Phuket leads to tourism recovery by year-end 2023

Friday, March 24, 2023 Favorite

Thailand’s leading resort island of Phuket’s post-pandemic tourism recovery has been headlined by a surge in Russian travellers in the high season.

But the backstory is how a spike in regional visitors from India, Malaysia, and Singapore set the stage in Q4 of last year that pushed hotels and the service sector back into action.

Data on hotel Phuket hotel performance in C9 Hotelworks’ newly released Phuket Hotel Market Update 2023 shows how the industry escalated after Thailand lifted travel restrictions at the beginning of October 2022.

The influx of tourists propelled market-wide occupancy for the year to 48%, up year-on-year from a COVID-19-impacted low of 8% in 2021.

While Phuket’s winter high season which is November through to March has seen a return of the island’s traditional ‘snowbird’ visitors from Northern Europe and Scandinavia, the main mover has been Russia and a handful of other Eastern European countries.

Despite limited direct airlift due to a backdrop of economic sanctions by the EU and airfares which have in many cases risen by 200-300%, the Russians indeed came.

Though numbers were sharply down compared to the nearly one million count in 2019, stays increased from a normal average of 11 days, and rose by over 50%.

Speaking about the impact of the Eastern European markets on the island C9 Hotelworks Managing Director Bill Barnett said the arrival of tourists from Russia not only created a spark in economic recovery for hotel and tourism businesses but radiated into retail, transportation, and real estate.

The segment is now the most active direct foreign investment (FDI) leader in Phuket’s booming property market.

A knock-on effect has been also seen on land prices across the island which are growing at their high rates in over two decades.

Looking inside the numbers and key trends in Phuket’s hospitality industry, C9’s research points to a broader overall movement of hotel owners converting from management agreements to franchises and also changes in brands.

Two recent notable deals has seen the Destination Group inking agreements with InterContinental Hotels Group (IHG) for two Holiday Inn properties and two with Radisson.

Additionally, one of the island’s largest hotels, the Arcadia has been reflagged as a Pullman under ACCOR, and Thailand’s hospitality giant AWC (Asset World Corporation) have made public plans to upgrade and convert the Westin Siray Bay into a luxury resort branded to Ritz-Carlton.

Citing the conversions C9’ Bill Barnett commented this is a sign of maturity for Thai hotel owners who are experienced enough to operate but look for distribution and brand value in a franchise scenario.

This practice is prevalent in North America and Europe so it was only a matter of time until Asia caught up.

They expect to see more changes in brands for the remainder of 2023 and beyond, given many hotel agreements signed in the early millennium tourism boom years are set to expire.

Despite positive economic indicators, the reality on the ground is evident everywhere in the stress placed on Phuket’s transportation infrastructure.

Population growth, development spread to inland areas and skyrocketing tourism demand has created a massive traffic problem.

The clearest example was when a landslide closed an important thoroughfare between the popular Patong tourist area and its central island feeder road.

Delays in repairs caused a domino effect in access to west coast hotels in peak season and demonstrated how fragile the island’s transportation network is.

Reflecting on the potential return of mass tourism to Phuket, C9’s Bill Barnett who has lived and worked from Phuket for over 20 years said the lack of a dedicated tourism master plan for the island is a key long-term issue that much is resolved.

With airport flights and passenger flow mounting they can clearly see how important the new Phang Nga airport is, though the site remains inactive.

This goes for the expressway and Patong tunnel projects that are in essence a lifeline for the island’s future growth.

They punched the card of urbanization already and with nearly 100,000 registered hotel rooms on the island we’ve done too far to go back.

Subscribe to our Newsletters

« Back to Page

Related Posts

- GCC fuels strong recovery of inbound tourism to Japan

- Chicago’s record tourism numbers in first half of 2023

- Chinese airlines beefs up to increase capacity for May Day holiday travels

- Travel demand persists for Latin America, but recession and hotel supply growth loom

- Unvaccinated passengers may start cruising in Australia as early as April 23

Tags: COVID-19 PCR , InterContinental Hotels Group (IHG) , Phuket tourism , Thailand Tourism , Tourism boom , tourism businesses , tourism recovery

Select Your Language

I want to receive travel news and trade event update from Travel And Tour World. I have read Travel And Tour World's Privacy Notice .

REGIONAL NEWS

Condor Announces Soaring Fleet Modernization with Addition of Airbus A320neo

Wednesday, May 1, 2024

Belgium Steps into Spotlight with Antwerp Hosting 2027 World Tunnel Congress

Asian American and Native Hawaiian/Pacific Islander Heritage Month in Seattle

Air Canada Drops Seat Selection Fee After Breakthrough Passenger Outcry

Middle east.

Saudi Arabia’s Future Hospitality Summit Goes Digital, Sets New Global Sta

UAE Weather Department Issues Warning as Dust Storms Threaten Popular Western De

AirAsia Announces Flight Disruptions to Kuching, Sibu, and Bintulu Due to Mount

AirAsia Expands Its Reach with Launch of New Airline in Cambodia

Upcoming shows.

Apr 29 April 29 - May 1 Global Restaurant Investment Forum (GRIF) Find out more » Apr 29 April 29 - May 1 FUTURE HOSPITALITY SUMMIT Find out more » May 01 May 1 - May 2 ABTA: Travel Law Seminar 2024 Find out more » May 01 May 1 - May 2 AHICE Asia Pacific 2024 Find out more »

Privacy Overview

Government has huge plans to turn Phuket into a world-class tourism hub

The Thai government plans to invest heavily in transforming Phuket into a world-class tourism hub, according to thansettakij.com news website.

Prime Minister Srettha Thavisin's team visited Phuket and Phang Nga for the second time on September 29, just a month after their initial visit on August 25-26. This signals a clear commitment to expedite various projects with a budget in trillions of baht, aiming to elevate Phuket to a global city, stimulate tourism, and become a centre for spreading prosperity to the Andaman region, Thansettakij reported.

The strategy to elevate Phuket to a global city in the 2023-27 Provincial Development Plan focuses on diversifying the local economy, and not relying solely on tourism as in the past. Before the Covid-19 pandemic in 2019, Phuket had welcomed 14.5 million foreign tourists, generating revenue of 422 billion baht, ranking second after Bangkok. The province's gross domestic product was 251 billion baht. However, the pandemic inflicted a severe blow on Phuket, as 97% of its revenue came from tourism. Although tourism in Phuket is expected to recover rapidly and potentially reach 100% recovery in 2024, the lessons learned from Covid-19 led to a shift in Phuket's tourism strategy.

The five-year plan focuses on seven key objectives to generate new income for Phuket:

1. Become a global culinary hub (city of gastronomy)

2. Be a centre for global health and medical tourism (medical & wellness hub)

3. Sports tourism development (sport tourism)

4. Be an international education hub

5. Create value through digital technology (smart city)

6. Become a hub for marine tourism (marina hub)

7. Be a centre for processing and trading tuna in the Asean region, as well as generate revenue from MICE (meetings, incentives, conferences and exhibitions) activities.

Additionally, the plan aims to promote wellness tourism under the Andaman International Health and Wellness Centre project, a collaboration between the International Health College, Songklanagarind Hospital (Phuket), and the Digital Dental Center of Songklanagarind. The project received a budget approval of 5.1 billion baht on October 11, 2022, with an urgent need to expedite the allocation of funds for the project, Thansettakij said.

Infrastructure development plays a crucial role in achieving these goals. Prime Minister Srettha has been continuously overseeing the acceleration of the transportation infrastructure development plan, which includes seven projects with a combined investment of 148 billion baht, both short-term and long-term, focusing on promoting Andaman tourism.

One of the urgent projects is the "new city - Koh Kaew island - Patong tunnel project”. The budget for this project is 14.67 billion baht, divided into land and construction costs of 5 billion baht and tunnel construction costs of 8.89 billion baht.

The project was initially open to private sector participation, but due to lack of interest the government has decided to invest in the civil works portion of the project. The government will coordinate this project with the "new city - Koh Kaew - Kathu" expressway project, which has been studied, designed, and is currently undergoing legal procedures. This project will require a budget of approximately 35 billion baht to address traffic issues, Thansettakij reported.

Projects related to the handling capacity of three Andaman coast airports include:

1. Expanding the Phuket International Airport (2nd phase). This project will increase the airport’s capacity to handle passengers from 12.5 million to 18 million people a year. An investment of 6.21 billion baht is required, and it is expected to be completed by 2027.

2. Expanding the Krabi International Airport. This project focuses on increasing passenger capacity to 17 million people annually, from the current 5 million with an investment of 2.7 billion baht.

3. Construction of Phang Nga International Airport. Also known as Andaman International Airport, this project is located in Tambon Kok Kloy, Amphur Takua Thung, Phang Nga province, covering an area of about 2,372 acres. It involves diverting a significant portion of the land previously used for government purposes. The airport is designed to handle 40 million passengers a year and requires an investment of 80 billion baht. According to the plan, land expropriation will be completed within 18 months. Airports of Thailand Plc is expected to take approximately seven years to construct the airport.

This comprehensive plan aims to transform Phuket into a diversified and sustainable economy, not solely reliant on tourism, ensuring long-term economic stability for the province, Thansettakij said.

Phuket tourism revs up, 12 million arrivals expected this year

PM Srettha in Phuket to discuss airport expansion and tourism stimulus

New government focused on boosting tourism to stimulate economy: Srettha

Phuket continues to draw Russian tourists, investors

Phuket pushes new government to give priority to tourism

Thailand Dispatch

Phuket Was Poised for Tourism Comeback. A Covid Surge Dashed Those Hopes.

Phuket, one of Thailand’s top tourist havens, had an ambitious plan to reopen to the world this summer. But with a spike in cases, the island’s desperate situation is unlikely to end anytime soon.

Bars and nightclubs at Patong Beach on Phuket Island in Thailand have been ordered closed because of a recent Covid-19 outbreak. Credit...

Supported by

- Share full article

By Hannah Beech

Photographs by Adam Dean

- April 25, 2021

PHUKET, Thailand — Around the corner from the teeth-whitening clinic and the tattoo parlor with offerings in Russian, Hebrew and Chinese, near the outdoor eatery with indifferent fried rice meant to fuel sunburned tourists or tired go-go dancers, the Hooters sign has lost its H.

The sign, in that unmistakable orange cartoon font, now simply reads, “ooters.”

Like so much at Patong Beach, the sleazy epicenter of sybaritic Thailand, Hooters is “temporarily closed.” Other establishments around the beach, on Phuket Island, are more firmly shuttered, their metal grills and padlocks rusted or their contents ripped out, down to the fixtures, leaving only the carcasses of a tourism industry ravaged by the coronavirus epidemic.

The sun, which usually draws 15 million people to Phuket each year, stays unforgiving in a downturn. The rays bleach “For Rent” signs on secluded villas and scorch greens on untended golf courses. They lay bare the emptiness of Patong streets where tuk-tuk drivers once prowled, doubling as touts for snorkeling trips or peep shows or Thai massages.

Only a few weeks ago, Phuket seemed poised for a comeback. After a year of practically no foreign tourists arriving in Thailand, the national government decided that Phuket would start welcoming vaccinated visitors in July, without requiring them to go through quarantine. The project was called Phuket Sandbox.

But Thailand is now gripped by its worst Covid-19 outbreak since the pandemic began, spread in part by well-heeled Thais who partied in Phuket and Bangkok with no social distancing. The confirmed daily caseload — albeit low by global standards — has increased from 26 on April 1 to more than 2,000 three weeks later, this in a country that had about 4,000 total cases in early December.

For months, Thailand’s strict quarantines, lockdowns, border vigilance and rigorous use of masks kept the virus at bay , although the economy suffered. But even as the last couple of weeks have brought repeated daily caseload highs, the Thai government is reacting slowly.

In early April, as cases began to mount, Prime Minister Prayuth Chan-ocha reacted with a verbal shrug.

“Whatever happens, happens,” he said.

Desperate to resuscitate its tourism sector, Phuket, which had shut its airport during a Covid spike last year, continued to allow people in this spring on domestic flights, even as cases reached record highs. Only on Thursday did the local authorities start requiring Covid-19 screening for those arriving on the island.

“If you ask me how optimistic I am, I cannot say,” said Nanthasiri Ronnasiri, the director of the tourism authority’s Phuket office. “The situation changes all the time.”

On April 18, Thailand’s tourism minister acknowledged that a July 1 opening for Phuket looked unlikely given that the plan depended on Covid being squelched in Thailand.

To prepare for Phuket Sandbox, the Thai government funneled many of its limited number of vaccines to the island, in hopes of achieving herd immunity by the summer. As of mid-April, more than 20 percent of Phuket’s residents had been vaccinated. Nationwide, only about 1 percent of the population has received the needed doses.

“I am very relieved,” said Suttirak Chaisawat, a grocery store worker who received his Sinovac vaccine this month at a resort repurposed for mass inoculations. “We all need some hope for Phuket.”

While the vaccinations may have given Mr. Suttirak some optimism, the present picture remains grim.

Normally at this time of year, Patong Beach’s golden sands would be heaving with foreign holidaymakers.

But the beach is now almost deserted, save for a clutch of residents lining up for Covid tests at a mobile medical unit. Up the road, a monitor lizard, a creature more crocodile than newt, lumbered across the tarmac, with little traffic to impede its crossing.

Phuket’s half-built condominium complexes are being reclaimed by nature, always a battle in the tropics but a lost cause when developer money dries up. Billboards for “Exclusive Dream Holiday Home” are stained by mildew and monsoon mud.

The Thai New Year period this month was supposed to be a dress rehearsal for Phuket’s revival. Rather than foreign backpackers or business conference attendees, hotels tried to lure high-end Thai tourists who, were it not for the pandemic, might have decamped overseas for skiing in Hokkaido, Japan, or shopping in Paris.

But instead of prepping the island for its return as a global tourist haven, the Thai New Year may have wrecked the island’s chances for a July reopening.

At festivals in Patong and at other beaches this month, thousands of affluent Thais partied, fewer masks in evidence than bikini tops. For some in Thailand’s high society, Covid was seen as something that might infect vegetable sellers or shrimp peelers, not thejet set.

But then these beach revelers started testing positive, the virus spreading from luxe Bangkok nightclubs to Phuket.

The virus’s resurgence after so many months of economic hardship is shattering for the majority of Phuket’s residents, who depend on foreign tourists for their livelihoods.

As a 3-year-old elephant munched on sugar cane nearby, Jaturaphit Jandarot swung slowly in his hammock. There was little else to do.

Before the pandemic, he and the other elephant handlers on the outskirts of Patong used to lead more than 100 tourists a day, mostly from China, on 30-minute rides. Now there are no visitors.

“I was super excited to hear they are going to open Phuket for foreign tourists,” Mr. Jaturaphit said. “Thai people don’t ride elephants.”

Whatever the state of international travel, the elephants still need to be fed. Each month, a dozen beasts consume at least $2,000 worth of sugar cane, pineapples and bananas. The 3-year-old, little more than a toddler in elephant years, eats as much as the adults.

After Phuket’s tin and rubber industries declined, tourism grew from a few bungalows on Patong Beach in the 1970s to a global phenomenon, attracting golfers, clubbers, yachters, sex tourists and Scandinavian snow birds.

Much of Phuket’s high-end accommodation is clustered near the beach town of Bang Tao, a placid Muslim-majority community where placards for upscale wine bars mix with Arabic signs for Islamic schools.

Phuket’s largest mosque is in Bang Tao, and this year the first day of Ramadan coincided with the beginning of the Thai New Year festivities, an auspicious augur after a year of economic hardship. The night before fasting was to begin, worshipers streamed to the mosque. Women chopped shrimp, banana flowers and armfuls of herbs for the feasting to come.

But at the last minute, the Phuket authorities called off mass prayers for fear of the virus’s spread. Iftar, the breaking of the fast, is taking place in homes, not at the mosque.

As the local authorities traced Covid-19 cases on the island to the upscale beach parties, residents of Bang Tao grew frustrated.

“We want to welcome people to Phuket, of course, but when they don’t protect themselves and they bring Covid here, I’m a little bit angry,” said Huda Panan, a primary-school teacher who lives behind the mosque.

Ms. Huda’s husband is a taxi driver, but he hasn’t worked for more than a year. Most of the mosque’s community depended on tourism, working as concierges, cleaners, landscapers and water-sports guides. Now, some locals sell dried fish and scavenge the hills for a fruit used to add pucker to a local curry — whatever they can do to survive.

On occasion, Buddhist temples, churches and mosques in Phuket distribute meals to the hungry. Lines are long. The food runs out.

“We can wait a little longer for Phuket to get better,” Ms. Huda said in the heat of the day as the daily fast grew long. “But not much more.”

Muktita Suhartono contributed reporting from Bangkok.

Hannah Beech has been the Southeast Asia bureau chief since 2017, based in Bangkok. Before joining The Times, she reported for Time magazine for 20 years from bases in Shanghai, Beijing, Bangkok and Hong Kong. More about Hannah Beech

Advertisement

Copy this text to your clipboard and paste into your CMS

The timeline of Thailand’s tourism recovery

One year after the launch of the Phuket Sandbox, on 1 July 2021, Thailand is spearheading South East Asia’s tourism recovery. It has been a challenging and politicized 12 months, and several uncertainties remain for the travel industry.

A mask-wearing army general waving at tourists inside Phuket International Airport was among the most surreal images of the Covid-19 era.

On 1 July 2021, Thailand’s Prime Minister, General Prayut Chan-o-cha, greeted the first foreign arrivals in the Phuket Sandbox scheme. Those disembarking carried with them the hopes of the tourism industry after nearly 16 months of pandemic shutdown.

A year on from tourism reopening around Thailand and South East Asia, how are things looking? Photo by Mikk Tõnissoo on Unsplash

The pathway for Thailand to become the first South East Asian nation to reopen for tourism since the border closures in March 2020 had been politically arduous. The Prime Minister now cheered the first phase of his plan to reopen the entire country by the end of October.

Special Tourism Visa

Covid-19 arrived early in Thailand. On 13 January 2020, it became the first country outside China to confirm a case. By March, the government had declared a state of emergency. Strict travel bans were imposed. Tourism activity evaporated.

Thailand subsequently controlled the first wave of the pandemic. Between May and September, it went 102 days without a locally transmitted case.

This success emboldened an attempt to stimulate long-stay travel with the Special Tourist Visa. Introduced in October 2020, it coincided with tight travel restrictions in Thailand’s key Asian markets and widespread concerns about the safety of flying.

The Special Tourist Visa quickly faded from view, but over the next 9 months Thailand stepped up efforts to restore inbound tourism and breathe life into its stagnating economy.

Airports in Thailand have been seeing an increase of tourists as different travel schemes have been trialled. Photo by Markus Winkler on Unsplash

Covid-19 Tourism Economics

In 2019, Thailand was South East Asia’s most visited country, attracting 39.8 million visitors – more than double the 19.2 million visitors in 2011. Tourist spending expanded accordingly.

Tourism contributed 12 percent of GDP in 2019, and employed 20 percent of the workforce. The magnitude of those figures is highlighted by Thailand having the second-largest economy in South East Asia, after Indonesia.

Then came Covid-19. With its borders closed, Thailand’s 2.3 percent economic growth in 2019 was followed by a -6.1 percent reverse in 2020. It was the nation’s steepest economic downturn since the Asian financial crisis in 1998.

Restoring tourism, which generated foreign exchange and tax revenues for the government and provided jobs and a route out of poverty for many people, became a priority.

These factors explain the ensuing politicisation of tourism, with the Prime Minister playing a highly visible role to reopen the airport gates. It also explains why he led the chorus of greetings for passengers on Phuket’s first international flight since March 2020.

The Phuket Sandbox

The task of restoring Thai tourism was bestowed on the Phuket Sandbox, which was pieced together across several months by the government, health officials and the tourism board. Although heavily criticised for being too complicated and bureaucratic, the Phuket Sandbox will be remembered as an important landmark for South East Asia’s travel industry.

The Phuket Sandbox scheme became a landmark in South East Asia's reopening, allowing visitors to return. Photo by Miltiadis Fragkidis on Unsplash

Phuket was selected to host a pilot tourism scheme for four reasons: It is an island isolated from Thailand’s majority population. Phuket has an airport and a strong medical infrastructure. Plus, it is an established tourist destination, having received 10.5 million visitors in 2019.

Under the Phuket Sandbox, vaccinated foreign tourists from 66 countries were permitted to visit Phuket without undertaking a formal quarantine. Visitors were required to stay on the island for 14 days in an accredited hotel before taking a Covid-19 test. A negative result unlocked onward travel in Thailand.

A couple of weeks later the Samui Plus programme enabled the islands of Koh Samui, Koh Pha Ngan and Koh Tao to operate a Sandbox scheme, albeit with slightly different rules.

7 + 7 Extension

One month later, the “Phuket Sandbox 7 + 7 Extension” began. Under this model, travellers spending seven days in Phuket could relocate to eight other island destinations – including Koh Samui, Koh Phi Phi and Ko Pha Ngan – to complete the second seven days of their mandatory 14-day stay before travelling elsewhere in Thailand.

Although the Phuket Sandbox generated global hype, arrival numbers were underwhelming. In July 2021, the first month of the scheme, 18,060 visitors arrived. Over the next three months, the Phuket Sandbox welcomed just 47,610 visitors.

Tourists complained about the administrative burden and the confusing components of the Sandbox. Controversially, vaccinated Thai travellers were initially excluded from the scheme.

Meanwhile, Thailand was experiencing its first surge of Covid-19 infections, which peaked at 22,782 daily cases on 12 August 2021. The Delta variant was also scything through South East Asia, and the likelihood of attracting regional tourists receded.

It was time for a rethink.

Despite the evident flaws of the Phuket Sandbox, the concept was seized upon by other South East Asian governments as the Delta Wave began to subside.

Indonesia accelerated its vaccine programme on the island of Bali, although its reopening was delayed until March 2022. Langkawi in Malaysia and Phu Quoc in Vietnam hosted pilot Sandbox schemes for vaccinated travellers. Although visitor numbers were subdued, both projects enabled airports and tourism authorities to test new health and safety protocols. This paved the way for Vietnam and Malaysia to reopen a few months later in April 2022.

Test & Go

Thailand chose a different route. On 1 November 2021, the Test & Go scheme was introduced. Vaccinated visitors were required to pre-apply for a Thailand Pass, by submitting various documents online, including proof of vaccination. Upon approval, a one-night stay needed to be pre-booked (and pre-paid) at a specified hotel to await the result of an on-arrival PCR test. If the test was negative, travellers were free to explore Thailand. But if a member of a travelling party or family or a close contact on the plane tested positive, the grim destination was a quarantine hotel.

Whereas the Phuket Sandbox was confined to Phuket, Test & Go enabled tourists to arrive at selected airports, including Bangkok, and was timed to coincide with peak tourism season.

Test & Go delivered immediate results. In its first month, November 2021, Thailand welcomed 91,260 visitors – significantly more than the four-month Phuket Sandbox scheme. In December, arrivals jumped to 230,500.

The Test & Go scheme was introduced in November 2021. Image: Thai Embassy

Applications for Test & Go were temporarily suspended at the onset of the Omicron wave but restarted in early 2022. On 1 May 2022, the on-arrival PCR test was eliminated. That month, 521,420 visitors arrived. In June, the figure will surpass 600,000.

So far in 2022, Thailand has welcomed 1.9 million tourists, “an increase of 4,621 percent compared to the same 2021 period.”

Consequently, Thailand forecasts a minimum of 7 million visitors in 2022, rising to 20 million in 2023 – which would surpass the 2011 total.

Exactly one year from the start of the Phuket Sandbox, on 1 July 2022, the Thailand Pass registration process is being removed. Thailand has also rescinded its mask mandate, permitted bars to stay open late and decriminalised cannabis.

Elephant in the Airport Lounge

From the depths of despair in July 2021, South East Asia’s travel landscape has been transformed. The region is now open for tourism.

Tough challenges have emerged. China, the region’s primary tourism source market, remains closed, airline fares are high and some airports are overcrowded at peak times. Inflation is rampant, interest rates are rising and currencies are weakening.

The elephant in the airport lounge, though, remains Covid-19. Singapore and Indonesia have cautioned about rising infection numbers, and the travel industry is wary that governments could impose new restrictions in the coming months.

With headwinds circling, South East Asia is still navigating uncharted territory – but its recent progress is largely attributable to the unloved and unwieldy Phuket Sandbox.

- Asia Media Centre

Other relevant stories

Subscribe to Asia Digest

Robust Phuket tourism numbers in Q4 2022 and high winter season to lead to recovery by year-end 2023

Thailand’s leading resort island of Phuket’s post-pandemic tourism recovery has been headlined by a surge in Russian travellers in the high season. But the backstory is how a spike in regional visitors from India, Malaysia, and Singapore set the stage in Q4 of last year that pushed hotels and the service sector back into action.

Data on hotel Phuket hotel performance in C9 Hotelworks’ newly released Phuket Hotel Market Update 2023 shows how the industry escalated after Thailand lifted travel restrictions at the beginning of October 2022. The influx of tourists propelled market-wide occupancy for the year to 48%, up year-on-year from a COVID-19-impacted low of 8% in 2021.

While Phuket’s winter high season which is November through to March has seen a return of the island’s traditional ‘snowbird’ visitors from Northern Europe and Scandinavia, the main mover has been Russia and a handful of other Eastern European countries. Despite limited direct airlift due to a backdrop of economic sanctions by the EU and airfares which have in many cases risen by 200-300%, the Russians indeed came. Though numbers were sharply down compared to the nearly one million count in 2019, stays increased from a normal average of 11 days, and rose by over 50%.

Speaking about the impact of the Eastern European markets on the island C9 Hotelworks Managing Director Bill Barnett said “the arrival of tourists from Russia not only created a spark in economic recovery for hotel and tourism businesses but radiated into retail, transportation, and real estate. The segment is now the most active direct foreign investment (FDI) leader in Phuket’s booming property market. A knock-on effect has been also seen on land prices across the island which are growing at their high rates in over two decades.”

Looking inside the numbers and key trends in Phuket’s hospitality industry, C9’s research points to a broader overall movement of hotel owners converting from management agreements to franchises and also changes in brands. Two recent notable deals has seen the Destination Group inking agreements with InterContinental Hotels Group (IHG) for two Holiday Inn properties and two with Radisson. Additionally, one of the island’s largest hotels, the Arcadia has been reflagged as a Pullman under ACCOR, and Thailand’s hospitality giant AWC (Asset World Corporation) have made public plans to upgrade and convert the Westin Siray Bay into a luxury resort branded to Ritz-Carlton.

Citing the conversions C9’ Bill Barnett commented “this is a sign of maturity for Thai hotel owners who are experienced enough to operate but look for distribution and brand value in a franchise scenario. This practice is prevalent in North America and Europe so it was only a matter of time until Asia caught up. We expect to see more changes in brands for the remainder of 2023 and beyond, given many hotel agreements signed in the early millennium tourism boom years are set to expire. “

Despite positive economic indicators, the reality on the ground is evident everywhere in the stress placed on Phuket’s transportation infrastructure. Population growth, development spread to inland areas and skyrocketing tourism demand has created a massive traffic problem. The clearest example was when a landslide closed an important thoroughfare between the popular Patong tourist area and its central island feeder road. Delays in repairs caused a domino effect in access to west coast hotels in peak season and demonstrated how fragile the island’s transportation network is.

Reflecting on the potential return of mass tourism to Phuket, C9’s Bill Barnett who has lived and worked from Phuket for over 20 years said “the lack of a dedicated tourism master plan for the island is a key long-term issue that much is resolved. With airport flights and passenger flow mounting we can clearly see how important the new Phang Nga airport is, though the site remains inactive. This goes for the expressway and Patong tunnel projects that are in essence a lifeline for the island’s future growth. We punched the card of urbanization already and with nearly 100,000 registered hotel rooms on the island we’ve done too far to go back.”

Hotel performance was outstanding during the Lunar New Year holiday in Feb 2024 for…

Phuket is now the largest leisure property market in the world with branded…

Bali’s Dynamic Tourism Landscape: Latest Trends in Hotels and Branded…

HRAWI pitches for reforms in GST for restaurants within hotel premises

Since you're here...

...there are many ways you can work with us to advertise your company and connect to your customers. Our team can help you design and create an advertising campaign

We can also organize a real life or digital event for you and find thought leader speakers as well as industry leaders, who could be your potential partners, to join the event. We also run some awards programmes which give you an opportunity to be recognized for your achievements during the year and you can join this as a participant or a sponsor.

Let us help you drive your business forward with a good partnership!

Yes, contact me I want to download the media kit

Comments are closed.

LATEST STORIES

Samar Province, DOT tout 3 new tourism circuits

Sustainable pathways with the ‘JW Garden’ at JW Marriott Khao Lak, Thailand

Check in for the Official Launch of Hengqin's 2024 Global Investment Promotion Campaign

Bob W unveils Tallinn's newest gem: A tech-infused oasis in Arter Quarter

Welcome, Login to your account.

Sign in with Google

Powered by wp-glogin.com

Recover your password.

A password will be e-mailed to you.

Welcome back, Log in to your account.

SIGN UP FOR FREE

Be part of our community of seasoned travel and hospitality industry professionals from all over the world.

- LOGIN / SIGN UP

- Middle East

- UK & Europe

- USA & Canada

- Hospitality

- HR & Careers

- Luxury Travel

- MICE (Meetings, Incentives, Conferencing, Exhibitions)

- Travel Tech

- Travel Agents

- Airlines / Airports

- Conferences

- Cruising (Ocean)

- Cruising (River)

- Destination Management (DMC)

- Hotels & Resorts

- Hotel Management Company

- Hotel Technology

- HR / Appointments

- Meetings, Incentives, Conferencing, Exhibitions (MICE)

- Travel Agents (all)

- Travel Technology

- Tourism Boards

- Industry appointments

- Travel Bloggers

- Podcasts – Features

- How to join

- RSVP Portal

- Event Photos/Videos

- Competitions

- Search for Jobs

- Destination NaJomtien BanAmphur BangSaray *NEW*

- จุดหมายปลายทาง นาจอมเทียน หาดบ้านอำเภอ บางเสร่ *NEW*

- South Australia Reward Wonders *NEW*

- Ponant Yacht Cruises and Expeditions

- Encore Tickets (Chinese Guide)

- Affordable Luxury in Thailand by Centara Hotels

- Rising Above the Oridinary by Conrad Bangkok

- The Best of Thailand

- Who is IWTA

- Philippines

- Recommend Someone

- Recommend yourself

- IWTA AWARDS

- TRAVEL CLUB

- ASSOCIATIONS

- CLIMATE CHANGE

- TRAVEL COMPANIES

- ASIA PACIFIC

- MIDDLE EAST

- NORTH AMERICA

- PHILIPPINES

- BANYAN TREE

- NORWEGIAN CRUISE LINE

- PANDAW CRUISES

- PRINCESS CRUISES

- ROYAL CLIFF

- THAI AIRWAYS

- TRAVEL DEALS

Sarawak hosts tourism resilience training

Changi traffic returns to 2019 levels in Q!

Airasia adds two destinations in india, aapa signals march passenger traffic growth, etihad’s a380 says bonjour to paris.

Are hotels ready to dump harmful chemicals?

Stay Your Way at Centara

Pandaw sails from central Saigon

Doesn’t get better than a THB100 fare

Thai Vietjet makes Songkran fare splash

Emirates bargains up for grabs

India’s Vistara launches Points Fest

Emirates rolls out fare bargains

Singapore: Top spot in Asia for expats

First trip without Mum and Dad

Is sustainable travel losing its shine?

Vietnam: I’m only here for the beer

Early bookers catch cheap fares

Smog and dams a threat to tourism?

Sailing on calmer waters

Is the global travel industry isolating Russia?

Will China reopen outbound travel soon?

Agoda clarifies reviewer privacy rules

Research points to Phuket’s full recovery

PHUKET, 2 November 2023: Phuket hotels experienced promising momentum for the first half of 2023, which has set an optimistic path for the remainder of the year, according to research from C9 Hotelworks presented in its latest Phuket Hotel Market Update report.

At the mid-year juncture, international and domestic flight volume was already up 75% over total flights in 2022.

Russia and China led the way as the two top tourism source markets in the first six months of the year, followed by India, Australia and Kazakhstan.

Half-year market-wide hotel occupancy surpassed the 70% threshold, but the real boost for hotel owners was the sustained post-pandemic trend in higher room rates. While business is back to normal for over 2,000 Phuket registered accommodation establishments encompassing 106,000 rooms, hotel owners and operators have been plagued by recurring staff shortages.

With Phuket’s hotel market roaring back this year and year-end forecasts likely to exceed pre-Covid levels, there is mounting concern over the resort island’s failing infrastructure. A surge in full and part-time residents – driven by a sharp uptick in tourism, an overheating property market and wholesale return of development activity – has created massive traffic issues that threaten long-term growth.

Addressing the situation, C9 Hotelworks managing director Bill Barnett said: “High season 2023/2024 is likely to see a traffic gridlock scenario that will have a profound impact on tourists and residents alike. The absolute failure to bring transportation infrastructure projects from paper to reality over the past decade will have long-term repercussions.

“Key projects that have not found their way forward include the Patong-Kathu tunnel, cross-island expressway and light-rail (LRT). While the current government has made all the right noise about making these projects a priority, there is no public sector funding capacity at present. This effectively means that a series of public-private partnerships or BOT (build-operate-transfer) projects are needed to move these to the execution stage. This includes the much-needed Andaman International Airport.”

Looking towards the coming winter peak period, C9’s market research reveals that both hotels and tourism businesses remain deeply concerned over the slow return of Chinese travellers. Thailand’s image has been damaged in this enormous market, and travel sentiment to the kingdom is muted despite a visa-free initiative. With China’s recovery a work in progress, most hotels are looking to strong demand from Russia, Kazakhstan and India, along with traditional ‘snowbird’ seasonal travellers.

Despite strong underlying fundamentals for Phuket hotels, C9’s Barnett points out, “the first-aid, band-aid approach by the public sector to tourism simply won’t work in a mature international destination that Phuket has evolved into. For nearly two decades, the island’s private sector has outgrown antiquated provincial infrastructure. What is desperately needed is a master plan and strategy that can fast-track an ailing infrastructure backbone.”

Read and download C9 Hotelworks Phuket Hotel Market Update

About C9 Hotelworks

C9 Hotelworks is led by founder and managing director Bill Barnett, who brings over 30 years of experience in the Asian hospitality and real estate sectors. Before founding C9 in 2003, he held senior executive roles in hotel operations, development and asset management. For more information contact www.c9hotelworks.com

RELATED ARTICLES

Colin hastings: big chili legend passes, pata’s whistleblower blows more steam, thai cabinet reshuffle after seven months.

This is unsurprising, as the winter season is when “snowbird” travelers migrate from the West to bask in Thailand’s sunshine and service, both of which are very warm.

What is surprising is the strength of the Israel market this summer. For the first time, Israel, a relative newcomer, ties with the UK as the top source for Phuket in July-September, with Germany as second biggest source. El Al starts operating a daily direct flight from Tel Aviv to Phuket from July 1.

“This shows the industry needs to look at other factors, beyond travel restrictions, that will shape travel decisions and change traditional market sources and segments. These factors include airline connectivity, currency and safety perceptions such as racism,” said Jameson Wong, director Asia-Pacific for ForwardKeys.

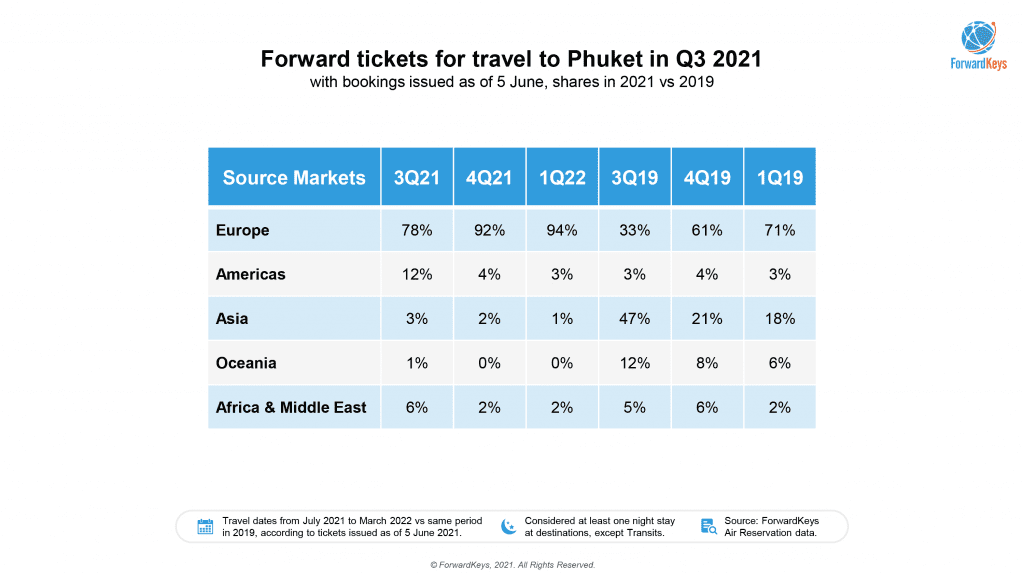

Europe (including Israel) is the dominant source for Phuket this summer, accounting for 78 percent of bookings, followed by Americas at 12 percent and Africa/Middle East at 6 percent (see chart). In a reversal, Asia/Oceania is but only 4 percent, from 59 percent in 2019, due to travel restrictions and/or quarantines upon return.

Krystal Prakaikaew Na-Ranong, co-founder/owner of the five star hotel The Slate Phuket, said hoteliers are waiting for Thailand to establish travel corridors with Singapore, Vietnam and other neighboring destinations.

“That will help,” she said. “Enquiries and bookings are coming in but more for October [onwards] than for summer. But it [sandbox] is a good start, with direct flights coming into Phuket.” (See here for other airlines that are operating to Phuket.)

“Greng Jai”

In public, Thai tourism members keep an optimistic front and laud the sandbox as something of a miracle, where the state government, provincial government, various ministries and industry sectors are able to come together to chart an unprecedented travel reopening.

“What makes this different [from past crises] is it involves public health, local and national governments, foreign affairs, airports authority, et cetera. The kitchen is full of cooks, so some chaos is to be expected,” said Bill Barnett, managing director of C9 Hotelworks and founder of Phuket Hotels Association.

But a local hotel owner with properties in Bangkok and Pattaya spoke of Thailand’s “Greng Jai” culture, which makes the reopening process akin to “moving mountains.”

“You can’t order an official to do something, you have to ask for it politely. It’s mediation over confrontation,” said the owner.

It’s easy to see how a melting pot of “Greng Jai,” differing agendas of various ministries and fat bureaucracy is resulting in a compromise, and a small outcome of 2 percent after reopening is being hailed as good enough.

But this masks the hardship that tourism players are facing. Average occupancy countrywide in May was 6 percent, with June being no better, as the third wave is keeping Thais at home, said Marisa Sukosol, president of Thai Hotels Association and executive vice president of Sukosol Hotels.

Half of 16,000 registered hotels in Thailand are still closed. Of those opened, more than 60 percent said in a survey that their revenue is below 10 percent over 2019, and 50 percent said their cashflow would last for another two to three months only.

“Thailand’s National Economic and Social Development Board has revised its international arrivals forecast to 500,000 this year, which is horrible,” said Sukosol. “We had 6.7 million last year [mostly in the first quarter before Covid hit].”

As for domestic travel business, income from Thai tourists last year dropped 55 percent over 2019, which means Thais are spending less.

“We are hanging by a thread,” said Sukosol.

In Phuket, average occupancy is more or less 10 percent in the first six months, said Anthony Lark, Phuket Hotels Association president and executive director of Montara Hospitality Group, which owns the luxury hotel Trisara.

“We are forecasting this to increase to 15-20 percent July to October, and 30-40 percent November-March 2022.”

On how many Phuket hotels will reopen, Lark said half of closed hotels “wait-and-see” how the reopening unfolds. “No one wants to reopen at sub 10 percent occupancy. They closed because there’s no cashflow. To reopen involves re-employment, training, maintenance, all of which costs a lot of money,” said Lark.

Nothing is Risk-Free

The destination itself faces risks of reopening. Lark admits the association is “a little worried” about what tourists may be sharing on social media “of devastated Phuket villages such as Patong, Kata and Karan which have seen thousands of people leaving and small businesses closed down.”

“Some of these concerns are real,” he said. “But our community is getting together, restaurants are reopening and staff are returning from other provinces and are getting vaccinated. This is a process of baby steps.”

The province is also aware of the risk of an increase in Covid infections, as vaccinated tourists can still carry the virus, he said. “Yet those concerns are mitigated by the fact that the Phuket population has really done a great job with vaccination . You hear rumors about locals not wanting to vaccinate, but if you see the long queues of people from all walks of life at the six vaccination stations around Phuket, it is heartening,” said Lark.

Phuket may also lose domestic travelers who fear catching infections from vaccinated tourists. “Certainly this is a concerned and will likely inhibit demand or push Thais to Krabi, Khao Lak or other drive/fly locations,” said C9 Hotelworks’ Barnett.

But not to reopen also poses consequences. Chiefly, Thailand’s battered tourism industry can’t take it anymore, and the peak winter season 2021/2022 will be lost, which is disastrous.

Ruth Landolt, general manager of Asia365, a European tour operator with Swiss and German clients, said, “We have quite a lot of requests for November onwards. Clients are waiting to finalize bookings, because they want to trust that the destination will really open. This is why psychologically it is extremely important that the sandbox materializes.”

Hopefully, more bookings will materialize once the world sees Thailand has opened. Hopefully, too, it will be a reopening without incident, which will strengthen Thailand’s confidence and lead to a relaxation of rules in the months ahead.

Most importantly, hopefully Thailand’s vaccine management, not just virus management, will keep pace.

Then, it’ll be amazing.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: phuket , reopening travel , thailand

Photo credit: A hammock in Phuket awaits tourists. QUO / Phuket Hotels Association

After the Tsunami: The Phuket Action Plan

Download this case study to find out how Thailand recovered from the devastating effects of the tsunami which hit Phuket & Southern Thailand in 2004.

Download the Full Case Study

The tsunami which impacted communities around the Indian Ocean rim on the morning of 26th December 2004 wreaked particular havoc with the tourism industry in Phuket and southern Thailand. Although it did not suffer the greatest loss of life (which occurred in Indonesia’s Aceh province), Phuket was the most easily accessible for the international news media. Reports of thousands of missing tourists at the height of the Christmas holiday season dominated TV news bulletins and newspaper headlines around the world.

Phuket Action Plan Involved all Stakeholders

More than 5,400 people representing 33 nationalities died along the western coast of phuket, in phang nga province and on neighbouring islands including kho phi phi..

A further 2,800 people were reported missing. In the days after the tsunami hit, some European governments arranged flights to rescue their citizens from Thailand and multiple governments sent relief supplies and personnel to assist with identifying the deceased and repatriating foreign victims.

The tourism sector, hotels and resorts accounted for roughly 12% of Thailand’s gross domestic product (GDP) in 2004, and up to 42% of the economy in Phuket province.

In the immediate aftermath of the tsunami, visitor arrivals fell by more than 40% and up to 100,000 people whose livelihoods depended on tourism lost their jobs. Average hotel occupancy in Phuket, Phang Nga and Krabi fell by more than half.

Download Full Case Study

Integrate the Communication Strategy with the Recovery Plans

In february 2005, the un world tourism organisation (wto) convened a meeting in phuket of tourism experts representing 42 countries, international organisations (including pata) and the private sector to develop a plan to restore market confidence and speed up the recovery of the affected destinations..

The Phuket Action Plan comprised five operational areas: marketing-communications, community relief, professional training, sustainable redevelopment and risk management.

The most important element was marketing and communications, which would be key to recovering the confidence of potential visitors and tourism partners. This would mean engaging with multiple audiences including governments, businesses, tour operators, travel agents, the media and the public. Despite the reports of the widespread destruction of resorts along the west coast of Phuket and surround areas, in fact many beaches were virtually unscathed and properties could reopen as soon as tourists returned.

Work Collaboratively and Use Consistent Messaging

In an effort to reassure tourists about their safety, the Thai Government approved the construction of 55 tsunami warning towers in the six affected provinces, together with signs pointing out escape routes. The WTO itself set up a dedicated tsunami recovery website providing articles, reports, research studies and videos showing progress towards rebuilding tourism in all the affected locations. Other activities organised by the WTO included familiarisation visits for key journalists and tour operators from major source markets including a visit by more than 800 international tour operators to Andaman coastal areas in March 2005.

Airlines that cancelled flights to Phuket gradually returned, including carriers from Australia, the Republic of Korea, Singapore, and Europe. Others started new services from markets such as Hong Kong, China, Russia and South Korea directly to Phuket and Krabi. Tourist numbers to the tsunami-affected areas of Thailand began to increase in 2006 and by the end of that year, the tourism industry had almost recovered to pre-tsunami levels.

Timeline of Phuket after the Tsunami

Indian Ocean tsunami strikes Phuket on the morning of 26 th December. More than 5,400 people from 33 countries are lost at the height of the Christmas holiday season.

Visitor arrivals fall by 40%. Average hotel occupancy in Phuket, Phang Nga and Krabi falls by more than half.

Global meeting of tourism experts held in Phuket to develop Phuket Action Plan. Focused on five key areas, including marketing and communications.

Hundreds of media and travel industry visits to Phuket and Andaman Sea resorts to view recovery efforts. Post-tsunami marketing strategy includes focusing on new markets and niche sectors such as medical tourism, wellbeing and spa holidays.

Now recieve the latest travel trade industry news straight into your Inbox!

- Do You Know

Phuket leads to tourism recovery by year-end 2023

.png)

Thailand’s leading resort island of Phuket’s post-pandemic tourism recovery has been headlined by a surge in Russian travellers in the high season.

But the backstory is how a spike in regional visitors from India, Malaysia, and Singapore set the stage in Q4 of last year that pushed hotels and the service sector back into action.

Data on hotel Phuket hotel performance in C9 Hotelworks’ newly released Phuket Hotel Market Update 2023 shows how the industry escalated after Thailand lifted travel restrictions at the beginning of October 2022.

The influx of tourists propelled market-wide occupancy for the year to 48%, up year-on-year from a COVID-19-impacted low of 8% in 2021.

While Phuket’s winter high season which is November through to March has seen a return of the island’s traditional ‘snowbird’ visitors from Northern Europe and Scandinavia, the main mover has been Russia and a handful of other Eastern European countries.

Despite limited direct airlift due to a backdrop of economic sanctions by the EU and airfares which have in many cases risen by 200-300%, the Russians indeed came.

Though numbers were sharply down compared to the nearly one million count in 2019, stays increased from a normal average of 11 days, and rose by over 50%.

Speaking about the impact of the Eastern European markets on the island C9 Hotelworks Managing Director Bill Barnett said the arrival of tourists from Russia not only created a spark in economic recovery for hotel and tourism businesses but radiated into retail, transportation, and real estate.

The segment is now the most active direct foreign investment (FDI) leader in Phuket’s booming property market. A knock-on effect has been also seen on land prices across the island which are growing at their high rates in over two decades.

Looking inside the numbers and key trends in Phuket’s hospitality industry, C9’s research points to a broader overall movement of hotel owners converting from management agreements to franchises and also changes in brands.

Two recent notable deals has seen the Destination Group inking agreements with InterContinental Hotels Group (IHG) for two Holiday Inn properties and two with Radisson.

Additionally, one of the island’s largest hotels, the Arcadia has been reflagged as a Pullman under ACCOR, and Thailand’s hospitality giant AWC (Asset World Corporation) have made public plans to upgrade and convert the Westin Siray Bay into a luxury resort branded to Ritz-Carlton.

Citing the conversions C9’ Bill Barnett commented this is a sign of maturity for Thai hotel owners who are experienced enough to operate but look for distribution and brand value in a franchise scenario.

This practice is prevalent in North America and Europe so it was only a matter of time until Asia caught up.

They expect to see more changes in brands for the remainder of 2023 and beyond, given many hotel agreements signed in the early millennium tourism boom years are set to expire.

Despite positive economic indicators, the reality on the ground is evident everywhere in the stress placed on Phuket’s transportation infrastructure.

Population growth, development spread to inland areas and skyrocketing tourism demand has created a massive traffic problem.

The clearest example was when a landslide closed an important thoroughfare between the popular Patong tourist area and its central island feeder road.

Delays in repairs caused a domino effect in access to west coast hotels in peak season and demonstrated how fragile the island’s transportation network is.

Reflecting on the potential return of mass tourism to Phuket, C9’s Bill Barnett who has lived and worked from Phuket for over 20 years said the lack of a dedicated tourism master plan for the island is a key long-term issue that much is resolved. With airport flights and passenger flow mounting they can clearly see how important the new Phang Nga airport is, though the site remains inactive.

This goes for the expressway and Patong tunnel projects that are in essence a lifeline for the island’s future growth.

They punched the card of urbanization already and with nearly 100,000 registered hotel rooms on the island we’ve done too far to go back.

TIN.media - Travel Industry Network is Malaysia's home grown B2B Travel Industry Media with the most influential B2B online resources including news, research, events, and marketing services and more.

Recommended News View More

Indonesia's tourism developed with sustainable practices: Minister Uno

Tourism Malaysia Targets Central Asia with Major Showcase at KITF 2024 in Kazakhstan

Garuda Indonesia Rejects Tourism Fee on Flight Tickets Saying It Burdens Passengers

Thailand reconsiders $8 tourism tax as Phuket, Pattaya face overtourism

Thailand welcomes 1.9 mln foreign tourists during Songkran festival

Angkor pride takes to the air as AirAsia Cambodia announces new domestic schedules

TAT, Klook deepen collaboration to enhance Thailand as global tourism hub

Quang Ninh aims to become international tourism hub, says Vietnam govt

Rising interest and spending among Malaysian tourists in Australia

Ready for take-off at MATTA Fair Penang 2024

New programme targets ASEAN & Indian tourists in Thailand

Tourism Malaysia showcases at VITM Hanoi 2024

Subscribe newsletter for latest updates , announcement.

Download our app

Featured story view more.

First Edition of Asian Tourism & Hospitality Awards launched; nominations are open!

.png)

Keep safe when traveling with these travel gadgets

Safest destinations to travel in the year 2022

Latest videos view more.

Travel Industry Network Media is Malaysia's first Independent Travel Trade Media that has been delivering acute news, editorials, and analysis on relevant travel trade developments in Malaysia and worldwide. We perform as a digital companion for the readers, providing news as it happens.

Contact info

TIN Tech Group Sdn Bhd 2-28, MKH Boulevard, Jalan Bukit 43000 Kajang, Selangor, Malaysia

- +601-926-09458

- [email protected]

Terms & Policies

- Subscribe to Our News

- Partner with us

- Privacy Policy

- Cookie Policy

- Copyright Policy

- Data Policy

- Subscriber Agreement & Terms of Use

- Tin Digital & web services

- Tin Talk Show

- Submit a News

- Advertise with us

- Request a Media Kit

- Sell Your Business

- Your Ad Choices

- Annual Outlook

- Central Banks

- Emerging Markets

- Geopolitics

- Japan in focus

- Sustainability

- The Week Ahead

- All content

- Case Studies

Nomura Connects

- Nomura in Numbers

- Nomura Careers

- Our Community

Nomura in Focus

- Healthcare Ecosystem

- Digital Transformation

- Infrastructure and Power Finance

- Horticulture

Emerging Markets | 3 min read | July 2021

Thailand: The Long Road to a Tourism Recovery

Our TRIPTracker index indicates there's still a long way to go before tourist arrivals to Thailand recover.

- Phuket reopened its borders to vaccinated tourists on July 1, and other provinces are scheduled to open in phases through October.

- Our proprietary index, TRIPTracker, designed to estimate the recovery in tourist arrivals in Thailand, indicates it will take time before international travel to the country returns to pre-pandemic levels.

- Push and pull factors such as the pace of vaccine rollout, the increased number of local and foreign Covid-19 cases, and degree of openness of source countries will determine the pace of the tourism recovery.

On July 1, Phuket reopened its borders to fully vaccinated tourists. To boost economic recovery, the government of Thailand intends to extend the “Phuket tourism sandbox” model to other provinces over the course of the next few months with the aim of reopening the entire country to international arrivals by mid-October. Tourism revenue from foreign tourists accounted for 11.4% of GDP in 2019 and represented a significant contribution to the current account surplus of 7.0% of GDP.

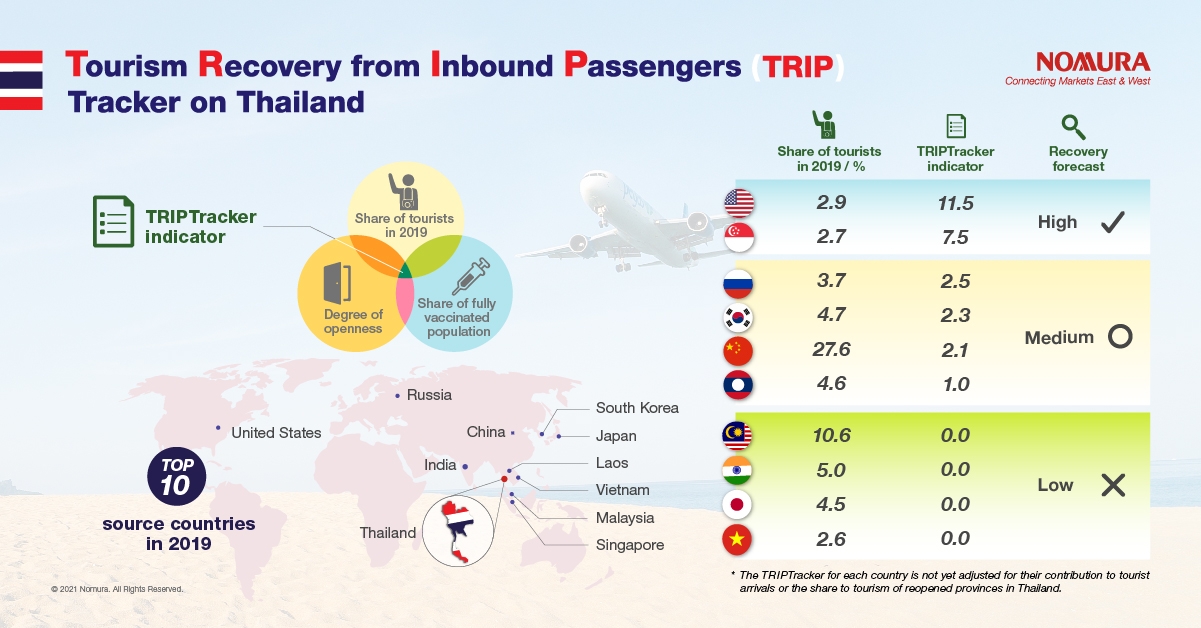

To quantify the near-term prospects of tourism sector recovery, we constructed the Nomura Tourism Recovery from Inbound Passengers (TRIP) Tracker for Thailand. The TRIPTracker is based on various indicators: the share of fully inoculated people in Thailand’s source countries for tourists, the degree of openness of these countries to international travel and Thailand’s willingness to accept visitors from them, as well as the contribution to tourism from each of the Thai provinces that have already reopened. It is designed to provide an estimate of the recovery rate of tourist arrivals compared to a normal year when the index is pegged at 100%.

As of July 1, the TRIPTracker read 0.5%, suggesting a limited recovery in visitors compared to 2019 levels year-to-date. Further out, it projects a weak tourism recovery rate of 0.8% in Q3 2021 and 2.9% in Q4. As a result, we lower our 2021 tourist arrivals forecast from 2 million to 400,000, and for 2022, from 31 million to 13 million. This will have knock-on effects this year on the current account balance which we forecast to be in deficit of 1.7% of GDP, and on GDP growth, which we maintain at a below-consensus 2.1%.

There are push and pull factors at play that could delay the recovery rate of tourist arrivals. Pull factors include slow vaccine rollout and an increased rate of Covid-19 cases locally. As of early July, only 7.7% of the country’s population was inoculated, well below other Asian countries. The delay risks to reopening are particularly high for Bangkok, which accounts for 41.5% of tourism revenue, but remains a major Covid-19 hotspot. The surge in new cases there and in some other provinces prompted the government to tighten measures such as prohibiting dine-in services, lowering the limit for public gatherings and keeping all entertainment venues shut. These restrictions on domestic activities not only casts doubt on a timely full reopening, but also suggests tourism sentiment will likely remain weak.

In terms of push factors, the supply of foreign tourists will be limited by the pace of vaccination in the source countries of tourists and existing international travel restrictions. We estimated the full vaccination rate in 44 source countries, which accounted for 96.4% of tourist arrivals in 2019, weighted by their average contribution to Thai tourism. As of July 1, only 16.6% of the total population in these countries was fully vaccinated. Especially in the early stages, where many source countries face recurring pandemic waves, tourists from there may not be allowed to enter Thailand. This is especially true for Malaysia and India, the second and third largest sources of travelers into Thailand, respectively. Conversely, while the Thai regions are scheduled to reopen slowly, many countries are expected to maintain strict border rules.

All this suggests that as Thailand prepares to attract vaccinated foreign travelers, there’s a long way to go before its tourism industry makes a full recovery.

For a more in-depth view into our Thailand TRIPTracker, read our full report here .

Contributor

Euben Paracuelles

Southeast Asia Economist

Charnon Boonnuch

Asia Economist

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html .

Suggested views

Jump to all insights on emerging markets, introducing cassandra: our early warning model for financial crises.

Economics | 2 min read June 2021

Nomura Investment Forum Asia – The Diverging Recovery Paths of Asia’s Biggest Economies

Economics | 3 min read June 2021

What's on the horizon for the global economy?

Central Banks | 3 min read April 2024

Share this article

- Twitter Twitter

- LinkedIn LinkedIn

- icon-email email

Tourism sector gets recovery hopes up

PUBLISHED : 3 Jan 2021 at 06:33

NEWSPAPER SECTION: News

WRITER: Chairith Yonpiam

Despite concern about the latest Covid-19 outbreak, tourism operators are hopeful their businesses will bounce back this year as they pin their hopes on new vaccines to stamp out the virus.

The new outbreak stemming from a seafood market in Samut Sakhon has now spread to 53 provinces across the nation, and infections are likely to continue to rise.

This prompted the government to order the closure of several premises and outlets, bringing an economy only just showing the first signs of recovery since being battered by the first wave of the pandemic early last year to a halt again.

Tourism, Thailand's major engine for economic growth, has been among the sectors hit hardest by virus.

According to the Tourism and Sport Ministry, the tourism sector earned 760 billion baht from January to November of last year, a decline of 1.93 trillion baht or 71.75%, compared to the same period of 2019.

There were 6.69 million foreign tourist arrivals during that time which represents a drop of 29.27 million (81.38%), while income from foreign travellers fell by 1.38 trillion baht to 332 billion baht (an 80.59% decrease), according to the ministry.

Hope of a vaccine

For 2021, however, the world is pinning its hopes on an effective Covid-19 vaccine arising from the work of pharmaceutical companies, including Pfizer, Moderna and AstraZeneca.

The United States has allowed Pfizer's vaccine to be administered to citizens under an emergency use authorisation as it seeks to halt the country's massive infection rate.

Meanwhile, the Thai government has pre-ordered 26 million doses of AstraZeneca's vaccine, enough for 13 million people.

Deputy Prime Minister and Public Health Minister Anutin Charnvirakul previously said he had secured the supply of at least 2 million doses of Covid-19 vaccine for "between February and April".

He did not name the vaccine he had secured, and nor is it known how long the roll-out will take.

The government earlier signed an advance agreement with AstraZeneca for 26 million doses and the right to produce its Covid-19 vaccine in Thailand, but supplies are not expected before May.

The Bangkok Post interviewed operators in a number of previously popular destinations for tourists -- Koh Samui in Surat Thani, Pattaya in Chon Buri, Phuket and Chiang Mai.

For Koh Samui, 95% of its income was derived from foreign tourists, and the pandemic has sent its local economy spiralling downwards for most of the year.

A slow 2021 hard to avoid

Worasit Phongkhamphan, president of the Tourism Association of Koh Samui, said the island had lost 50 billion baht in revenue last year.

Of the total 660 hotels there, only about 180 now remain open.

"If the local transmissions continue at this rate, domestic tourism will have to halt, as well as plans to welcome the return of foreign travellers. Tourism on the island is likely to remain sluggish,'' Mr Worasit said.

But if local infections can be contained during the first quarter of this year, the second quarter, which is when high season falls, could see the return of tourist business, especially due to its preparation of alternative state quarantine facilities (ALSQ), he said.

Mr Worasit said Koh Samui is ready to welcome tourists who travel directly to its ALSQ facilities at 11 hotels which have made the necessary adjustments.

However, a special tourist visa (STV) scheme launched by the government has not yet been rubber-stamped so the hotels remain empty, he said.

"Therefore, we may have to rely on travel bubbles with other countries with low infection rates, so we can reduce the quarantine period to no more than 10 days. That might allow the island to start receiving foreign arrivals in February or March,'' Mr Worasit said.

"If we are fortunate human trials of vaccines should take place in Thailand in the second quarter, and if vaccines prove to be effective by the end of the year, foreign tourists from Western countries who receive vaccines are expected to be allowed into the country on commercial flights,'' he said.

"However, I can't see light at the end of the tunnel for 2021. Overall, the slowdown will continue unless foreign travellers arrive,'' he said.

Phuket's eggs in one basket

Sarayuth Mallam, president of the Phuket Tourism Council, said a vaccine is the only hope for Phuket's economic recovery.

"We are waiting for the government to provide vaccinations. If the vaccines are proven to be safe and effective, they should be made available between February and March. If more people are vaccinated and if foreign travellers are allowed to enter, the economy in Phuket should start to recover," he said.

Mr Sarayuth said foreign tourists, particularly from China, are ready to travel again, although the Chinese government continues to enforce a ban on outgoings -- a decision he has urged Deputy Prime Minister Jurin Laksanawisit and the Foreign Affairs Ministry to negotiate an end to.

"Business operators are haemorrhaging cash reserves and struggling to survive. Please allow foreign visitors to enter as quickly as possible. The government should prioritise provinces which are important to tourism and can generate income for the country,'' he said.

Ekkasit Ngampichet, president of the Pattaya Business and Tourism Association, said that Pattaya has always relied mainly on foreign tourists but will be shifting its focus to attract domestic visitors this year, even though their spending power is lower.

He said that there were four main groups of foreign visitors to Pattaya -- Chinese, Russians, Indians, South Koreans.

Before Covid-19, about 10 million foreigners visited the resort city, bringing in about 240 billion baht in revenue annually.

That figure plummeted to 40 billion baht for 2020, Mr Ekkasit said.

"Under a worst-case scenario, a recovery won't take place until late 2021 or even mid-2022. However, if vaccines tested by other countries prove effective and foreigners are allowed into Thailand, we might be able to get back and running sooner,'' Mr Ekkasit said.

Chiang Mai wants STV clarity

Chiang Mai was affected by infections from Thai workers sneaking back across the border from Myanmar in early December, with a drop in hotel room bookings by 50%.

Even though its number of infections remains comparatively low, Chiang Mai is still feeling the pinch as it is now the province's traditional peak period for visitors.

Before the pandemic, Chiang Mai earned more than 100 billion baht in tourism income annually, but that was slashed in half after Covid-19 hit.

"In 2021, if the reopening of the country is late, we may only reach 40% of our usual target," Pallop Sae Jew, president of the Tourism Council of Chiang Mai, said.

He also warned that without the STV scheme going live soon, he did not predict an economic upturn for the year as a whole in the region.

"It appears that the scheme is not being taken seriously. No agencies have been given clear guidelines on how to proceed. It is all still up in the air,'' Mr Pallop said. "The private sector is of the same mind. Without a vaccine, most of the factors that prompt global tourism remain absent."

RECOMMENDED

Yellow line to resume normal services 'next month', navy chief repeats call for submarines purchase, kasing lung, the artist behind labubu, stark corp suspects face huge asset seizures, navy on standby to evacuate thais from myanmar.

IMAGES

COMMENTS

Friday, March 24, 2023. Favorite. Thailand's leading resort island of Phuket's post-pandemic tourism recovery has been headlined by a surge in Russian travellers in the high season. But the backstory is how a spike in regional visitors from India, Malaysia, and Singapore set the stage in Q4 of last year that pushed hotels and the service ...

Phuket tourism market edging towards recovery in 2024. Phuket 's tourism industry is undergoing an ongoing rebound, with last year's airport passenger arrivals edging towards pre-pandemic figures according to a new report from consulting group C9 Hotelworks. While hitting 7 million, it was still short of the 9 million mark set in 2019.

Although tourism in Phuket is expected to recover rapidly and potentially reach 100% recovery in 2024, the lessons learned from Covid-19 led to a shift in Phuket's tourism strategy. The five-year plan focuses on seven key objectives to generate new income for Phuket: 1. Become a global culinary hub (city of gastronomy) 2.

Phuket, one of Thailand's top tourist havens, had an ambitious plan to reopen to the world this summer. But with a spike in cases, the island's desperate situation is unlikely to end anytime soon.

29 June 2022. One year after the launch of the Phuket Sandbox, on 1 July 2021, Thailand is spearheading South East Asia's tourism recovery. It has been a challenging and politicized 12 months, and several uncertainties remain for the travel industry. A mask-wearing army general waving at tourists inside Phuket International Airport was among ...

Phuket's tourism industry has been on a road to recovery, following a year of pandemic-induced disruptions. A newly released Phuket Hotel Market Update by C9 Hotelworks reveals that the island's tourism industry has experienced a significant uptick in activity, with the recovery starting in Q4 of last year.

As of Q1 2023, Phuket's unemployment rate decreased to 0.45%, below Bangkok and the national average, indicating economic recovery from the return of tourism. Source: Department of Land Transport • In the year to October 2023, new vehicle registrations totaled 12,672, a 39% increase from 2022 (9,111). Total

The influx of tourists propelled market-wide occupancy for the year to 48%, up year-on-year from a COVID-19-impacted low of 8% in 2021. While Phuket's winter high season which is November ...

With China's recovery a work in progress, most hotels are looking to strong demand from Russia, Kazakhstan and India, along with traditional 'snowbird' seasonal travellers. Despite strong underlying fundamentals for Phuket hotels, C9's Barnett points out, "the first-aid, band-aid approach by the public sector to tourism simply won't ...

Thailand's leading resort island of Phuket's post-pandemic tourism recovery has been headlined by a surge in Russian travelers in the high season. But the backstory is how a spike in regional ...

PHUKET: Phuket tourism operators expect the country's reopening to tourism on Monday (Nov 1) to help build momentum for Phuket to receive 1 million international arrivals in the first quarter of nex

Phuket's 2023 hotel surge faces infrastructure challenges; C9 highlights traffic and delayed projects despite tourism growth. ... As Phuket tourism market recovers, a potential "carmageddon" infrastructure crisis looms ... With China's recovery a work in progress, most hotels are looking to strong demand from Russia, Kazakhstan and India ...

Thailand targets only 129,000 overseas arrivals in July-September in the country, with Phuket as the main destination, said Tourism Authority of Thailand deputy governor Asia and South Pacific ...

PHUKET: Minor International and other hospitality businesses in Phuket and nationwide are mostly content with the ongoing tourism recovery despite slow growth in arrivals. Hotel occupancy remains belo

In February 2005, the UN World Tourism Organisation (WTO) convened a meeting in Phuket of tourism experts representing 42 countries, international organisations (including PATA) and the private sector to develop a plan to restore market confidence and speed up the recovery of the affected destinations. The Phuket Action Plan comprised five ...

PHUKET: Tourism industry insiders who have monitored trends in the Phuket tourism industry over the past decade describe the recovery after the worst natural disaster to ever hit the region as "remarkable". Few potential visitors these days are dissuaded from coming to the island out of fear of another inundation. The successful introduction of a …

Ms Nanthasiri said that tourism in Phuket from Jan-Oct 2022 generated B119.18 billion in income for the island. With 101,221 rooms available on the island, occupancy averaged 35.04%, she said.