Your guide to Amex's travel insurance coverage

Update : Some offers mentioned below are no longer available. View the current offers here .

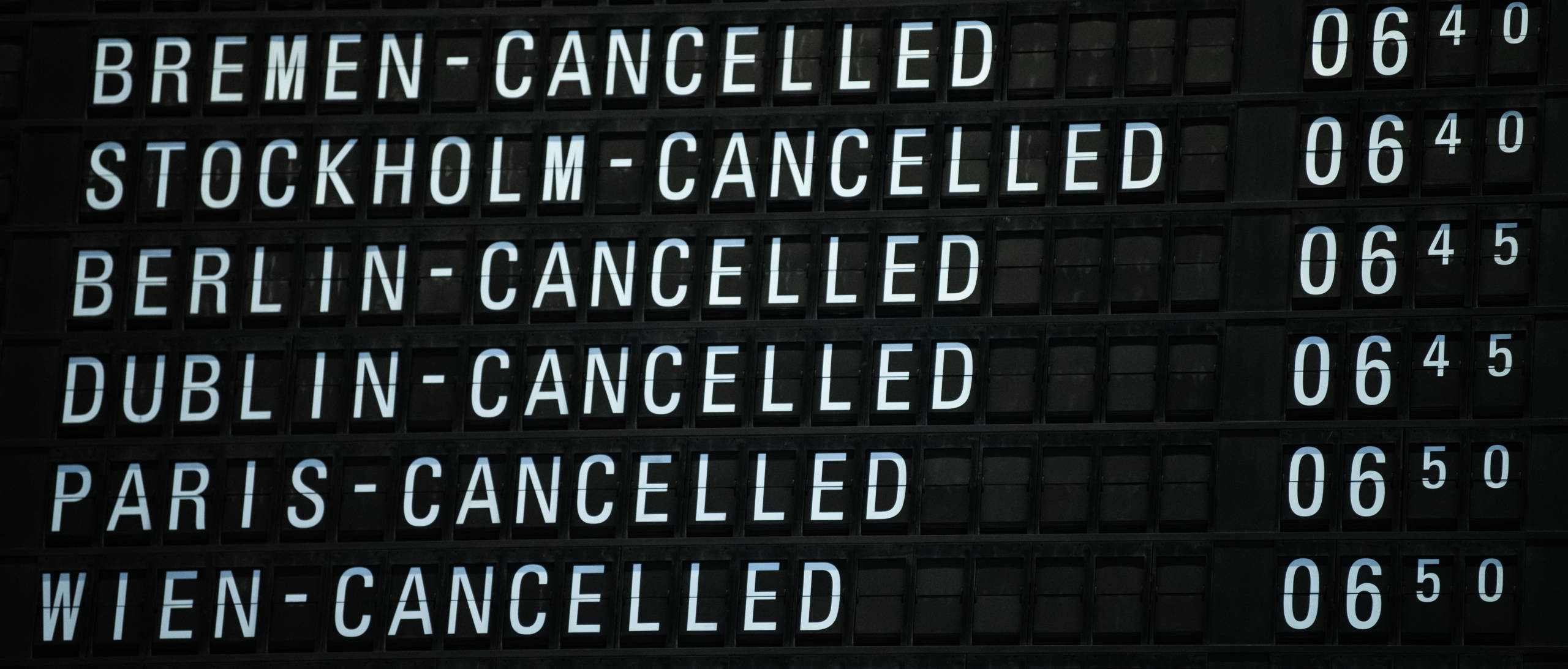

American Express premium credit cards offer some of the best perks in the credit card space. While lounge access and travel credits are typically the highlights of these cards, some of the lesser-known benefits, such as trip delay reimbursement and trip cancellation and interruption insurance, are becoming hot topics as the coronavirus pandemic continues to impact the travel industry.

Want more credit card news and advice from TPG? Sign up for our daily newsletter!

As a result, many TPG readers have sent in questions about Amex's travel insurance protections. As travel restrictions change, policies and best practices will likely change as well. But this guide will walk you through which Amex credit cards have these benefits, what's currently covered and how you can file a successful claim.

Related: Best credit cards for trip cancellation and interruption insurance

Amex cards offering trip delay, cancellation or interruption insurance

Here is an overview of the Amex cards that offer trip delay reimbursement, trip cancellation/interruption insurance or both:

The information for the Hilton Aspire Amex card and American Express Corporate Platinum Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: The best credit cards with travel insurance

What is covered by trip cancellation and interruption insurance?

You can find the full terms and conditions of what is generally covered on your respective card in your Guide to Benefits, which can be found through your online account. I'll use the Delta SkyMiles® Reserve as an example.

Here is a rundown of the "covered losses" provided by Amex's trip cancellation and interruption insurance:

- Accidental bodily injury or loss of life or sickness of either the eligible traveler, traveling companion or a family member of the eligible traveler or traveling companion

- Inclement weather, which prevents a reasonable and prudent person from traveling or continuing on a covered trip

- The eligible traveler or his or her spouse's change in military orders

- Terrorist action or hijacking

- Call to jury duty or subpoena by the courts, either of which cannot be postponed or waived

- The eligible traveler or traveling companion's dwelling made uninhabitable

- Quarantine imposed by a physician for health reasons

Related: Book carefully if you have multiple Amex cards that offer travel protections

Amex also provides an extensive list of things that are not covered by trip cancellation/interruption insurance:

- Pre-existing conditions

- The eligible traveler's suicide, attempted suicide or intentionally self-inflicted injury

- A declared or undeclared war

- Mental or emotional disorders, unless hospitalized

- The eligible traveler's participation in a sporting activity for which he or she receives a salary or prize money

- The eligible traveler's being intoxicated at the time of an accident. Intoxication is defined by the laws of the jurisdiction where such accident occurs

- The eligible traveler being under the influence of any narcotic or other controlled substance at the time of an accident, unless the narcotic or other controlled substance is taken and used as prescribed by a Physician

- The eligible traveler's commission or attempted commission of any illegal or criminal act, including but not limited to any felony

- The eligible traveler parachuting from an aircraft

- The eligible traveler engaging or participating in a motorized vehicular race or speed contest

- Dental treatment except as a result of accidental bodily injury to sound, natural teeth

- Any non-emergency treatment or surgery, routine physical examinations

- Hearing aids, eyeglasses or contact lenses

- One-way travel that does not have a return destination

- A counterfeit scheduled airline or train ticket; or a scheduled airline or train ticket which is charged to a fraudulently issued or fraudulently used eligible card.

- Any occurrence while the eligible traveler is incarcerated

- Loss due to intentional acts by the eligible traveler

- Financial insolvency of a travel agency, tour operator or travel supplier

- Any expenses that are not authorized and reimbursable by the eligible traveler's employer if the eligible traveler makes the purchases with a commercial card

If you do find yourself canceling or cutting a covered trip short, here are the basic guidelines provided by Amex on what types of expenses are covered for trip cancellation/interruption:

"If a Covered Loss causes an Eligible Traveler's Trip Interruption, we will reimburse you for the nonrefundable amount paid to a Travel Supplier with your Eligible Card for the following: 1. The forfeited, non-refundable, pre-paid land, air and sea transportation arrangements that were missed; and 2. Additional transportation expenses that the Eligible Traveler incurs less any available refunds, not to exceed the cost of an economy-class air ticket by the most direct route for the Eligible Traveler to rejoin his or her places of origin.

If a Covered Loss causes an Eligible Traveler to temporarily postpone transportation by Common Carrier for a Covered Trip and a new departure date is set, we will reimburse you for the following: 1. The additional expenses incurred to purchase tickets for the new departure (not to exceed the difference between the original fare and the economy fare for the rescheduled Covered Trip by the most direct route); and 2. The unused, non-refundable land, air, and sea arrangements paid to a Travel Supplier with your Eligible Card."

What is covered by trip delay insurance?

Trip delay coverage provides reimbursement for reasonable additional expenses incurred when your trip is delayed due to a covered hazard for more than six hours.

Coverage is limited to $500 per trip and cardmembers are only eligible for two claims each 12 consecutive month period.

Amex outlines what is not covered, which includes the following:

- Covered losses that are made public or known to the eligible traveler prior to the departure for the covered trip

- An eligible traveler's expenses paid prior to the covered trip

Filing a claim

When you have a delay or trip cancellation/interruption that you think qualifies for coverage, you can file a claim by calling Amex at 1-844-933-0648 within 60 days of the covered loss.

Trip delay reimbursement requires the following documentation:

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss

- Receipts - Acceptable documentation includes the following:

- A statement from the common carrier that the covered trip was delayed

- Charge receipt

- Copies of common carrier ticket(s)

- Receipts for travel expenses

Trip cancellation/interruption insurance requires slightly different documentation.

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss. Acceptable documentation includes:

- Court subpoenas, orders to report for active duty, physician orders, etc.

- Copies of your common carrier tickets and travel supplier receipt

- Your eligible card billing statement showing the charges for the covered trip

- Copy of travel supplier's cancelation policy

After Amex receives notice of your claim, instructions will be sent on how to send the proof. Typically, you have up to 180 days to file a claim after a delay or cancellation.

Proof of flight delay or cancellation

One of the documents required to file for trip delay reimbursement is a verification form that outlines the reason for the delay or cancellation by the carrier. You can typically get this at the airport when the delay or cancellation is announced, but keep in mind that it may require a supervisor. Each U.S. major airline also has a process for requesting this information after the fact.

Here is an overview of the process that major U.S. airlines require for you to receive a delay or cancellation verification form:

Amex cards that offer car rental insurance

Unfortunately, no American Express credit cards offer primary car rental coverage, although most offer secondary coverage. You can see the entire list of cards that offer secondary car rental protection on the American Express website . However, all American Express credit cards offer an optional "Premium Car Rental Protection policy" that can be added to rentals made using the card for a small fee.

Read our guide on when to use American Express' Premium Car Rental Protection for more details on this coverage option.

You can add Premium Car Rental Protection to any American Express card . TPG has a guide of the best American Express cards , but here are some of the best cards in terms of the return you could receive when renting a car. Note, the estimated return rate for these cards is based on TPG's latest valuations:

- Hilton Honors American Express Aspire Card: $450 annual fee (see rates and fees); 4.2% return on car rentals booked directly from car rental companies; no foreign transaction fees (see rates and fees)

- The Blue Business® Plus Credit Card from American Express: $0 annual fee (see rates and fees); 4% return on general spending on the first $50,000 in purchases per calendar year and 1x thereafter; 2.7% foreign transaction fee (see rates and fees)

- The Amex EveryDay® Preferred Credit Card from American Express: $95 annual fee; 3% return on general spending in billing cycles where you make 30+ purchases; 2.7% foreign transaction fee

The information for the Amex EveryDay Preferred card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer baggage insurance

If you're a frequent traveler, you've likely run into this situation at some point (it's the worst). Over the years, airlines have been working on improving the baggage system by introducing live bag tracking. Regardless, it's still a smart idea to have some protections in place, like baggage insurance.

Related: Everything you need to know about Amex's baggage insurance plan

This is why you need to pay attention to the benefits each of your travel rewards cards offers. Nearly all of Amex's premium rewards cards offer baggage insurance. You can check out the full list of cards and details on American Express's website.

The types of losses it covers: You're covered for losses resulting from damaged, stolen or lost baggage, including both carry-on and checked bags.

When you're covered: To be eligible for coverage, you have to travel on a common carrier, which Amex defines as any air, land or water vehicle (other than a personal or rental vehicle) that is licensed to carry passengers for hire and available to the public. Your rental car, as well as taxis and ride-share services such as Uber and Lyft, would be excluded from this protection.

To receive coverage, you also need to pay for the entire fare with an eligible American Express card or by using Membership Rewards points to book tickets through Amex Travel . Trips booked with miles from other sources — even the cobranded Delta SkyMiles cards from Amex — are excluded. Your trip also isn't covered if you used a combination of miles and dollars unless the miles came from a Membership Rewards transfer. This is a welcome change. A few years ago, a TPG staffer found out the hard way that Amex's policy didn't cover frequent flyer mile awards.

Who's covered: This policy covers both primary and additional cardholders, as well as cardmembers' spouses or domestic partners and any dependent children under 23 years old. In addition, travelers must be permanent residents of one of the 50 states, Washington, D.C., Puerto Rico and the U.S. Virgin Islands.

How much it covers: Most American Express credit cards will cover replacement costs for checked bags and their contents up to $500 per person, although so-called "high-risk items" are only covered for a maximum of $250. These items include jewelry, sporting equipment, photographic or electronic equipment, computers and audio/visual equipment. Carry-on bags are covered for up to $1,250, which is good to know since your belongings could be stolen from the overhead bins.

You'll enjoy additional coverage if you use The Platinum Card from American Express, The Business Platinum Card from American Express, the Platinum Card from American Express Exclusively for Mercedes-Benz and Morgan Stanley-branded Platinum Card (but not the Delta SkyMiles® Platinum American Express Card).

The information for the Amex Platinum Mercedes-Benz and Morgan Stanley Platinum card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer medical assistance

One of the lesser known benefits of some of Amex's most premium cards is its Premium Global Assistance. This benefit can quite literally be a lifesaver if you or an immediate family member run into any unexpected issues or accident on your trip. For example, this service can help you arrange emergency medical referrals.

All Amex cards have access to Amex's Global Assist Hotline, but the Premium Global Assist Hotline and higher level of coverage are reserved exclusively for the Amex's premium cards:

- The Platinum Card from American Express

- The Business Platinum Card from American Express

- American Express Corporate Platinum Card

- Hilton Honors Aspire Card from American Express

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

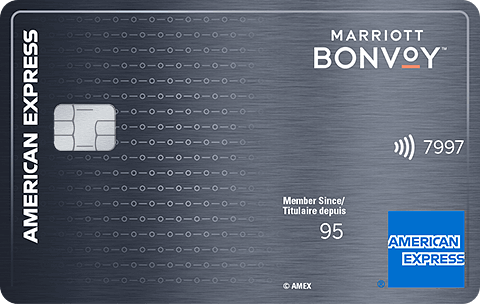

- Marriott Bonvoy Brilliant® American Express® Card

- American Express Centurion Card

- American Express Business Centurion Card

The information for the Amex Centurion and Amex Business Centurion cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

Having a card with trip insurance can save you hundreds of dollars when unexpected hiccups happen in your travel plans. Still, it can be confusing to know what is covered and the right documentation you need to file a claim.

Nothing is worse than getting through an entire claims process only to be denied or have to start over because you don't have the required documentation for the insurance provider. Before you start filing a claim, make sure you have the documents listed above. Keep in mind that a provider may ask for additional documentation related to the incident, so you may have to collect receipts and other forms to help your case.

If you're starting to travel again, it's also a good idea to consider booking refundable travel . Some airlines and hotels even waive cancelation fees and/or change fees for certain fares, which can make last-minute adjustments in the case of emergencies.

Additional reporting by Stella Shon and Madison Blancaflor.

For rates and fees of the Amex Platinum card, please click here. For rates and fees of the Amex Gold card, please click here. For rates and fees of the Amex Business Gold card, please click here. For rates and fees of the Amex Green card, please click here. For rates and fees of the Hilton Aspire card, please click here. For rates and fees of the Amex Blue Business Plus card, click here. For rates and fees of the Marriott Bonvoy Brilliant card, click here. For rates and fees of the Delta SkyMiles Reserve card, please click here. For rates and fees of the Delta SkyMiles Reserve Business card, please click here. For rates and fees of the Delta SkyMiles Platinum card, please click here. For rates and fees of the Amex Business Platinum card, click here.

- $120 annual fee

- 70,000 Marriott Bonvoy points when you charge $3,000 in the first 3 months with a referral link

- Earn 5 Marriott Bonvoy points per $1 spent at participating Marriott properties

- Earn 3 Marriott Bonvoy points per $1 spent at gas and travel purchases for the first 6 months (up to 15,000 points) – Offer ends May 6, 2024

- Earn 2 Marriott Bonvoy points for per $1 spent on all other purchases

- Annual free night certificate worth up to 35,000 points

- MESSAGE ME FOR A REFERRAL LINK

Welcome bonus and earn rate

The Marriott Bonvoy Amex Canada Card typically has a welcome bonus of 50,000 Marriott Bonvoy points. However, they have better offers where you can earn 55,000 – 80,000 points. What’s interesting is that if you sign up with a referral link sent by a friend or family member (or if you use mine), you’ll usually get another 5,000 points.

As for the earn rate, you’ll get 5 Marriott Bonvoy points for every dollar spent at participating Marriott Bonvoy properties. All other purchases on your card earn you 2 points per dollar spent. The earn rate is pretty respectable for a co-branded Marriott Bonvoy credit card.

To give you some perspective, I personally value one Marriott Bonvoy point at about .9 cents. That means the welcome bonus is worth much more than the $120 annual fee.

Benefits and perks

It’s time to go over the benefits and perks in this Marriott Bonvoy Amex Canada review. As you can imagine, most of the benefits are Marriott-related. That’s not a bad thing since Marriott International has more than 8,000 properties in 140+ countries. You’ll be able to use your points just about anywhere and you can look forward to the following benefits:

Free night certificate

On the anniversary of your cardmembership, you’ll get a free night certificate of up to 35,000 points at any participating Marriott property. The value of those points is easily worth more than the annual fee, so the card pays for itself. You can also top up your certificate with up to 15,000 points, so that gives you some added flexibility.

Elite status

With this card, you start at Marriott Bonvoy Silver Elite status, which gives you additional benefits such as 10% bonus points on stays and priority late checkout. In other words, if you pay for your stays with your Marriott Bonvoy American Express Card at participating properties, you get 5.5 points per $1 spent.

Gold status is given when you spend $30,000 on your card each year. If status is important to you, you may want to consider the American Express Platinum Card instead since you automatically get Gold status.

Elite night credits

At the start of every calendar year, you’ll also get 15 Elite Night credits, meaning you’ll only need ten additional nights to reach Gold Status (if you don’t spend $30,000 before then). This is handy for people who stay at Marriott hotels occasionally.

Travel insurance

- Flight delay insurance – $500

- Baggage delay insurance – $500

- Car rental theft and damage insurance – 48 days/$85,000

- Hotel/motel burglary insurance – $500

- Travel accident insurance – $500,000

The main travel insurance you get is travel accident insurance of $500,000. That may sound good, but it’s something you never want to collect since it mainly covers loss of body parts or death. American Express does offer generous car rental theft and damage insurance since you’re covered for car rentals with an MSRP of $85,000 on trips up to 48 days. Your flight delay insurance kicks in after four hours, while baggage delays require 6 hours. Note that the $500 in coverage for both types of insurance is an aggregate amount.

Finally, the hotel/motel burglary insurance gives you $500 in coverage. Remember, you need to charge your travel expenses to your credit card for your travel insurance to apply. One strategy I recommend is to use your Marriott Bonvoy Amex Canada Card for your hotel stays since you’ll earn extra Marriott Bonvoy points and you’ll get hotel/motel burglary insurance.

Purchase insurance

- Purchase protection – 90 days

- Buyer’s assurance – Double, up to one additional year

Purchase protection is often overlooked, but it can save you since you’ll be reimbursed if your purchases are lost, damaged, or stolen within 90 days from when you make the purchase. There’s a limit of $1,000 for each claim, but that’s still a fair amount. Note that you do need to make the entire purchase with your Marriott Bonvoy Amex card for your purchase protection to be valid.

Buyer’s assurance is just a fancy way of saying extended warranty. Purchases made with your Marriott Bonvoy American Express Card get double the manufacturer’s warranty, up to one additional year. Just make sure you have a copy of the original receipt.

American Express experiences

By being an American Express cardholder, you get access to some additional benefits, including:

- Front of the line presales – Enjoy exclusive access to tickets before they go on sale to the general public to concerts, theatre products, restaurants and more.

- Reserved tickets – American Express has deals in place where cardholders can buy exclusive tickets to various entertainment events.

- Experiences – Enjoy specially curated entertainment and retail events such as advance screenings, private shopping, exclusive dining and more.

- Offers – Get retail offers where you’ll get a statement credit when you meet minimum spend requirements.

How to redeem your points

I’ve written a detailed Marriott Bonvoy review so you can check that out if you want the full details, but I’m going to quickly highlight a few things about the program.

Marriott Bonvoy used to categorize their hotels. However, in recent years, they’ve eliminated the categories and introduced dynamic pricing. In other words, the number of points required for each property can vary quite a bit. This can work against people, but since Marriott has so many properties, you can usually find something that’s of fair value.

What makes Marriott Bonvoy appealing is that they have over 8,000 hotels and almost all of them have reward redemption availability at any given time. That said, if certain dates are getting full or there’s a major convention in town, you may see less reward availability.

One major perk of Marriott Bonvoy is that when you book four nights on points, you get the fifth night free. This can help reduce the overall number of points you’re using, but the five nights must be consecutive and at the same hotel. It’s also worth mentioning that Marriott Bonvoy has some of the better benefits once you reach Platinum status (50 nights per year). That’s where you get free breakfast and lounge access.

Generally speaking, if you’re getting at least .9 cents per point in value, it’s a decent deal. To calculate your cost per point (CPP), use the following formula:

Cash value of redemption X 100 / Points required = CPP

When doing your calculation, don’t forget to select add all fees and taxes so you get an accurate number.

Marriott Bonvoy American Express eligibility

It’s now time to go over eligibility requirements in this Marriott Bonvoy Amex Canada review.

- You must be a Canadian resident

- You must be the age of majority in the province or territory where you live

What’s interesting is that American Express has no formal income requirement. In addition, American Express does not list what credit score you need to be approved. That said, it’s safe to assume that you’ll need at least a good credit score, so 700+, to be approved.

How the Marriott Bonvoy Amex Card compares

The Marriott Bonvoy Amex Card is hard to compare since it’s the only consumer co-branded Marriott Bonvoy card in Canada. That said, some American Express credit cards allow you to transfer your points to Marriott Bonvoy at a 1:1.2 ratio, so let’s look at some of those cards.

Marriott Bonvoy Amex vs. American Express Cobalt Card

Admittedly, it’s not a fair comparison, but I like to stack the Marriott Bonvoy Amex up against the American Express Cobalt Card . The welcome bonus is easier for the Marriott card, but the earning rate is where things get interesting. As you know, the Bonvoy Card gives you 5 points per dollar spent at Marriott Bonvoy properties at 2 points everywhere else. The Cobalt Card earns 5 points per $1 spent on eats and drinks, 2 points on travel and transportation, and 1 point on everything else.

Anyone who stays at Marriott properties frequently is likely better off with the Bonvoy Card since you get an increased earning rate, status qualifying nights, instant status, and an annual free night certificate. However, if you spend a lot on groceries, food, and travel in general, the Cobalt Card could be better since you can convert your points to Marriott Bonvoy or even Aeroplan , as needed.

Marriott Bonvoy Amex vs. American Express Gold Rewards Card

The American Express Gold Rewards Card is more of a multi-use travel credit card, so we’ll focus on the benefits. With this card, you get an annual $100 travel credit and a Priority Pass membership with 4 free annual airport lounge passes to Plaza Premium lounges. That easily offsets the annual fee of $250. Some would argue that holding this card and the Marriott Bonvoy card are worth it since the yearly benefits are worth more than what you pay in annual fees.

Marriott Bonvoy Amex vs. American Express Business Gold Rewards Card

It may seem odd to use a business credit card as a comparison, but it’s worth mentioning due to the welcome bonus. The American Express Business Gold Rewards Card has consistently had a welcome bonus of 75,000 American Express Membership Rewards points when spending $5,000 in the first three months. When factoring in the minimum spend and transfer ratio, that’s 96,000 Marriott Bonvoy points you could potentially get.

Final thoughts

My Marriott Bonvoy Amex Canada review is positive. This card will likely be great for people in the following situations:

- You want to save on hotels – Marriott has over 8,000 properties in 140+ countries. That means you’ll be able to use your Marriott Bonvoy points almost anywhere in the world.

- You want a free hotel night – You’re given a free night certificate worth up to 35,000 points (can be topped up with an additional 15,000 points) every year on your anniversary.

- You want to earn hotel status – With this card, you’re instantly given 15 status qualifying nights each year.

Those who prefer free hotel stays may favour this card from my list of the best travel credit cards in Canada. The welcome bonus and free annual night certificate more than pays for the annual fee, which is why the Marriott Bonvoy Card is one of the best American Express credit cards. It’s a must-have card for anyone who stays at Marriott properties regularly .

About Barry Choi

Barry Choi is a Toronto-based personal finance and travel expert who frequently makes media appearances. His blog Money We Have is one of Canada’s most trusted sources when it comes to money and travel. You can find him on Twitter: @barrychoi

17 Comments

Excellent article. I had no idea that my Amex Bonvoy card had NO TRAVEL INSURANCE. I guess I won’t be holding this card as long as I thought (thank God, the lowly President’s Choice mastercard still gives me 10 days travel insurance for free).

The card does come with an annual free night certificate worth up to 35K points which is a good reason to keep the card.

Hi Barry – just wondering if you know: if I was an SPG Amex cardholder several years ago, does this disqualify me from getting the bonus points on this new card?

Technically yes, but 99% of people who had the card years ago report that they’ve been able to get the sign up bonus. That being said, Amex is within their rights to deny you them.

Ah, I’ve heard this too! Well I’m glad to hear from a Canadian expert. I think I’ll give it a shot. Thanks so much Barry!

If you have a family, this card sucks because none of the rooms we fit in are included in the points redemption. Marriott will let me acquire points by booking suites and other rooms that sleep my 5 family members, but none of those rooms are available for us when we try to use points. USELESS!!!! TERRIBLE CARD if you can’t spend the points you’ve accumulated!!!!! And there’s no flexibility, no humans who can override their inflexible computer system. It’s terrible!!

You could just try lowering the # of people when making a reservation.

I have a family of five – I want a hotel room that sleeps five. Booking a room for four, while easy, wouldn’t actually provide us with five places to sleep.

I have a family of 5 and never pay for hotel rooms, I do it all on points. You can easily book larger rooms on points by just calling in and often you will not need to because once you are platinum or titanium they will almost always upgrade you for free.

Well that wouldn’t help us book the type of room we need so we all have beds to sleep in. I can book rooms to fit us when I pay for the rooms, but if I want to use the points I’ve collected, I cannot book the very same type of room that we always pay for. Case in point: a 2 bedroom suite that has 2 queens and a sofa bed in Bloomington. I can pay $174/night but it’s not available AT ALL using points or even points plus cash. It’s a useless “reward” system for my family as it is currently structured.

Have you tried calling to book, I have found many times that rates not available on the internet are available if you ask one of their reservations agents.

You could just stay at home, Jeff. You seem upset. Maybe a warm bath with some Epsom salt would relieve some of that anger. Or perhaps, just book a room for one, and do the remaining four family members the favour of a few nights without your negativity.

Ummm… why would you want a credit card that has an annual fee? If you keep the card you’ll probably use the rewards in the first couple of years, but after that you’ll be stuck with the fees.

Since the card charges foreign exchange fees, when staying at a Marriott outside Canada, it is better to use a no forex card, if you have one. Which in my mind defeats the purpose of this card if it is not used at Marriott properties.

Since you get 5 points per dollar spent and 1 point is worth about .9 cents, you’re getting 4.5 cents in points for a 2.5% fee. To me, that’s reasonable. That said, I wouldn’t use the card for any other foreign purchases.

Do the Marriott points earned through the Amex card get automatically applied to your Marriott account? If so, when will they show up?

Yes, your points are automatically transferred to your Marriott account when your monthly statement posts.

Leave a Comment Cancel Reply

Get a FREE copy of Travel Hacking for Lazy People

Subscribe now to get your FREE eBook and learn how to travel in luxury for less

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Marriott Bonvoy Travel Insurance Review — Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Editor & Content Contributor

150 Published Articles 743 Edited Articles

Countries Visited: 35 U.S. States Visited: 25

Stella Shon

News Managing Editor

88 Published Articles 630 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

What Is Marriott Bonvoy Travel Insurance?

Sample coverage for a paid international stay, sample coverage for an international points stay, sample coverage for a domestic points stay, sample coverage for a domestic paid stay, how to purchase marriott bonvoy travel insurance, comprehensive single-trip travel insurance policy, an annual multi-trip travel insurance policy, credit card travel insurance, everything else you need to know, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

We’ve all become more aware of the need for purchasing travel insurance over the past few years. Even if you haven’t actually purchased coverage, chances are you’ve checked out the cost of adding it to your flight, hotel, cruise, or your entire trip.

Perhaps you’ve also noticed the increased availability of travel insurance including more opportunities for purchasing Cancel for Any Reason Insurance and expanded coverage for COVID-19 events. We’ve also seen companies introduce new product offerings such as American Express adding its own version of Cancel for Any Reason Insurance .

Today we’re going to cover another option available for protecting your trip investment: Marriott Bonvoy Travel Insurance .

Available to customers booking a Marriott hotel stay, the insurance covers you and your traveling companions who will be staying with you.

While the option is certainly a convenient one, we’re here today to determine if purchasing Marriott Bonvoy Travel Insurance is actually worth it.

Stay with us to find out.

Marriott Bonvoy Travel Insurance is an insurance policy available to customers when booking a Marriott Bonvoy hotel stay.

The policy is underwritten by Allianz , a highly-rated and established travel insurance company. The company is known for partnering with a variety of travel providers, including online travel agencies (OTAs), cruise lines, tour operators, and airlines to provide trip insurance options. You may have seen Allianz coverage offered at checkout during one of your previous travel purchases. It’s a natural extension to add Marriott Bonvoy to the company’s list of partnerships.

Let’s look closer at the coverages being offered, how you can purchase a plan, and some of the alternatives to consider.

What’s Covered

The policy offered at checkout is a basic travel insurance plan providing coverage for trip cancellation, trip interruption, emergency medical/dental, and emergency transportation. The plan also offers personal belongings insurance plus concierge and trip assistance services.

Coverage limits will depend on your state of residence, where the hotel is located, and the cost of your stay. The types of coverage you receive will also depend on whether you’re using Marriott Bonvoy points to cover your stay or if it’s a paid stay.

Let’s look at a few policy examples and the types of coverage you can expect.

The sample policy above was offered at checkout for an international paid hotel stay. Here is a breakdown of the coverages offered.

Trip Cancellation

Non-refundable trip expenses — such as your hotel costs, transportation (including flights), and activities — are included, but coverage is limited to 100% of the amount of your purchase from Marriott Bonvoy. Allianz defines trip cost as “the price for travel expenses you are booking on our partner’s website at the time you purchase insurance.”

This means that if your hotel stay purchase is $2,000, you will have up to 100%, or $2,000, for trip cancellation coverage.

Covered events that can qualify for trip cancellation include your illness or that of other guests who would be staying in the same room.

Trip Interruption

If your trip is disrupted for a covered reason, you could receive up to 150% of the amount of your Marriott hotel stay purchase price for trip interruption insurance.

Examples of events that can be covered for trip interruption include severe weather, illness, or flight cancellations and delays.

Emergency Medical and Dental Coverage

Receive reimbursement for the cost of emergency medical treatment up to the policy limit of $50,000 . Emergency dental coverage is limited to a sub-limit of $500.

Emergency Transportation

If you should need emergency transportation due to a covered medical or dental emergency, you could receive reimbursement up to the policy limit of $50,000 .

Personal Belongings Insurance

You or your traveling companions could receive up to $250 for personal belongings that are lost, stolen, or damaged during your trip. Coverage limits vary by policy offering.

An example of a covered loss would be if your wallet or baggage was stolen.

Concierge Services

Enjoy travel assistance services before and during your trip. Services can include restaurant reservations, securing tickets to special events, arranging golf tee times, and more.

24-Hour Assistance

Receive 24/7 assistance anywhere in the world. Services include help getting emergency cash, arranging translation services, medical/dental/legal referrals, medical transport, and more.

Pre-existing Medical Condition Exclusion Waiver

The pre-existing medical waiver is included in the plan if you purchase the policy within 14 days of your first trip deposit. You must also be medically able to travel at the time you purchased the insurance and a U.S. resident at the time of policy purchase.

COVID-19 Coverage

COVID-19 is covered like other illnesses when you are diagnosed by a doctor or receive a positive test result from a third party. Coverage for COVID-19 is provided under trip cancellation, trip interruption, and emergency medical/transportation.

Bottom Line: Key travel insurance coverages such as trip cancellation and trip interruption are offered with Marriott Bonvoy Travel Insurance for paid international hotel stays. Limits for these coverages are tied to the purchase price of the entire hotel stay. You’ll also find medical/dental coverage and emergency medical transportation coverage and personal belongings insurance.

When booking a Marriott stay with Marriott Bonvoy Rewards points, the type of policy you’re offered at checkout may differ . The good news is that there may be additional coverage and the premium will be much lower.

This policy is for a 3-night stay costing 112,000 Marriott Bonvoy Rewards points. The premium for this policy was $20. This appears to be a great value when you consider you’re receiving $50,000 of international emergency medical and associated transportation coverage.

While there is no trip cancellation coverage included, there is the addition of trip delay coverage and baggage insurance.

As you can see, available coverages and travel insurance premiums vary depending on the hotel location and whether it’s a paid stay or a reward stay. The premium for this stay, purchased with 41,000 Marriott Bonvoy points, was $10 .

You’ll notice that missed activity coverage is added to this domestic stay’s Marriott Bonvoy Travel Insurance plan. This coverage provides for reimbursement should a scheduled activity need to be canceled due to a covered reason.

You’ll also notice the absence of any medical coverage and the increased personal belongings coverage.

When we look at the Marriott Bonvoy Travel Insurance policy offered at checkout while booking a domestic paid stay, we find that emergency medical/dental, and associated transport is once again included. The coverage limits are also much lower than the policy offered for international bookings.

The total premium to purchase this policy with a $644 stay was $43 .

This is just an overview of the coverage offered by Marriott Bonvoy Travel Insurance. You’ll be able to access the actual policy documents with full coverage descriptions and terms/conditions before you actually purchase the policy.

Bottom Line: The policy plan, the premium, types of coverage, and limits of coverage you receive on offer at checkout will depend on several factors. These include the total cost of your hotel stay, your state of residence, whether the property is international or domestic, and whether it’s a paid stay or covered with Marriott Bonvoy Rewards points.

When booking a Marriott Bonvoy stay either at Marriott.com or via the Marriott Bonvoy iOS app , you’ll have the opportunity at checkout to purchase coverage. The coverage will be available via the Android app at a later date.

The cost of the insurance will be added to your hotel stay purchase. Your credit card statement will show 2 charges: 1 from Marriott and 1 from Allianz.

I priced out an international hotel stay that came to $1,192 , including taxes/fees. The premium for the associated insurance coverage was $80.90 .

When changing my booking for a stay that totaled $492 , the premium for the travel insurance came to $33.41 .

If you decide you do not want to purchase a policy while booking, you can still visit the Marriott Bonvoy Travel Insurance/Allianz site to purchase a plan before your trip.

Bottom Line: You can purchase Marriott Bonvoy Travel Insurance during checkout when booking a stay at a Marriott property online. The cost of the insurance is added to the total cost of your hotel stay.

How Marriott Bonvoy Travel Insurance Compares

Although purchasing Marriott Bonvoy Travel Insurance at checkout may be a convenient option, there are other considerations.

Here are some viable alternatives to Marriott Bonvoy Travel Insurance:

Because of all the variables involved, single-trip travel insurance plan costs can vary widely. We used the travel insurance comparison site SquareMouth to price out a single-trip policy with similar coverages to the Marriott Bonvoy Travel Insurance plan offered with an international paid hotel stay:

Single-trip plans covering the hotel stay costing $1,200 ranged from $30 to $117 , depending on the company. Prices will vary based on your state of residence, the age of the travelers, and the desired coverage. However, it’s entirely possible to duplicate or find a better plan for the same or less cost than the Marriott Bonvoy Travel Insurance.

If you’re going to purchase a single-trip travel insurance policy, you may want to select more coverage than simply lodging costs. We used the lodging cost to receive quotes for comparison purposes only.

Purchasing a basic annual travel insurance policy covering all the trips you’ll take in a 12-month period can cost less than a few hundred dollars. You’ll also find that coverages can compare favorably with the Marriott Bonvoy Travel Insurance plan.

Pictured above is an annual AIG Travel Guard policy with a total premium of $259 . As you can see, coverage is similar to the Marriott Bonvoy plan, and in some cases, it’s better. And, the pricing is the same whether you’re age 40 or age 70.

Allianz offers its own annual multi-trip plan for $280 per traveler with similar coverage to the Marriott Bonvoy plan. If you take just a few trips each year, it can pay for you to have a multi-trip annual plan.

Coverage limits are stated per policy year, so you should purchase greater coverage in order to cover multiple expensive trips.

The travel insurance that comes with your credit card is not meant to replace a comprehensive travel insurance policy . Marriott Bonvoy Travel Insurance has coverage that is broader than what comes on your credit card, largely because the Marriott Bonvoy plan contains high-limit medical coverage which is not found on credit cards.

Additionally, the Marriott Bonvoy coverage is primary coverage . The travel insurance that comes on your credit card can be secondary, which means that you must first file a claim with any other insurance that applies before card coverage kicks in.

With that said, the travel insurance that comes with your credit card certainly has value . If you’re simply purchasing a flight, a hotel room, or even an inexpensive weekend getaway when a large investment is not at stake, credit card travel insurance may be enough.

You’ll find several common types of travel insurance on your credit cards, including the following:

- Trip cancellation, trip interruption , and trip delay insurance

- Car rental insurance

- Baggage insurance

- Roadside dispatch (for a fee)

- Travel accident insurance

Premium travel credit cards may offer this additional protection:

- Emergency evacuation

- Limited emergency medical/dental coverage

- Premium roadside assistance

- Cell phone protection

Here are some of the best credit cards for travel insurance:

Chase Sapphire Preferred ® Card

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- 3x points on dining purchases, online grocery purchases, and select streaming services

- 2x points on all other travel worldwide

- $50 annual credit on hotel stays booked through the Chase Travel portal

- 6 months of complimentary Instacart+ (activate by July 31, 2024), plus up to $15 in statement credits each quarter through July 2024

- Excellent travel and car rental insurance

- 10% annual bonus points

- No foreign transaction fees

- 1:1 point transfer to leading airline and hotel loyalty programs like United MileagePlus and World of Hyatt

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Financial Snapshot

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

Chase Ultimate Rewards

- The Chase Sapphire Preferred 80k or 100k Bonus Offer

- Benefits of the Chase Sapphire Preferred

- Chase Sapphire Preferred Credit Score Requirements

- Military Benefits of the Chase Sapphire Preferred

- Chase Freedom Unlimited vs Sapphire Preferred

- Chase Sapphire Preferred vs Reserve

- Amex Gold vs Chase Sapphire Preferred

Travel insurance that comes with the Chase Sapphire Preferred card includes the following:

- Primary car rental insurance

- Trip cancellation, trip interruption, and trip delay insurance

- Lost and delayed baggage

- Roadside dispatch

- Travel and emergency assistance services

Chase Sapphire Reserve ®

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- 5x points on airfare booked through Chase Travel SM

- 3x points on all other travel and dining purchases; 1x point on all other purchases

- $300 annual travel credit

- Priority Pass airport lounge access

- TSA PreCheck, Global Entry, or NEXUS credit

- Access to Chase Luxury Hotel and Resort Collection

- Rental car elite status with National and Avis

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

- APR: 22.49%-29.49% Variable

- Chase Sapphire Reserve 100k Bonus Offer

- Chase Sapphire Reserve Benefits

- Chase Sapphire Reserve Airport Lounge Access

- Chase Sapphire Reserve Travel Insurance Benefits

- Chase Sapphire Reserve Military Benefits

- Amex Gold vs Chase Sapphire Reserve

- Amex Platinum vs Chase Sapphire Reserve

The Chase Sapphire Reserve card comes with all the same travel insurance benefits as the Chase Sapphire Preferred card. Additionally, the card offers emergency evacuation, limited emergency medical/dental coverage, and premium complimentary roadside assistance.

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- Annual and monthly statement credits upon enrollment ( airline credit, Uber Cash credit, Saks Fifth Avenue credit, streaming credit, prepaid hotel credit on eligible stays, Walmart+ credit, CLEAR credit, and Equinox credit )

- TSA PreCheck or Global Entry credit

- Access to American Express Fine Hotels and Resorts

- Access to Amex International Airline Program

- No foreign transaction fees ( rates and fees )

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card ® , Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card ® . Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card ® . Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR ® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card ® . Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck ® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card ® . An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- APR: See Pay Over Time APR

American Express Membership Rewards

- Amex Platinum 150k Welcome Bonus Offer

- Benefits of The Amex Platinum

- How to Use 100,000 Amex Platinum Points

- Amex Platinum Card Requirements

- American Express Platinum Military Benefits

- Amex Platinum and Business Platinum Lounge Access

- Amex Platinum Benefits for Authorized Users

- Amex Platinum vs Delta Platinum

- Capital One Venture X vs Amex Platinum

- Amex Platinum vs Delta Reserve

The Amex Platinum card comes with similar types of travel insurance as the Chase Sapphire Reserve card, such as access to Premium Global Assist Hotline. An exception to this is that the Amex Platinum card offers secondary car rental insurance . You will have the option to purchase Premium Protection for 1 low price that covers the entire rental period.

The card also comes with cell phone protection . However, the card does not offer any limited medical or dental coverage.

Capital One Venture X Rewards Credit Card

The Capital One Venture X card is an excellent option for travelers looking for an all-in-one premium credit card.

The Capital One Venture X Rewards Credit Card is the premium Capital One travel rewards card on the block.

Points and miles fans will be surprised to see that the Capital One Venture X card packs quite the punch when it comes to bookings made through Capital One, all while offering the lowest annual fee among premium credit cards.

Depending on your travel goals and preferences, the Capital One Venture X card could very well end up being your go-to card in your wallet.

- 10x miles per $1 on hotels and rental cars purchased through Capital One Travel

- 5x miles per $1 on flights purchased through Capital One Travel

- 2x miles per $1 on all other purchases

- $300 annual travel credit on bookings made through Capital One Travel

- Unlimited complimentary access for cardholder and 2 guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- 10,000 bonus miles awarded on your account anniversary each year

- Global Entry or TSA PreCheck credit

- Add authorized users for no additional annual fee ( rates & fees )

- No foreign transaction fees ( rates & fees )

- $395 annual fee ( rates & fees )

- Does not offer bonus categories for flights or hotel purchases made directly with the airline or hotel group, the preferred booking method for those looking to earn elite status

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

- Receive up to a $100 credit for Global Entry or TSA PreCheck ®

- APR: 19.99% - 29.99% (Variable)

Capital One Miles

- Benefits of the Capital One Venture X Card

- Best Ways to Use Venture X Points

- Capital One Venture X Credit Score and Approval Odds

- Capital One Venture X Lounge Access

- Capital One Venture X Travel Insurance Benefits

- Capital One Venture vs Venture X

- Capital One Venture X vs Chase Sapphire Reserve

- Best Credit Cards with Priority Access

- Best Credit Cards for Airport Lounge Access

- Best Capital One Credit Cards

- Best Luxury and Premium Credit Cards

- Best Metal Credit Cards

- Best High Limit Credit Cards

- Choice Privileges Loyalty Program Review

The Capital One Venture X card also comes with great travel insurance benefits , including auto rental collision damage waiver , trip cancellation and interruption insurance. Plus, the card offers cell phone protection .

The previous information is an overview of travel insurance benefits and is highly abbreviated. We’ve also not included any terms and conditions or limits on coverages. You’ll want to access the card’s Guide to Benefits for the actual coverage descriptions, limits, and terms/conditions.

To learn more about the best credit cards for travel insurance and protection , including both personal and business credit cards, our article goes into great detail.

Bottom Line: Before you purchase Marriott Bonvoy Travel Insurance, you’ll want to check your credit cards for possible coverage. However, credit cards do not include any major medical coverage, so if you need this coverage, purchasing Marriott Bonvoy Travel Insurance or additional travel insurance would be necessary.

Marriott Bonvoy plans cover friends, family, and anyone staying in your room. Allianz states that your traveling companions also do not need to be listed on the reservation to be covered. The maximum number of covered persons is limited to the number of published maximum occupants of the room.

If the price of your lodging should increase after you purchase Marriott Bonvoy Travel Insurance, you can purchase additional coverage by logging in to the Allianz site. An example would be if you added an additional hotel night to your reservation.

You will have 15 days after the receipt of your policy (longer in some states) to review the policy. Within this period, and if you have not yet started your trip, you may request a full refund if you are unsatisfied with the policy.

Marriott Bonvoy Travel Insurance plans are available to U.S. residents only .

The policy begins once Allianz has received your order and payment. The beginning date will also be listed on the policy documents.

You can file a claim online , by calling 800-334-7525, or by emailing [email protected] .

Although convenient to purchase, the Marriott Bonvoy Travel Insurance may be a bit pricey for international paid hotel stays . You could already have some of the same coverage on your credit card or be able to purchase a single-trip travel insurance policy for less. Also, if you have additional trips planned, a multi-trip annual plan may make more economic sense.

With multiple international reservations, you would also need to purchase coverage on each reservation. In this case, a travel insurance policy could be a better option to cover your entire trip.

One sweet spot for Marriott Bonvoy Travel Insurance is the value proposition for stays paid for with Marriott Bonvoy points . For a range of $7 to $20 in our sample findings, there appears to be a good value in relation to the coverage offered. On stays purchased with points, it can make sense to consider the options you’re presented with at checkout.

With international paid stays, it’s not the worst idea to quickly grab $50,000 worth of emergency medical coverage at checkout. Having peace of mind if your health insurance doesn’t cover you if you’re traveling abroad can add value.

For Capital One products listed on this page, some of the above benefits are provided by Visa ® or Mastercard ® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

For the baggage insurance plan benefit of The Platinum Card ® from American Express, eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

For the car rental loss and damage insurance benefit of The Platinum Card ® from American Express, eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

For the cell phone protection benefit of The Platinum Card ® from American Express, eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the premium global assist hotline benefit of The Platinum Card ® from American Express, eligibility and benefit level varies by Card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. If approved and coordinated by premium global assist hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, card members may be responsible for the costs charged by third-party service providers.

For the trip cancellation and interruption insurance benefit of The Platinum Card ® from American Express, eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the trip delay insurance benefit of The Platinum Card ® from American Express, eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Is the marriott bonvoy travel insurance worth it.

It can be. Marriott Bonvoy Travel Insurance is a convenient option when booking a hotel stay at a Marriott property. If you do not have medical coverage that will cover you while abroad, purchasing the coverage at checkout may be worth securing $50,000 in immediate coverage.

For hotel stays paid for with Marriott Bonvoy Rewards points, you may find good value in relation to the coverage offered.

If you don’t need medical coverage, you may even be able to rely on a refundable hotel booking and travel insurance coverage on your credit card.

Does Marriott Bonvoy Travel Insurance cover COVID-19?

Marriott Bonvoy Travel Insurance covers COVID-19 like any other illness. With proper documentation, you’ll have coverage for COVID-19 illnesses under trip cancellation, trip interruption, and emergency medical coverage with Marriott Bonvoy Travel Insurance.

What does Marriott Travel Insurance cover?

Marriott Bonvoy Travel Insurance coverage varies by the type of policy offered at checkout.

A typical policy for international paid stays comes with trip cancellation insurance for up to 100% of the cost of your hotel stay and trip interruption insurance for up to 150% of the cost of your hotel stay.

The policy also covers emergency medical/dental and associated transportation, up to $50,000 for each coverage, and personal belongings insurance of up to $250.

Where can I purchase Marriott Bonvoy Travel Insurance?

You can purchase Marriott Bonvoy Travel Insurance when checking out while booking a Marriott hotel stay. The option is available online and via the iOS app when paying for your reservation. Android functionality will be available at a later date.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![amex marriott bonvoy canada travel insurance The Best Travel Insurance Options for Seniors [Ages 65, 70, and Over 80]](https://upgradedpoints.com/wp-content/uploads/2021/05/Senior-couple-on-beach-at-sunset.jpeg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Marriott Bonvoy TM American Express ® Card

Flytrippers award won.

Summary of Flytrippers' review

Why get this card.

- Great welcome bonus of ≈ $519

- Annual certificate for free luxury night worth ≈ $315 every subsequent year

- Marriott points that are more lucrative and can provide outsized value

- Flexibility of points with no time limit to be used

- Automatic Marriott Silver Elite status (and shortcut to Gold and higher)

- Good base earn rate

- No-fee additional cards

WHO SHOULD GET THIS CARD

- All Canadian travelers, without exception

- Go to our editorial card review page

- Go to our card summary page

- Keep scrolling here for all the details

- Watch our video review

- Apply now via Amex secure link

- See all the best credit cards in Canada

Scroll for all details or check out our review (VIDEO or TEXT)

Detailed review of the Marriott Bonvoy American Express Card

Card details.

Welcome bonus structure (2 separate bonuses)

65,000 points Bonus after spending $3,000 (in a maximum of 3 months) * 15,000 points Bonus of 3 pts/$ more on travel and gas (maximum of $5000 and 6 months) *NOT INCLUDED IN OUR FLYTRIPPERS VALUATION

65,000 points Total with the main part of the bonus *80,000 points Total with the 2 parts of the bonus *NOT INCLUDED IN OUR FLYTRIPPERS VALUATION

Earn on the minimum spending requirement

6,000 points Minimum earn on the minimum spending requirement of $3,000 (at base earn rate of 2 pts/$)

Total rewards by unlocking the welcome bonus

71,000 points Main part of welcome bonus + earn on the minimum spending requirement to unlock it *86,000 points Welcome bonus + earn on the minimum spending requirement to unlock it *NOT INCLUDED IN OUR FLYTRIPPERS VALUATION

‣ Apply for the Marriott Bonvoy ™ American Express ® Card

Value of the welcome bonus offer (at our Flytrippers Valuation of ≈ 0.9¢/pt )

≈ $585 Bonus after min. spend (65,000 pts) ≈ $54 Earn on min. spend (6,000 pts) –$120 Card fee (deducted from Valuation)

≈ $519 Total net value by unlocking the welcome bonus alone

‣ Learn more about our Flytrippers Valuation of welcome bonuses

Effective return rate

≈ 17.3% Return on the minimum spending requirement ( ≈ $519 on $ 3,000 in 3 months)

‣Learn more about effective return rates (coming soon)

Rewards acquisition summary

≈ $639 Rewards you get for $120

Value of redemption options (welcome bonus)

For each available redemption option, here is the value of the 71,000 Marriott Bonvoy points you get by unlocking the welcome bonus:

≈ $639 Hotel nights at the 30+ Marriott brands ≈ $568 Nights in private lodging with Homes & Villas by Marriott Bonvoy ≈ $568 Unique experiences with Marriott Bonvoy Moments ≈ $426 Specific flights booked via transfers to airline programs ≈ $355 Flights and car rentals through Marriott ≈ $284 Gift cards ≈ $213 Merchandise

‣ Learn more about the best redemptions of Marriott Bonvoy points (detailed guide coming soon)

Value of redemption options (per point)

For each available redemption option, here is the value per Marriott Bonvoy point to help you understand:

≈ 0.9¢ Hotel nights at the 30+ Marriott brands ≈ 0.8¢ Nights in private lodging rentals with Homes & Villas by Marriott Bonvoy ≈ 0.8¢ Unique experiences with Marriott Bonvoy Moments ≈ 0.6¢ Specific flights booked via transfers to airline programs ≈ 0.5¢ Flights and car rentals through Marriott ≈ 0.4¢ Gift cards ≈ 0.3¢ Merchandise

‣Learn more about the basics of the values per point (coming soon)

Redemptions for Marriott hotel nights

The more valuable type of reward redemption, with a variable value: the amount of points required is unrelated to the cash price of the hotel. The value depends on how many points are required (varies and isn’t fixed by a chart) and the cash price. This is the best use for 99% of travelers. You can use the points for any standard room in the 8,000+ Marriott hotels.

Redeem your 71,000 Marriott points for a completely free hotel night:

≈ 6,000 pts In a few destinations (if you book 5 consecutive nights) ≈ 7,500 pts In a few destinations (if you don’t book 5 consecutive nights) ≈ 10,000 pts In a few dozen countries (if you book 5 consecutive nights) ≈ 12,500 pts In a few dozen countries (if you don’t book 5 consecutive nights) ≈ 14,000 pts In hundreds of destinations (if you book 5 consecutive nights) ≈ 17,500 pts In hundreds of destinations (if you don’t book 5 consecutive nights) ≈ 30,000 pts In thousands of destinations anywhere ≈ 50,000 pts In hotels that can be very expensive in cash anywhere

‣ Learn more about the best uses of Marriott Bonvoy points (detailed guide coming soon)

Redemptions for anything other than travel

Should always be avoided , as with all rewards!

‣Learn more about why you should always redeem your rewards for travel (coming soon)

Expiry Marriott points don’t expire as long as you use your card at least once every 2 years, so essentially they never expire (there are ways to avoid expiration without having the card too but you should absolutely never close it).

‣ Learn more about Marriott Bonvoy points expiry (coming soon)

Pooling Marriott points can be pooled with travel companions easily online.

‣ Learn more about pooling Marriott Bonvoy points (coming soon)

Logistics Marriott points can be used directly on the Marriott website or app.

‣ Learn more about how to get started with Marriott Bonvoy rewards (coming soon)

Rewards program summary Rewards: Marriott Bonvoy Points Source: Hotel rewards Type: More valuable Flytrippers Valuation: ≈ 0.9¢/pt Minimum value: N/A Maximum value: Unlimited Transferable: Yes (40+ partners)

‣ Learn more about rewards programs basics (coming soon)

5 points per $ ( ≈ 4.5% ):

- Marriott hotels

2 points per $ ( ≈ 1.8% ):

- Everywhere else

‣Learn more about credit card earn rates (coming soon)

Earning with additional cards

Fee for additional cards: $0 Quantity allowed: 9 Minimum age: 13 years old

‣Learn more about additional cards (coming soon)

Annual free night certificate On every anniversary of your account, you’ll get a certificate that’s worth 35,000 points (≈ $315) for a completely free night at thousands of hotels, including many high-end ones, so never cancel this card!!!

‣ Learn more about the Marriott free night certificate

Marriott Silver Elite Status As a cardholder, you get free Silver Elite status for VIP benefits at hotels.

‣ Learn more about the Marriott Bonvoy elite status

Shortcut to higher elite status (15 Elite night credits) Your number of nights required to reach the higher elite statuses is reduced by 15 nights (Gold Elite status also offered depending on $30,000 but it’s highly unrecommended).

Amex Offers program Access to discounts, credits, and special offers throughout the year.

‣ Learn more about the Amex Offers program

American Express Experiences program Access to exclusive virtual and in-person experiences and pre-sale tickets to lots of events.

‣Learn more about the American Express Experiences program (coming soon)

Insurance included

Flight delay insurance Baggage delay insurance Rental car insurance Lost or stolen luggage insurance Hotel burglary insurance Travel accident insurance Purchase insurance Extended warranty

‣Learn more about the Marriott Bonvoy American Express Card’s insurance coverage (coming soon)

Insurance not included

Medical travel insurance Travel cancelation insurance Trip interruption insurance Mobile device insurance

‣Learn more about the different types of insurance coverage (coming soon)

Card eligibility Minimum income: $0 Age: Majority in your province Estimated credit score: Good or Excellent Credit bureau: TransUnion

‣ Learn more about credit card eligibility requirements (coming soon)

Welcome bonus eligibility You must not have had the Marriott Bonvoy ® American Express ® Card before

‣ Learn more about credit card welcome bonus eligibility rules (coming soon)

Offer end date Offer ends May 6th, 2024

‣ Subscribe to Flytrippers’ free travel rewards newsletter to get all card updates

Card details Issuer: American Express Network: American Express Card Type: Credit card Product Type: Personal card

‣Learn more about credit card types (coming soon)