HSBC TravelOne Card

Looking for Rewards? You Came to the Right Place.

Sign up for free to explore our selection of gifts and claim yours today..

By continuing I agree to MoneySmart.sg’s Terms of Use and Privacy Policy

Already have an account? Login

Get a Hinomi Q1 Ergonomic Chair (worth S$499) or a Samsung 27-inch Smart Monitor M5 (worth S$432) or an Apple AirPods 3rd Gen + S$50 Cash (worth S$313.80) or S$150 Cash via PayNow when you apply and spend a min. of S$500 from Card Account Opening Date to the end of the following calendar month. T&Cs apply .

Are you eligible?

Promotion is valid from 15-April-2024 to 30-April-2024

Applicable for New-to HSBC cardholders only.

Customers need to apply through MoneySmart to be eligible

Applicants need to p rovide HSBC their consent to receive marketing and promotional materials from HSBC at the time of submitting their application.

What you need to know

Log into your MoneySmart account and submit your claim by 30th May 2024

Gift Options: Hinomi Q1 Ergonomic Chair (worth S$499) or a Samsung 27-inch Smart Monitor M5 (worth S$432) an Apple AirPods 3rd Gen + S$50 Cash (worth S$313.80) or S$150 Cash via PayNow

Please note that gifts will typically be fulfilled approximately 5 months after the end of the campaign month (30 April 2024).

MoneySmart exclusive rewards do not stack with external or third party promotions unless otherwise stated. See T&Cs for details.

*Instantly Activate Your Virtual Card for Google Pay and Apple Pay Shopping! T&Cs apply.

Quick Facts

Instant Rewards Redemption

Categories to maximise this card

What people use it for.

Frequent travellers who are looking for more flexibility & choices in redeeming miles and good earn rate

You are looking for a miles credit card with high earn rate and fast redemption

All Details

Key features.

- Instant reward redemption with an extensive selection of airline and hotel partners via HSBC Singapore mobile app

Accelerated earn rate: up to 2.4 miles for your spending

Travel privileges: Complimentary travel insurance coverage (including COVID-19), 4 x complimentary airport lounge visits for primary cardholders and more

Split flexibly: Split your purchases across a range of flexible tenors that suits your needs with HSBC Instalment Plans

Receive complimentary access to ENTERTAINER with HSBC app, with over 1,000 worldwide 1-for-1 deals on dining, lifestyle and travel.

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Overseas Spending

Annual interest rate and fees, minimum income requirements, documents required, card association, wireless payment, moneysmart promotions.

Disclaimer: At MoneySmart.sg, we strive to keep our information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products and services are presented without warranty. Additionally, this site may be compensated through third party advertisers. However, the results of our comparison tools which are not marked as sponsored are always based on objective analysis first.

HSBC TravelOne Credit Card Review 2024

Introduced in early 2023, the HSBC TravelOne credit card represents HSBC's newest addition to its credit card lineup, specifically designed for those passionate about travel. It offers enhanced flexibility, ease, and appealing rewards.

Notable highlights include fee-free miles transfers with 9 frequent flyer partners and the integration with the HSBC mobile app, allowing users to effortlessly redeem travel rewards and handle their payments with utmost convenience. If you're considering whether to get the HSBC TravelOne Credit Card, let's find out if this card is suitable for you as we consider the requirements, pros and cons and more.

Pros and Cons of HSBC TravelOne Card

- 20,000 welcome bonus miles (50,000 reward points) upon payment of annual fee

- Up to 2.4 miles for every S$1 spent overseas

- No cap on miles/points earned

- Up to 1.2 miles for every S$1 spent locally

- No redemption fee when you redeem for air miles or hotel points

- Annual fee waiver available (from 2nd year onwards)

- Exclusive access to HSBC ENTERTAINER with HSBC Singapore mobile app, enjoy over 1,000 worldwide 1-for-1 deals on dining, lifestyle and travel

- Flexibility to split your purchases across a range of flexible tenors that suits your needs with HSBC credit card Instalment Plans at 0% interest fee

- Complimentary travel insurance

- Complimentary airport lounge visits per year for primary cardholders

- Interest rate of 26.90%, which is lower than some cashback credit cards (as per MoneySmart's Credit Cards comparison tool)

- Min. spend of S$1,000 to qualify for the 20,000 welcome bonus miles

- Min. spend of S$25,000 per year to qualify for the annual fee waiver

Compare HSBC TravelOne vs. Citi PremierMiles Card vs. SCB Journey Credit Card

Currently, the HSBC TravelOne Card offers the lowest minimum interest rate chargeable as compared to the Citi PremierMiles Card and Standard Chartered Journey Card.

In terms of annual fee, you'll definitely save more with the Standard Chartered Journey Card as compared to the HSBC TravelOne Card and Citi PremierMiles Card, as you wouldn't have to pay any annual fees for it.

When it comes to air miles benefits, the Citi PremierMiles Card comes up on top with the most attractive perks as compared to the HSBC TravelOne Card and Standard Chartered Journey Card, offering the highest air miles per S$1 spent on online travel bookings via Kaligo and Agoda.

However, the Citi PremierMiles Card requires a minimum spend of $800 per month for the first-year fee waiver, unlike the Standard Chartered Journey Card which does not have minimum spend requirements. HSBC TravelOne Card requires an even higher minimum spending of S$25,000 annually to be eligible for the second-year annual fee waiver.

In a nutshell, the HSBC TravelOne Card is worth getting if you're after its fee-free miles transfers with 9 frequent flyer partners, no cap on miles/points earned, plus the instant reward redemption with its extensive selection of airline and hotel partners via the HSBC Singapore mobile app.

Find Out More In Our HSBC TravelOne Blog Review

Hsbc travelone card application.

Here are 3 simple steps to apply for the HSBC TravelOne Credit Card:

Apply via MoneySmart’s credit cards page

You may begin your application by clicking on our HSBC TravelOne Card application link.

When you choose to apply online or through the HSBC mobile app and via SingPass MyInfo, HSBC will pull your identity and income data from SingPass (which is already verified), thus cutting short the processing time. The approval-in-principle page will appear within minutes of submitting your MyInfo.

Provide all documentation required

You'll need to provide all the necessary documentation in order for HSBC to approve your credit card application. This list of documents include:

- NRIC or other identification details

- Latest computerised payslip

- Latest 12 months' CPF Contribution History Statement

- Latest Income Tax Notice of Assessment (NOA)

Receive your HSBC TravelOne Credit Card

You’ll be able to activate your HSBC TravelOne Card instantly through the HSBC mobile app, and enter a One-Time Password (OTP) after keying in your 6-digit Online Banking PIN to secure all your credit card transactions. Thereafter, it’s ready for you to use on any of your purchases and you can track your air miles and other rewards with your HSBC mobile app!

Frequently Asked Questions

Are there any fees if i apply for the hsbc travelone credit card, am i eligible for the hsbc travelone credit card, if i’m late for my monthly hsbc travelone credit card bill payment, how much do i have to pay.

HSBC Cookie Policy

- News and media

- Management team

- History timeline

- Postcode lending data

- Inclusion and Diversity

- Working with fintechs

- Regulated Covered Bond Programme

- HSBC in Singapore

- Our climate strategy in Singapore

- Our digital strategy in Singapore

- Main content

- Language selector

- Share on Facebook

- Share on LinkedIn

11 May 2023

HSBC launches new TravelOne credit card

HSBC Singapore announced today the launch of the new HSBC TravelOne credit card, tailored for travel enthusiasts who want greater flexibility, convenience and incentives as they embrace new experiences in the post-pandemic travel boom.

Launched in partnership with Mastercard and powered by both Mastercard Reward System and Ascenda, the HSBC TravelOne credit card offers an easy rewards redemption experience with a wide range of international airlines and hotel partners via the HSBC Singapore mobile application.

HSBC is the first in Singapore to offer customers the convenience of instantly redeeming their card reward points for a wide range of airline miles and hotel stays via their mobile.

Ashmita Acharya, Head of Wealth and Personal Banking, HSBC Singapore, said, “We are seeing a resurgence in overseas travel by our customers from Singapore who, post-pandemic, are embracing the freedom to travel again. Credit cards continue to be valued by customers traveling internationally, and the HSBC TravelOne credit card allows customers to easily redeem travel rewards and manage their payments flexibly all from the convenience of the HSBC mobile banking app. Alongside products and services such as HSBC Global Money Transfers, we are delighted to provide our customers with more choice and convenience for their international transactions.”

Travel roars back

According to the latest Mastercard Economics Institute report, daily outbound air travel bookings have consistently exceeded pre-pandemic averages since May 2022. The strong bookings momentum suggest much more room for resident departures in 2023 as more flight capacity is brought back online and ticket prices cool. Total resident departures have recovered to 5.2 million in 2022 compared to 830,000 in 2021 and 1.5 million in 2020. 1 Average spend per trip for 2022 was also similar to that of 2019. In 2022, travelers from Singapore said they will likely spend $3,468 on international travel over the year, similar to how much they spent in 2019 ($3,547 on average) 2 .

Deborah Heng, Country Manager, Singapore, Mastercard, said, “With travel demand recovering strongly and continuing to grow, Mastercard is proud to partner with HSBC to introduce the HSBC TravelOne credit card which is set to revolutionise travel with exclusive benefits and digital features for cardholders that cater to their travel preferences and needs. Cardholders can instantly redeem their rewards wherever and whenever they choose, enjoy easy access to airport lounges enabled by the Mastercard Travel Pass and have the option of flexible payments, all while being ensured secure transactions anywhere, anytime. The HSBC TravelOne credit card is set to provide unprecedented frictionless and safe travel experiences for cardholders in Singapore.”

Deepening capabilities to provide customers seamless experience and access to international banking and payment solutions

HSBC Singapore has introduced more than 70 transactional banking, wealth management and customer servicing features on its mobile app since 2020. In March, HSBC Singapore also introduced a new capability, International Credit History , which enables the Bank to use customers’ overseas credit bureau report in key markets including India, Australia and the UK.

Media enquiries to:

Betty Fong | +65 6658 4103 | [email protected]

Note to editors:

1. Key features of the HSBC TravelOne Credit Card include:

- The HSBC TravelOne Credit Card will bring together more than 20 international airline programmes and three global hotel chain partners on a single credit card platform by end of 2023.

- At launch, there are

- Nine participating international airline programmes: Air France – KLM Flying Blue; airasia rewards; British Airways Executive Club; Cathay Pacific Asia Miles; Etihad Guest; EVA Air Infinity MileageLands; Qantas Frequent Flyer; Singapore Airlines KrisFlyer; Vietnam Airlines Lotusmiles:

- Three participating global hotel partners: ALL-Accor Live Limitless; IHG One Rewards; Marriott Bonvoy.

- Primary cardholder is entitled to 4 complimentary visits per year to over 1,300 airport lounges around the world.

- Complimentary travel insurance coverage (including COVID-19) of up to USD100,000 for you and your family.

- Earn accelerated points: Earn 1.2 miles per SGD1 charged on purchases in Singapore; earn 2.4 miles per SGD1 charged on purchases overseas.

2. HSBC TravelOne Credit Card Reward Points Programme T&Cs apply. Visit www.hsbc.com.sg/travelone for more details

HSBC TravelOne credit card offers customers instant travel rewards redemption via the HSBC mobile banking app.

About HSBC Singapore

HSBC opened its first branch in Singapore in 1877. A qualifying full bank serving international needs of individual, corporate and institutional clients, HSBC in Singapore offers a comprehensive range of banking and financial services including retail banking and wealth management; commercial, investment and private banking; insurance; forfaiting and trustee services; securities and capital markets services. It was recognised by Asiamoney as “Best International Bank in Singapore” in 2022.

About The Hongkong and Shanghai Banking Corporation Limited

HSBC Holdings plc, the parent company of HSBC, is headquartered in London. HSBC serves customers worldwide from offices in 62 countries and territories. With assets of US$2,990bn at 31 March 2023, HSBC is one of the world’s largest banking and financial services organisations.

About Mastercard (NYSE: MA) www.mastercard.com

Mastercard is a global technology company in the payments industry. Our mission is to connect and power an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart and accessible. Using secure data and networks, partnerships and passion, our innovations and solutions help individuals, financial institutions, governments and businesses realize their greatest potential. With connections across more than 210 countries and territories, we are building a sustainable world that unlocks priceless possibilities for all.

About Ascenda

Ascenda powers innovative premium rewards programs that accelerate the growth of financial services. The company delivers easy-to-deploy rewards infrastructure to rapidly scale acquisition, card spending, cross-selling, and retention. Serving major financial services brands and disruptive fintechs across the globe, Ascenda’s clients include HSBC, Brex, Virgin Money, American Express, and Capital One.

For more information about Ascenda, please visit ascendaloyalty.com .

1 Outbound Departures Of Singapore Residents By Mode Of Transport , Singapore Department of Statistic.

2 Consumer travel spend priorities 2022: How fintech is supporting industry renewal, Amadeus.

- Privacy and security

- Terms of use

- Hyperlink policy

You are about to e-mail us

Before sending us your information, please read our Privacy and security .

You are leaving about.hsbc.com.sg

Please be aware that the external site policies, or those of another HSBC group website, may differ from this website's terms and conditions and privacy policy. The next website will open in a new browser window or tab.

Note: HSBC is not responsible for any content on third party sites, nor does a link suggest endorsement of those sites and/or their content.

Having just returned home from a trip to Europe, I was reminiscing about the good times and already entertaining thoughts of another getaway. Travelling is my escape from the hustle of life where I can go at a slower pace, preferably somewhere picturesque in nature, experience new sights, learn about different cultures, and meet new people.

However, amidst the excitement and adventure, there’s an aspect of travel that can be inconvenient—the admin side of things, especially finances. This includes things like splitting expenses when travelling with a group of friends, fumbling with unfamiliar coins and notes—especially if they have a gazillion zeros behind, and getting used to local payment methods.

However, the irksome inconveniences of travelling can be mitigated. We take a look at some common travel pet peeves and how the HSBC TravelOne Credit Card can come in handy .

Travel pet peeve #1: The price to pay for decent accommodation

Some folks seem always to get deals and may know when to book for cheaper flights, monitor flight prices or camp in wait for sales but sometimes, you just want to book a flight without the risk of your flight price increasing if you wait any longer.

Since borders have opened post-Covid-19, the post-pandemic travel frenzy has sent flight prices skyrocketing. Take, for instance, the popular route from Singapore to Japan. Prior to the pandemic, one could find reasonably priced round-trip flights for around S$500 to S$700.

Now, with borders reopening and pent-up demand, these prices have surged to staggering heights. A round-trip ticket to Tokyo that once cost S$600 can now exceed S$1,000 during peak travel periods. Similarly, a flight from Singapore to Bangkok, once attainable for around S$200 to S$300, can now reach eye-watering prices of S$500 or more.

For my upcoming solo trip to Japan, I wanted to base myself in Shibuya or Shinjuku, but finding a good and reasonably priced hotel that was within walking distance of the train station was next to impossible. The other alternative was hotels with bad reviews or locations that might not be safe, especially for solo travellers.

For example, I get to use the points earned during my trip at Europe for my next trip to Japan!

Plus, HSBC has partnered with a wide range of airline partners & hotel groups that give you more options in finding the best deals.

Travel pet peeve #2: The disappointment when good flights are fully booked

After earning my hard-earned miles over the past 2 travel-free years thanks to Covid, I eagerly logged into the redemption portal to exchange them for miles.

However, I soon realised that the process would take a few working days to complete. During this waiting period, the flight to Tokyo that I had my eye on was quickly booked out and I was left with a flight that required more miles.

I didn’t have enough miles and had to chalk up more points and start the redemption process all over again, which was a no-go.

In the end, I had to settle for a flight time that wasn’t convenient for me and was feeling pretty bummed.

Travel pet peeve #3: The sticky feeling from sweating all day

One of the greatest icks has got to be the feeling of clothes clinging to your body after a whole day of sweating. You know that you’ve been a real trooper, navigating a slew of security checks and braving endless queues. But even as you sit at the terminal and remind yourself of the adventures that lie ahead, there is but one wish deep down inside you: a refreshing shower and a change of clothes…if only you don’t have to pay extra for airport lounges.

Travel pet peeve #4: The effort it takes to camp for good deals

Picture this: you’ve set out to book a cozy hotel and secure that all-important travel insurance, but there’s no sweet promotion in sight. Alternatively, you’re drowning in a sea of promotions, each one vying for your attention, and you’re left wondering which one will truly save you those hard-earned bucks. Add to that your jam-packed schedule, a to-do list longer than your arm, and the ticking clock of limited-time promotions—that’s enough to make the most seasoned bargain hunter want to pull their hair out.

Timing is the name of the game when it comes to scoring the best travel deals. How do you seize those deals before they slip through your fingers?

Travel pet peeve #5: The sinking feeling when watching your bank balances deplete

Many of us spend a lot on holidays with things like flights, hotels, car rental, transport, changing currency, food, attraction fees and shopping. That’s a lot of money going out in a couple of weeks.

This expense sees a huge chunk of savings depleted from your bank account—which reduces your monthly bonus interest received as well—and you may even need to put your investments on hold.

Travel pet peeve #6: The inflexibility of rewards-stacking

Oftentimes credit cards come with many terms and conditions that do not allow you to stack rewards. You’re forced to make a decision—it’s either cashback or miles. It’s like being at a delicious buffet and being told you can only choose 1 dish.

Get the HSBC TravelOne Credit Card instantly ## and receive 20,000 miles as welcome gift!

HSBC TravelOne Card

Get a Hinomi Q1 Ergonomic Chair (worth S$499) or a Samsung 27-inch Smart Monitor M5 (worth S$432) or an Apple AirPods 3rd Gen + S$50 Cash (worth S$313.80) or S$150 Cash via PayNow when you apply and spend a min. of S$500 from Card Account Opening Date to the end of the following calendar month. T&Cs apply .

Air Miles Features

Instant reward redemption with an extensive selection of airline and hotel partners via HSBC Singapore mobile app

Accelerated earn rate: up to 2.4 miles for your spending

Travel privileges: Complimentary travel insurance coverage (including COVID-19), 4 x complimentary airport lounge visits for primary cardholders and more

Split flexibly: Split your purchases across a range of flexible tenors that suits your needs with HSBC Instalment Plans

Receive complimentary access to ENTERTAINER with HSBC app, with over 1,000 worldwide 1-for-1 deals on dining, lifestyle and travel.

Apply now till 31 December 2023 and you can enjoy either of the following:

- Get 20,000 air miles (awarded in the form of 50,000 reward points) ~ ; or

- Opt for no welcome gift and get your first-year annual fee waived.

Plus, no conversion fee when you redeem for air miles or hotel points until 31 December 2023. Terms and Conditions apply.

Bon voyage!

# HSBC TravelOne credit card reward points programme terms and conditions apply.

+ Air miles and hotel points redemptions will be completed instantly or within 1 business day. For Accor Live Limitless, it will take up to 5 business days. Please note that this list may be updated from time to time.

^Travel insurance coverage is underwritten by HSBC Life (Singapore) Pte. Ltd. HSBC Bank (Singapore) Limited is not the underwriter nor the distributor for this insurance plan. It is not an obligation of, deposit in or guaranteed by HSBC Bank (Singapore) Limited (Company Registration No. 201420624K).

*SGD deposits are insured up to S$75k by SDIC. HSBC Everyday+ Rewards Programme Terms and conditions apply.

~ 20,000 miles welcome gift is applicable when:

i. you apply for HSBC TravelOne Credit Card from 1 September to 31 December 2023; ii. spend at least S$1,000 in eligible spend within the qualifying spend period; iii. pay the annual fee of S$194.40 (inclusive of GST); iv. and provide marketing consent in your credit card application to HSBC.

Please refer to full terms and conditions here .

## Instant card approval is applicable to customers who are: (i) Singaporeans/Permanent Residents residing in Singapore; (ii) New to HSBC customers; (iii) Salaried individuals; and (iv) MyInfo applicants. All application and its final approval will be reviewed and determined by HSBC in its discretion. Please refer to full terms and conditions here .

Terms and conditions apply for all offers listed in this article. Visit www.hsbc.com.sg/travel or https://www.homeandaway.hsbc.com/sg/en-gb/travel/ for more details. HSBC is not the supplier of and accepts no liability for the goods and/or services provided by the merchants) involved in the promotions and offers set out above. These promotions and offers are subject to the terms and conditions of the merchant(s) providing the relevant goods and/or services; please refer to the respective merchant(s) for details. HSBC reserves the right to vary the terms of, or withdraw, these promotions and offers at any time without prior notice. All information is correct at the time of posting online.

This post was written in collaboration with HSBC. While we are financially compensated by them, we nonetheless strive to maintain our editorial integrity and review products with the same objective lens. We are committed to providing the best information in order for you to make personal financial decisions with confidence. You can view our Editorial Guidelines here .

- Reward types, points & expiry

- What card do I use for…

- Current Credit Card Sign Up Bonuses

- Credit Card Lounge Benefits

- Credit Card Airport Limo Benefits

- Credit Card Reviews

- Points Transfer Partners

- Singapore Airlines First & Business Class Seat Guide

- Singapore Airlines Book The Cook Wiki

- Singapore Airlines Wi-Fi guide

- The Milelion’s KrisFlyer Guide

- What is the value of a mile?

- Best Rate Guarantees (BRGs) for beginners

- Singapore Staycation Guide

- Trip Report Index

- Credit Cards

- For Great Justice

- General Travel

- Other Loyalty Programs

- Trip Reports

HSBC TravelOne Card adds 8 new airline and hotel partners, including Aeroplan

HSBC TravelOne Cardholders can now redeem miles for Aeroplan, Qatar Privilege Club, Turkish Miles&Smiles, JAL MileageBank and more. The catch: very poor conversion ratios.

Back in May 2023, HSBC launched the TravelOne Card, its first-ever mass market miles card. This had a lot of things going for it: a 20,000 miles welcome offer for both new and existing customers, eight lounge visits in the first membership year, instant transfers with no conversion fees, and conversion blocks of just two miles after the first 10,000 miles.

But the thing that intrigued me the most were the transfer partners. At the time of launch, HSBC TravelOne Cardholders could transfer points to 12 different airlines and hotels, snatching away Citi’s “most transfer partners” crown. And HSBC made it clear that they weren’t done yet, because the plan was to have more than 20 airline and hotel partners by the end of 2023.

HSBC has now made good on their word by adding eight new airline and hotel partners to the TravelOne’s stable, including a Singapore debut for Air Canada Aeroplan and Japan Airlines Mileage Bank , as well as miles community favourites Qatar Privilege Club and Turkish Airlines Miles&Smiles.

Unfortunately, it’s not all good news. While I always welcome new transfer partners, the conversion ratios at which many of these are being offered threaten to nerf any potential value.

Let’s dive into the details.

HSBC TravelOne Card new partners

Effective immediately, HSBC TravelOne Cardholders can transfer their points to 16 airlines and 4 hotel programmes.

Conversions can be made at the following ratios.

Airlines (16)

All HSBC TravelOne Card partner transfers are processed instantly , with the exception of the following:

- Accor Live Limitless: Within 5 business days

- Club Vistara: Within 5 business days

- Hainan Fortune Wings Club: Within 5 business days

- Qatar Privilege Club: Within 5 business days

- Japan Airlines Mileage Bank: Within 21 business days

All transfers are currently processed free of charge until 24 January 2024. Following this, HSBC will impose an (absurdly) expensive fee of 10,000 points per transfer, which I’ve talked about in the post below.

HSBC TravelOne Card adds hefty 10,000 points conversion fee

My thoughts on the new transfer partners

Let’s ignore transfer ratios for a minute and just talk about the new partners.

For me, the biggest excitement is undoubtedly Air Canada Aeroplan. This is the first time it’s been available through a Singapore credit card, and it’s well-loved by the miles and points community, for good reason.

- No fuel surcharges

- More airline partners than any programme (including non-Star Alliance partners like Air Mauritius, Azul, Gulf Air and Oman Air)

- Stopovers can be added on one-way awards for just 5,000 points

- Virtually all partner awards can be booked online

- Access to Singapore Airlines award space can be better than KrisFlyer even

Japan Airlines Mileage Bank is another first for Singapore. This used to be an excellent programme for redeeming Emirates First Class awards, but that’s no longer been possible since September 2021. You can still redeem Emirates Business Class awards, but you’ll have to pay some very hefty fuel surcharges. Domestic Japan awards start from 6,000 miles.

Qatar Privilege Club offers competitive Business Class redemption rates between Singapore and Europe (70,000-75,000 miles) and North America (95,000 miles), and the best part is that Qatar does not impose fuel surcharges for redemptions on its own flights. This can save you hundreds of dollars compared to booking through Asia Miles or another oneworld programme.

However, this shouldn’t be seen as a new addition per se, since HSBC TravelOne Cardholders already have access to British Airways Executive Club, and Avios can be transferred between the programmes at a 1:1 ratio.

Turkish Miles&Smiles offers great value Business Class awards between Singapore and Japan/Europe, which cost just 35,000 miles/45,000 miles respectively.

Club Vistara is an odd addition, particularly since Vistara is living on borrowed time. It’s already been announced that Air India will discontinue the brand once the merger with Tata SIA Airlines is completed. This presumably means that Club Vistara members will become part of Air India’s Flying Returns programme.

From what I know, there isn’t really anything to get excited about Hainan Fortune Wings or THAI Royal Orchid Plus, so I wouldn’t waste time studying their award programmes if I were you.

Transfer ratios

If you were waiting for the other shoe to drop, here it is: the transfer ratios are poor.

The seven new airline partners have ratios ranging from 30,000 to 50,000 points to 10,000 miles , 20%-100% more than the 25,000 points to 10,000 miles that was the standard for all nine airline partners prior to this.

To put it another way, HSBC TravelOne Card cardholders currently earn:

- 3X HSBC points per S$1 on local spend

- 6X HSBC points per S$1 on foreign currency spend

That works out to 1.2 mpd/2.4 mpd, but only if you’re choosing a partner with a 25,000 points to 10,000 miles ratio.

Otherwise, the earn rates can fall as low as 0.6 mpd/1.2 mpd respectively.

This problem is compounded by the fact that it’s not easy to accrue HSBC TravelOne points:

- HSBC points don’t pool — the bank says they’re working on adding this, but it won’t be coming in 2023 — so you can’t tap the 4 mpd earning power of the HSBC Revolution

- HSBC does not have an equivalent of Citi PayAll; in fact, they ended their income tax payment facility for credit cards in January this year

- HSBC does not allow cardholders to earn points on CardUp/ipaymy transactions

Therefore, it’d take a significant amount of spending to reach the critical mass required for a long-haul Business Class award, let alone several, let alone if you’re looking at a frequent flyer programme with a 30,000-50,000 points : 10,000 miles ratio!

The Aeroplan silver lining

Now, all that having been said, I want to spend a little time talking about Aeroplan specifically, because that can be the potential silver lining here.

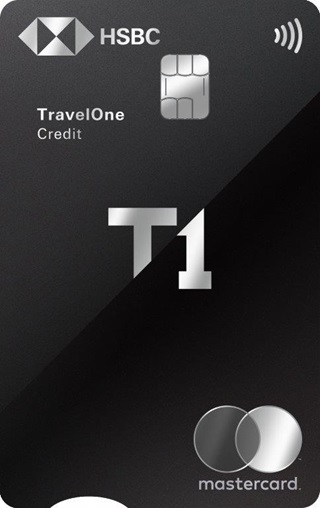

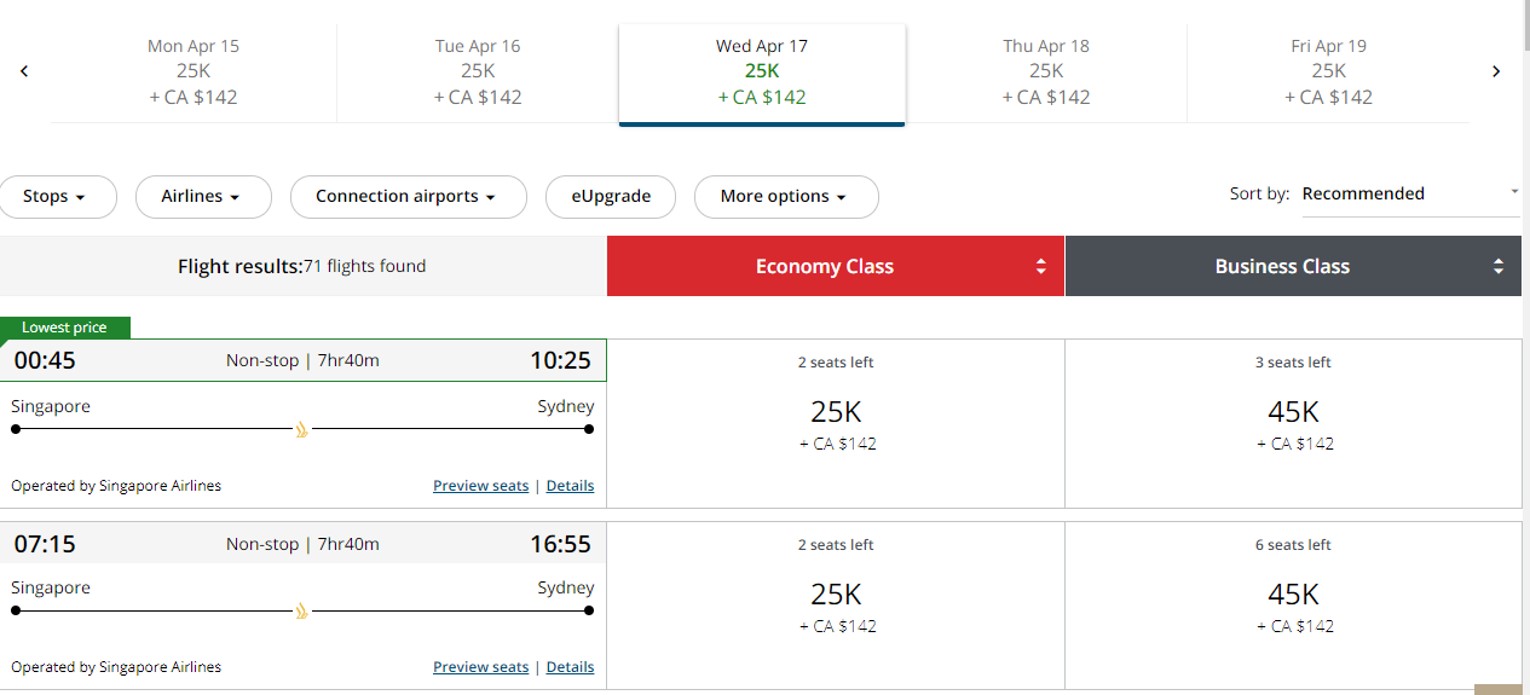

This probably deserves a separate post on its own, but here’s a quick idea of how Aeroplan’s award pricing for one-way Business Class flights compares to KrisFlyer.

Now, this would be phenomenal if you could earn Aeroplan and KrisFlyer miles at the same rate. But you can’t, and since Aeroplan is 3.5:1 versus KrisFlyer 2.5:1, we need to increase the Aeroplan figures by 40%.

This narrows the use cases significantly, though it doesn’t destroy them altogether.

Look at Australia, for example. Not only is Aeroplan cheaper than KrisFlyer, it sometimes has better access to Singapore Airlines award space than KrisFlyer! Yes, you read that right: Aeroplan members can sometimes see Singapore Airlines award space that KrisFlyer members can’t.

Here’s an example from April 2024. Notice how Aeroplan can see three Business Class seats on the 0045 SQ231 flight from SIN-SYD.

If you try to book three Business Class seats on the 0045 SQ231 flight from SIN-SYD via KrisFlyer, you’ll have to waitlist.

And that’s not even taking into account fuel surcharges. Singapore Airlines does not impose these on its own flights anymore, but if you’re redeeming KrisFlyer miles for Star Alliance partners like ANA, Lufthansa or Turkish, you still need to pay.

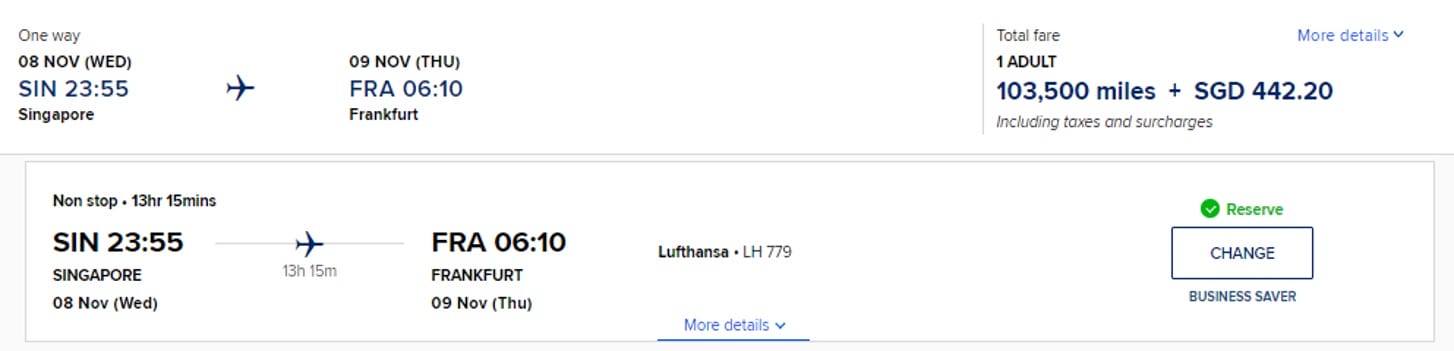

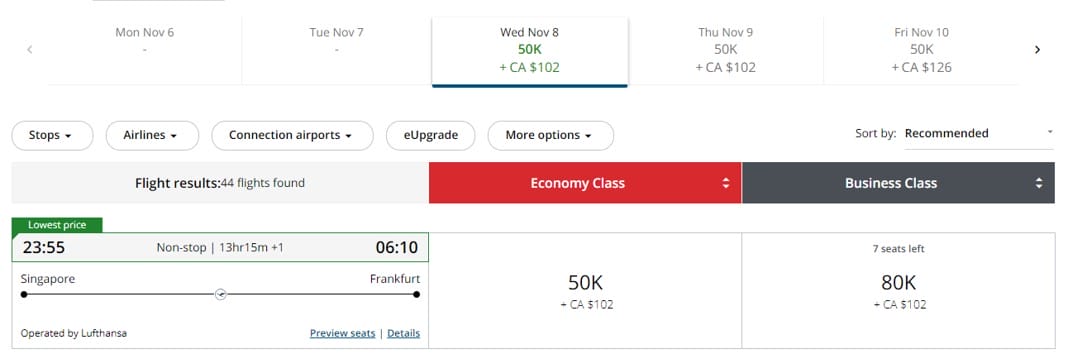

For example, it will cost 103,500 miles + S$442 to redeem a one-way Business Class award from Singapore to Europe on Lufthansa.

With Aeroplan, the equivalent cost is 112,000 miles (80,000 + 40%) + S$100.

I think it says quite a bit about how good Aeroplan is that even with a 40% handicap, it can still be competitive with KrisFlyer!

The HSBC TravelOne Card has added eight new airline and hotel partners, bringing its total options to 20.

As excited as I am to see new faces like Air Canada Aeroplan and Japan Airlines Mileage Bank, the transfer ratios make them relatively unattractive. There could still be some cases for transfers to Aeroplan, but otherwise most people would do better by sticking with 25,000 pts: 10,000 miles partners like KrisFlyer, Asia Miles, British Airways, Flying Blue and EVA Infinity MileageLands.

What do you make of the new TravelOne partners?

- credit cards

Similar Articles

Hsbc visa infinite cutting earn rates from may 2024, finally: hsbc points pooling to be added from may 2024.

Should revolution be given this redemption list, it will change the environment of redemptions in Singapore quite a bit with Aeroplane. SQ should be concerned about this.

How is HSBC able to transfer miles instantly when others take up to X days. What’s the barrier preventing others from doing the same? More fees for the bank?

This is made possible via api integration provided by ascenda loyalty. Ocbc and scb use the same platform too (though not for krisflyer miles, which is why those still require a few days)

Oh, interesting! I’m not sure if there’s value in it for the site, but I would love to read a Milelion article on how the backend points/miles system works today (ie APIs, banks, third parties, airlines, etc).

I would be interested to know how things work too! But you are right that it might not of value for this site.

try this: https://milelion.com/2023/01/30/behind-the-scenes-how-do-airlines-tie-up-with-credit-cards/

Thanks, but the miles earn rate is extremely slow. With UOB PP or citibank rewards card, I can easily earn 4mpd.

when will the HSBC point pools ready? Do you have any information?

CREDIT CARD SIGN UP BONUSES

Featured Deals

© Copyright 2024 The Milelion All Rights Reserved | Web Design by Enchant.sg

The Straits Times

- International

- Print Edition

- news with benefits

- SPH Rewards

- STClassifieds

- Berita Harian

- Hardwarezone

- Shin Min Daily News

- Tamil Murasu

- The Business Times

- The New Paper

- Lianhe Zaobao

- Advertise with us

HSBC laying off at least a dozen Asia dealmakers amid weaker activities: Sources

HONG KONG - HSBC is laying off more than a dozen of its investment banking staff in Asia as dealmaking in the region slows, three people with knowledge of the matter told Reuters on April 16.

Bankers in Hong Kong and Singapore will be affected as the lender cuts costs, two of the people said.

The cuts mainly affect associates and vice-presidents, according to one of the two people and a third source. All sources declined to be named as they are not authorised to speak to the media.

The Asia-focused bank is the latest to scale back its Asia dealmaking team as plunging markets in China and Hong Kong have weighed on the outlook for dealmaking. In January, Bank of America laid off around 20 bankers in the region.

“The size of our work force will fluctuate in any given year,” a spokesperson for HSBC said in a statement, adding the investment banking division has delivered strong results during “a very challenging few years”.

The spokesperson didn’t comment on the number of jobs to be cut.

Europe’s largest bank has been beefing up its senior banker line up in the last two years, with around six new hires from banking rivals in Asia.

Mr Greg Guyett, chief executive for global banking and markets at HSBC, said during the bank’s investment summit last week that he did not see evidence that Hong Kong’s initial public offering market is picking up yet.

Once the hottest global fundraising market, Hong Kong’s stock exchange slid to No.10 globally in the first quarter, with HK$4.7 billion (S$818.33 million) raised by 12 companies in IPOs, a 30 per cent drop year on year and the worst since 2009, according to data from Deloitte. REUTERS

Join ST's Telegram channel and get the latest breaking news delivered to you.

Read 3 articles and stand to win rewards

Spin the wheel now

Travel | Only one North American airport makes list of…

Share this:.

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to print (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to share on Reddit (Opens in new window)

Today's e-Edition

Things To Do

- Food & Drink

- Celebrities

- Pets & Animals

- Event Calendar

Breaking News

Travel | california gas prices are spiking again, what’s going on, travel | only one north american airport makes list of world’s best.

Ali versus Frazier. The Red Sox versus the Yankees. Doha versus Singapore.

For the last decade, Singapore’s Changi International Airport and Doha’s Hamad International Airport have been going back and forth, battling over the title of ‘world’s best ’.

Every year, UK-based airline and airport review and ranking site Skytrax surveys travelers from around the globe to compile its list of the best airports in the world, and for 2024 the honor goes to Qatar’s airport, which is known for its ultra-modern design, easy-to-navigate terminals and high-end shopping.

Singapore (SIN) had the title in 2023 and 2020, while Doha (DOH) took the gong in 2022 and 2021.

“This year, [Hamad International Airport] celebrates its milestone tenth year of operations and we are truly honored that passengers have voted us Best Airport in the World for a third time,” Qatar Airways Group’s CEO, Badr Mohammed Al Meer, said in a statement. “We look forward to continuing to surprise and delight passengers by creating memorable and exceptional passenger journeys in the years to come.”

DOH is one of several airports that offer free city tours for passengers with long layovers, which earned it high marks from respondents. It’s also home to the Oryx Airport Hotel , where visitors can enjoy spa treatments, a squash court and an 82-foot swimming pool.

The Skytrax rankings were announced at the World Airport Awards in Frankfurt, Germany, on April 17. Data for the list was collected between August 2023 to March 2024 from people of more than 100 nationalities. Respondents were polled on a variety of topics, from ease of getting through security checkpoints to quality and variety of food and drink.

European airports dominate

CDG’s terminal 3 was named the world’s best low cost terminal, and Paris’ Orly (ORY) has been named the best regional airport in Europe.

Other European airports also scored accolades from Skytrax. Rome Fiumicino Airport (FCO) scored the prize for world’s best airport security processing, Zurich Airport (ZRH) was named best in class in the 20- 30 million passengers per year division and Helsinki-Vantaa Airport (HEL) ranked the highest in the 10-20 million annual passengers category.

Japan shines

Seven of Skytrax’s top 20 airports are in Asia. Both of Tokyo’s hubs, Haneda (HND) and Narita (NRT), landed in the top 10, with Haneda one spot ahead of its sibling airport in fourth.

New Chitose Airport in Sapporo (CTS) won the prize for the world’s most improved airport, while Chubu Centrair International Airport in Nagoya (NGO) was named best in class for the airports with 5-10 million passengers per year category.

Kansai International Airport (KIX), which serves the Osaka area, scored the award for the world’s best airport baggage delivery.

Regional highlights

In all, 570 airports were evaluated around the world.

Vancouver International Airport (YVR) was crowned the best airport in North America.

Down under, Melbourne Airport (MEL) took the highest honor for the Australia-Pacific region.

Delhi’s Indira Gandhi International Airport (DEL) was named the best airport in India.

Cape Town Airport (CPT) won the prize for the best airport in Africa, as well as recognition for being the African airport with the best staff service. King Shaka International Airport (DUR) in Durban was the winner in the category for airports with under five million annual passengers.

El Dorado International Airport (BOG), which serves Bogota, Colombia, was voted the best airport in South America, while Panama Tocumen Airport (PTY) won the honor of best airport for Latin America and the Caribbean.

Not just airports

In addition to ranking airports, Skytrax also gives out honors for exceptional airport hotels.

The retro-inspired TWA Hotel at New York JFK was named the best airport hotel in North America. Others recognized in this category were the Hyatt Regency Shenzhen (best in China), Hilton Munich Airport (best in Europe), and the Crowne Plaza Changi Airport (best in the world, for the ninth year running).

The world’s best airports for 2024

1. Doha Hamad Airport 2. Singapore Changi Airport 3. Seoul Incheon Airport 4. Tokyo Haneda Airport 5. Tokyo Narita Airport 6. Paris Charles de Gaulle Airport 7. Dubai Airport 8. Munich Airport 9. Zurich Airport 10. Istanbul Airport 11. Hong Kong Airport 12. Rome Fiumicino Airport 13. Vienna Airport 14. Helsinki-Vantaa 15. Madrid-Barajas 16. Centrair Nagoya Airport 17. Vancouver Airport 18. Kansai Airport 19. Melbourne Airport 20. Copenhagen Airport

The-CNN-Wire ™ & © 2024 Cable News Network, Inc., a Warner Bros. Discovery Company. All rights reserved.

- Report an error

- Policies and Standards

More in Travel

Travel | 5 airport lines you can ditch (and how to skip them for free)

SUBSCRIBER ONLY

Business | sfo strikes back against oakland airport with lawsuit over ‘san francisco bay’ name change.

Transportation | Caltrans works around the clock to stabilize Highway 1 at Rocky Creek slip-out

Things To Do | Free National Park Day is coming on Saturday, April 20

- Companies & Markets

Banking & Finance

- Reits & Property

- Energy & Commodities

- Telcos, Media & Tech

- Transport & Logistics

- Consumer & Healthcare

- Capital Markets & Currencies

HSBC changes insurance head after Hingston’s surprise exit

THE head of HSBC Holdings’ insurance business is unexpectedly leaving the Asia-focused lender after two years in the post, and will be replaced by veteran insider Ed Moncreiffe.

Greg Hingston will pursue opportunities outside the firm, according to a statement from the bank. Moncreiffe has been with HSBC for 18 years and held a number of leadership roles including head of life and pensions Brazil. The changes are effective immediately.

“Insurance, one of our fastest-growing businesses, is integral to our strategy to become a leading global wealth manager,” said Nuno Matos, who runs HSBC’s wealth and personal banking business.

“We will build our recent investments in HSBC Life to capture new opportunities in Hong Kong and supercharge growth in mainland China, Singapore and India, while continuing to deepen penetration in the UK and Mexico.”

Hingston, who took over as global chief executive of HSBC’s insurance unit in January 2022, closed the group’s first acquisition in the sector in a decade, building out the China business.

The lender has been expanding in Asia with billions of US dollars in fresh investments and in February 2022 completed its purchase of AXA SA’s Singapore unit, a deal that effectively doubled the size of its insurance business in the city state.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

HSBC recently reported fourth-quarter profit fell 80 per cent after taking unexpected charges on holdings in a Chinese bank and from selling its French retail operations. However, rising interest rates globally boosted HSBC’s full-year earnings to a record.

The bank is several years into a strategy of pivoting its business increasingly towards the faster-growing markets of Asia, where it makes most of its money.

Disposals of businesses in France and Canada have been balanced by acquisitions of insurance and wealth management assets in Asia, a region with swelling ranks of the rich. BLOOMBERG

KEYWORDS IN THIS ARTICLE

- KKR, HSBC talk up China opportunities after lengthy sell-off

- HSBC’s Quinn targets lifting wealth business in China, India

- HSBC helps funds navigate India’s bond market as inclusion nears

- HSBC chairman says Asia business spinoff ‘will not happen’

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Telegram messaging service to allow Tether stablecoin payments

Dbs puts 46 retail units, hdb shops on market for s$210 million, american express’ premium customers help it surpass profit expectations, singapore-licensed triple-a to offer paypal stablecoin support, deutsche bank has cut dozens in asia private banking overhaul, australia fines macquarie bank us$6.4 million for not preventing unlawful third-party transactions, support south-east asia's leading financial daily.

Get the latest coverage and full access to all BT premium content.

Browse corporate subscription here

- International

- Opinion & Features

- Startups & Tech

- Working Life

- Events & Awards

- Breaking News

- Newsletters

- Food & Drink

- Style & Travel

- Arts & Design

- Health & Wellness

- Paid Press Releases

- advertise with us

- privacy policy

- terms & conditions

- cookie policy

- data protection policy

SPH MEDIA DIGITAL NEWS

MCI (P) 064/10/2023 © 2024 SPH MEDIA LIMITED. REGN NO. 202120748H

- Side Hustles

- Power Players

- Young Success

- Save and Invest

- Become Debt-Free

- Land the Job

- Closing the Gap

- Science of Success

- Pop Culture and Media

- Psychology and Relationships

- Health and Wellness

- Real Estate

- Most Popular

Related Stories

- Careers These are the top 5 companies to work for in India, according to LinkedIn

- Land the Job The 10 best U.S. companies to work for in 2024, according to LinkedIn

- Get Ahead The 4 best industries to work in, according to Glassdoor

- Work 10 companies that will let you work from anywhere and are hiring right now

- Closing The Gap Many of world’s happiest countries are also the best for women, research shows

Here are the top 15 companies in Singapore to work for, according to LinkedIn

Banks dominated the top 5 best companies in Singapore to work for, according to LinkedIn's list on the best workplaces in the country in 2024 .

"Commercial banking firms from banking to insurance and digital payments, dominated the 2024 LinkedIn Top Companies in Singapore, comprising more than half of the top 15 (up from 5 in 2023)," Pooja Chhabria, head of editorial for Asia-Pacific for LinkedIn told CNBC Make It .

"This is no surprise as Singapore is a well-established financial hub in the region, characterized by stable regulatory frameworks, and increased adoption of digital banking," she said.

LinkedIn's data assesses various aspects of career progression. It ranked companies based on eight pillars: ability to advance, skills growth, company stability, external opportunity, company affinity, gender diversity; educational background and employee presence in the country.

The list, released Wednesday, only includes companies that had at least 500 employees in Singapore as of the end of 2023. Additionally, recruiting firms, educational institutions and government agencies were excluded from the list.

Here are the top five names on LinkedIn's 2024 list for Singapore:

1. DBS Bank

Industry: Banking

Size of company: 30,000+

Most notable skills: Commercial banking, criminal law, intellectual property

Most common job titles: Business development officer, wealth manager, software engineer

Headquartered in the city-state, the Development Bank of Singapore was established by the government in 1968 to help finance the young nation's industrialization and urban development projects. It is today Southeast Asia's largest bank, offering corporate banking and financial services. This is the third year in a row that DBS Bank has landed in the top five on LinkedIn's top companies to work for in Singapore.

2. Schneider Electric

Industry: Manufacturing, machinery, automation

Size of company: 100,000+

Most notable skills: Power systems, electronic control systems, utilities, instrumentation

Most common job titles: Account manager, project manager

Founded almost two centuries ago in 1836, this French multinational company is a new addition to the list. Schneider Electric specializes in energy management and digital automation and offers solutions across sectors such as energy, infrastructure and more.

3. Standard Chartered Bank

Size of company: 80,000+

Most notable skills: Commercial banking, capital markets, software development life cycle

Most common job titles: Business analyst, business development officer, product team manager

Standard Chartered Bank moved down one notch to third place after being ranked second from 2021-2023. Established in 1969 in London, the international banking group provides treasury services as well as retail, corporate and institutional banking.

4. American Express

Industry: Financial services, banking

Size of company: 70,000+

Most notable skills: Travel management, commercial banking, sales leads

Most common job titles: Relationship manager, data science manager, director

Another new addition to the list is American Express , which was founded in 1850 in Buffalo, New York. The global financial services company specializes in credit cards and offers products for consumers and businesses alike.

5. OCBC Bank

Size of company: 15,000+

Most notable skills: Commercial banking, insurance, investment banking

Most common job titles: Business development officer, financial advisor, financial planner

OCBC topped the list in 2021, ranked 4th in 2022, and dropped off LinkedIn's list last year. This year, the company regained a spot in the top five. Founded in 1932, the Oversea-Chinese Banking Corporation is among the country's top three banking giants. This multinational financial firm offers services from commercial banking to wealth management. Almost 20% of its roles are on a hybrid schedule, according to LinkedIn .

Whilst commercial banking dominated the list, the healthcare, pharmaceutical and biomed sector made a strong showing with five companies in the top 15. Pooja Chhabria Head of Editorial APAC and LinkedIn Career Expert

Another sector that is quickly growing in Singapore is health care.

Some of the companies in the health-care sector are featured high up on the list in Singapore:

6. Singlife (a subsidiary of Sumitomo Life Insurance Company) 7. Procter & Gamble 8. BD 9. Abbott 10. Mastercard 11. Takeda 12. Roche 13. S&P Global 14. Alphabet Inc. 15. HSBC

"Interestingly, only six companies from last year retained their placement on this year's list, indicating a significant turnover in featured companies and suggesting that more firms are investing in attracting top talent and helping employees create meaningful careers," Chhabria told CNBC Make It.

Want to make extra money outside of your day job? Sign up for CNBC's new online course How to Earn Passive Income Online to learn about common passive income streams, tips to get started and real-life success stories. Register today and save 50% with discount code EARLYBIRD.

Plus, sign up for CNBC Make It's newsletter to get tips and tricks for success at work, with money and in life.

Important notice:

Due to the recent adverse weather situation in UAE, our Sharjah branch will remain closed until further notice.

Our mobile banking app, online banking and phone banking services remain fully operational.

Our website doesn't support your browser so please upgrade .

Mastercard Travel Pass

Enjoy complimentary airport lounge access

- What you'll get with this Mastercard flagship offer

- Black and Global Private Banking: Unlimited, complimentary access for you and one guest per visit to over 1,200 airport lounges in more than 450 cities in over 135 countries, as part of the Dragon Pass airport lounges network.

- Premier: Unlimited, complimentary access for you to over 1,200 airport lounges in more than 450 cities in over 135 countries, as part of the Dragon Pass airport lounges network.

- Advance: Unlimited, complimentary access for you to over 25 regional and international airport lounges across UAE, Saudi Arabia, Jordan, Kuwait, Egypt, Morocco, USA, UK, Canada, Germany, France, Singapore, and more.

- Access to business facilities: email, internet, phones, fax machines and conference space in some lounges.

- Complimentary refreshments and snacks.

Terms and conditions

- Download the Mastercard Travel Pass app from the App Store or Google Play Store and register your Mastercard card.

- See the lounges near you, and whether they offer complimentary access.

- Once you choose a lounge, book your visit to generate a QR code.

- Present the app QR code or your membership number to access the lounge.

I love dining

From local favourites to popular international cuisines, a sumptuous spread of discounts and privileges is all yours for the taking.

HSBC credit cards

Find out more about our credit cards. Apply and you could get approved for a credit card in less than 30 minutes.

600 55 4722 (within the UAE) or +971 4 228 8007 (outside the UAE). To find out more about our latest offers call: 800 7010

Connect with us

New safety measure for Android device

Beware of apps from sources other than your phone’s official app stores which may contain malware. From 27 March 2024, new safety measure in the Android version of the HSBC Singapore app will be launched to protect you from malware. Read more on malware scams .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Privacy Policy .

19 Apr 2024

Important Risk Disclosure

- The investment decision is yours but you should not invest in this product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation and investment experience.

- Investment involves risk. Loss may be incurred as well as profits made as a result of buying and selling investment products.

- Currency conversion risk - the value of your foreign currency and RMB deposit will be subject to the risk of exchange rate fluctuation. If you choose to convert your foreign currency and RMB deposit to other currencies at an exchange rate that is less favourable than the exchange rate in which you made your original conversion to that foreign currency and RMB, you may suffer loss in principal.

- RMB is currently not freely convertible and subject to regulatory restrictions (which might be changed from time to time).

Support / Resistance

vs USD 0.6312 / 0.6586 ⬇

AUD fell against the dollar yesterday slumped on Fed officials’ comments and after the downbeat Australian employment data, with a slight increase in the unemployment rate casting shadows over RBA forecasts. AUDUSD fell 0.22% yesterday while AUDHKD ended at 5.02 level.

vs USD 1.0533 / 1.0819 ⬇

EUR weakened against the dollar yesterday as the USD rose against major peers. ECB President Lagarde said the ECB will monitor exchange rates “very carefully” as “we have to look at how foreign-exchange variations affect inflation. EURUSD fell 0.26% yesterday while EURHKD ended at 8.33 level.

vs USD 1.2321 / 1.2629 ⬇

GBP fell against the dollar yesterday amid dismal market mood and the USD recovery amid expectations that the Fed will keep interest rates higher for a longer period. GBPUSD fell 0.09% yesterday while GBPHKD ended at 9.73 level.

vs USD 0.5812 / 0.6036 ⬇

NZD fell against the dollar yesterday as market sentiment turns risk-averse and after USD rebounded on Fed's hawkish stance. While the RBNZ is expected to pivot to rate cuts starting in November. NZDUSD fell 0.24% yesterday while NZDHKD ended at 4.62 level.

vs USD 7.2280 / 7.2448 ⬆

CNH ended lower against the dollar yesterday as USD gains ground on strong labor market data and also as Fed's stance remains hawkish. While the PBOC vowed to maintain yuan stability. USDCNH rose 0.08% yesterday while CNHHKD ended at 1.08 level.

vs USD 1.3545 / 1.3916 ⬇

CAD ended slightly stronger against the US dollar yesterday, unable to sustain earlier gains as the gap between Canada's 2- year yield and US equivalent widened to 75 bps. CAD did not get any support from oil prices which remained nearly flat. USDCAD fell 0.04% yesterday while CADHKD ended at 5.68 level.

vs USD 152.03 / 156.01 ⬆

JPY ended lower against the dollar yesterday, hovering close to 34-year low of 154.79 hit on Tuesday. BoJ Governor Kazuo Ueda said the central bank may raise interest rates again if the yen declines significantly push up inflation. USDJPY rose 0.16% yesterday while JPYHKD ended at 5.06 level.

vs USD 0.9028 / 0.9183 ⬇

CHF ended weaker against the US dollar yesterday as the USD strengthened across the board. In the near term, CHF is expected to face more downside as the SNB is expected to reduce interest rates further. USDCHF rose 0.16% yesterday while CHFHKD ended at 8.58 level.

vs USD 1.3479 / 1.3715 ⬇

SGD ended weaker against the US dollar yesterday as the USD strengthened against a basket of currencies while US treasury yields rose to 5-month high after comments from Fed officials saying there is no urgent need to cut rates. USDSGD rose 0.12% yesterday while SGDHKD ended at 5.74 level.

Your FX needs are well taken care of with our comprehensive suite of FX solutions

Open an investment account and start your wealth journey with us

Related insights.

FX Viewpoint: A resilient USD

FX Viewpoint: RMB: Internationalisation is not over

FX Trends: G10 FX: Focus on “relativity”

FX Viewpoint: BoJ hiked but SNB cut ahead of other G10 peers

This document has been prepared for information only. Information contained in this document is obtained from sources believed to be reliable; however HSBC does not guarantee its completeness or accuracy. The information contained in this document is intended for Singapore residents only and should not be construed as an offer to purchase or subscribe for any investment where such activities would be unlawful under the laws of such jurisdiction, in particular the United States of America and Canada. This material is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment or securities nor shall it or any part of it form the basis of, or be relied on in connection with, any contract or commitment whatsoever. The specific investment objectives, personal situation and particular needs of any person have not been taken in consideration. You should therefore not rely on it as investment advice. Opinions and estimates expressed are subject to change without notice and HSBC expressly disclaims any and all liability for representations and warranties, express or implied, contained herein, or for omissions. All charts and graphs are from publicly available sources or proprietary data. The mention of any security should not be construed as representing a recommendation to buy or sell that security, nor does it represent a forecast on future performance of the security.

This document is prepared by HSBC Bank (Singapore) Limited (“HBSP”) to its customers for general reference only. HBSP is not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use or reliance of this document. HBSP gives no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document.

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group.

IMAGES

VIDEO

COMMENTS

To apply for an HSBC TravelOne card, you must be aged 21 or above and have a minimum annual income of: SGD30,000, if you're a Singaporean or Permanent Resident. SGD40,000, if you're a self-employed or commission-based Singaporean or Permanent Resident. SGD40,000, if you're a foreigner residing in Singapore.

Key Features. Instant reward redemption with an extensive selection of airline and hotel partners via HSBC Singapore mobile app. Accelerated earn rate: up to 2.4 miles for your spending. Travel privileges: Complimentary travel insurance coverage (including COVID-19), 4 x complimentary airport lounge visits for primary cardholders and more.

The HSBC TravelOne Card is an excellent general spending card that's missing one important puzzle piece: points pooling. Here's The MileLion's review of the HSBC TravelOne Card, which shook up the miles game when it launched back in May this year with 12 transfer partners, instant, free conversions, a generous lounge benefit and a ...

The HSBC TravelOne credit card is set to provide unprecedented frictionless and safe travel experiences for cardholders in Singapore.". Deepening capabilities to provide customers seamless experience and access to international banking and payment solutions. HSBC Singapore has introduced more than 70 transactional banking, wealth management ...

HSBC miles redemption is a straightforward and efficient process designed for HSBC TravelOne Cardholders to convert their accumulated reward points into airline miles. It has a decent earn conversion rate of 1.2 mpd (3X Reward points) for local spending and 2.4 mpd (6X Reward points) for foreign currency spending.

The HSBC TravelOne Credit Card is a reliable travel credit card that allows you to earn 1.2 miles per dollar on local spend and 2.4 miles per dollar on overseas spend. It's biggest selling point is the number of transfer partners - featuring 9 airlines and 3 hotel partners - the most in Singapore. It also provides 4 complimentary lounge visits ...

From now till 31 Aug 2023, you can get up to 20,000 Miles (in the form of 50,000 Rewards Points) when you apply for the HSBC TravelOne Card. The downside is that you need to pay the card's annual fee of S$194.40 (GST already included), as well as spend at least S$800 in qualifying transactions within 1 month.

HSBC normally requires cardholders to join its Mileage Programme to convert points, which costs S$43.20 a year for unlimited conversions to Asia Miles or KrisFlyer. You only pay one fee, regardless of how many HSBC cards you have. With the TravelOne Card, all conversion fees are waived till 31 December 2023.

From 11 May to 31 August 2023, customers who apply for a HSBC TravelOne Card will enjoy 20,000 bonus miles (in the form of 50,000 HSBC points) when they: Pay the annual fee of S$194.40. Spend at least S$800 by the end of the month following approval. Opt-in for marketing communications during the sign-up.

HSBC launched a new travel credit card last week - the TravelOne card - a general spend option which boasts nine frequent flyer transfer partners and a 20,000 miles sign-up bonus when you apply between now and the end of August 2023. The card also boasts fee-free transfers to frequent flyer miles until the end of 2023, while the transfers ...

You may login to the HSBC Singapore Mobile app or HSBC Online Banking to check your Reward points balance. You can also check the detailed points history for the spend and redemption you make on your HSBC TravelOne Credit Card by ... For One Tree Planted (OTP) redemptions, you can expect the redemption will be completed on the next month from ...

One of the biggest benefits of the HSBC TravelOne Credit Card is that you're able to redeem your points instantly through your HSBC Singapore mobile banking app. What's more, a unique benefit is that HSBC has partnered with 9 partner airlines and 2 hotel groups including global hotel chains, so you'll have a wide variety of merchants to ...

The HSBC TravelOne Credit Card earns you an accelerated 2.4 miles per S$1 (mpd) on foreign currency spend#. This rate outperforms that of its peers like the DBS Altitude Card, OCBC 90°N Card or SCB Journey Card. Otherwise, the 1.2 mpd rate on local spend is competitive too.

Vanessa Nah. 11 August 2023 · 19-min read. hsbc-travelone-card-review. Let's talk about the HSBC TravelOne card's name—"Travel One". It aims to be the 1 travel card you need. HSBC says so as well: "Unlock instant travel rewards and elevated travel experiences everywhere you go with the one and only travel card you need.".

Here's the breakdown: 2.4 miles (6x Reward points) per S$1 charged on foreign currency spend; 1.2 miles (3x Reward points) per S$1 charged on local spend. HSBC Points are valid for 37 months and the redemption fee is waived until 31 Dec 2023. With these perks, the new HSBC TravelOne Credit Card certainly becomes one of the most attractive ...

How HSBC TravelOne can help. HSBC TravelOne gives you an accelerated earn rate, with no cap on miles/points earned. You can then redeem for miles and hotel stays, without feeling the pinch of crazy flight and hotel prices! 2.4 miles (6× Reward points) per S$1 on foreign currency spend #. 1.2 miles (3× Reward points) per S$1 on local spend #.

This travel insurance includes travel medical expenses and travel inconveniences like flight and baggage delays, baggage loss, COVID-19, etc. Terms apply. Exclusive year-long deals on Agoda Valid for the booking period until 31 March 2024, enjoy a 10% Agoda discount on worldwide hotel booking with your HSBC TravelOne credit card.

HSBC TravelOne Cardholders can now redeem miles for Aeroplan, Qatar Privilege Club, Turkish Miles&Smiles, JAL MileageBank and more. ... it will cost 103,500 miles + S$442 to redeem a one-way Business Class award from Singapore to Europe on Lufthansa. With Aeroplan, the equivalent cost is 112,000 miles (80,000 + 40%) ... Aaron founded The ...

Apr 16, 2024, 08:45 PM. HONG KONG - HSBC is laying off more than a dozen of its investment banking staff in Asia as dealmaking in the region slows, three people with knowledge of the matter told ...

London CNN —. Thousands of Taylor Swift's UK fans have been duped into buying fake tickets for her upcoming Eras Tour concerts, according to a major British bank. More than 600 customers have ...

Travel News News Based on facts, ... one of the world's top airports in Singapore, July 12, 2012. DOH is one of several airports that offer free city tours for passengers with long layovers ...

"Insurance, one of our fastest-growing businesses, is integral to our strategy to become a leading global wealth manager," said Nuno Matos, who runs HSBC's wealth and personal banking business. "We will build our recent investments in HSBC Life to capture new opportunities in Hong Kong and supercharge growth in mainland China, Singapore ...

Here are the top five names on LinkedIn's 2024 list for Singapore: 1. DBS Bank. Industry: Banking. Size of company: 30,000+. Most notable skills: Commercial banking, criminal law, intellectual ...

Welcome gift. Receive 35,000 miles (awarded in the form of 87,500 Reward points) when you pay the annual fee of: SGD497.12 (inclusive of GST) for HSBC Premier customers. SGD662.15 (inclusive of GST) for everyone else. Other terms and conditions apply. Compare cards. Find out more. HSBC Premier Mastercard Credit Card.

Premier: Unlimited, complimentary access for you to over 1,200 airport lounges in more than 450 cities in over 135 countries, as part of the Dragon Pass airport lounges network. Advance: Unlimited, complimentary access for you to over 25 regional and international airport lounges across UAE, Saudi Arabia, Jordan, Kuwait, Egypt, Morocco, USA, UK ...

Support / Resistance. vs USD 0.9028 / 0.9183 ⬇. CHF ended weaker against the US dollar yesterday as the USD strengthened across the board. In the near term, CHF is expected to face more downside as the SNB is expected to reduce interest rates further. USDCHF rose 0.16% yesterday while CHFHKD ended at 8.58 level.