- Home ›

- Exchange Rates ›

RBS exchange rates

Today's latest RBS travel money exchange rates, updated 2 minutes ago at 6:20pm

RBS have 51 currencies in stock and ready to order now. Buy your currency online and get it delivered securely to your home address free of charge, or collect your order from any RBS branch.

Jump to section:

- View today's latest RBS rates

- Compare RBS's rates

Travel money order limits and fees

- RBS reviews

RBS travel money rates

These are the latest RBS exchange rates available right now. You must buy or reserve your currency online to guarantee these rates or you may be given a lower rate in-store.

Compare RBS's exchange rates

We compare hundreds of exchange rates from dozens of currency suppliers across the UK. Select a currency below to see how RBS's rates compare against other providers. Bear in mind that exchange rates aren't the only important factor when it comes to getting the best deal; commission, card surcharges and delivery costs can all affect the final amount of currency you'll receive. You can see the full range of currency deals on offer right now on our travel money comparisons .

RBS have a minimum order value of £200 for in-store collection and £200 for home delivery. The maximum amount you can order is £2,500 for collection and £2,500 for delivery. Delivery is free for orders over £500, otherwise a £5.00 delivery charge will apply.

Latest RBS reviews

Our users have rated RBS Poor in 19 reviews. Read more on our RBS reviews page.

If you accept just one piece of advice today, do not use RBS/Natwest for FX transactions. They really are truly awful in every way, failed to deliver, terrible customer service and poor email communication.

Read the full review

Eleanor Young

I have had a bad experience with the RBS Bank/ Natwest. When I made my complaint they said that they could not trace my phone calls apart from the very first one which I find very strange as they say that all phone calls are recorded. I sent a list [...]

Linda Atkinson

It took 9 weeks for a cheque in Canadian dollars to clear. It miraculously cleared just as the value of the £ against the Canadian dollar rose. If they had cleared the cheque within the original frame line promised when we deposited the cheque, we w [...]

The euro rate at RBS right now is 1.1319. You'll need to buy or reserve your euros online to guarantee this rate; the euro rate offered in your local branch may be lower if you don't order online beforehand.

RBS exchange rates are typically below average, and their travel money deals are not competitive when compared to other high street currency providers such as Tesco and Asda .

If you want the absolute best exchange rate on the market, better currency deals are available from other suppliers, especially if you order online. Check out our travel money comparisons to find the best currency deals available right now.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

Royal Bank of Scotland: Foreign Currency Exchange, International Wire Transfer & ATM Fees explained

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Travelling or sending money abroad? Discover RBS's fees for International Wire Transfers, Currency Exchange and for using your credit or debit card abroad (incl. ATM fees). You'll learn how to save money and how to make smarter decisions about currency exchange.

Royal Bank of Scotland international wire transfer - all you need to know

The Royal Bank of Scotland provides comprehensive international money transfer services to send funds overseas. You can transfer money online via your banking service, over the phone, on a branch, or through the mobile app.

There is a limit on how much you can send through RBS, with a maximum transfer value of £10,000 a day.

What are RBS’s international money transfer fees and how fast are they?

The fee for sending UK pounds to another country depends on where you’re sending money to and how quickly you want it to arrive.

Sending UK pounds to Europe in Euros

- The “Standard” service costs £10 and will get the money into the beneficiary’s bank account on the next business day, provided you start your transfer before 4 PM, UK time

- The “Urgent” service costs £30 and will get the money into the beneficiary’s bank account on the same business day, provided you start your transfer before 1:30 PM, UK time

Sending UK pounds to Europe in a currency other than Euros

- The “Standard” service costs £22 and will get the money into the beneficiary’s bank account within two to four business days, provided you start your transfer before 4 PM, UK time

- The “Urgent” service costs £30 and will get the money into the beneficiary’s bank account within one to two business days, provided you start your transfer before 4 PM, UK time

Sending UK pounds outside Europe

- The “Urgent” service costs £30 and will get the money into the beneficiary’s bank account within one to two days, provided you start your transfer before 4 PM, UK time

RBS exchange rates

Here’s an example of how much you’ll pay through RBS in exchange rates when you’re transferring between UK pounds and Euros, compared to the best rate you could get:

- RBS will convert £1,000 to 1,124 euros

- The best exchange rate you can get would be £1,000 to 1,151 euros

- With the £10 RBS fee, the beneficiary will actually receive 1,113 euros

- So sending money through RBS means you’ll pay around 3.3 percent more in fixed and hidden fees

This is why it is generally not recommended to send money internationally with RBS if you’re looking for the cheapest way to send money abroad, but to compare all providers with Monito and find cheaper alternatives.

Find out more with our complete guide on how banks and money transfer operators make money with hidden fees .

How long does an RBS international wire take to arrive at the recipient bank?

Depending on the service you choose, an international money transfer with RBS could arrive the same day (in Europe) or take up to four business days to other parts of the world.

If you’re in a hurry, try finding the fastest way to send money abroad by comparing all international money transfer services with Monito .

How to make an RBS international wire transfer?

The process for sending money internationally through RBS differs by how you’re making the transfer. However you’re sending money, you will need to setup the beneficiary’s (payee’s) details first.

Setting up the beneficiary’s details

- Go to the relevant section in your online banking or mobile app

- Choose to add a new payee

- Enter the name of the payee

- Enter their details including:

- Name and address

- Bank branch name and address

- Bank routing code and account number

- SWIFT or IBAN code

- Any special messages, references, notes or details

- Check the details you've entered

Sending money through the RBS mobile app

- Log in to mobile banking

- Select the account that you wish to send your payment from

- Select ‘International payments’

- Select ‘Choose saved payee’

- Choose a payee from your list

- Select 'enter amount', enter the amount you want to send and press ‘Done’

- Then choose between the transfer types ‘Standard’ or ‘Urgent’

- Select the fee type

- Review and confirm your payment

- Read the terms and conditions and accept the transfer

Sending money through RBS online banking

- Select 'Payments and transfers' from the left hand menu

- Under the 'International payments' section select 'Make a Payment'

- Choose a payee that you’ve previously entered

- Enter a reference for the payment, the account you want it to leave from, and the date you want it to be sent. Once done, select ‘Next’

- Review the information you have entered

- Confirm your payment

Sending money through RBS telephone banking

- Make sure you’re setup for RBS telephone banking

- Call on: 03457 242424 Overseas: +44 (0) 131 549 8888

- Enter PIN and password

- Follow the instructions

What is RBS’s SWIFT Code?

If someone needs to send you money from abroad, they’ll need a SWIFT Code . The SWIFT Code for RBS is: RBOSGB2L

Which RBS address and details should someone use when sending me money from abroad?

- Bank address: Premier Place, Devonshire Square, London, EC2M 4XB, Kingdom

- Beneficiary Account Number: RBS bank account number, including leading zeros

What Monito Likes About RBS

- If you’re an RBS customer, you can send money internationally simply from your online banking, in a branch, over the phone, or via their app

- Secure transfer with a bank you already trust with your money

What Monito Dislikes About RBS

- Fixed fee for money transfers, which can be expensive if you want to send money quickly

- Hidden fees in the currency exchange rate margin

- No visibility on the exchange rate applied to your transfer beforehand

- You can only send money to a bank account

- It takes up to four business days

Alternatives to RBS

- Trust & Credibility 10

- Service & Quality 8.7

- Fees & Exchange Rates 10

- Customer Satisfaction 9.4

- Trust & Credibility 8.1

- Service & Quality 7.2

- Fees & Exchange Rates 9.2

- Customer Satisfaction 9.6

- Trust & Credibility 8.9

- Service & Quality 6.7

- Fees & Exchange Rates 9.7

- Customer Satisfaction 8.4

Find the cheapest way to send money abroad

Royal bank of scotland currency exchange service.

If you’re travelling abroad and want to exchange UK pounds to a foreign currency before your travel, you have several options:

- You can order any amount between £100 and £2,500

- There are no fixed fees for buying currency, but the exchange rates are worse than you could get elsewhere

- You can order foreign currency up to 10 days before you need it and choose a delivery date

- Foreign currency will be delivered to your closest RBS branch for free

- You can also have currency delivered to your home for free (£5 charge applies if order is under £500)

- You can go into a branch to order travel money or call RBS on 0345 300 1278

Exchange rates for RBS foreign exchange services

Here’s how much RBS provides when you buy a foreign currency.

- RBS will convert £1,000 to 1,100 euros

- So sending money through RBS means you’ll pay around 4.5 percent more in hidden fees

You can find much better deals, and pay much less, by comparing international money transfer providers .

Compare travel money services for any major currency

Using your Royal Bank of Scotland credit card abroad

In general, the foreign fees applied for using your RBS credit card abroad will depend on your credit card. You can learn about innovative multi-currency cards here .

What are the fees for using RBS credit or debit cards at an ATM abroad?

Foreign currency withdrawal from any UK cash machine (ATM)

Foreign Cash Fee of 2 percent of the value of the transaction (minimum £2, maximum £5) plus a Non-Sterling Transaction Fee of 2.75 percent of the value of the transaction.

Currency withdrawal at an ATM outside the UK

What are the fees for paying in foreign currencies online or at a shop with RBS credit or debit cards?

RBS typically charges a foreign purchase fee of three percent of the total transaction amount (minimum £3) for credit cards. For debit cards they charge a foreign purchase Fee of 2.75% of the value of the transaction (minimum £1).

What you need to know when withdrawing money/paying abroad?

The ATM or Point of Sale device will often ask you if you want to use your card’s currency (UK pounds if you’re banking with RBS) or the local currency (let’s say Euros if you’re in Paris).

💡 Tip You always want to pay in the local currency! If you pay in your home currency (UK pounds), you’re getting a dynamic currency conversion (DCC) which is often a very bad rate ( we’ve seen 5-18% currency exchange margin).

Save money now and find the cheapest way to send money abroad

You might also like.

- Jump to Accessibility

- Jump to Content

Travel guide

On this page

Help when travelling abroad

Spending abroad.

A guide to using your card abroad, registering your card for travel, and important fee information.

Membership Services

If you have a Royal Bank of Scotland current account with benefits, you can access them all in one place.

My trip is cancelled

To claim for a cancelled holiday you paid for on your card, please fill in the goods or services not received form.

Help if your travel plans have changed

We understand your travel plans may have changed. Find out how we can help with travel money refunds, debit and credit card payments below.

If your holiday or flight has been cancelled, please get in touch with your travel provider in the first instance as we can only dispute the payment after the travel date has passed and the travel provider is unable to assist you.

Coronavirus travel advice and FAQs

We've pulled together a range of commonly asked questions and answers to help you during this difficult time.

Travel advice during the coronavirus outbreak

You can find the latest travel guidance on the UK Government website, including information on travelling abroad, safety and security, entry requirements and travel warnings.

Ideas for travelling more sustainably

Whether you’re exploring new lands or staying local, sustainable travel provides new ways to see the world that could even save you money too.

Snappier shopping with contactless

- Breeze through checkouts . Tap your card to pay for shopping up to £100 (retailer exclusions may apply).

- For bigger baskets, tap your phone. Buying more? Use Apple Pay or Google Pay for anything over the contactless limit.

Apple Pay available on selected devices. Retailer limits may apply. Google Pay available on selected Android devices. Retailer limits may apply. Google Pay TM is a trademark of Google LLC

Download the app

Follow the three simple steps below.

App available to customers aged 11+ with compatible iOS and Android devices and a UK or international mobile number in specific countries.

1. On your mobile or tablet, go to the App Store if using Apple or Google Play if using Android

2. Search for 'Royal Bank of Scotland'

3. Tap to download the app

Get the app

Is there something else you're looking for?

Cheap Holiday Money At Your Fingertips

Find The Best Travel Money Rates

Our rates are updated hourly and sorted by the best currency exchange rates at the moment of inquiry. We pride ourselves on being one of the industry’s most comprehensive and accurate sites, but we recommend double-checking the rates before placing an order.

Best Travel Money Rates Provider (Wise):

Additional providers:.

* This is a comparison of more than 30 recommended travel money providers (doesn’t include other companies which have been included in some of the comparison tables on the site but have not made it into our “recommended” list).

* We do not guarantee the accuracy of quotes, but you can go ahead and check us out. If the provider is offering a different quote than what we featured, go and check other providers (sometimes the rates fluctuate heavily which causes some discrepancies but it’s rare). We feel this holiday money rate comparison is more accurate than most.

* Customer rating component is taken from CompareHolidayMoney with their permission.

View our Per Currency Comparison of top travel money providers:

Pound to Euro

Pound to Dollar

Pound to “Aussie” Dollar

Pound to Canadian Dollar

Pound to Turkish Lira

Pound to Costa Rican Colon

Pound to “Kiwi” Dollar

Pound to Sri Lankan Rupee

Pound to Indian Rupee

Pound to Thai Baht

Finding the best travel money provider

With travel money, finding the best travel money provider for your needs could be complicated. For once, the amount of currency required impacts the rates you are getting. Additionally, some providers are cheaper for particular currency pairs and more expensive for others. Finally, some people value rates, while others care about quality of service and reliability (and are willing to pay more for it).

This is why we have established CompareTravelMoney.net, to provide travellers with all the information they require to make a sober choice. For each currency, we have a separate list of recommended providers with specific rates which apply to the amount you are willing to exchange.

Websites like ours don’t charge money off clients (you will not get better rates by approaching them yourself; on the contrary). We only take a small fee for each client we refer over to a travel money company. In fact, we encourage competitiveness in the niche, and as a whole, what we do helps people get better and better rates each year for their currency.

Happy Travels!

Be sure to read through our About Us and Terms and Conditions . We have covered international money transfers for bank account transfers in a separate guide, but we are unable to present rates from these companies.

Need assistance?

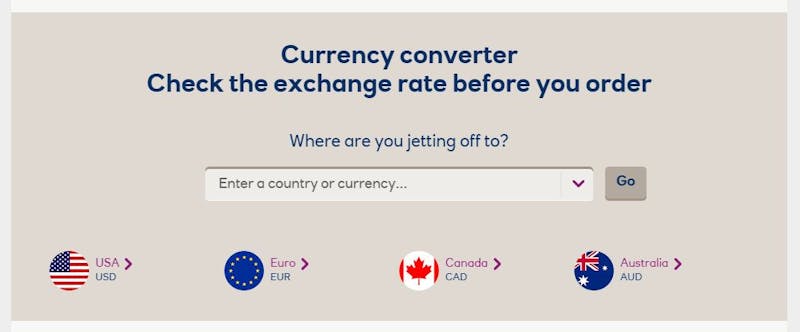

Foreign Exchange Currency Converter

Our Foreign Exchange Currency Converter allows you to quickly convert over 30 foreign currencies.

- Foreign Exchange

- This conversion is not offered by RBC.

- Please enter a lower currency amount or visit an RBC branch for conversions over CAD $10,000.

- The currencies could not be switched, the conversion is not offered by RBC.

- Rates not available at this time.

- Go to the error

Currency I Have:

Currency i have, currency i want:, currency i want.

Non-Cash Rates as of

Foreign Exchange cash transactions are available to RBC clients only.

Exchange rates quoted in the media are the exchange rates, used by banks and other market participants to buy and sell currencies in the wholesale market. Client transactions require additional processing and are usually for much smaller amounts, and as a result, are priced using a retail rate.

Exchange rates applied to cash transactions include shipping and handling charges, making the exchange rate for cash less favorable than the non-cash rate. Non-cash rates are applied to paper instruments such as cheques and drafts. Non-cash rates are also applied to incoming and outgoing wire payments and other electronic transactions. These instruments do not require physical storage or movement, and incur less time and cost for processing than cash transactions. Therefore a more favorable rate is applied to non-cash instruments.

It is often more beneficial to convert your Canadian dollars to the local currency of your travel destination before you leave Canada. Many banks, foreign exchange kiosks and hotels in other countries charge commission or service charges in addition to exchange rates that are often higher than those in Canada when converting your Canadian dollars to their local currency.

- Learn how to purchase it through RBC Online Banking and pick it up at a branch of your choice.

- Sign in to purchase

View Legal Disclaimers Hide Legal Disclaimers

Locate a Branch for Foreign Currency or U.S. Cash ATM

- Buy US Dollars

- Buy Turkish Lira

- Buy Australian Dollars

- Buy Bulgarian Lev

- Buy Canadian Dollars

- Buy Czech Koruna

- Buy New Zealand Dollar

- Buy UAE Dirham

- Buy Norwegian Krone

- Buy Polish Zloty

- Buy South African Rand

- Buy Thai Baht

- View all currencies

- Buy Back Guarantee

- Compare Rates

- Travel Guides

- Order & Collection Timetable

- Home Delivery Timetable

- Find Nearest Store

- Multi Currency Card

- Top up / Login

- Order Your Card - Online

- Order Your Card - In Branch

- Download on the App Store

- Get it on Google Play

- Multi Currency Card Terms & Conditions

- Multi Currency Card Fees & Limits

- Have an old Ramsdens Travel Card?

- Win A Holiday To Las Vegas

- Find out more

- Login (Existing Money Transfer Customers)

- Compare Rates Compare Rates

- Find Store Find Store

- Travel Money FAQs

- Multi Currency Card FAQs

- Contact Us - 01642 579975

- All Services

0% COMMISSION

CLICK AND COLLECT

& HOME DELIVERY AVAILABLE

OVER 40 CURRENCIES

AVAILABLE ONLINE

GREAT RATES

Your cart is empty.

Continue Shopping

Get great rates when you buy currency with

Four reasons to buy travel money online with Ramsdens

Why Choose Travel Money?

You could... WIN £1,000

IN OUR MONTHLY COMPETITION!

Travel Money

- Clubcard Prices Clubcard Prices

Clubcard Prices are available for all currencies, just enter your Clubcard number on the next page. Full T&Cs below.

- Click & Collect Click & Collect

Collect for free from more than 350 Tesco stores with a Bureau de change.

- Home Delivery Home Delivery

Free delivery on orders worth £500 or more.

Exchange rates may vary during the day and will vary whether buying in store, online or via phone.

Select currency

Error: Please select if you have a Clubcard to continue

Do you have a Tesco Clubcard?

How much would you like?

Error: Please enter an amount between £75 and £2,500

Find a Store to get your Travel Money

With Click & Collect you can order your travel money online and pick it up from selected Tesco stores near you, or you can buy instantly from an in-store travel money bureau.

Enter a postcode or location

Search results

3 easy ways to purchase Travel Money

Click & collect.

- Order online and choose to collect from over 500 Tesco store locations Order online and choose to collect from over 500 Tesco store locations

- Pick a collection day that works for you Pick a collection day that works for you

- Order euro or US Dollars Order Euros or US Dollars before 2pm and you can pick-up from most stores the next day

About Click & Collect

Home delivery

- Order online by 2pm Mon-Thurs for next day delivery (excludes bank and public holidays), to most parts of the UK Order online by 2pm Mon-Thurs for next day delivery (excludes bank and public holidays), to most parts of the UK

- Free delivery for orders of £500 or more Free delivery for orders of £500 or more

- Secure delivery via Royal Mail Special Delivery Secure delivery via Royal Mail Special Delivery

About Home Delivery

Buy in-store

- Buy your foreign currency instantly in our travel money bureaux in selected Tesco stores across the UK Buy your foreign currency instantly in our travel money bureaux in selected Tesco stores across the UK

- Turn unspent travel money back into Pounds with our Buy Back service Turn unspent travel money back into Pounds with our Buy Back service

About Buy Back

Best Travel Money Provider 2023/24

Now in it’s 26th year and voted for by the public, the Personal Finance Awards celebrate the best business and products in the UK personal finance market. We’re delighted that you voted us as Best Travel Money Provider 2023/24.

Additional Information

Ordering and collection.

You can pick a collection date when you're ordering your money. Order before 2pm and you can pick up Euros and US Dollars from most Tesco Travel Money bureaux the next day. Other currencies can take up to five days. Alternatively, you can order any currency for next weekday delivery to most of the selected customer service desks.

Please make sure you collect your money within four days of your chosen date. If you don't, your order will be returned and your purchase will be refunded, minus a £10 administration charge.

Will I be charged if I cancel my order?

Collection fees

Click and collect from stores with a Bureaux de change:

- Free for all orders

For non-bureaux stores with a click and collect function:

- £2.50 for orders of £100.00 - £499.99

- Free for orders of £500 or more

What to bring

For security, travel money will need to be picked up by the person who placed the order.

- a valid photo ID – either a passport, EU ID card, or full UK driving license (we do not accept provisional driving licenses)

- your order reference number

- the card you used to place the order (you’ll also need to know the card’s PIN)

Home Delivery

We can send your travel money directly to you via secure Royal Mail Special Delivery. You can even pick the delivery date that suits you best.

We also offer next-day home delivery on all currencies to most parts of the UK if ordered before 2pm Monday-Thursday.

Check the Royal Mail site to find out if your postcode is eligible for next day delivery

Delivery costs

£4.99 for orders of £100 - £499.99 Free for orders of £500 or more

- You’ll need to make sure there’s someone at home to sign for your delivery.

- Bank holidays and public holidays will affect delivery times.

- We are unable to cancel or amend home delivery orders after they have been placed.

Clubcard Prices

Clubcard Prices are available on the sell rate only for currencies in stock online, on your date of purchase. The Clubcard Price will be better than the standard rate advertised online on the date of purchase. When purchasing online you must enter a valid Clubcard number to obtain the Clubcard Price rate. Exchange rates may vary whether buying in store, online or by phone.

Clubcard Prices apply to foreign currency notes in stock on your date of online purchase. Due to constant market and currency fluctuations, rates on the date of purchase cannot be compared to another day’s rates. The actual rate you receive may vary depending on market fluctuations. Clubcard data is captured by Travelex on behalf of Tesco Bank.

Check out the Tesco Bank privacy policy to find out more.

Buying foreign currency using a credit or debit card

No matter how you purchase your travel money, whether it be in store, online or over the phone, you will not be charged any card handling fee by us. However, regardless of your card type, your card provider may apply fees, e.g. cash advance fees or other fees, so please check with them before you purchase your travel money.

Click & Collect cancellations

You can cancel a Click & Collect order any time prior to collection. We'll refund you with the full Sterling amount that you paid for your order, unless you cancel less than 24 hours before your collection date, in which case we'll charge a £10 late cancellation fee.

We are unable to refund any fees charged by your card issuer, so please contact them if you have any further queries.

When you get home, we'll buy your travel money back

Let us turn your unspent holiday money into Pounds. It couldn't be simpler.

Just pop into one of our in-store Travel Money Bureaux when you get home. We buy back all the currencies we sell in most banknote values and also the Multi-currency Cash Passport™. Buy back rates may vary during the day.

It doesn't matter where you bought your travel money, even if it wasn't from a Tesco Travel Money Bureau, we'll still buy it back.

More about currency buy back

How our Price Match works

If you find a better exchange rate advertised by another provider within three miles of your chosen Tesco Travel Money Bureau, on the same day, we'll match it.

Price Match only applies in store on a like-for-like basis on sell transactions and does not apply to any exchange rate advertised online or by phone. This is not available in conjunction with any other offer. We reserve the right to verify the rate you have found and the three mile distance (using an appropriate route planning tool).

See full terms and conditions below.

Tesco Travel Money is provided by Travelex

Tesco Travel Money ordered in store is provided by Travelex Agency Services Limited. Registered No. 04621879. Tesco Travel Money ordered online or by telephone is provided by Travelex Currency Services Limited. Registered No. 03797356. Registered Office for both companies: Worldwide House, Thorpewood, Peterborough, PE3 6SB.

Multi-currency Cash Passport is issued by PrePay Technologies Limited pursuant to license by Mastercard® International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

How much travel money will I need?

Whether it’s a burger in Brisbane or a taxi in Toronto, get a feel for how far your travel money might go with our foreign currency guides. We’ll help you manage your travel budget like a pro.

Looking to stash some cash? These places offer the highest interest rates and lowest fees.

Interest rate hikes over the past few years have been a saver’s delight, but your return can vary based on where you park your savings.

Your best bet for snagging the highest rate is an online-only personal savings account , which even beat the average rate on a one-year certificate of deposit (CD) , according to the Banking Landscape report released Thursday by finance site WalletHub. That study analyzed nearly 2,700 deposit accounts.

And if you need regular access to your money, rates at credit union checking accounts are 65 times higher than those at regional banks, and they charge lower fees.

Credit unions can offer higher rates because of “their small, local, and nonprofit nature, which results in lower overhead costs,” said Alina Comoreanu, WalletHub senior researcher .

Here are more banking trends and tidbits to help you get the most out of your cash:

Learn more: Best current CD rates

Where are the highest savings interest rates?

Online savings accounts continue to beat their brick-and-mortar counterparts by a wide margin. Their rates are 4.9 times higher than their branch-based counterparts and 3.7 times more than traditional checking accounts, WalletHub said.

A few banks recently lowered their online rates. But with the Fed remaining in higher-for-longer mode on interest rates, most online banks should keep their online savings and money market rates steady, said Ken Tumin in his Bank Deals Blog earlier this month.

After three consecutive months of hotter-than-expected inflation , economists lowered their forecasts for rate cuts this year to between zero and three from as many as seven at the start of the year.

“A run-of-the-mill online savings account” yielding 3.84% annually is roughly 24% more than the average 1-year CD of 3.09% annual percentage yield (APY), WalletHub said.

Magic number: The amount of money Americans think they need to retire comfortably hits record high: study

Where are the best checking accounts?

Credit unions have the lowest fees, highest rates and most features, WalletHub said.

On average, they’re 47% cheaper than checking accounts from small banks and 75% less expensive than those from national banks, it said. They also have roughly 1.6 times more features and their rates are 8.1 times higher, on average.

“Credit union members are also shareholders, which means that profits are returned to members in the form of better rates and lower fees,” Comoreanu said. “This is in contrast to banks, which aim to generate profits for their stockholders.”

To save money, consider electronic statements wherever you bank. The cost of receiving a paper statement grew by 8.95% over the past year, WalletHub said.

Where are the highest CD rates?

Again, credit unions win across all maturities, from three months to five years, WalletHub said. National institutions were the lowest across the spectrum.

Regional banks were second with the best rates in shorter maturities (three months to one year), but community banks ranked second for two-, three- and five-year CDs.

Specialty checking accounts

- Business accounts are the most expensive and offer the lowest rates, WalletHub said.

They’re 87% more expensive than branch-based personal checking accounts and 5.6 times more expensive than online-only personal checking accounts, the report said. Their interest rates are generally 66% lower than personal accounts and have 68% fewer features than online-based personal accounts.

“Small business owners who aren’t looking for business-specific features should gravitate to personal banking options whenever possible – much like with credit cards,” WalletHub said.

- Student checking accounts have the lowest fees, making them 73% less expensive than their general-consumer counterparts. “But lower fees come at a cost,” WalletHub said. Interest rates offered to students are 84% lower than those for the general population.

Medora Lee is a money, markets, and personal finance reporter at USA TODAY. You can reach her at [email protected] and subscribe to our free Daily Money newsletter for personal finance tips and business news every Monday through Friday.

COMMENTS

Via the Royal Bank mobile app. Just click on your account, look for Manage My Card, then going abroad and click Order Travel Money. By telephone. If you would prefer to order your currency over the phone, or if you have any questions about our travel money service, you can speak to one of our team on 0330 174 8524 (Relay UK 18001 0330 174 8524).

Travel money made simple. When you buy travel money from ROYAL BANK OF SCOTLAND, you can expect: The market's widest range of currencies, including euros, US dollars, Turkish lira and Polish zloty. A choice of home delivery, or Click & Collect from over 190 branches across the UK. Competitive rates, 0% commission and no hidden fees.

The market rate (or spot rate) is used by banks when changing currencies between themselves. Our exchange rate factors in the market rate, plus an extra fee to cover the costs and time it takes to get the travel money into your hands. This includes other parties buying the currency on your behalf and retailing the money (e.g. eurochange).

You'll get an email when your order is ready to pick up. Home delivery orders can be delivered the following day if placed before 2:30pm, or at a later date of your choosing. Weekend delivery is also available. Buy and sell travel money online. Click & Collect in 60 seconds or free next day delivery over £500.

Currency conversion charges. When making a payment or withdrawing cash abroad, you might get the option to pay in that currency or Pound Sterling (£). If you choose Sterling, RBS won't be handling the currency conversion, so any estimate we provide using this tool won't be at our rate. If you choose Sterling you may be charged more.

Register your card in the mobile app before you go. Enter the details of your trip in 'Home> Choose your account> Manage my card & Google Pay> Going Abroad> Register card' section of the mobile app. App available to customers aged 11+ with compatible iOS and Android devices and a UK or international mobile number in specific countries.

Get your travel money quickly and securely, with competitive rates and no hidden fees. Order before 2:30pm Monday-Friday for next working day delivery (excludes bank holidays). Free delivery on orders over £500 or just £5 on orders under £500. Wide range of currencies, from euros and US dollars to Turkish lira.

Travel money order limits and fees. RBS have a minimum order value of £200 for in-store collection and £200 for home delivery. The maximum amount you can order is £2,500 for collection and £2,500 for delivery. Delivery is free for orders over £500, otherwise a £5.00 delivery charge will apply.

Here's what you need to bring when you collect your order: The debit card you paid with (we reserve the right to PIN authenticate the card through the till.

You can go into a branch to order travel money or call RBS on 0345 300 1278; Exchange rates for RBS foreign exchange services. Here's how much RBS provides when you buy a foreign currency. RBS will convert £1,000 to 1,100 euros ; The best exchange rate you can get would be £1,000 to 1,151 euros ; So sending money through RBS means you'll ...

You can easily get better rates by using Wise. You can check out the difference in the table below: Currency. RBS 1000 GBP =. Wise 1000 GBP =. Additional Info. GBP to Euro. 1,123.2634 EUR. 1,170.7463 EUR.

Order amounts. The maximum amount you can order online is £2,500 worth of currency. If you need to order more than £2,500 worth of currency, please get in touch with our customer services team.; Payment online

Top 5 exchange rate need-to-knows. 1. The RIGHT cards consistently beat travel cash rates. 2. Beware charges for using credit cards to buy your travel money. 3. Avoid the debit cards from HELL - some fine you for spending abroad. 4. Don't let bureaux hold your cash for long - you've little protection.

If you would prefer to order travel money via the telephone, please contact us on the number below and one of our team will be happy to assist you. 03301 748 524. Lines are open Monday to Saturday 09:00 until 17:00 Sunday 11:00 until 16:00.

eurochange Branches. Collect your Royal Bank of Scotland Travel Money from any of the 200+ eurochange branches throughout England, Scotland, Wales and Northern Ireland. Enter your postcode to find your nearest eurochange branch:

These are indication rates only and payments made or received on your behalf by RBS will be converted at the rates prevailing at the time. These rates do not apply to currency notes or travellers cheques. Please contact your nearest branch for the most up to date foreign exchange rates. The exchange rate board contains indication rates only.

Travel advice during the coronavirus outbreak. You can find the latest travel guidance on the UK Government website, including information on travelling abroad, safety and security, entry requirements and travel warnings. Gov.uk travel advice.

Compare more than 30 different UK-based travel money suppliers with our website. Our rates are updated hourly and sorted by the best currency exchange rates at the moment of inquiry. We pride ourselves on being one of the industry's most comprehensive and accurate sites, but we recommend double-checking the rates before placing an order.

Currency I Want: U. S. Dollar (USD) Rate: 1.40600. Non-Cash Rates as of April 20, 2024. tooltip. Foreign Exchange cash transactions are available to RBC clients only.

You are now getting our best rate. 1 GBP = 1.14650 EUR. GBP. EUR. You'll pay GBP. You'll get NaN EUR. Max. order value for the selected currency is shown. Buy travel money. Exchange rates shown are for online purchases only - actual rates may vary in branch.

Whether it's a burger in Brisbane or a taxi in Toronto, get a feel for how far your travel money might go with our foreign currency guides. We'll help you manage your travel budget like a pro. Purchase travel money online with Tesco Bank and benefit from competitive exchange rates and 0% commission.

Credit unions have the lowest fees, highest rates and most features, WalletHub said. On average, they're 47% cheaper than checking accounts from small banks and 75% less expensive than those ...