- Internet ›

Online Search

- Google: global annual revenue 2002-2023

Google’s revenue

Annual revenue of google from 2002 to 2023 (in billion u.s. dollars).

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

January 2024

2002 to 2023

Values regarding 2013 and onwards have been adjusted retroactively to reflect Google segment revenue of Alphabet Inc. instead of Google's total company revenue as prior to restructuring. Alphabet Inc. is an American multinational conglomerate created in 2015 as the parent company of Google and several other companies previously owned by or tied to Google.

Other statistics on the topic Google

Online Video & Entertainment

- Most viewed YouTube videos of all time 2024

- Global market share of leading desktop search engines 2015-2024

Mobile Internet & Apps

- Google Play: number of available apps 2009-2023

- Google: quarterly revenue 2008-2024

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

* For commercial use only

Basic Account

- Free Statistics

Starter Account

- Premium Statistics

Professional Account

- Free + Premium Statistics

- Market Insights

1 All prices do not include sales tax. The account requires an annual contract and will renew after one year to the regular list price.

Statistics on " Google "

- Alphabet: global annual revenue 2011-2023

- Alphabet: quarterly revenue 2014-2024

- Alphabet: quarterly net income 2014-2024

- Alphabet: global annual revenue 2017-2023, by segment

- Google: quarterly operating income 2014-2024

- Market value of the largest internet companies worldwide 2023

- Market capitalization of the largest U.S. internet companies 2024

- Apple, Google, and Microsoft: revenue comparison 2008-2023

- Most valuable brands worldwide 2023

- Biggest revenue source of leading tech companies 2023

- Most visited multi-platform U.S. web properties 2024

- Reach of most popular U.S. smartphone apps 2024

- Google: revenue distribution 2017-2023, by segment

- Google Cloud revenue worldwide 2017-2023

- Google: annual app, media, and hardware revenues 2001-2023

- Google: annual advertising revenue 2001-2023

- Google sites: advertising revenue 2001-2023

- Google network sites: advertising revenue 2001-2023

- Leading Google search queries worldwide 2023

- Global market share of leading search engines 2015-2024

- Google: desktop search market share in selected countries 2024

- Google search engine global mobile market share 2015-2024

- Leading U.S. search engines by share of core searches 2008-2024

- Leading U.S. search engines by number of core searches 2008-2024

- Global YouTube advertising revenues 2017-2023

- YouTube: share of Google revenues 2017-2023

- YouTube: global advertising revenues as of Q1 2024

- YouTube: most viewed channels 2024

- Google Play Store app update frequency 2024

- Number of monthly Google Play app releases worldwide 2019-2024

- Distribution of free and paid Android apps 2019-2024

- Average price of paid Android apps 2024

- Google Play app ratings 2024

- Government requests for content removal from Google H1 2023

- Number of infringing URLs requested to be removed from Google Search 2024

- Google user data requests by U.S. federal authorities 2010-2023

- Google user data requests from federal agencies and governments H1 2023, by country

- Google: quarterly federal lobbying expenses 2010-2023

- EU Commission Google antitrust fines 2017-2023

- EPA Green Power Partnership's leading green power users in the U.S. 2022

- EPA Green Power Partnership's Fortune 500 green power users in the U.S. 2023

- Google's GHG emissions FY 2019-2023

- Google carbon intensity FY 2019-2023

- Google: energy consumption FY 2011-2022

- Google's waste generation FY 2015-2023

Other statistics that may interest you Google

Company financials

- Basic Statistic Alphabet: global annual revenue 2011-2023

- Basic Statistic Alphabet: quarterly revenue 2014-2024

- Basic Statistic Alphabet: quarterly net income 2014-2024

- Basic Statistic Alphabet: global annual revenue 2017-2023, by segment

- Basic Statistic Google: global annual revenue 2002-2023

- Basic Statistic Google: quarterly revenue 2008-2024

- Basic Statistic Google: quarterly operating income 2014-2024

- Basic Statistic Market value of the largest internet companies worldwide 2023

- Basic Statistic Market capitalization of the largest U.S. internet companies 2024

- Basic Statistic Apple, Google, and Microsoft: revenue comparison 2008-2023

- Basic Statistic Most valuable brands worldwide 2023

- Premium Statistic Biggest revenue source of leading tech companies 2023

- Basic Statistic Most visited multi-platform U.S. web properties 2024

- Basic Statistic Reach of most popular U.S. smartphone apps 2024

- Basic Statistic Google: revenue distribution 2017-2023, by segment

- Basic Statistic Google Cloud revenue worldwide 2017-2023

- Basic Statistic Google: annual app, media, and hardware revenues 2001-2023

- Basic Statistic Google: annual advertising revenue 2001-2023

- Basic Statistic Google sites: advertising revenue 2001-2023

- Basic Statistic Google network sites: advertising revenue 2001-2023

- Basic Statistic Leading Google search queries worldwide 2023

- Basic Statistic Global market share of leading search engines 2015-2024

- Basic Statistic Global market share of leading desktop search engines 2015-2024

- Premium Statistic Google: desktop search market share in selected countries 2024

- Basic Statistic Google search engine global mobile market share 2015-2024

- Premium Statistic Leading U.S. search engines by share of core searches 2008-2024

- Premium Statistic Leading U.S. search engines by number of core searches 2008-2024

- Premium Statistic Global YouTube advertising revenues 2017-2023

- Basic Statistic YouTube: share of Google revenues 2017-2023

- Basic Statistic YouTube: global advertising revenues as of Q1 2024

- Basic Statistic Most viewed YouTube videos of all time 2024

- Basic Statistic YouTube: most viewed channels 2024

Google Play

- Basic Statistic Google Play: number of available apps 2009-2023

- Basic Statistic Google Play Store app update frequency 2024

- Premium Statistic Number of monthly Google Play app releases worldwide 2019-2024

- Basic Statistic Distribution of free and paid Android apps 2019-2024

- Premium Statistic Average price of paid Android apps 2024

- Basic Statistic Google Play app ratings 2024

- Basic Statistic Government requests for content removal from Google H1 2023

- Basic Statistic Number of infringing URLs requested to be removed from Google Search 2024

- Premium Statistic Google user data requests by U.S. federal authorities 2010-2023

- Basic Statistic Google user data requests from federal agencies and governments H1 2023, by country

- Basic Statistic Google: quarterly federal lobbying expenses 2010-2023

- Basic Statistic EU Commission Google antitrust fines 2017-2023

Environmental impact

- Premium Statistic EPA Green Power Partnership's leading green power users in the U.S. 2022

- Premium Statistic EPA Green Power Partnership's Fortune 500 green power users in the U.S. 2023

- Premium Statistic Google's GHG emissions FY 2019-2023

- Premium Statistic Google carbon intensity FY 2019-2023

- Basic Statistic Google: energy consumption FY 2011-2022

- Premium Statistic Google's waste generation FY 2015-2023

Further related statistics

- Basic Statistic Alphabet's & Google's revenue: share generated in the United Kingdom (UK) 2007-2016

- Premium Statistic Canada frequency of use of Google/Alphabet products and services 2018, by region

- Premium Statistic Canada frequency of use of Google/Alphabet products and services 2018, by age group

- Premium Statistic Canada frequency of use of Google/Alphabet products and services 2018, by gender

- Basic Statistic U.S. Google Search clickstream via desktop among U.S. users 2019

- Basic Statistic Alphabet: number of full-time employees 2016, by department

- Premium Statistic Google: revenue distribution 2001-2018, by source

- Premium Statistic Share of pupils finding google easy at school in Sweden 2018, by school level

- Premium Statistic Alphabet: ad spend in the U.S. 2012-2022

- Basic Statistic Google usage frequency in the United States 2017, by ethnicity

- Premium Statistic Canadian opinions on Google/Alphabet's influence on consumer choices 2018, by region

- Premium Statistic Canadian opinions on Google's influence on consumer choices 2018, by age group

- Premium Statistic Canadian opinions on Google/Alphabet's influence on consumer choices 2018, by gender

- Premium Statistic Italy: estimated turnover of Google and Facebook 2018

- Premium Statistic Financial results of LifeTube 2018-2019

- Premium Statistic Most used search engine for online shopping inspiration in France 2021

- Premium Statistic Satisfaction with the voice of Google Assistant in the U.S. 2017

- Premium Statistic Share of referrals and direct visits to news websites Australia 2017 by type

- Premium Statistic Sales by product - Autoliv 2018

Further Content: You might find this interesting as well

- Alphabet's & Google's revenue: share generated in the United Kingdom (UK) 2007-2016

- Canada frequency of use of Google/Alphabet products and services 2018, by region

- Canada frequency of use of Google/Alphabet products and services 2018, by age group

- Canada frequency of use of Google/Alphabet products and services 2018, by gender

- U.S. Google Search clickstream via desktop among U.S. users 2019

- Alphabet: number of full-time employees 2016, by department

- Google: revenue distribution 2001-2018, by source

- Share of pupils finding google easy at school in Sweden 2018, by school level

- Alphabet: ad spend in the U.S. 2012-2022

- Google usage frequency in the United States 2017, by ethnicity

- Canadian opinions on Google/Alphabet's influence on consumer choices 2018, by region

- Canadian opinions on Google's influence on consumer choices 2018, by age group

- Canadian opinions on Google/Alphabet's influence on consumer choices 2018, by gender

- Italy: estimated turnover of Google and Facebook 2018

- Financial results of LifeTube 2018-2019

- Most used search engine for online shopping inspiration in France 2021

- Satisfaction with the voice of Google Assistant in the U.S. 2017

- Share of referrals and direct visits to news websites Australia 2017 by type

- Sales by product - Autoliv 2018

- Skift Research

- Airline Weekly

- Skift Meetings

- Daily Lodging Report

A Deep Dive Into Google’s Impact on Travel 2020

Related reports.

- State of Travel 2024: Travel in 350 Charts August 2024

- Booking Vs. Expedia: A 50 Chart Factbook August 2024

- A Deep Dive into Google Travel Part III: Hotel Distribution From East to West April 2024

- India’s Travel Booking Landscape March 2024

Report Overview

Google, the online giant touches, in one way or another, nearly every stage of the traveler’s journey. Commensurate with that huge impact, Skift Research estimates that globally, the travel industry may have spent as much as $16 billion advertising on Google in 2019. Booking Holdings and Expedia Group are the two largest contributors to that.

Google’s impact on travel though, is increasingly moving beyond just traditional search engine marketing. YouTube is a powerful influence on the travel decisions of many and Google Maps is one of the most commonly used apps by travelers when in their travel destination.

This report provides an overview of Google’s many business lines and how they interact with the travel industry. We explore the impact of Google across the travel supply chain from rivals in the metasearch space, to uneasy allies at the online travel agencies, and brand clients that can use Google tools to reach their audiences.

Overview of Google’s Business Model

What are the most important forces shaping the business of travel across the globe today? Perhaps some big picture themes come to mind: overtourism, Millennial travelers, climate change, the rise of the global middle class. We would argue that just as powerful in shaping our business, alongside all of those themes, is one company: Google.

Google, more accurately its parent company, Alphabet, touches most parts of the travel experience nowadays (except in China where Alphabet has limited operations). There are two sides to its business: first-party, meaning websites owned and operated by Google (e.g. Gmail, Youtube, etc.) and third-party, independent websites that plug into Google’s large network of marketers and user data to display advertisements. Let’s examine the key products and where they sit within the organization.

Horizontal Search Google’s First Party Ad Properties are websites owned and controlled by Google that monetize through advertising.

The core of this is the search business on Google.com, where users query the website and receive organized results. Google has a 75% global desktop search share and a 90% mobile search share, according to web statistics tracker Net MarketShare . So, much of the world’s online queries outside of China are going through the site.

Google can then capture the intent outlined by the user and serve ads around it. This product, called Google Ads (formerly known as Google AdWords), is the bread and butter of Google’s business and drives most of its revenue. The Google Ads product has several sub-offerings such as advertising within Google Maps, which we will touch on later. Buti the core product, sponsored blue links at the top of the results page, is known to nearly every modern internet user.

The sponsored links are a horizontal search product, meaning that they work in the same way for queries across any industry. The query “trips to Japan” will serve me four blue ad links, just as a search for “running shoes” will do the same.

Advertisers bid to have their sites displayed as high as possible in the search results of a given query and only pay Google when a user clicks on one of their links. This is known as a pay per click (PPC) or cost per click (CPC) bidding method.

The cost of PPCs vary dramatically across search terms based on the demand from other advertisers to also display alongside these terms. According to WordStream , which helps manage Google ad campaigns, the median CPC on Google’s search site is $2.41. For travel keywords, however, WordStream finds that CPC prices actually come in a bit lower than that at $1.42 per click in 2019.

Vertical Search In addition to the classic search, which works the same for everyone, Google has also built out a number of vertical search tools specific to the travel business and its sub-industries. This covers special search modules for flights, hotels, and vacation rentals. We will cover these in greater depth in future sections.

Maps Maps are perhaps the killer app type of the smartphone era. With the massive shift to mobile, nearly everyone has a map in their pocket. The result is more users that use mapping apps not just for directions, but to explore the locations around them such as finding coffee shops and restaurants. This applies both at home and on vacation. Google has big ambitions for Maps and is trying to build it into a super app .

Google has monetized its position in maps by building sponsored listings and other forms of advertising into its interface.

Display Ads: YouTube Gmail, and 3rd Party Google also operates its Display Network which shows users a variety of ad formats as they move through their web browsing experience.

Parts of the display network are in-house, most notably online video giant YouTube. YouTube’s influence on the travel industry is twofold. First is the wide range of popular content creators and travel vloggers that use the video platform. These influencers are key sources of travel inspiration and reviews for many young customers. Increasingly we are seeing sponsored relationships between travel brands and these social media stars, but those transactions take place off the Google platform and are outside the scope of this report.

YouTube is monetized, from Google’s perspective, through an advertising model. This is primarily programmatic display ads that target specific viewer profiles and types of YouTube clips.

Google also offers Gmail ads which are units formatted to look like new messages, complete with subject line and sender, that show in up the promotions and social tabs of a user’s inbox. Gmail users can click on the ads which then expand in an email-like way into a more interactive ad.

The same highly targeted placement of display ads by user profile, demographics, and behavior as is done on Google’s own sites can also be extended to non-Google websites through its 3rd Party Display Network.

This is a group of more than 2 million websites that sign up to contribute their inventory to Google’s ad buying program in exchange for a commission from Google. These sites reach an estimated 90% of internet users worldwide per ComScore.

In 2019, the Google Display Network generated $21.5 billion in revenue, up 8% from last year, and representing 16% of Google’s advertising revenue.

How Does Google Interact with Travel?

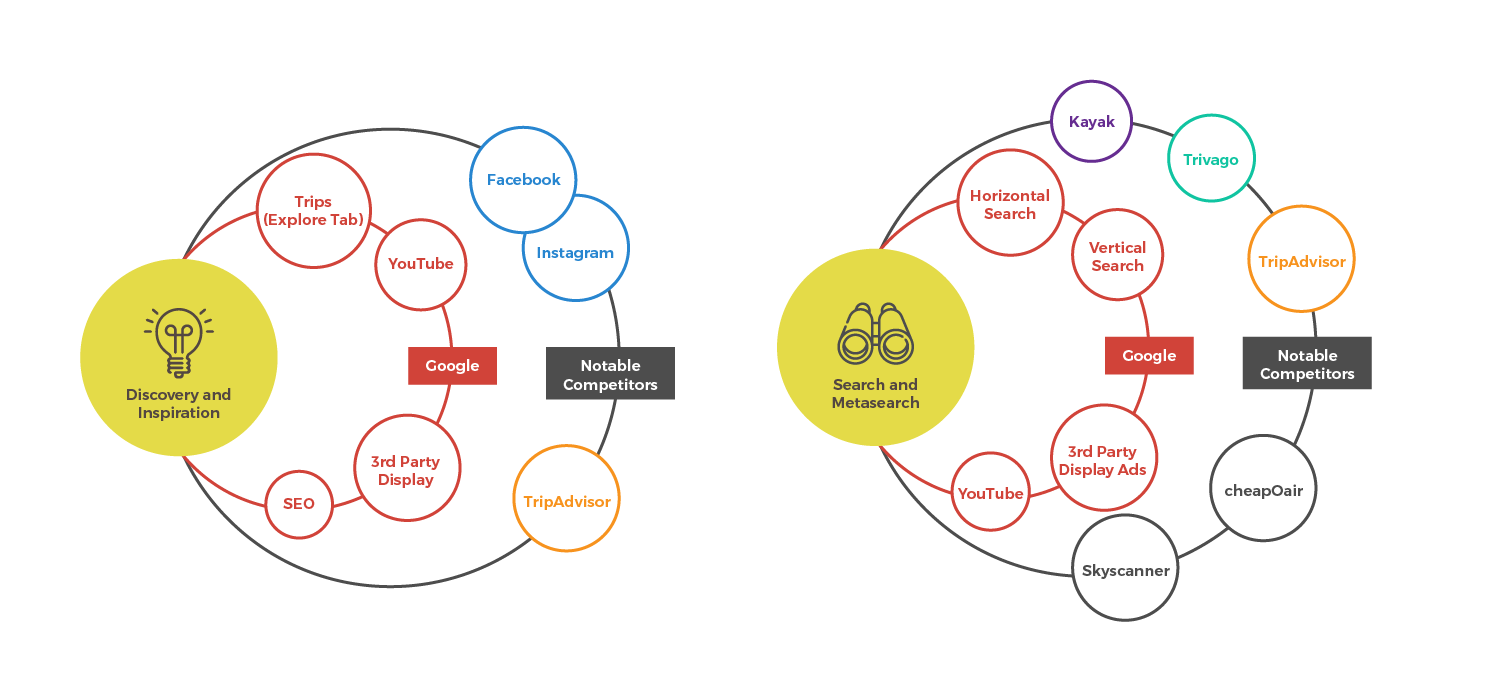

Let’s examine where and how Google interacts with the customer along his or her travel journey, which we break down into four parts: discovery and inspiration, search and metasearch, booking, and in-destination activities.

Google told us, its “travel mission is to be the trusted place where travelers go for the most useful information to make fast, effortless decisions, and we view our role in the industry as that of a connector between users and travel companies. This will remain true even as our products evolve.”

It’s worth emphasizing that Google is one of the very few companies that can reach across the entire customer travel journey from inspiration through visitation. To illustrate this point, we have mapped out examples of how Google products interact with the travel industry. We’ve also mapped out similar offerings from competitors that focus on the same part of the customer journey. The graphic is color coded so that businesses owned by the same parent company are outlined in the same color (e.g. all of Booking Holding’s properties are in purple, all of Expedia Group’s in green).

We hope that this helps point out that Google can tie together data from across the entire travel journey in ways that few others can. Not only does it have a deep vertical reach, but it can pull in web browsing behavior from non-travel activities to develop a much more holistic view of the customer. This is a powerful competitive advantage that few can replicate and explains the company’s business dominance.

- Discover and inspiration: Google sits at the very top of the marketing funnel for travel. Its products play a huge role in driving customer awareness of travel destinations and products. YouTube personalities and channels which create travel content and reviews have a growing ability to drive customer interest in travel. These channels can be highly influential in driving customer awareness and decision-making about where to go and what to do. The Google travel page also has an ‘explore’ tab that creates customer suggestions about where to visit based on past browsing behavior. Google’s primary competition in this space are other social media networks such as Facebook and its subsidiary Instagram. TripAdvisor also competes in this space.

- Search and metasearch: Now we move into the bread and butter of Google’s product. Best suited for the consideration and conversion phase of the customer journey. Google does an excellent job of capturing customer intent for a specific destination or activity and giving travel marketers the opportunity to capture that customer in the moment. It does this through both horizontal search ads and vertical metasearch ads. Its main competitors here are other travel metasearch players such as TripAdvisor, Kayak, and Trivago.

- Booking: The actual booking and payment of travel! Probably the most complex phase of the journey given the tangled mess of industry plumbing that can underlie even a seemingly simple transaction. In addition to needing to securely process payments, exchange foreign currencies, and properly levy local taxes, booking systems also need to talk with a variety of B2B travel distribution middlemen. Not only is this an expensive proposition, but it is the primary domain of some of Google’s largest revenue generating ad clients, online travel agencies such as Booking.com and Expedia. Alienating those clients would likely entail a large loss in revenue on top of a costly tech infrastructure build. As a result, Google has invested limited resources into untangling this backend of travel and so this is its weakest link in the customer travel journey. That said, Google is not totally helpless and has recently pursued a number of integrations on the flights side. For instance, Spirit Airlines tickets can now be fully booked and issued without ever leaving Google.com.

- In-Destination: A growing strength of Google’s due to its Maps app. As travelers increasingly expect and behave the same on the road as they do at home, they are turning to their smartphone mapping apps to explore and discover their travel destinations. Google is also testing semi-automated ‘travel guides’ of things to do (based primarily on visits from other travelers) on its Google Trips page. Google’s primary competitors here are, for the most part, not travel-specific brands. Rather they are local-focused apps like Yelp, OpenTable, Uber, and Lyft. Though TripAdvisor, and its tour and activities subsidiary Viator, also compete.

Google’s Travel Advertising Business

So how big is the market for travel advertising and how big is Google’s role in it?

30–45%+ of travel sales are done online, varying with sub-industry. That is far more than most other service industries which only make 7% of sales online. Digital advertising, accordingly, has an outsized role to play in travel marketing. Skift Research’s Digital Advertising Trends in Travel 2018 report shows that 59% of all travel advertising budgets are devoted to digital advertising. What’s more, 56% of travel marketers had plans to increase their digital advertising spend while just 7% planned to cut, the most and fewest, respectively, out of any form of advertising medium.

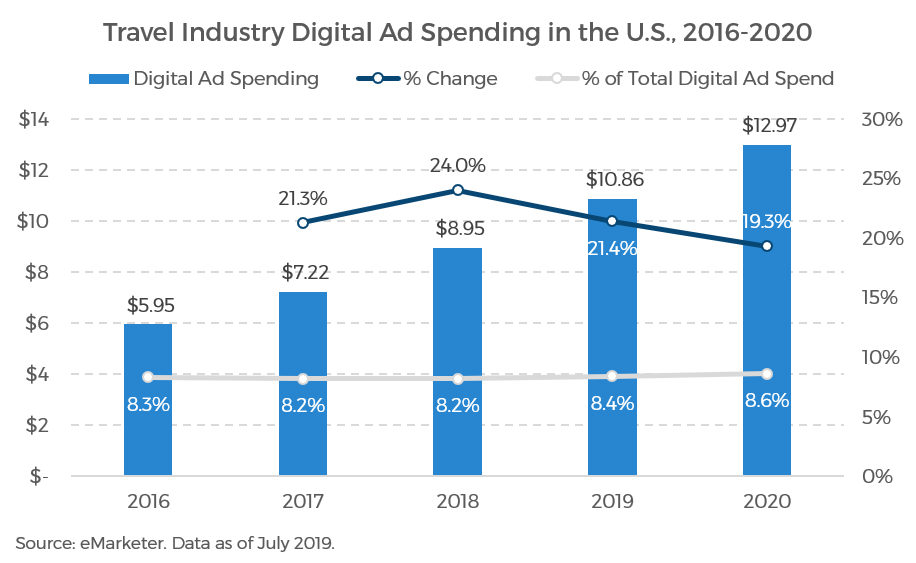

Research firm eMarketer estimates that in the U.S., travel’s digital ad budgets in 2019 were worth $10.86 billion, representing 8.4% of total digital marketing spending, the 6th most out of any industry. That dollar figure grew 21.4% in 2019 and is estimated to grow a further 19.3% in 2020, bringing total spending to $12.97 billion. Travel is also leaning heavily into mobile digital ads which accounted for 70% of U.S. digital ad budgets in 2019, or $7.6 billion.

Travel has an outsized focus on search, playing right into Google’s strong suit. In fact, eMarketer believes that 54% of travel’s U.S. digital ad spending in 2019 went towards search, the largest out of any single industry. Other industries average just 42% of digital ad spend on search.

A substantial chunk of that money flows to Google, including the majority of the $5.75 billion spent on search.

Google’s Vertical Search Products

Google’s horizontal search products are a long-time staple of the internet. But Google has in the last few years dramatically increased its impact on the travel industry by debuting new vertical search features for the sector.

Rather than the one-size-fits-all blue links and text descriptions that come with horizontal search, the vertical search modules have been customized to display additional relevant search information specific to individual travel segments. The three travel segments Google currently operates in are: flights, hotels, and short-term rentals.

A Google spokesman said that, “at a high level, we want to create more opportunities to connect our partners with travelers at the right moments of intent, whether that’s driving demand for a brand at the top of the funnel when someone is looking for trip inspiration, or capturing a booking when someone is further along on their travel journey.”

These vertical travel search offerings have grown rapidly in prominence, both as a function of their convenience to travelers and due to strong promotion by the Google algorithm (though the vertical search units rank organically on results pages and do sometimes rank below other organic blue links, more often than not, the industry module ranks towards the very top of the results page).

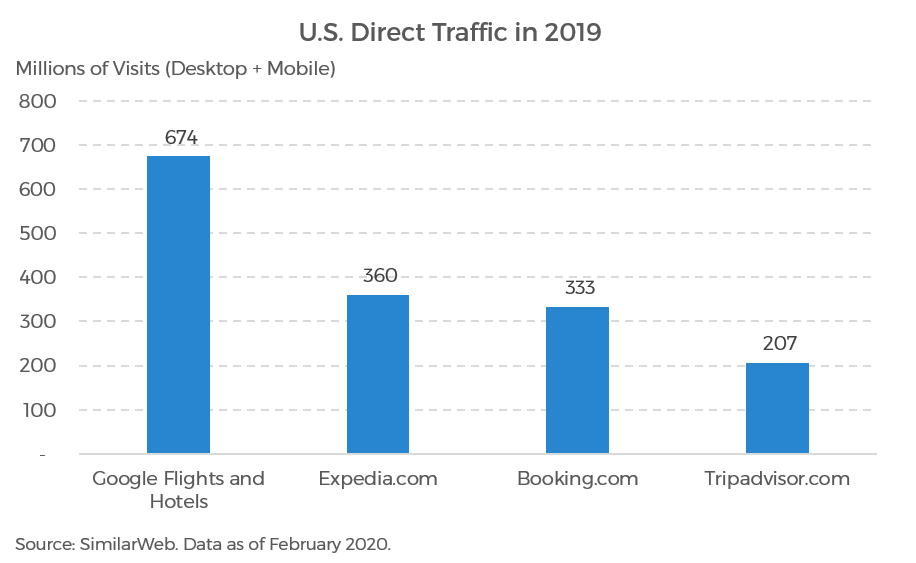

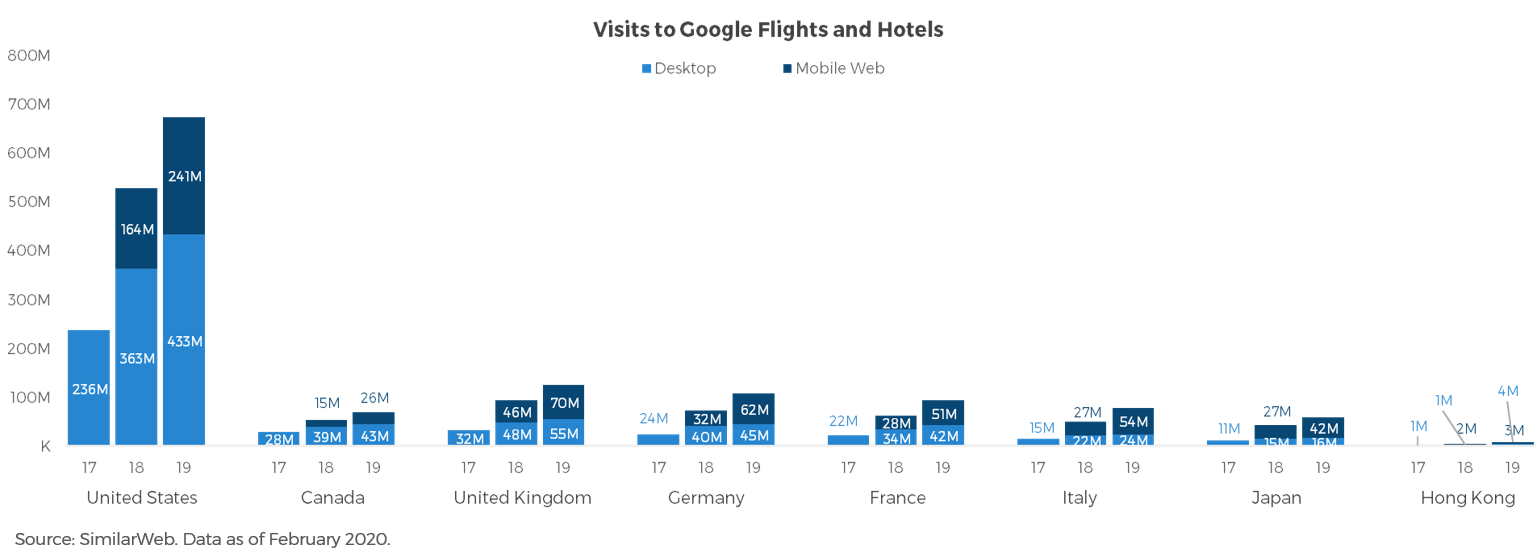

SimilarWeb data shows that Google travel vertical search products (Hotels + Flights) received 674 million visits in the U.S. in 2019. To put that figure into perspective, that is practically as much traffic as Expedia.com and Booking.com combined received.

The U.S. visitation figure is not just big, but growing quickly: up 28% from last year. That double-digit growth rate comes off an even more impressive 54% increase in desktop traffic the prior year (SimilarWeb did not track travel mobile visits before February 2018).

The U.S. is by far the largest market for Google Flights and Hotels, receiving more than five times as many visits as the UK, the second largest user of the vertical travel search products. But offsetting this lower base in international markets is higher traffic growth rates. We are seeing 30–40%+ year-on-year increases in volumes in major European markets — the UK, Germany, France, and Italy — as well as in Japan.

Clearly these vertical search modules are an important part of Google’s role in the travel ecosystem. Let’s examine sub-industry units more closely below.

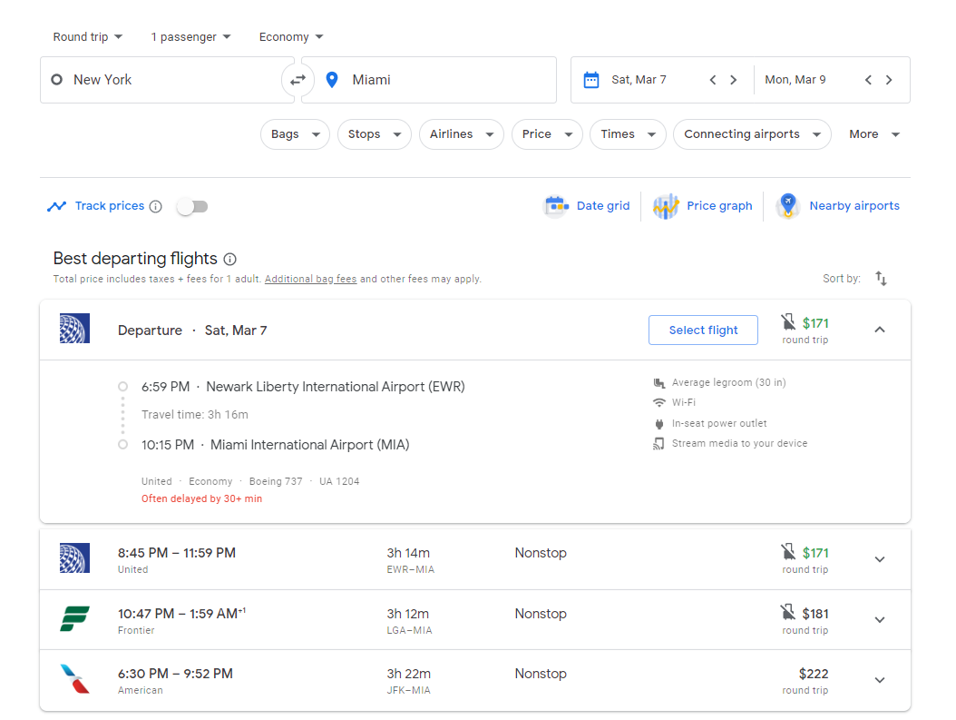

Google Flights

Flights is Google’s oldest travel search offering, and an outgrowth of its 2011 acquisition of ITA Software. When Google believes you are searching for a flight it will display the flight search module as a part of the results, below the sponsored blue links. The module is nearly always the first organic result displayed on the page, though our understanding is that this module is technically free floating and is not pre-programmed to always be the top organic result.

Clicking into the ad unit will bring users to Google’s dedicated flight search page, a part of its Google Trips offering. This page, to be quite frank, offers huge customer utility and its powerful search tools have been endorsed by some of the savviest frequent flyers around. It includes some sophisticated search tools like the ability to filter on attribute-based, semi-branded fares like basic economy and premium economy seats.

The resulting routes and fares are displayed by a proprietary Google sort, but which the company says do not take into account ad dollars.

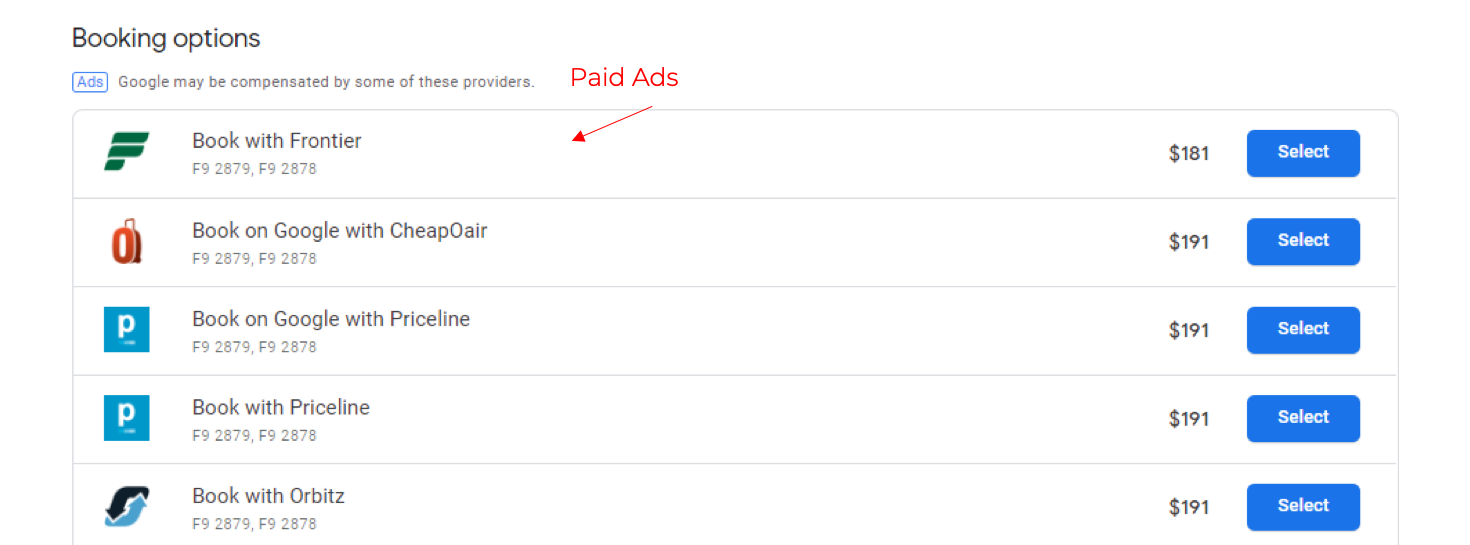

It is only once the user has selected the route and airline they want to fly that Google then serves metasearch ads which click off to a third-party booking site or the carrier’s direct page.

The search module has been highly successful from a user point of view. 2017 research from OAG finds that one in 10 frequent travelers starts their search on Google Flights. Millennial frequent flyers even more so ; they start their flight searches on Google Flights more than twice as much as the average traveler.

However, Google has struggled to monetize this product. Yes, Google has prioritized search results for airlines that paid, but nonetheless Google still listed all flights it could find in its search module results for the sake of completeness. The result of this policy: few airlines paid up, knowing that they would show up in searches regardless. That most airlines felt they could abstain was aided by the relatively consolidated nature of the airline industry, especially in the U.S. — fewer rogue actors willing to drive an industry-wide race to the bottom. Plus, those savvy flyers we were mentioning earlier could use advanced filtering features that let them bypass advertised results.

After struggling to turn a profit, Google announced that it will stop monetizing its flights module altogether . Today, a Google spokesman says that, “our team is mainly focused on improving our pricing prediction algorithms so users have more confidence that they’re booking a flight at the best possible time.”

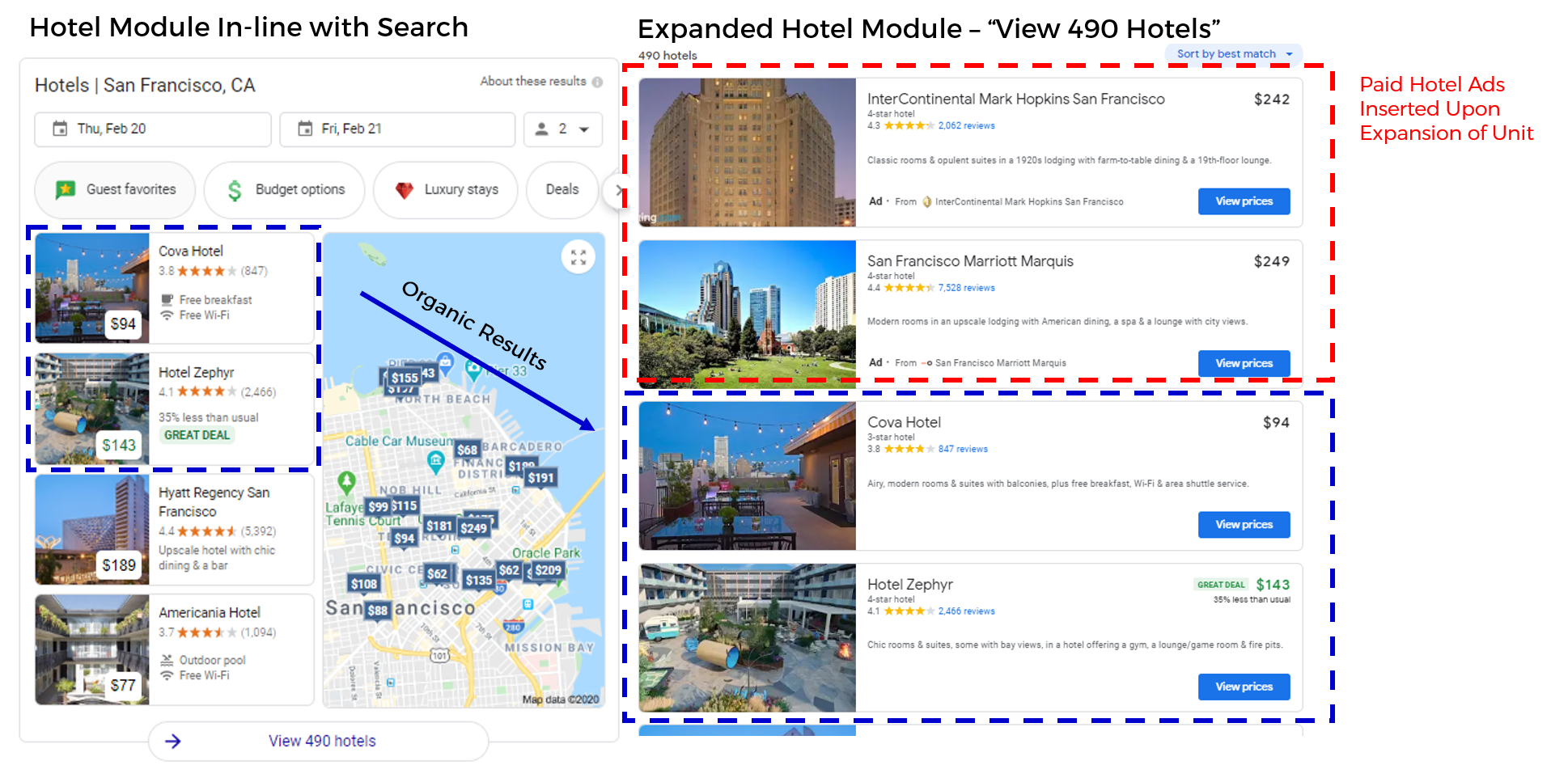

Google Hotels

The most successful of Google’s vertical travel offerings from a profitability standpoint, we beleive that the hotels module drives nearly all of Google’s vertical search revenue today. The in-line version of the module displays a select few hotels that it believes are relevant to you alongside a location map with prices.

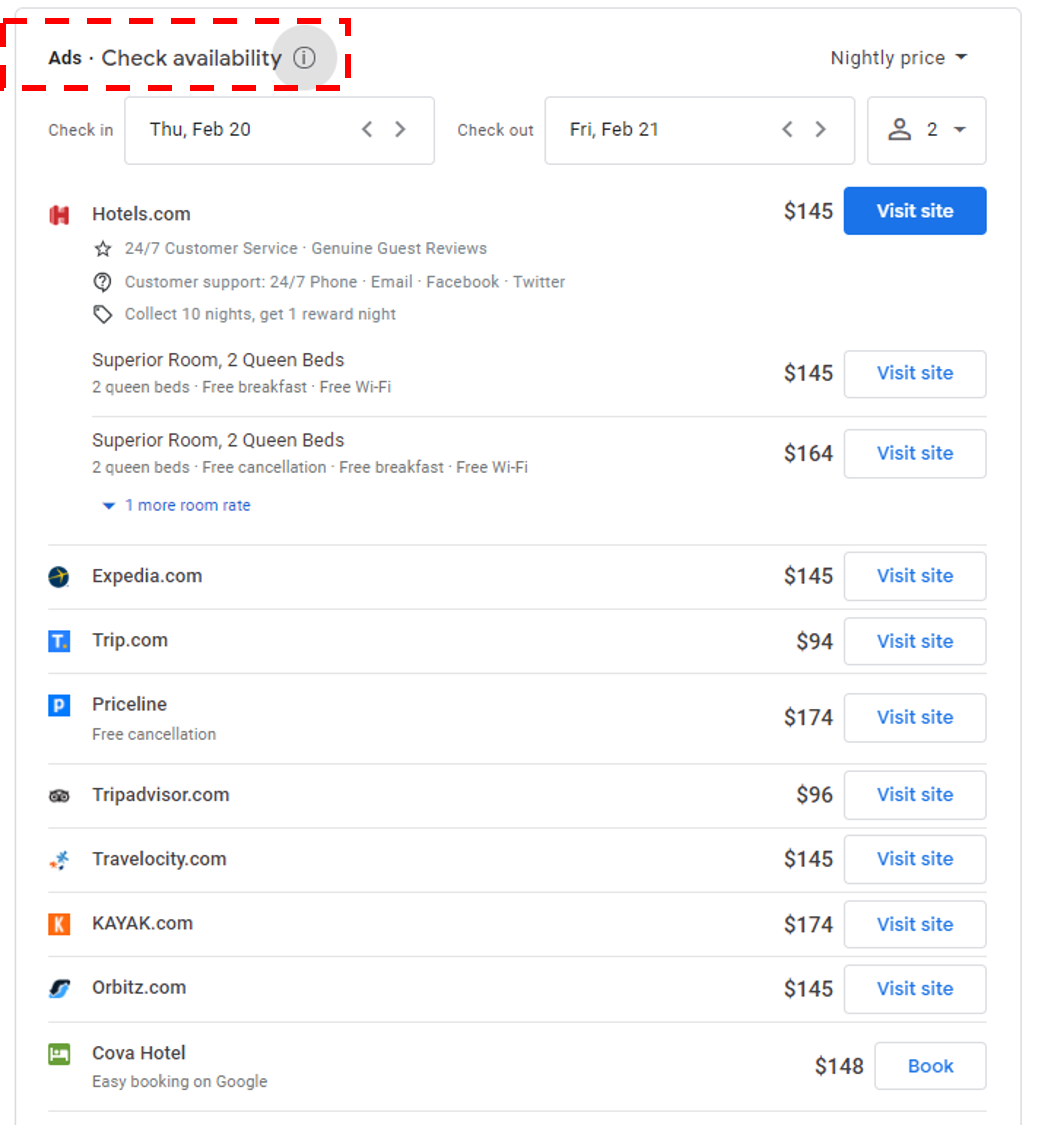

Google says that, “Hotel Ads offer an enhanced experience for traveler suppliers above and beyond Search Ads. Hotel Ads help users find and compare rates and availability from around the web in one place when they’re looking at a specific property, making it easier to connect with the travel partners who provide that rate.”

As with flights the actual positioning of the Hotel unit itself is organically ranked based on how relevant Google believes the box would be to you rather than an organic blue link. In our testing, the Hotel search module always appears as the top organic search result when there are multiple hotel options to compare within a city. When a specific, unambiguous property name is searched for, however, then the traditional SEO blue links rank higher than the hotel module.

The hotel listings returned within the Google Hotel Ad units, to the best of our knowledge, are also organic and unpaid. However, when users click into the unit to view more hotels it takes the browser over to Google’s full hotel search site. Here, Google will insert paid sponsored hotel ad listings into the top spot of results.

Once you select a specific property to book, Google also monetizes in a classic metasearch style, displaying multiple offers for the same property from across the web. Google tells us that depending on the ad format, ads are charged on a per-click or per-booking basis.

Our understanding is that Google has been quite successful in monetizing this search and booking funnel. Why is a different dynamic playing out in Google Hotels as opposed to Google Flights, since after all Google Hotels still includes as many non-paid results as possible for the sake of completeness? We would argue that there are two major differences between hotels and flights driving the better monetization (from Google’s perspective) in this channel.

The first is that hotels are much more highly fragmented than airlines. In the U.S., the 10 largest chains make up 16% of industry revenue , in Europe that same figure is 17% . That leaves a valuable long tail of unbranded hotels that rely on Google for customer acquisition.

The other issue is the large presence of online travel agencies and metasearch websites in hospitality (while they often sell flights as well, hotels are typically 60%+ of revenue). The OTAs and metasearch sites rely on Google for a substantial portion of their customer traffic.

Google’s dedication to having a completeness of hotel offerings, even if that means including unpaid results, only benefits the hotels that potentially receive free listings. But if the OTAs want to feature prominently, and they do because much more of their profit comes from hotels than airlines, they need to bid on ads.

So when you take those OTA dynamics and throw in the independent hotels which are also bidding for business, this creates critical mass to jumpstart an ecosystem of paid auctions. And that leaves the big chains with little option but to respond as well, helping to drive the monetization of this Google product, in our opinion.

Google Vacation Rental

Google’s latest vertical travel search offering is in short-term rentals . It’s a sign of the times that the space has arrived in a big way in the travel industry. And why shouldn’t that be the case? We estimate that short-term rentals are a $115 billion industry globally ; 10% of the total accommodation sector in the U.S., and 13% of the sector in Europe.

The module is very similar to the Hotels user experience and so we will not duplicate the screenshots here.

The offering is new and began with a rocky start, as vacation rental giant Airbnb initially sat out the launch . While Airbnb relented and began to advertise on the module a few weeks later, Google quickly hit a nearly-as-serious setback. Booking.com pulled out around the same time that Airbnb came in and as of this writing is yet to return. Booking.com is the second largest booking site in the short-term rental space and has nearly as many accommodation listings as Airbnb.

The latest bump in the road for this product is the early stages of an anti-trust challenge in the European Union . This month, more than 30 rivals, including TripAdvisor, Expedia, and eDreams, filed an official letter to EU competition commissioner Margrethe Vestager. This complaint follows similar concerns raised about Google Flights Hotels as well as a landmark EU anti-trust fine related to Google’s vertical search product for the online shopping space .

But the rough start aside, the market dynamics in this space are, in our opinion, like those for hotels, but turned up a few notches. The industry is even more fragmented than in traditional accommodations; new brands, funded with large pools of venture capital are desperate to acquire customers and show growth; the booking sites are mostly all racing full speed to grab as much share as possible; and the giant in the space, Airbnb, is prepared to spend huge sums on marketing to prop up financials ahead of its expected 2020 IPO.

All of this leads us to suspect that the Vacation Rental vertical search product will be a hit — for Google, that is — more akin to Hotels than to Flights. That means the short-term rental industry marketers are likely to lose a lot more sleep over their Google strategy in the near future and could potentially bring Booking.com back to the table.

Mobile phone ownership is ubiquitous across the globe. And one of the most impactful shifts this has brought with it is that nearly everyone carries a map with them in their pocket. The map has become the killer app of the smartphone era and is not strictly used for navigation but has become an overlay with which the end-user can explore their surroundings.

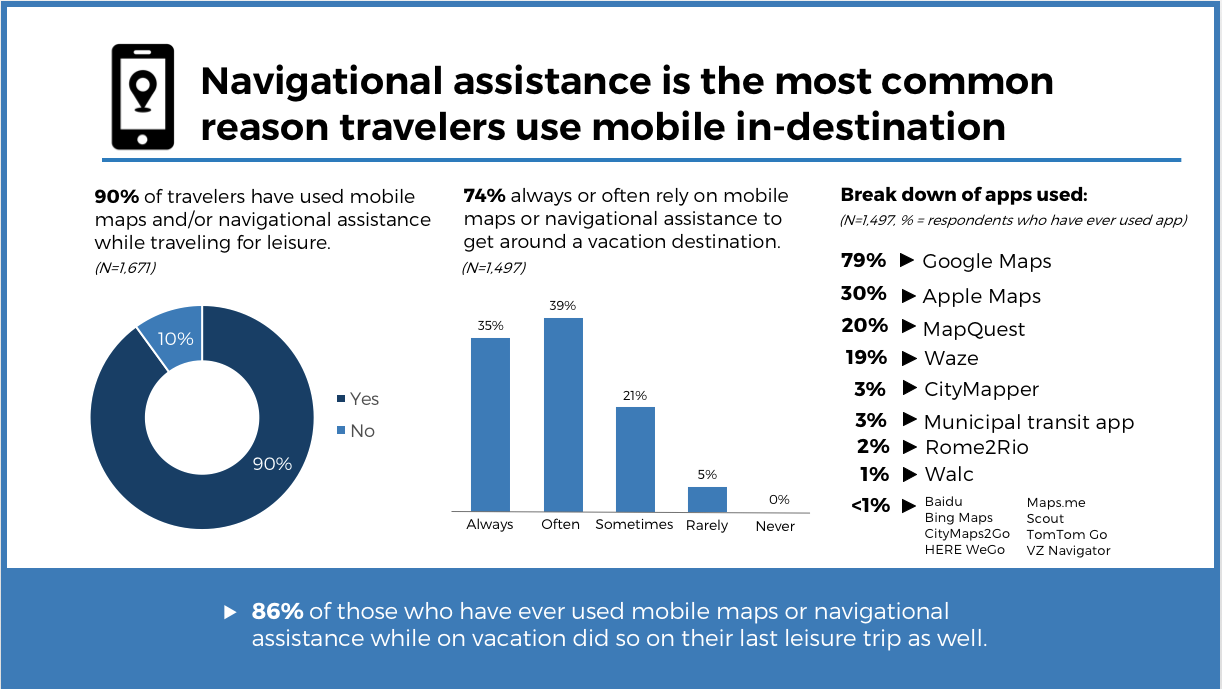

With wifi and cellular data widespread most travelers expect to be able to use their phones, and these mapping apps in particular, when they travel. Our U.S. Traveler In-Destination Mobile Behavior 2018 of 1,671 travelers asked about this. We found that 90% of American travelers had used their mobile phones for navigation when traveling.

This is not a coincidence. Google has devoted a huge amount of resources towards a strong ecosystem around its maps. It has worked hard to develop commercial relationships with businesses so that their info appears on the map.

Google Maps has also grown by crowdsourcing local information from its large network of ‘Local Guides’ who add, review, and correct location information. Google now has 120 million local guides, up from five million in 2016 and 50 million in 2018. Those reviewers are located across 24,000 cities and towns, with the majority of new locations being added outside the U.S.

It has used this commercial and crowdsourced data, paired with algorithms to add a number of useful features including ‘areas of interest’ that are shaded brown and an ‘explore around you’ bar that suggests nearby restaurants, bars and activities. While locals are the primary use case for these offerings, the modern, connected traveler is just as likely to have access to and make use of these features.

Google has also been busy adding travel specific features to Maps. It has, for instance taken the reservation tracking features from the now defunct Google Trips app — the ability to automatically load and track flight, hotel, and restaurant reservations from Gmail — and ported them into Google maps.

This has helped Google maps break out of the box of just being a simple piece of navigation software. Instead it is moving towards becoming a super app with implications both at home and when traveling.

Fact is, Google Maps was one of the most popular apps for use in-destination mentioned by travelers across multiple parts of their journey. For instance, 31% of U.S. travelers said they had used a mobile app or website as a tour guide about a destination. The most popular app of choice? The ‘explore’ feature of Google Maps — 59% of respondents which had used a mobile tour app, said they had used it.

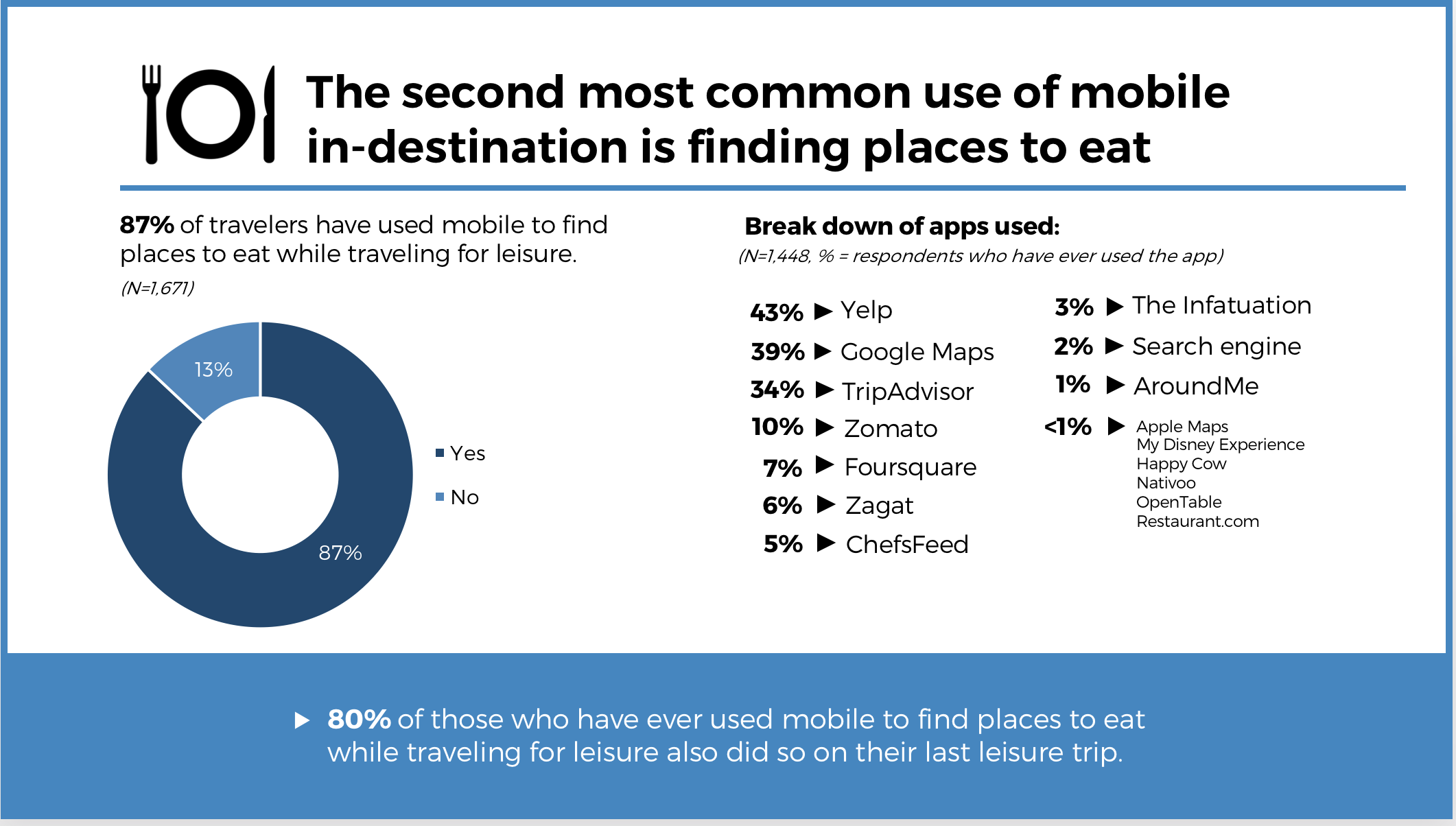

There is a similar pattern at play for restaurants. Here, 87% of travelers reported using a mobile app to find places to eat. And amongst that group, 39% had used Google Maps. That makes it the second most popular app for eating abroad behind only Yelp and ahead of TripAdvisor.

Google’s online video giant holds sway over a generation of young people who increasingly consume digital content rather than traditional TV.

Alphabet has long been tight lipped about the size of YouTube but recent financial disclosures shed new light on this business. In 2019, YouTube collected $15.1 billion dollars from advertisers on its platform, up 36% from last year, and representing 13% of Google’s first-party ad business. That is around the same size as advertising giant Omnicom. And in the fourth quarter, YouTube’s $4.72 billion in ad revenue nearly rivaled online streaming giant Netflix’s $5.47 billion.

The net revenue and profit impact from YouTube on Alphabet is much smaller than that, as the company pays out a substantial chunk of the gross ad dollars it collects to its content creators. Though the figure is undisclosed, we believe Google pays out about 60% of gross dollars in content acquisition costs leaving YouTube with an annual net ad revenue near around $6 billion.

But how YouTube divvies up this windfall between itself and its contributors matters little from an ad buyer’s perspective. What matters to advertisers is YouTube’s two billion global users who are consuming a growing amount of travel content on the platform.

According to Blogkens and Kedoo data, ‘travel and events’ is the 13th most popular category of videos on YouTube, receiving an estimated 6.5 billion monthly views which equates to 433 million hours of content watched per month. Though a bit dated, Google’s own report tells us that in 2014, nearly half of travel subscribers tune into personal travel vlogs. We suspect that proportion is even higher today.

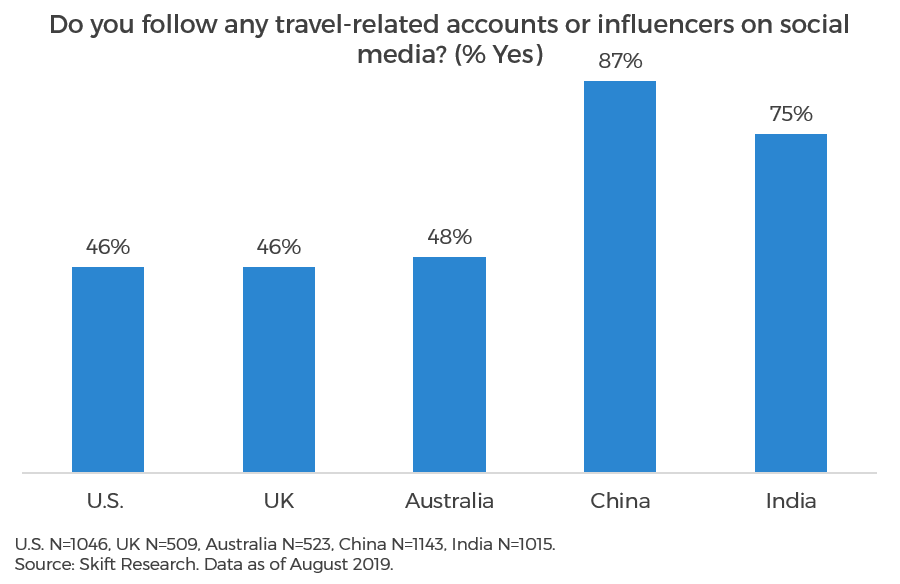

Skift Research’s own research into Millennial and Gen Z travelers in the U.S., UK, Australia, India, and China suggests that YouTube is one of the most influential social platforms in travel worldwide. Nearly half of Millennial and Gen Z travelers in developed nations follow travel-related social media influencers and an even greater share do so in China and India.

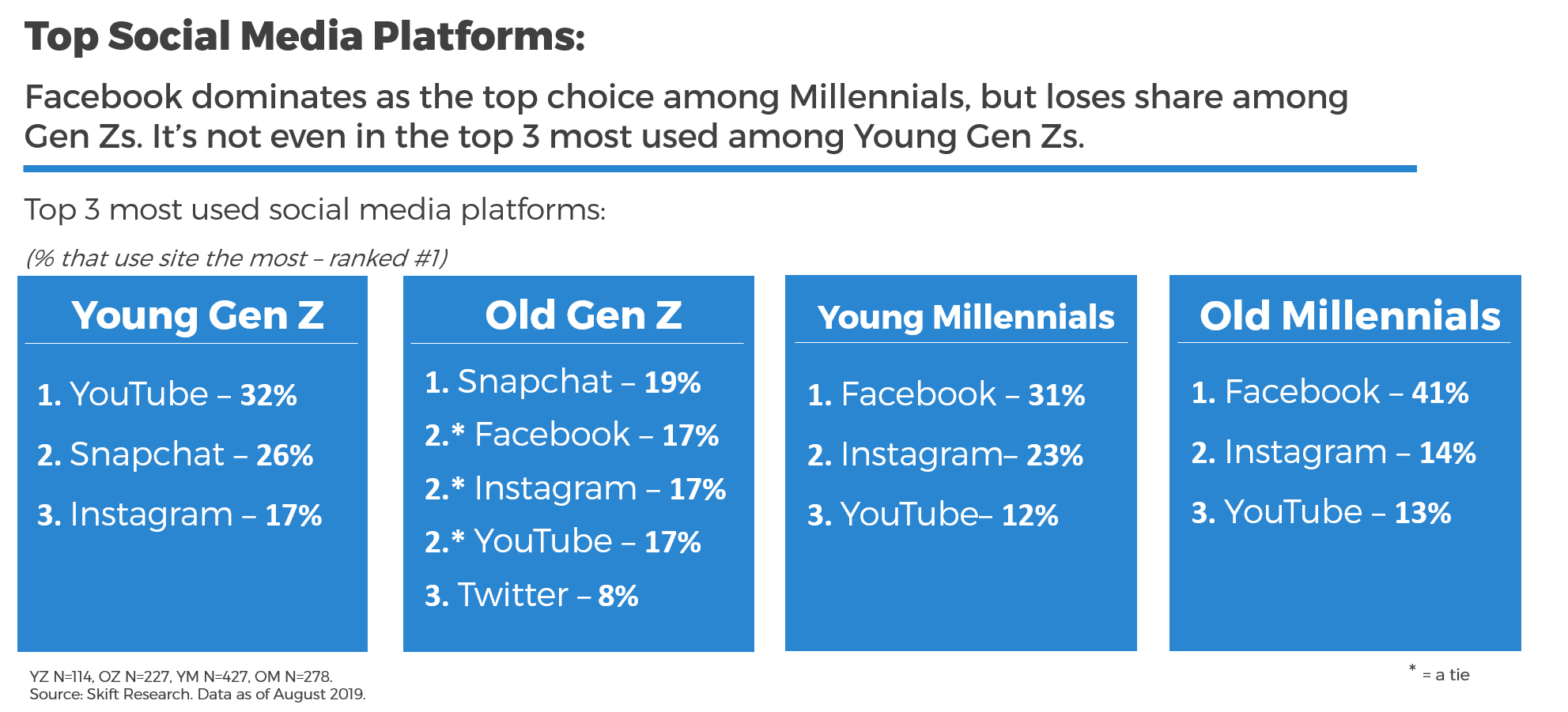

Except for China, where Google is inaccessible, the other four countries all rate YouTube as a top three social media platform for travel. But drilling into just the U.S. shows some important distinctions. Here, YouTube is more prominent amongst younger cohorts.

Millennials rate YouTube as their third most used social media platform behind Facebook and Instagram. But older Gen Zs see YouTube’s prominence rise to second place in the pecking order. And for young Gen Zs, YouTube is their single most used social media site.

As this demographic ages into prime earnings potential, we suspect YouTube’s influence in the travel industry will only grow.

Today, there are two main ways for travel brands to position themselves on YouTube: brand advertising or direct response (performance) advertising.

Brand advertising is one of the most common types of marketing run on the platform. And these branded ads themselves come through two channels. First is the ‘official,’ mostly programmatic, advertisements run through the Google Ads program that runs branded ads including video pre-roll and banners on the site. Best Western used this format recently and acheived 2.2 million views across 13.6 million minutes, 25 years, of watch-time. Best Western also reported searches for its brand increase 6x as a result.

The second form of brand advertisement on YouTube is sponsored content or even brand-owned and operated channels. While these certainly have a very real cost to them and are a growing part of many marketer’s budgets, these dollars do not get spent via Google’s platform. They are paid directly to content creators or expensed as video production charges.

Using social media influencers is a hot topic of debate in marketing circles and outside the scope of this report. Many travel marketers are facing growing pains in understanding how to launch these new campaigns; but regardless of the pain, this channel seems likely to continue growing.

YouTube is also rolling out a direct response ad product on YouTube that lets brands prompt video watchers with a tailored call to action. Alphabet CFO Ruth Porat, specifically called out the example of a travel advertiser using these products to download an app or book a trip on the company’s third quarter 2019 earnings call. Though still, we believe, a minority of ad sales on YouTube, Porat says they are showing “very substantial growth.” Amongst travel companies, Vrbo, Airbnb, and United Airlines are examples of brands experimenting with this format.

Airbnb targeted Brazilians with a direct response ad that called for viewers to ‘reserve,’ linked them off to an Airbnb search landing page with date. The company reported a 14% increase in bookings and a 1.4x increase in searches.

Estimates of Google Advertising in Travel

Skift Research estimates that globally, the travel industry might’ve spent as much as $16 billion or more advertising on Google in 2019.

For context, Alphabet’s advertising revenue over that same time frame was $135 billion; its total revenue base was $162 billion meaning travel would make up about 12% of its ad business and 10% of its overall business. These numbers seem relatively in-line compared to eMarketer estimates that travel makes up about 8% of overall digital advertising in the U.S. Though this implies that travel over-indexes on Google relative to other channels, and given what we know about travel over-indexing to search, that again seems about right to us.

Again based on eMarketer’s U.S. travel digital advertising data we believe that at the low-end nearly $6 billion is being spent by the industry on Google. That implies the U.S. represents about 38% of travel’s Google spending. This too, is roughly in line with what we believe the U.S. represents as a share of the global travel industry’s output. It also comes close to Google’s self-reported figure that it generates 46% of its total revenue in the U.S.

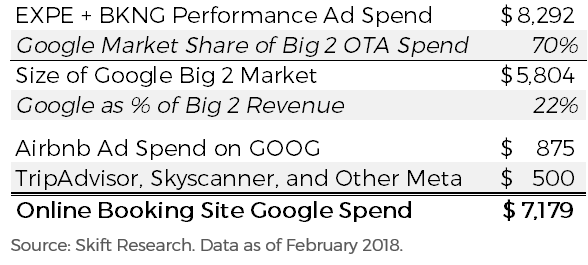

A number of datapoints and assumptions go into that figure. We start with Expedia Group and Booking Holdings, the two largest online advertisers in the travel industry. Using those companies’ latest filings we examined their marketing spend for the 12 months ended September 30, 2019. Booking Holdings spent $5.9 billion on sales and marketing in that time frame just about on par with Expedia Group’s $6 billion spend.

Booking further delineates its marketing spend into groupings for ‘performance advertising,’ ‘brand advertising,’ and ‘sales and other.’ For the sake of simplicity, we only count performance advertising, which takes place online, and accounted for $4.4 billion, or 74% of total sales and marketing spend.

Expedia Group doesn’t break down their sales and marketing spend in the same way, but we do know that the company spent $4.8 billion on ‘direct advertising,’ which includes both performance and brand advertising, setting the upper bounds on how much they could have dedicated towards online ad buys. We need to make an assumption here, but ultimately estimate that Expedia spent $3.9 billion on performance advertising in the 12 months ended September 2019, or 64% of its total sales and marketing budget. This is 10% less than peer Booking which we understand to have a greater preference for performance marketing over brand marketing than Expedia does.

This means the performance ad spend from the big two western OTAs is $8.3 billion. Let’s say that the majority of that, 70%, is going towards Google. That gives us a spend from Booking and Expedia of $5.8 billion collectively, or 22% of combined revenues.

What about the other online travel advertisers out there? Assuming Airbnb is spending at a similar rate, that’s perhaps another $850–900 million to Google. Given that Google doesn’t operate in China, Ctrip, the third largest OTA probably doesn’t spend too much on the platform.

And metasearch? Trivago and Kayak are already accounted for in their respective parents’ spending. TripAdvisor spent $458 million on direct sales and marketing, which, using similar ratios to the OTAs could imply $200–250 million in Google spend. Skyscanner, based on its private accounts, had $341 million of revenue in 2018. That could imply $70 million of ad spend on Google. The metasearch players outside of China quickly drop off after that.

All told, we think it is possible that the online travel booking sites and metasearch sites, spent $7.2 billion on Google in the 12 months ended September 30, 2019.

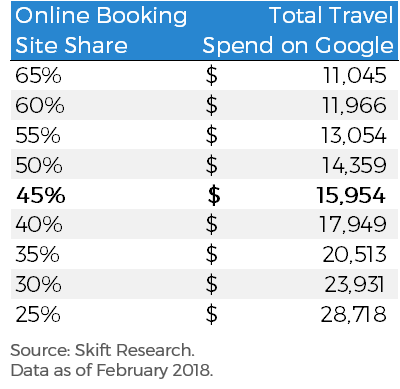

It’s hard to do a similar bottom’s up analysis for the travel supplier space — hotels, airlines, tour operators, and DMOs — as that segment of the market is much more fragmented. Instead we will make an assumption about how much of the travel industry’s spend on Google is accounted for by the online booking sites, and use that ratio to back into the full figure.

We believe that the online booking sites make up a little under half of the entire travel industry’s spend on Google which implies $16 billion spent by travel on Google worldwide and across all its advertising products, inclusive of search, maps, display, and YouTube.

Given the rough approximations involved here, we present a sensitivity table below. If you believe that online booking sites are the minority of online travel advertisers, say 30%, then the full scope of Google’s impact is far larger, nearly $24 billion. Conversely, if booking sites have a majority share compared to suppliers, say 60%, then the overall size of Google’s travel business is much smaller, more like $12 billion.

Google’s Impact on Online Travel Intermediaries: Can Booking Sites Stand the Heat?

Travel’s largest online intermediaries — the online booking platforms and metasearch sites — have a rocky relationship with Google that might best be described as ‘frenemies.’ These sites are working hard to drive as many customer relationships direct to their own brands, but can’t escape the simple reality that most customer searches, for travel and nearly everything else, start on Google.

Google owns — and will likely continue to own — the top of the customer acquisition funnel in travel. This has long been the case and as a result the online booking sites developed some basic tactics to deal with this fact. They would participate in Google’s horizontal keyword ad searches while at the same time optimizing their sites for ‘search engine optimization’ (SEO), a wide range of techniques designed to get their respective travel sites placed as highly as possible in the organic, free, part of the Google search result pages.

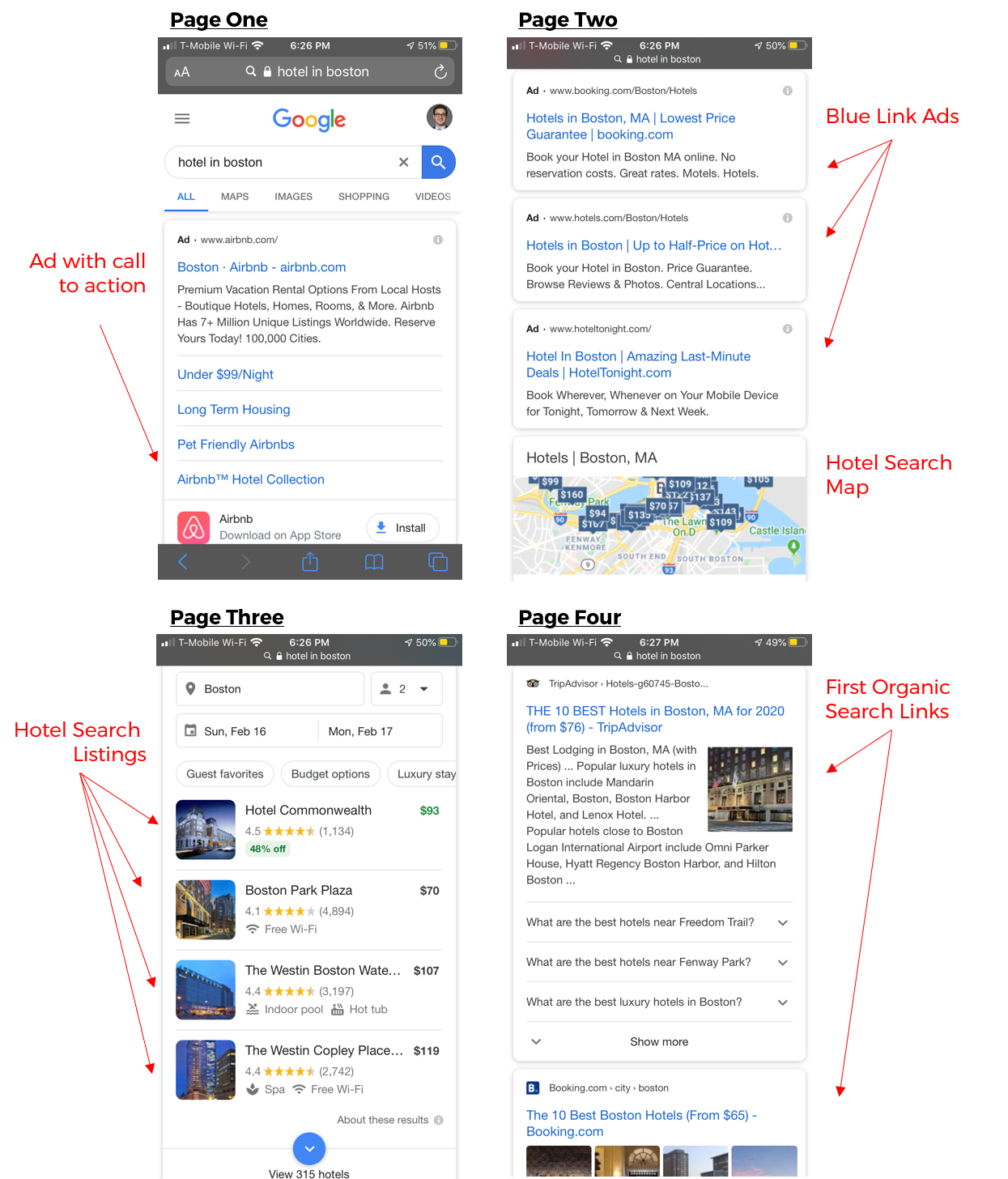

But in recent months and years Google has increased the ad loading on its site, oftentimes displaying three or four blue links rather than one or two. Now, add in the prominent size and placement of the flight or hotel search module, and those tactics are becoming less and less effective. The booking sites’ organic SEO results are getting pushed down into far less relevant and lower volume positions on the search page.

The problem is particularly bad on mobile. In a recent mobile search for ‘hotel in Boston,’ we had to scroll down four pages before reaching the very first organic result.

The crowding out of organic metasearch and OTA results was felt sharply in the disastrous third quarter 2019 results of TripAdvisor and Expedia. Both management teams described an online environment that saw SEO volumes drop off, forcing them to bid more in the paid search results just to maintain a similar level of volume, resulting in a sharp drop-off in return on ad spend.

The unexpected extra marketing expenses eat into profits and surprised many Wall Street analysts. Worse yet, both management teams suggested that the elevated marketing spend and lower ROI environment could continue in months to come.

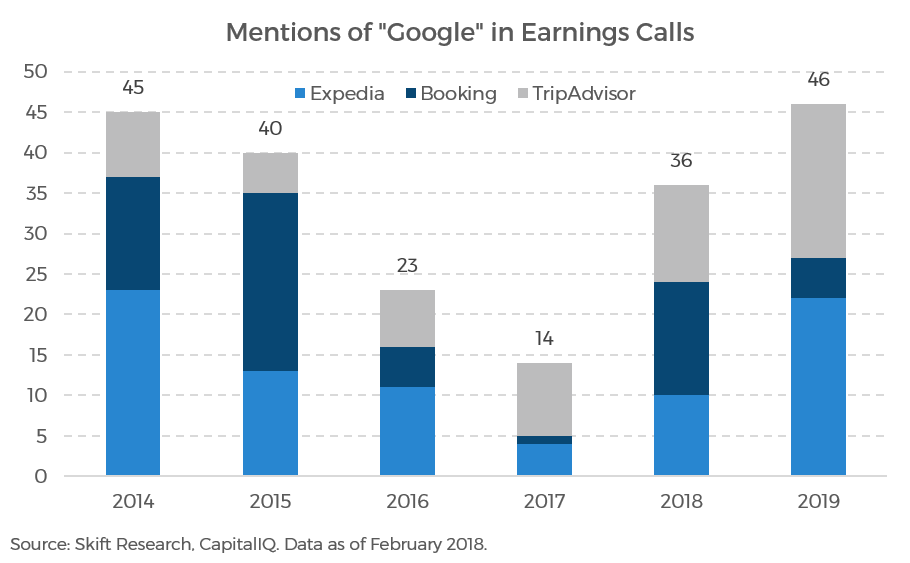

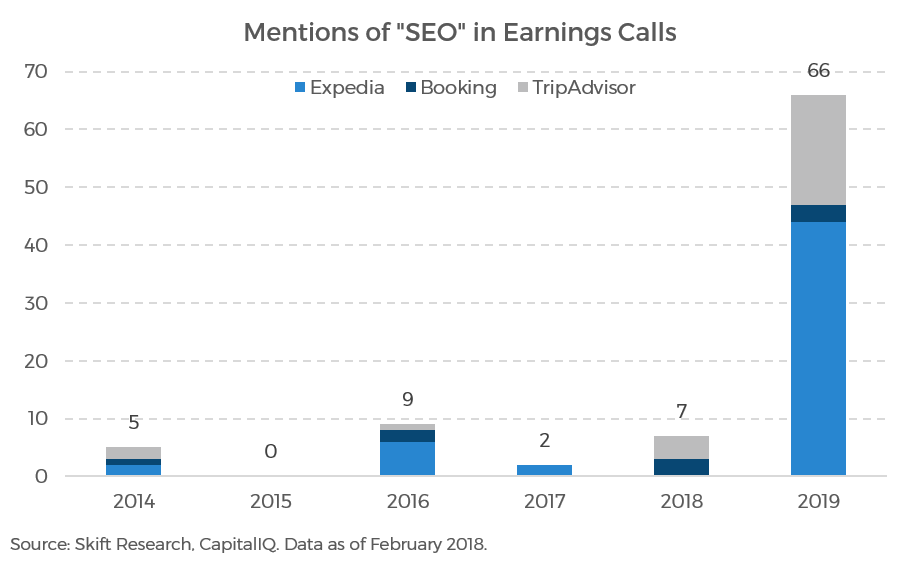

We analyzed the number of times both “Google” and “SEO” came up on earnings calls, mentioned by management or analysts, at Expedia Group, Booking Holdings, and TripAdvisor.

Google has clearly been creeping up towards the front of everyone’s minds over the last few years, rising from 14 mentions in 2017 to 46 mentions in 2019. But, it should be noted that Google is a regular topic of conversation at these sites and we’ve seen a similar 40+ level of mentions before in both 2014 and 2015.

What is shockingly out of the norm is the number of times that “SEO” has come up in earnings calls over the last year. Rising from practically no mentions over the last half-decade to 66 this year alone, primarily at Expedia and TripAdvisor, not Booking.

To us this speaks clearly to the dramatic impact of ongoing changes to the Google search engine results page. Let’s dive deeper into these challenges for the online travel intermediaries and delineate further between the metasearch sites and the online travel agencies.

Metasearch in the crosshairs

It is becoming increasingly difficult for independent travel metasearch sites to survive in markets where Google has a large presence.

The key tipping point was the launch of industry specific vertical search units which effectively replicate a traditional metasearch comparison shopping screen but places it on or near the top of the Google search results page.

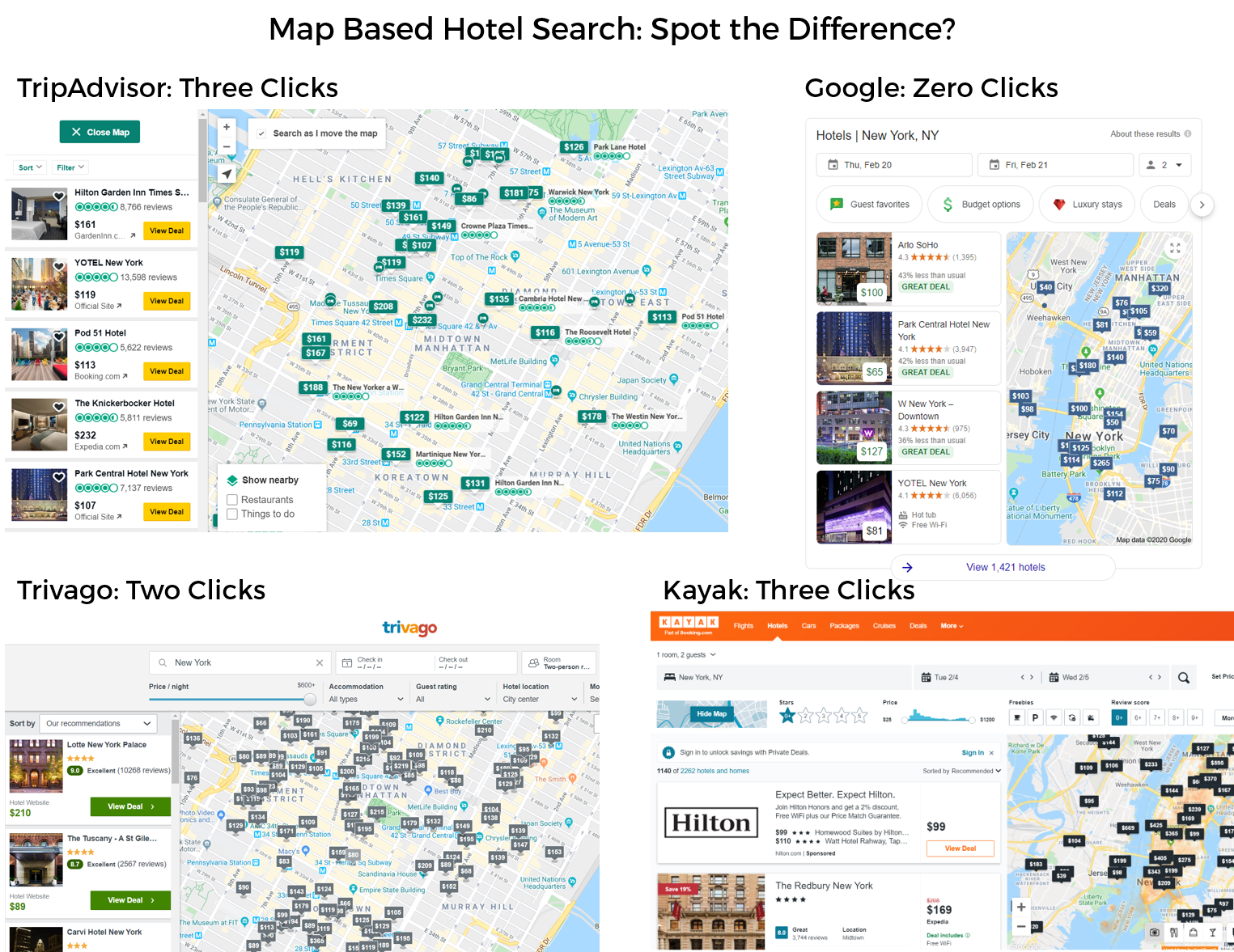

Google is not making a cheap knock-off either. Its vertical metasearch tools for travel are powerful and the company is making smart decisions about how to design the customer shopping workflow that stand out against leading competitors.

For instance, the search engine decided to lead its hotel results with a map-based search, rather than the more traditional model that offers property-by-property price comparison. Smart, in our view. Google’s hotel map-based shopping page shows up with zero clicks. It takes two clicks to reach a functionally identical screen on Trivago; three at TripAdvisor and Kayak.

The result is that you have two near-identical products, but the Google version does not pay for customer acquisition since most searchers start on Google and do not need to leave the site. In contrast the dedicated travel metasearch sites pay for customer acquisition to deliver a similar results page that takes more clicks to reach.

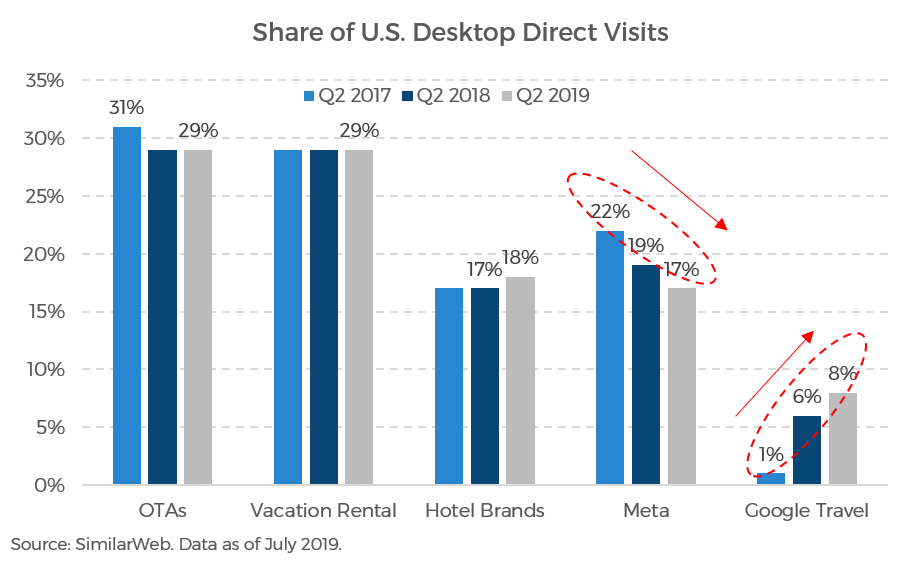

Web traffic data demonstrates the damage done to stand-alone metasearch by Google vertical search modules. SimilarWeb analysts collected traffic data on a variety of prominent travel industry websites.

Representing hotel brands, direct visitation data was aggregated from Marriott, IHG, and Hilton; from OTAs: Expedia.com, Booking.com, Hotels.com, Priceline, and others; from vacation rental companies: Airbnb and Vrbo; and finally TripAdvisor, Kayak, Skyscanner, Trivago, and other metasearch sites.

The data is then normalized to show which of these major groupings controlled what share of U.S. desktop web visits. We can clearly see the rise of Google vertical search units (across hotels and vacation rentals) rising from a 1% share of U.S. desktop web visits to 8% in 2019. Most interesting is that the share gain came directly at the cost of metasearch share, which fell from 22% of traffic in 2017 to 17% today.

This data makes it clear to us that metasearch sits clearly in the crosshairs of Google travel, to a far greater extent than the online travel agencies.

And unsurprisingly, financial results from TripAdvisor and Trivago, the two largest U.S. metasearch sites with public stand-alone financial results show these businesses struggling.

We are not convinced that metasearch sites can turn these trends around on the merit of their core product offerings alone. Survival will likely require shifts in internal strategy or government intervention , if not both.

Metasearch sites need to move either higher up the funnel, to become a greater part of the inspiration and discovery part of the traveler’s journey, or lower down the funnel, to a more transactional relationship with customers and suppliers.

In fairness to TripAdvisor, it is experimenting with both of these tactics. The late-2018 redesign of its website takes a page from Facebook’s playbook and puts more image-forward and user generated content on its homepage. Additionally, TripAdvisor’s tours and activities subsidiary, Viator, has been transactional from day one. As that business grows, it de facto increases the OTA portion of TripAdvisor’s revenue.

TripAdvisor has also been active in discussing potential anti-competition cases with government agencies. It joined a letter, asking the EU to investigate Google’s vacation rental metasearch and CEO Steve Kaufer told Skift in a previous statement that, “TripAdvisor remains concerned about Google’s practices in the U.S., the EU, and throughout the world. For the good of consumers and competition on the internet, we welcome any renewed interest by U.S. regulators into Google’s anticompetitive behavior.”

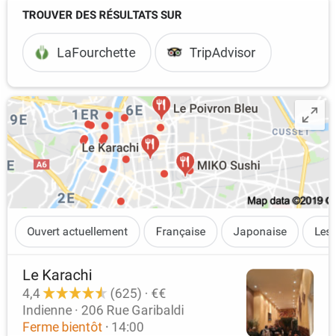

We are starting to see some results from this anti-competition push in Europe. Google has been testing a new search results page in several major European countries that would display a carousel of links to rival metasearch sites on top of Google’s own organic results.

The example below, tweeted out by LaFourchette , a restaurant reservation platform owned by TripAdvisor, shows the beta version of this new search format for a restaurant which allows users to “find results on” LaFourchette or TripAdvisor before leading them into Google’s own restaurant metasearch results.

A Google spokesman said that, “We’re currently testing a new format for specialist searches in Europe including jobs, local and travel where people might see a carousel of links to direct sites across the top of the search results. This is designed to demonstrate the range of results available.”

It is possible that U.S. regulatory scrutiny will be stepped up as well, with, for instance, the Wall Street Journal reporting that State Attorneys General from at least seven states will meet with the Department of Justice to discuss their respective anti-competition probes into Google.

We asked Google about how they balance the positive consumer experience that their integrated travel offerings can bring with the needs and wants of travel intermediaries and suppliers. Google told us that, “We strongly believe it’s important to balance the needs of the entire ecosystem. We have large teams dedicated to building great travel user experiences. At the same time, we work in close collaboration with our industry partners to provide useful information for consumers during moments of travel intent. The result is a virtuous cycle: a better user experience means more users returning to Google, which means we can send more traffic to our partners and help them better meet travelers’ needs.”

Is Google Squeezing the Online Travel Agencies?

The natural next question is, can Google apply the same pressure it put on metasearch sites, intentionally or not, to the online travel agencies?

Our answer is, ultimately, no. It can certainly squeeze the OTAs financially, but these sites have a much stronger defensive position because they handle financial transactions with travel suppliers directly.

Let’s start by looking at the SEO data which shows, similar to the metasearch experience, a crowding out of free search traffic.

SimilarWeb data which shows U.S. desktop traffic referred by Google to the major OTAs tells the story. Expedia’s overall traffic was flat, about 25 million visits in 2019 versus 2018. But its free organic search traffic fell by 2.6 million visits, the difference made up entirely by paid channels split nearly evenly between Google Hotels and the classic blue link search product.

The story was similar at smaller western OTAs. Take Booking.com and Hotels.com which both saw traffic grow, but organic search traffic fall. Again here, all of the growth in Google desktop traffic referrals came from paid channels.

Interestingly, at Booking.com, in contrast to Expedia.com’s 50/50 split, all of the growth came from Google Hotels as traditional PPC search traffic declined alongside organic. Airbnb also stands out here as the only major western OTA measured that saw growth in SEO volumes, which grew alongside paid search traffic as well.

Looking at the data shows that Expedia.com’s organic traffic fell by 15% while Booking.com’s fell by a smaller, but still concerning, 10%. But the financial impact on Booking’s business was much less because the U.S. is a much smaller piece of its business than Expedia’s. Booking gets most of its traffic and revenues from Europe, where, as our earlier traffic data indicated, Google vertical search products are much less prominent.

The much bigger challenge to these corporates from Google would be if the search giant took steps towards handling transactions and building the back-end pipes to talk to hotels, airlines, and other suppliers itself, effectively becoming an online travel agency.

It should be noted that Google has been making some in-roads into the realm of direct booking , mostly in the airline space. But so far those tests are small scale and the U.S. airline market, especially the low cost carriers that have tested the water with this direct connection so far, is low hanging fruit. The global airline market in Europe and Asia is much more fragmented than in the U.S. and even those markets are highly consolidated when compared to other travel sub-industries like hotels and short-term rentals.

Google continues to insist it does not want to be an OTA, and for the most part, we believe it. Further expansion into the world of travel plumbing would be costly, both in terms of direct expenses and the opportunity cost of losing a steady and high margin revenue stream from OTA advertisers.

How Do Travel Brands Succeed in a Google World?

What about airlines, hotels, and other travel brands? If Google is a rival to metasearch and a frenemy to the online travel agencies, how does it stand in relation to the direct suppliers of travel services and activities? Well, it’s quite complementary, in our view.

For many brand managers, Google is a powerful and effective marketing tool to acquire customers. Yes, sometimes we hear a hotelier refer to a ‘Google tax,’ but this sounds a tad unfair to our ear. Afterall, every channel, even the direct channel, has a cost of customer acquisition associated with it.

But the cost of customer acquisition on Google can be highly variable. The real question is how travel operators can maximize their returns on Google marketing investments.

There are many ways to approach this problem and they all vary depending on the specific nature of the business. At the core of most however, is the ability to retain the customer through a strong guest experience and/or loyalty program. Brand recognition helps significantly as well.

Brand Recognition

Let’s say you want to advertise your hotel, airline, or tour company on Google. Pretty immediately after setting up a Google Ads account you will be faced with the decision of which keywords to display ads against. And you will quickly find that not all keywords are alike.

Let’s take the example of hoteliers. The winning bid for generic keyword such “Hotels in New York” will be much more expensive than a keyword linked to a specific property such as the “The Skift Research Hotel and Spa.”

Generic terms almost always funnel customers into a paid Google product. 49% of outbound Google traffic from destination searches like “New York Hotel” led to the Google Hotels search unit and a further 21% fed into paid per click blue link ads. Only a small minority, 29%, actually converted into unpaid, organic traffic to hotels.

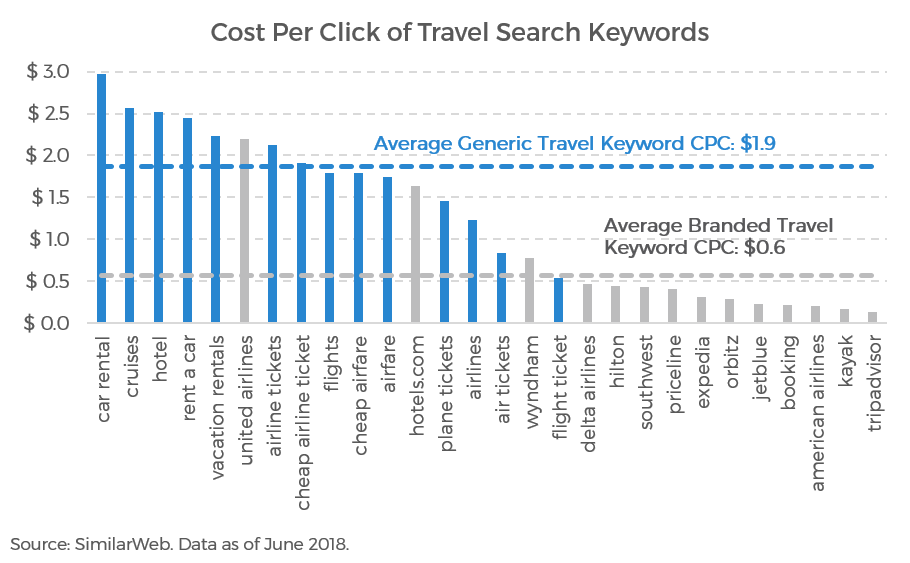

What’s more is it’s not just a volume game. Our own prior research into Google advertising in travel found a dramatic difference between the CPCs for generic keywords, where there are more bidders and the competitions is stiffer, and branded keywords where, most of the time, just one company is bidding for the term. Based on a small sample of keywords from SimilarWeb data , we found a mean CPC of $1.90 for generic travel keywords versus a CPC of $0.60 for branded terms.

The point here is this: brand recognition is critical to optimizing your Google search results.

Branded search terms favor organic search traffic over paid search engine marketing. The SimilarWeb data indicates that 70%+ of outbound Google traffic from branded keywords, like “Marriott,” come from organic results. This is not to say that search engine optimization, required to appear highly in the organic results, is free but the cost is cheaper than a paid keyword campaign over the long run.

Another benefit of branding is that CPCs costs are lower; in many cases a branded keyword is a 70% savings over the generic one. So with brand recognition not only is less of your traffic going to be coming from paid search engine marketing, but you will pay a lower unit cost on that smaller portion of traffic that still does come through SEM.

But this only works if people are discovering and searching for your brand in the first place. This is how brand advertising, like TV spots and digital display ads, can work in tandem to optimize performance advertising spend. It is also a distinct advantage that large corporations, with their greater ability to spend on brand marketing, hold over smaller companies and independent operators.

Own the Customer Relationship

Let’s also not forget that the cheapest way to acquire a customer is to make him or her a repeat guest. That takes the customer out of the Google funnel entirely.

It is important to market yourself and spend on Google and other advertising channels is unavoidable. But what can get lost in all of the technical conversation about click-through and conversations is that even with a world-class digital marketing team, if you cannot retain the customer, it just leaves you running on a hamster wheel, reacquiring the same customers over and over again.

Rémy Merckx, Vice President of Global Digital at Radisson Hotel Group, told us that he is “very happy to pay quite expensively a customer if it is a first time customer … But after that, we as a hotel company, we need to do the best job possible that these guys are coming back to us through one of our direct channels.”

Effectively, it is worth nearly any price to acquire a customer for life, the challenge is getting them to stick around.

Merckx emphasized the experiential nature of the travel industry and how brands need to use it as a selling point that differentiates them from their digital distributors and marketers. Guests will remember how you made them feel and that makes them want to come back or stay with you again.

“Have you ever seen on Facebook or on Instagram a picture, a screenshot of your booking on Booking.com or on Expedia saying ‘Wow. What an experience!?’” Merckx jokes, “But you have millions of pictures of our pools … or our beaches.”

In addition to a great guest experience, another powerful way to retain customers is, of course, through a loyalty program (though it should be emphasized retaining a customer through a loyalty program is still not free). Here the larger brands have an advantage in being able to implement comprehensive loyalty programs with wide-ranging networks.

Therefore, in our view, the growing prominence of Google as the first port of call for most would-be travelers in the U.S. skews the equation for many hoteliers towards brands of any sort — both traditional ‘hard’ brands and new ‘soft’ brands — and away from independent status.

In a Google world, brands have an advantage in generating more organic traffic, cheaper per-click paid traffic, a pooled war chest with which to spend on brand advertising, and loyalty programs designed to pry customers out of the all-encompassing Google funnel.

Though perhaps that is not entirely the case. It might be more accurate to say that in a Google world, brands have a cost advantage in terms of acquiring and retaining customers over independents.

This doesn’t necessarily put independent hotels out of business, but it does force them to be savvier online marketers than in the past and to emphasize their unique offerings, be it a historic property, wellness, or a six-star luxury experience. Google pushes independent brands towards the higher end of the market because those properties are better able to deliver the unique experiences that create repeat guests without a formal loyalty program and that inspire name recognition. It also means that because these properties charge higher room rates, they can afford to bid higher prices for customer acquisition online because the higher absolute price is still lower than what many OTAs would charge as a percentage of the daily rate.

This leaves low-end, unbranded independent hotels in a tough space. They do not charge high enough rates to justify expensive online customer acquisition costs or offer a differentiated enough product to retain repeat experiential business. That leaves them still reliant on the OTAs to do their marketing for them, further helping to ensure that the OTA business model, as discussed earlier, remains viable.

Despite not being a dedicated travel company, Google is still one of the most influential businesses in the entire industry. It’s influence is huge, interacting with nearly every part of the traveler journey. And that strong positioning is not going anywhere anytime soon; in fact its influence may even grow as newer product like Google Maps and YouTube continue to gain usage.

Travel execs cannot bury their head in the sand, but must instead face up to this challenge of how to Google-proof their businesses or, better yet, embrace Google as a powerful partner and tool.

Travel too, is a major part of Google’s business, making up perhaps as much as 10% of revenues of more. So this conversation should not be a one-way street. Google itself needs to listen to the wants and needs of the travel industry and adapt to those. Or else government regulators might step in and force them to change.

The conflicts and opportunities created by Google are not going anywhere and continue to evolve. We will continue to monitor this changing and crucial piece of the travel landscape.

Google search ads beat targets despite global 'uncertainty'

- Medium Text

SALES THREATS

Sign up here.

Reporting by Nivedita Balu in Bengaluru and Paresh Dave in Oakland, Calif. Editing by Anil D'Silva, Peter Henderson and Matthew Lewis

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Thomson Reuters

San Francisco Bay Area-based tech reporter covering Google and the rest of Alphabet Inc. Joined Reuters in 2017 after four years at the Los Angeles Times focused on the local tech industry.

Nivedita Balu is a correspondent for Reuters based in Toronto, where she reports on Canadian banks and financial services. She previously covered U.S. tech, media and telecom companies, and consumer and retail companies in Bengaluru.

Court blocks key part of California law on children's online safety

A U.S. appeals court on Friday left intact a key part of an injunction blocking a California law meant to shield children from online content that could harm them mentally or physically.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds Rates

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Stock Comparison

- Advanced Chart

- Currency Converter

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car insurance

- Mortgage Refinancing

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Financial Freestyle

- Capitol Gains

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Can online travel’s titans ever break free of google.

In our latest report , Skift Research estimates that the travel industry spent at least $8.9 billion on Google performance advertising in 2021. The search engine continues to be one of the most impactful players on all sectors of the travel industry with its role only growing due to the Covid-19.

We see five big open questions about the role of Google in travel that arose before and during the pandemic.

The Key Questions for Google and Metasearch

Can online travel agencies use the pandemic to reset their relationships with Google?

Can travel metasearch diversify away from booking site advertising?

Can Google bring hotel brands onto their metasearch platform?

Can travel-specific metasearch beat back Google?

What is the future of online travel in a Google world?

The below excerpt focuses on the first of these, exploring how major online travel agencies like Expedia Group, Booking Holdings, and Airbnb have changed their relationship with Google during the pandemic.

The full report dives deeper into the rest of these questions. It provides the full methodology for how we arrived at our estimate for travel industry spending on Google performance ads.

Can Online Travel Agencies Use the Pandemic to Reset Their Relationships with Google?

Expedia and Booking act as consolidators of, and clearinghouses for, marketing dollars throughout the travel space. This creates a scale advantage that few other travel suppliers can match and makes the booking sites critical partners for hotels and airlines, which can not otherwise afford to secure consumer traffic without being listed on a booking site.

While this model worked well in the early 2000s, even before the pandemic cracks were beginning to show. The big two online travel agency groups found themselves bidding for advertising space not against hotels and other suppliers, but against one another. This created a downward spiral where each tried to outspend the other, cutting into profit margins and lowering the returns for each dollar invested into ads.

This contest played out primarily on Google, much to the delight of its Silicon Valley executives. Expedia and Booking wound up relying on Google for traffic, ironically in much the same way that independent hotels were in turn relying upon the big booking sites.

In our view, for Expedia and Booking to grow long-term profits they need to cut their dependence on Google. And we believe that the pandemic offered a unique opportunity for these companies to do just that.

During the pandemic we have seen Expedia, Booking, and others cut their marketing spend to near nil. Covid-19 was a once-in-a-lifetime opportunity for a hard reset of Google advertising spend. OTA execs could build back up their marketing budgets in new and unique ways that reset their relationship with Google in a more productive way.

So, has that happened? Simply put: No.

Instead, with the rapid recovery of travel over the last six months, the floodgates of advertising spend have been thrown wide open again. We estimate that Expedia and Booking spent a combined $5 billion on advertising in 2021, up 98 percent vs. 2020 and 75 percent recovered vs. 2019.

The main reason that ad spending is not fully recovered is because OTA gross bookings and room nights sold have not yet returned to their pre-pandemic pace. But in common size terms relative to online travel revenue generated, the booking sites are back to their pre-pandemic levels of spending. Expedia spent 34% of revenue on advertising in 2021 (vs. 33 percent in 2019) and Booking spent 23 percent of revenue on ads (vs. 24 percent in 2019).

We take the fact that advertising as a share of revenue is the same today as it was pre-pandemic as a signal that Booking and Expedia are mostly going back to their old playbooks and we can expect marketing dollars to continue to grow in line with the OTAs’ revenue recovery.

We dug further into the online travel agencies’ advertising mix to explore how many of those dollars are flowing to Google. We started with Expedia Group and Booking Holdings’ disclosed marketing and advertising spend. We combined this with company filings from other metasearch companies, historical performance, and expert-informed assumptions to estimate how performance ad dollars are allocated at these sites. We found that Google’s importance to these two booking sites has increased during the pandemic. Details are discussed in the “How Big is Google Travel” section of this report.

We estimate that Expedia and Booking spent a combined $2.9 billion on Google performance advertising in 2021. That is 92% recovered vs the $3.1B of estimated Google ad spend in 2019.

However, as discussed above, the “big 2” OTA advertising budgets are not recovered relative to 2019. So for Google advertising to be so close to being fully recovered means that spend on the search platform has grown as a share of Expedia and Booking’s marketing budgets during the pandemic.

By our estimate, Google now accounts for 65 percent of performance advertising budgets, up from 53 percent pre-pandemic.

Data from SimilarWeb suggest that this growth in advertising is following the same tit-for-tat pattern that existed pre-Covid. Their analysis shows that Expedia and Booking both sharply accelerated spend on Google paid per click advertisements in the U.S. starting in spring of 2021. Expedia seems to have led the charge and Booking rapidly followed.

Rather than use the pandemic to wean themselves away from Google, it would seem the pandemic had the opposite effect. Expedia and Booking are more dependent on Google today than they were pre-pandemic.

This failure to capitalize on this opportunity is reinforced by the opposite actions of Airbnb. We estimate that at the short-term rental booking giant performance spend made up 57 percent of its total marketing budget pre-pandemic but has fallen to just 13 percent of its marketing budget today. Google was the primary recipient of Airbnb’s performance advertising spend. See our “How Big is Google in Travel” section below for more details.

Airbnb shows that it was possible to use the pandemic to rethink its customer acquisition strategy and to significantly cut reliance on Google, and performance advertising as a whole. In that context, the fact that Expedia and Booking saw the share of their budgets dedicated to Google grow during the crisis is all the more striking.

Let’s return to the initial question of this section: Can online travel agencies use the pandemic to reset their relationships with Google? To us, Airbnb is the exception that proves the rule. Few others seem to be following in Airbnb’s footsteps and we believe most online booking sites will remain reliant on Google for top of the funnel marketing post-pandemic. This sets up the search engine well to retain its dominant position in travel.

A Deep Dive Into Google’s Impact on Travel 2022

Purchase this report, or subscribe to Skift Research to read our latest analysis on the performance of the travel industry.

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.