- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

AXA Assistance USA travel insurance review 2024

Jennifer Simonson

Mandy Sleight

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Heidi Gollub

Published 12:39 p.m. UTC April 16, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

AXA Assistance USA

Top-scoring plan

Covers covid, medical & evacuation limits per person, what you should know.

If you travel with expensive items, AXA Assistance USA’s Platinum travel insurance plan offers $3,000 in baggage and personal effects coverage. Learn more in our AXA travel insurance review.

- Primary coverage for emergency medical benefits.

- $1 million coverage for emergency evacuation.

- Excellent lost baggage coverage of $3,000 per person.

- Best-in-class 75% “cancel for any reason” upgrade available.

- Covers lost ski and golf days due to bad weather.

- 12-hour wait before travel or baggage delay coverage applies.

- No “interruption for any reason” coverage.

- Missed connection coverage applies only to cruises and tours.

Why trust our travel insurance experts

Our team of experts evaluates hundreds of insurance products and analyzes thousands of data points to help you find the best product for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content. You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

AXA travel insurance plans

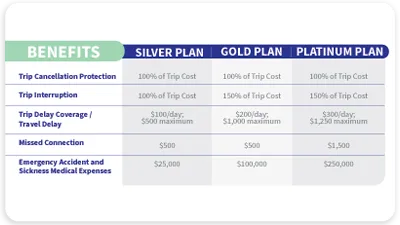

AXA Assistance USA offers travelers three comprehensive plans: Silver, Gold and Platinum. Each plan includes coverage for trip cancellation, interruption, emergency medical expense, emergency evacuation and baggage delay. Here’s a sample of the coverage you can expect from each policy.

Silver

AXA’s budget-friendly Silver plan includes the following benefits.

- Trip interruption insurance : 100% of your trip cost.

- Missed connections: $500.

- Travel medical insurance : $25,000 per person.

- Emergency medical evacuation : $100,000 per person.

- Accidental death and dismemberment: $10,000 per person.

- Baggage and personal effects: $150 per article, up to $750.

The Gold plan covers everything the Silver plan covers but increases the coverage limits.

- Trip interruption insurance: 150% of your trip cost.

- Travel medical insurance: $100,000 per person.

- Emergency medical evacuation: $500,000.

Unlike the Silver plan, the Gold plan also includes coverage for non-medical emergency evacuation and the option to purchase a collision damage waiver for rental cars.

Platinum

A benefit of AXA’s Platinum plan is that it covers sports equipment. If the airline loses your golf clubs or skis, the Platinum plan pays $25 per day for lost ski days, $500 for lost golf rounds and $1,000 for sports rental.

AXA’s Platinum plan also increases the optional collision damage waiver from $35,000 to $50,000.

And this is the only AXA travel insurance plan that gives you the option to upgrade to “cancel for any reason” (CFAR) coverage . This coverage reimburses up to 75% of your prepaid and nonrefundable trip expenses, as long as you cancel your trip at least 48 hours prior to departure.

Compare AXA travel insurance plans

Additional coverage options, “cancel-for-any-reason” (cfar) coverage.

Platinum plan policyholders have the option to purchase upgraded “cancel-for-any-reason” (CFAR) coverage, which allows you to cancel for any reason, not just those listed in your policy. CFAR coverage must be purchased within 14 days of paying the initial trip deposit. It covers up to 75% of your prepaid nonrefundable trip expenses provided you cancel your trip at least 48 hours prior to departure.

Collision damage waiver

Gold and Premium plans come with the option to purchase a collision damage waiver to cover rental car damage, collision or loss anywhere in the world. The Gold plan includes up to $35,000 in coverage while the Platinum plan offers up to $50,000.

What isn't covered by AXA travel insurance?

Like all travel insurance companies, AXA Assistance USA does not cover every incident that occurs while traveling. It’s a good idea to read your policy closely to learn what is and what is not covered.

Here are some examples of exclusions to AXA Assistance USA’s Platinum plan:

- Event cancellations.

- Travel to Afghanistan, Belarus, Burundi, Central African Republic, Chad, Congo, Crimea/Sevastopol, Eritrea, Guinea, Iran, Iraq, Lebanon, Liberia, Libya, Mali, Niger, North Korea, Pakistan, Russia, Sierra Leone, Somalia, South Sudan, Sudan, Syria, Ukraine, Venezuela and Yemen.

- War risks, civil commotion or terrorism.

- Dental treatment (except as a result of accidental injury).

- Suicide or attempted suicide.

AXA Assistance travel insurance rates

The price of AXA travel insurance will vary based on factors such as the plan you choose, your age, the length of the trip and your destination. In general, the average cost of travel insurance is 5% to 6% of your total trip cost.

Here are some sample quotes to give you an idea of how much you might pay for AXA’s Platinum plan.

Compare the best travel insurance companies of 2024

Via TravelInsurance.com’s website

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance of 2024 . For companies with more than one travel insurance plan, we shared information about the highest-scoring plan.

Insurers could score up to 100 points based on the following factors:

- Cost: 40 points. We scored the average cost of each travel insurance policy for a variety of trips and traveler profiles.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Pre-existing medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover pre-existing medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

AXA travel insurance FAQs

AXA travel insurance is a good option. It gets 3.5 stars out of 5 in our rating of the best travel insurance of 2024 .

Yes, AXA travel insurance offers “cancel for any reason” (CFAR) coverage as an optional upgrade to the Platinum plan. This coverage can reimburse you for up to 75% of your prepaid and nonrefundable trip expenses if you cancel your trip for any reason, as long as you cancel at least 48 hours before your scheduled departure.

CFAR coverage is only available as an optional benefit on the Platinum plan and must be purchased within 14 days of your first trip deposit.

Yes, AXA travel insurance covers both domestic and international travel.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Jennifer Simonson covers everything from business to the wine industry to international travel. Outdoor adventure, water parks and all things Texas are by far her favorite beats. Her work has appeared in Forbes, Travel + Leisure, Texas Monthly, Smithsonian Magazine, Fodor's, Lonely Planet, Slate and more. You can follow her on Instagram at @storiestoldwell.

Mandy is an insurance writer who has been creating online content since 2018. Before becoming a full-time freelance writer, Mandy spent 15 years working as an insurance agent. Her work has been published in Bankrate, MoneyGeek, The Insurance Bulletin, U.S. News and more.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

10 worst US airports for flight cancellations last week

Cheapest travel insurance of April 2024

Travel Insurance Mandy Sleight

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

Travel Insurance Jennifer Simonson

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travelex travel insurance review 2024

Best travel insurance companies of April 2024

Travel Insurance Amy Fontinelle

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

Outlook for travel insurance in 2024

- Travel Insurance Plans

- AXA Assistance USA Cost

Compare AXA Travel Insurance

- Why You Should Trust Us

AXA Assistance USA Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Travel insurance is important because it can help cover the cost of unexpected medical expenses while you're traveling. It can also reimburse you for lost or stolen baggage, canceled flights, and other unforeseeable problems that may occur while you're away from home.

Simply put, there's a lot to consider.

But not all policies are created equal, and you must understand what you're covered for before you purchase a policy. This article will look in-depth at AXA Assistance USA travel insurance. We'll discuss the costs, coverage limits, exclusions, and more to help you make an informed decision about whether or not this particular travel insurance provider is right for you.

- Trip cancellation coverage of up to 100% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical evacuation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1,500 per person coverage for missed connections on cruises and tours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Covers loss of ski, sports and golf equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous baggage delay, loss and trip delay coverage ceilings per person

- con icon Two crossed lines that form an 'X'. Cancel for any reason (CFAR) coverage only available for most expensive Platinum plan

- con icon Two crossed lines that form an 'X'. CFAR coverage ceiling only reaches $50,000 maximum despite going up to 75%

AXA Assistance USA keeps travel insurance simple with gold, silver, and platinum plans. Emergency medical and CFAR are a couple of the options you can expect. Read on to learn more about AXA.

- Silver, Gold, and Platinum plans available

- Trip interruption coverage of up to 150% of the trip cost

- Emergency medical coverage of up to $250,000

AXA Assistance USA Travel Insurance Review: Types of Policies Offered

AXA Assistance USA offers three levels of coverage: Gold, Silver, and Platinum. Each plan comes with different protections and varying coverage limits, with the Gold being the most basic option and Platinum offering the most premium coverage.

Some policies might even include added coverage free of charge, such as a waiver for pre-existing conditions, fee reimbursement for single occupancy rooms, or emergency medical assistance anywhere in the world. Compare each policy carefully to know what is included.

Additional Coverage Options

The plan you purchase will determine which add-ons are available. For example, those with a Platinum plan can add CFAR (cancel for any reason) coverage , allowing you to receive a full refund if you cancel your trip within 14 days of making the initial deposit.

Or, if you want extra protection for your rental car, depending on your AXA Assistance USA plan, you might be able to add a collision damage waiver (CDW). Policyholders with Gold plans can add $35,000 CDW, and those with Platinum plans can include $50,000 CDW.

AXA Assistance USA Travel Insurance Cost

The premium you pay will depend on various factors, including the age of the travelers, destination, and total trip costs. The average cost of travel insurance is 4-8% of total non-refundable travel costs.

For example, look at the premiums for a 50-year-old Florida resident spending $5,000 on a trip to Denmark.

In this case, the Silver plan costs nearly 3.5% of the total trip cost, while the Platinum plan costs just over 5% of the trip's price.

And here's another example. In this scenario, we looked at premium costs for a 45-year-old New York resident taking a trip to Mexico that cost $3,000. The lowest cost Silver plan costs just 3% of the total trip cost, while the Platinum plan runs 5%.

You can see that the higher the trip cost and the older the traveler, the greater the premium. But these rates still fall within industry standards, if not on the lower end.

How to File a Claim with AXA Travel Insurance

To file a claim with AXA Assistance USA, head to the claims forms online to find the appropriate form. Once you've filled out your form and gathered the required documentation, you can mail your claims to:

AXA Assistance USA

On Behalf of Nationwide Mutual Insurance Company and Affiliated Companies

P.O. Box 26222

Tampa, FL 33623

Or, submit your claim via email to [email protected].

AXA Assistance USA's customer service phone numbers are as follows:

Toll-Free (888) 957-5015

Collect (727) 450-8794

See how AXA Travel Insurance compares to top travel insurance providers.

AXA Assistance USA vs. AIG Travel Guard

When comparing AXA Assistance USA to Travel Guard , we'll look at the coverage levels from both of their mid-tier plans, the Silver plan and Travel Guard Preferred plan, respectively.

With AIG's Travel Guard Preferred plan, you'll get:

- Trip cancellation coverage up to $150,000

- Trip interruption coverage up to $225,000

- Emergency medical coverage of $50,000

- Coverage for baggage loss, theft, or damage up to $1,000

- Travel delay coverage of up to $800

Comparing those AIG Travel Guard coverages with AXA's Silver plan, you'll see that AXA's coverage limits are a bit higher. With AXA's Silver plan you'll get $100,000 in emergency medical coverage, for example. And the baggage loss coverage limit is up to $1,500.

If you're looking for greater coverage limits, AXA makes the most sense in this scenario. But premiums will also vary based on factors like the traveler's age, trip destination, and trip cost. So you'll have to run your own numbers to make a final decision.

AIG Travel Insurance Review

AXA Assistance USA vs. Allianz Travel Insurance

Allianz provides single-trip and multi-trip insurance for travelers who want to go abroad for an extended period of time. And, like with all insurance, the various plans have varying degrees of coverage.

Allianz's most popular single-trip option is the OneTrip Prime plan, which offers:

- Trip cancellation coverage up to $100,000

- Trip interruption coverage up to $150,000

- Emergency medical coverage for $50,000

- Coverage for baggage loss, theft or damage up to $1,000

- Travel delay coverage up to $800

Looking at AXA's mid-tier Silver plan, you'll see that, again, AXA offers more coverage for emergency medical and baggage loss, theft, or damage than Allianz. That said, if cost is an essential factor for you, you'll have to get quotes using your personal trip information to make an informed decision.

Allianz Travel Insurance Review

AXA Assistance USA vs. Credit Card Travel Insurance

Already have a great travel credit card, like the Chase Sapphire Reserve or American Express Platinum? Some of the standard coverages, such as rental car insurance, may be included in the card you already have. It's a good idea to research your travel rewards credit cards' insurance coverage before purchasing a separate travel insurance policy.

If you're driving to your destination and don't have any non-refundable trip expenses, the coverage from your credit card may be enough. Another time it might work is if you have health insurance covering you while abroad and you're in good health without worrying about possible medical costs.

It's essential to remember that credit card coverage is usually secondary. This means you'll have to file a claim with the other applicable insurance before filing a claim with your credit card company.

Best Credit Cards with Travel Insurance

Why You Should Trust Us: How We Reviewed AXA Assistance USA

We researched AXA Assistance USA by evaluating its travel insurance plans compared to other plans from the top travel insurance companies. The aspects we looked at included, but were not limited to, different coverage options, claims limits, what is covered, available add-ons, and extra services for policy holders.

What's important when choosing a policy isn't just the price — it's making sure you're getting adequate coverage that meets your needs without breaking the bank. Filing a claim should also be easy and stress-free if you ever have to use your policy.

AXA Assistance USA FAQs

AXA Assistance USA is owned by the AXA Group and provides various insurances, including travel, home, health, and automotive. With over 8,000 employees, it operates in over 200 countries and territories.

Yes, you can be covered anywhere in the world with an AXA Assistance USA travel insurance policy. Just remember, your policy will likely come with restrictions that'll exclude coverage under certain circumstances, like, for example, traveling to a war-torn country,

Review the specific terms of your plan concerning refunds. You can get a refund within 10 days of the cancellation request.

- Main content

COVID Travel Insurance

What does travel insurance cover .

We recognize that the outbreak has created unprecedented challenges for travelers and have sought to provide coverage that is relevant and useful in the current context. One of the most significant changes that we have made to our Travel protection plans is to include COVID coverage. This coverage varies depending on the policy and includes benefits such as Trip Cancellation or Trip Interruption coverage in the event that the insured or a family member contracts COVID, as well as Emergency Medical and Evacuation coverage related to COVID.

AXA Travel Protection coverages:

- Coverage for medical emergencies if you have an accident or become ill, including COVID

- Coverage for medical repatriation, including when its causes are related to COVID

- Cancellation of your trip if you fall ill with COVID before your departure or if you are placed in quarantine

- Your doctor advises you not to travel due to a proven medical contraindication

- You (or your travel companion) fall ill with COVID before your departure

- You are placed in quarantine because a member of your household has tested positive for COVID or if you have been officially notified

Disclaimer: The COVID Coverage applies within the limits provided in the general conditions and when supporting documents are provided to us - i.e., results of an official PCR text medical certificate attesting to your isolation. It is important to note that the specifics of travel coverage for COVID will depend on the plan selected, date of purchase, and state of residency. Customers are advised to carefully review the terms and conditions of their policy and to contact AXA Partners with any questions or concerns they may have. Consult the general conditions of the travel policy to ensure that the guarantees offered correspond to your needs.

Getting Travel Insurance has never been easier!

Start your quote now, and within minutes, you’ll have your insurance certificate in hand. Select your destination, travel dates, and traveler details, compare travel coverage options , and add any optional benefits to create a custom policy that fits your unique needs. In addition, we have taken steps to ensure that our customers are able to access the coverage and assistance they need in the event that they contract COVID while traveling. Travelers seeking more information while traveling or who have any other questions regarding their specific travel protection plan, call us at 1-855-327-1442 or via collect call at 1-312-935-1719 While travel remains challenging in the current context, our effort to provide relevant and useful coverage can help provide peace of mind for travelers as they navigate the new normal. IMPORTANT : This list is subject to change depending on the evolution of the health situation. Travelers are advised to keep themselves regularly informed of the situation in the country they wish to visit. We advise you to consult the website of the U.S. Department of State, which updates and details the conditions of entry and / or obtaining visa country by country.

Compare Travel Insurance Plans

Get covered against Trip Delays, Medical Emergencies, Lost Baggage, and more!

If I am quarantined before or during my trip because of COVID exposure or illness, am I covered?

Can i take out travel insurance even though i am not yet vaccinated against covid, if i want to cancel my trip because i’m afraid of exposure to covid, does my travel protection plan cover that, if i have booked a trip that leaves at some future date and my destination is affected by covid-19, will i receive reimbursement for my claim if i cancel my trip, does the u.s. require covid testing for re-entry, if i am required to be quarantined on my scheduled return date, will my additional expenses be covered for hotel, food, and transportation, if i test positive for covid during my trip, does the plan provide reimbursement for my lodging expenses, can i claim the ticket expenses if the airlines denied my boarding due to failure to meet the entry requirements of the destination country related to travel restrictions associated with covid, a family member who was our host contracted covid, and i am now forced to incur hotel expenses. is this covered, if the destination/resort to where i traveled mandates covid testing: 1) is the cost of the mandatory test covered 2) will a positive test result administered by a non-qualified physician be satisfactory, due to the restrictions in place in the country where i had to travel, my travel agent changed my dates of stay and/or destination. does my travel coverage apply the same way, i tested positive for covid and my physician ordered me to quarantine. my quarantine is now over, and i am feeling well; however, i have an upcoming trip next month, can i proceed to file a trip cancellation claim.

Do you have questions about your policy regarding COVID? Receive a free quote within minutes Or call us at 855-327-1441 to speak with our licensed Travel Insurance Advisors. Monday-Saturday, 8 AM-7 PM Central Time

Need Help Choosing a Plan?

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

7 Best Cheap Travel Insurance Companies in April 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Finding the cheapest travel insurance is often a priority for travelers hoping to protect themselves and their finances while away from home.

But is it better to err on the side of affordable travel insurance or opt for a more comprehensive plan? That depends on your needs .

On average, a comprehensive plan that covers some combination of trip cancellation and interruption costs, medical coverage and baggage protection (and perhaps a number of other things) will cost you 5%-10% of what you paid for the trip, according to NerdWallet partner Squaremouth, a travel insurance marketplace.

That means a comprehensive policy for a trip that costs you $3,000 could run you anywhere between $150 and $300. Factors like the cost and length of your trip, the age of the travelers and how much protection you want can significantly influence what you pay for your plan.

Ultimately, Squaremouth recommends “the least expensive policy that offers the coverage [travelers] need.”

» Learn more: The best travel insurance companies right now

Factors we considered when picking cheap travel insurance plans

We considered a few factors as we looked for the most affordable travel insurance plans.

Price: If your goal is to find cheaper travel insurance, you want the price to be affordable.

Breadth of coverage: The best budget travel insurance is typically going to be a plan that offers a wide range of protections at an affordable cost, ensuring you’re protected with at least some coverage for a wide range of scenarios.

Uniqueness or customizability : While many travel insurance plans have similar protections, some stand out for particular coverage that can be helpful to certain travelers, like those needing to Cancel For Any Reason , those going on a cruise, or travelers with preexisting health conditions. We didn’t spring for the priciest plans with broad, deep coverage; instead, we picked those that meet a sort of budget "sweet spot" when it comes to cost efficiency.

» Learn more: Is travel insurance worth getting?

An overview of the best cheap travel insurance plans

We looked at travel insurance quotes for a hypothetical 10-day trip to Italy in October 2023. The traveler is a 40-year-old man living in North Carolina who spent $2,000 on the trip, including airfare.

Reliable but cheap travel insurance providers

1. axa assistance usa (silver plan: $70).

Why we picked it:

The $500 missed connection benefit is great for cruise and tour participants. It covers additional transportation, accommodations and meal costs when you miss a cruise or tour departure.

Full trip cancellation and interruption coverage, along with up to $25,000 for out-of-pocket medical costs and baggage coverage.

Among the lowest prices we found.

If you’re willing to spend a bit more than AXA's $70 Silver plan, a Gold plan only costs $19 more and gets you deeper coverage amounts and up to $35,000 in collision rental car insurance.

2. Berkshire Hathaway Travel Protection (ExactCare Value plan: $56)

Cheapest plan we found while still offering a wide array of protections.

Includes a preexisting medical condition waiver.

Add-on rental car collision coverage optional for $10 per day. You can pick how many days you want the additional coverage — it’s not all or nothing.

At $56, this plan comes in at less than 3% of the $2,000 trip cost.

3. IMG (iTravelInsured Lite plan: $77)

Treats COVID-19 like any other illness, which is to say, if your claim accepts flu, strep throat or appendicitis as an acceptable, covered condition, the coronavirus is, too.

Covers costs related to trip interruption up to 125%

Higher than normal limits on dental expenses, at $1,000. If your teeth are your Achilles heel (or your biggest fear), this plan might be for you.

The iTravelInsured Lite plan doesn’t offer some of the bells and whistles that other plans do, like rental car coverage , Cancel For Any Reason coverage or waivers for pre-existing conditions. But you’ll have relatively solid across-the-board trip protections.

4. John Hancock (Silver plan: $93 for a mid-tier plan)

Mid-level plan (as opposed to a basic plan) at an affordable price for travelers who want more coverage without paying too much.

Includes an optional Cancel For Any Reason add-on for travelers wanting flexibility. It is a bit pricey, at half the cost of the insurance ($46.50 extra for a $93 plan).

Reimburses up to $1,000 for lost baggage , far more than many basic plans.

Add-on rental car coverage for $9 per day.

At $88, John Hancock’s basic (Bronze) plan isn’t particularly affordable. But for just $4 extra, you can tap into the benefits of a mid-tier plan at still less than 5% of the total trip cost.

5. Nationwide (Essential plan: $76)

Includes a preexisting conditions waiver.

Add-on rental car coverage for $90.

Covers trip interruption at 125% of the trip cost while providing comprehensive emergency medical and baggage coverage.

6. Seven Corners (Basic plan: $75)

On top of standard trip protections, it includes a relatively affordable Cancel For Any Reason option for $31.50 extra.

If you plan to rent expensive sporting equipment, you might consider paying $10 extra to cover lost, damaged, stolen or destroyed gear.

COVID-19 coverage reimburses you for costs incurred if you have to quarantine .

Rental car coverage comes in at an affordable $7 per day.

Seven Corners’ Basic plan stands out because it offers a little bit of everything, appealing to athletic travelers, those who need affordable trip protections, those who want the flexibility to cancel for any reason and those still concerned about getting quarantined due to COVID-19.

7. Travelex Insurance Services (Basic plan: $71)

Straightforward: What you see is what you get. This plan’s coverage has fewer rules and caveats than many.

While not sporting the highest coverage amounts, it offers a solid range of protections to ensure you get at least something back when your travel is disrupted or you have a medical emergency.

Offers add-on rental car coverage for $10 per day.

At $71, the Travelex Basic plan’s cost is just over 3% of the $2,000 trip’s cost.

If you want to get travel insurance at the cheapest possible rate, here’s a trick. Put $0 as your trip cost, Stan Stanberg, co-founder of comparison site Travelinsurance.com said in an email.

“When excluding trip cancellation and trip interruption coverage the cost of a travel insurance plan goes down significantly,” Stanberg said.

That means you won’t get reimbursed if you need to cancel your trip or if it gets interrupted. But you may still have access to the plan’s medical, trip delay , missed connection, baggage and other protections.

You’ll often find comprehensive travel insurance plans cost 5%-10% of your total trip cost, according to Squaremouth. This will often get you full trip cancellation and trip protection, baggage protection, emergency medical coverage and often other benefits.

Typically, the more you pay, the broader and deeper the coverage.

For many plans, you can purchase travel insurance up until you depart. However, to get access to the most protections possible, booking two days to two weeks after making your initial deposit is the best rule of thumb.

That means you won’t get reimbursed if you need to cancel your trip or if it gets interrupted. But you may still have access to the plan’s medical,

, missed connection, baggage and other protections.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

AXA Travel Insurance Review | Money

T raveling can be an incredibly enriching experience, but it’s important to be prepared for the unexpected. From flight delays to medical emergencies, unforeseen events can quickly turn a dream vacation into a nightmare. Luckily, you can get travel insurance for peace of mind and financial protection during your journey.

There are many options out there, and choosing the best travel insurance company for your needs requires some research. In this article, we’ll take you through the pros and cons of choosing AXA Travel Insurance. We’ll also look at AXA’s plans, pricing, accessibility and customer satisfaction.

Best travel assistance services while abroad

If you’re traveling internationally, having reliable assistance services can go a long way.

AXA Travel Insurance stands out in this department. It has a presence in 30 countries, and customer support services that include:

- 24/7 emergency assistance : AXA’s travel support team is available around the clock. Whether you’re facing a medical emergency or need help with lost documents, you can call for assistance.

- Multilingual support : Language barriers can be a significant challenge when dealing with emergencies in foreign countries. AXA’s multilingual customer support team bridges this gap by offering help in 20 different languages.

- Travel information services : AXA keeps travelers informed with up-to-date travel advisories and safety tips. AXA also offers referrals for lodging, transportation, restaurants and entertainment.

AXA Travel Insurance pros and cons

Concierge services included in all plans, high lost baggage coverage, coverage for lost sports days and equipment, negative customer reviews, cancel for any reason coverage only available with platinum plan, pros explained.

One of AXA’s strengths is the broad range of concierge services it offers with every plan tier. This includes support for booking hotel accommodations, rescheduling flights, arranging ground transportation, obtaining event tickets and making restaurant reservations.

AXA’s Platinum plan offers a maximum benefit of $3,000 for lost baggage. If you’re traveling with valuable property, this might be a worthwhile option.

If your travels include golfing or skiing, AXA Platinum covers up to $1,000 in rental costs should your checked sports equipment be delayed, lost or damaged by your carrier. The plan also covers lost golf rounds up to $500 and lost ski days at $25 per day for five days.

Cons explained

AXA has quite a few poor ratings on online review sites like TrustPilot. Some customers complained about delayed or unfulfilled insurance claims; others say it took months for their claim money to get reimbursed.

AXA’s Cancel for Any Reason (CFAR) benefit, which lets you cancel your trip without losing a dime, is only available on its most expensive plan.

AXA Travel Insurance plans

When evaluating whether AXA is the right provider for you, take some time to research what various travel insurance policies cover . Here’s a quick look at AXA’s plans.

Silver plan

AXA’s Silver plan provides basic coverage for travel-related risks. With this plan, you’ll be covered for 100% of your trip’s cost if it needs to be canceled or cut short due to illness, natural disaster or another specific reason outlined by the company.

The Silver plan also includes emergency medical coverage for emergencies like broken bones, strokes or allergic reactions. This coverage also includes compensation for accidental death and dismemberment, providing an added layer of security and support during your travels.

Moreover, the Silver plan provides baggage and personal belongings coverage, offering compensation if your baggage is lost, stolen or damaged during your trip.

Like the Silver plan, the Gold plan includes 100% trip cancellation coverage, but expands trip interruption coverage to 150%, which gives you an extra safety net if you have to cut your trip short — reimbursing you for a new flight home and any pre-paid expenses you weren’t able to use.

There’s also an option to add a Collision Damage Waiver to this plan, which covers damage or loss to a rental car due to collision, theft or vandalism.

Platinum plan

The Platinum plan is the most comprehensive offering from AXA Travel Insurance, encompassing all the benefits of the Gold Plan at higher maximums. In addition, the Platinum plan offers limited coverage for pre-existing medical conditions and for equipment and reservations related to golf and skiing. You’ll also have access to the Collision Damage Waiver.

At the Platinum plan tier, customers have the option to enhance their coverage with the Cancel for Any Reason benefit. This extends coverage (with a maximum benefit of up to 75% of the trip cost) for cancellations outside the scope of AXA’s standard coverage, like those related to work obligations.

AXA Travel Insurance pricing

The cost of travel insurance depends on several factors. The type of coverage you choose, as well as your destination, total trip cost and the age of travelers in your party all impact how much you pay. Older travelers will pay higher premiums, for example. AXA travel insurance offers competitive pricing, though premiums do vary. To get an accurate quote for your specific trip, use the quote tool on AXA’s website or contact the company at 855-327-1441.

AXA Travel Insurance financial stability

AXA Assistance USA operates as a subsidiary of AXA Group, a French firm, which has a strong financial standing. Major credit rating agencies give AXA Group solid ratings, including an A+ (Superior) from A.M. Best and an Aa3 from Moody’s. These ratings mean travelers can be confident in the company’s ability to pay out claims.

AXA Travel Insurance accessibility

Availability.

AXA Travel Insurance is available to U.S. travelers from all 50 states and Washington, D.C., providing coverage for trips to 200 destination countries around the globe.

Contact information

AXA Travel Insurance’s general customer support is available from Monday to Friday, 8 a.m. to 7 p.m. For policyholders, travel assistance is available by phone 24/7.

Here are the main points of contact for AXA:

- Sales phone number: 855-327-1441

- Customer support phone number: 855-341-9877

- AXA Travel Insurance claim support: 888-957-5015

- AXA Travel Assistance phone number: 855-327-1442

- AXA Travel Insurance email address: [email protected]

User experience

AXA’s website has a personalized quote tool, which can give you an estimate of how much your insurance premium will cost for all three of its plan levels. A downloadable PDF for each plan is available, which provides more details about coverage definitions, limitations and exclusions.

Filing a claim also happens online. To complete the process, policyholders need to download the applicable claim forms and upload them to AXA’s online portal.

AXA Travel Insurance customer satisfaction

AXA Assistance USA is rated A+ by the Better Business Bureau (BBB), though it’s not accredited by the organization. Customers give the company 1 out of 5 stars on the BBB site. Most of the negative feedback is focused on unpaid claims and poor communication with the company.

AXA Travel Insurance FAQ

Is axa travel insurance good, how much is axa travel insurance, does axa travel insurance cover cancellation, how we evaluated axa travel insurance.

To provide an accurate and objective review of AXA Travel Insurance, we analyzed:

- Coverage options

- Coverage limits and pricing

- Accessibility

- Financial stability

- Customer feedback

Summary of Money’s AXA Travel Insurance review

As a global company with employees on five continents, AXA is our pick for offering the best travel assistance services while traveling abroad. All plans include concierge services, which provide invaluable support and multilingual assistance during your travels. AXA’s Platinum plan is particularly good, providing high coverage amounts for lost baggage and sports equipment, among other expenses.

That said, some customers have faced issues with AXA’s claim process and customer service representatives, according to online reviews. Moreover, the company’s Cancel for Any Reason benefit is only available at the Platinum plan level.

Before you pay for a travel insurance policy, be sure to carefully research different providers and compare plans to find the best coverage for your situation. For more guidance, check out our explainers on whether travel insurance is worth it and the best time to buy travel insurance .

© Copyright 2023 Money Group, LLC . All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer .

This article may contain affiliate links that Microsoft and/or the publisher may receive a commission from if you buy a product or service through those links.

Travel insurance

- Insurance provided by Travelex Insurance Services

- Travel Protection Plan provided by AXA Assistance USA, Inc.

- Insurance provided by AXA Assistance

Jump to section

What will insurance cover?

Policies purchased after January 24, 2020 do not cover COVID-19 related trip interruptions and cancellations. Coverage might be available for other benefits, so please refer to your plan for more details. If you added Travelex insurance between February 20, 2020 and February 12, 2021, you’ll find your policy details here .

How to claim compensation or assistance

- Insurance confirmation email

- Your e-ticket

- Your account

How to cancel or change your insurance

- Travelex (for American nationals): After purchasing it you can cancel within 15 days, as long as your trip hasn’t already begun. Insurance cancellation must be done for all passengers at once.

- AXA Assistance USA, Inc. (for American nationals): After purchasing it you can cancel within 10 days, as long as your trip hasn’t already begun. Please review your plan documents for full details as cancellation terms vary by state. Insurance cancellation must be done for all passengers at once.

- AXA (for non-American nationals): You can cancel anytime, for any traveler, up to 48h before your journey.

Related articles

What is the difference between the kiwi.com guarantee and travel insurance.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

8 Cheapest Travel Insurance Companies Worth the Cost

Trawick International »

World Nomads Travel Insurance »

AXA Assistance USA »

Generali Global Assistance »

Seven Corners »

Allianz Travel Insurance »

IMG Travel Insurance »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Cheapest Travel Insurance Companies.

Table of Contents

- Trawick International

- World Nomads Travel Insurance

- AXA Assistance USA

There are plenty of smart ways to save money on your travel plans, but refusing to buy travel insurance isn't necessarily one of them. Not having travel insurance can mean being on the hook for exorbitant medical bills or costs for emergency transportation if you become sick or injured during your trip. You could also face significant financial losses if your trip is delayed or your bags are lost or stolen, and without travel insurance you won't have a third party to rely on for assistance.

Buying affordable travel insurance makes more sense than skipping this coverage altogether, so read on to find out which companies offer the cheapest plans and all the protections you can get for a low cost.

How We Chose the Cheapest Travel Insurance Companies

To determine the cheapest travel insurance companies, U.S. News created sample traveler profiles for three separate eight-day trips to different destinations (the Cayman Islands, Spain and California) at a range of price points ($6,500, $10,500 and $8,500, respectively). We used that information to get quotes for the cheapest option for 100% trip cancellation coverage for each trip. We then calculated the average cost of the trips.

The travel insurance companies that made our ranking have a high credit rating and offer the lowest average cost, outlined below. (Note: The sample average costs are not price quotes from U.S. News. To find a travel insurance price quote, use the "View plans" link to enter your trip details and find more information.)

- Generali Global Assistance

- Seven Corners

- Allianz Travel Insurance

- IMG Travel Insurance

- Trip cancellation coverage (up to $30,000) for 100% of the insured vacation

- Trip interruption coverage (up to $30,000) for 100% of the insured vacation

- Trip delay coverage worth up to $1,000 ($150 per day for delays of 12 hours or more)

- $750 in coverage for lost and damaged luggage; $200 for baggage delays

- Up to $500 in coverage for missed connections of three hours or more

- Up to $50,000 in emergency medical coverage ($750 sublimit for emergency dental)

- Up to $200,000 in coverage for emergency medical evacuation

- Up to $2,500 of trip protection for cancellation or interruption

- Up to $1,000 in coverage of lost, stolen or damaged baggage; up to $750 for baggage delays on your outward journey

- Up to $100,000 in emergency medical insurance; $750 dental sublimit

- Up to $300,000 in coverage for emergency medical evacuation

- 24-hour travel assistance services

- Up to 100% coverage for trip cancellation and interruption

- Up to $500 in coverage for trip delays ($100 per day)

- Up to $500 in coverage for missed connections

- Up to $25,000 in coverage for emergency medical expenses

- Up to $100,000 in coverage for emergency medical evacuation

- Up to $750 in coverage for baggage and personal effects; $200 for baggage delays

- Up to $10,000 in coverage for accidental death and dismemberment (AD&D)

- Up to $25,000 in coverage for common carrier AD&D

- Coverage up to 100% of the insured vacation for trip cancellation

- Up to 125% of the insured vacation cost for trip interruption

- Travel delay coverage worth up to $1,000 per person ($150 per person daily limit)

- Up to $1,000 per person for lost, damaged or stolen bags; $200 per person for baggage delays

- Up to $500 per person for missed connections

- Up to $50,000 in emergency medical and dental coverage

- Up to $250,000 in coverage for emergency assistance and transportation

- AD&D coverage for air travel worth up to $50,000 per person ($100,000 per plan)

- Trip cancellation coverage up to $30,000

- Trip interruption coverage up to 100% of the cost of the trip

- Trip delay coverage worth up to $600 (for six-hour delays; $200 limit per person per day)

- Lost, stolen or damaged baggage coverage up to $500

- Baggage delay coverage worth up to $500 (for six-hour delays; $100 per day)

- Missed cruise or tour coverage worth up to $500 ($250 per day)

- Emergency accident and sickness medical coverage worth up to $100,000 (secondary coverage)

- Up to $750 in emergency dental coverage

- Up to $250,000 in protection for emergency medical evacuation and repatriation of remains

- Trip cancellation coverage worth up to $10,000 per traveler

- Trip interruption coverage worth up to $10,000 per traveler

- Travel delay coverage worth up to $300 ($150 per day)

- Luggage loss and damage protection up to $500 per traveler

- Baggage delay coverage worth up to $200 per day

- Emergency medical and dental coverage up to $10,000 ($500 for dental expenses)

- Emergency medical transportation coverage worth up to $50,000

- 24-hour hotline assistance

- Up to 100% in coverage for trip cancellation

- Trip interruption benefit worth up to 125% of the trip cost

- Up to $500 for travel delays per person ($125 daily maximum per person)

- Up to $750 for lost, damaged or stolen bags ($250 maximum per item)

- Up to $150 in luggage delay coverage

- Up to $100,000 in emergency medical coverage

- Up to $500,000 in coverage for emergency medical evacuation and repatriation of remains

- Trip cancellation coverage worth up to 100% of trip cost (up to $10,000)

- Trip interruption coverage up to 100% of trip cost

- Up to $500 in coverage for travel delays (five-hour delay required; $100 daily limit)

- Coverage worth up to $1,000 for lost, damaged or stolen baggage ($250 per item)

- Coverage worth up to $200 for baggage delays of 12 hours or more

- Up to $250 in coverage for airline reissue or cancellation fees

- Up to $250 in coverage for reinstatement of frequent traveler awards

- Emergency medical and illness coverage worth up to $10,000

- Up to $500 in coverage for emergency dental expenses

- Up to $250,000 in coverage for emergency medical evacuation and repatriation of remains

- AD&D coverage worth up to $10,000

- Travel assistance services

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world and has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family media business.

You might also be interested in:

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

Holly Johnson

These are the scenarios when travel insurance makes most sense.

9 Best Travel Insurance Companies of April 2024

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

The 5 Best International Travel Insurance Companies for 2024

International travel insurance is a must-have for every trip abroad, and for more reasons than one.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

Is It Safe in Moscow?

:max_bytes(150000):strip_icc():format(webp)/RussianKerry2-56a39e8d5f9b58b7d0d2ca8c.jpg)

Stanislav Solntsev / Getty Images

When you visit Moscow , Russia, you’re seeing one of the world’s largest, and most expensive, capital cities . While there is a history of violent crime against foreign journalists and aid personnel in Russia, a trip to Moscow is usually safe for mainstream travelers. Most tourists in Moscow only face potential issues with petty crime, though terrorism is also a concern. Visitors should stick to the principal tourist areas and abide by the local security advice.

Travel Advisories

- The U.S. Department of State urges travelers to avoid travel to Russia because of COVID-19 and to "exercise increased caution due to terrorism, harassment, and the arbitrary enforcement of local laws."

- Anyone exploring more of Russia should avoid "The North Caucasus, including Chechnya and Mount Elbrus, due to terrorism, kidnapping, and risk of civil unrest." Also, travelers should stay away from "Crimea due to Russia’s occupation of the Ukrainian territory and abuses by its occupying authorities."

- Canada states travelers should use a high degree of caution in Russia due to the threat of terrorism and crime.

Is Moscow Dangerous?

The Moscow city center is typically safe. In general, the closer you are to the Kremlin , the better. Travelers mainly need to be aware of their surroundings and look out for petty crime. Be especially careful in tourist areas such as Arbat Street and crowded places like the Moscow Metro transit system. The suburbs are also generally fine, though it is advised to stay away from Maryino and Perovo districts.

Terrorism has occurred in the Moscow area, leading authorities to increase security measures. Be more careful at tourist and transportation hubs, places of worship, government buildings, schools, airports, crowds, open markets, and additional tourist sites.

Pickpockets and purse snatching happen often in Russia, perpetrated by groups of children and teenagers who distract tourists to get their wallets and credit cards. Beware of people asking you for help, who then trick you into their scheme. Don’t expect a backpack to be a safe bag bet; instead, invest in something that you can clutch close to your body or purchase a money belt . Always diversify, storing some money in a separate location so that if you are pickpocketed, you'll have cash elsewhere. Keep an eye out for thieves in public transportation, underground walkways, tourist spots, restaurants, hotel rooms and homes, restaurants, and markets.

Is Moscow Safe for Solo Travelers?

Large cities like Moscow in Russia are overall fairly safe if you are traveling alone, and the Moscow Metro public transit is a secure and easy way to get around. But it is still a good idea to follow basic precautions as in any destination. Avoid exploring alone at night, especially in bad areas. You may want to learn some basic Russian phrases or bring a dictionary, as many locals don't speak English. However, in case you need any help, there are tourist police that speak English. Also, exploring with other trusted travelers and locals or on professional tours is often a good way to feel safe.

Is Moscow Safe for Female Travelers?

Catcalling and street harassment are infrequent in Moscow and the rest of Russia and females traveling alone don't usually have problems. There are plenty of police officers on the streets as well. Still, it serves to stick to Moscow's well-lit, public areas, avoid solo night walks, and use your instincts. Women frequenting bars may take receive some friendly attention. Females can wear whatever they want, but those entering Orthodox churches will be required to cover up. Though women in Russia are independent, domestic violence and other inequality issues take place regularly.

Safety Tips for LGBTQ+ Travelers

Russia is not known as a gay-friendly country. However, Moscow is one of the more welcoming cities with a blooming LGBTQ+ community and many friendly restaurants, bars, clubs, and other venues. Hate crimes in Russia have increased since the 2013 anti-gay propaganda law. Openly LGBTQ+ tourists in this conservative country may experience homophobic remarks, discrimination, or even violence, especially if traveling with a partner. Also, while women hold hands or hug publicly—whether romantically involved or not—men should avoid public displays of affection to prevent being insulted or other issues.

Safety Tips for BIPOC Travelers

Moscow and other big cities in Russia have sizable populations of various cultures, so discrimination against BIPOC travelers is rarer than in other parts of the country where it can become dangerous. Some people living in Russia who are Black, Asian, Jewish, and from other backgrounds have experienced racial discrimination and violence. Tourists won't usually experience overt racism but may be the recipients of some stares. If anyone should bother you, be polite and resist being taunted into physically defending yourself.

Safety Tips for Travelers

Travelers should consider the following general tips when visiting:

- It's best not to drink the tap water. If you do, boil it before drinking, though showering is safe and the amount used to brush teeth is generally not harmful. Mineral water is widely drunk, especially at restaurants, and if you prefer not to have it carbonated ask for “ voda byez gaz” (water without gas).

- If you need emergency assistance in case of fire, terrorism, medical issues, or more, dial 112 in Russia for bilingual operators.

- Be judicious about taking photographs, especially of police or officials. This can potentially bring unwanted attention to yourself by members of law enforcement who won’t mind asking to see your passport. Also avoid snapping photos of official-looking buildings, such as embassies and government headquarters.

- Carry your passport in as secure a manner as possible. If you get stopped for any reason by the police, they can fine or arrest you if you don't have the document with you. Also, keep photocopies of your passport, the page on which your travel visa appears, and any other documents that relate to your stay in Russia.

- Use official taxis only and steer clear of illegal taxi companies, especially at night. Ask your hotel to call a reputable taxi company.

U.S. Department of State. " Russia Travel Advisory ." August 6, 2020.

Government of Canada. " Official Global Travel Advisories ." November 19, 2020.

Is It Safe in Peru?

Is It Safe in Guatemala?

Is It Safe in Rio de Janeiro?

Is It Safe in Barbados?

Is It Safe in Egypt?

Is It Safe in Sweden?

Is It Safe in Colombia?

Is It Safe in Jamaica?

Is It Safe in Germany?

Is It Safe in Iceland?

Is It Safe in Mexico?

Is It Safe in Amsterdam?

Is It Safe in Russia?

2020 Travel Warnings for Countries in Africa

Is It Safe in Thailand?

Is It Safe in Trujillo, Peru?

Basic Travel Insurance Questions

What is Travel Insurance?

Do I need travel Insurance?

How much does Travel Insurance Cost?

How does Travel Insurance Work?

10 Reasons to have a trip protection plan

Women who have made history by Traveling

AXA COVID position statement

What is Overbooking ?

What to do if my luggage is stolen ?

What is a consular notice and what is it used for?

What is ETIAS?

What is Airline Travel Insurance

IMAGES

VIDEO

COMMENTS

Travel Assistance Wherever, Whenever. Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage. 855- 327- 1441.

With our travel insurance we can take great care of you too. GET A QUOTE Hidden. PLANS Silver Gold Platinum Compare Plans BENEFITS ... SRTC 2000, or state equivalent. Benefits are administered by AXA Assistance USA, Inc. (in California, doing business as AXA Assistance Administrators, License Number 0H74893). Non-insurance assistance services ...

Travelers in need of assistance worldwide can tap into AXA's extensive international network of assistance services. AXA Assistance USA's Platinum plan (above) is its highest-rated plan ...

Platinum. Platinum is AXA's highest tier level. This plan includes: Trip delay: $300 per day, with a $1,250 maximum. Trip cancellation: 100% of the trip cost. Trip interruption: 150% of the trip ...

AXA's budget-friendly Silver plan includes the following benefits. Trip interruption insurance: 100% of your trip cost. Missed connections: $500. Travel medical insurance: $25,000 per person ...

The average cost of travel insurance is 4-8% of total non-refundable travel costs. For example, look at the premiums for a 50-year-old Florida resident spending $5,000 on a trip to Denmark. AXA ...

Or call us at 855-327-1441 to speak with our licensed Travel Insurance Advisors. Monday-Saturday, 8 AM-7 PM Central Time ... SRTC 2000, or state equivalent. Benefits are administered by AXA Assistance USA, Inc. (in California, doing business as AXA Assistance Administrators, License Number 0H74893). Non-insurance assistance services are ...

With our business partners we co-design solutions to help enrich their customers' travel experience. Our 60 years of experience in Worldwide Medical Assistance is trusted by multinational corporations and millions of travelers globally. Our holistic assistance approach supports travelers 24/7 with our in-house medical professionals and ...

Or call us at 855-327-1441 to speak with our licensed Travel Insurance Advisors. Monday-Saturday, ... SRTC 2000, or state equivalent. Benefits are administered by AXA Assistance USA, Inc. (in California, doing business as AXA Assistance Administrators, License Number 0H74893). Non-insurance assistance services are provided by AXA Assistance USA ...

Monday - Friday 8AM - 7PM Central Time. Here are the steps to purchase AXA Travel Protection plan online: 1. Click here to get a quote. 2. Enter your travel details, such as the destination, travel dates, and number of travelers. 3. Select the type of insurance policy you need based on your travel plans and needs. 4.

Contributing to make travel extraordinary experiences. Our wide range of proven travel solutions includes medical and non-medical services so that your customers can travel in comfort and safety. In line with our policy of "One AXA" and "Customer First," we design our services to be simple, rapid, and intuitive.

If you're willing to spend a bit more than AXA's $70 Silver plan, a Gold plan only costs $19 more and gets you deeper coverage amounts and up to $35,000 in collision rental car insurance. Learn ...

Discover the best student travel insurance plans for studying abroad. Protect your health, belongings and trip investment. ... AXA Assistance USA Platinum takes the cake when it comes to luggage ...

AXA travel insurance offers competitive pricing, though premiums do vary. To get an accurate quote for your specific trip, use the quote tool on AXA's website or contact the company at 855-327-1441.

How to cancel or change your insurance. Sign in to your booking, scroll down to Extra services, and click Insurance. You can cancel your insurance up to a certain date. Afterwards, insurance is non-refundable. Travelex (for American nationals): After purchasing it you can cancel within 15 days, as long as your trip hasn't already begun.

Average cost of travel insurance across sample trips: $253. AXA Assistance USA offers three tiers of travel insurance for customers who want to pay more (or less) to get the right amount of ...

AIG Travel Guard offers a variety of travel plans, including basic coverage, single-trip, and annual coverage options. ... AXA offers straightforward travel plans with three options to choose from: Silver, Gold, and Platinum. ... 24/7 assistance services. Several travel insurance cover includes 24/7 assistance services that offer emergency ...

With over ¾ million policies sold in the UAE and 20,000+ 4.5 star Google reviews, we are also the most popular. BUY AXA TRAVEL INSURANCE NOW. Our Sales team is available around the clock for any medical emergency assistance or questions on our Travel Inbound, Travel Smart, Annual Travel insurance or Business Travel insurance. CALL +971 4 429 4000.

Present in 51 countries, AXA's 145,000 employees and distributors are committed to serving our 93 million clients. Our areas of expertise are applied to a range of products and services that are adapted to the needs of each and every client across three major business lines: property-casualty insurance, life, savings & health and asset management.

Safe Travels International is available for people up to age 89 years. You can choose the deductible from $0 to $5,000 in Safe Travels International insurance. Other travel health insurance plans commonly don't have $5,000 deductible. Safe Travels International provides policy maximums ranging from $50,000 to $1,000,000.

Travel Advisories . The U.S. Department of State urges travelers to avoid travel to Russia because of COVID-19 and to "exercise increased caution due to terrorism, harassment, and the arbitrary enforcement of local laws."; Anyone exploring more of Russia should avoid "The North Caucasus, including Chechnya and Mount Elbrus, due to terrorism, kidnapping, and risk of civil unrest."

Basic Travel Insurance Questions ... Applicable to policy forms NSIGTC 2000, NSHTC 2000, SRTC 2000, or state equivalent. Benefits are administered by AXA Assistance USA, Inc. (in California, doing business as AXA Assistance Administrators, License Number 0H74893). Non-insurance assistance services are provided by AXA Assistance USA, Inc. and ...