How to Claim Travel Insurance? A Comprehensive Beginner’s Guide (2022)

Nobody ever wants to make travel insurance claims unless they really, really have to. Why? Because it’s troublesome, lah .

It’ll always be a hassle to fill up forms and rustle up the required documents, but just like waxing your legs, if you already know exactly what to do and how to prepare, the entire process can be relatively quick and painless — easy-peasy !

- Most common travel insurance claims

- How to claim travel insurance [step by step guide]

- Covid-19 travel insurance claims

- How long do travel insurance claims take?

- Travel insurance claims were rejected

- Why your travel insurance claims were rejected

1. Common travel insurance claims

What is the most common travel insurance claim?

Think it’s loss of baggage? You’re way off.

If you were to guess medical expenses or personal accident, you’d be closer, but that would still not be the answer.

In actual fact, flight delays are what most travellers experience, and it’s not surprising, especially when you consider the preference for budget airline travel.

Flight delays

Let’s be fair here, flight delays could happen to anyone, due to a myriad of reasons. It could be a mechanical fault with the plane, bad weather, or naming your airline Scoot. Whatever the reason, flight delays can really put a damper on your plans.

Lost or Damaged Luggage

You hope it never happens to you, but when your luggage looks like everyone else’s (especially if all of you got it from the same credit card roadshow) there’s always a chance that someone else may have disappeared with your luggage. Alternatively, your suitcase may be too heavy for a tired, overworked airport staff to handle, and they may drop it, damaging the contents.

Luggage delayed

You’re lucky enough that your baggage isn’t lost, however, because a budget airline decided that your suitcase needed a short vacation away from you, you find yourself without clothes and more importantly, without your Macbook Pro for several hours! Leaving you to use… a PC at the hotel lobby. Such a travesty.

2. How do I make a travel insurance claim [Step-by-step guide]

So, the thing about travel insurance is that people only remember it when something unpleasant messes up our travel plans. Then, we panic and scramble when the insurer asks for things like the purchase receipt of a DSLR camera bought 6 years ago.

Sound familiar? If yes, here’s a pro-tip — be familiar with what you can and can’t claim for, and make sure you have a rough idea of the supporting documents needed.

It’s good practice to have a copy of your insurance policy on your phone, so you can always check it as and when you need, even on the go. Some travellers also have a habit of snapping photos of their luggage and belongings before the trip, just in case anything gets lost, delayed or damaged.

The exact claim procedure will depend on your insurance company, but generally, the process goes like this:

Step 1: Contact your insurance company as soon as possible

Depending on your policy, there is usually a time limit as to how long you can wait to give written notice about your intention to claim.

Usually it’s 30 days, but even then you shouldn’t be taking your time. Remember that you may need to get others involved, like the police or your GP, and that will take time.

Step 2: Download and fill up the travel insurance claim forms

Not all travel claims forms are made equal. Make sure you know what you’re claiming for – if you’re claiming on medical grounds, or if there was a delay or cancellation, or even if it’s both.

Choosing the right form is important because leaving any blanks in the form could cause delays in the claim process.

Also note that, for claims that are a result of illness, injury or death, you may need a GP or Specialist to fill up sections of the form for you. Yes, that means even if you’re claiming for travel cancellation due to sickness, you will need to get your GP or Specialist to certify that your illness did not exist, or that you were not aware of it, before booking the trip.

Step 3: Prepare your supporting documents

This is the biggest cause of delayed or rejected claims, so make sure you have everything you need before filing the claim.

Other than a completed claim form and a copy of the policy/certificate of insurance, you will also need to include your passport/itinerary to prove that you had travelled or at least made travel plans.

Then there’s a whole list of supporting documents you’ll need to provide depending on the type of claim you’re making.

Generally, if it requires a police report, you will need to report it to the local police within 24 hours of the incident.

Also, if you intend to claim for belongings that were damaged or stolen, you’d need to produce the original purchase receipts and photos of it to prove that you own these items.

If you are a hardcore “KonMari” fan and have tossed the receipts for all your fancy gadgets — cameras, laptops, etc — then it’s best not to travel with these items.

Step 4: Submit your claims documents online, in person or via snail mail

Once you’ve got everything you need, you can officially file the claim. Most insurers now have online platforms for easy submission, which is great for the younger, more tech-savvy crowd.

I’ve personally done medical expenses claims via FWD’s website and it was surprisingly fast and seamless.

For those who prefer to do it offline, you can either mail your documents over or head down to the branch office directly.

3. Covid-19 travel insurance claim

Travel insurance companies these days have extended their coverage for Covid-19, but at a cost. It’s usually a $20 to $40 dollar add-on, and you need to check if your insurer requires you to take and receive a negative PCR test result immediately after buying your policy.

In the event that you do catch Covid-19 before, during or after your trip, here are the things you need to do:

Read on: Your Ultimate Covid-19 Travel Insurance Claims Guide

4. How long do travel insurance claims take?

Typically, claims take a week to a month to be processed. The first thing to do is to make sure they’ve received your supporting documents.

If you haven’t heard anything from them in 2 weeks, you should definitely be pro-active and contact your insurer. The last thing you want to hear is that they hadn’t even started processing your claims because you left something out, and weren’t informed.

5. My travel insurance claims were denied and rejected

Should you appeal? Yes you should.

If your claims were denied, the insurer is obligated to provide you with a valid reason and the grounds for their decision. Once you get that, you can then request for claims appeal .

What happens moving forward depends on the insurer and how they handle your case, but let’s be honest here: there is always a conflict of interest when making an insurance claim.

Your agenda is to get as much compensation as possible. An insurance company’s agenda is to reduce your claim as much as possible. So yes, you can appeal, but it may not always be successful.

6. Mistakes causing your travel insurance claims to be rejected

So, you’ve bought travel insurance. Now it’s time to go skydiving and swimming with the sharks. Right? Not so fast.

Travel insurance isn’t a “get out of jail free” card that magically frees you from having to pay any expense you incur due to stupid mishaps.

In fact, if you actually take the time to read your travel insurance policy, you’ll realise that there’s actually a truckload of things you can do to get your claims thrown straight into the bin.

Here are 5 common travel mistakes that may cause your travel insurance claims to be rejected:

Playing in a competition or tournament

Participating in a seemingly harmless game of football may not exactly be as exciting as jumping off cliffs into the ocean, but suffer an injury during the game and you could well get your insurance claim for medical expenses rejected.

Read your insurance policy carefully to see if cover is excluded if you participate in a competition or tournament. Beware, as any sporting event that gives you the opportunity to win a prize might be considered a competition.

That means if someone punches your lights out during the drunken muay thai boxing event organised by that Thai pub, you won’t get covered.

Risky activities

Many Singaporean tourists flee the country to escape from boredom during the holidays, since there’s so much more fun stuff you can do overseas, like skydiving and bungee jumping !

But before you sign yourself up for that motorcycle drag race, know that many travel insurance will not cover you for injuries or losses suffered in the course of high risk activities, which often include flying planes for hobby or sightseeing, racing any kind of vehicle, skydiving, and even rock climbing on actual rocks, as opposed to artificial rock walls.

Consuming alcohol or drugs

Virtually everyone has gotten smashed overseas. Every day of the year, Singaporeans are spotted disembarking at the Phuket and Bangkok airports and heading straight to the duty free shop to buy a bottle of Martell. But guess what, if you are under the influence of alcohol or drugs, you probably aren’t going to be able to make a claim for anything that happens to you during that time.

That means getting run over by a tuk tuk after a night out at the Thai discos is going to be even worse than you imagined. Bear in mind that your travel insurance covers more than just medical expenses. If you injure someone else and become liable at law or lose your passport while drunk or high, you will lose your chance to make some big claims.

Pre-existing medical conditions

The thing people are most concerned about when they buy travel insurance is making sure their medical expenses will be covered when they’re overseas. It’s worth noting that most basic travel insurance policies will not cover pre-existing medical conditions. As sinister as “ pre-existing medical conditions ” sounds, it isn’t restricted to deadly terminal diseases.

If you broke your leg two years ago and then break it again while you’re overseas, you might not be able to make a claim for medical expenses incurred. If you were recently injured or have a medical condition like diabetes or anaemia, you might want to consider upgrading your insurance so it includes pre-existing medical conditions, just in case something happens and you run into problems when trying to make a claim.

Not making a police report ASAP

Before you heave a sigh of relief that your insurance policy offers coverage if you lose your passport or laptop, beware. To make sure people don’t try to make claims for forgetting their stuff on the train or trying to pawn their belongings, most insurance policies require that you make a police report or contact the authorities within 24 hours of the loss.

This can be a pain in the neck if you’re in a remote area or you lose your stuff over a public holiday or weekend when the embassy is closed. Still, knowing you have a lot more to lose in insurance money, make sure you lodge a report by hook or by crook.

Any other tips for making travel insurance claims ? Share them with us in the comments below!

Related Articles

Best Travel Insurance Policies for Places Prone to Natural Disasters (2024)

Cheapest Travel Insurance Promotion: Promo Codes for NTUC, FWD, Sompo travel insurance

Travel Wifi Router Rental Guide (2022) – ChangiWiFi vs Y5 Buddy vs Yogofi

Best Travel Insurance Plans in Singapore [content outdated due to Covid]

- Today's news

- Genshin Impact

- Honkai: Star Rail

- League of Legends

- Mental health

- Relationship and dating

- Entertainment

- My Portfolio

- Commodities

- Budget 2024

- Cryptocurrencies

- Volume Leaders

- World Indices

- Price Gainers

- Price Losers

- Stock Comparison

- Currency Converter

- Business Services

- Computer Hardware & Electronics

- Computer Software & Services

- Consumer Products & Media

- Diversified Business

- Industrials

- Manufacturing & Materials

- Retailing & Hospitality

- Telecom & Utilities

- Privacy dashboard

Yahoo Finance

Ntuc income travel insurance review: covid-19 coverage, pre-existing conditions, premiums.

What do you think of when you hear the acronym “NTUC”? The FairPrice supermarket, of course, said every self-respecting auntie ever. But frequent travellers might also think of NTUC Income’s popular travel insurance plan since they are one of Singapore’s biggest travel insurance providers.

However, NTUC Income travel insurance plans also have a reputation for being expensive. Some internet users have also complained that it is difficult to make claims.

Are these rumours true? Let’s find out once and for all.

NTUC Travel Insurance: Summary

NTUC Travel Insurance Coverage

NTUC Travel Insurance Pre-Existing Conditions

NTUC Travel Insurance COVID-19 Coverage

NTUC Travel Insurance: Extreme Sports

NTUC vs MSIG vs Etiqa Travel Insurance

NTUC vs FWD Travel Insurance

NTUC Travel Insurance vs Other Travel Insurers

NTUC Travel Insurance Promo

NTUC Travel Insurance Claim

Should I buy NTUC Travel Insurance?

1. NTUC Travel Insurance Summary

NTUC Income has 2 travel insurance plans:

NTUC Travel Insurance Standard

NTUC Income Enhanced PreX (covers pre-existing medical conditions)

Each travel insurance plan is then further sub-divided into 3 plan tiers which provide different amounts of coverage:

Classic/ Basic PreX

Deluxe/ Superior PreX

Preferred/ Prestige PreX (most expensive)

The premiums you will pay for your travel insurance plan largely depend on the country you’re travelling to. Usually, the further your country of destination, the more expensive your travel insurance plan will be. Here are the countries that are covered by NTUC travel insurance:

ASEAN : Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Thailand, Vietnam

Asia : Australia, China (no Mongolia, Tibet), Hong Kong, India, Japan, Korea, Macau, New Zealand, Sri Lanka, Taiwan, ASEAN

Worldwide : All countries

Countries not covered : Afghanistan, Iraq, Liberia, Sudan, Syria

2. NTUC Travel Insurance Coverage

Here’s a quick look at the premiums and coverage for the NTUC Travel Insurance Standard plans:

At $250,000 to $1,000,000, NTUC travel insurance’s overseas medical coverage is generous compared to some of its competitors such as Sompo Travel Insurance’s $200,000 to $400,000 overseas medical limit.

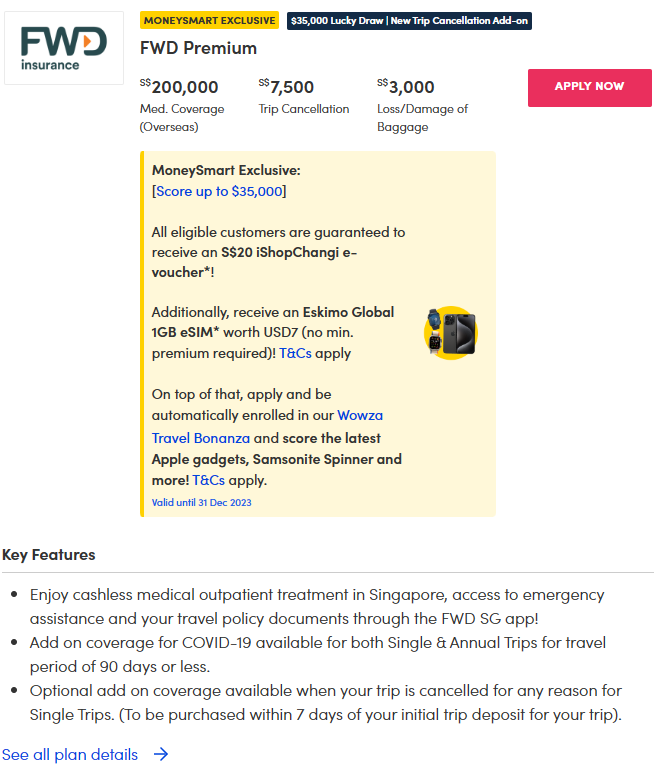

However, do note that emergency medical evacuation shares the same overseas medical expense claim limit for adults aged 70 and over – which may not be sufficient if you are in that age range, run into an adverse medical situation abroad, and require both immediate treatment and a medical flight home to Singapore. If medical coverage is important to you, FWD Travel Insurance offers unlimited medical evacuation and repatriation coverage.

Total Premium

25% Off Total Premium S$18.13

MoneySmart Exclusive

$35,000 Lucky Draw | New Trip Cancellation Add-on

FWD Premium

Med. Coverage (Overseas)

Trip Cancellation

Loss/Damage of Baggage

Total Premium Total Premium S$18.13 25% Off

MoneySmart Exclusive:

[ Score up to $35,000 ] All eligible customers are guaranteed to receive an S$20 iShopChangi e-voucher* ! Additionally, receive an Eskimo Global 1GB eSIM* worth USD7 (no min. premium required)! T&Cs apply On top of that, apply and be automatically enrolled in our Wowza Travel Bonanza and score the latest Apple gadgets, Samsonite Spinner and more! T&Cs apply.

Valid until 15 Dec 2023

More Details

Key Features

Enjoy cashless medical outpatient treatment in Singapore, access to emergency assistance and your travel policy documents through the FWD SG app!

Add on coverage for COVID-19 available for both Single & Annual Trips for travel period of 90 days or less.

Optional add on coverage available when your trip is cancelled for any reason for Single Trips. (To be purchased within 7 days of your initial trip deposit for your trip).

See all plan details

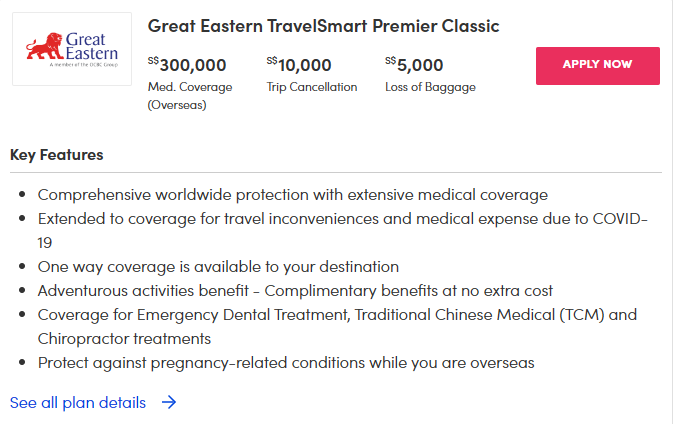

One great advantage of NTUC Income’s travel insurance is the high trip cancellation coverage ranging from $5,000 to $15,000. Other travel insurance providers might not be so generous. For instance, Great Eastern is offering $2,000 to $15,000, while AIG offers $2,500 to $15,000.

Great Eastern TravelSmart Premier Classic

Loss of Baggage

Comprehensive worldwide protection with extensive medical coverage

Extended to coverage for travel inconveniences and medical expense due to COVID-19

One way coverage is availble to your destination

Adventurous activities benefit - Complimentary benefits at no extra cost

Coverage for Emergency Dental Treatment, Traditional Chinese Medical (TCM) and Chiropractor treatments

Protect against pregnancy-related conditions while you are overseas

Most Flexible Plan

AIG Travel Guard® Direct - Supreme

Overseas Medical Expenses

Travel Cancelation / Postponement

Loss/Damage of Personal Baggage

[Receive your cash as fast as 30 days*] All eligible customers are guaranteed up to S$70 in Cash (via PayNow) and rewards*! Additionally, receive an Eskimo Global 1GB eSIM* worth USD7 (no min. premium required)! T&Cs apply.

Valid until 31 Dec 2023

Voted TripZilla's Best Travel Insurance (Single Trip).

Up to S$250,000 in overseas COVID-19 related medical coverage if you are diagnosed with COVID-19 overseas.

Overseas quarantine allowance of up to S$100 per day per person for up to 14 days if you test positive for COVID-19 overseas and are unexpectedly placed into mandatory quarantine.

Up to S$1,500 if you are diagnosed with COVID-19 and have to postpone your trip.

Up to S$7,500 in curtailment costs if you are diagnosed with COVID-19 while travelling and need to return to Singapore earlier than planned.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact AIG Asia Pacific Insurance Pte. Ltd. or visit the AIG, GIA or SDIC websites (www.AIG.sg or www.gia.org.sg or www.sdic.org.sg).

Purchase your travel insurance with confidence and enjoy unlimited flexibility with AIG's Travel Guard® Direct

3. NTUC Travel Insurance Pre-Existing Conditions

NTUC Income is one of the few insurers in Singapore that provide comprehensive travel insurance plans that cover pre-existing medical conditions , such as asthma, eczema, diabetes, high blood pressure, even heart disease. The other two that cover pre-existing conditions are MSIG travel insurance and Etiqa travel insurance .

The most obvious difference between a Pre-Ex travel insurance plan and a regular travel insurance plan is, of course, price. The cheapest NTUC PreX plan costs over twice the price of a regular NTUC travel insurance plan!

For those who have major health problems, you don’t have much of a choice. There’s no point buying a cheap normal insurance with no coverage for you at all because you definitely will not be able to claim medical expenses, evacuation costs or travel delays linked to a flare-up of your condition.

It is especially worth the money if your condition is either life-threatening or very expensive to treat overseas.

However, if you have a condition that’s pure suffering not immediately life-threatening, such as eczema, then it is your choice whether you want to spend more on Pre-Ex travel insurance for better coverage.

It’s important to look at the coverage limits if you’re seriously considering pre-existing travel insurance. Why? If you’re travelling to somewhere with really expensive healthcare, like Europe or the US, you might want to upgrade to the Enhanced PreX Prestige plan.

NTUC Enhanced PreX Travel Insurance Premiums and Coverage:

Is NTUC’s travel insurance for pre-existing medical conditions any good? For one, NTUC PreX travel insurance covers COVID-19 while MSIG Pre-Ex and Etiqa Pre-Ex don’t cover you for COVID-19. So, if you want both pre-existing medical conditions and COVID-19 coverage in your travel insurance, NTUC Enhanced PreX is your only choice.

Even though NTUC Pre-Ex travel insurance offers you COVID-19 coverage, the downside is that they’ve lowered the medical benefits you get if you’re aged 70 and above.

For example, for those aged 70 and above NTUC PreX’s overseas medical and emergency medical evacuation coverage share a total claim limit of $500,000 for its basic plan tier (as opposed to up to $250,000 in overseas medical expenses and $500,000 in medical evacuation coverage for under 70s).

By comparison, MSIG Pre-Ex basic offers $250,000 / $50,000 medical (below 70 / above 70) and $1,000,000 evacuation regardless of age, while Etiqa Pre-Ex basic offers $200,000 medical and $1,000,000 evacuation and repatriation of mortal remains.

Otherwise, NTUC PreX’s miscellaneous trip cancellation and baggage delay benefits are pretty good.

4. NTUC Travel Insurance COVID-19 Coverage

Whether you buy an NTUC Travel Insurance Standard or an NTUC Enhanced PreX Travel Insurance plan, you’ll be relieved to know that all NTUC travel insurance plans automatically come with COVID-19 coverage.

You won’t find the COVID-19 coverage table in the usual NTUC travel insurance policy wording. Instead, there’s a separate NTUC travel insurance COVID-19 policy wording document that you should refer to.

NTUC travel insurance’s COVID-19 coverage and benefits:

Few of us really scrutinise the individual coverage limits on our travel insurance, trusting that they do cover the bare essentials.

The good news is that NTUC travel insurance’s COVID-19 extension is simple, and adequate. Take COVID-19 overseas medical coverage for example, NTUC offers $150,000 while MSIG’ basic plan offers $75,000. Then, there’s overseas COVID-19 quarantine cash allowance, which NTUC gives $100 per day, up to $1,400, but Etiqa’s basic plan offers $100 per day, up to $500 only.

5. NTUC Travel Insurance: Extreme Sports

Since our last review in July 2022, NTUC has updated its Travel Insurance policy to include more c ommon vacation activities like scuba diving and skiing. Nevertheless, extreme thrill seekers may want to go for a more lenient insurance provider such as Direct Asia travel insurance , which properly covers extreme sports and martial arts.

To be honest, NTUC Travel Insurance is adequate if you’re looking to snorkel or join a guided tour group with a licensed outdoor adventure operator. But if you’re a hardcore adrenaline junkie…you might want to look around instead.

6. NTUC vs MSIG vs Etiqa Travel Insurance

If you’re considering NTUC travel insurance, you should be comparing it against established household insurance providers such as MSIG and Etiqa.

All 3 insurers, NTUC, MSIG, and Etiqa offer COVID-19 coverage in their travel insurance plans automatically. Other plans that include automatic COVID-19 coverage include Starr TraveLead Comprehensive, Bubblegum Travel Insurance, Singlife Travel Insurance and DBS Chubb Travel Insurance.

In terms of overseas medical expenses, MSIG offers comparable coverage to NTUC’s travel insurance. When it comes to other travel and logistics-related coverage such as trip cancellation and baggage loss, NTUC and MSIG travel insurance plans’ coverage are also pretty much on par.

All things considered, NTUC and MSIG travel insurance plans are shockingly similar and competitive. A key difference is emergency medical evacuation coverage for people aged 70 and over–NTUC travel insurance parks that under the overseas medical expense limit.

7. NTUC vs FWD Travel Insurance

When you pit NTUC travel insurance against one of the most popular “budget” travel insurance providers, FWD, you’ll realise that the travel insurance offerings are very similar and competitive.

Between NTUC travel insurance and FWD travel insurance, coverage is actually largely on par if you’re considering a basic travel insurance plan with COVID-19 coverage. However, FWD’s prices are lower even if you purchase the COVID-19 add-on.

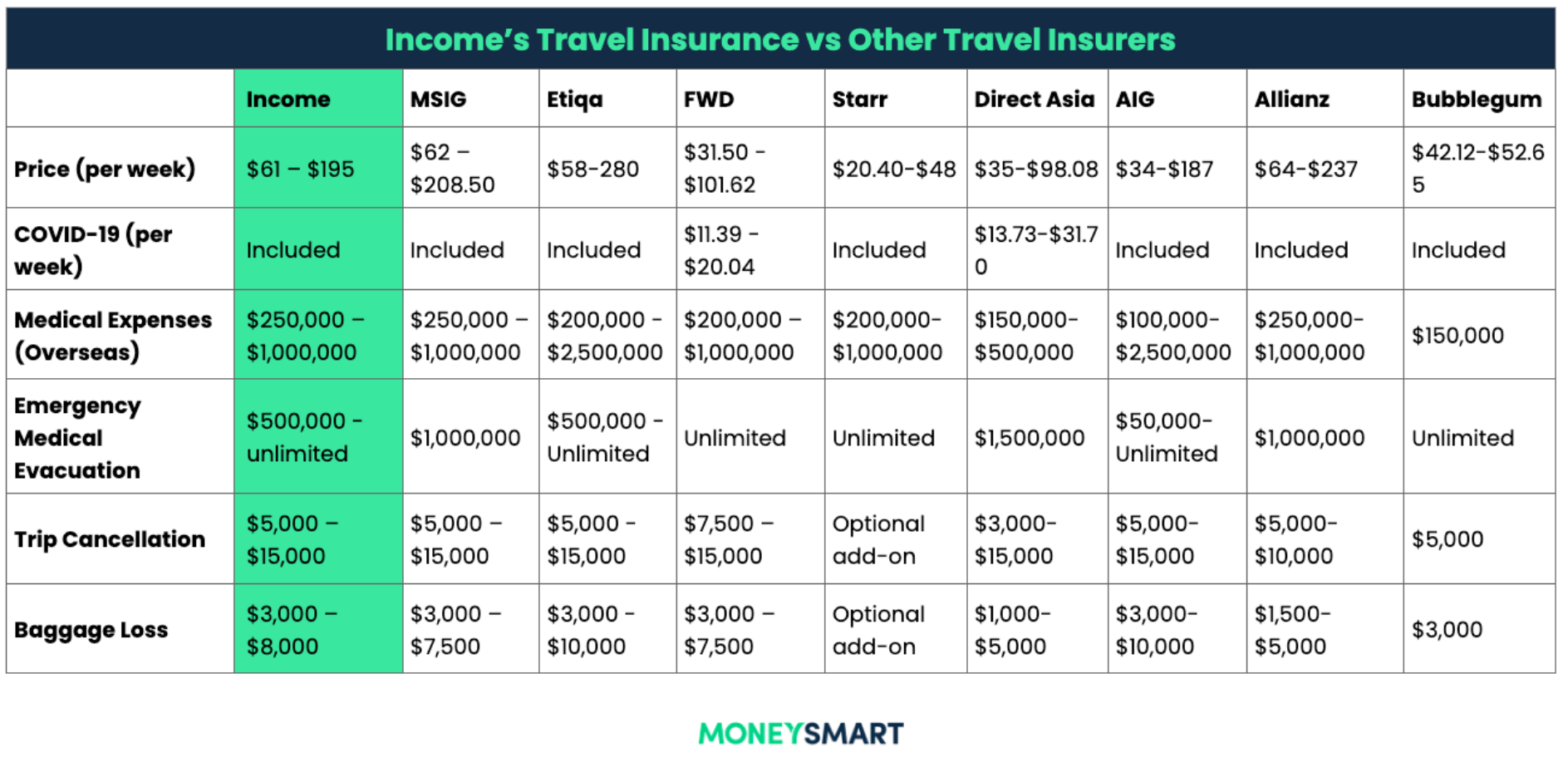

8. NTUC Travel Insurance vs Other Travel Insurers

At a glance, here’s how NTUC Income’s travel insurance stacks up compared to the other major travel insurers in Singapore.

9. NTUC Travel Insurance Promo

Even though many Singaporeans probably don’t mind paying more for NTUC travel insurance just because it’s a household brand name, their travel insurance plans are actually pretty expensive.

However, with ongoing promotions like the current 45% discount promo, it can be value for money. All standard per-trip plans qualify for the promo. For example, if you wanted to go temple-hopping for a week in Myanmar, the cheapest Classic plan would cost just $33.55 after the discount. Here are the premiums you’ll be paying with the current 45% discount promo:

In addition, Income is offering an additional 15% off Enhanced PreX per-trip plans with complimentary personal accident coverage for 6 months.

10. NTUC Travel Insurance Claim

If you follow insurance threads on forums or even talk to your friends about insurance claims over kopi , you might have gotten wind of NTUC Income’s bad claims reputation .

Unfortunately, online forums such as Hardwarezone and Reddit are full of similar stories from users claiming that their NTUC insurance claims were slow, long-drawn-out and plagued with difficulties. According to the users’ NTUC claim experiences, there was a lot of emphasis on the need for original invoices to be submitted.

To be fair, between these nasty stories, you’ll also find users who managed to claim from NTUC insurance smoothly and received their cheques in the mail.

So, how do you make a claim? Your first port of call should be to get in touch with NTUC Income ASAP.

NTUC Travel Insurance Emergency hotline: Call the NTUC emergency assistance hotline at +65 6788 6616

Here’s where it gets confusing. You have to identify the type of claim that you’re making and the “correct” way to submit it. Super important: all claims must be made within 30 days of the event or incident.

NTUC Travel insurance online claims: Submit NTUC travel insurance claims online with supporting documents such as invoice, flight itinerary, police report, etc. through their website. You can do so for the following benefits:

Trip cancellation

Trip shortening

Travel delay

Baggage delay

Loss and damage of baggage or personal belongings

NTUC Hard copy claims: For medical expenses, you need to fill in the NTUC travel insurance claim form and drop off the hard copy form with the supporting documents such as hospital bill, medical report, boarding pass, etc. at an NTUC Income branch.

NTUC Email claims: For claims that do not involve travel inconveniences (see above) and medical expenses (see above), you’ll need to fill in the NTUC travel insurance claim form digitally, and email it together with your supporting documents to [email protected]. Include your travel policy number in the subject line.

NTUC Claims settlement time: If there is no dispute, NTUC Income will settle your claims within 10 working days or longer during high-volume travel periods like school holidays.

11. Conclusion: Should I buy NTUC Travel Insurance?

NTUC travel insurance isn’t the absolute cheapest around, but their regular travel insurance plans are very affordable and value for money when there’s a 45% promotion going on.

However, just because it’s a brand name doesn’t mean that their coverage is the highest in town, especially when you compare it with newcomers like FWD. That’s not a problem for most travellers though, unless you’re going to a super expensive country or encounter some unusual scenario.

For most Singaporeans who just want to eat, chill and relax on holiday, NTUC travel insurance is more than adequate especially as it also provides COVID-19 coverage. However, daredevils should take note that it does not cover more thrilling activities like mountaineering and other extreme sports.

If you have a pre-existing medical condition , NTUC Enhanced PreX is one of the very few travel insurance options suitable for you. It is pricey for sure, but probably worth the money if you have a life-threatening condition like asthma or heart disease. Make sure that the plan is sufficient to cover your overseas expenses and/or evacuation.

Still looking for travel insurance? Compare the best travel insurance in Singapore here .

The post NTUC Income Travel Insurance Review: COVID-19 Coverage, Pre-existing Conditions, Premiums appeared first on the MoneySmart blog .

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans , Insurance and Credit Cards on our site now!

The post NTUC Income Travel Insurance Review: COVID-19 Coverage, Pre-existing Conditions, Premiums appeared first on MoneySmart Blog .

Original article: NTUC Income Travel Insurance Review: COVID-19 Coverage, Pre-existing Conditions, Premiums .

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

- Up next Advertisement

The Straits Times

- International

- Print Edition

- news with benefits

- SPH Rewards

- STClassifieds

- Berita Harian

- Hardwarezone

- Shin Min Daily News

- Tamil Murasu

- The Business Times

- The New Paper

- Lianhe Zaobao

- Advertise with us

NTUC Income adds Covid-19 insurance coverage for overseas travel

(THE BUSINESS TIMES) - NTUC Income customers who buy its travel insurance will now receive Covid-19 coverage as well, for medical-related expenses while overseas.

Outbound travellers, departing Singapore, who are covered by Income's single-trip insurance will be protected for the first 90 days of each trip for Covid-19 related hospitalisation expenses of up to US$100,000 (S$133,900) while abroad.

They will also be covered for costs incurred for medical evacuation or repatriation of up to US$100,000, if necessary.

These Covid-19 benefits are automatically included in single-trip insurance plans purchased from Thursday (Nov 26) - including plans covering pre-existing conditions - and also for travel dates starting Thursday.

However, the Covid-19 benefits will be excluded from travel insurance for trips to countries that the World Health Organization deems as high risk for Covid-19 at the point of purchase.

Policyholders with existing annual travel insurance plans from Income can contact the insurer to find out about getting covered by these benefits for upcoming travel.

Fabian Ng, Income's general manager for consumer business, said that there are some individuals who will need to travel for necessary business-related and other essential matters, even as overseas travel is still restricted in general.

"Nevertheless, we urge everyone to take all necessary precautions when planning your travels as there are countries that are seeing a resurgence in Covid-19 cases or are still experiencing a high number of infections," Mr Ng added.

The Business Times (BT) reported last month that most travel insurance products do not cover Covid-19 related claims, although market leaders including Income had been reviewing some of their offerings.

Income told BT at the time that it may develop a product to cover inbound travellers to Singapore. On Thursday, an Income spokesperson said in response to BT's queries that the insurer is, at the moment, focusing on providing suitable Covid-19 cover for Singapore-based residents so that they can travel overseas with a greater peace of mind.

AXA Insurance currently offers Covid-19 travel cover for Scoot passengers on flights departing Singapore, and will soon be making such coverage available to all travellers regardless of the airline they fly, Julien Callard, its managing director, retail & health, told The Straits Times on Thursday.

Last week, Changi Airport Group and the Singapore Tourism Board announced that three insurance companies had each developed Covid-19 travel insurance plans for foreign visitors entering Singapore.

The three - AIG Asia Pacific Insurance, Chubb Insurance Singapore and HL Assurance - are providing at least S$30,000 in coverage for Covid-19 related medical treatment and hospitalisation costs for inbound travellers to the city-state.

Join ST's Telegram channel and get the latest breaking news delivered to you.

Read 3 articles and stand to win rewards

Spin the wheel now

NTUC Income adds Covid-19 insurance coverage for overseas travel

NTUC Income customers who buy its travel insurance will now receive Covid-19 coverage as well, for medical-related expenses while overseas.

Outbound travellers, departing Singapore, who are covered by Income's single-trip insurance will be protected for the first 90 days of each trip for Covid-19 related hospitalisation expenses of up to US$100,000 while abroad.

They will also be covered for costs incurred for medical evacuation or repatriation of up to US$100,000, if necessary.

These Covid-19 benefits are automatically included in single-trip insurance plans purchased from Thursday - including plans covering pre-existing conditions - and also for travel dates starting Thursday.

However, the Covid-19 benefits will be excluded from travel insurance for trips to countries that the World Health Organization deems as high risk for Covid-19 at the point of purchase.

Policyholders with existing annual travel insurance plans from Income can contact the insurer to find out about getting covered by these benefits for upcoming travel.

A NEWSLETTER FOR YOU

Friday, 2 pm

Our picks of the latest dining, travel and leisure options to treat yourself.

Fabian Ng, Income's general manager for consumer business, said that there are some individuals who will need to travel for necessary business-related and other essential matters, even as overseas travel is still restricted in general.

"Nevertheless, we urge everyone to take all necessary precautions when planning your travels as there are countries that are seeing a resurgence in Covid-19 cases or are still experiencing a high number of infections," Mr Ng added.

The Business Times (BT) reported last month that most travel insurance products do not cover Covid-19 related claims, although market leaders including Income had been reviewing some of their offerings .

Income told BT at the time that it may develop a product to cover inbound travellers to Singapore. On Thursday, an Income spokesperson said in response to BT's queries that the insurer is, at the moment, focusing on providing suitable Covid-19 cover for Singapore-based residents so that they can travel overseas with a greater peace of mind.

Last week, Changi Airport Group and the Singapore Tourism Board announced that three insurance companies had each developed Covid-19 travel insurance plans for foreign visitors entering Singapore .

The three - AIG Asia Pacific Insurance, Chubb Insurance Singapore and HL Assurance - are providing at least S$30,000 in coverage for Covid-19 related medical treatment and hospitalisation costs for inbound travellers to the city-state.

more in Banking & Finance

Hsbc to double uk wealth business as banks target 'mass affluent'.

Aug 23, 2024 03:52 PM

Australia's CBA cuts interest rates on some home loans for new borrowers

Aug 23, 2024 02:43 PM

US Federal Reserve chair expected to signal support for rate cuts

Aug 23, 2024 10:09 AM

Bank of Japan’s Ueda signals readiness to raise rates if growth, inflation on track

Aug 23, 2024 09:46 AM

Australian regulator increases capital add-on requirement for ANZ to A$750 million

Aug 23, 2024 08:42 AM

Ping An profit rises as market recovery bolsters returns

Aug 22, 2024 08:02 PM

Hong Kong crypto exchanges face challenges to get full licences

Aug 22, 2024 02:23 PM

AIA Singapore’s value of new business rises 27% in H1 to US$219 million

Aug 22, 2024 11:56 AM

- privacy policy

- terms & conditions

- cookie policy

- data protection policy

MCI (P) 064/10/2023. Published by SPH Media Limited, Co. Regn. No. 202120748H. Copyright © 2024 SPH Media Limited. All rights reserved.

- Dating | Relationships

- Family | Parenting | Kids

- Health | Wellness

- Home & Decor

- Personal Care

- Personal Growth & Development

- Technology | Media

- New Zealand

- South Korea

- Switzerland

- United Arab Emirates

- United Kingdom

- Bar / Pub / Club

- Convenience Foods

- Fine Dining

- Food Trucks

- Hawker Centre Fare

- International

- Malay / Muslim / Halal

- Middle Eastern

- South African

- Street Food

- Vegan / Vegetarian

- Baking & Roasting

- Bento / Lunchbox

- Dessert & Sweet Treats

- Drinks & Beverages

- Fish & Seafood

- Keto & Low Carb

- Miscellaneous

- Poultry & Meat

- Rice, Pasta & Noodles

- Salad & Vegetables

- Sandwich & Bread

- Snacks & Finger Foods

- Soups & Stews

Comprehensive Review of NTUC Travel Insurance: Coverage, Benefits, and More

NTUC Travel Insurance is a product offered by NTUC Income, a leading insurance provider in Singapore. Established in 1970, NTUC Income is dedicated to offering affordable, comprehensive, and accessible insurance coverage to individuals and families. Their travel insurance plans are tailored to safeguard travelers against a wide range of unexpected circumstances, ensuring peace of mind during their journeys.

Primary features and highlights

Primary features and highlights refer to the key characteristics and notable aspects of a subject. These are often the distinguishing factors and unique attributes that set it apart. Speaking of which, an NTUC travel insurance review typically focuses on these primary features and highlights, offering insights into how it stands out in the competitive insurance market. They can refer to an event’s main activities, a product’s exceptional features, or a service’s outstanding components.

In-Depth Review of NTUC Travel Insurance Coverage

Medical and accident coverage.

Medical and accident coverage is a type of insurance policy that helps cover medical expenses resulting from sudden illnesses or accidents. It offers financial assistance towards hospitalization costs, doctor’s fees, medication, and related health care services following an unexpected event.

Travel inconvenience benefits

Travel inconvenience benefits offer compensation for unexpected challenges encountered during a journey. These include flight delays, lost luggage, emergency accommodation needs, and medical emergencies. Such benefits alleviate stress, offering travelers peace of mind and financial security.

Baggage and personal effects protection

Baggage and personal effects protection is an important feature in travel insurance policies. It covers loss, theft, or damage to personal items during your transit or stay. This ensures secure travel experiences, granting peace of mind to travelers while on their journeys.

Extra coverage – Adventure Sports, Golf Equipment, etc.

Extra coverage options for adventure sports and golf equipment provide specialized protection for enthusiasts. These coverages ensure your gear is protected from theft or damage, and in the case of adventure sports, it covers potential accidents or injuries as well.

Overview of COVID-19 Coverage under NTUC Travel Insurance

NTUC Travel Insurance now includes coverage for COVID-19-related incidents for customers. This includes medical and hospitalization expenses incurred overseas due to infection. Additionally, cancellation and trip postponement benefits related to the virus are also part of the coverage.

Detailed benefits of NTUC Travel Insurance

Extended coverage options.

Extended coverage options provide additional insurance protection beyond standard policies. These options may cover unforeseen circumstances such as natural disasters, vandalism, or unexpected health issues. They may cost more, but offer increased peace of mind.

High claims limit

A high claims limit refers to the maximum amount an insurance company is willing to pay for a claim. It’s beneficial for policyholders as it provides extensive coverage, safeguarding against substantial financial losses caused by accidents, illnesses, or damages.

Access to 24/7 emergency assistance

With around-the-clock availability, 24/7 emergency assistance provides immediate help during urgent situations. Access to this service ensures safety at all times, regardless of when an emergency occurs. Thus, it promotes peace of mind and guarantees immediate response in crisis events.

Special benefits for family plans

Family plans offer special benefits such as discounted rates, shared data, and free add-ons for multiple lines. These plans may also include parental controls, unlimited talk and text, and exclusive family features enhancing connectivity and savings.

Option of pre-existing medical coverage

Pre-existing medical coverage is an insurance option that covers prior health conditions. It is vital for individuals with ongoing health issues as it ensures they receive necessary care and medication regardless of their health status at the onset of the policy.

Variety of Add-ons

Add-ons refer to optional features or enhancements that can be added to improve a basic product or service. They enhance functionality or offer customization options to suit the user’s unique needs, increasing product versatility and overall user experience.

Pricing and plan options

Pricing and plan options are vital considerations for any product or service. They provide flexibility and choice to customers, allowing them to select an option that best fits their budget and needs. Proper pricing strategies can significantly enhance market competitiveness.

Overview of different plans

Various plans encompass different objectives and strategies. They include business plans, marketing strategies, project timelines, and financial plans. These documents guide decision-making processes, outlining goals, expected outcomes, timeframes, and necessary resources for achieving predetermined objectives.

Cost comparison with other travel insurance

Comparing the cost with other travel insurance policies is crucial while purchasing travel insurance. The coverage, benefits, and exclusions differ among the policies, so comparing helps in choosing the best out of all financially feasible options.

Claims Procedures for NTUC Travel Insurance

General procedure for filing a claim.

The general procedure for filing a claim typically involves notifying the relevant authority or insurance company about the incident. Detailed documentation must then be gathered, supporting your claim. Afterward, a claim form must be filled and submitted, typically accompanied by the gathered documentation.

Typical claim processing time

Typical claim processing time varies across different industries. For insurance claims, it generally takes 30 days from filing the claim to receiving a payout. However, complex claims can require extended periods, sometimes up to 60 days or longer.

Common reasons for claim rejection

Claim rejections often result from errors in billing information, missing documentation, or procedural missteps. Insufficient evidence of medical necessity and delayed claims submissions are common reasons. In some instances, services may not be covered by an individual’s insurance policy.

NTUC Travel Insurance Customer Service

NTUC Travel Insurance Customer Service provides exceptional assistance to policyholders. They offer prompt responses and resolve issues efficaciously. Their well-trained staff are adept at answering queries and guiding customers through the intricacies of their travel coverages. This reinforces the trust and satisfaction of their clients.

Analysis of customer service quality

Analyzing customer service quality involves understanding customer interactions, expectations, and satisfaction levels. It includes measuring response times, query resolution efficiency, communication skills, and service delivery standards. Such analysis guides improvements, fostering loyalty, and ensuring customer retention.

Overview of customer feedback and reviews

Customer feedback and reviews are crucial tools in understanding customer satisfaction and their perception of a product or service. These insights help businesses improve their offerings, resolve issues, enhance customer experience, and foster brand loyalty. It shapes future strategic decisions and influences business growth.

The Upsides and Downsides of NTUC Travel Insurance

NTUC Travel Insurance offers comprehensive coverage spanning medical expenses, travel inconveniences, and personal accidents. It includes unique benefits such as overseas study interruption and safety measures against novel viruses. It’s customizable, offering varied plans to cater to unique travel needs.

While NTUC Travel Insurance boasts numerous advantages, there are some downsides to consider. One drawback is the potential for higher premiums compared to basic travel insurance plans offered by other providers. Despite its comprehensive coverage, the cost may be prohibitive for budget-conscious travelers. Additionally, while NTUC Travel Insurance offers customization options, the process of selecting and tailoring a plan to individual needs may be complex or time-consuming for some customers. Another disadvantage is that certain exclusions or limitations within the policy may not be immediately apparent, requiring careful scrutiny of the terms and conditions to fully understand the extent of coverage.

1. What is the best travel insurance?

The best travel insurance varies based on individual needs; however, NTUC Income is widely recognized for its comprehensive coverage. It covers medical emergencies, trip cancellations, and lost baggage, and offers 24/7 worldwide assistance, suitable for both leisure and adventurous travelers.

2. Does NTUC insurance cover in Malaysia?

NTUC Income’s travel insurance does cover trips to Malaysia and it includes coverage for medical expenses, trip cancellation, personal accident, and other travel inconveniences. It provides comprehensive coverage, offering peace of mind for travelers to the neighboring country.

3. What does travel insurance not cover?

Travel insurance typically does not cover incidents related to pre-existing medical conditions, extreme sports injuries, losses due to civil unrest, or cancellations due to personal reasons. It also often excludes coverage for pandemic-related disruptions or expenses.

4. When should I buy travel insurance?

You should consider buying travel insurance as soon as you book your trip. It will cover unforeseen circumstances such as trip cancellation, medical emergencies, or travel disruptions due to weather conditions, ensuring you’re financially protected.

Disclosure: This article is sponsored. The views expressed herein are solely those of the author. The content presented is for informational purposes and may not necessarily represent the viewpoints or opinions of Spring Tomorrow.

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on Reddit (Opens in new window)

Tags: advertorial sponsored post sponsored review

Leave a Comment Cancel reply

Subscribe to our newsletter to receive the latest updates in your inbox

Enter Email Address

Trending Posts

- Moo Ping Recipe | Thai Grilled Pork Skewers

- Bangkok Airport Rail Link - Getting from Central Bangkok to Suvarnabhumi Airport

- One Day in Tamsui: What to See, Do and Eat in Taipei's Seaside District

- Food Factory Outlet Shopping at Woodlands Terrace (Part 1 of 3): Fassler Gourmet

- Famous JB 101 Firewokz 新山101小厨 @ WCEGA Tower, Bukit Batok

- CHAGEE 霸王茶姬 - Where Every Sip Counts

- Kimberley Street Night Market | Penang

- Continental Bakery - A Popular Old-School Bakery in Penang

- 50年 Taste of Tradition - Best Portuguese Egg Tarts in Singapore

- Pan Fried Sutchi Fish Recipe (with assorted vegetables)

NTUC Income Travel Insurance Review: Get the Best Coverage at the Right Price

- Financially Reviewed by Edward Hee

- Published: 28 October, 2023

- Last Updated: 28 October, 2023

At Dollar Bureau, we’re committed to providing you with reliable, unbiased financial guidance. Our content is crafted by everyday Singaporeans who are trained in finance and insurance, ensuring relatable and practical guidance. We uphold strict editorial independence, regularly update our reviews, and value your feedback to keep our information accurate and relevant.

Discover more about our editorial guidelines here .

Table of Contents

Key features of the ntuc income’s travel insurance plan.

- NTUC Income Travel Insurance plans offer travel insurance for both single and annual trips.

- There are 3 different tiers of plans under 2 categories – Classic, Deluxe, Preferred under the Standard Plans category, and Basic, Superior, and Prestige under the Enhanced PreX Plans category.

- You can purchase NTUC Income Travel Insurance plans for yourself (as an individual), or as a family.

- You can conveniently pay for your policy with Cash, Giro, AXS, or credit card/debit card (Visa and Mastercard), Internet Banking, via My Income Portal, NETS, and cheque.

- You can purchase your policy up to 180 days in advance.

- Covers pre-existing conditions under the Enhanced PreX Plan.

Eligibility

In order to be eligible, you must:

- Be living or legally working in Singapore.

- Have a valid Singapore identification (NRIC, Employment Pass, Work Permit, Long-Term Visit Pass or Student Pass).

- Start and end your trip in Singapore.

- Have bought and fully paid for your policy before leaving Singapore.

- Be over 30 days old.

Premium Rates

These premium rates are based on trips for a week under the Standard Plan and Enhanced PreX Plan.

Standard Plan

Enhanced prex plan, here are some of the key benefits it covers:.

Individuals under 70 years old

You can refer to the highest payout amount the benefit will pay under the family plan for a single journey.

Each individual covered by the policy is entitled to the maximum benefit as specified in th e table of cover .

Benefits Explained

Section 1: cancelling your trip, what is covered:.

A. This benefit covers you in the event that you are prevented from traveling due to the reasons listed below and are forced to cancel your trip, if they happen within 30 days before you are due to leave Singapore.

- Death, serious sickness, or serious injury that you, your family member, or travelling companion may suffer. This applies if you purchased your policy at least three days before leaving Singapore, unless the event is solely accidental in nature.

- Government authorities are preventing you from travelling overseas due to an infectious disease.

- Sudden riots, strikes, or civil commotions occurring in Singapore or at your planned travel destination.

- Natural disasters occurring in Singapore or at your planned travel destination.

- Serious damage to your home caused by a fire or natural disaster.

B. This benefit covers you If you are prevented from travelling due to the reasons listed below and are forced to cancel your trip, if any of the following happens at any time before you are due to leave.

- The flight is cancelled by the airline due to the closing of the airport, runway, or airspace, or poor weather conditions that force airplanes to be grounded.

- You have to appear in court as a witness during your trip, and you were not aware of this when you took up the policy.

- You are forced to cancel your trip because you are a child, and your travelling companion, who is your guardian, has to cancel their trip due to one of the reasons listed in A or B above.

C. If you must cancel your trip for reasons listed in A or B, this benefit will only be paid after receiving documented evidence that your claim was denied, rejected, or partially paid by the transportation or accommodation provider.

What is not covered:

Besides the general exclusions listed in Part 4 of the General Conditions, this benefit will also not pay for the following, or for loss or liability directly or indirectly caused by the following:

- Any expenses resulting from your failure to promptly notify the travel agent, tour operator, transport, or accommodation providers as soon as you become aware of the need to cancel your trip.

- Costs related to prepaid or non-refundable expenses for unused local excursions, tours, seminars, courses, theatre shows, theme parks, sporting events, concerts, or any other charges unrelated to transportation or accommodation.

- Compensation for using air miles, holiday points, membership rewards, or credit card redemption to partially or fully pay for the trip.

- You decide not to travel when the conditions listed in A2 to A4 have not actually occurred.

- If you opt not to travel due to the non-serious illness or injury of a family member or travelling companion.

- Claims arising from events that were already known or anticipated.

- Claims resulting from pre-existing medical conditions or illnesses you were aware of before purchasing the policy. It’s important to note that if you are covered under the Enhanced PreX Superior or Prestige plan, this pre-existing medical condition exclusion will not apply to you, but it will remain in effect for your family members and travelling companions who are not covered under the Enhanced PreX Superior or Prestige plan.

- Compensation for flight cancellations arising from airline-related issues, including aircrew rotation, rescheduled flights, operational requirements, or mechanical breakdown of the aircraft on which you have a pre-scheduled reservation.

Section 2: Postponing Your Trip

A. If you are unable to embark on your trip due to the following circumstances and need to postpone your journey within 30 days before your departure from Singapore:

- The occurrence of death, severe illness, or a significant injury affecting you, a family member, or your travel companion. However, this is applicable only if you purchased your policy at least three days before your departure, unless the event is purely accidental.

- The imposition of travel restrictions by government authorities due to your infectious disease.

- A sudden outbreak of a riot, strike, or civil commotion in Singapore or your planned destination.

- Natural disasters striking either Singapore or your intended destination.

- Substantial damage to your residence caused by a fire or natural calamity.

- If your journey is significantly interrupted for a continuous period of at least 12 hours because the public transport you are using as a passenger has been hijacked.

- If your flight is cancelled by the airline due to circumstances such as airport closure, runway closure, airspace closure, or adverse weather conditions that result in the grounding of the aircraft.

B. If you are unable to embark on your journey due to the circumstances mentioned below and are forced to reschedule your trip, and in case any of the following situations arise at any time before your scheduled departure:

- In the event of flight cancellation by the airline due to airport, runway, or airspace closures, or adverse weather conditions leading to the grounding of aircraft.

- If you find yourself summoned to court as a witness during your trip, an occurrence that you were unaware of when you acquired the policy.

- Should you need to postpone your trip because you are a minor, and your guardian, who is your travel companion, has to cancel their trip due to one of the reasons detailed in A or B above.

C. Should you be compelled to reschedule your trip due to any of the reasons outlined in A or B above, the Insurer will only process your claim once you furnish them with written or documentary evidence confirming that your claim has been denied, declined, or partially settled by the transport or accommodation provider.

- Failure to promptly notify the travel agent, tour operator, transport, or accommodation providers once you know the need to postpone your trip.

- Incurred additional expenses resulting from upgrading to a higher class or category of transportation or accommodation compared to your original itinerary. For example, any supplementary costs associated with changing from a budget airline to a commercial airline.

- Expenses that are prepaid or non-refundable and cannot be recovered.

- Compensation claims for air miles, holiday points, membership rewards, or credit card redemptions used for partial or full payment of the trip.

- Your decision not to proceed with your travel plans when an event described in A2 to A4 has not occurred.

- Electing to postpone your travel due to the sickness or injury of a family member or travel companion, provided that it is not a serious illness or severe injury.

- Claims arising from events that were already known or foreseeable.

- Claims stemming from pre-existing medical conditions or any illnesses you were aware of, including conditions you, your family member, or your travel companion suffered. Please note that if you are covered under the Enhanced PreX Superior or Prestige plan, the exclusion for pre-existing medical conditions will not apply to you, but it will still be in effect for your family members and travel companions who are not covered under these plans.

- Claims arising from flight cancellations due to airline-related issues such as aircrew scheduling changes, rescheduled flights, operational requirements, or mechanical breakdown of the aircraft for which you had a pre-booked flight.

Section 3: Shortening Your Trip

Aside from Section 2.B.3 and Section 2.C, this benefit also covers the following:

A. In the event that you need to cut your trip short and return to Singapore due to the following circumstances:

- Death, severe illness, or significant injury affecting you, a family member, or your travel companion.

- Authorities are preventing your further travel due to your contagious illness.

- A sudden outbreak of riots, strikes, or civil commotion at your destination or planned travel location.

- Natural disasters occurring at your current location or your intended destination.

- Severe damage to your residence resulting from a fire or natural disaster.

- A disruption to your trip lasting at least 12 consecutive hours due to the hijacking of public transportation in which you are a passenger.

- Flight cancellation by the airline due to the closure of the airport, runway, or airspace, or adverse weather conditions resulting in the grounding of aircraft.

Besides Section 2, Excluded items 1, 2, 3, and 4. This benefit also excludes the following:

- The part of the trip before you cut short your trip.

- If you choose to cut short your trip because of sickness or injury to a family member or travelling companion that is not a serious sickness or serious injury.

- Compensation for any air miles, holiday points, membership, or credit card redemption you use to pay for all or part of the trip.

- Claims that result from any known event.

- Claims that result from a pre-existing medical condition or any sickness you knew about, including conditions suffered by you, your family member, or your travelling companion. If you are insured under the Enhanced PreX Superior or Prestige plan, the preexisting medical condition exclusion will not apply to you, but will still apply to your family members and travelling companions who are not insured under the Enhanced PreX Superior or Prestige plan.

- The cost of your unused portion of the original transport ticket back to Singapore, which you have already paid for.

- Claims that result from flights being cancelled due to any fault on the part of the airline, such as aircrew rotation, rescheduled flights or operational requirements, or mechanical breakdown of the aeroplane in which you have a pre-booked flight.

Section 4: Trip Disruption

Aside from Sections 3.B and 3.C, this benefit also covers the following:

A. Trip Disruption Coverage Overseas

- Serious Sickness or Injury: If you or your traveling companion experience a serious illness or injury, you must provide a medical report from a General Practitioner or other medical professional confirming the severity of the condition.

- Riot, Strike, or Civil Commotion:Coverage applies in the event of sudden riots, strikes, or civil commotions at your destination or planned travel location.

- Natural Disasters:Protection is provided if natural disasters occur at your destination or intended travel spot.

- Flight Cancellation: Coverage includes situations where your flight is canceled by the airline due to airport closures, runway shutdowns, airspace closures, or adverse weather conditions leading to grounded airplanes.

Aside from Section 3, excluded items 1, 2, and 3, this benefit also excludes the following:

- Failure to Notify Providers: Coverage does not extend to additional expenses resulting from delayed notification to travel agents, tour operators, or transportation and accommodation providers about your trip changes.

- Prepaid Expenses: No coverage for non-refundable expenses, including unused transport, accommodations, local excursions, tours, seminars, courses, theatre shows, theme parks, sporting events, or concerts that you have already paid for.

- Portion of Trip Before Changes: Expenses related to the portion of the trip before alterations are not covered.

- Companion’s Non-Serious Sickness or Injury:Changes made due to your traveling companion’s sickness or injury, which is not classified as serious, are not covered.

- Compensation Methods:Claims do not include compensation for air miles, holiday points, memberships, or credit card redemptions used to fund all or part of the trip.

- Known Events:Claims resulting from events already known to you are not covered.

- Preexisting Medical Conditions: Claims stemming from preexisting medical conditions, including those of you, your family members, or traveling companions, are not covered. Enhanced PreX Superior or Prestige plan holders are exempted, except for their uninsured family members or traveling companions.

- Unused Portion of Transport Ticket: The cost of the unused segment of the original transport ticket back to Singapore, which has already been paid, is not covered.

- Airline Operational Faults: Claims arising from airline faults like aircrew rotations, rescheduled flights, operational requirements, or mechanical breakdowns of pre-booked airplanes are not covered.

Section 5: Travel Delay

A. Trip Delay Due to Public Transport

- Coverage is applicable if the public transport you’re scheduled to use during your trip is delayed for over six consecutive hours, and you are not the cause of the delay. Written proof, including the reason for the delay, must be obtained from the transport operator or their handling agent.

What is Not Covered:

- Failure to Follow Itinerary: Claims do not apply if you fail to board public transport according to the specified time provided in the itinerary.

- Known Delays: Claims resulting from delays known to you or the public at the time of purchasing this policy are not covered.

- Late Check-Ins: Coverage does not extend to situations where you check in late at the airport, port, or station.

Section 6: Missed Connection

A. Coverage applies if you miss your travel connection due to a delay in the arrival of the scheduled public transport. This applies if you have a confirmed reservation and no alternative travel arrangement is made available to you within six hours of the scheduled departure of your onward travel connection. You must obtain written proof of your missed connection from the transport operator (flight, rail, coach, or ferry with a fixed itinerary) or their handling agents.

What is not covered:

Please read the General Exclusions listed i n Part 4 of the General Conditions .

Section 7: Overbooked Public Transport

A. Coverage applies if you are not allowed to board a form of public transport for which you have previously received confirmation, and this denial is due to overbooking. If no compensation or alternative transport is provided to you within six hours of the scheduled departure time, you must obtain written proof of being denied boarding from the transport operator of the public transport (whichever applies) or their handling agents.

Please refer to the General Exclusions listed i n Part 4 of the General Conditions .

Section 8: If The Travel Agency Becomes Insolvent

A. Coverage applies if you are forced to abandon your trip because the travel agency, transport provider, or tour operator ceases operations and cannot fulfill part or the entirety of your trip. To be eligible for this coverage, you must have purchased the policy at least three days before your scheduled departure.

Besides the General Exclusions listed in Part 4 of the General Conditions, the Policy will also not pay for the following, or for loss or liability directly or indirectly caused by the following:

- Unused Local Activities and Entertainment: Expenses for unused local excursions, tours, seminars, courses, theatre shows, theme parks, sporting events, concerts, and any other charges not related to transport and accommodation that are prepaid or non-refundable are not covered.

- Compensation Using Reward Points or Memberships: Compensation for any air miles, holiday points, membership rewards, or credit card redemption used to pay for all or part of your trip is not covered under this policy.

- Bankruptcy or Ceasing Operations Before Policy Purchase: If the travel agency, transport provider, or tour operator filed for bankruptcy or a similar petition or ceased operations before the policy was purchased, claims related to these events are not covered.

- Claims arising from government regulations or control are not covered by this policy.

Section 9: Baggage Delay

A. If your checked-in baggage has been delayed, misdirected, or temporarily misplaced by any transport operator for more than six hours in a row while you are in Singapore or overseas, you are covered. To make a claim, you must obtain written proof from the transport operator or their handling agent stating the period of delay and the reason for the delay.

- Any claims on the same baggage by more than one insured.

- Any claims under 1A if the baggage was not received overseas.

1A. Coverage for Delayed Baggage Overseas:

If your baggage is delayed while overseas, the Policy will provide you with a cash benefit for every continuous six-hour period of delay. The calculation starts from the time you arrive at your final destination overseas until the moment you receive your baggage.

Section 10: Loss or Damage of Luggage and Personal Belongings

If your baggage or personal belongings are lost or damaged due to an accident or theft while overseas, the following conditions must be met for coverage:

- Taking Precautions: You should have taken all reasonable precautions to secure your belongings and prevent loss or damage.

- Reporting the Loss: Report the loss to local authorities, such as the police or relevant agencies (e.g., hotel, airline, or transport operator), within 24 hours of discovering the loss or damage. Provide the Insurer with a copy of the police report or a written document from the relevant authority detailing the loss or damage, along with all relevant receipts or proof of purchase.

- Initial Claim with Service Provider: File any claims related to loss or damage to your baggage or personal belongings while in the custody and care of the transport or accommodation provider with the respective service provider initially.

- Adjustment of Claim: The Insurer will adjust your claim based on the amount refunded to you by the transport or accommodation provider. Your claim will be processed only after you provide written or documentary evidence that your claim has been denied, rejected, or partially paid by the transport or accommodation provider.

Besides the General Exclusions listed in Part 4 of the General Conditions, the Policy will also not pay for the following or for loss or liability directly or indirectly caused by the following:

- Checked Baggage: Baggage separately checked in advance is not covered.

- Wear and Tear: Claims related to wear and tear, including scratches, discolouration, stains, tears, or surface dents that do not affect an item’s functionality, as well as claims arising from atmospheric or climatic conditions, gradual deterioration, pests, insects, or damage during repair procedures, are not covered.

- Confiscation: Items confiscated or held by customs or authorities are not covered.

- Motor Vehicles: Claims for motor vehicles, including their accessories, are not covered.

- Special Items: Claims for fragile items, antiques, artifacts, manuscripts, paintings, musical instruments, dentures, fur, contact lenses, or corneal lenses are not covered.

- Perishables: Claims for fruits, perishables, consumables, and animals are not covered.

- Information Loss: Claims for the loss of or restoration of lost or damaged information stored in tapes, cards, discs, or other storage devices are not covered.

- Business Goods: Claims for business goods or equipment of any kind are not covered.

- Valuables: Claims for money, securities, stamps, debit or credit cards, cash cards, Ez link cards, bonds, and coupons are not covered.

- Travel Documents: Claims for identity cards, passports, travel passes, tickets, and travel documents are not covered.

- Belongings: Claims for any item that does not belong to you are not covered.

- Mysterious Disappearance: Unexplained and mysterious disappearance of your baggage or personal belongings is not covered.

- Deliberate Acts: Claims resulting from your deliberate acts, failures to act, negligence, or carelessness are not covered.

- Unattended Items: Claims resulting from your items being lost or damaged when left unattended in a public place, not in the custody of an authorised party (including transport and accommodation providers like airlines, trains, ferries, hotels, and resorts) are not covered.

- Invited Guests: Claims resulting from deliberate acts of anyone you or your travelling companion invited to join you or your travelling companion at any time during your trip are not covered.

Section 11: Losing Money

A. Stolen Money Overseas

If your money is stolen from you while you are overseas, you must demonstrate that:

- You have taken all possible steps and exercised care to ensure that your money is securely stored and not left unattended in a public place.

- You have reported the loss to the police at the location where the loss occurred within 24 hours of discovering it. You must provide the Insurer with a copy of the police report, including details of the loss.

Besides the General Exclusions listed in Part 4 of the General Conditions, the Policy will also not pay for the following, or loss or liability directly or indirectly caused by the following:

The Insurer will not be liable for any claims related to the loss of money while you are overseas if:

- You fail to report the loss to the police or the relevant authority within 24 hours of discovering it.

- You do not exercise due care and precautions to ensure the safekeeping of your money.

- The loss is due to changes in exchange rates or the devaluation of currencies.

- The money was not under your care and custody at the time of the loss.

- The loss is unexplained or involves the mysterious disappearance of your money.

- The claim arises from your deliberate actions, failures to act, negligence, or carelessness.

- The claim results from deliberate acts by individuals you or your travelling companion invited to join you during your trip.

Section 12: Losing Travel Documents

A.If your passport or travel documents are accidentally lost or stolen while you are overseas, you must fulfill the following conditions:

- You have taken all steps and observed due care to ensure that your passport and travel documents are secure and not left unattended in public places.

- You have reported the loss to the police or the relevant authority where the loss occurred within 24 hours after discovering it.

- Claims arising from the loss of your passport or travel documents while they are in the custody and care of the transport or accommodation provider should be directed to the service provider first.

- The Insurer will adjust your claim amount based on any refund received from the transport or accommodation provider. The Insurer will process your claim only after you provide them with written or documentary evidence confirming the denial, rejection, or partial payment of your claim by the transport or accommodation provider.

- Ticket Replacement: Expenses incurred in purchasing new air or train tickets to replace lost, stolen, or unusable tickets due to changes in travel dates are not covered.

- Failure to Report Loss: Claims are not accepted if the loss is not reported to the police or relevant authorities within 24 hours of discovery.

- Negligence in Safekeeping: The Insurer will not cover losses resulting from negligence in safeguarding your passport and travel documents.

- Mysterious Disappearance: Coverage does not extend to the mysterious disappearance of your passport or travel documents.

- Deliberate Actions and Negligence: Claims arising from your deliberate actions, negligence, or carelessness are not covered.

- Unattended Items: Loss of items left unattended in public places, not in the custody of authorized parties like airlines, trains, ferries, hotels, or resorts, is not covered.

- Acts of Invited Individuals: Claims resulting from deliberate acts committed by individuals invited by you or your traveling companion during the trip are excluded from coverage.

Section 13: Personal Accident

- Personal Accident Cover: If you are involved in an accident during your trip that results in injury and leads to your death or permanent disability within 90 days from the accident date, the personal accident cover will be applicable.

- Public Transport Double Cover for Accidental Death: In the event of an accident involving public transport while you are overseas and on board as a fare-paying passenger, if your death occurs solely due to this accident within 90 days from the date of the accident, the public transport double cover for accidental death will be applicable.

- Sickness-Related Disabilities or Deaths: Disabilities or deaths caused by sickness are not covered. For example, claims will not be paid if the cause of death or permanent disability is a heart attack or a stroke that occurred during the trip.

- Pre-existing Physical Disabilities: Any physical disability that existed before the trip is not eligible for coverage under this policy.

- Pre-existing Medical Conditions: Claims arising from pre-existing medical conditions or any sickness that you were aware of before the trip are not covered by this policy.

Section 14: Overseas Medical Expense

A. Medical Treatment During Your Trip: If you unexpectedly suffer an injury or sickness during your trip and require medical treatment while overseas, the Insurer provides coverage. To process your claim, you must provide a written report of your medical condition from your medical practitioner, along with the original medical bills and receipts.

Besides the General Exclusions listed in Part 4 of the General Conditions, the Policy will also not pay for the following, or loss or liability directly or indirectly caused by the following.

- Planned or Prearranged Overseas Medical Treatment: The Insurer does not cover medical treatments that have been planned or prearranged in advance.

- Dental Treatment for Tooth, Gum, or Oral Diseases: Claims for dental treatment resulting from tooth, gum, or oral diseases, or from the normal wearing of your teeth, are not covered.

- Pre-existing Medical Conditions or Known Sickness: Claims resulting from pre-existing medical conditions or any sickness you were aware of before the trip are not covered, unless you are insured under an Enhanced PreX plan.

- Enhanced PreX Plan Exclusions: For individuals insured under an Enhanced PreX plan, the first $100 for each visit for outpatient medical treatment related to pre-existing medical conditions or known sickness is not covered.