What to do if you lose your passport while traveling internationally

When I studied abroad in college, my mother told me to take a photo of my passport to keep on hand in case I somehow lost my passport.

More than 10 years later, I still don't understand why I was given that instruction since photocopied passports don't serve as substitutes or makeshift passports, even in times of crisis.

Even so, the U.S. Department of State does recommend travelers copy all their relevant travel documents, including passports, which we will get to later.

Luckily for both me and my mom, I managed to keep my passport and all my belongings during my time abroad, but that wasn't the case for some of my classmates.

Situations like losing your passport while traveling internationally arise for many Americans. Sometimes, you just drop or misplace it; other times, you may find yourself the victim of theft.

As you can imagine, losing your passport while overseas creates quite a pickle, and I would argue it is one of the worst-case travel scenarios. Should you find yourself in this most unfortunate situation (which we hope you never do), here's what you need to know.

Where do I go to replace my passport?

This may seem like a no-brainer, but you cannot enter the U.S. by air, land or sea without a passport. Specifically, you need a passport book if flying or a passport card if entering via land or sea.

If you misplace your passport while abroad, you must replace it before returning to the U.S. This will require contacting the closest U.S. Embassy or Consulate for help.

"We encourage travelers to keep the contact details for the nearest U.S. embassy or consulate on hand when abroad," a State Department spokesperson said via email. "The Department can assist you if you lose your passport or it is stolen."

Additionally, the agency encourages travelers to report the loss or theft of their U.S. passport to their current destination's local police.

"However, don't spend time obtaining a police report if doing so will cause you to miss a flight or delay your travel unreasonably," the State Department spokesperson said.

Though you may be stuck beyond your originally planned departure, the agency will do everything it can to assist with getting you a replacement passport in time.

"If you are scheduled to leave the foreign country shortly, please provide our consular staff with the details of your travel," the State Department spokesperson said. "We will make every effort to assist you quickly."

Know, though, that most embassies and consulates cannot issue passports on weekends or holidays.

"In most cases, except for serious emergencies, a replacement passport will not be issued until the next business day," the State Department spokesperson said.

What do I need to apply for a replacement passport?

As outlined online, travelers need at least six items to apply for a replacement passport, specifically:

- A passport photo (one photo is required, and the agency recommends getting it in advance to speed up the process)

- Identification (i.e., a driver's license, an expired passport, etc.)

- Evidence of U.S. citizenship (such as a birth certificate or a photocopy of your missing passport)

- Travel itinerary (like airline or train tickets)

- Police report (if applicable)

- Completed DS-11 application (may also be completed at the time of application)

- Completed DS-64 statement form describing the circumstances under which the passport was lost or stolen (may also be completed at the time of application)

How much does a replacement passport cost?

The same fees associated with obtaining a non-emergency passport apply to replacement passports. You can expect to pay $130 for a passport book and $30 for a limited-use passport card.

Though replacement passports are usually valid for 10 years for adults and five years for minors, there are limited-validity emergency passports that can be produced quicker for travelers so they can return home to the U.S. or continue with their travels.

"Once you return home, you can turn in your emergency passport and receive a full-validity passport," the State Department spokesperson said.

Is it helpful to have a photocopy of my passport?

My mother's comment all those years ago evidently stemmed from the State Department's recommendation to copy your relevant travel documents, including passports.

"Leave one copy with a trusted friend or relative and carry the other separately from your original documents," the State Department advises. "Also, take a photograph of your travel documents with your phone to have an electronic copy."

This copy can also serve as evidence of your U.S. citizenship, which is necessary to replace a missing passport.

If you want to help a friend or family member abroad who has lost their passport, you can call the Office of Overseas Citizens Services at 888-407-4747, which can connect the passport holder with the relevant embassy or consulate.

Bottom line

If you lose your passport abroad, all hope is not lost, but it's in your best interest to locate the nearest U.S. Embassy or Consulate ASAP, as all travelers must obtain a replacement passport in person.

These passports serve travelers in all the same ways as a normal passport, though they may not have the same length of validity.

For more frequently asked questions on obtaining a replacement passport, visit the State Department website .

Related reading:

- Where can I cruise without a passport?

- Guide to the 6-month passport rule — what is it?

- 4 best places to travel without a passport from the US

- Here are 15 places you need a visa to travel with an American passport

- Guide to getting your child's passport

- How the State Department's Smart Traveler Enrollment Program could help you on your next trip abroad

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

5 Steps to Take If You Lose Your Passport

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Your hotel room is all askew and your suitcase is turned inside out. Panic sets in as you realize your passport is gone.

Losing your passport — or worse, having it stolen — is a nightmare scenario that can leave any traveler feeling helpless and wondering: How will I get home? How can I get it replaced? Will I need to change my travel plans? What else do I need to do?

Here’s your step-by-step guide to dealing with a lost or stolen passport.

What to do when you lose your passport

1. report the loss or theft to u.s. authorities.

While it can be a good idea to report a stolen passport to the local police — the information you provide will help them if it does turn up — reporting your lost or stolen passport to the U.S. government is also very important.

In addition to helping prevent identity theft, reporting a loss or theft can also stop someone from using your passport to commit a crime, making it imperative that you report your missing passport. It is also critical to report it because you'll need the loss documented when you go to apply for a replacement, which typically requires you to present your current passport as part of the renewal process.

You can request the assistance of the State Department's Office of Overseas Citizens Services if you need help with the process.

Be sure your passport is really gone first. Once the U.S. logs it as lost or stolen, the passport becomes invalid and you will not be able to use it for travel, even if you find it later.

» Learn more: How to get your first passport

2. Apply for a replacement

If you're overseas when you lose your passport, you'll need to replace it quickly so you can get home. If you're home but have upcoming travel plans, you'll need to replace it before your trip. Both of these scenarios require you to appear in person, perhaps traveling to a passport facility or embassy/consulate if overseas. This may take time if the offices are not nearby.

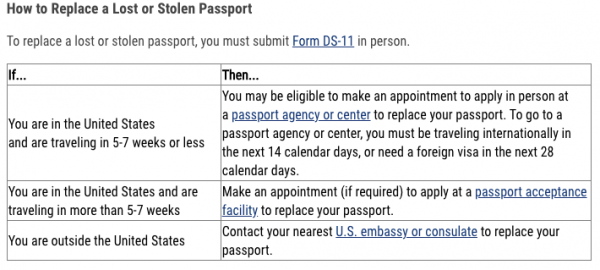

You can use Form DS-64 to report it lost or stolen online , but for a replacement, you must appear in person. The steps you must follow to replace your passport depend on where you are when you discover it missing and when you plan to travel. If you’re in the U.S., you can search for your nearest passport acceptance facility by entering your ZIP code here.

If you're overseas and need to apply for a replacement, you will need an alternate form of government-issued identification, like a driver’s license, to prove who you are. Photocopies of your passport will help, but you will still need to show official government identification.

You will complete form DS-11 to apply for a new passport. You'll need to supply recently taken passport photos .

Even if your lost passport wouldn’t have expired for years, you will have to pony up more cash for another passport. The regular fees apply. If you're in the U.S., you can pay an additional fee to have it expedited . There is an online calculator that will help you determine the cost of a replacement (typically $130) depending upon your circumstances.

The good news is that if you had Global Entry linked with your old passport, you will not need to apply and pay for the program again. Simply log in to the Global Entry system to update it with your new passport number when you receive it. If you use the popular and much cheaper Mobile Passport app , which requires less time to apply, you will also need to update it with your new document details.

4. Stay put until a replacement arrives

Unfortunately, you cannot travel internationally without a passport. While there are some exceptions for using a passport card (which is good for only land and sea travel between Canada or Mexico and the U.S.), once you report your passport lost or stolen, your passport card is invalid, too.

And given that 2023 is on track to set the record for the highest demand of passports ever — according to the U.S. State Department — applying for a passport will likely take longer. Apply as soon as possible (that's at least three months in advance of your next trip) and be prepared for delays.

If you have a history of losing your passport, the State Department may issue a limited passport that’s valid for only a short period of time until you can get home and go through the steps to get a regular passport again.

» Learn more: The best credit cards for travel insurance benefit

5. Check your travel protection benefits

Some premium cards, like The Platinum Card® from American Express and The Business Platinum Card® from American Express , offer concierge services that can come in handy when you need help. Though they cannot do the hard work for you (such as appearing in person to request a passport replacement), a concierge can help with changing flight and hotel reservations that might be necessary.

Travel insurance might also help in covering flight change fees or additional expenses, especially if a police report can show that a passport was stolen and not just misplaced. This type of travel protection comes with many cards including the American Express® Green Card and the Chase Sapphire Preferred® Card and Chase Sapphire Reserve® .

More passport management tips

Of course, the best strategy is to not lose your passport in the first place. Keep it in a safe place at all times, like your hotel room’s safe, and have a color photocopy of the picture page of your passport. Also, snap a picture to have on your phone.

You can put your email or phone number on the back of your passport in case it was genuinely lost (rather than stolen). It is best not to include your home address for security reasons, though.

The bottom line

If you lose your passport, first make sure it’s really gone, then report it lost or stolen. Check the State Department website to find the nearest location where you can get a replacement and, if you’re out of the country, make arrangements to stay there until your new passport is issued.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Does Travel Insurance Cover Lost Passports?

When your passport is lost or stolen and you’re getting ready to leave or already on your trip, that loss could spell disaster for your travel plans – not to mention your wallet and credit card bill! Getting a replacement passport isn’t nearly as quick or easy as it was before 9/11 either.

If you cannot get a replacement in time for your trip departure or your trip home, you could be facing a big loss.

Here’s how travel insurance covers lost passports:

- Pre-departure trip cancellation benefits will reimburse you for your pre-paid and non-refundable trip expenses if your lost or stolen passport cannot be replaced in time for your trip.

- Post-departure trip interruption benefits will reimburse you for unused travel arrangements plus additional transportation costs to catch up to your covered trip.

- Trip delay benefits will be paid to include unexpected expenses incurred while you’re waiting for your passport to be replaced.

- Reimbursement of the fees required to get a replacement passport is usually included in travel insurance cover for lost passports too, but only up to a certain amount (usually $50 to $100).

Travel insurance companies are also very helpful when your passport is lost or stolen and you need to secure a replacement – and quick! Insured travelers should call their travel insurance assistance services hotline (listed in your plan documents) for advice and help getting a passport replacement either before they leave or while they’re on their trip.

Tips to make a travel insurance claim for lost or stolen passport

As with any insurance claim, you’ll need to follow the rules listed in your plan to ensure that the claim process goes smoothly. Essentially, there are two rules to be aware of when making a claim due to a lost or stolen passport:

- A claim for a stolen passport must be substantiated by a police report.

- A claim to be reimbursed for the fees to replace your lost or stolen passport must be accompanied with a paid receipt to substantiate the claim.

If you’re already on your trip and your passport is stolen, call your travel insurance company and let them know the situation. The travel assistance services representatives will help you find local law enforcement so you can make a report (be sure to get a copy!) if it was stolen. They’ll also help you find a local embassy where you can get your lost or stolen passport replaced.

DamianTysdal

Damian Tysdal is the founder of CoverTrip, and is a licensed agent for travel insurance (MA 1883287). He believes travel insurance should be easier to understand, and started the first travel insurance blog in 2006.

How does annual travel insurance work?

- 18 September 2013

How does travel insurance work?

- 17 September 2013

Why does travel insurance need the airline reimbursement for my lost bag?

Travel with peace-of-mind... compare quotes for free.

Trip Interruption Benefits

What is trip interruption.

Trip Interruption offers coverage if a trip is disrupted or cut short due to unforeseen circumstances such as sicknesses, severe weather conditions, or other eligible events that are out of the traveler's control. Trip Interruption Coverage typically covers expenses such as the cost of additional transportation, accommodation, and other expenses incurred because of the interruption. The exact coverage and benefits vary depending on the insurance policy.

Is Trip Interruption necessary?

Whether Trip Interruption insurance is necessary or not depends on several factors, including the type of trip you're taking, the cost of the trip, and your personal risk tolerance. The Trip Interruption benefit can provide coverage for unexpected events such as sickness, weather-related cancellations, and other eligible events that can cause you to interrupt your trip. Trip Interruption also allows travelers to rejoin their trip after an interruption has occurred. In general, having a trip interruption is a personal decision that should be based on the traveler's specific needs and circumstances. However, it's always a good idea to consider trip interruption coverage, especially if the trip involves a significant investment of time and resources. This can help to protect against financial losses if the trip is interrupted for a covered reason.

What Qualifies as Trip Interruption

1. Sickness, accidental injury, or death that results in medically imposed restrictions as certified by a physician during your trip preventing your continued participation in the trip A physician must advise to cancel the trip on or before the scheduled return date 2. If a family member or traveling companion booked to travel with you incurs sickness, accidental injury, or death. A & B must occur: a.) While you are on Your trip b.) Requires necessary treatment at the time of interruption, certified by a physician that results in medically imposed restrictions to prevent that person’s continued participation on the trip 3. In case of sickness, injury, or death of a non-traveling family member 4. The death or Hospitalization of Your Host at the Destination during Your trip 5. If you are terminated or laid off from your full-time employment by your company through no fault of your own, one year or more after starting employment, during your trip 6. You transfer your employment more than 250 miles away from your home during the trip. This applies if you have been employed by the transferring employer since your policy's effective date and the transfer requires you to relocate your home 7. If your previously approved military leave is revoked or you experience a military reassignment during the trip 8. If you, your traveling companion, or a family member who is military personnel is called to provide aid or relief in the event of a natural disaster (excluding war) 9. Severe weather causes the complete cessation of services for at least 48 consecutive hours of the common carrier (e.g., airline), preventing you from reaching your destination. Note: This benefit does not apply if the natural disaster was predicted or a storm was named before you purchased this policy 10. If a natural disaster at your destination renders your accommodations uninhabitable 11. If a terrorist incident occurs in your departure city or in a city listed on your trip itinerary during your trip, and the travel supplier does not offer a substitute itinerary. Note: This does not cover flight connections or transportation arrangements to reach your destination. The scheduled departure date must be within 15 months from your policy's effective date. Terrorist incidents that occur on an in-flight aircraft are not covered 12. If you or your traveling companion are victims of a felonious assault during the trip 13. If you or your traveling companion are hijacked, quarantined, required to serve on a jury, or subpoenaed if your home is made uninhabitable by a natural disaster or experience a burglary at your principal place of residence during the trip 14. You or Your Traveling Companion are directly involved in a traffic accident en route to departure. Note: This must be substantiated by a police report obtained by you and presented along with other claim forms and documentation. 15. If a travel supplier goes bankrupt or defaults during your trip, resulting in a complete halt of their services. However, these benefits will only be provided if there is no other transportation option available. If there is an alternative way to reach your destination, the benefits will be limited to covering the change fee required to transfer to another airline. Note: This coverage applies only if your scheduled departure date is within 15 months from the start date of your insurance policy 16. Strike that causes complete cessation of services of the common carrier affecting you or your traveling companion who is scheduled to travel. Note: Strike must last for at least forty-eight (48) consecutive hours File for a free quote

Do I need Trip Interruption coverage?

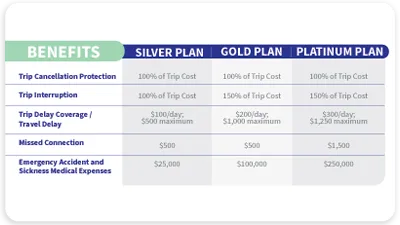

Having trip interruption coverage is a savvy idea. It offers coverage for multiple reasons to help you get your trip back on track. All three of AXA’s travel plans include Trip Interruption coverage, maximum coverage per person is up to:

Maximum Benefit: 100% of Trip Cost Reasonable Expenses Per Day: $100

Maximum Benefit: 150% of Trip Cost Reasonable Expenses Per Day: $100

Maximum Benefit: 150% of Trip Cost Reasonable Expenses Per Day: $100

Receive a free quote within minutes, and decide which plan fits best for your travel needs!

Why choose axa travel protection.

With a presence in over 30 countries worldwide, AXA provides assistance with a wide range of features that include: • Extensive knowledge of local health risks and medical facilities to respond swiftly in the event of a medical emergency • 24/7 global team of travel experts that offers assistance and assurance while traveling

Compare Travel Insurance Plans

Get covered against Trip Delays, Medical Emergencies, Lost Baggage, and more!

Trip Interruption Insurance FAQs

How much does trip interruption cost.

- Length of Stay

- Destination

- Type of Trip

- Number of Travelers

- Extent of Guarantees

What types of vacations does Trip Interruption apply to?

When does trip interruption coverage begin.

- Trip Interruption coverage begins when a specific travel package has been selected

- Trip Interruption coverage will begin on the day after the required premium for such coverage is received by the authorized representative

When does Trip Interruption coverage end?

- The scheduled return date as stated on the travel tickets

- The date and time you return to your origination point if prior to the scheduled return date

- The date and time you deviate from, leave, or change the original trip itinerary (unless due to unforeseen and unavoidable circumstances covered by the policy)

- If you extend the return date, coverage will terminate at 11:59 P.M., local time, at your location on the scheduled return date unless otherwise authorized by the Company in advance of the scheduled return date

- When your trip exceeds ninety (90) days

- The return date as stated on your purchase confirmation

How to get a Travel Protection Quote?

Need Help Choosing a Plan?

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation protection, our team of travel experts will help you choose the right coverage.

404 Not found

HelloSafe » Travel Insurance » Expat

Expat Travel Insurance: A Complete Guide (2024)

verified information

Information verified by Alexandre Desoutter

Our articles are written by experts in their fields (finance, trading, insurance etc.) whose signatures you will see at the beginning and at the end of each article. They are also systematically reviewed and corrected before each publication, and updated regularly.

Medical care can be expensive when living and working in a foreign country, making it crucial for expatriates to consider comprehensive expat travel insurance.

Expatriate travel insurance or expat health insurance serves as a safety net, offering protection against unexpected medical expenses and other challenges that may arise during your time abroad.

So, let's dive into the realm of expat travel insurance, understand its coverage options, and explore the top choices available in Canada. You could use our comparator to compare multiple policies and get free personalized travel insurance quotes so you can pick a policy that truly suits you the best.

Expat Travel Insurance: 5 Key Takeaways

- Expat travel insurance typically includes medical coverage, emergency evacuation, trip protection, and more.

- Types of expat travel insurance include annual multi-trip and single-trip policies.

- Comprehensive policies offer extensive coverage, while basic policies cover a narrower range of expenses.

- Notable expat travel insurance providers include Manulife, Blue Cross, AXA, Cigna Global, and World Nomads.

- The cost of expat travel insurance varies based on factors like the trip duration, age, activities, and coverage level.

What is expat travel insurance?

Expat travel insurance, short for "expatriate travel insurance," is a type of insurance designed to provide coverage and protection for individuals who are living and working in a foreign country , away from their home country or country of origin.

Expatriates are people who have moved to another country for an extended period, often for employment, retirement, or other personal reasons.

The specific coverage and benefits of expat travel insurance can vary significantly depending on the insurance provider and the policy you choose. Expatriate travel insurance can be vital for providing peace of mind and financial protection while living abroad, as healthcare systems and legal regulations can differ greatly from one country to another.

We recommend that you compare multiple travel insurance plans before zeroing in on one. While that may seem daunting, we've made it simple for you. Use our comparator below to compare coverages, policies, and get free personalized travel insurance quotes from the best providers in Canada, and in a few seconds.

comparatorTitles.name

What does expat travel insurance cover?

Expatriate travel insurance offers a range of coverage options, which may include:

- Medical coverage: This is one of the most important aspects of expat travel insurance. It covers medical expenses in case of illness or injury while living abroad. This can include doctor's visits, hospitalization, surgeries, prescription medications, and emergency medical evacuation if necessary.

- Evacuation and repatriation: This coverage ensures that you can be transported to the nearest appropriate medical facility or even repatriated to your home country for treatment if the local healthcare facilities are inadequate or if you require specialized care.

- Emergency assistance: Many policies provide access to 24/7 emergency assistance services, including help with language barriers , locating medical facilities, and coordinating medical care.

- Trip cancellation or interruption : This coverage can reimburse you for non-refundable expenses like airline tickets or accommodations if your trip is canceled or cut short due to covered reasons, such as a medical emergency.

- Personal liability: It can cover legal expenses and compensation for damages in case you are held liable for injuring someone or damaging their property.

- Lost or stolen property: This coverage can reimburse you for lost or stolen belongings , such as luggage, electronics, or important documents.

- Personal accident insurance: This provides coverage in the event of accidental death or disability.

Some policies also offer legal assistance in case you encounter legal issues in your host country, such as visa problems or disputes with landlords or employers.

What does expat travel insurance not cover?

Exclusions in expat travel insurance are specific situations or circumstances under which the insurance policy will not provide coverage. It's crucial to understand these exclusions because they define the limitations of your insurance coverage.

While the specific exclusions can vary from one insurance policy to another, here are some common examples:

- Pre-existing medical conditions

- High-risk activities such as extreme sports, skydiving or mountaineering

- Injuries or damage resulting from war, acts of terrorism, or civil unrest

- Any injuries or damages that result from illegal activities

- Pregnancy and childbirth

- Excessive alcohol or substance abuse

Also, if you fail to follow prescribed medical advice or treatment recommendations, your insurance may not cover related expenses. For example, if a doctor advises you to have a specific medical procedure, and you refuse, the insurance may not cover complications that arise from your refusal.

How much does expat travel insurance cost?

The cost of expat travel insurance from these providers can vary depending on a number of factors, including:

- The length of your stay abroad

- Your age and health

- The activities you plan to do while you are abroad

- The level of coverage you want

- The exclusions and waiting periods

Here is a table of the estimated annual premiums for expat travel insurance from some of the leading providers in Canada:

These are just estimates. The actual cost of your insurance will depend on your individual circumstances and factors like the level of coverage, exclusions, and waiting periods.

We recommend that you get personalized quotes to find the perfect policy and for that look no further. You can simply use our comparator below and get multiple free travel insurance quotes from the best providers and in no time.

Prepare for your trip Compare. Choose. Save.

What are the types of expat travel insurance?

There are a few different types of expat travel insurance available, such as expat annual travel insurance, each with its own set of benefits and drawbacks.

What are the best Canadian expat travel insurance options?

When searching for the best Canadian expat travel insurance options, it's essential to consider your specific needs and circumstances, such as where you're living abroad, your health status, the activities you plan to engage in, and your budget. Here are some reputable Canadian insurance providers and types of policies to consider:

- Manulife travel insurance

- Blue Cross travel insurance

- World Nomads travel insurance

- AXA travel insurance

- Cigna Global insurance

Manulife travel insurance: Medical expenses up to $5 million

Manulife travel insurance offers a variety of plans to suit different needs and budgets. Their plans include coverage for medical expenses, trip cancellation, lost luggage, and emergency medical evacuation. They also offer a variety of add-on benefits, such as coverage for pre-existing conditions and lost passports.

Here are some of the features of Manulife's expat travel insurance plans:

- Medical expenses up to $5 million

- Trip cancellation and interruption up to $5,000

- Coverage for lost luggage up to $1,000

- Emergency medical evacuation up to $1 million

- Coverage for pre-existing conditions with an additional premium

- Protection for lost passports with an additional premium

- Comprehensive coverage

- Variety of plans to choose from

- Competitive prices

- Good customer service

- Some plans may not be as comprehensive as others

- Add-on benefits can be expensive

- There may be waiting periods for certain coverages

Blue Cross travel insurance: Medical expenses up to $10 million

Blue Cross travel insurance also offers expat travel insurance plans for Canadian citizens. Their plans are designed for people who live and work outside of Canada, and they offer a variety of coverage options to suit different needs and budgets.

Here are some of the features of Blue Cross's expat travel insurance plans for Canadian citizens, which include coverage for:

- Medical expenses up to $10 million

- Lost luggage up to $1,000

- Pre-existing conditions with an additional premium

- Lost passports with an additional premium

- Repatriation of remains

- Dental and vision care

- Prescription drugs and mental health services

- Worldwide travel

Here are some of the pros and cons of Blue Cross's expat travel insurance for Canadian citizens:

- A global network of providers

- Coverage for worldwide travel

You can weigh multiple expat travel insurance plans against each other right here using our comparator below. You can also get tailor-made quotes for these plans in seconds.

World Nomads travel insurance: Designed with expats in mind

World Nomads travel insurance , offers travel insurance designed with expats in mind, allowing for flexibility in coverage duration. You can tailor your insurance to your specific needs, whether you require it for an extended period or a shorter trip.

The convenience of World Nomads' online travel insurance is a significant advantage. It's accessible to most nationalities, regardless of their location outside their home country. This means you can purchase coverage while abroad, and you don't need to be physically present in your country of residence to do so.

Here are the pros and cons of World Nomads travel insurance:

- Flexible travel insurance options

- Accessible online even when you've left your home country

- Comprehensive coverage for various activities and events

- Depending on your trip's duration, you may face higher premiums

- There are specific policy conditions to consider

- May not be the ideal choice for expats with highly specialized needs or living in high-risk areas

Good to know

What is expat travel medical insurance?

Expat travel medical insurance, also known as expatriate travel health insurance, is a specialized type of insurance designed to provide medical coverage and protection for individuals who are living and working in a foreign country, away from their home country or country of origin. This type of insurance primarily focuses on covering medical expenses and related healthcare costs that expatriates may incur while residing in a foreign country.

AXA travel insurance: An affordable option

AXA is a large insurance company that offers a variety of travel insurance plans, including plans for expats. Their plans are generally less expensive than some of the other options, but they may not offer as much coverage.

Here’s what AXA travel insurance covers:

- Medical expenses

- Trip cancellation and interruption

- Lost luggage

- Emergency medical evacuation

- Baggage delay

- Personal liability

- Cancellation of connecting flights

- Missed connections

- Accidental death and dismemberment

Pros of AXA travel insurance:

- Generally less expensive than some of the other options

- Offers a variety of plans to choose from, so you can find one that fits your needs and budget

- AXA's website and customer service are easy to use

Cons of AXA travel insurance:

- AXA's travel insurance plans may not be as comprehensive as some of the other options.

- There may be waiting periods for certain coverages, such as pre-existing conditions.

Cigna Global Insurance: International network

Cigna Global is a well-known and respected insurance company that offers a variety of international health insurance plans for expats. Their plans are comprehensive and cover a wide range of expenses, including medical, dental, and vision care, as well as emergency evacuation and repatriation.

Cigna Global covers:

- Prescription drugs

- Mental health services

- Maternity care

Pros of Cigna Global:

- Offers comprehensive coverage for a wide range of expenses

- Has a global network of providers, so you can get care wherever you are in the world

- Provides 24/7 support, so you can get help when you need it

- Has a good reputation for customer service

Cons of Cigna Global:

- One of the more expensive options for international health insurance

- There may be waiting periods for certain coverages, such as pre-existing conditions

Staysure expat travel insurance is for Brits living in France, Spain, or Portugal, covering pre-existing medical conditions. It also covers medical emergencies and repatriation, cancellation, curtailment, baggage claims, personal liability, and more.

Save up to 25% on your travel insurance with our partner soNomad

Get a quote

1-888-550-8302

Sunny has over six years of experience curating engaging content spanning across industries. Specifically in finance, his expertise is insurance reviews and lending and investment topics.

This message is a response to . Cancel

Baggage Lost or Stolen Benefits

What is baggage and personal effects, what does “personal effects” mean, do i need baggage and personal effects coverage.

Maximum Benefit: $750 Per Article Limit: $150 Combined Article Limit: $250

Maximum Benefit: $1,500 Per Article Limit: $250 Combined Article Limit: $500

Maximum Benefit: $3,000 Per Article Limit: $500 Combined Article Limit: $1,000

Article: Possessions are privately owned and used for personal use or enjoyment. Combined Article Definition Watches, Jewelry, Articles made of silver, gold, or platinum, Furs, Articles trimmed with or made mostly of fur, Cameras, and their accessories, including related equipment. All of these items are subject to the Combined Article Limit.

Combined Article Definition: Watches, Jewelry, Articles made of silver, gold, or platinum, Furs, Articles trimmed with or made mostly of fur, Cameras, and their accessories, including related equipment. All of these items are subject to the Combined Article Limit.

What are the benefits of Personal Effects coverage?

- Actual cash value at time of loss, theft, or damage to baggage and personal effects

- The cost of repair or replacement in like kind and quality up to the policy limit

Other Travel Insurance Benefits : Trip Cancellation , Emergency Evacuation , Baggage Loss , Cancel For Any Reason , Trip Interruption , Medical Travel Benefit , Trip Delay

Why choose AXA Travel Protection?

With a presence in over 30 countries worldwide, AXA provides assistance with a wide range of features that include:

- Extensive knowledge of local health risks and medical facilities to respond swiftly in the event of a medical emergency

- 24/7 global team of travel experts that offers assistance and assurance while traveling

Compare Travel Insurance Plans

Get covered against Trip Delays, Medical Emergencies, Lost Baggage, and more!

Baggage Loss FAQs

Imagine you are on a trip, and something unexpected happens to your belongings – your bags get lost, your things get stolen or damaged. You might be surprised to learn that AXA Travel Protection can rescue you. Let us dive into the details.

Reporting is Key:

If something goes wrong with your belongings – like if they are stolen – you must report them to a few people. First, you should tell the local authorities where and what happened. Tell the tour leader if you are on a trip organized by someone else, like a tour. Then, notify your AXA travel insurance advisor. Reporting is essential for your claim to be processed.

Protect, Save and Recover:

When traveling, you must do your part to keep your belongings safe. If something happens to them, travel insurance will help, but you must show that you took steps to protect your stuff.

What is Covered:

AXA Travel Protection may reimburse you for the value of your stuff if they are lost, stolen or damaged during your trip. They will consider the value of the things when they were lost, stolen or damaged. If they cannot repair your items, they can pay for replacements that are similar in quality.

Limits and Special Things:

AXA Travel Protection will not pay for everything, and some limits exist for valuable items like jewelry, watches, etc. Payment is up to a certain amount based on the protection plan selected.

Policyholders can find this information in the schedule of benefits section of an AXA Travel Protection plan.

When Your Stuff is Delayed:

Imagine you have checked in your bags with a travel company, and they take a while to return them to you. This coverage can help you out if your bags are delayed for too long. They will cover you until the travel company finally gets your loads to you, or if they say your bags are lost – whichever happens first.

To Sum Up:

Traveling is great, but sometimes things can go wrong. With AXA Travel Protection, you are not alone when your stuff gets lost, stolen, or damaged. Remember to report what happened, take care of your belongings, and know the limits of what the insurance will cover. It is like having a backup plan for your things when you are on the go.

My luggage has been lost or stolen; How do I file a claim?

- Notify AXA or authorized representative as soon as possible.

- Take immediate actions to protect, save, or recover the property that has been affected.

- Inform the carrier (such as an airline), travel supplier, property manager, or anyone who may be responsible for the loss or damage. Provide a copy of this notification to AXA.

- If the loss or damage is due to robbery or theft, report it to the police or relevant authorities within 24 hours. Make sure to obtain a copy of the police report and provide it to AXA.

Is Baggage and Personal Effects Coverage included in all AXA Travel Plans?

Can i purchase baggage and personal effects coverage separately from a travel plan policy, how to get a travel protection quote.

Disclaimer: It is important to note that the specifics for Baggage Loss will depend on the policy selected, date of purchase, destination, and state of residency. Customers are advised to carefully review the terms and conditions of their policy and to contact AXA Partners with any questions or concerns they may have .

Need Help Choosing a Plan?

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation protection, our team of travel experts will help you choose the right coverage.

IMAGES

VIDEO

COMMENTS

At AXA, we want to make this situation easier for our customers. We offer 24/7 assistance to all of our customers in case your passport is lost or stolen. If your passport was lost or stolen while traveling, please follow these basic steps: Proceed to a police station or the nearest embassy or consulate to report how your passport was lost or ...

Contact AXA USA for emergency medical and travel assistance including any prior arrangements for evacuations and medical repatriations. In the event of theft or loss of property, contact the police or transportation carrier such as the airline immediately to obtain a filed report. Check your policy documents to confirm your coverage details.

This copy can also serve as evidence of your U.S. citizenship, which is necessary to replace a missing passport. If you want to help a friend or family member abroad who has lost their passport, you can call the Office of Overseas Citizens Services at 888-407-4747, which can connect the passport holder with the relevant embassy or consulate.

1. Report the loss or theft to U.S. authorities. While it can be a good idea to report a stolen passport to the local police — the information you provide will help them if it does turn up ...

You can make a claim for the cost of a replacement document. If your trip has been delayed at least six hours because your passport was lost or stolen, you can also get reimbursed for: Any pre-paid, non-refundable land or water accommodations that have not been used. Necessary expenses such as meals and lodging, phone calls, and local ...

Here's how travel insurance covers lost passports: Pre-departure trip cancellation benefits will reimburse you for your pre-paid and non-refundable trip expenses if your lost or stolen passport cannot be replaced in time for your trip. Post-departure trip interruption benefits will reimburse you for unused travel arrangements plus additional ...

AXA travel medical insurance agents will make sure you have peace of mind when travelling abroad. One simple payment and the right coverage will make sure that an unexpected hospitalisation or even a tragedy do not become a big financial burden that could make a dream vacation a real nightmare. Policies are easy to understand and cover anything ...

Insurance cover if your passport is stolen on your trip. According to Defaqto, 77% of 1,053 annual travel insurance policies include cover for loss of passports, and 62% of policies have cover of £250 or more [1] Typically, you'll be covered for the costs you incur to get an ETD, up to the maximum amount stated in your policy.

GET A QUOTE 855-327-1441. Trip interruption offers compensation if a trip is disrupted or cut short due to unforeseen circumstances such as illnesses, severe weather conditions, or other events that are out of the traveler's control. Trip interruption coverage typically covers expenses such as the cost of additional transportation ...

A: During subscription, you will be asked to provide the name, the birthday, the passport number, the nationality and the country of residence of the insured. Q: Can I buy AXA Schengen travel insurance in an AXA representative office in my country? A: No. The AXA Schengen travel insurance can be purchased only on this website. Visa Schengen

Partnering with AXA to offer travel insurance means you and your clients benefit from the support of an industry leader with extensive experience and outstanding customer service. We will assist you in choosing the best plans to offer your customers, ensuring they are protected by the most suitable coverage for their trip, at the most cost ...

Travel Insurance USERNAME Cards: Click that AXA Travel Assistance button on the left side to this cover in order the access your AXA Travel Assistance NAME card. ... and lost passport/travel documents. Fire Protection Abroad: This OSAC download details and steps you, your total, and your family can use as protection from the dangers of flame ...

AXA has a variety of different Schengen travel insurance policies, tailored for different budgets, trips, and depending on what coverage you would like - all with different levels of warranty and limits on claims. Our cheapest option is the Low Cost Schengen Area travel insurance that meets your visa requirements from as little as €22 per ...

They also offer a variety of add-on benefits, such as coverage for pre-existing conditions and lost passports. Here are some of the features of Manulife's expat travel insurance plans: Medical expenses up to $5 million; ... Cons of AXA travel insurance: AXA's travel insurance plans may not be as comprehensive as some of the other options.

Travel insurance coverages within the Adventure Travel Product are underwritten by United States Fire Insurance Company (NAIC #21113) under policy form series T210. Travel protection plans are administered by AXA Assistance USA, Inc. (in California, doing business as AXA Assistance Administrators, License Number 0H74893)

Travel Insurance USER Karten: Click the AXA Vacation Assist button on the left side of this page in order to access your AXA Travel Assistance ID select. Medical Support: ... This will be helpful in proving yours citizenship and identity if your passport is lost or stolen. If you exist traveling with family membersation, you shall man own ...

With over ¾ million policies sold in the UAE and 20,000+ 4.5 star Google reviews, we are also the most popular. BUY AXA TRAVEL INSURANCE NOW. Our Sales team is available around the clock for any medical emergency assistance or questions on our Travel Inbound, Travel Smart, Annual Travel insurance or Business Travel insurance. CALL +971 4 429 4000.

GET A QUOTE 855-327-1441. If you are traveling with valuable items or have a lot of luggage, it may be a good idea to consider Baggage & Personal Effects type of insurance coverage to protect yourself against the risk of loss, theft, or damage.. All three of our AXA's travel plans, Gold, Silver and Platinum include Baggage and Personal ...

Get GIG Gulf Travel Insurance today (previously AXA Gulf) Special Offer: Save 50% on children's travel insurance. Get a Quote in 1 minute. *Terms and conditions apply. Our team is available around the clock for any medical emergency assistance you may need worldwide. CALL +971 4 429 4000.