UponArriving

How Much Cash Can You Travel With? (TSA & International Rules) [2023]

So you have a load of cash and you want to transport it across the country or perhaps even internationally. But exactly how much cash are you allowed to travel with?

In this article, I will break down everything you need to know about traveling with cash including important rules and limitations when flying.

I’ll also cover a number of key considerations you will want to think about before taking your cash with you when going through TSA or even traveling internationally.

Table of Contents

How much cash can you travel with?

There are no limits on the amount of cash you can travel with but there are some major considerations you need to think about when doing so.

If you are traveling domestically, your primary concern is avoiding forfeiture of your cash.

If you are traveling internationally, forfeiture is a concern but you should also be focused on remembering to declare the value of your currency and monetary instruments totaling above $10,000. Keep reading to find out more.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Legal risks of traveling with cash

TSA is concerned about dangerous threats such as explosives and not with enforcing laws and penal codes. (This is why they do not check for arrest warrants .)

Your cash money does not present a dangerous threat and so there should be no legitimate concern about it harming other passengers on the plane.

However, in the past there have been reports of TSA agents initiating the process for seizing cash from passengers under the suspicion that it is money gained from an illegal activity or money that is intended to be used on illegal activity.

Think drugs, weapons, and organized crime activities.

The seizing of cash can be accomplished under a number of different statutes including 21 U.S. Code § 881(a)(6) which governs forfeitures.

It states that you have no property right for:

(6) All moneys, negotiable instruments, securities, or other things of value furnished or intended to be furnished by any person in exchange for a controlled substance or listed chemical in violation of this subchapter, all proceeds traceable to such an exchange, and all moneys, negotiable instruments, and securities used or intended to be used to facilitate any violation of this subchapter.

It’s possible that if a TSA agent spots a lot of cash on you or in your bag (especially a lot of smaller bills like $20 bills) they could refer you to authorities (i.e., DEA) for some type of questioning.

The authorities may check to see if you are on some type of watchlist but even if you are not they may still deem that your cash is subject to civil forfeiture, which means that it will all be taken from you.

This can happen even if you have not been charged or convicted of any crime.

Some dogs that patrol airports have a nose for cash and a lot of cash has come into contact with illegal narcotics.

In fact, a study by Yuegang Zuo of the University of Massachusetts Dartmouth in 2009 found that about 90 percent of banknotes contain traces of cocaine . Traces of other drugs have also been found on cash like codeine, amphetamines and methamphetamines .

That means that “false positives” could be triggered, which could potentially be used as further evidence about your illegal activity (reportedly dogs don’t usually sniff out these faint traces).

If your money is seized you should have the opportunity to petition the process and to retrieve your funds.

It’s an odd legal proceeding where your cash is literally the defendant: “United States of America v. $50,000 in United States currency.”

That’s important because it means that the legal burden of proof is at the civil level which only requires it to be more likely than not that you were up to no good.

This petition process may not be very fun, could last a long time, and could be very costly. For example, you will likely need to hire an attorney which might cost you as much money as you have at stake.

Your success rate could also be very low.

In March 2017, the Justice Department’s Office of Inspector General reported that over the course of 10 years, the DEA only returned money in 8% of cases.

And if you do get your money back, if you owe taxes or judgments, those will likely have to be paid out first.

For these reasons, I would try to limit the cash I take through TSA security to maybe just a couple of thousand dollars (If that).

Personally, the most cash I ever carry on me is a couple of hundred bucks.

This may be problematic for people who want to gamble at their destination or who are looking to do things like purchase a car with cash but you should make alternative arrangements to receive your cash at your destination if possible.

Tips for traveling domestically with cash

If you are thinking about traveling through TSA with cash my advice would be the following:

Keep the amount as small as possible

First, avoid bringing more than $2,000 in cash if possible. That should be well below the level considered to be suspicious, as the lowest amount I saw subject to forfeiture was $6,000.

Also, try to avoid $20 bills since those are customarily used in drug deals.

Notify a TSA agent

If you do bring cash consider notifying a TSA agent when you enter the line and see if you can get some type of private or secondary screening.

If you have TSA Pre-Check , an agent might consider you to be less likely to be engaged in criminal activity but that is not a guarantee.

But note that cash has been seized in cases where people notified a TSA agent themselves so this is not a full proof method.

And it goes without saying but do not attempt to conceal the cash on your body such as strapping it to your chest because the full body scanners will find this quite easily.

Avoid checked baggage

You might be thinking about putting the cash in your checked baggage but that is not a good idea.

For one, if the cash was detected you will not be there to explain the situation and you may be caught off guard later when you are brought in for questioning by the DEA.

Second, if your cash is detected it’s possible that an unethical TSA agent could simply decide to take your cash.

And finally, if your luggage is lost you will not be able to retrieve that cash and cash is almost always an exception to baggage insurance policies.

Bring documentation

If you are traveling with a lot of cash because you want to purchase a vehicle or take care of some other transaction make sure that you have all of the supporting documentation already with you in case you are brought in for questioning.

Presenting anything less than an airtight explanation for transporting cash can mean instant forfeiture.

Avoid transporting suspicious items

It is a good idea to avoid transporting other items such as marijuana along with your cash since that will only reinforce the image that you are up to some type of criminal drug activity.

This is even the case if the state you are flying out of has legalized marijuana.

Consider your criminal history

And finally, if you have any type of criminal history — especially cases related to drug infractions — the odds of you encountering an issue with forfeiture go up.

That’s because it will be that much easier for them to make a case against you. Remember, we are talking about a civil court burden of proof — not criminal court.

So you should really reconsider bringing a lot of cash if that applies to you.

The International cash limit of $10,000 and the need to declare

US Customs and Border Protection is clear that you can transport “any amount of currency or other monetary instruments into or out of the United States.”

The caveat is that if the amount of currency exceeds $10,000 or it’s for an equivalent then you will need to file a FinCEN Form 105 (“Report of International Transportation of Currency or Monetary Instruments”) with U.S. Customs and Border Protection.

This is a pretty simple form to fill out and basically just requires you to input the following information:

- Contact information including passport number

- Export/import information

- Shipping information if applicable

- Details of the currency or monetary instrument

You can file this form electronically at FinCEN Form 105 CMIR, U.S. Customs and Border Protection (dhs.gov) but you can also file it in paper form.

In addition, if you are entering the United States you must declare if you are carrying currency or any other monetary instruments if they total over $10,000.

You can make this declaration on your Customs Declaration Form (CBP Form 6059B) and then file a FinCEN Form 105.

Do not blow off this requirement because failing to declare could mean forfeiture of your money and some pretty serious criminal penalties.

And remember each country has its own policy regarding traveling with cash so you have to make sure you are in compliance with the country you are headed to.

Monetary instrument

Unless you went to law school for three years you might be wondering what a “monetary instrument” is as it’s found on the FinCEN Form 105 .

US Customs and Border Protection defines it as:

- Traveler’s checks in any form

- All negotiable instruments (including personal checks, business checks, official bank checks, cashier’s checks, third-party checks, promissory notes, and money orders) that are either, in bearer form, endorsed without restriction, made out to a fictitious payee, or otherwise in such form that title passes upon delivery

- Incomplete instruments (including personal checks, business checks, official bank checks, cashiers’ checks, third-party checks, promissory notes, and money orders) signed but with the payee’s name omitted

- securities or stock in bearer form or otherwise, in such form that title passes thereto upon delivery.

In this article we are mostly focused on cash which would most definitely fall under “currency.”

Specifically, 19 CFR § 1010.100(m) defines “currency” as the coin and paper money of the United States or of any other country that:

- (1) is designated as legal tender, (2) circulates, and (3) is customarily used and accepted as a medium of exchange in the country of issuance.

- Currency includes U.S. silver certificates, U.S. notes, and Federal Reserve notes.

- Currency also includes official foreign bank notes that are customarily used and accepted as a medium of exchange in a foreign country.

The big take away here is that this restriction applies to cash of the US and also other countries.

The cash of pretty much every developed country is going to meet the requirements for currency listed above so it doesn’t matter if you are transporting Great Britain Pounds, Euros, etc.

Keep in mind that each form of currency and monetary instrument counts separately, as well. So if you have $6,000 in cash and a $5,000 traveler’s check, you are above the limit.

And members of a family residing in one household entering the United States that submit a joint or family declaration must declare if the members are collectively above the $10,000 limit.

So if a husband has $4,000 and the wife has $7,000, that family must declare because they are collectively above the limit.

Items that don’t count as currency

Some items related to currency do not officially count as currency but you still may have to declare them as “merchandise.”

For example, coins of precious metals, including silver and gold, do not fall into the definition of “monetary instrument” or “currency.”

However, coins of precious metals must be declared as merchandise if they are acquired abroad.

Other articles of precious metals (including gold bullion, gold bars, and gold jewelry) also do not fall into the definition of “monetary instrument” or “currency.”

However, these articles must also be declared as merchandise if they are acquired abroad.

They also have a list of excluded items which includes:

- Warehouse receipts and bills of lading

- Monetary instruments that are made payable to a named person, but are not endorsed or which bear restrictive endorsements

- Credit cards and prepaid cards

- Virtual currencies including Bitcoin

So if you are traveling around with credit limits above $50,000 or a nice stash of cryptocurrency you don’t have to worry about declaring those items.

Factors to consider when traveling with cash

When you are traveling chances are you are going to want to spend some money on various expenses like dining and excursions. It is highly recommended to use a good travel rewards credit card for these expenses for a few reasons.

Getting through security

If you have a bag full of cash money, that bag is going to have to get through security at some point. This may be at the airport, a train station, etc.

As explained in detail above, if a screening agent notices that you have wads of cash in a bag this could potentially raise a red flag and a worst-case scenario of you losing your cash and never getting it back.

The theft risk

Traveling with cash is risky whether you keep that cash on you or you stored in your hotel room.

If you are walking around with cash on you there is always that chance that you could run into a thief. This could be someone who could pick pocket your wallet or cash right out of your clothes or bag.

Or in a more serious case, this could be someone who holds you up with some type of weapon and forces you to handover your cash.

If you are going to travel with cash on your person it’s recommended to have some type of hidden wallet and a dummy wallet in your pocket. Your dummy wallet will have a small amount of cash, perhaps a duplicate credit card and even a duplicate ID to make it look as realistic as possible.

The idea is that if someone were to take that dummy wallet they would only get away with a minimal amount of your valuables. You could then have your real stash of cash hidden beneath your clothing.

If you choose to store your cash in your hotel room you also need to be careful. Putting your cash into a hotel safe is not quite as secure as you might think . In some cases you may actually want to just hide your cash somewhere in the room where a thief would not think to look.

Either way you go, carrying a lot of cash on you is a risk that you need to weigh very carefully.

Travel insurance

You can get travel insurance by paying for your excursions and travels with a good travel credit card.

So if for some reason you purchase a nonrefundable hotel or tour and then you have to cancel because you get sick or for some other covered reason, you can get fully reimbursed for your purchase. In some cases this could put thousands of dollars back in your pocket.

But if you paid for something like your hotel with cash there is a good chance that you will simply be out of luck and get hit with the loss.

Also, you might struggle to even be able to pay cash for certain travel expenses like rental cars .

Foreign conversion fees

When you convert your cash into a foreign currency you will be paying some type of conversion fee and in some cases may be dealing with a subpar rate, especially at those kiosks .

Certain types of ATM cards will allow you to withdraw cash in the local currency with minimal fees but the best way to make purchases abroad is to simply have a credit card with no foreign transaction fees.

Travel credit cards are great about offering rewards on purchases made abroad.

You don’t have to look very far to find a credit card that will earn you extra bonus points on flights, hotels, and even your tours and events. Earning extra points on dining, even when dining abroad, is also easy with cards like the Amex Gold Card.

By paying with cash you are missing out on all of these valuable rewards.

Traveling with a lot of cash can be problematic because that is often how actors travel who are engaged in criminal activities.

Your best bet is to avoid bringing a lot of cash but if you must, try to bring as much supporting documentation as possible and be prepared for questioning and the possibility of you having to fight against the government to retrieve your money.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo . He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio .

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Privacy Overview

Traveling With Money: Everything You Need to Know

With the COVID-19 pandemic finally fizzling away, many people are now making plans to travel internationally again. Traveling with money typically entails finding the balance between safety and utility. On one hand, it is important to have a reasonable amount of travel money with you so you can sort out all necessary expenses. And, on the other hand, you do not want to become a victim of theft.

In this article, we will discuss the best way to travel with cash internationally. How much money you should bring, using other payment alternatives, the best options for currency exchange, and how to keep your money in a secure place while traveling.

Table of Contents

So, How Much Money Should I Bring?

Calculating the amount of money you will need for your next trip will depend on a few important things. How long will your trip be? How many family members are traveling with you? What kind of activities are you planning? And, what locations are you planning to visit?

The general rule for calculating the exact amount you’ll need for a trip is to multiply $50 to $100 by the number of days you plan to spend on the trip. However, other factors can influence this, including your destination, accommodation, activities, and preferences.

While you may be tempted to bring as much money as you can, it’s not recommended to carry large amounts of cash with you. I do recommend, however, that you always carry a small amount of cash for any emergencies.

Note that if you’re carrying any amount above $10,000 us dollars, you will be required to declare it. This is a simple process that entails filing a few forms. Some countries also have different policies regarding foreigners coming in with cash. So, it is best to always research and find out what the policy for traveling with money is in the country you’re going to.

Use a Travel Budget Calculator

There are free online tools available for you to use, like the travel budget calculator . It is easy to use and can help you make a daily budget, which will give you a better idea of the exact amount of travel money you will need.

Consider Paying with Cards

As mentioned above, traveling with money, specially large sums of money, is not advisable. A good alternative to this would be to make as many payments with your bank cards as possible. Bank card payments are generally accepted in most countries. However, card payments will not always be an option. In these instances, you will need to have a reasonable amount of their local currency on hand. When traveling to small towns or less developed countries, take some extra cash with you.

It’s always a good idea to first do some research. Find out if card payments are accepted at your destination, and plan accordingly. I also recommend that you find out whether your specific credit card company works for international transactions. If it does, are there any foreign transaction fees attached?

Lastly, if traveling with money is not necessary, and you can pay with cards instead, using a credit card instead of a debit card is safer, as it protects your bank account even in the case of theft.

Bring Multiple Bank Cards

Traveling with multiple bank cards is a great way to ensure financial security and convenience while on the go. It provides a backup in case one card is lost, stolen, or declined, and also allows for access to different accounts and banks. Carrying multiple cards from different providers can also help avoid issues with merchants who may only accept certain types of cards or payment methods. For example, American Express is not accepted in many places.

If you don’t have a second travel credit card, traveling with money (an emergency stash) is necessary. If your card gets temporarily blocked, while you can resolve this issue with your bank, your cash will be your safety line.

Use ATMs Abroad Safely

When traveling in a foreign country, at one point or another, you will have to use an ATM machine to withdraw money. Using an ATM is a convenient and easy way to access your money while traveling internationally. However, there are some precautions that you should take to ensure that your transactions are safe and secure.

Firstly, before leaving for your trip, inform your bank about your travel plans, including the countries you will be visiting and the duration of your stay. This will help prevent your account from being flagged for unusual activity and potentially being frozen or blocked.

Secondly, when using foreign ATMs, choose one that is in a secure location, preferably inside a bank or a shopping center. Avoid using standalone machines that are located in isolated or poorly-lit areas, as they are more susceptible to theft and fraud.

Lastly, use a machine that belongs to your bank to avoid extra atm fees and to ensure that the machine is more secure. Additionally, make sure you are aware of your bank’s daily withdrawal maximum limit and the fees that may be associated with exceeding that limit.

Know When and Where to Exchange Money

To get the best foreign currency exchange rates, I recommend exchanging at your destination. Although you will be charged a service fee, it is still your best option.

Do note that airports offer the worst exchange rates and fees for their service. So, to get better exchange rates, it is always best to do it once you are at your final destination. Be careful, though. Ensure that the vendor is legit; otherwise, you risk getting scammed .

For ease, I also suggest you exchange a small amount at your home country before traveling. This way, you’ll have enough cash on hand for anything you want or need to buy at the airport, and a taxi to your accommodation.

Use Other Payment Alternatives

Research what options there are to make as many payments and purchases online. And, use tickets where possible. This is a great option when booking any activities or sites you plan to visit on your holidays. This way, you guarantee having an entry ticket, and you avoid traveling with money.

What to Do in Case of Theft

Experiencing money theft while traveling abroad can be a stressful and unfortunate situation. The first important thing to do is to report the criminal activity to the local police station and obtain a copy of the report for insurance purposes. Then, contact your bank or credit card company immediately to report the theft and cancel any affected cards. You can also consider informing your embassy or consulate for assistance and guidance on obtaining emergency cash or replacement documents.

Taking precautions to prevent theft while traveling is crucial for ensuring a safe and worry-free trip. By following the tips below, you can safeguard your money and enjoy your travels with peace of mind.

Safety Tips for Traveling with Money

As we have seen, flying with a lot of cash is not recommended, however, in some instances it is necessary. If this is the case, you are probably wondering how to keep money safe while traveling. No worries, I got you. Below are a few tips on how to hide money while traveling, so you and your money stay safe.

Use Discreet Storage Options

Always keep your money away from your checked bags. Those bags can be accessed by many people while they are out of your sight. If your money goes missing, it’ll be difficult to track or make a case for it.

So, where do you hide money while traveling? Your carry-on, handbag, or any hidden pocket! As long as it is always in your direct line of sight, you’re good to go. A good wallet alternative, depending on the amount of money you are traveling with, is a money belt.

Other safe spots to hide your money include, bra stashes and built-in pockets. Although these are not appropriate wallet alternatives, they can come in handy at the airport, bus station, train station, or when taking any public transportation.

It is always best to avoid conspicuous storage options like a fanny pack or travel purses, as these will automatically label you a tourist and make you more prone to theft.

Carry Different Denominations

One nifty trick I’ve picked up over the years is to carry different denominations of cash while traveling. A variety of small and big bills will be practical when you need to pay for something. It also makes it easy to keep your money safe.

Split the Money

Split your cash into different places; the small bills in your wallet for simple purchases and transactions, and the big bills in a more secure part of your bag, where it would not attract undue attention.

Invest in Anti-theft Bags

Depending on the amount of money you are traveling with, you should also consider getting a dummy wallet or an anti-theft bag. These are designed specifically for travelers and come with features such as steel cable reinforced shoulder straps, lockable zippers, slash-proof fabric, and hidden compartments that can slow down or deter pickpockets and thieves.

Ultimately, the ideal answer to how much cash you need will be: just enough. Enough money for an emergency, or to cover expenses that cannot be paid with cards. Instead, try using your cards as much as possible. Also, exchange money once at your destination. And, if absolutely necessary to bring cash, follow the tips above on how to keep money safe while traveling.

Plan ahead, do some research, carry minimal cash, and keep it safe!

ln 2017, not wanting to follow the traditional life in Mexico, I left to explore the world and live on my own terms.

Full of hunger for experience & independence, I started an online business while traveling the world.

Now, I split my time between traveling and living in Bali. Doing what I love, living the life I want.

Recent Posts

Leave a Reply Cancel Reply

Save my name, email, and website in this browser for the next time I comment.

Hiding Money When Traveling: Savvy Tips to Give You Peace of Mind

Anti-theft Products , LUGGAGE

Support TFG by using the links in our articles to shop. We receive a small commission (at no extra cost to you) so we can continue to create helpful free content. We earn from qualifying purchases made to the featured retailers. Thank you, we appreciate your support!

Traveling with money can be a bit of a challenge to figure out, but TFG readers share their favorite ways to hide cash and cards on your trip.

Hide Money When Traveling

Written By: Tae Haahr

Table Of Contents

If you’re looking for the best way to carry money while traveling , look no further. TFG readers have shared their best tips, tricks and accessories to hide cash and cards while you’re out and about exploring.

Not sure you need to be concerned about hiding money while traveling ? One TFG reader shares, “I’ve been robbed and they only got my bag one time and a dummy wallet the second. My passport and real cash and cards were always in a secret pocket on my body.”

While this is an extreme example, it’s always a good idea to prepare for the worst. Whether you’re most comfortable tucking your items into a hidden pocket, zipping it into a scarf, or carrying it in a bag, we’ve got the best things to hide money in .

Use a Conceal Wear Hidden Money Pouch

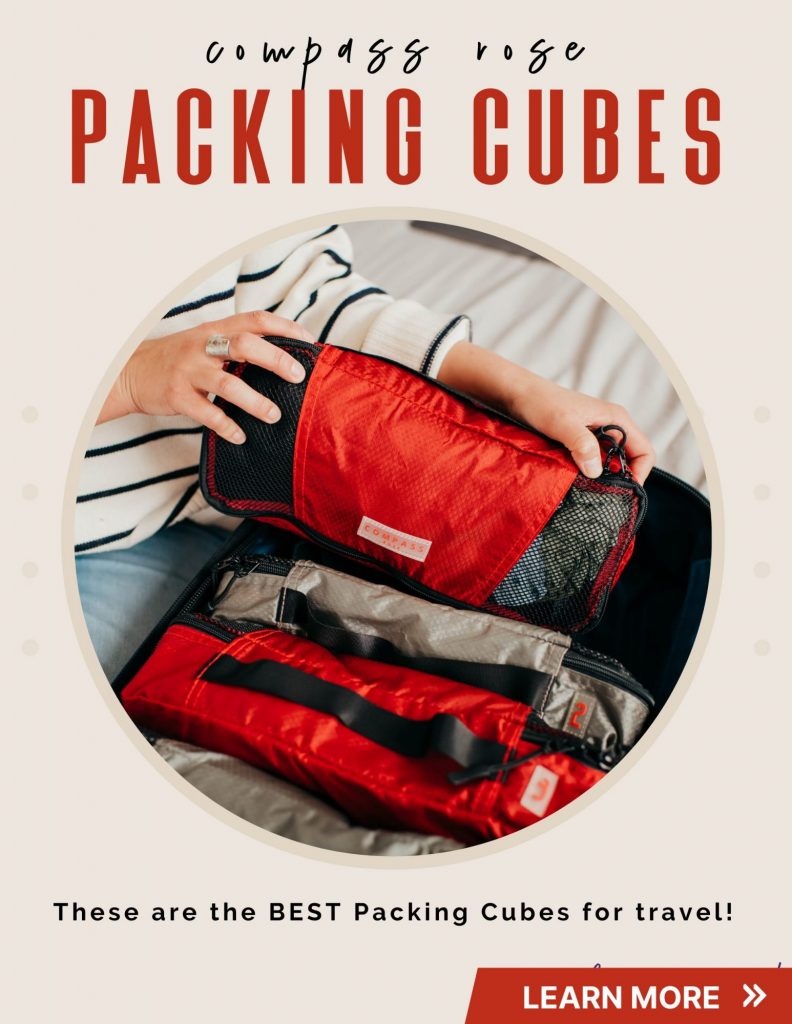

Compass Rose Secret Bra Wallet

Top Readers’ Pick: Compass Rose Bra Wallet

When it comes to traveling with cash our favorite hidden pouch is the Compass Rose Secret Bra Wallet . It is big enough to store some extra money, credit cards, your hotel key, and a few essentials whilst traveling and has RFID protection to help secure you against digital theft too.

The design allows you to carry your cards and other travel must-haves safely. In order to wear it, you simply attach it to your bra strap or band, your underwear, or your belt loop and wear it discreetly underneath your clothing.

One TFG reader shares, “I kept all my money in a little packet in my bra and still kept an eye out.” Another reader pairs their bra wallet with a Travelon anti-theft bag (see below), they put the stuff they don’t need easy access to in the Compass Rose wallet so it’s safe and secure.

If you want to learn more, read our thorough review on the Compass Rose RFID secret bra wallet!

Find out how getting left behind on an organized tour to Europe is actually the reason why my Secret Bra Wallet became one of my all-time travel essentials! Learn why here.

Venture 4th RFID Blocking Money Belt

Venture 4th Money Belt

The Venture 4th also comes highly recommended by TFG readers for this tried and true body money storage option . It has a slim, minimalist design with RFID blocking technology so your credit cards and cash are safe. And its slim, lightweight design helps ensure that the pouch is secretly hidden.

One reader shares, “For extra-large amounts of cash in Europe I have used a money belt. When out and about, I carry as little as possible in a cross body.” With its superior construction, this belt is bound to last you a lifetime!

Peak Gear Money Belt With RFID Block

Peak Gear Travel Money Belt

If you’re looking for how to carry cash without a wallet , the Peak Gear money belt is a discrete and comfortable accessory to wear under any outfit. It has added RFID technology to help keep your things even more secure.

One TFG reader shares that when they head to Europe, “we put our credit cards, cash and passport in this, and wear it under our clothes.” Another adds, “I carry my passport, main cards, and money in my money belt at all times.”

Stashbandz Sports Running Belt Waist Pack

Stashbandz Running Belt

Instead of using a traditional travel money belt, a number of TFG readers recommend using a running belt to carry money instead. The Stashbandz model has three security and one zip pocket.

One reader explains, “I use a runner’s belt because it feels like a thick yoga pant waistband.” Another adds that “it’s so comfortable I forget I’m wearing it.” It has more than enough room to hold everything you need to hide.

Venture 4th Travel Neck Pouch

If you’re looking for where to hide money when traveling , the Venture 4th Neck Pouch will not only block RFID but is also comfortable and water-resistant. It has three storage components including two zippered and one velcro closure patch with an ID window.

One TFG reader shares, “I wear a neck wallet crossbody-style under a shirt. I keep a passport, extra credit card and cash in it.” Another reader wears it a tad bit differently, “I wear a neck pouch crossbody under my clothes and tucked into the waistband of my panties. It’s not hot or uncomfortable.”

Travelon Women’s Undergarment Pouch

Travelon Undergarment Pouch

The Travelon Undergarment Pouch is a great way to keep your valuables secure and out of sight. It’s made out of a comfortable, breathable and adjustable material that you simply tuck under your clothes. And, yes, your passport will fit!

One TFG reader shares that when it comes to how to hide cash while traveling , you can wear this “around the waist and tucked into underpants for me.” While another adds, “Wear hidden under your clothes for your money.”

Eagle Creek Undercover Hidden Pocket

Eagle Creek Travel Undercover Hidden Pocket

The Eagle Creek Undercover Hidden Pocket is a handy little pouch that you can slip onto your belt and tuck into the waistband of your pants. That way you’ve got everything you need secure and hidden.

If you’re looking for how to hide money on your body , this is a great way to keep your personal items like your credit cards and cash safe. It’s also made of moisture-wicking material, so your passport and money remain dry no matter where you find yourself exploring.

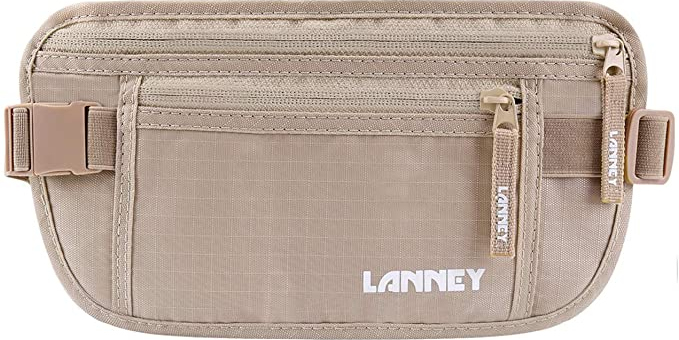

Lanney Money Belt RFID Blocking

LANNEY Travel Money Belt

If you’re looking for the best way to carry passport and money when traveling , and specifically something that can help you keep ultra-organized, then look no further than the Lanney Travel Money Belt . It has two zip pockets, the larger of which has three sections for convenient organization. There is also a hidden pocket to keep something super secret.

One reader shares “I like these when I travel with my passport for my own piece of mind.” It also comes with 10 RFID sleeves, so you can keep whatever you want on you safely.

Our readers recommend the best money belts !

Clever Ways To Hide Money In Clothing While Traveling

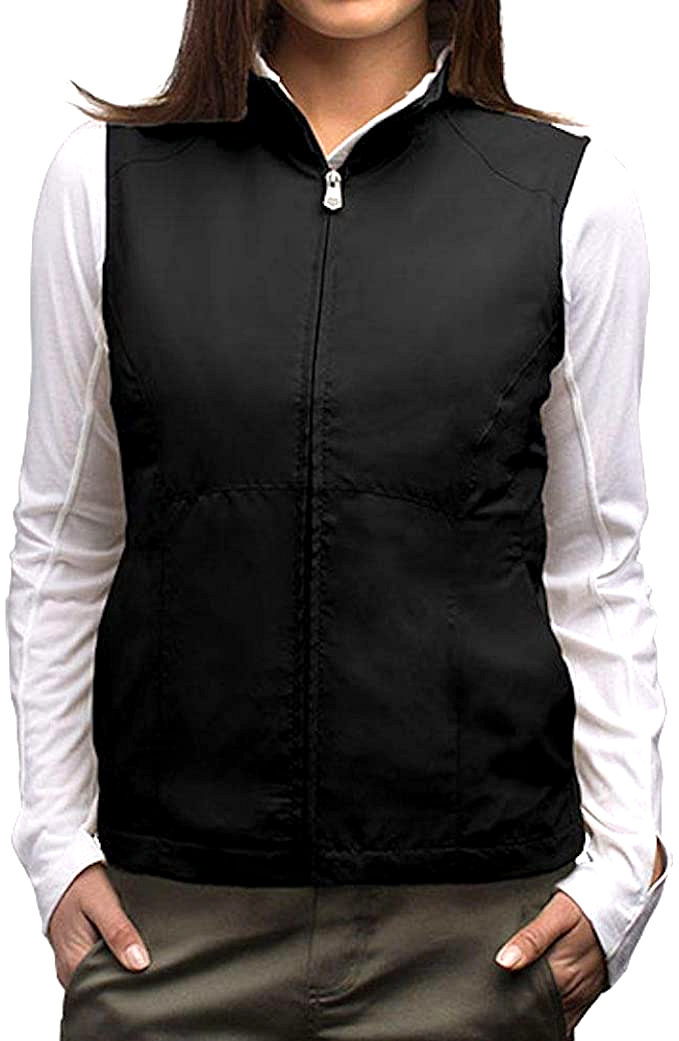

SCOTTeVEST RFID Travel Vests

SCOTTeVEST RFID Travel Vest

The SCOTTeVEST RFID Vest was made for keeping your things safe while you travel. It has 18 pockets (no, that isn’t a mistake) so that you can organize and store all of your things safely. No need to worry about pickpockets!

One TFG reader shares, “This vest has many pockets inside so you can keep your passport and belongings safe. Not to mention it makes a good extra layer whether it’s warm or cold.”

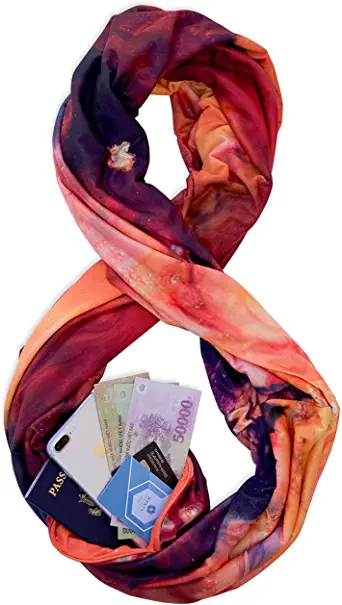

Waypoint Goods Hidden Zipper Pocket Travel Scarf

Waypoint Goods Travel Scarf

Clothing is a great place if you’re looking for how to hide money while traveling if you find the right items like this Waypoint Goods Scarf which comes highly recommended by TFG readers. It has a hidden pocket that you can slip your belongings into and zip right up. Voila, hidden!

One TFG reader shares, “I was a little hesitant to purchase this scarf because it cost $29 but it was worth it! It’s soft, spacious, looks, and feels quality made. Plus, the zipper is well hidden so it will do the job of hiding your goods—you couldn’t tell I was hiding anything.”

Sprigs Banjees 2 Pocket Wrist Wallet

Sprigs Banjees Pocket Wrist Wallet

Getting yourself one of the handy Sprigs Banjees 2 Pocket Wrist Wallets can help ensure that you keep your cards and cash-on-hand so they can easily be accessed. The band is lightweight and stretchy and has one zipper and one foldover pocket.

One TFG reader shares, “I’m very excited to order and use these wrist wallets. They’re great to use for your ID, credit card, and cash for the day.”

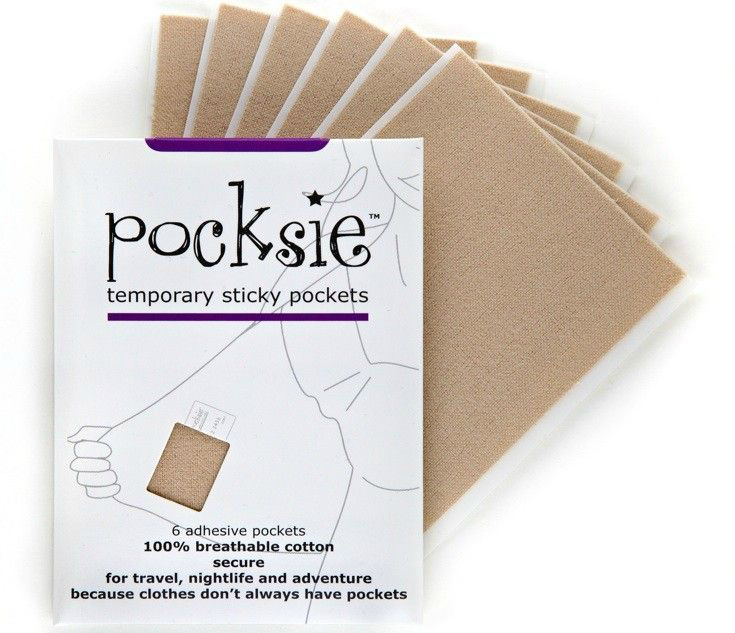

Pocksie Temporary Sticky Pockets – 6 pcs.

Pocksie Temporary Sticky Pockets

If you find yourself without a convenient pocket to stash your cash in and hide money travel style, then make one! Pocksie Sticky Pockets instantly add an extra pocket to the inside of your clothing, boots or bags. And it’ll stay there until you take it off yourself or throw it in the wash.

One TFG reader shares, “I use these in all of my knee-high boots and occasionally in sweaters and jackets without pockets. They really do work! Perfect for hiding cash and credit cards, but having them easily accessible.”

Skechers Bobs Woven Mary Jane Flat

Hide Essentials in Shoes

When it comes to the best way to travel with money , it helps to get creative if you’re going to hide your cash. One of the best places to hide money when traveling is in your shoes like these Skechers Mary Jane flats , because realistically who’s going to steal your shoe while you’re wearing it!

One TFG reader shares, “I put cash under the sole insert in my shoes— shhh don’t tell anybody!” It works so long as you’re not wearing sandals. Another suggests keeping your cash in multiple spots on you, including your shoe, wallet, bra, and so forth.

Want more tips? Check out the best clothes with hidden pockets !

Hide Money While Traveling In a Purse

Longchamp Le Pliage Neo Crossbody Bag

Crossbody Purse

If you’re looking to keep your belongings safe, but don’t want to get something new or pack another item, then TFG readers recommend bringing along your favorite (functional) crossbody bag like Longchamp Le Pliage —just make sure you keep an eye on it.

One TFG reader shares that they “don’t carry more than one credit card and only use a small cross body, which I never take off!” Just make sure that your bag stays on you and in front all of the time!

Travelon Anti-Theft Essential Messenger Crossbody Bag

Anti-Theft Bag

If you want to take an extra step to keep your belongings safe, an anti-theft bag will help to make sure that your items are safe while you’re out and about. You’ll find brands like Pacsafe and Travelon that specialize in these kinds of bags.

One TFG reader shares that the “Travelon feels very safe and secure. I just left Paris where there was a reported upsurge in pickpockets and I felt very safe. I stashed my extra credit card in a suitcase in my accommodation.”

Pacsafe Anti-Theft Backpack in Blush Tan

Anti-Theft Backpack

Anti-theft bags tend to have steel mesh and wires in both their bodies and straps. They also often have zippers so that they cannot be easily opened. Another great option is backpacks.

One TFG reader shares, “I use a Pacsafe backpack . Steel in the straps and cables at all zippers.” However, one TFG reader shares that even if you’re using an anti-theft backpack, never put all of your money or cards in the same place. Great tip!

Tarriss TSA Lock

If you simply want to make sure that your bag is not easily opened by someone wandering by, then a purse lock might be in order. One TFG reader shares that “Amazon sells little S locks that are perfect for backpacks or zippers that are not secured.” Another suggested using carabiners .

Keeping your belongings protected is crucial while you’re traveling because you never know what might happen. One reader shared, “ It was so crowded around the Eiffel Tower and one of the pockets on my backpack/purse was picked. They got nasty tissues and lotion. Luckily, I have a cable lock I put on the main part of the purse.”

Get equipped with the best cross body purses for travel!

Hide Money Travel Product Comparison Chart

Tips for traveling with cash.

When you’re traveling with cash or cards and trying to play things safe (realistically, when are you not) there are a few things TFG readers suggest doing to stay ahead of pickpockets. They suggest making sure that you store cash in different places. That way if something is taken, you’ll still have something left.

One reader shares, “Keep your money belt under your clothes, run and have just a daily amount of money in your purse. Don’t take the belt out in public, only in a toilet or changing room if you need more cash.”

What do you feel is the best way to carry cash or cards when traveling? Share your tips below!

For more anti-theft travel tips, please read:

- Best Money Belts and Anti-theft Travel Accessories

- Best Anti-theft Travel Bags for Women

- Worried about Pickpockets in Europe? Read These Tips and Tricks

- How to Keep Your Passport Safe When Traveling

LIKE THIS POST? PIN THIS PIC TO SAVE IT!

We hope you liked this post on the best way to travel with money. Please share with your friends on Facebook, Twitter, and Pinterest. Thanks for reading!

Submit a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

The Best Way to Travel with Money (and Tips on Using Money Abroad)

This article may contain references to some of our advertising partners. Should you click on these links, we may be compensated. For more about our advertising policies, read our full disclosure statement here.

What’s the best way to travel with money? I’m glad you asked.

If you’re new to traveling abroad, dealing with currency exchange can seem a bit overwhelming. What type of currency do you need? Where should you exchange your money? How much should you take? It can all be a bit stressful.

Don’t fret. We’re here to help! We’ve made dozens of trips across Europe and the Caribbean, and we’ve definitely learned a lot about handling money overseas. By following these tips, you can learn from our mistakes, save money on fees, and relax knowing that your money situation is taken care of. So, let’s get started!

Traveling with Money: Where are You Going?

Before we talk about the best way to travel with money, it’s important to talk about where you’re going. The location of your travel has a big impact on how you’re going to handle your money abroad. Each area handles money differently, and it’s important to know what you’re dealing with before you get there.

For instance, if you’re traveling to the Caribbean, you probably don’t need to worry about exchanging money at all. Most travel destinations in the Caribbean are happy to accept USD as a form of payment. So, instead of converting a a bunch of cash to the local currency, just bring a stack of USD with you. Of course, it’s always a good idea to bring smaller bills, especially if you’re leaving tips at an all-inclusive. That way, you’re not stuck with $100 bills you can’t spend.

On the other hand, if you’re traveling to Europe, you’ll definitely need to change your money into the local currency. Unlike countries in the Caribbean, Europeans will simply scoff at your attempt to use USD. So, unless you plan to exchange those dollars at a currency exchange (see why you shouldn’t below), those dead presidents hold roughly the same value as a roll of toilet paper.

Many European countries use the Euro as their currency. However, certain places – like the United Kingdom, Switzerland, and others – still use their own. Before you leave, know which currency is used in the countries you plan to visit. Then, decide how you can get your hands on it without paying a fortune in fees.

Best Way to Travel with Money: Use Your Card

When it comes to taking money abroad, there’s no contest for the best way to do it: Use your credit cards whenever possible. Not only are credit cards more convenient, they’re likely “safer” than carrying around a bunch of cash. And, if you happen to lose your card, you’re not out a bunch of money.

Of course, you can’t just take any ol’ card with you. Make sure you’ve brought along a card that doesn’t charge for foreign transaction fees! This saves you money by eliminating foreign transaction fees, eliminating currency exchange fees, and by getting you the best/current exchange rate when you go to pay. (More on that in a bit!) You can find our favorite travel cards here!

Preparing Your Money to Travel

Before heading to the airport, it’s important that you take some steps to ensure everything is working properly, including:

- Alert your bank. – Even though using a credit card is generally best practice, you’ll still need some cash. (I like to get cash at a local ATM upon arrival.) Before leaving the country, it’s important to alert your bank that you’ll be traveling. Simply call your bank and let them know where you’re going and when. They’ll put a travel alert on your bank account so you’re not stuck getting a “denied” message at a foreign ATM machine. If it sounds like I’m talking from experience, it’s because I am.

- Alert your credit card company. – Just like your bank, be sure to alert your credit card company (or companies) that you’ll be traveling. Even if you bank with the same company who issues the credit card, you must alert both departments. Again, you don’t want to be trying to pay for dinner and get denied.

- Carry a credit card that doesn’t charge for foreign transactions. – As I mentioned above, it’s important to bring a credit card without foreign transaction fees. Typically, non-travel credit cards charge around 3% per purchase for foreign transaction fees. So, for every $1,000 you spend, you waste about $30 in fees. That’s not a ton of money, but it adds up quickly. Skip them all-together by using good travel cards without foreign transaction fees.

- Bring a backup credit card. – It’s always a good idea to bring a second credit card, just in case something goes wrong. Perhaps your card doesn’t work, you lose it, or it gets compromised while you’re there. Having a second card makes this a minor inconvenience instead of a major issue. Again, it’s best to bring a card without foreign transaction fees as your backup. Like with your primary card, be sure to alert your credit card company that you are traveling.

Other Tips for Using Money Abroad

- Understand the exchange rate. – Before you go, be sure to check the exchange rate. When paying in Euros (or Pounds), it’s easy to think you’re paying less than you actually are. However, depending on the current exchange rate, a €20 item may actually cost $22 or a £100 meal may actually equal $150. Add this up over the course of your trip, and you could easily blow your budget without realizing it.

- When given the option, pay in the local currency. – When using a credit card, some merchants may offer you the option of paying in USD. Don’t do it. You’ll almost always get a better exchange rate if you pay in the local currency.

- Use ATM machines, not money exchange centers. – Avoid using the money exchange centers you see at airports and in popular tourist areas. These businesses typically charge higher fees and offer worse rates. Instead, use your ATM card to simply withdraw money once you get there. You’ll almost always get a better exchange rate, saving you money right off the bat. (Remember to call your bank before you leave home!!!)

- Carry USD for emergencies. – With respect to the above, it’s still a good idea to bring some USD with you. (I usually bring a couple hundred dollars.) In an emergency, you can always hit the money exchange and trade your USD for the local currency. It may cost you more, but at least you’ll have it.

- Always carry some cash in the local currency. – Although the best way to travel with money is using a card, it’s always a good idea to have some cash in the local currency on you. Some places are more card friendly than others, but – even in those destinations – you’ll still find merchants that are “cash only.” Smaller denominations are typically better.

- Take out only what you’ll need. – Don’t take out too much cash. Withdrawing too much local currency isn’t just a pain to exchange, you’ll also take a double whacking in currency exchange fees – both when you take it out and when you exchange it back to USD.

Handling Money Abroad: Final Thoughts

Before traveling, not knowing how to deal with money can be stressful. Having money problems while on your trip can send you straight into panic city. Lord knows I’ve made my fair share of money mistakes abroad, and while you can’t plan for every eventuality, I’ve learned that preparing ahead of time can save you tons of headaches.

I hope you’ve found these travel and money tips helpful! I’m happy to answer any questions you have in the comments below. Thanks again for reading, and – until next time – happy traveling!

Free Travel Rewards Advice – Need help choosing the best rewards cards for your trip? We can help! Tell us where you want to go, and we’ll help you build a personalized travel rewards program to suit your needs. Learn more here!

Greg Johnson is the co-founder of Club Thrifty and an expert in personal finance, family travel, and credit card rewards. His work and commentary have been featured in publications like Newsweek , Kiplinger’s Personal Finance , Dough Roller , CreditCardReviews.com , and more. He also works as a freelance personal finance editor at Bankrate.com.

Greg travels the world for about 20 weeks each year and has visited over 40 countries. He holds two bachelor's degrees, is the co-author of the book Zero Down Your Debt , and owns his own independent travel agency. Learn more about Greg here.

Similar Posts

How to Cruise for Cheap

Cruising can be expensive if you don’t know how to find the right deals. Fortunately, there are plenty of ways that you can cruise for cheap if you simply look around. Here are a few tips to help you get the most out of your cruise while staying within your budget.

Carnival Sensation Review

In mid-August, I took my husband and kids on a mini-trip to the Bahamas on the Carnival Sensation. I’m not big on ships, the open ocean, tsunamis, or drowning, but I thought “what the heck” and decided to go for it. What could go wrong?

Vacation Hangover? These Tips Make Coming Home Less of a Nightmare

You’ve been there. You know the feeling. A vacation hangover is real! Use these tips to plan ahead and make coming home less of a nightmare.

Are Sightseeing Passes a Good Deal for You?

You’ve heard of them before, but are sightseeing passes a good deal? Use these 5 questions to determine if a sightseeing pass is worth it for your trip.

London Pass Review and Guide 2024: Is It a Good Deal?

Is the London Pass worth it? We think so. Check out our complete London Pass review and learn how you can save money on sightseeing in London.

Credit Card Rewards: Our Budget Travel Plans for the Rest of 2015

We love budget travel, and we’ve taken a lot of cheap trips in this year. But, 2015 isn’t over yet! Here are our travel plans for the rest of 2015.

Disclaimer: Comments, responses, and other user-generated content is not provided or commissioned by this site or our advertisers. Responses have not been reviewed, approved or otherwise endorsed by this website or our advertisers. It is not the responsibility of our advertisers or this website to ensure that all comments and/or questions are answered. Club Thrifty has partnered with CardRatings for our coverage of credit card products. Club Thrifty and CardRatings may receive a commission from card issuers.

I agree: I think traveling with a card is the easiest thing to do. I always carry local cash AND USD with me for emergencies, but cards are so much more convenient. In places like Europe you’ll look like a total tourist if you try to use cash. It’s best to use cards and blend in (pssst–you can get better prices if you look like a local!).

I give these tips to my students as well when I take them on study tours. However, they always forget. I have to bring extra currency because I basically become the ATM. Maybe I should start charging an extra fee for doing so.

Travelling in the eurozone is sooooooo much easier now with the euro. I remember travelling in the past and ending up with coins from all sorts of currencies. I think I still have some Dutch guilder and German marks somewhere. So much easier having just one currency for all those countries.

Get an app that will do currency conversion. There are tons of them. Yeah, you think you can do the conversion in your head, but sometimes your jet lagged or have had a few drinks.

See if one of your accounts will waive/refund ATM fees. I got a Fidelity ATM card tied to my money market account that refunds all ATM fees.

Credit card is the best travel companion as long as you’re able to control your spending. I would also find it very necessary to bring extra cash when card terminals won’t work all of a sudden.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

Notify me of new posts by email.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Pin It on Pinterest

18 tips to help you manage your money while traveling

International travel is full of excitement. Seeing new places, trying new cuisines, and navigating a different culture lead to memories that last a lifetime.

As a college student or young professional, travel can be one of the most rewarding ways to spend your well-earned money.

But with all the excitement of traveling abroad, you can’t forget about managing your money. In addition to having the right currency and understanding foreign exchange rates, you’ll want to take measures to manage your money well while on the move.

While traveling doesn’t have to be more expensive than your day-to-day life, there are extra considerations to take to keep money safe while traveling.

What’s Ahead:

Before you leave

1. alert your bank and credit card company.

Alerting your bank and credit card company used to be a standard practice when traveling abroad — so “suspicious” charges in another country didn’t put a freeze on your accounts.

These days, however, banks are a little better at tracking fraud. But alerting your bank and credit card company still can’t hurt — especially if you’ve never traveled abroad with your card and want to make sure you don’t run into any issues with your account.

2. Look into your cards’ foreign transaction fees

Foreign transaction fees — tacked onto any purchase made outside of the U.S. — can add up fast when you’re traveling abroad. If you’re not sure if your card company charges foreign transaction fees, give them a call before your trip to find out. While you’re on the phone, ask if there are specific ATMs to use that will help you avoid extra fees.

If your cards do charge foreign transaction fees and you have enough time before your trip, you might want to consider getting a credit card that doesn’t charge them. If you plan to do more traveling abroad in the future, a card without foreign transaction fees will save you a lot of money over the years.

3. Save copies of important information

Before you leave, make sure you have access to all of your important bank and credit card information in case something happens and you lose your cards. Keep an accessible digital record of the following:

- Your bank’s phone number

- Your credit card company’s phone number

- Your credit and debit card numbers

It might be easiest to take photos of your cards and save them on your phone. The important thing is to be able to access your card numbers and contact your bank in case of an emergency.

4. Confirm or purchase travel insurance

If you have a travel credit card, chances are it comes with travel insurance benefits. These benefits can come in handy when things don’t work out as planned — like when your flight gets delayed or your rental car windshield cracks. You don’t want to be on the hook for added expenses, especially after working hard to plan a trip within your budget.

Look up the travel insurance benefits that come with your card so you know exactly what’s covered. If you don’t have a travel credit card — or your benefits don’t cover enough — consider buying travel insurance. You can compare policies online using sites like SquareMouth and Travelinsurance.com to find the best option for your trip.

5. Get some local currency

It’s always wise to have at least some local currency on hand before arriving at your destination. You never know when you’ll have unexpected card troubles and need cash when there’s no ATM or bank around. Bring at least enough cash to get you a couple of meals, a hotel room, and transportation to tide you over until you can access a bank or ATM.

And don’t wait until you get to the airport to get cash, or you’ll pay a fortune to exchange currencies. Instead, call your bank ahead of time to see if you can exchange your money there — you’ll usually get a much better deal.

6. Consider a prepaid travel debit card

If you don’t have a credit card without foreign transaction fees — or you’re worried about using your card abroad — you can always get a prepaid travel debit card to load up with cash before your trip.

These cards, while they can be costly, come with lots of perks — like fee-free transactions, 24/7 assistance, and no ATM withdrawal fees. But just like credit cards, the perks vary card-to-card — and the fees can add up — so weigh your options and do your research to pick the best card for your trip.

During your trip

7. know when to use card vs. cash.

It’s always wise to have several methods of payment while traveling abroad. Some businesses will prefer card over cash, while others may not accept a card at all.

For example, using a credit card at a local street market may not be possible — so you’ll probably want some cash on hand. And in some countries, it’s best to tip with cash rather than on your card.

Alternatively, businesses like hotels may prefer you pay with a card — and you may save money if your card doesn’t have foreign transaction fees. And depending on how you tend to spend and budget, using a card can help you categorize and analyze your spending more easily at the end of your trip.

8. Use points

Travel hacking — or using miles or points to pay for travel — has become more popular in recent years. And contrary to what you may think, you don’t need to spend a ton of time or effort to earn and make use of points.

Travel credit cards usually issue points or miles when you pay with the card, which add up over time to help you save big on flights or hotel stays. If you have a travel credit card, read the fine print to understand how to earn points and make the most of them while traveling. If you don’t have a travel credit card, pick one that maximizes benefits you’ll actually use, doesn’t clobber you with fees, and — to get you some rewards right off the bat — has an attractive sign-up bonus.

9. Avoid random ATMs

When withdrawing money in a foreign country, be smart about what ATMs you use. First of all, if your bank allows fee-free withdrawals at particular ATMs — or they have branches where you’re traveling — make sure to use those machines to save money on withdrawal fees.

Try to avoid independent ATMs — they’ll often have higher fees and lower security than bank ATMs. And don’t use any ATM in an area that feels unsafe. Use machines in public places, and check your surroundings before making a withdrawal.

10. Protect yourself from theft

A smart way to manage money while traveling is to not keep all your money in the same place. If your wallet gets lost or stolen while you’re out, you don’t want to risk losing all your cash.

If you withdraw more cash than you need to spend at once, keep the extra bills in your hotel safe. When you’re out, carry your cash securely in a money belt or tamper-proof wallet. You might even want to invest in an RFID-blocking wallet, which protects your cards from digital theft by radio-frequency identification skimmers.

11. Choose local currency when paying with a card

When you’re paying with your credit card in a foreign country, you may notice an option to select either your home currency or the local currency when checking out. It might not seem like a big deal in the moment, but you’ll save money by choosing the local currency.

Despite having a credit card without foreign transaction fees, you may still pay a fee — usually around 3% —for paying in your home currency. And though you may have to do a quick currency conversion to determine how much you’re spending, you can end up saving a lot of money with this one easy tip.

12. Understand tipping culture

In North America, it’s not just polite — it’s expected — to tip 15% or more in restaurants and for other services. But tipping culture isn’t the same across the globe, and in some countries, tipping is even considered rude.

In Europe, for example, you’ll often pay a 5-10% service charge that’s already tacked on to the bill. In Asia, however, tipping isn’t the norm (and in some countries, like Japan, can even be disrespectful). Do some research on tipping culture in the countries you’re visiting. Consult travel guides and tourism websites to find out what’s expected before you go.

13. Check your account regularly

When you’re spending a different currency than your own, it’s easy to spend more than you realize (I am definitely guilty of this ). And when you’re using a card — in any currency — it’s easy to overspend. Now that lots of restaurants and stores are now card-only, you might be spending more than you realize.

Make sure you check your account regularly to avoid overspending your budget. You don’t want to arrive home after your trip with a pile of credit card debt that you weren’t expecting to pay.

14. Bank securely while traveling

Banking securely will help you keep money safe while traveling. And since most of us bank online these days, it’s extra important.

First of all, make sure all of your devices are password-protected before you travel. Otherwise, if your computer or phone gets stolen — and you have your passwords saved automatically — someone could instantly gain access to your online accounts.

If you can help it, try to avoid using free public Wi-Fi, which could potentially put your information at risk. If you need to log into your bank accounts, make sure you’re using cellular data or a protected Wi-Fi network.

15. Don’t forget the exchange rate

No matter whether you’re paying with card or cash, keep the exchange rate in mind when you’re spending. It’s easy to lose sight of how much you’re actually spending — and think something is “cheap” when you’re really paying with a more expensive currency.

If you need to, you can use an app to convert currency prices before making a purchase. That way, you know exactly how much you’re spending each time you swipe your card.

After your trip

16. convert your leftover cash.

Unless you know you’ll be traveling again soon, try to spend any foreign currency before returning home. If you come back with foreign cash, you’ll have to exchange it back to U.S. dollars. Exchanging money twice — to a foreign currency and then back to U.S. dollars — will cost you a lot in fees.

If you do need to exchange currency back into U.S. dollars, you’ll want to return to the bank. That’s where you’ll find the best exchange rates and lower fees. Or better yet, if you have a friend who’s planning to visit the destination you just came from, see if they’ll buy your leftover currency for a reasonable, fee-free rate. You’ll both come out ahead.

17. Pay off your credit card

When you return from your trip — and before you start dreaming up the next one — make sure to pay off your credit card. If you used your card for most of your purchases abroad, you don’t want to let that hefty balance linger.

Make sure you pay off your credit card and any travel-related expenses as soon as you can so your trip doesn’t end up costing you more down the line.

18. Check on your accounts

On a similar note, make sure you check up on your accounts after returning home from your trip. Don’t let any unfamiliar charges go unnoticed — instead, if you see something suspicious, call your bank or credit card company right away to report the charges.

Next time you travel abroad, use these tips to help keep your money safe while traveling. When you take the time to make security a priority, you can travel with a lot less stress — and spend a lot more time having fun.

Featured image: HappyTime19 /Shutterstock.com

About the author

Cassidy Horton

Cassidy is a personal finance writer with an MBA and a bachelor’s degree in public relations. She has published hundreds of finance articles online covering a range of topics for variety of publications, including Forbes, The Balance and Money Under 30.

Your money deserves more than a soundbyte.

Get straightforward advice on managing money well.

Most financial content is either an echo chamber for the "Already Rich" or a torrent of dubious advice designed only to profit its creators. For nearly 20 years, we've been on a mission to help our readers acheive their financial goals with no judgement, no jargon, and no get-rich-quick BS. Join us today.

We hate spam as much as you do. We generally send out no more than 2-3 emails per month featuring our latest articles and, when warranted, commentary on recent financial news. You can unsubscribe at any time.

Get Daily Travel Tips & Deals!

By proceeding, you agree to our Privacy Policy and Terms of Use .

10 Smart Ways to Carry Money While Traveling

Christine Sarkis

There's a 95 percent chance Senior Editor Christine Sarkis is thinking about travel right now. Follow her on Instagram @postcartography and Twitter @ChristineSarkis .

Christine Sarkis is an SATW-award-winning journalist and executive editor at SmarterTravel. Her stories have also appeared on USA Today, Conde Nast Traveler, Huffington Post, and Business Insider. Her advice has been featured in dozens of print and online publications including The New York Times , Conde Nast Traveler , and People magazine. She has also shared travel tips on television and radio shows including Good Morning America, Marketplace, and Here & Now. Her work has been published in the anthologies Spain from a Backpack and The Best Women's Travel Writing 2008 . She is currently working on a travel memoir.

The Handy Item I Always Pack : The Trtl Pillow . It's easy to pack and comfortable, and makes it so I can actually sleep on flights.

Ultimate Bucket List Experience : Seeing the Aurora Borealis from the comfort of somewhere warm, like a glass igloo or hot spring.

Travel Motto : Curiosity is an amazing compass.

Aisle, Window, or Middle Seat : Aisle all the way.

Email Christine Sarkis at [email protected] .

Travel Smarter! Sign up for our free newsletter.

Carrying money on vacation is a balancing act between safety and utility. Making money difficult to access deters thieves, but when it comes time to pay for something, you still want to be able to get to it without stripping off clothes or playing hide-and-seek with a bag’s hidden pockets. With that in mind, here are 10 tips that will help you carry money safely and elegantly while traveling.

Some of the links featured in this story are affiliate links, and SmarterTravel may collect a commission (at no cost to you) if you shop through them.

Divide Money

Even if you disregard all other advice about carrying money, take this tip to heart: Whenever possible, divvy up your travel cash and even credit cards into multiple safe spots. If you have all your money in one place, it only takes one incident for a thief to totally wipe you out.

When possible, leave all the cards and cash you won’t need immediately in a secure location in your hotel or vacation rental. And when you’re out and about, keep some of your money attached to your person (see below for ideas about how to wear money securely), and some in a bag you carry. If you’re smart about how you distribute your funds, you’ll still have enough money to get to a police station or back to your hotel in the event your bag gets lost or snatched.

The Best Credit Cards for Travelers

Favor On-Body Storage

Under-clothing storage accessories have come a long way since neck pouches and money belts came onto the scene. Though those classics are still effective, newer options include bra stashes , as well as long johns , underwear , and undershirts with built-in pockets for safe storage. On-body storage accessories are particularly useful if you’re sleeping somewhere that doesn’t have a secure place for cash and other valuables.

Note that on-body storage isn’t a good wallet alternative, since fishing around under your clothes for money advertises where you’re hiding the goods.

Keep Small Bills Handy

Changing or withdrawing large amounts of money minimizes the fees you’ll pay to get local currency, but it also means you’ll be traveling with far more cash—and larger bills—than you’d likely have on you at home. In addition to dividing your money, it’s also wise to make smaller denominations of currency easily accessible. That way, you won’t pull out the local equivalent of a $100 bill while attempting to buy a 30-cent souvenir. You also won’t have to reach down into your jeans to get more money from an under-clothing money pouch.

Make money preparation part of your morning routine: As you’re packing your bag, make sure you’ve got a variety of small bills and coins at the ready for purchases such as food, souvenirs, and attraction entry fees. Squirrel away larger bills in your under-clothing money pouch , or tuck them into a secure part of your wallet or bag.

3 Incredible Money-Saving Tips from a Flight Attendant

Carry an Anti-Theft Bag

If garbage-bag commercials have taught us anything, it’s that some bags are tougher than others. The same goes for travel purses , backpacks , and bags —some, designed specifically for travel, have features such as cut-proof, steel-cable-reinforced shoulder straps; slash-proof fabric; and locking zippers.

Since elements like these slow down thieves, anti-theft bags can do a decent job deterring opportunistic pickpockets. Anti-theft bags are available online from Arden Cove , Pacsafe , Travelon , and other retailers. Consider your purchase an investment that might save you some money.

Trim Your Wallet

Are you going to need your library card when you’re 6,000 miles from your local branch? Probably not. Before you leave, take the time to go through your wallet and take out everything except the necessities (a primary credit card and a backup, an identification card, an insurance card, etc.). Not only will it help you travel lighter, but if your wallet does get lost or stolen, you’ll have fewer items to replace.

How to Save Money on Gas: 8 Easy Tricks

Use a Dummy Wallet

If you’re traveling in a place known for pickpockets or muggings, consider getting a cheap wallet that looks real enough to use as a decoy that you can keep in your pocket or bag. Pad the wallet with some small bills and make it look more real by slipping in one or two of those sample credit cards you get with offers in the mail. A dummy wallet can stop pickpockets before they get to your real wallet.

Buy a Travel Wallet

In addition to a dummy wallet, you might also consider a wallet that you reserve specifically for travel. There’s one simple reason for this: If you’re the type of person whose day-to-day wallet is packed with cards—gym memberships, prepaid coffee cards, frequent-buyer punch cards, and the like—the card pockets are likely to be stretched out and won’t be able to securely hold just an item or two. By keeping a travel-only wallet at the ready, your cards will have snug pockets that they can’t slip out of accidentally.

As an added bonus, you won’t have to unpack and repack your day-to-day wallet; you can simply transfer what you need for your trip to your travel version.

Is It Better to Pay in Local Currency or USD When Given the Option Abroad?

Adapt to the Local Money Culture

Being prepared to pay your way on vacation means different things depending on where you are. In a cash economy, you’ll need to make sure to have a variety of bills and coins on hand at all times, but your credit cards will likely just collect dust.

However, in much of Europe and parts of Asia, where automation is common and chip-and-PIN credit card technology is standard, having a compatible credit card will come in very handy, especially if you find yourself at an unattended gas station late at night or a train station after hours. Also keep in mind that in some countries, U.S. dollars are an official or unofficial secondary currency, so it’s wise to keep a few greenbacks at the ready.

Use Money Alternatives

In high-traffic settings such as metro stations and close quarters like bus lines, it’s nice to be able to forgo cash or credit card transactions and rely instead on a multi-use ticket or other cash alternative. If you’re in a city where the public transportation system offers multi-use cards (for instance, London’s Oyster card or San Francisco’s Clipper card) or where you can buy a bunch of tickets at once for a discounted price, then take advantage. You’ll reduce your chances of losing your wallet simply by retrieving and stowing it fewer times.

Where to Get the Best Exchange Rate When You Need a Foreign Currency

Stow Valuables Securely

Sometimes the best way to carry money is not to carry it at all . Hotels’ in-room safes are generally pretty secure, and if you’ve got an item (or a wad of cash) you’re particularly nervous about, check to see if the hotel has a safe-deposit box behind the desk. If you do use a hotel lockbox of any sort, remember to retrieve your items when you leave. In the rush to pack up and depart, out of sight can easily mean out of mind—until you’re on your way to the airport. If you’re a forgetful type, leave a colorful note on top of your suitcase .

Editor’s note: This story was originally published in 2016. It has been updated to reflect the most current information.

You Might Also Like:

We hand-pick everything we recommend and select items through testing and reviews. Some products are sent to us free of charge with no incentive to offer a favorable review. We offer our unbiased opinions and do not accept compensation to review products. All items are in stock and prices are accurate at the time of publication. If you buy something through our links, we may earn a commission.

Top Fares From

Don't see a fare you like? View all flight deals from your city.

Today's top travel deals.

Brought to you by ShermansTravel

9-Nt Dublin, Cork, Killarney & Galway...

Railbookers

Luxe, 12-Night Spain, France, Monaco &...

Regent Seven Seas Cruises

Ohio: Daily Car Rentals from Cincinnati

Trending on SmarterTravel

- Work With Us

36 Real Ways to Save Money While Traveling (Actionable Tips)

Written by Becca

Updated on March 21st, 2024

Here are our proven best ways to save money while traveling. When traveling on a budget, there are lots of ways to make your money last longer, even during inflation.

This article may contain affiliate links. We earn a small commissions when you purchase via those links — and it's free for you. It's only us (Becca & Dan) working on this website, so we value your support! Read our privacy policy and learn more about us .

Table of contents

- Travel in the off-season (aka never around Christmas)

- Find things to do for free when you travel

- Walk and take public transit when you travel

- Minimize attractions with entrance fees or cover charges

- Minimize buying drinks at bars

- Avoid losing all your money with an emergency stash

- Cook more and eat out less

- Cook with fun local (and cheap) ingredients from markets

- Compare the flight costs in low season

- Save money by staying in hostels

- Try house-sitting to save money on accommodations

- Save money by booking accommodation for longer to get discounts

- Travel in places where your home currency takes you farther

- Travel on less than $50 per day

- Track your spending with an app

- Use Splitwise to keep track of splitting bills with friends

- Avoid the most expensive places to travel (or know the reality)

- Research the price of travel and the trends

- Cut out shopping and take photos instead

- Get connected to some locals

- Drink the tap water (if it’s safe)

- Buy local brands and locally-grown produce as snacks

- Do your research in order to save money and avoid fines

- Listen to travel and finance podcasts!

- Use a credit card to get a good foreign exchange rate

- Sign up for credit card a bonus to pay for your trip on miles

- Don’t pay foreign transaction or ATM withdrawal fees, ever

- Shop around for trip insurance online

- Get Priority Pass to save on airport lounges, and get in for free

- Find the best price for flights

- Save money with rental cars

Save money by using ride-share-style cabs

- Travel in a group and share download links for free credit

- Shop around for the best hotel, Airbnb and hostel prices

- Take out a weekly budget in cash

- Find creative and new ways to work remotely and travel

When traveling, you may want to save as much money as possible so that you can extend your trip. The less money that you spend means that you have more money to spend on experiences, accommodations and everything else.

It’s easy to not think twice about expensive upgrades and eating at restaurants every meal. At home, you’re in control and you know your budget. When traveling, you may have different currency and don’t want to skimp!

So, how can you still have a great time on your trip while optimizing for a budget?

Let’s find out!

Travel in the off-season (aka never around Christmas)

Have you heard the term ‘high season’? It’s a real thing!

Some places become more expensive during Christmas and New Year’s, during summer (relative to the hemisphere!) and during spring breaks (depends on local university schedules).

If you avoid these times of year, you’ll find hotels that want to fill up their properties, tours that may discount prices in order to draw visitors in the off-season and lower flight prices.

Depending on where you are going, do your search to determine when high season is and try to avoid it.

Find things to do for free when you travel

All over the world, it is possible to find things to do for free. It’s a great way to beat inflation or rising costs, and enjoy activities that cost nothing.

If you’re not interested in walking for miles to see a city and its parks or buildings, you can seek out ways to enjoy nature and the arts, like for example with this list of free things to do in NYC .