JavaScript is required to use this site.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Nationwide Travel Insurance Review: Is it Worth The Cost?

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does Nationwide travel insurance cover?

What does nationwide travel insurance cost, what isn’t covered by nationwide travel insurance, can you buy a nationwide plan online, is nationwide travel insurance worth it.

Are you considering purchasing travel insurance for your next vacation? It could be a good idea, especially in an era of overbooked flights, travel delays and lost luggage. Insurance company Nationwide can sell you travel insurance, which will cover you in the event that things stray from the plan.

Let’s take a look at Nationwide travel insurance, the policies available and the benefits that they provide.

Nationwide offers two different travel insurance plans for its customers: an Essential option and a Prime version. As the name implies, Prime provides more coverage and is more expensive.

With the essential plan, you'll have benefits like trip cancellation or interruption, coverage for medical emergencies and a fixed fee for delayed/lost luggage. The prime plan includes missed connection reimbursement, and generally, a higher reimbursement amount per benefit.

» Learn more: Common myths about travel insurance and what it covers

To do a proper Nationwide travel insurance review, we input a search for a 28-year-old from Michigan traveling to France for three weeks on a $7,000 trip.

A quick Nationwide travel insurance review shows that you’ll see quite a few more benefits associated with the Prime plan, though neither option is especially cheap. Coverage areas that are missing from the Essential plan include missed connection reimbursement, itinerary change reimbursement and 24-hour AD&D insurance, though this last one can be added on.

The Essential plan also sees significant drops in the monetary reimbursement you can expect when things go awry. Despite being only 38% cheaper than the Prime plan, coverage is significantly stripped down. You can especially see this with baggage delay ($100 versus $600), lost baggage ($600 versus $2,000) and trip delay ($600 versus $2,000). Trip cancellation is basically the only coverage area that remains the same — 100% no matter which plan you choose.

» Learn more: How to find the best travel insurance

Additional options and add-ons

No review of Nationwide travel insurance would be complete without mentioning add-ons. Your available options will differ based on the plan you choose.

As you can see, the available options and their costs can range quite a bit. If you’re looking for maximum coverage, it’s easy to more than double the cost of your original quote.

The most expensive add-on is only available to Prime policyholders. Cancel For Any Reason insurance allows the ultimate in flexibility as it’ll refund you up to 75% in trip costs in the event you want to cancel your trip.

Those opting for an Essential plan can also choose to purchase 24-hour AD&D coverage, which comes included with the Prime policy. Doing so includes flight-only coverage for Essential plans, though strangely that’s considered an add-on for Prime.

Finally, rental car insurance is available regardless of which plan you pick, though you can receive more coverage with the higher-tier Prime policy.

Many different travel credit cards provide complimentary trip insurance when you use your card to pay. Check these before purchasing travel insurance.

» Learn more: The best travel credit cards right now

As nice as it would be to purchase fully comprehensive travel insurance, the truth is that nearly all policies have exclusions of some kind. This may mean that your policy won’t cover instances of COVID-19 or the decision to jump out of a plane.

Here are some general exclusions you can expect:

Accidental injury or sickness when traveling against the advice of a physician.

Participation in canyoning or canyoneering, extreme sports or bodily contact sports.

War or any act of war whether declared or not.

Exclusions vary based on the policy and where you live, so you’ll want to read your guide to benefits carefully to see what coverages apply to your policy.

» Learn more: Is there travel insurance that covers COVID quarantine?

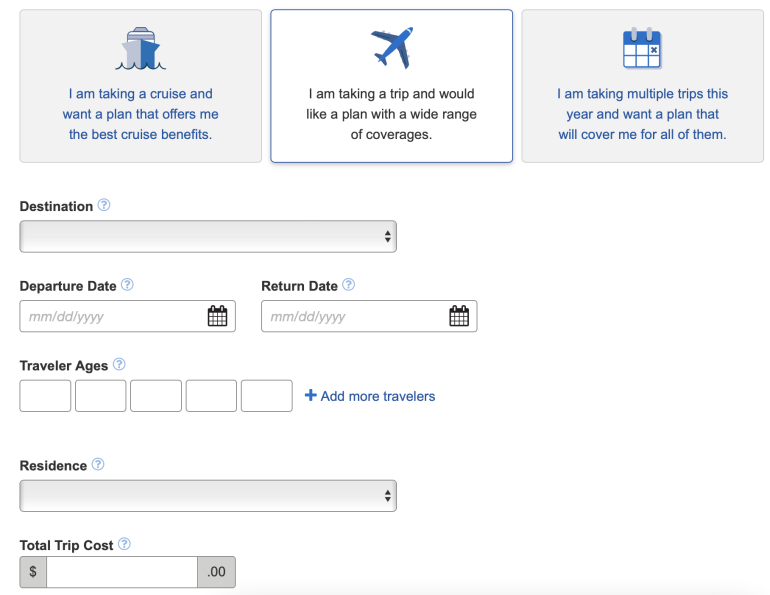

If this Nationwide essential travel insurance review has spurred you to make a decision, it’s simple to find a quote for yourself. You’ll need to navigate to Nationwide’s travel insurance page , where you’ll find a form asking for your personal information.

In addition to single-trip coverage, Nationwide also provides multi-trip plans and plans focused on cruises.

» Learn more: How much is travel insurance?

Nationwide has been in operation since 1925 and is a well-established insurance provider. They offer a range of insurance policies including car, motorcycle, homeowners, pet, farm, life and travel insurance. Nationwide's travel insurance policies can be purchased for cruises , single trips or multi-trips.

Nationwide travel insurance plans have various benefits including trip cancellation, interruption or delay, financial default, missed connection, itinerary change, Cancel For Any Reason (CFAR), medical emergencies, 24-hour accidental death and dismemberment (AD&D), pre-existing conditions exclusion and waiver, and baggage delay. Each policy is different, so you'll want to ensure you read the fine print to know your coverage.

Nationwide's essential plan does not cover Cancel For Any Reason. However, for an additional cost, you can add CFAR to Nationwide's Prime plan. With that coverage, you will be eligible for reimbursement of up to 75% of nonrefundable trip costs. Note that this must be added on within 21 days of your first trip payment.

If you need to submit a claim, you'll first call the CBP Claims Department at 888-490-7606. A representative will provide a claim form and a list of documents to submit. Claims can then be submitted via U.S. mail, fax or through email. Assuming your claim is reimbursable, you'll receive payment via direct deposit or a check.

Nationwide has been in operation since 1925 and is a well-established insurance provider. They offer a range of insurance policies including car, motorcycle, homeowners, pet, farm, life and travel insurance. Nationwide's travel insurance policies can be purchased for

, single trips or multi-trips.

Are you looking for strong coverage over a wide range of incidents? Nationwide could be a good travel insurance option for you, but only if you’re willing to shell out for its more expensive policy.

That being said, if you hold a travel credit card, odds are that you already have some form of complimentary travel insurance. You’ll want to check this first to see if those benefits are enough for your trip — if not, a Nationwide insurance policy could offer the coverage that you need.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Introduction to Nationwide Travel Insurance

- Coverage Options

- How to Purchase and Manage Your Policy

Nationwide Customer Reviews and Claims Experience

Compare nationwide travel insurance.

- Why You Should Trust Us

Nationwide Travel Insurance Review 2024: Comprehensive Review and Analysis

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate travel insurance products to write unbiased product reviews.

Nationwide has been around close to 100 years after being founded in 1926. The Ohio-based company has many different products in the insurance and finance space, including coverage for trips. Nationwide Travel Insurance policies are available for single or multiple trips and can cover cruise trips too.

Nationwide Travel Insurance Summary

Nationwide is one of the leading names in insurance across various areas of coverage including life, auto, and travel insurance. Nationwide's coverage is also as comprehensive as it is varied. It tops our list of the best travel insurance companies and best cruise travel insurance , also ranking among the best cheap travel insurance companies for the value it provides.

With single trip, multi trip, and cruise-specific policies along with an abundance of riders, there's a good chance Nationwide will have the coverage you're looking for.

That said, Nationwide lacks some of the niche coverage that other companies can provide. For example, Nationwide doesn't insure trips over 31-days long. Its annual travel insurance only applies to trips 30 days or under. Additionally, Nationwide lacks specific adventure sports coverage.

Ultimately, Nationwide is the company to beat. If you're shopping for something a little more specific, use Nationwide's quotes as your baseline as you search for something more tailored to your trip.

Coverage Options from Nationwide

Nationwide offers many of the standard benefits you might see with a travel insurance policy. This can include things like trip cancellation coverage, so you can recover pre-paid costs or trip interruption in the event your vacation is interrupted by an unexpected event. There's also baggage delay coverage and medical coverage.

The travel insurance policies offered by Nationwide are available to consumers and are divided up by the type of trip: single trip, multiple trips, or cruise coverage.

Single-trip travel insurance policies

Nationwide offers two single-trip travel insurance policies: the Essential plan and the Prime plan.

As the name suggests, Nationwide Essential travel insurance covers the basics. It offers some protection should anything happen ahead of your trip or while you're on your trip.

The Prime plan takes your coverage to the next level, with higher coverage limits and the option to add on the coveted cancel for any reason (CFAR) coverage at an extra cost.

Both plans include trip cancellation or interruption coverage in the event of terrorism in your destination city, travel assistance from Nationwide at no additional charge, and refunds with a 10-day review period (except in Washington and New York). Note that for baggage and personal effects coverage, there is a $500 combined maximum limit for valuable items (see your policy's terms and conditions for details on what's considered valuable). It also covers damaged or lost sports equipment.

Here's how the two plans stack up in terms of coverage limits. For trip delay coverage, you'll be eligible for reimbursement for delays of six hours or more.

Annual and multi-trip travel insurance policies

If you're looking for travel insurance coverage for more than one trip and want to cover your partner and children, the Travel Pro Plan may be an affordable option. It's important to note that this policy only covers events after departure, not pre-departure events. This policy could be as low as $59 as of the time of writing.

The Travel Plus Plan is another multi-trip policy from Nationwide that has flexible term limits for trip interruption and cancellation coverage, up to $10,000. This covers the gaps from the Travel Pro Plan, which only covers post-departure events. So if you needed to cancel the trip due to a covered illness or other reason, this is the plan for you.

If you want to increase the level of benefits for your after-departure coverage, the Travel Pro Deluxe Plan does just that. It builds on the Travel Pro Plan, hence the name, and includes higher coverage limits for just $20 more.

All plans include the same travel assistance from Nationwide that's included with the single-trip policies. Here's how the multiple-trip plans compare:

Cruise coverage

Nationwide offers three cruise travel insurance plans.

If you're going on a short cruise or going for the first time, the Universal Cruise Plan may be a good starting point if you want added protection and to recoup nonrefundable costs. Just make sure that you qualify based on your state, as cruise coverage isn't available in all states.

If you're going on a longer cruise and want added coverage to protect your trip, the Choice Cruise plan is an option to consider. And if you're looking for the most benefits and go on many cruises, the Luxury Cruise plan offers the most coverage options.

All three policies can be refunded with a 10-day review period, except in Washington and New York.

Here's a comparison of the coverage you'll get with Nationwide's three different cruise travel insurance policies:

Additional coverage options from Nationwide

Nationwide has a number of additional coverage options that can add more protection to your policy but also add to the cost as well. These include:

- Financial default coverage , in the event your travel supplier ends up in default or bankruptcy. This is available with the Essential and Prime single-trip policies.

- Pre-existing condition waiver, which may offer coverage for pre-existing illnesses or diseases if certain conditions are met. This is available with the Essential and Prime single-trip policies.

- Accidental death and dismemberment, which can have limits of $5,000, $10,000, $25,000 or $50,000 depending on the plan. This is available with the Essential and Prime single-trip policies.

- Accidental death for flights only, which can have limits of $100,000, $250,000, or $500,000. This is available with the Essential and Prime single-trip policies.

- Rental car collision or loss coverage, in the event something happens to your rental car, you can add on this coverage for up to $25,000 or $35,000 depending on the plan.This is available with the Essential and Prime single-trip policies (except in Texas or New York).

- Cancel for any reason (CFAR) , which must be added to a policy and is available through the single-trip Prime Plan, the Choice Cruise Plan, and the Luxury Cruise Plan.

Nationwide Travel Insurance Cost

The premium you pay will depend on various factors, including the age of the travelers, destination, and total trip costs. The average cost of travel insurance is 4% to 8% of your travel costs.

After inputting some personal information, such as your age and state of residence, along with your trip details, like travel dates, destination, and trip costs, you'll get an instant quote for Nationwide Insurance plans available for your trip. And from there, it's easy to compare each option based on your coverage needs and budget.

Now let's look at a few examples to estimate Nationwide coverage costs.

As of 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following travel insurance quotes:

- Essential: $89.55

- Prime: $129.19

Premiums for Nationwide Insurance plans are between 3% and 4.3% of the trip's cost, well within the average cost of travel insurance.

Nationwide insurance provides the following quotes for a 30-year-old traveler from California heading to Japan for two weeks on a $4,000 trip:

- Essential: $113.01

- Prime: $160.47

Once again, premiums for Nationwide plans are between 2.8% and 4% of the trip's cost, within and below the expected range of travel insurance costs.

A Texas family consisting of two 40-year-old parents with a 10-year-old and 4-year-old on a two-week trip to Australia for $20,000:

- Essential: $571.62

- Prime: $801.94

Nationwide plans cost between 2.8% and 4% of the trip's cost, below and within the average cost of travel insurance.

A 65-year-old couple looking to escape New Jersey for Mexico for two weeks with a trip cost of $6,000 would have the following quotes:

- Essential: $248.56

- Prime: $352.44

Premiums for Nationwide plans are between 4.1% and 5.9%, which is well the average cost for travel insurance. While its certainly more expensive than coverage for younger travelers, it's on the lower end of what travel insurance companies tend to quote for older travelers.

Nationwide Annual Travel Insurance Cost

Quotes from Nationwide's annual travel insurance plans don't actually change based on age or state. You'll get a base quote of $69, which will vary based on how much trip cancellation coverage you'd like to purchase. Prices range from $155 to $729

You can also select a Pro Delux upgrade, which will cost an additional $20.

How to Purchase and Manage Your Nationwide Policy

To purchase a Nationwide travel insurance policy, you first need to obtain a quote from Nationwide's website. You should be prepared to provide the following:

- Destination

- Departure date

- Return date

- State of Residence

- Total trip cost

- Initial trip payment date

When you select a plan, be sure to also take a moment and scroll through the optional add-ons, such as rental car coverage.

How to File a Claim with Nationwide

If you purchased travel insurance through Nationwide and need to file a claim, you can contact a Nationwide representative. You have seven days from the start of the issue that caused loss to notify Nationwide of your claim.

Claims through Nationwide are handled by Co-ordinated Benefit Plans, LLC. You can use its claims portal or call a representative, based on your type of policy.

Single trip policy phone number: 888-490-7606

Annual plan policy phone number: 866-281-1017

Cruise policy phone number : 866-281-0334

Rather reach out via email? You can contact Nationwide via [email protected].

If you need to send documents via mail, the mailing address is:

Co-ordinated Benefit Plans, LLC

On Behalf of Nationwide Mutual Insurance

Company and Affiliated Companies

P.O. Box 26222 Tampa, FL 33623

Nationwide refrains from promising a specific response time frame. However, customers have reported waiting several weeks before hearing any updates.

Since Nationwide offers such a wide breadth of insurance types, it's difficult to separate its travel-specific customer reviews from reviews on its other products. It received an average of 1.16 stars out of five across over 340 reviews on its BBB page, though most customers are writing about experiences with Nationwide's auto and health insurance.

On SquareMouth, a travel insurance-specific aggregator, Nationwide has an average of 4.01 stars across 570 reviews. Reviewers reported unresponsive a claims team and long wait times. Additionally, while insurance companies often engage directly with customer reviews on SquareMouth, Nationwide doesn't respond to customer reviews.

Learn more about how Nationwide Travel Insurance compares against the competition.

Nationwide Travel Insurance vs. Allianz Travel Insurance

Much like Nationwide, Allianz Travel Insurance insurance offers many different types of insurance coverage. While the company may be most well known for auto insurance, it offers travel insurance as well and has eight options. Allianz Travel Insurance, a major player in the travel insurance space, has 10 options listed.

Allianz Travel Insurance may offer higher coverage limits for the policies offered and have a streamlined process for filing a claim online. Where Nationwide wins out is the fact that you can add cancel for any reason (CFAR) for an added cost, whereas CFAR coverage isn't available when purchasing an online policy via Allianz Travel Insurance.

Read our Allianz Travel Insurance review here.

Nationwide Travel Insurance vs. John Hancock Travel Insurance

John Hancock Travel Insurance is similar to Nationwide in that it provides a wide range of insurance offerings and financial services. One of those offerings is travel insurance. John Hancock travel insurance offers travel insurance through Bronze, Silver, and Gold policies.

When comparing policies, the budget option may be slightly more affordable with Nationwide. However, mid-tier and higher coverage options may be more affordable with John Hancock travel insurance. It depends on your policy, trip details, and age. One good thing is that you can add cancel for any reason (CFAR) coverage under all John Hancock travel insurance plan options.

Read our John Hancock Travel Insurance review here.

Nationwide vs. credit card travel coverage

Rewards credit cards come chock full of benefits for cardholders, some of which they might be unaware of. One such perk can be travel interruption or cancellation coverage as well as rental car coverage. Credit cards may have sufficient coverage for quick trips. However, if you want the peace of mind of having solid medical coverage or higher limits, going the traditional travel insurance route may be a better fit.

For frequent travelers, credit card travel protection may be appealing as the coverage is constant. If you're looking for a comparable travel insurance plan with more comprehensive coverage, some companies offer annual travel insurance.

You can find our guide on the best credit cards with travel insurance here.

Nationwide Travel Insurance Frequently Asked Questions

Nationwide's travel insurance offers very comprehensive coverage, including trip cancellation, interruption, medical emergencies, and baggage loss.

Yes, Nationwide allows the purchase of travel insurance up to a day before your departure. It doesn't offer plans for trips already in progress.

Nationwide covers COVID-19 like any other illness, covering trip cancellations with proof of a positive test and covering emergency medical expenses.

Nationwide single trip plans cover pre-existing conditions as long as you purchase the Essential plan within 10 days of your trip deposit and the Prime plan within 21 days of your trip deposit. The annual plan doesn't cover pre-existing conditions, with a 60-day look-back period.

Nationwide is known for its reliable customer service, wide range of coverage options, and the ability to tailor policies with various add-ons, setting them apart from many competitors.

Why You Should Trust Us: How We Reviewed Nationwide Travel Insurance

For our review of Nationwide, we looked at the leading travel insurance providers and compared the amount of options provided, coverage limits, cost, customer service options, and flexibility.

Nationwide is a top contender for cruise-related travel insurance policies and stands out for having cancel for any reason (CFAR) coverage, though it's not available with every policy and comes with an extra cost. To find the best travel insurance policy for you, review various providers and compare quotes before buying a policy.

Read more about how Business Insider rates travel insurance companies here.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Search Please fill out this field.

- Newsletters

- Trip Planning

- Safety & Insurance

Nationwide Travel Insurance: The Complete Guide

:max_bytes(150000):strip_icc():format(webp)/joecortez_headshot-56a97f185f9b58b7d0fbf9ac.jpg)

Digital Vision / Getty Images

About Nationwide Travel Insurance

Already one of the biggest names in insurance, Nationwide Travel Insurance is one part of Nationwide Mutual Insurance Company. As a whole, the Columbus, Ohio-based insurance giant started in 1925 , when the Ohio Farm Bureau Federation incorporated the Farm Bureau Mutual Automobile Insurance Company. The insurer officially changed its name to Nationwide in 1955, after expanding service to 32 states and the District of Columbia. Today, Nationwide offers more than just insurance – their divisions include a bank, a financial services company, a farmland insurance company and even a pet insurance brand.

Compared to other companies, Nationwide is a relatively new travel insurance provider. The company began offering their travel insurance products on InsureMyTrip.com in 2015, and expanded to Squaremouth.com in 2018. Currently, the insurance company focuses on three types of products: cruise travel insurance , single trip travel insurance, and annual travel insurance .

How is Nationwide Travel Insurance rated?

As one of America’s oldest insurance companies, Nationwide has a solid reputation for their financial stability and commitment to policy holders. All travel insurance policies are underwritten by Nationwide Mutual Insurance Company, which has an A+ Superior rating from A.M. Best in the financial size category of $2 billion or greater. The company also holds an A+ rating with the Better Business Bureau , with a composite customer review score of one star (out of five).

In the travel insurance marketplaces, InsureMyTrip.com gives Nationwide an average score of 4.5 stars (out of five) for their cruise travel insurance and single trip travel insurance products. At Squaremouth.com , Nationwide has earned a rating of 4.04 out of five stars, and has sold over 5,783 policies since January 2018.

What travel insurance products are available from Nationwide?

Nationwide Travel Insurance primarily focuses on three travel insurance products: cruise trip insurance , single trip insurance , and annual trip insurance . The company also offers two student education plans, which are available through InsureMyTrip.com : Academic Explorer All Inclusive Domestic and Academic Explorer All Inclusive International.

Please note: all schedules of benefits are subject to change. For the most up-to-date coverage information, contact Nationwide Travel Insurance.

Nationwide Cruise Travel Insurance

Universal Cruise Plan: Nationwide is among the few travel insurance companies to provide an independent cruise-only travel insurance plan. At the lowest end, the Universal Cruise Plan covers many of the basic situations that can go wrong while embarked at sea.

- Like traditional travel insurance plans, the Universal Cruise Plan covers a maximum trip cancellation benefit of 100 percent of non-refundable trip costs and a trip interruption maximum benefit of 125 percent of non-refundable trip costs. Covered reasons for trip cancellation or trip interruption include weather, extension of a school operating session, work-related issues, or an act of terrorism in the itinerary city.

- This plan differs from a traditional travel insurance plan by offering an Interruption for Any Reason benefit, which reimburses transportation change costs up to $250. Missed connections that cause a delay of over three hours or trip delays of over six hours are also covered, with a maximum benefit of $500 for each type of incident.

- Should you get ill or injured on the ship, this plan offers up to $75,000 of both emergency accident and sickness medical expense coverage. It is important to note that this is secondary coverage, not primary coverage. This means that all other insurance, including policies from a credit card must be depleted before the Nationwide insurance plan will cover claims. The plan also offers up to $750 of emergency dental expense coverage and up to $250,000 of emergency medical evacuation coverage.

- If your bags are delayed or lost , Nationwide’s Universal Cruise Plan can help. If your bags are delayed by more than eight hours, the baggage delay benefit will cover up to $250 in qualifying expenses. If your luggage is outright lost or stolen, the insurance plan offers a maximum of $1,500 in payouts, including a maximum of $600 for special items and a $300 per article limit.

- Finally, unplanned itinerary changes are also covered under this plan. If a port of call is changed prior to departure, this plan offers a maximum of $500 in coverage. If a covered issue impacts your cruise experience, like a fire or mechanical issue, you could qualify for up to $100 in coverage. These two specific benefits are not available to residents of Florida, Minnesota, Missouri, New Hampshire, Oregon, Pennsylvania, Virginia, or Washington state.

- As a third-party travel insurance plan covering a cruise, Nationwide’s Universal Cruise Plan is a frugal purchase with lots of benefits. For a 34-year-old male traveling on a $1,500 four-day cruise from North Carolina sailing to the Bahamas, we were quoted a price of $51.45, but your insurance quote and benefits may vary based on age, location, trip price, trip length, cruise line and destination.

- See the sample certificate of coverage

Choice Cruise Plan: While the Choice Cruise Plan introduces new benefits, including the pre-existing condition waiver, non-medical evacuation and accidental death and dismemberment coverage, the primary advantage over the basic Universal Cruise Plan is the higher maximum benefits.

- For those concerned about a pre-existing condition , this plan offers a waiver if it is purchased prior to the final trip payment and all eligibility requirements are met. The additional accidental death and dismemberment benefit offers up to $25,000 of coverage in the event of an emergency causing the loss of life or limb. If a non-medical evacuation from the ship is required, this plan offers a maximum of $25,000 of coverage.

- Like the Universal Cruise Plan, the Choice Cruise Plan offers a maximum of 100 percent trip cancellation coverage of non-refundable trip costs. The plan also offers a 150 percent maximum of non-refundable trip costs for trip interruption, an increase of 25 percent. The plan may pay up to $500 towards transportation change cost reimbursement under the interruption for any reason benefit, if eligibility requirements are met.

- If you miss a connection which causes a delay of more than three hours, the plan offers up to $1,500 in coverage for lost events or costs incurred. If your trip is delayed by over six hours, the trip delay benefits can reimburse up to $750 of incidental costs.

- Emergency accident and sickness medical expense benefits are increased to a maximum of $100,000 of secondary coverage, meaning other insurance plans must be exhausted before this plan will pay for coverage. Emergency medical evacuation coverage is increased to a maximum of $500,000, and emergency dental expense is a maximum of $750.

- For those concerned about their luggage getting lost or stolen, this plan offers increased maximums from the Universal Cruise Plan. If baggage is delayed by eight hours or more, this plan offers a maximum baggage delay reimbursement of $500 towards incidental costs. Baggage that is lost or stolen is covered to a maximum of $2,500, with a special item maximum of $600 and a limit of $300 per article. The plan also offers itinerary change coverage: a maximum of $750 for ports of call change prior to departure, $200 maximum for fire, mechanical, or other covered issue affecting your cruise experience after departure and $500 maximum for an itinerary change after departure that causes you to miss a pre-paid shore excursion . Again, changes to the ports of call and cruise experience impact coverage are not available to residents of Florida, Minnesota, Missouri, New Hampshire, Oregon, Pennsylvania, Virginia, or Washington state.

- The Choice Cruise Plan is also the first to offer the Cancel for Any Reason benefit , which allows travelers to recover up to 70 percent of non-refundable trip costs if you decide not to take your cruise after all. The Cancel For Any Reason option is an additional purchase, priced based on your quoted rate.

- Compared to the Universal Cruise Plan, the Choice Cruise plan is equally as economic as the lower plan but with more benefits. When we quoted the same trip above for the Choice Cruise Plan, we saw only an 8 percent price increase for more maximum allowances. At the price point, it could make more sense to purchase the Choice Cruise Plan to ensure you get a higher level of coverage for almost the same price.

Luxury Cruise Plan: If you are planning an expensive, once-in-a-lifetime cruise, then you may definitely want to consider the Luxury Cruise Plan.

- Offering the highest level of coverage, the Luxury Cruise Plan increases all of the maximum coverage levels, helping you retain the most peace of mind on your trip.

- Like the Choice Cruise Plan, the Luxury Cruise Plan offers a maximum 100 percent trip cancellation benefit for non-refundable trip costs, as well as a maximum 150 percent trip interruption benefit for non-refundable trip costs. The interruption for any reason benefit is increased to $1,000 to cover transportation costs if eligibility requirements are met.

- If your trip is delayed by three hours or more from a missed connection, this insurance plan can cover up to $2,500 of costs. If your trip is otherwise delayed, the Luxury Cruise Plan can reimburse up to $1,000 in costs if you are delayed for more than six hours.

- Emergency accident and emergency sickness medical expenses are still secondary coverage, but provide a large safety net for cruise travelers. Should you fall ill or have an accident, this plan offers a maximum coverage limit of $150,000. If emergency medical evacuation is required, this plan can cover up to $1 million in costs. The emergency dental expense is also increased to a maximum of $750, but accidental death and dismemberment coverage still maxes out at $25,000.

- As with the Choice Cruise Plan, this travel insurance plan offers a $25,000 non-medical evacuation benefit, along with coverage for lost and stolen luggage or delayed baggage. The plan also includes a pre-existing condition waiver if your plan is purchased prior to final trip payment and all eligibility requirements are met.

- Using the same itinerary for the Universal Cruise Plan, this high-end plan is priced significantly higher than both lower plans. Compared to the Universal Cruise Plan, prepare to pay nearly 50 percent more for the best benefits offered on a cruise ship by Nationwide.

Nationwide Single-Trip Insurance

Essential Plan : Travelers who are not going to be on a cruise ship but still want a high level of protection may want to consider purchasing a Nationwide Single-Trip insurance plan instead. The Single-Trip Essential plan balances benefits with additional buy-ups in order to build the best protection for your trip.

- At the base level, this plans offers a maximum $10,000 benefit for trip cancellation, which will cover pre-paid, non-refundable trip costs if you are forced to cancel for a qualified reason. If your trip is interrupted early, this plan offers a reimbursement benefit of up to 125 percent of insured trip costs, with a maximum of $12,500. Should your trip be delayed for a covered reason by at least six hours, this plan offers a $150 per day trip delay benefit, with a maximum benefit of $600. Luggage delay benefits offer up to $100 of coverage for incidental costs if your luggage gets lost for more than 12 hours.

- If your bags are lost or stolen during your trip, the Single-Trip Essential Plan offers up to $600 of travel insurance benefits. Individual articles are limited to $250 maximum, while valuable items are capped at a combined total of $500.

- As a basic plan, Nationwide’s Single-Trip Essential Plan also offers coverage for emergency accidents and illness while abroad. The accident and sickness medical expense benefit offers up to $75,000 of secondary coverage, meaning all other collectible insurance must be paid up to its limits before this plan will pay benefits. Emergency dental coverage is capped to $500 and is included in the medical expense coverage, while emergency medical evacuation or repatriation of remains benefits are limited up to $250,000.

- Nationwide’s plan is unique in that it extends trip cancellation or trip interruption coverage due to an act of terrorism in an itinerary city. Should you decide to cancel your trip due to an act of terrorism, you may be able to receive benefit payments. If you buy your plan within 10 days of your initial trip deposit, you will also be covered for trip cancellation and interruption due to common carrier financial default and receive the pre-existing condition waiver benefit. Additional coverages you can purchase in this plan includes accidental death and dismemberment, accidental death during a flight, and rental car collision or loss coverage.

- When we requested a quote for a 34-year-old traveler going to Germany on a $1,500 trip, Nationwide priced our plan at $45.27, which is a competitive price for travel insurance. Your price will vary based on your age, destination, trip price, travel dates and any additional options you may choose.

Prime Plan : As the premier plan offered by Nationwide for a single trip, the Single-Trip Prime Plan offers the highest coverage levels and the most add-on options.

- Prime is the only single trip travel insurance plan to feature a Cancel for Any Reason benefit, along with add-ons for accidental death and dismemberment, flight-only accidental death and dismemberment and rental car collision/loss coverage.

- The trip cancellation benefit is increased to $30,000 and is limited to prepaid, non-refundable trip costs. If you decide to purchase additional Cancel for Any Reason coverage within 21 days of your initial trip payment, you can recover up to 75 percent of your non-refundable trip costs. Cancel for Any Reason benefits are not available to those in New Hampshire, New York, or Washington state.

- The trip interruption benefit is also increased to up to 200 percent of your non-refundable tour costs, with a maximum of $60,000. If your trip is delayed by at least six hours, you could also qualify for trip delay benefits of up to $250 per day. Trip delay is limited to a maximum benefit of $1,500. This plan also offers a missed connection or itinerary change benefit of up to $500.

- If your bags are delayed or lost, the Prime Plan may cover you. The baggage delay benefit can reimburse up to $600 of incidental expenses if you are delayed by 12 hours or more. If your bags are lost or stolen, the baggage and personal effects benefits offers maximum coverage of $2,000, including a $250 per article limit and $500 maximum for valuable items.

- As with the Essential Plan, the Nationwide Single-Trip Prime Plan offers emergency accidental and sickness medical expense coverage. In an emergency, this plan offers a maximum secondary benefit of $150,000 if all expenses are covered during your trip. Included in the medical expense coverage is a maximum emergency dental benefit of $750. If you need emergency medical evacuation or your remains must be repatriated, the maximum benefit is $1 million.

- By purchasing your plan within 21 days of your initial trip payment, you also qualify for two additional benefits: trip cancellation and trip delay due to financial default and the pre-existing condition waiver benefit. These two benefits can only be accessed through early purchase. If you might add additional costs to your trip later, still purchase your insurance early because you can always add more coverage later.

- Because this travel insurance plan offers a lot more coverage, it also comes with a higher price tag. When we priced out our trip, the cost was almost double that of the Essential Plan.

What is excluded from Nationwide Travel Insurance?

All travel insurance plans have key exclusions. Before you file a claim, it’s important to know what situations are excluded from Nationwide plans. Exclusions on these plans include:

- War, Invasion, acts of foreign enemies, or civil war: If a war breaks out while in your destination country , don’t count on Nationwide Travel Insurance to pay out benefits. Any acts of war are specifically excluded from your travel insurance plan.

- Participation in underwater activities: Although deep sea diving and spelunking may sound tempting, injuries or death resulting from underwater activities are not covered under this plan. But recreational swimming is covered, so don’t be afraid to get in the water.

- Piloting an aircraft: Regardless of your status or experience as a pilot, operating an aircraft is not covered by Nationwide Travel Insurance plans. This includes actual piloting, learning to pilot, or acting as an aircraft crew member.

- Participation in hazardous activities or bodily contact sports: Much like other travel insurance plans , participating in activities such as rock climbing, hang gliding, rugby, or rodeo are not covered by Nationwide Travel Insurance. Nationwide Travel Insurance does not offer a hazardous activity add-on benefit, so you shouldn’t participate in hazardous activities while covered by these plans.

- Accidental injury or sickness when traveling against a doctor’s advice: If a doctor says you shouldn’t travel, it may be in your best interests to follow their advice. Should you get injured or ill, Nationwide Travel Insurance will not cover your treatment costs as a result.

- Confinement or treatment in a government hospital: Voluntary or not, receiving care in a government hospital is not covered under your travel insurance plan. But in some situations, the United States Government could seek claim payment for treatment.

- Pregnancy and childbirth: As with most travel insurance plans, pregnancy and childbirth is not covered. However, should you experience complications from either, those may be covered by your trip insurance.

- Services not shown as covered: Simply put: if it’s not on your travel insurance certificate of coverage, it isn’t covered.

Please note that this is not a comprehensive list of all exclusions. Before filing a claim, be sure to refer to your certificate of coverage to see all exclusions.

How do I file a claim with Nationwide Travel Insurance?

Nationwide Travel Insurance does not allow you to file a claim online, nor do they allow you to access the required claim forms online. Instead, if you need to file a claim, you must first contact Co-ordinated Benefit Plans, LLC, who processes the claims on behalf of Nationwide. The number you will call will depend on which plan you purchased and can be found on the Nationwide website .

When you call, a customer service agent will help determine if your situation may be covered under your plan and will forward claim forms you will need to return. When completing your claim, be sure to submit supporting documentation, including receipts, doctor’s reports, or time-stamped lost luggage claims with your common carrier. A claims adjuster will then determine if your situation qualifies for payment under the policy.

Some situations, like doctor or facility referrals, may be handled through Nationwide’s 24/7 travel assistance partner, On Call international. Contact phone numbers, both toll-free and collect, are available on Nationwide’s website.

Who are Nationwide Travel Insurance products best for?

Hands down, Nationwide offers the best travel insurance products for those embarking on a cruise. Because of their specialized attention to the needs of cruise travelers, their three cruise insurance plans provide an increased level of care that many others can’t provide. If you are planning a cruise and are concerned about the worst that could happen, you should definitely consider Nationwide’s cruise insurance plans ahead of plans offered by the cruise lines.

The single trip plans are comparable to many other plans, but the costs do not necessarily equate to the level of coverage you are receiving. In addition, the medical coverage offered by the plans are secondary, which could be okay if you don’t have any other medical insurance available. Before you decide to purchase a single-trip plan, be sure to weigh all your options: filing an emergency medical claim may require you to exhaust any options available through credit cards or other sources first.

Related Articles

More related articles.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Nationwide Travel Insurance Review — Is It Worth It?

News Managing Editor

195 Published Articles 126 Edited Articles

Countries Visited: 197 U.S. States Visited: 50

Jessica Merritt

Editor & Content Contributor

105 Published Articles 544 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Stella Shon

Senior Features Editor

118 Published Articles 805 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Table of Contents

Why purchase travel insurance, travel insurance and the covid-19 virus, types of policies available with nationwide, how to obtain a quote, how nationwide compares — summary, how to file a claim with nationwide travel insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

If you’re looking at travel insurance policies, you may feel overwhelmed by the seemingly endless number of options. Some of the names of insurance providers will sound familiar; others you’ve likely never heard of. If you’re wondering about the first step for narrowing down your options, choosing a well-known name like Nationwide could be a good start.

Nationwide began in Ohio as Farm Bureau Mutual Automobile Insurance Company, selling its first policy (automobile insurance) in 1926. Thus, the company has nearly a century of insurance experience. It’s a household name at this point, meaning you can trust that it knows how to process claims should you need to submit one and isn’t likely to give you the headaches of a company that just started and needs to work out a few kinks. Nationwide and its subsidiaries have “Superior” financial ratings from A.M. Best. ¹

Now that we’ve established Nationwide as a quality travel insurance provider, let’s see if what it provides works for your trip and your budget.

Travel insurance , as with other types of insurance, protects your investment (read: money) from loss because of unforeseen circumstances. The more money that’s at risk, the more it makes sense to protect it with an insurance policy.

Travel insurance can protect more than your money, though. It can provide medical coverage in case of an accident or illness while you’re away from home.

The following are some of the reasons you may want to buy travel insurance:

- Your existing healthcare coverage won’t cover you at your destination or for some of the activities you’ll be doing.

- Your trip involves costly, nonrefundable deposits or prepayments that you would lose if the trip were canceled at the last minute .

- Health care at your intended destination may not be sufficient, and you might need evacuation (which is costly) if you become ill or injured.

- Your trip involves multiple destinations or forms of transportation, creating additional chances for a missed connection or delay.

Travel insurance isn’t always necessary. However, getting a travel insurance policy is smart if you’ve invested significant money or are worried about medical coverage during your trip.

As nearly all destinations worldwide have been affected by COVID-19, Nationwide says canceling a trip for “ general concerns related to potential COVID-19 exposure is not generally covered under our travel protection plans.”

However, specific plan terms and reasons for trip cancellation/delay will be evaluated on a case-by-case basis for every claim. That’s because certain elements of your travel insurance plan “may provide coverage if you have been diagnosed with COVID-19, are under quarantine or are traveling to a destination that is currently under a CDC travel restriction.”

Rather than canceling a trip, postponing it due to COVID-19 is another option. Your plan may be extended to cover your new trip dates if your travel is no more than 18 months from the original dates and if you pay the difference in fare (if any) for the adjusted plan.

Cancel for Any Reason (CFAR) coverage , added at the time you purchased your plan, may provide certain benefits if you cancel a trip due to COVID-19 concerns. However, this may not result in a 100% refund for all losses you incur. Nationwide says CFAR means “you may be covered for a percentage of the loss in the form of a credit or refund based on the terms of your specific plan.”

A few other situations are worth considering as well:

- If you test positive or are sick because of COVID-19, proof of this and a doctor’s note stating you’re medically unable to travel (or proof of quarantine requirements) should be sufficient for trip cancellation coverage.

- If your plan includes medical expense coverage, this benefit should apply if you become sick with COVID-19 during a trip.

- If you are forced to quarantine, your plan should remain in effect until the quarantine ends. And trip cancellation, interruption, or medical expense benefits should apply.

Nationwide offers 3 main tips of travel insurance plans: single-trip, cruise, and multi-trip.

Single-Trip Plans

There are 2 types of single-trip plans : Essential and Prime . The Prime Plan has higher coverage limits in nearly every category. Note which coverage types are secondary in the following comparison.

Cruise Plans

There are 3 types of plans available for cruisers : Universal , Choice , and Luxury . In addition to typical travel insurance inclusions, these plans have coverage for altered itineraries and even missed shore excursions due to altered itineraries.

Annual/Multi-Trip Insurance Policies

There are 3 types of annual insurance policies available: Pro, Plus, and Pro Deluxe. Interestingly, only the Plus plan includes an option for trip cancellation . The other 2 plans don’t offer this.

These plans include a $7 nonrefundable processing fee and aren’t available to residents of AK, CA, MT, or SC, or those 81+ years old. Plans must start in or include a stop in the U.S. and must be 30 days or less in duration.

To get a quote, head to the Nationwide travel insurance page and click on Get started .

The next page will ask you what type of plan you need.

Once you choose a plan type, you’ll provide information about the traveler(s) age(s), state of residence, and total trip cost . You’ll also include a date for the initial deposit and intended final payment date for your trip. For cruise and single-trip plans, you’ll also include a destination and dates of travel. Cruise trips also ask what line you’re sailing with.

The next page will show available plan options and let you compare them for coverage maximums and inclusions.

If you click on the text for a coverage amount in the chart, a pop-up window shows details. Here’s the description for the optional add-on for Cancel for Any Reason (CFAR) coverage.

Once you choose a plan, click on Buy this plan at the top, near the cost. On the next page, you’ll need to agree to certain disclosures and provide the names, birth dates, and contact information for the insured travelers.

If the detailed traveler information you provide doesn’t match what you originally included when obtaining the quote, the price may change. If that happens, you’ll see a message stating so at the top of the final payment page.

On this final page, you’ll provide your billing address and credit card number to complete the payment.

Nationwide vs. Credit Card Travel Insurance

It’s possible that you have a credit card with travel insurance . This type of coverage may be sufficient for small, simple, or inexpensive trips, but it doesn’t offer everything that a comprehensive travel insurance policy covers when it comes to more complex itineraries.

For comparison, we’ll put Nationwide’s best policy side-by-side with 2 premium credit cards with robust insurance coverage: The Platinum Card ® from American Express and the Chase Sapphire Reserve ® . Before we get started, note that enrollment may be required for some of the Amex benefits described below and, unlike typical credit cards, the Amex Platinum card allows you to carry a balance for certain charges, but not all.

And while you’ll pay to get a separate travel insurance policy, there’s no fee for the insurance perks built into these credit cards. They come as part of the cards’ annual fees.

At first glance, it looks like these credit cards provide robust coverage. However, some of these coverage items are secondary, meaning you’d need to deal with other insurance providers first, such as your homeowner’s insurance or personal vehicle insurance, and then deal with your credit card’s insurance provider for any expenses not yet reimbursed or to cover the deductible on other policies. Having your car insurance rates go up because of a claim related to your vacation could be frustrating. Travel insurance policies, as primary coverage, mean you would deal with the travel insurance provider first.

Nationwide’s Prime Plan provides more robust travel insurance coverage in several key areas : trip cancellation, trip interruption, emergency medical, and emergency evacuation.

Nationwide vs. Other Travel Insurance Companies

To compare Nationwide to other travel insurance companies, we obtained a quote for a couple, ages 38 and 36, traveling to Mexico for a 1-week trip that costs $2,000 (with the original payment made today). Note that the costs you see for a policy can vary, based on factors like age, trip cost, number of people covered, and where you reside.

We started our search with Squaremouth , a travel insurance comparison website analyzing numerous policies to help you find the right one. We listed a departure date 3 months in advance, an original deposit date the same day, and the state of residence as Arizona.

All 3 plans include COVID-19 coverage and 100% trip cancellation coverage. Nationwide’s travel insurance Prime Plan had the middle cost of the 3 options, yet it includes the best trip interruption level (200%, rather than 150% or 125% for the others). Nationwide also has the best coverage for financial default: 10 days wait, rather than 14 with Seven Corners Trip Protection Choice and no coverage with Generali Global Assistance Travel Insurance Standard.

Lastly, Nationwide has better coverage than Seven Corners for hurricane and weather, but the best coverage includes delays of “any time” with Generali — which also has the cheapest plan.

You can file a Nationwide claim online . Under File a personal insurance claim , find the button for File a claim .

The next page outlines the process for filing a claim, including the basic information you’ll provide, uploading documents, and then reviewing before submission.

Nationwide is a household name in insurance, and it offers multiple types of travel insurance to cater to different needs. While it doesn’t offer extreme sports-focused plans or numerous additional add-ons to customize everything you want, plans cover most of what you’re looking for when choosing a single-trip, multi-trip, or cruise-focused plan.

Within each plan type, you can choose different levels to save money with common coverage amounts or pay more to increase the maximum payout limits. This can be handy if you’re traveling to remote areas, have an increased risk of injury or illness during your trip, or have expensive items in your luggage.

Travel insurance options can feel countless. Ensure you check multiple plan types and coverage levels — as well as competing insurance companies — to find the plan that fits your needs and your budget.

For the baggage insurance plan benefit of the Amex Platinum card, baggage insurance plan coverage can be in effect for covered persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an eligible card. Coverage can be provided for up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage, in excess of coverage provided by the common carrier. The coverage is also subject to a $3,000 aggregate limit per covered trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each covered person with a $10,000 aggregate maximum for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

For the car rental loss and damage insurance benefit of the Amex Platinum card, car rental loss and damage insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the commercial car rental company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

For the premium global assist hotline benefit of the Amex Platinum card, eligibility and benefit level varies by Card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. If approved and coordinated by premium global assist hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, card members may be responsible for the costs charged by third-party service providers.

For the trip delay insurance benefit of the Amex Platinum card, up to $500 per covered trip that is delayed for more than 6 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the trip cancellation and interruption insurance benefit of the Amex Platinum card, the maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For rates and fees of The Platinum Card ® from American Express, click here .

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Nationwide Insurance

Learn about travel insurance plans offered through Nationwide and how they compare.

Offers single-trip coverage, annual plans and coverage for cruises

Robust limits for emergency medical expenses and medical evacuation

Can purchase preexisting medical conditions waiver with some plans

10-day review period available

Cancel for any reason (CFAR) coverage available with some plans

Coverage may be more expensive than competitors

Baggage delay coverage for individual trips requires 12-plus hour delay

What Nationwide Travel Insurance Is Known For

Nationwide Insurance is unique among other top travel insurance providers since the company offers so many other types of insurance. For example, consumers can turn to Nationwide for homeowners insurance, auto coverage and renters insurance in addition to travel insurance protection.

The company's travel insurance offerings stand out for their generous limits for emergency medical expenses, which start at $75,000 for the single-trip Essential Plan. The higher-tier Prime Plan for single trips comes with $150,000 in medical expense coverage that kicks in after your own health insurance limits are exhausted (when it applies). This compares favorably to many other providers that offer coverage for single trips, which often have limits as low as $10,000 for emergency medical expenses.

Nationwide also has annual travel insurance plans , which is a benefit not all travel insurance companies offer. Annual trip insurance plans can provide protection for all trips taken over the span of 365 days, and they include coverage for trip delays, emergency medical expenses, emergency medical evacuation, lost or delayed baggage, and more.

These basic offerings are in addition to Nationwide's cruise-specific travel insurance plans, which offer coverages that are specific to this type of vacation. For example, cruise insurance from Nationwide includes coverage for trip cancellations and interruptions, travel delays, missed connections, itinerary changes, emergency medical expenses and evacuation, baggage and personal effects, and more.

Nationwide Travel Insurance for Individual Trips

Nationwide offers two travel insurance plans to choose from that cover individual trips: the Essential Plan and the Prime Plan. Essential coverage is more basic with lower limits on coverage and no option to add cancel for any reason (CFAR) protection . The Prime Plan offers more included benefits and upgrade options for a higher total cost.

Here's a rundown of all the included benefits you can get with Nationwide travel insurance for individual trips.

Nationwide Travel Insurance for Cruises

Cruise insurance from Nationwide offers a range of important protections that make the most sense for cruise vacations, including specialty coverage for missed connections and itinerary changes. The company offers three tiers of protection that let you choose how much insurance coverage you want to pay for, as shown in the chart below.

Nationwide Travel Insurance for Multiple Trips

Annual travel insurance plans from Nationwide come in three different tiers: Travel Pro, Travel Plus and Travel Pro Deluxe. Note that annual plans from Nationwide are offered without any coverage for trip cancellations and interruptions. Otherwise, available plans let you tailor how much coverage you want for all individual trips you have planned within a single year.

Nationwide Travel Insurance Costs

Travel insurance premiums from Nationwide vary based on the plan chosen, how many travelers are in the plan, the age of travelers, total trip cost and more. To give you an idea of coverage, we received quotes for individual trips in several countries with varying costs.

Nationwide is an accredited business with the Better Business Bureau (BBB), where the company features an A+ rating. However, Nationwide has received an average star rating of 1.16 stars out of 5 across more than 300 user reviews with the BBB so far, and the company has resolved 221 individual customer complaints on the platform in the last three years.

The company has an average star rating of just 1.5 out of 5 stars on Trustpilot, but a 4.6-star rating on InsureMyTrip. Here's an overview of some positive and negative user reviews that show the experiences of past customers.

Nationwide Mutual Insurance Essential

Being older, we prefer to be cautious and have been purchasing trip insurance for our major trips. It gave us peace of mind being able to purchase insurance based on our airfare and lodging expenses. Nationwide provided a good value and reassurance. – Paul T. via InsureMyTrip

Nationwide Mutual Insurance Choice Cruise

I did not need to file a claim for this trip, but I have filed 4 claims with Nationwide travel insurance over the last several years, and all 4 were handled promptly and courteously. We will continue to use Nationwide for our cruise travel insurance. – Anna M. via InsureMyTrip

The initial cost of the plan was okay when I first purchased the insurance, but when I tried to add more coverage for additional expenses prior to the trip (e.g., paid for a rented an apartment in Paris), the price was outrageously high. I didn't get all the coverage that I wanted because it became too expensive. – Jeffrey H. via InsureMyTrip

Terrible claim service

Terrible claim service. I filed a small claim for our cancelled Israel trip. All I get is endless requests for more documents. I've sent them everything you can imagine and just get back the same message, "Please send the official cancellation letter". I've sent all communications including one where the travel company offered a different trip. Nationwide is garbage coverage. Don't waste your money.

Update: Nationwide Consumer Relations got involved and approved my claim. I’m waiting on the check. – Rob via Trustpilot

Asking us to return claim $

Trip planned for Caribbean. 3 days before our trip our island was in the path of a Cat 5 hurricane. Hotel said under a hurricane watch we would be asked to leave property. Search of flight, none would have been available to escape. We would have been stranded with nowhere to go. We elected to not get caught in a Cat 5. Hurricane turned a little so the hotel didn't close down. Nationwide paid our claim. A gutless Nationwide auditor did a claims review 3 months later and they want the full amount returned. Three employees of Nationwide said we had a valid claim. Not the auditor. Buyer beware! Taking them to court. – Brian W. via Trustpilot

Why Trust U.S. News Travel

Holly Johnson is a travel writer who covers topics like travel insurance, family travel, all-inclusive resorts and cruises. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world and has experience navigating the claims and reimbursement process. Johnson works alongside her husband, Greg, who sells travel insurance through their travel agency, Travel Blue Book .

Read more about Nationwide Travel Insurance in:

- The Best Travel Insurance Companies

- The Best Vacation Rental Travel Insurance

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Discover It® Cash Back Discover It® Student Chrome Discover It® Student Cash Back Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Cards Best Discover Cards Best American Express Cards Best Visa Credit Cards Best Bank of America Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel insurance

Nationwide travel insurance review 2024

Jennifer Simonson

Mandy Sleight

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Heidi Gollub

Updated 12:12 p.m. UTC April 16, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Top-scoring plans

Average cost, medical & evacuation limits per person, what you should know.

Nationwide’s Cruise Choice plan is good travel insurance for cruises . It has a $500 per person benefit if a cruise itinerary change causes you to miss a prepaid excursion.

Cruise Choice also has a missed connections benefit of $1,500 per person after only a 3-hour delay when you’re taking a cruise or tour. But note that this coverage is secondary coverage to any compensation provided by a common carrier.

Customer reviews