- Travel Planning Guide

Singapore Travel Budget - Visit Singapore on a Budget or Travel in Style

- Singapore Costs

- Is Singapore Expensive?

- How much does a trip to Singapore cost?

- Is Singapore Worth Visiting?

- Singapore Hotel Prices

- Singapore Cities: Hotel Prices by City

- Best Hotels for First Time Visitors in Singapore

- Best Luxury Hotels in Singapore

- Best Business Hotels in Singapore

- Best Cheap Hotels in Singapore

- Best Hotels for One Night in Singapore

- Best Hotels for One Week in Singapore

- Best Pet-Friendly Hotels in Singapore

- Best Hotels for a Weekend Getaway in Singapore

- Best Romantic Hotels for Couples in Singapore

- Best Family-Friendly Hotels in Singapore

- Best Beach Hotels in Singapore

- Hostel Prices & Reviews

- Singapore Tour Prices

- The Best Family-Friendly Tours to Singapore

- The Best Historical Tours in Singapore

- The Best 2-Week Tours in Singapore

- The Best 3-Week Tours in Singapore

- The Best Christmas & New Years Tours in Singapore

- The Best Coach Bus Tours in Singapore

- The Best Adventure Tours to Singapore

- The Best Sightseeing Tours in Singapore

- The Best Cultural Tours in Singapore

- The Best Romantic Tours for Couples in Singapore

- The Best Budget Tours to Singapore

- The Best Tours for Seniors to Singapore

- The Best Contiki Tours to Singapore

- How much does it cost to travel to Singapore? (Average Daily Cost)

- Singapore trip costs: one week, two weeks, one month

How much do package tours cost in Singapore?

Is singapore expensive to visit.

- How much do I need for a trip to Singapore?

- Accommodation, Food, Entertainment, and Transportation Costs

- Travel Guide

How much does it cost to travel to Singapore?

You should plan to spend around $154 (SG$210) per day on your vacation in Singapore. This is the average daily price based on the expenses of other visitors.

Past travelers have spent, on average for one day:

- $27 (SG$37) on meals

- $10 (SG$14) on local transportation

- $195 (SG$266) on hotels

A one week trip to Singapore for two people costs, on average, $2,158 (SG$2,937) . This includes accommodation, food, local transportation, and sightseeing.

All of these average travel prices have been collected from other travelers to help you plan your own travel budget.

- Travel Style: All Budget (Cheap) Mid-Range Luxury (High-End)

- Average Daily Cost Per person, per day $ 154 SG$ 210

- One Week Per person $ 1,079 SG$ 1,469

- 2 Weeks Per person $ 2,158 SG$ 2,937

- One Month Per person $ 4,624 SG$ 6,294

- One Week For a couple $ 2,158 SG$ 2,937

- 2 Weeks For a couple $ 4,316 SG$ 5,874

- One Month For a couple $ 9,248 SG$ 12,588

Are You an Experienced Traveler?

Help other travelers! Answer a quick question about your past travels. Click here: let's do it!

How much does a one week, two week, or one month trip to Singapore cost?

A one week trip to Singapore usually costs around $1,079 (SG$1,469) for one person and $2,158 (SG$2,937) for two people. This includes accommodation, food, local transportation, and sightseeing.

A two week trip to Singapore on average costs around $2,158 (SG$2,937) for one person and $4,316 (SG$5,874) for two people. This cost includes accommodation, food, local transportation, and sightseeing.

Please note, prices can vary based on your travel style, speed, and other variables. If you're traveling as a family of three or four people, the price per person often goes down because kid's tickets are cheaper and hotel rooms can be shared. If you travel slower over a longer period of time then your daily budget will also go down. Two people traveling together for one month in Singapore will often have a lower daily budget per person than one person traveling alone for one week.

A one month trip to Singapore on average costs around $4,624 (SG$6,294) for one person and $9,248 (SG$12,588) for two people. The more places you visit, the higher the daily price will become due to increased transportation costs.

Organized tours are usually more expensive than independent travel, but offer convenience and peace of mind that your trip has been planned by a travel expert.

The average price for an organized tour package in Singapore is $388 per day. While every tour varies by total price, length, number of destinations, and quality, this is the daily average price based on our analysis of available guided tours.

- Malaysia and Singapore Highlights (8 Days) 8 Days - 5 Destinations $ 1,068

- Independent Singapore City Stay 4 Days - 1 Destinations $ 1,499

Independent Travel

Traveling Independently has many benefits including affordabilty, freedom, flexibility, and the opportunity to control your own experiences.

All of the travel costs below are based on the experiences of other independent travelers.

Singapore is a moderately priced destination to visit. It's about average with most other countries for travel costs. The prices for food, accommodation, and transportation are all fairly reasonable.

Within Asia, Singapore is somewhat more expensive compared to the other countries. It is in the top 25% of countries in Asia for its travel costs. While a few countries in the region are more expensive, Singapore is more expensive than most.

For more details, see Is Singapore Expensive?

How much money do I need for a trip to Singapore?

The average Singapore trip cost is broken down by category here for independent travelers. All of these Singapore travel prices are calculated from the budgets of real travelers.

Accommodation Budget in Singapore

Average daily costs.

Calculated from travelers like you

The average price paid for one person for accommodation in Singapore is $98 (SG$133). For two people sharing a typical double-occupancy hotel room, the average price paid for a hotel room in Singapore is $195 (SG$266). This cost is from the reported spending of actual travelers.

- Accommodation 1 Hotel or hostel for one person $ 98 SG$ 133

- Accommodation 1 Typical double-occupancy room $ 195 SG$ 266

Hotel Prices in Singapore

Looking for a hotel in Singapore? Prices vary by location, date, season, and the level of luxury. See below for options.

Find the best hotel for your travel style.

Actual Hotel Prices The average hotel room price in Singapore based on data provided by Kayak for actual hotel rooms is $111. (Prices in U.S. Dollars, before taxes & fees.)

Kayak helps you find the best prices for hotels, flights, and rental cars for destinations around the world.

Recommended Properties

- River City Inn Singapore Budget Hotel - Kayak $ 18

- Raffles Singapore Luxury Hotel - Kayak $ 728

Local Transportation Budget in Singapore

The cost of a taxi ride in Singapore is significantly more than public transportation. On average, past travelers have spent $10 (SG$14) per person, per day, on local transportation in Singapore.

- Local Transportation 1 Taxis, local buses, subway, etc. $ 10 SG$ 14

Recommended Services

- Singapore Changi Airport Arrival Transfer Viator $ 66

- Singapore Departure: Hotel to Singapore Cruise Centre Transfer Viator $ 60

What did other people spend on Local Transportation?

Typical prices for Local Transportation in Singapore are listed below. These actual costs are from real travelers and can give you an idea of the Local Transportation prices in Singapore, but your costs will vary based on your travel style and the place where the purchase was made.

- Taxi to Airport SG$ 32

Food Budget in Singapore

While meal prices in Singapore can vary, the average cost of food in Singapore is $27 (SG$37) per day. Based on the spending habits of previous travelers, when dining out an average meal in Singapore should cost around $11 (SG$15) per person. Breakfast prices are usually a little cheaper than lunch or dinner. The price of food in sit-down restaurants in Singapore is often higher than fast food prices or street food prices.

- Food 2 Meals for one day $ 27 SG$ 37

Recommended

- Private History & Culture Tour with River Cruise, Hawker Dinner & Tea… Viator $ 211

- Secrets of Singapore Kick Scooter Tour with Dinner Viator $ 47

What did other people spend on Food?

Typical prices for Food in Singapore are listed below. These actual costs are from real travelers and can give you an idea of the Food prices in Singapore, but your costs will vary based on your travel style and the place where the purchase was made.

- Sugarcane Juice SG$ 2.00

- Breakfast SG$ 6.09

Entertainment Budget in Singapore

Entertainment and activities in Singapore typically cost an average of $32 (SG$44) per person, per day based on the spending of previous travelers. This includes fees paid for admission tickets to museums and attractions, day tours, and other sightseeing expenses.

- Entertainment 1 Entrance tickets, shows, etc. $ 32 SG$ 44

Recommended Activities

- Singapore Full Day Tour with a Local: 100% Personalized & Private Viator $ 261

- Private Customised Tour City Highlights - Half Day or Full Day Viator $ 157

Tips and Handouts Budget in Singapore

The average cost for Tips and Handouts in Singapore is $9.22 (SG$13) per day. The usual amount for a tip in Singapore is 5% - 15% .

- Tips and Handouts 1 For guides or service providers $ 9.22 SG$ 13

Scams, Robberies, and Mishaps Budget in Singapore

Unfortunately, bad things can happen on a trip. Well, you've just got to deal with it! The average price for a scam, robbery, or mishap in Singapore is $55 (SG$75), as reported by travelers.

- Scams, Robberies, and Mishaps 1 $ 55 SG$ 75

Alcohol Budget in Singapore

The average person spends about $27 (SG$36) on alcoholic beverages in Singapore per day. The more you spend on alcohol, the more fun you might be having despite your higher budget.

- Alcohol 2 Drinks for one day $ 27 SG$ 36

- Tour of Tiger Brewery in Singapore Viator $ 21

- Enjoy Gin Distillery Tour with Tasting Flight and Singapore Sling Masterclass Viator $ 55

Water Budget in Singapore

On average, people spend $2.94 (SG$4.00) on bottled water in Singapore per day. The public water in Singapore is considered safe to drink.

- Water 2 Bottled water for one day $ 2.94 SG$ 4.00

Related Articles

Singapore on a budget.

At A Glance

- If you've been backpacking through Southeast Asia and you're about to head home, then Singapore is a great place to splurge on a nice hotel. You can find some excellent four star hotel options that are a fraction of the cost you might pay in Europe of the United States. Many offer rooftop pools that look out over the city's skyline. If it's your last night on the road live it up with a nice splurge for the evening.

- There are some great tourist attractions around Singapore, but a more interesting experience is to get off the tourist trail for a while and explore some back roads and residential neighborhoods. It's fun to see how people are living, where they're doing their shopping and what daily life is like in this unique country.

- Public transportation in Singapore is excellent. It's really not necessary to take a taxi anywhere because most places are served by either the subway or the bus system. You'll save yourself a lot of money if you avoid taxis in general.

- You can expect it to rain almost once a day in Singapore, whatever time of year you visit. Come prepared with an umbrella and be prepared to hop inside a shop or restaurant until it passes. Storms are usually short, hard, and abrupt before they blow over.

- Chinese New Year is a great time to visit Singapore. Because there is such a strong Chinese influence over the country, the festivities are popular and there is always something going on. If you're in town for the events definitely check them out. Do make sure you have reservations well in advance though as hotels tend to fill up and last minute prices can be quite high.

Top Tourist Attractions

Popular foods.

We've been gathering travel costs from tens of thousands of actual travelers since 2010, and we use the data to calculate average daily travel costs for destinations around the world. We also systematically analyze the prices of hotels, hostels, and tours from travel providers such as Kayak, HostelWorld, TourRadar, Viator, and others. This combination of expenses from actual travelers, combined with pricing data from major travel companies, gives us a uniqe insight into the overall cost of travel for thousands of cities in countries around the world. You can see more here: How it Works .

Subscribe to our Newsletter

By signing up for our email newsletter, you will receive occasional updates from us with sales and discounts from major travel companies , plus tips and advice from experienced budget travelers!

Search for Travel Costs

Some of the links on this website are sponsored or affiliate links which help to financially support this site. By clicking the link and making a purchase, we may receive a small commission, but this does not affect the price of your purchase.

Travel Cost Data

You are welcome to reference or display our travel costs on your website as long as you provide a link back to this page .

A Simple Link

For a basic link, you can copy and paste the HTML link code or this page's address.

Travel Cost Widget

To display all of the data, copy and paste the code below to display our travel cost widget . Make sure that you keep the link back to our website intact.

- Privacy / Terms of Use

- Activities, Day Trips, Things To Do, and Excursions

Editorial note: We may not cover every product in this category. For more information, see our Editorial guidelines .

The 5 best travel money cards for singapore in 2024.

Singapore is a vibrant place to visit with amazing nightlife, delicious food and a gateway to the rest of the world, it has a lot to offer visiting Australians.

In Singapore you are likely to pay for accommodation, food, transport and entertainment as well as withdraw cash from ATMs with your card.

We have looked at a number of best travel card for overseas in 2024 and have summarised their best points.

Best 6 Travel Money Cards for Singapore in 2024:

- Wise Travel Card - for the best exchange rates

- Revolut Travel Card for low fees

- Travelex Money Card - best all rounder

- HSBC Global Everyday Debit Card for ATM cash withdrawals

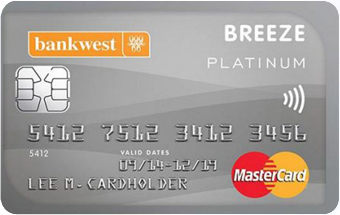

- Bankwest Breeze Platinum Credit Card for lowest interest rate

- ING One Low Rate Credit Card with no annual fee

Wise Travel Card - Best Exchange Rates

- 40+ currencies available

- Best exchange rates globally

- One of the lowest conversion fee on the market

- No international transaction fees

- No annual or monthly fees

- Extremely low costs to send money overseas

Wise Travel Card

- Cross currency conversion fees are between 0.24–3.69%. AUD to USD, EUR or GBP was 0.42%, which is one of the lowest on the market

- Free cash withdrawals up to $350 every 30 days. However after that, Wise Card charge a fixed fee of $1.50 per transaction + 1.75%

- Daily ATM withdrawal is $2,700

- Issue up to 3 virtual cards for temporary usage

- It takes between 7 to 14 business days to receive your card

- Can be used wherever MasterCard is accepted

The Wise Travel Card is an excellent choice for people traveling to Singapore, offering a multitude of benefits tailored to international visitors. One of the key advantages is access to over 40 currencies at the interbank exchange rate, widely acknowledged as the most cost-effective globally. This is particularly useful for travelers coming to Singapore, as they can exchange their home currency for Singapore Dollars (SGD) at very competitive rates. However if you use ATMs frequently this is not the card to use due to the fees. Finally Wise Travel Card lets you transfer money to an overseas bank account with extremely low fees and the best exchange rate.

Revolut - Best Exchange Rates

- 30+ currencies available

- One of the best exchange rates globally

- No annual or monthly fees for standard membership

- No initial card fee

- Instant access to a range of cryptocurrencies

Read our Revolut Card Review

Revolut Travel Card

- No fee ATM withdrawals up to A$350, or 5 ATM withdrawals, whichever comes first, per rolling 30 day period and 2% of withdrawal amount (minimum charge of A$1.50) after that

- Exchanging currency on the weekend can incur a 1% mark-up fee

- Fees on international money transfers were introduced in April 2021.

- Can be used wherever Visa is accepted

The Revolut Travel Card is a decent option for those who travel a lot as it offers over 30 currencies at a great exchange rate, which is the cheapest rate globally. However if you exchange currency on the weekend you can incur a one-percent mark-up fee. In addition they have introduced fees for international transfers. Finally if you use ATMs frequently this is not the card to use due to the fees.

Travelex Money Card - Best All Rounder

Best features.

- Unlimited free ATM withdrawals

- 24/7 Emergency Assistance

- Initial and replacement card are free

- Lock in up to 10 currencies

Read our Travelex Review

Travelex Money Card

- Minimum load of $100 and maximum load of $100,000

- Can be used wherever Mastercard is accepted

- Fees include a $10 closure fee, $5 for an additional card and $4 inactivity monthly fee.

- While Travelex don't charge ATM fees, some ATM operators may charge their own fees.

- Currencies that can be loaded are AU$, US$, EU€, GB£, NZ$, TH฿, CA$, HK$, JP¥, SG$

- If your card is lost or stolen you can access cash in your account through Moneygram or Western Union agents, with no charge

- Boingo hotspots offer free wifi and you can look at their number of free hotspots per country on this map

The Travelex Money Card is a good all-rounder no matter if you are heading to the bustling streets of Hong Kong or visiting the serene Lantau Island.

You can use it to take money out of the ATM, for merchant purchases like restaurants and even for online shopping in foreign currency. While the exchange rates aren't as good as Wise or Revolut for travelling , the support network if the card is lost or stolen is very good. This service can be extremely useful when journeying across the cosmopolitan city of Hong Kong.

HSBC Everyday Global Travel Card - Best Travel Card by Bank

- Great exchange rate offered for Singapore dollars (SGD)

- No ATM fees at HSBC tellers

- No initial card, closure, account keeping or monthly fees

- No cross currency conversion fees

HSBC Everyday Global Travel Card

- 10 Currencies can be loaded are SGD, AUD, USD, EUR, GBP, CAD, JPY, NZD, HKD and CNY (currency restrictions on CNY)

- No maximum balance for any currency

- Very competitive exchange rates on all currencies when you have currencies already loaded on your card

- ATMs within Australia need to be HSBC and overseas they need to display a VISA or VISA Plus logo, not be be charged fees

- Earn 2% cash back when you tap and pay with payWave, Apple Pay or Google Pay for purchases under $100.

- Daily maximum ATM withdrawal is $2,000

- Fraud protection covered by Visa Zero Liability

The HSBC Everyday Global Travel Card offers a great exchange rate for Singapore dollars, ATMs, so you can withdraw cash without the hefty overseas ATM fees.

In addition it does not charge an ‘international transaction fee’ so you can spend in Singapore and online in Australia and not pay an additional 3%.

Finally, on top of the excellent currency exchange rate, there is no maximum balance on currencies held and a 2% cash back incentive when you tap and pay under $100.

Bankwest Breeze Platinum Credit Card - Lowest Interest Rate

- Lowest interest rate at 9.90%

- No international transaction fees on purchases

- Up to 55 days interest free on purchases

- Low annual fee

- Complimentary international travel insurance

Bankwest Breeze Platinum Credit Card

- Free annual fee first year, then $69 annual fee

- Free international travel insurance that includes the basics but does not cover cancellation costs, pre existing conditions and travellers over 80

- $6,000 minimum credit card

- 0% p.a. on purchases and balance transfers for the first 15 months, then reverts to 9.90%

- 21.99% interest rate on purchases and cash advances

- Cash advance fee of the higher of $4 or 2% of cash advance

The Bankwest Breeze Platinum is a great no frills credit card that offers ‘no foreign transaction fees’ and the lowest interest rate on the market, at 9.90%. These two factors alone will save you hundreds of dollars when travelling throughout Singapore.

In addition it has a low annual fee and complimentary international travel insurance. Finally for its price point it is a great value credit card that will be accepted most places in Singapore.

ING One Low Rate Credit Card - No Annual Fee

- No annual fee

- Up to 45 days interest free on purchases

- Lowest cash advance interest rate of 11.99%

- Use instalment plans to pay off your purchases over time at a lower interest rate

ING One Low Rate Credit Card

- 11.99% interest rate on purchases

- Make payments from your mobile with pay with Apple Pay and Google Pay

- International ATM fee and Foreign currency conversion fee are waived when you deposit $1,000 into your Orange Everyday each month, and make 5+ card purchases that are settled. Otherwise they are the higher of 3% or at least $3

- Put repayments on auto payment each month to pay the minimum balance or full amount

The ING One Low Rate credit card is a great option to take to Singapore as it charges no annual fee and offers a low interest rate for purchases and cash advances of 11.99%. The cash advance interest rate is very low and about 50% less than most of its competitors who charge around 22% on cash advances.

Furthermore the ING One Low Rate credit card has no international transaction fees, so you can save money on your travels and when you buy goods from overseas. It's a handy backup card to have in your wallet when travelling through Singapore.

Learn more about the best credit, debit and prepaid cards for travel

Best Credit Card for Overseas Travel

International Prepaid Cards

Overseas Debit Card

The best travel card for Singapore is the Wise Multi Currency card for tap or swipe large transactions like accommodation and restaurants. Wise offers the best exchange rate for Singapore dollars globally and charges no international transaction fees.

HSBC Global and Citibank Plus cards are the best for ATM withdrawals and great exchange rates for Singapore dollars. Both these cards charge no international transaction fee and can be used within Australia without penalties.

The best credit cards for Singapore are the BankWest Platinum Breeze and ING One Low Rate as they have the lowest interest rates on the market with and charge no international transaction fees.

Yes, you should bring cash to Singapore and buy Singapore dollars before you travel to Singapore. It is one of the best ways to take money to Singapore. Having Singapore dollars on hand when you arrive at the airport will make your life a lot easier. The airport is also the most expensive place to exchange currency, so you will save a lot of money as well. Even though Singapore is card friendly, having cash on hand will always be handy for small purchases, tipping and paying for transport.

HSBC and Citibank have the best travel money cards for Singapore. Both have lots of ATMs within Singapore, both offer fantastic exchange rates for the Singapore dollar and both offer ‘no international transaction fees’.

A travel money card is more secure than cash because you need your pin to authorise transactions, if you lose cash you are unlikely to have it returned. If your travel money card is stolen, then you can report it lost or stolen online quickly. It is also less bulky to carry 2 or 3 cards than lots of cash.

The best prepaid cards for Singapore are Wise , HSBC and Citibank which offer the most competitive cards in the market. Other older style prepaid cards like Australia Post, Cash Passport, Travel Money Oz and Travelex have lots of charges like load, unload, inactivity, ATM withdrawals and initial card fees.

You can place money on your travel money card online and paying by direct debit from your bank account will cost you the least. Log in to your bank account, transfer your funds into the travel money card and the money should be there within 24 hours.

As a general rule, working out how much money to take to Singapore depends on where you go and your type of travel. If you travel on a budget to Singapore it can cost from $70 a day. If you travel in the middle range throughout Singapore it can cost from $150 per day. Finally if you travel with luxury throughout Singapore it can cost anywhere from $300 per day.

You can only use Singapore dollars in Singapore, you can not use Australian dollars or US dollars . The currency in Singapore is the Singapore dollar. There are 4 commonly used bank notes with different colours, they are $2, $5, $10, $50, $500 and $1,000. There are 5 coins, they are 5c, 10c, 20c, 50c and $1.

More Travel Card Guides

Learn more about the best travel money cards for your holiday destination.

ASIC regulated

Like all reputable money exchanges, we are registered with AUSTRAC and regulated by the Australian Securities and Investment Commission (ASIC).

S Money complies with the relevant laws pertaining to privacy, anti-money laundering and counter-terrorism finance. This means you are required to provide I.D. when you place an order. It also means the order must be paid for by the same person ordering the currency and you must show your identification again when receiving your order.

Free Things to Do

Family-Friendly Activities

Foods to Try

Hawker Centers

Restaurants

10 Reasons to Visit Singapore

Best Time to Visit

Weather & Climate

Changi Airport Guide

Neighborhoods to Explore

48-Hour Itinerary

Public Transportation

Singapore On a Budget

Surviving Singapore on a Budget

10 Tips for Saving Money in Singapore

:max_bytes(150000):strip_icc():format(webp)/greg-rodgers-adventure-ed92646b25f247049e53af6d36f6c15f.jpg)

Theresa Chiechi / TripSavvy

Believe it or not, you can experience Singapore on a budget! There's no need to sacrifice meals or sell plasma to explore Southeast Asia's interesting little city-island-country.

Singapore has always been the bane of backpackers and budget travelers . With a nefarious reputation of being expensive, made even worse by the numerous opportunities to be fined , many travelers in Southeast Asia give Singapore only a few days or opt to skip it altogether.

Despite having lots to offer (including the best airport in the world), Singapore's reputation on the Banana Pancake Trail is more or less all about shopping and as a great layover destination. You don't have to become Singa-poor to enjoy a few days or longer in this exciting multinational city! Follow these tips for saving money while in Singapore.

Get a CEPAS/EZ-LINK Card

Many travelers make the mistake of not purchasing Singapore's excellent transportation card when they first arrive. Instead, they pay for each bus and train journey which quickly adds up.

At train stations, an EZ-Link card costs S$12 and includes S$7 worth of credit. You can also purchase and add credit to cards at 7-Eleven minimarts for S$10 (includes S$5 in credit). Having an EZ-Link card will also save you a lot of time waiting in queues at ticket machines in MRT stations.

The EZ-Link card can be used on the LRT and MRT trains, along with the excellent public bus system. By using an EZ-Link card, you pay only for the distance traveled, rather than a flat fare like everyone else (drivers don't give change).

Tip: Don't forget to tap your card on the reader as you exit the bus or you'll pay more than you should have!

Don't Buy the Singapore Tourist Pass

The Singapore Tourist Pass is similar to the EZ-Link card, however, it allows for unlimited rides during a one, two, or three-day stay. The Tourist Passes aren't cheap: A one-day pass costs S$10 plus an additional S$10 that is refunded after returning the card. You would need to take four or five rides on the MRT per day just to break even!

Unless you really get a thrill out of riding trains around the city (they are nice), chances are that you'll spend most of your time walking around the sights, inside massive shopping malls, exploring world-class museums , and less on the train.

Drink the Water

Unlike other countries in Southeast Asia , the tap water in Singapore is safe to drink. This is good news, as a bottle of water can cost around S$2 at minimarts!

If you don't carry a water bottle, buy a small bottle of water then refill it for free at hotels or from the tap.

Eat in Food Halls

Singapore is blessed with some of the best food courts, food halls, and hawker street stalls found anywhere in Asia. Yes, it is safe to eat street food! In fact, enjoying the street food is a quintessential part of experiencing Singapore.

Quality is often even a notch above the street food typically found in places such as Thailand. A delicious meal can be enjoyed for between S$4–6 in food halls. You can eat for under S$3 if you're in the mood for noodles soup. The food courts found in posh malls and at the bottoms of nearly every skyscraper are priced slightly higher than standalone food centers. Check out the sprawling food center in Chinatown, or the cheap-yet-delightful Lau Pa Sat food center near the Raffles MRT stop .

Don't Drink or Smoke

Thanks to excessive taxation, either of these two vices will simply destroy your budget in Singapore.

A pack of Marlboro cigarettes costs over S$13, and drinking is terribly expensive even by U.S. or European standards. Entry into nightclubs can be up to S$30 which includes one watery drink. A rambunctious night out could cost you as much as the average night out in Ibiza.

Budget travelers craving a social atmosphere outside of hostels often opt to buy drinks from the 7-Eleven located at the end of Clarke Quay, then hang out around the waterfront. Just look for the pedestrian bridge covered with people lounging around.

Note: Electronic cigarettes are actually illegal in Singapore. Don't cross the border with one!

Enjoy the Parks

Although Singapore has a reputation for concrete, the city is blessed with an excellent park matrix with green spaces that spider through the city. Elevated bike trails and skywalks provide excellent views.

The parks and skyline views can be enjoyed for free. Take advantage of the complex, interconnecting network that links parks and different neighborhoods to each other.

Take Advantage of Freebies

Savvy travelers can find art displays, public performances, and street performers along the riverfront, esplanade, and city center. There are almost always options for free entertainment—particularly on weekends.

Entrance to museums in Singapore is expensive, however, several days or evenings a month the entrance fee is waived for special exhibitions. Check at the counter and inside of the many free attractions magazines for promotion dates.

A number of tourist passes are available that provide discounted entrance fees at numerous museums and attractions. Most of these passes are only a bargain if you intend to do a lot of indoor sightseeing.

Only Shop in the Right Places

Singapore has more shopping malls than you could explore in months. Even ultra-modern Changi Airport is practically one big mall which happens to have the occasional airplane land or take off.

Many of these malls are ridiculously expensive. Instead, do your souvenir and incidental shopping in cheap shops and tourist markets around Chinatown and Little India. Don't forget to negotiate !

Purchase your snacks, drinks, and toiletries from the big supermarkets located under many of the big malls rather than in mini-marts. VivoMart, beneath VivoCity—the largest mall in Singapore—regularly has food and drink specials.

Finally Give Couchsurfing a Try

Accommodation in Singapore is expensive. A bunk bed in a crowded hostel dorm costs S$20 or more. A night in a modest hotel may require you to give blood. Many travelers have to opt for hostels over hotels in Singapore just to cut costs.

Couch surfing with one of the many expats living in Singapore is a great way to sleep for free, and also gives you a local's insight into how to enjoy Singapore on a budget.

Tip: If you're squeamish about staying with a stranger, search for accommodation around Little India where hostels and hotels tend to be slightly cheaper.

Don't Get Busted

Locals joke that Singapore is a "fine" city—which obviously has two meanings. Although you rarely see police officers around the city, rest assured that many people do get fined here for seemingly innocuous activities; the fine-payment kiosks dotted around for convenience are a sure indication.

Although you would have to be unlucky to get caught, be aware of the following:

- The number one reason to get fined in Singapore is for not using marked crosswalks.

- Seatbelts are required when in a car; the driver cannot use a mobile phone while moving.

- Riding a bike on pedestrian-only paths, especially near the river, is forbidden.

- Chewing gum, snacks, and drinks are not permitted on the MRT trains or public transportation.

- Electronic cigarettes and "vaping" are illegal.

- Technically, failing to flush a public toilet is illegal.

- Spitting will get you a big fine in Singapore.

- Feeding pigeons in the park is an S$500 fine!

Singapore Guide: Planning Your Trip

How to Stay Out of Trouble in Singapore

What $100 Can Get You in Southeast Asia

Chinese New Year in Singapore: An Islandwide Celebration

Top Ten Reasons to Visit Singapore

Dining at Singapore's Block 51 Old Airport Road Food Centre

How EZ-Link Cards Let You Travel Cheaply in Singapore

Where to Stay in Bangkok

15 Easy Ways to Save Money on Your India Trip

Seoul Guide: Planning Your Trip

Visiting Paris on a Budget

The Best Cheap and Free Things to Do in Singapore

Your Trip to Shanghai: The Complete Guide

Your Trip to Florence: The Complete Guide

Your Trip to Hong Kong: The Complete Guide

The 9 Best Beaches in Singapore

Nomadic Matt's Travel Site

Travel Better, Cheaper, Longer

Singapore Travel Guide

Last Updated: September 1, 2023

Singapore is one of my favorite cities in the world. It’s a foodie’s dream, bursting with tasty hawker stalls, delicious Indian food, and fresh seafood. There are hiking trails where you can stretch your legs and beaches for chilling out and soaking up the sun.

Home to around 5.7 million people, Singapore is a cosmopolitan city-state that gained independence from the British in 1965. It is now one of the world’s leading economic centers in shipping and banking.

Because of its status as a global economic hub, Singapore is expensive by Southeast Asian standards, with everything costing almost double what it does elsewhere in the region. In fact, it consistently ranks as one of the most expensive cities in the world!

For this reason, visiting Singapore isn’t as popular with budget travelers compared to affordable destinations like Thailand, Vietnam, or elsewhere in Southeast Asia .

But while most people come here for a couple of days just to see the highlights, the city actually has a lot to offer and requires more time than you might think. Don’t rush your visit if you can afford it; Singapore can fill any schedule.

Use this Singapore travel guide to help plan your trip, save money, and make the most of your visit to this lively multicultural metropolis.

Table of Contents

- Things to See and Do

- Typical Costs

- Suggested Budget

- Money-Saving Tips

- Where to Stay

- How to Get Around

- How to Stay Safe

- Best Places to Book Your Trip

- Related Blogs on Singapore

Top 5 Things to See and Do in Singapore

1. Eat at the Boat Quay

Boat Quay is the place to go for dining and entertainment. The alfresco pubs and restaurants make Boat Quay ideal for relaxing after a long day of sightseeing. Try Wakanui for quality Japanese steak cooked over a white oak fire, or Kinara for reasonably priced North Indian cuisine.

2. See the supertrees at Gardens by the Bay

This urban landscaping project is a series of towering metal “supertrees.” There are roughly 200 species of orchids, ferns, and other tropical plants coating their structure. It’s free to walk through the outdoor gardens, but you have to pay 8 SGD for the canopy walk (which is worth doing!) as well as for the stunning Flower Dome and Cloud Forest biodomes .

3. Hang out (and party) on Sentosa

This little island is home to a nighttime light show on the beach and a host of bars, restaurants, and beaches to enjoy. Hang out at Bora Bora Beach Bar or splash out and try the cable car sky dining experience (it isn’t cheap). You can get to Sentosa via the Sentosa Express train (4 SGD). Entering on foot/bicycle is free.

4. Tour the Singapore Zoo

Spanning 70 acres, the Singapore Zoo is massive, boasting over 3,600 mammals, birds, and reptiles. There are lions, tigers, sun bears, Komodo dragons, primates, and much more! The zoo offers a night safari featuring over 900 different nocturnal animals (41% are endangered). Admission is 44 SGD and the night safari is 48 SGD.

5. Hang with the Merlions

The Merlion is Singapore’s mascot and has the head of a lion and the body of a fish. The original statute (and most impressive Merlion) can be found in Merlion Park, but the 37-meter-tall (121-foot) replica on Sentosa is also pretty cool to see. There is no entrance fee for Merlion Park.

Other Things to See and Do in Singapore

1. admire thian hock keng temple.

Thian Hock Keng (Palace of Heavenly Happiness) is one of the most photogenic buildings in Singapore. The temple originated as a small building that served the local Chinese population. It was expanded in 1840 and made from the finest materials available at the time, paid for by years of donations from the local community. It’s the oldest Chinese temple in Singapore, dedicated to Mazu, the Goddess of the Sea (Chinese immigrants came here to ask for safe passage before leaving to cross the South China Sea). The temple was designated as a national monument in 1973. Admission is free.

2. Explore Bukit Timah Nature Reserve

Bukit Timah, located within Singapore’s only remaining stretch of rainforest, is the country’s premier eco-tourism attraction. On the hiking and biking trails, you’ll be able to get up close to the macaques, squirrels, flying lemurs, and various species of birds. The reserve covers over 400 acres and is 30 minutes from the city center. It’s open daily from 7am-7pm. The weekends get really busy, so come during the week if you want to avoid the crowds.

3. Wander around Chinatown

Chinatown encompasses two square kilometers of traditional Chinese life, nestled beside the modern Central Business District. This remains the place to get a real sense of Chinese culture within Singapore. The streets are filled with temples, craft shops, stalls, and restaurants and are a great place to pick up a bargain. Head down Chinatown Food Street to find some char kway teow (stir-fried noodles) or grilled meats. If you can, eat at Hong Kong Soya Sauce Chicken Rice and Noodle (aka Hawker Chan), the world’s most affordable Michelin-starred restaurant. Tian Tian Hainanese Chicken Rice is another Michelin-starred hawker stall worth a visit. Like Hawker Chan’s, it’s located in the Maxwell Hawker Center.

4. Eat hawker food

Singapore’s hawker food scene is one of the best in the world. It has been recognized by Michelin in 2016 with the world’s first street food Michelin star and by UNESCO in 2020 with Cultural Heritage status. Whether you go to Newton Food Center (of Crazy Rich Asian fame), to the Old Airport Hawker (many locals’ favorite), or to one of the other 103 centers across the island, you won’t be disappointed and you can grab a cheap meal surrounded by locals. Don’t miss the chili crab, satay, dim sum (dumplings), or nasi lemak (fried chicken with coconut rice). If you’re not sure where to go or what to eat, take a guided food tour!

5. Take a trip to Pulau Ubin

This island lies off the northeastern coast. It’s incredibly different from the modern city; locals still use a diesel generator for electricity and fetch water from wells. Rent a bike and explore the sights, villages, and beaches of this island. To get there, hop on a bumboat from the Changi Point Ferry Terminal, which costs about 3 SGD and takes 10-15 minutes. There are no fixed departure times — just line up and wait. Very few tourists make it out this way; it’s one of the most off-the-beaten-path things you can do here.

6. Relax in the Singapore Botanic Gardens

The Botanic Gardens lie close to the city and consist of 128 acres of gardens and forest. Founded in 1859, the main attraction is the National Orchid Garden, home to over 1,000 species of orchids. There is also a ginger garden, a rainforest, and various streams and waterfalls to explore. The Botanic Gardens are Singapore’s first UNESCO World Heritage site (and the only tropical botanic garden on UNESCO’s World Heritage List). It’s open daily from 5am-12am, and admission is free to everything except the National Orchid Garden, which is 15 SGD.

7. Eat in Little India

No trip to Singapore is complete without a visit to Little India, where you can get amazing, cheap, and delicious food, fresh vegetables, snacks, and souvenirs. Seek out local favorites like roti prata (pancakes) and teh tarik (“pulled” tea). Make sure you stop off at the Tekka Center, a hawker center with Indian clothing, groceries, and food. The food here is cheap and delicious and makes for an authentic Little India experience.

8. Learn about Singapore’s History

For a more cultural experience, visit the former British naval base of Fort Siloso located on Sentosa. It’s a decommissioned coastal artillery battery the only preserved fort on the coast of Singapore, providing a fantastic look into the city-state’s complicated history. You’ll get to see the coastal guns and the remains of tunnels under the fort. It’s a well-constructed, interactive attraction. Entrance is free.

9. Visit Sri Mariamman Temple

This extremely colorful, ornate temple is the oldest Hindu temple in Singapore, built in 1827 in Chinatown. It was constructed in what is known as the Dravidian style and is devoted to the goddess Mariamman, known for curing illnesses and diseases. During the post-war colonial period, it was a hub for community activities and was even the Registry of Marriages for Hindus. Admission is free.

10. Watch a free concert

The Singapore Symphony Orchestra hosts various free concerts at different venues around the country. You might just be lucky enough to catch one of their shows — just check their website for details during your visit.

11. Visit the MacRitchie Reservoir Park

MacRitchie Reservoir is Singapore’s oldest reservoir, dating back to 1868. Today, this beautiful and lush city park is a relaxing place to spend an afternoon. Walk the 8-kilometer (5-mile) treetop hike, with bridges suspended high above the forest floor, where you might see long-tailed macaque monkeys, squirrels, monitor lizards, owls, and even flying lemurs. In addition to the TreeTop Walk, there’s also a network of walking trails. Admission is free.

12. Visit the National Museum of Singapore

First opened in 1849, this is the oldest museum in Singapore . Learn about the country’s history, culture, and people through the various permanent and temporary exhibitions. There are gold ornaments, 18th-century drawings and artwork, the mace used by King George VI when he declared Singapore a city in 1951, and the Singapore Stone (an indecipherable stone with inscriptions from the 10th century). Admission is 15 SGD.

13. Admire the street art

Singapore has some really incredible street art to admire. While none of it is spontaneous (unauthorized graffiti is illegal), it can be found all over the island. Yip Yew Chong is probably the best-known artist as he has murals everywhere from Chinatown to the East Coast. His images depict scenes from days gone by and range from small pictures to entire walls. Kampong Glam, Chinatown, and Little India all have masses of art to look at, as does the east coast, but you can find it on random buildings in most areas. Take a walking tour if you want more detail, or Art Walk Singapore has three self-guided walks outlined on their website.

14. Marvel at the rain vortex in Jewel

Located adjacent to Changi International Airport, Jewel Mall is home to the world’s tallest indoor waterfall. Cascading from the roof, the water falls seven stories (around 130 feet) to the basement through a huge tiered garden. At night it is lit up for a light and music show. There’s more to do at Jewel if you have time including two mazes, a canopy bridge, sky nets, slides, and a topiary walk. It’s free to see the rain vortex and prices range from 5-22 SGD each for the other activities. You can get bundles that work out cheaper.

15. Explore Kampong Glam

Also known by its most popular street, Haji Lane, and as the Arab Quarter, Kampong Glam is one of Singapore’s oldest neighborhoods. The shophouses here are now stores selling textiles, rugs, and Turkish homewares such as dishes and glass lamps. There are some great Arabic restaurants around here all under the shadow of the enormous golden-domed Sultan Mosque. There’s some street art around here and Haji Lane has some cool eclectic shops by day and a buzzing nightlife with outdoor live music by night. If you have time, check out the Malay Heritage Center (admission is 8 SGD).

16. Get spooked at Haw Par Villa

Hands down the quirkiest thing you can do or see in Singapore, Haw Par Villa is a huge outdoor art gallery. It was built in 1937 by Aw Boon Haw, a millionaire philanthropist one of the men behind Tiger Balm, for his younger brother. Once a theme park for locals, Haw Par Villa was also used as an observation point by the Japanese army during World War II. It’s filled with dioramas depicting Chinese mythology and has recently reopened after a 9-month refurbishment and renovation project. Entry to the grounds is free but the museum — called Hell’s Museum as it includes an exhibit depicting the 10 Courts of Hell — is 18 SGD.

Singapore Travel Costs

A budget hotel room with amenities like air-conditioning, private bathrooms, free Wi-Fi, and a TV starts around 65 SGD per night. Most larger chain hotels cost at least 80-110 SGD per night.

Airbnb is available in Singapore, with private rooms starting at 25 SGD per night (though they average closer to 60 SGD). Entire homes/apartments average 85 SGD per night.

Food – As a cosmopolitan hub, Singapore has food from all over the world, however, there is an abundance of Chinese and Indian food, which is usually around 8-9 SGD per meal. Rice or noodles are usually the backbone of most meals, and popular dishes include steamed chicken, chili crab, fishhead curry, satay, and nasi lemak (coconut rice cooked in a pandan leaf). The city’s hawker centers (large halls full of various food stalls) are one of the most popular and cheapest places to try Singapore’s vibrant cuisine.

As for Singaporean specialties, try the seafood, which costs around 20-35 SGD for a main dish. For drinks, beer is typically 8-10 SGD, a glass of wine is about 10-16 SGD, and a cappuccino is around 5 SGD.

There are also plenty of low-cost eateries around Singapore, with street stalls typically selling food for less than 6 SGD per meal. A fast-food burger is around 8-10 SGD while sandwiches at a café are around 11-14 SGD. There are many restaurants offering a set lunch menu for around 12-16 SGD, and a dish at dinner in most casual restaurants is around 20 SGD. After that, the sky is the limit.

If you want to cook your own meals, expect to pay 95 SGD per week for basic staples like rice, noodles, vegetables, and some meat or fish.

Backpacking Singapore Suggested Budgets

If you’re backpacking Singapore, expect to spend around 90 SDG per day. This budget covers staying in a hostel dorm, eating at the cheap hawker stalls and in Little India, cooking some meals, limiting your drinking, using public transportation to get around, and doing mostly free activities like walking tours and enjoying nature.

On a more mid-range budget of 175 SGD per day, you can stay in a private hostel room or Airbnb, eat out for all your meals at cheaper hawker stalls, enjoy a few drinks, take the occasional taxi to get around, and do more paid activities like visiting the zoo and the botanic gardens.

On a “luxury” budget of 300 SGD or more per day, you can eat out for all your meals, take taxis everywhere, stay in a hotel, and do whatever tours and activities you want. This is just the ground floor for luxury though. The sky is the limit!

You can use the chart below to get some idea of how much you need to budget daily, depending on your travel style. Keep in mind these are daily averages — some days you’ll spend more, some days you’ll spend less (you might spend less every day). We just want to give you a general idea of how to make your budget. Prices are in SGD.

Singapore Travel Guide: Money-Saving Tips

Singapore isn’t a super cheap destination so you’ll need to tread carefully if you want to avoid blowing your budget. Here are some ways you can save money during your visit:

- Take public transit – Singapore’s public transit system is fast and efficient, making it the best way to get around. Unlimited travel on public transport is 10 SGD per day with a Singapore Tourist Pass. If you’re staying a few days, the pass gets cheaper per day, as a two-day pass is 16 SGD and a three-day pass is 20 SGD.

- Eat on Smith Street – The stalls here offer food for less than 6 SGD and are a great place to sample local snacks.

- Eat cheap – Save money on food by eating in Little India, Chinatown, or the hawker stalls throughout the city. Meals in these places cost only a few dollars and are some of the tastiest around!

- Stay with a local – Use Couchsurfing to stay with a local for free. You’ll not only save money but you’ll get to connect with someone who can share their insider tips and advice.

- Stick to happy hour – Alcohol is expensive in Singapore, so limit your drinking to save money. If you do plan on drinking, stick to the happy hours.

- Avoid bottled water – The tap water here is perfectly fine to drink, so avoid buying water and just refill your bottle. It will save you money and it’s better for the environment! LifeStraw is my go-to brand as their bottles have built-in filters to ensure your water is always clean and safe.

Where to Stay in Singapore

Looking for budget-friendly accommodation? Here are some of my suggested places to stay in Singapore:

- Dream Lodge

- The Pod Capsule Hostel

How to Get Around Singapore

Like the MRT, Singapore’s bus system is extensive and efficient. You can use your Singapore Tourist Pass on the buses as well. You can also pay with cash, but it has to be the exact change. A single trip costs between 1.40-2.50 SGD.

Trishaws – Trishaws (like rickshaws) are less popular these days in Singapore, and now they’re largely used for guided tours that cost around 40 SGD for a 30-minute run. Trishaw Uncle is the only licensed trishaw tour operator in the city, offering various guided tours by trishaw.

Taxi – Taxis are comfortable and convenient, but they’re not cheap! All cabs are metered, but there might be surcharges depending on the company and where you’re going. For example, if you’re hiring a taxi from midnight to 6am there is a 50% surcharge on the total metered cost, while rides in the mornings and evenings carry a 25% surcharge. Prices start at 3.20 SGD and then increase by 0.22 SGD every 400 meters. Skip them if you can!

When to Go to Singapore

It’s always a good time to visit Singapore! The island is warm year-round with a tropical climate that boasts daily temperatures in the high 20s°C (80s°F). December to June is the busiest time to visit, especially during the Chinese New Year. February-April is the driest period with the most sunshine and least amount of rain.

Monsoons occur between December-March, with December usually being the rainiest month. The weather is windy, cloudy, and humid.

Late summer and early fall (July to October) are also a good time to visit if you’re hoping to avoid all the tourist traffic. The weather is still pleasant, averaging around 30°C (87°F) each day, and accommodation might be a bit cheaper during this time as well.

How to Stay Safe in Singapore

Singapore is an incredibly safe place to backpack and travel — even if you’re traveling solo, and even as a solo female traveler. In fact, it’s one of the safest countries in the world (it’s currently the 11th safest country).

Solo female travelers should feel comfortable here, though the standard precautions apply (don’t walk home alone at night, don’t accept drinks from strangers, etc.)

Be aware that penalties for breaking the law here are stiff. For example, you’ll be fined up to 1,000 SGD for things like littering, spitting, and smoking in public. Singapore is also notoriously strict on drugs. If you’re caught even with marijuana in your system you could do jail time. In short, say no to drugs here!

Scams are rare in Singapore, however, if you’re worried about getting ripped off you can read about common travel scams to avoid here .

If you experience an emergency, dial 999 for assistance.

Always trust your gut instinct. If a taxi driver seems shady, stop the cab and get out. Make copies of your personal documents, including your passport and ID. Forward your itinerary along to loved ones so they’ll know where you are.

If you don’t do it at home, don’t do it when you’re in Singapore. Follow that rule and you’ll be fine.

The most important piece of advice I can offer is to purchase good travel insurance. Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. You can use the widget below to find the policy right for you:

Singapore Travel Guide: The Best Booking Resources

These are my favorite companies to use when I travel. They consistently have the best deals, offer world-class customer service and great value, and overall, are better than their competitors. They are the companies I use the most and are always the starting point in my search for travel deals.

- Skyscanner – Skyscanner is my favorite flight search engine. They search small websites and budget airlines that larger search sites tend to miss. They are hands down the number one place to start.

- Hostelworld – This is the best hostel accommodation site out there with the largest inventory, best search interface, and widest availability.

- Agoda – Other than Hostelworld, Agoda is the best hotel accommodation site for Asia.

- Booking.com – The best all around booking site that constantly provides the cheapest and lowest rates. They have the widest selection of budget accommodation. In all my tests, they’ve always had the cheapest rates out of all the booking websites.

- Get Your Guide – Get Your Guide is a huge online marketplace for tours and excursions. They have tons of tour options available in cities all around the world, including everything from cooking classes, walking tours, street art lessons, and more!

- SafetyWing – Safety Wing offers convenient and affordable plans tailored to digital nomads and long-term travelers. They have cheap monthly plans, great customer service, and an easy-to-use claims process that makes it perfect for those on the road.

- LifeStraw – My go-to company for reusable water bottles with built-in filters so you can ensure your drinking water is always clean and safe.

- Unbound Merino – They make lightweight, durable, easy-to-clean travel clothing.

Singapore Travel Guide: Related Articles

Want more info? Check out all the articles I’ve written on Singapore travel and continue planning your trip:

The 5 Best Hotels in Singapore

The 4 Best Hostels in Singapore

Where to Stay in Singapore: The Best Neighborhoods for Your Visit

Is Southeast Asia Safe for Travelers?

18 Free and Cheap Things to Do in Singapore

Get my best stuff sent straight to you, pin it on pinterest.

- Where To Stay

- Transportation

- Booking Resources

- Related Blogs

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Travel Cards: What are the best options in Singapore? 2024

Whenever you’re planning to spend internationally - in person or online - you’ll want to avoid excessive bank fees, and get the very best available exchange rate. If you’ve heard of international debit cards - also known as travel debit cards - you might be wondering if it’s worth getting one to use instead of your normal card when you travel.

International debit cards can offer some great benefits to anyone living an international lifestyle, allowing you to cut the overall costs of spending in a foreign currency, and access a better exchange rate. This guide walks through the key advantages of international debit cards, how they work, and which cards are the best on offer for customers in Singapore.

Our Top 4 Travel Debit Cards in SG:

Wise Travel Card

HSBC Everyday Global Travel Card

Sainsbury Travel Card

Travel cards: the best options in Singapore

How do travel cards work.

Travel cards work much like your normal bank debit card, but with a focus on overseas transactions. You can use your card to spend while you travel, when you shop online with international retailers, and to make overseas ATM withdrawals. Depending on how you want to use your card, you may also find that a travel debit card lets you cut the costs of international transactions and manage your money across currencies more conveniently.

Types of travel card

Travel cards break down into 3 key categories:

Prepaid travel cards

Travel debit cards

Travel focused credit cards

Each option has its own advantages, but depending on how you want to use it, you’ll probably find that one suits you better than the others. Here are some pointers to consider:

Prepaid travel card

A prepaid travel card - also called a travel money card - may be issued by a bank or a specialist provider. It’s not linked to your normal bank account which makes it pretty secure, but can also make it inconvenient to add money. Prepaid cards may have a broad range of fees, and terms and conditions can vary a lot between providers. Not all merchants and websites accept prepaid cards, so you’d need to have a secondary source of funds when you travel, just in case.

International card with traditional banks

Singaporeans love to travel - and of course Singapore is a popular expat destination too. So it’s no surprise that many banks here offer their own international cards which are linked to accounts with multi-currency capability. We’ll look at one of them - the HSBC Everyday Global account and card in more detail later. DBS also offers the popular My Account which has foreign currency options and a linked card.

Using your own bank’s card when you travel can be convenient - but banks may not offer the best fees and exchange rates. There’s also an inherent risk of using your regular bank card when you’re abroad or spending with an international retailer online - if it’s stolen or cloned your full balance could be at risk.

Travel card with neobanks

Online specialist providers and neobanks also offer a strong range of travel cards which can provide a good balance of cost, security and convenience. They can often be the cheapest option out there, with easy to use online and in-app services, industry level security, and some of the lowest fees available.

Cards are easy to order, with a fully online application and verification process in many cases.

Best travel debit cards: a comparison

There are a few money transfer providers which offer cheaper and more flexible alternatives to the international debit cards commonly issued by traditional banks, like the Wise account and card, which is available for Singapore customers.

We’ll dive into a few strong contenders in a moment - first let’s take a look at some highlights from our 4 top Singapore travel debit cards:

Open a free Wise personal multi-currency account and order the Wise card for a one time fee. You’ll get your card details instantly, and your physical card will be with you in around 3 days. You can hold, convert, send and spend in 50+ currencies from your Wise account - and make payments in 200+ countries and in 150+ currencies with your card.

Pros of the Wise card

Personal accounts are free to open with no monthly fees

Hold and exchange 50+ currencies in your Wise account

Auto convert feature so you always get the cheapest available currency conversion

Freeze and unfreeze your card in the Wise app and get instant transaction notifications

Cons of the Wise card

10 SGD fee for your first card

ATM fees apply if you make more than 2 withdrawals a month

Spending limits apply

No option to top up account in cash or with a cheque

HSBC travel card

HSBC offers its Everyday Global Account which allows customers to hold and manage 11 currencies in their account, and spend on a linked debit card. HSBC doesn’t charge a fee when you spend or withdraw currencies you hold from an in-network ATM - but there may be an exchange fee applied when you switch from one currency to another. These fees can be tricky to spot, as they may be wrapped up in the exchange rates used.

Pros of the HSBC travel card

Hold and manage 11 currencies in your account

Earn cashback on spending and interest on your SGD balance

No HSBC fee for withdrawing currencies you own at an HSBC ATM

Access Global Transfers when you want to send funds overseas

Cons of the HSBC travel card

Minimum balance requirements apply - 2,000 SGD for a standard account

In branch international payments cost 55 SGD

Receiving an inward payments cost 10 SGD

Early close fees apply

Revolut Money Travel Card

Revolut offers several different account plans which can be opened and operated online or in the Revolut app. Get a free standard account, or upgrade to a paid plan to unlock more benefits. All accounts come with a linked debit card, and can hold and handle 28 currencies. You’ll also be able to make withdrawals at ATMs internationally, fee free to 350 SGD for the standard plan, or more for fee paid plans.

Pros of the Revolut travel card

Pick the plan that suits your needs

Covers 28 currencies and lets you spend in 150 currencies with your card

Even free standard accounts come with some impressive perks

Some free currency exchange is offered, depending on your account plan

Cons of the Revolut travel card

Fee paid plans cost up to 19.99 SGD/month

Once you’ve hit your ATM withdrawal limits you pay 2% fees for each withdrawal

Out of hours and exotic currency exchange fees apply

YouTrip travel money card

YouTrip cards can be used to hold 10 currencies, spend and make cash withdrawals. There’s no fee to exchange currencies within the account, but there may be a charge rolled up into the exchange rate applied so it’s worth comparing the rates offered against the Google rate so you know exactly what you’re paying.

Pros of the YouTrip travel money card

Popular and recognized local brand

10 supported currencies

Co-branded with EZLink

Manage your account and card from the YouTrip app

Cons of the YouTrip travel money card

5 SGD cash withdrawal fee

Exchange rate markups may apply when you convert from one currency to another

Fees apply when you top up with a credit card

10 SGD fee for replacement cards

How does the travel card work?

Whenever you spend or make a cash withdrawal with your travel card, the money will be deducted from your account balance, which means there’s no interest cost to worry about, and no chance you can accidentally blow your travel budget. However, by choosing a travel card instead of a normal bank card, you’ll often be able to hold your account balance in different currencies, like US dollars or British pounds.

Top up your account in Singapore dollars and switch to the currency you need when you need it - or look out for a great rate and convert in advance so you’re making the most of your money. Holding foreign currency on your travel card makes it convenient to spend internationally, and means you’ll know in advance exactly how much foreign currency you have to enjoy when you travel.

It’s normally easy to get a travel card through an app, website or by calling a provider. Travel cards are also secure as they’re not usually linked to your primary bank account, and mean there’s no need to tell your normal bank you’re heading off overseas.

How can I use a travel debit card abroad?

Use your travel debit card internationally just as you would use your normal card here in Singapore. Travel cards often come with handy contactless and mobile functionality to tap and pay wherever you are.

You’ll need to make sure your card’s network is accepted by the merchant or ATM - look out for the network symbol, like Visa or Mastercard, which will be displayed. You’ll also want to double check all costs of using your card in advance, as these can vary somewhat by provider. And finally, remember to pay in the local currency when you’re abroad. That’s important to avoid dynamic currency conversion (DCC) which is where you’re charged overseas in Singapore dollars, which sounds convenient, but actually means extra fees and a bad exchange rate.

How to request a travel debit card

You may choose to get a specialist international debit card from your normal bank, or through an online and digital provider like Wise or Revolut . Providers like these allow you to open an account easily with a 100% online onboarding process.

To give an example, here’s how to get a Wise card in a few simple steps:

Download the Wise app or head to the Wise desktop site

Sign up for a Wise account with just an email address, Google, Facebook or Apple ID

Get verified using your Singpass and Myinfo - or by manually uploading a photo of your ID documents

Order your card online or in the Wise app for a one off 10 SGD fee

Your physical card will arrive within a few days - or you can access your card details in the Wise app right away for mobile payments

What are the transaction fees applied to a travel card?

There are a few different common types of travel card - which we’ll run through in just a moment. Each has its own fees, but there are a couple of common charges it’s worth looking out for, no matter which card you choose:

Exchange fee

An exchange fee - which can be called a currency conversion charge, a margin or a spread, among other things - covers the costs of exchanging currency for international spending. In some cases this fee is split out so you can clearly see it - but often it’s a cost added into the exchange rate, which is less transparent and means you’ll have to double check the rates applied against the Google rate to see how much it’s costing you.

Withdrawal fee

Even if you hold the currency you need in your account, you might still need to pay a withdrawal fee when you get cash from an ATM. Your bank might add a charge for this service, and there may also be an extra cost added by the ATM operator itself. Keep an eye on the ATM to see any extra charges, as these are usually disclosed during the transaction, or in a notice displayed on the ATM terminal.

Advantages of the travel debit cards

An international debit card can be a good alternative to traditional bank cards to spend money abroad. Here are some of the benefits you can expect:

Depending on the card you pick you may get lower fees and a better exchange rate

It’s easier to set and plan your budget ahead of time by converting currency in advance

Travel cards aren’t usually linked to your normal bank, making them relatively secure

Manage your money on the go through handy mobile apps

Are there any limitations on the travel debit card?

Of course, travel debit cards also have some drawbacks, which may not make them the best choice for everyone. Here are a few things to consider:

You often can’t use a debit card to pay a security deposit or hire a car

Travel cards do come with their own fees - you’ll need to review these before selecting one

Deposits to your account may not apply instantly

Many travel cards don’t offer cash back or interest on funds held

Conclusion: is the travel debit card worth it?

Travel debit cards are a useful tool for many people who travel or spend internationally . They can offer a more flexible and convenient way to manage money across several different foreign currencies, compared to using a normal bank account. Different travel debit cards are available for different customer preferences - use this guide to kickstart your research to find the perfect travel card for your needs.

An international debit card lets you spend and make cash withdrawals in a range of foreign currencies - often with lower fees than using your normal bank card.

Many online and specialist providers allow you to apply for a card easily through a desktop site, app or call centre.

Use your travel debit card just like you would your regular card, to spend and make cash withdrawals around the world.

Travel debit card fees do vary based on the provider, and can include ATM charges, early closure fees and exchange rate markups. Compare a few providers to get the best available deal for your needs.

You are here

Select your destination.

Currency information

Welcome to singapore.

The ultimate melting pot of culture, colour and cuisine, Singapore is one party you won’t want to leave. Serving up warm weather all year long, there’s no wrong time to brush up on your Singlish and explore the city’s urban landscape. Besides, when “How are you?” is replaced with “Have you eaten?”, why wouldn’t you want to go?

5/5 stars – To accommodate the large number of foreigners visiting all year long, there’s an abundance of no-fee internationalaccess ATMs available. Those foreign transaction fees are better spent on chili crab, no?

Not the norm, but your bellhop won’t turn down a dollar

Phone and Internet access

Internet is pretty consistent, and free Wi-Fi is common

Prices are pretty comparable to what you’d pay here, so you should feel right at home

Coffee: AU$5.30 (regular espresso) Water: AU$1.15 (300mL bottle) Beer: AU$9.75 (pint in a pub) Food: AU$44 (a restaurant meal) Taxi: AU$24 (Changi Airport – Orchard Rd) Big Mac: AU$4.60 (cheap Macca’s!)

Daily budget

Budget: Around AU$80/day (2x cheap meals, supermarket snacks, train ticket & entry to Singapore Zoo) Moderate: Around AU$150/day (2x cheap meals, supermarket snacks, train ticket & entry to the Night Safari Zoo) Luxury: Around AU$200/day (2x restaurant meals, supermarket snacks, and entry to Universal Studios)

Safety rating

5/5 stars - Sleep soundly knowing Singapore is ranked one of the safest cities in the world. Just avoid any accommodation renters who ask you to pay upfront with cash. You know the type

Travel Money Trivia

‘Sing’ it loud The lyrics of the Singapore national anthem are printed on the $1,000 note. Ain’t no mountain higher Singapore coins in circulation stacked up would be 710 times higher than Mt. Everest. Interchangeable change You can use Singapore dollars in Brunei, and vice versa. Hey big spender The largest denomination in Singapore currency was $10,000. Standing the test of time The Tembusa Tree featured on $5 notes is in the Botanic Gardens and has been since before it opened.

Let's talk money

In Singapore you’ll be dealing with Singapore dollars, so it’s easy enough to remember. With ATMs readily available throughout the city, you won’t want to leave your travel card at home. Though you’ll still want to always have a little cash handy for some cheap street eats.

- Tips are included in restaurant receipts

- ATMs generally won’t charge an operator fee

- It’s a super card-friendly place

- Use cash for small stuff

- Grab extra ‘sing’ for shopping

- Taxis charge surcharges in busy periods

- Grab an ezLink card for trains and buses

- Mind your manners – the elder folk are referred to as Aunty or Uncle here

Gardens by the Bay Set in the middle of the city, a visually stunning garden reaching over 101 hectares is more than worth your time. Universal Studios Singapore Rollercoasters, 3D rides and live shows in the one spot? Sign us up! Night Safari Singapore See your favourite nocturnal creatures when they’re not snoozing away. Chinese New Year Immerse yourself in the non-stop festivities for a truly unforgettable experience. Orchard Road Of course, no trip to Singapore is complete without visiting the most famous shopping street in Asia.

Get the best deal on your foreign exchange today & take off with more spending money. Order online 24/7 or visit one of our 130+ stores .

Travel Money Oz has sought to ensure that the information is true and correct at the time of publication. Prices, details and services are subject to change without notice, and Travel Money Oz accepts no responsibility or liability for any such changes, including any loss resulting from any action taken or reliance made by you on any information provided. Daily Cost: All prices are approximations. Your costs may differ depending on where you go, where you shop, and their individual factors. Daily Budget: Costs are estimated per person and do not include accommodation.

Why Travel Money

- Home ›

- Travel Money ›

- Singapore Dollars

Compare Singapore dollar travel money rates

Get the best Singapore dollar exchange rate by comparing travel money deals from the UK's top foreign exchange providers

Best Singapore dollar exchange rate

If you're travelling to Singapore, it's important to shop around and compare currency suppliers to maximise your chances of getting a good deal. We can help you to find the best Singapore dollar exchange rate by comparing a wide range of UK travel money suppliers who have Singapore dollars in stock and ready to order online now. Our comparisons automatically factor in all costs and commission, so all you need to do is tell us how much you want to spend and we'll show you the top suppliers who fit the bill.

Compare before you buy

Some of the best travel money deals are only available when you buy online. By using a comparison site, you're more likely to see the full range of deals on offer and get the best rate.

Order online

Always place your order online, even if you plan to collect your currency in person. Most supermarkets and high street currency suppliers offer better exchange rates if you order online beforehand.

Combine orders

If you're travelling with others, consider placing one large currency order instead of buying individually. Many currency suppliers offer enhanced rates that improve as you order more.

The best Singapore dollar exchange rate right now is 1.6745 from Travel FX . This is based on a comparison of 17 currency suppliers and assumes you were buying £750 worth of Singapore dollars for home delivery.

The best Singapore dollar exchange rates are usually offered by online travel money companies who have lower operating costs than traditional 'bricks and mortar' stores, and can therefore offer better currency deals than their high street counterparts.

For supermarkets and companies who sell travel money online and on the high street, it's generally cheaper to place your order online and collect it from the store rather than turning up out of the blue and ordering over the counter. Many stores set their 'walk-in' exchange rates lower than their online rates because they can. By ordering online you're guaranteed to get the online rate and you can collect your order from the store as usual.

Singapore dollar rate trend

Over the past 30 days, the Singapore dollar rate is up 0.08% from 1.6745 on 31 Mar to 1.6758 today. This means one pound will buy more Singapore dollars today than it would have a month ago. Right now, £750 is worth approximately $1,256.85 which is $0.97 more than you'd have got on 31 Mar.

These are the average Singapore dollar rates taken from our panel of UK travel money providers at the end of each day. You can explore this further on our British pound to Singapore dollar currency chart .