- Search Search Please fill out this field.

What Is a Traveler’s Check?

- How It Works

- Where to Get Traveler's Checks

- Where to Cash Traveler's Checks

- Pros and Cons

- Alternatives to Traveler's Checks

The Bottom Line

- Personal Finance

Traveler's Check: What It Is, How It's Used, Where to Buy

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

Investopedia / Eliana Rodgers

A traveler’s check (sometimes spelled "cheque") is a once-popular but now largely outmoded medium of exchange utilized as an alternative to hard currency and intended to aid tourists. The product is typically used by people on vacation in foreign countries. It offers a safe way to travel overseas without the risks associated with losing cash. The issuing party, usually a bank, provides security against lost or stolen checks.

Beginning in the late 1980s, traveler’s checks have increasingly been supplanted by credit cards and prepaid debit cards.

Key Takeaways

- Traveler’s checks are a form of payment issued by financial institutions such as American Express.

- These paper cheques are generally used by people when traveling to foreign countries.

- They are purchased for set amounts and can be used to buy goods or services or be exchanged for cash.

- If your traveler's check is lost or stolen it can readily be replaced.

- Once widely used, traveler’s checks have largely been supplanted today by prepaid debit cards and credit cards.

How Traveler’s Checks Work

A traveler’s check is for a prepaid fixed amount and operates like cash, so a purchaser can use it to buy goods or services when traveling. A customer can also exchange a traveler’s check for cash. Major financial service institutions issue traveler’s checks, and banks and credit unions sell them, though their ranks have significantly dwindled today.

A traveler’s check is similar to a regular check because it has a unique check number or serial number. When a customer reports a check stolen or lost, the issuing company cancels that check and provides a new one.

They come in several fixed denominations in a variety of currencies, making them a safeguard in countries with fluctuating exchange rates , and they do not have an expiration date. They are not linked to a customer’s bank account or line of credit and do not contain personally identifiable information, therefore eliminating the risk of identity theft. They operate via a dual signature system. You sign them when you purchase them, and then you sign them again when you cash them, which is designed to prevent anyone other than the purchaser from using them.

Many banks, hotels, and retailers used to accept them as cash, although some banks charged fees to cash them. However, with the rising worldwide use of credit cards and prepaid debit cards—such as the Visa TravelMoney card, which offers zero liability for its unauthorized use—it is getting much harder to find institutions that will cash traveler’s checks.

History of Traveler’s Checks

James C. Fargo, the president of the American Express Company, was a wealthy, well-known American who was unable to get checks cashed during a trip to Europe. In 1891, a company employee, Marcellus F. Berry, believed that the solution for taking money overseas required a check with the signature of the bearer and devised a product for it. American Express and Visa still use the British spelling on their products.

Where to Get Traveler's Checks

Companies that still issue traveler's checks today include American Express , Visa , and AAA . They often come with a 1% to 2% purchase fee. AAA now offers members pre-paid international Visa cards instead of paper checks.

In the U.S., they are available primarily from American Express locations. You can also buy traveler's checks online from the American Express website, but you need to be registered with an account. Visa offers traveler's checks at Citibank locations nationwide, as well as at several other banks.

American Express, Visa, and AAA are among the companies that still issue traveler’s checks.

Where to Cash Traveler's Checks

If you want to convert your traveler's checks into cash (instead of spending them directly), you can often deposit them normally at your bank. Many hotel or resort lobbies will also provide this service to guests at no charge. American Express also provides a service to redeem traveler's checks that they issue online to be deposited into your bank account. The redemption application online should take less than 15 minutes to complete.

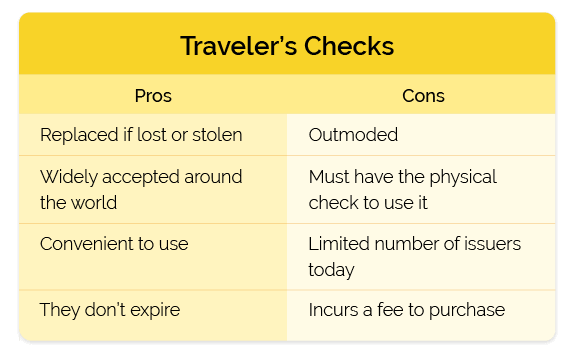

Advantages and Disadvantages of Traveler's Checks

Traveler's checks are handy for tourists who do not want to risk losing their cash or having it stolen while abroad. Because traveler's checks can be reported lost or stolen and the funds replaced, they provide peace of mind. This was particularly a concern before credit cards and ATMs were widespread and affordable worldwide for most travelers. At the same time, these paper checks are now a bit outdated and come with a fee to purchase, making them potentially more expensive and cumbersome than using plastic or electronic payments.

Replaced if lost or stolen

Widely accepted around the world

Convenient to use

They don't expire

Must have the physical check to use it

Incurs a fee to purchase

Limited number of issuers today

Alternatives to Traveler's Checks

The most obvious alternative is to use a credit or debit card issued by a bank that works worldwide and charges low or no foreign exchange fees on purchases or ATM withdrawals. If your bank doesn't allow for this or charges high fees, then prepaid travel cards are the modern version of traveler’s checks. They allow you to get local currency from ATMs and make purchases with merchants—effectively eliminating the need for traveler’s checks.

Prepaid cards are not linked to your bank account, which prevents anybody from draining your checking account if the card gets lost or stolen—and you can’t go into debt. Credit cards offer similar (or better) protection, but you might not want to use your everyday card abroad. By using a dedicated travel card, you avoid spreading your card numbers around, which means you can be less vigilant about monitoring your accounts when you get back home. Visa and MasterCard both offer prepaid cards designed for use abroad. Those cards are available online, through travel agents, and at banks or credit unions.

Travel cards should feature low ATM fees, technology that lets you operate like a local in foreign countries, emergency cash when you lose the card, and “zero liability” fraud protection. That said, prepaid cards can be expensive, so you need to compare fees against your other cards to decide whether or not a travel card makes sense.

For U.S. citizens living abroad for extended periods, maintaining checking and other bank accounts in the United States provides several advantages, and many checking accounts are friendly for foreign transactions .

Where Do You Buy Traveler's Checks?

You can buy still buy traveler's checks from American Express, Visa, and a handful of other financial institutions. To buy them, visit a location or check the website of an issuing institution. You may need a photo ID in order to set up an account.

How Do You Cash Traveler's Checks?

Many hotels, resorts, and currency traders will cash traveler's checks in exchange for local currency. However, with the rising prevalence of credit and debit cards fewer locations cash traveler's checks.

What Do You Do With Traveler's Checks?

Traveler's checks are a secure way of carrying money while abroad. Many businesses in the tourism industry will cash traveler's checks, and they can also be deposited into a bank account. Because the checks can be easily replaced, they have a lower risk of theft or loss. However, traveler's checks have fallen out of favor due to the increased convenience of credit cards and prepaid debit cards.

Traveler's checks were once a popular way to carry money while vacationing abroad. They are sold in fixed denominations, and can be used for purchases or cashed like an ordinary check. Traveler's checks can be easily replaced, making them less risky than carrying large amounts of cash. However, they have fallen out of favor due to the convenience of using credit or debit cards.

Sparks, Evan. “ Nine Young Bankers Who Changed America: Marcellus Flemming Berry .” ABA Banking Journal, June 26, 2017.

Time Magazine. " Travel (April, 1956): The Host with the Most ."

American Express. " Travelers Cheques ."

:max_bytes(150000):strip_icc():format(webp)/_How-does-a-prepaid-card-work-960201_Final2-a914cdbc7901430d80de45153461af0a.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Compare rates and fees for your money transfers.

Read our range of money transfer and banking guides.

Reviews and comparisons of the best money transfer providers, banks, and apps.

Helpful tools to ensure you get the best rates on money transfers.

A Guide to Travellers Cheques

Once a foreign currency staple, this form of prepaid funds has existed for hundreds of years, designed as a way to allow payment from one person to another across currencies. As the financial services sector continues to shift to online solutions , we look at how, where and why travellers cheques are used, as we discuss the relevance of this form of currency.

What are travellers cheques?

The history of the travellers cheque spans as far back as 1772 when the first of its kind was issued by the London Credit Exchange Company, in the UK. Over the coming centuries the concept became popularised on a global scale, with major banks and financial institutions adopting this form of travel money in the 20th century. American Express became the largest issuer of travellers cheques and continues to offer these services to customers to this day.

A safe and convenient method of payment for anyone travelling to foreign territories, these pre-printed cheques hold a fixed amount which can be used worldwide across a range of currencies. Designed to facilitate payments from one person to another, using different currencies, travellers cheques were initially seen as a more practical way for individuals to carry their spending money.

Travellers cheques had their heyday in the late 20th century, reaching peak popularity in the mid-90s, before alternatives such as credit and debit cards became more widely available and easier to manage financial transactions. It was reported in 2018 that a mere 1.5% of Britons use travellers cheques, a rapid decrease over the course of two decades.

How do you use travellers cheques?

When you first receive your travellers cheques, you will be required to sign each one before use, as a way of verifying your signature. Each cheque will have a fixed value (usually $20, $50, $100, $500 etc.) as well as a unique serial number which can typically be found in the top right corner.

It is important to take note of these serial numbers as they will be referenced in any case of lost or stolen cheques. Unlike cash, if anything happens to your travellers cheques, the original vendor will be able to issue a refund for the exact same value. This added level of security is why this payment method was seen as revolutionary when first introduced.

As well as signing upon receipt, you will also need to sign each travellers cheque when used by a retailer or exchanged for cash. The act of signing your name as a form of security is somewhat outdated, given the modern technologies in place nowadays.

When accepted by retailers, a travellers cheque will be treated like local currency, which means you should receive any change in the standard, local currency.

Where can I get travellers cheques?

Due to dwindling demand, travellers cheques are not as readily available as they once were. However, they can still be acquired from some banks and financial institutions, post offices and currency exchange offices, like Travelex.

One thing to note is you may be required to settle the handling, commission or cash-in fees that often accompany travellers cheques, and these can be expensive, amounting to 2 - 3% in some cases. This cost is another reason they are no longer as frequently used.

Where can I use travellers cheques?

Generally, travellers cheques are still accepted all over the world, albeit harder to find vendors selling them and retailers accepting them as legal tender. Consider your destination before deciding on this form of travel money: if you are travelling to major cities there is more chance of you finding somewhere to cash your cheques or use them for in-store purchases. However, more remote destinations may not be equipped or able to accept this type of funds.

How safe are travellers cheques?

The original blueprint for travellers cheques was a paper payment method which could be used as foreign currency but was more secure than handling cash. At the height of its popularity, travellers cheques were generally considered much safer than cash due to the added security of their unique serial numbers, meaning customers could cancel and replace cheques if need be. These numerical codes were a money-back guarantee for anyone whose cheques were misplaced, destroyed or stolen. Another added benefit, if your travellers cheques are intercepted, you will not be vulnerable to bank fraud, as they are in no way connected to your bank account, unlike credit or debit cards.

Financial security measures have evolved greatly since the inception of travellers cheques, however, with the introduction of PIN codes, two-factor authentication, fingerprint touch ID and facial recognition, to name a few forms of fintech security commonly available now. With this in mind, the concept of a travellers cheque no longer measures up in terms of fraud protection and data encryption.

Travellers cheque vs. Cashiers cheque: What is the difference?

In terms of appearance, a travellers cheque looks nearly identical to a standard issue cashier's cheque: but are they similar in any other ways?

A cashiers cheque is issued by a bank or financial institution and is designed to be processed quickly, by the individual whose name is printed on the cheque. Conversely, a travellers cheque is for use overseas, is loaded with prepaid foreign currency - usually USD or GBP - and does not have a name or account number printed on it, although it does require a signature. Because travellers cheques do not have any bank details printed on them, they are deemed safer than cashiers cheques in terms of potential for fraudulent use. In addition to this, they are paid for when printed, meaning it is not possible for a travellers cheque to bounce.

What are the alternatives?

Credit or debit cards.

If you are worried about travellers cheques not being widely accepted where you are going, then this form of travel money will offer more flexibility. Using your regular bank cards overseas provides a record of spending and offers maximum convenience, but there are also some frequently flagged concerns. Primarily these concerns focus on the sky-high fees and below-average exchange rates related to using your debit or credit card abroad. This isn’t always the case, however, as many banks and financial institutions offer travel credit cards, tailored to suit the needs of frequent flyers.

Travel money cards

Prepaid travel money cards are the modern equivalent to travellers cheques and have become very popular. This is largely due to the fact that they are totally separate from your regular bank account, allowing users to spend their balance freely without the worry of potential fraud or overspending. Preloaded with funds, travel money cards often help limit additional currency exchange charges. In addition to this, in spite of fluctuating currency rates, these cards let customers lock-in a favourable exchange rate ahead of time.

International bank accounts

If you are headed overseas for a sustained period of time, it could be more convenient and cost-effective to open a bank account in your destination country. You would be subject to the relevant security and eligibility checks but this decision pays off if you are making regular international money transfers or being paid in a different currency by foreign clients . Find out more about this option by reading our guide: How to Open a Bank Account Overseas.

Due to the growing alternative digital payment methods available nowadays, it seems this age-old travel money no longer measures up in terms of accessibility, cost and convenience. When travellers cheques were originally launched, ATM withdrawals were not commonplace for travellers, and digital point of sale systems had not been invented. Nowadays, it is easy to access local currency using an assortment of different payment methods such as debit or credit cards, travel money cards or money transfer apps .

The best option for anyone who is reluctant to use their debit or credit card overseas, would be to use a prepaid travel money card. Prepaid travel money cards are a safer and more widely used alternative to travellers cheques, and customers do not need to seek out a bank to use them, are not required to sign for each transaction and security measures in place are far more advanced. This method enables customers to secure multiple foreign currencies, locking in the optimum exchange rate for your currency pairing ahead of your trip abroad. Use our comparison tool to ensure you receive the most competitive exchange rates for your international money needs.

Related content

Related content.

- A Guide to Travel Money Cards Travel money cards are a popular payment method for individuals headed abroad. Customers will load funds onto the card, using the money as foreign currency when overseas, much like a debit card is used at home. Also known as travel money prepaid cards or currency cards, they facilitate free foreign transactions and overseas ATM withdrawals. January 16th, 2024

- UK Passports Offer Better Travel Freedom Since Brexit The Henley Passport Index is an annual research project that evaluates the relative power of passports from 199 countries. It determines how many locations each passport allows its holders to access visa-free or with visa-on-arrival, creating a global ranking. June 5th, 2023

- Revealed: Summer Cruises Increase your CO2 Emission by 4700% per KM vs Train Travel Travelling by cruise ship rather than train this summer could increase passengers’ CO2 emissions each kilometre by 4716%, MoneyTransfers.com can reveal. June 5th, 2023

- Cheapest European city breaks on the British government’s exemption list The study incorporated numerous factors across a variety of areas including: February 15th, 2023

- 10 Years of Data Predicts the Go-to Holiday Destinations for Brits Now COVID Is Over To establish the expected changes to tourism and GBP(£) spend abroad going forwards, MoneyTransfers.com analysed 10 years' worth of UK travel data from the Office for National Statistics (ONS) - 2009 - 2019, to discover and predict where Brits will be travelling to in the next 10 years now that travel is well and truly back on again since Covid! February 19th, 2024

Contributors

April Summers

.png)

What is a Traveler's Check?

What is a traveler's check and how might this payment option be useful on vacation? Learn more about the benefits of this prepaid check and how it can make travel easier.

Today there are many options available for travelers who want to safely travel abroad without risking lost or stolen money. You may not have heard of a traveler's check before, but they can be really useful when you need a secure form of payment while traveling abroad.

Learn all about what a traveler's check is and how they work so you can determine whether this is a good payment option for your trip or not.

Do you have a check you need to cash? Visit any nearby Check City store today to use our quick and convenient check cashing services .

A traveler's check is a type of check with a prepaid amount so the user can exchange the check for local currency while traveling. They can also be referred to as "traveler's cheques."

It is a form of paper payment often used by travelers who need a secure form of payment while traveling abroad. It can also help make dealing with foreign currencies a little easier on travelers.

They are a type of prepaid check that can act as an alternative to hard currency. Many travelers would rather not carry around hard cash while on vacation abroad. A traveler's check provides a different option for travelers and vacationers.

How Do Traveler's Checks Work?

Now that you know more about what a traveler's check is, you can learn more about how they work.

Travelers' checks work like cash, except this "cash" is a slip of paper that you have to sign yourself in order to be made valid upon payment. This provides a big security perk to anyone using this check because only the owner of the check can endorse the check for actual use.

Travelers' checks can also be exchanged for local currency when a vender won't accept a check. But either way, you won't have to carry around cash on you all the time while traveling.

These checks are also not linked to your bank account or checking account, so if someone does steal them, they won't gain access to your checking account or your credit or debit cards.

How to Use a Traveler's Check

Step 1: Find a financial institution that offers traveler's checks.

Step 2: Purchase the traveler's checks you need in whatever foreign currency you might need. When you purchase the traveler's checks, this gives the checks their monetary worth, allowing you to use them like cash.

Step 3: When you go to use a traveler's check, you'll endorse the check with your signature.

Are Traveler's Checks Still Used?

Now you know more about what a traveler's check is and how they work, but are traveler's checks still used today?

Travelers checks were first issued in 1772 by the London Credit Exchange Company. In 1890, American Express copyrighted this product as a way for travelers to safely make transactions in foreign countries.

They were largely popular among travelers as a safer way to make foreign transactions up until the late 1980s when the product began being replaced by credit cards, prepaid cards, debit cards, and even special traveler's cards with security features for lost or stolen cards.

Many financial institutions, like American Express, still offer traveler's checks, but there are many other alternatives to travelers checks available now.

Now travelers and tourists can use debit cards and credit cards that can accommodate the local currency and exchange rates of wherever you are traveling.

However, you may need to tell the financial institution that facilitates your bank account before traveling abroad to properly use foreign exchange capabilities on your card when abroad. Otherwise, your account may automatically lock when you try to use it in a foreign place.

Weigh your options for making foreign transactions when traveling, because there are different foreign transaction fees and exchange rates to compare with each option.

Alternatives to Travelers Checks

Knowing what a traveler's check is will help you better weigh your payment options when traveling.

There are many advantages to using traveler's checks, but you may still decide to go with another option. There are now many alternatives to traveler's checks that can potentially come with less cons and more benefits.

Travel-Friendly Credit or Debit Cards

If you have a travel-friendly credit or debit card, then that can be a great option to use while abroad. Not all credit cards and debit cards can be used outside of the country though, so do your research.

You want a credit or debit card that works worldwide and that ideally also has the bank you are using present in that country. You also want to use a bank card that charges low or no foreign exchange fees or ATM fees so you can access cash without paying a lot in fees.

Prepaid Cards

Prepaid cards are a great tool for travelers because they have their own account with their own funds outside of your checking account.

So instead of putting your checking account at risk, you can deposit a set amount of money you want available on your trip to a prepaid debit card instead.

Now, if your prepaid card is lost or stolen, card thieves only have access to whatever money you deposited onto the card and not your entire checking account.

Prepaid cards can also help you budget for the trip. You can put only the money you want to spend on the trip on the card to avoid overspending or going over budget while you travel.

Keep Learning

Article sources.

Payday Loans are also commonly referred to as Cash Advances, Payday Advances, Payday Advance Loans, and Fast Cash Loans. Check City may, at its discretion, verify application information by using national consumer loan underwriting databases that may include information relating to previous cash advance transactions that Check City may take into consideration in the approval process. Approval, products, and loan terms may vary based on applicant qualifications and applicable state or federal law. See Rates and Fees for specific information and requirements. Some customers applying for payday loans or installment loans may be required to submit additional documentation due to state law and qualification criteria. CheckCity.com provides loan services in: Alabama, Alaska, California, Colorado, Idaho, Kansas, Missouri, Nevada, Ohio, Utah, Wisconsin, and Wyoming. In Texas, CheckCity.com acts as a credit services organization/credit access business (CSO/CAB) and will not be the lender for loans obtained through this site; CheckCity.com will instead attempt to arrange a loan between you and an unaffiliated third-party lender. Customer Notice: A single payday advance is typically for two to four weeks. However, borrowers often use these loans over a period of months, which can be expensive. Payday advances are not recommended as long-term financial solutions. Loan proceeds issued through our website are generally deposited via ACH for next business day delivery if approved by 8pm CT Mon. – Fri. This is an invitation to send a loan application, not an offer to make a short-term loan. This service does not constitute an offer or solicitation for payday loans in Arizona, Arkansas, Colorado, Georgia, Maryland, Massachusetts, New York, Pennsylvania, or West Virginia. Tosh of Utah, Inc. dba Check City Check Cashing, a payday lender, is licensed by the Virginia State Corporation Commission (License #PL-57). Anykind Check Cashing, LC. dba Check City, a payday lender, is licensed by the Virginia State Corporation Commission (License #PL-21). The maximum funded amount for payday loans or installment loans depends on qualification criteria and state law. See Rates and Terms for details. Utah Customers: For consumer questions or complaints regarding payday loans and/or title loans you may contact our Customer Service Department toll-free at (866) 258-4672. You may also contact our regulator The Utah Department of Financial Institutions at (801) 538-8830. In California, CheckCity.com is licensed by the California Department of Financial Protection and Innovation pursuant to the California Deferred Deposit Transaction Law, Cal. Fin. Code D. 10. Please see Rates and Terms to check the availability of online loans in your state. Check City does not provide loan services in all states.

Navigating Finances Safely: A Beginner’s Guide to Traveller’s Cheques

When it comes to managing money while on the go, the term Traveller’s Cheque might sound like an old-fashioned option in today’s digital age. However, it still holds value for secure financial transactions during travel. Let’s delve into the world of Traveller’s Cheques in simple and easy-to-understand language.

What are Traveller’s Cheques? Traveller’s Cheques are a form of prepaid currency that travelers can use as a secure and convenient alternative to carrying cash . These cheques are pre-printed with fixed denominations and often include a space for the traveler to sign when ready to use them.

Key Aspects of Traveller’s Cheques Prepaid and Fixed Denominations:

Traveller’s Cheques are purchased in advance with a specific monetary value. They typically come in fixed denominations, such as $20, $50, or $100. It’s like having ready-to-use currency notes with predetermined values. Bold Point : The fixed denominations make it easy for travelers to manage their expenses in a structured manner. Security Features:

Traveller’s Cheques are designed with various security features to prevent unauthorized use. This can include a signature line that the traveler must sign in front of the recipient. It’s like having a personalized layer of security for each cheque. Bold Point: Security features help protect against theft or misuse, providing peace of mind for travelers. Replacement in Case of Loss:

One of the significant advantages of Traveller’s Cheques is that they can be replaced if lost or stolen. The traveler is usually provided with a record of cheque serial numbers, and upon reporting the loss, the issuer can arrange replacements. It’s like having a safety net for unexpected situations. Bold Point: The replacement feature adds an extra layer of security, ensuring that the traveler doesn’t lose the entire value if the cheques are lost. Global Acceptance :

Traveller’s Cheques are widely accepted globally, making them a convenient option for international travel. They can be exchanged for local currency at banks, currency exchange offices, or even some hotels. It’s like having a universally recognized financial instrument . Bold Point: The global acceptance of Traveller’s Cheques makes them a practical choice for those exploring different countries. Why Traveller’s Cheques Matter for Travelers Security and Peace of Mind:

Traveller’s Cheques provide a secure way to carry funds while traveling. The combination of fixed denominations, security features, and the replacement policy offers peace of mind, especially in unfamiliar environments. Bold Point: Travelers can enjoy their journey without the constant worry of carrying large amounts of cash. Convenience in Transactions:

With Traveller’s Cheques, transactions become convenient. Travelers can use them for purchases, dining, or other expenses, similar to using cash. It’s like having a versatile financial tool that fits various spending scenarios. Bold Point: The convenience of using Traveller’s Cheques adds flexibility to financial transactions during travel. Protection Against Exchange Rate Fluctuations:

Traveller’s Cheques often come with the benefit of protection against exchange rate fluctuations. If the cheques are purchased in one currency and used in another, the rate is usually fixed at the time of purchase. It’s like having a shield against unpredictable currency value changes. Bold Point: Protection against exchange rate fluctuations can save travelers from potential losses during currency conversion . Example of Traveller’s Cheques in Action Let’s say Sarah is planning a trip abroad, and she decides to purchase $500 worth of Traveller’s Cheques:

Purchase of Traveller’s Cheques:

Sarah visits a bank or a financial institution that offers Traveller’s Cheques. She exchanges $500 in her local currency for Traveller’s Cheques with fixed denominations. Bold Point: The purchase is straightforward, and Sarah now has Traveller’s Cheques equivalent to $500. Security Measures:

Before her journey, Sarah signs each Traveller’s Cheque in the designated space. This signature will be verified when she uses the cheques. It’s like putting her personal stamp of approval on each cheque. Bold Point: Sarah enhances the security of her Traveller’s Cheques by adding her signature. Using Traveller’s Cheques Abroad:

During her trip, Sarah uses the Traveller’s Cheques for various expenses. She can exchange them for local currency at banks or authorized exchange offices. It’s like having a safe and universally accepted form of currency in her pocket. Bold Point: Sarah enjoys the convenience of using Traveller’s Cheques for seamless transactions. Loss Reporting and Replacement:

Unfortunately, Sarah’s wallet, containing her Traveller’s Cheques, gets misplaced. She promptly reports the loss to the issuer, providing the serial numbers of the lost cheques. The issuer arranges for replacements, ensuring that Sarah doesn’t lose the entire value. Bold Point: The replacement feature comes into play, safeguarding Sarah’s funds even in the face of unexpected events. Conclusion In the realm of travel finances, Traveller’s Cheques prove to be more than just a relic from the past. They offer a secure, convenient, and globally accepted means of carrying funds, with built-in features that prioritize the safety and ease of travelers. So, the next time you embark on a journey, consider Traveller’s Cheques as your reliable financial companion, ensuring smooth transactions and peace of mind along the way.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Contact Info

- 123 Fifth Avenue, New York, NY 10160, United States.

- +191062685255 +192083885366

- [email protected]

- Accounting Service

- Tax Service

- Financial Service

Get In Touch

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis.

- How it Works

- Why choose us

- Snowbirds Real Estate

- Personal Expenses

- Importing Businesses

- Exporting Businesses

- Property Buyers

- International Students

Get started

What Are Traveller’s Cheques and How Do They Work?

You’ve probably heard of traveller’s cheques but may not have used them. A traveller’s cheque is among the many cashless methods of paying for services or goods. However, traveller’s cheques have been losing their popularity since the onset of credit and debit cards.

The good news is that traveller’s cheques are still functional and can save you from the stress and risk of carrying a huge chunk of money while travelling.

Here, we will answer the following questions:

- What are traveller’s cheques?

- How do they work?

- What are the benefits of traveller’s cheques?

- Can traveller’s cheques be a hassle?

- What are alternatives to traveller’s cheques?

Let’s get started.

Don't Waste Money With Banks. Get Exchange Rates Up to 2% Better With KnightsbridgeFX

What are Traveller’s Cheques?

A traveller’s cheque is a printed cheque that allows payment from one person to another and across currencies. So, travellers get the cheque before they travel to exchange it with the local currency after getting to their destination.

You can easily get traveller’s cheques in Canada from financial institutions like American Express or Visa. Also, some local banks offer traveller’s cheques, but most of them scrapped it a long time ago.

How Do Traveller’s Cheques Work?

Traveller’s cheques do not bounce since you pay upfront for a specific amount that you wish to spend. The cheque will have a fixed value and a unique serial number.

Once you receive your traveller’s cheque, you should be conversant with how to use it. So, you should follow the issuer’s instructions and sign the traveller’s cheque upon receipt.

When making purchases, countersign the cheque in the presence of the receiver; the recipient should compare the signatures and confirm that they match. Any change is returned in the local currency since the traveller’s cheque is accepted at the same exchange rate as a cash payment.

However, you must enquire from the recipient if they accept traveller’s cheques as a means of payment before making any purchases. While the traveller’s cheques still work, some institutions and persons refer to them as outdated and do not accept them. You can still make the purchases in such cases, but you need to deposit the traveller’s cheque and receive cash in the local currency. Also, do your research ahead of your trip. Ensure that you can easily access services via your traveller’s cheque before purchasing them.

Most importantly, keep the details of your traveller’s cheque safe. If you lose your traveller’s cheque, you need to provide proof of purchase and the unique serial number to get a refund. Also, contact your cheque issuer immediately after losing your traveller’s cheque.

The traveller’s cheques do not expire. Therefore, you can keep them safe and use them in the future. Alternatively, you can deposit them in your bank account once you get home.

Benefits of Traveller’s Cheques

Here are the various advantages of traveller’s cheques.

- Safety: Traveller’s cheques are safe and can allow you to carry a large amount of money while travelling.

- Refunds are possible: With traveller’s cheques, you can get a refund after you lose and report the issue to your issuer. Also, you can deposit your traveller cheque at your bank once you get home.

- Does not expire: Your traveller’s cheque does not expire and can be kept and used again in the future.

- Branded Cheques: The American Express and Visa offer branded traveller’s cheques that come in various denominations and are readily acceptable globally.

- Good exchange rates: In some cases, traveller’s cheques can access a better conversion rate.

Can Traveller’s Cheques Be A Hassle?

Traveller’s cheques have several advantages, but today, you can experience many struggles while using them.

For starters, the cheques have become outdated. Therefore, most hotels, banks, and individuals will decline them.

As a result, you will likely be forced to hunt down banks and hotels that will accept the traveller’s cheques prior to travelling. If you travel without doing your research, you can be frustrated finding that the cheques are not accepted at your destination.

Also, most banks no longer offer traveller’s cheques. The few banks that offer the cheques might charge you traveller’s cheque fees for the service.

Other Payment Methods That You Might Consider

Purchasing a traveller’s cheque may save you from the stress of carrying a large amount of money that can get lost or stolen. However, it has several limitations.

So, while travelling, you may need to consider the following alternatives:

Debit Cards

The popularity of debit cards is increasing every day. The size of the card and its acceptability rate make it among the most convenient methods of payment. So, many foreign banks, hotels, and ATMs accept foreign debit cards.

Credit Cards

Like a debit card, a credit card is small and secure to travel to various places. Besides, credit cards like MasterCard, Visa, and American Express are accepted as a method of payment in most countries globally.

Although carrying a huge amount of money while travelling is risky, it’s ideal to have a certain amount of money in cash for emergency purposes. For that reason, ensure you bring with you a given amount in the form of cash.

Prepaid Card

Prepaid cards work like debit cards and credit cards since you load them with your bank account money. Therefore, you can use your prepaid card as a debit card on the ATMs and credit card when making purchases and in hotels.

Traveller’s cheques are a safer, cashless method to use when travelling.

However, with the growing popularity of debit cards and credit cards, traveller’s cheques are quickly losing their place in the payment method.

Also, they are unacceptable in most places, making them more unreliable when travelling to destinations that limit their use. So, alongside your traveller’s cheque, carry your debit card, credit card, and some little cash to enjoy your travels .

Stop overpaying with your bank on foreign exchange

We are built to beat bank exchange rates and save you money

KnightsbridgeFx is registered with FINTRAC, under the MSB registration number M09819788. Like most financial institutions, we are required to validate the identity of all clients. We have strict measures in place to protect your privacy.

You're 0% there.

KnightsbridgeFx is registered with FINTRAC, under the MSB registration number M09819788 .

130,000+ Satisfied customers

There is no obligation to transact and no hidden fees.

We guarantee to beat your bank's rate 100% of the time.

Day 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31

Month January February March April May June July August September October November December

Year 1934 1935 1936 1937 1938 1939 1940 1941 1942 1943 1944 1945 1946 1947 1948 1949 1950 1951 1952 1953 1954 1955 1956 1957 1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

Are you or any close relative a Politically Exposed Foreign Person?

(Head of State, Member of Senate, House of Commons, or Legistrature, etc)*

I confirm I am not transacting on behalf of a third party and I have read and I agree to the Terms and Conditions*

- Daily Update (2,671)

- Editorials (40)

- Finance Tips (23)

- Guides (285)

- Holiday Hours (1)

- In the News (34)

- International Money Transfer (10)

- Monthly Canadian Dollar Outlook/Forecast (108)

- Real Estate (11)

- Trading Tips (15)

- Travel Tips (34)

- Uncategorized (6)

Recent Posts

- Canadian Dollar Update – Canadian Dollar caught in a geopolitical vortex

- Canadian Dollar Update – Canadian Dollar Ignores Federal Budget

- Canadian Dollar Update – Canadian Dollar Awaits CPI

- Canadian Dollar Update – Canadian Dollar recoups some losses

- Canadian Dollar Update – Canadian Dollar remains under pressure

- Canadian Dollar Update – Canadian Dollar gets hammered

- Canadian Dollar Update – Canadian Dollar facing dual risks

- Canadian Dollar Update – Canadian Dollar becalmed before BoC

- Canadian Dollar Update – Canadian Dollar Eclipsed

- FX Monthly Update | April 2024

- Canadian Dollar Update – Canadian Dollar on back burner

- Canadian Dollar Update – Canadian Dollar bounces off of support

- Canadian Dollar Update – Canadian Dollar is Steady

- Canadian Dollar Update – Canadian Dollar trickles higher

- Canadian Dollar Update – Canadian Dollar consolidating losses

Foreign/Currency Exchange Resources

- Currency converter Canada

- Currency Conversion

- Foreign Exchange

- $100 USD in CAD

- RBC currency converter

- RBC foreign exchange rate

- BMO exchange rate

- CIBC exchange rate

- BMO currency exchange

- Tire Bank Exchange Rate

- Scotiabank exchange rate

- HSBC exchange rate

- PayPal conversion rate

- Knightsbridge FX Reviews

- Canadian Dollar History

Useful Links

- Why Choose Us

- Get Started

- Send Money to US

- Currency Exchange Canada

- Currency Converter

- USD to CAD Exchange

Our Offices

Main office (Appointment only)

First Canadian Place

100 King Street West Suite 5700 Toronto, ON, M5X 1C7

(416) 479-0834 Toll-Free: 1-877-355-5239 Fax: 1-877-355-5239

Local offices

Toronto : (416) 479-0834 Montreal : (514) 613-0393 Calgary : (403) 800-3025 Ottawa : (613) 704-1798 Vancouver : (604) 229-1065 Victoria : (877) 355-5239 Winnipeg : (204) 318-1150 Halifax : (902) 800-2063

Get up to 5% better than the bank

Choose your currency pair and get rate alerts

All rights reserved. Knightsbridge Foreign Exchange

Currency Exchange Canada.

- Skip to main content

- Skip to primary sidebar

Beyond Borders

Traveler’s Checks: Remitly’s 2023 Guide

Personal Finance

Last updated on January 31st, 2024 at 09:14 am

When traveling, you have plenty of options for exchanging money and paying for goods and services. ATMs, credit cards, and money exchange counters are all more common than ever—but what about traveler’s checks? Are they still a good idea? If so, when?

You might be surprised to learn that traveler’s checks are still popular in certain cases. Read on to learn more about how they work, their pros and cons, and where to get them.

What is a traveler’s check?

Traveler’s checks were first issued in England by the London Exchange Credit Company in 1772. They were developed for use throughout Europe in 90 cities. It wasn’t until American Express created a large-scale system for traveler’s checks in 1891 that they started seeing widespread use internationally.

Today, traveler’s checks are checks issued by financial institutions to help travelers make payments abroad. The checks are exchanged for local currency or given to retailers for payment.

Travelers can purchase checks for fixed amounts in different denominations. The amounts range in value from $20 to $1,000.

The difference between traveler’s checks, cashier’s checks, and money orders

Traveler’s checks, cashier’s checks, and money orders are three payment options travelers can use when traveling abroad. Each payment type is easy to use, but it may not be obvious how they differ and when it makes sense to use one over the other.

A cashier’s check is primarily used in your home country and made out to specific people or companies. Banks and credit unions can issue cashier’s checks if you have an account with them.

Traveler’s checks are ideal for people traveling outside their home country. They don’t need to be made out to specific individuals or companies. Ask your bank or credit union for a traveler’s check.

A money order is similar to a cashier’s check. It’s given to a payee to allow them to receive cash on demand. You can get money orders at the post office, grocery stores, and other similar businesses. Because you don’t need access to a bank account, money orders are the most helpful for people without banking access.

How traveler’s checks work

A traveler’s check works like cash. You get a set of checks from a financial institution in your chosen amount, then take the checks to shops or banks in the country you’re traveling in and exchange them for cash, goods, or services.

When should I use traveler’s checks?

Traveler’s checks are a great option if you’re in situations where you can’t use other payment methods. Although credit and debit cards offer convenience, not every traveler has them.

Another common situation is traveling to an area without ATMs. ATMs may be hard to find in some cities, and you’ll need a method of payment that locals accept.

Traveler’s checks are also a great way to access local currency. A traveler’s check will lock in the exchange rate and allow you to get a fixed amount of local currency when you’re in other countries.

Where to get traveler’s checks

Financial institutions, like banks and credit unions, are the most common places to get traveler’s checks from. American Express, Visa, and the American Automobile Association also offer traveler’s checks.

Keep in mind that traveler’s checks aren’t free. You’ll pay a fee between 1% and 4% in addition to the amount you want the checks in.

Where to cash traveler’s checks

The first places to look are locations that cater to travelers. Hotel or resort lobbies might offer traveler’s check services, and if they don’t, they may be able to point you in the direction of a business that can. Many banks also have locations worldwide that offer services for people using traveler’s checks.

It’s a good idea to research the area you’re staying in and the surrounding area to find businesses that accept checks.

What to do if your traveler’s checks get stolen

One of the wonderful things about traveler’s checks is that the issuer will replace lost or stolen checks.

If you lose your check or it gets stolen, the first step is to contact the provider you purchased the checks from. The provider will ask a few questions, such as the serial number of the checks, how the checks went missing, and other relevant information.

After you provide the information required, replacement checks will be issued, and your money will be refunded if someone else uses the checks.

Advantages of traveler’s checks

Although traveler’s checks are used less frequently these days, they do have a unique set of benefits that make them worthwhile.

- Traveler’s checks are easy to replace

- Traveler’s checks don’t expire

- Because the checks don’t have a link to your accounts, your identity stays safe

- You can exchange traveler’s checks for local currency

Disadvantages of traveler’s checks

Traveler’s checks can offer safety and ease of use to users, but there are a few downsides of using them.

- You have to pay an institution to issue a traveler’s check

- A limited number of institutions issue and accept traveler’s checks

- You must keep track of the serial numbers

Modern alternatives to traveler’s checks

Below are a few popular alternatives to traveler’s checks that allow you to spend money while you’re away from home.

Credit cards

Credit cards are a popular way to spend money abroad. Instead of carrying cash and checks, you only need a piece of plastic to make purchases.

One of the great things about credit cards is security. Most credit cards have fraud protection that safeguards your money if your card gets stolen or lost.

Credit card companies also offer spending rewards . Reward cards give you points whenever you use them for purchases. Once you get enough points, you can redeem them for rewards or cash back.

One thing to be aware of with credit cards is foreign transaction fees. Some companies charge a percentage of your purchase when out of the country.

You’ll also need to let your credit card company know you plan to use your card out of the country. If you don’t, you risk having your card locked.

Debit cards

Debit cards offer the same conveniences as credit cards. Instead of carrying several checks, you only need a small card.

A debit card is also ideal if you would rather not borrow money. You won’t need to worry about extra bills and interest payments since you’re withdrawing cash from your checking account.

Another way to use a debit card is to get local currency . You can use your debit card at a local ATM and withdraw the local currency. Depending on your issuer, you may have fees with a cash withdrawal.

Like credit cards, you may also see foreign transaction fees if you use them when out of the country. These fees will depend on the bank you use.

An additional problem with debit cards is you’re out of luck if your card gets stolen. Because it’s your money and not borrowed on a credit card, you’ll need to wait for a bank to refund your cash.

Prepaid cards

A prepaid card is easier to carry than cash. Unlike credit and debit cards, prepaid cards have a specific amount loaded on the card. You pay to load the card with cash before you go on your trip.

Many consider this a safer option, since you only lose cash on a prepaid card if it’s lost or stolen. Nobody will have access to your bank or credit accounts.

One of the biggest issues with prepaid cards is their cost. You’ll pay a fee every time you load money on your card. These fees usually happen when you reload your card from a retail location.

Mobile wallet

A mobile wallet is a convenient way to make overseas purchases if you carry your phone everywhere, and you’re in a country where mobile payments are common.

Mobile wallets act like real wallets, allowing you to store digital versions of credit cards and debit cards without hauling the physical card with you.

The biggest plus of mobile wallets is convenience. You can easily pick which payment method you wish to use and pay by holding your phone to the payment system.

Because a mobile wallet is on your phone, you also benefit from your phone’s security. It’s not easy for thieves to use your mobile wallet if they can’t access your phone.

That said, mobile wallets are more common in urban areas and in certain countries. Don’t rely on one as your only form of payment when you travel.

London Business Mag is the best UK blog for discovering more cool stuff on the internet.

What Are Travellers Cheques? Understanding the Basics

- by Lucy James

- March 10, 2023

- 6 minutes read

Table of Contents

Traveller’s cheques are banknotes issued by banks to their customers for making payments at foreign currency exchange offices or ATMs or for withdrawing money. The cheque’s issuer is the bank that issues it. Traveller’s cheque usage was first introduced in 1772 and has seen a number of improvements since then. Today, travellers’ cheque usage has grown tremendously, with more and more financial institutions offering these convenient payment options. While they are mostly used overseas, you can now use them at home as well. In this blog, we’ll tell you all you need to know about traveller’s cheques – how they work and how to use them safely at home as well as abroad.

What Are Travellers Cheques?

If you’re travelling overseas, you might be familiar with traveller’s cheques . These pre-printed cheques for fixed amounts are a convenient way of holding money when travelling. They’re issued in foreign currencies and can be exchanged for cash at any bank abroad. While they’re a safe alternative to carrying cash, it’s important to sign each cheque and take note of the serial number of every cheque that is issued in case it needs to be replaced at a later date. Traveller’s cheques are popular because they’re safer than cash and don’t have an expiry date, making them a preferred option for many travellers.

How Travellers Checks Work?

One of the most common ways for travellers to check work visas is to apply for them through recruitment agencies. These agencies have contacts with various organisations that need visa-holders and can help find employment for them. They generally charge a fee for their services, which varies from agency to agency.

Another method of checking work visas is through online job boards. These are commonly used by professionals looking to seek out opportunities in other countries. They can be found on websites such as Indeed and Monster.

Travellers who want to check work visas can also opt to visit embassies or consulates of the country they are interested in working in. These are generally tasked with issuing visas and will be able to help provide accurate information about conditions, pay, and other considerations.

Who Provides Travellers Cheques?

When travelling to the United Kingdom, it is important to know where you can obtain travellers cheques. Travellers cheques can be obtained from the post office, a bank, currency exchange offices and travel agents.

1. The post office is a good place to start when looking for travellers cheques. The post office offers a variety of services, including currency exchange and money transfer. In addition, the post office offers a wide range of currencies, so you are sure to find the right one for your needs.

2. Banks are another option for obtaining traveller’s cheques. Banks offer many of the same services as the post office, including currency exchange and money transfer. However, banks typically have a wider range of currencies available. In addition, banks usually offer better rates than the post office.

3. Currency exchange offices are another option for obtaining travellers cheques. Currency exchange offices offer a variety of services, including currency exchange and money transfer. In addition, currency exchange offices often have a wide range of currencies available. However, currency exchange offices typically charge higher fees than banks or the post office.

4. Travel agents are another option for obtaining travellers cheques. Travel agents typically offer a variety of services, including currency exchange and money transfer. In addition, travel agents usually have a wide range of currencies available. However, travel agents typically charge higher fees than banks or the post office.

Where Can I Exchange Travellers Cheques?

Travellers’ Cheques are a widely accepted form of payment throughout the world and can be exchanged at many financial institutions and banks. Here are some places where you can exchange Travellers Cheques.

Local Post Office: You can exchange Travellers Cheques at your local post office. Most post offices accept Travellers Cheques as payment for postage or money orders.

Bank: You can also exchange Travellers Checes with your bank. Many banks and credit unions offer Travellers Cheque exchange programs, which allow you to deposit Travellers Cheques into a bank account and withdraw them as cash when you travel abroad.

Local Currency Exchange: If you do not have an account with a mainstream bank, consider visiting a currency exchange that specializes in Travellers Cheques. They will be able to exchange your cheque for local currency at a competitive rate.

Tips for Safely Using Travellers Cheques

Traveller’s cheques are a convenient and secure payment method for travellers. They can be refunded if lost or stolen and offer the same level of protection as bank debit or credit cards .

However, pre-travel budgeting is important to avoid spending too much on the trip. Look for a secure payment method, such as a prepaid card, that offers features such as transaction fees and balance checks.

American Express provides its Travelers Cheques Encashment service, enabling users to cash traveller’s cheques at an exchange rate of 0.5 per cent above the interbank exchange rate for Visa and MasterCard holders. On the other hand, Visa Travelers Cheques offer convenience and security with a currency exchange rate of 1 per cent. Both options provide travellers with a choice of payment options and financial protection.

How to Redeem Your Travellers Cheques?

Redeeming your travellers cheques involves making sure that the funds are available in your bank account. Once you have accomplished this, you can use it to pay for your travel expenses. Here are some steps on how to redeem your travellers cheques:

1. Ensure that the funds are available by checking the statement and reconciling any discrepancies with the bank.

2. Contact your bank and ask them whether they have any issues with the cheque. They may require additional documents, such as a copy of their passport or a personal identification number (PIN).

3. If they do not have any issues, go ahead and deposit the cheque. This is done by going to a nearby ATM or using a payment machine at your bank.

4. Finally, keep a photocopy of your cheque for future reference. You will need it to get another one if you wish to withdraw money from an ATM or use it for other purposes.

Security Features of Travellers Cheques

Travellers cheques are a specific paper that is used to make payments between banks and other financial institutions. These cheques have intricate details such as watermarks, raised textures, and a holographic thread to help improve security.

Watermark: The watermark is a subtle image or pattern that appears on the front of the cheque when it is held up to a light source. The watermark can contain information about the bank or financial institution that issued the cheque, such as its logo or name, and can serve as an additional security feature.

Raised Textures: The texture on the back of the cheque has small bumps or ridges that make it more difficult for someone to counterfeit by using a laser printer. This provides an additional layer of security for banks and financial institutions that use Travellers’ cheques.

Holographic Thread: A holographic thread is a line of the fine print on the back of the cheque that appears when it is held up to varying lighting conditions, making it even more difficult for someone to counterfeit.

Advantages and Disadvantages of Travellers Cheques

1. Travellers’ cheques are a fast and convenient way to get money out of the country.

2. They can be used in almost any country, so you’re not limited to certain areas when using them.

3. If something goes wrong with your traveller’s cheque, there is usually a global network of banks that will help you sort it out.

Disadvantages

1. They can be a bit more expensive than other methods of getting money out of the country, such as cash or electronic transfer.

2. Traveller’s cheques can sometimes take a long time to clear, so if you need money quickly, you may be unable to use them.

3. If you lose or misplace your traveller’s cheque, it can be hard to get another one, and you may have to go through the process of replacing it.

Travellers checks are a popular option used in travelling. They’re a fast and relatively secure way to exchange currency. However, there’s a lot of misconception surrounding travellers cheques. We’ve explained the basics of traveller’s cheques and how they work.

Share This Post:

Why are there so many travellers in surrey, why do travellers steal dogs understanding the reasons, leave feedback about this cancel reply.

- Quality 5 4 3 2 1

- Price 5 4 3 2 1

- Service 5 4 3 2 1

Related Post

What is Travellers Cheque? Get Ready to Travel

- Subscriber Services

- For Authors

- Publications

- Archaeology

- Art & Architecture

- Bilingual dictionaries

- Classical studies

- Encyclopedias

- English Dictionaries and Thesauri

- Language reference

- Linguistics

- Media studies

- Medicine and health

- Names studies

- Performing arts

- Science and technology

- Social sciences

- Society and culture

- Overview Pages

- Subject Reference

- English Dictionaries

- Bilingual Dictionaries

Recently viewed (0)

- Save Search

- Share This Facebook LinkedIn Twitter

Related Content

More like this.

Show all results sharing these subjects:

traveler's cheque

Quick reference.

A cheque issued by a bank, building society, travel agency, credit-card company, etc., to enable a traveller to obtain cash in a foreign currency when abroad. They may be cashed at banks, exchange bureaus, restaurants, hotels, some shops, etc., abroad on proof of identity. The traveller has to sign the cheque twice, once in the presence of the issuer and again in the presence of the paying bank, agent, etc. Most traveller's cheques are covered against loss.

From: traveler's cheque in A Dictionary of Finance and Banking »

Subjects: Social sciences — Economics

Related content in Oxford Reference

Reference entries, traveller's cheque.

View all related items in Oxford Reference »

Search for: 'traveler's cheque' in Oxford Reference »

- Oxford University Press

PRINTED FROM OXFORD REFERENCE (www.oxfordreference.com). (c) Copyright Oxford University Press, 2023. All Rights Reserved. Under the terms of the licence agreement, an individual user may print out a PDF of a single entry from a reference work in OR for personal use (for details see Privacy Policy and Legal Notice ).

date: 20 April 2024

- Cookie Policy

- Privacy Policy

- Legal Notice

- Accessibility

- [66.249.64.20|185.80.150.64]

- 185.80.150.64

Character limit 500 /500

How Traveler’s Cheque Issued? – Step by Step guide, Benefits & Requirements

Traveler’s cheques have long been a trusted and convenient form of payment for individuals traveling abroad. They offer a secure and reliable method of carrying funds while ensuring peace of mind. If you’re planning a trip and considering using cheques, it’s essential to understand how they are issued. In this article, we will provide you with a step-by-step guide to help you grasp the procedure thoroughly.

Let’s explore step by step guide for “How Traveler’s Cheque is issued?”

1. Purchasing the Cheque

The first step in obtaining a traveler’s cheque is to purchase it from a reputable financial institution or authorized agent. These institutions may include banks, credit unions, or specialized companies. Choosing a reliable source that offers competitive exchange rates and low fees is advisable.

2. Completing the Required Information

Once you have obtained the traveler’s cheque, it’s time to fill out the necessary information. The cheque typically includes spaces for the recipient’s name, date of issuance, and the total value of the cheque. It’s crucial to provide accurate details to avoid any complications during the payment process.

3. Signing the Cheque

After completing the required information, you need to sign the traveler’s cheque. Your signature serves as a form of authorization and ensures that only the designated recipient can use the cheque. It’s essential to sign the cheque immediately and avoid leaving any blank spaces to prevent misuse.

4. Validating the Cheque

Before finalizing the issuance process, the financial institution or authorized agent will validate the cheque. This step involves confirming your identity and verifying the details provided on the cheque. The validation process adds an extra layer of security to protect against fraudulent activities.

Once the traveler’s cheque has been issued and validated, it is ready to be used during your travels. It’s important to keep the cheques in a safe place and treat them as you would treat cash. When you need to use it, you can simply sign it in the presence of the recipient and hand it over as payment.

Benefits of Traveler’s Cheque

1. Security :

They are a secure way to carry money while traveling. They can be replaced if lost or stolen, providing peace of mind and protection against financial loss.

2. Acceptance

They are widely accepted in many countries around the world. They can be used at hotels, restaurants, and retail establishments, making them a convenient payment option.

3. Flexibility

Traveler’s cheques are available in various currencies, allowing you to choose the currency of your destination. This eliminates the need for currency exchange and provides flexibility in managing your expenses.

4. Budgeting

You can better manage your travel budget. You can pre-determine how much you wish to carry, helping you stick to your financial plan.

Also read: 7 Best Alternative Options For Promoting Your Travel Blog Instead Of Instagram

Requirements and why you need a traveler’s cheque.

1. Identification:

Financial institutions or authorized agents will require proper identification, such as a valid passport or driver’s license.

You will need to have the necessary funds to purchase the cheques. The amount will depend on the value and currency of the cheques.

3. Travelling Abroad:

Traveler’s cheques are specifically designed for individuals traveling abroad. They are particularly useful when visiting countries where credit cards may not be widely accepted or where carrying large amounts of cash may pose a risk.

Are traveler’s cheques still widely accepted?

Yes, traveler’s cheques are still accepted in many countries worldwide. However, their usage has declined in recent years due to the availability of other payment options such as credit cards and prepaid travel cards.

Can I use traveler’s cheques in any currency?

Traveler’s cheques are available in various currencies, including major ones such as USD, EUR, and GBP. It’s advisable to choose the currency of the country you’re traveling to for easier acceptance and conversion.

What should I do if my traveler’s cheques are lost or stolen?

If your cheques are lost or stolen, report the incident immediately to the issuing institution. Most companies provide a 24/7 helpline for such emergencies and will assist you in canceling lost cheques and issuing replacements.

Are there any fees associated with traveler’s cheques?

Yes, there may be fees associated with the purchase of cheques, such as an issuance fee or currency exchange fees. It’s important to inquire about these fees before purchasing the cheques and compare them across different institutions.

Can I cash traveler’s cheques anywhere?

Cheques can be cashed at various financial institutions, including banks and exchange offices. It’s advisable to cash them at authorized locations to ensure a smooth and hassle-free process. Some establishments may charge a small fee for cashing.

How do I keep my traveler’s cheques secure during my trip?

It’s essential to keep your cheques secure during your trip. Treat them as you would treat cash and store them in a safe and separate place. Make sure to keep a record of the serial numbers of your cheques in case of loss or theft.

Can I use traveler’s cheques for online purchases?

Traveler’s cheques are primarily designed for in-person transactions. They are less commonly used for online purchases. It’s recommended to use alternative payment methods, such as credit cards or online payment platforms, for online transactions.

Do traveler’s cheques expire?

Traveler’s cheques typically do not have an expiration date. However, it’s advisable to check the terms and conditions of the specific issuer as policies may vary. It’s always a good practice to use them within a reasonable time frame to ensure hassle-free acceptance.

Are there any alternatives to traveler’s cheques?

Yes, there are alternative forms of payment for travelers, such as credit cards, prepaid travel cards, and digital payment options. These alternatives offer convenience and ease of use. However, traveler’s cheques remain a reliable choice for those seeking a secure and widely accepted payment method.

In conclusion, traveler’s cheques continue to be a trusted and valuable option for travelers. Their secure nature, widespread acceptance, emergency replacement services, and budget control features make them an ideal choice for individuals venturing abroad. By understanding the step-by-step process of obtaining and using traveler’s cheques, you can confidently incorporate them into your travel plans. Remember to research and choose a reputable institution for purchasing your cheques, keep them secure throughout your trip, and enjoy the convenience and peace of mind they offer. Happy travels!

Related posts:

Leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Traveler’s Checks When Traveling Abroad — Useful or Outdated?

Christy Rodriguez

Travel & Finance Content Contributor

87 Published Articles

Countries Visited: 36 U.S. States Visited: 31

Keri Stooksbury

Editor-in-Chief

32 Published Articles 3112 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

What Are Traveler’s Checks?

Where to buy traveler’s checks, how to use traveler’s checks, what to do if traveler’s checks are stolen, 1. no access to credit or debit card, 2. limited access to atms, 3. access good exchange rates , 4. avoid common credit or debit fees, 5. as an added safety measure, 1. limited availability for use, 2. not all banks offer them, 3. potential for additional fees, 4. bulky paperwork, credit card, prepaid card, do your research, tell your bank you are traveling, don’t keep all of your money in 1 place, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

When traveling abroad, you might wonder how to pay for things once you arrive. Should you bring currency on your trip? Which currency should you bring? Can you get money once you arrive? How much cash should you carry at once?

Many of these questions can be answered by using traveler’s checks. Traveler’s checks might seem like an outdated choice, but they can still be useful in certain situations.

In this article, we’ll explain what traveler’s checks are, how they work, and when they might be worth the hassle. We’ll also explore other more common alternatives and give tips for obtaining foreign currency.

Traveler’s checks are documents that can be used like standard paper checks and cash. Travelers purchase them before they leave home to exchange for cash in the local currency when they arrive at their destination.

These checks are printed in varying denominations, and each check is uniquely numbered so that it can be replaced quickly if lost or stolen.

Banks, hotels, and merchants were once very used to accepting traveler’s checks. These places liked traveler’s checks because of the safeguards that were put in place. Basically, as long as the original signature matched the signature made at the time of the purchase, payment is guaranteed — eliminating any “bounced checks.”

Now, with the increased use of credit and debit cards (especially those with no foreign transaction fees ), prepaid cards, and ATMs on every corner, traveler’s checks have become less popular.

You may find it difficult to find banks or hotels that accept them , and if you do, you might be at the mercy of their business hours to cash them in.

How To Buy and Use Traveler’s Checks

You can still buy and use traveler’s checks in the U.S. and other countries.

You can find traveler’s checks offered by companies like American Express and Visa . You can also go to your local AAA office to purchase them.

The best place to purchase traveler’s checks is from your own bank, but unfortunately, many banks no longer offer traveler’s checks, including Chase, Wells Fargo, and Bank of America.

If you’re not sure if your bank offers traveler’s checks, it’s worth contacting them to confirm. If you are a customer, banks typically waive any fees to obtain them and this can add up because other companies can add on a 1% to 3% fee on top of the base currency amount that you request.

In order to obtain a traveler’s check, you will need to:

- Either go in person to an eligible bank or visit the website of the traveler’s check issuer.

- Select the total amount of currency to purchase.

- Submit payment, including any fees.

Once you have the traveler’s checks, you need to know how to use them. Traveler’s checks work a bit differently than other forms of currency. Here are the steps you’ll need to take:

- Sign the checks immediately. Follow the issuer’s instructions to find out where to sign (and only sign once).

- Leave evidence of your traveler’s check purchase somewhere safe. If checks get lost or stolen, you’ll need to provide proof of purchase along with check numbers to get a refund. Leave those details with a friend or save them online for easy remote access.

- Complete the payee and date fields. Once you have confirmed that the payee or bank will accept traveler’s checks, fill out the payee and date fields.

- Sign the check again. You must complete this portion in-person to ensure that the signature matches the original. You may also need to show some sort of identification as well. This is key to keeping traveler’s checks secure.

- If checks get lost or stolen, contact the issuer immediately. You may be able to get replacement checks locally, and the issuer needs to know which checks to cancel.

Traveler’s checks don’t expire , so if you don’t use them you can either keep them for future use or deposit them into your bank account once you’re home.

If all of your cash is stolen while you’re traveling abroad, you’ll have next to no chance of getting it back.

However, if this happens with your traveler’s checks, you’ll likely get them replaced as long as you’ve complied with your check issuer’s purchase agreement . This is the primary benefit of traveling with traveler’s checks.

Bottom Line: Treat your traveler’s checks like cash. If you lose your checks, you may not get replacements if your check issuer has reason to believe you didn’t safeguard them appropriately.

Here’s what to do if your traveler’s checks are lost or stolen:

- Call the customer service phone number provided by your issuer or find it by accessing their website.

- Provide proof that the check is yours by submitting the check number, proof of purchase, and your identification. It’s important to have easy access to this information for this reason.

- If required by your issuer, provide evidence that you have reported your stolen check to the police.

- Be sure to return any other refund paperwork requested.