Find out what you really need to know, plus easily compare prices from hundreds of deals, no matter what insurance you need.

Our Top Picks

- Cheap Car Insurance

- Best, Largest Car Insurance Companies

- Cheap Motorcycle Insurance

- Cheap Home Insurance

- Cheap Moped Insurance

- Best Cheap Cruise Insurance

- Best Pet Insurance

- Best Insurance for Bulldogs

- Best Travel Insurance

- Pet Insurance

- Home Insurance

- Travel Insurance

- Car Insurance

- Motorcycle Insurance

- Caravan & Motorhome Insurance

- Campervan Insurance

- Health Insurance

- Van Insurance

Solar Panels

Get solar panels for your home.

- Best Solar Panels

- Solar Panel Installers

- Solar Panels for Home

- Solar Panel Comparison

- Solar Panel Installation

- Solar Panel Battery

The Financial Aspects

- Solar Panel Costs

- Solar Panel Grants

- Solar Panel Quotes

- Solar Panel Tariffs

Business Insurance

Find the best insurance deals for you and discover what you need to know, whatever your business.

Popular Types of Cover

- Public Liability Insurance

- Employers' Liability Insurance

- Professional Indemnity

- Directors and Officers

- Fleet Insurance

- Best Business Insurance Companies

- Guide to Small Business Insurance

- How Much Does Business Insurance Cost?

- Business Loans

By Type of Business

- Limited Company Insurance

- Self Employed Insurance

By Occupation

- Click for insurance by occupation!

Credit Cards

Read reviews and guides to get clarity over credit cards and see which is best for you.

Credit Card Categories

- Credit Builder Cards for Bad Credit

- Rewards Credit Cards

- Travel Credit Cards

- 0% Interest Credit Cards

- No Foreign Transaction Fee Credit Cards

- Balance Transfer Credit Cards

- Cashback Credit Cards

- Credit Cards with No Annual Fee

- Student Credit Cards

Helping you make the most of your money with our in-depth research on the topics that matter to you.

Stay up to date with the latest news that affects you.

Come say hi!

Connect with NimbleFins

- Follow NimbleFins on LinkedIn

AA Travel Insurance Review: Looking for Good Value?

- Including Personal Belongings/Baggage on all plans

- Giving extra perks to AA members

- Including kids for free

- Securing a 20% online discount

- Covering high-value baggage

- Covering tickets bought with frequent flier miles

- Covering trips that exceed the maximum length

Editor's Rating

The guidance on this site is based on our own analysis and is meant to help you identify options and narrow down your choices. We do not advise or tell you which product to buy; undertake your own due diligence before entering into any agreement. Read our full disclosure here .

Compare Cheap Travel Insurance

Protect your holiday today. Quick quotes from 20 insurers.

While AA's higher-tier Travel Insurance plans offer some desirable features and good value, and cover for pre-existing conditions , cover limits and features on lower-level policies may be too low for some travellers. And customer complaints about the claims process leave something to be desired. Let's take a look at what AA travel insurance does well, and where they could improve.

In This Review

Aa travel insurance customer reviews and ratings.

- AA Travel Insurance Price Comparison

- AA Travel Insurance Policy Limits and Coverage Options

- Comparing AA to the Competition

- Policy Wording and Claims

AA Travel Insurance Review: What You Need to Know

Is AA Travel Insurance any good? We think that higher-tier Silver/Silver Essential and Gold/Gold Essential travel insurance plans produce good value, but their lower-tier Bronze/Bronze Essential plans are lacking in features.

We particularly like that the Silver/Silver Essential and Gold/Gold Essential policies offer a "Travel Disruption" benefit, which provides for reasonable additional accommodation and public transport travel expenses (up to the standard of your original booking) so that you may continue your trip if it's disrupted by:

- Catastrophe (e.g., fire, earthquake, volcanic eruption, hurricane, an outbreak of food poisoning or an infectious disease, flood, explosion, storm or civil commotion)

- Insolvency of the accommodation provider, transport provider or their booking agents

- The public transport on which you were booked to travel being cancelled or delayed for at least 12 hours, diverted or redirected after take-off; or

- Being involuntarily denied boarding and offered no suitable alternative

AA's lower tier Bronze/Bronze Essential plans are really quite basic and cover amounts may not be sufficient in the case of travel disaster. For example, cancellation cover is only £1,000. However you do still get a decent amount of emergency medical cover on these plans (£5 million on Bronze/£10 million on Bronze Essential). This is really only suitable for those needing to protect very inexpensive holidays/those who primarily want travel insurance for the emergency health cover.

In our opinion, some of the most noteworthy limitations of the Essential plan beyond lower overall limits are the lack of Travel Disruption to cover unforeseen events like storms or volcanic eruption, lack of Hospital Benefit and lack of Delayed Arrival benefit. For a side-by-side analysis of the features, see our Policies section below.

However, customer reviews are questionable.

If you go with AA, be sure to keep your trips shorter than the maximum trip length, or else any claims will be invalid. Longer trips can be accommodated, with direct policies providing the option of 30, 44 or 61 days.

Does AA Travel Insurance Cover Trips in the UK? AA policies cover UK travel so long as you pre-booked at least 2 consecutive nights in paid accommodation such as a hotel, motel, holiday park, holiday camp, bed and breakfast or holiday cottage, or pre-booked transport at least 50 miles from your home (Isle of Man and Channel Islands treated separately).

Pre-Existing Conditions: AA can consider cover for pre-existing medical conditions, but your premium is likely to increase.

Over 65s: The policy documents list no upper age limits.

What are the 'Essential' plans? AA 'Essential' policies are those sold via comparison sites. They have slightly different terms, features and limits when compared to buying direct from AA. Broadly speaking, the 'Essential' policies have slightly less in terms of coverage and options, but may be a bit cheaper to buy. We advise you to look at both before deciding.

COVID-19 Cover

AA will not cover any trips to a destination where the Foreign and Commonwealth Office (FCO) have advised against all non-essential travel.

AA will cover:

- any medical claims because of Coronavirus if you are travelling to an area where no FCO advice against travel exists

- if you have to cancel your trip because you, your travelling companion, close relative or colleague has fallen ill with COVID-19

- if you have to cancel your trip because you or your travelling companion has to self-isolate due to COVID-19 symptoms or orders from NHS Test and Trace

- if you're denied boarding at an airport because you have symptoms of COVID-19. In such an event, you'll need to be tested for COVID-19 in line with government guidance.

AA Travel Insurance Key Facts

- Three levels of cover available direct: Bronze, Silver, Gold

- Three levels of cover available from comparison sites: Bronze Essential, Silver Essential, Gold Essential

- Travel Disruption available on Silver/Silver Essential and Gold/Gold Essential policies

- Max trip length, annual policies: Option to choose between 30, 44 and 61 nights when buying direct

- Extra perks for AA members: £1,000 UK Rehabilitation and £50 of prescription cover on Silver and Gold plans

Is AA Travel Insurance any good? AA Insurance gets high ratings for the features provided by AA travel insurance. While we agree that AA travel insurance has policies that rate well for features, their customer reviews are a mixed bag. Please keep in mind that the Trustpilot and Reviews.co.uk ratings are based on AA insurance as a whole, which includes car insurance, home insurance, breakdown cover, and more. We've read through hundreds of reviews to see what real customers have to say about AA travel insurance specifically. Here's what we found:

AA Travel Insurance Trustpilot

Overall, AA insurance has earned 4.3 out of 5 stars by over 20,000 customers at Trustpilot , with 65% having a 5-star, "Excellent" experience and 12% of customers leaving just 1 star indicating a bad experience. We noticed also that their Trustpilot review has increased from 3.5 to 4.3 in the past few years, leading us to believe they're working on improving their customer experience, which is always a good thing. Here is a sample of the more common complaints and praise:

"I have my car insurance, home insurance and travel insurance with the AA. Their rates seem comparable and it is easy to renew on-line." "Trust the AA totally. They are very helpful & professional. I have breakdown cover, car & travel insurance. Always very competitive." "I used to obtain my annual travel insurance directly from AXA. However they stopped selling under their own name but a list of other insurers underwritten by AXA was published. The AA one was both the best price and had the option of adding in pre-existing medical conditions (relevant in my case) in online rather than phone up. Hopefully I won't need to claim, but AXA handled two previous claims very efficiently which was my reason for searching for one underwritten by them." "Trying to claim for a cancelled holiday due to COVID - a situation entirely covered within my annual travel insurance (we actually purchased the insurance as it was recommended by Money Saving Expert). The process of making the claim has been utterly awful. I first logged the claim in March and, after several calls and emails to them, I was told by AA to go straight to the Axa underwriters. I finally received a claims back at the end of June. I submitted by evidence quickly and waited the 30 working days (6 weeks!) in which they tell you not to chase. Having heard nothing, I got back in touch and, eventually, was told they'd not received my evidence (I'd had an automated email confirming receipt originally). Having re-submitted my evidence, i've received a number of back and forth emails asking the same questions and requesting evidence I've already provided. Clearly delay tactics. An awful, awful experience with AA abdicating their responsibility to their awful underwriters. I'll be referring them to the Ombudsman and FCA - would suggest others with similar grievances do too. People are losing life-changing amounts of money and it is despicable behaviour from established and (previously) well-thought of companies." "Travel claim now ongoing for almost 4 months. Spent hours on phone chasing.Unhelpful information, incomplete and misleading. Finally submitted all evidence they eventually requested over 1 month ago. Told not to enquire for 30 days. Rang today - taken message and they should give me update in 10 days! Probably my worst ever customer experience." "Very poor customer service. Submitted a claim in April and have heard nothing from AA. Called 5 times only to be told we will call you back and still absolutely nothing. I made a complaint and still heard nothing back. It's been more than 2 months and nobody at AA had even acknowledged they have the claim." "Put in a claim from my travel insurance policy via the online claim form (as directed) in mid April 2020. Never received a confirmation, called and never got through, two months on, no one has ever got in touch with me. Understandably the volume of claims have rocketed due to COVID 19, but you cannot justify 2 months with absolutely no response to policyholders! I contacted AAtravelinsurance @ axa-insurance.co.uk. on 15 May and they told me to go back to the claims team, which never responded to me for 2 months in the first place. AA is sending me around in circles."

Unfortunately we did not come across any positive reviews of AA travel insurance on Trustpilot to offset these negative reviews. We appreciate that travel insurance companies have had a spectacularly difficult time during the pandemic, but we would expect a higher level of customer service nonetheless.

AA Price Comparison

According to our data research, AA travel insurance sample quotes we gathered were generally competitive against the average cost of travel insurance in the UK. We've gathered some sample quotes so you can see roughly how much our test travellers would need to pay, looking at two age groups (35 and 65 years old). You can see how prices change across geographical locations like Europe and America

Insurance quotes can vary significantly from day to day and according to your individual details, so please just use the following data for educational purposes only; your quotes may reflect a large degree of variation. As you can see in the table below, there can be a significant premium for travelling with pre-existing medical conditions.

A family of four can generally expect to pay on average 2X the cost of an individual policy, meaning kids go free. and policy types for a family of four, with and without Winter Sports cover.

Types of AA Travel Insurance Policies

AA offers 3 tiers of Single and Multi-Trip travel insurance through their website: Bronze (less cover), Silver (more cover) and Gold (the highest tier). AA also sells three tiers of travel insurance through comparison sites: Bronze Essential, Silver Essential and Gold Essential.

AA Travel Insurance Cover Limits (Single Trip and Annual, Multi-Trip)

Those heading off on a Winter Sports holiday can get the following levels of cover under AA’s Winter Sports add on.

Cover Limits for AA Winter Sports Cover

Note, AA travel insurance does not off any cover for piste closure , for instance if there is no snow—or too much snow!

Please read some of our Travel Insurance Guides if you're trying to decide between Single Trip or Multi-Trip policies, learn about What May Not be Covered by Travel Insurance or decide if you Need Travel Insurance or Not .

Pre-Existing Conditions

You will need to declare the following types of condition, if the person to be covered has had any medical advice, treatment (including surgery, tests or investigations) or been prescribed medication for any of the following in the past 5 years:

on_current="true" Any cancer condition (including leukaemia, non Hodgkin's lymphoma and any type of skin cancer) Any heart-related or blood circulatory condition (including high blood pressure and high cholesterol) Any diabetic condition Any neurological condition (including stroke, brain haemorrhage, multiple sclerosis, epilepsy and dementia) Any breathing condition (including asthma, bronchitis and chronic obstructive pulmonary disease) Any renal, kidney or liver condition Any psychiatric or psychological condition (including anxiety, stress and depression) Any chronic condition that can be controlled but not cured (including back pain, Crohn’s, diverticular and coeliac disease and ulcerative colitis) And/or in the last 12 months, been referred to or seen by a hospital doctor for any other medical condition

As shown above in the cost section, travellers with pre-exiting conditions should expect to pay more for their travel insurance.

AA travel insurance is underwritten, sold and administered by AXA Insurance UK plc.

How does AA Travel Insurance Compare to Competitors?

To better understand the value of AA travel insurance you need to look at it in the context of other available options. We compared it to other plans in the market so you can see which may be more suitable for you.

AA Travel Insurance vs Direct Line Travel Insurance

Direct Line travel insurance plans include cover for End Supplier Failure and Natural Disasters, plus cover for the replacement cost of used points or miles in case of Cancellation/Curtailment for a trip bought with air miles or another rewards structure. While prices are a bit higher than average, according to our analysis, you are getting these extra cover features. One surprising extra is Baggage—you'll need to pay extra to cover your personal belongings as they're not included as standard.

Bottom Line: If you really want cover for End Supplier Failure or Natural Disasters, or if you book trips with miles, then Direct Line might provide more comprehensive travel insurance for you. AA only covers travel tickets paid for using any reward scheme (e.g., Avios or supermarket loyalty points) if evidence of specific monetary value can be provided.

AA Travel Insurance vs AXA Travel Insurance

We found that AXA travel insurance offers solid cover for reasonable prices, offering good value for money. Insolvency, Baggage, Cancellation/Delay/Curtailment and Catastrophe are included on all plans. AXA under

Bottom Line: AXA underwrites AA travel insurance, so if you'd rather work directly with the underwriter you might prefer buying an AXA policy.

Other Useful Information

- AA Travel Insurance Policy Wordings

Erin Yurday is the Founder and Editor of NimbleFins. Prior to NimbleFins, she worked as an investment professional and as the finance expert in Stanford University's Graduate School of Business case writing team. Read more on LinkedIn .

- 4.8 out of 5 stars**

- Quotes from 20 providers

Our Top Insurance Picks

- Cheap Travel Insurance

Cheap Travel Insurance by Destination

- Travel Insurance to Australia

- Travel Insurance to Ireland

- Travel Insurance to Canada

- Travel Insurance to Turkey

- Travel Insurance to India

Articles on Travel Insurance Costs

- Average Cost of Travel Insurance

- Average Cost of Travel Insurance to USA

- Cost of Travel Insurance with Pre-Existing Medical Conditions

- Average Cost of Travel Insurance to India

- Average Cost of Travel Insurance to Ireland

Recent Articles on Travel Insurance

- Travel Insurance with Optional Gadget Cover

- Top Tips for Travel Insurance with Medical Conditions

- Can Travel Insurance Help if Natural Disaster Strikes?

- Should You Buy Travel Insurance from a Comparison Site?

- Should You Buy Single-Trip or Annual Multi-Trip Travel Insurance?

Travel Insurance Guides

- Do I Need Travel Insurance? 3 Key Questions

- Will Your Travel Insurance Claim be Rejected? Boost Your Odds with These Tips

- 7 Things Your Travel Insurance May Not Cover

- Travel Insurance Guide

Travel Insurance Reviews

- AA Travel Insurance Review

- Admiral Travel Insurance Review

- Aviva Travel Insurance Review

- AXA Travel Insurance Review

- Cedar Tree Travel Insurance Review

- CoverForYou Travel Insurance Review

- Coverwise Travel Insurance Review

- Debenhams Travel Insurance Review

- Direct Line Travel Insurance Review

- Holidaysafe Travel Insurance Review

- Insure & Go Travel Insurance Review

- Sainsbury's Bank Travel Insurance Review

- Tesco Travel Insurance Review

- Travelinsurance.co.uk Travel Insurance Review

- Zurich Travel Insurance Review

Reviews of Travel Insurance for Pre-Existing Conditions

- Fit2Travel Travel Insurance Review

- Free Spirit Travel Insurance Review

- goodtogoinsurance.com Review

- JustTravelcover.com Insurance Review

- OK To Travel Insurance Review

- Saga Travel Insurance Review

- Virgin Money Travel Insurance Review

- Privacy Policy

- Terms & Conditions

- Editorial Guidelines

- How This Site Works

- Cookie Policy

- Copyright © 2024 NimbleFins

Advertiser Disclosure : NimbleFins is authorised and regulated by the Financial Conduct Authority (FCA), FCA FRN 797621. NimbleFins is a research and data-driven personal finance site. Reviews that appear on this site are based on our own analysis and opinion, with a focus on product features and prices, not service. Some offers that appear on this website are from companies from which NimbleFins receives compensation. This compensation may impact how and where offers appear on this site (for example, the order in which they appear). For more information please see our Advertiser Disclosure . The site may not review or include all companies or all available products. While we use our best endeavours to be comprehensive and up to date with product info, prices and terms may change after we publish, so always check details with the provider. Consumers should ensure they undertake their own due diligence before entering into any agreement.

Note regarding savings figures: *For information on the latest saving figures, pay-less-than figures, and pay-from figures used for promotional purposes, please click here .

**4.8 out of 5 stars on Reviews.co.uk is the rating for our insurance comparison partner, QuoteZone.

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

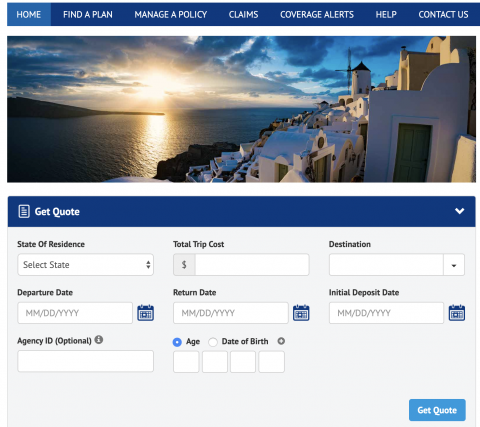

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

Travelex Insurance

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

Seven Corners

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

Enable JavaScript

Please enable JavaScript to fully experience this site. How to enable JavaScript

Allianz Trip Insurance

Protect your travel experience

Read about Allianz Trip Insurance’s COVID-19 insurance coverage limitations and accommodations.

U.S. coverage alert Opens another site in a new window that may not meet accessibility guidelines.

Top reasons to buy trip insurance

- Financial reimbursement if you have to cancel or interrupt your trip due to a covered illness, injury, jury duty, and more

- Emergency medical benefits in and outside the U.S. – where many personal health insurance policies (like Medicare) won’t cover you

- 24-hour emergency assistance to help you solve medical and other travel-related problems on the go

Types of trip insurance plans

Allianz Trip Insurance comes in a variety of plans to fit your specific needs. Single-trip plans can protect one trip, annual plans can protect all your trips for an entire year, and rental car protection plans can keep your budget safe from accidental collision and damage to a rental vehicle.

All insurance is recommended / offered / sold by 3rd party, Allianz Global Assistance, not American Airlines. Underwriter: Jefferson Insurance Company or BCS Insurance Company. AGA Service Company is the licensed producer and administrator of these plans. AGA Service Company is a licensed producer in all 50 states plus the District of Columbia.

Get a quote Opens another site in a new window that may not meet accessibility guidelines.

Trip insurance benefits

Reimburses your prepaid, non-refundable travel expenses if you need to cancel your trip due to a covered illness, injury, and more.

Reimburses the unused, non-refundable portion of your trip and increased transportation costs it takes for you to return home early or to continue your trip due to a covered illness, injury, and more.

Reimburses expenses related to covered emergency medical or dental care incurred on your trip.

Provides benefits for medically necessary transportation to the nearest appropriate medical facility following a covered injury or illness.

Reimburses extra meals and accommodations you may need if your flight is delayed for 6 or more hours for a covered reason.

Reimburses you if your luggage is lost, damaged or stolen during your trip—keeping your travel plans on track.

Reimburses the purchase of essential items if your luggage is delayed for more than 24 hours.

Turn your trip into a VIP experience. Our travel experts can give you destination information, make restaurant reservations, find tickets to shows, and more.

Help is just a phone call away. Our team of multilingual problem solvers is available to help you with medical and other travel-related emergencies.

Provides primary coverage with no deductible.

Review period

If you’re not completely satisfied, you have 15 days (or more, depending on your state of residence) to request a refund, provided you haven’t started your trip or initiated a claim. Plans are non-refundable after this period.

Additional assistance

Coverage by country of residence.

- Frequently asked questions

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best’s 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive,Richmond, VA 23233 or [email protected]

Email [email protected]

PLEASE BE ADVISED: This plan contains insurance benefits (which may include disability and/or health insurance benefits) that only apply during the covered trip. This optional coverage may duplicate coverage already provided by your personal auto, home, renter’s, health, life, personal liability, or other insurance policy or source of coverage but may be subject to different restrictions. You should review the terms of this policy with your existing coverage. If you have any questions about your current coverage, call your insurer/health plan or insurance agent/broker. This insurance is not required to purchase any other products/services. Unless licensed, travel retailers and their employees may provide general information about the insurance, including a description of coverage and price, but are not qualified/authorized to answer technical questions about terms, benefits, exclusions, and conditions of the insurance or evaluate the adequacy of existing coverage. Plans are intended for U.S. residents only and may not be available in all jurisdictions. Rental Car Protector is not available to KS and TX residents, except when purchased as a separate policy and is not available in all countries or for all cars. This coverage does not provide liability insurance or comply with any financial responsibility law, or any other law mandating motor vehicle coverage and does not cover you for any injury to another party. Additionally:

California Residents: We are doing business in California as Allianz Global Assistance Insurance Agency, License # 0B01400. California offers a toll-free consumer hotline at 1-800-927-4357.

New York Residents: The licensed producer represents the insurer for purposes of the sale. Compensation paid to the producer may depend on the policy selected, or the producer’s expenses, volume of business, or profitability. The purchaser may request and obtain information about the producer’s compensation, except as otherwise provided by law.

Maryland Residents: The purchase of travel insurance would make the travel insurance coverage primary to any other duplicate or similar coverage. The Commissioner may be contacted to file a complaint at: Maryland Insurance Administration, ATTN: Consumer Complaint Investigation Property/Casualty, 200 St. Paul Place, Suite 2700, Baltimore, MD 21202.

Texas Residents: Before deciding whether to purchase this insurance plan, you may wish to determine whether your own automobile insurance or credit card agreement provides you coverage for rental vehicle damage or loss and determine the amount of deductible under your own insurance coverage. The purchase of this insurance plan is not mandatory. This coverage is not all inclusive, which means it does not cover such things as personal injury, personal liability, or personal property. It does not cover you for damages to other vehicles or property. It does not cover you for any injury to any other party.

Plan charge includes the cost of insurance benefits and assistance services. See your Plan Details for more information, or call Allianz Global Assistance at 800-284-8300.

AGA Service Company dba Allianz Global Assistance (AGA) compensates their suppliers or agencies for allowing AGA to market or offer products to customers of the supplier or agency.

*Terms, conditions, and exclusions apply, including for pre-existing conditions. Plans may not be available to residents of all states. Insurance benefits are underwritten by either BCS Insurance Company or Jefferson Insurance Company, depending on insured’s state of residence. AGA Service Company is the licensed producer and administrator of these plans.

- Domestic Travel Insurance

- International Travel Insurance

- Make a Claim

- COVID-19 FAQs

Travel Insurance

Travel a little freer knowing we're on the journey with you

AA Travel Insurance

Travel is part of the Kiwi DNA, but even the best laid travel plans can go unexpectedly wrong. That’s why we offer AA Travel Insurance plans - so you can travel a little freer here in NZ or overseas, knowing help is only a phone call away.

With AA Travel Insurance, your trip can be protected from unforeseen cancellation and loss of deposits before you even depart. So if something happens in the lead-up to your trip, we can be there to help you.

To understand what cover AA Travel Insurance provides for epidemic and pandemic diseases, like COVID-19, check out our FAQs .

Get a quote

Why choose AA Travel Insurance

Get a quote online in minutes, so you can get back to planning your adventure. All you need are your travel dates, destination and any companions.

We’ve made the process simple, with domestic and international plans to choose from.

With AA Travel Insurance being one of NZ’s trusted travel insurance brands, we are proud to take care of Kiwis’ insurance needs.

We’re backed by the Allianz Worldwide Emergency Assistance programme, ready to help you no matter where you are in the world.

Playing at home or away?

Whether you're hitting the ski slopes or ticking a Great Walk off your list, make sure your trip is covered from unexpected costs like cancellation, travel disruption, and rental vehicle excess.

International

With three plans to choose from, our International Insurance cover is designed to make sure you can still enjoy your holiday even if something goes south.

AA Travel Insurance Benefits:

- AA Member discount

AA Members can get a 10% discount* on new AA Travel Insurance policies. Simply provide your AA Membership number when you apply.

- Cover for missed connections or travel delay

If you miss connections or have any travel delays because of an unexpected situation, you’ll be able to claim up to the benefit limit of your chosen policy. That means cover for extra costs to make alternative travel arrangements or additional delay costs.

- Free cover for dependent children

Dependent children travelling with someone covered under a policy can be covered at no additional charge (for Domestic Cover – that's up to 18 years, and for International Cover – up to 21 years).

- Cover for some COVID-related situations^

Both domestic and international options include selected cover for epidemic and pandemic diseases, like COVID-19. So if you’re diagnosed on your trip and need medical assistance or need to change your plans, you’ll be covered.

- Cover before you depart

Your trip is protected from unforeseen cancellation and loss of deposits the moment your cover is confirmed.

- Cover for recreational activities

Some recreational sports are automatically covered under our policies, including leisure skiing and snowboarding, hot air ballooning, parasailing and paragliding, bungee jumping, and white-water rafting in grade 4 rivers (or less).

For all of these benefits, please make sure you read the Policy Wording to understand the terms, conditions, limits, and exclusions that may apply.

^The policy still has a general exclusion for epidemics and pandemics, and does not cover disinclination to travel due to fear or change of mind. Cover is only provided if you have not commenced your journey against the New Zealand Government’s advice not to travel. There is no cover for lockdowns, changes in government alert levels, quarantine or mandatory isolation applying to a population or part of a population. Please refer to the Policy Wording for full details.

^Terms, conditions, limits, sub-limits and exclusions apply and these are stated in the Policy Wording . Customers considering the purchase of a travel insurance policy should read the Policy Wording to check what is and isn’t covered.

Have a question?

Our friendly New Zealand-based team are here to help. Give them a call anytime from 8:30am to 5pm Monday to Friday, or pop into one of our AA Centres to speak to a consultant.

Call: 0800 630 115

Frequently asked questions

What countries does my selected cover^ for epidemic and pandemic diseases (including Covid-19) cover?

All countries that do not appear on the Level 4 warning “Do not travel” advisory listed on SafeTravel.

SafeTravel houses all warnings inclusive of non-Covid-19 advisories which are issued by the Ministry of Foreign Affairs and Trade (MFAT).

If I contract Covid-19 prior to travelling do I have selected cover^ for epidemic and pandemic diseases?

Cover is in place, providing that the country you are travelling to does not have a MFAT, SafeTravel or New Zealand Government Level 4 warning “Do not travel” in place.

If I contract Covid-19 in transit to my destination country do I have selected cover^ for epidemic and pandemic diseases?

Cover is in place, providing that the countries you are travelling to do not have a MFAT, SafeTravel or New Zealand Government Level 4 warning “Do not travel” in place.

Does selected cover^ for epidemic and pandemic diseases still apply if I am unvaccinated?

Cover is in place as there is no requirement to be vaccinated/boosted under our policy. However, if the destination country requires an inbound traveller to be vaccinated, then the traveller must be able to meet these entry requirements. This also applies to the condition of carriage for example of the airline they are travelling. There is no cover if denied boarding or entry to a country due to not meeting the carrier or country vaccination requirements.

Are there any mandatory epidemic and pandemic insurance requirements to enter certain countries?

Many countries, even before the pandemic, had compulsory health and travel insurance requirements, but many more have since added rules – typically around Covid-19 medical expenses and the associated costs. The coverage type and amount varies by vaccination status and country. Prior to travelling, check with the nearest embassy, consulate or immigration department of the destination.

If I had Covid-19, should I declare this as a Pre-existing Medical Condition?

At the time of purchasing your policy if you have previously had Covid-19 and are now testing negative, are feeling well with no symptoms at all, then you do not need to declare this as a Pre-existing Medical Condition. A Covid-19 positive test result at a later date would be considered a new infection.

However, if you are:

- still testing positive; or

- still displaying Covid-19 signs and symptoms; or

- have been diagnosed with 'long Covid';

and you wish to have cover, you need to disclose the condition as a Pre-existing Medical Condition and an additional premium may be payable.

Our insurance partner

AA Travel Insurance policies are brought to you by the New Zealand Automobile Association Incorporated (AA), are issued and managed by AWP Services New Zealand Limited trading as Allianz Partners and underwritten by The Hollard Insurance Company Pty Ltd ABN 78 090 584 473 (Incorporated in Australia) ("Hollard"). You should consider the Policy Wording before making any decisions about this insurance policy. Terms, conditions, limits, sub-limits and exclusions apply.

Financial Strength Rating

The Hollard Insurance Company Pty Ltd ABN 78 090 584 473 (Incorporated in Australia), ("Hollard"), has been given a financial strength rating of A (Strong) issued by Standard and Poor's. View the full details on the Financial Strength Rating .

An overseas policyholder preference applies. Under Australian law, if The Hollard Insurance Company Pty Ltd is wound up, its assets in Australia must be applied to its Australian liabilities before they can be applied to overseas liabilities. To this extent, New Zealand policyholders may not be able to rely on The Hollard Insurance Company Pty Ltd’s Australian assets to satisfy New Zealand liabilities.

Financial advice

The New Zealand Automobile Association provides general information about AA Travel Insurance products and services so that you can make a choice that best meets your needs. Information provided does not take into account your personal circumstances, needs or goals and is not intended to be financial advice. If you'd like to receive financial advice, you can get professional advice from a registered financial adviser.

More information

Contact us Policy Wording Make a claim Terms and conditions AA Traveller Member Benefits

*AA Members can receive a 10% discount on AA Travel Insurance. Simply provide each traveller’s valid AA Membership number on application. Discount applies to the premium for each AA Member on standard policy and any additional pre-existing medical cover, but doesn’t apply to additional cover for high value items.

- Car Insurance

- Travel Insurance

- Home Insurance

- AA Membership

- Van Insurance

- Car Service

- EU Breakdown

Annual Travel Insurance

Travel Insurance from €14.99^ with 24/7 GP access.

Discover AA Travel Insurance Features And Benefits 🏝

Peace of mind for every adventure: Travel anywhere with AA Travel Insurance Ireland!^ Our comprehensive coverage protects you at home or abroad, including 24/7 access to a GP – that’s standard! Plus, there are even more benefits to discover. Get a quote today!

Annual Multi Trip

Get cover before, during and after your holiday the whole year.

Cancellation Cover

Cover up to €6,000 for any lost travel and accommodation costs if cancelling your trip is unavoidable

Medical Cover

Emergency medical and repatriation cover up to €10,000,000

Baggage Cover

If your baggage is delayed for more than 12 hours we cover you for up to €300 (€50 per day)

Winter Sports Cover

Covers a wide array of winter sports activities including skiing and snowboarding

COVID-19 Cover

Cancellation, Curtailment, Medical Expenses & additional accommodation cover if you contract COVID-19 while abroad & unable to return home as planned.

24/7 access to a GP as standard.

All AA Travel Insurance policies now give you access to an English speaking GP 24/7 whilst you are abroad. If you need a doctor , they are just a call away or click away…

COVID-19 Cover. Holidays without worry 👌

Our cover for covid-19 gives you the peace of mind you need for a stress-free return to travelling.

Our cover for COVID-19 gives you benefits such as:

- Cancellation cover if you, a close relative or travelling companion receive a positive diagnosis for COVID-19

- Cancellation cover if you, or any person insured by the policy, are required to self-isolate on your scheduled departure date

- Curtailment cover if The Department of Foreign Affairs (or any other equivalent government body in another country) advises you to return home due to COVID-19

- Related Medical Expenses if you contract COVID-19 while abroad

- Additional accommodation if you contract COVID-19 while you are abroad and are unable to return home as planned

Please note that cancellation claims relating to government restrictions for COVID-19 are excluded and any Pandemic illness is not covered within 48 hours of your policy purchase date.

Cover is subject to Terms & Conditions and some exclusions will apply. For full details of cover available please click here

*Please note that cancellation claims relating to government restrictions for COVID-19 are excluded and we will not cover any claim where your travel to a country or specific area or event to which the Travel Advice Section of the Department of Foreign affairs or the World Health Organisation has advised the public not to travel to.

With AA Travel Insurance, we have something for everyone.

Get cheap holiday Insurance from as low as €14.99 We Cover Medical, Baggage, Annual Multi-Trip, Cancellation etc.

Our Cover Options You Might be Interested In....

Eyeing a short adventure?

Single Trip Travel Insurance

Big break or mini-vacation? We can help you plan!

Backpacker Travel Insurance

Already Insured with us? 🤝

We hope your trip will go off without a hitch, but should something change. We’re here.

Uncover Our Travel Tips & Guides

Boost Your Travel Know-How – Explore Tips on Our Travel Hubs!

The Best Time to Buy Travel Insurance: Don't Wait Until It's Too Late

Hottest Holiday Destinations This Summer

5 Unexpected Situations Where Travel Insurance Saves the Day

Terms and Condition

^ AA Travel Insurance Annual Multi Trip Value price covers one adult under 50 to Europe with private medical insurance. AA Ireland is tied to Inter Partner Assistance SA for travel insurance policies.

Have a question? Get in touch with our customer service 👌

0818 227 228.

RelAAx, Yellow & Black have got your back

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AAA Travel Insurance Review 2024: Is it Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does AAA travel insurance cover?

Aaa single-trip plans, aaa annual plans, which aaa travel insurance plan is best for me, can you buy aaa travel insurance online, what isn’t covered by aaa travel insurance, aaa travel insurance, recapped.

- You don't need to be an AAA member.

- Annual or single-trip policies are available.

- Can add on a Rental Car Damage protector plan.

- Cheapest option doesn't include medical coverage.

- CFAR upgrade is only available for higher-cost plans.

Before going on a trip, it's important to give travel insurance some serious thought as it can protect you if anything goes wrong on your vacation. One provider to consider is AAA Travel Insurance.

The company’s policies are administered by Allianz Global Assistance, an insurer that serves 40 million customers in the U.S. and operates in 35 countries. You do not have to be a AAA member to purchase AAA travel insurance.

AAA offers annual or single-trip policies for domestic and international travel. The policies vary by state and travel destination, so the plans available in your home area may differ from the examples shown below. Use AAA's Get A Quote tool to see your specific pricing.

» Learn more: The majority of Americans plan to travel in 2022

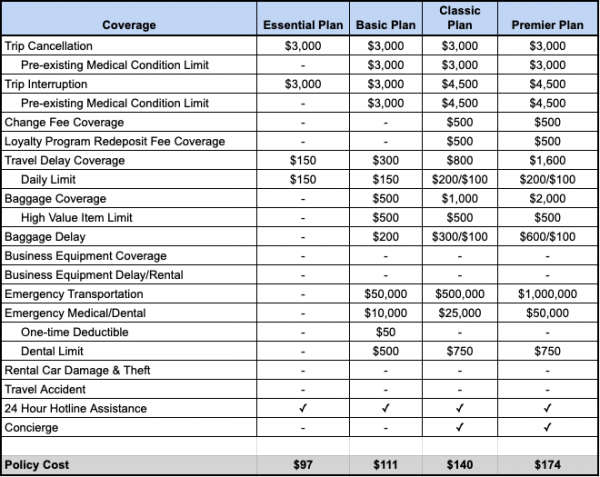

AAA’s single-trip plans are designed for travelers who are leaving their homes, visiting another destination, domestic or international, and returning. To get an idea of which plans are available, we input a sample itinerary of a $3,000, two-week trip to Spain by a 45-year-old from Indiana. For this itinerary, AAA offered four single-trip plans.

* Higher limit requires receipts to be submitted.

AAA single-trip plans cost

The Essential Plan ($97) is ideal for those who just want the basics of trip cancellation and trip interruption insurance and don't need the other protections. This is a good fit for domestic travelers who already have health coverage in the U.S. and don't plan on bringing business equipment.

The Basic Plan ($111) includes all the features of the Essential Plan, along with medical coverage and some increased protections for baggage and travel delays.

The Classic ($140) and Premier Plans ($174) are nearly identical, but the latter provides double emergency medical coverage, emergency transportation, trip delay and baggage delay limits.

The Classic Plan offers a "cancel for any reason" optional upgrade for $71, which would bring the total to $211.

There is also a Rental Car Damage protector plan for $135, which provides $1,000 of trip interruption and baggage loss coverage and $40,000 of rental car damage and theft benefits. This plan will cover your costs if the rental car is stolen or damaged. In addition, you’ll be reimbursed for the unused portion of your trip and if your bags are lost or damaged. This plan offers an alternative to purchasing coverage at the rental counter.

» Learn More: Cancel For Any Reason (CFAR) travel insurance explained

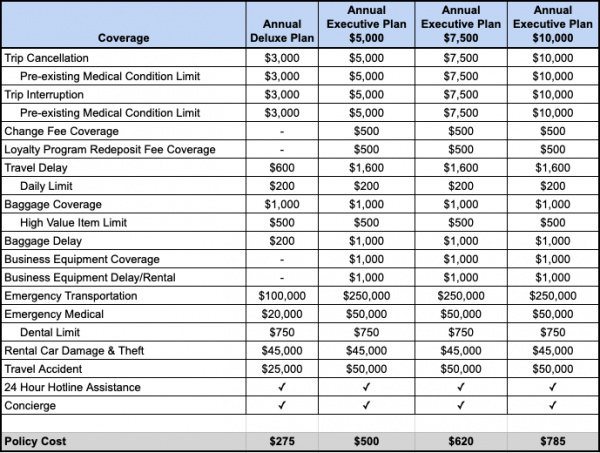

The annual policies provide 365 days of domestic and international coverage and are best suited for those who travel often. To see which plans are available, we input a $15,000 annual travel budget for coverage starting in July 2020 for a 30-year-old from New Hampshire. For this itinerary, AAA is offering four policies, with the three higher-end plans geared toward business travelers.

AAA annual plans cost

The Annual Deluxe Plan ($275) is designed for those who aren’t too concerned with pre-trip cancellation benefits or business equipment protections and are more interested in medical coverage while abroad. If you already have some travel insurance through a credit card, this plan may be sufficient.

The next three Annual Executive Plans ($500-$785) are tiered based on the amount of trip cancellation and interruption coverage provided ($5,000, $7,500 or $10,000). All the other protections under the Executive Plans are identical. All three plans include business equipment coverage as well as business equipment rental and delay protections. If you’re traveling for work, these plans may be your best bet.

Although all four of these are annual plans, no individual trip can exceed 45 days. For trips longer than 45 days, Allianz offers an AllTrips Premier plan , which provides coverage for up to 90 days per trip.

» Learn more: What to know before buying travel insurance

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’re traveling.

If you have a premium travel card that already provides you with a sufficient level of trip cancellation coverage, you may only need to get a standalone emergency medical policy. For example, The Business Platinum Card® from American Express offers $10,000 per trip and $20,000 per year in trip cancellation benefits. Terms apply. Only the Annual Executive Plan ($10,000) has a comparable level of trip cancellation coverage.

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card, then you might be better off with a comprehensive plan like one of the single or annual trip plans, depending on your travel goals.

If you’re a long-term traveler and expect to take many trips, the annual plans will be the most suitable. However, with coverage for each trip capped at 45 days, you’ll want to look at other options if you will be away from home for longer.

Yes, you can buy AAA Travel Insurance onlince. Head over to Agentmaxonline.com , input your trip details and choose “Get Quote” to see a list of available plans.

Trip insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It's important to note that exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

» Learn more: Will travel insurance cover winter weather woes?

Yes. However, plan choices depend on your state of residence and trip duration. We performed various searches for sample trips and found policies for single trips and annual trips. Single-trip plans are great for travelers who are traveling from their home to a different destination (domestic or international) and then returning. Coverage ends when the traveler returns home. Annual trip plans are designed for those who want to take several trips during a specific period of time, regardless of how many times they return home during the covered period.

The cost of a travel insurance policy depends on many factors , including the trip length, your state of residence and how much coverage you’d like. Our sample search for a $3,000 two-week trip to Spain showed policies ranging from $97 to $211, representing 3% to 7% of the total trip cost.