</> API

Information on Spain’s tourism industry

A selection of the most significant Spanish tourism data for consultation and study.

A selection of current posts on Spanish tourist information

- Practical case: the impact of a major event on travel to a destination

- Cruise lines: its passenger figures in 2023 and its changes and trends over the last year and since the pandemic

- Geospatial Data: Maps that Help Us Interpret Data

9,3% of employment

Accommodation

Sustainability

Receive all the news in your inbox. Always be up-to-date with the latest tourism information in Spain.

¡Espera! Antes de irte...

Por favor, completa nuestra encuesta:

- Global Network

- Select language ESPAÑOL ENGLISH 中文

Tourism and Leisure

Spain, a world leader in tourism .

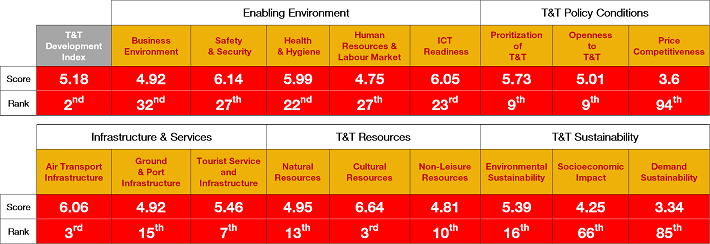

Spain leads the world in tourism. Since 2015 it has ranked in the top 3 on the World Economic Forum (WEF) podium, which awards the most competitive countries in the tourism industry from among 119 economies.

Spain 2 nd /119

Travel&Tourism Development Index, 2024

Spain has broken its record in number of international visitors: thanks to the more than 85 million tourists arriving in Spain, every year it is recognized as the second most visited country in the world, after France. The United States and Italy follow.

Spain's success in the tourism industry is due especially to its rich cultural and natural attractions, but also to its exceptional infrastructures and services , tourism policy, an enabling operating environment and sustainability efforts. These are the five key points that the WEF considers essential to having a competitive advantage over other countries in tourism.

The tourism industry is an important engine of the Spanish economy and employment (2.8 million jobs). The strong public policies backing the industry, with public-private collaboration, and a clear orientation towards a sustainable and quality tourism model, ensure that about half of the tourism industry’s revenues come from international visitors (tourists spend around 186 billion euros).

Catalonia, the Canary Islands, the Balearic Islands, Andalusia and the Community of Valencia are the Spanish regions that welcome the most tourists.

Margarita González

Our advisers will inform and support you in setting up your business

Discover the RDI Ecosystem IN SPAIN

Why invest in the tourism and leisure industry in Spain?

Spain upholds its position year after year in competitiveness and demonstrates that this industry offers great investment opportunities.

Second country in the world by number of visitors.

According to the World Economic Forum, Spain is second in the Travel + Tourism Development Index.

5th country in the world in UNESCO World Heritage Sites (50 sites). Historic cities, outstanding monuments and museums.

With 53 designated Natural Areas and Natural Spaces, UNESCO declares Spain to be the country with the highest number of Biosphere Reserves in the world, followed by the United States, Russia and China.

More than 300 days of sun a year and over 2,000 km of green slopes; various ski facilities; rural activities; wellness. Spain is distinguished for the number of its beaches awarded the Blue Flag eco-label, compared to other countries like Greece and Turkey.

The exceptional quality and variety of Spanish gastronomy is world renowned

It has an outstanding and modern public health system with very high standards.

Infrastructures. High-level land, rail and air connectivity.Spain holds a leading position in digital infrastructures according to the European DESI Index 2023 and it is the first country in at least 100 Mbps broadband take-up.

What are the best investment opportunities?

Cultural heritage tourism, health tourism and gastronomic tourism

MICE Tourism

One of the best sources for business opportunities is digital transformation in the tourism industry. It is based around four mainstays: cloud solutions, mobile devices, the internet of things (IoT) and the sharing economy.

Cloud solutions

- Developing new business models

- e-Commerce integration solutions and advanced customer relationship management (ERP, CRM)

- Centralization, efficiency and savings in ICT management

- Customer relations and internal collaboration models

- Insights and big data monitoring

Mobile devices

- Customization and customer service centers

- Improved experience through innovative models

- Infrastructures and access

The Internet of Things

- Smart destinations

- Automation of products and services

- Innovative experiences for niche markets

Social networks and the sharing economy

- Customer communication and relationships channel

- Online reputation and active listening

- Specialized social media

- Exchange of goods and services between companies and individuals

The objective of public institutions is to diversify the industry in order to expand the offer to tourists seeking other alternatives to sun and beaches.

Inland tourism in Spain is a business niche yet to develop. It is an upmarket industry associated with gastronomy and culture that attracts medium to high- spending visitors. Especially interesting is wine tourism, which has great potential given the allure of the sector in Spain.

While local and provincial administrations devote resources to promote it, in fact, the wine industry is highly atomized and lacks agents to coordinate and organize activities, therefore the level of business that drives this type of tourism is well below its potential.

Spain has an established position as a destination for mice tourism (meetings, incentives, conferences and exhibitions) thanks to the country's professionalism, stability and security. Spain attracted over 10 million MICE travelers in 2023, generating an industry turnover of 13.367 billion euros.

It ranks third in world destinations with the highest meeting participation according to the International Congress and Convention Association (ICCA). In 2022 there were over 5,712 events in Spain.

Spain’s primary advantage is that it perfectly combines business and leisure ("bleisure") tourism, but in order to maintain this position, the industry has to quickly adapt to the changes in mice tourism trends, the increase of specialization, technological innovation and continuous advancement of customized meetings.

The most popular destinations for business tourism in Spain are Barcelona and Madrid, followed by Valencia, Sevilla, Málaga and Palma.

Find your Assistance and Incentive

The Directorate General for industrial strategy and SMEs provides information of aid and incentives to companies through this search engine

Success stories

The British budget hotel company has a plan for growth in Spain that will create hundreds of jobs

Travelodge was the pioneer of budget hotels in the UK back in 1985. Over nearly four decades, it has grown from strength to strength ...

Evaneos recently closed a financing round of 20 million euros, which it will be mainly investing in marketing ...

A lifelong seasoned traveller like Yvan Wibaux, his long-time friend and now co-founder and CTO of the company, Eric la Bonnardière ...

For the past two decades, Ryanair has been a crucial player in the Spanish tourism industry, connecting ...

A pioneer in introducing new Spanish destinations to travellers, it is the number one airline in Spain, carrying 50 million passengers ...

Anytime Fitness

The Anytime Fitness chain plans to open 200 clubs Spain by 2020

Anytime Fitness is a US gym franchise which currently has some 2,300 fitness centres around the world, of which 1,600 are in the ...

Publications

Spain second world power in tourism

VI Global LATAM Report

Spanish airports to receive more tourists this summer

Alhambra Venture 2024

The ICEX-Invest in Spain team will be attending the 11th edition of Alhambra Venture, the largest entrepreneurship event in the south of Spain, which will be held in Granada on 10-12 July, bringing together national and international leaders in entrepreneurship ...

ICEX-Invest in Spain will be participating in CIFIT, the China International Investment and Trade Fair, from 9 to 11 September, the most important annual event for investment agencies operating in China, which takes place in Xiamen (Fujian) every year.

COOKIES NOTICE

We use our own and third-party cookies exclusively for internal and analytical purposes. They allow us to remember, control and understand how users navigate through our website so we can offer a service based on the user's browsing information. Some belong to third parties in countries whose legislation does not guarantee an adequate level of data protection. Click here for more information about our cookie policy. You can accept all cookies by clicking the "Accept" button or configure or reject their use by clicking "Settings".

Spain: Tourism and employment boom puts economy back on track

The first quarter of 2022 will be impacted by the Omicron wave, but from the second quarter onwards we expect the economy to grow faster again. A strong labour market, an uplift in public investment, and a further recovery of the tourism sector will boost economic activity. Inflation is high, but we expect it to come down this year

Stronger growth from 2Q onwards

The Spanish economy ended 2021 on a strong note. GDP growth came in at 2% quarter-on-quarter, which was higher than expectations. Due to the Covid-19 Omicron wave consumption contracted, but investment and exports grew sharply. The economy is now about 4% smaller than pre-pandemic levels. This is in contrast to the eurozone as a whole, which reached its pre-pandemic level in 4Q21.

Survey data, however, points to a weakening in the first quarter of this year caused by Omicron. But from the second quarter onwards we expect the economy to grow faster again. The main reasons for this are a vibrant labour market, a boost to public investment, and a continued recovery of the tourism sector. High inflation, however, is currently a threat, even though we think it will come down over the year.

Evolution of GDP and components during the pandemic (4Q 2019 = 100)

A very strong labour market will support consumption.

Historically, the negative impact of a recession on the Spanish labour market is quite extreme and long-lasting. But the impact of the pandemic is already digested. Indeed, there are currently more people registered with the social security system and fewer people are jobless than before the pandemic. The unemployment rate was 13.3% in the final quarter of 2021, which is lower than before the pandemic. Looking ahead, it is likely that the unemployment rate will continue to fall. Demand remains strong as industrial companies indicate that their order books are richly filled, even more so than before the pandemic. And the number of businesses that report labour shortages is still limited, certainly compared to the eurozone.

Figure 2: Spanish companies are less labour strapped (% of businesses saying that labour limits their production)

Structural problems in the labour market are still with us.

All this is obviously good news for short-term economic activity, but that does not mean the structural problems in the labour market are history. Indeed, the Spanish unemployment rate is still almost double the rate of the eurozone, youth unemployment is very high, and almost one in four Spanish workers is on a temporary contract.

The latest labour market reform, which tweaks the 2012 measures and focuses on limiting the use of temporary contracts, caused a lot of discussion on the political front. It is backed by businesses and unions, but initially it did not have sufficient support in parliament. Surprisingly, it did pass recently… by accident . This could obviously cause some political tension.

Rise in public investment will support growth

The labour reform is also important for short-to-medium term activity as it would help to secure new NextGenerationEU (NGEU) funds which should boost public investment. The Spanish government wants to frontload the EU money and spend 77% of the €70bn in grants (about 4.5% of 2021 GDP) over the period 2021-23. The next instalment of €14bn should be requested before April. Even though we think this rate of absorption is very ambitious, the NGEU will still have a positive impact on growth in 2022 and 2023.

Another issue that will support public investment is the budget for 2022, the largest in Spanish history. It was approved at the end of last year, which lowered political uncertainty and includes €40bn of investments (including NGEU funds).

Tourism sector will further recover

During the first quarter of this year, the tourism sector will still be affected by the Omicron wave, but we think that from the second quarter onwards the sector will be able to continue its recovery. In 2021 the tourism sector was able to recuperate but less than expected due to travel restrictions and new Covid waves. The number of international tourists grew from about 19 million in 2020 to about 31 million in 2021, but this is still about 52 million (!) less than in 2019. Since this sector has not yet fully recovered, this of course gives more potential to support growth in the years to come.

Inflation should come down during 2022

As for the whole of Europe, rising inflation is a threat to the Spanish economy. Headline inflation was about 0% at the beginning of 2021, but in January 2022 it equalled about 6%. Core inflation started to rise in the middle of 2021 from about 0.2% to 2.4% in January 2022. The biggest contributor to the rise was higher energy prices, and this item has a larger weight in Spain than the eurozone as a whole. But the sharp rise of core inflation warrants caution. Indeed, higher energy prices can feed into other consumer prices and on top of that more and more companies are saying that they will increase their selling prices. We nevertheless expect that inflation will come down during 2022 as we do not expect energy prices to rise as much in 2022 as they did in 2021. They might even come down. However, due to second-round effects, we expect about 2.5% headline inflation at the end of 2022, which is higher than pre-pandemic levels of about 1.0%.

All in all, the economic outlook is good for Spain. We expect the economy to grow by about 5.0% in 2022, matching the 5.0% growth in 2021. For 2023 we expect about 3% growth. In this scenario the Spanish economy would reach its pre-pandemic level in the first half of 2023. Indeed, the firm labour market, a push of public investment, a further recovery of the tourism sector and declining inflation should all help to push the economy further.

10 February 2022

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. (" ING ") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).

Spain’s travel sector can’t afford to wait to recover. What can stakeholders do?

The 2010s were Spanish tourism’s moment in the sun. In 2019, three of Europe’s top-five tourist destinations were Spanish (nights spent at tourist accommodations), and the country’s tourism sector was worth $200 billion, or 14.3 percent of the national GDP.

With the COVID-19 pandemic, the clouds have rolled in and could be here to stay for at least the next few years. Our forecast suggests that by the time the sector recovers, Spain may have amassed cumulative GDP losses of $300 billion, and up to 4.4 million jobs might be eliminated. With this much at stake, stakeholders in Spain’s tourism industry may not be able to afford to wait for the storm to pass.

This article takes stock of COVID-19’s impact on Spain’s tourism sector and suggests steps that travel companies and public-sector stakeholders can take to catalyze recovery. Indeed, many positive signs point to tourism bouncing back when COVID-19 protocols ease. And while it’s impossible to predict with certainty when that would happen, there are many things industry players could be doing now.

Businesses could step up their digitalization efforts while exploring more cross-sector collaborations. Local governments could become a more proactive player in tourism management, employing measures to promote destination appeal, fostering cross-sector collaborations, and reskilling and retraining the travel workforce. While discussions around some of these ideas predate the pandemic, the time for implementation may have finally come.

COVID-19’s impact on Spain’s travel industry

Even though the effects of the pandemic are far from over, a number of insights are emerging. If current trends hold, it will take years for Spain’s travel sector to fully recover, and the economic devastation that has hit the sector the hardest would trickle down to the rest of the economy. This would also be a time of transformation for the industry. When tourism returns (and with a vengeance, we expect) the profile of Spain’s tourism industry will likely have changed structurally as the country emerges from the crisis, with segments such as MICE (meetings, incentives, conferences, and exhibitions) and group travel activities becoming less central.

1. Full recovery could take years

We project that domestic tourism in Spain might not return to prepandemic levels until 2024, and inbound international tourism by 2025, if recovery is muted by recurrent bouts of the virus that hold back economic growth in the near term (Exhibit 1). Based on analysis from our colleagues, this “A1” scenario is cited in surveys of business executives as most likely to happen.

Five factors will determine how fast Spain’s tourism sector could recover:

- Attractiveness of domestic destinations: The more innately attractive a destination is, the more likely it is to draw domestic travelers from other parts of the country at a rate that could make up for the loss in international tourism. Regions such as Catalonia, the Balearic Islands, and Andalusia are tourist magnets. According to the World Economic Forum, Spain ranks among the top three countries in the world for natural and cultural resources.

- Availability of air transport: Destinations that require travelers to hop on a plane to reach them will feel the economic impact of the pandemic more acutely as a result of health-safety concerns and air-travel restrictions. Some of the most famous Spanish tourist destinations depend heavily on air transport, and air travel accounted for 82 percent of all of Spain’s inbound trips in 2019.

- Health and hygiene: Health and hygiene standards, along with the personal health and travel insurance policies of the individual, affect where travelers choose to visit. In this regard, Spain lags behind other countries. Take medical infrastructure as an example: Spain has 30 hospital beds per 10,000 residents, far fewer than other countries such as France (65 beds), Germany (83 beds), or Japan (134 beds).

- Importance of business travel: Since business travel will take longer to recover, Spanish cities and destinations with a greater reliance on corporate travel will be more seriously affected over the medium term. In Spain, business travelers make up 17 percent of domestic-travel expenditure, which is much higher than in many other countries; in the case of Spain’s neighbor Portugal, for example, only 7 percent of domestic-travel expenditure comes from business travelers.

- Sustainability: Travelers are increasingly conscious about the size of their carbon footprint when they travel and may base their travel decisions on environmental issues. According to the Yale Center for Environmental Law & Policy, Spain’s environmental performance index ranks 14th internationally.

Even though the Spanish tourism sector saw its deep freeze begin to thaw immediately after lockdowns were lifted in 2020, its relatively weak performance in a number of the above factors is leading to a prolonged period of recovery at a devastating cost to the economy.

2. Damage to Spain’s travel industry will ripple across other sectors in the economy

Tourism is particularly important for Spain’s economy—and its people. It accounts for 14.6 percent of total jobs in the country, if direct, indirect, and induced effects are factored in. Individual regions that depend on tourism are even more adversely affected. In places such as Andalusia, the Balearic Islands, the Canary Islands, Catalonia, and the Valencian Community, tourism represents more than 20 percent of the local GDP and more than 20 percent of jobs (Exhibit 2). These areas are also highly dependent on international tourism.

To make matters even more complex, the industry is highly fragmented and made up of many small, family-owned companies. Travel entrepreneurs and start-ups contribute significantly to the development and sustainability of areas and cities beyond the industrialized areas and the major cities. In 2019, tourism companies with less than €1 million ($1.2 million) in revenues accounted for 15 percent of the total sector revenues. This figure is around 4 percent for the rest of the sectors in the country. Without further government support or external intervention, these small enterprises may not survive the pandemic.

While the pandemic’s impact on Spain’s tourism industry was especially severe as a result of measures put in place to control the spread of the virus—including lockdowns, curfews, airline-capacity reductions, physical distancing, and restrictions on the use of space within hotels, restaurants, and bars—the economic devastation is also deeply felt by other sectors of the economy.

Take the real-estate and finance sectors. As the number of tourists dwindle, hotels and tourist attractions aren’t the only businesses feeling the brunt; countless other small businesses that rely on healthy foot traffic to stay afloat, such as malls, restaurants, and retailers, feel it as well. As their revenue streams dry up, many small-business owners may not be able to fulfill their financial obligations and could default on loans. Similarly, people who took out mortgages to buy a second home to lease out for short-term rentals may default as well. If this happens on a large enough scale, the resulting economic fallout could deliver a serious blow to the financial sector.

In aggregate, we estimate that between 2020 and 2024, Spain could lose 4.4 million jobs and forfeit $300 billion of GDP (equivalent to 22 percent of 2019 GDP levels), considering both direct as well as indirect and induced effects.

3. Since COVID-19’s impact varies across different tourism segments, the profile of Spanish tourism is undergoing a structural overhaul

The profile of the Spanish tourism sector is changing significantly, and recovery won’t be even across segments. Spain’s tourism industry is a mosaic of different segments, such as group travel, individual business travel, and sun and beach travel, to name just a few. We scored more than a dozen segments’ dependence against indicators under four broad categories—trip to destination, experience at destination, mandated changes in habits, and reliance on international travel—to assess how vulnerable each of these segments is. The higher the overall score, the longer recovery will take.

Our analysis suggests that MICE, group travel, cruise, individual business, and urban segments will be the most affected by the pandemic and will take longer to recover. As more employees get used to remote working and companies look to minimize business-travel expenses, some highly affected segments such as business-related air travel and MICE-related travel may not fully recover to prepandemic levels. On the other hand, second-home tourism, ecotourism, and religious, sport, and culture tourism will be less affected and should recover faster (Exhibit 3).

The most vulnerable segments (MICE, group travel, cruise, individual business, urban, and sun and beach) also make up the bulk of Spain’s tourism GDP (Exhibit 4). We can likely expect significant changes in the composition and nature of tourism activity over the next several years. Companies in vulnerable segments such as trade shows or MICE events may have to reimagine their business models entirely, while others may need to undergo significant restructuring to optimize operations and processes. We will likely see small players that are struggling with liquidity consolidate their resources and merge.

Accelerating the recovery of Spain’s travel sector

As travel players cast their eyes further on the horizon, they will have to grapple with the trends outlined in this article, while taking into account other forces that have been accelerated by the pandemic, such as automation. Our recent report The future of work after COVID-19 indicates that Spain’s travel sector will likely see greater transformation both during and after the pandemic.

The sobering trends outlined above belie the fact that Spain has many key advantages that the tourism sector can capitalize on to thrive amid turbulent times. Government stakeholders and travel companies could proactively work together on three high-priority areas to turn the tide and hasten the sector’s recovery. Measures should be assessed for their return on investment, factoring in the direct economic return, indirect and induced effects, and the sustainability of the jobs created.

1. Double down on competitiveness

Travel companies will need to become much more efficient in their operations, not only by launching more “traditional” cost transformations but also by increasing their focus on productivity and competitiveness. COVID-19 has pushed many travelers to explore alternative destinations, and competition will increase as a result. Companies will also need to become much more agile to be able to react more quickly to changes in demand and to innovate how they interact with customers.

Digitalization of the sector has been a hot topic over the past decade, but the pandemic has compelled many travel companies to step up their efforts in this area much more so in the past year than in the previous five years. The pandemic may have brought on great economic devastation, but massive stimulus is also available. Companies could build and increase momentum with help from local governments, which are seeking to catalyze further digitalization. The Spanish government is pledging €5 billion in digital funding for small and medium-size enterprises through the “Plan de Digitalización de Pymes 2021–2025.” Meanwhile, the recently launched NextGenerationEU requires projects to meet digital and sustainability requirements to be eligible. Travel companies would be wise to take advantage of the slew of incentives, such as tax benefits for digital initiatives.

Digitalization in Spain’s tourism sector could focus on two broad priorities: hygiene and operations. Mobile apps and digital vaccine passports could be used for contact tracing to help boost traveler confidence and make it easier to contain potential new outbreaks. Promoting the widespread use of contactless transactions to minimize close physical interaction could also enhance traveler safety.

Companies could equip themselves with the IT infrastructure to benefit from advanced analytics and the digitalization of back-end processes to track and forecast traveler behavior and preferences at a more granular level, detecting and predicting microbubbles of demand and emerging trends. For instance, as “work from anywhere” arrangements become more common, travel companies in Spain could market destinations as attractive places to work remotely. Revenue-management systems could be sped up and made more efficient.

2. Innovate collaboratively across organizations and sectors

The crisis has also precipitated the innovation of new revenue streams by monetizing novel experiences through promotions and packages. Travel companies that explore more cross-sector collaborations on the following themes could further open up new revenue streams and transform vulnerable tourism segments such as MICE events and business travel.

- Identify and meet new pockets of demand: Travel companies can work with businesses in other sectors to identify new tourist segments with unique demands and create products to cater to them. For instance, hotels could partner with hospitals to offer healthcare workers rest-and-relaxation packages, and MICE venues could be converted to remote-education facilities to host “schoolcations.” Also, hotel parking lots could provide charging stations to meet the needs of the growing number of electric car owners—both guests and other urban drivers. Some hotels have revisited their pricing structures to allow for more flexibility—for example, by offering day passes, home-office packages, or even long-term stays to accommodate an increasing number of remote workers. These initiatives may start off as low-risk and low-investment tactical experiments, but they could serve as potential openings for companies in vulnerable segments to break into new markets and reimagine their business models.

- Pooling resources to improve flexibility: Collaboration among companies is also a way to reduce labor costs while alleviating bottlenecks. For instance, quick-service restaurants that are able to staff only drive-throughs (when dining inside restaurants is restricted) could redeploy their servers to grocery retailers that need additional workers. In some countries, flight attendants were retrained to provide support in short-staffed hospitals. Hotels could look at similar partnerships, both within the sector and beyond.

3. Build a ‘tourism reimagination task force’ to play a more active role in tourism management

The most resilient tourism segments are those that are closely linked to the respective region’s inherent appeal and unique characteristics. Aside from providing financial assistance to the sector, government agencies could take on a more active role in tourism management by partnering with businesses to increase the attractiveness of tourist destinations while maintaining high hygiene and safety standards.

There are several examples of this in other parts of the world. For instance, Chinese policy makers have supported local retailers by creating duty-free shopping zones to incentivize domestic tourists to shop. Other partnerships may provide a blueprint for longer-term policy management. In Spain, many smaller or rural destinations are becoming more popular, but the local destination-management organizations (DMOs) lack sufficient budgets and capacity to capitalize on this trend and to communicate the unique traits of their respective regions to draw in significant tourist flows.

A collaboration across regional DMOs through tourism clusters could be a solution. A successful case can be found in Germany’s Schleswig-Holstein region, where multiple levels of government agencies and local tourism companies formed a “cluster” to foster close central collaboration and launch joint initiatives (for example, on sustainability practices) that no player could afford individually. Another case is the Wellness Cluster Tirol, in Austria, where more than 120 companies from tourism- and health-related businesses contribute to the shared mission of increasing the region’s value proposition in health and wellness tourism. Such partnerships could not only strengthen DMOs in new growth areas but also support small and medium-size travel businesses.

In Spain’s case, the country’s travel sector could prepare to meet the pent-up demand for tourism by revisiting its tourism segments to identify positions of strength to leverage. For instance, second-home, culture, and adventure tourism are expected to recover faster than most others. As consumer personal savings are at an all-time high among those still employed, it may make sense for stakeholders to collaborate and develop premium travel experiences across the Iberic peninsula targeted at millennials eager to embark on their next adventure after being grounded for so long.

Effective coordination is key to successful collaboration, whether it’s among government agencies from different regions, among businesses, or among the public and private sectors. Concentrating crucial leadership into a “tourism reimagination task force” is a crisis-management response that many organizations have deployed in similar situations (Exhibit 5). 1 See Margaux Constantin, Steve Saxon, and Jackey Yu, “ Reimagining the $9 trillion tourism economy—what will it take? ,” August 5, 2020. This reimagination task force, which brings together public, private, and semiprivate players into project teams to address five core priorities, could provide a collaboration framework that is particularly suited to the diverse stakeholders within the tourism sector.

Given the uncertainty surrounding the timing and speed of the tourism recovery, obtaining quick feedback and redeploying funds accordingly will be critical to ensuring that stimulus packages have the maximum impact. The tourism reimagination task force coordinates the five teams to ensure agile decision making and the alignment of activities with expected output.

As they say in Spain, “ Camaron que se duerme se lo lleva la corriente, ” or, in English, “The shrimp that sleeps gets carried away by the current.” In other words, companies that sit by and do nothing as they wait for the organic recovery of the sector may find themselves unable to outlast the pandemic. There’s optimism in this saying, too. Companies that take the proactive steps outlined in this article may find themselves riding the currents of unpredictability toward greater success.

Urs Binggeli is a senior knowledge expert in McKinsey’s Zurich office, Javier Caballero is a partner in the Madrid office, Margaux Constantin is a partner in the Dubai office, and Steffen Köpke is an insights specialist in the Düsseldorf office.

The authors wish to thank Alejandro Beltrán, Alex Dichter, Hugo Espirito Santo, Sebastián Giménez, Evgeni Kochman, Anchit Sood, and Jackey Yu for their contributions to this article..

This article was edited by Jason Li, a senior editor in the Shanghai office.

Explore a career with us

Related articles.

NEF Spotlight: Mapping the travel sector’s recovery

COVID-19 tourism spend recovery in numbers

For corporate travel, a long recovery ahead

- Newsletters

Signs of strength in Spain’s tourism industry

Tourism ended this year’s summer season in great shape with international tourist arrivals coming very close to the records set in 2019, a year that was extremely positive for the industry. Domestic tourism has also continued to post very good figures. However, the macroeconomic scenario represents a risk for the trend in tourism activity over the coming quarters due to high inflation and the economic slowdown in Europe. Nevertheless, we believe that tourism demand still enjoys significant levers for growth in the coming year and we therefore expect the sector to complete its recovery in 2023.

The situation in the tourism industry has altered dramatically. After an extremely difficult 2020 and a 2021 in which the recovery was far from satisfactory, 2022 has categorically confirmed that the sector continues to be a driver of growth for the Spanish economy. Official business indicators published by Spain’s National Statistics Institute (INE) point to the fact that, this summer, real tourism demand (without the price effect) was very close to the figure recorded in the same period of 2019. Total overnight stays in hotel and non-hotel accommodation during the months of July, August and September were just 1.3% below those of summer 2019. These good figures were further cemented by dynamic domestic tourism, whose volume of overnight stays was 6.6% higher than in 2019. However, this figure was slightly down on the one posted in the summer of 2021, probably due to an increase in trips abroad thanks to the recovery in international travel. For its part, international tourism performed much better than in 2021, reaching a level of overnight stays just 5.9% lower than in 2019.

Tourist overnight stays

If we look at which countries lie behind this strong recovery in international tourist arrivals in recent months, we can see some interesting trends. Based on passenger data for flights operated in Spain (see the table below), we note that improvements in tourist arrivals from the EU have been key. The figures are still 9% below those of 2019 (coming from –42% in 2021), mainly due to the saturation problems experienced at northern European airports. 1 The impact of this saturation can be seen most clearly in UK passenger arrivals which, in the summer, were 14% below those of the same period in 2019. The situation appeared somewhat similar for arrivals from Germany, with numbers still 15% lower, but this was not the case for arrivals from countries with less saturation, such as France and Portugal. It should be noted that the sharp drop in the number of passengers from countries under the «Rest of Europe» heading since Q2 2022 reflect the cutting of air connections with Russia since the start of the war in Ukraine, although this decline is not noticeable in the overall figure due to its small relative weight.

On the other hand, 2022 has also been a turning point for long-haul tourism. After the extremely low number of arrivals in 2021, the most recent figures for 2022 are highly positive for tourism from the Americas, and particularly from Latin America. We therefore anticipate that, looking ahead to 2023, the recovery in non-European international arrivals will be one of the key levers of growth. This will also mean the return of the emerging markets prior to the pandemic, which were the ones offering the greatest growth potential for some Spanish tourist destinations.

- 1. See the article «Europe’s saturated airports: a brake on the summer’s recovery», in this Sector Report.

This good performance by tourism demand is surprising because of two factors: it has been achieved in an environment of sharp price rises and also a loss of purchasing power among consumers throughout the EU. Tourism prices were no exception, reaching record highs during the last summer season . Consequently, for the time being it seems that the tourism sector has been able to raise its prices without too much impact on demand.

Although tourism prices have responded to the rise in production costs, according to our analysis the increase seen in prices has been mainly due to the strong recovery in international demand which, together with domestic demand, filled the market in many Spanish tourist destinations. This has been the case in the hotel sector, achieving occupancy rates above 80% in a third of the more than 100 tourist municipalities analysed by Spain’s National Statistics Institute in its hotel occupancy survey. CPI accommodation prices were more than 17% higher than those recorded in summer 2019 and this situation can also be seen in other prices related to tourism, such as hospitality and air travel, as shown in the chart below.

Trend in tourism-related prices of the CPI

Looking ahead to the next few months, the indicators for interest in travelling to Spain we produce based on Google search results have remained dynamic, albeit somewhat less «euphoric» for European tourism. The interest indicator places searches from the United Kingdom and EU within the benchmark range, 2 which is very good news given the economic situation in Europe, especially in the United Kingdom with sharp increases in inflation and an economic slowdown, in addition to the depreciation of the pound for British tourists. Given this situation, one would expect a decline in interest in travel from European countries, something which is not being observed, however.

Also noteworthy is the fact that interest in travelling to Spain seems to have returned to normal in the US market since March and, more recently, the interest of Japanese tourists appears to be picking up , after remaining at very depressed levels until last June. This is highly relevant since it suggests that two of the most important outbound markets (USA and Canada, Japan and Korea) that generated the most growth in the tourism sector before the pandemic, in the absence of the Chinese market, might recover throughout the course of 2023.

- 2. The benchmark range is constructed from searches recorded between 2017 and 2019.

The data point to recovery throughout the course of 2023 in two of the fastest growing pre-pandemic outbound markets (USA and Canada, Japan and Korea)

Weekly searches in Google for trips to Spain

The current scenario is difficult to interpret: It looks very positive judging by the recent trend in all indicators, both official and internal and also high-frequency, but negative due to the macroeconomic outlook of the outbound countries. Nevertheless, our forecast for 2023 remains positive, supported by the levers for growth we continue to see for the sector and tourism demand’s limited exposure to the macroeconomy.

- Improved air travel in northern Europe: tourist arrivals from northern Europe were trapped by a growth ceiling due to airport saturation in the summer (the figures for the United Kingdom and Germany, for instance, are about 20% below their pre-COVID air travel level). This situation should adjust in the coming quarters and could lead to a considerable improvement in international travel by European tourists. 3

- High potential and great room for improvement in long-haul tourism: indicators point to the improving trend in long-haul tourism continuing over next few quarters. The room for improvement is still significant, with US tourist arrivals 20% below their pre-COVID levels and Korean and Japanese tourist arrivals more than 70% below.

- Low exposure to the macroeconomy: according to the sensitivity analysis we carried out in order to understand how declines in economic activity in outbound markets correlate with declines in tourism demand for Spain, we estimate that the tourism sector has only limited exposure to the economic slowdown in Europe. Specifically, we estimate that the drop in economic activity in the United Kingdom (GDP is expected to fall by 1.3% in 2023) will impact annual growth in British overnight stays by –2.9 percentage points. For Germany (GDP is expected to fall by 0.2% in 2023), we estimate an impact of –2.2 percentage points of growth in overnight stays. 4 These impacts, which are certainly appreciable, are nevertheless relatively small compared with the margin for growth enjoyed by both the United Kingdom and Germany thanks to the improvement in airport saturation.

Taking all this into account, our tourism GDP forecast for 2022 stands at 98% of its 2019 level ; i.e. just 2% below its pre-COVID level and 66% above the figure for 2021. It should be noted that we expect the sector’s dynamism to be somewhat weaker in Q4 this year as the economic difficulties faced by the EU are felt, albeit to a limited extent. However, we expect tourism activity to pick up strongly from Q2 2023 onwards, as well as some improvement in the economic tone of the EU, so we have placed our tourism GDP forecast 2% above the 2019 level of activity for the whole of next year .

- 3. See the article «Europe’s saturated airports: a brake on the summer’s recovery», in this Sector Report.

- 4. For each outbound country, we have estimated the linear sensitivity of the growth rate in hotel overnight stays to the year-on-year growth in that country’s GDP. To calculate the impact of our macroeconomic scenario on growth in tourism demand, we use the difference between our most recent growth forecast for each country and that of our counterfactual scenario (we have used our February 2022 scenario, prepared before the outbreak of the war in Ukraine).

Our tourism GDP forecast for 2022 is just 2% below its pre-COVID level and 66% above the figure for 2021.

Tourism GPD

Although the outlook is positive, we can only repeat the mantra that we are currently going through a time of great economic uncertainty. In the case of the tourism sector, the main source of uncertainty is related to costs , so managers of tourism firms will have to be vigilant in order to tackle any possible deviation from what has been budgeted for 2023. For the time being, the upturn in costs in 2022 is being handled without any major tensions in the sector as a whole, thanks to the significant increases in tourism prices we have seen. This has been very effective in combating the rising energy costs (which have more than doubled compared with the previous year), the cost of agrifood products (whose prices rose by 12% year-on-year in September) and renovation costs (with construction materials 16% more expensive than a year ago at the end of July).

Looking ahead to 2023, we expect production costs to remain high and, in some cases, to continue rising. There is also the potential impact from wage increases which, although they are expected to be contained, are the main cost for tourism businesses (on average, companies in the sector spend 21% of their revenue on wages), as can be seen in the next chart. As a result, if the sector wants to go on defending its margins, it will be forced to continue to raise prices.

The upturn in costs in 2022 is being handled without any major tensions in the sector as a whole, thanks to the significant increases in tourism prices we have seen.

To read below

Tourism in Portugal: 2023 recap and 2024 so far

El reto de crecer de forma sostenible

La fidelización del turismo y el cambio climático

Spain’s Upbeat Outlook Is a Rare Bright Spot Among Eurozone Economies

By Nicholas Larsen , International Banker

O n May 1, Fitch Solutions upgraded its 2024 forecast for the Spanish economy, stating that gross domestic product (GDP) will expand by 2.2 percent in 2024 instead of the 1.5 percent it had predicted previously. This follows the healthy 2.5-percent growth rate recorded by the Southern European nation for 2023. With a myriad of key factors underpinning this revised, upbeat outlook, including stronger domestic consumption, a thriving tourism sector and a buoyant labour market, moreover, Spain’s economy in 2024 distinctly stands out as a rare bright spot amid the eurozone gloom.

With real GDP growth for 2024’s first quarter (Q1) registering at 0.7 percent quarter-over-quarter and 2.4 percent year-on-year, Fitch acknowledged that Spain’s performance well exceeded its expectations, as well as Bloomberg ’s consensus estimate (which suggested only 0.4-percent quarterly growth) and those of many other important institutions, including the Bank of Spain, the OECD (Organisation for Economic Co-operation and Development) and the European Commission (EC). The main underlying factors for this stellar Q1 quarter-on-quarter growth were the strength of the foreign sector, which accounted for 0.5-percent growth, as tourism performed particularly well, along with household consumption, which grew by 0.3 percent. Investment, meanwhile, rebounded by 2.6 percent during the January-March quarter, having previously suffered two quarters of contractions.

Spain’s strong Q1 performance is particularly laudable given the long-term struggles of much of the rest of the eurozone that continue to be acutely felt in 2024, including persistently above-target inflation and higher-for-longer interest rates. Indeed, Spain’s minister of economy, trade and business, Carlos Cuerpo Caballero, highlighted that the strong quarterly growth confirmed Spain’s “differential” growth versus the other eurozone economies, “something that is especially relevant in the international environment of high uncertainty that we are experiencing”. Cuerpo added that this growth “puts us in an optimal position to meet the government’s growth target for 2024, which stands at 2 percent”.

Compared to its previous quarterly update, Fitch also decisively upgraded its outlook for the Spanish economy in its latest assessment published on May 1, attributing this improvement largely to its stronger projection for private consumption this year than it had previously anticipated. “Domestic demand stayed stable, contributing 0.7 percentage points (pp) to quarterly growth in Q124, while the external sector added 0.5pp despite a slight quarterly slowing in export growth from 2.8 percent to 2.4 percent,” Fitch company BMI Industry Research (Fitch Solutions) noted. “Looking ahead, we expect that 2024 will see private consumption expand further as it capitalises on 2023 gains in employment and nominal wages as well as easing inflationary pressures.”

Strong growth in housing demand has also been an important pillar of Spain’s growth in recent quarters, with ING highlighting how this has helped to bolster residential investments. “Strong housing demand growth continues to outpace housing supply growth,” ING analysts wrote in late March. “Finally, government spending also increased, and the net trade position improved. Looking at the details by sector, interest rate-sensitive sectors such as manufacturing and construction grew strongly in the fourth quarter, against expectations.”

Indeed, Fitch highlighted annualised industrial production as a key driver of Spain’s growth on the supply side, with modest expansions in January and February following a trough in December 2023. “The Purchasing Managers’ Index (PMI) for manufacturing has ticked into expansionary territory in February 2024, and the composite index remains well above the 50.0 threshold (separating contraction and expansion) at 55.3 points in March 2024 (up from 53.9 points in February),” the credit-rating firm added in its May 1 assessment. “The service sector, which has been a main driver of economic growth in Spain in 2023, remains relatively resilient. The services PMI continues its ascension in expansionary territory at 56.1 points in March 2023.”

Banco Bilbao Vizcaya Argentaria (BBVA), meanwhile, recently identified the country’s strong export sector as a key contributory factor to Spain’s outperformance vis-à-vis the rest of the eurozone, particularly on the services side. “The tourism abroad continues to show surprising strength: spending data with foreign cards suggests that the non-resident consumption growth was increasing by 5 percent quarter-on-quarter in real terms at the beginning of [the] year,” BBVA Research explained in a press article dated March 11. “In addition, the rest of service exports, which include consulting, information technology and communication, financial services, etc., and which have a greater weight than foreign tourism (7.6 percent of GDP, compared to 5.0 percent), show an increasing trend (0.5 percent in Q1 ‘24).”

BBVA also pointed to the increasingly service-oriented nature of Spain’s household spending in recent years, which is proving crucial for the country’s robust economic performance this year. The Spanish lender noted that four of the five components that have gained the most weight within the basket of consumption of Spanish families since 2019 fall under the services sector, including catering, outpatient services, and financial and social protection. Meanwhile, the biggest reductions in spending have been observed in goods, such as clothing, food, vehicles and footwear. “This redirection of spending is particularly benefiting the Spanish economy, which is intensive in service provision,” BBVA Research added.

Nonetheless, downside risks to Spain’s outlook persist—the biggest one arguably being political, with the Socialist Workers’ Party’s (PSOE’s) Pedro Sánchez, who was re-elected as prime minister in November—a full four months after July’s parliamentary elections, heading up a decidedly fractured coalition government alongside the far-left Sumar party. To garner votes, the coalition reached out to regionalist parties and is thus supported by the ERC (Republican Left of Catalonia) and Junts (Together for Catalonia) from Catalonia, the PNV (Basque Nationalist Party) and EH Bildu from the Basque Country, the BNG (Galician Nationalist Bloc) from Galicia and Coalición Canaria from the Canary Islands. With so many parties to appease, therefore, the ability to get legislation passed could prove decidedly tricky.

Indeed, coalition talks late last year delayed the 2024 budget approval, while the government decided again in March not to send the budget bill to the Spanish Parliament (Cortes Generales) and instead roll over the 2023 budget for the rest of the year after the Catalonia region called an early election that could further damage Sanchez’s support in Parliament. Such a move underscores the political deadlock in Spain’s government that could translate into a potentially significant drag on Spain’s economic prospects over the coming months.

While S&P Global Ratings affirmed its ‘A/A-1’ credit rating for Spain on March 15, it also warned that this rating could be lowered in the future if the economy’s external position and the government’s budgetary position deteriorate against expectations, most likely as a result of “significant and negative budgetary slippages”, as well as “an unexpected deterioration of Spain’s current account, slowing external deleveraging or increasing external liquidity risks”. That said, Spain’s rating could be lifted “if the sovereign’s external position strengthens, government debt to GDP declines at a faster pace than currently expected, while Spain’s commercial banking system remains solid and largely domestically funded (in net terms)”. As such, S&P noted that its affirmation reflects the counterbalancing of diverging factors in its assessment of Spain’s creditworthiness.

“The fragmented political landscape could hinder the implementation of reforms, including those related to the National Reform Plan, required for disbursement of the remaining Recovery and Resilience Facility (RRF) grants, clouding economic growth prospects and delaying structural budgetary consolidation,” S&P wrote as part of its March 15 rating assessment for Spain. “At the same time, Spain’s gross general government debt reduction is relatively slow in spite of strong nominal growth. Despite these weaknesses, Spain’s economy has performed well in the face of a series of shocks and steady external deleveraging. The rating is also underpinned by Spain’s large and diversified economy and institutional strength in the eurozone membership context.”

Since then, however, Spain’s political vulnerability was further exposed when corruption allegations against Sanchez’s wife prompted the prime minister to suspend his duties from April 24 until April 29. Although he did confirm that he will continue in office, which, in turn, has helped to boost confidence in Spain’s governance in the interim, such events highlight the potentially fragile, fractured nature of Spain’s present political environment.

“The Prime Minister’s resignation would have left Spain without an immediate successor, further policy uncertainty, and likely a snap election as parties would have struggled to build a cohesive governing coalition. The decision to remain in office will ensure the continuity of policy and prevent another election in the space of less than a year,” Fitch noted on April 29. “We highlight, however, that Sánchez still heads up an unstable minority government that took four months to form and has had limited success in passing policy. This to us suggests that any certainty this event provides will be short-lived and the government will continue to struggle with policy formation.”

Fitch also cited tight financial conditions and weaker net trade as likely constraints on Spain’s economy in 2024. “While the Spanish economy returned to its pre-pandemic size in Q3 ‘22, we think that still tight financial conditions as well as a weak external demand backdrop from the eurozone and potentially the US will weigh on Spain’s economy,” Fitch stated. “Even with our upward revisions, we see Spanish GDP growth to remain below trend until at least end-2025, which informs our forecast for the Spanish economy to grow by 2.0 percent in 2025.”

Second Recession in Less Than 18 Months Subdues New Zealand’s Economic Outlook

Related articles, second recession in less than 18 months subdues..., a roadmap to resilience: how banks can leverage..., interview with mr. daniel varela, chief investment officer,..., the great green wall: an african sustainable-development powerhouse..., go for gold: feel like a champion at..., global shadow banks face scrutiny as risks rise, why singapore is consistently regarded as asia’s smartest..., bancoestado: proud to be an innovative and sustainable..., will the eu ai act stifle the banking..., digitize financial services to improve financial inclusion, why responsible banking is pivotal for a sustainable..., nuam: a new capital market for south america, money goes mobile: transforming the future of financial..., the transformation of the traditional originate-to-distribute model in..., how can banks improve supplier resilience in an..., leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Full Name Email Address By subscribing I accept the privacy rules of this site

unbranded - Newsworthy

Here's Why Barcelona Is Banning Holiday Apartments

Posted: June 26, 2024 | Last updated: June 26, 2024

Barcelona, Spain's top tourist destination, is set to ban all holiday apartments by November 2028. Mayor Jaume Collboni announced the measure to revoke around 10,000 short-let licenses, aiming to ease the city's housing market. Despite the economic benefits of tourism, locals are frustrated with sky-high visitor numbers and rising housing costs. Over the past decade, rent prices have surged by 68% and buying prices by 38%. This drastic step is expected to make 10,000 new homes available, helping locals find affordable housing. The decision, while praised by anti-tourism activists, is facing criticism from rental platforms like Airbnb and associations such as Apartur. Collboni emphasized that the move addresses the need for locals, especially young people, to remain in the city. Additionally, the city plans to ease restrictions on new hotels and mandate that 30% of new housing projects be allocated to social housing. Similar measures have been taken by Madrid to curb overtourism, reflecting a broader trend in Spain.

More for You

Sandy Hook victim's brother is 'shocked' that a letter Trump once sent him turned up in a Mar-a-Lago evidence photo

Planet killer asteroid ‘the size of Mount Everest’ will skim past Earth today

Lauren Boebert's Chances of Beating Trisha Calvarese in Colorado: Polls

Huge shipping company shuts down and files Chapter 7 bankruptcy

“Sometimes I’m just tired of words”: Yellowstone Star Has No Regrets Exchanging Blows With Taylor Sheridan Before Becoming a Fan-Favorite Among Women for His Role

‘The Price Is Right' Contestants Are Frequently High Or Drinking, Claims Host Drew Carey

Tourist learns the hard way never to approach a grizzly bear for photos – no matter how cute it looks

13 Slowest Selling Trucks in Today’s Market

NBA Fans Are Saying The Same Thing About Wizards' Alex Sarr Pick

Webb telescope makes discovery that was previously impossible

Here are 5 common traits of Americans who can never, ever retire — how many do you have?

Sean Penn says he felt 'misery' making movies for years. Then Dakota Johnson knocked on his door

Spy agency issues urgent warning to billions of smartphone users to avoid being spied on

10 Cars You Should Buy Used (and 5 You Shouldn’t)

World’s largest cruise ship catches fire, loses power during mishap

US Navy nuclear ballistic missile submarine surfaces off Norway in unusual flex as 'Doomsday' plane flies overhead

Watch a grandpa's surprise when his grandson restores his 40-year-old truck

Woody Harrelson on Why He Hasn't Owned a Cell Phone in Three Years

Star Player Ruled OUT for Chicago Sky vs. Las Vegas Aces

The best place to retire in each state, based on data

MORE SECTIONS

- Dear Deidre

MORE FROM THE SUN

- Newsletters

- Deliver my newspaper

- Sun Vouchers

- The Sun Digital Newspaper

- Racing Members Enclosure

- Fabulous Clothing

Inside Majorca’s tourism row as locals say ‘we’re being colonised by foreigners’ while Brits hit back ‘we help economy’

- Emily-Jane Heap

- Published : 21:08, 26 Jun 2024

- Updated : 11:34, 27 Jun 2024

- Published : Invalid Date,

LAPPING up the Magaluf sunshine, holidaymaker Zoe Kemp dismissed the anti-tourism demos which are sweeping the Costas as “completely hypocritical”.

She told The Sun: “They rely on tourists to survive. If you look around, everything is based on tourists.

“Places like Magaluf are advertised as cheap drinking holidays . We help the economy.”

The resort lies on the west coast of Majorca , which receives around 40 per cent of its income from tourism.

Yet in May 15,000 people stormed through the island’s capital Palma jeering at visitors as they sat down for meals.

Stickers have been plastered around the island, reading: “More tourists? No thanks”, “Stop Tourism” and “Tourist go home — you are not welcome here”.

READ MORE WORLD NEWS

Chilean actor, 42, found dead in Airbnb 'after Tinder date with 2 women'

Jay Slater cops give update as drones & dogs scour place phone lost signal

Last week more than 300 protesters “reclaimed” Instagram-famous cove Calo des Moro in the south of the island by blocking foreigners from entering the 130ft stretch of sand.

There are plans for another rally on July 21 across the four main Balearic Islands, Majorca, Menorca, Ibiza and Formentera — just as many UK schools break up for the summer .

Nursery manager Zoe, 25, from Barnsley , said she experienced a rude waiter on the first night of her ten-day holiday in Magaluf, renowned for its nightlife.

She said: “It was like he just couldn’t be bothered with us.

Most read in The Sun

Channel 4 star, 24, found dead alongside woman's body sparking murder probe

Jay Slater gang beating emerges after he was attacked by 3 mystery men aged 12

Jay Slater’s mum withdrawing cash from £36k GoFundMe to fly family to Tenerife

Emmerdale star to be a dad for the first time as he reveals fiancée is pregnant

“He was rude and treated us like we were an inconvenience. It felt like he just didn’t like English tourists — but we had made him money .”

The wider anti-tourism demos , from the Spanish mainland to the Balearic and Canary Islands, threaten a summer of chaos for British holidaymakers.

Protesters have told The Sun their recent action is just the start, and say they will keep up their campaign until holidaymakers stay away.

Greedy developers

But Brits’ summer breaks could be ruined by protests on UK soil too.

Just Stop Oil has threatened to target airports at peak holiday times after a demo at Stansted Airport in Essex last week was ominously called “just a prelude”.

It means flights to and from the UK could face delays or even cancellations due to the protests.

Just Stop Oil has been crowd-funding all month to raise money for its “flight disruption” campaign that it believes will make the world greener.

Beyond Britain, we have discovered that activists plan to bring the Balearic and Canary Islands to a standstill during the peak season for British travellers by marching through the streets in their thousands and shutting down airports altogether.

They blame mass tourism, and the Spanish government allowing the development of hotels and holiday lets, for causing a housing and cost-of-living crisis.

Alícia Aguiló, spokeswoman for SOS Residents, an activist group co-ordinating rallies in Majorca, told The Sun the movement is spreading rapidly across Spain .

She said: “They started in the Canaries. Now I see that in Ibiza they are beginning to mobilise.

“This is just the beginning. We will continue until politicians are willing to make changes.

“Majorca is being colonised by foreigners and greedy developers have turned the islands into a theme park for tourists.

“Our children have no chance of becoming independent, because rental prices are far above their means, even if they have an average salary.

“We are becoming poor workers without services. We can’t allow the greed of some to condemn our children to emigrate to have a decent life. The roads, beaches, bars and hospitals are saturated.

“Waste management is disastrous. Mega-polluting cruise ships are an attack that affects the air quality in Palma.”

Mass tourism

SOS Residents is selling anti-tourism merchandise for locals to display across the island.

One chilling banner, draped over several balconies, shows a silhouette of holidaymakers laden with suitcases being chased by an axe-wielding figure, with the words: “City for those who inhabit it. Not for those who visit it.”

Brits visiting the island this week say they have already started to notice animosity from locals.

District nurse Sally Smith, 36, from Rochdale, Greater Manchester, said: “I’ve noticed in a few bars their attitude is a bit stand-offish, angry. They slam things down on the table.”

think the protests will get bigger and spread across Spain. There are problems elsewhere that are even bigger than here.

Pal Kelly Butterworth, 44, added: “This area in particular is definitely a bit Brits abroad, but we’re bringing in a lot of money.

“If everything closed down, where would they get their money from?”

In Palma, New Yorker Jules Seo, 32, said Majorcans show more hostility to tourists compared with other European countries she has visited.

She said: “People seem to have less manners here, they’re very sharp with tourists. People have been a little bit rude sometimes.”

After Catalonia on the Spanish mainland, the Balearic Islands was the second most popular region of Spain for tourists last year, attracting 14.4million holidaymakers, according to the Spanish National Statistics Institute.

Palma resident José Mercader, 52, was compelled to support the protests — despite relying on the tourism industry in his job as an airport baggage handler.

He said: “I think the protests will get bigger and spread across Spain. There are problems elsewhere that are even bigger than here.

“It’s impossible to buy a house and to rent is really expensive. My mother has just one Majorcan neighbour, everyone else is from other countries.

“Before the tourists, everyone on the island had a house and land. Maybe the work was harder but Majorcans had all the basics. Life without tourists would not be hell.”

José said locals are also tired of “rude” Brits, adding: “They say good manners are born in the UK but it’s like they forgot it. People come here with their noses in the air.”

Sky high rent

Market trader Martina Salerno, 30, will also join the demos, even though most of her sales come from foreign visitors.

She said: “There are so many tourists on this island. We don’t have the space to go to the beaches because there are too many people.

“Restaurants and bars are all full of tourists and because of that, prices go up, so locals cannot afford them.

“Rents are very high. We don’t have that kind of money. A lot of people have to live with their parents because it’s very expensive.

“Ten years ago I was paying €170 (£144) per month for a flat, now I am paying €400 (£338) for a room in a shared apartment.”

Property prices in Majorca have more than doubled in ten years.

On Thursday, estate agent Adela Kovacs showed clients around a three-bedroom flat in central Palma which is valued at €4.9million (£4.15million).

She said the agency has had interest from England , Germany , Sweden and Russia but not Majorca, as “we could never in our life afford to buy anything like this”.

Welsh-born Rhiannon Lewis, 41, who emigrated to the island five years ago with partner George Rees, 40, said: “There are families that have lived here for generations and they can’t get on the property ladder.

“It’s not fair. I think they will keep protesting until the government does something. If people can’t keep a roof over their heads, they’re not just going to give up.”

But defiant Brits are not about to give up their holidays.

Martial arts instructor Phil Moody, 44, from Rotherham, is in Magaluf for two weeks with his wife Joanne, 34, and son Riley, 13.

He said: “The protests won’t put us off, I’d happily live here. I’ve actually got a six-year plan to move here.”

Before the tourists, everyone on the island had a house and land.

Joanne, an O2 manager, added: “We saw a few anti-tourism banners, but all the Spanish people we’ve come across have been really friendly. It seems they really want our custom.”

And some islanders say activists are blaming the wrong people.

Lory Lithriu, 43, who owns El Gordito Restaurant on the Magaluf Strip, said: “I haven’t seen one person here who is upset that tourists are coming, they are very happy and rubbing their hands together.

“The protesters are blaming the English people but they are not the problem. The government’s to blame.”

READ MORE SUN STORIES

Alton Towers launches new VIP experience for fans - and it only costs a tenner

I’m mum to a child millionaire & I never wash my own hair as we're so rich

And ice cream seller Claudio Garlant said: “Eighty per cent of my business comes from tourists.

“I don’t agree with Majorcans. It’s a beautiful island but without tourism it would just be full of goats.”

- Print Features

- The Sun Newspaper

Travel, Tourism & Hospitality

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

- Monthly growth rate of tourism GDP in Spain 2022

Percentage change in the contribution of travel and tourism to GDP in Spain from January to December 2022

To access all Premium Statistics, you need a paid Statista Account

- Immediate access to all statistics

- Incl. source references

- Download as PDF, XLS, PNG and PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

January 2023

January to December 2022

percentage change over the same months of 2019

Other statistics on the topic Travel and tourism in Spain

- Inbound tourism volume in Spain 2023, by origin

- Tourism contribution to Spanish GDP 2006-2023

- Most visited cities in Spain 2022

Leisure Travel

- Pilgrims on the Way of Saint James 2011-2023

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

* For commercial use only

Basic Account

- Free Statistics

Starter Account

- Premium Statistics

The statistic on this page is a Premium Statistic and is included in this account.

Professional Account

- Free + Premium Statistics

- Market Insights

1 All prices do not include sales tax. The account requires an annual contract and will renew after one year to the regular list price.

Statistics on " Travel and tourism in Spain "

- Leading European countries in the Travel & Tourism Development Index 2023

- Tourism sector as share of GDP in Spain 2010-2021

- Tourism employment in Spain 2015-2021

- Tourism employment in Spain Q4 2022, by industry

- Inbound visitors in Spain 2000-2023

- International tourism spending in Spain 2012-2022

- Domestic trips in Spain 2015-2022

- Domestic trips in Spain 2023, by destination

- Domestic tourism spending in Spain 2015-2022

- Share of travel and tourism spending in Spain 2022, by traveler origin

- Inbound tourism volume in Spain 2023, by travel reason

- Domestic trips in Spain 2022, by travel reason

- Share of travel and tourism spending in Spain 2022, by purpose

- Inbound trips for cultural purposes to Spain 2010-2022

- Number of enotourists in Spain 2008-2022

- Number of skiers and snowboarders in Spain 2010-2022

- Tourism premises in Spain 2015-2021

- Share of tourism companies in Spain 2021, by size

- Main hotel groups in Spain FY2021, by sales revenue

- Main passenger airlines in Spain 2022

- Main travel agencies in Spain FY2021, by sales revenue

- Main restaurants and food stall companies in Spain FY2021, by sales revenue

- Ecotourism businesses' average revenue in Spain 2022, by type

- Main coastal destinations in Spain 2022, by number of hotel guests

- Attendance to Spanish National Heritage sites 2022

- Attendance to Spanish national parks 2022

- Cruise ship calls at Spanish ports 2022, by authority

- Enotourism destination areas in Spain 2022, by region

- Quarterly online revenue of accommodation businesses in Spain 2014-2022

- Quarterly online revenue of travel agencies & tours operators in Spain 2014-2022

- Airbnb revenue in Spain 2015-2020

- Willingness to purchase tourism services online in Spain 2019-2022

- Average spend on tourism services booked online in Spain 2018-2022

- Hotel / private accommodation online bookings by brand in Spain 2024

Other statistics that may interest you Travel and tourism in Spain

- Premium Statistic Leading European countries in the Travel & Tourism Development Index 2023

- Premium Statistic Tourism contribution to Spanish GDP 2006-2023

- Premium Statistic Tourism sector as share of GDP in Spain 2010-2021

- Premium Statistic Monthly growth rate of tourism GDP in Spain 2022

- Premium Statistic Tourism employment in Spain 2015-2021

- Premium Statistic Tourism employment in Spain Q4 2022, by industry

Tourism volume and expenditures

- Premium Statistic Inbound visitors in Spain 2000-2023

- Premium Statistic Inbound tourism volume in Spain 2023, by origin

- Premium Statistic International tourism spending in Spain 2012-2022

- Premium Statistic Domestic trips in Spain 2015-2022

- Premium Statistic Domestic trips in Spain 2023, by destination

- Premium Statistic Domestic tourism spending in Spain 2015-2022

- Basic Statistic Share of travel and tourism spending in Spain 2022, by traveler origin

- Premium Statistic Inbound tourism volume in Spain 2023, by travel reason

- Premium Statistic Domestic trips in Spain 2022, by travel reason

- Basic Statistic Share of travel and tourism spending in Spain 2022, by purpose

- Premium Statistic Inbound trips for cultural purposes to Spain 2010-2022

- Premium Statistic Number of enotourists in Spain 2008-2022

- Premium Statistic Number of skiers and snowboarders in Spain 2010-2022

- Premium Statistic Pilgrims on the Way of Saint James 2011-2023

- Premium Statistic Tourism premises in Spain 2015-2021

- Premium Statistic Share of tourism companies in Spain 2021, by size

- Premium Statistic Main hotel groups in Spain FY2021, by sales revenue

- Premium Statistic Main passenger airlines in Spain 2022

- Premium Statistic Main travel agencies in Spain FY2021, by sales revenue