- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Travelex Money Card Review Australia

The Travelex Travel Money Card replaces the pre-existing Multi-currency Cash Passport with enhanced features and benefits. Learn about the Travelex travel card in this review to help you decide whether this is the card for you.

What is the Travelex Travel Money Card?

The Travelex Travel Money Card is a prepaid Mastercard%C2%AE currency card, designed specially for your overseas adventures. It replaces the Multi-Currency Cash Passport, which is no longer available.

Travelex itself is owned by Finablr, a financial company that owns many well known brands like Remit2India and UAE Exchange.

The company listed on the London stock exchange in 2019 with an implied valuation of about 1.23 billion pounds, making it one of the largest foreign exchange businesses in the world.

Pros and cons of the Travelex Travel Money Card

- Smartphone app and Free Wifi

- $0 international ATM fees

- Lock in exchange rates

- Limited number of currencies

- Expensive - high cross-currency conversion, extra initial loading, inactivity and closing fees

- ATM fees in Australia

When to use (and avoid) the Travelex Money Card for your travels

We think the Travelex Money Card is ideal for an organised traveller going to popular holiday destinations like Europe or the US. It comes with free Wifi, which fantastic for you to keep in touch with family or friends. Travelex has better online rates than your bank so you can lock in a good initial loading rate and save. Plus they don't charge you ATM fees while you're overseas.

Unfortunately, all of these conveniences comes with a high price tag. If you're looking for cheaper travel money options , you can also try the Wise (formerly TransferWise) debit card or Revolut .

Best way to use the Travelex card

The best way to use this card is to take cash from ATMs, because your limit is $3,000 and there are no additional ATM fees. The limit for in-store purchases is only $350 per day, which isn't much.

We also think it's a good idea to get a spare card, kept securely and separately from your main card. This way if your card gets lost or stolen, you won't have the hassle of ordering and waiting for a new card.

Learn more about the Travelex Money Card

Benefits of the travelex money card.

- Chip and PIN

- 24/7 Global Travel Assistance

- Emergency card/cash available if stolen/lost

Convenience

- Easy way to manage, spend and save on multiple currencies

- No bank account required

- Contactless payments

- No international ATM fee

- Lock in exchange rate by loading funds to foreign currencies and avoid fluctuations

Manage Your Money

- Reload and manage your funds easily online

- Redeem your unused funds easily on your return

How does a Travelex card work?

There are three main steps to setting up the travel money card with Travelex Australia, outlined below. You can also watch our video tutorial for a complete guide.

Step 1: Purchase Card

Order your Travelex Money Card online , over the phone or in your local Travelex store. Make an initial load amount of A$100 minimum. Get your travel card.

Step 2: Activate

Register your travel card details through the Travelex website or via the Travelex Money app and activate your card. You can manage your account online or through your app.

Step 3: Top-Up

Top up or reload money onto your travel card online, over the phone or via the Travelex Money app.

How much does the Travelex Money Card cost?

Travel money cards have multiple fees associated with them, which can make it difficult to compare.

For the Travelex Money Card, the initial load fee for Australian Dollars are the greater of 1.1% of the initial amount or A$15.00, but for loads or top-ups into all other currencies it's free. There is also a A$4.00 monthly inactivity fee.

Travelex exchange rates

Travelex provides a currency calculator on their website . However Travelex quotes the market rate, which is not necessarily the rate you will get when you load currencies on your card.

Travelex sets the exchange rate at the time you move your funds from one currency to another. If you don't have enough currency in your account and have made a purchase, Travelex will use the Mastercard%C2%AE exchange rate ("FX Rate") plus a margin of 5.95% of the transaction value to cover the cost.

All prices are in AUD * Foreign currency conversion is charged when you spend in a currency that is not loaded in the card

All prices are in AUD

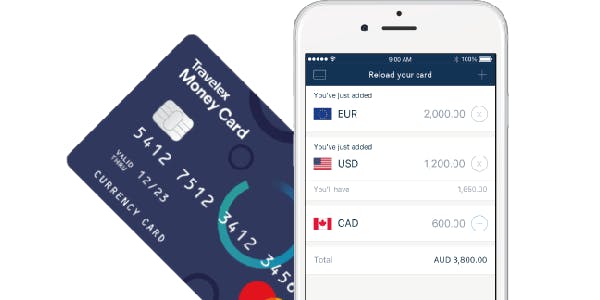

Does the Travelex Money Card have an App?

Yes. When you have an account with Travelex, you can top-up your card through their website, or through their iOS and Android apps. This means Travelex is available to both Apple and Android users.

Like their website, Travelex's Money Card app is very easy to use. Having the app makes loading currencies and taking out cash on the go when you're travelling much easier.

Travelex Customer Reviews

TrustPilot TrustScore: 8.9/10

On TrustPilot , Travelex have four stars and most customers think it's an "excellent company" to use. Generally customers speak favourably about their experiences with Travelex Australia as a whole.

However customers are more negative when it comes to reviewing Travelex's travel money card. A lot of customers complained about difficulty in using the app and issues with reloading money onto the travel card.

With too many negative user experience stories in online forums, we think a comparison with alternative travel cards for your situation is a good idea.

Is the Travelex Money Card safe to use?

Yes. Travelex is regulated in Australia. They have an Australian Financial Services Licence, and are regulated by the Australian Securities and Investment Commission (ASIC). They also have strict regulatory guidelines to follow.

How to contact Travelex if you have a problem

Website: https://www.travelex.com.au/travel-money-card/contact

Phone: https://www.multicurrencycashpassport.com/contact-us/card-service-numbers/

Frequently asked questions about Travelex Money Card

How do i get a travelex card.

You can buy a Travelex Money Card from any Travelex store or online and can collect it from any Travelex store in Australia. In-store fees for the card are more expensive than buying online.

Where can I get a Travelex Money Card?

Travelex have plenty of stores all over Australia . They have 1,400 Bureau de Change outlets principally located in airports and tourist locations in over 100 airports, across 26 countries. You can pick up your Travelex Money Card instantly from any Travelex store.

Can I use my Travelex Money Card in Australia?

Yes, you can use your Travelex Money Card in Australia. However if you are withdrawing money from an Australian ATM you will be charged 2.95% of the total amount you are withdrawing.

What currencies can you load on your card?

Your Travelex Money Card can be loaded with Australian dollars, which is your default currency.

You can load up your card with 9 additional currencies, including US dollars (USD), Euro (EUR), Great British pounds (GBP), New Zealand dollars (NZD), Hong Kong dollars (HKD), Canadian dollars (CAD), Singapore dollars (SGD), Thai baht (THB) and Japanese yen (JPY).

Can I still use my Travelex Multi-Currency Cash Passport?

If you're an existing Cash Passport customer with Travelex, you can still use your card until the expiration date on the front of the card. Positively, you can also order and use a Travelex Money Card should you wish to do so. You can even transfer the balance from your existing Cash Passport to your new Travelex Money Card, in the same currencies and at no extra cost.

What happens if I lost my Travelex card?

If you lose or misplace your card you can contact 24/7 Global Assistance. Travelex quickly and securely provides you with emergency cash and a free replacement card.

Your currency knowledge centre

5 Cheaper Ways to Transfer Money Overseas

Using a bank is one of the easiest ways of transferring money overseas, but can also be the most costly. There are alternatives that can make the whole process cheaper.

- Read more ⟶

International Money Transfer Comparison and Reviews

Find the best international money transfer exchange rates to send money overseas from Australia. Compare the rates and fees from leading banks and money transfer services.

5 Safe Alternatives to Wise

Wise (formerly known as TransferWise) is a transparent and easy-to-use money transfer option. But it can still be worth looking at Wise's competitors to see which is the best option for you.

- Tour Account ›

- Travel Forum ›

- Travel Forum

- General Europe

- Is a Travelex mon...

Is a Travelex money card worth it?

Hello, I was looking into some of my options for accessing my money abroad, and I came across the Travelex money card while ordering some euros from travelex.com. I was wondering if the Travelex money card would be worth getting for a 2 month trip. Mainly, I want to avoid incurring large fees for converting USD to Euros via my debit card, so I was originally thinking just carrying cash, but that’s a good way to get robbed and be broke in a foreign country for a couple months. So, a card that I can load with euros as well as other currencies for my 2 month trip seems like a better option, but I’m not sure if it’s the best option. Thanks.

Go to your nearest credit union (or find one online). Get an ATM card from them. They don't charge exorbitant fees because they're not-for-profit (I pay 1% of each transaction with my ATM card, no other fees). Get cash as you need it, use a no foreign exchange credit card whenever you can. No need to reinvent the wheel here. Travelex is not a good option for anything (haven't you discovered this when ordering money from them? what was the markup?). I don't believe this money card will be readily accepted anywhere, which is an even worse problem.

Give this a read: https://www.ricksteves.com/travel-tips/money

I didn’t notice a major markup using Travelex to order cash, but I did notice that when the hostel I booked for my arrival charged my chase account, I was charged a $5 transaction fee as well as a 5% markup. As for a credit union, I just checked and the nearest one to me requires you to be retired (I live near a wealthy retirement community), and the next one is over 70 miles away, so a credit union isn’t really an option.

Hate to tell you, but I think virtually everything you've written above is a mistake.

Two things which are highly contradictory...

I want to avoid incurring large fees

ordering some euros from travelex.com

Anything involving Travelex = you are paying VERY high fees, you are getting gouged.

There is no reason to "order euros", from anyone (least of all, from Travelex). There's also no reason to pay large fees for pulling your own money out of an account via debit card. As stated above, just use any reasonable bank or credit union, use their ATM in Europe to pull out Euros (or other local currency). The fees should be pocket change (unless your bank is a terrible one - in that case, join a local credit union).

You do not need to get Euros before you leave home, and you do not want to "exchange" money. You land at any airport in Europe, there will be ATM machines there, you use your ATM/debit card to pull out cash, any fees charged will be less than the cost of a beer.

It's easy, reliable, a non-issue.

As for a credit union, I just checked and the nearest one to me requires you to be retired (I live near a wealthy retirement community), and the next one is over 70 miles away, so a credit union isn’t really an option.

This is hard to believe. Credit unions are everywhere and they're prolific. I could be wrong, but I'd guess that your search for creit unions may not have been very effective. Where do you live? Would that be the Wyoming town in your username?

Wherever you are, try this link - a decent search engine for finding credit unions near anyplace: Credit Unions Near Me

Note: is says there are 50 credit unions near Cody, WY (although their definition of "near" may be a little loose)...

Travelex is synonymous with high cost foreign currency exchange. Germans don't like credit cards because the merchant usually has to pay about 3% fee and the money is slow, 7 to 10 days, to make it into their bank account, and rubs Germans the wrong way. So a 5% adder is common, especially for smaller establishments when using a credit card.

Besides credit unions, there are internet banks, like CapitalOne that don't charge foreign currency transaction fees.

Or open an online account with Charles Schwab and fund the checking account with the amount you want to have for your trip. No fees. When you need cash, you get the local currency from an ATM. Use a credit card that doesn't charge a foreign transaction fee.

perhaps this will help you search for a CU

http://www.asmarterchoice.org/

Thanks for the help. So, the overall message I’m getting is that Travelex is horrible, normal banks are a necessary evil, or credit unions are the best options in my case? Would incurring the transaction fees from chase be better than atm fees, or is cash the way to go in Europe? From my experience, cards have always been better, but I’ve read a lot that Europe is different in where cards are useful. I want to avoid issues with using USD on an ATM where I wouldn’t be able to, or are there no issues so long as I use an ATM that has the currency I need? For example, can I use my debit card with USD on an ATM in France to get Euros, and an ATM Switzerland to get Francs? Do they have to be special ATM’s?

I dumped my big bank for a credit union long ago. The fees are lower and the customer service is better. I still don't know what the advantage of a big bank is for checking and savings.

(You get the local currency from the ATMs in Europe - in France you get Euros, in Switzerland, Francs, etc. No USD comes from an ATM in Europe. The currency is converted for you - plus any other fees charged.)

There are plenty of credit unions you can join. You don't even have to visit physically. If you want one just for traveling, the Andrews Federal Credit Union in Maryland for example offers an ATM card (not even a debit card if you don't want a checking account) with no fee per-use and 0% currency conversion fee. I've used one for years. Andrews also offers a visa credit card with no foreign transaction fee and no annual fee (but no rewards program to speak of). It's also a chip and PIN card that works in train station ticket machines and unattended gas pumps, where many US chip credit cards won't work.

The only stipulation is that, to be eligible, you might need to join the American Consumer Council (ACC) - a one-time $5 fee.

If it bothers you to join a credit union that isn't local, no doubt you can join a local one even if it doesn't have quite the same rates as Andrews.

Credit unions offer reciprocal use of ATMs through something called the Co-Op network. You can use your local credit union's ATM without belonging to it, for no fee, if you use your ATM card from another credit union. And sometimes they offer something called "shared-branch banking" so you can do transactions in person with your remote credit union (like Andrews) without being a member there.

As for your Chase visa: they certainly offer some visa credit cards with no foreign transaction fees and no per-charge fees. All of their cards have different terms.

My take on Travelex prior to arriving in Europe....forget it period. Even the most generous exchange rate offered is just plain bad! There is a Travelex at SFO in the international departure area.

A couple of years ago I got 1,000 Euro from BofA, the minimum at which no service or any sort of fee would be charged. I went to a major branch office in SF, was told the cash would be available in a few days. They certainly did not have it on stock, so to speak.

It was, either I could have it mailed to me or come back to pick it up. The bank said I would receive a phone call so that I could come by to pick the cash. I chose that option instead of receiving in the mail

Part 2....credit cards are not necessarily better. It does depend upon where you are and who is being paid with your US credit card.

In Austria and Germany the small hotels/Pensionen and restaurants which don't primarily cater to tourists would much prefer cash. On the last 2 trips, 2016 and 2017, I've found myself paying more often with cash in Germany, so I didn't have to bother with a credit card, or I would not even check if the Visa/MC logo was on the restaurant door or window before stepping in.

You can use the credit card more freely in France and London.

Emma, my plan is to start in Paris, go to Lauterbrunnen, all over Italy, Athens, Budapest, Germany, Vienna, Prague, Amsterdam, Brussels, London, Edinburgh, and Dublin.

Travelex is fine for getting a starter pack of the local currency, whether it's Euros, Forints, Korunas, or English pounds. While you'll be paying a premium on the exchange you can minimize the damage by withdrawing the minimum, ie just enough to get you started, then rely on ATM's upon arrival...using a no fee debit card as others have suggested. Capitol One credit cards are a good choice for foreign travel.

I do not mean to be rude, condescending, obnoxious, etc to the OP, but - I am shocked at how many times this question has been answered in these pages with the same information over the several years I have been here, and how many times this same question gets asked, with the same anti-consumer products being looked at, and the same information always being given in response.

If you open a bank account online with CapitalOne or Schwab, since you say a credit union is not working for you, you will get an ATM card that working in the system will have a cost to use of between point-three and point-seven of one percent over the interbank exchange rate at the time. You cannot do better. Neither of these, as well as the various credit unions, charge a fee for ATM use (and Schwab refunds the fee if an external ATM charges you). European banks by law do not charge ATM fees. While the CapOne card is an ATM card only, the Schwab card is a chip-and-pin debit card and thus also may be used for ticket machines, automated gas, point-of-sale, overseas purchases online, and so on. If this is a joint account you can get a card for each of you with different numbers with the daily limit applied separately to each card. We have used these cards in 18 countries without any problem - ever. That there may be no physical bank within 500 miles of you will not matter, as you can transfer money to these accounts online from your regular daily bank.

I hope this article will help you choosing a good credit card for overseas travel (only for credit card purchases, not cash withdrawals)...give it a read (there is a link to cards with zero foreign transaction fees, which is helpful): "What to ask before taking credit cards overseas" https://www.bankrate.com/finance/credit-cards/taking-credit-cards-overseas-1.aspx

By the way, my credit union is in CA and I live in VA. Everything is done online, I don't visit the "bank" at all.

I use Schwab. I put 50% more than what I think will be needed into the Schwab account. I can access those funds on any terminal on the Plus system, which is common. No direct fees. As Larry notes, the conversion rate is how the system makes money. We have the Chase Sapphire card which does not charge fees for foreign transactions. As Larry says, these are well-known options.

European banks by law do not charge ATM fees.

That statement might be a little strong, since the Unicredit (big Italian bank) ATM's in Italy charged ATM fees last year when I was there. Walked down the street to an ATM operated by an Italian equivalent of a credit union/savings bank and they did not have ATM fees.

Caixa, a major Spanish bank, charged me its own fee as well as the ATM fee imposed by my own bank. Fortunately that is an exception. The OP should understand that a user fee for foreign exchange is charged by the issuer of the card back in the US. The exchange rate is a separate issue. Any way to get foreign currency -- over the counter, by bank card or credit card -- is actually buying the currency. The customer will pay more than the published exchange rate, and if selling it back at the end of the trip, will receive less than the published rate. The difference is profit margin for the bank. While fees for plastic vary, there's little to no difference on exchange rates. If I land at a European airport with no euros in my wallet, I will seek out a bank machine, even Travelex if no bank as available, and withdraw enough euros to keep my going until I get to an ATM in a bank near my hotel. There is no need to buy the euros back home, which is often more expensive. As a precaution, I maintain chequing accounts with ATM cards at two different financial institutions, so I have back-up. Travelling solo, I also never carry all my plastic in the same wallet. And I do withdraw substantial cash; it's no less secure than at ATM that gets lost/stolen/mangled.

Not all credit unions offer debit/ATM cards providing zero foreign transaction fees. The ones near me charge 3%. Search the Travel Forum for prior posts which include a full description of Travelex costs....high.

You've asked a good question. You are wise to be thinking in advance about such things.

Debit Cards: I have the Charles Schwab Investor Checking Account that I use exclusively for travel. I've used it for several years and have been very pleased. There are never any ATM fees period. There are no foreign transaction fees. This is better than anything you will get at a credit union. I have been pleased with their service. This is a great debit card for travel. I have found a secondary plus is that I put my travel savings into it each month and then it is separate and I always know how much money is available for travel. Note: In order to open this account, you also open a brokerage account. Don't be mislead by this. Although you open the brokerage account, you have no requirement to put any money into it. I never have. It is quite a simple process to do.

Credit Cards: There are several credit cards out there that do not charge foreign transaction fees. Next look for added features such as travel insurance, discounts, cash back, or frequent flyer miles. Andrews Federal Credit Union (anyone can join by first joining a consumer protection group) offers one of the few true chip and pin credit cards out there. Most of the time you will not need a true chip and pin unless you are dealing with automated services such as ticket machines or toll booths.

Travelex: They provide a service and do charge fees. If that service has enough value to you so that you don't mind the fees, there is not a problem with using them. They will cost more than other options.

Sam is correct, some Italian banks, along with Spanish banks, are in fact charging ATM fees. But note these are Italian banks. We used German bank ATMs in Italy and Spain the ,last two trips, they did nto charge fees as per their policy.

Regarding Travelex ATMs, we tested the Travelex ATM in Heathrow and were charged the identical conversion rate that we received later that morning at a NatWest Bank in London. With all ATMs and credit cards you must make certain that the transaction is being done in the local currency, and do not accept their offer to do this in your currency, which will be at a 3 to 5% mark-up.

For a really good version of the Chase Sapphire card, their Amazon card is no annual fee, no foreign transaction fee, 3% cashback on Amazon purchases, 25 cashback on gas, drugstores, restaurants and office supplies, and 1% on everything else. Foreign charges are exactly at the conversion rate as there is no friction to pay for ATM servicing. So using this at restaurants in Europe is the least expensive option, since you get cash back.

There are many many fees for everything you do on a Travelex money card. A fee to buy the card, a fee to add money to the card, an exchange fee to convert your USD to EUR to load to the card, a fee if you spend the money as a different currency than what you asked to be loaded to the card, a fee to get money from an ATM, a fee to use it to make a purchase, a fee to check the balance, a fee to close out the card after your trip if you want the remaining cash, and so on. Sounds like the exact opposite of what you wanted.

The default Capital One Debit card which has no fees is a Debit card with a MasterCard logo on it. It is not an "ATM only" card as reported in one comment. I have had one now for nearly 15 years and have never had it not work in Europe when getting cash from an ATM (which is the only thing I use it for). There is absolutely no cost for the Capital One 360 account, no minimum balance requirements (the account will never close as long as you have at least $1 in it), no fees to move money in and out. You can sign up for it online and never have to go to a physical location. Much better than the 5% + $5 the big US banks charge per transaction.

Unfortunately some European ATMs now do charge a fee. It is clearly indicated so you can avoid the fee by going to an ATM operated by a different bank. Also, never allow an ATM or a merchant to bill you in your home currency, always insist on being billed in the local currency (EUR, GBP, etc) or they will use an exchange rate that is very inflated in their favor costing you up to 5% over what you should pay. Your account will always get billed in your home currency anyway when the transactions settle.

Looking into both Shwab and Capital One, neither of them look like they’d work. Capital One says it’s used at their locations or ATMs to withdraw cash, so wouldn’t I still be hit with the same fees as Chase? And Shwab doesn’t have an ATM in Paris (just searched as an example), so wouldn’t it be the same scenario? Or would I just use a random ATM wherever I’m at?

Plus Shwab requires the brokerage account which says has a minimum $1,000 deposit.

I have no idea why people make this so complicated. I've had my Andrews FCU ATM card for years. $0 fee and 0% conversion fee sure is nice in Europe. Maybe someday I'll actually visit an Andrews branch if I ever get to Maryland - but I doubt it.

I don't think you have a very clear understanding of now ATMs work. Do you currently have and use a debit card at ATMs in your area? Second, the ATMs is a machine that processes your card regardless of who issues the card. It is the card issuer - generally the bank - who determines the fees charge for using the debit card. Therefore, Chase can charge different fees than Schab, or Bank One, or Capitol One, etc. There is no question that the cheapest and most convenient way to obtain local currency is via debit card at a bank owned ATM. It is best if your debit card charges low or no fees, but even if your debit card charges a standard 3% fee it is still cheaper than any other alternative -- including Travelex.

Ive always used a Wells Fargo card with Wells Fargo atms, and chase with chase atms. I was always told never to use other atms, so this scenario is completely new to me.

Will you withdraw $1000 while in Europe? If yes, then open a Schwab account and transfer money from the account as needed to the related checking account. What's so challenging?

I was always told never to use other atms

This makes sense as they probably charge you high fees to use other ATMs, and it keeps you loyal to Wells Fargo. The key is to find a less punishing bank because there is a spectrum of greedy to super greedy. A credit union works for me, I don't care to be shaken down when accessing my own money.

Every banking product (whether credit union or for-profit bank, or ATM debit card or credit card) spells out all the various fees on a one page-disclosure/summary. No one can answer what the fees are for the cards you are using, or plan to use overseas because each card has its own terms specific to that card (there are a variety of different combinations). You have to look up the exact card and the fees will be spelled out. It's not even small print, it's pretty large print so it's impossible to miss.

100% agree with Agnes. I never need to worry about hunting down an ATM in Europe from some specific bank - just use the closest most convenient one and never get charged any fees. Some people warn you away from ATMs not owned by banks, but I've never been charged a fee to use my credit union ATM cards anywhere in Europe over many trips. (In some countries e.g. Spain I hear some ATMs do charge fees but I've never been there.)

I'm one who will warn you to avoid ATM's not owned by banks. That's only because some machines that resemble ATM's have names on them like Travelex and are really exchanges that charge big fees. Stick with something that has bank, banc, banco, etc. in the name. I've really only seen the automated exchange machines in airports.

As for paying fees, if it's a bank ATM, the European bank won't charge you a fee (the comment about Italy is the first I've heard of in Western Europe). Your bank probably charges something. Shop for foreign transaction fees when you pick a bank or credit union. Some banks and brokerages have free options but they come with requirements. If the requirements work for you, great. The biggest banks often charge something like $5 per transaction plus three percent, which adds up quickly. It's fairly easy to find a one percent flat fee option from smaller banks and credit unions. Finally some banks advertise free transactions at participating ATM's in Europe. I'd avoid these. Unless you know exactly where a free ATM will be, and it's convenient, you're likely to spend too much effort trying to find a free machine and end up just paying big fees. I'm sure there are millions of ATM's in Europe. A couple thousand free one's may seem like a lot, until you start searching for them.

Schwab requires $1,000 in the brokerage account? Really? Do you have that in writing? Because I can tell you that my required Schwab brokerage account has ZERO dollars in it, and that has been the balance since it was opened several years ago. The checking account keeps about 2 grand in it, not because it is required, but because that is a comfortable amount for me to leave there and have ready. If there even is a minimum for the checking account, it can't be more than a hundred, but this simply is something I can ignore.

Perhaps you are confusing the $1,000 with the $1,000 that you are allowed to withdraw from it daily.

As for my CapOne account, the card is in fact an ATM only debit card, it has no chip, and CapOne says I will not be getting one with this account, which is their hi-interest money market account and I think is no longer an offered product. This is no problem, as with both cards, plus no foreign transaction fee credit cards from CapOne and the Chase's Amazon card we have all our cash needs covered.

And please, codyw - - it's been stated so many times here and in the past - CapOne and Schwab DO NOT CHARGE FEES AT THEIR END FOR ATM WITHDRAWALS - period.(sorry for theCaps)

The $1000 Schwab brokerage minimum is waived if you have a checking account.

"The Minimum Deposit Requirement is waived if you open a linked Schwab Bank High Yield Investor Checking® account or establish an incoming monthly transfer of at least $100 through direct deposit or Schwab MoneyLink.®"

https://www.schwab.com/public/schwab/nn/agreements/schwab_pricing_guide_for_individual_investors.html

There's currently a $100 bonus for new Schwab customers. It's not totally clear if the $1000 in brokerage account is necessary for the bonus. Opening the accounts will result in hard credit pulls. Google "schwab $100 bonus" for the bonus link plus details on various financial blogs.

I've used a Capital One bank ATM card pretty widely in Europe (it's the back-up to my credit union card). No problems and no fees. I did encounter an ATM in the eastern part of Germany that did not like my US ATM cards, and the bank confirmed that its machines were touchy that way. That was just one place in the eleven countries I've visited recently.

I think Brad hasn't spent much time in Spain in the last few years. As others have stated, there are most definitely some European banks charging ATM-usage fees. Several of them have machines in Barcelona, enough that it was sort of annoying. But there were also plenty of machines with no fees, so it was a matter of paying attention to which bank's machines you liked and which you wanted to avoid.

First of all, you do not have to fund a Charles Schwab brokerage account, only open it. Many, many people on this forum have done just that. You are not reading the information correctly.

A Debit card with a Visa logo (such as the Charles Schwab one) works at any ATM that takes VISA. This is pretty much any ATM anywhere in the world. They do not charge fees. If the local bank charges a fee, then Schwab credits your account back.

You are not required to use the same bank as issues your card.

I think we should drop the discussion about Schwab because it is just adding a lot of confusion -- yes they do. No they don't. We are mixing up the discussion about two complete different fees. ONE - a fee to use an ATM and TWO a fee for converting your money into the local currency -- currency conversion fee.

It is obvious that codyw does not have a good handle on how ATMs and Debit cards work. Too bad we cannot have a phone conversation for this one. It would be easier. See if I can keep it simple.

In the US and Europe all ATMs are owned by someone -- generally a bank. Generally any debit card with a VISA or Mastercard brand can be used at any ATM in the US and Europe. In the US the bank customers of the bank that owns the ATM can use that ATM for free. All other users will be charge a fee if they use a different bank's debit card at that ATM. That fee is often $2 or $3.

Therefore this is why your statement ----- Ive always used a Wells Fargo card with Wells Fargo atms, and chase with chase atms. I was always told never to use other atms .... is not totally accurate. You can use other ATMs but you will be charged a fee. OK ?? Free to use you own ATMs but not someone else.

In Europe, it is NOT common for the bank owner of the ATM to charge a fee to non-customers of that bank. Therefore, it is generally free to use your debit card with any other bank owned ATM. OK ????

The other fees we are discussing is commonly called the currency conversion fee (3-5%). THAT fee is totally determined by the card issuer and can be anything that they want to charge but it must be disclosed to you. Cannot be hidden. Any question about fees being charged -- call your bank.

I didn’t notice a major markup using Travelex to order cash

Really? You need to pay more attention.

Right now, according to Oanda.com, the Interbank (official exchange) rate is 804,18€ for $1000 US.

I just checked with Travelex's website and their rate is 729,90€ for $1000 US. That's for cash or to load a card. That's a 9¼% exch rate discount.

Wells Fargo, today, will give you 706€ for $996.97 US, which is a 5.2% discount. (Actually, Wells sets their rate or the day at 5% sometime in the early morning. As the day goes on, and the Interbank rate changes, the WF rate might be more or less than 5%.)

I was charged a $5 transaction fee as well as a 5% markup.

I guess I wouldn't be surprised for Chase, because I consider them crooks, but Wells Fargo only charges 3% for "exchange conversion" and charges $5 only for foreign ATMs, not other transactions. I put exchange conversion in quotes because it's really a foreign transaction fee. The bank will charge you this whether they pay in local currency or USD. So, Dynamic Currency Conversion, where the bank or vendor changes the charge for you into USD at their rate doesn't save you anything. Your bank will still charge you 3% regardless.

Good job Frank .

I think on the subject of fees to use an ATM, it can also be expanded to the 2 separate fees. In the example of the OP having accounts at Chase and Wells Fargo. If the OP tried to use the Chase card at a Wells Fargo, he would incur 2 fees, one from Chase for using somebody else's ATM, and another from Wells Fargo for using a card from somebody else's bank. The first would just show up on his bank statement, the second would be disclosed on the ATM screen before the cash is dispensed and you would have to click on the "OK" button to accept the fee and get your money.

So now, for the purpose of minimizing fees, lets use CapitalOne Bank as an example. CapitalOne is an internet bank that has no ATM's, so they can't charge a fee for using somebody else's ATM. The ATM owner may charge a fee, but that will be disclosed at the time of the transaction. Most, but not all, banks in Europe do not charge a fee for using the ATM. Since CapitalOne does not charge foreign currency transaction fees, that will be at the interbank rate prevailing at the time of the transaction. Currencies trade just like stocks, the precise rate changes constantly as millions of $ worth of currencies are being exchanged continually through out the day, 24-7.

Ok, so I think I understand now. Basically, even though capital one doesn’t have any ATM’s in Paris for example, I can use any ATM without incurring a fee on capital ones end? The only fees I’d occur would be on the end of whoever owns the ATM, and I can avoid those by finding an ATM with no fees?

Just the reverse of what you said. It is your card issuer that determines the fees.

Yes Frank, but doesn’t the capital one card have no fees so that means any fees would bevfrom the atm’s end?

Okay, this thread has become confusing for just about everyone....

First of all. Make sure you are talking about a Debit or ATM card (not a credit card). Credit Cards should not be used at ATMS unless it is the only option available to you. With Credit cards you accrue interest on a cash advance.

Secondly, each bank or credit union that issues a debit card has its own policy regarding ATM fees and foreign transaction fees. You want a card that 1) Does not charge ATM fees anywhere 2) Credits your account back for any ATM fees charged by ATM provider 3) Does not charge foreign transaction fees.

Several cards that meet these requirements have already been suggested in this thread so I won't go through it again. If your Debit Card has the VISA logo on it, you should not have difficulties using it in almost any ATM around the world. If you sign up for an account with the features listed above, you should not have any fees associated with the transaction.

No, Frank. You might still get charged a fee to use the ATM by the ATM's owner, particularly if it is not a bank ATM. There have been posts here about that happening.

Credit Cards should not be used at ATMS.

Correspondingly, I would say that debit cards should not be used for POS transactions.

CapitalOne is an internet bank that has no ATM's, so they can't charge a fee for using somebody else's ATM

Capital One has bank branches, ATMs, and Allpoint ATMs associated with it. It's not an internet bank, it has brick and mortar locations throughout the US. There is no evidence (that I know of) that they can't or don't charge for using other ATMs.

Capital One doesn't charge for use of European ATMs. I haven't tried using my Capital One ATM card in another bank's US ATM so cannot say for sure what would happen.

Cody, I saw nothing wrong with your short summary.

Why not? That is exactly what they are designed for. I use my debit card a lot more than my credit card, both to extract money from an ATM and for shopping. I only use the credit card on the internet (sometimes, debit card is often cheaper), or when travelling and the shop doesn't accept debit cards.

On the US end, of course lots of people use debit cards for POS. The issue is that credit cards have more legal protections than debit cards. Maximum liability for fraudulent use is $50 I believe, and even that almost never happens. When the statement is viewed, you can dispute and be reimbursed for fraud. With a debit card, someone can drain your entire bank account and the fine print of your bank agreement says the bank is not liable for the lost funds. In practice, banks usually do reimburse their customers, but it can be a hassle in time spent being "pennyless" until it gets cleared up and all the proper hoops have been jumped through.

Lately, the fraudsters have been using skimmers and tiny hidden cameras on unattended gas pumps, so they get both the card number and PIN.

When I am in Germany, I use mostly cash, which I get from ATMs with my debit card, for almost everything. The small, independent hotels or guesthouses I use almost never take plastic, and they are always less expensive than those that do. If I do use a credit card, it is usually for a purchase from a major retailer, and I never lose sight of the card.

At home, I have a debit card that I use for internet sales. It is tied to a checking account in which I usually keep less than $100, with no overdraft protection. I did this on the advise of my bank after they called me one day to ask if I had charged $18,000 to Avon for cosmetics.

You have to be careful which Capital One account you get: It must be the 360 online account they offer to guarantee you have no fees for ATM transactions. Some of their other accounts do charge fees for ATM use.

I have had the 360 account for over 15 years. I have never been charged any ATM fees by Capital One (or its predecessors for this account) anywhere in the entire world. I have used that Debit card in ATMs all over Europe.

I agree with the statement made about being told to not use your Wells or Chase card at ATMs not belonging directly to them. This is good advise in the US where ATM owners love to charge large fees when you use their ATMs. Since most places in Europe do not charge fees at the ATM, not something to really worry much about as long as the ATM is run by a bank. You do have to worry about the fees your bank will charge you for international transactions. They charge just because they can. . And no, you will not find ATMs operated directly by US banks anywhere in Europe so don't waste time looking for one.

This topic has been automatically closed due to a period of inactivity.

Suggested companies

Travelex insurance services, allianz partners usa, seven corners.

Travelex US Reviews

In the Money Transfer Service category

Visit this website

Company activity See all

Write a review

Reviews 4.5.

11,759 total

Most relevant

Travelex Retaining Personal Currency Transaction

On 08 June 2023 I converted UK Pound Sterling to 290 U.S. dollars and was only offered the Travelex Money Debit Card. I accepted this offer with the assurance that once I returned to the U.S. that day I would be able to obtain my funds in U.S. dollars, which my Travelex receipt reflected. Upon return to the U.S. I have been unable to access my funds after two attempts at my financial institution. I sent an email to Travelex on 8 June 2023 requesting they provide me funds through through traditional methods and they have failed to respond.

Date of experience : June 08, 2023

My 18 year old granddaughter tried to…

My 18 year old granddaughter tried to order a Travelex card. The first time, It didn't go through, although funds in her bank account were placed on hold pending the transaction. Once the funds were back in her account, tried again, including a phone call to Travelex. The request still didn't go through even with Travelex on the phone, guiding the process. They didn't know why the transaction couldn't go through. I ordered Canadian funds without any problem, and they were delivered by FedEX as promised.

Date of experience : August 09, 2020

The whole experience went well

The whole experience went well. Being pretty much confined to the house during the coronavirus event, I found it helpful to order online. I was able to pay with my credit card (air miles), free shipping, and the package arrived in a couple of days as promised. Perfect experience. Will definitely do business with them in the future.

Date of experience : March 26, 2020

Legacy customer

I have been using TravelEx ever since I was 18 going abroad for the first time on my own, back then I just stopped by the store in Tampa. These days my travel has grown a bit more rushed and time sensitive. It is nice to know I can go online and order local currency for delivery the next day amazing. Many local shops won’t swipe your credit card for small purchase as they do in the US/CA. You would be surprised how many experiences you can miss out on because you don’t have cash.

Date of experience : May 01, 2020

Could not understand the foriegn guy…

Could not understand the foriegn guy with the accent who disconnected phone connection after I had to ask him repeatedly what he was saying and was going to ask him to speak slower and louder but he decided hanging up was easier. I can understand accents but not low fast mumbling. Have your people speak slower and ANUNCIATE. My other preceeding French born English Rep was 5 stars.

Date of experience : June 10, 2020

Excellent Service/Excellent Rates

I travel to Brazil often; once or twice each year, and always use Travelex for my currency exchange. Your online systems are quick and easy and I love the fact I can pick-up my cash locally at the airport. Also, I trust your conversion rates, which I often compare with the conversion rates my friends give me from Sao Paulo. Often your rates are spot on, or sometimes better. I appreciate your service and thank you for being a very important part of my international travel. For frequent customers, it would be nice to have a personalized account, information on best conversion rates and places to travel in the world, etc. T.

Date of experience : May 05, 2020

The only way to exchange money

The website timed out on me which was frustrating after putting all the required information in; it also rejected a perfectly good credit card. Once I resolved those issues, it was smooth and expedient. Received the cash less than 24 hours later!

Date of experience : April 19, 2020

Great service!

This was the first time I've used this website and I will definitely do it again. The process was simple, well thought out, and uncomplicated. The funds were delivered promptly as promised. Thank you for making this transaction painless and successful!

The process was clear and easy

The process was clear and easy, you could edit and navigate backwards well on the site to explore options. I bought Euro very close to the most recent exchange rate and do not feel I got nickeled and dimed at all so that was refreshing.

Date of experience : May 08, 2020

As a result of purchase

As a result of purchase, I was exspecting large bill notes more than two hundred dollars notes. Easier to work with while vacationing. Especially, since it was not purchase in Mexico. This certainly is an incentive to anyone wanting to visit Mexico. Also, a good selling point and public relations to Americans. More purchasing power.

Date of experience : June 16, 2021

I have ordered foreign currency twice…

I have ordered foreign currency twice and was extremely happy with the delivery and the ease of ordering. Your customer service department is excellent . I know I will be ordering again in the future as my daughter is now living abroad. Thank you.

Date of experience : July 09, 2020

I love the idea of being able to travel with local currency.

I love the idea of being able to travel and carry local currency purchased in advance, avoiding on site exchange fees and other issues with credit cards, etc.; the Travelx allows you to do just that. The only issue I have is with the navigability of the website and reloading a card .. it’s clumsy and not intuitive. Part of that is understandable security, but part of it is website design.

Date of experience : April 25, 2020

Bulls purchase

Date of experience : May 09, 2020

Was making a trip to Canada and ordered…

Was making a trip to Canada and ordered Canadian cash. Was delivered on time however trip may be canceled. Unless Trevelex can make Covid disappear then I'd say the experience was pretty good.

Date of experience : April 10, 2020

I’ve used this site twice now and have…

I’ve used this site twice now and have been pleased. The arrival date you pick option is great since it’s definitely a package you don’t want to miss. The staff are pleasant when you call. One thing to note: there are no tracking numbers for security reasons. Just call the day your package is set to arrive and they will let you know the time it will be there.

Date of experience : April 23, 2020

An excellent travel card!

The ease of working through my card reload was great, effortless and quick! Much improved and I feel that my transaction and information are secure. Thank you for improving the site so much!

Date of experience : April 30, 2020

Easy, simple online transaction and convenient in this era of a global pandemic. Something to consider is this ease is costly, not inexpensive albeit convenient. The credit card transaction is processed as a cash advance, not just a regular credit card purchase transaction. A visit to a nearby storefront using cash would not have the added $60 onto my purchase. Quite steep, and have not other choice but to pay for the convenience.

Date of experience : April 17, 2020

Brilliant!!!

What fast, friendly, trustworthy and with a smile (by way of telephone) customer service experience I had today with Travelex US! I will share my delightful experience with everyone I know. Due to Travelex professionalism and attention to detail I won't hesitate to place my next order with Travelex US. The best darn currency exchange company on the planet!

Date of experience : March 27, 2020

Legit business

Legit business. Reasonable charges. I only wish you could order specific denominations. I use most of the currency for tipping at the resort we stay at, not shopping.

Date of experience : March 22, 2020

Travelex could make club or monthly prior to vacation for foreign currency to where you are vacationing one or multiple countries.

Travelex is buy currency each month in anticipation to prepare & go on vacation. If you have the local economy currency, it is easier to start your vacation, usually you need the taxi once you arrive. They conveniently break up the currency into lower denomination to higher denomination. If you get taxi in another country if you have the lower denomination, then you do not have to hear I do not have change. The money is quickly shipped & think they should have more sales. Also they should have account that will send smaller amounts each month year out. You can purchase currency & be ready for vacation. In the country you have to deal with currency exchange & I personally found, some times you get what you pay for & sometimes you do not. The hotels with currency exchange are the most fare, but you will spend more to convert the currency. Reproable hotel will give you proper amount with less chance of them skimming from the exchange. Exchanges on the economy, in some places if they give you the rate, take moment and do the math. Cell Phone or watch calculator, see they try to skim the money, even the change. You can go to restaurants, but they will give you change unless you are super sharp, you do not know if correct or not.

Date of experience : May 07, 2020

- United States

- United Kingdom

In this guide

Restrictions

Your reviews, ask a question, travelex money card review.

The Travelex Money Card lets you carry 10 currencies, with no fees for international ATM withdrawals or top-ups made through Travelex, but a 1% fee for BPAY loads from your bank account.

Travelex Money Card supported currencies

You can load funds and spend them in these 10 currencies:

- Australian dollars (AUD)

- Canadian dollars (CAD)

- Great British pounds (GBP)

- Euros (EUR)

- Hong Kong dollars (HKD)

- Japanese yen (JPY)

- New Zealand dollars (NZD)

- Singapore dollars (SGD)

- Thai baht (THB)

- US dollars (USD)

Features of the Travelex Money Card

- Support for 10 currencies. As well as Australian dollars, you can load 9 supported currencies. This gives you a way to avoid exchange rate changes and manage your travel budget.

- No currency conversion fees for other currencies. If you're paying in a currency not supported by the card, the funds will be converted as part of the transaction, with no currency conversion fee. In comparison, some other cards charge a currency conversion fee of around 2–4%.

- Complimentary Wi-Fi access. This card offers complimentary Wi-Fi access at millions of locations around the world through Boingo. Just pre-load $100 or more on your card, then register via the Boingo website to get up to 3 months of free Wi-Fi. You can also get an additional 3 months free for further top-ups of $100 or more.

- Worldwide acceptance. You can use this card in over 200 countries and regions around the world, wherever Mastercard prepaid cards are accepted.

- Fee-free ATM withdrawals. The Travelex Money Card does not charge a withdrawal fee at overseas ATMs. There's also no ATM fees in Australia if you have Australian dollars loaded on the card. Just keep in mind that some ATM operators charge a fee, which is typically displayed before you make a withdrawal.

- Card management. You can check your balance, load foreign currency, view details of current exchange rates and manage other details for your card through the Travelex website and Travelex Money app. There are also no fees when you top up through the Travelex website or app.

How much does the Travelex Money Card cost?

- Purchase fee. There is no purchase fee when you order the Travelex Money Card online through the website or Travelex Money App. When you get one in-store, you won't pay a fee if you're loading foreign currency directly onto the card but when loading in AUD, you'll pay 1.1% of the initial load or $15 (whichever is worth more).

- Loading AUD in store: 1.1% of the initial load or AUD$15 (whichever is worth more).

- BPAY from a bank account (not through Travelex): 1% of the reload amount.

- Monthly inactivity fee. A fee of $4 per month applies if you have not loaded or made a transaction with this card in the past 12 months. This fee won't be charged if you start using the card again, if the balance on your card is less than the fee or if you cancel the card.

- Closure/withdrawal fee. A Mastercard Prepaid fee of $10 applies when you close your card or withdraw from your card funds.

How to apply

You can apply for the Travelex Money Card online or through the Travelex Money App. You can also get one in a participating Travelex store. Just make sure you meet the following requirements.

- Australian address. You'll need to provide a valid Australian residential address, including if you're not an Australian resident.

- Identification. You need to provide a valid form of government-issued photo ID, such as your driver's licence or passport.

- Age. If you apply online or through the Travelex Money app, you'll need to be at least 18 years of age.

If you get a card in-store, it will be ready to use once you load funds onto it. But keep in mind the exchange rates in-store may be different to those online.

If you order a card online or through the app, you'll just need to activate it and load funds before you can use it.

- Travelex Money Card information PDF

- Travelex Money Card TMD

To ask a question simply log in via your email or create an account .

Hi there, looking for more information? Ask us a question.

Error label

You are about to post a question on finder.com.au :

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our 1. Terms Of Service and 6. Finder Group Privacy & Cookies Policy .

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.

December 13, 2023

how to cancel a travelex money card after my holiday has ended

Amy Bradney-George Finder

December 14, 2023

Hi Catherine, You can cancel your card by contacting Travelex online or over the phone on 1800 440 039. You can also arrange to cash-out any remaining funds on the card, but be aware that there is a $10 fee when you close the account or withdraw money (set and charged by Mastercard Prepaid). I hope this helps.

July 23, 2019

I have used Travelex Money Card in the U.S. Travelex Money Card is basically Cash Passport with a “Travelex” logo printed on it. I have found it be fine to use for small transactions, e.g. purchasing meal at an airport, souvenir at gift shop. However, I have not always found it reliable for instances where your address details have to be transmitted with your CC details through the EFTPOS system. Cash Passport uses what’s called the Address Verification System (A/V.S.) as one means to verify the cardholder. All it does is try to match up the numerical components of the cardholder’s address – as stored in Cash Passport’s records – with the billing address provided to the merchant If the system does not recognize a ‘match’ for whatever reason, then the transaction is declined.

I used it a number of times pver the past 5 years with a particular motel in the U.S. with success. But then the last time I used it. the card was rejected because of some formatting error with the address. The staff member serving me didn’t seem very knowledgeable (she wasn’t the manager), and suggested I call Cash Passport. They told me it was an address error, and I asked them to detail me exactly how my address was recorded in their system, right down to lettering, full stops, spaces, abbreviations, etc. Then I instructed the merchant to enter my address again exactly as provided to me by CP. Still no joy. The CP consultant advised me that the only other option with the card was to withdraw from an ATM. On this occasion I did so, and had to withdraw a number of times, because ATM’s in that area had a USD $200 limit, and charged for each transaction. I suspect the merchant I was dealing with could have overridden the decline if she knew how (I provided I.D. and verification of my address). Unfortunately the manager was away for a few days. I did have another card to try, a debit card, and that did not work either.

Unfortunately, I did not get much help from Mastercard in trying to understand exactly why the transaction declined. They just told me it was an A.V.S. failure to do with ‘bad address’. Some cursory research suggests to me that A.V.S. is capable of some false positives, and is not reliable with prepaid cards. Furthermore, U.S. and Canadian providers using A.V.S. don’t seem to ‘handshake’ very well with CC’s issued outside of those countries… in terms of verification of address. (I believe Cash Passport is ‘issued’ by Heritage Bank).

In my case, I suspect the decline was a combination of the merchant’s system and Cash Passport’s AVS.

Moral of the story? Have a contingency plan. Take a mix of money sources (which I did), e.g. backup card, currency. And find out in advance where your nearest ATM’s are, especially in a small town/city. If you are taking your CC linked to your native home account, make sure you advise your bank of your travel plans before you go (which I did). And preferably use a travel card that doesn’t employ A.V.S., which I am doing now.

October 17, 2018

If I have a Travelex money card with Euro and English pounds loaded, can I use it to touch and go on public transport and taxis overseas? Would there be fees attached? Cheers

Charisse Finder

Thanks for reaching out to finder.

You can use the Travelex money card to make contactless payments as long as the public transports and taxis have Mastercard payment terminal (EFTPOS) that has contactless symbol. If you will be using the card to pay in any currency other than the currency available on your card, a foreign exchange margin applies to the transaction amount.

You can visit Travelex’ website to see the full information on their rates and fees.

I hope this helps.

Cheers, Charisse

October 07, 2018

I need to use a travel card to go OS. However, I am going to Switzerland, Hungary, and Austria – I’m not sure if Austria has euro, but the other 2 don’t. What’s the best way for me to work out my money if cards like Travelex don’t hold currency that I want? I have used Travelex before in USA.

October 08, 2018

Thanks for your question.

Apparently, there are no travel money cards that can hold all the currencies of the three countries you’ve mentioned. However, you may want to do deeper research on a practical way of bringing money/cards to those countries. You may need to consider the fees charged for currency conversion and international ATM withdrawals when comparing your options. Furthermore, you may like to check the following guides instead to get an idea of which card you could possibly get and use overseas:

- Travel Money Guide to Switzerland

- Travel Money Guide – General for all other countries.

Best to check the reviews of your chosen card to make sure that it provides you the benefits considering your travel plans and spending habits.

I hope this somehow helps.

Cheers, May

August 02, 2018

I’m trying to sign up for the free wi-if but it says my card is not eligible

Joel Marcelo

Thanks for leaving a question on Finder.

You are supposed to get free WiFi from Travelex. All you have to do is to load at least $100 on your Travelex Money Card, enter your card details at mastercard.boingo.com, and wait 24 hours for it to be verified. If you can confirm that you have the steps I mentioned, you can contact them directly to ask what could be causing this decline. Cheers,

Amy Bradney-George

Amy Bradney-George was the senior writer for credit cards at Finder, and editorial lead for Finder Green. She has over 16 years of editorial experience and has been featured in publications including ABC News, Money Magazine and The Sydney Morning Herald. See full profile

- Debit cards

- Wise Travel Money Card Review

- Revolut travel account review

- South Korea

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

International Money Made Simple

Travelex Card Review

About Author: Hi, I’m Quinn Askeland. In 2014, I started Transumo after experiencing expensive, slow, and frustrating international money transfers and payments through banks. Once I discovered how to manage my own international currencies much better, I became driven to help others improve their transfers and payments. Fortunately, today, there are many excellent options. See My Full Bio .

7 Things You Need To Know Before Getting One

The Travelex card a multi-currency prepaid Mastercard you can top up in your local currency and use around the globe in other currencies and save on expensive ATM fees.

Good or Not?

In some situations it may be the best choice, but in others there are likely better options.

The card holds various currencies ; the actual number varies by country No fees for ATM withdrawals worldwide Available in various countries, including the USA, Australia, UK, and New Zealand Physical locations (like airports everywhere)

Less competitive exchange rates and fees (compared to competition) Mandatory initial loading and high inactivity fee Limited to holding the following currencies or less – AUD, USD, CAD, EUR, GBP, HKD, JPY, NZD, SGD, THB

- Is a Travelex Card Right for You?

- How Does the Travelex Card Work (or Not)

- Travelex Card vs. Bank Debit Card: Main Differences

- How to Get a Travelex Card

- Travelex Card Countries

- Travelex Card Fees and Limits

- Final Verdict

1. Is a Travelex Card Right for You?

Travelex card has received mixed reviews from its users. On Trustpilot, it has a low rating of 2.3/5 from 41K+ reviews. Many customers complained about the bad exchange rate and the customer service issues. On the contrary, it has better ratings on App Store with 4.5/5 from 5.5k reviews.

Compared to using your debit or credit card from home, Travelex card can help you save some money on exchange rates and hold multiple currencies in your account. Also because there are no ATM withdrawal fees , it can be a better option when you’re traveling overseas.

But that does not mean it is right for everyone.

Although not available in the US, the Wise Card (review) may be a better option.

Travelex is quite simply not the most competitive card of this kind. While the company was one of the first to offer a travel card – many emerging companies offer a far cheaper service , and some even let you hold many more currencies .

Travelex may be right for you if:

- You live in a country where travel cards like Travelex are limited (like the USA)

- You plan to visit countries where you have to withdraw high sums from ATMs. Most similar cards apply ATM withdrawal fees

Here is a video that shows the positives of the card. Read on to get the full picture.

2. How Does the Travelex Card Work (or Not)

Travelex is a prepaid card issued by Mastercard . You can top it up via bank transfer from your bank account (using the 16 digits on your card as payment reference), or from the Travelex app . The latter is the fastest method, and you can use either your debit or credit card to add funds to your Travelex Card.

It is possible to add funds either in your local currency or top up in foreign currency directly.

You can then use your card to withdraw cash from ATMs worldwide or make payments in any location that accepts Mastercard .

Because Travelex is a prepaid card, it also has some limits. To begin with, you can only spend funds that have already been added. This could be a positive thing if you want to keep your spending under control, but it’s not possible to arrange overdrafts.

As is the case with some prepaid cards in general, some vendors may also refuse to accept your card ; for instance, it is unlikely to be able to use it for hiring a car or to make online bookings at some tourist facilities.

3. Travelex Card vs. Bank Debit Card: Main Differences

The main difference between Travelex and a bank debit card is the possibility to hold multiple currencies on the same card. While some banks offer multicurrency accounts , their debit cards are issued in local currency only.

Founded in the pre-internet era, Travelex has over 1,000 stores and ATMs in 26 countries. If you have any issues with your card, you can ask for support in any of these locations.

Alternatively, you can benefit from online and in-app support.

4. How to Get a Travelex Card

Unless there is a Travelex store near you, the easiest way to get a Travelex card is by ordering it online. The card is usually delivered in the next business day, although delivery times could vary from country to country.

You can also order the card online and opt for store collection. In this case, you will usually be able to collect the card after 14 days.

You will have to activate your Travelex Card upon arrival. It is possible to activate it from your desktop or mobile app, or by calling the Card Services.

5. Travelex Card Countries

Travelex is currently present in 26 countries including the UK, USA, Canada, Australia, New Zealand, some countries in the EU, as well as countries in Asia, Middle East, and South America.

The Travelex Card may hold more or fewer currencies depending on the country where you order it. For instance, it holds 10 currencies in the UK and Australia, but US customers can only hold six.

6. Travelex Card Fees and Limits

Travelex Card is one of the most expensive prepaid foreign currency cards despite its free ATM withdrawals.

Here are the fees and limits you can expect.

For comparison, the Wise card has an exchange fee of 0.35% to 2% compared to 5.5% for Travelex.

In the video above, this traveller suggests the solution is cash, but the problems with this is that you still get charged a conversion fee by you bank which is potentially even less competitive. The solution is a multi currency card that offers a good exchange rate of which there are many in recent years, such as TransferWise, WeSwap, and Revolut.

7. Final Verdict

Travelex Card could be a great financial product , but many of its competitors offer better deals and more advantageous currency exchange rates which is where the majority for fees often get charged.

Currently, the card is popular mainly in the USA, due to a lack of solid competition in this country.

However, it will likely lose clients as soon as other similar services start to expand their business.

Is Travelex Card worth it? If you live in the US and need a card for traveling, Travelex is undoubtedly a great alternative to a traditional bank debit card . Consumers in the UK, Oceania, and the EU surely have better options to choose from.

Happy Travels!

Similar Posts

Moneygram review – 8 things you need to know.

Disclosure: This post may contain offers and affiliate links to save you money and it also helps us to keep providing the best information. For more information, see our disclosures here. 1. Quicktake On Trustpilot, MoneyGram is rated 4.5/5 with over 35k reviews, which is considered “Excellent”. 83% of the reviews are positive and say…

Skrill Review

8 Things You Need to Know Before Sign Up One of the remarkable features that I enjoy with Skrill is the convenience of sending or receiving money through email or phone number linked to Skrill wallet. It’s very easy and convenient, complemented by a MasterCard-powered prepaid card for easy spending. But this is not a…

Airwallex Review

In the dark times of old school banking (just a few years ago), businesses either juggled accounts in different countries or paid exorbitant fees for a multi currency account. The biggest expense though might be the time it took to administer everything especially when you consider expenses in different currencies, accounting, approvals, reporting and cards…

Western Union Review

7 Things You Should Know Before You Sign Up! I first used Western Union in Costa Rica to get some local currency many years ago. At the time I can still remember seeing the difference between the “buy” and “sell” and thinking I was paying a lot for convenience and confidence. And pay I did….

Monese Review

Digital banking is a great way to manage your money if you are serious about flexibility and convenience. In this review of Monese, I will share the good, the bad, and the alternatives. Monese enables you to get GBP, EUR, and RON accounts in minutes – ideal for those wanting to build credit, save, travel,…

Xoom vs Western Union

In my quest to find fast, easy, and affordable ways to send money abroad, Xoom and Western Union are top of my list especially because Xoom is owned by PayPal. So, which one is better for you? In this article, we will compare Xoom and Western Union in terms of coverage, payment methods, transfer speeds…

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Travelex Money Card Review

Learn about the Travelex Money Card in this review to help you decide whether this is the card for you.

The Travelex Money Card is a prepaid Mastercard® currency card, designed specially for your overseas travels. Travelex Money Card also replaces the pre-existing Multi-currency Cash Passport with enhanced features and benefits.

With the Travelex Money Card there is no need to carry around a lot of cash. You can load up to 10 currencies and benefit from contactless payment.

You can also download the Travelex Money App, which allows you to check your balance on the go, or reload more/different currency in seconds.

And what if you need some cash for all those smaller purchases? With the Travelex Money Card you can withdraw cash at no extra cost as there are no ATM charges overseas.

Another benefit is the 24/7 Global Assistance. This means you don’t have to worry about losing your card or the card being stolen. Travelex quickly and securely provides you with emergency cash and a free replacement card.

Pros and cons of using Travelex Money Card

- Smartphone app and Free Wifi. Manage your account instantly with the Travelex Money app. Enjoy free WiFi at over 1 million Boingo Hotspots.

- $0 international ATM fees. This is a huge benefit if you are travelling often and prefer to take out local cash from an ATM.

- Lock in exchange rates. Set your exchange rates ahead of travel, so you don't have to worry about currency movements when you withdraw.

- Limited number of currencies. New Zealand dollars only available for in-store deposits - unavailable for online loading or reloading.

- Local Operator ATM fees. Travelex do not charge ATM fees, but local operators may charge or set limits. Check the ATM before using.

- Expensive. High cross-currency conversion fee of 4%. Extra initial loading, inactivity and closing fees. Plus 2.95% fee at New Zealand ATMs.

Benefits of the Travelex Money Card

- Chip and PIN

- 24/7 Global Travel Assistance

- Emergency card/cash available if stolen/lost

Convenience

- Easy way to manage, spend and save on multiple currencies

- No bank account required

- Contactless payments

- No international ATM fee

- Lock in exchange rate by loading funds to foreign currencies and avoid fluctuations

Manage Your Money

- Reload and manage your funds easily online

- Redeem your unused funds easily on your return