20 Best Travel Journals to Document Your Trips

Some include prompts and templates to help get you started.

We've been independently researching and testing products for over 120 years. If you buy through our links, we may earn a commission. Learn more about our review process.

Last-minute planning of a trip can consist of chaotic lists in your phone's notes app while the chronicling of said trip may look like sporadic photos in your camera roll. But what if there was a collective place you could plan in advance and jot down funny moments along the way? A travel journal can culminate the ups (and downs) of your vacation with guided prompts and templates.

Our experts at Good Housekeeping Institute extended our expertise in the best photo book makers and best wedding planning books to research the best travel journals, a category we have not yet formally tested. We rounded up the best travel journals of 2023, whether you want a self-designed bullet journal or a notebook with fun maps and stickers. At the end of our list, you can find advice on how to start your travel journal as well as read more about why you can trust Good Housekeeping. And if you have a frequent traveler in your life besides yourself, check out our guide to the best travel gift ideas (although a journal is a great idea too!).

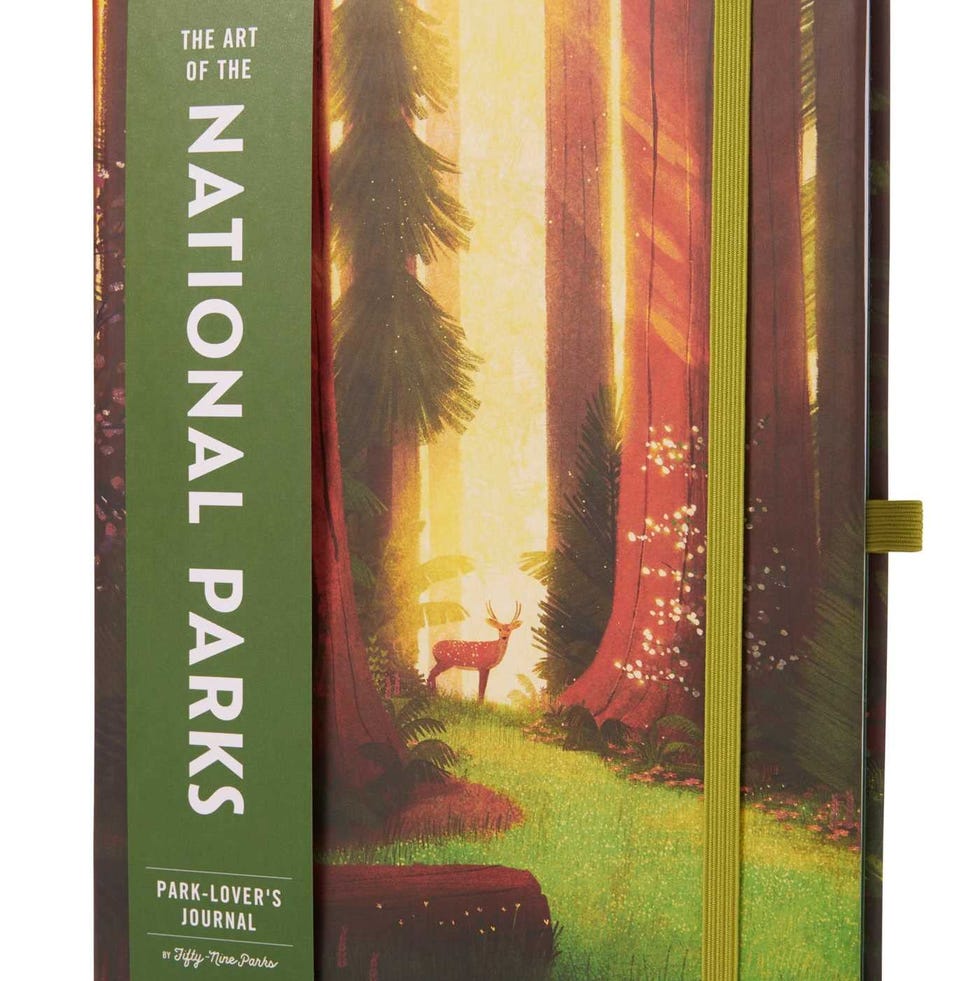

The Art of the National Parks: Park-Lover's Journal

Perfect for the outdoors enthusiast in your life, this journal celebrates each of the 63 parks. It's 175 pages long and comes with prompts that'll help them chronicle their journey. It doesn't hurt that this journal has gorgeous illustrations of each park by real artists.

Papier Off Piste

Whether this is your first or fifth travel journal, or a gift for the college student in your life who's about to go abroad, Papier's notebooks will check all of the boxes. One GH editor has the Off Piste journal and loves the cover, a simple design that includes a meaningful quote, and appreciates the helpful templates you'll find inside the notebook. You'll be able to document up to six trips with templates for your budget, packing list, transportation, accommodation, itinerary and a journaling space for freestyle writing. There are also pages dedicated to a travel wishlist as well an illustrative map you can color in as you mark off countries you've visited.

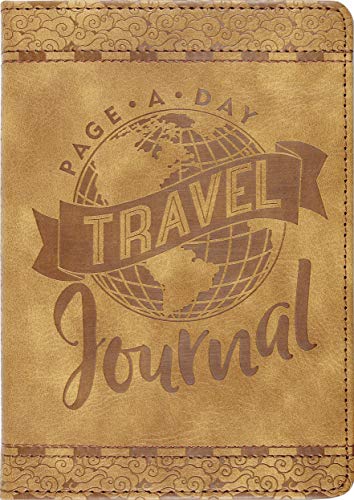

Peter Pauper Press Page-A-Day

Journals can ring in at a variety of prices, but you can find a great travel journal for under $10 that will still give you enough space to write about your wanderings around the world. This leather-bound journal dedicates one page to each day of your trip, with spaces to add in the date, location and weather conditions (we especially like the delicate drawings for types of participation which you can circle with your pencil or pen). Dotted lines on the page will keep your entries neat and organized and an included ribbon bookmark will keep track of where you left off last. Even though this journal is pretty basic in design and on the smaller side, we think it's a great option for someone who doesn't want to spend too much on their first travel journal.

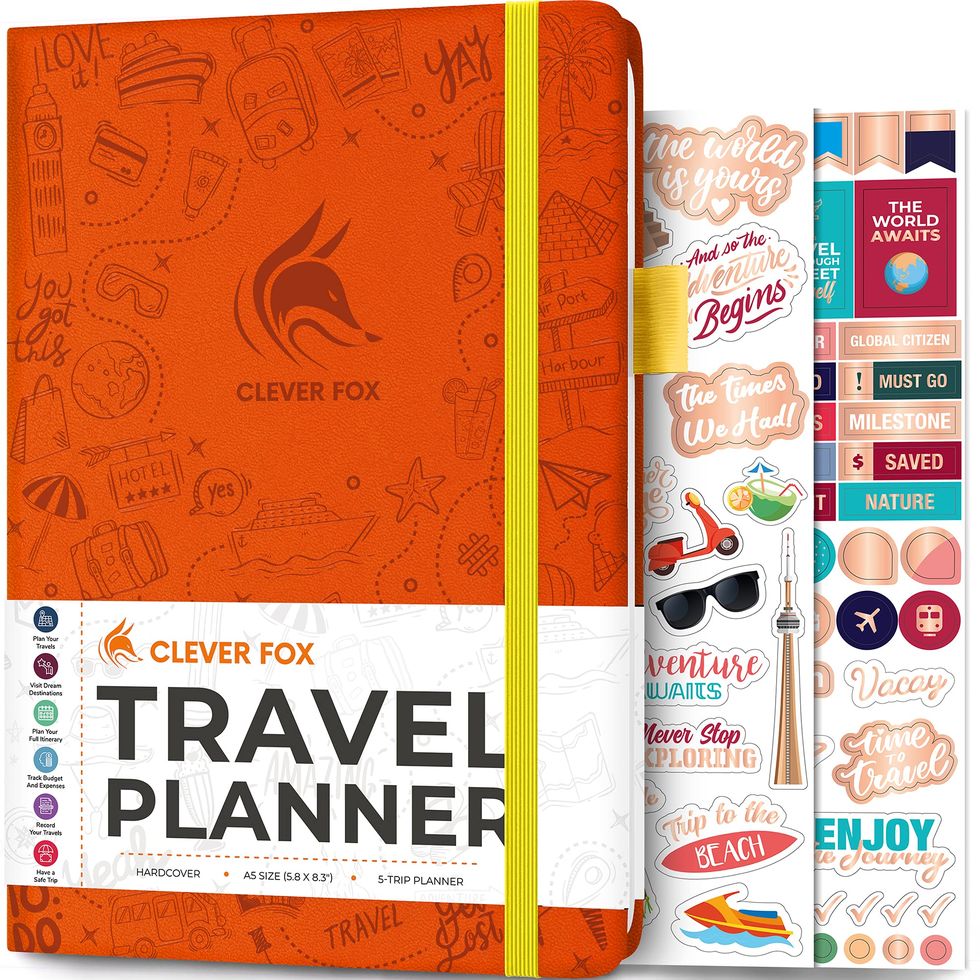

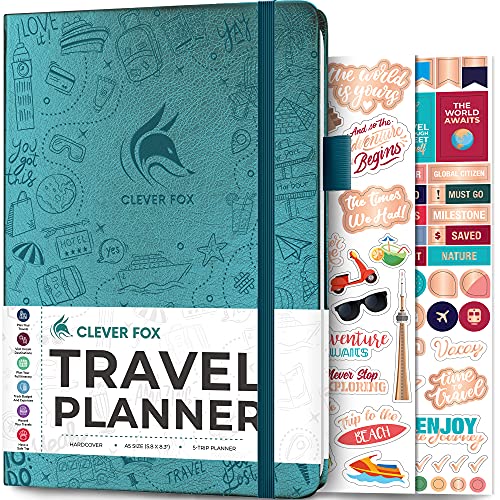

Clever Fox Vacation Planner

Amazon's Choice with a 4.6-star rating across over 900 customer reviews, this travel journal comes with more than just a notebook. You'll also get 150+ fun stickers to embellish your entries, plus the journal also has a pocket to hold the pages of stickers and an elastic band for your pen. But what makes this journal really stand out is its extensive range of templates geared towards helping you plan your trip. For five trips, you'll get pages for research and budget, a packing checklist, transportation and accommodation details and an expense tracker, plus a map and more journaling pages. If you like to plan out every detail, this is the perfect travel journal for your needs. We wish you could fit more than five trips in the journal, but for the price, it's a great value.

Peter Pauper Press Kids Travel Journal

Perfect for the adventure-inclined kiddo, this 96-page travel journal lets young travelers record everything from general entries about a trip to a packing list. Kids can even paste in photos, tickets and more and store the rest in the journal's back pocket. The journal is also full of games, maps, helpful phrases in other languages, metric information, quotes and fun facts. Not only is this kid-friendly journal a creative means to document their early adventures, but its accessories encourage international learning.

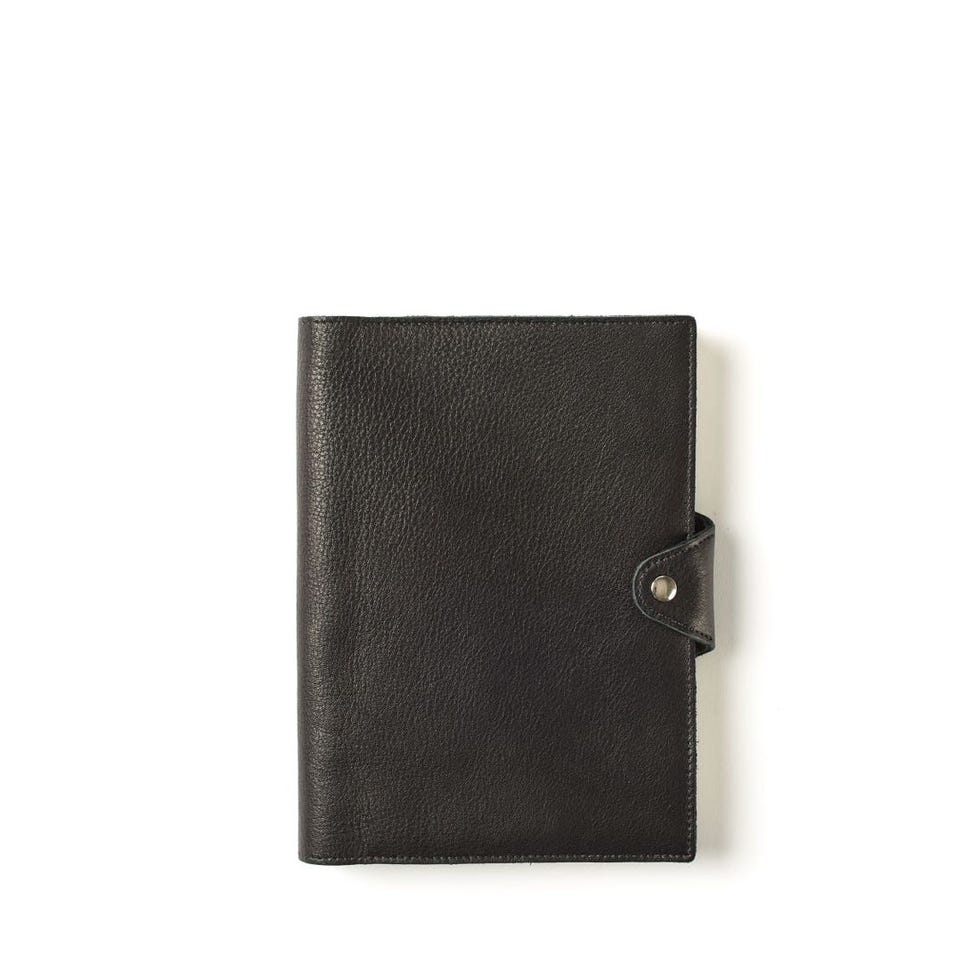

Leatherology Medium Spiral Snap Journal

Available in four hues including black onyx (pictured), brown, azure and lilac, this journal is made from gorgeous dyed leather with light gold hardware. You can choose from a spiral or bound format, but note that the spiral option has 130 perforated pages while the bound journal has 265 ruled sheets (or 128 pages). Regardless of which style you choose, you'll will get the benefit of a snap closure and a built-in pen loop, although the writing utensil is not included. We appreciate the versatility of this journal given the blank pages that let you doodle and write freely over the course of your next trip.

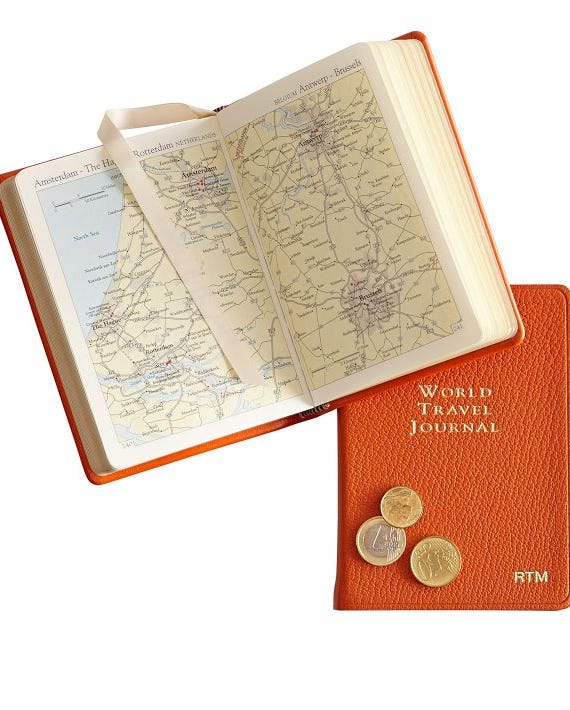

Mark and Graham Leather Bound World Travel Journal

This beautiful leather bound journal not only has pages for writing about your trips, but it also includes full-color maps of major cities plus world weather information, international dialing codes and more. A perfect gift for the international traveler, you can also add a foil debossed monogram to the cover if you want to add a personal flare to the notebook. We wish that the journal was available in more than one color, but the rust orange is a versatile enough choice that will stick out in a dark suitcase or bag.

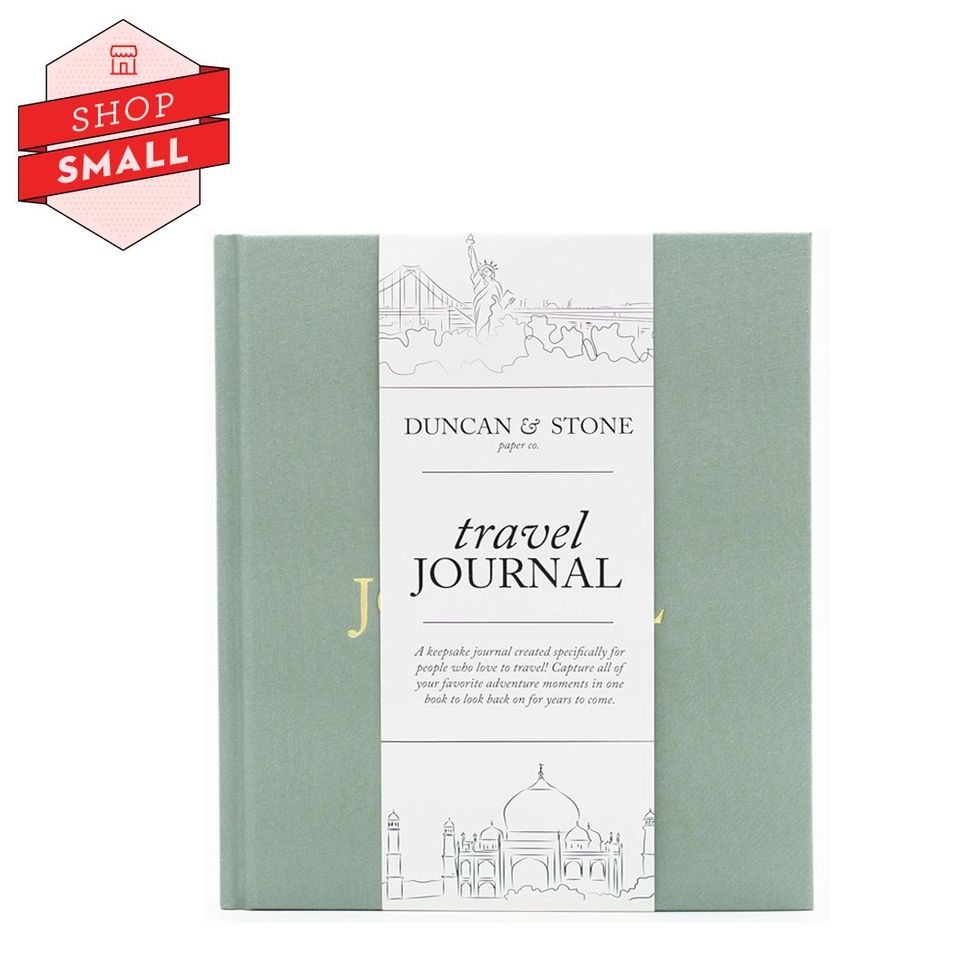

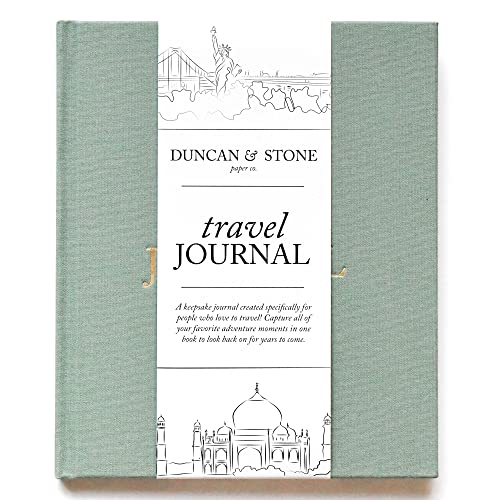

Duncan & Stone Paper Co. World Trip Adventure Book

An almost-perfect five-star rating on Amazon and the titular Amazon's Choice badge is enough to make you add this travel journal to your cart. The layflat design makes it easy to open and write on, and you'll have enough pages to reflect on 15 trips plus a back pocket for extra photos and blank pages for notes and random musings. What we love most about this journal are the helpful prompts that guide newbies through the process of journaling, with questions like "Where did you stay?." and "Something I learned from this destination/culture..." From basic to more thought-provoking questions, you'll have a boost of inspiration to help you document your journey.

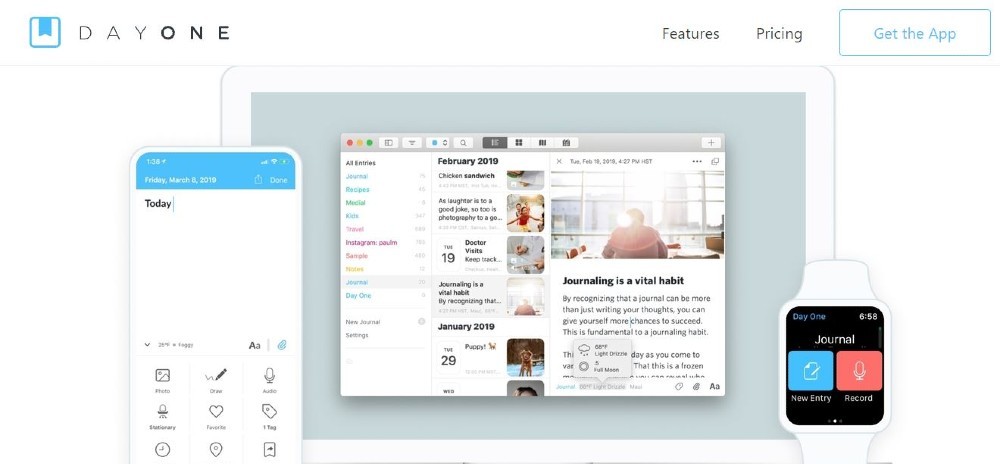

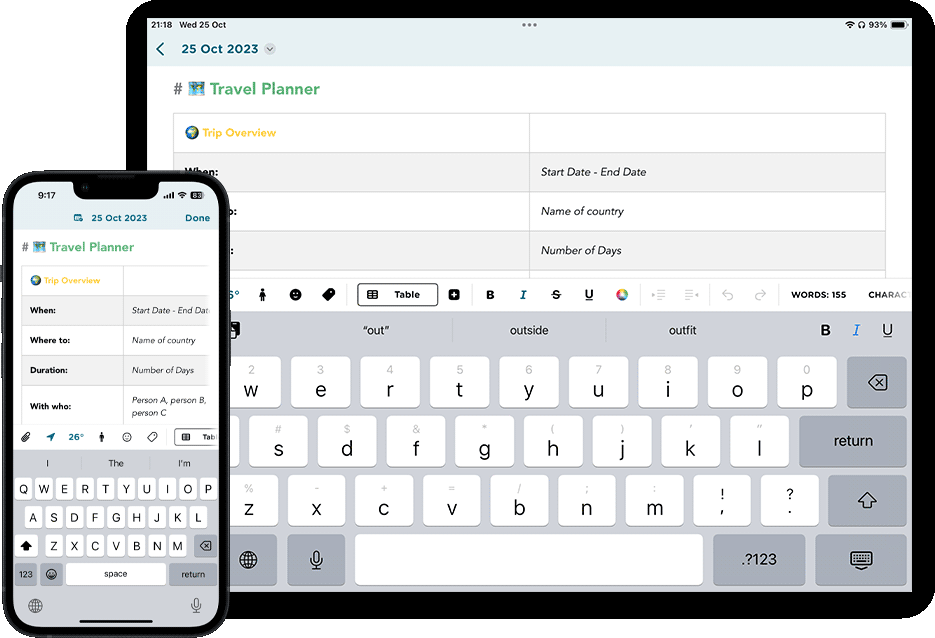

Day One Day One

While the majority of picks on this list are physical journals, you can also document your trips through an app if you prefer a digital format or have minimal space in your luggage . Chief Technologist & Executive Technical Director at the GH Institute Rachel Rothman , says Day One is a solid choice with ample positive reviews from consumers. You can download the app for free on your iPhone, Android, iPad, Mac and Apple Watch. You'll get one journal for one device with the ability to add a photo per entry, plus templates, export capabilities and tags. If you want unlimited journals, devices and photos plus the option to add videos, audio recordings and more, opt for Day One Premium which rings in at $2.92 per month.

Extreme Assistants Classic Notebook

If you travel a lot, or tend to squish as much as you possibly can into your carry-on (we have all been there), you'll want a durable journal that can withstand being tossed around and bumping against other items in your bag. A faux leather hardcover and thick paper ensure your journal will stay intact as you travel to and fro. The manufacturer adds that the cover is designed to be easy to clean, which is helpful if you are journaling on the airplane or train and accidentally spill your drink. We also appreciate that you can add a photo or logo to the cover for an element of personalization, especially since the notebook is more basic in style.

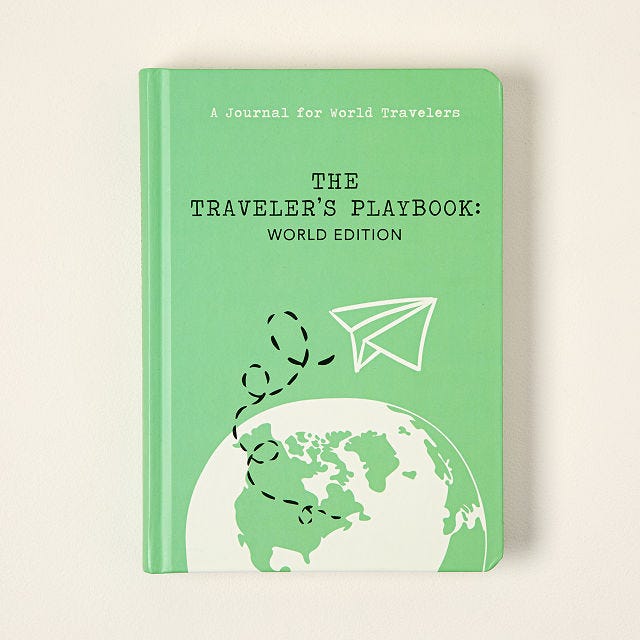

Deanna Didzun The Traveler's Playbook: A World Travel Journal

Journaling of any kind can be intimidating as you don't always know where to start — even a notebook with guiding prompts can lead to partial writer's block. If this sounds like you, then opting for a book that has more structure and a variety of templates is the way to go. This popular travel journal has a 4.3-star rating on Uncommon Goods is designed by explorer Deanna Didzun who created illustrations and lists to help jog your memory of your most recent journey. You can give overall star ratings for each destination and write down food and drink highlights if you so please.

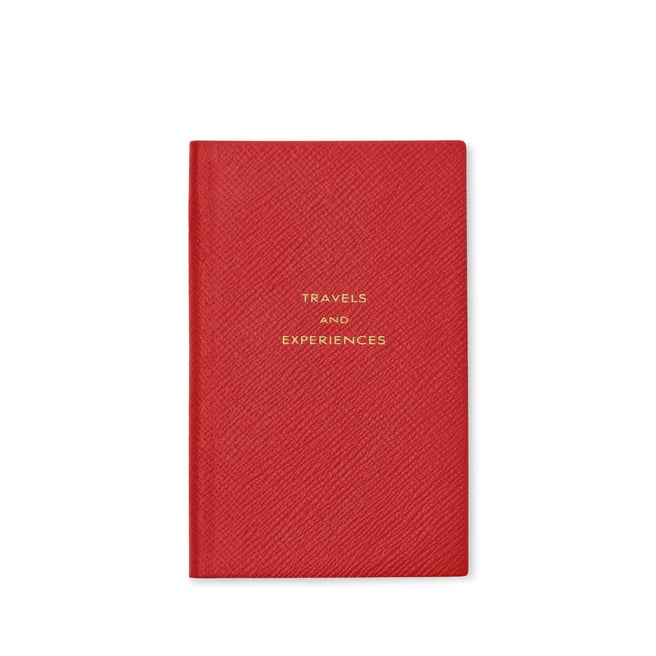

Smythson Travels and Experiences Panama Notebook

There are journals and then there are journals — and this beautiful handcrafted leather journal falls into the latter category. Bound in crossgrain lambskin and available in a light blue or scarlet red, you'll have 128 pages of lined Featherweight paper to fill. This notebook is all about quality and is designed to last, but with that comes a higher price tag. It would be a great gift for the writer in your life who loves to travel, but given its simple layout and lack of templates other travel journals can have, it may not be splurge-worthy for every traveler.

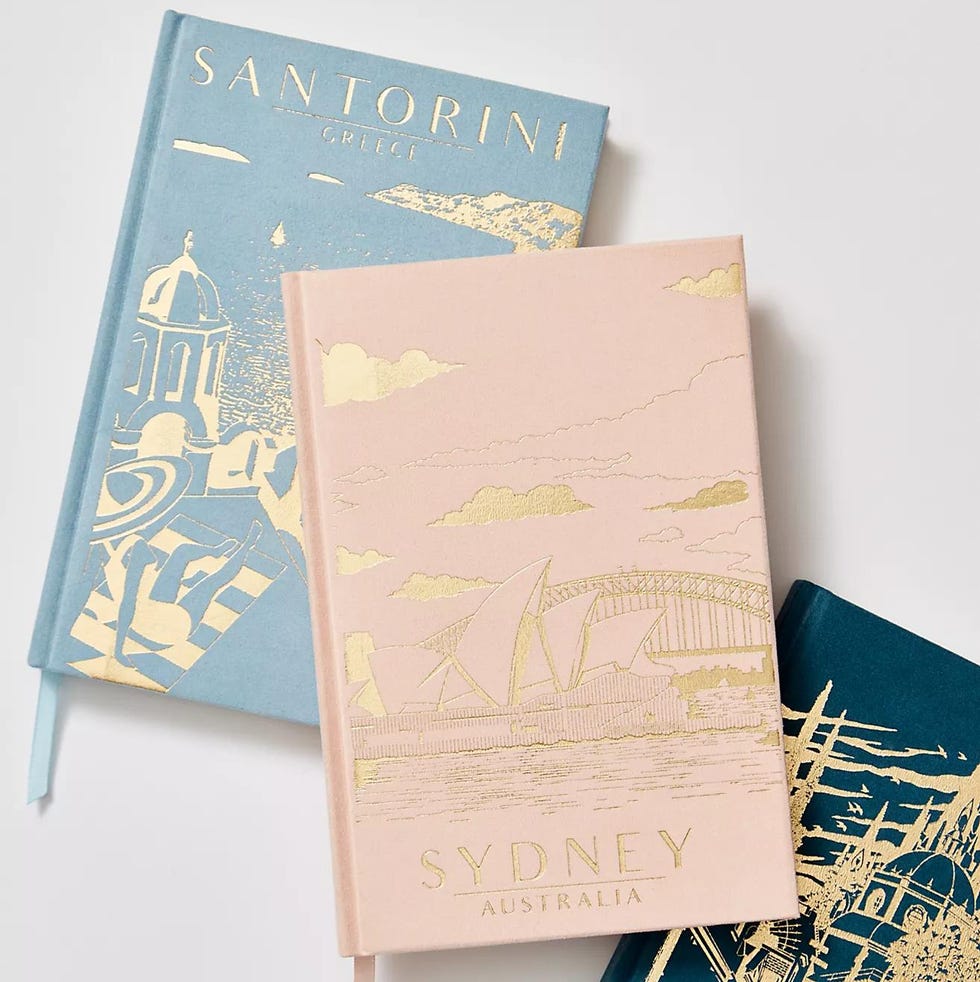

DesignWorks Ink Suede Travel Journal

If you or a friend is traveling to Santorini, Mexico and/or Sydney in the near future, you may want to opt for this travel journal inspired by each of those stunning cities. You can add personal information in the first page of the notebook and the 240 pages are lined with spaces to include the subject and date. Although the journal does not include prompts or templates, we love the eye-catching gold design and appreciate the ribbon bookmark to keep track of your last entry.

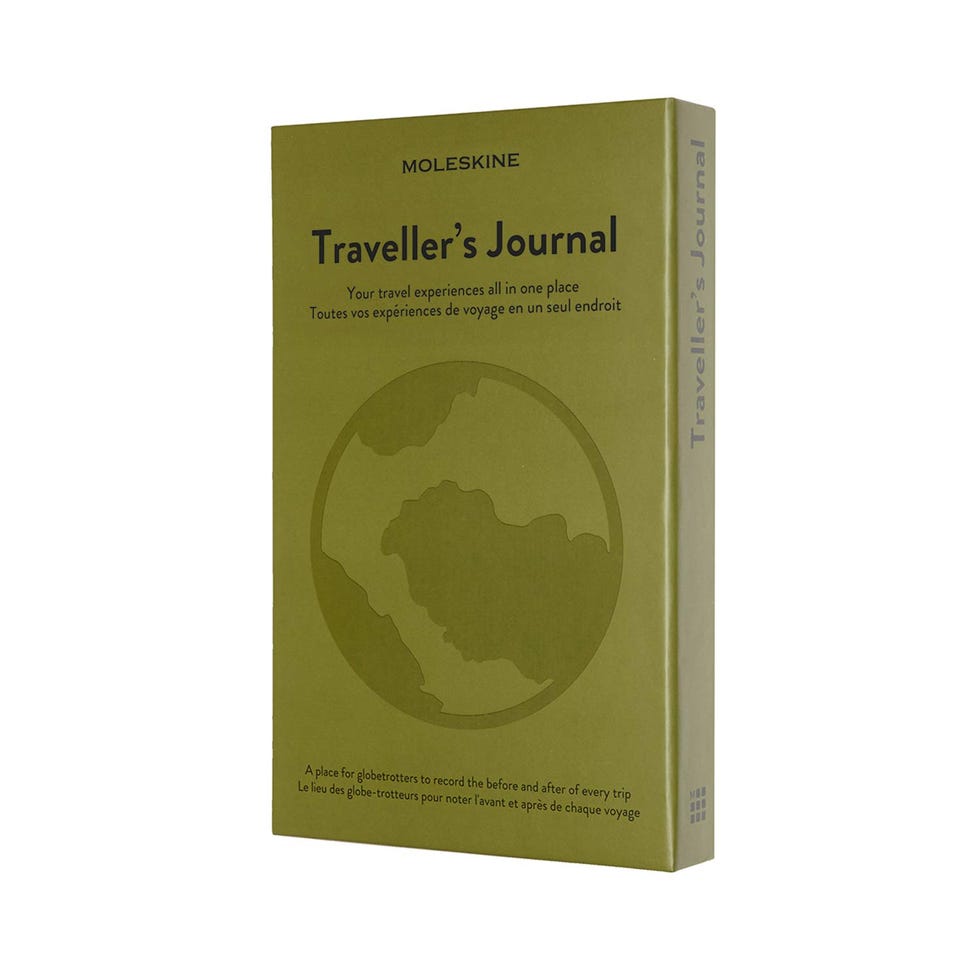

Moleskine Traveller's Journal

Moleskine, the established brand that has been around for over two decades, is synonymous with traditional, high quality notebooks — and this travel-specific journal is no different. There are three sections for a travel wish list, short trips and long trips plus two sheets of stickers and a ribbon bookmark. The journal has a 4.6-star rating on Amazon across over 3,200 consumer ratings. One five-star review calls this notebook "the traveler's best friend," and notes how helpful it can be to keep track of places, restaurants and sites so you don't forget.

JB Leather Personalized Travel Notebook

For a personalized touch, this pick lets you choose from over 1,000 charm and stamp combinations including astrological charms, meaningful quotes and more . There are also three different vegan leather hues to choose from: cinnamon, cedar and sandy brown. The notebook has 18 plastic card slots, a zippered pocket for storage and a total of 152 lined pages. You can also refill the notebook as you cross places off your travel wish list. A best-seller on Etsy with a perfect five-star rating, this customizable notebook is popular among customers. Multiple reviews comment on the fast delivery, and its high-quality, beautiful appearance.

Transient Books Custom Travel Journal for Kids

With this journal, you can customize the cover color, font and cover map, as well as choose between 100- and 200-page books with lined, unlined and prompts variations. We love the various ways you can personalize this kid-friendly journal, making little ones that more excited to explore new places. The five-star seller has over 3,000 customer reviews on Etsy. And the travel journal doesn't just have to be a gift for the kids: Adult customers also said they enjoyed using the notebook for camping trips and vacations around the globe.

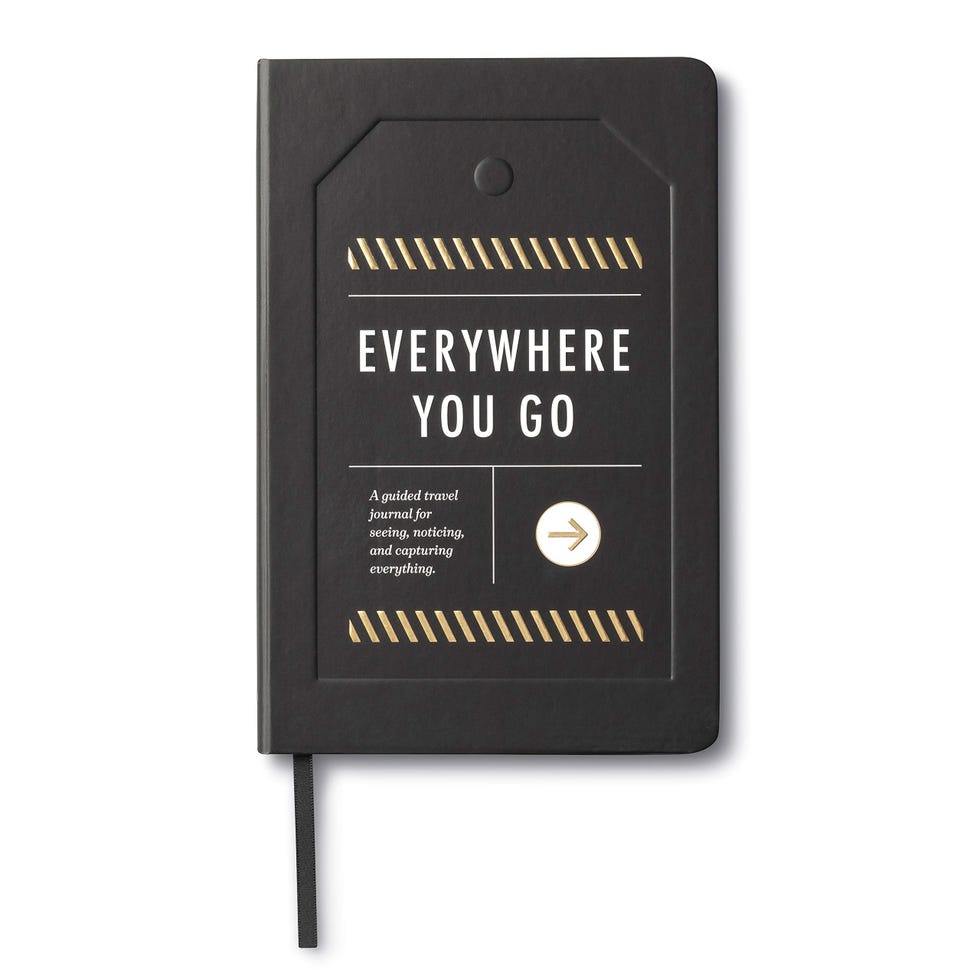

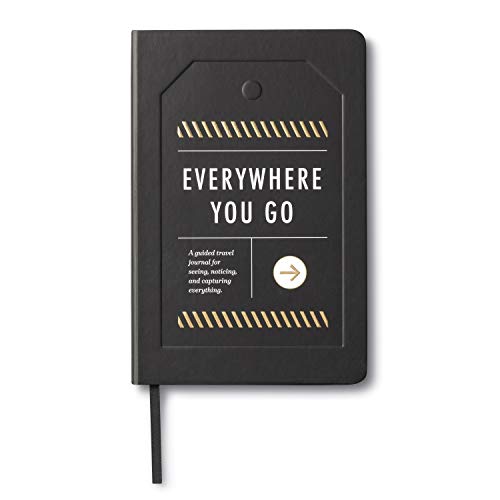

Compendium Everywhere You Go

We have included travel journals on this list that have prompts but none like the unexpected ones in this notebook that will get your creative wheels turning. The questions may catch you off guard, but prompt thoughtful reflection: they range from "If this place had a perfume, it would smell like..." to, "If this place had a soundtrack, these songs would be on it." The notebook is Amazon's Choice and has a 4.5-star rating, with multiple customers calling it the perfect gift for the traveler in your life, whether you need a gift for a teen or a present for a thirtieth birthday .

PAPERAGE Dotted Journal Notebook

Keeping a bullet journal is a popular trend that can easily translate to an aesthetic yet meaningful travel journal. This popular bullet notebook has a 4.7-star rating on Amazon with over 18 color options to chose from including mustard yellow (pictured), burgundy, lavender, royal blue and more. The 5.7-by-8-inch dotted pages lend themselves to open-ended creativity. While it can be hard to start designing and writing a journal from scratch, you have the benefit of customizing how much space you want for each list or entry.

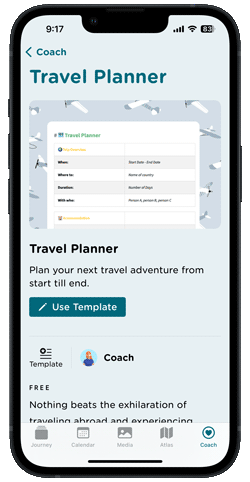

Polarsteps Travel Tracker

Physical journals are not everyone's cup of tea, which is where an app like Polarsteps comes into play. Available for iOS and Android devices, Polarsteps lets travelers track their journeys. You can utilize over 300 helpful guides created by travel editors, as well as use the itinerary planner to dream up your perfect vacation and check the transport planner when unsure of what mode of transportation to use from one destination to another. Once you begin your trip, plot each site you visit and slowly form a personalized map that you can embellish with photos and videos. From there, share your map with friends and family or turn it into a travel book to look back on for years to come.

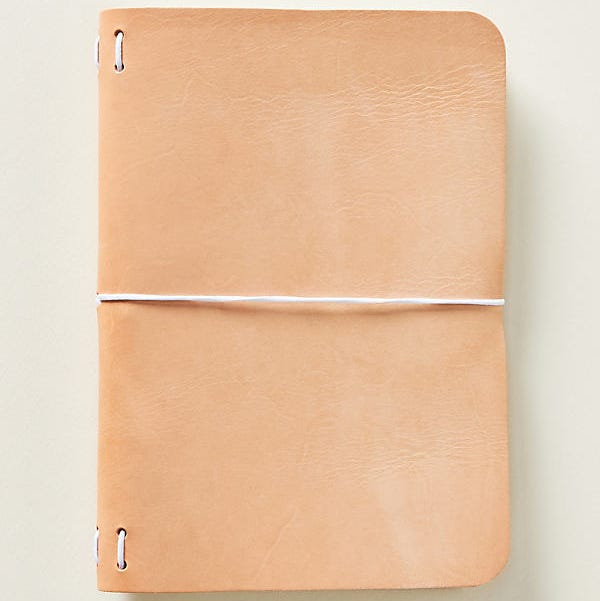

Glad & Young Studio The Traveler's Journal

If you have a bookshelf with rows of novels, photo albums and notebooks, you may want an aesthetic-looking travel journal that fits your style. This leather notebook has 60 pages to document your travels, and is available in a neutral shade (pictured) as well as two marbled patterns that are unique to each purchase. We personally love the brightly colored assorted pattern that has swirls of lavender, yellow, fuchsia and blue. The lined pages are great for daily entries and you can also note the day and weather. Note that to clean, you'll want to wipe away and spills or messes with a soft cloth.

Elizabeth Berry (she/her) is the Updates Editor at the Good Housekeeping Institute where she optimizes lifestyle content across verticals. Prior to this role, she was an Editorial Assistant for Woman’s Day where she covered everything from gift guides to recipes. She also has experience fact checking commerce articles and holds a B.A. in English and Italian Studies from Connecticut College.

@media(max-width: 64rem){.css-o9j0dn:before{margin-bottom:0.5rem;margin-right:0.625rem;color:#ffffff;width:1.25rem;bottom:-0.2rem;height:1.25rem;content:'_';display:inline-block;position:relative;line-height:1;background-repeat:no-repeat;}.loaded .css-o9j0dn:before{background-image:url(/_assets/design-tokens/goodhousekeeping/static/images/Clover.5c7a1a0.svg);}}@media(min-width: 48rem){.loaded .css-o9j0dn:before{background-image:url(/_assets/design-tokens/goodhousekeeping/static/images/Clover.5c7a1a0.svg);}} Product Reviews

The Best Humidifiers for Babies

The Best Nail Stickers and Wraps

The Best Shower Filters

The 5 Best Outdoor Security Cameras

The 14 Best Sunscreens of 2024

The Best Checked Luggage

The Best Gifts for 7-Year-Old Boys

The Best Dresses on Amazon

Best Stain Removers for Clothes

The Best Bathroom Cleaners

I Tried Skinvive, the New "Injectable Moisturizer"

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Sweepstakes

- Travel Products

- Travel Accessories

The 13 Best Travel Journals

From leather-bound to Moleskine, here are the best travel journals to keep track of your adventures.

:max_bytes(150000):strip_icc():format(webp)/Lauren-Dana-Ellman-1cd58a16cf194beaad4749c08ba31269.jpeg)

In This Article

Jump to a Section

- Our top picks

- Tips for Buying

- Why Trust T+L

We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation. Learn more .

Travel + Leisure / Alli Waataja

Whether you’re staying close to home or embarking on a bucket-list trip, it’s no secret that travel helps enrich our minds and provides us with a better understanding of the world around us — all while creating lifelong memories. To document your adventures and preserve these precious memories, consider snagging a travel journal. As you shop, keep in mind that the best travel journals come in a slew of different forms — including some with all-blank pages for long-form freewriting and others with a mix of dotted pages and prompts to spark some inspiration. All in all, it’s safe to say that there’s a travel journal out there for everyone. Ahead, we’ve rounded up our favorites, including a handful with bonus features like illustrations, maps, stickers, detachable packing lists, and storage pockets.

Best Overall

Papier joy travel journal.

The journal is divided into six sections to help travelers stay organized while planning their vacations and documenting their memories.

There’s no place to store a pen.

Divided into six distinct sections, the Papier Joy Travel Journal makes documenting your travels easy and fun. Use the wishlist and trip ideas sections to write down your top bucket list travel locales, while the journey planning and reflection sections provide plenty of space to document your escapades. Pass the time en route to your destination — be it by train, plane, or automobile — by filling out the travel games section of the notebook which includes fun activities like “I Spy,” airport bingo, word searches, and word scrambles. At the very back of the journal, you’ll find an illustrative world map to color in. You can, of course, use the journal to jot down packing must-haves, restaurant recommendations, and anything else to help you stay organized while on the go.

The Details: 192 pages | 5.5 × 8.5 inches

Best Hardcover

Moleskine voyageur notebook.

This journal features fun and functional bonus features like stickers, detachable packing lists, and to-do lists.

There are limited color options.

Moleskine is renowned for its durable notebooks, and this travel-themed one is no exception. Featuring a clothbound hardcover, elastic closure, and an expandable inner back pocket, this 208-page travel notebook is unique in that it also comes complete with detachable packing lists, to-do lists, and, best of all, a sheet of themed stickers for decorating. The travel-planning section is excellent for — you guessed it — planning out your itinerary, while the budget pages come in especially helpful for jotting down and keeping track of expenses. And, since this is a travel journal, it should come as no surprise that there is also a dedicated section for writing down key memories to look back on.

The Details: Lined, blank | 208 pages | 4.5 x 7 inches

Best Accessories

Clever fox travel journal.

It comes with fun themed stickers and offers specific sections for budgeting and trip reviews.

It’s made with faux leather, which is considered less durable than genuine leather.

Creative types will especially appreciate this Clever Fox Travel Journal, which comes with over 150 stickers to decorate away. Need some inspo? Check out the included user guide with examples to help you create your own one-of-a-kind travel journal. The calendar page can be used to mark down important trip dates, while the illustrative map page can be used to plan out your route. There are also research and budgeting pages, along with a trip review section where travelers can look back on their favorite activities. Additional highlights include a ribbon bookmark, a back pocket, and a pen loop.

The Details: Blank, lined, dotted | 120 pages | 5.8 x 8.4 inches

Best Sustainable

Rocketbook smart reusable notebook.

This innovative journal utilizes QR code technology to scan and safely store your entries in a digital app on your smartphone.

Those who prefer a more traditional journaling experience may not feel so connected to this smart journal.

Travelers looking for a more sustainable approach to journaling (read: one that doesn’t require excessive amounts of paper) should consider snagging the Rocketbook Core Reusable Smart Notebook. Simply scan the QR code printed on each page, and your smartphone will automatically snap a photo of your work before subsequently updating it to the corresponding app where your entry will live on forever. You don’t need to worry about accidentally losing the journal, and your memories, along with it!). To “write,” use the included reusable pen, add a drop of water, and wipe with the included microfiber cloth to reveal a blank page ready to fill once more.

The Details: Dotted | 36 pages | 6 x 8.8 inches

Best Pocket Sized

Letterfolk trip passport journal.

This compact travel journal can be easily stashed away in your backpack or pocket while on the move.

With just 48 pages, this journal is not ideal for longform entries.

As the name suggests, the Letterfolk Trip Passport Journal is about the size of a passport, which means it can easily fit in your carry-on, tote bag, backpack, or everyday purse. Despite its small size, it contains a total of 20 entry logs for travelers to jot down key details of each trip. Each entry page is also accompanied by a blank page that can be used to record thoughts, photos, illustrations, and even keepsakes like ticket stubs and museum tickets. The back pages of the journal offer checklists, flight logs, bucket lists, and other fun activities.

The Details: Lined, blank | 48 pages | 3.5 x 5.5 inches

Best Prompts

The traveler's playbook.

Uncommon Goods

The specific prompts will help inspire travelers to record small but memorable details of their vacations.

Conversely, the creative, hyper-focused pages and prompts may feel overwhelming to some.

Document each and every one of your adventures with this beautiful journal, which was created by an avid traveler. Inside, you’ll find a slew of illustrations and prompts to help get those creative juices flowing and inspire travelers to record seemingly small but unique details of their journeys that will live on for decades. There’s even a dedicated page for each country, a master tracker to help plan the ultimate itinerary, a travel bucket list, checklists, and pages where travelers can record the names and details of new friends made while globetrotting. Finally, for each country visited, color it in on the world map page.

The Details: 256 pages | 5.8 x 8.3 inches

Best Leather

Smythson "travel and experiences" cross-grain leather notebook.

Bergdorf Goodman

This timeless travel notebook features a chic albeit durable cross-grain calf leather construction.

There are no specific prompts or unlined pages.

This portable, pocket-sized travel journal is both functional and fashionable thanks to its cross-grain leather construction, which is known for its excellent ability to withstand wear and tear. As such, you can expect it to stay intact for years on end while serving as your trusty travel companion. Plus, it can even be personalized with your initials for an extra-special touch. Choose from four fun color options: Nile Blue, Orange, Scarlet Red, and Bright Emerald.

The Details: Lined | 64 pages | 3.5 x 5.5 inches

Mark and Graham Leather Bound World Travel Journal

Mark and Graham

This leather-bound travel journal includes colored maps of cities around the world.

It’s not refillable, meaning that you’ll need to purchase an entirely new journal when you run out.

World travelers may opt for a travel journal with multiple maps to 1) plan their upcoming trips, 2) map out future itineraries, and 3) know where they’re going when wandering through new-to-them locales. This one from Mark and Graham includes full-color maps of major cities, as well as world weather information and international dialing codes. The leather-bound book is a sleek and functional choice. For extra-luxe flair, consider adding foil-debossed monogramming for just $12.50.

The Details: 320 pages | 6 x 4.5 inches

Best Customizable

No ordinary emporium personalised travel journal with map pages.

This fully customizable journal makes an excellent gift for friends or family, or a keepsake for yourself!

Since it ships from the United Kingdom, it can take several weeks to arrive.

Whether shopping for yourself or a lucky giftee, this travel journal can be fully personalized based on specific preferences and travels. Shoppers can customize the cover with a title, subtitle, name, date, and message. There’s also the option to select the number of pages, along with the page design. Choose between blank or lined pages, and between colored or gray maps. Lastly, the journal boasts a sleek matte finish and sturdy hardcover construction to ensure it’ll stand the test of time.

The Details: Blank, lined | 50-150 pages | 5.9 x 8.2 inches

Best Refillable

Robrasim refillable travelers notebook.

Three different paper refills are available.

It’s a small notebook.

This versatile leather travel journal has not one, not two, but three different 64-page refill inserts — lined, blank, and kraft paper — based on personal preference. When one notepad is full, simply remove it and replace it with a new one. The included pouch is also great for storing receipts, ticket stubs, and other small travel mementos. And while this is technically classified as a travel journal, it can also be used for general note-taking, sketching, or daily planning. Take your pick of two colors: coffee and wine.

The Details: Lined, blank | 64 pages | 4 x 5.2 inches

Best with Stickers

Legend travel planner.

It has three sheets of stickers, plus dedicated pages for safety tips and checklists.

It only holds info for a maximum of five trips.

This fun travel journal-slash-itinerary planner has three sheets of themed stickers to decorate. With dedicated pages for emergency contacts, safety tips, pre-trip checklists, and even translation to commonly spoken languages, think of this journal as the ultimate travel companion. Globetrotters also have the opportunity to add photos and mementos while simultaneously jotting down notes, ideas, and expenses. The attached pen loop, three ribbon bookmarks, elastic closure, and pocket for loose notes and documents are all added bonuses. Travelers can take their pick of six fun color and pattern options, as well.

The Details: Ruled, dotted | 5.8 x 8.3 inches

Best for Kids

Peter pauper kids’ travel journal.

A combination of maps, prompts, illustrations, and games make this the ultimate kid-friendly travel journal.

It's most suited for international travel.

Surprise and delight your child(ren) with this kids’ travel journal ahead of your next family trip. Suitable for those ages seven through 12, this journal is filled with prompts, photos, illustrations, maps, puzzles, and games to keep little ones entertained for hours on end. Kids can use the blank pages to paste photos and mementos, while the lined pages are great for jotting down memorable experiences, reflections, and drawings. The travel journal is also chock full of travel-centric quotes and fascinating world facts. The back pocket is great for stashing keepsakes.

The Details: Blank, lined | 96 pages | 6.2 x 8.2 inches

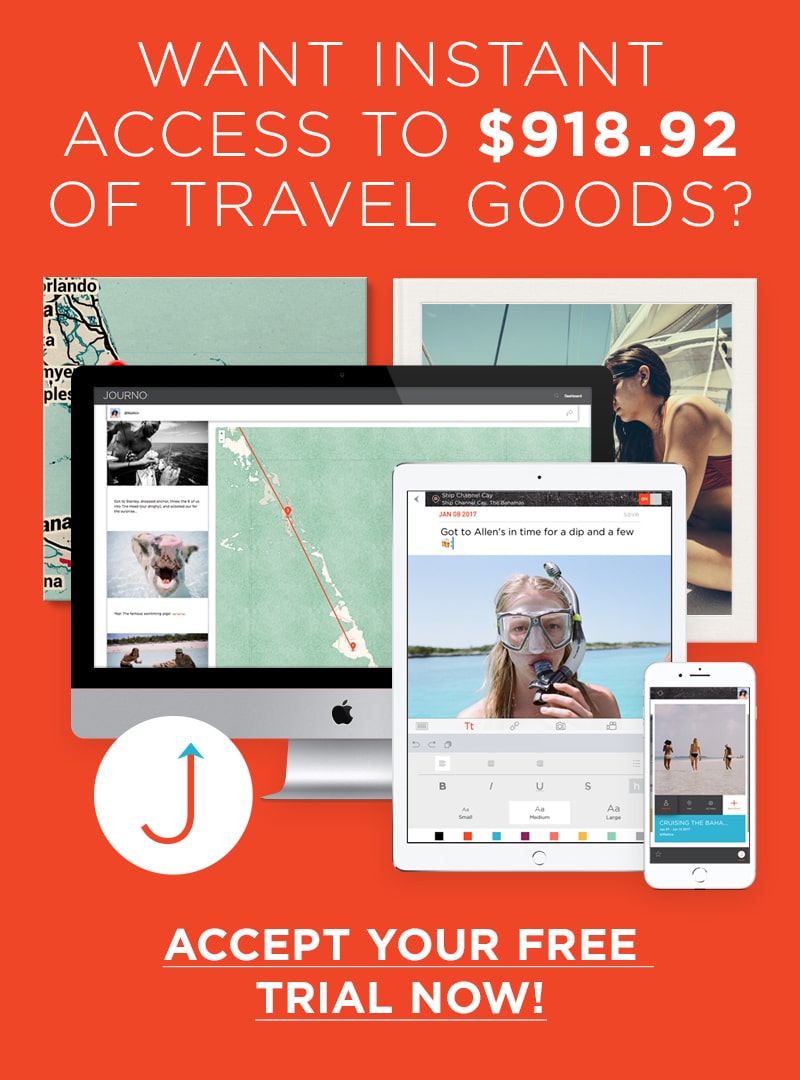

Journo Travel Journal & Trip Tracker

Apple App Store

This is a great option if you plan to transfer your digital travel memories to a glossy photo book.

Digital journaling may not be for everyone.

Travelers looking for a non-traditional journaling option should download Journo, a travel journal app and trip tracker that’s Android and Apple smartphones — along with tablets and Macs. Think of this app as a digital travel scrapbook complete with notes, photos, and — get this — audio clips. Travelers can choose to type or handwrite their entries, and the digital journal can be completely customized with specific text styles and colors. It can also be printed out into a gorgeous coffee table book.

The Details: Customizable | Unlimited pages

Tips for Buying a Travel Journal

Consider your needs.

Are you going on a road trip? Backcountry hiking? On a month-long ship journey across the ocean? Consider where you’re going and for how long when picking a journal. If you’re going to be in some extreme weather, you might want to pick a journal that has some weather protection. Short on suitcase space? Or maybe you’re only bringing minimal gear? Consider a pocket-sized journal to maximize precious packing room.

Pick the right page format and style

Be sure to look at what types of pages come with your journal, and if it is refillable, what types of page refills are available. If you’re used to writing on lined paper, you’ll want to make sure your journal has that. But if you’re looking for some blank pages so you can sketch or add photos, make sure the journal includes them, too.

There is no right or wrong way to journal. Simply start and just let the words flow onto the pages. Talk about what you’re doing, how you’re feeling, who you're traveling with, the itinerary, what you ate, etc. If you’re not quite sure how to journal, choose a journal with prompts that will help you get started.

A bullet journal is more for to-do lists, scheduling, organizing, and jotting down ideas. Usually, bullet journals include dotted pages instead of lined pages, but you could simply add in your own bullet points to a lined journal if you wish. Bullet journals are great for quick notes while on the go, or for organization in between long journaling sessions.

Why Trust Travel + Leisure

For this article, T+L contributor Lauren Dana Ellman utilized a combination of research and personal expertise as a travel commerce writer to compile a list of the best travel journals on the market. She also combed through dozens — if not hundreds — of product reviews and ratings to narrow down the specific product picks mentioned above.

Love a great deal? Sign up for our T+L Recommends newsletter and we'll send you our favorite travel products each week.

:max_bytes(150000):strip_icc():format(webp)/JasmineGrant-c7aebf391faf4c1c8767a407a955548a.jpg)

Winter is here! Check out the winter wonderlands at these 5 amazing winter destinations in Montana

- Travel Essentials & Accessories

11 Amazing Travel Journal for 2024

Published: August 20, 2023

Modified: December 27, 2023

by Peggy Cabello

- Plan Your Trip

- Weird & Amazing

Are you a passionate traveler looking for the perfect travel journal to accompany you on your adventures in 2023? Look no further! We have curated a list of 11 amazing travel journals that are sure to capture all the unforgettable moments you'll be experiencing. Whether you prefer a sleek and compact design or a more elaborate and artistic layout, these journals cater to every traveler's unique style. Get ready to document your journeys in the most creative and personalized way possible with these remarkable travel journals for 2023.

Jump to Review

Page-A-Day Artisan Travel Journal

This product has a rating of A. * What does this rating mean?

Overall Score : 9/10

The Page-A-Day Artisan Travel Journal is a stylish and functional diary made from vegan leather. It features lined pages that lay flat, making it perfect for jotting down travel memories. The journal has a convenient section at the bottom of each page to record the weather, allowing you to capture the ambiance of your travel experiences. With a handy size that fits in your purse or backpack, it is ideal for documenting your adventures on the go. The journal is well-made and attractive, with a beautifully designed cover. It also makes a great gift for travel enthusiasts and newlyweds embarking on their honeymoon. Overall, it is a versatile and high-quality travel accessory.

Key Features

- Stylish vegan leather travel journal

- Lined pages that lay flat

- Weather recording section on each page

- Handy size for easy portability

- Well-made and attractive cover

Specifications

- Dimension: 5.00Lx0.50Wx7.25H

- High-quality construction

- Ideal size for travel

- Convenient weather recording section

- Versatile gift for travel enthusiasts

- Limited color options

The Page-A-Day Artisan Travel Journal is a must-have accessory for avid travelers. Its stylish vegan leather design, convenient size, and lay-flat pages make it a practical and elegant choice for documenting travel memories. Whether you’re embarking on a solo adventure or planning a romantic honeymoon, this journal will be your perfect companion. The added weather recording section adds a unique touch to capture the mood of each day. The journal also makes a thoughtful gift for friends and family who love to travel. With its high-quality construction and timeless design, the Page-A-Day Artisan Travel Journal is an essential item for any wanderlust soul.

DUNCAN & STONE PAPER CO. Travel Journal: A Perfect Memory Keeper for Travelers

The DUNCAN & STONE PAPER CO. Travel Journal is a perfect keepsake diary for avid travelers. With its high-quality materials and thoughtful design, this journal allows you to capture all of your favorite adventures and special memories. The journal includes space for photos and notes, along with a back pocket for extra pictures. Its simple, yet elegant Sage Green linen cloth hardcover adds a touch of sophistication. The journal contains 110 pages and comes in a protective cellophane bag. With prompts and sections dedicated to each trip, as well as a bucket list for future travel ideas, this journal is a great companion for any traveler. Preserve your travel memories and tell your stories with the DUNCAN & STONE PAPER CO. Travel Journal.

- Travel Notebook with 110 pages

- Space for photos and notes

- Linen cloth hardcover with gold embossed title

- Includes prompts and sections for each trip

- Comes with a back pocket for extra pictures

- Color: Sage Green

- High-quality materials and elegant design

- Plenty of space for personalization and capturing memories

- Includes prompts and sections for easy journaling

- Back pocket for storing extra pictures

- Comes in a protective cellophane bag

- Limited use for experienced travelers

- Fixed-format may be confining for some

- Blank pages for photos may strain the binding

- Envelope for keepsakes may not be practical

The DUNCAN & STONE PAPER CO. Travel Journal is a beautiful and well-designed companion for any traveler. With its high-quality materials, thoughtful prompts, and space for personalization, it allows you to capture and cherish your travel memories. While it may not be suitable for experienced travelers who prefer more flexibility, it is perfect for first-time travelers or as a gift. The journal’s elegant Sage Green linen cloth hardcover adds a touch of sophistication and the included back pocket is great for storing extra pictures. Overall, this travel journal is a wonderful tool for preserving your adventures and sharing your stories.

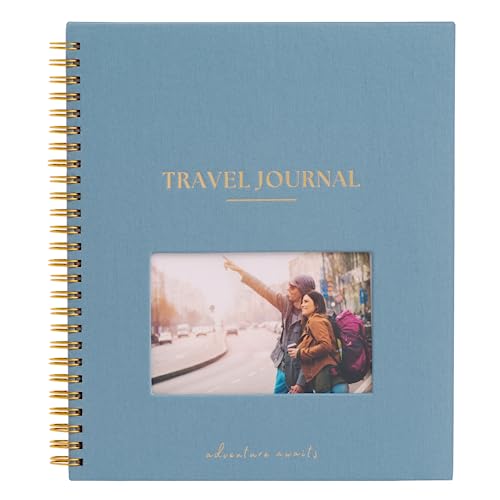

Women's Travel Journal with Prompts

The Travel Journal for Women with Prompts is a beautiful and customizable journal designed specifically for travelers. With its convenient ring-bound design and purposeful layout, this journal offers ample space to capture all your special memories from up to 12 trips. The superior non-smudge paper ensures a smooth writing experience, while the practical back pockets provide a neat and organized way to keep your travel mementos safe. The travel notebook features a sophisticated linen cover with gold foil debossing, adding a touch of elegance to your travel experience. Perfect as a gift or a personal keepsake, this ocean-colored journal is a must-have for any adventurous woman.

- Customizable Front Window

- Convenient Ring-Bound Design

- Purposeful Layout with Ample Space

- Superior, Non-Smudge Paper

- Practical Back Pockets

- Sophisticated Linen Cover

- Color: Ocean

- Customizable front window adds personal touch

- Ring-bound design allows for easy journaling

- Ample space for notes, bucket list, and memories

- Non-smudge paper ensures a smooth writing experience

- Back pockets for organizing travel mementos

- Sophisticated linen cover adds elegance

- Prompts seem more geared towards future trips

- Some prompts may not be applicable to all travelers

The Travel Journal for Women with Prompts is a perfect companion for any female traveler. Its customizable features, practical design, and thoughtful layout make it an excellent tool to capture and preserve your travel memories. With its superior quality and elegant cover, this journal is not only functional but also a timeless keepsake. Whether you’re a seasoned adventurer or planning your first trip, this journal will inspire and guide you in documenting your journeys. Get ready to fill this journal with your travel tales and create a cherished memento of your adventures!

Tree of Life Journal for Travel and Work

Overall Score : 8/10

The Hardcover Leather Lined Journal Notebook is the perfect accessory for travelers, business people, and students. This vintage-style notebook features a waterproof brown faux leather cover with a beautiful Tree of Life design. The medium-sized notebook is ideal for writing journals, note-taking, and sketching. It contains 256 pages of premium light yellow paper, which is resistant to damage from light and air. The 180° lay flat design and elastic closure band make it convenient to use and protect your content. This journal makes an ideal gift for various occasions. Overall, it's a stylish and practical notebook that will inspire creativity and organization.

- Tree of Life vintage Leather Journal Notebook

- Hardcover Leather journal

- 256 Pages Premium Paper

- 180° Lay Flat Design

- Ideal Business Notebook Gift

- Color: Brown

- Dimension: 8.30Lx5.70Wx0.70H

- Beautiful Tree of Life design

- Comfortable to write on with thick, high-quality paper

- Durable and waterproof faux leather cover

- Convenient elastic closure band and ribbon bookmark

- Resistant to ghosting and bleed-through

- Ideal for various occasions and as a gift

- Not spiral bound

- Some issues with the first page attachment

The Hardcover Leather Lined Journal Notebook is a fantastic product for those who love to write, sketch, or take notes. Its vintage design and high-quality construction make it not only a functional item but also an aesthetically pleasing one. With its durable cover, thick pages, and convenient features like the ribbon bookmark and elastic closure band, it provides a great writing experience. The Tree of Life design adds a touch of elegance and symbolism to the notebook. Although it’s not spiral-bound and there were some occasional issues with the first page, overall, it is a great choice for travel, work, or daily use. Whether for personal use or as a gift, this notebook is sure to impress.

Compact Travel Journal

Overall Score : 8.5/10

The Travel Journal (Notebook, Diary) from the Compact Journal Series is a handy and stylish companion for travelers. With a compact size of 5'' x 7'', it is perfect for carrying around during your adventures. The journal features 144 lightly lined opaque pages, providing ample space to document your travel experiences. It also includes an inside back cover pocket, ideal for storing tickets and other souvenirs. The die-cut fold-over front panel with a magnet closure adds a touch of elegance and keeps your journal securely closed. The Travel Journal is a great gift for avid travelers and offers excellent quality. However, some customers mentioned that the back pocket is missing or that the journal becomes too thick to close when filled completely.

- Compact size: 5'' x 7''

- Inside back cover pocket

- 144 lightly lined opaque pages

- Die-cut fold-over front panel closes with a magnet

- Dimension: 5.30Lx0.80Wx7.20H

- Compact and easy to carry

- Includes a back pocket for storing tickets and souvenirs

- Stylish design with a magnet closure

- Excellent quality and well-made

- Back pocket may be missing in some cases

- Becomes too thick to close when filled completely

The Travel Journal (Notebook, Diary) is a great companion for travelers who enjoy documenting their adventures. With its compact size, stylish design, and practical features like the back pocket and magnet closure, it offers convenience and elegance. The 144 lightly lined opaque pages provide plenty of space to write about your travel experiences. Despite some minor drawbacks, such as the occasional missing back pocket and the journal becoming thick when filled, it remains a popular choice among travelers. Whether as a personal journal or a thoughtful gift, the Travel Journal is sure to please any travel enthusiast.

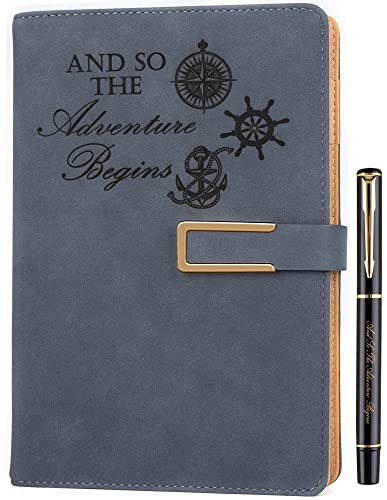

Adventure Writing Journal with Refillable Pages

This product has a rating of B. * What does this rating mean?

Overall Score : 9/10/10

The Refillable Adventure Writing Journal is a stylish and functional accessory for men and women who love to document their adventures. The faux leather hardcover features a nautical theme with an engraved compass, rudder, and spear, as well as the inspiring phrase 'And so the adventure begins.' The journal contains 200 lined pages, perfect for work, personal diary entries, or note-taking. It is also refillable, making it an environmentally friendly choice. The durable faux leather cover is soft to the touch and protects your writings for years to come. The magnetic buckle closure adds convenience and security. With ink-proof thick paper, strong binding, and a lay-flat design, this journal offers a pleasant writing experience. Overall, it is a versatile and well-designed journal that makes a great gift or personal accessory. Score: 9/10

- Nautical theme with engraved compass, rudder, and spear

- Refillable with A5-sized replaceable refill (200 pages)

- Durable faux leather hardcover with soft touch

- Magnetic buckle closure for convenience and security

- 200 pages of ink-proof thick paper with lay-flat design

- Strong binding and ribbon bookmark for durability and easy navigation

- Color: Blue

- Size: Adventure

- Stylish and inspiring nautical theme

- Environmentally friendly with refillable pages

- Durable faux leather cover

- Ink-proof thick paper with no feathering or bleeding

- Lay-flat design for easy reading and note-taking

- Strong binding and ribbon bookmark

- Slight leathery smell at first (fades over time)

- Boxes may arrive damaged during shipping

- Magnetic closure may not always stay closed

- Printing on front cover may be lighter than expected

The Refillable Adventure Writing Journal combines style, functionality, and eco-friendliness to provide a great writing experience. Its nautical design and inspiring quote make it a delightful companion for any adventurer. The option to refill the pages ensures long-lasting use, while the durable faux leather cover and magnetic buckle closure add convenience and protection. The ink-proof thick paper and lay-flat design enhance the joy of writing. Despite a few minor drawbacks like a temporary smell and occasional shipping issues, this journal offers excellent value for the price. Whether you’re recording memories, taking notes, or journaling, this journal is a worthy investment.

Travel Journal Notebook

The Travel Journal: 6" x 9" Lined Blank Softcover 150 Page Notebook is a must-have accessory for any traveler. This journal is the perfect size to bring with you on the go, allowing you to jot down your adventures on planes, trains, and more. It features thick, lined pages that prevent bleeding and make your handwriting appear neat. The simple and portable design sparks creativity and provides ample space to document your trips and adventures for the entire year. The sturdy binding and cute cover ensure that your journal will withstand the rigors of travel. Whether you want to plan your road trips or simply record your experiences, this travel journal is a practical and stylish choice.

- 6" x 9" notebook size

- Softcover with 150 lined blank pages

- Portable and easy to carry

- Thick pages prevent bleeding

- Sturdy binding for durability

- Simple design sparks creativity

- Dimension: 6.00Lx0.34Wx9.00H

- Portable and lightweight design

- Ample space to document adventures

- Thick pages prevent ink bleeding

- Sturdy binding for long-lasting use

- Simple and stylish design

- Relatively expensive for a notebook

- Some customers received incorrect content

The Travel Journal: 6″ x 9″ Lined Blank Softcover 150 Page Notebook is a practical and stylish accessory for travelers. With its portable size, thick pages, and sturdy binding, it is built to withstand the adventures of your journey. While the notebook may be slightly pricey for some, its ample space and simple design make it worth considering. However, it is important to note that a few customers have reported receiving incorrect content. Overall, this travel journal is a great companion for documenting your experiences and sparking creativity on the go.

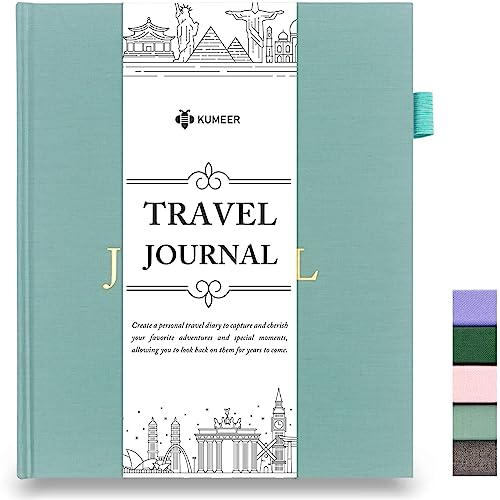

KUMEER Travel Journal for Women, Men

Preserve your cherished adventures and unforgettable moments in a single travel notebook, creating a timeless collection to revisit for years to come. Customize this travel memory organizer by jotting down your travel wish list and capturing special memories from up to 17 remarkable journeys.

- Dedicated travel diary for women and men

- Simple guided prompts, wish list, favorite things pages

- Premium linen cloth hardcover, gold embossed title and spine

- Thick 120g no bleed writing paper, sewn pages

- Pen loop, elastic closure, and back pocket

- Money-back guarantee

- Color: Emerald Green

- Dimension: 9.10Lx7.60Wx0.50H

- Thoughtfully designed for travel needs

- High-quality craftsmanship and durable

- Easy and effortless journaling

- Satisfaction guaranteed

- Limited pages for longer trips

The KUMEER Travel Journal is a beautifully designed and practical travel companion. With its thoughtful layout, high-quality materials, and ample space to document your adventures, it’s a must-have for any travel enthusiast. The prompts, wish list, and favorite things pages add a personal touch, while the durable construction ensures your memories will be well-preserved. Although it may not be suitable for longer trips with extensive note-taking, it is perfect for shorter journeys and weekend getaways. Whether for yourself or as a thoughtful gift, this travel journal is sure to become a cherished keepsake filled with treasured memories.

Clever Fox Travel Journal

Overall Score : 9.5/10

The Clever Fox Travel Journal is the ultimate organizer for travelers seeking to fulfill their travel dreams and create long-lasting positive memories. This A5 size hardcover journal is packed with features to help you plan, organize, and document your trips. It includes a budget plan, packing list, expense tracker, and trip journal, as well as sections for safety tips, travel tips, and emergency contacts. The journal is made with premium quality materials, featuring a beautifully engraved PU-leather cover and 120 gsm pearl white pages. It also comes with 150+ complimentary stickers and a kickstart user guide. The Clever Fox Travel Journal is a must-have for any traveler. Score: 9.5/10

- Fulfill your travel dreams

- Plan organized and safe trips

- Document memorable moments

- Includes budget plan and expense tracker

- Premium quality with PU-leather cover

- Comes with 150+ complimentary stickers

- Color: Aquamarine

- Size: A5 (5.8" x 8.3")

- Helps plan trips more efficiently

- Keeps you organized on the go

- High-quality materials and design

- Comes with a variety of useful features

- Includes a kickstart user guide

- Limited to 4 trips

- Font may be difficult to read for visually impaired

The Clever Fox Travel Journal is an essential tool for travelers who want to make the most of their trips. With its comprehensive planning features, high-quality materials, and thoughtful design, this journal offers everything you need to stay organized and create lasting memories. While it may be limited to 4 trips, it still provides a valuable resource for documenting and reflecting on your adventures. Whether you’re a seasoned explorer or a beginner, this journal will enhance your travel experience and make planning a breeze. With its stylish cover and compact size, it’s also a great accessory to carry with you on your journeys. Invest in the Clever Fox Travel Journal and embark on a carefree and unforgettable journey!

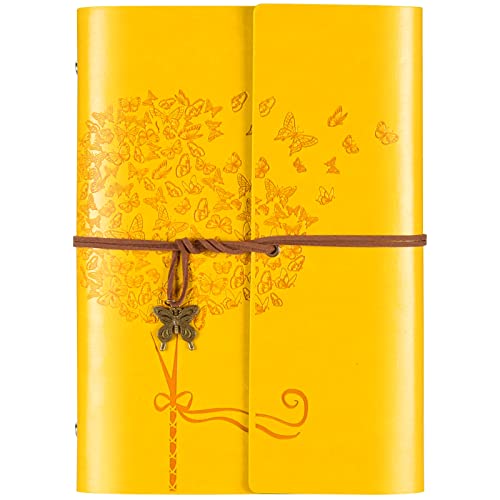

Leather Notebook Journal, Vintage Refillable Journal with 2 PVC Pockets

The Leather Notebook Journal is a vintage-style travel journal made of premium PU leather. It features refillable 100GSM lined paper with a beautiful dandelion pattern on the cover. The convenient A5 size makes it perfect for carrying in a handbag or schoolbag, and it's ideal for school, travel, or personal diary. The thick material of the paper prevents ink from bleeding through, making it suitable for all types of pens. The journal also includes 2 zipper binder pockets, one large and one small, for storing bills, cards, and other small items. It makes for a perfect inspirational gift for friends, family, teachers, or yourself. With its high-quality construction and attractive design, this journal is a great companion for capturing and preserving memories.

- Premium PU Leather

- Convenient A5 Size

- Thick 100GSM Lined Paper

- 2 Zipper Binder Pockets

- Perfect Inspiration Gift

- Color: Yellow

- Size: A5-9.3''×6.3''

- Strong and durable leather cover

- Refillable paper prevents wastage

- Zipper pockets for organization

- Perfect as a gift

- Suitable for various pens

- Wrap-around strap may stretch over time

- Some users find it flimsy or not to their taste

The Leather Notebook Journal is not only a functional accessory for writing and taking notes but also a beautiful keepsake with its vintage design. The high-quality PU leather cover and thick refillable paper ensure that your memories stay preserved for years to come. The addition of 2 zipper binder pockets provides convenient storage for small items, making it a practical choice for travelers. With positive customer reviews praising its elegance and versatility, this journal would be a fantastic companion for anyone who loves writing or journaling. Whether you’re a seasoned writer or just starting to explore the world of journaling, this Leather Notebook Journal is a fantastic choice.

Compendium Travel Journal with Prompts

Capture the moments of each excursion in this one-of-a-kind travel journal. Its reflective spaces and creative prompts will help you fully immerse yourself in the experience. Bring it along as your travel companion on one trip, or many! This unique guided journal holds unexpected prompts to help inspire thoughtful reflections from any travel adventure. It includes breakout spreads with uplifting quotes to help frame your thoughts and experiences, along with space for packing lists, notes, addresses, and things you want to remember. An elegant gift to celebrate a travel adventure, retirement, bon voyage party, or big vacation.

- Reflective spaces and creative prompts for immersive experiences

- Includes breakout spreads with uplifting quotes

- Space for packing lists, notes, addresses, and memories

- Foil stamping on softcover and a ribbon marker

- Printed with soy and metallic inks

- Color: Everywhere You Go

- Dimension: 0.30Lx5.75Wx8.50H

- Thought-provoking prompts enhance reflection during travel

- Beautiful design with foil stamping and ribbon marker

- Includes uplifting quotes to inspire

- Some customers received the journal in poor condition

- Limited color options available

The Compendium Everywhere You Go travel journal is an excellent companion for any journey. With its thoughtful prompts, it encourages reflection, allowing you to capture and remember your travel experiences. The elegant design, including foil stamping and a ribbon marker, adds a touch of luxury to the journal. The inclusion of uplifting quotes further inspires and uplifts during your adventures. While some customers received the journal in poor condition, overall, it makes for a great gift or personal travel keepsake. Whether you’re a seasoned traveler or embarking on your first trip, this guided journal is a valuable companion.

Buyer's Guide: Travel Journal

Things to consider.

- Size: Determine the size that suits your travel style. Compact journals fit well in pockets or small bags, while larger ones offer more space for detailed entries and sketches.

- Binding: Consider the binding style that best suits your needs. Spiral-bound journals allow for easy flipping and lie flat, while stitched or glued bindings provide a more traditional feel.

- Cover Material: Choose a cover material that withstands the rigors of travel. Leather offers durability and a classic look, while synthetic materials provide a more lightweight and weather-resistant option.

- Page Format: Decide between lined, plain, or gridded pages based on your preference for writing, drawing, or organizing your thoughts.

- Page Quality: Look for acid-free, high-quality paper that won't yellow or deteriorate over time. Thicker pages can prevent ink from bleeding through and provide a better writing surface.

- Additional Features: Think about any additional features you may want, such as a pen loop, bookmarks, pockets, or an elastic closure band.

- Weight: Consider the weight of the journal, especially if you're backpacking or have limited luggage space. A lighter journal can make a significant difference.

Types of Travel Journals

- Classic Journal: A traditional journal with blank or lined pages for freeform writing, sketching, and documenting your travels.

- Guided Journal: These journals provide prompts, questions, and activities to guide your writing and reflection throughout your trip.

- Scrapbook Journal: Ideal for the creative traveler, these journals combine writing space with areas for pasting pictures, ticket stubs, postcards, and other mementos.

- Digital Journal: If you prefer a modern approach, consider a digital journal or app that allows you to capture and organize your travel memories on your electronic devices.

Tips for Choosing the Right Travel Journal

- Consider Your Style: Choose a journal that matches your personal taste and suits the mood you want to create while journaling.

- Think About Accessibility: Opt for a journal that is easy to carry, open, and write in, while still providing sufficient space for your thoughts.

- Reflect on Your Preferences: Do you prefer structured writing or the freedom of blank spaces? Consider whether a guided journal or a classic, unstructured one suits you best.

- Evaluate Durability: Look for a sturdy journal that can endure the wear and tear of your adventures, particularly if you'll be traveling in varied weather conditions.

- Test the Writing Surface: Before purchasing, check the paper quality to ensure it accommodates your preferred writing instrument without smudging or bleeding through.

Frequently Asked Questions about 11 Amazing Travel Journal for 2023

Keeping a journal allows you to reflect on your experiences, capture unique moments, and create a personal narrative of your journey. It enables you to connect deeper to your trips and helps preserve memories for the future.

While it’s possible to use a regular notebook, travel journals are specifically designed for travel with features like durable covers, portable sizes, and high-quality paper. They offer a more suitable experience for documenting your adventures.

Guided travel journals provide prompts and questions that inspire self-reflection, encourage exploration of your surroundings, and help you delve deeper into the places you visit. This structure can be beneficial for those looking for more direction in their journaling.

Digital journals offer convenience, searchability, and the ability to add multimedia elements. However, some travelers prefer the sensory experience of pen and paper, the freedom from screens, and the tangible aspect of traditional journals.

Absolutely not! Travel journaling is a personal and creative outlet that should be tailored to your own style and preferences. You don’t need to be an expert writer or artist – just let your experiences and emotions guide your entries.

There are no rules when it comes to frequency. Write when inspiration strikes or on a daily basis – it’s entirely up to you. Find a rhythm that allows you to capture the essence of your journey without overwhelming yourself.

Sharing your travel journal is a personal choice. Some prefer to keep it private, while others enjoy sharing glimpses of their experiences with friends, family, or even through a blog or social media. It’s entirely up to you!

Consider using an elastic closure band or keeping your journal in a zippered pouch to prevent it from opening or getting damaged during your travels. Additionally, make copies or backups of your journal entries in case of loss or theft.

Absolutely! Some travelers enjoy using different journals for various destinations or trips to keep each experience separate. It can be a great way to organize your thoughts and make each journal a unique keepsake.

Regularly journaling helps develop writing and artistic abilities over time. By documenting your experiences and observations, you’ll naturally become more attuned to details, descriptive language, and visual representations.

Yes! In addition to recording past adventures, a travel journal can serve as a valuable resource for future trips. You can refer to it to remember favorite places, notes on accommodations, or tips and recommendations for an upcoming journey.

A: Absolutely! While it’s wonderful to journal in the moment, starting your journal after your trip is still worthwhile. It allows you to reflect on your experiences and bring back the memories vividly, even if they are no longer as fresh.

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

How to Start and Keep a Travel Journal: A Guide to Travel Diaries

When you capture your memories, you’ll never lose them.

Traveling is a transformative and enriching experience – and one of the best ways to capture and preserve those memories is by keeping a travel journal. A travel journal serves as a personal record of your adventures, reflections, and emotions throughout your journey.

A travel journal offers numerous benefits and can become a cherished keepsake for years to come. Here is a comprehensive guide on how to start and keep a travel journal – and how to make the most of your journaling experience.

Why Keep a Travel Journal?

Keeping a travel journal is a gateway to a treasure trove of memories , self-reflection , and creative expression . From preserving the details of your journeys to unlocking personal growth, a travel journal is definitely worthwhile. Let’s uncover the magic of travel journaling together.

Preserving Memories

Preserving memories is crucial when it comes to maintaining a travel journal. It is essential to capture the moments and experiences during your trips. Here are some techniques to effectively preserve your memories:

– Write comprehensive descriptions of the places, individuals, and activities you encounter. It is important to be vivid and use expressive language in your writing.

– Capture photographs of the landscapes, landmarks, and memorable moments you come across.

– Keep tickets, receipts, and other mementos from your travels as keepsakes.

– Maintain a daily log of your activities, thoughts, and emotions throughout the journey.

– Consider recording voice memos to encompass ambient sounds and conversations, which will add depth to your memories.

– Document the people you meet on your journey, including their names and stories .

Incorporating these practices into your travel journal will allow you to effectively preserve your memories for the years to come.

Self-Reflection and Personal Growth

Self-reflection and personal growth are essential aspects of travel journaling. When you take the time to introspect and process your experiences and emotions, you not only gain a deeper understanding of yourself but also foster personal growth .

Here are five effective ways to enhance self-reflection and personal growth through your travel journal:

1. Embracing emotions : Use your journal to describe your feelings and emotions during your travels. This practice can help you process and comprehend your emotional responses.

2. Contemplating experiences : Take the opportunity to write about the impactful moments, challenges, and lessons you encounter. By doing so, you can gain valuable insights, learn, and grow.

3. Recognizing strengths and weaknesses : Assess your reactions to various situations and identify areas where you excel as well as struggle. This self-awareness will optimize your personal growth.

4. Establishing personal goals : Utilize your journal to set realistic development goals for yourself. For instance, if you tend to be shy, challenge yourself to interact with locals. Regularly reflect on these goals and track your progress.

5. Documenting achievements : Take the time to celebrate your accomplishments in your journal. Whether it’s conquering fears, trying new activities, or pushing yourself out of your comfort zone, recognizing these achievements will boost your self-confidence and inspire further growth.

By actively engaging in self-reflection and personal growth through your travel journal, you can maximize your travel experiences and create positive changes that spill over into various aspects of your life.

Creative Outlet

Travel journaling provides you with a valuable creative outlet that allows you to express yourself and document your experiences in unique ways.

There are several methods through which travel journaling serves as a creative outlet:

1. Writing: You can vividly describe your adventures, including the places you visit, the people you meet, and the emotions you experience. By skillfully using descriptive language, you can bring your experiences to life on the pages of your journal.

2. Drawing and Sketching: If you possess artistic abilities, you can visually represent your travels through sketches and drawings. You have the opportunity to capture breathtaking landscapes or intricate architectural wonders.

3. Collages and Scrapbooking: Incorporating various mementos such as pictures, tickets, and postcards can elevate your travel journaling experience. By artfully arranging these items, you can create visually appealing collages that effectively capture your journey.

4. Mapping and Planning: You may enjoy incorporating maps and itineraries into your journals. By using different colors, markers, and symbols, you can highlight your routes, points of interest, and even plan future adventures.

5. Poetry and Prose: Travel journals offer a platform for you to explore your emotions and experiences through poetry, short stories, and song lyrics. This allows you to express your thoughts and reflections in a profound and meaningful way.

Incorporating a creative outlet into travel journaling enhances the overall experience, enabling you to express yourself artistically. It adds a personal and unique touch to your journals, reflecting your unique personality and perspective.

Editor’s Note : You don’t have to be a famed artist to enjoy adding artistic touches to your journal – even a postcard can help you capture a moment or memory, it’s art!

How to Start a Travel Journal?

You might be wondering, “Where do I start?”

You’ll need to start with a journal and a journey. Consider the following guidelines as you choose and prepare to record an adventure you’ll never forget. Are you ready to dive into the world of travel journaling and embark on an adventure of self-expression and reflection?

Choose the Right Journal

When selecting a journal, it’s important to choose one that suits your needs and preferences. Consider the following factors:

Consider these factors to choose the right journal that meets your needs and enhances your travel journaling experience.

Determine Your Journaling Style

When it comes to travel journaling, determine your style. This helps capture your travel experiences authentically and true to your voice. Consider these factors when determining your style:

1. Writing or Visual: Decide if you prefer writing or capturing your thoughts and experiences through drawings, sketches, or collages. Some may prefer a combination.

2. Length and Detail: Consider how much detail you want in your journal entries. Do you enjoy writing long and descriptive passages or shorter, more concise entries? This determines entry length and depth.

3. Structure: Think about if you prefer a structured journal with a specific format like a daily log or reflection on specific trip aspects. Alternatively, you may prefer a free-flowing and spontaneous approach.

4. Multimedia Elements: Decide if you want to include additional elements like travel photos, tickets, or souvenirs. These bring memories to life and add a visual dimension.

Remember, your journaling style can evolve and change over time. The important thing is to find a resonating style that effectively captures your travel experiences. Experiment with different approaches and embrace the freedom to authentically express yourself. Happy journaling!

Gather Essential Supplies

To gather essential supplies for your travel journal, follow these steps:

1. Choose a journal: Select a journal that fits your style and preferences. Consider factors like page count, paper thickness, and lay-flat design for easy writing.

2. Pens and markers: Bring a variety of writing tools , including pens, markers, and highlighters, to add color and creativity to your journal.

3. Sticky notes and adhesive: Pack sticky notes or adhesive to incorporate extra elements like tickets, postcards, or photos into your journal. This will make your journal visually appealing.

4. Travel accessories: Consider including travel-specific items such as a small pouch for souvenirs, a ruler for straight lines or measurements, or a pocket-sized travel guide for reference.

5. Accessories for organization: Keep your journal organized with accessories like paper clips, binder clips, or page flags. These can be useful for marking important pages or sections.

6. Glue or tape: If you plan to add larger or heavier items to your journal, such as brochures or maps, bring glue or tape to securely attach them.

7. Travel-friendly storage: Make sure you have a sturdy and compact bag or case to store all your journaling supplies in one place. This will make it easier to access them while traveling.

Remember, the purpose of gathering essential supplies is to enhance your journaling experience and creativity. Consider which items will be most useful and enjoyable for you personally.

What to Include in Your Travel Journal?

Keeping a travel journal is the perfect way to capture the essence of your adventures. You have a lot of options when it comes to what to include – especially if you’re detailed oriented. Here are some of the major players.

Daily Itinerary and Activities

When traveling and keeping a journal, you may want to document your daily itinerary and activities. Here are some key points to consider:

– Record your daily activities: Write down the places you visit, the attractions you see, and the activities you engage in each day. This helps you remember the details and experiences.

– Date and timestamp your entries: Include the date and time of each activity in your journal. This creates a chronological account of your journey.

– Include details and descriptions: Be descriptive in your writing, capturing the sights, sounds, and smells of each activity. Use vivid language to paint a picture of your experiences.

– Add personal reflections: Alongside your itinerary, include your thoughts and feelings about each activity. Reflect on how the experience impacted you and what you learned from it.

– Document any challenges or surprises: Note any unexpected obstacles or pleasant surprises you encountered during your activities. This adds depth and authenticity to your travel narrative.

– Attach mementos: Include tickets, brochures, or other physical items related to your daily activities. These mementos bring back memories and enhance your journal entries.

Remember, the goal of documenting your daily itinerary and activities is to create a comprehensive record of your trip. By capturing the details and emotions of each day, you’ll be able to relive your travel experiences in the future. Happy journaling!

Impressions and Emotions

Impressions and emotions are crucial aspects when capturing the essence of travel experiences. By actively describing and reflecting on them, you have the ability to construct a vibrant and meaningful travel journal.

- To start, describe your impressions by taking note of the sights, sounds, smells, and tastes that stand out to you when visiting a new place. Utilize descriptive language to effectively convey the atmosphere and essence of the location. For instance, instead of simply stating “the beach was beautiful,” vividly describe the vibrant colors of the sunset reflecting off the water, the delightful scent of the salty breeze, and the comforting sensation of warm sand between your toes.

- Describe the enticing taste of local delicacies, the texture of cobblestone streets beneath your feet, or the vibrant array of colors at a bustling market. Engaging multiple senses not only makes your journal entry more immersive but also evokes a more vivid recollection .

- It is important to reflect on your emotions while traveling. Travel often evokes a range of emotions, such as excitement, awe, nostalgia, and introspection . Write about how certain moments or experiences made you feel. Did you experience a surge of adrenaline while embarking on a chalenging hiking trail? Were you filled with a sense of wonder and reverence when visiting a historic site? By capturing your emotions in words, you are able to evoke and relive those unforgettable moments while comprehending their impact.

- Express your personal connections in your journal. Share how you connected with the individuals you encountered during your journey. Write about the meaningful conversations you had, the friendships you formed, or the cultural exchanges that touched your heart. These personal connections and interactions leave a lasting impression and add depth to your travel journal.

- Reflect on your personal growth as a result of your travels. Travel provides unique opportunities for self-discovery and personal development. Contemplate how your experiences challenged you, pushed you out of your comfort zone, or broadened your perspectives. Write about the valuable lessons you learned and how you have grown as an individual. Reflecting on personal growth helps to further enrich your travel journal.

By prioritizing and focusing on impressions and emotions in your travel journal, you can create a comprehensive and meaningful record of your adventures. This record will effectively transport you back to those treasured moments whenever you revisit your journal.

Photos, Tickets, and Souvenirs

Photos, tickets, and souvenirs are important for travel journals to capture and preserve trip memories. Here are reasons why these items are valuable:

– Photos: Capture landscapes, views, and moments of travel. They serve as visual reminders of places and experiences.

– Tickets: Save tickets from attractions, museums, shows, or events attended during the trip. These tickets transport you back to the exact date and time of something new and exciting.

– Souvenirs: Physical mementos that evoke powerful memories of travel. They can be notes, postcards, shop receipts, or even food wrappers. Souvenirs remind you of the culture, traditions, and unique aspects of the destination.

By including photos, tickets, and souvenirs, you create a comprehensive record of your experiences. These items add depth and richness to your written descriptions , allowing you to relive your adventures more tangibly. Photos serve as visual aids to jog your memory and bring back specific details of each location visited. Similarly, tickets and souvenirs help recall specific events or attractions interacted with during the trip.

Tips for Effective Travel Journaling

Looking to up your travel journal game? Say goodbye to mundane travel entries and hello to captivating narratives that will transport you and your readers back to your adventures in a heartbeat. Ready to unleash your inner storyteller and create a travel journal that will truly stand the test of time?

Here are our top tips.

Write Regularly

To maximize your travel journal’s effectiveness, it is crucial to write regularly. By consistently recording your experiences, thoughts, and feelings, you can capture the essence of your travels and create a vibrant and meaningful record.

1. Set a schedule : Establish a routine for journaling, whether in the evening before bed or during breakfast each morning. By incorporating journaling into your daily routine, you ensure that you don’t forget to record important moments and details.

2. Make it a habit : Treat journaling as a regular practice, like brushing your teeth or exercising. By prioritizing journaling and making it a non-negotiable part of your day, you are more likely to write regularly and consistently – at home or away.

3. Write in the moment : Don’t wait too long before jotting down your experiences. Memories fade quickly, and by writing while the details are still fresh in your mind, you can capture the nuances and emotions of each adventure.

4. Keep it simple : You don’t need to write a lengthy essay every time you journal. Sometimes, a few sentences or bullet points can be enough to jog your memory and capture the essence of the moment. Focus on the key highlights and impressions that stand out to you.

5. Use prompts and writing techniques : If you’re feeling stuck, use prompts or writing techniques to stimulate your creativity. Try freewriting, list-making, or describing a specific sensory experience. This can help generate ideas and deepen your journal entries.

By writing regularly, you will cultivate a substantial collection of travel memories for future reflection. So, make it a habit, be consistent, and enjoy the process of documenting your adventures. Happy journaling!

Be Descriptive and Detailed

Keeping a travel journal requires being descriptive and detailed. This allows you to capture the essence of your travel experiences and create vivid memories. Besides sharing sensory descriptions and your emotions and responses , here are some tips to help you be descriptive and detailed in your travel journal:

1. Include colorful anecdotes : Share interesting stories, encounters, or observations that stood out to you during your travels. These anecdotes add depth and personality to your journal entries.

2. Add context : Provide background information about the places you visit. This can include historical facts, cultural traditions, or local customs. It helps create a richer understanding of the destinations you explore.

3. Use quotes and dialogue : Incorporate conversations you had with locals or fellow travelers, as well as any memorable quotes or phrases that resonated with you. This adds authenticity and liveliness to your journal.

Being descriptive and detailed in your travel journal creates a personal time capsule of your adventures . So, grab your journal, embrace your inner storyteller, and let your words transport you back to those incredible moments you experienced while traveling.

It can also enhance memory retention – writing about experiences in detail helps solidify memories and improve recall.

Keeping Your Travel Journal Safe

When it comes to keeping your travel journal safe, there are a couple of important considerations to keep in mind. With the increasing use of technology, finding the right methods for digital backup is crucial. Safeguarding your physical journals from loss or damage is also a key aspect of preserving your travel experiences.

Let’s explore the best practices for keeping your travel journal safe and secure!

Digital Backup

When it comes to keeping your travel journal safe and secure, digital backup is essential. Here are some options to protect your travel journal:

- Cloud Storage: Use Google Drive, Dropbox, or iCloud to upload digital copies of your travel journal. This way, even if you lose or damage your physical journal, you can always access your entries from any device with an internet connection.