Medicare Wellness Visits Back to MLN Print November 2023 Updates

What’s Changed?

- Added information about monthly chronic pain management and treatment services

- Added information about checking for cognitive impairment during annual wellness visits

- Added information about Social Determinants of Health Risk Assessments as an optional element of annual wellness visits

Quick Start

The Annual Wellness Visits video helps you understand these exams, as well as their purpose and claim submission requirements.

Medicare Physical Exam Coverage

Initial Preventive Physical Exam (IPPE)

Review of medical and social health history and preventive services education.

✔ New Medicare patients within 12 months of starting Part B coverage

✔ Patients pay nothing (if provider accepts assignment)

Annual Wellness Visit (AWV)

Visit to develop or update a personalized prevention plan and perform a health risk assessment.

✔ Covered once every 12 months

Routine Physical Exam

Exam performed without relationship to treatment or diagnosis of a specific illness, symptom, complaint, or injury.

✘ Medicare doesn’t cover a routine physical

✘ Patients pay 100% out-of-pocket

Together we can advance health equity and help eliminate health disparities for all minority and underserved groups. Find resources and more from the CMS Office of Minority Health :

- Health Equity Technical Assistance Program

- Disparities Impact Statement

Communication Avoids Confusion

As a health care provider, you may recommend that patients get services more often than we cover or that we don’t cover. If this happens, help patients understand they may have to pay some or all costs. Communication is key to ensuring patients understand why you’re recommending certain services and whether we cover them.

Initial Preventive Physical Exam

The initial preventive physical exam (IPPE), also known as the “Welcome to Medicare” preventive visit, promotes good health through disease prevention and detection. We pay for 1 IPPE per lifetime if it’s provided within the first 12 months after the patient’s Part B coverage starts.

1. Review the patient’s medical and social history

At a minimum, collect this information:

- Past medical and surgical history (illnesses, hospital stays, operations, allergies, injuries, and treatments)

- Current medications, supplements, and other substances the person may be using

- Family history (review the patient’s family and medical events, including hereditary conditions that place them at increased risk)

- Physical activities

- Social activities and engagement

- Alcohol, tobacco, and illegal drug use history

Learn information about Medicare’s substance use disorder (SUD) services coverage .

2. Review the patient’s potential depression risk factors

Depression risk factors include:

- Current or past experiences with depression

- Other mood disorders

Select from various standardized screening tools designed for this purpose and recognized by national professional medical organizations. APA’s Depression Assessment Instruments has more information.

3. Review the patient’s functional ability and safety level

Use direct patient observation, appropriate screening questions, or standardized questionnaires recognized by national professional medical organizations to review, at a minimum, the patient’s:

- Ability to perform activities of daily living (ADLs)

- Hearing impairment

- Home and community safety, including driving when appropriate

Medicare offers cognitive assessment and care plan services for patients who show signs of impairment.

- Height, weight, body mass index (BMI) (or waist circumference, if appropriate), blood pressure, balance, and gait

- Visual acuity screen

- Other factors deemed appropriate based on medical and social history and current clinical standards

5. End-of-life planning, upon patient agreement

End-of-life planning is verbal or written information you (their physician or practitioner) can offer the patient about:

- Their ability to prepare an advance directive in case an injury or illness prevents them from making their own health care decisions

- If you agree to follow their advance directive

- This includes psychiatric advance directives

6. Review current opioid prescriptions

For a patient with a current opioid prescription:

- Review any potential opioid use disorder (OUD) risk factors

- Evaluate their pain severity and current treatment plan

- Provide information about non-opiod treatment options

- Refer to a specialist, as appropriate

The HHS Pain Management Best Practices Inter-Agency Task Force Report has more information. Medicare now covers monthly chronic pain management and treatment services .

7. Screen for potential SUDs

Review the patient’s potential SUD risk factors, and as appropriate, refer them to treatment. You can use a screening tool, but it’s not required. The National Institute on Drug Abuse has screening and assessment tools. Implementing Drug and Alcohol Screening in Primary Care is a helpful resource .

8. Educate, counsel, and refer based on previous components

Based on the results of the review and evaluation services from the previous components, provide the patient with appropriate education, counseling, and referrals.

9. Educate, counsel, and refer for other preventive services

Include a brief written plan, like a checklist, for the patient to get:

- A once-in-a-lifetime screening electrocardiogram (ECG), as appropriate

- Appropriate screenings and other covered preventive services

Use these HCPCS codes to file IPPE and ECG screening claims:

Initial preventive physical examination; face-to-face visit, services limited to new beneficiary during the first 12 months of medicare enrollment

Electrocardiogram, routine ecg with 12 leads; performed as a screening for the initial preventive physical examination with interpretation and report

Electrocardiogram, routine ecg with 12 leads; tracing only, without interpretation and report, performed as a screening for the initial preventive physical examination

Electrocardiogram, routine ecg with 12 leads; interpretation and report only, performed as a screening for the initial preventive physical examination

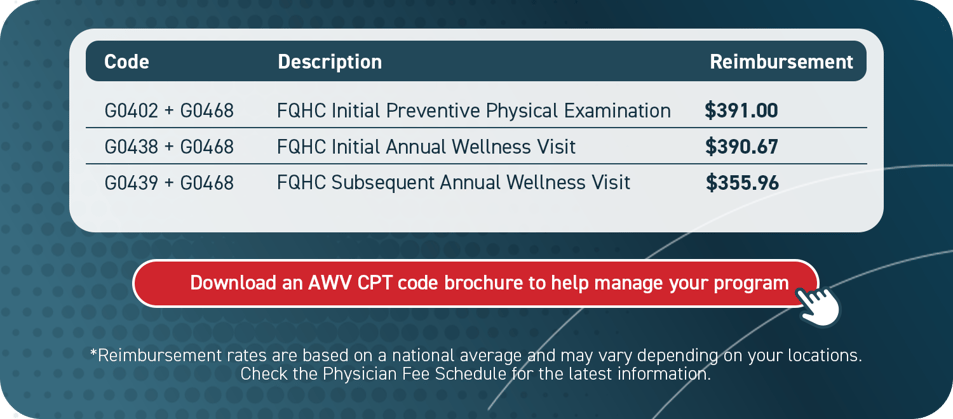

Federally qualified health center (fqhc) visit, ippe or awv; a fqhc visit that includes an initial preventive physical examination (ippe) or annual wellness visit (awv) and includes a typical bundle of medicare-covered services that would be furnished per diem to a patient receiving an ippe or awv

* Section 60.2 of the Medicare Claims Processing Manual, Chapter 9 has more information on how to bill HCPCS code G0468.

Report a diagnosis code when submitting IPPE claims. We don’t require you to use a specific IPPE diagnosis code, so you may choose any diagnosis code consistent with the patient’s exam.

Part B covers an IPPE when performed by a:

- Physician (doctor of medicine or osteopathy)

- Qualified non-physician practitioner (physician assistant, nurse practitioner, or certified clinical nurse specialist)

When you provide an IPPE and a significant, separately identifiable, medically necessary evaluation and management (E/M) service, we may pay for the additional service. Report the additional CPT code (99202–99205, 99211–99215) with modifier 25. That portion of the visit must be medically necessary and reasonable to treat the patient’s illness or injury or to improve the functioning of a malformed body part.

CPT only copyright 2022 American Medical Association. All rights reserved.

IPPE Resources

- 42 CFR 410.16

- Section 30.6.1.1 of the Medicare Claims Processing Manual, Chapter 12

- Section 80 of the Medicare Claims Processing Manual, Chapter 18

- U.S. Preventive Services Task Force Recommendations

No. The IPPE isn’t a routine physical that some patients may get periodically from their physician or other qualified non-physician practitioner (NPP). The IPPE is an introduction to Medicare and covered benefits, and it focuses on health promotion, disease prevention, and detection to help patients stay well. We encourage providers to inform patients about the AWV during their IPPE. The Social Security Act explicitly prohibits Medicare coverage of routine physical exams.

No. The IPPE and AWV don’t include clinical lab tests, but you may make appropriate referrals for these tests as part of the IPPE or AWV.

No. We waive the coinsurance, copayment, and Part B deductible for the IPPE (HCPCS code G0402). Neither is waived for the screening electrocardiogram (ECG) (HCPCS codes G0403, G0404, or G0405).

A patient who hasn’t had an IPPE and whose Part B enrollment began in 2023 can get an IPPE in 2024 if it’s within 12 months of the patient’s Part B enrollment effective date.

We suggest providers check with their MAC for available options to verify patient eligibility. If you have questions, find your MAC’s website .

Annual Wellness Visit Health Risk Assessment

The annual wellness visit (AWV) includes a health risk assessment (HRA). View the HRA minimum elements summary below. A Framework for Patient-Centered Health Risk Assessments has more information, including a sample HRA.

Perform an HRA

- You or the patient can update the HRA before or during the AWV

- Consider the best way to communicate with underserved populations, people who speak different languages, people with varying health literacy, and people with disabilities

- Demographic data

- Health status self-assessment

- Psychosocial risks, including, but not limited to, depression, life satisfaction, stress, anger, loneliness or social isolation, pain, suicidality, and fatigue

- Behavioral risks, including, but not limited to, tobacco use, physical activity, nutrition and oral health, alcohol consumption, sexual health, motor vehicle safety (for example, seat belt use), and home safety

- Activities of daily living (ADLs), including dressing, feeding, toileting, and grooming; physical ambulation, including balance or fall risks and bathing; and instrumental ADLs (IADLs), including using the phone, housekeeping, laundry, transportation, shopping, managing medications, and handling finances

1. Establish the patient’s medical and family history

At a minimum, document:

- Medical events of the patient’s parents, siblings, and children, including hereditary conditions that place them at increased risk

- Use of, or exposure to, medications, supplements, and other substances the person may be using

2. Establish a current providers and suppliers list

Include current patient providers and suppliers that regularly provide medical care, including behavioral health care.

- Height, weight, body mass index (BMI) (or waist circumference, if appropriate), and blood pressure

- Other routine measurements deemed appropriate based on medical and family history

4. Detect any cognitive impairments the patient may have

Check for cognitive impairment as part of the first AWV.

Assess cognitive function by direct observation or reported observations from the patient, family, friends, caregivers, and others. Consider using brief cognitive tests, health disparities, chronic conditions, and other factors that contribute to increased cognitive impairment risk. Alzheimer’s and Related Dementia Resources for Professionals has more information.

5. Review the patient’s potential depression risk factors

6. Review the patient’s functional ability and level of safety

- Ability to perform ADLs

7. Establish an appropriate patient written screening schedule

Base the written screening schedule on the:

- Checklist for the next 5–10 years

- United States Preventive Services Task Force and Advisory Committee on Immunization Practices (ACIP) recommendations

- Patient’s HRA, health status and screening history, and age-appropriate preventive services we cover

8. Establish the patient’s list of risk factors and conditions

- A recommendation for primary, secondary, or tertiary interventions or report whether they’re underway

- Mental health conditions, including depression, substance use disorders , suicidality, and cognitive impairments

- IPPE risk factors or identified conditions

- Treatment options and associated risks and benefits

9. Provide personalized patient health advice and appropriate referrals to health education or preventive counseling services or programs

Include referrals to educational and counseling services or programs aimed at:

- Fall prevention

- Physical activity

- Tobacco-use cessation

- Social engagement

- Weight loss

10. Provide advance care planning (ACP) services at the patient’s discretion

ACP is a discussion between you and the patient about:

- Preparing an advance directive in case an injury or illness prevents them from making their own health care decisions

- Future care decisions they might need or want to make

- How they can let others know about their care preferences

- Caregiver identification

- Advance directive elements, which may involve completing standard forms

Advance directive is a general term that refers to various documents, like a living will, instruction directive, health care proxy, psychiatric advance directive, or health care power of attorney. It’s a document that appoints an agent or records a person’s wishes about their medical treatment at a future time when the individual can’t communicate for themselves. The Advance Care Planning fact sheet has more information.

We don’t limit how many times the patient can revisit the ACP during the year, but cost sharing applies outside the AWV.

11. Review current opioid prescriptions

- Review any potential OUD risk factors

- Provide information about non-opioid treatment options

12. Screen for potential SUDs

Review the patient’s potential SUD risk factors, and as appropriate, refer them for treatment. You can use a screening tool, but it’s not required. The National Institute on Drug Abuse has screening and assessment tools. Implementing Drug and Alcohol Screening in Primary Care is a helpful resource .

13. Social Determinants of Health (SDOH) Risk Assessment

Starting in 2024, Medicare includes an optional SDOH Risk Assessment as part of the AWV. This assessment must follow standardized, evidence-based practices and ensure communication aligns with the patient’s educational, developmental, and health literacy level, as well as being culturally and linguistically appropriate.

1. Review and update the HRA

2. Update the patient’s medical and family history

At a minimum, document updates to:

3. Update current providers and suppliers list

Include current patient providers and suppliers that regularly provide medical care, including those added because of the first AWV personalized prevention plan services (PPPS), and any behavioral health providers.

- Weight (or waist circumference, if appropriate) and blood pressure

5. Detect any cognitive impairments patients may have

Check for cognitive impairment as part of the subsequent AWV.

6. Update the patient’s written screening schedule

Base written screening schedule on the:

7. Update the patient’s list of risk factors and conditions

- Mental health conditions, including depression, substance use disorders , and cognitive impairments

- Risk factors or identified conditions

8. As necessary, provide and update patient PPPS, including personalized health advice and appropriate referrals to health education or preventive counseling services or programs

9. Provide advance care planning (ACP) services at the patient’s discretion

10. Review current opioid prescriptions

11. Screen for potential substance use disorders (SUDs)

12. Social Determinants of Health (SDOH) Risk Assessment

Preparing Eligible Patients for their AWV

Help eligible patients prepare for their AWV by encouraging them to bring this information to their appointment:

- Medical records, including immunization records

- Detailed family health history

- Full list of medications and supplements, including calcium and vitamins, and how often and how much of each they take

- Full list of current providers and suppliers involved in their care, including community-based providers (for example, personal care, adult day care, and home-delivered meals), and behavioral health specialists

Use these HCPCS codes to file AWV claims:

Annual wellness visit; includes a personalized prevention plan of service (pps), initial visit

Annual wellness visit, includes a personalized prevention plan of service (pps), subsequent visit

Report a diagnosis code when submitting AWV claims. We don’t require you to use a specific AWV diagnosis code, so you may choose any diagnosis code consistent with the patient’s exam.

Part B covers an AWV if performed by a:

- Medical professional (including health educator, registered dietitian, nutrition professional, or other licensed practitioner) or a team of medical professionals directly supervised by a physician

When you provide an AWV and a significant, separately identifiable, medically necessary evaluation and management (E/M) service, we may pay for the additional service. Report the additional CPT code (99202–99205, 99211–99215) with modifier 25. That portion of the visit must be medically necessary and reasonable to treat the patient’s illness or injury or to improve the functioning of a malformed body part.

You can only bill G0438 or G0439 once in a 12-month period. G0438 is for the first AWV, and G0439 is for subsequent AWVs. Don’t bill G0438 or G0439 within 12 months of a previous G0402 (IPPE) billing for the same patient. We deny these claims with messages indicating the patient reached the benefit maximum for the time period.

Medicare telehealth includes HCPCS codes G0438 and G0439.

ACP is the face-to-face conversation between a physician (or other qualified health care professional) and a patient to discuss their health care wishes and medical treatment preferences if they become unable to communicate or make decisions about their care. At the patient’s discretion, you can provide the ACP during the AWV.

Use these CPT codes to file ACP claims as an optional AWV element:

Advance care planning including the explanation and discussion of advance directives such as standard forms (with completion of such forms, when performed), by the physician or other qualified health care professional; first 30 minutes, face-to-face with the patient, family member(s), and/or surrogate

Advance care planning including the explanation and discussion of advance directives such as standard forms (with completion of such forms, when performed), by the physician or other qualified health care professional; each additional 30 minutes (List separately in addition to code for primary procedure)

Report a diagnosis code when submitting an ACP claim as an optional AWV element. We don’t require you to use a specific ACP diagnosis code as an optional AWV element, so you may choose any diagnosis code consistent with a patient’s exam.

We waive both the Part B ACP coinsurance and deductible when it’s:

- Provided on the same day as the covered AWV

- Provided by the same provider as the covered AWV

- Billed with modifier 33 (Preventive Service)

- Billed on the same claim as the AWV

We waive the ACP deductible and coinsurance once per year when billed with the AWV. If we deny the AWV billed with ACP for exceeding the once-per-year limit, we’ll apply the ACP deductible and coinsurance .

We apply the deductible and coinsurance when you deliver the ACP outside the covered AWV. There are no limits on the number of times you can report ACP for a certain patient in a certain period. When billing this service multiple times, document changes in the patient’s health status or wishes about their end-of-life care.

SDOH is important in assessing patient histories; in assessing patient risk; and in guiding medical decision making, prevention, diagnosis, care, and treatment. In the CY 2024 Medicare Physician Fee Schedule final rule , we added a new SDOH Risk Assessment as an optional, additional element of the AWV. At both yours and the patient’s discretion, you may conduct the SDOH Risk Assessment during the AWV.

Use this HCPCS code to file SDOH Risk Assessment claims as an optional AWV element:

Administration of a standardized, evidence-based social determinants of health risk assessment tool, 5-15 minutes

Report a diagnosis code when submitting an SDOH Risk Assessment claim as an optional AWV element. We don’t require you to use a specific SDOH Risk Assessment diagnosis code as an optional AWV element, so you may choose any diagnosis code consistent with a patient’s exam.

The implementation date for SDOH Risk Assessment claims is July 1, 2024. We waive both the Part B SDOH Risk Assessment coinsurance and deductible when it’s:

We waive the SDOH Risk Assessment deductible and coinsurance once per year when billed with the AWV.

If we deny the AWV billed with SDOH Risk Assessment for exceeding the once-per-year limit, we’ll apply the deductible and coinsurance. We also apply the deductible and coinsurance when you deliver the SDOH Risk Assessment outside the covered AWV.

AWV Resources

- 42 CFR 410.15

- Section 140 of the Medicare Claims Processing Manual, Chapter 18

No. The AWV isn’t a routine physical some patients may get periodically from their physician or other qualified NPP. We don’t cover routine physical exams.

No. We waive the coinsurance, copayment, and Part B deductible for the AWV.

We cover an AWV for all patients who’ve had Medicare coverage for longer than 12 months after their first Part B eligibility date and who didn’t have an IPPE or AWV within those past 12 months. We cover only 1 IPPE per patient per lifetime and 1 additional AWV every 12 months after the date of the patient’s last AWV (or IPPE). Check eligibility to find when a patient is eligible for their next preventive service.

Generally, you may provide other medically necessary services on the same date as an AWV. The deductible and coinsurance or copayment applies for these other medically necessary and reasonable services.

You have different options for accessing AWV eligibility information depending on where you practice. Check eligibility to find when a patient is eligible for their next preventive service. Find your MAC’s website if you have specific patient eligibility questions.

Know the Differences

An IPPE is a review of a patient’s medical and social health history and includes education about other preventive services .

- We cover 1 IPPE per lifetime for patients within the first 12 months after their Part B benefits eligibility date

- We pay IPPE costs if the provider accepts assignment

An AWV is a review of a patient’s personalized prevention plan of services and includes a health risk assessment.

- We cover an annual AWV for patients who aren’t within the first 12 months after their Part B benefits eligibility date

- We cover an annual AWV 12 months after the last AWV’s (or IPPE’s) date of service

- We pay AWV costs if the provider accepts assignment

A routine physical is an exam performed without relationship to treatment or diagnosis for a specific illness, symptom, complaint, or injury.

- We don’t cover routine physical exams, but the IPPE, AWV, or other Medicare benefits cover some routine physical elements

- Patients pay 100% out of pocket

View the Medicare Learning Network® Content Disclaimer and Department of Health & Human Services Disclosure .

The Medicare Learning Network®, MLN Connects®, and MLN Matters® are registered trademarks of the U.S. Department of Health & Human Services (HHS).

CPT codes, descriptions and other data only are copyright 2022 American Medical Association. All Rights Reserved. Applicable FARS/HHSARS apply. Fee schedules, relative value units, conversion factors and/or related components are not assigned by the AMA, are not part of CPT, and the AMA is not recommending their use. The AMA does not directly or indirectly practice medicine or dispense medical services. The AMA assumes no liability for data contained or not contained herein.

Working with us

Existing health care professionals, patient care programs & quality assurance.

- Medicare resources

Patient's mental health

Education, trainings and manuals, regulations, news and insights, annual wellness visit (awv) documentation and coding.

A Medicare Annual Wellness Visit (AWV) is not a typical physical exam. Rather, it’s an opportunity to promote quality, proactive, cost-effective care. AWVs help you engage with your patients and increase revenue.

A physician, PA, NP, certified clinical nurse specialist or a medical professional under the direct supervision of a physician (including health educators, registered dietitians and other licensed practitioners) can perform AWVs.

AWV documentation

Document all diagnoses and conditions to accurately reflect severity of illness and risk of high-cost care.

An ICD-10 Z code is the first diagnosis code to list for wellness exams to ensure that member financial responsibility is $0.

- Z00.00 — encounter for general adult medical examination without abnormal findings

- Z00.01 — encounter for general adult medical examination with abnormal findings

The two CPT® codes used to report AWV services are:*

- G0438 — initial visit**

- G0439 — subsequent visit (no lifetime limits)

Additional services (lab, X-rays, etc.) ordered during an AWV may be applied toward the patient’s

deductible and/or be subject to coinsurance. Before performing additional services, discuss them

with the patient to verify that the patient understands their financial responsibilities.

More information

For additional information and education, contact us at [email protected] .

*CPT® is a registered trademark of the American Medical Association.

**Code G0438 is for the first AWV only. The submission of G0438 for a beneficiary for which a claim code of G0438 has already been paid will result in a denial.

Legal notices

Aetna is the brand name used for products and services provided by one or more of the Aetna group of companies, including Aetna Life Insurance Company and its affiliates (Aetna).

Health benefits and health insurance plans contain exclusions and limitations.

Also of interest:

You are now being directed to the AMA site

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its affiliated companies are not responsible or liable for the content, accuracy or privacy practices of linked sites, or for products or services described on these sites.

You are now being directed to the Give an Hour site

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its affiliated companies are not responsible or liable for the content, accuracy or privacy practices of linked sites, or for products or services described on these sites.

You are now being directed to the CVS Pharmacy® site

You are now being directed to the cdc site.

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its its affiliated companies are not responsible or liable for the content, accuracy or privacy practices of linked sites, or for products or services described on these sites.

Aetna® is proud to be part of the CVS Health family.

You are now being directed to the CVS Health site.

You are now being directed to the Apple.com COVID-19 Screening Tool

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its affiliated companies are not responsible or liable for the content, accuracy, or privacy practices of linked sites, or for products or services described on these sites.

You are now being directed to the US Department of Health and Human Services site

You are now being directed to the cvs health covid-19 testing site, you are now being directed to the fight is in us site.

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its affiliated companies are not responsible or liable for the content, accuracy, or privacy practices of linked sites, or for products or services described on these sites.

You are now leaving the Aetna® website

Please log in to your secure account to get what you need.

You are now leaving the Aetna Medicare website.

The information you will be accessing is provided by another organization or vendor. If you do not intend to leave our site, close this message.

Get a link to download the app

Just enter your mobile number and we’ll text you a link to download the Aetna Health℠ app from the App Store or on Google Play.

Message and data rates may apply*

This search uses the five-tier version of this plan

Each main plan type has more than one subtype. Some subtypes have five tiers of coverage. Others have four tiers, three tiers or two tiers. This search will use the five-tier subtype. It will show you whether a drug is covered or not covered, but the tier information may not be the same as it is for your specific plan. Do you want to continue?

Applied Behavior Analysis Medical Necessity Guide

By clicking on “I Accept”, I acknowledge and accept that:

The Applied Behavior Analysis (ABA) Medical Necessity Guide helps determine appropriate (medically necessary) levels and types of care for patients in need of evaluation and treatment for behavioral health conditions. The ABA Medical Necessity Guide does not constitute medical advice. Treating providers are solely responsible for medical advice and treatment of members. Members should discuss any matters related to their coverage or condition with their treating provider.

Each benefit plan defines which services are covered, which are excluded, and which are subject to dollar caps or other limits. Members and their providers will need to consult the member's benefit plan to determine if there are any exclusions or other benefit limitations applicable to this service or supply.

The conclusion that a particular service or supply is medically necessary does not constitute a representation or warranty that this service or supply is covered (i.e., will be paid for by Aetna) for a particular member. The member's benefit plan determines coverage. Some plans exclude coverage for services or supplies that Aetna considers medically necessary.

Please note also that the ABA Medical Necessity Guide may be updated and are, therefore, subject to change.

Medical necessity determinations in connection with coverage decisions are made on a case-by-case basis. In the event that a member disagrees with a coverage determination, member may be eligible for the right to an internal appeal and/or an independent external appeal in accordance with applicable federal or state law.

Aetna® is proud to be part of the CVS® family.

You are now being directed to CVS Caremark ® site.

ASAM Terms and conditions

By clicking on “I accept”, I acknowledge and accept that:

Licensee's use and interpretation of the American Society of Addiction Medicine’s ASAM Criteria for Addictive, Substance-Related, and Co-Occurring Conditions does not imply that the American Society of Addiction Medicine has either participated in or concurs with the disposition of a claim for benefits.

This excerpt is provided for use in connection with the review of a claim for benefits and may not be reproduced or used for any other purpose.

Copyright 2015 by the American Society of Addiction Medicine. Reprinted with permission. No third party may copy this document in whole or in part in any format or medium without the prior written consent of ASAM.

Precertification lists

Should the following terms and conditions be acceptable to you, please indicate your agreement and acceptance by selecting the button below labeled "I Accept".

- The term precertification here means the utilization review process to determine whether the requested service, procedure, prescription drug or medical device meets the company's clinical criteria for coverage. It does not mean precertification as defined by Texas law, as a reliable representation of payment of care or services to fully insured HMO and PPO members.

- Applies to: Aetna Choice ® POS, Aetna Choice POS II, Aetna Medicare ℠ Plan (PPO), Aetna Medicare Plan (HMO), all Aetna HealthFund ® products, Aetna Health Network Only ℠ , Aetna Health Network Option ℠ , Aetna Open Access ® Elect Choice ® , Aetna Open Access HMO, Aetna Open Access Managed Choice ® , Open Access Aetna Select ℠ , Elect Choice, HMO, Managed Choice POS, Open Choice ® , Quality Point-of-Service ® (QPOS ® ), and Aetna Select ℠ benefits plans and all products that may include the Aexcel ® , Choose and Save ℠ , Aetna Performance Network or Savings Plus networks. Not all plans are offered in all service areas.

- All services deemed "never effective" are excluded from coverage. Aetna defines a service as "never effective" when it is not recognized according to professional standards of safety and effectiveness in the United States for diagnosis, care or treatment. Visit the secure website, available through www.aetna.com, for more information. Click on "Claims," "CPT/HCPCS Coding Tool," "Clinical Policy Code Search."

- The five character codes included in the Aetna Precertification Code Search Tool are obtained from Current Procedural Terminology (CPT ® ), copyright 2023 by the American Medical Association (AMA). CPT is developed by the AMA as a listing of descriptive terms and five character identifying codes and modifiers for reporting medical services and procedures performed by physicians.

- The responsibility for the content of Aetna Precertification Code Search Tool is with Aetna and no endorsement by the AMA is intended or should be implied. The AMA disclaims responsibility for any consequences or liability attributable or related to any use, nonuse or interpretation of information contained in Aetna Precertification Code Search Tool. No fee schedules, basic unit values, relative value guides, conversion factors or scales are included in any part of CPT. Any use of CPT outside of Aetna Precertification Code Search Tool should refer to the most Current Procedural Terminology which contains the complete and most current listing of CPT codes and descriptive terms. Applicable FARS/DFARS apply.

LICENSE FOR USE OF CURRENT PROCEDURAL TERMINOLOGY, FOURTH EDITION ("CPT ® ")

- CPT only Copyright 2023 American Medical Association. All Rights Reserved. CPT is a registered trademark of the American Medical Association. You, your employees and agents are authorized to use CPT only as contained in Aetna Precertification Code Search Tool solely for your own personal use in directly participating in health care programs administered by Aetna, Inc. You acknowledge that AMA holds all copyright, trademark and other rights in CPT. Any use not authorized herein is prohibited, including by way of illustration and not by way of limitation, making copies of CPT for resale and/or license, transferring copies of CPT to any party not bound by this agreement, creating any modified or derivative work of CPT, or making any commercial use of CPT. License to sue CPT for any use not authorized herein must be obtained through the American Medical Association, CPT Intellectual Property Services, 515 N. State Street, Chicago, Illinois 60610. Applications are available at the American Medical Association Web site, www.ama-assn.org/go/cpt.

U.S. Government Rights

This product includes CPT which is commercial technical data and/or computer data bases and/or commercial computer software and/or commercial computer software documentation, as applicable which were developed exclusively at private expense by the American Medical Association, 515 North State Street, Chicago, Illinois, 60610. U.S. Government rights to use, modify, reproduce, release, perform, display, or disclose these technical data and/or computer data bases and/or computer software and/or computer software documentation are subject to the limited rights restrictions of DFARS 252.227-7015(b)(2) (June 1995) and/or subject to the restrictions of DFARS 227.7202-1(a) (June 1995) and DFARS 227.7202-3(a) (June 1995), as applicable for U.S. Department of Defense procurements and the limited rights restrictions of FAR 52.227-14 (June 1987) and/or subject to the restricted rights provisions of FAR 52.227-14 (June 1987) and FAR 52.227-19 (June 1987), as applicable, and any applicable agency FAR Supplements, for non-Department of Defense Federal procurements.

Disclaimer of Warranties and Liabilities.

CPT is provided "as is" without warranty of any kind, either expressed or implied, including but not limited to the implied warranties of merchantability and fitness for a particular purpose. No fee schedules, basic unit, relative values or related listings are included in CPT. The American Medical Association (AMA) does not directly or indirectly practice medicine or dispense medical services. The responsibility for the content of this product is with Aetna, Inc. and no endorsement by the AMA is intended or implied. The AMA disclaims responsibility for any consequences or liability attributable to or related to any use, non-use, or interpretation of information contained or not contained in this product.

This Agreement will terminate upon notice if you violate its terms. The AMA is a third party beneficiary to this Agreement.

Should the foregoing terms and conditions be acceptable to you, please indicate your agreement and acceptance by selecting the button labeled "I Accept".

The information contained on this website and the products outlined here may not reflect product design or product availability in Arizona. Therefore, Arizona residents, members, employers and brokers must contact Aetna directly or their employers for information regarding Aetna products and services.

This information is neither an offer of coverage nor medical advice. It is only a partial, general description of plan or program benefits and does not constitute a contract. In case of a conflict between your plan documents and this information, the plan documents will govern.

Dental clinical policy bulletins

- Aetna Dental Clinical Policy Bulletins (DCPBs) are developed to assist in administering plan benefits and do not constitute dental advice. Treating providers are solely responsible for dental advice and treatment of members. Members should discuss any Dental Clinical Policy Bulletin (DCPB) related to their coverage or condition with their treating provider.

- While the Dental Clinical Policy Bulletins (DCPBs) are developed to assist in administering plan benefits, they do not constitute a description of plan benefits. The Dental Clinical Policy Bulletins (DCPBs) describe Aetna's current determinations of whether certain services or supplies are medically necessary, based upon a review of available clinical information. Each benefit plan defines which services are covered, which are excluded, and which are subject to dollar caps or other limits. Members and their providers will need to consult the member's benefit plan to determine if there are any exclusions or other benefit limitations applicable to this service or supply. Aetna's conclusion that a particular service or supply is medically necessary does not constitute a representation or warranty that this service or supply is covered (i.e., will be paid for by Aetna). Your benefits plan determines coverage. Some plans exclude coverage for services or supplies that Aetna considers medically necessary. If there is a discrepancy between this policy and a member's plan of benefits, the benefits plan will govern. In addition, coverage may be mandated by applicable legal requirements of a State or the Federal government.

- Please note also that Dental Clinical Policy Bulletins (DCPBs) are regularly updated and are therefore subject to change.

- Since Dental Clinical Policy Bulletins (DCPBs) can be highly technical and are designed to be used by our professional staff in making clinical determinations in connection with coverage decisions, members should review these Bulletins with their providers so they may fully understand our policies.

- Under certain plans, if more than one service can be used to treat a covered person's dental condition, Aetna may decide to authorize coverage only for a less costly covered service provided that certain terms are met.

Medical clinical policy bulletins

- Aetna Clinical Policy Bulletins (CPBs) are developed to assist in administering plan benefits and do not constitute medical advice. Treating providers are solely responsible for medical advice and treatment of members. Members should discuss any Clinical Policy Bulletin (CPB) related to their coverage or condition with their treating provider.

- While the Clinical Policy Bulletins (CPBs) are developed to assist in administering plan benefits, they do not constitute a description of plan benefits. The Clinical Policy Bulletins (CPBs) express Aetna's determination of whether certain services or supplies are medically necessary, experimental and investigational, or cosmetic. Aetna has reached these conclusions based upon a review of currently available clinical information (including clinical outcome studies in the peer-reviewed published medical literature, regulatory status of the technology, evidence-based guidelines of public health and health research agencies, evidence-based guidelines and positions of leading national health professional organizations, views of physicians practicing in relevant clinical areas, and other relevant factors).

- Aetna makes no representations and accepts no liability with respect to the content of any external information cited or relied upon in the Clinical Policy Bulletins (CPBs). The discussion, analysis, conclusions and positions reflected in the Clinical Policy Bulletins (CPBs), including any reference to a specific provider, product, process or service by name, trademark, manufacturer, constitute Aetna's opinion and are made without any intent to defame. Aetna expressly reserves the right to revise these conclusions as clinical information changes, and welcomes further relevant information including correction of any factual error.

- CPBs include references to standard HIPAA compliant code sets to assist with search functions and to facilitate billing and payment for covered services. New and revised codes are added to the CPBs as they are updated. When billing, you must use the most appropriate code as of the effective date of the submission. Unlisted, unspecified and nonspecific codes should be avoided.

- Each benefit plan defines which services are covered, which are excluded, and which are subject to dollar caps or other limits. Members and their providers will need to consult the member's benefit plan to determine if there are any exclusions or other benefit limitations applicable to this service or supply. The conclusion that a particular service or supply is medically necessary does not constitute a representation or warranty that this service or supply is covered (i.e., will be paid for by Aetna) for a particular member. The member's benefit plan determines coverage. Some plans exclude coverage for services or supplies that Aetna considers medically necessary. If there is a discrepancy between a Clinical Policy Bulletin (CPB) and a member's plan of benefits, the benefits plan will govern.

- In addition, coverage may be mandated by applicable legal requirements of a State, the Federal government or CMS for Medicare and Medicaid members.

See CMS's Medicare Coverage Center

- Please note also that Clinical Policy Bulletins (CPBs) are regularly updated and are therefore subject to change.

- Since Clinical Policy Bulletins (CPBs) can be highly technical and are designed to be used by our professional staff in making clinical determinations in connection with coverage decisions, members should review these Bulletins with their providers so they may fully understand our policies.

- While Clinical Policy Bulletins (CPBs) define Aetna's clinical policy, medical necessity determinations in connection with coverage decisions are made on a case by case basis. In the event that a member disagrees with a coverage determination, Aetna provides its members with the right to appeal the decision. In addition, a member may have an opportunity for an independent external review of coverage denials based on medical necessity or regarding the experimental and investigational status when the service or supply in question for which the member is financially responsible is $500 or greater. However, applicable state mandates will take precedence with respect to fully insured plans and self-funded non-ERISA (e.g., government, school boards, church) plans.

See Aetna's External Review Program

- The five character codes included in the Aetna Clinical Policy Bulletins (CPBs) are obtained from Current Procedural Terminology (CPT®), copyright 2015 by the American Medical Association (AMA). CPT is developed by the AMA as a listing of descriptive terms and five character identifying codes and modifiers for reporting medical services and procedures performed by physicians.

- The responsibility for the content of Aetna Clinical Policy Bulletins (CPBs) is with Aetna and no endorsement by the AMA is intended or should be implied. The AMA disclaims responsibility for any consequences or liability attributable or related to any use, nonuse or interpretation of information contained in Aetna Clinical Policy Bulletins (CPBs). No fee schedules, basic unit values, relative value guides, conversion factors or scales are included in any part of CPT. Any use of CPT outside of Aetna Clinical Policy Bulletins (CPBs) should refer to the most current Current Procedural Terminology which contains the complete and most current listing of CPT codes and descriptive terms. Applicable FARS/DFARS apply.

LICENSE FOR USE OF CURRENT PROCEDURAL TERMINOLOGY, FOURTH EDITION ("CPT®")

CPT only copyright 2015 American Medical Association. All Rights Reserved. CPT is a registered trademark of the American Medical Association.

You, your employees and agents are authorized to use CPT only as contained in Aetna Clinical Policy Bulletins (CPBs) solely for your own personal use in directly participating in healthcare programs administered by Aetna, Inc. You acknowledge that AMA holds all copyright, trademark and other rights in CPT.

Any use not authorized herein is prohibited, including by way of illustration and not by way of limitation, making copies of CPT for resale and/or license, transferring copies of CPT to any party not bound by this agreement, creating any modified or derivative work of CPT, or making any commercial use of CPT. License to use CPT for any use not authorized herein must be obtained through the American Medical Association, CPT Intellectual Property Services, 515 N. State Street, Chicago, Illinois 60610. Applications are available at the American Medical Association Web site, www.ama-assn.org/go/cpt.

Go to the American Medical Association Web site

You are now leaving the Aetna® website.

We're working with 3Won to process your request for participation. Please select "Continue to ProVault to begin the contracting and credentialing process.

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its affiliates are not responsible or liable for the content, accuracy or privacy practices of linked sites, or for products or services described on these sites.

FOR 20% OFF CVS HEALTH BRAND PRODUCTS:

Excludes sale and promo items, alcohol, prescriptions and copays, pseudoephedrine/ephedrine products, pre-paid, gift cards, and items reimbursed by any health plan. Not combinable with other offers. 20% discount is not valid on other CVS brands such as CVS Pharmacy, Beauty 360®, CVS, Gold Emblem® or Gold Emblem abound®. CVS reserves the right to apply the 20% discounts to qualifying items in any order within the transaction. For in-store use only.

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its subsidiary companies are not responsible or liable for the content, accuracy, or privacy practices of linked sites, or for products or services described on these sites.

Healthcare.gov

For a complete list of participating walk-in clinics, use our provider lookup. Walk in appointments are based on availability and not guaranteed. Online scheduling is recommended. Includes select MinuteClinic services. Not all MinuteClinic services are covered. Please consult benefit documents to confirm which services are included. Members enrolled in qualified high deductible health plans must meet their deductible before receiving covered non preventative MinuteClinic services at no cost share. However, such services are covered at negotiated contract rates. This benefit is not available in all states.

Talk to an Expert

- CCM for Primary Care

- CCM for Specialties

- CCM for RHCs

- CCM for FQHCs

- Annual Wellness Visits

- RPM Enrollment Service

- Quality Improvement Services

- Press Releases

- White Papers

- Case Studies

- About ChartSpan

- Join Our Team

- For Patients

Talk with a ChartSpan Representative Today!

Our team is ready to help you improve patient care and outcomes.

Explore by Topic

- Chronic Care Management

- Annual Wellness Visit

- Remote Patient Monitoring Enrollment As a Service (RPM EaaS)

- MIPS & Quality Improvement

Explore by Type

- Research & Education

- Patient Stories

- White Paper

CPT Codes for Annual Wellness Visits

Annual Wellness Visits (AWV) are a type of preventive care for Medicare patients. There are many benefits to implementing this type of program, such as improving patient outcomes and filling in gaps in care. However, you must understand the CPT billing codes to ensure your claims are not denied and help drive revenue at your organization.

What Is the CPT Code for Annual Wellness Visits?

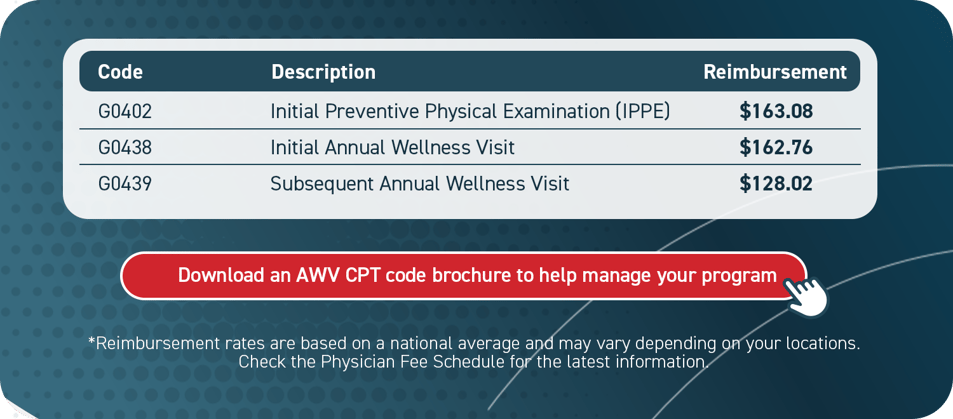

There are generally three codes associated with Annual Wellness Visits representing distinct phases in AWV programs:

- G0402: This code applies to the Welcome to Medicare visit — also referred to as an Initial Preventive Physical Exam (IPPE). This exam is not an Annual Wellness Visit, but it is valuable for understanding the framework of an AWV program. A patient is only eligible for the first 12 months they are enrolled in Medicare. This one-time visit focuses on gaining a general understanding of health with a vision screen, vital measurements and other assessments. This code will be rejected if you apply it after the 12-month mark of enrollment.

- G0438: After 12 months of being enrolled in Medicare, a patient becomes eligible for their initial Annual Wellness Visit. If a patient completes an IPPE, they are permitted to use this initial visit on the first day of the same calendar month the next year. When a patient does not complete IPPE, this code will apply any time after the 12-month mark.

- G0439: You must use this code for all Annual Wellness Visits following the initial one. Among the AWV codes, this is the last one you will use, and it's the only one you will use repeatedly.

There are various factors that define an Annual Wellness Visit. There are even differentiators between the initial AWV and all subsequent AWVs. However, you should first make sure you understand the difference between an Annual Wellness Visit and an annual physical .

Requirements and Components for Billing AWV

The requirements and components for an AWV vary based on whether you apply G0438 or G0439.

The G0438 requirements include:

- A Health Risk Assessment (HRA)

- Medical and family history

- List of current providers involved in the patient's health

- Cognitive function assessment

- Blood pressure, height, weight, body mass index and other appropriate measurements

- Risk factors for depression

- Functional ability and safety assessment

- Screening schedule creation

- Risk factors and conditions

- Personalized health advice

- Advance Care Planning, if desired

The G0439 requirements involve updating all of the above factors. Additionally, the patient must not have received an Annual Wellness Visit in the last 12 months.

Who Can Bill AWV Codes?

Unlike some other billing codes under CMS, Annual Wellness Visit billing does have some flexibility. Practices do not need to hire additional staff for their AWV program, and physicians do not have to be the only professionals involved. Rather than assigning specific tasks and responsibilities to different team members, CMS allows for AWV coverage with any of the following individuals:

- A physician

- A physician assistant (PA)

- A nurse practitioner (NP)

- A certified clinical nurse specialist (CNS)

- A medical professional or team under a physician's supervision, such as registered dieticians or health educators

AWV billing is also not limited to primary care providers. Select specialty practices can bill for AWVs, such as neurology and cardiology. Regardless of who bills the AWV with CMS, a person is only permitted to receive one AWV per year. For instance, a cardiologist cannot bill for an AWV two months after a primary care provider did — the claim will be denied.

It's not unusual for Medicare patients to see one or more specialists, which can lead to AWV billing conflict. Having a real-time system in place to check eligibility can be a major advantage to all care providers.

Additional AWV Codes

At ChartSpan, we provide eligibility checks for G0438 and G0439 — the core codes for Annual Wellness Visits. However, some AWVs may involve additional codes depending on a patient's needs. Examples of additional codes include:

- 99497: Advance Care Planning is an optional element of an AWV, and it includes a discussion about advance directives and other care wishes. The co-pay is waived when it's billed on the same day as an AWV.

- G0442 and G0443: These codes must be used together, and they apply to an Annual Alcohol Screening and 15-minute alcohol counseling session, respectively.

- G0477: This code is for a 15-minute obesity counseling session and it can be billed with IPPE or an AWV.

- G0153 and G0154: When an AWV takes longer than the typical service, these codes can be added for prolonged preventive services. The codes represent an extra 30 minutes and an additional 60 minutes, respectively.

Talking About AWV With Medicare Patients

Introducing an AWV program at your practice can help you shift from the Fee-for-Service model to Value-Based Care (VBC) . AWV programs contribute to the VBC model because your practice receives payments based on patient health outcomes. Since AWVs are a form of preventive care, you can identify risk factors in your Medicare patients and take action on those factors to improve patient outcomes and close gaps in care.

The VBC model offers benefits to all parties involved in the healthcare system. Patients spend less to maintain their health, and providers can increase patient satisfaction to keep them coming back for appointments. While practices have to spend more time on preventive care, the time saved on chronic disease management is meaningful. Payers then reduce risks and have stronger cost controls.

When discussing the Annual Wellness Visit with your patients, remind them that this type of preventive care reduces the risk of more severe disease and can improve their quality of life in the long term.

Grow Your Medicare AWV Program With ChartSpan

Annual Wellness Visits offer advantages at many stages in the healthcare system, but they still come with challenges. The greatest hurdle your practice faces is patient eligibility. With specialists and primary care providers capable of billing for these visits, a patient may have already had an AWV without you knowing. Providing AWV services and being denied can diminish the value of the program itself.

At ChartSpan, we have a software solution that supports eligibility checks for your AWV program. RapidAWV™ starts by identifying eligible Medicare patients as they come in for their regularly scheduled appointments. From there, the system checks the HIPAA Eligibility Transaction System (HETS) to determine if a patient has had an AWV with any other provider.

This process allows providers to bill for an AWV when they can guarantee reimbursement rather than being denied following a claim. With our team supporting this function through patient engagement and interaction, your overall approach to billing and care becomes more efficient. Improve patient outcomes, close gaps in care and introduce a VBC model with ease.

Learn more about ChartSpan or contact us to get started with our software.

Subscribe for More Insights

Get valuable resources delivered straight to your inbox.

" * " indicates required fields

By providing your information, you agree to receive marketing emails from ChartSpan.

You Might Also Like

Why measuring patient satisfaction is critical to your Chronic Care Management program

The Challenges of Managing Patients with Multiple Chronic Conditions

Inova Partners with ChartSpan to Elevate Chronic Care Management for Patients

Value-Based Care Solutions Glossary

Empower your providers and delight your patients!

Proactively address patient health with preventive care programs that provide more revenue for your practice and more personalized care for your patients..

A Wellness Pros Guide to the What, Why, and How of CPT Codes

October 17, 2023

Health and wellness professionals who bill insurance or third-party payers directly, or provide Superbills to clients, need to be well-versed in Current Procedural Terminology (CPT) codes.

Accurate use of these codes is critical for successful billing and reimbursement. These codes are also important for documenting healthcare services provided to patients.

Even wellness pros who are paid directly by clients may need to be up to speed on CPT codes. That’s because local regulations and licensing boards may have specific requirements to use CPT codes for the purposes of record-keeping and documentation.

With CPT codes changing yearly, staying up to date is critical. Keep reading for your complete CPT code primer, including how they’re structured, who maintains them, how they differ from other medical codes, and where to find the most up-to-date codes.

Key Takeaways

- CPT codes are used to report surgical and medical procedures and services and diagnostic services. They are critical for accurate reporting and reimbursement.

- There are three categories of CPT codes plus modifiers to provide additional information. CPT codes are different from ICD-10 codes and have some overlap with HCPCS codes.

- The American Medical Association’s CPT Editorial Panel is responsible for revising, updating, and modifying CPT codes, descriptors, rules and guidelines.

Understanding Current Procedural Terminology (CPT) Codes: The Basics

CPT codes are a standardized set of codes used to describe medical, surgical, and diagnostic services provided to patients in the U.S. healthcare system.

Developed and maintained by the American Medical Association (AMA), CPT codes are essential for billing and reimbursement through health insurance providers.

For health and wellness practitioners who operate within the traditional U.S. reimbursement and billing system, these codes can cover services like evaluations, consultations, therapeutic interventions, and more.

CPT Code Structure

A CPT code typically consists of three parts:

- Numeric Code. CPT codes begin with a five-digit numeric code. This code is the core identifier for a specific medical procedure or service.

- Modifier. Some CPT codes may include one or more two-digit modifiers. Modifiers provide additional information about the service or procedure performed. For example, modifiers can indicate that a procedure was performed on the left or right side of the body or that multiple procedures were performed during the same session.

- Description. Each CPT code is associated with a description that explains what the code represents. This allows healthcare providers and payers to understand the nature of any service provided.

CPT vs. ICD Codes

In the simplest terms, CPT codes describe things like procedures and services and ICD codes describe diagnoses and conditions.

ICD stands for International Statistical Classification of Diseases. ICD-10 codes are maintained and updated by the World Health Organization (WHO) and used around the globe for the purposes of health recording and statistics.

In the U.S. ICD-10-CM codes are standard, where the CM stands for “Clinical Modification.” These codes include additional clinical details and specificity, making them more suitable for clinical and billing purposes within the U.S. healthcare system.

Types of CPT Codes: A Closer Look

CPT codes are divided into three main categories: Category I, II and III.

Category I CPT Codes

Category I codes are the most commonly used CPT codes for the purposes of billing and documentation. They describe a vast array of medical procedures, diagnostic tests, office visits, and treatments relevant to healthcare providers and wellness professionals.

For example, CPT code 97802 is a Category I code that represents “Medical nutrition therapy; initial assessment and intervention, individual, face-to-face with the patient, each 15 minutes.” Registered dietitians and nutrition professionals use this code to bill for their services when providing individualized medical nutrition therapy to patients.

Category II CPT Codes

Category II codes are supplementary codes used for performance measurement and quality reporting. They are not used for billing. Rather, these codes help with data collection for quality reporting and research.

While wellness professionals won’t commonly use Category II codes in their day-to-day practice, they may use them in situations where they are participating in quality improvement initiatives or research.

For example, Category II CPT code 3008F is used for the documentation of body mass index (BMI) in adults. Specifically, it is used to indicate that healthcare providers have documented an adult patient’s BMI as part of the patient’s medical record.

Category III CPT Codes

Category III codes are temporary codes used with emerging technologies and services that don’t yet have established Category I codes.

These codes allow providers, payers, and researchers to track the use of and outcomes related to new and experimental treatments or technologies. They are often used in clinical trials or when new procedures are in the early stages of adoption.

It’s unlikely that wellness pros would use Category III codes, but it could be possible. For example, someone who is involved in clinical research or trials that involve novel wellness interventions or technologies might use these codes to document and track the specific procedures or services they are providing as part of the study.

The Role of Medical Coders in CPT Coding

Although health and wellness practitioners may engage in coding-related tasks when billing for their services, they are not considered full-fledged medical coders.

Medical coding is a distinct profession with its own formal education, training, and certification requirements. The role specifically involves accurately assigning codes to care services and procedures.

Challenges Faced by Medical Coders

Medical coding professionals must continuously update their skills and knowledge to ensure accurate coding and compliance with healthcare regulations.

- Regulations are always changing. Medical coders must keep up with evolving healthcare regulations and changes in payer policies and compliance requirements.

- Data security and privacy. The Health Insurance Portability and Accountability Act (HIPAA) regulations mandate protecting the security and privacy of patient health information. Medical coders must comply with the Health Insurance Portability and Accountability Act .

- Audits and compliance. Medical coders are under the constant pressure that insurance companies or government agencies can perform a coding audit at any time to ensure accuracy and compliance with billing and coding standards.

Importance of Accurate Coding for Medical Procedures

Accurate coding means proper reimbursement. When codes are incorrect or lack specificity, it can lead to underpayment, delayed payments, or even non-payment by insurance companies.

Although getting paid correctly and on time matters a lot, it’s important to know that coding errors can also impact patient care, legal compliance, data quality, research, and healthcare quality improvement. It plays a central role in the integrity and effectiveness of healthcare providers and the system as a whole.

Category I CPT codes are updated annually and effective for use on January 1 of a new calendar year. The updates may include the addition of new codes, revisions to existing codes, and deletions of obsolete codes. Staying current with these changes will help with accurate coding.

CPT Modifiers: Adding Context to Codes

Modifiers are added to Current Procedural Terminology codes to provide additional information. They indicate that a service or procedure performed has been altered, yet the definition of the service hasn’t changed.

CPT modifiers are added to the end of a CPT code with a hyphen. When using more than one modifier, list the modifier that most impacts reimbursement first. The informational modifier can go second.

Types of CPT Modifiers

Modifiers are typically either composed of two digits or two alphanumeric characters.

- Two-digit modifiers consist of two numbers. They provide specific information about the service or procedure, such as indicating that a separate and distinct service was performed, or that a service was repeated.For example, if a dietitian used CPT code 97803 to get reimbursed for nutrition counseling, but she provided the service via Telehealth, then she would add the modifier code 95 like so: 97803-95.

- Alphanumeric modifiers use a combination of letters and numbers. One well-known alphanumeric modifier is “-LT” (left side) and “-RT” (right side), used to specify whether a procedure was performed on the left or right side of the body.

- HCPCS (Healthcare Common Procedure Coding System) Level II modifiers aren’t technically CPT modifiers. They may include alphanumeric characters to convey specific information about services, equipment, and supplies. We’ll get into the distinction between CPT and HCPCS a little later in this article.

Where to Find Current CPT Codes

There are a variety of resources that can help with finding current CPT codes.

- The American Academy of Professional Coders (AAPC) sells several different CPT books. They also power a platform called Codify that offers a subscription-based look-up tool.

- The American Medical Association offers links to various coding resources . And they share monthly updates on the CPT code set and related industry news to those who subscribe to their newsletter .

- The Centers for Medicare & Medicaid Services (CMS) offers a free search (CPT code lookup) for RVU (Relative Value Units) for every CPT code. You can also request a CPT/RVU Data File license from the American Medical Association if you want to import codes and descriptions into existing claims and medical billing systems.

The CPT Code Approval Process

The CPT Editorial Panel is composed of 21 members who are responsible for maintaining the CPT code set.

The CPT Editorial Panel is authorized by the American Medical Association Board of Trustees to revise, update, or modify CPT codes, descriptors, rules and guidelines.

The CPT Editorial Panel meets three times a year and addresses over 200 major topics, each reviewed and discussed with careful consideration.

Criteria for CPT Code Applications

The American Medical Association has set out specific guidelines for adding, deleting, or modifying codes through the CPT Editorial Panel.

There are specific applications to use depending on the nature of the request. The AMA has also outlined the CPT code process in great detail. Here are a few highlights:

- Many different entities can submit applications for changes to CPT codes, including medical specialty societies, individual physicians, hospitals, and third-party payers.

- All requests to revise CPT codes are reviewed by AMA staff. If they believe the CPT Editorial Panel has already addressed a request, they let the requesting party know. If the request represents a new direction then the application is referred to members of the CPT Advisory Committee for consideration and comments.

- After the Advisory Committee consideration, the AMA staff prepare an agenda item that includes the application, compiled CPT Advisor comments and a ballot for decision by the CPT Editorial Panel. Once the CPT Editorial Panel has taken an action and preliminarily approved the minutes of the meeting, AMA staff informs the applicant of the outcome.

- After going through the above process, there are four possible outcomes: a new CPT code is added, a request is referred for further study, consideration is postponed to a future meeting, or the request is rejected.

CPT Codes vs. HCPCS Codes: Key Differences

The American Medical Association first published CPT codes back in 1966 , when they were mainly used for coding surgical procedures. In 1983, the CMS adopted CPT codes as part of HCPCS.

The HCPCS code set is divided into two principal subsystems:

- Level I of the HCPCS is the same as the CPT code set. These codes primarily describe medical services and procedures provided by physicians and other healthcare providers in clinical and outpatient settings.

- Level II of the HCPCS is a set of codes distinct from CPT codes. They are used for a broader range of non-physician services and supplies, including durable medical equipment (DME), ambulance services, and certain outpatient procedures. They give providers and payers a standardized language for communication and reimbursement.

Master CPT Codes to Drive Revenue and Elevate Care

Understanding the ins and outs of CPT codes can be a valuable skill for health and wellness practitioners.

Yes, getting CPT codes right the first time ensures you get reimbursed accurately and on time when dealing with insurance of third-party payers. The codes also represent a standardized way to describe and document the specific healthcare services you provide. Keeping comprehensive records supports continuity of care and can be valuable for tracking patient progress over time.

Learn more about the features built into Practice Better to help automate insurance billing – from setting up your insurance billing profile to storing CPT and custom codes into the platform so they are available for use at any time.

Frequently Asked Questions

What are 5 common cpt codes.

The CPT codes that a wellness practitioner uses frequently when billing will depend on the nature of services provided. Here are five Five CPT codes that could be commonly used in a wellness practice.

CPT code 99401 – Preventive Medicine, Individual Counseling . Wellness professionals might use this code for counseling sessions related to lifestyle modifications, such as nutrition, exercise, or stress management.

CPT code 99078 – Group Health Education. Wellness professionals who conduct group workshops or classes on various health and wellness topics (e.g., diabetic teaching or a prenatal nutrition class for expectant mothers) might use this code to document those educational sessions.

CPT code G0438 – Annual wellness visit (AWV), includes personalized prevention plan of service (PPPS), initial visit. CMS allows for AWV coverage for a medical professional or team under a physician’s supervision, for example registered dietitians or health educators.

CPT code G0439 – AWV, includes PPPS, subsequent visit. This code is used for AWV visits following the initial one.

CPT code 97802 – Medical Nutrition Therapy Procedure. A dietitian could use this code for an initial individual, face-to-face assessment and intervention with a client.

How do I look up CPT codes?

The Centers for Medicare & Medicaid Services (CMS) offers a free search (CPT code lookup) for RVU (Relative Value Units) for every CPT code. You can also request a CPT/RVU Data File license from the AMA if you want to import codes and descriptions into existing claims and medical billing systems.

How many CPT codes are there?

According to the AMA, the 2023 CPT code set includes 10,969 codes that describe the medical procedures and services available to patients.

What are CPT 4 codes used for?

CPT 4 is another name for the set of CPT codes published by the AMA for reporting medical procedures and services. It includes the Category I, II, and III CPT codes outlined in the above article.

What is the structure of CPT codes?

CPT codes are five digits and are either numeric or alphanumeric. Each has a descriptor to help users understand their purpose. They are organized into three categories: Category I (most commonly used to report services and procedures), Category II (tracking codes for performance management) and Category III (temporary codes for emerging or experimental activities).

Practice Better is the complete practice management platform for nutritionists, dietitians, and wellness professionals. Streamline your practice and begin your 14-day free trial today.

Keep Exploring

Mastering Insurance Billing for Couples and Families: A Guide for Dietitians

Published April 08, 2024

If you are a dietitian looking to expand your practice by offering group, family, or couples sessions, navigating through the maze of insurance billing…

Get Clients to Rebook with 3 Simple Strategies

Published April 02, 2024

From Scheduling to Billing: Saving Time with Clinic Management Software

Published April 01, 2024

How to Choose a New Behavioral Health Billing Software

Published March 18, 2024

- Annual Wellness Visit

- Preventive Care

- Chronic Care Management

- RPM Overview

- Management of Disease States

- Cardiology Patient Monitoring

- Endocrinology Patient Monitoring

- Gastroenterology and Bariatrics Patient Monitoring

- Pulmonology Patient Monitoring

- Resource Library

- ROI Calculator

- Working with Prevounce

- Annual Wellness Visits

- Medicare Annual Wellness Visit

Billing for a Medicare Annual Wellness Visit: Codes G0438 and G0439

- Remote Patient Monitoring (41)

- Chronic Care Management (21)

- Medicare Annual Wellness Visit (19)

- Preventive Care (12)

- Prevounce News (12)

- Compliance (9)

- Remote Care Management (9)

- Centers for Medicare & Medicaid Services (7)

by Lucy Lamboley

The importance of using preventive medicine to improve the health and ultimately lives of patients is widely recognized. The Medicare annual wellness visit (AWV) plays an important role in helping Medicare beneficiaries stay current with their health and take actions that can prevent illness and reduce risk.

An essential piece of the process required to ensure offering and providing preventive services remains financially viable is for organizations to complete the Medicare annual wellness visit reimbursement coding process accurately. Doing so can help ensure providers receive their earned reimbursements and protect them against possible penalties they might incur from failed coding audits. We know some organizations struggle with meeting compliance requirements set forth by the Centers for Medicare & Medicaid Services.

In this blog post, we take a look at what's required for compliant AWV coding. While this is by no means a comprehensive guide to Medicare annual wellness visit reimbursement, it provides organizations with information that can assist them in avoiding some of the most common AWV coding mistakes that result in rejected claims, lost revenue, or failed audits — all of which can be mitigated when using Prevounce software.

Three Unique Annual Wellness Visit Codes: G0402, G0438, and G0439

Medicare preventive wellness visits fall into three categories; the "Welcome to Medicare" visit, also known as the Initial Preventive Physical Exam (IPPE); the initial annual wellness visit, and the subsequent annual wellness visits. Each has its own Healthcare Common Procedure Coding System (HCPCS) code that must be used in the right circumstances and proper order.

Understanding HCPCS G0402

During the first 12 months a patient is enrolled in Medicare, they are eligible for the Welcome to Medicare visit or IPPE. This is a one-time visit that includes vital measurements, a vision screening, a depression screening, and other assessments meant to gauge the health and safety of an individual patient. This visit must be coded using HCPCS G0402. Once a patient has been enrolled for more than 12 months, the G0402 code will be rejected regardless of whether the IPPE visit previously took place or not.

Understanding HCPCS G0438