Stroke Helpline

Monday to Friday: 9 am to 5 pm

Saturday: 10 am to 1 pm

Sunday: Closed

Supporter Relations

Saturday: Closed

- Professionals

Going on holiday after stroke

Holidays are an important part of life, and this guide can help you with holiday planning if you have a health condition or disability after a stroke.

The information on this page can be accessed in other formats:

- Download our PDF and large print Word document Holidays and stroke.

- Order your printed copy from our shop.

- Request a braille copy by emailing [email protected].

On this page:

Can I still go on holiday after a stroke? Types of holiday Flying after a stroke Do I need travel insurance? Travelling with medication

Can I still go on holiday after a stroke?

If you're thinking about getting away, there are various holiday options to choose from with different levels of support.

If a stroke has left you with mobility problems, you may prefer to book with a specialist travel agency that can arrange care and equipment for you. Some holiday packages also include an organised programme of activities, such as sports and outdoor activities or visits to local attractions, while others only offer accommodation so that you can do your own thing.

Coronavirus (COVID-19) and holidays

We know that holidays and travel may be affected by changing social distancing rules for some time. You need to check on the latest rules about your journey and destination before travelling.

If you are more vulnerable due to a health condition, you will need to follow the advice you are given to reduce your risk of infection.

Air travel after a stroke

People often ask whether it is safe to fly after a stroke. There is no hard and fast answer to this. Most airlines will not carry someone within days of a stroke, but the rules vary between airlines and countries.

In the weeks after a stroke you are at the highest risk of another stroke. So the most important thing is to get individual advice from your hospital or GP about the likely risks of travelling.

In the UK, the Civil Aviation Authority suggests waiting 10 days after a stroke before a flight. But if your condition is stable you may be able to fly after three days.

Each airline will have its own rules on flying with medical conditions, so you need to check with the airline before flying. You may be asked to provide a doctor's note or certificate.

Immediately after a stroke, you may need to attend check-ups and have medical treatment. The full effects of a stroke may take time to emerge. You might need help with these effects, and you might need to attend therapy sessions. So it's really important to get medical advice about your own situation before you travel.

If you have a stroke caused by a clot (ischaemic stroke) you will be given medication to reduce the risk of blood clots. This needs to be taken regularly to be effective. So you need to plan carefully before travelling to make sure you have the right medications with you, and that you take them at the right times.

Carry medication in both your hold bag and hand baggage, in case any of your luggage gets lost.

If you have a stroke while on holiday, you might need to take a flight to get back home. If you have medical insurance, your insurance company should give you help and advice on medical treatment and getting back home. You can also contact the local British Consulate, which can offer advice and practical support.

Travel and blood circulation

During a flight, the air pressure inside an aeroplane cabin is lower than it is on the ground. So when you fly, you have a bit less oxygen in your blood than normal. This may affect certain people with a heart problem or breathing condition, so ask your GP if this applies to you.

On a long flight, you are likely to be inactive for a period of time which makes you more likely to develop a deep vein thrombosis (DVT). A DVT is a blood clot in a vein, often in the leg.

The best way to reduce the risk of a DVT on any long journey is to drink plenty of water, and stay active. Simple exercises like flexing your ankles or walking around will improve your blood flow. Do this regularly during the journey.

If you have had a DVT in the past, and you don't take anti-coagulation medication, ask your GP for advice before a long journey.

Some travellers wear compression stockings during a flight. However, you should not wear these if you have peripheral artery disease (PAD). This condition reduces blood flow in your legs, so wearing the stockings can reduce blood flow too much. Ask your GP or pharmacist for individual advice.

Getting around the airport

All European airports should have facilities to help you move through the airport and get on and off the plane if you have reduced mobility. Airline crew are not able to provide personal care, and the airline may insist that you travel with a companion if you are unable to eat, understand safety briefings or reach emergency exits without help.

Most airlines will carry two items of mobility equipment for free. This should be in addition to your baggage allowance. If you have a wheelchair, it will be stored in the hold. You should tell your airline, travel agent or tour operator before you travel if you're taking a battery-powered wheelchair or mobility aid.

Contact the airline to discuss your requirements, and any additional help you will need on the flight, at least 48 hours in advance.

Do I need travel insurance?

It is important to have travel insurance, especially if you are going abroad.

Make sure you declare that you've had a stroke when arranging your insurance and check that you are fully covered. Many policies will exclude conditions that you had before you took out the policy (known as pre-existing medical conditions). This varies between policies, but it could mean that you would have to pay for any costs relating to these conditions. There are specialist travel insurers that provide cover for pre-existing conditions.

Specialist insurance from All Clear

The Stroke Association has a partnership with specialist medical travel insurer AllClear Travel, which provides comprehensive cover to stroke survivors. Find out more at our travel insurance page .

Global Health Insurance Card (GHIC)

The Global Health Insurance Card (GHIC) replaces the European Health Insurance Card (EHIC) for most people. Despite the name, it allows you to receive state-provided healthcare only in European countries. Treatment is at the local cost, or sometimes for free. It will cover your treatment until you return to the UK. It also covers the treatment of pre-existing medical conditions.

It won't cover certain costs, including the cost of returning you to the UK, so you still need to get private travel insurance as well.

How to apply

Visit the Global Health Insurance Card page on Gov.uk for full details of eligibility and a link to the free application page. A GHIC is free of charge. If you are charged a fee while applying online, leave the site, go to the NHS GHIC page .

European emergency number: 112

Dial 112 from anywhere in the UK or Europe to be connected to local emergency services.

Travelling with medication

If you carry medication or medical equipment such as syringes in your hand luggage, you should bring documentation like a doctor's letter. You should also carry a copy of your prescription. As well as helping you avoid any problems at airline security and customs, this will be useful if you need medical help while you're away.

Make sure you take enough medication with you in case you are unexpectedly delayed. If you are travelling across time zones, ask your pharmacist for advice about timing your medication.

It may be possible to take oxygen cylinders on board a plane. You need to contact the airline about this before you book.

Liquid medication

Current rules on liquids in hand luggage say that you can only take containers of up to 100ml. However, you can carry liquid medication of more than 100ml in hand luggage, as long as you have a doctors letter. Airport staff may need to open the containers to screen the liquids at the security point. For more information about this, contact the airline.

Check before you fly

Always contact the airline or travel company if you have any questions about health conditions or support for disabled travellers. There may be restrictions on taking medications into some countries or specific health advice on travel in a particular area.

Check beforehand with the embassy of the country you're travelling to, or check the government's foreign travel advice.

Related pages

Useful links.

Information Line: 0345 1307172

Travel insurance after a stroke, please note this article was created to promote our affiliate partnership with medical travel compared.

We regularly get asked about travel insurance. As stroke survivors ourselves we know how difficult it can be to find affordable insurance that covers you for the right things should you fall ill whilst on holiday.

We answer some of the common questions about travel insurance after a stroke below.

Can I get travel insurance after a stroke? Life after a stroke can feel very different to how it did before, but that doesn’t have to stop you doing what you love. While recovery is unique for every stroke survivor, the opportunity to get away from it all on a holiday or trip to another country can provide some much-needed relaxation and enjoyment (just make sure you have the all clear from your doctor before you travel).

The good news? You can get travel insurance that’s designed specifically for people who have had strokes. It’s just a case of finding the right cover for you, which is where Medical Travel Compared can help.

How to find the right cover We know that strokes come on suddenly and often without warning. So when you have a history of strokes or mini-strokes (TIA), it’s important you know that if one should happen while you’re away, you can get the medical help and support you need.

Without the right travel insurance policy in place, you could find yourself financially out of pocket due to expensive medical bills – not something you want to be worrying about in the lead up to – or during – your getaway.

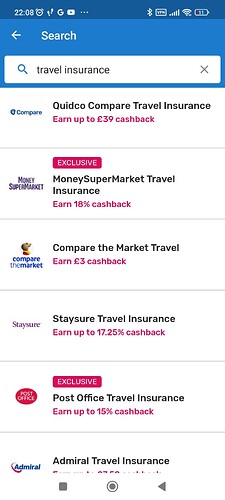

Medical Travel Compared can save you time and hassle searching for travel insurance on lots of different sites, by helping you compare relevant policies from over 40 leading insurers – all in one place. All they’ll need are a few details about your medical history and past strokes, so they can find the right cover options for you.

What will be covered? This will vary depending on the insurance provider, but you can usually expect to be covered for:

- Emergency medical expenses

- Repatriation

- Cancellation and curtailment

- Loss of medicine (including if it’s stolen)

How much will it cost? The cost of travel insurance for stroke survivors will vary depending on your medical history and the severity of any long-lasting symptoms you have. Generally speaking, if it’s been three months since your last stroke and your condition is stable, your premiums should be relatively low.

Find Out More

For every travel insurance policy bought via this page, Different Strokes will receive a donation. This will not affect the price you pay, so benefits stroke survivors through accessing appropriate travel insurance while earning important funds for Different Strokes.

My Neuro Survey

Everyone deserves access to the right care, treatment and support at the right time, no matter who you are or where you live. But too often this isn’t the case.

Please share your experiences and help improve services for everyone affected by neurological conditions now.

Celebrate Jim’s Birthday as he Raises Funds for Different Strokes

Jim has been an invaluable part of our community for over 17 years, bringing hope and support to many stroke survivors. This year, as he approaches his 70th birthday on July 26th, Jim is marking this milestone with a series of incredible fundraising challenges to support his local group.

Join Our Webinar: Understanding PFO Closures – Insights from Stroke Survivors

Join us to gain valuable insights from stroke survivors about their PFO closure procedures

Join us and meet other stroke survivors this September!

Join us at one of our “Living Beyond Stroke: Community and Connection” conferences, where we celebrate life after stroke and the importance of community.

Sovereign Health Care £2,500 Grant

We’re absolutely thrilled to share the wonderful news that Different Strokes has been awarded a generous grant of £2,500 to bolster our regional efforts in West Yorkshire.

Share your experience of post-stroke fatigue to help others

Different Strokes is looking to recruit volunteers for taking part in research in partnership with the Universities of Birmingham and Cambridge. This would involve being filmed talking about your experiences of post-stroke fatigue.

GET IN TOUCH

Information : 0345 1307172 Admin Line : 01908 317618

Email Us Different Strokes 9 Canon Harne tt Court Wolverton Mill Milton Keynes MK12 5NF

NEWS AND EVENTS

Reclaiming lives after stroke.

Telephone Hours

Opening hours.

- Mon-Fri: 8:30am - 8pm

- Sat: 9am - 5:30pm

- Sun: 10am - 5pm

- 28th August: 9am - 5pm

Stroke Travel Insurance

Travel Insurance for Stroke

If you are thinking of travelling abroad or within the UK following a stroke or transient ischaemic attack (TIA or mini-stroke), then let this AllClear guide to specialist medical travel insurance help you through the process. At AllClear we are committed to giving high-quality service to our customers, and our tailored, comprehensive travel insurance policies are especially designed to cover pre-existing medical conditions such as a stroke.

Regardless of your age we can provide 5-star cover for you and your travelling party. As long as the FCDO or the WHO are not advising against travelling to your chosen destination then we can get you covered.

AllClear Comprehensive Travel Insurance for Stroke or TIA (Mini-Stroke)

Each year in the UK, 100,000 people suffer from a stroke or TIA according to Stroke Association – that’s around one stroke every 5 minutes! And with over 1.2million stroke survivors in the UK, it’s vital that we can supply you with the kind of medical insurance cover that you need.

Following a stroke we understand that you might be hesitant to travel, so there’s a few things you might want to check before making your decision:

- You haven’t been advised not to travel by a medical professional

- Think about the destination you’re travelling to and if it is suitable for you regarding physical exertion etc

- If you feel that your destination is suitable and that you are confident to travel then you’ll need to have a suitable medical travel insurance policy in place before you leave the UK that will take care of any costs for emergency medical treatment abroad. That’s where AllClear can provide you with the added satisfaction of knowing that you have a 5-star comprehensive insurance policy in place that will protect you financially should you require any emergency treatment while away

If the worst happens while away abroad it’s bad enough that you are far from home, family and friends, so you don’t want the added pressure and worry about paying the costs of any emergency medical treatment you might require as a result of your stroke or TIA.

Medical expenses abroad can accumulate and be significantly costly. They can leave you or your loved ones with a life-changing debt to pay. Should you require medical transport back to the UK, this alone can be tens of thousands of pounds.

Our AllClear policies can cover you for emergency medical expenses, including repatriation, up to an unlimited amount. We can offer you cover for cancellation as well as personal property and a whole host of additional, optional extras to enhance and personalise your policy to suit your specific needs.

Do you need Travel Insurance for Stroke or TIA

With so many different things to consider and arrange when booking a holiday, it’s so easy to forget why we need travel insurance . Following a stroke, even if you go on holiday in the UK, you should have a medical travel insurance policy in place to protect you from things like cancellation or curtailment costs that might occur.

Should you or a travelling companion require medical transport repatriation back to your local area then this may not be covered by the NHS. When travelling outside of the UK it is simply essential to have medical travel insurance following a stroke/ TIA . If you have any other pre-existing medical conditions then they should also be covered by your insurance provider.

At AllClear, our insurance policies will cover up to unlimited costs of any emergency medical expenses. A study by The Independent found that a claim is made every minute by UK residents abroad . A comprehensive AllClear medical travel insurance policy can give you the cover you need to feel safe and secure within your travels following a stroke or TIA.

One policy for the Whole Family following a Stroke

Our 5-star rated AllClear policies are designed to cover singles, couples, families or even large groups. You don’t need to have separate policies if you are travelling with loved ones or friends. Let AllClear make it simple and easy and give all of your party the same policy, regardless of individual age or pre-existing medical conditions.

Get everyone covered in one place at the same time with a comprehensive medical travel insurance policy from AllClear.

How much will your Travel Insurance for Stroke or Mini-Stroke cost?

Your travel insurance policy premium will be based on any pre-existing medical conditions that you declare to start with. Then the cost of specific medical treatment in the country you are going to as well as the length of time you will be away for will also be contributing factors.

Any optional extras that you add to your policy to enhance it will also affect the final premium.

What if Your Stroke or TIA Was Many Years Ago?

If you still take any kind of prescribed medication as a result of having a stroke or transient ischaemic attack (TIA or mini-stroke) then you will still need to declare it on your insurance policy, no matter how long ago it was. This is so we can see that you are taking medication following the stroke and that may affect any treatment you receive while you’re away which can alter the costs.

Be sure to read our guide on travelling after a stroke .

Should You Talk to Your GP Before You Travel?

You may want to speak to your GP or medical practitioner if you are planning to travel following a stroke or mini-stroke. The air pressure inside of a plane is lower than we breathe on the ground level, which results in less oxygen being carried in your bloodstream. So let your doctor know you’ll be flying – in case you need any oxygen to be provided during your flight.

After a stroke, you’re at greater risk of developing a clot in the leg during a flight. Make sure you keep active on a flight to prevent clots, including standing up every 30 minutes or taking a walk along the plane.

In addition, it may be worth buying compression socks to wear during your flight. Consider booking seats with extra leg-room to make your journey as comfortable as possible. Or even arrange priority boarding. The aim is to make your trip as stress-free as possible.

All Clear Enhanced Cover and Optional Extras

At AllClear we have lots of ways to design your policy to suit your individual needs. Should you be going on a cruise or a skiing holiday, then we can offer you the specific cover you’ll require. Make sure you let us know of any specialist activities you are thinking of doing and we will let you know what cover you will need.

With a number of our optional extras available such as gadget cover , we are sure you will find the right policy with AllClear.

Cruise Holidays following a Stroke

If you are thinking of going on a cruise holiday following a stroke then it’s important that you have the correct and adequate cover in place before you travel. Should you require a medical helicopter to transport you to the nearest medical vicinity then you’ll need to ensure that your policy will cover that specific expense.

Add AllClear cruise insurance to your policy and travel safely and securely.

Golf Holidays following a Stroke

Thinking of going on a golf holiday following a stroke or TIA? We at AllClear have specialist golf travel insurance to give you that extra protection you will need. Add golf cover to your policy and enjoy a few rounds with 5-star insurance to cover your whole game.

Covid-19 and Stroke

Following a stroke or TIA, patients are more likely to contract pneumonia as a complication following a positive COVID-19 Coronavirus test result, according to Stroke Association . This means that we need to be extra cautious following a stroke/ TIA (mini stroke) Before we can offer you travel insurance we must have a few things checked:-

Are you fit to travel?

As long as you haven’t been advised not to travel by a medical professional then we are happy to give you a quote.

Are any Travel Restrictions in Place?

Providing that there are no current travel restrictions in place by the FCDO or the WHO then we are happy to offer you cover!

Does having a Stroke or Mini-Stroke Limit your Travel Ability?

Following a stroke you may find it more difficult to get travel insurance from your usual provider. That’s why you’ll need a specialist medical travel insurance provider to give you the cover you need. Wirth a medical specialist insurance provider like AllClear we will be able to offer you comprehensive medical travel insurance with a whole host of benefits so you can still enjoy your much-loved holidays away.

At AllClear we can offer you single trip cover with a maximum duration limit of 365 days or an annual multi trip policy, which will cover any amount of holidays you choose to go on during a 12 month period. We believe everyone deserves the right to travel following a stroke or mini-stroke.

What Should a Travel Insurance Policy for a Stroke or TIA Cover?

You’ll need to declare your stroke as well as any other pre-existing medical conditions you might have.

- Emergency medical expenses – cover for stroke/ TIA (mini stroke) and any emergency medical expenses

- Cancellation and curtailment – cover for the cancelation of your holiday and also for curtailment, should you have to come home early due to medical circumstances

- Baggage and Personal Property – Your passport, bags, personal possessions and cash can also be covered should they be lost, stolen or damaged while you’re away

- Gadget Cover – your medical travel insurance policy can also cover any gadgets and smart devices that you might need extra protection for

SWIPE TO COMPARE POLICIES

* If you buy a policy which includes cancellation cover. / All these figures are per person and per trip.

Simple 3 step quote process

1. call us or click a quote button on our site, 2. complete our simple medical screening process, 3. get your quotes, why choose all clear for stroke travel insurance.

We hope you have found this guide to travelling following a stroke helpful and we hope you can enjoy your travel plans in the future with a policy you can trust. So why choose AllClear for your medical travel insurance needs? We have been committed to giving the highest level of service and product for over 20 years and our customers have given us a 4.9 Trustpilot rating.

What our Customers Say

Here’s what a recent customer had to say:

We’re very proud to have been awarded many awards and accolades for our commitment to service, product and customer satisfaction. When you travel with AllClear you are travelling with a medical insurance provider specialist. So leave it in the hands of the experts and call AllClear today!

Written by: Letitia Smith | Travel Insurance Expert Last Updated: 6 August 2024

† Based on Trustpilot reviews of all companies in the Travel Insurance Company category that have over 70,000 reviews as of January 2024. AllClear Gold Plus achieved a Which? Best Buy.

Policy Wordings

Modern Slavery Statement

MaPS Travel Insurance Directory

Earn rewards by sharing with friends

- Get covered in 2 minutes

- 1,000's of medical conditions considered

- £10m medical cover

- 14 Day Cooling Off Period

Stroke Travel Insurance

Save 15%Ɨ online

Finding affordable travel insurance after a stroke can be daunting, but we’re here to help. There are over 1.2 million stroke survivors in the UK and more than 100,000 strokes happen every year – our aim is to make purchasing stroke travel insurance the easiest part of your trip.

What cover levels are available on travel insurance for stroke victims?

We pride ourselves on being medical travel insurance specialists. Cover for medical conditions is available on all of our policy types and we provide 100’s of policies for stroke victims each year. Cover levels includes:

Up to £10,000,000 for medical emergencies , such as:

- If you need emergency medical attention

- Hospital benefit

- Repatriation

- Mobility and disability equipment

As well as:

- Up to £5,000 cancellation and curtailment cover

- Up to £4,000 for lost, stolen or damaged possessions

- Up to £750 to cover your travel documents

- Up to £2,000,000 for personal liability

- Up to £50,000 for legal advice

Get A Quote

Why Choose Get Going?

Over 1000 medical conditions considered

24/7 emergency medical assistance team, £10m cover for emergency medical expenses, 93% of customers have rated us 4 or 5 stars $.

SAVE 15%Ɨ BUYING ONLINE!

Safe travel after a stroke

Experiencing a stroke is a difficult time for both you and your wider family. When you’re getting everything back on track, even if you’ve been left with mobility problems, you should be able to get away and have a holiday. There are plenty of tour operators that will specialise in offering a tailored package and it will be worth spending some time researching the right trip for you.

Once you have a holiday in mind, you need to get an adequate travel insurance policy. Use our bespoke medical screening process to get your quick quote . We won’t ever share your information with third party companies and your screening is entirely confidential.

- Before you travel, take the time to save the emergency assistance number in your phone and if you’re travelling with someone, in their phone too.

- If you are travelling with medication, always keep these in your hand luggage. Make sure that any medication is labelled accurately and has your full name on it.

- There are a number of things you can do travel safe after a stroke. Importantly, you should always consult your GP before travelling, they will be able to Offer you advice specific to your circumstances.

- Always keep your medication in your hand luggage and in it’s original packaging. It may also be wise to carry an original copy of your prescription, just in case.

- Before travelling make sure you have our emergency assistance number saved in your phone and written down.

- Also note down the details of our GP service, just in case you need to seek advice whilst abroad.

We offer up to £10,000,000 in case of any medical emergency you could face. This includes medical attention, emergency replacement of prescription medication, plus mobile and disability equipment.

We understand that whether you, a family member or close friend experiences a stroke, going away can feel more daunting, but we’re here to provide specialist cover so you have nothing to worry about.

Frequently Asked Questions

Getting travel insurance after a stroke may seem like it is going to take a lot more of your time and potentially a lot more of your spending budget! Get Going are medical travel insurance specialists. We consider and cover 1000’s of medical conditions every year and regularly provide travel insurance for stroke patients.

Applying for travel insurance after a stroke can stir concern that you’ll be faced with sky high premiums. Get Going provides extremely competitive premiums, even after medical conditions are declared, this is part of what makes us medical travel insurance specialists. The final cost of your policy will be dependent on your policy type, cover level, any additional extensions or activity packs and your final medical declaration.

The best travel insurance for stroke patients is one that is able to cater for your medical history. Once you have that part, you might then look for a policy that meets your cover level requirements and has all of your medical conditions accurately declared upon purchase. If your medical status changes between the time your purchase your insurance and the intended date of travel, give us a call and we can advise based on your new medical status.

What our customers say

Ms Bowditch

“Hi , I’m writing to let you know just how lovely your staff are. I had to phone yet again to alter my travel insurance due to the Corona virus, I spoke to a young lady called Monica this m... Ms Bowditch

Mr Phillips

“Very satisfied, I will contact you before our next holiday which we hope to arrange in September.” Mr Phillips

“Had to change holiday date and all completed with ease with a quick phone call. At NO EXTRA cost what a nice change well done.” Mr Reece

Mrs Tullock

“Unfortunately had to cancel cruise to Alaska due to husband’s sudden illness 6 days before due to go. Once I set the ball rolling for an insurance claim and received necessary document... Mrs Tullock

“I don’t normally leave feedback but after dealing with Paul I have to commend you on an excellent service. It was a pleasure to deal with a polite competent person who sorted out my qu... Mrs Arlett

ƗPlease note, Get Going ‘s online prices automatically include a 15% discount against our Customer Service Centre prices. This is discounted from our core policy price before you add any additional cost of optional extensions or additional medical premium.

$Get Going has been rated 4.7 out of 5 (Excellent) based on over 7000 customer reviews on Trustpilot. Based on Trustpilot data 2024

Stroke Travel Insurance

Compare cover from as little as £19.76*.

Tommy has over 15 years experience within the insurance industry, and his primary focus is helping travellers find the right cover for their medical conditions.

Can you get travel insurance if you have had a stroke or TIA?

Having a stroke should not prevent you from travelling abroad. Find out more about getting travel insurance after a stroke.

And, since there are more than 1.3 million stroke survivors in the UK , it’s a good job that there are plenty of specialist medical travel insurance providers who can cover people who have had a stroke or TIA (mini-stroke) in the past.

If you’ve had a stroke in the past, stroke travel insurance cover provides you peace of mind - knowing that should you become unwell or face a medical emergency on holiday, you’ll be taken care of. With multiple types of cover including single-trip and annual multi-trip insurance , you can tailor your insurance to suit you.

Specialist Medical Cover

We only work with providers who specialise in covering pre-existing conditions.

No discounts. No pressure. We’ll always show you the best prices from providers.

Declaring your condition

Even if you had a stroke a long time ago - it’s still important to declare it with us when comparing travel insurance.

Once you do, it’s likely that you might be asked a few questions, such as:

- How many strokes have you had?

- How long ago was your last stroke?

- Are you awaiting surgery for this condition or for any scans?

- Do you currently use any mobility aids?

- Have you had any transient ischaemic attacks (TIA) since your last stroke?

The answers you provide help insurance providers to determine the more specific nature of your condition, while getting a clearer insight into your medical background.

This helps them to offer you the appropriate insurance for you after a stroke when you start comparing quotes.

Top tips for travelling if you've had a stroke

Dr Sarah Jarvis is the Clinical Director of the Patient Platform, an active medical writer, broadcaster, and the resident doctor for BBC Radio 2.

Having had a stroke or TIA (sometimes called a 'mini stroke') doesn't automatically mean you can't go on holiday. But depending on how long ago your stroke was, and what symptoms you've been left with, you will need to take a few extra precautions to make sure your trip goes smoothly.

- If you've had a stroke in the past few months, check with your doctor whether they think it's safe for you to fly. You certainly shouldn't fly the first two to three weeks after a stroke – this is the time your problems are likely to be most severe and you're most likely to develop other issues related to your stroke. However, if your stroke was caused by a bleed into the brain (rather than the more common clot on the brain) you may need to wait longer.

- If you have mobility problems as a result of your stroke, consider booking with a travel agency that provides a range of activities tailored to your needs. They should also be able to offer options that have step-free access and are wheelchair accessible.

- It's very common to tire more easily if you've had a stroke. Take into account the length of travel involved in getting to your destination and consider booking trips that don't involve early morning or late-night transfers.

- If you've had a stroke, you're at higher risk of a clot on the leg (a deep vein thrombosis or DVT) that could travel to your lungs. Reduce the risk by doing simple exercises to keep your legs moving if you can (most airlines have examples in their in-flight magazines), avoiding alcohol and drinking plenty of non-alcoholic fluids. Speak to your doctor about whether elastic compression stockings might help.

For more tips check out my full guide here .

What does stroke travel insurance typically cover?

You can expect this type of cover to include the same things that a standard travel insurance policy would include - but you can also claim for stroke-related medical issues (whereas you otherwise wouldn’t be able to).

This will normally include:

- Lost, Stolen or Damaged Personal Belongings: Including any medication you need to treat your condition.

- Emergency Medical Expenses and Repatriation: Specifically including any stroke-related medical expenses incurred by emergency medical treatment.

- Cancellation and Curtailment: If you suddenly decide to cancel your trip or end up cutting it short.

- Travel Delay: This won’t always be included, check with your provider.

- Personal Liability: If you cause accidental damage to another person or someone else’s property - cover is provided.

You can compare this type of cover across a range of leading providers, click below to get started.

Optional extras

Also, feel free to add any optional extras that you need - such as gadget cover, cruise cover or winter sports cover.

This may increase your premium, but it’s definitely something to consider when shopping around, especially if you have different types of holidays planned.

- Gadget cover

- Cruise cover

- Winter sports cover

Get cheap quotes from specialist stroke travel insurance providers

Comparing quotes will make it much easier to find the right travel insurance policy to cover your medical conditions with pre-existing medical travel insurance.

We work with plenty of specialist providers, and once you tell us about your trip and medical condition(s) you’ll be able to compare competitive quotes, all in one place - saving you money and precious holiday-planning time.

Rated Excellent

Trusted by thousands of people like you who've reviewed us on Trustpilot.

No phone calls or paperwork. Join millions who've sorted cover online in minutes.

Frequently Asked Questions

With us you can compare specialist stroke travel insurance across a range of providers. Get a quote today and start comparing competitive cover before you embark on your trip.

Premiums vary depending on the nature of your condition - but it’s still possible to compare competitive quotes with us and find a suitable policy for a reasonable cost. Get a quote .

Although not as serious as a stroke, if you have had TIA, you should absolutely purchase travel insurance that covers this particular condition. If you don’t, then any problems caused or lasting symptoms from the TIA whilst you’re on holiday may not be covered by your policy – and you could be left out of pocket should you have to seek medical help on your trip. Get a quote .

Single Trip insurance is for one-off, individual trips and will cover your specified travel dates. This is usually up to 45 days; however, some insurance providers can cover up to 94 days. If you’re not a frequent traveller, single trip cover is a great option and will likely be cheaper than an annual multi-trip cover .

If you travel 2 or more times a year, annual trip cover may very well save you money. The maximum duration of any trip will always be specified and will vary by provider. But don't worry, when you get a quote, we'll ask you what your maximum trip length is and only show you quotes that match!

A pre-existing condition is a diagnosed medical condition that existed before taking out a policy. We'll ask a series of questions about the medical history for you and any travellers on your quote. If you answer yes to any of these, you will need to tell us about the traveller's conditions. This could be a condition that a traveller has now or has had in the past. If you are not sure what conditions you need to declare, we have online support available to help you 24/7!

* Price is based on 1 traveller aged 61, who has declared Stroke and is travelling to France for 7 nights. The price is correct as of July 2024. Prices may vary according to your individual requirements.

Trusted by people just like you

Don't just take our word for it...

If we're unable to help you find cover for a pre-existing medical condition , the Money Helper Directory has listings of companies that may be able to assist you. Further details can be found on their website.

Related Products

Single trip travel insurance.

Compare travel insurance for a specific trip, covering medical conditions and expenses. We'll search our specialist panel and show you prices from over 30 of the UK’s best travel insurance providers.

Annual Multi-Trip Travel Insurance

Taking more than one or two holidays a year? Compare annual multi-trip travel insurance from over 30 specialist insurers and save money whilst having peace of mind whilst you travel.

Travel Insurance for Cruises

If you're taking to the high seas for an adventure, make sure your policy includes specialist cover for cruises. Start your travel insurance comparison today.

Pre-existing Conditions

Save time and money on travel insurance for pre-existing medical conditions. Use our comparison tool to compare medical travel insurance cover.

Winter Sports & Ski Cover

When hitting the slopes, it pays to make sure your travel insurance includes cover for winter sports like skiing or snowboarding.

Check out our articles

Read the latest articles from our blog

We make finding specialist stroke travel insurance simple. Find the most suitable travel insurance provider for you, at the best prices! Compare today!

Sign up to receive regular updates

Get the latest news, advice, travel tips and destination inspiration straight to your inbox.

Oops, did you travel without insurance? We can get you back on track

Mon - Fri 9am - 8pm

Sat 9am - 4pm

Sun 10am - 4pm

- 0800 294 2969

- Single Trip Travel Insurance

- Annual Travel Insurance

- Cruise Travel Insurance

- Family Travel Insurance

- Staycations

- Winter Sports

- Business Travel Insurance

- School Trip Travel Insurance

- All No Upper Age Limit Travel Insurance >

- Car Insurance

- Home Insurance

- Smart Luggage

- Life Insurance

Specialist Travel Insurance with no upper age limit

- Angioplasty

- Atrial Fibrillation

- Cardiomyopathy

- High Blood Pressure

- Multiple Sclerosis

- Breast Cancer

- Skin Cancer

- Lung Cancer

- Prostate Cancer

- Crohn’s Disease

- Back Problems

- Osteoporosis

- Coronavirus

- South Africa

- All Africa Insurance >

- All Asia Insurance >

- The Dominican Republic

- All Caribbean Insurance >

- All Central America Insurance >

- All Europe Insurance >

- Puerto Rico

- All North America Insurance >

- New Zealand

- All Oceania Insurance >

- All South America Insurance >

- Get a Quote

- Airport Hotels & Parking

- Travel Money

- Travel Advice

- Working with Us

- Medical Advice Hub

- Brand Showcase

- Meet The Team

- Careers: Apprenticeship Scheme

- Amend your policy

- Your Questions Answered

- Make A Complaint

- Making a Claim

Travel Insurance for Strokes

Don’t let the fear of a stroke stop you from travelling. your travel insurance has you covered.

Travel can be a concerning prospect if you have had a stroke, and worrying about whether it will happen again is entirely normal. Strokes are a common medical issue for many people in the UK, with reports of a new case every five minutes .

With this in mind, it’s crucial to have a Travel Insurance plan that specifically addresses your needs, especially if you have suffered a stroke in the past or have a medical condition associated with strokes. Our specialised stroke Travel Insurance includes the medical cover you need, designed to give you confidence and peace of mind while you explore the world, ensuring you are well-protected in case of any health emergencies related to a stroke or any other declared medical condition.

Travel Insurance for Stroke Survivors

Our specialist insurers have extensive experience assisting customers in their quest for Travel Insurance that can protect them in the event of a stroke or TIA (mini-stroke) while abroad.

Don’t let the fear of a stroke or TIA stop you from enjoying your well-deserved trip! Getting stroke Travel Insurance that covers you for a stroke, TIA, or a declared medical condition that caused a past stroke, will help you prepare for a medical emergency while you’re on holiday.

Securing Stroke-Specific Travel Insurance: Finding the Right Policy

We aim to make finding Travel Insurance for a stroke or TIA easy by working with a range of insurers which specialise in covering pre-existing medical conditions , including post-stroke. Get a quote online, or if you prefer to speak with someone, contact one of our Travel Insurance specialists, who can help you find Travel Insurance for stroke victims over the phone.

When responding to medical screening questions, try to be as honest and accurate as possible. Once we receive your response, we will be able to scan our market accurately, understand the type of Travel Insurance you need for your pre-existing medical condition, and try to assist you in finding stroke Travel Insurance.

Enjoy Your Holiday with Peace of Mind

Once you have Travel Insurance that covers you for a stroke or TIA, you’re all set to enjoy your holiday. Whether that be lounging at a pool, exploring jungles, or hitting the ski slopes! Just make sure to select winter sports cover or activity pack B as an additional premium if you plan any exciting activities that aren’t included as standard.

Pre-Travel Tips for Stroke Survivors

There are other precautions you can take before travelling as a stroke survivor. Alongside making sure you have stroke Travel Insurance that covers you, we recommend that you speak with your doctor if you are unsure whether you are fit to travel. If you need a specific type of medication, make sure it is easily accessible while travelling. Additionally, getting a note from your GP stating that you need that medication to get through security with no unnecessary delays is a good idea.

Travel Insurance for Stroke FAQs

Frequently asked questions about Travel Insurance for Stroke.

Can I get Travel Insurance after I have had a stroke?

Travel Insurance policies are available for hundreds of pre-existing medical conditions, including strokes or TIA. Finding Travel Insurance that covers your specific situation is essential. Our Travel Insurance specialists are experienced in helping customers who have suffered from a stroke or TIA find stroke Travel Insurance that suits them.

Do I need to declare my stroke on my Travel Insurance?

If you do not declare a stroke or TIA with your insurance company, you could risk your Travel Insurance becoming void if a stroke-related medical issue were to occur while you are away. If you do not declare your stroke, you would not be covered if you had a stroke on holiday, but also anything related, such as a heart attack. To be fully prepared, make sure your Travel Insurance covers stroke or TIA.

Is a stroke a pre-existing condition?

A pre-existing medical condition is any illness or injury you had before taking out your Travel Insurance. If you have suffered from a stroke or TIA, this qualifies as a pre-existing medical condition.

Is Travel Insurance expensive after a stroke?

The average cost of Travel Insurance after a stroke or TIA may increase due to the potentially higher risk of needing to make a claim while travelling. However, it will also depend on your age, other medical history, where you’re going and for how long.

It also depends on how long ago your stroke was. As for full strokes, we will ask you if it was more or less than 3 months ago and how many strokes you have had in the last 6 months, which may affect the price.

Securing stroke Travel Insurance is vital as if something were to happen and you did not have adequate cover, you could end up paying out of pocket. We’ll compare prices from several insurers and offer bronze, silver and gold options on most policies. Secure your peace of mind.

Can you fly after a TIA (Transient Ischemic Attack) or Stroke?

Yes, you can generally fly after experiencing a TIA or stroke, but it’s essential to consult with your GP before making travel plans. The timing of your flight post-stroke or TIA will depend on your overall health, the severity of the episode, and any underlying medical conditions that might have contributed to the TIA. Your doctor will assess your situation and may recommend waiting a period before flying to ensure stability and manage any risks. You must declare these conditions as a pre-existing medical condition when securing Travel Insurance.

Do I need to inform my Travel Insurance company after a TIA?

Yes, you must inform your Travel Insurance company if you’ve had a TIA. Declaring a TIA is crucial because it’s considered a pre-existing medical condition. Not disclosing this information could invalidate your policy, leaving you without cover for any stroke-related medical issues while travelling or if you need to cancel your trip due to your condition. If you have already purchased your Travel Insurance and have suffered a TIA since, have spoken to your doctor and are still planning on travelling, you must update your policy. Informing your insurer allows them to provide a policy that accurately reflects your medical history and ensures you have the appropriate cover, should something happen.

Undiagnosed Medical Condition?

Do you have an undiagnosed medical condition or are you on a waiting list for treatment?

We may still be able to help you find Travel Insurance.

Travel Insurance for Strokes – Your Cover

- Cancellation/ curtailment up to £12,500 (£30,000 on referral)

- Missed departure up to £1,500 per person

- Baggage up to £3,000 per person

- Personal Liability up to £2 million per person

- Zero excess policies available

Medical Cover for Strokes

- Emergency medical expenses and repatriation up to £15 million

- 24/7 emergency medical assistance

- Cover for all types of Autoimmune Conditions

We Compare Prices From These Insurers

Compare Travel Insurance with medical conditions easily with us. We diligently compare various options, helping you find the best Travel Insurance with medical conditions tailored to your needs. Click here to download the Policy Wording and Insurance Product Information document for all insurers. In the event you are unable to find a suitable product from our panel of multiple providers, you can find contact details of some additional Insurers who specialise in travel insurance for people with serious medical conditions here , or call 0800 294 2969 for more information.

How do I know if my passport is valid?

Aug 12, 2024 | Blogs , Europe , FAQs

This blog contains information on travelling to Europe. For more information on travelling to Europe and for insurance, click here The rules around...

What are the new passport fees?

Jul 26, 2024 | Blogs , Europe

What are the new passport fees? As of the 11th of April 2024, the UK passport increased by 7% compared to last year. This announcement came...

10 Must-Sees in Berlin

Jun 18, 2024 | Blogs

If you've been watching Euro 2024 you will have seen Germany in all its glory. Whether you're a history buff, a nature lover or you're simply...

Compare prices in minutes

Copyright © 2023. Just Travel Cover

- Travel Tips Advice

- Compare Travel Insurance

- Pre-Existing Medical Conditions

- Holiday Home Insurance

Customer Services

- Opening Times

Victoria House, Toward Road, Sunderland, SR1 2QF

Call: 0800 294 2969

Monday - Thursday 9am - 6pm, Friday 9am - 5.30pm

Buy with Confidence

Secure Payments

UK Call Centre

Leading Broker

Justtravelcover.com is a trading style of Just Insurance Agents Limited, which is authorised and regulated by the Financial Conduct Authority (FCA) number 610022 for General Insurance Distribution activities. Registered in England. Company No 05399196, Victoria House, Toward Road, Sunderland SR1 2QF. Our services are covered by the Financial Ombudsman Service. If you cannot settle a complaint with us, eligible complainants may be entitled to refer it to the Financial Ombudsman Service for an independent assessment. The FOS Consumer Helpline is on 0800 023 4567 and their address is: Financial Ombudsman Service, Exchange Tower, London E14 9SR. Website: www.financial-ombudsman.org.uk/

Privacy Overview

HelloSafe » Travel Insurance » Medical Travel Insurances » Stroke Patients: Which Travel Insurance?

Stroke: Which Travel Insurance?

verified information

Information verified by Adeline Harmant

Our articles are written by experts in their fields (finance, trading, insurance etc.) whose signatures you will see at the beginning and at the end of each article. They are also systematically reviewed and corrected before each publication, and updated regularly.

Table of Contents

Do you have (or have you had) stroke and would like to get travel insurance for your coming trip in case you face medical expenses abroad?

Travel insurance that covers stroke treatment can be hard to find or very expensive. But you’ve come to the right place.

In this guide, we will explain everything you need to know about stroke travel insurance: is stroke travel insurance compulsory? What specific medical cover should you get if you have or have had stroke? What are the best stroke travel insurance companies and how much will you pay? Let’s dive in!

Why do I need travel insurance if I have (or have had) stroke?

Travel insurance for stroke patients is not compulsory.

However, you should know that your national healthcare cover, your European Health Insurance Card (if you are travelling in Europe), your credit card travel insurance or any other kind of assistance you would have as a country resident or citizen, may not be sufficient to cover any medical expenses you may have abroad.

Some countries may ask for valid proof of travel insurance to deliver visas, whether you have pre-existing medical conditions or not.

Much more than a nice-to-have, travel insurance is one of the highest value-for-money insurance products, especially for people with stroke.

A recent study from Which has shown that in around 10000 UK travellers in 2018, 64% of them have already had medical treatment while travelling abroad. The average spend of medical care abroad is around £1300. But it can be much more.

As a stroke sufferer, you may especially face expenses such as:

Travelling in Europe, what does my European Health Insurance Card cover?

As a current or former stroke sufferer, always remember that while travelling in Europe, your first ally is your EHIC card. Your EHIC card will cover for any treatment you may need abroad, including any treatment linked to a pre-existing stroke.

Remember that your EHIC will only cover you until 31/12/2020, the time of Brexit. Make sure you have both EHIC and travel insurance before travelling. Many insurers will ask you to get your EHIC if travelling in Europe, and would waive the excess if you have a valid card with you.

If you are going to Australia or New Zealand, the UK also has specific healthcare system cooperation programs.

For any specific information on the European Health Insurance Card, check out the NHS website .

Can I easily get travel insurance with or after stroke?

If you have been diagnosed with stroke, whether you are in remission or not, you may find it difficult to find cheap stroke travel insurance that will cover you for your trip without major exclusions.

Getting travel insurance after stroke can indeed be very time-consuming and you could end up paying three or four times the price people without a medical history would pay for a standard cover policy.

Unfortunately, insurers will see you as being at higher risk of making a claim such as:

- Cancelling your trip for reasons due to stroke, such as an important medical appointment being postponed

- Needing expensive medical treatment linked to your stroke while travelling abroad

- Needing repatriation to the UK.

We all agree that this is unfair, especially, for example, if you are in a very stable condition. But don’t worry, some insurers – fortunately – have agreed to cover people at higher risk. You could get travel insurance post stroke either through:

- Companies that will provide you with standard cover as they would do for any other tourist, but may invalidate any claim due to your treated stroke (if you are sure about your recovery and only need cover for a few days trip, for example);

- Or specialised travel insurance for stroke sufferers (or other existing medical conditions).

We are here to help you find the best and cheapest travel insurance after stroke surgery depending on your current medical condition, your age, the length and destination of your trip, etc.

What are the best travel insurance policies for stroke patients?

You will find below a list of specialist travel insurance policies for stroke patients – as well as for those with other pre-existing medical conditions – who will provide you with good cover and dedicated assistance.

All the above insurers are specialists in covering pre-existing medical conditions. Unless it is clearly mentioned in the features, they all use the Verisk screening system and apply a change in health disclosure in their policy which will allow them to inflate premiums and change or cancel your travel insurance policy if an unexpected event related to your healthcare occurs before your trip.

Find out more cheap travel insurance for stroke with our 100% anonymous tool.

Do I need to declare stroke for travel insurance?

You are required by law to declare any pre-existing medical condition when purchasing an insurance policy.

A pre-existing medical condition is typically one for which you have been diagnosed and have received treatment before you apply for any travel insurance policy, regardless of whether this is short- or long-term.

Therefore, stroke counts as a pre-existing medical condition. You are therefore required to declare your stroke to your insurer, whether you are in remission or not.

Good to know

Not disclosing your stroke could invalidate your claim as well as your entire travel insurance policy.

How does stroke screening for travel insurance work?

If you have stroke, or any pre-medical condition, you are more likely to be screened before applying for a policy.

On insurers’ websites, you’ll be asked to answer a set of questions administered most of the time by the Verisk medical screening system before getting quote results. Some insurers may have their own set of questions and may attribute their risk rating based on your answers.

Do you have or have you had stroke? Here is the list of questions you will most probably be asked to answer when purchasing travel insurance covering stroke:

The below list of screening questions is not exhaustive and may vary depending on your specific answer to each of the question.

Those questions are the most common ones you may find on insurer's websites. In the case that there is no screening system on an insurer’s website, you will need to disclose any health condition by contacting your insurer directly.

How much is stroke travel insurance?

Here are some indicative quotes for single trip and annual travel insurance for stroke patients:

* Quotes above are only indicative and for stroke with no recent complications.

It is quite difficult to give precise ranges of how much stroke care travel insurance is. Prices are based on a wide range of criteria and will not only depend on your pre-existing medical condition, but also:

- Your age and destination

- If you’re going for a single or annual multi-trip, as mentioned above

- If you’re subscribing to upgrades such as cruise, business or gadget cover

- The length of your stay abroad

- If you’re travelling alone, with your partner, a group or your family

- The financial limits you’d like to get in case of a claim

- The excess amount you’re willing to pay

- What you will be doing abroad (e.g. winter or extreme sports).

What is usually covered by stroke travel insurance?

Insurers covering a pre-existing medical condition such as stroke often provide a high compensation amount for trip cancellation, medical expenses and repatriation.

Here is a typical list of what you should pay attention to while applying for stroke travel insurance cover:

Besides compensation limits, you should also go for a company including specific healthcare upgrades as standard such as:

- Bespoke medical screening before applying for travel insurance : the possibility to easily talk to someone and find the right cover for your needs (especially for terminal illness)

- UK-based 24/7 assistance helpline while you’re abroad : dedicated free-of-charge landline to get healthcare advice and help in finding the right doctor or hospital abroad, reactive assistance, etc.

If you are about to make a medical claim while you are abroad, we advise you to get your insurer to accept it first and pay upfront. In the case you need to pay up front, always keep receipts and submit your claim as soon as possible.

What is not covered by stroke travel insurance?

That will vary from one insurer to another.

Besides the main exclusions usually found in insurers’ policy booklets (terrorism, strikes, natural disasters, claims related to drug, alcohol, etc.), regarding pre-existing travel insurance, your claim may be invalidated:

- If you are travelling without your doctor’s consent

- If you have been told you have a terminal illness and you have applied for travel insurance without saying so

- If you are waiting for a diagnosis or medical treatment at the time of applying.

Does travel insurance cover terminal stroke?

As said above, most insurers will not cover any terminal illness diagnosed, and therefore won’t cover incurable stroke.

However, we’ve come up with a list of companies still offering cover for people with terminal stroke depending on the length and destination of your trip, the stability of your medical condition and your doctor’s consent:

Most of the time, insurance companies will still ask you a minimum duration between your prognosis and your return travel date. You should also know that no insurer will cover you for your trip against your doctor’s consent.

What if I am diagnosed with stroke after having applied for travel insurance?

When it comes to medical condition travel insurance, insurers often add an ‘ongoing duty of disclosure’.

It basically means that if any important change related to your healthcare occurs after you applied for travel insurance policy, they have the right to either:

- Screen you again;

- Raise your premiums;

- Change your policy contract;

- Cancel your policy.

Most of the time, if your health condition changes, insurers will either:

- Provide you with new travel insurance for your new health condition with an additional fee;

- Provide you the same insurance but the new condition will be excluded;

- Or simply offer no cover, as they consider your condition too risky.

Ask for a pro rata refund or full refund if they cancel or change your policy before you make any claim.

Can you travel abroad with stroke?

The short answer is yes, of course.

However, here are some tips we would advise you to carefully read:

- Get your doctor’s consent and advice before travelling with past or current stroke.

- Get any vaccinations needed.

- Get the right stroke travel insurance for your trip, covering treatment linked to your disease and any medical care you may need abroad, and carefully read your policy booklet (exclusions, limits and deductible amounts, etc.)

- If you are not in remission, be sure that the trip will not be too much effort and not too tiring for your medical condition.

- Remain prudent and take with you your doctor’s phone numbers and local emergency contact details. If possible, travel with someone.

- Make a list of needed medication and keep them in their original packaging (for customs) and store them safely. Prepare back-up meds.

Top 5 tips to get cheaper travel insurance quotes for stroke victims

If you have or ever had stroke, here are some tips you may like to use to lower your insurance premiums:

- Use our comparison table to find out which companies are the best and the cheapest for stroke patients.

- Take your phone and try to speak to humans! If you have someone on the phone, they are more likely to understand your stroke medical situation and find you the appropriate cover.

- Go for single trip cover rather than annual multi-trip . You’ll be seen as a lower risk traveller as you will only need cover for a defined stay.

- Change your destination and opt for European trip rather than a roadtrip across the USA’s legendary Route 66! You’ll be less likely to make a very high medical care claim, which could see your premium go down.

- Benefit from a joint travel policy discount, insuring both your partner or family and yourself.

Alexandre Desoutter has been working as editor-in-chief and head of press relations at HelloSafe since June 2020. A graduate of Sciences Po Grenoble, he worked as a journalist for several years in French media, and continues to collaborate as a as a contributor to several publications. In this sense, his role leads him to carry out steering and support work with all HelloSafe editors and contributors so that the editorial line defined by the company is fully respected. and declined through the texts published daily on our platforms. As such, Alexandre is responsible for implementing and maintaining the strictest journalistic standards within the HelloSafe editorial staff, in order to guarantee the most accurate, up-to-date information on our platforms. and expert as possible. Alexandre has in particular undertaken for two years now the implementation of a system of systematic double-checking of all the articles published within the HelloSafe ecosystem, able to guarantee the highest quality of information.

Freephone our UK Team

0800 072 6778

Sales & Service

Monday to Friday: 8:30am to 8pm Saturday: 9am to 5:30pm Sunday: 10am to 5:00pm

Monday to Friday: 9am to 7pm Saturday: 9am to 5:30pm

Travel Insurance

Medical travel insurance, seniors travel insurance, europe travel insurance, worldwide travel insurance, coronavirus travel insurance, stroke travel insurance.

- Unlimited medical emergency expenses¹

- Up to £10K cancellation cover

- 24/7 emergency medical helpline

Covered 27 million+ travellers

Trusted for 20+ years

24/7 emergency helpline

Travel insurance after a stroke or TIA

We understand that insuring a medical condition can be a bit frustrating, and with around 100,000 people suffering from strokes every year in the UK , we want to make it as easy as possible for you to get travel insurance . So, if you or someone you care for has been affected by a stroke and are concerned about whether travel insurance will be able to cover you and your condition we may be able to help you, even if you’ve had trouble getting covered in the past.

A Transient Ischemic Attack (TIA), also called a mini-stroke, can affect your holiday plans as much as a stroke. Airlines have different policies on how long you should wait to fly after having a TIA or stroke, but most recommend waiting at least 10 days before getting on a plane for a TIA and 21 days if you’ve had a stroke.

Air travel is known to increase the chance of a stroke or pulmonary embolism. If you have an increased chance of suffering a stroke due to high blood pressure , remember to keep moving your legs regularly and wear flight socks on your journey.

One of the things that makes us stand out from the crowd is that we will consider all medical conditions , including strokes and TIAs! Simply contact us or get a quote online to go through our simple medical screening process.

What does stroke travel insurance cover?

If you have had a stroke or TIA, we’ll do our best to offer a policy that’s suited to your needs. Like all our policies, our travel insurance that covers you in the event of a stroke will include some great features as standard, including:

- Holiday cancellation cover

- Belongings and baggage cover

- Passport, money and documents cover

- Delayed departure cover

- Personal accident cover

- Accommodation cover

- Cover for over 50 sports and activities

- Medical and hospital expenses cover (including expenses related to any medical conditions you have declared and have been covered by us)

For more information on what’s covered with travel insurance for strokes and other medical conditions, have a read of our policy documents . If you have any other pre-existing medical conditions don’t worry, we will still consider you!

And if you still can’t find what you’re looking for, why not get in touch with us; we’ll try and help.

Please note: ‘TIA travel insurance’ is a general term for one of our standard travel insurance policies including cover for other health conditions, which is subject to medical screening and may require an additional premium. We don’t offer specialist cover for this specific condition.

*Discount excludes any premium generated to cover medical conditions or optional extras & is automatically applied. This offer cannot be used in conjunction with any other offer. Discount tiers of 5% for premiums between £0-49, 10% for £50-249, & 20% for £250+ apply. Offer ends at 23:59 on 02/09/24. T&Cs apply.

- Unlimited emergency medical expenses available on Black level policies.

- InsureandGo’s Gold achieved a Which? Best Buy.

- Home Medical Travel Advice Travelling After a Stroke

Travelling After a Stroke

Travel insurance | medication | destination, when to travel after a stroke.

Life after a stroke can be a struggle but people want to try and get back to their normal routine as soon as possible, part of which can be heading abroad on holiday for some much-needed relaxation.

However, buying travel insurance for your holiday after a mini or major stroke can be difficult – but it doesn’t have to be; we have put together everything you need to know about planning a post-stroke holiday and how to find the right travel insurance, that doesn’t cost the earth.

There is no set timeframe to travelling after a stroke as this will depend solely on both the severity and implications of the stroke. Generally, patients are advised not to travel within ten days of suffering a Transient Ischaemic Attack (Mini Stroke), but this can extend to three months or more following a Cerebrovascular Accident (Major Stroke). In all cases, you should consult your doctor about your travel plans before booking your holiday.

It is essential to not travel by air too soon after a stroke as it can be dangerous. When in flight there is less oxygen and it can be taxing on people who have a stroke, heart condition or respiratory condition.

You may be prescribed medication following your stroke, so ensure this is legal in the country you are travelling to as some medication which are prescribed in the UK are banned in other countries. Follow the medication link to read more on taking your medication abroad.

HOW A STROKE CAN AFFECT YOUR TRAVEL PLANS

Following a stroke, you may be left with reduced mobility, speech or sight impairments which could make travelling more difficult, but doesn’t mean you can’t travel. Provided your GP has confirmed it is safe for you to travel you can speak to your transport provider and ask for assistance to be arranged. Airlines, cruise ships and rail companies all offer these services, but they do have to be booked prior to your trip.

You may also be at higher risk of a DVT (deep vein thrombosis/blood clot). Whichever mode of transport you choose it is advisable to wear flight socks if you are going to be seated for long periods of time, and if possible, carry out small exercises in your seat to keep the blood moving. Drinking fluids to avoid becoming dehydrated will also help with blood flow.

Some destinations may be less practical after a stroke, so this will be something to consider when booking your holiday. Make sure the accommodation has the access you require and try to keep everything within walking distance so you don’t exert yourself too much. Depending on how soon after your stroke you are travelling, it is a good idea to consider the activities you will be undertaking and make sure you set a suitable itinerary. Run your plans past your GP first before booking them.

TRAVELLING AFTER A STROKE CHECKLIST

- Check that your doctor is happy for you to travel to your chosen destination and that your itinerary isn’t going to be too much too soon.

- Spend some time research travel insurance companies. There are medical specialists out there, quote prices and cover will vary between them so make sure you buy one that is suitable for your needs.

- Whilst we’re talking about travel insurance, make sure you check the medical excess. This will be applied against your declared medical condition and will only need to be paid if a claim is submitted related to the condition.

- Make sure you pack enough medication to allow for delays. Sometimes transport delays can be over 24 hours so you will need to ensure you have enough medication to allow for this.

- If you are taking medication abroad, speak to your GP and ask for a note confirming your condition, that you are fit to fly and the names of the medication you are taking.

- Once you have chosen your destination spend some time researching where the nearest public hospital and pharmacy is – just in case.

- Before you travel make a note of the policy reference number and travel insurance emergency contact number. It is also a good idea to leave these details with either the hotel or someone back home.

MORE ADVICE FOR TRAVELLING AFTER A STROKE

Before you go

Here are some more articles you might like:

Become an expert in all things travel with our monthly newsletter…

- About Stroke4Carers

- How to use this site

6) Holidays

Holidays should be enjoyable for everyone. When someone has had a stroke you may need to do more forward planning to ensure the trip goes smoothly from start to finish. Any extra planning will depend on how the stroke has affected the person. If they have to use a wheelchair for all or part of the journey, how often they will need a break, do they need to take other equipment or hire additional equipment at the destination. If it is a trip for a day, a weekend or a longer holiday here are some tips when planning and going on holiday.

Tips when planning and going on holiday

- Check facilities when you book . There are travel operators who specialise in holidays for people with disability. The more complex the person’s needs are the more carefully you need to check the facilities at the destination and on the journey.

- Take a note of the person’s medical conditions . If the person does become ill during the holiday you will have information to hand which will help the doctor in the place you are visiting.

- Ensure your vaccinations are up to date This includes the flu vaccination. Take any certificates with you.

- Check the accommodation thoroughly . Some hotel or brochure descriptions of “disabled access or facilities “may not be exactly what you are looking for. Bathrooms in particular can be very variable. Call the accommodation directly and speak to the manager or person in charge and explain what the person needs in terms of space, facilities and equipment. A travel agent or booking clerk will not know what you need.

- Bear in mind that most aircraft have poor access in toilets . Space is very restricted and no room if the person needs assistance. Consider the length of the flight and how long the person can realistically go without a bathroom break.

- Check access for electric powered scooters . Most train operators do not have access for electric powered scooters in passenger carriages.

- If you can - book assistance in advance . This will give you extra help at rail stations, airports or ferry crossings. Remember you will have to book assistance at each stage of the journey for example if you have to change trains.

- Electrical equipment check you have the correct adaptors for your destination.

- Take all your medication in your suitcases . If your luggage is delayed or goes missing you may have difficulty and expense getting replacements .Keep medications in your hand bag or carry on bag. For people who are also diabetic, it is possible to take insulin and needles on board aircraft if you have a doctor’s letter and put them in a separate bag. Some airlines will put your insulin in a cool fridge for the duration of the flight. Check in advance of travel.

- Take as many “home comforts” as you can . Take only what you need. If the person needs help to walk or use a wheelchair, who ever is assisting cannot also pull suitcases or carry bags. Clever packing also helps. Take only what you need and clothes which can be easily washed and dried without looking too creased.

- You don’t need travel or medical insurance . This could be an expensive mistake especially if you are travelling abroad. It may be wise to take out travel insurance even if you are travelling in the UK if you have to take expensive items of equipment with you, a wheelchair for example.If you have to cancel a holiday due to illness some insurance policies will refund the costs. Check with your policy

View Text Alternative

- If you can – book assistance in advance . This will give you extra help at rail stations, airports or ferry crossings. Remember you will have to book assistance at each stage of the journey for example if you have to change trains.

- Take all your medication in your suitcases . If your luggage is delayed or goes missing you may have difficulty and expense getting replacements. Keep medications in your hand bag or carry on bag. For people who are also diabetic, it is possible to take insulin and needles on board aircraft if you have a doctor’s letter and put them in a separate bag. Some airlines will put your insulin in a cool fridge for the duration of the flight. Check in advance of travel.

See Topic 3 Practical advice and tips for carers – Driving and transport alternatives/Transport for wheelchair users on this website.

Travel Insurance

Does anyone know a travel insurer specialising in people who have had a TIA or stroke?

Hi @PeterTS and welcome to the forum.

Travel insurance has come up before & you’ll fibd some recommendations at these links

Annual travel insurance

Travel insurance recommendations, please

As a starting point though I have used LV & RIAS. Stroke Association work with All Clear

And Different Stroke use medical travel compared.

Hope this helps.