Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

AIG Travel Guard Insurance Coverage Review – Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

29 Published Articles 3077 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1170 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Why Purchase Travel Insurance

Core coverages, optional coverages for an additional fee, aig travel guard and covid-19, additional information — aig travel guard, to other travel insurance companies, to credit card travel insurance, the value of travel insurance comparison websites, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Purchasing insurance for your home, auto, or your life, can be complicated and time-consuming if you want to compare coverages and premium costs between companies. Fortunately, the process of purchasing travel insurance is quite simple , and you can secure immediate coverage within minutes.

It all starts with determining the coverages that most important to you, securing a quote, then making sure you’re purchasing from an established, highly-rated company. One such established travel insurance company is AIG Travel Guard .

With over 25 years of experience and high ratings from premier insurance financial rating company A.M. Best , AIG Travel Guard was named the best travel insurance company of 2020 by Forbes . Its Travel Guard Deluxe policy was also given a top 5-star rating by Forbes’ insurance analysts.

We’ll certainly discuss AIG Travel Guard’s policy offerings in our article today but we also want to discuss why you’d want to purchase travel insurance , whether travel insurance covers COVID-19, the process for obtaining a quote, and additional resources to help ensure you’re receiving good value.

Plus, if you’re wondering if you need to purchase travel insurance or whether you might have enough coverage elsewhere, you’ll want to read on.

While the primary reasons for purchasing travel insurance are to protect your economic investment and to cover unexpected additional expenses you might incur due to trip disruptions, purchasing travel insurance has another, more intangible, purpose.

Purchasing travel insurance can provide peace of mind prior to and during your trip as you won’t be worried that an unforeseen event will result in an economic loss. Knowing you have evacuation insurance when you’re traveling to a remote area on safari, for example, could be tremendously reassuring, even if you never use the coverage.

Here are some sample situations where travel insurance may provide coverage:

- Your sister is diagnosed with a life-threatening illness and you must cancel your trip

- You broke your ankle and will not be able to go on your skiing trip

- You become ill and cannot travel

- You or your traveling companion is terminated or involuntarily laid off from your job

- You are summoned to jury duty or other legal action such as requiring you to appear as a witness

If your trip is expensive, complicated, or you need medical coverage while traveling, a travel insurance policy is a must.

Bottom Line: In addition to protecting your trip investment and covering unexpected expenses due to trip disruptions, travel insurance can also provide peace of mind before and during your travels.

AIG Travel Guard — Coverages and Policy Options

There’s probably nothing more boring than listing insurance coverages but it’s important to know the types of coverages you can expect when purchasing an AIG Travel Guard policy.

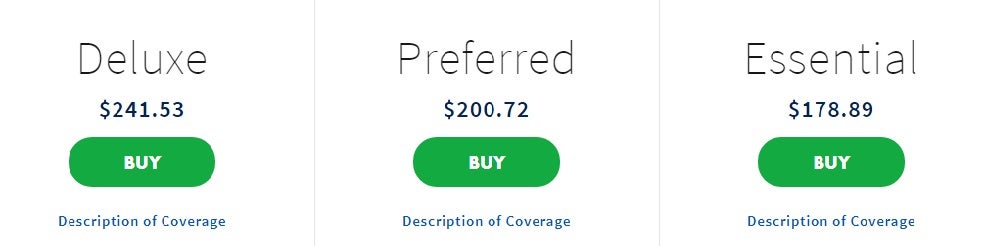

First, AIG Travel Guard offers 3 policy options for U.S. residents (not including NY residents), 3 separate options for NY residents, and 1 policy for Canadian residents.

- Tr avel Guard Essential

- Travel Guard Preferred

- Travel Guard Deluxe

- Travel Guard Essential Expanded — available to NY residents

- Travel Guard Protect Assist — available to NY residents

- Travel Guard Tour, Cruise, & Travel — available to NY residents

- Gold Trip Cancellation Policy — available to Canadian residents

Coverage options and limits will vary by policy, however, you can expect to find the core and optional coverages listed here.

Here are the types of coverages you’ll find offered on AIG Travel Guard policies and the applicable coverage limits for each type of policy.

There are also additional coverages that may be included at no extra charge, depending on the policy type selected. Terms and conditions apply.

- 1 child under 17 per covered adult is included for no extra charge

- Pre-existing conditions waiver

- Trip exchange coverage

- Single occupancy fee coverage

- Evacuation for a security reason

- Non-flight accidental and dismemberment insurance

- Worldwide travel and medical assistance services

You may secure any of the following add-on coverages by paying an additional fee.

- Cancel for Any Reason Insurance — covers trip cancellation for any reason

- Rental vehicle damage — coverage for collision damage when renting a vehicle

- Pet bundle coverage — pet care, medical expenses, and adds pet illness to trip cancellation benefit

- Adventure sports coverage — coverage for higher risk adventure activities

- Increased lodging expense bundle — increases the amount covered under travel inconvenience benefit

- Wedding bundle — coverage when a destination wedding is canceled

- Name a family member bundle — select a traveler to be covered as a family member

Hot Tip: For more information and tips on purchasing travel insurance, start here in our article on travel insurance basics .

Travel insurance , in general, is designed to protect you from financial loss due to unforeseen events that may cause you to cancel your trip, or to cover disruptions that could occur during your journey. It is not meant to cover voluntary trip cancellations due to fear of getting ill.

Voluntary cancellations, including those that are related to the fear of getting ill, are not covered on travel insurance policies. However, there is 1 option for obtaining coverage for voluntarily canceling your trip.

Cancel for Any Reason insurance (CFAR) is an optional coverage that can be added to select travel insurance policies allowing you to cancel your trip for any reason you deem necessary and be covered for partial reimbursement.

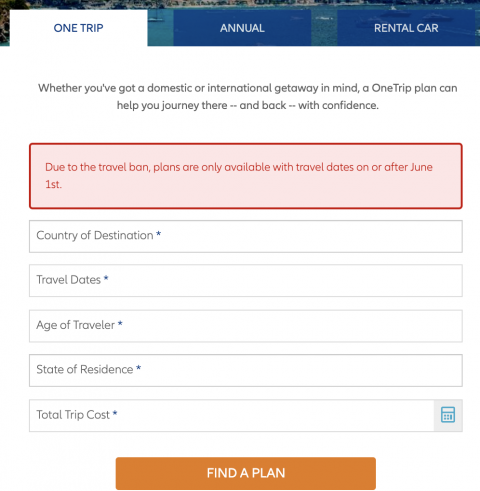

AIG Travel Guard offers CFAR coverage as an optional add-on to add to its Preferred and Deluxe plans , with these stipulations:

- Must be purchased within 15 days of the initial trip deposit

- The trip must be canceled more than 48 hours prior to departure

- The full cost of the trip must be insured for at the time of purchase

Cancel for Any Reason insurance does not cover the entire cost of the trip. In this case, to add CFAR insurance to the Deluxe and Preferred plans above, the additional premium would be $53.31 for coverage to cover up to 50% of the trip price. Additional options may be available to cover up to 75% of the cost of your trip.

The above prices are for a single trip 1-week in length for a traveler of 40 years of age at a cost of $3,000.

AIG Travel Guard policies, even without the CFAR insurance add-on, offer coverage for trip cancellations due to COVID-19 related illness and also medical coverage should a covered traveler become sick with COVID-19 during their travels. Terms and conditions apply.

Bottom Line: While trip cancellation, trip interruption, and emergency medical may offer some coverage for illness, you must purchase Cancel for Any Reason insurance to have coverage for canceling a trip due to the fear of getting ill. AIG Travel Guard offers this coverage on its Deluxe and Preferred plans.

Point-of-Sale Availability — In addition to offering travel insurance package policies directly to the public, AIG Travel Guard offers travel insurance products via several travel providers including airlines and various travel services. You’ll find the option to purchase Travel Guard protection during the checkout process with companies such as United Airlines or Frontier Airlines when purchasing a flight and when making a travel purchase via Costco Travel .

Call for Additional Quotes — While AIG Travel Guard does sell annual multi-trip policies, you must call to request a quote. Adventure sports coverage, medevac coverage, and rental vehicle damage coverage quotes are also available via phone.

15-Day Free Look Period — If you decide, after you have reviewed your purchased policy, that you do not want it, you may receive a full refund.

Cruise Insurance Option — AIG Travel Guard offers cruise insurance that includes cruise diversion and other applicable coverages.

Filing a claim — to initiate a claim, you can either call AIG Travel Guard at 866-478-8222 or access travelguard.com to begin the process. You will need your policy number handy. Once your claim is submitted, you can check the status at claims.travelguard.com/status .

How Does AIG Travel Guard Compare

First, know that when purchasing a policy from AIG Travel Guard, you’re buying from a highly-rated established insurance company. Here’s how the company stacks up in relative comparison with other travel insurance companies.

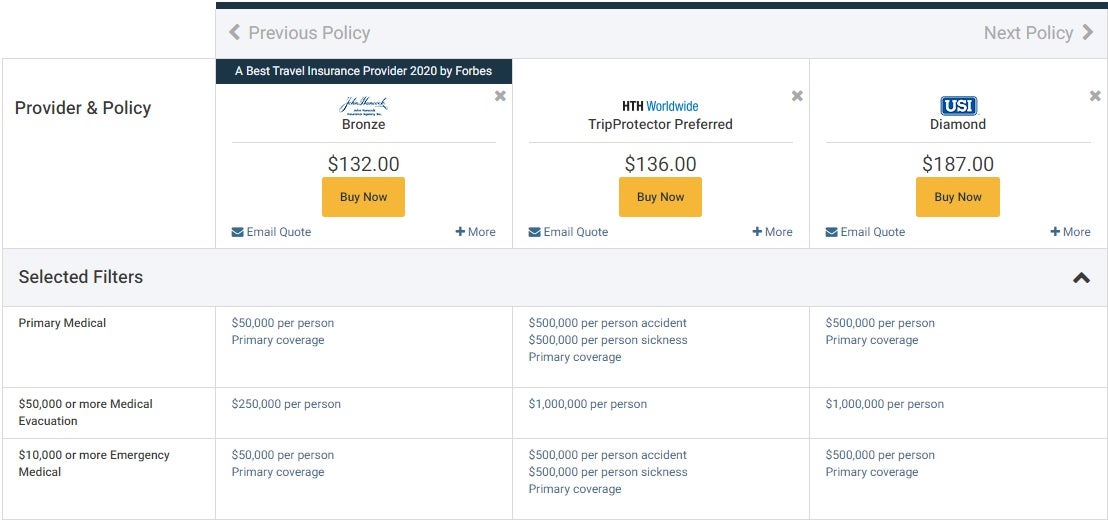

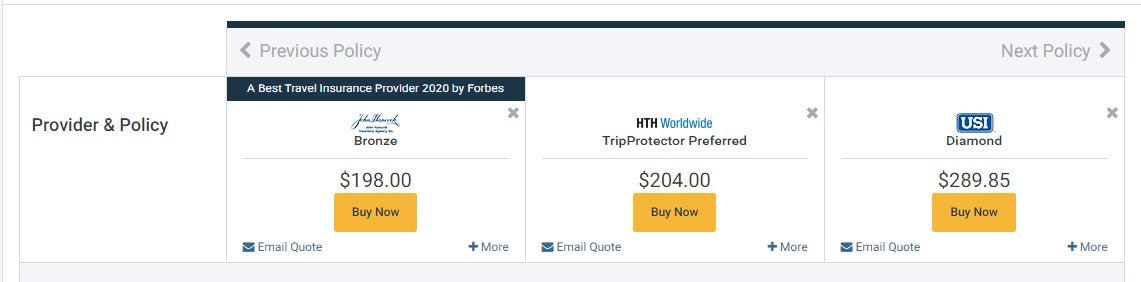

Comparing travel insurance policies can be complicated as coverage limits and prices vary widely. We looked at a 1-week trip to Mexico for a traveler 40 years of age and a total trip cost of $3,000 as criteria for obtaining a quote.

AIG Travel Guard’s Preferred plan, which prices out at around $200, aligns with the John Hancock Bronze policy above. Add in CFAR coverage, however, and the comparison costs are closer to AIG Travel Guard’s $254 premium for its Preferred level plan that also includes CFAR.

This 1 example uses the criteria of a specific trip for an individual traveler of a certain age and may not reflect the same relative premium costs as other comparisons.

Your own individual traveler information, the number of travelers, trip length, destination, state of residence, selected coverages, and the total cost of your trip will ultimately determine the premium cost. Our example is just a narrow snapshot comparison.

Bottom Line: Travel insurance policy coverages and costs vary dramatically. To ensure you’re receiving good value, determine the coverages that are most important to you, compare policy options, and purchase from a reliable company.

The travel insurance coverages that come complimentary on your credit cards are no substitute for a comprehensive travel insurance policy. With that being said, the coverage that comes with your credit card could be enough to cover some trips.

Here are some examples of trips where you may not need travel insurance and the coverage you have on your credit card could be sufficient.

- The trip consists of only a round trip domestic flight and hotel stay

- The trip is a road trip by car

- The trip does not include any non-refundable trip expenses

- The trip does not have several travel providers involved

- Your health insurance covers you while traveling and you are not worried about having additional medical coverage during your trip

Also, keep in mind that coverage offered on your credit card is generally secondary versus a primary travel insurance policy. This means you must first file a claim with other applicable insurance, including coverage with the airline or travel provider, for example, before the credit card coverage will kick in.

Bottom Line: If you have a significant investment at stake, several travel providers involved, or want medical coverage during your travels, you should purchase a comprehensive travel insurance policy for your trip and not depend on a credit card with travel insurance .

Travel insurance is widely available and competitive. You won’t have trouble purchasing some level of coverage regardless of your situation. Additionally, there are travel insurance comparison websites that make it easy to find a policy that fits and purchase coverage that is effective immediately.

These travel insurance comparison websites are each easy to use, have qualified people to assist, and all feature policies offered only by highly-rated companies.

Travelinsurance.com

- Instant coverage

- Simple format, easy to secure a quote quickly

- Guarantees the best price for the policy you’re purchasing

Squaremouth

- Features 20 companies with nearly 120 different policy options

- Its customer service team is award-winning

- You can access thousands of customer reviews

InsureMyTrip

- Educational content to assist you in understanding coverages

- Features 21 highly-rated companies

- Licensed agents can answer questions and assist with a claim

Bottom Line: Travel insurance comparison websites provide quick easy access to securing a quote, compare several high-rated travel insurance providers at once, and the benefit of receiving immediate coverage.

While airlines and travel providers have made significant changes to cancellation, refund, and exchange policies, it’s still important to consider purchasing travel insurance if you’re uncomfortable with the possibility of losing your trip investment or incurring unexpected expenses during your journey.

In addition, if you need medical insurance coverage during your trip, you won’t find that coverage on a credit card or with the airlines — you’ll need to purchase it.

The fact that AIG Travel Guard does not exclude COVID-19 related claims under certain coverages and offers a Cancel for Any Reason add-on is significant as not every travel insurance company can make that claim.

Also, if you have children traveling with you, you may find good value with AIG Travel Guard having those under 17 included for no extra charge (1 per premium-paying adult).

The bottom line when purchasing travel insurance from AIG Travel Guard is that if you can secure the coverages you need at a price you’re comfortable with and you’ll know you’re completing that transaction with a highly-rated established company.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

Frequently Asked Questions

Is aig travel guard a good travel insurance company.

AIG Travel Guard is a highly-rated established travel insurance company. It is rated A by the prominent insurance financial rating company A.M. Best and has been in business for over 25 years.

It was also named the best travel insurance company of 2020 by Forbes.

Does AIG Travel Guard cover trip cancellation?

Yes, AIG Travel Guard will cover trip cancellations but only for covered reasons listed in the policy. Examples of situations that may be covered include becoming ill and having to cancel your trip, being called for jury duty or other covered legal obligation, or your home becomes uninhabitable.

Does AIG Travel Guard cover flight cancellations due to COVID?

AIG Travel Guard, like other travel insurance companies, does not cover canceling a flight due to the fear of getting ill. However, if you become ill from COVID-19 and have to cancel your trip, you may have coverage for trip cancellation, trip interruption, or emergency medical if should become ill during your trip.

How do I make a claim with AIG Travel Guard?

You can file a claim with AIG Travel Guard by calling 866-478-8222 Monday through Friday from 7 a.m. to 7 p.m. CST. You can also initiate a claim online at travelguard.com using your policy number and last name.

Once you have submitted a claim, you can check the status of your claim at claims.travelguard.com/status , using your claim number and last name.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

You are using an outdated browser. Please upgrade your browser to improve your experience.

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Travel Insurance: Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , John Hancock , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective (meaning two companies are very close) our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don't click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Product name, logo, brands, and other trademarks featured or referred to within our site are the property of their respective trademark holders. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services.

Best Price Guarantee By Comparing Top Providers In A Single Platform

- Buy online and get instant coverage by email

- 24/7 emergency assistance worldwide

- Over 100,000 verified customers with 5-star reviews and $3.5 billion in protected trip costs

- Includes coverage from theft, trip cancellations, baggage loss and delay, medical expenses for hospital treatments

- Policies from trusted providers including: Travel Insured International, AEGIS, Global Trip Protection, Arch RoamRight and others

- Travel Insurance

- Travel Guard Insurance Review

AIG Travel Guard Travel Insurance Review

The following companies are our partners in Travel Insurance: Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , John Hancock , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity. Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

How is Travel Guard Insurance rated?

Overall rating: 4.8 / 5 (excellent), travel guard insurance plans & coverage, coverage - 5 / 5, emergency medical coverage details, baggage coverage details, travel guard insurance financial strength, financial strength - 4.5 / 5, travel guard insurance price & reputation, price & reputation - 4.8 / 5, travel guard insurance customer assistance services, extra benefits - 5 / 5, travel assistance services.

- Lost Passport/Document Assistance

- Up to the Minute Travel Advisories

- Roadside Assistance

Emergency Medical Assistance Services

- Physician Referral

- Emergency Prescription Replacement

Concierge Assistance Services

- Restaurant/Event Referral and Reservation

- Ground Transportation Recommendations

- Weather Advisories

- Wireless Device Assistance

- Plane/Boat Charter Assistance

Our Comments Policy | How to Write an Effective Comment

29 Customer Comments & Reviews

- ← Previous

- Next →

Related to Travel Insurance

Top articles.

- Trip Cancellation Insurance – What is Covered?

- Do I Really Need Travel Insurance?

- Emergency Travel Insurance Coverage

- Common Parasites and Travel-Related Infectious Diseases

Suggested Comparisons

- Travel Guard Insurance vs. Travelex

- Allianz Global Assistance vs. Travel Guard Insurance

- Allianz Global Assistance vs. Berkshire Hathaway

- Allianz Global Assistance vs. Travelex

- Or via Email -

Already a member? Login

AIG Travel Guard Review

Aig travel guard travel insurance is great for cruise cover and families..

Top Ten Reviews Verdict

AIG Travel Guard has all the makings of a very good travel insurer. It has service centers scattered around the world, multi-lingual assistance, free cover for kids and a host of coverage options to suit all, including for those who enjoy a holiday cruise. Sadly, it slightly lets itself down when it comes to some areas of the website, and more information about making a claim wouldn't go amiss. Overall, there is still much to like, but a little extra attention to detail in some key areas could easily elevate Travel Guard to so much more.

Free cover for under 17s

Cover options specifically for cruises

Website is a little sparse of information

Few details about claims process

Why you can trust Top Ten Reviews Our expert reviewers spend hours testing and comparing products and services so you can choose the best for you. Find out more about how we test .

AIG is the well known global insurance company that, with operations in more than 80 countries worldwide, has all the makings to be one of the best travel insurance companies from the off. Serving the needs of millions of leisure and business travelers through its Travel Guard offering each year, AIG is almost unrivaled when it comes to underwriting travel insurance. Eight wholly owned service centers conveniently located in Asia, Europe and the Americas means AIG can provide its customers with access to 24/7 emergency travel assistance, medical and security services. While enjoying recognition for its travel insurance proposition, AIG also provides a range of other insurance products, from life insurance through to retirement and investment services.

<a href="http://www.aig.com/individuals_3171_411333.html" data-link-merchant="aig.com"" target="_blank"> Find travel insurance at AIG Travel Guard Whether you're venturing overseas for the first time or a business person regularly between countries, AIG Travel Guard will have a travel cover solution for you.

AIG Travel Guard Review: Plan options

Travel Guard comes in a variety of guises, with three main plans for single trip coverage. The Deluxe plan provides the most coverages, global travel assistance and access to 24/7 travel assistance services, while the Preferred plan is the next step down, and so is a cheaper but less comprehensive option for typical travelers. Completing the trio is the Essential plan, aimed primarily at those traveling domestically who need basic coverage. All three variations also include family coverage, meaning one child under 17 is covered for free for each paying adult.

Alongside these more standard packages are the Pack N' Go Plan for last minute travelers not in need of cancellation coverage, and the Annual Travel Plan, for multiple trips all year round. Further "offline" specialty plans can also be arranged by contacting a representative. What will also appeal to some are the specific cruise insurance policies that are on offer, and can be filtered out when you apply online.

AIG Travel Guard Review: What to expect

As you would expect of a company of such standing, the AIG website is easy on the eye, accessible and contains plenty of plan-specific information. Getting a quote is simple too, with a step-by-step process taking you through the options at your own pace - it is also here that you can specify whether you are flying, going on a cruise, or indulging in a bit of both, to make sure you get a policy best suited to you.

While you get a side-by-side comparison of plan benefits once you've entered details for a quote, a similar comparison before you reach this stage might prove useful. The Help Center is also a slight disappointment and little more than a bridge to some sparse FAQs. It also plays host to an online form that you can fill in for assistance and various phone numbers to call should you prefer. Policyholders can also sign in to Agentlink to have their problem heard that way too. Help is on hand round-the-clock and with more than 40 languages spoken on-site, you shouldn't have trouble getting your message across. A rating of 4.58 out of five on InsureMyTrip.com suggests you won't be unhappy with the service either.

Finally, the travel news section is useful, and divided into different travel categories, both geographic and by vacation type, including cruise news and honeymoon travel, among others.

AIG Travel Guard Review: Coverage

The coverage available under Travel Guard will depend on your selected plan, with the Deluxe package including trip cancellation up to $150,000 and interruption to $225,000. Medical expense coverage is up to $100,000, emergency evacuation and repatriation of remains coverage is up to $1 million, and security evacuation coverage is up to $100,000, among other benefits.

Cancel For Any Reason coverage is available on the Deluxe and Preferred plans for an additional cost, while rental car damage coverage can be added on to all plans. All three plans can also include pre-existing conditions if you purchase cover within 15 days of your first payment on your trip, and meet a couple of other conditions.

AIG Travel Guard Review: Making a claim

Should you need to make a claim, the process can be started online with your policy number and last name, and this is also the direction in which you are pointed should you want an update on the status of a claim. If you have any questions or concerns that you wish to raise over the phone, be aware that the toll free number for the US is only available 7am to 7pm, Monday to Friday.

The website lists the different types of document you will need for each type of claim, and reveals these can be emailed, faxed or mailed to the relevant department. There are some claims related FAQs too, but general information about the process as a whole is lacking and somewhat unknown.

Should you choose AIG Travel Guard travel insurance?

AIG Travel Guard will be a decent travel insurance option if you like the security of a well-known insurance name and welcome its undoubted presence on the ground in locations all around the world. Those traveling as a family will appreciate the free kids cover, while cruise travelers will like having plan options that are specific to them. While a little more attention could be paid to explaining the claims process, Travel Guard, and all its options, still represents a travel insurance plan that will be more than suitable for the needs of most heading on their travels.

<a href="http://www.aig.com/individuals_3171_411333.html" data-link-merchant="aig.com"" target="_blank"> Find cruise cover at AIG Travel Guard If your idea of a great holiday is a cruise, AIG Travel Guard offers tailor-made cruise specific travel insurance plans.

With over 20 years’ experience in the financial services industry, Tim has spent most of his career working for a financial data firm, where he was Online Editor of the consumer-facing Moneyfacts site, and regularly penned articles for the financial advice publication Investment Life and Pensions Moneyfacts. As a result, he has an excellent knowledge of almost areas of personal finance and, in particular, the retirement, investment, protection, mortgage and savings sectors.

Save $80 on Bissell Pet Hair Eraser Vacuum—it's perfect for spring cleaning and discounted to its cheapest ever price on Amazon

Our top-rated mini chainsaw is a limited-time deal on Amazon — get it or regret it

DeWalt 20V Cordless Dry Hand Vacuum review: perfect for the workshop

Most Popular

By Terri Williams March 17, 2024

By Terri Williams March 15, 2024

By Jason Cockerham March 14, 2024

By Alex Temblador March 13, 2024

By Joanne Lewsley March 12, 2024

By Alexandra Pamias March 12, 2024

By Dan Fauzi March 10, 2024

By Camryn Rabideau March 07, 2024

By Alex Temblador March 05, 2024

By Caroline Preece March 04, 2024

By Joanne Lewsley March 04, 2024

- Travel Insurance

- Travel Guard Travel Insurance Review

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

Travel Guard Travel Insurance Review 2024

Updated: Feb 28, 2024, 7:42am

Travel Guard travel insurance offers unlimited emergency medical coverage for travellers under age 54, and a still-generous $10 million for those 55 and up. There’s also a number of add-ons for certain plans if you’re a business traveller, taking a golf or ski vacation, or flying to a destination wedding. And if you’re worried about having to cancel, the Cancel For Any Reason upgrade gives peace of mind. But there are downsides. The mail-in claims process is clunky, and the upgrades aren’t available for all plans. Plus Travel Guard travel insurance isn’t currently offered in Quebec. Still, Travel Guard offers comprehensive coverage for a competitive price.

- Unlimited medical coverage under age 54

- Several benefit add-ons

- Pre-existing medical condition exclusion waiver

- CFAR coverage option

- Not available for Quebec residents

- Medical questionnaire required at age 56

- Clunky claims process

- Maximum age is 85

Table of Contents

About travel guard travel insurance, what travel insurance does travel guard offer, travel guard travel insurance plans, summary: plan comparison, travel guard travel insurance cost, comparing travel guard travel insurance with other insurers, optional add-ons for travel guard travel insurance, does travel guard travel insurance offer any discounts, does travel guard offer annual multi-trip plans, travel guard 24/7 travel assistance, does travel guard travel insurance have cancel for any reason (cfar), does travel guard travel insurance have interruption for any reason (ifar), travel guard travel insurance and pre-existing medical conditions, travel guard travel insurance exclusions, travel guard travel insurance eligibility, how to file a claim with travel guard travel insurance.

AIG Travel, Inc., a member of American International Group, Inc., is a worldwide leader in travel insurance and global assistance. Travel Guard is the marketing name for AIG’s portfolio of travel insurance and related services for both leisure and business travellers. Medical and security services are provided through a network of wholly-owned assistance centres located in Asia, Europe and the Americas.

Travel Guard Travel Insurance is underwritten by Toronto-based AIG Insurance Company of Canada.

Travel Guard Travel Insurance is currently not available for Quebec residents.

Here are the key types of travel insurance coverage offered in Travel Guard Travel Insurance plans:

- Emergency medical insurance: If you get ill or are injured on your trip, travel medical insurance can pay for emergency medical expenses, up to the coverage limits in your plan. These expenses can include doctor and hospital bills, medication and lab work, as well as medical evacuations, repatriation and arranging for a bedside companion if you are hospitalized.

- Trip cancellation insurance: If you cancel a trip for a reason listed in your travel policy, such as you or your travelling companion becoming ill, weather conditions cause a massive delay or you lose your job, trip cancellation insurance can reimburse you for prepaid, non-refundable costs.

- Travel interruption or delay insurance: Trip interruption insurance can pay for a last-minute flight home in an emergency and reimburse money that you lose by cutting a trip short due to a covered reason, including non-refundable activities and hotel stays. If your flight is delayed , your insurance can cover the cost of incidentals, such as meals or accommodations, after a specified period of time, such as six, 10 or 12 hours.

- Baggage insurance: Baggage travel insurance can compensate you up to your policy limits if your luggage is lost or stolen. It will reimburse the depreciated value of your suitcases and what you packed. If your bags are delayed, it can reimburse you for the cost of the necessities you’ll have to buy to tide you over. It also extends to your personal belongings, if they are lost, damaged or stolen.

- Travel accident insurance: This coverage offers compensation in the event of accidental death or catastrophic injury from an accident during your trip. Flight Accident Insurance covers injury while you’re on a commercial plane, during a connection or in an airport. Travel Accident Insurance covers death or dismemberment, including the loss of limbs or eyesight, while in transit during your trip.

Travel Guard Travel Insurance offers four plans for travelling outside of Canada.

Platinum All Inclusive Package: This is the most comprehensive plan offered by Travel Guard with unlimited emergency medical insurance for travellers under age 59, and $10 million in coverage for travellers 60 and up. It includes coverage for unforeseen medical emergencies, trip cancellation and interruption, flight and travel accident coverage, and baggage loss, damage and delay insurance.

Eligible emergency medical expenses include:

- Care received from a physician in or out of hospital

- A hospital room

- Rental or purchase of a hospital bed

- Medical appliances including a wheelchair, brace or crutches

- Diagnostic tests

- Prescription medication

- Private duty nursing

- One follow-up visit for your emergency

- Ground ambulance transportation

- Emergency evacuation and repatriation

- Dental treatment due to a blow to the face, up to $1,500

- Dental treatment due to other causes, up to $600

- Paramedical services, such as treatment from a physiotherapist, chiropractor, chiropodist, podiatrist or osteopath, up to $300 per profession

Medical benefits also include coverage to bring someone to your bedside, expenses for meals, hotel accommodations and associated expenses if you are hospitalized and/or if a medical delay prevents you from returning home, repatriation expenses and return of your remains if you die.

The Platinum All Inclusive Package offers two optional add-ons: Cancel For Any Reason (CFAR) and Cruise and Tour Protector coverage.

The Platinum All Inclusive Package is for travellers age 74 and younger.

Gold Emergency Medical Plan: If you’re only worried about medical emergencies while travelling, this benefit offers all of the medical coverage listed above. The Gold Emergency Medical Plan offers unlimited medical coverage for travellers aged 54 and under, and $10 million in coverage for travellers 55 and older.

Silver Deluxe Trip Cancellation & Interruption Package: This coverage option reimburses you for insured non-refundable travel expenses (such as hotels or prepaid excursions) if you have to cancel, interrupt, or delay your trip due to a covered reason. This benefit also includes baggage loss, damage and delay coverage, flight and travel accident coverage, and provides a specific benefit for a missed connection.

The Silver Deluxe Trip Cancellation/Interruption Package includes six optional add-ons: Cruise and Tour Protector, Expanded Benefits Upgrade, Golf Protector Coverage, Ski Protector Coverage, Business Protector Coverage and Collision Damage Waiver Coverage.

Gold Deluxe Trip Cancellation & Interruption Package: This coverage option offers the same benefits as the Silver package but some have higher payouts.

The Gold Deluxe Trip Cancellation/Interruption Package includes one optional add-on: Cruise and Tour Protector. There is also a Change of Mind benefit that reimburses your cancellation penalties up to $400 if you cancel a trip because you changed your mind, provided your trip has been paid in full.

We’ve highlighted the key benefits of Travel Guard Travel Insurance for the four single trip plans to help you identify which coverage is the best fit for you.

The price of a Travel Guard Travel Insurance plan depends on factors such as the cost of your trip, your age, your answers to a medical questionnaire, if required, and the amount of coverage you choose.

Here are some examples of the cost for Travel Guard Travel Insurance single trip plans for healthy travellers based in Ontario:

TravelSafe Travel Insurance Review

Emergency medical: $1 million Cancel For Any Reason: Yes, 75% Baggage insurance (maximum): $2,000

Related: TravelSafe Travel Insurance Review

CAA Travel Insurance

Emergency medical: $5 million Cancel For Any Reason: Yes, 50% to 75% Baggage insurance (maximum): $1,500

Related: CAA Travel Insurance Review

TuGo Travel Insurance

Emergency medical: $10 million Cancel For Any Reason: Yes, 50% Baggage insurance (maximum): $500

Related: TuGo Travel Insurance Review

Travel Guard offers several optional add-ons for its travel insurance.

The following six add-ons are available with the Silver Deluxe Trip Cancellation & Interruption Package :

- Business Protector coverage

- Cruise and Tour Protector

- Expanded Benefits Upgrade

- Golf Protector coverage

- Ski Protector coverage

- Collision Damage Waiver coverage

Business Protector coverage: This upgrade offers the following added benefits if you are travelling for business and need to make a claim under these scenarios:

Cruise and Tour Protector: If your pre-booked cruise is cancelled or if the dates are changed by the cruise company or tour operator, you are eligible for the following benefits:

Expanded Benefits Upgrade: This upgrade offers the following increased benefits and added benefits under these scenarios:

- Wedding coverage: If the primary reason for your trip is to attend a wedding and the wedding is cancelled due to the death or hospitalization of the bride, groom and/or parents of the bride or groom

- Wedding, sporting event or conference arrival delay: If the primary reason for your trip is to attend a wedding, sporting event or conference and your arrival is delayed for a reason beyond your control.

- Entertainment benefit: If you are delayed beyond your scheduled return date, the entertainment benefit pays for a ticketed event, such as a movie, live production or sporting event.

- Same-class ticket benefit: If you travelled on business or first class and you are later eligible for a flight replacement under your trip cancellation. Interruption or delay coverage, this benefit upgrades your economy-class ticket to your same-class ticket.

- Meals & accommodation benefit increase: Your meals and accommodation benefits for trip interruption and trip delay are increased.

- Baggage delay benefit increase: Your baggage delay benefit is increased from $400 to $750.

- Hurricane coverage: Your trip cancellation, interruption and delay coverage will now cover hurricanes.

Golf Protector coverage: This upgrade offers the following added benefits if you are playing golf on your trip and need to make a claim under these scenarios:

Ski Protector coverage: This upgrade offers the following added benefits if you are skiing or snowboarding on your trip and need to make a claim under these scenarios:

Collision Damage Waiver coverage: The benefit offers $50,000 in coverage if you need to make a claim due to physical loss or damage to a rental car during your trip.

If you purchase the Platinum All Inclusive Package , you can purchase the following add-ons:

- Cancel For Any Reason coverage

- Cruise and Tour Protector coverage

If you purchase the Gold Deluxe Trip Cancellation & Interruption Package , you can purchase the following add-on:

There are no add-ons with the Gold Emergency Medical Plan .

Using the example of the couple travelling to Mexico, here is the cost of the optional add-ons when selecting the Silver Deluxe Trip Cancellation & Trip Interruption Package with a base premium of $134:

Yes. You can buy multi-trip annual insurance if you travel more than once a year for multiple individual trips. Travel Guard offers nine, 16, 30 and and 60-day annual plans for emergency medical coverage.

Here’s how the cost compares for a single-trip emergency medical plan and the four multi-trip annual plans:

Worldwide emergency travel assistance is available 24/7 by calling the LiveTravel hotline.

When you have a travel medical emergency, the following support may be available:

- Health care facility location

- Assistance finding a doctor who speaks your preferred language

- Translation assistance

- Prescription refill assistance

- Coordinating medically necessary return travel arrangements

- Emergency medical evacuation

- Medical monitoring

- Medical equipment rental/replacement

Depending on your coverage, worldwide travel assistance services include:

- Lost baggage search and stolen luggage replacement assistance

- Lost passport and travel documents assistance

- ATM locator

- Emergency cash transfer

- Travel information, including visa and passport requirements

- Emergency telephone interpretation services

- Urgent message relay to family, friends or business associates

- Up-to-the-minute travel delay reports

- Assistance with obtaining long-distance calling cards for worldwide telephoning

- Inoculation information

- Embassy or consulate information

- Currency conversion or purchase assistance

- Up-to-the-minute information on local medical advisories, epidemics, required immunizations and available preventive measures

- Up-to-the-minute travel supplier strike information

- Legal referrals/bail bond assistance

- Worldwide public holiday information

- Flight rebooking assistance

- Hotel rebooking assistance

- Rental vehicle booking assistance

- Coordinate emergency return travel arrangements

- Roadside assistance

- Rental vehicle return assistance

- Guaranteed hotel check in

- Missed connection coordination

Personal security assistance includes:

- Arrange emergency and security evacuations

- Coordinate consultants to extract client to safety

- 24/7 access to security and safety advisories, global risk analysis and consultation specialists

- Immediate security intelligence on events occurring throughout the world

- Collaboration with law enforcement

The Gold and Silver Deluxe Trip Cancellation & Interruption Packages also offers the following Concierge Services:

- Assistance with restaurant reservations

- Ground transportation arrangements

- Event ticketing arrangements

- Tee times and course referrals

- Floral services

- Local activity recommendations

You must contact the Assistance Centre before receiving medical treatment or you may have to pay 30% of the eligible medical expenses. If you are unable to call, you must get someone to call on your behalf.

Yes. Travel Guard offers Cancel For Any Reason coverage as an optional add-on with the Platinum All Inclusive Package. If you are prevented from taking your trip for any reason not otherwise covered by the trip plan, Travel Guard will reimburse you for up to 75% of your prepaid, forfeited and non-refundable payments or deposits.

This add-on must be purchased at the same time the base plan is purchased, and within 15 days of the initial trip payment. Any additional payments must also be insured under this coverage within 15 days. To be eligible for coverage, you need to cancel your trip 48 hours or more prior to your departure date.

In general, a pre-existing condition is defined as any sickness, injury or medical condition that existed before the start of your coverage, whether or not diagnosed by a physician, that you showed signs or symptoms of or received medical attention for.

With a Travel Guard travel insurance plan, any pre-existing conditions must be stable and controlled for 90 days before the start of your policy to be eligible for coverage. In additional, Travel Guard will not cover any losses if you:

- Have been required to use, take or been prescribed nitroglycerin in any form more than once during a seven-day period for a heart condition

- Require the use of home oxygen or had to take oral steroids, such as prednisone or prednisolone, for a lung condition

According to Travel Guard, a medical condition is considered stable and controlled when there has been:

- No new treatment, new medical management or newly-prescribed medication

- No change in treatment, change in medical management, or newly prescribed medication

- No new, more frequent or more severe symptom or finding

- No test results showing deterioration

- No investigations or future investigations initiated or recommended for symptoms whether or not your diagnosis has been determined

- No hospitalization or referral to a specialist (made or recommended)

Travel Guard offers a Pre-existing Medical Condition Exclusion Waiver whereby the company will waive any pre-existing medical condition exclusions if:

- The policy is purchased within 15 days of making the initial trip payment

- Any additional payments or deposits are insured within 15 days of purchase

- You (the insured) are medically able to travel when you pay your premium

In addition to pre-existing condition exclusions, there are a number of scenarios not covered by travel insurance and it’s critical to know what not to do before you make a claim. The following are general exclusions to coverages provided by Travel Guard travel insurance:

- Expenses from any sickness or injury present before you bought your policy that you would expect to need medical treatment or hospitalization during your trip

- Expenses incurred once the medical emergency ends

- Non-emergency or prescription medication, including vaccinations, medication for the maintenance of a medical condition, vitamins, physical exams or routine tests

- Organ or bone marrow transplants, or surgery for artificial joints or prosthetic devices or implants

- Expenses for acupuncture or holistic treatment

- Ionizing radiation or radioactive contamination

- Eligible expenses that were not pre-approved

- Any medical condition if if was determined you could return home but you chose not to travel

- Expenses for any services prohibited by your provincial or territorial health insurance plan

- Routine prenatal care, a child born during your trip, childbirth or associated complications, pregnancy or associated complications after 26 weeks or any time after the expected date of delivery

- Your mental or emotional disorders

- Suicide or attempted suicide or intentional self-inflicted injury

- Any alcohol-related sickness, injury or death, or the abuse of medication, drugs, alcohol or other toxic substance

- A trip taken against your physician’s orders not to travel

- Your commission of, or attempt to commit, a crime

- Your participation in rock or mountain climbing, hang-gliding, parachuting, bungee jumping, skydiving, ski jumping, ski flying, heli-skiing, ski acrobatics, ski stunting, freestyle skiing, ski racing, ski bob racing, on-piste and off-piste skiing in areas designated as unsafe

- Your participation as a professional athlete in a sporting event

- Your participation in a motorized race or motorized speed contest

- Operating or learning to operate any aircraft, performing employment duties on any aircraft or ship, performing duties in any regular armed force services

- Travel to any country where there is an active travel advisory not to travel before your departure date

- War, acts of foreign enemies or rebellion

- Expenses relating to travel in, to or through Cuba, Iran, Syria, Sudan, North Korea or the Crimea region

There may be additional exclusions specifically for medical, trip cancellation/interruption/delay and baggage coverage.

To be eligible for Travel Guard Travel Insurance you must:

- Be a Canadian resident

- Have purchased your policy prior to your departure date

- Have purchased your policy less than 18 months prior to your departure date

- Have purchased your policy for the full duration of your trip

- Have purchased your policy for the full value of your non-refundable, prepaid travel arrangements

- Be insured under your provincial or territorial insurance plan (or your emergency medical benefits will max out at $10,000)

- Be less than 75 years old

- Be travelling for less than 183 days if you are less than 60 years old

- Be travelling for less than 60 days if you are between 60 and 75 years old

In addition, the following makes you ineligible for Travel Guard Travel Insurance:

- A licensed physician has diagnosed you with a terminal condition.

- You have undergone a bone marrow transplant or an organ transplant (except for a corneal transplant) that requires the use of anti-rejection/immune suppression drugs.

- You require dialysis of any type for kidney disease.

- If you are under the age of 75 and in the last 12 months you have been prescribed or utilized home oxygen therapy at any time.

You can file a claim by contacting Travel Guard by telephone at the numbers listed on the website depending on the province or territory you are calling from.

The insurer will provide the forms for your claim within 15 days of you initiating the claim. However, if you haven’t received the required forms during that time, you can submit your proof of claim in the form of a written statement outlining the cause or nature of the accident, sickness or disability that caused the claim.

If you are making an emergency medical claim, you must provide original receipts for incurred expenses, including those for subsistence allowance expenses.

For a trip cancellation/trip interruption/trip delay claim, you may be asked to provide:

- Proof of all non-refundable, prepaid deposits or payments

- Completed documentation if a medical condition was the cause of the cancellation

- Complete unused transportation tickets and vouchers

- Original receipts for subsistence allowance expenses

- Original receipts for new tickets

- Reports from police or local authorities documenting the missed connection or travel delay

- Invoices and original receipts from travel service providers

If you are making a baggage insurance and personal effects claim, you may need to provide:

- A letter of coverage or denial from the transportation carrier

- A written report regarding the loss or damage

- Original receipts or sales slips for all lost and stolen items over $149.99 per item claimed and proof that you owned the articles

- Original receipts and sales slips for all items claimed under baggage and personal effects coverage

If you are making a Rental Car Collision Damage Protection Benefit claim, you may be asked to provide:

- Your car rental invoice

- Your rental agreement with the record of the damages that existed when you picked up the car

- The police report and rental car agency report including estimate of repair costs

You must file your claim with us within 30 days of the loss or damage in the case of a claim under Rental Car Protector Coverage.

Travel Guard Travel Insurance FAQs

Does travel guard travel insurance pay for medical costs upfront.

According to the company, benefits for emergency medical expenses, emergency evacuation and repatriation of remains services may be payable directly to the provider of the services, however the provider, “must comply with the statutory provision for direct payment and may not have been paid from any other sources.” The insurer adds it will “make every effort, though we cannot guarantee, to pay providers directly.”

Does Travel Guard Travel Insurance offer coverage extensions?

Yes. Your coverage is automatically extended for up to 72 hours if your return home is delayed due to a transportation issue. If you or your travelling companion are hospitalized, your coverage is extended for the period of hospitalization, plus up to 120 hours after discharge. If you or your travelling companion are too sick to travel on your return date but do not require hospitalization, your coverage is automatically extended for up to 120 hours after your planned return date.

If you want to stay longer on your trip, you can extend your coverage if you apply and pay the premium before your original return date as long as you have not made a claim and there is no reason to make a claim.

Does Travel Guard Travel Insurance require a medical questionnaire?

Yes. Travellers over age 55 are required to complete a medical questionnaire to determine your eligibility and rate category.

Does Travel Guard Travel Insurance have any age restrictions?

Yes. You must be a minimum of 15 days old and no more than 85 years old.

When does my coverage with Travel Guard Travel Insurance begin?

In general, if you purchase cancellation coverage, it begins the day you buy your policy and ends the day you make a claim or leave on your trip. Your medical and interruption coverage, if purchased, begins when you leave home. Your delay coverage begins once an insured risk prevents you from returning home as scheduled.

Does Travel Guard Travel Insurance offer a free look period?

Yes. Travel Guard offers a 10-day Right to Examine period during which you can review your policy and cancel if you’re not satisfied with it.

Can I get a refund with Travel Guard Travel Insurance?

You can request a refund for the all-inclusive plan up to the departure date as long as you have not made a claim against the policy. A refund will also be issued if your travel supplier cancels or changes your trip and all your insured trips costs are refunded without penalty.

With an emergency medical plan, you can request a refund if you have a minimum of four unused days of coverage.

No refund will be issued if you have initiated, reported or made a claim against your policy.

Fiona Campbell is a Staff Writer for Forbes Advisor Canada. She started her career on Bay Street, but followed her love for research, writing and a good story into journalism. She is the former editor of Bankrate Canada, and has over 20 years of experience writing for various publications, including the Globe and Mail, Financial Post Business, Advisor’s Edge, Mydoh.ca and more.

- Goose Travel Insurance Review

- CAA Travel Insurance Review 2023

- TuGo Travel Insurance Review

- Blue Cross Travel Insurance

- Manulife Financial CoverMe Travel Insurance

- World Nomads Travel Insurance Review

- Medipac Travel Insurance Review

- RBC Insurance Travel Insurance

- TD Insurance Travel Insurance Review

- Johnson MEDOC Travel Insurance

- Allianz Global Assistance Travel Insurance

- TD Bank Travel Insurance

- CUMIS Travel Insurance Review

- AMA Travel Insurance

- GMS Travel Insurance Review

- CIBC Travel Insurance Review

- BMO Travel Insurance Review

- Desjardins Travel Insurance Review

- Travelance Travel Insurance

- Scotia Travel Insurance Review

- How To Get Pre-Existing Conditions Covered By Travel Insurance

- Should You Buy Travel Insurance And Is It Worth It?

- Why Travel Medical Insurance Is Essential

Do I Need Travel Insurance When Travelling Within Canada?

- Trip Cancellation Travel Insurance

- How To Get Reimbursement For A Travel Insurance Claim

- Do Canadian Travellers Need Schengen Visa Insurance?

- How Travel Insurance Works For Baggage

- How To Travel To The U.S. From Canada

- Do You Need Annual Multi-Trip Travel Insurance?

- Travel Insurance For Trips To Europe

- What Travel Insurance Does Not Cover

- Top 10 Travel Insurance Tips For 2023

- Travel Insurance For A Mexico Vacation

- How To Read The Fine Print Of Your Travel Insurance Policy

- 5 Top Tips For Handling Flight Cancellations Like A Pro

- What Does Travel Delay Insurance Cover?

- Advantages Of Buying Travel Insurance Early

- Travel Insurance For U.K. Trips

- Travel Insurance For Trips To Italy

More from

$10 etias travel pass for europe visits pushed to 2025, what’s the purpose of an etias travel authorization, bcaa travel insurance review 2024, pacific blue cross travel insurance review 2024, cumis travel insurance review 2024.

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Log in to pay bills, manage policies, view documents, company news, materials & more.

Individuals

Private client group.

Policyholders in the U.S. can make online payments.

Workers’ Compensation (AIG Go WC)

Access workers’ compensation claims information, including FAQs, payments, prescription data, doctor information, and more.

Report a Claim

Report Aerospace, Commercial Auto, General Liability, Property, and Workers’ Compensation claims.

Dental, Group Life, and AD&D Claims

Employers and employees can access claim forms, claim reports, and information on claim status.

IntelliRisk Advanced

Clients and brokers can file claims, manage risks, and access claims data from 100+ countries.

myAIG Client Portal for Multinational

Track the status of controlled master programs, view policy details, download policy documents, access invoices, and more.

AIG Multinational Insurance Fundamentals

Receive free, accredited online training in multinational risk assessment and program design.

Brokers & Agents

Myaig portal for north america.

Generate loss runs, download policy documents, access applications and tools, and more.

myAIG Portal for Multinational

U.s. producer appointment and licensing.

Submit requests to become an AIG appointed brokerage/agent, expand or terminate your current AIG appointment.

Risk Managers

Log in to pay bills, manage policies, view documents, company news, materials & more.

- INDIVIDUALS

- BROKERS & AGENTS

- RISK MANAGERS

AIG Travel Guard

Get a quote in less than two minutes and travel with more peace of mind.

Travel Guard Plans

Compare coverage levels and pricing on our most popular plans with our product comparison tool—and find a Travel Guard plan that’s right for you.

Deluxe Plan

Our top-of-the-line, comprehensive travel coverage that sets the standard.

Preferred Plan

A comprehensive travel plan with superb coverage and service from start to finish.

Essential Plan

Savvy coverage for the budget-minded traveler.

Pack N' Go Plan

Immediate coverage for unplanned trips and adventures

Annual Travel Insurance Plan

Year-round coverage for your travel investments.

Millions of travelers each year trust AIG's Travel Guard to cover their vacations

Travel insurance plans provide coverage for certain costs and losses associated with traveling. Travel Guard ® helps you navigate canceled flights, lost bags, sudden health emergencies, and much more—almost anywhere in the world. Whether you’re planning a two-day getaway, a cruise, an adventure vacation, or a month-long international holiday, our plans help cover travelers and their trip inverstments.

Education Center

Sort through common questions about travel insurance

Traveler Resources

Safety information and travel tips for travelers

Preparing travelers wherever their journey takes them

AIG Travel CEO Jeff Rutledge shares how the underlying risks of travel have changed and what AIG is doing to help companies and individuals manage risks.

Coverage available to residents of U.S. states and the District of Columbia only. These plans provide insurance coverage that only applies during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of each policy with your existing life, health, home, and automobile insurance policies, as well as any other coverage which you may already have or is available to you, including through other insurers, as a member of an organization, or through your credit card program(s). If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc .(Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP.

This is only a brief description of the coverage(s) available. The policy will contain reductions, limitations, exclusions and termination provisions. Insurance underwritten by National Union Fire Insurance Company of Pittsburgh, Pa., a Pennsylvania insurance company, with its principal place of business at 1271 Ave of the Americas, Floor 41, New York, NY, 10020-1304. It is currently authorized to transact business in all states and the District of Columbia. NAIC No. 19445. Coverage may not be available in all states.

Related Content

COVID-19 Updates

Corporate Accident & Health Insurance

Insurance for Individuals and Families

DO NOT SELL OR SHARE MY PERSONAL INFORMATION

The California Consumer privacy Act gives California residents the right to opt-out of the sale or sharing of their personal information. A "sale" is the exchange of personal information for payment or other valuable consideration and includes certain advertising and anatytics practices. "Sharing" means the disclosure of personal information for behavioral advertising purposes, where the informatirm used to serve ads is collected across different online services.

Opt-out from the sale or sharing of your personal information.

Your request to opt out will be specific to the browser from which you submit your request, and you will need to submit another request from any other browser you use to accessour website. Additionally, if you clear cookies from your browser after submitting an opt-out request, you will clear the cookie that we used to honor your request. For this reason, you will have to submit a new opt-out request.

For information about our privacy practices, please review our Privacy Notice .

Thank you. We have received your request to opt out of the sale/sharing of personal information.

More information about our privacy practices.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Payroll Services

- Best HR Software

- Best HR Outsourcing Services

- Best HRIS Software

- Best Performance Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Bad Credit

- Best Home Equity Loan Rates

- Best Home Equity Loans

- What Is a HELOC?

- HELOC vs. Home Equity Loan

- Best Free Checking Accounts

- Best High-Yield Savings Accounts

- Bank Account Bonuses

- Checking Accounts

- Savings Accounts

- Money Market Accounts

- Best CD Rates

- Citibank CD Rates

- Synchrony Bank CD Rates

- Chase CD Rates

- Capital One CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

The Best Annual Travel Insurance Plans (2024)

Alex is a MarketWatch Guides team writer that covers automotive and personal finance topics. She’s worked as a content writer for over a dozen car dealerships across the U.S. and as a contributor to several major auto news websites.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

Annual travel insurance can provide travelers with protection for multiple trips in one year. After researching and reviewing travel insurance companies nationwide, the MarketWatch Guides team found that Seven Corners and Trawick offer the best annual travel insurance plans. International Medical Group, Allianz and AIG Travel Guard also offer annual plans worth considering.

What Is Annual Travel Insurance?

Annual travel insurance — also known as multi-trip travel insurance — can protect multiple trips over a year. For frequent travelers planning several vacations in a year, an annual travel insurance plan can offer a more economical option than purchasing multiple single-trip policies. With annual travel insurance, you should only pay one premium for a year’s worth of coverage.

While each annual travel insurance plan varies by provider, you may find that per-trip or yearly coverage limits apply rather than item-specific limits. In addition, some coverages found with single-trip policies are not typically included in an annual travel insurance plan, such as trip cancellation insurance, baggage loss and rental car coverage. Providers may also not offer the option to add cancel for any reason (CFAR) coverage with an annual plan. Annual travel insurance usually focuses more on medical protection versus a broader range of coverages, based on our assessment.

The 5 Best Annual Travel Insurance Plans

Based on our team’s extensive research on annual, multi-trip travel insurance plans, we’ve named the following as our top picks.

- Seven Corners : Trip Protection Annual Multi-Trip

- Trawick International : Safe Travels Annual Basic

- International Medical Group (IMG): Patriot Multi-Trip Travel Medical

- Allianz Travel Insurance: AllTrips Premier

- AIG Travel Guard: Annual Plan

Seven Corners Travel Insurance

Pros and Cons

Why we picked seven corners.

Seven Corners provides annual coverage through its Trip Protection Annual Multi-Trip plan. The plan includes COVID-19 protection, trip cancellation insurance and pre-existing condition coverage as standard, and allows for unlimited trips lasting 40 days or less throughout your policy term. You can also customize your annual trip cancellation limit, with up to $10,000 in total benefits.

Trawick International

Why We Picked Trawick

If you’re looking for basic coverage at a low cost, Trawick International offers its Safe Travels Annual Basic plan for a flat rate of $155 per person. Coverage extends up to 30 days for each trip taken more than 100 miles from home during your coverage period and can apply to both U.S.-based and international trips. While Trawick features lower coverage limits than other providers on our list, it offers 100% trip cancellation coverage at no additional cost.

International Medical Group

Why We Picked IMG

International Medical Group (IMG) provides the highest medical coverage maximum of all the providers on our list through its Patriot Multi-Trip Travel Medical plan. The policy offers protection of up to $1 million after paying a $250 deductible for medical benefits, dental, emergency medical evacuation and more. IMG also provides medical and emergency medical evacuation coverage if you have a sudden and unexpected recurrence of a pre-existing condition. Note that you can upgrade your plan to allow for 45 days of coverage per trip versus 30 days.

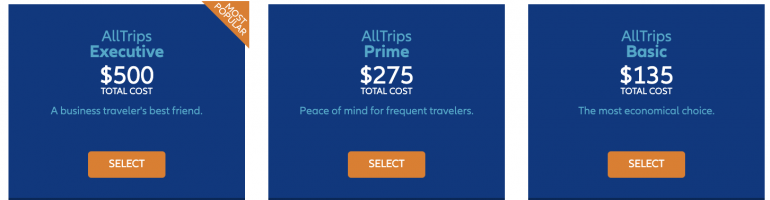

Allianz Global Assistance

Why We Picked Allianz

The Allianz AllTrips Premier plan provides annual travel insurance coverage for your entire household through one plan — regardless of whether you travel separately or together. The plan includes trip cancellation and interruption benefits as standard coverage, but you can customize the coverage limits at an additional cost. The AllTrips Premier plan also provides rental car coverage, which most providers in this review lack.

AIG Travel Guard

Why We Picked AIG

AIG Travel Guard (AIG) offers one annual travel protection policy, called the Annual Plan. It provides non-flight accidental death and dismemberment coverage up to $50,000, which is not typically included in other yearly policy offerings based on our review. AIG also offers up to $100,000 specifically for security evacuations. Note that there is no age limit to purchasing a policy — the only requirements include holding U.S. residency and buying the policy no later than 24 hours before departure.

Compare Annual Travel Insurance Plans

You can refer to the table below for a side-by-side comparison of our team’s picks for the best annual travel insurance policies.

* Our team gathered quotes from each provider’s website for the above-listed plans based on a 30-year-old sample traveler.

How To Choose an Annual Travel Insurance Plan

There are several steps you can take to help make the process of choosing an annual travel insurance plan easier while ensuring you pick the right plan for your needs as a traveler.

First, it is best practice to research providers before choosing an annual travel insurance plan. Not all travel insurance providers offer this type of policy, and for the ones that do, we recommend you consider industry and customer reputation when making a decision. Note the coverage limits, medical benefits and any additional add-ons each company offers. While the providers listed in this article are our top picks for annual coverage, every traveler’s needs and best-suited plan will vary.

If you have your travel itinerary for the year mapped out and know what you’re looking for in terms of coverage, consider an annual plan that aligns with your needs and concerns. For example, if you have a pre-existing medical condition , you may consider a provider that provides a pre-existing condition waiver and high medical coverage limits. If you’re more concerned about cancellation coverage, you may choose a plan that offers this type of protection, which not all companies include in their annual plans.

How Does Annual Travel Insurance Work?

Annual travel insurance works by covering a traveler during multiple trips over the course of a year. There’s usually no limit to the number of trips you can take during this time. However, companies do include limits on how long each trip can last under coverage. This limit varies by provider, but a standard threshold is a maximum of 90 days based on our review.

Some annual travel insurance benefits work on a per-trip or per-year basis. For example, a yearly plan may have a baggage loss limit that resets every trip, while it sets separate limits for trip interruption benefits for an entire year of travel. Plans are typically non-renewable, so once your coverage is up, you would have to buy a new plan to cover another year of travel.

After purchasing a plan, coverage begins on the effective date, which your provider should list within your policy documents. Coverage ends on your policy’s expiration date, which your provider should also detail within your policy. How long coverage extends per trip, and the associated coverage levels, will depend on your provider.

We recommend you read your policy carefully to ensure you fully understand the applicable limits of your annual travel insurance plan.

Benefits of Annual Travel Insurance

The benefits of an annual travel insurance plan include low costs compared to purchasing individual plans, convenience and consistent coverage across all of your trips. Learn more in the sections below.

Cost-Efficiency