- Home / Blog

- Package Deals

- All Inclusive Deals

- Flight Search

- From Other Cities

Thursday, August 22nd 2024

"I'm a travel junkie who's hooked on deals from YVR." - Chris Myden

Recent Posts

- • Vancouver to All Over Europe - $800s / $900s roundtrip | Sorted by Temperature (v2)

- • Vancouver to St. John's, Newfoundland - $333 to $375 CAD roundtrip including taxes

- • Vancouver to Rio de Janeiro, Brazil - $754 CAD roundtrip including taxes

- • Vancouver to Charlotte or Dallas - $235 to $277 CAD roundtrip including taxes

- • Vancouver to Tokyo, Japan - $679 to $899 CAD roundtrip [Nonstop Flights]

As Featured On...

Best travel sites - my picks, best local deals, other great sites, 2024 18 august vancouver to all over europe - $800s / $900s roundtrip | sorted by temperature (v2).

Lately there's been quite a few flights available in the $800s and low $900s roundtrip between Vancouver and Europe on a variety of different airlines including Air Canada, Lufthansa, Air France, and KLM.

A few destinations are available for September travel. Most destinations are available in October or November 2024 at the very least. Others can be found into winter and early spring 2025.

Below I've sorted the available destinations by the temperature (average high) one can expect in October or November, unless otherwise noted.

Availability for travel

September, October, November 2024

January, February, March 2025

How to find and book this deal

- Start with one of the following Google Flights searches:

Vancouver to Seville, Spain -- 26 Celsius in November

Vancouver to Alicante, Spain -- 25 Celsius in October

Vancouver to Palma de Mallorica, Spain -- 24 Celsius in October

Vancouver to Malaga, Spain -- 24 Celsius in October

Vancouver to Valencia, Spain -- 24 Celsius in October

Vancouver to Tenerife South, Canary Islands -- 23 Celsius in October

Vancouver to Faro, Portugal -- 23 Celsius in October

Vancouver to Ibiza, Spain -- 23 Celsius in October

Vancouver to Cagliari, Sardinia, Italy -- 22 Celsius in October

Vancouver to Rome, Italy -- 22 Celsius in October

Vancouver to Olbia, Sardinia, Italy -- 22 Celsius in October

Vancouver to Bari, Italy -- 21 Celsius in October

Vancouver to Bilbao, Spain -- 21 Celsius in October

Vancouver to Florence, Italy -- 21 Celsius in November

Vancouver to Marseille, France -- 21 Celsius in October

Vancouver to Luqa, Malta -- 20 Celsius in October

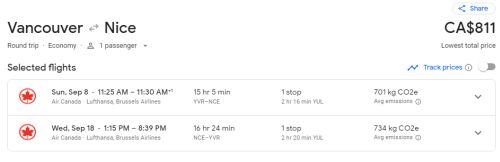

Vancouver to Nice, France -- 20 Celsius in October

Vancouver to Rome, Italy -- 20 Celsius in October

Vancouver to Madrid, Spain -- 19 Celsius in October

Vancouver to Split, Croatia -- 19 Celsius in October

Vancouver to Bordeaux, France -- 19 Celsius in October

Vancouver to Catania, Sardinia, Italy -- 19 Celsius in October

Vancouver to Valencia, Spain -- 19 Celsius in October

Vancouver to Naples, Italy -- 18 Celsius in October

Vancouver to Athens, Greece -- 18 Celsius in October

Vancouver to Venice, Italy -- 18 Celsius in October

Vancouver to Lyon, France -- 17 Celsius in October

Vancouver to Copenhagen, Denmark -- 16 Celsius in October

Vancouver to Zagreb, Croatia -- 16 Celsius in October

Vancouver to Florence, Italy -- 15 Celsius in October

Vancouver to Vienna, Austria -- 15 Celsius in October

Vancouver to Prague, Czech -- 14 Celsius in October

Vancouver to Edinburgh, Scotland -- 13 Celsius in October

Vancouver to Ljubljana, Slovenia -- 9 Celsius in October

Vancouver to Budapest, Hungary -- 5 Celsius in October

- Click on the departure date box to open up the calendar view.

- Browse for cheap date combos by adjusting the trip length at the bottom.

screenshot from Google Flights

Can't find this deal anymore? Prices change as deals sell out. The key is to be among the first to know when an amazing deal is posted.

Click here for tips on how to never miss a deal again.

Sign up for YVR Deals Alerts from Vancouver

Go to the Alerts Page to sign up for flight deal alerts by e-mail, Facebook, or Twitter.

Travellers from Vancouver also often sign up for alerts from Calgary and Toronto .

Join us in the YVR Deals Facebook Group

For live discussion of this deal, or to get some amazing travel advice (about anywhere) from your 107,000 fellow passengers in Vancouver, join us in the YVR Deals Facebook Group . ^^^ click the 'Join Group' button when you arrive.

Hit Like if you like this deal! Click Share to show your friends on Facebook.

2024 16 August Vancouver to St. John's, Newfoundland - $333 to $375 CAD roundtrip including taxes

2024 15 August Vancouver to Rio de Janeiro, Brazil - $754 CAD roundtrip including taxes

2024 13 August Vancouver to Charlotte or Dallas - $235 to $277 CAD roundtrip including taxes

2024 12 August Vancouver to Tokyo, Japan - $679 to $899 CAD roundtrip [Nonstop Flights]

2024 10 August Vancouver (or Victoria or Nanaimo) to Hawaii for under $359 CAD roundtrip including taxes | non-stop flights

2024 9 August Vancouver to Sydney, Australia - $982 CAD roundtrip including taxes

2024 8 August Vancouver to Paris, France - $586 to $650 CAD roundtrip including taxes [Off-Season]

2024 6 August Vancouver to Orlando, Florida - $339 CAD roundtrip including taxes [Nonstop Flights]

2024 5 August Vancouver to Montreal (or vice versa) - $219 to $256 CAD roundtrip including taxes [Nonstop Flights]

Next Page »

Keeping Up With The Deals

- YVR Deals Alerts

- @YVRdeals on Twitter

- YVR Deals Facebook Group

- YVR Deals Facebook Fan Page

- Blog Entries (RSS Feed)

- Blog Comments (RSS Feed)

- Privacy Policy

- Sitemap for Google

Other Sites

Abbotsford :: YXX Deals Calgary :: YYC Deals Charlottetown :: YYG Deals Comox :: YQQ Deals Deer Lake :: YDF Deals Edmonton :: YEG Deals Fort McMurray :: YMM Deals Grande Prairie :: YQU Deals Halifax :: YHZ Deals Hamilton :: YHM Deals Kamloops :: YKA Deals Kelowna :: YLW Deals London :: YXU Deals Moncton :: YQM Deals Montreal :: YUL Deals Ottawa :: YOW Deals Prince George :: YXS Deals Quebec City :: YQB Deals Regina :: YQR Deals Saint John :: YSJ Deals Saskatoon :: YXE Deals St. John's :: YYT Deals Thunder Bay :: YQT Deals Toronto :: YYZ Deals Victoria :: YYJ Deals Winnipeg :: YWG Deals

All Inclusive Vacations from Vancouver

Book all inclusive resort deals with Flight Centre for the best rates and even better customer care! Search and compare our expert travel agents’ top deals on resort vacations in Mexico, Jamaica, Dominican Republic, Cuba, Saint Lucia, Bahamas, Hawaii, Florida, and beyond!

CALL US TO BOOK

Choose from fantastic all inclusive packages offered by some of Canada’s favourite travel providers, like Air Canada Vacations , Transat Holidays , WestJet Vacations and more.

Last minute all inclusive trips, sell-off vacations and all inclusive deals? We’ve got those too. All inclusive resorts throughout the Caribbean, Mexico and Central America, many of which have been experienced first-hand by our agents, offer the ultimate value in beach holidays.

All of our all inclusive vacations come complete with direct or non-stop flights, roundtrip airport/resort transfers, accommodations in your selected room type, meals, drinks and snacks. Many all inclusive resorts also offer the complimentary use of non-motorized water sports equipment, daytime activities and nightly entertainment all included in your pre-paid package price.

Your all inclusive vacation package can be as short or as long as you like. Using both scheduled airlines as well as charter flights, we can tailor your trip based on your desired duration. From a quick long weekend sojourn to a proper two week or longer retreat, how long you stay is up to you.

Ahhh theres nothing like kicking back, umbrella cocktail in hand on the perfect beach, where the most difficult decision all week is which sites to see and where to dine. Sometimes life really is that easy.

Last-minute vacation packages from Vancouver

Are you in need of a great last-minute vacation packages from Vancouver? End your search here with WestJet Vacations, where you’re sure to find the perfect getaway. Our vacation package deals have been hand-picked to ensure our guests have a great experience – no matter when you book. Whether you’re looking to swoosh through powdery white snow or relax on soft-sand beaches, we have a package for you.

Vacation finder

Looking for a the ultimate getaway? We can help you find it.

Other available packages:

Cheap vacation packages

All-inclusive vacation packages

Why we’re Canada’s first choice

When you fly with WestJet, you’ll notice a team of dedicated WestJetters who work hard to provide affordable flights and getaways to great destinations. With us, you can always expect an extensive schedule, a state-of-the-art fleet and superior service. As a matter of fact, we have Canada’s best guest service and guest satisfaction ratings.† What a great reason to fly with WestJet for your next last-minute vacation packages from Vancouver.

Choose from hundreds of vacations, and be on your way to a great getaway before you know it. Book now!

† Based on a 2012 survey of Canadian vacationers by Leger Marketing, which found that WestJet Vacations was rated highest among the six most-used Canadian packaged vacation companies.

Search for great WestJet vacations

Find vacation packages from vancouver:.

- Adults-only

- Destination Wedding

- Spring Break

- Scuba Diving

- Your Profile

- Your Subscriptions

- Your Business

- Support Local News

- Payment History

- Sign up for Daily Headlines

- Sign up for Notifications

Travel Deals

Zipair flights: You can fly direct from Vancouver to Tokyo for $361

Deal alert: You can fly from Vancouver to Paris for $291

Deal alert: Air Canada and WestJet offer massive sales on Vancouver flights

Hot deal: You can fly direct from Vancouver to Hawaii for only $176

Sail from Vancouver to Hawaii on an ultra-luxury cruise for a steal

Zipair flights: Fly direct from Vancouver to Tokyo, Japan for $361

Sail to California from Vancouver on a 5-star cruise ship for a bargain

Hot deal: You can fly direct from L.A. to Vancouver for only $37

Deal alert: You can fly from Vancouver to Dublin for $336

Sail on a luxury cruise from Vancouver to Hawaii, Fiji, and Tahiti at a great value

Canada’s inflation rate fell to 2.5% in July, paving way for another BoC rate cut

The latest on inflation in canada.

Canada’s annual inflation rate fell to 2.5 per cent in July, largely driven by lower prices for travel tours, passenger vehicles and electricity.

It was the lowest inflation rate since March, 2021, and matched analyst expectations. It also brings consumer price growth even closer to the Bank of Canada’s 2-per-cent target.

The next Bank of Canada interest rate announcement on Sept. 4.

Further reading:

- Bank of Canada cuts key rate to 4.5%, tees up additional easing with focus on downside risks

- ‘Clear consensus’ among Bank of Canada policymakers on need for more rate cuts if inflation keeps easing

- Canadians are still making their mortgage payments – more so than Americans

- From pensions to health benefits, the absence of inflation indexing is making us poorer

- Calculate your personal inflation rate

Find updates from our reporters and columnists below.

What’s next?

There is not much happening between Tuesday’s inflation report and the next Bank of Canada rate announcement on Sept. 4.

Statistics Canada will publish numbers on retail spending on Friday, along with gross domestic product for the second quarter on Aug. 30. However, it’s unlikely that either would disrupt the central bank from further easing monetary policy next month, as is widely expected.

Interest rate swaps, which capture market expectations of monetary policy, are pricing in rate cuts at each of the next three announcements this year. That would take the bank’s benchmark interest rate to 3.75 per cent.

– Matt Lundy

Is price relief finally coming for rent costs and mortgage renewals?

In this photo taken by a drone, in the Kitsilano neighbourhood of Vancouver is pictured Monday, October 3, 2022. Officials with the City of Vancouver say eight people were taken to hospital after an early morning fire at an apartment building in the Kitsilano neighbourhood. THE CANADIAN PRESS/Jonathan Hayward JONATHAN HAYWARD/The Canadian Press

With the annual inflation rate slowing to 2.5 per cent, price relief is finally coming to where it matters most: shelter.

Even as the overall pace of inflation has been on a gradual downward path for over two years now – after reaching a peak of 8.1 per cent in June of 2022 – rents and mortgage interest costs have been stubbornly defying that trend.

If you bought shoes, clothing, a laundry machine or a new couch in recent months, there’s a chance you paid less than you would have a year ago. That’s because prices in all those categories have recorded year-over-year declines.

Used cars and trucks are another area where you might find deals, with prices down 5.7 per cent in July compared with the same month last summer.

But month after month, shelter costs – the biggest monthly outlay for most people – kept posting outsized gains. Now, that’s finally starting to change.

The best mortgage rates in Canada? We tested five websites in a head-to-head comparison

You won’t see any price declines yet in that component of the Consumer Price Index. In fact, mortgage interest costs were still up a hefty 21 per cent in July compared with the same time last year. Still, that was a smaller jump than the 22.3-per-cent increase Statistics Canada reported in June.

Expect more relief for homeowners renewing their mortgages, as the Bank of Canada continues to cut interest rates, with many economists expecting three more cuts this year. Declining rates soften the payment shock that awaits households who’ll be forgoing their rock-bottom, pandemic-era mortgage rates in the next couple of years.

There’s light at the end of the tunnel for those who have a landlord, rather than a mortgage, too. The rent index was up 8.5 per cent in July compared with the same month in 2023, down compared with an annual increase of 8.8 per cent in June.

That small decline masks some more meaningful gyrations in the rental market. Statistics Canada’s overall gauge of rents is a national measure that captures trends for both existing and new tenants. But the latest survey by rental platform Rentals.ca and housing analytics firm Urbanation, which focuses on what landlords are asking for available units, found that average rents were up a more modest 5.9 year-over-year in July.

And while advertised rents in places like Saskatchewan – one of the last outposts of affordability – are still posting double-digit annual increases, Vancouver and Toronto registered annual declines of 7.2 per cent and 4.6 per cent, respectively, according to the report.

– Erica Alini

Are U.S. rate cuts coming soon?

U.S. Federal Reserve Chair Jerome Powell holds a press conference following a two-day meeting of the Federal Open Market Committee on interest rate policy in Washington on July 31, 2024. Kevin Mohatt/Reuters

The U.S. economy seems to be in a sweet spot – and that’s an encouraging sign for Canada and its central bank.

Despite the market selloff earlier this month, the U.S. is not close to slipping into a recession, based on data that have inspired an equity rally in recent sessions. Meantime, the Bureau of Labor Statistics reported last week that the annual U.S. inflation rate fell to 2.9 per cent in July – the first reading below 3 per cent since early 2021.

The numbers suggest the U.S economy is slowing, but not to an alarming degree.

Still, this deceleration should allow the Federal Reserve to start the process of monetary policy easing soon. Money markets are pricing in the first quarter-point cut from the Fed at its next decision on Sept. 18, followed by several more cuts this year.

This scenario should alleviate some pressure on the Bank of Canada, which began to cut interest rates in June, prompting questions about how much the central bank could differ from its U.S. counterpart.

Bank of Canada Governor Tiff Macklem has said there is a limit to policy divergence, but that Canada isn’t close to it. And it doesn’t look as if the BoC will test that limit if the U.S. is about to cut rates.

Why does rate divergence matter? Because in this instance, it’s putting downward pressure on the Canadian dollar, which has various tradeoffs. For example, a weaker loonie could lead to stronger exports, but on the flip side, the cost of imported goods would be higher.

Here’s how economists are reacting to today’s inflation report

Here’s a snapshot of how some economists are reacting:

James Orlando, director and senior economist, TD Economics

Canadian inflation continues to ease, with headline and core rates stabilizing around the mid-2-per-cent level. When stripping out the impact of shelter inflation, price growth is a meagre 1.2 per cent y/y. Looking forward, the downward impact of base effects will continue to support lower inflation next month, pushing the headline figure even further towards the BoC’s target.

The BoC makes its next rate announcement in two weeks and there is nothing stopping the bank from cutting rates by another 25 basis points. With inflation risks fading, the central bank’s focus has pivoted to weakness in the rest of the economy. Indeed, consumer spending looks to have taken a breather alongside a steady deterioration in the jobs market. Given that the policy rate remains at restrictive levels, even after two rate cuts in June/July, there is plenty of room for the BoC to keep cutting over the rest of this year.

Olivia Cross, North America economist, Capital Economics

The softer monthly gains in the Bank of Canada’s preferred core price measures in July suggest that the previous two months reflected normal volatility rather than a stalling of the downward trend in core inflation. With core inflation on track to surprise to the downside of the bank’s latest forecasts, there is not much now that could derail another interest rate cut at the early September meeting. If anything, there is a growing possibility of a larger 50 bp cut later this year.

The 0.3 per cent m/m seasonally adjusted rise in the headline CPI was smaller than we expected and brought the headline rate down to 2.5 per cent. That downside surprise was helped by a much softer 0.3 per cent m/m rise in food prices, after some unusually strong gains in May and June. Shelter price gains also moderated, rising by just 0.2 per cent m/m in July. That was largely due to another soft rise in rent prices, which suggests that the slowdown in rent inflation is happening earlier than we initially expected.

Ultimately, the softer 0.1 per cent m/m average gain in CPI-trim and CPI-median shows that the disinflationary pressures in July were encouragingly broad-based. For now, the three-month annualized rate is still 2.7 per cent, down from 2.9 per cent, but if the recent momentum continues then core inflation would undershoot the bank’s forecast for the average of CPI-trim and CPI-median to be 2.5 per cent in the third quarter. While that alone is probably not enough to prompt the bank to cut interest rates by a larger 50bp, it does leave the door open for the bank to take a larger step later this year if there is additional weakness in the labour market or activity data.

Benjamin Reitzes, managing director, Canadian rates & macro strategist, BMO Capital Markets

The core inflation figures were very encouraging, with the Trim and Median CPIs both up 0.1 per cent m/m. That cut the yearly rates one-to-two ticks to 2.7 per cent and 2.4 per cent, respectively, the lowest since April, 2021. Short-term inflation metrics also headed in the right direction, with the three-month rates both easing to 2.7 per cent and six-month rates holding just above 2 per cent.

The July CPI report should further cement a 25 bp rate cut from the Bank of Canada in September. There’s no urgency for policymakers to act more aggressively at this point, but rate cuts will keep coming as inflation continues to move toward 2 per cent and the economy sports a sizable output gap.

Read the full roundup of economist and market reaction .

– Darcy Keith

Inflation highlights: Consumers see rent costs rise, car prices fall

A realtor's sign advertising a house as for sale or for rent is shown in Ottawa on June 9, 2023. Adrian Wyld/The Canadian Press

- July brought some moderation to core measures of inflation, which strip out volatile movements in the CPI. On a three-month annualized basis, the Bank of Canada’s preferred measures of core inflation rose by an average of 2.7 per cent in July, down from 2.9 per cent the previous month.

- “With core inflation on track to surprise to the downside of the Bank’s latest forecasts, there is not much now that could derail another interest rate cut at the early September meeting,” Olivia Cross, North America economist at Capital Economics, said in a client note.

- Rents are still an acute pressure. Those costs rose 8.5 per cent on an annual basis, down from the 8.8-per-cent pace in June.

- Consumers are seeing outright price declines in the vehicle industry. Prices for passenger vehicles fell 1.4 per cent in July from a year earlier. While prices are still rising for new vehicles, they fell 5.7 per cent for used cars. Statscan said that inventory levels have improved, relative to last year.

- From month to month, gasoline can swing widely in price. Those costs rose 2.4 per cent on a monthly basis in July. That followed a 3.1-per-cent drop in June.

- Grocery prices rose 2.1 per cent, year over year, in July, matching the increase that was seen in June. Adjusted for seasonality, food prices rose 0.3 per cent in July on a monthly basis, down from gains of 0.6 per cent in May and June.

July inflation data reinforces BoC shift in focus

Bank of Canada Governor Tiff Macklem participates in a news conference on the bank's interest rate announcement, and the release of the quarterly Monetary Policy Report, in Ottawa, on Wednesday, July 24, 2024. Justin Tang/The Canadian Press

At its last interest rate decision in July, there was a subtle but important shift at the Bank of Canada. Instead of focusing mainly on the risk of a rebound in inflation, the bank’s six-person governing council began putting more emphasis on downside risks to economic growth and the possibility that inflation may undershoot the bank’s 2-per-cent target on the way down.

There was little in the July inflation numbers, published today, that will make Governor Tiff Macklem and his team second-guess this pivot. The relatively benign reading – a year-over-year CPI increase of 2.5 per cent – shores up the argument for a third rate cut on Sept. 4 and bolsters the case for additional rate cuts in October and December.

Crucially, the BoC’s two favourite measures of core inflation, which capture underlying inflationary pressures, came in softer than expected. That’s after two months where core measures were trending higher on a three-month basis, creating concerns about renewed inflationary pressures.

With inflation clearly on track back to the bank’s target, the biggest question is how fast the Bank of Canada will move to bring borrowing costs back to a more normal level. The central bank is mum on the issue, although it has been sending dovish signals, which has bolstered market expectations about three more quarter-point cuts before the end of the year. That would bring the bank’s key rate to 3.75 per cent.

There is a growing case for a relatively brisk pace of monetary policy easing. Economic growth is slow, unemployment is on the rise and there are clear risks ahead with the wall of mortgage renewals coming up over the next two years.

This was top of mind for Canada’s central bankers when they met last month to decide on interest rates, according to a summary of the discussions .

“There is a risk that consumer spending could be significantly weaker than expected in 2025 and 2026 given the number of households likely to be renewing their mortgage at higher rates,” the summary said.

“With the emergence of slack in the labour market, some members expressed concern that further weakness in the labour market could delay the rebound in consumption, putting downward pressure on growth and inflation.”

Look for Mr. Macklem and senior deputy governor Carolyn Rogers to say more on this at the press conference after the Sept. 4 rate announcement.

– Mark Rendell

Opinion: Welcome back to more or less ‘normal’ inflation

Inflation is low enough now for the Bank of Canada to be comfortable about interest rate cuts, writes columnist Rob Carrick. Chris Wattie/Reuters

The average inflation rate over the past 40 years was 2.5 per cent, which is exactly where we are now. Welcome back to more or less “normal” inflation.

Inflation’s recent peak was 8.1 per cent in June, 2022. Compared with that outrageous level, we’re doing great. Inflation is low enough now for the Bank of Canada to be comfortable about interest rate cuts. Food and shelter inflation are still a concern, but they’re losing momentum. Gone is the sense of turning your back for even a minute and finding the price of your everyday purchases has shot up.

Not feeling the joy of lower inflation just yet? Two reasons stand out, the first being an overlay of economic malaise. The economy has been growing slowly – just enough, really, to avoid meeting the technical definition of recession. Unemployment has risen in 2024 and the consumer spending binge that followed pandemic lockdowns is done.

The second reason is that inflation permanently altered household personal finances for the worse. The share of after-tax income needed for groceries, rent and mortgage payments is higher. The cost of sending kids back to school is also higher. A survey by Capital One Canada found that parents expect to spend $861 more per child overall on costs like food, daycare and extracurriculars, clothing and travel this year compared with 2023. Most of the increase, which takes average spending to $7,709 from $6,848, is accounted for by food costs.

Wages have been rising well above the inflation rate – at a 5.2-per-cent clip in July compared with a year earlier. But the cumulative weight of four years of higher-than-normal inflation feels hard to carry. The load does not get lighter as inflation declines, but there is still good news for households.

Normal inflation means a normal economy, with more manageable interest rates for people with mortgages and other debts. It also means more predictability about the cost of living your life, or at least fewer of those unwelcome surprises in the grocery store and elsewhere.

– Rob Carrick

Here’s a list of July inflation rates for selected Canadian cities

Canada’s annual inflation rate was 2.5 per cent in July, Statistics Canada says. The agency also released rates for major cities, but cautioned that figures may have fluctuated widely because they are based on small statistical samples (previous month in brackets):

- St. John’s, N.L.: 2.3 per cent (2.8)

- Charlottetown-Summerside: 2.3 per cent (3.7)

- Halifax: 2.6 per cent (3.6)

- Saint John, N.B.: 2.7 per cent (2.6)

- Quebec City: 2.2 per cent (2.2)

- Montreal: 2.6 per cent (2.5)

- Ottawa: 2.4 per cent (2.7)

- Toronto: 3.1 per cent (3.4)

- Thunder Bay, Ont.: 2.7 per cent (1.6)

- Winnipeg: 2.0 per cent (1.5)

- Regina: 1.6 per cent (1.4)

- Saskatoon: 1.8 per cent (1.9)

- Edmonton: 2.4 per cent (2.7)

- Calgary: 2.9 per cent (3.6)

- Vancouver: 2.5 per cent (2.3)

- Victoria: 2.7 per cent (2.9)

- Whitehorse: 1.4 per cent (1.9)

- Yellowknife: 2.4 per cent (1.8)

- Iqaluit: 1.0 per cent (1.0)

– The Canadian Press

Here’s a list of July inflation rates for Canadian provinces

Canada’s annual inflation rate was 2.5 per cent in July, Statistics Canada says. Here’s what happened in the provinces (previous month in brackets):

- Newfoundland and Labrador: 2.1 per cent (2.3)

- Prince Edward Island: 2.0 per cent (3.4)

- Nova Scotia: 2.3 per cent (3.5)

- New Brunswick: 2.9 per cent (2.8)

- Quebec: 2.3 per cent (2.2)

- Ontario: 2.7 per cent (3.0)

- Manitoba: 1.8 per cent (1.4)

- Saskatchewan: 1.6 per cent (1.4)

- Alberta: 2.7 per cent (3.0)

- British Columbia: 2.8 per cent (2.6)

Money markets fully priced for third Bank of Canada rate cut in September

Market reaction to the CPI data was pretty subtle, as the numbers largely matched Street expectations. The Canadian dollar did dip – by about one-10th of a cent to 73.38 cents US – given the fresh numbers would appear to almost guarantee a third Bank of Canada rate cut come September. The Canada two-year bond yield, which is particularly sensitive to central bank policy, fell by a few basis points too, to 3.319 per cent.

How market bets for further BoC rate cuts have shifted after today’s inflation data

Money markets are fully priced for a rate cut on Sept. 4, and in the wake of the data, traders see some - but modest - chance of a large 50-basis-point cut at that meeting. Implied interest rate probabilities in swaps markets suggest a 96-per-cent chance of a 25-basis-point cut, and about a 4-per-cent chance of a 50-basis-point cut, according to LSEG data. Prior to today’s data, swaps pricing suggested less than a 1-per-cent chance of the larger 50-basis-point cut.

Money markets are also nearly fully pricing in additional rate cuts at the October and December Bank of Canada meetings, which would bring the overnight rate to 3.75 per cent by the end of this year. Looking further out, markets are priced for an overnight rate of 2.63 per cent by October, 2025 - almost a full two percentage points below current levels. Of course, a lot can happen between now and then - but markets for the moment are anticipating steady declines in the Bank of Canada rate well into next year.

The new inflation numbers

Canada’s headline inflation rate is continuing to slow, bringing consumer price growth closer to the Bank of Canada’s 2-per-cent target.

The Consumer Price Index rose at an annual rate of 2.5 per cent in July, down from 2.7 per cent in June, Statistics Canada said Tuesday. It was the lowest inflation rate since March, 2021, and matched analyst expectations.

Statscan said the deceleration was broad-based, with price declines seen for travel tours, cars and electricity. Adjusted for seasonality, consumer prices rose 0.3 per cent in July.

While shelter is a financial headwind for many households, those costs are moderating slightly. They rose at an annual 5.7 per cent in July, down from 6.2 per cent in June. Mortgage interest costs were up 21 per cent from a year ago, although this is slower than peak increases of roughly 30 per cent.

Before Tuesday’s report, economists and investors considered it a certainty that the Bank of Canada will cut interest rates for a third consecutive time in early September. There was nothing in the inflation report to alter the consensus thinking.

Bank of Canada Governor Tiff Macklem has stressed that the central bank is not on a “predetermined path,” but also that it’s “reasonable to expect further cuts” to its policy rate, which is currently at 4.5 per cent.

At the July rate announcement, Mr. Macklem highlighted the downside risks to the economy, comments that were interpreted as dovish by market watchers.

“We don’t need more excess supply,” he told a news conference. “We need growth to start picking up. We need job creation to start picking up, to absorb the excess supply in the economy and get inflation sustainably back to target.”

Canada’s inflation rate eased to 2.5% in July: Statscan

Canada’s annual inflation rate fell to 2.5 per cent in July from 2.7 per cent in June, Statistics Canada said on Tuesday. The reading matched estimates on Bay Street.

July inflation report to be released today

People attend a job and continuing education fair in Montreal, Thursday, Oct. 5, 2023. Christinne Muschi/The Canadian Press

Another month, another step closer to the Bank of Canada’s 2-per-cent inflation target. That’s what economists are expecting on Tuesday morning when the latest Consumer Price Index figures are released.

The consensus estimate from analysts is that annual CPI growth eased to 2.5 per cent in July from 2.7 per cent in June. This would mark the weakest reading for headline inflation since March, 2021.

On a month-to-month basis, consumer prices are expected to rise 0.4 per cent, with gasoline a notable contributor to the increase.

The inflation report precedes a probable interest rate cut from the Bank of Canada on Sept. 4. Money markets are pricing in a third consecutive quarter-point cut next month, which would take the central bank’s key lending rate to 4.25 per cent. Traders expect the BoC to lower rates at each of the remaining three decisions this year.

At the previous rate announcement in July , Bank of Canada Governor Tiff Macklem highlighted the downside risks to the economy – comments that were broadly interpreted by economists and investors as supportive of additional rate cuts in the near future.

“With the [inflation] target in sight and more excess supply in the economy, the downside risks are taking on increased weight in our monetary policy deliberations,” Mr. Macklem said at a press conference last month. “We need growth to pick up so inflation does not fall too much, even as we work to get inflation down to the 2-per-cent target.”

One area of weakness is the labour market. The unemployment rate has risen to 6.4 per cent as of July , nearly two percentage points higher than the record lows seen a couple summers ago. It’s taking longer for people to find work, and jobless rates have risen especially high among recent immigrants and young people.

Tuesday’s report has several areas worth watching. For example, rents have been rising sharply for quite a while, given pervasive shortages of housing throughout the country. And after a cooldown period, grocery prices have accelerated on a year-over-year basis for two consecutive months – bad news for shoppers looking to save on their grocery bills.

Report an editorial error

Report a technical issue

Editorial code of conduct

Follow related authors and topics

- Darcy Keith

- Rob Carrick

- Mark Rendell

- Erica Alini

- Bank of Canada

- Banking and Financial Services Industry

Authors and topics you follow will be added to your personal news feed in Following .

Interact with The Globe

COMMENTS

All Packaged Deals Top Best Bets. Las Vegas, Nevada. September 29-December 30 ... air, most transfers Ports: Vancouver, Los Angeles. from. $1129. from. $1129. Mexican Destinations; Los Cabos, Mexico. September 26, 2024 - January ... Travel Best Bets makes every effort to remain competitive by offering our 'Match or Beat Any Price' offer ...

from. $579 + $367 tax. Luxury Yacht Cruise: Greenland & The High Canadian Arctic. September 17, 2024 (Grand Veranda) 1 night hotel, airfare from Copenhagen to Kangerlussuaq, 16 nights all-inclusive cruise aboard Scenic Eclipse, meals and beverages on board, butler service, shore excursions, gratuities and transfers.

Select Travel Protection. This give flexibility to change or cancel your booking. Other wise it could be non refundable if you decline this option. Air Canada Vacations: Choose Careflex. West Jet Vacations: Choose Travel Protection. Sunwing: Choose Worry Free under insurance. Transat Holidays: Choose Option Flex - Extra for refund, standard ...

Vancouver's travel deal community. Find cheap flights, holiday packages, and all inclusive vacations from YVR. Featuring articles, guides, alerts, forums, discount promo codes, sales and more. ... Best Local Deals Travelzoo Vancouver Travelzoo Seattle; Other Great Sites Vancouver Deals Blog; 2024 15

Vancouver Last Minute Vacation Deals. Find all the best all inclusive vacation packages from Vancouver to great destinations like Cancun, Riviera Maya, Mexico, Cuba, Dominican Republic and more.At Escapes.ca we always offer the best prices on all inclusive vacation packages, flights and cruises.If you are planning a vacation from Vancouver, let us help you get the best deal along with the best ...

Sold and Serviced by Travel Best Bets [email protected] 1-877-523-7823. ... We're working hard to find you the best Flight and Hotel deals... 201-3011 Underhill Ave, , Burnaby, BC V5A3C2 Prices include the contribution of customers to the Compensation Fund for clients of Quebec travel agents. ...

The best vacation packages from Vancouver are closer than you think. Escape your routine with incredible all inclusive getaways. ... Book your travel deal today. ... Vancouver Cheap Vacations Showing results 1 - 10 of 42. Mgm Grand Hotel And Casino European Plan No Meals | studio king. Read 121 hotel reviews Las Vegas, United States ...

All Inclusive Vacations from Vancouver. Book all inclusive resort deals with Flight Centre for the best rates and even better customer care! Search and compare our expert travel agents' top deals on resort vacations in Mexico, Jamaica, Dominican Republic, Cuba, Saint Lucia, Bahamas, Hawaii, Florida, and beyond!

Oct 31, 2024 (7 days) Book with Deposit. was $2249 Save 48%. $1169 PP incl. taxes & fees. Continue. Vancouver Flight Deals. YVR Vancouver Flights - Find Cheap Flights from Vancouver, British Columbia, Canada. Whether it's Last Minute Flights from Vancouver or Hotel Deals in YVR you're looking for. Always get the Best Prices on Vancouver Flights ...

With us, you can always expect an extensive schedule, a state-of-the-art fleet and superior service. As a matter of fact, we have Canada's best guest service and guest satisfaction ratings.† What a great reason to fly with WestJet for your next all-inclusive vacation packages from Vancouver.

Travel Best Bets - Make Your Holidays Happen. Packages. As Seen On TV; Asia & Africa; ... Check out our new page called 'As Seen On TV' under Packages. Anaheim, California. September 30-December 31, 2024 Air and 4 ... 2024 20 nights cruise aboard Eurodam Ports: Vancouver, Santa Barbara, San Diego, Puerto Vallarta, Huatulco, Puerto ...

What a great reason to fly with WestJet for your next last-minute vacation packages from Vancouver. Choose from hundreds of vacations, and be on your way to a great getaway before you know it. Book now! † Based on a 2012 survey of Canadian vacationers by Leger Marketing, which found that WestJet Vacations was rated highest among the six most ...

Hot deal: You can fly direct from L.A. to Vancouver for only $37. Flair Airlines flights are priced considerably lower than the competition. Jul 29, 2024 2:19 PM Read more >.

She is the founder and owner of Travel Best Bets, one of the largest agencies in Canada and the best-selling author of Travel Best Bets - An Insider's Guide to Taking Your Best Trips, Ever. She has appeared in top broadcast and print media throughout U.S. and Canada over the last 22 years, including Canada's Global TV network, NBC's ...

8. Vancouver to Las Vegas ($132 roundtrip) Oh, Vegas! A city where neon dreams come alive and wallets often feel the adrenaline just as much as hearts. If you're flipping through the list of cheap places to fly from Vancouver, then Las Vegas dazzles as a glitzy contender.

Jan 2024 • Friends. Last month, I returned from a most memorable bucket list trip booked through Travel Best Bets. However, my pre-tour experience to book the trip with this travel agency was less than satisfactory. I was initially attracted by one of their many well advertised travel deals which prompted me to inquire further about a safari ...

Book and save with cheap vacation deals from Vancouver (YVR). Escapes.ca has the best all inclusive vacation deals at the lowest prices guaranteed! From Mexico to Las Vegas to Hawaii and beyond, we are Vancouver's vacation specialists! Mexico: Visualize yourself enjoying a cool cocktail while relaxing on the fine sands of Cancun, Riviera Maya ...

All Cruise Deals Top Best Bets. Pacific Northwest Cruise. April 22, 2025 4 nights ... Glacier Viewing (Stikine Icecap), Skagway, Juneau, Ketchikan, Vancouver Rates in USD. Family Travel! from. $1499 + $258 tax. from. ... Travel Best Bets makes every effort to remain competitive by offering our 'Match or Beat Any Price' offer however due to ...

Best Prices for Vacation Packages To Las Vegas From Vancouver. - per person incl. taxes. Aria Resort 469. Bellagio 547. Caesars Palace 423. Circa Resort and Casino 594. Circus Circus 325. Conrad Las Vegas at Resorts World 582. Delano Las Vegas 434.

Inclusions. Round trip airfare to Puerto Vallarta. 7 nights all-inclusive hotel. Round trip transfers from airport to hotel and hotel to airport. Vancouver, Calgary, Edmonton. Oct 5,20,27,Dec 8,11,15 from $965 + $500 tax ( Riu Jalisco; 4.5-star) Oct 5,20,27 from $1135 + $500 tax ( Riu Vallarta; 5-star) Oct 5,20,27 from $1345 + $500 tax ( Riu ...

Travel Deals ; Search. Search Hello BC for activities, events, places and more ... Travel Best Bets Accessibility. This business has self-assessed as having the following accessible attributes. Please contact the business directly for further detail if required. ... 510 Burrard Street, Vancouver, BC, V6C 3A8, Canada. [email protected ...

November 1-December 13, 2024. Air, 7 or 14 nights all-inclusive hotel and transfers. from. $975 + $500 tax. Flights Departing from: Vancouver Calgary Edmonton Show All. Mexican Destinations. Los Cabos, Mexico. September 26, 2024 - January 18, 2025. Air, 7 or 14 nights all inclusive hotel and transfers.

Canada's annual inflation rate fell to 2.5 per cent in July, largely driven by lower prices for travel tours, passenger vehicles and electricity. It was the lowest inflation rate since March ...

Jan 2024 • Friends. Last month, I returned from a most memorable bucket list trip booked through Travel Best Bets. However, my pre-tour experience to book the trip with this travel agency was less than satisfactory. I was initially attracted by one of their many well advertised travel deals which prompted me to inquire further about a safari ...