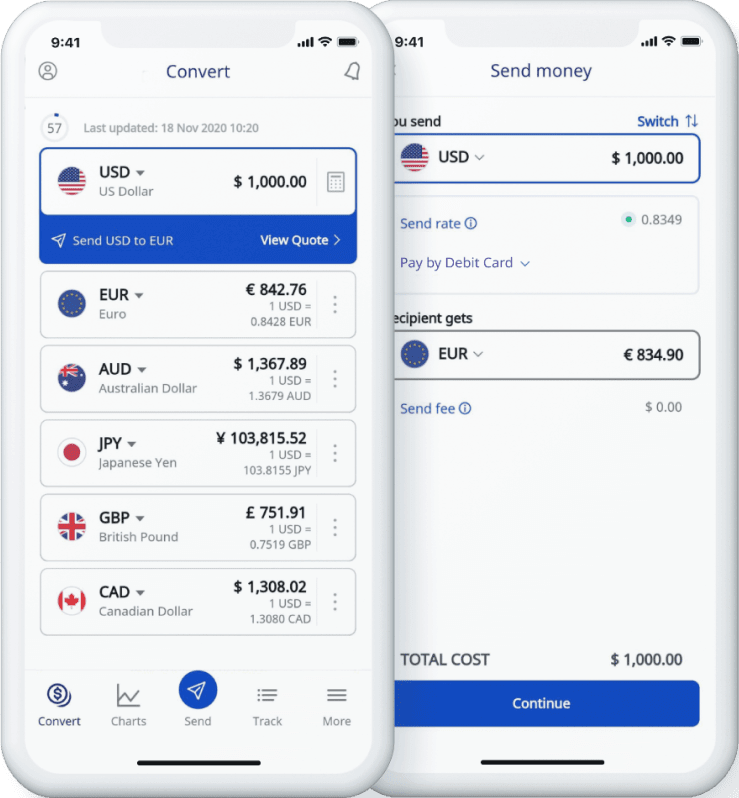

The world's most popular currency tools, xe international money transfer.

Send money online fast, secure and easy. Live tracking and notifications + flexible delivery and payment options.

Xe Currency Charts

Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable.

Xe Rate Alerts

Need to know when a currency hits a specific rate? The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs.

Xe Currency Data API

Powering commercial grade rates at 300+ companies worldwide

Xe Currency Tools

Recommended by 65,000+ verified customers.

Download the Xe App

Check live rates, send money securely, set rate alerts, receive notifications and more.

Over 70 million downloads worldwide

Daily market updates straight to your inbox

Currency profiles, the original currency exchange rates calculator.

Since 1995, the Xe Currency Converter has provided free mid-market exchange rates for millions of users. Our latest currency calculator is a direct descendent of the fast and reliable original "Universal Currency Calculator" and of course it's still free! Learn more about Xe , our latest money transfer services, and how we became known as the world's currency data authority.

Discover every bank branch and currency exchange location in the UK.

You are here: Home / Blog / Post Office Travel Money: Exchange rate, Locations and Opening Times

Post Office Travel Money: Exchange rate, Locations and Opening Times

This guide covers all you need if you want to sort your travel money through the Post Office, including a look at how the Post Office exchange rate is calculated, and your options if you want to use the Post Office travel money card.

We’ll also take a look at how Wise and the Wise account can help you cut the costs of spending while you’re abroad, so you can make the most of your holiday.

Post Office exchange rate

Let’s start with the basics. Whenever you’re buying travel money you need to know the exchange rate which will be used to convert your pounds to euros, dollars or whichever other currency you might require.

Unfortunately, figuring out the exchange rates used by different providers can be a tricky affair. You’ll find different banks and currency services use different rates - and some providers like the Post Office also offer different exchange rates depending on the amount you want to convert.

To give an example , let’s look at the Post Office euro exchange rate, as well as the rate to switch to US dollars:

Exchange rates correct at time of research (24th November 2020)

As you can see, you get a progressively better exchange rate, the more you convert. However, it’s not quite that simple. These rates reflect the Post Office travel money online service only. If you’re using a Post Office travel card, or simply walk into a Post Office travel money bureau to switch your cash, you may get a different rate. Post Office branch exchange rates vary from one branch to another , too, depending on where the branch is located and competition.

The range of exchange rates out there is confusing. But the way to know if you’re getting a good deal or not is to compare the exchange rate you’re offered against the mid-market exchange rate for your currency. That’s the rate set by global currency markets, and the ones banks and exchange services get when they buy currency themselves. You can find the mid-market rate online using a Google search or reputable currency converter tool.

If the rate you’re being offered isn’t the same as the live mid-market rate you find online this probably means your provider has added a markup. This is an extra fee and makes it hard to see exactly what you’re paying for your travel money.

Avoid this by choosing a provider like Wise (formerly TransferWise) which uses the mid-market exchange rate with no markups, and charges transparent fees for currency conversion.

Post Office Click and Collect

With Post Office Click and Collect you can order your currency online. You’ll then be able to call into your Post Office exchange bureau to collect your travel money, or have it delivered to your home.

Here are the fees and delivery times for the Click and Collect service - where there is no upfront fee, you may be paying a charge wrapped up in the exchange rate used:

What are the fees for getting travel money with the Post Office?

The Post Office advertises 0% commission - which sounds like the only fee you’ll need to pay is the delivery fee for smaller orders brought to your doorstep.

Many banks and currency services use a sounding headline like ‘zero commission’ or ‘fee free travel money’ - but add a markup to the exchange rates offered to customers instead . This can mean you’re paying more than you think you are for your currency exchange.

Compare the exchange rates you find with the Post Office against the mid-market exchange rate to see if a markup has been added.

Save with Wise when you spend in any currency

A smart way to cut the costs of your travel money is to use Wise.

The simplest way to access great value currency exchange which uses the real mid-market exchange rate with no markup, is to open a free Wise account online.

You can top up your account in pounds and switch to the currency you need using your laptop or mobile device. Simply use your linked Wise debit card Mastercard to spend when you’re overseas - or you can choose to take out local currency using an ATM when you arrive instead.

It’s free to spend any currency you hold using your linked debit card, and you can withdraw up to the currency equivalent of £200 per month from ATMs abroad with no additional Wise fee. It’s simple, cheap and can make it much easier to access and manage your money while you travel.

Post Office travel money products

Here’s a run through of the basic services available from Post Office travel money. It’s worth knowing that not all services are available at all Post Office branches so you’ll need to check your local options online.

1. Post Office Click and Collect

Order up to £2,500 of foreign currency for collection or home delivery. Euros and US dollars can be picked up in as little as 2 hours, with 60 currencies usually available.

2. Post Office foreign exchange

You can buy currency in a Post Office without ordering in advance too - but availability may be limited so it makes sense to check if they’ll have what you need at your local Post Office branch. If your currency is not available immediately you can order for home delivery instead.

3. Post Office Travel Money Card

The Post Office also has a travel money card which lets you top up in 23 different currencies, and spend wherever you see the Mastercard logo. More on that in a moment.

Post Office travel money bureau - exchange locations

You can get a full list of every UK Post Office online - or use the search function which is available on the Post Office Travel Money website .

Post Office foreign currency London

Here are some of the major Post Office locations offering travel money services in central London - find more branches using the branch finder tool on the Post Office website .

Travel money card London

Travel money services are not available at every single Post Office in the UK. For that reason it’s worth checking the options at the branches near you before you head out.

In most cases, major branches offer travel money services as well as the Post Office travel money cards. You can find details about the services on offer by branch using the branch locator on the Post Office travel money website .

Post Office travel money online

Order your travel money online and select whether you want to collect it in branch or have it delivered to your home. You’ll be able to pay online using a card, although there may be additional fees - check with your own card provider.

Does the Post Office offer a travel money card?

You can get a Post Office travel money card, to top up and spend in foreign currencies as you travel. 23 popular currencies are available, so you can top up in pounds and then switch to the currency you need using the Post Office travel money app. The card is accepted anywhere you see the Mastercard logo.

Get your card online and have it delivered to your home, or apply in a Post Office branch for quicker service. You’ll need to take your ID documents along when you do this.

There are also some limits and fees you need to know about. Check out the full details online to see the minimum and maximum top up amounts and balance, as well as the costs when you make an ATM withdrawal. For example , if you withdraw in euros from an ATM there's a EUR2 charge per withdrawal - in USD you’ll pay $2.50 USD per withdrawal.

The Post Office travel money services are convenient and can largely be accessed online - but it’s well worth understanding the fees you’ll pay for getting your foreign currency. Look carefully at the exchange rates you can access through the Post Office, to see if there's a markup added to the mid-market exchange rate for your currency. This is an extra cost which can push the price of your travel money up unexpectedly.

Return to the blog .

Currency converter

Travel insurance

Australia Post Travel Platinum Mastercard® 1

Enjoy safe and easy access to your travel money with our prepaid Travel Mastercard.

Money transfers

Send money overseas easily and reliably with Western Union at Australia Post.

Australia Post acknowledges the Traditional Custodians of the land on which we operate, live and gather as a team. We recognise their continuing connection to land, water and community. We pay respect to Elders past, present and emerging.

- Turkish Lira

- Australian Dollars

- Canadian Dollars

- Polish Zloty

- VIEW ALL CURRENCIES

- canadian dollars

- ALL BUY BACKS

- US Dollar Card

- Multi-currency Card

Travel Money Comparison

Get the best exchange rates when you buy or sell foreign currency online

- buy Currency

- sell Currency

What Currency do you want to buy?

How much do you want to spend, what currency do you want to sell, how much do you want to sell, buy currency, sell currency, why use a travel money comparison site.

Have you ever started researching the best rates between different travel money providers?

We know it can be overwhelming: the different suppliers, their different offers and of course, the ever-changing currency exchange rates. It's a lot of information to process and compile!

Our comparison site takes the stress out of researching and does it all for you. FInd the travel money supplier that will get you the best rate today.

- ✓ Compare Travel Cash is a non-biased travel money comparison site.

- ✓ To ensure our independence, we always use transparent, objective and verifiable criteria in our comparisons.

- ✓ Our mission is to show you the best rates so you can save when buying your travel money.

- ✓ We constantly update our exchange rates as they change for each money exchange supplier, and whilst we try to do this in almost real-time, there will be times when our data is slightly out of date (in normal circumstances, not more than 5 minute). Our travel money comparison site is designed to save you money by showing you the latest rates.

- ✓ We check out all the companies we list, ensuring they are reputable suppliers and pass our standards before we list them.

- ✓ We value your privacy. We do not sell your data - you don't even need to give us your information to use our site. Even if you choose to, it is safe with us, we will never pass it on to third parties.

- ✓ You won't get cheaper rates if you go directly to the supplier, at times, we may have discounts and incentives that you would not get by going direct!

- ✓ We do sometimes make money - but we don't make it from you. We will never add fees or commissions to the travel money rates on the site.

Frequently asked questions

It's a great idea to buy your currency online to ensure you get the best exchange rate. You can often get much better deals online compared to what you can find on the high street or the airport. In fact ccording to recent surveys, 9 out of 10 tourists find that exchanging money at airports is the most expensive option.

The best thing about buying your travel money online through a comparison site is seeing all currency prices in one place, so whether you are buying euros , buying dollars or other currencies you get the best rate for your travel money and more importantly save time!

The quickest way to get the best currency exchange rate is by using our comparison tool . We compare the latest information from all the best travel money providers in the market to show you the best currency exchange rates.

Keep an eye out for the following when searching for the best currency exchange deals so you can choose the best option for buying your holiday money:

- High exchange rate - The higher the exchange rate number, the more holiday money you will get to the pound

- Delivery Charges - different currency providers charge different amounts for delivering your holiday money to your door

- Special offer - We will let you know if the providers are offering travel money deals

Commission is the fee that travel money providers charge for the service to exchange your money into foreign currency . The charge is usually included in the exchange rate they advertise. You will see that many foreign exchange companies advertise 0% commission, they are still charging you by including the charge in the rates.

All the travel money prices we quote include any fees and commissions, including delivery!

The simple answer is yes! Usually, the minimum order amount for foreign currency is £100, and the maximum is usually £7,500, although some providers allow you to exchange more.

Travel money is normally sent via special delivery service with Royal Mail. Travel cash orders worth more than £2,500 will be sent via a courier or multiple Royal Mail packages. This is for insurance reasons, making sure your travel money is safe.

This depends on the currency provider. Some providers offer next-day delivery, sending your travel money using Royal Mail's Special Delivery Guaranteed by 1pm service. There will be an extra cost for this and you can see how much when you compare the holiday money prices.

Don't forget, many foreign currency providers also allow you to pre-order currency and you can collect it in store, this means you can avoid delivery charges.

Most do, any holiday money that you have leftover after your trip abroad can be sold using a buy-back service that will convert it back to pounds. Our comparison tool will show you the providers offering the best buy-back rates .

Every few of minutes we compare the exchange rates and latest currency deals from the best travel money providers in the UK. You can see instantly who is offering the best deals and choose a service that suits your needs best.

Also, if you've come home from a trip abroad and have leftover currency, we compare many foreign currency buy back companies, showing the best rates to convert your foreign currency back into pounds.

Hundreds of customers order travel money through our site daily and have a great experience. However, as with ordering anything online, the process is never completely risk-free and you should always take care when transfering money to any company.

We undertake comprehensive checks on all of our providers and monitor them to make sure they meet our high standards and continue to do so. Having said that, no company is guaranteed not to come into trouble and we cannot guarantee the solvency of any of the providers listed on our website. We always recommend that you conduct your own due diligence before placing an order with any company.

There are many destinations where taking some local currency is extremely useful to make sure you are covered in places where credit cards are not accepted. Many of the smaller retailers globally will not allow credit cards, so cash is the only option.

Read our blog post on taking cash on holiday .

The best time to buy any travel money is when the pound is performing strongly relative to the currency you are buying, this means it will have a higher exchange rate, so will give you more currency for your money. The amount you receive is calculated by multiplying the exchange rate by the amount of pounds you want to spend, so the higher the exchange rate, the more foreign currency you get.

Exchange rates are constantly changing but we show you the historical exchange rate performance for each of the currencies so you can have more of an idea of whether now is a good time to buy your travel money.

Exchange rates tend to be very similar wherever you are in the world to those offered in the UK, however waiting until you are away means you may be stuck with poor exchange rates, fewer options of places to offer competitive rates or even worse, you may have to pay big additional fees and commissions. By buying your travel money in the UK there are no hidden fees, charges or nasty surprises, you know exactly how much you are getting.

Once you have found the best rate, place an order on the currency suppliers’ site, and pay for your currency.Each currency supplier has different payment options, including bank transfer, debit card, with some suppliers offering payment by Apple pay and Android pay. Once your order has been confirmed your order will be prepared and your currency sent to you by registered delivery, some suppliers even offer next-day delivery.

LATEST CURRENCY NEWS

The 8 Best Travel Money Belts of 2024: Secure Your Valuables on the Go

The best travel money belts of 2024 excel in comfort, style and security. These belts are not just fashionable, they are also equipped with the latest technology like RFID-blocking to protect your personal information from theft. Particularly noteworthy is a model that offers sizes adaptable to multiple waist measurements. After all, securing your cash and

The Perfect Carry-on Case for Airline Travel: Top Recommendations and Tips

The perfect carry-on case for airline travel fits within the usual size limits of 22 x 14 x 9 inches. This ensures it complies with most airlines’ overhead bin space restrictions. Despite this uniformity, some international airlines may have varying rules, so cross-checking with your specific airline before purchasing a case is a smart move.

What currency is used in Dublin, Ireland? A clear answer for travellers

Dublin, the capital city of Ireland, is a popular tourist destination known for its rich history, vibrant culture, and stunning architecture. As a result, many people who plan to visit Dublin may wonder what currency is used in the city. The official currency of Ireland is the Euro, which is used throughout the country, including

Join newsletter

- Best Euro Rate

- Best US Dollars Rate

- Best Turkish Lira Rate

- Best Australian Dollars Rate

- Best Thai Baht Rate

- Best UAE Dirham Rate

- Best Canadian Dollars Rate

- Best Polish Zloty Rate

- Best Croatian Kuna Rate

- Buy Travel Money

- Sell US Dollars

- Sell Turkish Lira

- Sell Australian Dollars

- Sell Thai Baht

- Sell UAE dirham

- Sell Canadian Dollars

- Sell Polish Zloty

- Currency buy backs

- Currency Online Group

- Sterling FX

- Covent Garden FX

- The Currency Club

- Tesco Money

- Sainburys Bank

- Virgin Money

- Natwest Travel

- Post Office

- Thomas Cook

- Marks and Spencer

- No1 Currency

- Rapid Travel Money

- Best Supermarket Euros

- Privacy Policy

@2024 Comparison Technology Ltd, 71-75 Shelton Street, Covent Garden, London, WC2H 9JQ | Company Registration Number 12065287

CompareTravelCash.co.uk is a travel money comparison service that's designed to help you save money – whilst we do our best to ensure the site is 100% up-to-date, we cannot guarantee this. We advise you to carry out your own due diligence before buying or selling travel money.

- Where to exchange foreign currency

- Understanding currency exchange Services

How to exchange foreign currency

- Benefits of using local services

15 Banks and Credit Unions that Exchange Foreign Currencies

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate banking products to write unbiased product reviews.

- Not all banks or credit unions exchange foreign currency.

- Our list has options that let you exchange foreign currency at a branch, over the phone, or online.

- Most financial institutions require you to be a customer to exchange foreign currency.

If you're looking to exchange currency for a trip abroad, major brick-and-mortar banks or credit unions can help you get different currencies at a fair exchange rate.

You won't want to visit your nearest branch on a whim, though, as some banks do not offer exchanges. Here's everything you need to know about exchanging currency — from where you can go to what you'll need to place an order.

Financial institutions that allow you to exchange foreign currency

The following 15 banks and credit unions exchange foreign currency. These financial institutions are also featured in our guides for the best banks and the best credit unions. Keep in mind most banks or credit unions require you to be a customer to exchange currency.

- America First Credit Union : Credit union members may visit select branches to exchange up to $5,000. There's a $10 transaction fee if you exchange more than $300 and a $20 fee for exchanges under $300.

- Bank of America : Bank of America customers may exchange up to $10,000 online. You can also place an order over $10,000 at a branch. There isn't a fee for exchanging currency, but if you have your order shipped home, there's a $7.50 fee. If you place an order for $1,000 or more, you must pick up your money at a branch.

- Citi : You can call or visit a branch to exchange over 50 types of currency. There's no fee for Citigold or Citi Priority Account Package customers. Citi customers with accounts not mentioned will have to pay a $5 service fee for any transaction under $1,000. If you'd prefer to have money sent to your home, there's a $10 to $20 fee, depending on your shipping priorities.

- Citizens Bank : You may exchange currency at a branch. Contact a Citizens Bank branch for information on pricing.

- Chase Bank : Chase customers may exchange currency at local branches. You'll have to call your nearest branch to learn about transaction fees.

- First Citizens Bank : Customers may exchange over 70 types of currency at branches. There aren't any limits on how much you can exchange, but you'll need to contact your nearest branch to learn more about potential fees.

- First Horizon Bank : First Horizon Bank has currency for more than 65 countries. Bank account customers have to visit a branch to exchange currency and learn more about potential fees.

- Huntington Bank : Huntington Bank customers can exchange up to $20,000 for an $8 fee at bank branches. The bank has 75 types of currencies.

- PNC Bank : PNC Bank lets customers exchange currency at local branches. You'll want to call your PNC branch first so currency can be delivered beforehand. The bank charges zero transaction fees for exchanging currency.

- Regions Bank : Regions customers may exchange currency at local branches. You'll have to visit a branch to exchange currency and learn more about potential fees.

- Service Federal Credit Union : Service Credit Union has over 60 types of currencies. You may call or visit a local branch to place an order. Orders under $500 may entail a $15 transaction fee.

- State Employees Credit Union: Only credit union members can exchange foreign currency at branches. You'll want to call SECU customer service before you visit a branch to ensure the type of currency will be available at your nearest location. The credit union does not charge fees for exchanging currency.

- TD Bank : TD Bank has 55 types of currencies. You do not need to have a TD Bank account to place an order. Orders can be done online or at a TD branch. However, keep in mind online orders have $7.50 fee and a maximum order limit of $1,500.

- U.S. Bank : US Bank customers may exchange currency at a local branch or online. There's a $10 transaction fee for orders of $250 or less. Orders that exceed this amount do not have a transaction fee.

- Wings Financial Credit Union : Wings Financial Credit Union has over 90 different currencies. Only members may place orders. There's a $10 transaction fee for orders under $300. The fee is waived if you make an order over $300.

Understanding currency exchange services

Currency exchange allows you to swap out one denomination of money (for example, U.S. dollars) with another denomination (for example, Euros). There are several reasons you'd exchange currency; the two most common are exchanging money for traveling purposes, such as when you're vacationing in another country, and forex trading, where you exchange currency as an investment in the hopes of making money.

The forex market generally informs what rates you can get when exchanging money at banks and credit unions , although your rates won't be as favorable as the rates the bank is getting. You'll want to compare currency exchange rates locally to see which financial institution offers the best rate.

Not all financial institutions exchange currency. Even if your bank provides this service, your nearest branch may only have certain types of currency available or limited amounts.

To avoid unnecessary trips to a bank, consider taking the following steps for purchasing currency.

Call your bank's customer service

Sandra Jones, senior vice president of member communications at State Employees Credit Union, recommends calling your bank's customer service to see if your location has the type of currency you need to exchange.

If the currency isn't immediately available, a bank representative can place an order.

Some financial institutions may offer to have the money sent to your home for a fee. If your bank requires you to exchange currency in person, you can set up an appointment to visit a branch.

While you can check exchange rates online to get a rough idea of how much money you'll need, Jones says online rates do not accurately represent the rates available at financial institutions. You'll want to ask a banker about exchange rates, instead.

Make sure you have everything to complete the order

When you are exchanging currency, make sure you have the following readily available:

- A U.S. ID, like your driver's license or passport

- Currency being exchanged

- Additional cash or payment option if your bank charges a transaction fee

Banks will usually charge a transaction fee for exchanging currency. You'll either pay a flat fee or a variable fee. It depends on the amount and type of currency.

A bank representative will guide you through the steps of buying currency at your appointment.

When you return from your trip, your financial institution may also be able to buy back the foreign currency.

Benefits of using local currency exchange services

The biggest benefit of using local currency exchange services is that you're almost definitely getting a better rate than you'd get if you waited until you're in the airport or in the country you're visiting.

When you're at the airport or your destination, you might have a time limit; it's either right before or during the time you need the new currency. You'll only be able to use instant currency exchange locations. If you exchange your currency before you leave, you'll have weeks or months to compare rates. You can even use online banks , because you'll have time to wait for the money to get to you.

What's more, the rates at airports and near tourist locations are likely to be worse than the rates you'd find locally, because the people who run those currency exchange services know that you don't have many other choices. The best foreign exchange rates nearby your home won't have that assumption.

Currency exchange services FAQs

Compare rates from multiple providers, check for hidden fees, and stay updated on current market rates to get a good exchange rate. Online currency converters can provide a benchmark for what to expect.

If possible, avoid airport currency exchanges. They tend to have higher fees and offer you a worse rate, because they know you don't have other options. Exchanging currency before the trip will help you get the best rate.

Whether secure currency exchange services near you will allow you to negotiate will depend heavily on where you're getting the service. There are many places that won't let you negotiate, but you can always ask to see if they're willing to give you a better rate.

Online currency exchange services are generally safe, especially if they're at a bank or credit union. However, you should always research the service you're planning to use ahead of time to see if they've had any scandals and read reviews.

Generally, you'll want to exchange currency before arriving in the country you're traveling to. You'll have more time to look for a good rate, you usually know your local area better than the country you're going to, and you're less likely to end up at a currency exchange that targets tourists.

- Are banks open today? Here's a list of US bank holidays for 2023

- Best CD rates

- Best High-yield savings accounts

- Four reasons why your debit card might be denied even when you have money

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

trending now in US News

Sicko who lassoed woman around neck with belt, raped her on NYC...

Trump flies VP contender Doug Burgum with him to massive...

Celebrity chef using legal loopholes to avoid paying rent past 4...

NYC teacher fired after texting student 28K times, sex...

Aspiring doctor who nearly drowned after being pushed into lake...

Cop who groped OnlyFans star in XXX traffic stop vid axed after...

Horror video shows trans woman allegedly run over man, then kiss...

Concertgoer partially paralyzed after singer's stage dive into...

Biden claims inflation was 9% when he came into office — when it actually was 1.4%.

- View Author Archive

- Get author RSS feed

Thanks for contacting us. We've received your submission.

WASHINGTON — President Biden claimed Wednesday that voters were wrong to blame him for high inflation because it “was 9% when I came to office” — when in fact it actually was just 1.4%.

“No president has had the run we’ve had in terms of creating jobs and bringing down inflation, It was 9% when I came to office — 9%,” Biden told CNN’s Erin Burnett in a rare interview.

The 81-year-old president defended his economic policies after Burnett pressed him on the fact that “voters by a wide margin trust [former President Donald] Trump more on the economy.”

Biden insisted ahead of his November rematch against Trump that he already “turned around” the economy, despite persistently high inflation and interest rates.

Inflation crept up shortly after Biden took office before surging to rates unseen since the early 1980s, peaking at an annual rate of 9.1% in June 2022 — 17 months after he took office.

Inflation has remained stubbornly high at an annual rate of 3.5% as of March.

Biden’s critics, including prominent Democratic economists, say massive spending passed during Biden’s first year in office fueled the rapid loss of a dollar’s buying power by effectively printing more money.

Since Biden took office, the average prices of goods and services have increased 19% , according to Bureau of Labor Statistics data.

During Trump’s four years in office, by comparison, prices increased by 8%, or roughly 2% per year.

“Voters by a wide margin trust Trump more on the economy — they say that in polls — and part of the reason for that may be the numbers,” Burnett told Biden during a day-trip to swing-state Wisconsin.

“And you’re aware of many of these, of course: the cost of buying a home in the United States is double what it was — when you look at your monthly costs — from before the pandemic, real income when you account for inflation is actually down since you took office, economic growth last week fell short of expectations, consumer confidence — maybe no surprise — is near a two-year low.”

Burnett asked: “With less than six months to go to election day, are you worried that you’re running out of time to turn that around? “

“We’ve already turned it around,” Biden insisted.

“Look at the [University of] Michigan survey — 65% of the American people think they’re in good shape economically. They think the nation is not in good shape. They’re personally good shape. The polling data has been wrong all along.”

Biden said that high inflation was the result of “corporate greed” and “shrinkflation,” after previously blaming COVID-19 supply chain issues and Russian President Vladimir Putin’s invasion of Ukraine.

“There’s corporate greed going on out there,” the president said.

“But there’s real pain,” Burnett countered.

“I mean, grocery prices are up 30% — more than 30% — since the beginning of the pandemic. And people are spending more on food and groceries than they have at any time, really, in the past 30 years. I mean, that’s a real day-to-day pain that people feel.”

“It’s real,” Biden replied, adding, “But the fact is that if you take a look at what the people have, they have the money to spend; it angers them and angers me that you have to spend more. For example, the whole idea of this notion Senator [Bob] Casey [of Pennsylvania] talked about, shrink inflation. For example, Snickers bar they did a thing, and it’s like 20% less for the same price. That’s corporate greed, it is corporate greed. And we’ve got to deal with it.”

The pro-Trump super PAC MAGA Inc responded to the interview with a press release saying that “Joe Biden was confronted with the poor state of Bidenomics during a CNN interview Wednesday and was asked if he’s running out of time to improve the economy. Biden lied and said, ‘we’ve already turned it around.'”

The group highlighted data showing credit card debt up 38.7% since Biden took office, with 65% of Americans living paycheck-to-paycheck and a record number of people unable to afford rent.

Prominent Democrats also have blamed Biden for the inflation crisis, which prompted the Federal Reserve to raise interest rates dramatically.

Average credit card interest rates currently are 27.64% — nearly double the 14.6% average when Biden took office — and average 30-year home mortgage rates have soared from 2.65% to more than 7% for the average 30-year mortgage.

Democratic economist Steven Rattner, who led the Obama Treasury Department’s auto bailout, branded Biden’s $1.9 trillion stimulus law, passed in March 2021 without any Republican votes, as the “original sin” of the inflation crisis.

“The bill — almost completely unfunded — sought to counter the effects of the Covid pandemic by focusing on demand-side stimulus rather than on investment. That has contributed materially to today’s inflation levels,” Ratter wrote in a November 2021 New York Times op-ed.

Larry Summers, who worked as President Barack Obama’s top White House economist and as President Bill Clinton’s treasury secretary, also blamed Biden’s spending.

Summers wrote in a February 2021 Washington Post op-ed that Biden’s stimulus bill could “set off inflationary pressures of a kind we have not seen in a generation.”

“There’s an element in this that the secret sauce of economics is arithmetic,” Summers reflected in July 2022 .

“And there were many people in the debate who didn’t do arithmetic… and they thought more stimulus was good, so more stimulus was better, and they didn’t think too much stimulus was really possible.”

Share this article:

Advertisement

Money blog: Loud budgeting - the taboo-busting money hack you can do without giving up daily coffee

Created accidentally by a comedian, "loud budgeting" is breaking down the taboo of speaking about money. Read this and the rest of our Weekend Money features, and leave a comment, and we'll be back with rolling personal finance and consumer news on Monday.

Saturday 11 May 2024 20:15, UK

Weekend Money

- 'Loud budgeting': The money-saving trend that has nothing to do with giving up your daily coffee

- What is most in-demand period property?

- £12m tea advert, downsizing, £320 tasting menus and job interview mistakes: What readers have said this week

- Free childcare applications about to open for new age band

- Where has huge week for UK economy left us?

Best of the week

- How to avoid a holiday data roaming charge (while still using the internet)

- Mortgage rates up again this week - here are the best deals on the market

- My daughter discovered undeclared £600 management fee after buying her flat - can we complain?

- Best of the Money blog - an archive

Ask a question or make a comment

By Jess Sharp , Money team

Money saving trends are constantly popping up on social media - but one in particular has been gaining huge amounts of attention.

Created accidentally by a comedian, loud budgeting is breaking down the taboo of speaking about money.

The idea is based on being firmer/more vocal about your financial boundaries in social situations and setting out what you are happy to spend your money on, instead of "Keeping up with the Joneses".

On TikTok alone, videos published under the hashtag #loudbudgeting have garnered more than 30 million views - and that figure is continuing to climb.

We spoke to Lukas Battle - the 26-year-old who unintentionally created the trend as part of a comedy sketch.

Based in New York, he came up with the term in a skit about the "quiet luxury" hype, which had spread online in 2023 inspired by shows like Succession.

The term was used for humble bragging about your wealth with expensive items that were subtle in their design - for example, Gwyneth Paltrow's £3,900 moss green wool coat from The Row, which she wore during her ski resort trial...

"I was never a big fan of the quiet luxury trend, so I just kind of switched the words and wrote 'loud budgeting is in'. I'm tired of spending money and I don't want to pretend to be rich," Lukas said.

"That's how it started and then the TikTok comments were just obsessed with that original idea."

This was the first time he mentioned it...

Lukas explained that it wasn't about "being poor" but about not being afraid of sharing your financial limits and "what's profitable for you personally".

"It's not 'skip a coffee a day and you'll become a millionaire'."

While talking money has been seen as rude or taboo, he said it's something his generation is more comfortable doing.

"I've seen more debate around the topic and I think people are really intrigued and attracted by the idea," he said.

"It's just focusing your spending and time on things you enjoy and cutting out the things you might feel pressured to spend your money on."

He has incorporated loud budgeting into his own life, telling his friends "it's free to go outside" and opting for cheaper dinner alternatives.

"Having the terminology and knowing it's a trend helps people understand it and there's no awkward conversation around it," he said.

The trend has been a big hit with so-called American "finfluencers", or "financial influencers", but people in the UK have started practising it as well.

Mia Westrap has taken up loud budgeting by embarking on a no-buy year and sharing her finances with her 11.3k TikTok followers.

Earning roughly £2,100 a month, she spends around £1,200 on essentials, like rent, petrol and car insurance, but limits what else she can purchase.

Clothes, fizzy drinks, beauty treatments, makeup, dinners out and train tickets are just some things on her "red list".

The 26-year-old PHD student first came across the idea back in 2017, but decided to take up the challenge this year after realising she was living "pay check to pay check".

She said her "biggest fear" in the beginning was that her friends wouldn't understand what she was doing, but she found loud budgeting helped.

"I'm still trying my best to just go along with what everyone wants to do but I just won't spend money while we do it and my friends don't mind that, we don't make a big deal out of it," she said.

So far, she has been able to save £1,700, and she said talking openly about her money has been "really helpful".

"There's no way I could have got this far if I wasn't baring my soul to the internet about the money I have spent. It has been a really motivating factor."

Financial expert John Webb said loud budgeting has the ability to help many "feel empowered" and create a "more realistic" relationship with money.

"This is helping to normalise having open and honest conversations about finances," the consumer affair manager at Experien said.

"It can also reduce the anxiety some might have by keeping their financial worries to themselves."

However, he warned it's important to be cautious and to take the reality of life into consideration.

"It could cause troubles within friendship groups if they're not on the same page as you or have different financial goals," he said.

"This challenge isn't meant to stop you from having fun, but it is designed to help people become more conscious and intentional when it comes to money, and reduce the stigma around talking about it."

Rightmove's keyword tool shows Victorian-era houses are the most commonly searched period properties, with people drawn to their ornate designs and features.

Georgian and Edwardian-style are second and third respectively, followed by Tudor properties. Regency ranked in fifth place.

Rightmove property expert Tim Bannister said: "Home hunters continue to be captivated by the character and charm of properties that we see in period dramas.

"Victorian homes remain particularly popular, characterised by their historic charm, solid construction, and spacious interiors. You'll often find Victorian houses in some of the most desirable locations which include convenient access to schools and transport links."

Throughout the week Money blog readers have shared their thoughts on the stories we've been covering, with the most correspondence coming in on...

- A hotly contested debate on the best brand of tea

- Downsizing homes

- The cost of Michelin-starred food

Job interview mistakes

On Wednesday we reported on a new £12m ad from PG Tips in response to it falling behind rivals such as Twinings, Yorkshire Tea and Tetley....

We had lots of comments like this...

How on earth was the PG Tips advert so expensive? I prefer Tetley tea, PG Tips is never strong enough flavour for me. Shellyleppard

The reason for the sales drop with PG Tips could be because they increased the price and reduced the quantity of bags from 240 to 180 - it's obvious. Royston

And then this question which we've tried to answer below...

Why have PG Tips changed from Pyramid shape tea bags, to a square? Sam

Last year PG Tips said it was changing to a square bag that left more room for leaves to infuse, as the bags wouldn't fold over themselves.

We reported on data showing how downsizing could save you money for retirement - more than £400,000, in some regions, by swapping four beds for two.

Some of our readers shared their experiences...

We are downsizing and moving South so it's costing us £100k extra for a smaller place, all money from retirement fund. AlanNorth

Interesting read about downsizing for retirement. We recently did this to have the means to retire early at 52. However, we bought a house in the south of France for the price of a flat in our town in West Sussex. Now living the dream! OliSarah

How much should we pay for food?

Executive chef at London's two-Michelin-starred Ikoyi, Jeremy Chan, raised eyebrows when he suggested to the Money blog that Britons don't pay enough for restaurant food.

Ikoyi, the 35th best restaurant in the world, charges £320 for its tasting menu.

"I don't think people pay enough money for food, I think we charge too little, [but] we want to always be accessible to as many people as possible, we're always trying our best to do that," he said, in a piece about his restaurant's tie up with Uber Eats...

We had this in...

Are they serious? That is two weeks' worth of food shopping for me, if the rich can afford this "tasting menu" then they need to be taxed even more by the government, it's just crazy! Steve T

If the rate of pay is proportionate to the vastly overpriced costs of the double Michelin star menu, I would gladly peel quail eggs for four-hour stints over continuing to be abused as a UK supply teacher. AndrewWard

Does this two-star Michelin star chef live in the real world? Who gives a toss if he stands and peels his quails eggs for four hours, and he can get the best turbot from the fishmonger fresh on a daily basis? It doesn't justify the outrageous price he is charging for his tasting menu. Topaztraveller

Chefs do make me laugh, a steak is just a steak, they don't make the meat! They just cook it like the rest of us, but we eat out because we can't be bothered cooking! StevieGrah

Finally, many of you reacted to this feature on common mistakes in job interviews...

Those 10 biggest mistakes people make in interviews is the dumbest thing I've ever read. They expect all that and they'll be offering a £25k a year job. Why wouldn't I want to know about benefits and basic sick pay? And also a limp handshake? How's that relevant to how you work? Jre90

Others brought their own tips...

Whenever I go for an interview I stick to three points: 1. Be yourself 2. Own the interview 3. Wear the clothes that match the job you are applying Kevin James Blakey

From Sunday, eligible working parents of children from nine-months-old in England will be able to register for access to up to 15 free hours of government-funded childcare per week.

This will then be granted from September.

Check if you're eligible here - or read on for our explainer on free childcare across the UK.

Three and four year olds

In England, all parents of children aged three and four in England can claim 15 hours of free childcare per week, for 1,140 hours (38 weeks) a year, at an approved provider.

This is a universal offer open to all.

It can be extended to 30 hours where both parents (or the sole parent) are in work, earn the weekly minimum equivalent of 16 hours at the national minimum or living wage, and have an income of less than £100,000 per year.

Two year olds

Previously, only parents in receipt of certain benefits were eligible for 15 hours of free childcare.

But, as of last month, this was extended to working parents.

This is not a universal offer, however.

A working parent must earn more than £8,670 but less than £100,000 per year. For couples, the rule applies to both parents.

Nine months old

In September, this same 15-hour offer will be extended to working parents of children aged from nine months. From 12 May, those whose children will be at least nine months old on 31 August can apply to received the 15 hours of care from September.

From September 2025

The final change to the childcare offer in England will be rolled out in September 2025, when eligible working parents of all children under the age of five will be able to claim 30 hours of free childcare a week.

In some areas of Wales, the Flying Start early years programme offers 12.5 hours of free childcare for 39 weeks, for eligible children aged two to three. The scheme is based on your postcode area, though it is currently being expanded.

All three and four-year-olds are entitled to free early education of 10 hours per week in approved settings during term time under the Welsh government's childcare offer.

Some children of this age are entitled to up to 30 hours per week of free early education and childcare over 48 weeks of the year. The hours can be split - but at least 10 need to be used on early education.

To qualify for this, each parent must earn less than £100,000 per year, be employed and earn at least the equivalent of working 16 hours a week at the national minimum wage, or be enrolled on an undergraduate, postgraduate or further education course that is at least 10 weeks in length.

All three and four-year-olds living in Scotland are entitled to at least 1,140 hours per year of free childcare, with no work or earnings requirements for parents.

This is usually taken as 30 hours per week over term time (38 weeks), though each provider will have their own approach.

Some households can claim free childcare for two-year-olds. To be eligible you have to be claiming certain benefits such as Income Support, Jobseeker's Allowance or Universal Credit, or have a child that is in the care of their local council or living with you under a guardianship order or kinship care order.

Northern Ireland

There is no scheme for free childcare in Northern Ireland. Some other limited support is available.

Working parents can access support from UK-wide schemes such as tax credits, Universal Credit, childcare vouchers and tax-free childcare.

Aside from this, all parents of children aged three or four can apply for at least 12.5 hours a week of funded pre-school education during term time. But over 90% of three-year-olds have a funded pre-school place - and of course this is different to childcare.

What other help could I be eligible for?

Tax-free childcare - Working parents in the UK can claim up to £500 every three months (up to £2,000 a year) for each of their children to help with childcare costs.

If the child is disabled, the amount goes up to £1,000 every three months (up to £4,000 a year).

To claim the benefit, parents will need to open a tax-free childcare account online. For every 80p paid into the account, the government will top it up by 20p.

The scheme is available until the September after the child turns 11.

Universal credit - Working families on universal credit can claim back up to 85% of their monthly childcare costs, as long as the care is paid for upfront. The most you can claim per month is £951 for one child or £1,630 for two or more children.

Tax credits - People claiming working tax credit can get up to 70% of what they pay for childcare if their costs are no more than £175 per week for one child or £300 per work for multiple children.

Two big economic moments dominated the news agenda in Money this week - interest rates and GDP.

As expected, the Bank of England held the base rate at 5.25% on Wednesday - but a shift in language was instructive about what may happen next.

Bank governor Andrew Bailey opened the door to a summer cut to 5%, telling reporters that an easing of rates at the next Monetary Policy Committee meeting on 20 June was neither ruled out nor a fait accompli.

More surprisingly, he suggested that rate cuts, when they start, could go deeper "than currently priced into market rates".

He refused to be drawn on what that path might look like - but markets had thought rates could bottom out at 4.5% or 4.75% this year, and potentially 3.5% or 4% next.

"To make sure that inflation stays around the 2% target - that inflation will neither be too high nor too low - it's likely that we will need to cut Bank rate over the coming quarters and make monetary policy somewhat less restrictive over the forecast period," Mr Bailey said.

You can read economics editor Ed Conway's analysis of the Bank's decision here ...

On Friday we discovered the UK is no longer in recession.

Gross domestic product (GDP) grew by 0.6% between January and March, the Office for National Statistics said.

This followed two consecutive quarters of the economy shrinking.

The data was more positive than anticipated.

"Britain is not just out of recession," wrote Conway. "It is out of recession with a bang."

The UK has seen its fastest growth since the tailend of the pandemic - and Conway picked out three other reasons for optimism.

1/ An economic growth rate of 0.6% is near enough to what economists used to call "trend growth". It's the kind of number that signifies the economy growing at more or less "normal" rates.

2/ 0.6% means the UK is, alongside Canada, the fastest-growing economy in the G7 (we've yet to hear from Japan, but economists expect its economy to contract in the first quarter).

3/ Third, it's not just gross domestic product that's up. So too is gross domestic product per head - the number you get when you divide our national income by every person in the country. After seven years without any growth, GDP per head rose by 0.4% in the first quarter.

GDP per head is a more accurate yardstick for the "feelgood factor", said Conway - perhaps meaning people will finally start to feel better off.

For more on where Friday's figures leaves us, listen to an Ian King Business Podcast special...

The Money blog is your place for consumer news, economic analysis and everything you need to know about the cost of living - bookmark news.sky.com/money .

It runs with live updates every weekday - while on Saturdays we scale back and offer you a selection of weekend reads.

Check them out this morning and we'll be back on Monday with rolling news and features.

The Money team is Emily Mee, Bhvishya Patel, Jess Sharp, Katie Williams, Brad Young and Ollie Cooper, with sub-editing by Isobel Souster. The blog is edited by Jimmy Rice.

If you've missed any of the features we've been running in Money this year, or want to check back on something you've previously seen in the blog, this archive of our most popular articles may help...

Loaves of bread have been recalled from shelves in Japan after they were found to contain the remains of a rat.

Production of the bread in Tokyo has been halted after parts of a "small animal" were found by at least two people.

Pasco Shikishima Corp, which produces the bread, said 104,000 packages have been recalled as it apologised and promised compensation.

A company representative told Sky News's US partner network, NBC News, that a "small black rat" was found in the bread. No customers were reported to have fallen ill as a result of ingesting the contaminated bread.

"We deeply apologise for the serious inconvenience and trouble this has caused to our customers, suppliers, and other concerned parties," the spokesman said.

Pasco added in a separate statement that "we will do our utmost to strengthen our quality controls so that this will never happen again. We ask for your understanding and your co-operation."

Japanese media reports said at least two people who bought the bread in the Gunma prefecture, north-west of Tokyo, complained to the company about finding a rodent in the bread.

Record levels of shoplifting appear to be declining as fewer shopkeepers reported thefts last year, new figures show.

A survey by the Office for National Statistics shows 26% of retailers experienced customer theft in 2023, down from a record high of 28% in 2022.

This comes despite a number of reports suggesting shoplifting is becoming more frequent.

A separate ONS finding , which used police crime data, showed reports of shoplifting were at their highest level in 20 years in 2023, with law enforcements logging 430,000 instances of the crime.

Let's get you up to speed on the biggest business news of the past 24 hours.

A privately owned used-car platform is circling Cazoo Group, its stricken US-listed rival, which is on the brink of administration.

Sky News has learnt that Motors.co.uk is a leading contender to acquire Cazoo's marketplace operation, which would include its brand and intellectual property assets.

The process to auction the used-car platform's constituent parts comes after it spent tens of millions of pounds on sponsorship deals in football, snooker and darts in a rapid attempt to gain market share.

The owner of British Airways has reported a sharp rise in profits amid soaring demand for trips and a fall in the cost of fuel.

International Airlines Group said its operating profit for the first three months of the year was €68m (£58.5m) - above expectations and up from €9m (£7.7m) during the same period in 2023.

The company, which also owns Aer Lingus, Iberia and Vueling, said earnings had soared thanks to strong demand, particularly over the Easter holidays.

The prospect of a strike across Tata Steel's UK operations has gained further traction after a key union secured support for industrial action.

Community, which has more than 3,000 members, said 85% voted in favour of fighting the India-owned company's plans for up to 2,800 job losses, the majority of them at the country's biggest steelworks in Port Talbot, South Wales.

Tata confirmed last month it was to press ahead with the closure of the blast furnaces at the plant, replacing them with electric arc furnaces to reduce emissions and costs.

In doing so, the company rejected an alternative plan put forward by the Community, GMB and Unite unions that, they said, would raise productivity and protect jobs across the supply chain.

Be the first to get Breaking News

Install the Sky News app for free

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

- Currency Buy Back

Currency buyback

What is currency buyback.

If you’ve come back from your holiday with some spare cash, take it to a Post Office branch that deals in foreign currency and we’ll buy it back from you.

If your holiday’s been cancelled and you bought your currency from us, you can get a 100% refund within 28 days of purchase with our refund guarantee .

Calculate how much you’ll get back

- UAE Dirham AED

- Australian Dollar AUD

- Barbados Dollar BBD

- Bangladesh Taka BDT

- Bulgarian Lev BGN

- Bahrain Dinar BHD

- Bermuda Dollar BMD

- Brunei Dollar BND

- Canadian Dollar CAD

- Swiss Franc CHF

- Chilean Peso CLP

- Chinese Yuan CNY

- Colombian Peso COP

- Costa Rican Colon CRC

- Czech Koruna CZK

- Danish Kroner DKK

- Dominican Peso DOP

- Fiji Dollar FJD

- Guatemalan Quetzal GTQ

- Hong Kong Dollar HKD

- Hungarian Forint HUF

- Indonesian Rupiah IDR

- Israeli Sheqel ILS

- Icelandic Krona ISK

- Jamaican Dollar JMD

- Jordanian Dinar JOD

- Japanese Yen JPY

- Kenyan Shilling KES

- Korean Won KRW

- Kuwaiti Dinar KWD

- Cayman Island Dollar KYD

- Mauritius Rupee MUR

- Mexican Peso MXN

- Malaysian Ringgit MYR

- Norwegian Krone NOK

- New Zealand Dollar NZD

- Omani Rial OMR

- Peru Nuevo Sol PEN

- Philippino Peso PHP

- Polish Zloty PLN

- Romanian New Leu RON

- Saudi Riyal SAR

- Swedish Kronor SEK

- Singapore Dollar SGD

- Thai Baht THB

- Turkish Lira TRY

- Trinidad Tobago Dollar TTD

- Taiwan Dollar TWD

- US Dollar USD

- Uruguay Peso UYU

- Vietnamese Dong VND

- East Caribbean Dollar XCD

- French Polynesian Franc XPF

- South African Rand ZAR

- Brazilian Real BRL

- Qatar Riyal QAR

You will receive:

Today’s online rate:

Rates may vary by branch. This rate is for guidance only. T&Cs apply .

How does currency buyback work?

Pop in to see us.

Find a branch that sells travel money and pop in with your leftover foreign cash.

Sell us your cash

More than 2,500 branches can buy your travel money back without seeing a purchase receipt (but smaller ones will need to).

You’re done!

Pay cash straight into your UK Bank account at the counter. You can save yourself a couple of trips in future with a Travel Money Card , allowing you to swap between currencies.

Thinking of going away again?

If you need travel money, you’ve got loads of options with Post Office.

Order online for great rates and 0% commission

Collect US dollars and euros within 2 hours

Get next-day collection on other currencies

Or choose to have your currency delivered to your home the next day

For added ease and security, get a Travel Money Card

Our Travel Money Card holds 22 currencies and can be used anywhere you see the Mastercard® sign, including with contactless

Order travel money

Ready to get your holiday cash sorted?

Need some help?

Travel money help and support.

Read our travel money FAQs or contact our team about buying currency online or in branch:

Visit our travel money support page

Post Office Travel Money Card is an electronic money product issued by First Rate Exchange Services Ltd pursuant to license by Mastercard International. First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW8 9DF, (Financial Services Register No. 900412). Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

IMAGES

VIDEO

COMMENTS

The Post Office Travel Money currency converter helps holidaymakers quickly check today's exchange rates for 60 currencies. Order your foreign currency today! ... Today's online rates Spend. £400+ Spend. £500+ Spend. £1000+ Euro 1.1208: 1.1314: 1.1418: US Dollar ...

Airport currency exchange rates are among the worst you'll find. It's not uncommon to see airport exchanges charging 14% more than the current International Monetary Fund (IMF) exchange rate ...

Travel Money Online is the provision of foreign currency which is provided by First Rate Exchange Services Ltd. First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW89DF, (Money Services Business licence No. MLR-64068).

Top 5 exchange rate need-to-knows. 1. The RIGHT cards consistently beat travel cash rates. 2. Beware charges for using credit cards to buy your travel money. 3. Avoid the debit cards from HELL - some fine you for spending abroad. 4. Don't let bureaux hold your cash for long - you've little protection.

Travel money order limits and fees. The Post Office have a minimum order value of £400 for in-store collection and £400 for home delivery. The maximum amount you can order is £2,500 for collection and £2,500 for delivery. Delivery is free for orders over £500, otherwise a £4.99 delivery charge will apply.

Check travel money rates from Post Office against all other UK suppliers. Use our free service to ensure you are getting the best deal ... See our Buy Currency page for a full comparison of today's best rates. Post Office Currency Exchange Rates; CURRENCY RATE £750 BUYS; Euros: 1.1339: 850.43: See Deal: US Dollars: 1.2201: 915.08: See Deal ...

Calculate live currency and foreign exchange rates with the free Xe Currency Converter. Convert between all major global currencies, precious metals, and crypto with this currency calculator and view the live mid-market rates. ... Travel Expenses Calculator. Currency Email Updates. More tools. Recommended by 65,000+ verified customers 'Great ...

Dollar exchange rate (1GBP = USD) 1.2837. 1.3024. 1.309. Exchange rates correct at time of research (24th November 2020) As you can see, you get a progressively better exchange rate, the more you convert. However, it's not quite that simple. These rates reflect the Post Office travel money online service only.

The worst exchange rate is 1.1097. The difference between the highest and the lowest is 3.46%. This means that if you are buying £750 worth of euros you will get €29.85 more euros by buying with the best euro provider. This shows you it pays to shop around and get the best rates on travel money!

WHAT WE DO. We compare exchange rates from all the UK's top travel money providers. We search out the best rates for Euros, Dollars, and over 80+ other popular foreign currencies. We list all the best online travel money suppliers that can deliver currency to your door. We help you to save money by getting the best exchange rate today!

First things first, you might want to brush up on exchange rate basics. Look into the local currency of your destination and check for any rules and regulations. For example, you need to already be in Morocco to exchange for Dirhams. Many countries do allow, or even prefer, that American visitors pay in U.S. dollars.

Check our latest foreign currency exchange rates and order your travel money online. ... Post Office Boxes, Locked Bags, PO Box Plus and Common Boxes Terms & Conditions. ... The 5 privacy trends impacting organisations today. Back to Digitising services;