I spend $1,300 a year on credit-card fees to get big travel perks. Here are ones I swear by and which I won't pay for again.

- I'm a frequent traveler spending $1,300 a year on credit card fees to get great perks.

- The Platinum Card® from American Express saves me money with its complimentary Priority Pass membership.

- My United℠ Explorer Card card has gotten me priority boarding but I'm not sure I want to keep it.

I used to think that paying an annual fee for a credit card was a terrible idea and a waste of money.

For years, I prided myself on using no-fee credit cards that offered a small amount of cash back on purchases. But I changed my mind once I started traveling more and learning about the perks some credit cards offered.

I dove in head first. This year I've spent about $1,300 on annual fees. Most of the fees are worth every penny and have easily paid for themselves, though there are some I'm not sure about.

Here are my favorite travel card perks , plus a few I've enjoyed but would be OK losing.

I love having airport-lounge access and travel upgrades

My American Express Business Platinum comes with a hard-to-swallow $695 annual fee, but the perks have more than outweighed the cost. For context, I'm a freelance writer and use this card for expenses associated with my business, but American Express offers a personal version that's very similar.

Related stories

I've used this card's benefits to get CLEAR and Global Entry , both of which have helped me speed through security lines at airports. It got me an automatic upgrade to Hilton Honors Gold elite status, which has scored me free breakfast and room upgrades throughout my travels.

However, my favorite perk of this card is my free Priority Pass membership. With it, I've gained access to several airport lounges for myself and up to two travel companions, usually my children.

This benefit alone has saved me hundreds of dollars since I no longer have to buy pricey food at the airport — most lounges offer plenty of it for free. Plus, lounge access has made long travel days and layovers so much easier. I wish I had gotten this card sooner.

Being able to avoid foreign transaction fees has saved me a lot of money

The first credit card I applied for with an annual fee is the Chase Sapphire Preferred® Card , which has a $95 annual fee. Many of my cards charge up to 3% for every transaction made in a currency other than US dollars, but this one doesn't.

Foreign transaction fees can add up quickly, even on a short trip. Because I take a couple of international trips a year, the $95 annual fee more than pays for itself.

The Chase Sapphire Preferred® Card also has other money-saving perks for travelers I like, including competitive travel insurance and car-rental insurance for trips charged to the card.

Although my Amex Business Platinum also provides fee-free foreign transactions and travel insurance, American Express isn't as widely accepted internationally. I've had Chase credit cards accepted almost everywhere I've traveled so I will keep this one in my wallet.

I paid several hundred dollars to get an Amex Gold, but I got points galore

I applied for an American Express® Business Gold Card card when the company ran one of its rare promotions offering 150,000 points as a sign-up bonus. The card's $375 annual fee is high, but the generous sign-up bonus more than made up for it for me.

I have several international trips planned this year, and I expect that the 150,000 points I plan to redeem for airline tickets will easily save me at least triple the annual fee. For example, a ticket on a flight I'm eyeing to New Delhi from Washington, DC, costs $1,488 and is 148,000 points.

With this card, I also receive monthly statement credits — up to $20 a month — offsetting more than half of the annual fee I paid. However, it's a pain to keep track of earning the monthly credit, and the card's other benefits aren't that valuable to me.

I probably won't keep this card for a second year since American Express offers a personal version of it with similar perks and a lower annual fee.

Priority boarding has been nice, but not quite worth the price

I'm a frequent flyer on United but have never accrued enough points to gain status with the airline. To get more perks on United, I applied for a United℠ Explorer Card card, which doesn't charge an annual fee for the first year ($0 intro for the first year, then $95 annually in subsequent years).

My favorite perk of this card is priority boarding. Combined with other perks like single-entry passes to United Club lounges and free checked bags, I thought this card was a good value.

However, I now get lounge access and credit for checked bags with my Amex Business Platinum , and I don't think priority boarding is valuable enough to make up for the annual fee.

I would also rather earn points that can be transferred to several airlines and hotels rather than being locked into United. I plan on canceling this card when the next annual fee comes due, but I might reapply if I find that I miss priority boarding a lot.

For rates and fees of The Business Platinum Card® from American Express, please click here.

For rates and fees of the American Express® Business Gold Card, please click here.

Watch: Marketing leaders have to help their companies keep pace with the rapidly changing worlds of their customers, says Elizabeth Rutledge, CMO of American Express

- Main content

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

- Airlines + Airports

- Points + Miles

7 of the Best Ways to Redeem Amex Membership Rewards Points

Here are some of the best ways to use Amex points on flights, hotels, and more.

:max_bytes(150000):strip_icc():format(webp)/Stefanie-Waldek-7eed18a8c9734cb28c5d887eb583f816.jpg)

Courtesy of American Express

Every traveler who can get a credit card should get a credit card. Why? Points! For every dollar you spend, you'll receive at least one point that can go toward free travel, which is an incredible perk so long as you pay off your credit card bill each month.

While American Express has dozens of cards with card-specific perks, from airport lounge entry to travel credits to cash back, they all have one thing in common: American Express Membership Rewards. This rewards program allows Amex card members to earn points that can be used for travel, shopping, or even paying off their credit card bills. Depending on how you redeem those points, they can be worth anywhere from 0.5 to two cents per point.

If you're new to the American Express Membership Rewards program, here are the best ways to use your Amex points.

1. Transfer points to airline partners.

This is hands down the best way to maximize your Amex points because it gives you the biggest return — points can be worth up to 2 cents apiece when transferring to airline partners. How does this work? Amex has partnered with 18 airlines around the world, allowing you to transfer your Amex points into the airlines' frequent flyer programs as miles, typically at a 1:1 rate. Then you can use your new airline miles to book award flights. The key here is to transfer your Amex points only when you find a good award deal on an airline so your points aren't sitting in limbo. For example, if you find round-trip business-class flights between the U.S. and Europe for 110,000 Air France–KLM Flying Blue points (a solid redemption!), transfer your Amex points to Flying Blue and immediately book those flights.

2. Transfer points to hotel partners.

onurdongel/GettyImages

You can also transfer your Amex points to three hotel loyalty programs: Marriott Bonvoy, Hilton Honors, and Choice Hotels Choice Privileges. The transfer operates in the same way it does for airlines — your Amex points become hotel points, typically at a 1:1 rate, and you can use those points to book hotel rooms. (Keep an eye out for transfer bonuses, though, which can net you more points for free!) Most people who transfer go for splurges at luxury resorts — say the St. Regis Bora Bora, where you can find deals as low as 70,000 points per night. Both Marriott (of which the St. Regis is a part) and Hilton also offer a fifth night free if you book with points. Redemption values vary based on the deals you find, but they're typically not as lucrative as airline award bookings.

3. Bid on upgrades.

owngarden/Getty Images

Amex has partnered with 23 airlines to allow you to use Membership Rewards points to bid on upgrades. All you have to do is head to the Upgrade with Points site , select your airline from the list, and enter your reservation number. If your reservation is eligible, you can place a bid for an upgrade — Amex will notify you if your bid has been accepted by the airline, typically within five days of your flight. The redemption value depends on the number of points you bid and the cash value of the upgrade for your specific flight.

4. Book travel directly via American Express.

American Express has its own travel portal that lets you book flights, hotels, and packaged deals. If you can't find a good award deal that's worth a points transfer, this is a decent second option, as you'll still be getting "free" travel. But Amex caps the value of points at one cent per point, so it's not necessarily the best value redemption. Still, free travel is free travel!

5. Pay off your credit card bill.

If you're worried about paying off your credit card bill, you can use points to get a statement credit to lessen that final sum. No, it's not a travel hack, but it's important to keep yourself out of debt, too. Generally speaking, your points will be worth about 0.6 cents per point if you choose this redemption option.

6. Go shopping.

Amex offers several shopping options for points redemption. First, there's the company's own shopping portal, which has hundreds of retailers on the platform. Second, Amex allows you to pay with points when shopping on certain retail partners' websites, including Amazon, Best Buy, and Grub Hub — you'll have to add your Amex card to the site to select points when you check out. And third, you can also redeem Amex points for gift cards. These aren't bad ways to use your points if you need to stock up on travel supplies or clothes for your upcoming trip, though they are typically lower-value redemptions as compared to travel partner transfers.

7. Donate them to charity.

You might not get monetary value out of this redemption, but you can get emotional value! You can donate to charities with points through the website JustGiving at a redemption value around 0.7 cents per point.

Related Articles

- Our services & pricing

Insights > How to Use Amex Points to Book Flights and Travel

How to Use Amex Points to Book Flights and Travel

With 21 transfer partners — including 18 airlines and 3 hotels — American Express has one of the most useful points currencies with its Membership Rewards program. And while it’s easy to use the Amex Travel portal, those transfer partners are where you’ll get the most value for your points, from phenomenal business-class and first-class flights to five-star hotels and more.

Here’s everything you need to know about using Amex points to book flights and travel.

Table of contents

Using Amex Membership Rewards points to book travel with transfer partners

American Express has nearly two dozen hotel and airline transfer partners.

Airline programs

- Aer Lingus AerClub

- AeroMexico Rewards

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- ANA Mileage Club

- Avianca LifeMiles

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Delta Air Lines SkyMiles

- Emirates Skywards

- HawaiianMiles

- Iberia Plus

- JetBlue TrueBlue

- Qantas Frequent Flyer

- Qatar Airways Privilege Club

- Singapore Airlines KrisFlyer

- Virgin Atlantic Flying Club

Hotel programs

- Marriott Bonvoy

- Hilton Honors

- Choice Privileges

When you have Amex points, whether it’s from spending on an American Express credit card or earning a welcome bonus, you can transfer your points to any of these programs. However, there are some ways to use Amex points for travel that are better than others; we’ll discuss those in detail in a minute.

Paying for travel with Amex points via transfer partners

Each airline and hotel partner has a specific transfer ratio — the number of partner points you’ll receive for each Amex point you transfer.

Some Amex points transfer to partners at a 1:1 ratio, meaning you’ll get one partner point per dollar amount for each Amex point. Others might have different ratios (e.g., 1:2 or 3:2), meaning you’ll get two or three partner points for every Amex point. Check the Amex Membership Rewards website or your account for the current transfer ratios.

Amex also runs frequent transfer bonuses, which earn you additional points or miles when you transfer your Amex points to a partner program. Some programs, like Hilton Honors, Marriott Bonvoy , and British Airways Executive Club, offer transfer bonuses more frequently. These bonuses can significantly increase the value of your Amex points and boost your Membership Rewards balance, so it’s worth keeping an eye out for them.

Transfer-bonus offers usually occur at the beginning of the month after months of card membership and typically last about a month. However, while transfer bonuses can be extended, you’ll want to transfer points to your preferred program ASAP.

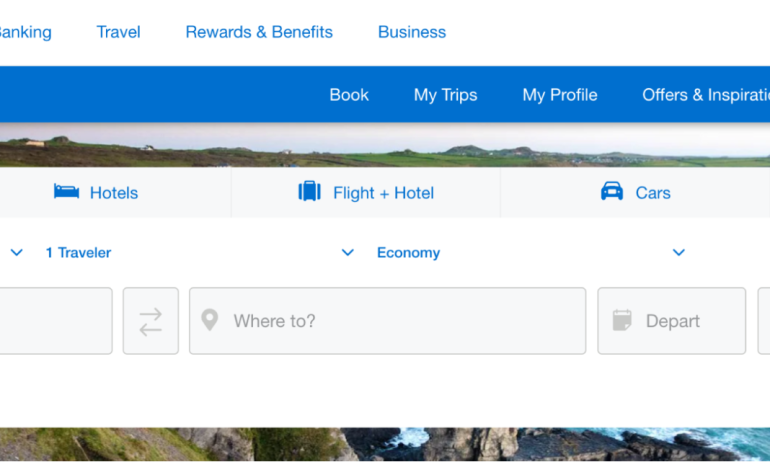

Booking flights with the Amex Travel booking portal

A traditional booking platform, AmexTravel.com lets you use Amex points to book flights and travel directly. You’ll enter your departure and arrival airports (if booking flights), departure dates, and cabin class, and the next page will display your results.

The important section here is the number of points required to book your flight, which you’ll see on the right side of the screen.

After you’ve selected your flight, you have the option of using some or all of your points to cover your booking.

Check out as you would normally, and that’s it!

Booking domestic flights with Amex points

Some of the best ways to book domestic flights with Amex points are by transferring points to British Airways Avios, Delta SkyMiles, and Virgin Atlantic Flying Club.

British Airways Avios

Booking domestic flights with British Airways is the best way to get maximum value from your Membership Rewards points. That’s because British Airways uses a distance-based award chart — not only for its own flights but also its partners, including American Airlines.

Unfortunately, British Airways does not publicly post its award chart, but the breakdown below is generally understood to be British Airways pricing for partner awards per calendar year.

This award chart is handy when booking short-haul flights, particularly on the U.S. East and West Coasts. Note that Zone 1 flights to, from, or within North America will cost at least 7,500 Avios.

Let’s take a look at a sample itinerary from New York to Boston. You can use a tool like Great Circle Mapper to calculate the distance between two airports — in this case, 190 miles.

Next, navigate to BA.com and select “Book flights with Avios.” You can then input your departure and arrival airports and dates and select a one-way or round-trip option.

Your results will be on the next page. On this route, for our specific dates, one-way award flights start at 8,250 Avios.

If you have enough Avios, you can book your flight. If not, you can transfer them from a transfer partner, like Amex.

Delta SkyMiles

Unlike British Airways, Delta does not use an award chart. Instead, its loyalty program, Delta SkyMiles, uses dynamic pricing. That means the cost of a reward flight can be higher or lower depending on factors such as seasonality, demand, and more.

While Delta SkyMiles aren’t typically highly valued as a points-and-miles currency, they can be incredibly valuable for booking short-haul domestic flights. For instance, flights between the airline’s Atlanta hub and Washington, D.C., start at just 8,500 SkyMiles each way — an excellent deal for such a popular route.

Another way to use SkyMiles for domestic flights is to book travel to U.S. territories, such as Puerto Rico and the U.S. Virgin Islands. SkyMiles awards on these flights are usually extremely affordable, such as the fare we found from New York to San Juan for just 9,500 one-way.

Booking international flights with Amex points

Booking international flights with Amex points is similar to booking domestic flights, although there is a bit more planning involved.

Once you’ve chosen a transfer partner, search for award availability on their website or through partner airlines in their alliance . (Not sure which transfer partner to seach with for your route? point.me can help. We search hundreds of airlines and dozens of loyalty programs to show you the best points fare, then tell you exactly how to transfer points and book them.)

If you transfer points to a membership with a SkyTeam member , like Virgin Atlantic Flying Club, you can book flights on partner airlines, like Delta, as long as you have enough miles in your membership rewards account. This expands your options and can help you find more convenient routes or better redemption rates.

As you’ll see in the example below, a Delta flight from Atlanta to Rio can cost just 44,000 Flying Club points — and while Virgin doesn’t fly on this route, you can still book partner flights through its Flying Club program.

Tips for booking flights with Amex points

Sometimes award availability on your preferred airline or program will be limited. In those cases, consider using the Membership Rewards travel portal to get a points rebate or book flights directly. While this option may offer less value than transferring points to airlines, it can still be convenient, especially for last-minute bookings or when flexibility is limited.

Speaking of flexibility: Keeping your travel dates and destinations open can significantly increase your chances of finding available award seats , especially during peak travel seasons.

When redeeming points for international flights, be aware of additional taxes, fees, and surcharges that may apply. Some programs have lower fees than others, so compare the total cost — including points and fees — across different redemption options to ensure you’re getting the best value.

One last piece of advice: Award availability tends to be more limited for international flights, especially in premium cabins. Try to book as early as possible — ideally nine to 12 months in advance — to secure the best redemption options and maximize your chances of finding award seats.

Using airline alliances to maximize your Amex points

To make the most of your Membership Rewards points, take a look at the Amex Travel transfer partners that have points and miles you can use on other airlines . For instance, you can book American Airlines flights with British Airways Avios, while Aeroplan points can be used for United Airlines and Etihad Airways.

Travel purchases you can pay for with Amex points

You can redeem points to pay for various travel purchases, such as flights, prepaid hotels, prepaid car rentals, vacation packages, and cruises.

The best ways to redeem your Amex points

The best way to redeem your American Express points is by booking flights and hotels, especially on airlines like Emirates, Etihad, Singapore, or British Airways. These airlines offer some of the best ways to fly in business and first class — think: Emirates First Class (which offers an onboard shower!) or Etihad’s Apartment.

Even if you don’t manage to score one of those highly coveted seats, not to worry. Amex has more than a dozen transfer partners, including many of the world’s largest airlines, so you’re bound to find a fare that fits the bill.

The worst ways to redeem your Amex points

The worst way to redeem your American Express points is on non-travel purchases. Generally, you’ll want to avoid using points to cover charges on your American Express card, whether it’s for cash back or a statement credit, to pay for items at merchants like Amazon, and on gift cards or other eligible purchases.

Frequently asked questions about using Amex points to book a flight

Can i use amex points for flights.

Yes, you can use Membership Rewards points for flights either by redeeming points on the Amex Travel portal or by transferring Amex points to partner airlines.

How many points do I need for a free flight?

For a free flight , the required Membership Rewards points per dollar depend on the airline. Some airlines, such as JetBlue, offer flights for as low as 500 points each way, usually on domestic short-haul flights.

Should I book my trip via Amex Travel or through the airline directly?

It’s fine to book your trip via the American Express travel portal or directly through your preferred airline. Each has its benefits and drawbacks, so it really comes down to personal preference. Amex Travel can be beneficial if you want to earn or redeem Membership Rewards points, enjoy travel benefits, and prefer to manage your trip on a single platform.

However, booking directly through the airline can, in some instances, offer lower prices, access to customer support, and more flexibility for changes or cancellations. It’s important to compare the prices and benefits of both options before making a decision. Ultimately, if you value loyalty program perks and direct airline support, booking with the airline might be the better choice, while Amex Travel can be ideal for leveraging cardholder benefits.

Will I earn points if I book my travel directly?

Yes, you’ll earn Membership Rewards points or miles when you use your Amex points to book directly with an airline or hotel; generally, you do not earn points on flights or hotels that you paid for with points.

Can I cancel a trip booked with Amex rewards points?

Yes, you can cancel a trip booked with Amex rewards points, provided you booked a refundable ticket. However, cancellations are subject to the airline’s fare rules agreed to at the time of booking. You’ll want to ensure that you booked a refundable ticket just in case you need to cancel.

Can I transfer my Amex points to an airline or hotel loyalty program?

Yes, you can transfer your Amex points to an airline or hotel loyalty program. The Amex travel portal has more than a dozen airline and hotel transfer partners.

How long does it take to transfer my Amex points to a travel partner?

Most programs transfer instantly, although some, such as Aeromexico, can take up to five days.

Will I earn miles or points on bookings made with Amex reward points?

You won’t be eligible to earn miles or points on bookings made with Amex reward points; however, you will earn Amex points on taxes and fees if you book with an Amex card.

Which Amex credit cards can I use to pay with points?

You can use any American Express credit card that participates in the Membership Rewards program to pay with points.

Better flights, fewer points. point.me users get 6-12x the value of their points. Join now

Share "How to Use Amex Points to Book Flights and Travel"

Share Tweet Share

Related Articles

How Much Are American Express Membership Rewards Points Worth?

Delta Airline Partners You Can Book with SkyMiles Points

Do American Express Points Expire?

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Discover It® Cash Back Discover It® Student Chrome Discover It® Student Cash Back Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Cards Best Discover Cards Best American Express Cards Best Visa Credit Cards Best Bank of America Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit cards

8 best ways to use Amex points

Ashley Barnett

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Updated 12:34 p.m. UTC April 30, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Yurii Sliusar, Getty Images

American Express Membership Rewards® points, aka Amex points, are earned from numerous Amex credit cards and have multiple uses. You can redeem these points for everything from cash back to Amazon purchases and from travel purchases in the Amex Travel portal to paying yourself back for purchases you’ve already made.

But if we’re looking at the best way to use Membership Rewards points , nothing compares to the potential value of transferring your Amex points to one of the many airline or hotel partners Amex offers. Obtaining value here requires an understanding of how to use these partners, how to find the hotel nights or flights you want to book with your points and what represents good value on these redemptions.

How to redeem Amex points comes down to one of two situations: Either you have almost all the points you need for an award stay and just need to transfer a small amount from Amex, or you’ve found an opportunity where the cash price of the hotel is inflated while the points cost has remained at a standard amount. Notably, the latter is the only time it’s the best way to use Amex points for hotels.

Otherwise, using your Amex points for flights tends to provide the best value. Here are some of the best ways to use Amex points.

We currently value American Express Membership Rewards points at 1.275 cents per point, and as we discuss the best and worst ways to use Amex points, you’ll see that all of the uses come in below this number but one.

If all of those numbers are below our valuation of Amex points (1.275 cents per point), that might not seem to make sense. It’s the remaining option (which actually provides many options) that holds the potential for massive value: transferring Amex points to hotel and airline partners.

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

American Express® Gold Card

Welcome bonus

- Earn 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Plus, receive 20% back in statement credits on eligible purchases made at restaurants worldwide within the first 6 months of Card Membership, up to $100 back. Limited time offer. Offer ends 11/6/24.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s take

- Multiple annual statement credits that can offset the annual fee.

- High rewards rate on restaurants, U.S. supermarkets, and travel.

- Generous welcome bonus.

- $325 annual fee.

- Minimal travel perks.

- Complex rewards structure.

Card details

- Get the American Express® Gold Card in either the Gold, Rose Gold or Limited-Edition White Gold metal design. White Gold design is only available while supplies last.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $84 Dunkin’ Credit: With the $84 Dunkin’ Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at Dunkin’ locations.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That’s up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges with every booking of two nights or more through AmexTravel.com. Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Book domestic flights on United Airlines using Avianca LifeMiles

It can be cheaper to book domestic United flights through a partner, rather than directly with United. And that’s advantageous for those with Amex points, because Amex points don’t transfer to United Airlines.

This generally applies to flights of 500 miles or less, so you won’t be going very far, but the more flying you do, the more you could save in the long run.

Consider a flight from John Wayne Airport in Orange County, California (SNA) to San Francisco International Airport (SFO). United charges a minimum of 8,700 miles for this flight.

However, you can book the exact same flight by transferring Amex points to Avianca LifeMiles and paying just 6,500 miles instead.

You’ll need to find what’s called “saver” award space to book at the cheapest rates with partners, and luckily United makes it very obvious. You’ll see that the image above says Saver Award clearly, and those flights are available through United partners at their optimal rates.

Take short American Airlines flights in North America using British Airways Avios

Just as you can book United flights cheaper with a partner, the same applies to short American Airlines flights booked through British Airways. This is especially true on flights with inflated costs, such as near holidays or those with little competition from other airlines.

Consider this American Airlines flight from Dallas-Fort Worth (DFW) to Oklahoma City (OKC). American Airlines is charging 9,500 miles for this flight.

However, British Airways, thanks to its distance-based pricing and the short distance of this flight, charges just 7,500 Avios.

A few items are worth noting. First, because British Airways uses a distance-based chart, you’ll pay more the farther you fly. That’s why short flights represent the best value. Additionally, British Airways charges by the distance of each segment, so prices can really inflate if you go out of your way for a connecting flight (such as flying from Kansas City to Cincinnati by way of Philadelphia).

Book Star Alliance around-the-world tickets in business class using All Nippon Airways (ANA) from Japan

Booking a trip around the world is a bucket list item for many, and you can save a ton of points and miles by booking your flights as part of an around-the-world ticket, rather than booking each piece separately. If you’re going to do this, ANA offers some of the best pricing.

There are a few rules to note, however. First, you must keep flying in the same direction; you cannot backtrack, flying east from New York to Paris, then west to Madrid before continuing east to Istanbul. You also must cross both the Atlantic and Pacific with these bookings and can have a maximum of eight stopovers (where you spend more than 24 hours at a stopping point), with a maximum of three stopovers in Europe and a maximum of four stopovers in Japan. The full rules are available here .

Pricing is based on the total distance of your flights, and you’ll pay based on the highest fare of any flight. Thus, if you take a single flight in first class, you’ll pay for first class on the whole itinerary.

Imagine flying from New York to London for a few days before continuing to Rome. Your next stop is Istanbul before spending time in Dubai, then a vacation to New Delhi and Bangkok. Your last country involves a stop in Sydney before flying through Los Angeles to get home to New York. This excellent holiday has a total flying distance of 24,903 miles. You’ll pay 100,000 miles to fly this route in economy, 145,000 per person in business class, or 220,000 miles each in first class. Do note that several of these routes don’t have an available airline flying first class.

Fly round-trip to Europe by booking with ANA

ANA also offers excellent rates on round-trip flights between the U.S./Canada on one side and Europe on the other. For this pricing, ANA treats the whole continental U.S. and Canada as the same zone, meaning this pricing applies broadly.

The airline you fly can change the taxes and fees added onto your redemption, so you might have a few hundred dollars to pay when flying with Lufthansa or less than $100 if you fly with United. Take this into consideration when booking.

However, the pricing can’t be beat. Paying 88,000 miles per person for round-trip tickets to Europe in business class is truly one of the best ways to use Amex points.

Book Iberia flights to/from Europe during off-peak dates

One of the craziest deals for using frequent flyer miles is flying from the U.S. to Spain with Iberia on off-peak dates. Iberia has lower prices during these dates, so if you can avoid Christmas and Spring Break, you might snag a round-trip ticket for what other airlines charge on a one-way trip.

Consider this business-class flight between Madrid and New York City for 34,000 Avios + $149.40 in taxes and fees. Paying 68,000 Avios for round-trip business class from the U.S. to Europe is incomparable.

Prices will climb if you fly further or fly on peak dates. Flights to Chicago, for example, would cost 42,500 Avios per person, while flights to the West Coast would cost as much as 51,000 Avios per person — all during off-peak (cheaper) pricing. You can view the current peak and off-peak calendar here .

Fly to Hawaii from the West Coast using Air Canada Aeroplan points

For those on the West Coast who can access nonstop United Airlines flights to Hawaii, using your Amex points with Aeroplan offers a great deal. You’ll pay just 12,500 Aeroplan points per person, plus roughly $45 in taxes and fees.

Prices jump to 22,500 points per person if you’re making a connection from the East Coast, so the best value is for those who can catch a nonstop flight to Hawaii. We consider taking a family of four to Hawaii and back for 100,000 points among the best ways to use Amex points.

Use monthly Air France–KLM Flying Blue Promo Rewards for discounted deals on flights to/from Europe

Air France and KLM share a rewards program called Flying Blue. Each month, the program offers Promo Rewards, which can offer up to 50% discounts on award tickets — though a 25% discount is more standard. These represent incredible value if you are headed to one of the eligible destinations.

The discounts apply to a set list of flights and eligible dates, typically published for the next three months. And the discounts only apply to flights operated by Air France and KLM, meaning you’ll be flying to or through these airlines’ hubs in Paris and Amsterdam.

The list of eligible destinations changes monthly, but examples from current and previous deals highlight just how much value can be found. Flying from Houston to Paris for just 16,875 miles per person is a fantastic price.

You can view the current list of routes and dates here .

Pay for flights with points using the 35% points rebate

The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. (terms apply) provides a unique benefit in which cardholders get 35% of their redeemed points back (up to 1 million points back per calendar year) when paying with points for a flight via Amex Travel.

All information about The Business Platinum Card® from American Express has been collected independently by Blueprint.

However, not all flights are eligible. This applies to first-class and business-class flights on any airline, as well as flights in any cabin on a preferred airline you choose in advance. This can make your points worth up to 1.54 cents each, and it presents a great opportunity to buy a flight with points when you’ve found a great deal.

When should you use this benefit? It’s most advantageous if the number of points you’d use to pay via Amex Travel is less than what you’d need to transfer to a rewards program and book the ticket as a redemption flight.

However, it’s worth pointing out that you must have the full number of points required (before the discount), because the discount is applied as a points rebate after the fact.

This business-class ticket from Madrid to San Francisco costs $1,108 or 110,750 points. You also could transfer points to Aeroplan and book a similar route for 90,000 points + $123 in taxes and fees.

But those with The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. would pay just 71,988 points in the end, thanks to the 35% points rebate. And that’s with everything included, no extra fees like you’ll pay when booking through partner airlines.

This benefit won’t always present cost savings, so it’s important to comparison shop. How many points would you pay if you transferred your Amex points to a partner airline for a redemption booking? Compare that to the points you’d pay (after the discount) by booking with Amex Travel. Choose whichever option costs less, which will vary.

This is a nice option for increasing your booking options. And when you can’t find award availability, this benefit is always available, so long as there’s a seat for sale.

Other ways to use Amex points

Transferring using your points for hotels and flights is the best way to use Amex points, but it’s not the only way.

The simplest way to use Amex points is redeeming them for cash, which you can do as a statement credit to offset your recent purchases. Points are worth only 0.6 cents apiece here — one of the lowest-value options available.

Other poor-value options for using Amex points include shopping with points at merchants like Amazon, where you can get 0.7 cents per point, or paying with points in Amex’s shopping portal, fetching the lowest value possible: half a cent per point. Amex also allows you to buy gift cards with your points, and the values here vary. You can use points between 0.5 cents and 1 cent apiece.

It’s also possible to use your points to pay for travel at Amex Travel, which offers flights, hotels, cruises and vacation packages. The value you’ll get from your points varies. They’re worth 1 cent each toward flights and hotel bookings with the Fine Hotels + Resorts® program. Points are worth just 0.7 cents each toward rental cars, cruises, hotels and vacation packages, however.

What are Amex Membership Rewards?

American Express Membership Rewards are the rewards currency earned with several Amex cards. Not all Amex credit cards earn these points, to be clear. Amex points have multiple uses, which is why they’re often called flexible points, and the best way to use them often involves flight redemptions with partner reward programs.

If you have multiple cards that earn Amex Membership Rewards points, the good news is that you can combine all of your cards into a single log-in on Amex’s website, thus putting all of your points together in one place. That makes it easy when it’s time to redeem them.

What Amex credit cards earn rewards points?

American Express issues numerous credit cards , but not all of them earn Membership Rewards points. Obvious examples include those with “cash” in the name of the card, and co-branded cards earning Delta SkyMiles, Marriott Bonvoy points, or Hilton Honors points also don’t earn Amex points.

You can earn Amex points with the following personal (consumer) cards (terms apply):

- American Express Centurion Black Card * The information for the American Express Centurion Black Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- The Platinum Card® from American Express

- The Platinum Card® from American Express for Charles Schwab * The information for the The Platinum Card® from American Express for Charles Schwab has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- The Platinum Card® from American Express Exclusively for Morgan Stanley * The information for the The Platinum Card® from American Express Exclusively for Morgan Stanley has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- American Express® Gold Card

- American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Amex EveryDay® Preferred Credit Card * The information for the Amex EveryDay® Preferred Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Amex EveryDay® Credit Card * The information for the Amex EveryDay® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Blue from American Express® (no longer available to new applicants)

All information about American Express Centurion Black Card, The Platinum Card® from American Express for Charles Schwab, The Platinum Card® from American Express Exclusively for Morgan Stanley, American Express® Green Card, Amex EveryDay® Preferred Credit Card and Amex EveryDay® Credit Card has been collected independently by Blueprint.

And the following small-business cards earn Membership Rewards points (terms apply):

- The Business Centurion® Card from American Express * The information for the The Business Centurion® Card from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- American Express® Business Gold Card * The information for the American Express® Business Gold Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Business Green Rewards Card from American Express * The information for the Business Green Rewards Card from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- The Blue Business® Plus Credit Card from American Express * The information for the The Blue Business® Plus Credit Card from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

All information about The Business Centurion® Card from American Express, The Business Platinum Card® from American Express, American Express® Business Gold Card, Business Green Rewards Card from American Express and The Blue Business® Plus Credit Card from American Express has been collected independently by Blueprint.

How to earn Amex Rewards points

You can earn Membership Rewards in a few ways:

- Welcome offers. Like all issuers, Amex makes welcome offers to entice you to open one of its cards. The welcome offer typically looks like this: “Earn x points if you spend this amount of money in this amount of time, starting from the date your account is opened.” This can be the most straightforward way to earn a significant sum of Amex points quickly.

- Spending. You can also earn Amex points from spending on its credit cards . Each card has different features and different earning rates, with some cards having high-value bonus categories where you earn extra points. A good example is the American Express® Gold Card , which earns 4 Membership Rewards points per $1 at restaurants worldwide, up to $50,000 in purchases per calendar year; then 1 point per $1, 4 points per $1 at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1 point per $1), 3 points per $1 on flights booked directly with airlines or through American Express travel and 1 point per $1 on other eligible purchases (terms apply, rates & fees ). In contrast, the Amex Platinum Card earns only minimal rewards at U.S. restaurants.

- Referral bonuses. It’s also possible to earn Amex Rewards points by referring a friend (or another small business owner for business cards) to apply for a credit card. If your friend uses your referral link and then is approved for the card, you could earn a bonus. Bonus amounts vary and are targeted to individuals, but you may be able to earn $100 cash or as much as 20,000 bonus points from each referral.

- Amex Offers. Cardholders also can earn bonus points through targeted spending offers via Amex Offers . These offers, which you must add to your card before using them, can provide cash back or bonus points when making purchases at the merchant highlighted in the offer. These offers could be related to your local supermarket, a cruise line, or online streaming services.

You also may receive other offers of bonus points, such as Amex offering a retention bonus of points to convince you not to close your account (if you’re in the process of doing so) or offering a bonus to entice you to upgrade your card to a more premium version. Again, these offers are targeted to the individual, so what you see may vary from offers others receive.

Holding a combination of Amex cards can also accelerate your earnings. The so-called Amex Trifecta provides a solid example, using three cards with complimentary bonus categories that can help you earn extra rewards on every purchase you make.

Frequently asked questions (FAQs)

The value of the points depends on how you use them. If you shop through Amex’s website and purchase goods with your points, they’re worth half a cent each — making 50,000 points worth $250. However, it’s also possible to redeem those 50,000 points for expensive flights, using Amex’s transfer partners, fetching thousands of dollars in value.

You can redeem points in many ways, with the worst option (shopping for gifts with Amex) providing just 0.5 cents in value per point — making 100,000 points worth $500. Conversely, 100,000 points is more than enough for a round-trip ticket from the U.S. to Europe in business class if you use the available airline transfer partners. That could make your 100,000 points worth $6,000 or more.

Points earned from an Amex Platinum card are the same Membership Rewards points that you’ll earn on other Amex cards. The best value redemptions for Membership Rewards points is typically booking airfare.

Points do not expire as long as your account is open and in good standing. However, if you close your account or Amex closes it due to a violation of program terms, failure to pay your bill or other negative reasons, you could forfeit your points. As long as you pay your credit card bill and follow the rules, points don’t expire.

American Express calls its annual fee a “membership fee” and it also issues several no-annual-fee credit cards.

For rates and fees for the American Express® Gold Card please visit this page .

*The information for the American Express Centurion Black Card, American Express® Business Gold Card, American Express® Green Card, Amex EveryDay® Credit Card, Amex EveryDay® Preferred Credit Card, Business Green Rewards Card from American Express, The Blue Business® Plus Credit Card from American Express, The Business Centurion® Card from American Express, The Business Platinum Card® from American Express, The Platinum Card® from American Express Exclusively for Morgan Stanley and The Platinum Card® from American Express for Charles Schwab has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Ryan grew up in Ohio but has lived in half a dozen states and multiple continents before recently returning to the U.S. and settling in southern California. After someone at his hostel in China said, “I flew here for free using points,” Ryan was hooked. In December of 2023, he completed his goal of visiting every country in the world. Ryan has been around points and miles for several years and has published content at Miles to Memories, AwardWallet, The Points Guy and Forbes Advisor. He also holds Brazilian citizenship and speaks fluent Portuguese. His wife joins him on many of his trips, and they enjoy snowboarding, scuba diving, seeing animals in the wild and hunting for vegan tiramisu. When not traveling, Ryan is probably answering questions from his family about how he travels so much and whether this points and miles stuff is illegal.

Ashley Barnett has been writing and editing personal finance articles for the internet since 2008. Before editing for USA TODAY Blueprint, she was the Content Director for an international media company leading the content on their suite of personal finance sites. She lives in Phoenix, AZ where you can find her rereading Harry Potter for the 100th time.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

How to redeem points for boutique luxury hotels

Credit cards Harrison Pierce

Why I chose the Wells Fargo Active Cash® Card over other cash-back cards

Credit cards Jason Steele

Big Changes to the American Express Gold Card

Credit cards Carissa Rawson

Chase Freedom Flex vs Freedom Unlimited

Credit cards Sarah Brady

Study: Over two-thirds of Americans are stressed by everyday expenses – these are the most frustrating ones

Credit cards Stella Shon

Chase trifecta: What it is and how to maximize it

Credit cards Ryan Smith

Best credit cards for families of August 2024

Credit cards Dawn Papandrea

Citi Strata vs. Chase Sapphire Preferred

Citi Merchant offers: Everything you need to know

Credit cards Louis DeNicola

Best credit cards for young adults of August 2024

How to redeem Citi Double Cash credit card rewards

Credit cards Rebecca Safier

Chase Ink Business Preferred welcome offer reaches new heights with 120k points for big spenders

Guide to Citi ThankYou transfer partners

Credit cards Lee Huffman

Blink and you’ll miss it, new elevated offers on IHG credit cards

Credit cards Sarah Sharkey

Best credit cards for lounge access of August 2024

Amex Membership Rewards vs. Chase Ultimate Rewards: Which is the best?

Editor's Note

American Express Membership Rewards points and Chase Ultimate Rewards points are two of the most highly sought-after transferable currencies among travel enthusiasts. These points can unlock incredible redemptions in aspirational locations like the Maldives and Bora Bora. Both programs offer a range of travel rewards credit cards and redemption options, including transferring points to airline and hotel partners or booking travel through the respective bank's portal.

However, it's important to note that not all points hold the same value. While both Amex Membership Rewards points and Chase Ultimate Rewards points are valued at approximately 2 cents per point, according to TPG , the best choice depends on your spending habits and travel objectives. Now, let's delve into a comparison between these two programs to see how they measure up.

Transfer partners with Amex Membership Rewards vs. Chase Ultimate Rewards

American Express Membership Rewards

Amex partners with 18 different airline programs and three hotel chains . Here's the current list of Amex airline partners:

- Aer Lingus AerClub

- Aeromexico Club Premier

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- All Nippon Airways Mileage Club

- Avianca LifeMiles

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Delta Air Lines SkyMiles

- Emirates Skywards

- Etihad Airways Guest

- Hawaiian Airlines HawaiianMiles

- Iberia Plus

- JetBlue TrueBlue

- Qantas Frequent Flyer

- Qatar Airways Privilege Club

- Singapore Airlines KrisFlyer

- Virgin Atlantic Flying Club

And these are the Amex hotel transfer partners:

- Choice Privileges

- Hilton Honors

- Marriott Bonvoy

You can book flights or hotels through Amex Travel , but transferring points to a partner and then redeeming them (more on that a little later) typically results in the best redemption value.

Related: How to redeem American Express Membership Rewards for maximum value

Chase Ultimate Rewards

With Chase Ultimate Rewards, you can transfer points to 11 airline programs:

- Southwest Airlines Rapid Rewards

- United Airlines MileagePlus

Chase also partners with three hotel programs:

- IHG One Rewards

- World of Hyatt

All transfer ratios are 1:1, and you must transfer in 1,000-point increments.

To decide which program is better for you, you'll want to consider the transfer partners you'll use most for your travel goals.

Remember that it's possible to use one airline's miles to book award flights on another if they're partners or part of the same alliance. For example, even though United Airlines isn't an Amex Membership Rewards transfer partner, you can book United award flights by transferring Amex points to Air Canada or Singapore Airlines (as they are Star Alliance partners).

Related: How to redeem Chase Ultimate Rewards points for maximum value

Earning points with Amex Membership Rewards vs. Chase Ultimate Rewards

Earning Amex points has become more accessible thanks to revamped card options such as the American Express® Business Gold Card and American Express® Gold Card , both offering generous welcome offers. Despite a once-per-lifetime policy for welcome offers , the wide range of cards that earn Membership Rewards points makes it relatively easy to accumulate a substantial points balance.

Here are some of the cards that earn Amex Membership Rewards points:

- American Express® Green Card

- American Express® Gold Card

- American Express® Business Gold Card

- The Platinum Card® from American Express

- The Business Platinum Card® from American Express

- The Blue Business® Plus Credit Card from American Express

The information for the Amex Green has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Some of these cards come with great welcome offers. For example, The Platinum Card from American Express offers 80,000 Membership Rewards points after you spend $8,000 on purchases within the first six months of card membership. According to TPG's monthly valuations , Amex Membership Rewards points are worth 2 cents each, making this 80,000-point bonus worth $1,600. That is more than double the card's $695 annual fee (see rates and fees ).

Related: Which is the best American Express credit card for you?

Another way to earn Amex points is through targeted Amex Offers . You'll see all the Amex Offers you have available on a given card if you scroll down on your online account page or by tapping the "Offers" tab in the Amex app.

These offers come from various merchants, including travel providers, restaurants, clothing and jewelry stores, and more. Generally speaking, Amex Offers come in one of three forms:

- Spend $X, get Y number of bonus points

- Spend $X, get $Y back

- Get additional points per dollar spent at select merchants

While some offers will give you cash back for meeting a specific spending requirement, many offer points.

If you hold multiple Amex cards, it's important to check all of them to ensure you're maximizing the available offers. Additionally, reviewing the terms of each Amex Offer you add to your cards is crucial, as some may exclude gift card purchases.

Amex Offers can be combined with online shopping portals and bonus categories. Consider using a shopping portal aggregator to determine which portal offers the highest return for a specific purchase. This way, you can make the most of your purchase.

Related: How to earn bonus cash back or Amex points on your online shopping purchases with Rakuten

Chase offers three cards that earn transferable Ultimate Rewards points, all of which have substantial welcome bonuses:

- Chase Sapphire Reserve

- Chase Sapphire Preferred Card

- Ink Business Preferred Credit Card

There are also four cards offered by Chase that, on their own, don't allow you to transfer points to travel partners. However, if you have one of the cards mentioned above, you can transfer points to that account and then move them to airline and hotel partners.

- Chase Freedom (no longer open to new applicants)

- Chase Freedom Unlimited ®

- Ink Business Cash Credit Card

- Ink Business Unlimited Credit Card

The information for the Chase Freedom has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Remember that the Chase 5/24 rule may limit your ability to get approved for these cards. If you're new to points and miles , your best bet is to apply for the Chase cards you want first.

Bonus points categories with Amex Membership Rewards vs. Chase Ultimate Rewards

We recommend maximizing everyday spending on several Amex cards by taking advantage of bonus categories. For example, the Amex Gold earns 4 points per dollar at restaurants worldwide (on the first $50,000 spent per calendar year, then 1 point per dollar). In comparison, the Amex Platinum earns 5 points per dollar on airfare booked directly with the airline or via Amex Travel (on up to $500,000 on these purchases per calendar year) and 5 points per dollar on prepaid hotels booked through American Express Travel.

Related: Best credit cards

Chase offers a range of cards that provide ample opportunities to earn points through bonus categories. For example, the Chase Sapphire Preferred offers 5 points per dollar on travel booked through Chase Travel℠, 3 points per dollar on dining and select streaming services, 3 points per dollar on online grocery purchases (excluding Target and Walmart), 2 points per dollar on other travel, and 1 point per dollar on all other expenses.

The Ink Business Preferred extends the bonus categories with 3 points per dollar on travel, shipping, internet, cable, phone services and advertising purchases made with social media and search engines (on up to $150,000 in combined purchases per account anniversary year, then 1 point per dollar), and 1 point per dollar on everything else.

With the Chase Sapphire Reserve , you'll earn 3 points per dollar on all travel (excluding the $300 travel credit) and dining worldwide, and 1 point per dollar on other expenses. This includes bonus categories like ride-hailing services and food delivery. Moreover, Sapphire Reserve cardholders will automatically earn 10 total points per dollar on Lyft rides when using their card, valid until March 2025.

Remember to assess your spending habits to determine which program suits you best. The Chase Sapphire Reserve or Preferred might be more suitable if you spend significantly on general travel. On the other hand, if you frequently spend on airfare or dining, it's hard to beat the Amex Platinum's 5 points per dollar or the Gold card's 4 points per dollar on dining at restaurants.

Related: 6 little-known Chase Sapphire Reserve perks

Redemption options with Amex Membership Rewards vs. Chase Ultimate rewards

As easy as it is to earn transferable points, you don't want to keep them just sitting in your account — you want to burn them. Just like the ways to earn points, all redemption options aren't created equal.

With Amex, you have many ways to score your dream redemption. Some of these are more valuable than others.

For instance, you could use Virgin Atlantic's award chart for All Nippon Airways to fly ANA's The Room business class for 145,000 points round-trip from the West Coast (or 170,000 from the East Coast).

You can also use Virgin Atlantic Flying Club points to fly Hawaiian Airlines between the U.S. mainland and Hawaii. Business-class awards cost 40,000 points one-way between Hawaii and the West Coast or 65,000 points between Hawaii and the East Coast .

You can also use the Amex Travel portal to find a preferred room and then pay with points — valued at 0.7 cents each — or cash. You can book various hotels, including those in Amex's Fine Hotels + Resorts program . You won't usually earn hotel points or elite credits for third-party bookings.

Related: Here are 9 of our favorite ways to use Amex Membership Rewards points

With Chase, you can book travel through the Chase Travel℠ and redeem points to pay for your plane tickets, hotel stays, rental cars or experiences. If you're a holder of the Chase Sapphire Preferred or the Ink Business Preferred , each point is worth 1.25 cents. If you have the Chase Sapphire Reserve , your points are worth 1.5 cents apiece toward redemptions through the portal.

While you can use your Chase points through Chase Travel, you'll usually get better value by transferring to a travel partner. One of our favorite ways to redeem Chase points is to transfer them to World of Hyatt and redeem them at low-category or high-end properties.

As with Amex, some transfer partners are more valuable than others. For example, we don't usually recommend transferring Chase points to hotels (except Hyatt), as you'll typically get more value moving your points to airline partners. And you'll usually get more bang for your points when you redeem them for high-value first- and business-class international award flights.

Related: Sweet spots: The best ways to use Chase Ultimate Rewards points

Bottom line

Choosing between these two programs depends on your preferences, but there's no reason why you can't collect both types of points.

With a valuation of around 2 cents each for both Chase and Amex points, you can't go wrong with either transferable currency. Chase Ultimate Rewards is a great choice if you're aiming for remarkable redemptions like Hyatt stays in the Maldives or Star Alliance business-class tickets to Europe or Asia. Additionally, the Ink Business Preferred Credit Card's 120,000-point sign-up bonus after spending $8,000 in the first three months from account opening makes it easy to accumulate a substantial amount of points quickly.

Amex Membership Rewards is a solid option for affordable award redemptions using Virgin Atlantic Flying Club. While Virgin Atlantic is a transfer partner of Chase, Amex often offers targeted transfer bonuses that can help you secure discounted premium-cabin awards to Japan.

Maintaining flexible and diverse points and miles balances will give you the most options when redeeming your rewards regardless of your preferred currency.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

Amex Membership Rewards Transfer Partners & How To Use Them [2024]

Jarrod West

Senior Content Contributor

453 Published Articles 1 Edited Article

Countries Visited: 21 U.S. States Visited: 24

Keri Stooksbury

Editor-in-Chief

41 Published Articles 3375 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

![amex for travel points Amex Membership Rewards Transfer Partners & How To Use Them [2024]](https://upgradedpoints.com/wp-content/uploads/2019/10/Lufthansa_B748_First_Class_Seat_1A_Cherag_Dubash.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Airline transfer partners, hotel transfer partners, how to transfer membership rewards, transfer bonuses, earning amex membership rewards, booking travel with the amextravel.com portal, other ways to use your points, combining membership rewards from different accounts, redeeming membership rewards, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Key Takeaways

- American Express Membership Rewards points transfer to numerous airline and hotel partners, typically at a 1:1 ratio, providing flexibility in redeeming points for travel.

- Popular airline partners include British Airways Executive Club, Delta SkyMiles, and Emirates Skywards.

- Hotel partners like Hilton Honors and Marriott Bonvoy allow points transfers for booking stays.

If you’re looking for a way to earn lots of points to redeem for some amazing travel, you can’t go wrong with American Express Membership Rewards credit cards. Amex provides a number of ways to earn Membership Rewards points and plenty of fun ways to redeem them for some great flights.

In this post, we’ll show you all of the American Express transfer partners, how to transfer Membership Rewards to these partners, and much more. With this guide in hand, you’ll be ready to book some amazing vacations!

The American Express Membership Rewards program has a ton of airline transfer partners.

Make sure you check the transfer rate (see below) since not all transfers are done at a 1:1 ratio.

Membership Rewards can also be transferred to 3 hotel rewards programs.

Like American Express airline partners, transfer ratios vary (see below), so make sure you check them before transferring.

Hot Tip: Use our transfer partner tool to see how many points you’ll get when you transfer your Amex Membership Rewards to their partner airlines and hotels!

With some Membership Rewards points in your account , it’s time to decide where you want to transfer your points so you can start traveling. Here are the simple steps to make the transfer process easy.

Step 1: Select Earn and Redeem from the menu.

Step 2: Select Transfer Points under Redeem .

Step 3: Choose your desired airline or hotel transfer partner and select Transfer Points . If you haven’t already, you will need to link your frequent flyer account to your Membership Rewards account. In the example below, we chose Delta Air Lines.

Step 4: Once you have linked your airline or hotel account to your Membership Rewards account, choose how many points you would like to transfer. Transfers must be made in increments of 1,000.

Step 5: Confirm the number of points you are transferring and complete the transfer.

Step 6: Head over to the appropriate airline or hotel program to book your award flight or award stay.

Bottom Line: Transferring Amex points to partners is easy. Just have your loyalty program numbers handy and your Amex card details, and you’ll be good to go!

Transferring your points when there is a bonus is an ideal situation. Getting the most value out of every point you have is the key to getting those high-level redemptions!

Amex has previously offered both public and targeted transfer bonus offers of 15% to 40%. For example, if you were to transfer 10,000 points when a particular partner is offering a 40% bonus offer, your points would be worth 14,000 points after transfer.

However, you shouldn’t transfer points JUST because there is a bonus. It’s best to keep your points in a transferable account (like Amex, Capital One, Chase, Citi, or Marriott Bonvoy) until you have a specific redemption in mind.

American Express provides tons of opportunities to earn Membership Rewards points . Pick the card or combination of cards that will help you earn the most points and get the benefits that matter to you.

Recommended American Express Cards (Personal)

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.