Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

Charge, reclaim and record VAT

Reclaim vat on business expenses.

You can reclaim VAT on items you buy for use in your business if you’re VAT registered. Do this in your VAT return .

There are different rules if your organisation is VAT-exempt (for example, an educational academy or an eligible charity). Read guidance on reclaiming VAT as an organisation not registered for VAT (VAT126) .

If any items are also for personal use, you can only claim the business proportion of the VAT .

Half of your mobile phone calls are personal. You can reclaim 50% of the VAT on the purchase price and the service plan.

You work from home and your office takes up 20% of the floor space in your house. You can reclaim 20% of the VAT on your utility bills.

You must keep records to support your claim and show how you arrived at the business proportion for a purchase. You must also have valid VAT invoices.

If you reclaim VAT on goods or services which you’ve not paid for, you must repay HMRC . This is called ‘clawback’. Read the guidance on clawback to find out when and how to repay VAT you previously reclaimed .

If you sell both taxable and exempt goods

If you sell goods or services that are a mixture of taxable and exempt from VAT , your business is considered ‘partly exempt’. Find out about partial exemption and how to calculate what you can reclaim .

Purchases before registration

You can reclaim VAT paid on goods or services bought before you registered for VAT if you bought them within:

- 4 years for goods you still have or goods that were used to make other goods you still have

- 6 months for services

You can only reclaim VAT on purchases for the business now registered for VAT . They must relate to your ‘business purpose’. This means they must relate to VAT taxable goods or services that you supply.

If you use the VAT Flat Rate Scheme

You cannot reclaim the VAT on your purchases - except for certain capital assets over £2,000.

Read section 15 of the guidance on the Flat Rate Scheme for small businesses to find out when you can reclaim VAT .

You might be able to reclaim all the VAT on a new car or commercial vehicle if you use it only for business. You must be able to show that it is not used on a personal basis, for example it’s specified in your employee’s contract.

‘Personal use’ includes travelling between home and work, unless it’s a temporary place of work.

You might also be able to claim all the VAT on a new car if it’s mainly used:

- for driving instruction

- for self-drive hire

If you buy a used car for business use, the sales invoice must show the VAT .

If you hire a car to replace a company car that’s off the road, you can usually claim 50% of the VAT on the hire charge.

If you hire a car for business use only, you can reclaim all the VAT if you hire it for no more than 10 days.

There are different ways of reclaiming VAT on fuel, if you do not pay a fixed rate under the Flat Rate Scheme .

You can reclaim all the VAT on fuel if your vehicle is used only for business.

If you use the vehicle for both business and personal purposes, you can either:

- reclaim all the VAT and pay the right fuel scale charge for your vehicle

- only reclaim the VAT on fuel you use for business trips - you’ll have to keep detailed mileage records

You might choose not to reclaim any VAT , for example if your business mileage is so low that the fuel scale charge would be higher than the VAT you can reclaim.

If you choose not to reclaim VAT on fuel for one vehicle you cannot reclaim VAT on any fuel for vehicles used by your business.

Additional vehicle costs

You can usually reclaim the VAT for:

- all business-related running and maintenance costs, like repairs or off-street parking

- any accessories you’ve fitted for business use

You can do this even if you cannot reclaim VAT on the vehicle itself.

Travel expenses

You can reclaim VAT on employee travel expenses for business trips. Travel expenses can include transport, meals and accommodation that you pay for. Find out who counts as an employee .

You can reclaim VAT on other kinds of expenses (not just those related to travel) for self-employed people who are treated as employees.

You cannot reclaim VAT if you pay your employees a flat rate for expenses.

Business assets of £50,000 and more

There are special rules for reclaiming VAT in the Capital Goods Scheme , which means you must spread the initial VAT claimed over a number of years.

What you cannot reclaim

You cannot reclaim VAT for:

- anything that’s only for personal use

- goods and services your business uses to make VAT -exempt supplies

- the cost of entertaining or providing hospitality to people you do business with (for example theatre or sports tickets)

- goods sold to you under one of the VAT second-hand margin schemes

- business assets that are transferred to you as a ‘ going concern’

Related content

Is this page useful.

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. Please fill in this survey (opens in a new tab) .

- Accountants in Bexley

- Why choose us

- Meet our team

- Accounts preparation

- Bookkeeping and Management accounts

- Payroll Services PAYE and CIS Services

- For individuals

- Free consultation

- Client portal login

VAT on expenses: Which are subject to VAT and which ones aren’t?

If your business earns more than £85,000 in turnover per year, you’re required to register for VAT. This means you are responsible for charging VAT to your customers but you can also reclaim any VAT you’ve paid on VATable supplies you bought for your business. The difference between the VAT charged and the VAT paid is the amount you’ll need to pay to or reclaim from HMRC. But VAT isn’t straightforward – there are different rates of VAT for different types of goods and services, so let’s get into the detail to make it clearer.

VAT on expenses recharged to the customer

HMRC requires that businesses must add VAT at their standard rate (usually 20%) to any expenses that are recharged to the customer, irrespective of whether they paid any VAT on those expenses. For example, if you incur postage costs when you send a letter to a client, this is a normal business expense and if you are recharging it to your client, you must add VAT.

However, there are some instances where you are not required to charge VAT, nor can you reclaim VAT for charges that are passed onto your client. These are known as disbursements and must meet strict criteria [1] to be classed as such for VAT purposes:

- you acted as an agent for your customer and paid the supplier on your customer’s behalf

- your customer received, used or had the benefit of the goods or services you paid for on their behalf

- it was not your responsibility to pay for the goods or services, it was your customer’s

- your customer knew that the goods or services were from another supplier and you had permission from your customer to make the payment

- the exact amount you incurred is passed onto your customer when you invoice them

- each disbursement is shown separately on your invoice

- the goods and services you paid for are in addition to the cost of your own services

For more information on recharged expenses vs. disbursements , visit the government website.

Accounting for VAT on expenses in your business

The UK VAT system has 4 different VAT classifications (correct at August 2023).

- Standard rate VAT is 20%

- Reduced rate VAT is 5%

- Zero rate VAT is 0%

- Exempt VAT means the supply is not taxable.

It’s easy to think that Zero rate Vat and VAT exempt are the same thing, and if you are the end consumer, in effect they are – you’ll pay no VAT, but if you are the seller, there’s a difference that needs to be accounted for so your VAT returns are correct. Put simply, if you supply zero rated goods or services to customers, you can reclaim VAT on costs incurred when making that supply. Examples include children’s books and clothing. However, if you supply VAT exempt goods or services, you are unable to reclaim any VAT incurred in making these supplies from HMRC. Examples of VAT exempt supplies include healthcare, insurance and education.

VAT rates on different supplies

Many supplies such as accounting services, selling clothes, providing taxi services, making cakes, party planning, will writing and so on are VATable at the standard rate of 20%, subject to your VATable turnover exceeding the £85,000 threshold. You can register for VAT even if your sales are below £85K which could be advantageous if you make significant VATable purchases. You can also use the Flat Rate VAT scheme which allows you to:

- pay a fixed rate of VAT to HMRC

- keep the difference between what you charge your customers and pay to HMRC

- you cannot reclaim the VAT on your purchases – except for certain capital assets over £2,000

Some supplies have a reduced VAT rate of 5% including electricity, gas, heating oil and solid fuel, mobility aids for the elderly and smoking cessation products to name a few.

As we’ve already mentioned, some supplies are taxed at 0% and others are VAT exempt. You can find all the current VAT rates on different goods and services on the government website.

Reclaiming VAT on expenses paid by employees

If an employee or contractor pays for goods or services that are used in your business and you fully reimburse them, you can reclaim the VAT. You’ll need a VAT invoice that clearly shows the amount of VAT paid but this can be in the employee or contractor’s name. For example, if an employee pays for travel and accommodation costs out of their own pocket for a business trip and you reimburse these in full, you can claim the VAT back.

Getting your VAT on expenses correct

Accounting for VAT correctly can be a headache for small business owners and making errors can result in VAT penalties which can be costly. If you are unsure about whether you are handling your VAT correctly or if you are getting close to the VAT threshold where you are obliged to register, get in touch with us for some free advice on your best next step. Our team of highly qualified bookkeepers and accountants will let you know what you need to do to ensure your VAT on expenses is correct and you don’t run into problems with the VAT man. Call us 01322 250001 for a free no-obligation chat about our comprehensive accounting and VAT services .

[1] https://www.gov.uk/guidance/vat-costs-or-disbursements-passed-to-customers

- Privacy Overview

- Strictly Necessary Cookies

- Cookie Policy

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

More information about our Cookies Policy .

Travel expenses and VAT

During routine checks, HMRC looks for mistakes which businesses commonly make. One such area is the VAT treatment of travel expenses. What should you check to ensure your VAT returns are correct?

One error often made by businesses that provide professional services involves passing on their employees’ travel expenses to their customers.

The following example illustrates the problem.

EXAMPLE ABC Ltd has clients all around the UK. Its standard terms state that its fees are based on time spent by its staff, plus expenses they incur if required to travel to meet the client. When ABC sends a bill it itemises any rechargeable travel costs and sends receipts for these. It believes by doing so it can treat the expense as a VAT disbursement. HMRC’s practice is that disbursements are not part of the supply of services and therefore not subject to VAT. For example, if ABC’s bill included £150 (zero-rated) for rail fares it can simply include this as an item on the bill without adding VAT.

However, as outlined in the disbursement criteria below, ABC Ltd is wrong. Several conditions must be met for an expense to be treated as a disbursement. At least one of these is not met in the circumstances described in the example above. Therefore, ABC should add VAT to the £150 travel cost recharged.

VAT Disbursement When you make payments on behalf of your customers, for goods or services received and used by them, you might be able to treat these payments as ‘disbursements’ for VAT purposes. This means that you:

• don’t charge VAT on them when you invoice your customer • can’t claim back any VAT on them However, the following criteria must be met in order to justify the costs incurred on behalf of your customers as a disbursement: • That you paid the supplier on behalf of your customer and acted as the agent of your customer. • That your customer received, used or had the benefit of the goods or services which you had paid for on their behalf. • It was your customer’s responsibility to pay for the goods or services and not yours. • That you had received permission from your customer to make the payment. • That your customer knew that the goods or services were from another supplier and not from you. • That you show the costs separately on your invoice to the customer. • That you pass on the exact amount of each cost to your customer when you invoice them. • That the goods and services you paid for are in addition to the cost of your own services. It’s usually only an advantage to treat a payment as a disbursement if the supplier didn’t charge VAT on it, or if your customer can reclaim the VAT.

If you recharge staff travel expenses to your customers, it is not a disbursement and therefore you must add VAT. Public transport fares don’t include VAT so there’s nothing for you to reclaim.

- travel expenses

Arrange a FREE consultation

You are currently viewing our [Locale] site

For information more relevant to your location, select a region from the drop down and press continue.

How to invoice your clients for expenses

As every small business owner knows, there are a variety of costs that you might incur in the process of supplying your goods or services to a customer.

In some situations, you might want to invoice a customer for a specific cost you incur in doing business with them. For example, if you provide training sessions and you have to buy a train ticket to travel to a client’s office, you might want to include the cost of the ticket when invoicing the client for the session.

When a business cost is passed on to the customer in this manner, it's often referred to as an ‘expense’. Here we explain how to add expenses to your invoices and some additional factors you might need to consider when you do so.

How to add an expense to an invoice

If you’re not registered for vat.

If your business isn’t registered for VAT , invoicing your clients for expenses is often as simple as adding an expense as a line on an invoice. In this situation, you should include both the price of the product or service you delivered and the expense as separate line items on the invoice. Make sure that you’ve agreed this with the client in advance, so they know what to expect when they receive the invoice.

If you’re registered for VAT

If your business is registered for VAT and you incur an expense that you want to include on an invoice, you have to charge VAT on that expense at the rate you usually charge for your services.

For example, if you stayed in a hotel that cost £120 + VAT while visiting a client to provide a training session, you could simply add the £120 + VAT as a new line on your invoice.

If you bought an item that was zero-rated for VAT, such as a train ticket , you’d still need to add VAT to the cost when invoicing your client. This means that if you wanted to invoice your client for a train ticket that cost you £50, and you want to recharge it at the same price, you need to charge £60 (£50 plus 20% VAT). This is because when you recharge the cost to your client, you are the one supplying the service (as opposed to the train company supplying the service to you).

If your customer is also registered for VAT, then they might be able to claim back the VAT you charged them when they file their VAT return for the quarter.

The difference between expenses and disbursements

There are certain types of costs that are known as ‘disbursements’ rather than ‘expenses’.

In broad terms, this distinction depends on who ends up using the product or service that the business has bought. If the item is something you use (e.g. a train ticket purchased to visit a client) it’s usually an expense; if the item is something that you buy for your customer and your customer uses (e.g. a plumber buying a bathroom sink for a customer’s project) it may be a disbursement.

If you choose to pass the cost of a disbursement on to your client, you should add it to your invoice in the same way you would add an expense. If you’re VAT-registered, you may be able to treat disbursements as outside the scope of VAT on your invoices and not charge your customers VAT on them if certain criteria are met.

HMRC provides more information about VAT and disbursements on its website. VAT is a notoriously complex subject, so we recommend speaking to your accountant if you’re unsure about anything in this area.

Invoicing for expenses with FreeAgent

FreeAgent lets you record and manage your business’s day-to-day running costs and add them to your invoices at the click of a button. Take a closer look at FreeAgent and start sending invoices today with a 30-day free trial .

Disclaimer: The content included in this blog post is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this blog post. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.

Want more inspiration and business tips?

If you check this box, we’ll send you business tips tailored for landlords. If you’d like more general small business tips, leave it unchecked.

Thank you for signing up, we'll be in touch soon.

In the meantime, feel free to browse for more handy content and useful ideas.

Related Articles

What can small businesses expect from the new government?

Here’s what we think small businesses can expect from the new government. Read more

How to balance running your business with surviving the summer holidays

Top tips to help master a balancing act that works for you, your business and your family. Read more

Cue the confetti… introducing the latest updates to payroll

Automatic pension calculations and brand new reporting have arrived. Read more

The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Our qualifications

- Getting started

- Your career

- Sign-up to our industry newsletter

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- ACCA apprenticeships

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- Computer-Based Exam (CBE) centres

- ACCA Content Partners

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- ACCA Study Hub for learning providers

- Find CPD resources

- Your membership

- Member communities

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- Affiliate video support

- About policy and insights at ACCA

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

- VAT on disbursements and recharges

- Technical activities and advice

- UK technical advice and support

- Back to March

- Help to Grow initiative falling flat

- Fuelling local growth

- Get Fit for Business

- Supporting your clients' sustainability journeys

- MTD ITSA: Your first 100 days plan

- ACCA and Capitalise's better business webinar series

- Changes to the ACCA Rulebook (Part 1)

- Have your say on HMRC’s performance levels

- Join our new insights community now!

- ACCA writes to Chancellor about payroll costs

- Housekeeping after the January madness

- Supporting practitioners across Wales

- Changes to the ACCA Rulebook 2022 (Part 2)

- Making Tax Digital for VAT is coming ― are you ready?

- MTD for ITSA: start preparing your clients

- Disengagement process for corporate clients

- Dormant subsidiary companies

- HMRC raises late payment interest rate again

- Shares owned by children

- How to prepare for an AML compliance review

- Updated accounting standards from 1 January 2021

- Specialist v generalist – should you niche or not?

- Did you jump too soon?

- Selecting the correct limit of indemnity for your practice

- Fixed-fee billing and why you should embrace it

- How to make your business look professional online

- Government scheme to give SMEs discounts on software

- Last few days to extended self-assessment window

- Late payments crisis threatens small firms in 2022

- New law: employers prepare for online-only ‘right to work’ checks for certain non-British nationals

- New guidance: Employers welcome new CIPD advice on whether and how to introduce ‘hybrid’ working

- New law: New rules set to help first-time homebuyers and self-builders in England

- New law: Employers assess workplace implications of upcoming laws against domestic abuse, including at work

- More Brits than ever want to start a business post-Covid

- Business guides for your clients

- ACCA Apprenticeships: Pledge for Potential

- Would you like to be on the FRC Tribunal Panel?

- ATED – new valuation date on the horizon

- Sage Inspire Me: MTD Edition

- Conference 1 for practitioners

- Free practitioner webinar series on risk

- MTD for ITSA podcast: segmenting your clients

- ACCA at the Accounting Excellence Awards 2022

- Accountex returns to London!

- Are you a genuinely proactive accountant?

- Cybersecurity – the latest updates

- Join ACCA’s global practice community

- Resolving unbilled work when moving to a fixed-fee model

- Accountants targeted amid furlough uncertainty

- Doing business in a foreign country

- Financial sanctions in relation to Russia

- AML supervision and the OPBAS levy

- Lowdown on the Scottish Budget 2022/23

- Software and website development costs

- Sanctions placed on Russia and Belarus

- Cracking down on dirty money in the UK

- Changes to HM Treasury list of high-risk third countries

- Webinar – Spring 2022 forecast update

- The dangers of scope creep

- IFRS 16 update - free webinar

How to avoid common errors which get it wrong between the two

It is very common to get it wrong between the two. A recharge expense is one that is incurred in the process of performing one's services but has been agreed to be paid for by the client. A disbursement, on the other hand, is an expense which you have paid on behalf of the client. In the case of disbursement, the payer acts as an agent when settling the amount due to the supplier, gets the invoice in the customer’s name and collects the exact sum paid.

The difference between reimbursement (recharge) and disbursement is significant from the VAT point of view as reimbursements are subject to VAT, while disbursements are outside the scope of VAT .

If a business is trading very close to the VAT registration threshold, an incorrect classification of expenses could mean that the threshold is breached sooner than anticipated.

HMRC defines ‘disbursements’ as ‘a payment made to suppliers on behalf of your customers’.

‘To treat a payment as a disbursement all of the following must apply:

- you paid the supplier on your client’s behalf and acted as the agent of your client

- your client received, used or had the benefit of the goods or services you paid for on their behalf

- it was your client’s responsibility to pay for the goods or services, not yours

- you had permission from your client to make the payment

- your client knew that the goods or services were from another supplier, not from you

- you show the costs separately on your invoice

- you pass on the exact amount of each cost to your client when you invoice them

- the goods and services you paid for are in addition to the cost of your own services.’

Disbursement examples

1. Mr A, an accountant, completes an annual return online at Companies House for a corporate client, and then recharges the company for the related filing fee. If the fee is separately itemised on the invoice issued by the accountants, and no ‘profit’ is made, then the fee charged by Companies House is a VAT-free disbursement because the annual return is the responsibility of the client.

2. A solicitor paying the stamp duty land tax (SDLT) on behalf of his client: this is clearly a client’s expense, as SDLT is the buyer’s responsibility not the solicitor’s. This is undoubtedly a disbursement .

Reimbursement/recharge example

Reimbursement of an agent by a principal is not consideration for the supply of services. However, where a person supplying goods or services includes the cost of the supplies to him in his charges to the third party, those costs are part of the consideration. If a solicitor or accountant travels to see a client or to attend court, the travel costs are not a disbursement. From HMRC’s point of view, those extra costs are reimbursements and as a result VAT should be added to them as they represent costs that the business incurs itself and are not disbursements.

Business must treat any recharge of such costs as further consideration for the main supply. This is important, as supplies, such as rail travel, which are zero rated purchased, must be recharged at the same VAT liability as the main supply of consultancy services, which are standard-rated . Thus, any recharge of these expenses follows this liability and standard-rating applies.

This only matters if the supply is not liable to VAT and the supplier can pass on the disbursement without adding VAT.

If the supply is standard-rated, it makes no difference:

- whether the payer acts as an agent, gets the invoice in the customer’s name and collects the gross amount; or

- whether he gets an invoice in his name, recovers the input tax and charges-on plus VAT.

…because either way, the VAT ends up with the customer.

Thus, if an accountant/solicitor travels by train to court on behalf of a non-taxable client, his client could save VAT by sending him the zero-rated return rail ticket.

An example of the elements of a disbursement invoice is below:

(Assume that the standard rate of 20% applies to all transactions.)

Court cases

In Brabners LLP v The Commissioners for Her Majesty’s Revenue & Customs, [2017] UKFTT 666 (TC) , the First-tier Tribunal considered whether electronic property search fees should be treated as part of overall client bills (and thus subject to VAT), or represented disbursements (outside the scope of VAT).

It was found that because the solicitors were using the information as ‘part and parcel’ of its overall service, the search fees should not be treated as disbursements.

The solicitors were not simply acting as a middle man to collect the search fee from the client; they used the results as part of their advice to clients. HMRC has confirmed that VAT would not be chargeable by either the search company or the solicitor if they passed it on ‘without analysis or comment’. However, if the firm provides advice or makes a report on the basis of the search, HMRC’s view is that the fee will form part of the charges for its services.

However, a distinction should be drawn between this case and Barratt, Goff and Tomlinson (A firm) v HMRC (Law Society Intervening) [2011] UKFTT 71 (TC) , a case which was referred to in the Brabners judgement above. In Barratt , the obtaining of medical records was a disbursement because the solicitor could only obtain the documents with the client’s consent, and the client was considered as the ‘owner’ of the information within the document. The solicitor was ‘merely an intermediary used to facilitate payment'.

In the case of Ellon Car Clinic Ltd [2017] (TC5813) the First-tier Tribunal considered whether a garage which had subcontracted MOT tests to an MOT approved centre had acted as agent for the car owners, or whether output tax was due on the full fee charged by the garage to their clients.

The company was not licensed to carry out MOT tests on customers’ vehicles, so subcontracted these tests to other garages, paying between £40 and £54.95 per test. It charged its customers a standard fee of £49.95 (no VAT), which HMRC assessed as being subject to 20% VAT. The company did not itemise the test fees as a separate entry on its sales invoices.

HMRC assessed output tax on the full fee, on the basis that the invoices did not meet the conditions of a disbursement.

However, the judge found that every customer knew that the company could not supply an MOT test. Even if the terms of the invoice did not show the involvement of the second garage, an agency arrangement was evident and the supply was clearly between the testing garage and the customer.

This was a partial victory for the company, as it was found that the only taxable element of the supply in relation to the MOT tests was the element which exceeded the amount actually paid. No output tax was due on deals where the company made a loss.

HMRC has now updated its guidance in order for garages to understand how to avoid the trap of being treated as principals. It clearly states ‘provided the unapproved garage charges on the exact amount it has been charged by the test centre and shows this separately on the invoice to its customer, it may treat this element as a disbursement and also outside the scope of VAT (assuming, of course, that all the other conditions set out in VTAXPER39000 are met)’.

Advertisement

- ACCA Careers

- ACCA Career Navigator

- ACCA Learning Community

Useful links

- Make a payment

- ACCA-X online courses

- ACCA Rulebook

- Work for us

Most popular

- Professional insights

- ACCA Qualification

- Member events and CPD

- Supporting Ukraine

- Past exam papers

Connect with us

Planned system updates.

- Accessibility

- Legal policies

- Data protection & cookies

- Advertising

- Foreign VAT

- Domestic VAT

- APAC & Canadian VAT Reclaim

- Our Partnerships

- Country VAT Guides

- VAT Potential Calculator

- Invoice Checklist

- Our Technology

- Our Services

- Our Company

- Corporate Social Responsibility

- Trust Centre

International business travel expenses: What can businesses reclaim?

Businesses are often looking for additional ways to increase revenue. However, the most significant source of savings may be in plain sight - within their international travel invoices and receipts. Here's what businesses may be eligible to reclaim from costs incurred during business travel and entertainment.

Reclaiming business travel expenses

Often, when planning a business trip, planning the budget can be more challenging than organizing the itinerary. Fortunately, there is a variety of business travel costs that are VAT reclaimable both within the local and international Travel and Entertainment VAT scope. Although that sounds great in theory, how can organizations switch the conversation from 'potential' savings to pocketing actual refunds back into their business? The first step is understanding what your business is eligible to reclaim.

When can you reclaim foreign VAT on travel expenses?

Many businesses leave significant savings on the table due to underclaiming on their VAT submissions. The reason? Unidentified hidden expenses. However, the VAT portion of business expenses is fully reclaimable, even when you're a non-resident organization incurring eligible business expenses in a foreign country. The only question, however, is what exactly constitutes an 'eligible' business expense?

Common recoverable international travel expenses

One of the most common errors that hinder the VAT reclaim process is claiming VAT on ineligible expenses. The other side of the coin, however, is missing out on the significant VAT reclaim potential within your business due to underclaiming and not including many expenses that are, in fact, VAT reclaimable. Fortunately, we're here to help guide you through the VAT reclaim process, one eligible expense at a time.

When navigating through the VAT reclaim process, however, it's important to remember that the VAT treatment will vary depending on the country you're reclaiming for. Therefore, the eligible expenses may differ for each unique country and industry. However, a few common expenses form a good baseline for the VAT reclaim process. Some common eligible expenses within the travel and entertainment reclaim scope include:

- Hotel and accommodation costs: Businesses can reclaim VAT on accommodation costs, including hotels and short-stay rentals.

- Meals and restaurants: VAT can often be reclaimed on restaurant bills, meals, catering services, and other meal costs related to business activities.

- Transportation costs: VAT is often incurred on transportation costs, including public transport, corporate car rental, taxi fares, fuel costs, train tickets, parking fees, and other business-related travel costs.

- Telecommunication services: A typical hidden cost that businesses often incur during global trips include VAT on international phone calls, internet access, and other communication services used for business purposes.

- Client entertainment: VAT is also commonly charged for various client entertainment expenses. This includes VAT on costs like sporting events, cultural events, and other costs related to business activities.

Reclaim your VAT on Travel and Entertainment with VAT IT

The process of recovering VAT on travel expenses can be challenging when considering that the entire process hinges on an organization's ability to identify the specific eligible expenses within each country and adhere to the country-specific VAT legislation, deadlines, invoicing instructions, and reporting requirements. Fortunately, you can replace the heavy lifting with our all-inclusive foreign VAT solution. At VAT IT, we understand the importance of tapping into industry-specific VAT opportunities while ensuring you align all processes with foreign VAT legislation.

Feeling too late to the party? Did you know some countries accept back-dated VAT reclaims of up to four years? Tap our experts into your corner and maximize your travel and entertainment costs by injecting up to 27% additional revenue into your business.

Related blogs

EU Throws a Virtual Party: New VAT Rules Unveiled for Your Liveliest Online Events!

Luxury on Wheels: Employee Perks or Parking Lot Shenanigans? Unveiling Car Perks in Belgium

VAT & Chill: Zen Practices for Stress-Free Reclaims

VAT-tastrophe! Common Mistakes and How to Avoid Them

VAT Hacks: Turning Receipts into Magic

Vat refund tool kit.

Come explore your refund possibilities.

Chat with us today.

Find out how you could turn company spend into income

Calculate your ROI

- Workforce Travel

- Roomex News

- Duty of Care

- Travel Manager

- Travel Safety

- Travel Policy

- Accommodation

- Time Savings

- Procurement

- Construction

- Forward Pricing Report

- Roomex Analytics

- Sustainability

- corporate retreat

Can you claim VAT back on travel expenses?

Business travel is big business. According to Statista , UK businesses collectively spent £25.7 billion on business travel in 2022, with projections suggesting this could increase 82% to £46.8 billion by 2025.

So, if you’re not managing your business travel expenses in a tax-efficient way, your business will be feeling the strain. Thankfully, we’ve got your back.

In this blog, we'll take a closer look at managing travel expenses for work and answer the question ‘Can you claim VAT back on travel expenses?’ (hint: you can!). We’ll also explore HMRC VAT implications on mileage and subsistence expenses in detail.

Ready to get stuck in?

- Travel expenses include various costs during business trips, such as transportation

- RoomexPay streamlines spending, but VAT reclaims have specific requirements.

- HMRC allows VAT reclaims on business travel expenses if the travel is for business purposes, proper invoices are provided and VAT guidelines are adhered to.

- Fuel VAT reclaims depend on usage – business or personal – while VAT can only be claimed back on subsistence claims when the business pays the whole cost, not a fixed allowance.

- Professional advice ensures accurate VAT reclaiming.

What is a travel expense?

When we talk about travel expenses, we're referring to the full gamut of costs incurred during business-related trips. These expenses can include everything from transportation and accommodation to meals and incidental purchases. For example:

- Transportation costs: Fares for flights, trains, buses and taxis, car hire and fuel for company vehicles.

- Accommodation fees : This includes the cost of staying in hotels, motels, serviced apartments or any other type of lodging during business trips.

- Meal expenses: The cost of meals incurred while travelling for business purposes, including breakfast, lunch, dinner and any associated gratuities.

- Incidental purchases: Covers additional expenses such as parking fees, tolls, tips or any other necessary purchases made during the course of the business travel. These costs may vary depending on the destination and the nature of the trip.

Some travel expenses will be managed on a per diem basis – either following the standard rates set by HMRC, or rates you have agreed for your employees.

Why is it important to manage travel expenses efficiently?

The reasons are manifold; here are just three of them: 1. Helps maintain financial accountability and transparency within your company or organisation. 2. Assists business in allocating resources wisely and in line with company policies. 3. Ensures compliance with regulatory requirements, minimising the risk of financial penalties or audits.

Managing travel expenses traditionally involves your workforce travellers keeping receipts during their trips and later claiming reimbursement from you. This process is time-consuming and inefficient for both parties. Employees may face delays in receiving their fund, while finance teams sometimes find it tricky to reconcile piles of receipts for end-of-month expenses.

Business travel solutions like RoomexPay can help.

RoomexPay simplifies on-the-road spending by giving your employees the flexibility to manage their expenses within predefined allowances. It reduces the time spent reconciling end-of-month expenses to ensure compliance, and eliminates the out-of-pocket expenses.

With RoomexPay, you can take control of your employees travel spend. But do you have to pay VAT on their business travel expenses?

Do you pay VAT on travel and subsistence?

Put simply, yes. Here’s what HMRC has to say:

“ You can reclaim VAT on employee travel expenses for business trips. Travel expenses can include transport, meals and accommodation that you pay for.”

When employees travel for work or make business-related purchases, there are typically two preferred methods of payment:

- Your employees receive a per diem or a scale rate provided by the company.

- Your employees pay out of pocket and seek reimbursement later.

Reimbursement usually occurs through an expense report, where employees detail their expenses and attach receipts. Once these have been submitted to your finance team, your employees can typically expect to receive their money in the next payment cycle.

You cannot claim VAT back if you pay employees a flat rate for travel expenses.

How to claim back VAT on business travel expenses?

Employees are usually reimbursed for all business-related expenses, including VAT, which the company can then reclaim from the government. However, HMRC sets out specific requirements that you need to fulfil if you want to claim back the VAT:

- Expenses must serve company interests. So, the travel expenses you are claiming must be solely related to business purposes. This could include visiting clients, attending meetings or training courses, travelling to buy stock or to another premises or office of your company.

- You must record proper invoices, detailing VAT amounts and other relevant information, for each expense.

- All bills must be addressed to the company, not individual employees. Your workplace travellers will need to be diligent in obtaining and retaining accurate paperwork throughout their trip.

- Your company must be VAT registered.

You can also reclaim VAT on accommodation and reasonable subsistence costs for overnight trips.

Which brings us on to….

HMRC travel expenses guidelines

HMRC provides comprehensive guidelines on claiming VAT back on travel expenses.

You can find them all on the HMRC website.

Can I claim VAT back on fuel?

Yes, but only when the fuel has been used for business travel.

Working out what you can claim back and what fuel use is ineligible is complicated, especially if your employees use company cars for business and personal reasons.

Guidelines for claiming VAT on HMRC mileage claims

The method you will use to reclaim VAT on fuel depends on your business usage. If your vehicle is used solely for business purposes, you can reclaim all the VAT on fuel expenses. If your vehicle is used for both business and personal use, you have two options:

- Reclaim all the VAT and pay the appropriate fuel scale charge for your vehicle.

- Reclaim VAT only on fuel used for business trips and maintain detailed mileage records.

You may choose not to reclaim VAT if your business mileage is low, and the fuel scale charge would exceed the VAT you can reclaim.

For mileage allowance HMRC guidelines, visit the HMRC website .

What are the benefits of VAT reclaim for fuel costs?

Reclaiming VAT on business fuel expenses offers significant benefits:

- You can reclaim 100% of the VAT incurred on fuel for business purposes, provided you can prove that the fuel is used entirely for business and not for private journeys.

- Reclaiming VAT on business fuel is simplified if you also pay a VAT fuel scale charge, which is based on vehicle CO2 emissions and type.

- Alternatively, you can reclaim VAT on the business portion of fuel purchases by maintaining a detailed mileage log or using HMRC's advisory fuel rates.

- Keeping four years' worth of receipts is essential for HMRC compliance and ensuring eligibility for reclaiming VAT on mileage claims.

- Understanding these guidelines and options for reclaiming VAT on fuel expenses empowers businesses to maximise tax efficiency and ensure compliance with HMRC regulations.

What about claiming VAT on subsistence per day?

VAT can be reclaimed on subsistence expenses if the business pays the actual cost of the expense. However, VAT cannot be reclaimed when a fixed allowance is paid to your employee, even if you have tax invoices for those costs.

Understanding the regulations on subsistence allowance and maximising claims within HMRC limits is essential if you want to manage corporate travel expenses efficiently.

Regulations on subsistence allowance

HMRC scrutinises bills for accommodation , food, drinks and sundry charges to ensure appropriateness and reasonableness. So, if you’re planning to wine and dine in a Michelin-starred restaurant with top-quality champagne, you might need to think again.

Maximising subsistence claims within HMRC limits

HMRC has published scale rates for subsistence payments to employees, ensuring tax and National Insurance-free payments:

- Travels lasting 5 hours or more: The maximum claimable meal allowance is £5.

- 10 hours or more: £10 meal allowance.

- Away for 12 hours or more: £15 meal allowance.

- For a full 24-hour period or longer: Meal allowance reaches a maximum of £25.

These rates apply to travel within the United Kingdom. For international travel, businesses should consult the HMRC website for recommended allowance rates by country. By adhering to these guidelines, you can ensure compliance with HMRC regulations while maximising tax efficiency in subsistence claims.

VAT reclaims can be complicated and getting it wrong may end up being costly. We recommend you hire a professional advisor or accountant to oversee the process to make sure your VAT reclaims are ship shape.

Wrapping up

While VAT can typically be reclaimed on legitimate business-related travel expenses, you will need to adhere to HMRC regulations and keep hold of the necessary documentation to ensure you don’t face unexpected costly audits and tax bills.

If you understand those requirements, then you can maximise tax benefits and boost travel budgets for your team.

Roomex offers a comprehensive solution to streamline travel expense management , with unique benefits such as consolidating all individual stays into one invoice and providing the convenience of paying on account. This simplifies the booking process and reduces the risk of fraudulent spending and expense debt, ultimately alleviating traveller stress.

Speak to a travel expert

Accommodation booking, expense management, policy compliance and more, all in one platform. Find out more from a Roomex travel expert now!

Sign up for free to start booking with Roomex

- English (CA)

- English (UK)

- Deutsch (DE)

- Deutsch (CH)

VAT is your money. Claim it back.

?)

VAT recovery made easy

All customers.

- Largest range of VAT-ready travel options

- Consolidated invoices

- Easy to use reporting tool

Premium/Pro

- VAT-ready invoices

- Billback invoicing documents

- Automatic syncing of invoices with integrated expense apps

- Expert advice from our account managers

Tap into our expert knowledge

?)

Why users love TravelPerk

Start booking business travel safely today with travelperk, travel at ease with an entire support team behind you.

?)

Frequently asked questions about VAT recovery

How do i claim a vat refund on travelperk's platform, can i claim vat back if i am not vat registered, can i also reclaim vat on foreign travel, do i need a vat receipt to make a claim, can i get a vat refund on hotel stays, can i reclaim vat on fuel, can i claim vat back on food and alcohol for staff.

?)

- Business Travel Management

- Offset Carbon Footprint

- Flexible travel

- Corporate Travel Resources

- Corporate Travel Glossary

- For Travel Managers

- For Finance Teams

- For Travelers

- Careers Hiring

- User Reviews

- Integrations

- Trust Center

- Help Center

- Privacy Policy

- Cookies Policy

- Modern Slavery Act | Statement

- Supplier Code of Conduct

Your guide to VAT on travel

Table of Contents

What can I claim VAT on?

Can i reclaim vat on all types of travel, what if i use the flat-rate vat scheme, can i always claim 20% back, how to reclaim vat in 3 steps, step 1: register your business for vat, details you’ll need to provide, step 2: track your income and expenses, step 3: file your vat return and pay hmrc, how to pay hmrc, how to simplify your vat expenses with countingup.

Online conference calls don’t always cut it, and sometimes, businesses need to expense travel costs to meet clients or to make sure projects are delivered on time. Find out how you can claim VAT back on your travel costs in this article.

We’ll summarise the essential information you’ll need to successfully make a VAT claim from your travel costs and answer key questions, including:

- What if I use flat-rate expenses?

Growing a successful business on the go means identifying ways you can save time and effort to focus on what matters. Learn how you can simplify your VAT expenses with Countingup below.

Businesses can reclaim VAT costs from the goods and services they purchase for business purposes, including things like travel costs. For this reason, only VAT claims on travel that’s related to your business are allowed. HMRC may audit your business

For example, if you need to provide a quote on a client project and have travelled to their home or offices to do so, your business is typically able to claim costs like VAT on travel back. Similarly, if you travel to attend a trade show or meet with potential investors or lenders, you can reclaim any VAT you’ve paid. Additionally, if you expand your business to a new location and need to travel in order to establish it, HMRC allows expense claims to be made for the first 24 months.

However, if you travel to the same office or manufacturing location regularly, this type of travel can’t be claimed back as it’s part of your normal commute. Moreover, if you exceed this 24-month threshold, you may lose your ability to claim the VAT back. This is because HMRC allows business travel for limited durations or for temporary purposes. If you’d like to learn more about the policy HMRC has for travel expenses, you can read our article What is the HMRC 24-month rule for expenses?

Yes, businesses can claim expenses on all types of travel, including any VAT rates that have been applied. However, if you choose to travel by car, expenses are handled differently. This means that if you travel by plane, train or bus, you can claim the ticket cost and other associated fees.

However, if you drive your own car, you can claim VAT in three different ways . In general, it’s simpler to file your car expenses under the Flat Rate VAT scheme (see below) as it includes VAT expenses on other vehicle costs like MOT and usage. If you’d like to learn more about how to handle your VAT costs, use the links provided above or speak with your accountant.

If your business has signed up for the Flat Rate VAT scheme , your VAT returns will be handled slightly differently.

The Flat Rate VAT scheme aims at helping businesses simplify their VAT payments to HMRC, by allowing them to keep the difference between the fixed VAT rate paid to HMRC and what they’ve charged to customers. However, the scheme places a minimum value on expenses you can claim VAT on.

Businesses are only able to reclaim the amount of VAT applied to the goods and services they’ve been charged for. This means that you can’t claim a consistent 20% across all the goods you’ve purchased – only the amount of VAT applied to each of them.

For example, most travel costs are charged at the standard 20% rate. However, if you happen to buy food while you’ve travelled, most items are exempt . If you don’t use the Flat Rate VAT scheme for your vehicle, VAT claims on fuel are calculated using the fuel scale charge. You can work out how much your vehicle is eligible to claim on VAT costs using HMRC’s online tool .

Reclaiming VAT costs works similarly to other expenses your business has, however, there is an additional step you’ll need to take – namely registering for VAT in the first place. We discuss the process for how you can reclaim your VAT below in three simple steps.

In order to be eligible to reclaim VAT, your business needs to be VAT registered also. Businesses can register for VAT with HMRC using the online portal . This process will create a VAT online account (sometimes referred to as a ‘Government Gateway account’) which you can use to submit your VAT returns each year.

Businesses need to register if their VAT-taxable turnover is over £85,000. This means that if your turnover is less than this amount, you may not need to register. However, if you know your turnover will pass this threshold in the next 30 days, or if your turnover from the last 12 months has already passed it, HMRC requires you to register for VAT. If you’d like more information on whether you need to register for VAT, read our article When do you pay VAT?

Note that, some businesses may have to register by post using the VAT1 form. For example, if you’re applying for a registration exception (if you sell goods completely exempt from VAT charges) or are joining the Agricultural Flat Rate Scheme (if your business is in agriculture, you may be eligible for a flat tax rate). Similarly, if you import goods to Northern Ireland worth more than £85,000 from an EU country (like the Republic of Ireland), you should register for VAT by post using VAT1B .

Regardless of which method you use to register, you’ll need to provide details about your business to HMRC during the process. These will include your business’ turnover , bank details, what it does to make a profit.

This information helps HMRC understand if your future VAT returns are correct (as you may exclude certain items from your VAT calculations across the year). If you haven’t already, it may be useful to have a dedicated bank account for your business as it can help your VAT calculations be more accurate and transparent.

If you sell goods across the UK to Northern Ireland, you may have to provide additional details to HMRC. In these cases, you need to tell HMRC if any of the following apply:

- Your goods are in Northern Ireland at the time of sale

- You receive goods in Northern Ireland from VAT-registered EU businesses for any business purposes

- You sell or transport goods from Northern Ireland to an EU country

This is to help your business use simplified VAT rates when trading with EU customers or businesses. For more information on the registration process, read our article How to register for VAT .

Businesses are required to keep records of their sales and expenses in order to calculate their taxes accurately, and VAT is no different.

Once you’ve registered, you’ll need to correctly apply VAT rates across your goods and services, and keep receipts of expenses where you’ve been charged VAT in order to claim it back. Without this accurate record, you may over-pay on your VAT return to HMRC.

Even if you have an organised and thorough system of recordkeeping, it still takes a significant amount of time to maintain across the financial year. Learn about how you can ease this burden below.

VAT returns are typically due every three months. VAT returns can be completed online or using integrated accounting software like Countingup if you’ve signed up for Making Tax Digital for VAT .

The specific steps for completing your VAT return will vary depending on which scheme you’re on. For example, whether you’re a part of the Flat Rate , Retail , Agricultural Rate , or any other VAT schemes. Similarly, VAT returns for businesses registered in Northern Ireland need to include an EC sales list as part of their submission.

HMRC has guidance published for how to file and submit your VAT return available here .

HMRC accepts several different payment methods in order to help businesses pay their required VAT amounts easily. These include:

- Online and in-person money transfers from banks or building societies

- Direct debits and standing orders

- Debit or corporate credit card payments

You’ll need to have crucial pieces of information ready, including your VAT registration number (which you would have received when you first registered) and the correct VAT sum.

Depending on the method you use, it could take up to six weeks to successfully complete the entire payment process – which is why it’s vital to plan ahead and be prepared. If you’d like more information on how to pay HMRC and what happens if you’re late, read our articles How to pay VAT to HMRC and What happens if you don’t pay VAT on time?

Tracking VAT rates across your business’ accounts can be a time-consuming and frustrating chore that distracts you from building your business. You can use the Countingup app to save time and stress on your financial admin.

Countingup is the business current account and accounting software in one app and provides a digital tax filing service to small businesses. With it, you can automate VAT calculations associated with each of your business transactions and make paying your VAT bill easier. If you’re new to the world of business, Countingup also makes it easier to share your business’ finances and VAT records with your accountant. With the touch of a button, you can send your transaction data for review so you can make sure you’re always compliant.

The Countingup app also offers essential business tools to save you time, including automated invoicing features and a receipt capture tool that can log expense and VAT data even while on the go. Best of all, Countingup offers you real-time profit and loss statements so you can make sure your insight is always up to date and accurate.

Make logging your VAT costs while travelling easier and more straightforward. Find out more about Countingup here and sign up for free today.

- Counting Up on Facebook

- Counting Up on Twitter

- Counting Up on LinkedIn

Related Resources

‘customer’ vs ‘client’: what’s the difference.

The main difference between a customer and a client is that a customer

Capital allowance vs. depreciation: how to explain the difference

The main difference between capital allowances and depreciation is that capital allowances allow

Budget vs forecast: What’s the difference?

The main difference between a budget and a forecast is that a budget

Debt vs equity: Advantages and disadvantages

The main difference between debt and equity financing is that debt involves borrowing

What is the difference between an invoice and a receipt?

As a small business owner or freelancer, you’ll have heard of receipts and

Operating profit vs EBIT: What’s the difference?

The main difference between operating profit and EBIT (Earnings Before Interest and Taxes)

Small business health checklist

Running a business can be a fairly hectic job. There’s often so much

What is financial reporting? 8 must-measure metrics for small businesses

Financial reporting is a crucial part of any business. After all, you need

Bookkeeping vs accounting: what’s the difference?

The main difference between bookkeeping and accounting is that bookkeeping focuses on recording

What is the difference between gross and net profit

Profit is categorised in two ways: gross and net. Each is important in

How to set prices for your small business

Your prices decide whether customers will buy your products or those of your

What are key performance indicators?

To gauge the success of your small business, you need to dive deeper

Tour Our Service

Welcome to inniAccounts, the award-winning accountancy service for contractors, consultants and freelancers.

Switch to inniAccounts from another accountant, quickly and easily

If you're new to contracting, we'll get you up and running

A complete service from professional accountants

First-class personal support from our friendly team

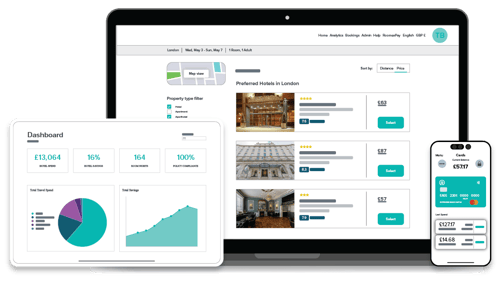

Our award-winning real-time app makes running your business a breeze

Helping you get outside, and stay outside IR35

Automated payroll and real-time dividend tools

Future-proofed for HMRC's upcoming tax changes

Help & Advice

Exclusive resources and tools to help your contracting business thrive outside IR35.

Expert guides on everything from starting out as a contractor to optimising your taxes

Over 250 expert-authored articles and tips to help you get the most from your limited company

Explore our brilliant free guides to deepen your IR35 knowledge and shape up your working practices

Our brilliant blog full of news and updates for consultants & contractors

We're passionate about the fair treatment of contractors, consultants and freelancers.

Founded by contractors for contractors. Learn more about inniAccounts' journey

8 reasons to choose inniAccounts

Meet some of our brilliant clients

Say hello to the dedicated team behind inniAccounts

Explore our current vacancies and get a feel for life at inniAccounts

Charging your clients VAT on expenses

If you have negotiated with your client that you can invoice them for expenses, with inniaccounts you simply mark expenses as billable then within seconds add them to an invoice..

Once an expense or mileage claim is identified as billable, when you create an invoice you simply select the expense from a list to add it. Care needs to be taken however to make sure that you charge your customers the correct amount of VAT.

Recording your billable expenses

When you record your expenses in either the Quick Entry area (business expenses paid for using personal money) or Bookkeeping (business expenses paid direct from a business account) you need to select the contract that will be billed for the expense. When you create your next invoice you can select the billable expenses to add.

Invoicing billable expenses

When you create your invoice you can click ‘Add invoice line’ then select ‘billable expense’ from here you will be able to select the expense you wish to bill your client for. The same applies when billing mileage, select the ‘billable journey’ option.

Charging VAT on billed expenses

If you are VAT registered you must ensure that VAT is charged on all your billable expenses, even if you did not incur VAT yourself.

Here are some common examples of expenses and their typical treatment of VAT when billing a client:

- Hotel stays – normally standard rate VAT. You bill your client exactly what you paid which includes VAT.

- Train tickets – public transport is zero rated. You charge your client what you paid but you will add 20% VAT.

- Flights – VAT can be complicated on flights but generally they are zero rated. You charge your client what you paid but you will add 20% VAT.

- Mileage – if you’ve negotiated a rate of 45p per mile with your client, you will charge for the number of mileage times the rate and you’ll add 20% VAT.

In general VAT must always be charged but you must not charge VAT on top of VAT. If you didn’t incur VAT on the expense, you charge VAT. If you incurred VAT on the expense, you don’t charge it again.

Check VAT rates on your invoice You should check the VAT applied to your billed expenses:

- If the expense originally was zero rated or exempt: ensure that VAT is applied to the expense on your invoice as you must charge VAT on that expense. If the line on your invoice shows Exempt or Zero rated, click the pencil icon and change it to Standard (20.00%).

- If the expense originally included VAT: the billable expense on your invoice will show as Standard (20.00%) VAT. Note that the amount shown on your invoice will appear less that the amount you paid. This is because on the invoice line it will show the Excluding VAT amount. The VAT is added at the bottom with the total for the invoice. The sum of the Excl VAT expense and the VAT will equal what you paid.

- If you add billable mileage: add billable mileage to your invoice by using the select the ‘billable journey’ option. If you are billing at 45p per mile, VAT must be charged on top of this. For example, if you bill 100 miles at 45p you invoice will show £45.00 excl VAT on the mileage item of your invoice then at the bottom there will be £9 VAT.

VAT can be complicated and the above is general guidance. If you are unsure if the treatment above applies to your circumstances, please get in contact to discuss.

Why do I need to charge VAT on expenses?

Expenses must be ‘recharged’ plus VAT at the rate at which your business charges it, i.e. 20%. In other words, if you recharge costs to your client you must charge VAT because the expense was for you, not for the client. In other words you stayed in the hotel and you travelled on the train – not your client.

An extract from HMRC website :

“There are many incidental costs that your business might incur that you can’t exclude from the VAT calculation when you invoice your customers. These could include travelling expenses and your own postage costs. They aren’t treated as disbursements for VAT purposes. Any costs that your business incurs itself in the course of supplying goods or services to customers are not disbursements for VAT purposes. It’s you, and not your customer, who purchases the goods or services, which are supplied to and used by your business. It’s up to you whether or not you itemise costs like these on your invoices. If you do show them separately when you invoice your customers then they’re known as ‘recharges’, and not disbursements, for VAT. You’ll have to charge VAT on them whether you paid any VAT or not. Some examples of costs that could be recharges but are not disbursements include: – An airline ticket that you buy to visit a client or to travel to a job. If you recharge the cost to your client you must charge VAT because the flight was for you, not for the client. – Postage costs you incur when you send letters to your customers. These are normal business costs and you must add VAT if you recharge them. – A bank transfer fee you might incur when transferring money from your business account to a client’s own account. Even though the bank’s fee is exempt from VAT, if you recharge the fee you must charge VAT. This is because it was for a service provided to your business and not to your customer.”

A further extract from Section 25.1 of HMRC Reference: Notice 700 sections 25-30:

“You may treat a payment to a third party as a disbursement for VAT purposes if all the following conditions are met: – you acted as the agent of your client when you paid the third party; – your client actually received and used the goods or services provided by the third party (this condition usually prevents the agent’s own travelling and subsistence expenses, telephone bills, postage, and other costs being treated as disbursements for VAT purposes); – your client was responsible for paying the third party (examples include estate duty and stamp duty payable by your client on a contract to be made by the client); – your client authorised you to make the payment on their behalf; – your client knew that the goods or services you paid for would be provided by a third party; – your outlay will be separately itemised when you invoice your client; – you recover only the exact amount which you paid to the third party; and – the goods or services, which you paid for, are clearly additional to the supplies which you make to your client on your own account. All these conditions must be satisfied before you can treat a payment as a disbursement for VAT purposes.”

Contact inniAccounts

0800 033 7827

Calling from overseas

+441332 460 010

Joining / sales

General enquiries

Head Office

1 Derwent Business Centre Clarke Street Derby DE1 2BU

Maximize travel expenses with VAT reclaim

What is a Payroll Management System? Features & Benefits

Securing Your Family’s Future: The Benefits of an Estate Planning Attorney

- Information

There are many advantages tied to business travel. In fact, for some, it’s a crucial aspect of building relationships, scaling operations, and networking. But at what cost? Due to the intricacies of VAT recovery, many business travel expenses are simply considered part and parcel of the industry, be it for marketing, tapping into new markets, or attending conferences and events. However, many businesses fail to realize that many associated costs may be eligible for VAT recovery. Here’s how.

Recovering VAT on business travel expenses

The first step is to get familiar with the VAT reclaim scheme in the country where your team will make the transactions. Let’s start with the basics – foreign VAT recovery. If your business is incurring VAT abroad during business trips or incentives, you’re most likely eligible to reclaim the VAT portion on those expenses. However, as mentioned above, this heavily relies on the foreign VAT recovery scheme of the relevant country and which travel and entertainment (T & E) costs are eligible for reclaim. Speaking of eligibility, let’s look at some of the most common qualified expenses within travel and entertainment.

What classifies as Travel and Entertainment (T & E)?

Simply referring to ‘travel expenses’ is a vast scope. A successful VAT claim on travel expenses primarily relies on a deep understanding of the smaller details. With that said, let’s zoom in. For starters, what is your VAT potential regarding travel expenses as a business ? Most companies can recover VAT on Travel and Entertainment costs if they:

- Have employees who travel for work purposes.

- Frequently attend or exhibit at trade shows, conferences, or exhibitions.

- Fall within the pharmaceutical, automotive, or manufacturing industry.

- Offer cloud-based solutions and require servers housed in multiple jurisdictions.

Recovering Travel and Entertainment costs

Now that you’ve confirmed that you are incurring VAT on travel expenses overseas, it’s time to maximize your VAT potential. This means looking closer at your internal organizational structure and how it may impact or influence recovery. For example, what does the spend visibility look like across departments? Are all team members informed of their responsibilities regarding recordkeeping and invoicing instructions? Eligible expenses can be hidden in the most unassuming places, and the only way to recover the expenses is to find them in the first place.

Educating your team on invoicing instructions

Although the VAT processes may seem unpredictable, one thing stands true: invoices are quintessential. However, even if your team has managed to hold onto the invoices, the invoices must have the correct information. What information? Like most things in the VAT landscape, the tax authorities of each country have specific requirements. One of the most significant requirements across most jurisdictions is that your supplier or seller must be VAT-registered in the country you claim from. In the event that your invoices are not compliant, VAT IT has a team that is ready and able to contact the suppliers to obtain the correct invoice.

Travel with VAT IT in the passenger seat

Naturally, significant savings often slip through the cracks, especially when navigating international VAT processes and legislation. Fortunately, you don’t have to drain critical resources to claim VAT on travel expenses successfully. Instead, claim up to 25% of your overseas business Travel and Entertainment spend in your VAT refund claim with a team of experts to guide you through every step.

Leverage the combined power of our industry-leading technology, efficient processes, and our specialist team with over 20 years of experience.

Are you keen to learn more tips and tricks about recovering Travel and Entertainment expenses? We’ve got you (re)covered.

Interesting Related Article: “ The top pros and cons of travelling for business “

Share this:

Leave a reply.

Your email address will not be published. Required fields are marked *

Can You Charge VAT When Passing Costs Onto Your Client?

If you are selling a product or service and you incurred expenses as part of normal business operations, these costs may be recharged to your client as part of your invoice. If you incurred a cost on behalf of your client that you need to pass over to them, then it’s called a disbursement, and there’s a difference between the two transactions.

We understand that VAT and tax can be quite complex and complicated. At Joanna Bookkeeping, our Oxford-based accounting and bookkeeping team can carry out an initial assessment of your accounts and discover the best strategy for your business’s finances going forward. And the good news is that we’re fully digital, so we can help you even if you’re not based in Oxford!

Our aim is to help you spend less time on bookkeeping and more time growing your business – Let’s have a chat with a member of our Oxford accounting team !

Our clients quite often ask us if they can charge VAT when passing costs onto their clients. We’ve put together this easy-to-follow article to help you better understand this topic.

Incidental Costs

In addition to the cost of goods and services you provide, you can calculate incidental costs such as travel expenses, hotel costs, and sustenance and invoice your client for these additionally. These are the costs that are part of running your business and supplying goods and services to your clients and they are your costs. In this case, it’s important to make sure you have a VAT invoice or receipt in order to recover any VAT charged on your expenses. When you add these costs to your sales invoice, your client will be able to claim VAT as well (if they’re VAT registered). These costs are incidental and are different from disbursements discussed below.

If you’re a VAT-registered business that wants to recharge expenses to your client, then you must charge VAT on all of those transactions, even if you didn’t pay VAT on the expense in the first place. That means that you still need to add VAT on zero-rated expenses when you recharge the client.

A few examples of costs that could be recharged to clients (but are not disbursements) are:

Travel costs – These are your costs not your client’s, so if you recharge the cost to your client you must charge VAT.

Postage costs – Again, these are your business costs, so when you buy stamps, send letters to your clients, you must include VAT on your invoices if you recharge them.

Bank transfer fees – When you’re incurring bank fees as a result of your normal business operations (even if the bank’s fee is exempt from VAT) you must charge VAT when recharging the cost to the client, because you paid for a service that was provided to your own business and not to your customers business.

Professional accounting support

Doing Your business's VAT Returns is giving you a headache?

Check our VAT return services and get in touch.

Disbursements

As a business, sometimes you might make transactions for goods or services to third parties on behalf of your customers. These transactions may be classed as disbursements for VAT purposes, meaning that you can’t :

- Charge VAT on them when you invoice your customer

- Claim back any VAT on them

To treat a payment as a disbursement all of the following must apply: