Top Travel Insurances For Vietnam You Should Know in 2024

Byron Mühlberg

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Vietnam is known for its friendly people, intriguing cultural heritage, stunning landscapes, and delicious cuisine such as the famous Pho and Banh Mi dishes. Although travelling to Vietnam can be an accessible holiday destination for many people, and although healthcare costs in the country aren't outrageously expensive, it's still a very good idea to arrive there with travel insurance anway, as you'll want the highest-quality healthcare you can find.

Luckily, online global insurances (known as 'insurtechs') specialize in cost-savvy travel insurance to Vietnam and other countries worldwide. Our list below explores the four services we believe provide the best deals for young travellers, adventurers, everyday holidaymakers looking for comprehensive but affordable coverage, and longer-term expats.

Vietnam Insurance Profile

Here are a few of the many factors influencing the scope and cost of travel insurances for Vietnam:

Best Travel Insurances for Vietnam

- 01. Do I need travel insurance for Vietnam? scroll down

- 02. Best medical coverage: VisitorsCoverage scroll down

- 03. Best trip insurance: Insured Nomads scroll down

- 04. Best mix for youth and digitial nomads: SafetyWing scroll down

- 05. FAQ about travel insurance to Vietnam scroll down

Heading to Vietnam soon? Don't forget to check the following list before you travel:

- 💳 Eager to dodge high FX fees? See our picks for the best travel cards in 2024.

- 🛂 Need a visa? Let iVisa take care of it for you.

- ✈ Looking for flights? Compare on Skyscanner !

- 💬 Want to learn the local language? Babbel and italki are two excellent apps to think about.

- 💻 Want a VPN? ExpressVPN is the market leader for anonymous and secure browsing.

Is Travel Insurance Mandatory in Vietnam?

No, there's currently no legal requirement to take out travel insurance for travel to or through Vietnam.

However, regardless of whether or not it's legally required, it's always a good idea to take our health insurance before you travel — whether to Vietnam or anywhere else. For what's usually an affordable cost , taking out travel insurance will mitigate most or all of the risk of financial damage if you run into any unexpected troubles during your trip abroad. Take a look at the top five reasons to get travel insurance to learn more.

With that said, here are the top three travel insurances for Vietnam:

VisitorsCoverage: Best Medical Coverage

Among the internet's best-known insurance platforms, VisitorsCoverage is a pioneering Silicon Valley insurtech company that offers comprehensive medical coverage for travellers going abroad to Vietnam, no matter whether you're planning to hike through the jungles of Phong Nha-Ke Bang or explore the busy streets of Hanoi.

VisitorsCoverage lets you choose between various plans tailored to meet the specific needs of your trip to Vietnam, including coverage for medical emergencies, trip cancellations, and travel disruptions. With its easy online purchase process and 24/7 live chat support, VisitorsCoverage is a reliable and convenient option if you want good value and peace of mind while travelling abroad.

- Coverage 9.0

- Quality of Service 9.0

- Pricing 7.6

- Credibility 9.5

VisitorsCoverage offers a large variety of policies, and depending on your needs and preferences, you'll need to compare and explore their full catalogue of plans for yourself. However, we've chosen a few highlights for their travel insurance for Vietnam:

- Policy Names: Varies

- Medical Coverage: Very good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, mental health-related conditions, and many others.

- Trip Coverage: Excellent - but only available for US residents.

- Customer Support: FAQ, live chat and phone support

- Pricing Range: USD 25 to USD 150 /traveller /month

- Insurance Underwriter: Lloyd's, Petersen, and others

- Best For: Value for money and overall medical coverage

Insured Nomads: Best Trip Coverage

Insured Nomads is another very good travel insurance option for Vietnam, especially if you're adventurous or frequently on the go and are looking for solid trip insurance with some coverage for medical incidents too. With Insured Nomads, you can choose the level of protection that best suits your needs and enjoy a wide range of benefits, including 24/7 assistance, coverage for risky activities and adventure sports, and the ability to add or remove coverage as needed. In addition, Insured Nomads has a reputation for providing fast and efficient claims service, making it an excellent choice if you want peace of mind while exploring the world.

- Coverage 7.8

- Quality of Service 8.5

- Pricing 7.4

- Credibility 8.8

Insured Nomads offers three travel insurance policies depending on your needs and preferences. We go through them below:

- Policy Names: World Explorer, World Explorer Multi, World Explorer Guardian

- Medical Coverage: Good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, and many others.

- Trip Coverage: Good. Includes coverage for trip cancellation and interruption, lost or stolen luggage (with limits), adventure and sports activities, and many others.

- Customer Support: FAQ, live chat, phone support

- Pricing Range: USD 80 to USD 420 /traveller /month

- Insurance Underwriter: David Shield Insurance Company Ltd.

- Best For: Adventure seekers wanting comprehensive trip insurance

SafetyWing: Best Combination For Youth

SafetyWing is a good insurance option for younger travellers or digital nomads in Vietnam because it offers flexible but comprehensive coverage at a famously affordable price. With SafetyWing, you can enjoy peace of mind knowing you're covered for unexpected medical expenses, trip cancellations, lost or stolen luggage, and more. In addition, SafetyWing's user-friendly website lets you manage your policy, file a claim, and access 24/7 assistance from anywhere in the world, and, unlike VisitorsCoverage, you can even purchase a policy retroactively (e.g. during a holiday)!

- Coverage 7.0

- Quality of Service 8.0

- Pricing 6.3

- Credibility 7.3

SafetyWing offers two travel insurance policies depending on your needs and preferences, which we've highlighted below:

- Policy Names: Nomad Insurance, Remote Health

- Medical Coverage: Decent. Includes coverage for doctor and hospital visits, repatriation, and many others.

- Trip Coverage: Decent. Includes attractive coverage for lost or stolen belongings, adventure and sports activities, transport cancellation, and many others.

- Pricing Range: USD 45 to USD 160 /traveller /month

- Insurance Underwriter: Tokyo Marine HCC

- Best For: Digital nomads, youth, long-term travellers

How Do They Compare?

Interested to see how VisitorsCoverage, SafetyWing, and Insured Nomads compare as travel insurances to Vietnam? Take a look at the side-by-side chart below:

Data correct as of 4/1/2024

FAQ About Travel Insurance to Vietnam

Travel insurance typically covers trip cancellation, trip interruption, lost or stolen luggage, travel delay, and emergency evacuation. Some travel insurance packages also cover medical-related incidents too. However, remember that the exact coverage depends on the insurance policy.

No, you'll not be required to take out travel insurance for Vietnam. However, we strongly encourage you to do so anyway, because the cost of healthcare in Vietnam can be high, and taking out travel insurance will mitigate some or all of the risk of covering those costs yourself if you need medical attention during your stay.

Yes, medical travel insurance is almost always worth it, and we recommend taking out travel insurance whenever visiting a foreign country. Taking out travel insurance will mitigate some or all of the risk of covering those costs yourself in case you need medical attention during your stay. In general, we recommend VisitorsCoverage to travellers worldwide because it offers excellent value for money and well-rounded travel and medical benefits in its large catalogue of plans.

Health insurance doesn't cover normal holiday expenses, such as coverage for missed flights and hotels, but in case you run into medical trouble while abroad, it may cover some or all of your doctor or hospital expenses while overseas. However, not all health insurance providers and plans offer coverage to customers while abroad, and that's why it's generally best to take out travel insurance whenever you travel.

Although there's overlap, health and travel insurance are not exactly the same. Health insurance covers some or all of the cost of medical expenses (e.g. emergency treatment, doctor's visits, etc.) while travel insurance covers non-medical costs that are commonly associated with travelling (e.g. coverage for missed flights, stolen or lost personal belongings, etc.).

The cost of travel insurance depends on several factors, such as the length of the trip, the destination, the age of the traveller, and the level of coverage desired. On average, travel insurance can cost anywhere between 3% and 10% of the total cost of the trip.

A single-trip travel insurance policy covers a specific trip, while an annual one covers multiple trips taken within a one-year period. An annual policy may be more cost-effective for frequent travellers.

Yes, you can sometimes purchase travel insurance after starting your trip, but it is best to buy it before the trip begins to ensure maximum coverage. If you do need to buy insurance after you've started your trip, we recommend VisitorsCoverage , which offers a wide catalogue of online trip and medical insurance policies, most of which can be booked with immediate effect. Check out our guide to buying travel insurance late to learn more.

Yes, you can most certainly purchase travel insurance for a trip that has already been booked, although we recommend purchasing insurance as soon as possible aftwerwards to ensure all coverage is in place before your journey begins. Check out our guide to buying travel insurance late to learn more.

See Our Other Travel Insurance Guides

Looking for Travel Insurance to Another Country?

See our recommendations for travel insurance to other countries worldwide:

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

- Ho Chi Minh City

- Planning A Trip

All-in-one Guide to Travel Insurance For Your Vietnam Trip

- 1. Why Would I Need Insurance?

- 2. What Types Of Insurances Are There?

- 3. Insurance Plan

- 4. When To Get Your Insurance

- 5. Where To Start Looking For Travel Insurance

In many countries, purchasing and showing proof of a purchase for a travel insurance is a must as you apply for your travel documents. As you get a visa for Vietnam, you are not required to present one. But do you need one? The answer is YES, you will greatly benefit from a wisely picked travel insurance. And how to figure out which one is the best in the pool of insurance offered? We will tell you right now.

Why Would I Need Insurance?

You can just skip this section if you already know how important it is to get travel insurance. For those who are still skeptical, read on.

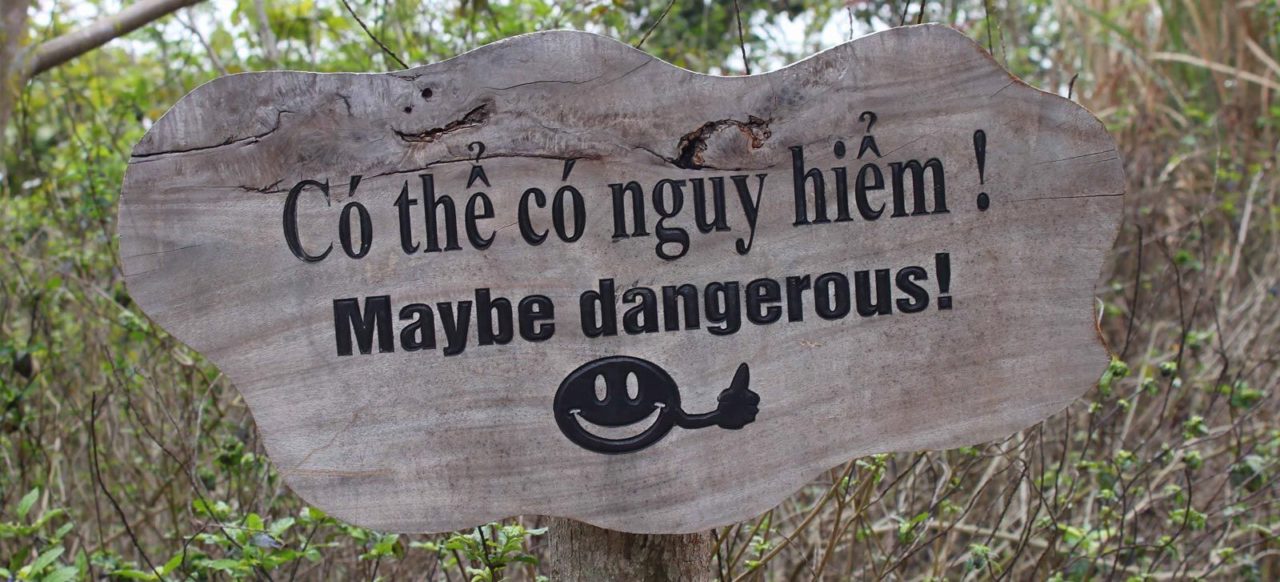

This is not to say Vietnam is an unsafe place to visit, but that anything can happen and it is better you get yourself prepared. Getting insurance sometimes will save you thousands of dollars, but in the least it gives you peace of mind. You know you are protected to a certain extent.

What Types Of Insurances Are There?

Thanks to Vietnam’s readily available tourism activities, you will find yourself anywhere from flying, taking cruise trips, staying at a high end resort, going kayaking on the bay or even simply crossing the streets. Fun as they may sound, some may be more prone to risk than others.

Currently in the insurance market, there is both individual and comprehensive plan for you to choose from: flight and trip cancellation insurance, travel health insurance, medical evacuation insurance, baggage coverage insurance, excess valuation, to name a few. Depending on your particular trip and preference, you may find one that best suits your interest.

How much your insurance will cost you will depend on the number of days you travel, the destination you will be travelling (Vietnam is generally listed as a safer place, and costing less money for insurance, some other countries), and the types that you choose.

Below is a closer look at the different types of insurance:

Trip cancellation.

If you book your flight with, Expedia or Orbitz or even directly from the airlines website such as Air Asia, chances are that you will be asked whether you want to purchase a flight or trip cancellation insurance. Unless you are 100% sure that you will make it for the trip, it may be wise to purchase one. This flight cancellation insurance starts from $13 and will be an excellent deal in case your flight or trip gets cancelled.

Flight Insurance

Baggage Insurance

You won’t be a happy traveler as you land and find out that you lost your baggage or your 2 trolleys were totally damaged. Most airlines will provide only hefty reimbursement in case of lost luggage. Baggage insurance will be necessary if you travel long distance.

Travel Health Insurance

Your national health care insurance will not cover your trip to Vietnam in particular. The Australian Reciprocal Medicare Agreement only entitle Australian nationals to get discounted treatment while in the UK, New Zealand, Sweden, Italy, among others, but Vietnam is not currently on the list. Canadians with OHIP coverage will too bear the full cost of medical expense while abroad. For US citizens, some private health insurance may cover basic needs for your travel but no company will assist you to evacuate or repatriate back to the homeland with your existing plan. With the evacuation or medication pack, you will be aided in case of injury or death and flown back to your home country. The annual premium starts from $250.

Other insurances available for your consideration are: Adventure travel, Credit card coverage, extreme sports insurance, to name a few.

Insurance Plan

Instead of going with individual coverage you may also purchase insurance plan:

Vacation plan

This is the most popular type of all travel insurance. Vacation plan includes trip cancellation or interruption, medical emergencies, loss or delays of luggage, and some over coverage depending on the insurance providers.

Specialty plan

This includes evacuation plans, accident plans, which cover the emergency evacuation and often-sold on annual basis. The insurance will cover transport and any emergency medial costs associated with the occurrence while you are abroad.

Travel medical plan

When To Get Your Insurance

It is best to get your travel insurance as you start your booking process: reserving a flight ticket, making deposit for a package tour to Vietnam or paying for your cruise trips.

Where To Start Looking For Travel Insurance

Below are some of the more prestigious travel insurance providers by countries:

Canada: Travel Guard, Kanetix (www.kanetix.ca), Manu Life (www.manulife.ca), RBC (http://www.rbcinsurance.com/travelinsurance/index.html)

US: Travel Guard, (http://www.travelguard.com)

UK: travel guard, Tesco Bank, Barclay (www.barclays.co.uk)

Australia: Travel guard, World Nomad, Travel Insurance Cover (www.travelinsurancecover.com.au)

Latest Travel Alerts & Updates for Vietnam

Can I travel to Vietnam right now? What are the requirement? When can I expect to be allowed to travel to Vietnam? Find answers to these questions with our frequently updated travel alerts.

Best Time to Visit Vietnam: When to Go & What to Expect

"When is the best time to visit Vietnam" is one of the most common questions that spring up to mind for all trip planners. Overall the golden time to visit the country is March-May and October-early December.

What $1 Can Buy in Vietnam

Although the cost of living has risen tremendously in Vietnam in recent years, you can still to live by with few dollars per day in your pocket. Below is a quick summary of what a dollar can be worth in various cities in Vietnam.

Featured Streets

Hang Thung - Street Of Buckets

Hang Bac - Street Of Silver

Hang Tre - Street Of Bamboos

Meet our experts.

Suggested Holiday Packages

Travel Insurance Vietnam

Travel insurance for vietnam.

Ah, Vietnam – a vibrant chaos of scooters zipping around, ancient temples that have seen it all, and greenery that makes you feel like you're in a nature hug. This Southeast Asian gem isn't just about rich culture and history – it's also the kingdom of adventures and, of course, the land of the mighty pho. Before you kick off your shoes and wade into the wonders of Vietnam, let's talk about practical matters. While Vietnam's known for the stunning Ha Long Bay and its gregarious people, it's also a place where even the savviest traveler might hit a speed bump. Let's dive into the everything you need to know abouet travel insurance for Vietnam so you can face unexpected travel hiccups with confidence.

- What should your Travel insurance cover for a trip to Vietnam?

- How does Travel Insurance work for Vietnam?

- Do I need Travel Insurance for Vietnam?

- How much does Travel Insurance cost for Vietnam?

- Our Suggested AXA Travel Protection Plan

What Types of Medical Coverage Do AXA Travel Protection Plans Offer?

Are there any covid-19 restrictions for travelers to vietnam.

- Traveling with pre-existing Medical Conditions?

What should your travel insurance cover for a trip to Vietnam?

At a minimum, your travel insurance should cover trip cancellation, trip interruption and emergency medical expenses. When it comes to international travel, the US Department of State outlines key components that should be included in your travel insurance coverage. AXA Travel Protection plans are designed with these minimum recommended coverages in mind.

- Medical Coverage – The top priority is making sure your health is in order. With AXA Travel Protection, you can have access to quality healthcare during your trip overseas in the event of unexpected medical emergencies.

- Trip Cancellation & Interruptions – Assistance against unexpected trip disruptions can dampen the mood, AXA Travel Protection offers coverage against unforeseen events.

- Emergency Evacuations and Repatriation – In situations where transportation is dire, AXA Travel Protection offers provisions for emergency evacuation and repatriation.

- Coverage for Personal Belongings – AXA offers coverage for your belongings with assistance against lost or delayed baggage.

- Optional Cancel for Any Reason – For added flexibility, AXA offers optional Cancel for Any Reason coverage, allowing you to cancel your trip for non-traditional reasons. Exclusive to Platinum Plan holders.

In just a few seconds, you can get a free quote and purchase the best travel insurance for Vietnam.

How does Travel Insurance for Vietnam work?

Imagine: you're on a motorbike adventure through the winding roads of Dalat. Suddenly, an unexpected slip or a minor mishap occurs, and you find yourself in need of medical attention. Here's where an AXA Travel Protection plan steps in with its "Emergency Medical Expenses" benefit. From hospital stays to doctor's fees, AXA can support and assist so you're not left navigating the complications of the Vietnamese healthcare system. Moreover, if the situation takes a serious turn and requires evacuation to the nearest medical facility or even repatriation, AXA Travel Protection's got your back. Here’s how travelers can benefit from an AXA Travel Protection Plan:

Medical Benefits:

- Emergency Medical Expenses: Should you fall ill or have an accident during your trip, your policy may offer coverage for medical expenses, including hospital stays and doctor's fees.

- Emergency Evacuation & Repatriation: In case of a serious medical emergency, your policy may include provisions for evacuation to the nearest appropriate medical facility or repatriation.

- Non-Emergency Evacuation & Repatriation : In non-medical crises (e.g., political unrest), your policy may cover evacuation or repatriation, subject to policy terms.

Pre-Departure Travel Benefits:

- Trip Cancellation: You may be eligible for reimbursement if you cancel your trip due to a sudden illness or injury.

- COVID-19 Travel Insurance: Coverage is available for trip cancellation and medical expenses related to COVID-19, subject to policy terms and conditions.

- Trip Delay: If your flight faces delays due to unforeseen circumstances, you may have coverage for additional expenses such as meals and accommodations.

Post-Departure Travel Benefits:

- Trip Interruption: In case of an unexpected event, you could be eligible for reimbursement for the unused portion of your trip.

- Missed Connection: If you miss a connecting flight due to delays or cancellations, this coverage may help with expenses like rebooking fees and accommodations.

Baggage Benefits:

- Luggage Delay: If the airline delays your checked baggage, your policy might offer reimbursement for essential items like clothing and toiletries.

- Lost or Stolen Luggage: In the unfortunate event of permanent loss or theft of your luggage, your policy may offer reimbursement for its value, assisting you in replacing your belongings.

Additional Optional Travel Benefits:

- Rental Car (Collision Damage Waiver): Exclusive to Gold & Platinum plan policy holders, this optional benefit gives travelers extra coverage on their rental car against damage and theft.

- Cancel for Any Reason: Exclusive to Platinum plan policy holders; this optional benefit gives travelers more flexibility to cancel their trip for any reason outside of their standard policy.

- Loss Skier Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate some costs associated with pre-paid ski tickets that you or your traveling companion cannot use due to specified slope closures.

- Loss Golf Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate the expenses linked to prepaid golf arrangements that you or your travel companion are unable to utilize due to specified golf closures.

Do I need Travel Insurance for Vietnam?

Although it's not required to have travel insurance for Vietnam, we highly recommend that travelers think about getting an insurance plan to make sure they stay well-protected during their visit. Why? There are several reasons:

Medical Emergencies: Given the adventurous activities in Vietnam, the potential for minor mishaps or unexpected health issues is notable. Having coverage for emergency medical expenses ensures that you can seek necessary medical attention without worrying about the financial burden.

Lost Baggage: Airlines sometimes mishandle baggage, and the last thing you want is to be without your essentials in an unfamiliar place. Travel insurance offers to cover the cost of replacing necessary items, allowing you to continue on.

Emergency Evacuation & Repatriation: While Vietnam's healthcare has improved through the years, the quality of healthcare in more rural or remote areas may not be as advanced. In the event of a serious medical emergency, having coverage for emergency evacuation to the nearest suitable medical facility or repatriation becomes crucial.

How much does Travel Insurance cost for Vietnam?

In general, travel insurance costs about 3 – 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans:

- Total Trip cost: The total non-prepaid and non-refundable costs you have already paid for your upcoming trip. This includes prepaid excursions, plane tickets, cruise costs, etc.

- Age: Like any other insurance type, the correlation is rooted in increased health risks associated with older individuals. It's important to note that this doesn't make travel insurance unattainable for older individuals.

With AXA Travel Protection, travelers to Ecuador will be offered three tiers of insurance: Silver, Gold and Platinum . Each provides varying levels of coverage to cater to individual's preferences and travel needs.

Our Suggested AXA Travel Protection Plan

AXA presents travelers with three travel plans – the Silver Plan , Gold Plan , and Platinum Plan , each offering different levels of coverage to suit individual needs. Given that Vietnam hospitals often do not accept U.S. health insurance or Medicare, we genuinely recommend travelers consider purchasing any of these plans, particularly for the crucial coverage they offer for emergency accident and sickness medical expenses. Travelers to Vietnam may want extra coverage. The Platinum Plan is a good choice for travelers who want a bit of extra coverage. Cancel for Any Reason is an option that offers coverage for canceling a trip for any reason. The Collision Damage Waiver coverage is also optional. It covers collisions, theft or damage to a rental car being used during your Vietnam trip.

AXA covers three types of medical expenses:

- Emergency medical expenses

- Emergency evacuation & repatriation

- Non-medical emergency evacuation & repatriation

Emergency Medical: Can cover medical expenses, hospital stays, and even emergency evacuations, covering the expenses of hefty bills and ensuring access to quality healthcare while away from home.

Emergency Evacuation and Repatriation: Can cover your immediate transportation home in the event of an accidental injury or illness.

Non-Medical Emergency Evacuation and Repatriation: Offers assistance in unexpected situations such as political unrest or natural disasters, ensuring safe and timely relocation to a secure location or repatriation back home.

Starting in 2023, travelers heading to Vietnam no longer have to show a valid Covid-19 vaccine card or a negative PCR test. The travel restrictions in Vietnam have been lifted, making the entry process simpler for all travelers.

Traveling with pre-existing Medical Conditions?

Traveling with pre-existing medical conditions can complicate your plans, but with AXA Travel Protection, we're here to support you during your trip. Our Gold and Platinum plans offer coverage for pre-existing medical conditions. The Platinum plan, in particular, is our highest-offered choice for travelers who want our highest coverage limits and optional add-ons,

What does this mean for you? If you've got a medical condition that's been hanging around, you can qualify for coverage under our Gold and Platinum plans with a pre-existing medical condition , so long as it’s within 14 days of placing your initial trip deposit and in our 60-day look-back period. We're here to ensure you travel easily, no matter your health situation.

1. Can you buy travel insurance after booking a flight?

You can buy travel insurance even after your flight is booked.

2. When should I buy Travel Insurance to Vietnam?

Purchasing travel insurance for your trip is advisable as soon as you have made your initial trip deposit (prepaid and non-refundable trip costs.) AXA Travel Protection offers coverage as soon as you purchase your protection plan. We can give coverage against unforeseen events before you leave for your trip. Additionally, our policies offer coverage for preexisting medical conditions and Cancel for Any Reason if you purchase your protection within 14 days of making your initial trip deposit.

3. Do Americans need travel insurance in Vietnam?

While travel insurance is not a mandatory requirement for Americans visiting Vietnam, it is highly recommended. Travel insurance can provide financial protection and assistance in case of unexpected events such as medical emergencies, trip cancellations, lost luggage, or other travel-related issues.

4. What is needed to visit Vietnam from the USA?

For a trip to Vietnam, US citizens need a visa for tourism or business, obtainable from the Vietnamese Embassy in the US or through a single-entry e-visa on the Vietnam Immigration website. Make sure your passport is valid for at least six months beyond your intended stay and has at least one blank visa page.

5. What happens if a tourist gets sick in Vietnam?

If you become sick in Vietnam, travelers with AXA Travel protection can contact the AXA Assistance hotline at 855-327-1442 . Contact information is typically provided within the insurance documentation. Please ensure to read through your policy details and information.

Disclaimer: It is important to note that Destination articles are for editorial purposes only and are not intended to replace the advice of a qualified professional. Specifics of travel coverage for your destination will depend on the plan selected, the date of purchase, and the state of residency. Customers are advised to carefully review the terms and conditions of their policy. Contact AXA Travel Insurance if you have any questions. AXA Assistance USA, Inc.© 2023 All Rights Reserved.

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

Get AXA Travel Insurance and travel worry free!

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip.

- Destinations

Vietnam Travel Insurance Requirements

Last updated: 03/07/2024

Effective May 15, 2022, Vietnam lifted all Covid-19 travel requirements, including mandatory travel insurance. With that said, these entry rules are subject to change at any time, and all travelers heading to Vietnam should confirm the latest entry requirements prior to departing for their trip.

Squaremouth’s Vietnam Travel Insurance Recommendations

In addition to a policy with Emergency Medical coverage with at least $50,000 in coverage, Squaremouth recommends a policy with at least $100,000 in Medical Evacuation coverage. Travelers who are visiting more remote areas of Vietnam should consider a policy with at least $100,000 of Emergency Medical and $250,000 in Medical Evacuation coverage, due to the potential for increased medical costs.

Emergency Medical coverage can offer reimbursement for treatment due to an unforeseen illness or injury, and typically includes treatment for contracting Covid-19. The Medical Evacuation benefit can provide reimbursement for costs associated with transportation costs associated with a traveler getting to the nearest adequate medical facility.

For travelers with prepaid and non-refundable trip costs, Squaremouth recommends the Trip Cancellation benefit, which can reimburse up to 100% of covered trip costs if a traveler has to cancel their trip before they’ve left. Typical reasons include an unforeseen illness or injury, death, inclement weather, or terrorism. Canceling from testing positive for Covid-19 is typically covered, as well.

Policies with Trip Cancellation coverage typically includes Trip Interruption. This benefit can cover a traveler’s unused, prepaid, non-refundable trip expenses if a person’s trip gets interrupted for a covered reason such as illness or injury, flight delays, or a natural disaster. If a traveler needs to cut their trip short, this benefit can also cover additional transportation expenses incurred to return home.

Vietnam Travel Insurance Trends and Data

Vietnam boasts delicious food, gorgeous hikes, and the world’s largest cave. Travelers also love to experience the limestone towers at Halong Bay.

Destination Rank: 20

Percentage of Squaremouth Sales: 1.26%

Average Premium: $288.74

Average Trip Cost: $3,783.99

Squaremouth Analytics compares thousands of travel insurance policies purchased pre- and post-pandemic to identify changes and trends in the travel insurance industry.

Helpful Resources

- Vietnam State Department Information

- Vietnam Travel Information

Available Topic Experts for Media:

Squaremouth's destination information is free and available for use within your reporting. Please credit Squaremouth.com for any information used.

Squaremouth's topic experts are on hand to answer your questions. Contact a member of our team for media inquiries about Squaremouth Analytics or to schedule an interview.

Steven Benna, Lead Data Analyst: [email protected]

We're here to help!

Have questions about travel insurance coverage? Call us! 1-800-240-0369 Our Customer Service Team is available everyday from 8AM to 10PM ET.

Vietnam Jack

Travel and discover the best things to do in Vietnam!

Vietnam Travel Insurance Guide: Top 5 Insurance Options for Your Trip

Embarking on a journey to Vietnam, with its captivating landscapes and rich cultural tapestry, is an adventure filled with excitement and discovery. Ensuring a safe and worry-free experience involves choosing the right travel insurance. From comprehensive coverage to specific needs for exploring Vietnam, this guide explores the best travel insurance options, providing peace of mind for every traveler’s unique journey.

1. World Nomads: Comprehensive Coverage

World Nomads stands out as a top choice for adventurous travelers exploring Vietnam’s diverse terrains. Offering extensive coverage for medical emergencies, trip cancellations, and adventure activities like trekking and motorcycling, it caters to the thrill-seekers. Their flexible policies and user-friendly online platform make it easy for travelers to customize plans based on their specific needs. With 24/7 customer support and a reputation for reliability, World Nomads ensures that adventurers can explore Vietnam with confidence.

2. Allianz Global Assistance: Versatile Coverage for Every Traveler

Allianz Global Assistance provides versatile coverage suitable for a range of travel styles, making it an excellent choice for Vietnam-bound tourists. Their comprehensive plans include coverage for medical emergencies, trip interruptions, and baggage loss. Allianz offers a user-friendly online interface for easy policy management and claims processing. With a global network of medical providers and assistance services, travelers can trust Allianz to provide reliable support throughout their journey in Vietnam.

3. AXA Assistance: Tailored Coverage with Global Support

AXA Assistance offers tailored travel insurance with a global support network, making it a reliable choice for Vietnam-bound travelers. Their plans cover a spectrum of needs, including medical emergencies, trip cancellations, and baggage protection. AXA Assistance’s emphasis on customer service ensures that travelers have access to assistance whenever needed. With a user-friendly online platform for policy management and claims, AXA Assistance provides a seamless experience for those prioritizing personalized coverage and global support.

4. Travel Guard: Customizable Plans for Personalized Protection

Travel Guard, powered by AIG, provides customizable travel insurance plans to suit individual preferences and needs. Their coverage includes medical expenses, trip disruptions, and comprehensive protection against unexpected events. With flexible options for coverage enhancements, travelers can tailor their policies for specific activities or preferences. Travel Guard’s commitment to customer satisfaction, coupled with its global presence, ensures that Vietnam-bound tourists have access to personalized protection for a worry-free exploration.

5. SafetyWing: Affordable and Flexible Coverage

For budget-conscious travelers seeking reliable coverage, SafetyWing emerges as an affordable and flexible option. With comprehensive medical insurance, SafetyWing is a practical choice for those exploring Vietnam on a budget. Their policies are available to travelers of all nationalities, and the coverage extends even during brief returns to the home country. SafetyWing’s affordability and flexibility make it an attractive option for those prioritizing financial considerations without compromising on essential coverage .

Choosing the Right Travel Insurance: Considerations and Tips

Selecting the best travel insurance for Vietnam involves considering factors like coverage for medical emergencies, trip cancellations, and specific activities such as adventure sports. Assess your individual needs, duration of stay, and the type of activities you plan to engage in. Read policy details carefully. Additionally, consider the ease of claims processing and customer support. Comparing quotes and reviews can guide you in making an informed decision tailored to your travel requirements.

Conclusion: Safeguarding Your Vietnam Adventure

Choosing the best travel insurance for your Vietnam adventure ensures a safety net for unforeseen circumstances. Whether you’re exploring off-the-beaten-path destinations or immersing yourself in cultural experiences, reliable coverage from providers like World Nomads, Allianz Global Assistance, SafetyWing, AXA Assistance, and Travel Guard ensures you can focus on creating lasting memories with peace of mind.

Featured Image: View of Hanoi at Night | Photo by Quang Nguyen Vinh

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- Best Global Medical Insurance Companies

- Student Insurance

- Overseas Health Insurance

- Insurance for American Expats Abroad

- Canadian Expats – Insurance and Overseas Health

- Health Insurance for UK Citizens Living Abroad

- Expat Insurance for Japanese Abroad

- Expat Insurance for Germans Living Abroad

- Travel Medical Insurance Plans

- Annual Travel Insurance

- Visitors Insurance

- Top 10 Travel Insurance Companies

- Evacuation Insurance Plans

- Trip Cancellation Insurance

- International Life Insurance

- Corporate and Employee Groups

- Group Global Medical Insurance

- Group Travel Insurance

- Group Life Insurance

- Foreign General Liability for Organizations

- Missionary Groups

- School & Student Groups

- Volunteer Programs and Non-Profits

- Bupa Global Health Insurance

- Cigna Close Care

- Cigna Global Health Insurance

- Cigna Healthguard

- Xplorer Health Insurance Plan

- Navigator Student Health Insurance

- Voyager Travel Medical Plan

- Trekker Annual Multi-Trip Travel Insurance

- Global Medical Insurance Plan

- Patriot Travel Insurance

- Global Prima Medical Insurance

- Student Health Advantage

- Patriot Exchange – Insurance for Students

- SimpleCare Health Plan

- WorldCare Health Plan

- Seven Corners Travel Insurance

- SafeTreker Travel Insurance Plan

- Unisure International Insurance

- William Russell Life Insurance

- William Russell Health Insurance

Atlas Travel Insurance

- StudentSecure Insurance

- Compare Global Health Insurance Plans

- Compare Travel Insurance Plans

- Health Insurance in the USA

- Health Insurance in Mexico

- Health Insurance in Canada

- Health Insurance in Argentina

- Health Insurance in Colombia for Foreigners

- Health Insurance in Chile

- UK Health Insurance Plans for Foreigners

- Health Insurance in Germany

- French Health Insurance

- Italian Health Insurance

- Health Insurance in Sweden for Foreigners

- Portuguese Health Insurance

- Health Insurance in Spain for Foreigners

- Health Insurance in China

- Health Insurance in Japan

- Health Insurance in Dubai

- Health Insurance in India

- Thailand Health Insurance

- Malaysian Health Insurance for Foreigners

- Health Insurance in Singapore for Foreigners

- Australian Health Insurance for Foreigners

- Health Insurance in New Zealand

- South Africa Health Insurance for Foreigners

- USA Travel Insurance

- Australia Travel Insurance

- Mexico Travel Insurance

- News, Global Health Advice, and Travel Tips

- Insurance Articles

- Travel Advice and Tips

- Best Travel Insurance for Seniors

- Best Hospitals in the United States

- Best International Hospitals in the UK

- Best Hospitals in Mexico

Or call for a quote: 877-758-4881 +44 (20) 35450909

International Citizens Insurance

Medical, Life and Travel Plans!

U.S. 877-758-4881 - Intl. +44 (20) 35450909

Safety and Travel Insurance for Visitors to Vietnam

Travel Insurance and Safety Tips for Visitors to Vietnam

Tourism in Vietnam is booming. In 2018, Vietnam welcomed 15.5 million international arrivals, up from a paltry 2.1 million in the year 2000. Visitors range from backpackers and digital nomads to culture, food, and nature lovers, to those interested in military history, including returning veterans. They come for culinary experiences and cooking classes, for nature, photography, and kayak trips, and military history tourism. However, while tourism is an increasingly important part of Vietnam’s economy, visitors who wander off the beaten path will encounter a country that still feels undiscovered by the hoards of tourists who visit Thailand and Cambodia. For all its attractions, most of Vietnam still feels quiet and neighborly. If you’re planning to travel to Vietnam , here are some important health, safety, and travel tips you need for this remarkable country.

Related: Health Insurance in Vietnam for Expats and Foreigners

Travel and Trip Insurance for Visitors to Vietnam

While the cost of paying a la carte for public healthcare services in Vietnam is low, very often the standards are low as well. Private health insurance is highly recommended for extended stays in Vietnam. Private care means treatment in cleaner, more comfortable, and more private facilities. It also means access to state-of-the-art diagnostic equipment and multilingual staff.

Travelers should ensure their health insurance covers them for treatment outside Vietnam. Often, visitors will need to travel to Thailand , Singapore, or Kuala Lumpur for specialist treatments and medical emergencies. While this kind of cross-border care isn’t as popular as it was in the past, it is still common for certain kinds of care.

Travel Insurance for Visitors to Vietnam

- Emergency medical, evacuation, repatriation benefits

- Choose between the basic and more extensive coverage

- Meets Schengen visa insurance requirements

- 24/7 worldwide travel and emergency medical assistance

Travelers Insurance for U.S. Citizens Who Travel to Vietnam

GeoBlue Voyager Plan

- For U.S. citizens up to age 95

- Includes pregnancy coverage, baggage loss, trip interruption & more

- 24/7/365 service and assistance

Trip Cancellation Insurance for U.S. Citizens Traveling to New Zealand

Seven Corners Trip Protection Insurance

- Comprehensive trip protection for U.S. residents traveling abroad.

- Optional rental car collision coverage available.

- Optional Cancel for Any Reason coverage available (if eligible).

Are Vaccines Required for Travel to Vietnam?

Like with all travel destinations, the Centers for Disease Control recommends visitors to Vietnam are up to date on all routine vaccinations. These vaccines include the measles-mumps-rubella (MMR) vaccine, the diphtheria-tetanus-pertussis vaccine, varicella (chickenpox) vaccine, the polio vaccine, and a yearly flu shot.

In addition to routine immunizations, the CDC also recommends anyone planning to travel to Vietnam is inoculated for the following:

- Hepatitis A

Depending on where you are traveling in Vietnam, you may require the following additional vaccines:

- Hepatitis B

- Japanese Encephalitis

- Dengue Fever

As well, there have been cases of malaria reported in rural areas around the Mekong and Red River Deltas. If your travels will bring you to these areas, it’s wise to speak with a travel medicine clinic before you go.

Understanding How to Access Medical Treatment in Vietnam

The good news about medical care in Vietnam is that it is greatly improving. Furthermore, the government is talking about developing a universal healthcare plan. However, the downside is that the quality of care is still extremely poor in most rural areas. In fact, in some of the most rural and remote areas, medical services are all but nonexistent. However, in urban areas, the outlook is more positive. That said, public hospitals are still often underfunded and equipped.

Fortunately, the standards of private hospitals are excellent, particularly in Hanoi and Ho Chi Minh City. Many doctors are Expats from the United States, Korea, Japan, and France. Many Vietnamese doctors in private hospitals have studied overseas. As such, patients can expect multilingual staff, a real bonus for visitors in need of care.

Vietnamese Pharmacy and Hospital Information and Tips

Pharmacies are well stocked and easy to find in Vietnam. However, expired products are sometimes a problem. It’s a good idea to carefully check the packaging before you pay for your purchase. Occasionally, there are problems with counterfeit brand-name drugs. Visiting a pharmacy within a private clinic or hospital will reduce the possibility of receiving knock-off drugs.

There are two internationally accredited hospitals in Vietnam, one in Hanoi and one in Ho Chi Minh City. As well, new hospitals have been built in smaller cities, including Nha Trang, Vung Tau, and Phu Quoc. One particular brand name to keep an eye out for is Vinmec Health Care, which is currently operating four full-service hospitals and two outpatient clinics.

For non-urgent care, the Family Medical Practice runs well-regarded clinics in Da Nang, Hanoi, and Ho Chi Minh City. As well, SOS International operates clinics in Vung Tau, Hanoi, and Ho Chi Minh City that offer good quality care and English-speaking staff.

Read: Hospitals in Vietnam for Visitors

Staying Safe and Healthy When Visiting Vietnam

The tap water in Vietnam is non-potable. As such, visitors should only drink bottled or sterilized water. Ice cubes and food washed with tap water should similarly be avoided. This includes raw fruits and vegetables, like salads and smoothies. The old traveler’s adage “Boil it, peel it, cook it, or forget it” applies to eating and drinking in Vietnam.

That said, some of the safest and most delicious food comes from street vendors. Look for busy vendors with fast-moving lines. That means food isn’t sitting around in the heat. As well, locals know their neighborhood vendors well. They wouldn’t line up to patronize any food stall with a bad reputation.

Emergency Numbers in Vietnam

- Dial 115 for emergency medical care and ambulances in Vietnam

- Dial *9999 for an emergency medical response service in English and Vietnamese

- Dial 113 to access the police in an emergency

- Dial 114 for fire emergencies in Vietnam

General Safety and Travel Tips for Trips to Vietnam

Plan in advance for your visa. Triple-check all of your information and have all your paperwork ready for the immigration officers. Travelers get turned away every day because they didn’t properly prepare for their visa requirements.

Don’t underestimate travel distances. For visitors from Canada, the United States, and Australia, Vietnam is but a tiny speck on a map. But when you’re on the ground you soon learn that traveling from one point to another takes much more time than you estimated. For instance, the train from Hanoi to Ho Chi Minh City takes close to 35 hours by train – and even longer by bus.

When it comes to covering distances short or long, motorbikes are one of the most popular modes of transportation. However, they are also one of the most dangerous. Wearing a helmet, renting from an established, reputable business, and starting out with a full tank of gas are all important safety steps. If you’re not a confident motorbike driver, consider hiring a motorbike guide through a company like Easy Riders Vietnam.

Violent crime is extremely rare in Vietnam. However, snatch-and-grab crimes are far more common. Leaving your phone on the edge of your cafe table or dangling from your hand as you walk down the street is a high-risk move. Before you know it, your phone will be gone! Keep a careful eye on your phone and all electronics.

Vietnamese Environmental Concerns

While Vietnam has unbelievably beautiful scenery, beaches aren’t their strong point. The seaside tourism industry isn’t nearly as developed as it is in nearby Thailand. And in nice beach towns, you might find that water and shoreline pollution and litter drastically reduces the appeal. Thankfully, community efforts like Let’s Clean Up The Ocean are raising awareness and mobilizing support to improve beach ecosystems.

- 12 Top Safety Tips for International Travel

- What is the Difference Between a Passport and a Visa?

Get a fast, free, international insurance quote.

Global medical plans, specialty coverage, company info, customer service.

The ultimate guide to buying travel insurance in Vietnam

Travel insurance has been gaining popularity during the covid-19 pandemic. you might wonder what benefits this type of insurance brings or why you need to buy it. so, let’s have a look at this below post for an overview and select the most suitable coverage for your trip., what is travel insurance.

Travel insurance is considered a financial plan used for protection against risks and loss of money or property in your trip. In detail, insurance companies will reimburse you in those circumstances or in any medication-related issue and additional cost during the journey.

Should you buy travel insurance?

As mentioned above, travel insurance helps you a lot on your vacation. You will obtain different amounts of compensation and benefits based on the companies and coverage you choose. Now let’s examine the cases below and give answers to the questions above.

Cases are covered by travel insurance

In general, 5 popular cases occurring during the trip you can make a claim are:

- Trip cancellation

If you have to suddenly change or cancel your trip, insurance companies will reimburse the prepaid for flights, accommodation or travel tickets. Yet, the coverage is valid only if your reasons for canceling are listed in the policy. For instance, natural disasters happen at your destination or you are too sick to join the trip.

- Accidents and medical emergencies

Accidents and injuries during the journey are not rare, especially when you partake in physical challenge activities. In case of abroad travel, medical expenses can cost you an arm and a leg if you get food poisoning or face other health-related issues. An insurance package can cover those problems.

- Loss luggage

Risks of lost luggage probably happen in both domestic and overseas travel. In this case, travel insurance with luggage coverage will pay for stolen or lost items with a respective amount of money.

- Missed departure time

Missed flights or trains might lead to lots of troubles and cost you a great deal of money for buying other tickets. Owning missed connection travel insurance can help you receive compensation in specific circumstances listed in the policy.

- Travel delays

Travel delays might result in missed connecting flights or planned tourism activities. In those cases, a policy with travel delay coverage can reimburse you for unused trip expenses including flight tickets and accommodation that are prepaid and nonrefundable.

You should buy travel insurance!

A detailed itinerary can lessen the possibility of unexpected events during the trip. Yet, risks are unpredictable so you should seriously consider buying travel insurance. In addition, the pandemic leads to the anxiety of exposure to the COVID-19 in the trip. Therefore, purchasing travel coverage is the right decision.

Who should buy travel insurance?

Travel insurance covers a wide range of people from 6 weeks to 85 years old depending on the companies’ policies. If you find yourself in one of the travel groups below, you might need travel coverage:

- Broad travel

Overseas trips often bear more risks than domestic travel, including lost luggage/personal paper, and more expenses as well. So if you are an abroad traveler, it is worth thinking about suitable coverage.

- Valuable trip

If you planned and pre-booked for your luxurious trip with an expensive resort, nonrefundable flights, and a 5-star cruise, you definitely should add travel insurance. In case you have to cancel your trip and prepaid services decline to refund, the coverage will reimburse you all those costs.

- Challenge activities included in the trip

Physical challenge activities and cave/jungle/waterfall exploration trips are appealing to tourists all over the world, and potential for injuries as well. This type of coverage is not compulsory, however, insurance companies often recommend it because of its necessity.

Some popular types of travel insurance

There are various ways to classify travel insurance, including by region and by insured.

Travel insurance by region

- Domestic travel insurance

This insurance package is designed for tourists traveling to destinations within the territory of Vietnam. Its cost is quite cheap but benefits are various, especially in medical and health issues.

- Global travel insurance

This type of insurance covers trips abroad and usually offers many benefits for travelers such as lost luggage, lost personal paper, or flight issues.

Travel insurance by the insured

- Individuals

It is suitable for travelers with private requests of criteria for their vacation. This coverage often provides a wide variety of benefits and compensation amounts for choosing.

- Family/groups

This coverage is applied to a group of tourists or a family traveling together. Prices for those packages are often cheaper than ones for individuals.

- Enterprises

This type of travel insurance is designed for business traveling purposes. The term in policies is usually by year for saving time and money.

- Travel tours

This travel coverage is specifically designed for travel agencies, generally included in total tour expense.

Some notices for buying travel insurance

- Not every trip needs travel insurance

This is a suggestion for you: if you plan an economically domestic trip with a limited budget and no valuable luggage, you might skip travel insurance. By contrast, in case the total cost for your trip is significant, you definitely should have one.

- Carefully read the policies

You should spend time reading every term of your coverage contract to know exactly what is covered and what is not. Then, you can add or narrow the list as needed. Moreover, choose the insurance companies with 24/7 support service so you can contact them anytime you get into trouble.

- Try not to overlap

If you already had life insurance or medical insurance, you might need to check that coverage’s policies to make sure you won’t pay for one benefit twice. For instance, your medical insurance possibly covers the hospital fees in case of your sickness and accident during the trip.

- You might need to buy it soon

After planning and pre-booking every service for the journey, you should get travel insurance as soon as possible, at least coverage with a cancellation policy. In the event of irresistibly canceling, you can be reimbursed by the insurance company.

- Don’t fall for tourist traps

Note that again, to not fall for sales tactics with additional terms, you need to read the policy carefully to identify what you want to be covered. Also, it is necessary to remove the benefits you already had.

Some reliable travel insurance in Vietnam

In Vietnam, many prestigious insurance companies are providing comprehensive solutions for travel, business trips, and study abroad. Some reliable ones are:

Renowned with many coverage packages that are financially suitable for travelers, Baoviet TravelCare is your reliable companion on every trip. Global travel insurance Flexi is one of the most outstanding solutions of Baoviet, designed for individuals and customers of Saigontourist.

Bao Minh is renowned for many insurance packages for domestic and international travel with 22 compensatory benefits, which is appropriate for applying for a worldwide Visa.

Vietnam National Aviation Insurance Corporation provides both domestic and global coverage for individuals and corporations. In unexpected events, VNI will reimburse you the amount of money fixed in the insurance certificate.

A well-known product of Chubb and PVI is TripCARE – the comprehensive travel insurance for customers of Vietnam Airlines.

BIC is BIDV’s insurance company, covering all customers from 1 to 70 years old in the event of accidental death, dismemberment, medical assistance, as well as any luggage and trip issues.

Insurance coverage Travel Guard of AIG offers various solutions with lots of benefits and professional compensation services.

Liberty company sells a great variety of insurance products. International travel insurance TravelCare is popular for its wide coverage for customers traveling individually and in groups.

As you can see, almost all insurance companies offer qualified domestic and global coverage packages. Each business gains the advantage over others on specific products, yet, all of their solutions focus on improving customers’ benefits.

Here is the overview of travel insurance. This post is expected to help you have a better understanding of the importance of travel coverage for your trip and get more useful information for choosing the most suitable coverage.

Leave a Reply Cancel reply

Save my name, email, and website in this browser for the next time I comment.

You Might Also Like

Why Vietnam Is One Of The Best Places To Travel With Kids?

Key Benefits To Choosing Private Car Rental (Update 2023)

Nature-based tourism – a new independent travel trend is worth a family getaway

- No products in the cart.

Vietnam Travel Insurance: The best guide before you go

Should I need Vietnam travel insurance ? What are the benefits that I got? In this post, Prime Trave l will help you address all your concerns about travel insurance when visiting Vietnam, ensuring you have the safest and most enjoyable trip.

Why do you need travel insurance in Vietnam?

Do you really need to purchase travel insurance? If not, what are the disadvantages? Here are some several reasons:

- Vietnam has a different health care system than your home country. You may not be able to access the same quality of care or facilities that you are used to. And you also may have to pay upfront for medical services, which can be expensive and difficult to claim back from your regular health insurance.

- Vietnam has various natural and man-made hazards that could affect your travel plans. You could encounter typhoons, floods, landslides, fires, civil unrest, terrorism, or crime. These could cause injuries, damages, delays, or cancellations that could cost you a lot of money and stress.

- You need to meet strict entry requirements, such as visa, passport, vaccination.

- Vietnam has different laws and customs than your home country. You may not be aware of some of the rules or regulations that apply to you as a visitor. You could unknowingly break the law or offend the local culture and face legal consequences or social backlash.

Why do you need Vietnam travel insurance ? ( Source: Internet )

Read more>>> How to apply Vietnam E-visa 2023

What does travel health insurance in Vietnam cover?

Each Vietnam travel medical plan varies just as each trip and traveler varies. A travel medical insurance plan for Vietnam can be purchased as a standalone plan or as a part of a comprehensive travel insurance plan. A comprehensive travel insurance policy offers coverage for various travel-related expenses, such as cancellation, lost baggage, or delays.

Travel insurance provides a safe experience for travelers ( Source: Internet )

Some common coverages to consider for a trip to Vietnam include:

- Motorcycle/Motorbike travel insurance

- Coverage for pre-existing conditions (obtaining a waiver for the condition before traveling)

- Emergency Medical Evacuation

- Accidental Death & Dismemberment

Read more>>> Things to do in Hanoi

What do Vietnam travel insurance not include ? ( Source: Internet )

There are a few eventualities a standard travel insurance policy is unlikely to cover, including:

- Pre-existing conditions: Make sure you declare any pre-existing medical conditions to your provider when you buy your policy, otherwise you won’t be covered.

- Drugs or alcohol: But be aware that if your belongings are stolen or you’re injured while you’re under the influence, you might find your insurance provider won’t pay out.

- Natural disasters: Vietnam’s long coastline makes it prone to storms and flooding, particularly in the cyclone season from May to November. While it’s unlikely that extreme weather will affect your trip, it’s worth knowing that you may not be covered if it does.

- Terrorism: Vietnam doesn’t have a history of terrorist attacks, but it still pays to be vigilant. Although your travel insurance will cover the cost of any medical care you might need following an attack, it won’t cover much else.

How much is travel insurance to Vietnam?

The price of Vietnam travel protection can vary depending on the age, health status, and number of travelers being covered, as well as the duration of the trip and type of coverage.

Tourists experience boat rowing on Trang An ( Source: Internet )

As risk involved with the trip increases, prices may also increase. For example, a trip to Vietnam that lasts one week may cost less than a two-week trip, even if the type of coverage is the same, due to the extended length of the trip. Additionally, a traveler with pre-existing health conditions can usually expect to pay higher rates than a traveler who does not have any diagnosed pre-existing conditions.

In general, the cost of purchasing travel insurance in Vietnam for foreigners will range from $40 to $80 for a trip lasting from 7 to 10 days in Vietnam.

Read more>>> Vietnam trip cost for Australian

How to choose the best travel insurance in Vietnam?

There are many travel insurance providers and plans available for Vietnam, but not all of them are suitable for your needs. Here are some tips on how to choose the best travel insurance in Vietnam:

- Compare different plans and providers online. You can use websites like: Chubs, Luma, or Care to compare different features, benefits, prices, and reviews of various travel insurance plans and providers for Vietnam.

- Check the coverage limits and exclusions. Make sure that the plan you choose covers you adequately for the risks you face in Vietnam. For example, if you plan to ride a motorbike in Vietnam, make sure that your plan covers motorbike accidents.

- Check the customer service and claims process. Make sure that your provider has a reliable and accessible customer service team that can assist you 24/7 in case of an emergency. Also check how easy and fast it is to file and settle a claim with your provider.

How to choose the best travel insurance in Vietnam ? ( Source: Internet )

Read more>>> Top 5 best Vietnamese traditional food

How to use travel insurance in Vietnam?

Using travel insurance in Vietnam is simple and straightforward if you follow these steps:

- Keep your policy documents and certificate of insurance handy at all times. You may need to show them at the airport or immigration checkpoints when entering or leaving Vietnam.

- Contact your provider or their assistance company as soon as possible if you encounter any emergency or problem during your trip. They will guide you on what to do next and how to access their network of medical providers or other services.

- Keep all receipts and evidence related to your claim. You may need to submit them along with a completed claim form to your provider within a certain time frame after your trip.

- Enjoy your trip with peace of mind knowing that you are covered by travel insurance in Vietnam.

Tips for using travel insurance ( Source: Internet )

Read more>>> Hanoi street food – Top 10 delicious dishes

How to buy travel insurance in Vietnam?

Buying travel insurance in Vietnam is easy and convenient with online platforms. You can follow these steps to buy travel insurance in Vietnam online:

- Visit one of the websites mentioned above or search for other reputable online travel insurance providers for Vietnam.

- Enter your personal details and travel information, such as your name, age, nationality, destination, duration, and purpose of travel.

- Choose the plan that suits your needs and budget from the options available.

- Review the policy details and terms and conditions carefully before confirming your purchase.

- Pay securely online with your credit card or other payment methods.

- Receive your policy documents and certificate of insurance instantly by email.

Capturing best moment with safe journey in Vietnam ( Source: Internet )

You can also choose to purchase travel insurance directly in your home country through travel companies. Additionally, if you have already arrived in Vietnam, you can consider buying it from providers like Liberty , Chubb , etc….

Read more>>> Top 5 best tours in Hanoi

To conclude, travel insurance is not mandatory when traveling to Vietnam, but considering its various uses and benefits, it’s something you should contemplate purchasing. With the information shared by Prime Travel above, it is hoped that it will give you a detailed understanding of this type of travel insurance.

Check out Prime Travel’s tours here:

Dinner with Locals

Authentic Vietnamese coffee workshop

Best of Vietnam from North to South

primetravel

Political Situation in Vietnam: Safety Tips for Travelers

Vietnam weather in december: a traveler’s guide to the best trip.

Leave a Reply: Cancel Reply

Save my name, email, and website in this browser for the next time I comment.

Please Sign In

You don't have permission to register.

- Tour packages

- Places to visit

- Tips & guide

Check out all the must-see places and things to do & see

The combination of fun and educational activities

Unique experience combined with top-notch services

Easy excursions combined with unique experience making the long-lasting romantic memories

Reveal off-the-beatentrack routes, least explored destinations, and unknown tribe groups

Explore the least visited destinations and unknown experience on foot

Explore every corners of the destination on two wheels

Easy excursion combined with week-long beach break

The combination of some must-see experience and the cruise tour along the mighty rivers

- Vietnam travel

- Tips & Guide

- Travel Insurance

Travel Insurance for Vietnam

- Best Time to Visit

- Tourist Visa Policy

- Getting Flight There

- Getting Around

- Vaccinations

- Internet & Phone

- Packing List

- Budget & Currency

- Buying & Bargaining

- Safety & Precautions

- Tipping Customs

- Local Etiquette

- Useful addresses

Do I need a travel insurance for Vietnam?

10 pocket tips for buying a good travel insurance, what do travel insurance plans cover, what is not covered by travel insurance, how often should i buy travel insurance, how to pick the right travel insurance plan, where can you buy a good travel insurance plan, how to buy a travel insurance plan, keep in mind, frequently asked questions.

Vietnam is a beautiful country with endless sandy beaches, breathtaking golden rice terraced fields, welcoming people, and never-fading rich culture. Millions of tourists visit the country every year.

If you are now preparing your packing list for Vietnam and wondering if you need a travel insurance for your journey or not. This article is for you.

We will help you learn from why you need a travel insurance or what risks you may encounter during your Vietnam trip , to how to buy the most suitable insurance plan for you and your family.

In this article, we aim to answer all the questions you may have regarding travel insurance for Vietnam.

First thing first, we will answer your most asked question.

The answer is a very loud YES!

Though not mandatory by the law, insurance is a must for Vietnam, as the cost of major medical treatment is prohibitive. A travel insurance policy to cover theft, loss and medical problems is the best bet.

Some insurance policies specifically exclude such ‘dangerous activities’ as riding motorbikes, diving and even trekking. Check that your policy covers an emergency evacuation in the event of serious injury.

If you're driving a vehicle, you need a Vietnamese insurance policy.

Traveling without an insurance plan is never a good idea, especially when you are traversing unfamiliar territory with rules and regulations that are different to what you know at home. Not only does an insurance plan help protect you against uncertain financial and health risks, but they also provide you with a peace of mind as you travel.

Accidents do happen and we cannot always prevent them, but if you are covered by insurance, you will not have to pay the full cost of a loss, which can come in mounting bills. And when it comes to peace of mind, this will not be just for you, but also for your loved ones back home.

You can check out some more information before reading further:

- Necessary vaccinations before traveling to Vietnam

- Vietnam safety and precautions

- Vietnam essential packing list for tourist

- Useful addresses in Vietnam

Below are some risks that you may encounter during your Vietnam trip

Travel scams

Scamming travelers is almost a national sport - be prepared for these common scams .

Hectic Traffic

Vietnamese traffic is legendary and city traffic is among the craziest in the world. Here are our travel tips for getting around Vietnam .

Tropical Diseases/Seasonal Illness

Due to tropical weather, poor healthcare system and poverty, it is not surprising to find a number of infectious diseases in Southeast Asia. This situation is now improving, however, be careful of malaria and dengue fever when you plan to travel to some rural areas on a Vietnam adventure tours .

Malaria can be found in the central highlands and some provinces in the south such as Bac Lieu and Ca Mau. There is no vaccine for this disease, thus, you should avoid getting bitten by mosquitoes. Mosquitoes usually live in humid, bushy, and dark places, so wear long pants in the evening and use mosquito spray during the daytime.

Try not to open the window when you sleep in your hotel or homestay in rural areas. Check if your guesthouse has a mosquito net or meshing on windows.

Thermal Shock

There are several exposures related to the weather in Vietnam . As an elongated country, the temperature changes significantly from the north to the south.

Therefore, sunburn and sunstroke will affect your health unless you wear sunscreen and other sun-protection items such as hats, sunglasses, and long-sleeve shirts. Do not participate in any outdoor activity at a sweltering noon.

Carry a bottle of water with you to avoid dehydration. Take yourselves time to rest if you travel to different regions in our country.

- The North possesses hot and humid summers (May – August) and cold winters (December – February) when the temperature may drop to 10 degrees Celsius. There may be snow in some northernmost points. Make sure you pack warm clothes if you plan an exploration in Northern Vietnam during winters.

- Central Vietnam is affected by storms between September and November, so make sure you plan your trip to this region during the period between January and August.

- The South experiences hot weather throughout the year and high rainfall from May to August.

Food allergy & safety

Vietnam is a threat to tourists with food allergies since many foods contain peanut and gluten. If you are allergic to a specific kind of foods (peanut, seafood, etc.), research the food in every destination. Inform your travel agent, tour guide, and restaurant so that we can arrange appropriate dishes for you.

Pack some medicines and carry your clinical record in case of emergency. There are many Western restaurants in major tourist destinations in Vietnam; and you can find fast food, pizza, and steakhouse on the way.

For those who travel to Vietnam in spring, pollen allergy is also a problem. The symptoms are sneezing, watery eyes, and runny nose. Moreover, to avoid allergic reactions, skip a Hanoi tour during autumn (October – November) since the milk flowers (hoa sua) may irritate your nose.

Another food-related risk is the safety standard.

Remember it is not safe to drink tap water in Vietnam. Buy bottled water or boil water using electric kettles at your hotels. Avoid using ice in case the water is not clean.

It will be a big regret if coming to Vietnam without sampling local specialties. Street food in Vietnam is such a bet; you should use your instinct to find restaurants with a large number of customers and acceptable hygiene standards.

Take some anti-diarrhea medicines with you. Look for some restaurants and skip every skeptical street stall or vendor.

Due to the hectic traffic, air pollution is a pressing issue in some major cities in Vietnam such as Hanoi and Ho Chi Minh City. If you have respiratory issues, purchase a medical mask while traveling around the cities during rush hour.

In case you want to stay away from metropolitan areas and seek for the bucolic countryside and natural landscapes, we have Mai Chau biking tours and Halong Bay Cruise for you.

Bites and Sting

You may be bitten by bed bugs, fleas, lice or scabies on dirty beds. If you stay in a local homestay, do not hesitate to tell the owner to change new bedclothes. Contact us for prestigious accommodations in Vietnam.

When visiting a rural area, avoid rabies caused by both wild and domestic animals. Don’t let your children play with dogs or cats. Stay away from the monkeys in Cat Ba Island on your Halong Bay day tour. Leeches are common in rice paddles, and you may find them on your farming tours to Vietnam’s countryside.

The best way to get rid of them is burning them with matches. Wear boots when trekking to jungles to avoid being bitten by poisonous snakes.

If you plan some activities such as swimming, snorkeling, and diving on a beach holiday in Vietnam, jellyfish, stingrays, scorpionfish, stonefish, and sea snakes are not your pleasant friends. Get out of the water immediately and ask the locals for vinegar to stop the stinging. Sharks do not like shallow and crowded beaches, so the probability that you see sharks in Vietnam is low.

1. Look beyond the costs

Cost should not be your only consideration when buying travel insurance. As a general rule, you should only consider policies that include $2 million for medical expenses, $1 million for personal liability, $3,000 for cancellation, $1,500 for baggage and $250 for cash.

Note that the level of excess you opt for – the part of the claim that you must meet before the insurer pays out – will affect your premium. Not all insurers allow you to adjust the excess, but the more you are prepared to pay, the lower your premium will be.

2. Consider annual cover vs single-trip

There are two main types of travel insurance – single-trip, which only covers one getaway, or annual multi-trip, which covers you for every trip you make over the course of a year.

A single-trip policy is best for people who will only go on one holiday in a 12-month period, and can cost as little as a few pounds. Annual policies can be a cheaper option if you know you’ll be going away several times in a year.

3. Family finances

If you are travelling with your partner and children, consider opting for family travel insurance – and check with your insurer to see if it will cover your children if they travel without you – on a school trip, for example.