- Travel Guide

How To Find The Best Antarctica Travel Insurance For You

Key considerations for antarctica travel insurance, geographical coverage, trip delays, missed flight/connection, trip cancellation, trip interruption, policy excess, medical emergency evacuation, repatriation and expenses (including covid-19), on-shore and off-shore adventure activity cover, baggage loss, theft and delay, frequently asked questions about antarctica travel insurance, why should i purchase travel insurance for my polar expedition, when should i arrange my travel insurance, what is the difference between medical insurance and emergency evacuation insurance, what part of my expedition do i need to cover with travel insurance, what if i have travel insurance through my own credit card benefits, what if i already have a worldwide travel insurance policy, can you not choose and book my travel insurance for me, what is the best travel insurance for antarctica, antarctica travel insurance providers, antarctica travel insurance for north american travelers, antarctica travel insurance for uk travelers, antarctica travel insurance for australian travelers, questions you may like to ask your insurer, i’ve bought my insurance. what next.

Travel insurance is not just important when visiting Antarctica due to its extreme isolation, conditions, and the considerable costs associated, but some levels of coverage—especially with regards emergency evacuation, repatriation, and medical cover—are a mandatory requirement for travelers.

As with any form of travel, insurance to protect you, your belongings, and your investment, is a wise choice, but perhaps never has it been more apparent than when booking an Antarctica expedition where the risk-reward relationship is higher than most.

Modern explorers certainly have it easier than those in whose wakes they follow, with the latest state-of-the-art expedition vessels arguably the safest found anywhere on the seven seas, but it would be foolhardy to take a trip to this wild and unpredictable part of the world without adequate protection.

Here we’ll take a look at how travel insurance for Antarctica—like the continent itself—is unlike anything else, and point out what makes a good policy to give you the peace of mind to embark on your expedition with only excitement and without any apprehension.

While most cruises tend to visit the Antarctic Peninsula region, some visit more remote reaches of the continent, and other trips even venture into the depths of the Antarctic interior. So whilst an insurance policy may state it covers Antarctica, please do check it covers the entire continent or at a minimum your chosen expedition route.

Operator requirements regarding travel insurance covering Antarctica’s interior are normally even greater than those for Antarctica cruises given the extra logistical complications, higher costs associated with evacuation, your likely participation in more adventurous (and subsequently hazardous) activities, and the added danger of higher altitude—as Buzz Aldrin, the second man on the Moon, will attest after having to be evacuated from the Amundsen-Scott South Pole Station to McMurdo Station on the south tip of Ross Island and on to Christchurch, New Zealand, after succumbing to its effects.

So if you are planning a visit to the South Pole or spending some significant time camping on the White Continent, be prepared for higher minimum coverage requirements for Medical Evacuation Insurance—anywhere from USD$150,000, but as high as USD$300,000 for expeditions outside of the Ellsworth Mountains—and also be aware that policies often need to be not just for the duration of your expedition but at least 7 days beyond your return flights home to ensure you’re covered in the event of any unforeseen delays.

Whichever part of the White Continent you’ll be exploring, you’ll likely be traveling to several countries en route to Antarctica so you will need to ensure your policy covers these destinations too. For example, if your cruise departs from Ushuaia, you’ll need a policy that covers you for both Argentina and Antarctica, or if you are booked on a fly-cruise from Punta Arenas you will require a policy covering Chile and Antarctica.

Related to this, it is also important to check whether your insurance will still cover you in the event of any changes to governmental travel advisories relevant to your trip, such as a Level 4 travel advisory being announced unexpectedly before or during your travels.

Nowhere else but Antarctica can the weather conditions actually dictate when your ship or aircraft can depart, and delays due to dangerous flight or unsailable sea conditions can be long, sometimes even days. It’s therefore vital to purchase an Antarctica travel insurance policy that covers you for trip delays.

Most Antarctica travel insurance policies will cover you up to somewhere in the region of USD$500 for trip delays, however, if you can find higher, do so, as trip delays in Antarctica are not uncommon. In order to avoid disappointment it’s best to book your Antarctica cruise with some leeway either side to give yourself the flexibility to adjust your travel plans as required.

While travel delay typically covers a daily amount for unplanned accommodations and other costs incurred as a result of a delay, missed flight/connection cover—often available as an add-on—additionally reimburses you for potentially expensive transportation costs required to “catch up” to your trip in the event of a covered delay. This may be very useful for those with short lay-overs or anyone considering a fly-cruise itinerary where the connecting flight is crucial to the experience.

Whilst Trip Cancellation insurance isn’t a requirement as such, given the high cost of Antarctica expeditions we strongly advise that you do purchase it to protect yourself against any event which may force you to cancel your trip before departure, including unforeseen illness, family death, or natural disasters.

Equally unlikely, potential cruise operator insolvency is also a possibility. Indeed, one of the major Antarctica cruise operators was forced to cease operations a few years ago and anyone who had not purchased Antarctica travel insurance prior to their trip lost any monies they had already paid. A good Antarctica trip cancellation policy will also include cover for the continent’s capricious weather conditions.

Trip cancellation generally pays out anywhere from USD$2,500 – USD$10,000 depending on the policy level, so if your trip costs more than the limit specified you may wish to consider purchasing a “top-up” policy to cover the difference.

A trip interruption normally occurs when a traveler unexpectedly has to cut short their trip and return home—like trip cancellation but after you have already begun your trip—so it is equally sensible to protect yourself for any events that may cause you to leave your polar experience part-way through.

Conversely, trip interruption can also encompass events which may cause you to have to stay in your destination longer than you’d originally planned. If you are sailing the notorious Drake Passage, trip interruption cover would be sensible as it is not unheard of for a ship to have to turn around due to high winds and rough seas. Trip interruption normally covers you up to USD$5,000 on a standard Antarctica travel insurance policy.

One tool at your disposal for reducing the price of your Antarctica travel insurance policy is by raising your policy excess—the amount you are willing to pay first as part of any claim. Most insurers will have a compulsory excess of roughly USD$100 – USD$200. If you wish to remove such an excess, note that only a few Antarctica travel insurers offer zero excess policies.

Because of Antarctica’s remote location and the expense of getting someone to a medical facility, every Antarctic tour operator requires you to have a certain level of medical emergency (air-)evacuation insurance before you can embark your expedition vessel. (Medical repatriation is slightly different to medical emergency evacuation as it covers travelers who’d prefer to be taken home to have medical treatment rather than just be taken to the nearest hospital.)

Given the cost of an Antarctica evacuation is upwards of USD$100,000 and simple hospital operations costing in excess of USD$10,000, it’s perhaps unsurprising that Antarctica operators typically require you to have a minimum emergency evacuation, repatriation and medical cover of USD$100,000 – USD$250,000 (or even higher for trips to the Antarctic interior outside of the Ellsworth Mountains). It is important that you check this minimum amount in advance. Be warned that while many Antarctica travel insurance policies may claim they cover you for USD$5,000,000 or more, this rarely includes any actual evacuation so do check the wording carefully.

Closely linked to the topic of geographical coverage, Argentina and Chile (or any other country you may be traveling through to get to Antarctica) may also have their own medical insurance requirements for entry into the country. For example, during the pandemic, both these countries required foreign nationals to have medical insurance that explicitly covered any expenses relating to COVID-19 (medical costs, quarantine, trip delay, etc.) upon entry, indeed Chile required a fixed level of medical insurance with a minimum claim value of USD$30,000.

Whilst these may no longer be applicable currently, the situation may revert back so we have included this point to raise awareness. Please be aware that whilst we make every effort to ensure the latest requirements are reflected here, it is your responsibility to check they haven’t changed before you travel.

Also note that, as with all medical insurance, Antarctica travel insurance policies will not cover you for any pre-existing medical conditions or illnesses.

One of the most important aspects of any Antarctica travel insurance policy is understanding what activities you are covered for. Some policies may stop covering you the moment you leave your cruise ship, others however may cover you (as standard or via an add-on) for some but not all polar pursuits you’ll be partaking in. Even if they do in fact cover every adventure, activity, insurers rarely openly state every covered activity so it will be up to you to read the fine print to make sure you’re covered.

Most policies will cover you for on-shore activities such as wildlife watching, but activities such as kayaking, scuba diving, camping and hiking are typically not covered as standard but easily added on for a premium. More hazardous activities or trips to the Antarctic interior like mountaineering, skiing, and skydiving may require separate specific coverage or higher minimum medical evacuation limits.

Another important consideration for your Antarctica travel insurance is your baggage cover—particularly important for the many Antarctica travelers planning to take high-end camera gear with them. No one wants to turn up for their once-in-a-lifetime Antarctica expedition to find their expensive equipment has been lost in transit, damaged, or worse still, stolen. Luckily, all standard Antarctica insurance policies cover for such scenarios to some extent, however, it’s important to understand how much you are covered for.

A standard amount for lost or stolen luggage is USD$1,000, but if you’re carrying expensive camera gear, this amount won’t really cut it! Also note that many policies will not actually cover you for any optic or electronic gear, or any items that have been bought second-hand.

It’s always advisable to bring a lock to secure your luggage. Although theft is not a problem in Antarctica or on any Antarctic expedition cruises, like any busy city the world over, Ushuaia and other South American cities you may visit or transit through are not exempt from crime and sensible precautions should be taken.

Here is a list of the most common questions we receive with regards travel insurance for Antarctica cruises and expeditions. Should you have any additional questions that aren’t covered here, feel free to get in touch with our specialists who will endeavor to answer your queries.

Given the remote regions you’ll be visiting, the unpredictable weather and sea conditions, and the high cost of a polar expedition, comprehensive travel insurance is not only strongly recommended to protect yourself, your belongings, and your investment, but certain levels of coverage is also a stipulation of cruise operators in order to embark on an expedition.

It is best practice to arrange any travel insurance at the same time as you book your trip (or as soon after booking as is feasible) not only to ensure your investment is protected for trip cancellation as soon as possible, but also because some insurance policies actually offer a reduced level of coverage—or none at all in the case of “Cancel for Any Reason” policies—if not bought sufficiently soon after paying for your cruise deposit.

Emergency Evacuation Insurance covers the incurred transportation costs associated with getting you to the nearest location with a medical facility for your needs, whereas Medical Insurance takes over once you get to that facility to cover your medical expenses, such as medical procedures, doctor/hospital fees, prescriptions, etc.

It is recommended you purchase travel insurance coverage for the entire cost and duration of your travel plans, including any countries you’ll be visiting or traveling through before and after your expedition. If you are planning to visit the Antarctic Interior you may even need to get coverage for up to a week after your scheduled return date in the event of any unforeseen delays.

Credit card travel insurance policies often exclude Antarctica expeditions, medical evacuations, and trip delays, but it is your responsibility to find out what travel insurance coverage and benefits you may have through your credit card provider to see if it is suitable and sufficient for your and any tour operator requirements.

Despite being called ‘worldwide’ policies, many do not include Antarctica so it is always advisable to check the geographical coverage of your policy. Even if they do, such policies rarely have the requisite levels of coverage for emergency evacuation, or indeed the desired trip cancellation amounts either. It may however be possible to top up an existing policy with your current or a separate provider, but do be aware that top up insurance is contingent on your base insurance paying out.

Antarctica Cruises are not insurance experts and are not legally permitted to provide insurance advice. Any considerations and comments here are solely based on our personal experiences and research, and should not be relied upon or construed as insurance advice in any way. Each traveler is individually responsible for arranging their own insurance and should always consult with an accredited insurance provider or broker for accurate information.

Really this question should be, “what is the best travel insurance policy for my Antarctica trip?” as everyone’s personal circumstances, age, health, belongings, route, activities, historical claims, affluence levels, and risk appetite are unique to them.

For example, someone may be too old, be wanting to bring too expensive camera equipment, or take part in too hazardous an activity for some underwriters to insure for a reasonable price or at all. Other travelers may be wanting to visit more remote locations than someone else, and may be willing to pay much more in excess in the event of a claim for a lower premium.

All this goes to highlight that the best Antarctica travel insurance policy for you will always be the one which provides you personally with sufficient peace of mind, whilst still satisfying the requirements of the tour operator you’ll be traveling with. For more detailed information on what is required for your specific expedition please refer to your tour operator’s terms and conditions.

We have provided a list of well-known Antarctica travel insurance providers below to assist you in finding and researching those Antarctica insurance policies we are aware of. As our expertise lies in Antarctic expedition cruises and not the nuances of insurance—not to mention that legally we are not permitted to provide any insurance advice—please address any specific questions you may have about your particular requirements to them.

Given insurance typically has to be bought in your country of residence, it may be worthwhile contacting a local insurance broker who has a thorough understanding of the options available in your region, as they may be able to match you up to a suitable policy.

Always take the time to thoroughly review any prospective policy and its exclusions before purchasing. Again, for legal reasons we are unable to check the wording or suitability of any policies you are considering, so should you have any queries needing clarification please contact the relevant insurer directly.

If your locale is not listed below then unfortunately we are unable to provide any insurer information.

Please note that many standard US-based insurance policies will cover you for travel to a Level 4 travel advisory country, but not for cancellation because of a state advisory change prior to entering the country or for “fear of travel” reasons. Known Antarctica travel insurance providers serving North America residents who you may like to contact for a quote include:

Cat70 Tin Leg HTH Travel Insurance Travel Guard Travelex Arch – RoamRight Allianz Squaremouth (comparison site)

Please note that standard UK insurance policies often have insufficient cancellation coverage to fully protect most trips to Antarctica, so you may need to consider purchasing an additional “top-up” policy. Known Antarctica travel insurance providers serving UK residents who you may like to contact for a quote include:

PJ Hayman Campbell Irvine Travel + General

Known Antarctica travel insurance providers serving Australia residents who you may like to contact for a quote include:

NIB Travel insurance

Here are some important points you may like to discuss with your insurer prior to purchasing your Antarctica travel insurance policy. We strongly recommend phoning insurers to discuss your requirements as it can prove difficult finding all the necessary answers online, not to mention time consuming.

Please note this list of questions is not exhaustive and you should ensure you also discuss any relevant personal circumstances which apply to you.

- Does the policy cover cruising or travel to countries that are subject to a travel advisory? For example, for US-based travelers it’s important to ask about scenarios around US State Department travel advisory Level 4, both prior to booking or during your trip.

- What coverage does this policy include in relation to COVID-19? For example, cancellation coverage for the full value of the trip should you test positive prior to departure, and travel delay, interruption, and medical coverage should you test positive during travel and need medical costs?

- Does the policy cover you for any missed flights, connections, or airline delays which may have a detrimental knock-on effect to your trip?

- Will the policy cover you for any lost or curtailed cruise days as a result of inclement weather, along with any charges for rescheduling other impacted travel arrangements such as hotels and flights.

- Does the cancellation coverage amount actually cover the full cost of the expedition cruise plus any flights and hotel arrangements that you may have booked separately?

- Is a “Cancel for Any Reason” policy available and, if so, what are its terms and conditions?

- Does the policy sufficiently cover all the requirements set out by your tour operator? This may include mandatory emergency evacuation coverage to a certain value.

- Are all the adventure activities I’ll be participating in covered?

Having the right travel insurance for you and your Antarctic adventure will give you peace of mind before and during your travels, so be sure to take your time to research the options available and scrutinize the fine print.

Once you have booked your trip with us and bought an appropriate insurance policy to comprehensively cover your full itinerary and any associated activities, your Antarctica specialist will request a copy, usually several weeks in advance of travel, to submit to the relevant tour operators for review and filing as proof of coverage. After that, you can concern yourself with packing your bags and building up the excitement for your trip of a lifetime.

When it comes to actually traveling, we recommend not only having your policy easily accessible on your phone, but also carrying a printout (or two) to show at airline counters when boarding your flight(s) if requested, and storing both your policy number any relevant claim hotline numbers in your contacts for ease of reference. Hopefully you’ll be among the throngs of Antarctic travelers who won’t be in need of any of them, but in the unlikely event a situation arises that you do need to make a claim for, be sure to inform your insurer immediately and adhere to any specific process they require you to follow as specified in their policy wording.

You May Also Be Interested In

Do You Need A Passport, Visa Or Permit To Go To Antarctica?

Do you need your appendix or wisdom teeth out to go to antarctica.

How Much Does It Cost To Go To Antarctica?

Modes of travel & transportation in antarctica.

A Day In Antarctica: What to Expect On An Antarctic Cruise

Antarctica Cruise Packing List: What (& What Not) To Bring

Antarctica money: currency, banks & atms.

How Dangerous Is The Drake Passage? Should I Fly Or Cruise?

Is Antarctica Safe? Dangers To Travelers & How To Avoid Them

Our travel guides are for informational purposes only. While we aim to provide accurate and up-to-date information, Antarctica Cruises makes no representations as to the accuracy or completeness of any information in our guides or found by following any link on this site.

Antarctica Cruises cannot and will not accept responsibility for any omissions or inaccuracies, or for any consequences arising therefrom, including any losses, injuries, or damages resulting from the display or use of this information.

Ready for the adventure of a lifetime?

Get in touch with us via phone or form today and you’ll be assigned a dedicated Antarctica specialist who’ll be with you every step of the way to help you choose, book and plan the right Antarctica cruise for you. Here’s how it works:

Listen & Match

We’ll carefully listen to your aspirations and curate an impartial shortlist of personalized polar cruise recommendations—and pre- and post-cruise extensions—to match your desired experience.

Reserve & Relax

Next we’ll place a free, no obligation, 24-hour cabin hold on your preferred cruise option whilst we discuss the final details. Book and relax safe in the knowledge you’ll be paying the lowest price guaranteed.

Prepare & Travel

Then we’ll provide you with our expert packing advice, insider travel tips, and more to ensure you are fully prepared for—and maximize your enjoyment of—your once-in-a-lifetime Antarctica expedition.

- With Partner/Friend

- With Family

- As Part Of A Group

- Emperor Penguin

- Photography

- Exploration Heritage

- Antarctic Peninsula

- Antarctic Circle

- Falklands/S. Georgia

- Weddell Sea

- Ross Sea/E. Antarctica

Antarctica Travel Insurance: Get The Right Protection

It goes without saying that Antarctica travel, like all travel, comes with certain risks .

To ensure you understand all of your Antarctica travel insurance options, we have set out the main Antarctica Travel Insurance considerations below.

These include trip cancellation , medical evacuation and repatriation , baggage issues and what Antarctica activities you need cover for.

We have also provided a quick little Antarctica travel insurance calculator from the adventure travel insurance experts – World Nomads . You can use the nifty calculator to get an instant quote for your Antarctica travel journey. We explain the procedure below.

Please note: Antarctica Guide are not insurance experts. The considerations and information presented below are based on our personal experience and research. This page is for information purposes only and should not be relied on upon or construed as a insurance opinion or insurance advice regarding any specific issue or factual circumstance. You should always consult with your insurance provider for accurate information.

Antarctica Travel Insurance

Get an immediate quote from our recommended travel insurance provider, World Nomads.

Key Considerations

Trip cancellation, interruption, delays and policy excess.

Your Antarctica cruise is a big investment and you should therefore get the right Antarctica travel insurance to cover you for any unfortunate circumstances such as long delays or, god forbid, trip cancellation!

Antarctica’s notorious weather often dictates when a ship can depart. Although there is nothing anyone can do, delays are often long and can stop people from actually joining their intended cruise. It’s therefore vital to purchase an Antarctica travel insurance policy that covers you for ‘trip delays’, ‘trip interruptions’ and ‘trip cancellation’.

Trip Delays

The weather waits for no man and this is certainly true for Antarctica where the ships sail to the weathers clock. Most Antarctica travel insurance policies will cover you up to US$500 for trip delays, however, if you can find higher, do, as trip delays in Antarctica are common. In order to avoid disappointment, try to book your cruise with some leeway either side.

Trip Cancellation

If your Antarctica cruise still goes ahead but you have been forced to cancel it because you’re on a tight schedule, then US$500 is hardly going to cover it. This is why trip cancellation is very important. A good Antarctica travel insurance policy will include Trip cancellation cover which includes bad weather ! Trip cancellation generally pays out US$2,500 for standard cover or US$10,000 for advanced cover. If purchasing with World Nomads you’ll need to select the ‘Explorer’ option to get the advanced cover price.

Important Note

Trip cancellation is also important for other issues including unforeseen illness, family death, natural disasters and cruise operator insolvency. Although it sounds unlikely, one of the major Antarctica cruise operators had to cease operations a few years ago due to the economic crisis. People who had not purchased Antarctica travel insurance prior to their trip lost all their money. In terms of financial protection when booking with an operator, you need to make sure they’re ABTA and ATOL protected as this will allow their insurers to pay you out should the company become insolvent.

Trip interruption

Trip interruption cover is also a must as it is not uncommon for a ship to turn around due to rough weather – especially on the notorious Drake Passage . Trip interruption will cover you up to US$5,000 on a standard Antarctica travel insurance policy, however, the explorer option on World Nomads covers you up to US$10,000.

Policy Excess

One of the most common things that drives down the price of Antarctica travel insurance policies is the excess amount. Most insurers will have an excess of roughly US$100-200. This means that any claim you make, you have to pay the excess amount first. World Nomads are one of the few Antarctica travel insurers that have a zero excess policy.

Emergency Evacuation, Repatriation and Medical Expenses

Because of Antarctica’s remote location and the expense of getting someone to a medical facility, every Antarctica operator requires you to be covered for emergency evacuation insurance.

All vessel companies require you to have insurance that covers air lift evacuation in case of a medical emergency, without this they will refuse you on board.

Most Antarctica operators will require you to have emergency evacuation, repatriation and medical cover up to US$200,000. Generally, the minimum cost of an Antarctica evacuation is US$100,000! Therefore, when it comes to emergency evacuation, medical fees and, in particular, repatriation, the higher the cover amount the better! Evacuation is never cheap, especially from somewhere as remote as Antarctica. Simple hospital operations will cost over US$10,000 and repatriation often costs in the hundreds of thousands.

A good Antarctica travel insurance policy will cover more than US$200,000, particularly in Antarctica where evacuation is very difficult.

Be warned here, many Antarctica travel insurance policies will claim that they cover you for US$10,000,000 or more, however, this rarely includes actual evacuation, especially from remote areas like Antarctica.

Please also note, antarctica travel insurance policies will not cover you for any pre-existing illnesses. Also, please do not rely on your credit card travel insurance or something similar as these policies often will not cover Antarctica expeditions, medical evacuations and trip delays.

Get an Insurance Quote

On-shore and off-shore activity cover.

One of the most important aspects of any Antarctica travel insurance policy is understanding what activities you are covered for.

Insurers will never openly state these activities and it is up to you to read the fine print to make sure you’re covered for the activities you wish to do. Be warned, some Antarctica travel insurance policies stop covering you at any point you leave your cruise ship!

Most policies will cover you for on-shore activities such as wildlife watching, however, if you add an activity on to this, you’ll need to check whether you’re covered, particularly for kayaking , scuba diving , skiing, camping and climbing.

For example, a travel insurance policy with World Nomads (who are particularly good when it comes to activities) cover cruises to Antarctica including zodiac trips, shore-landings, kayaking and paddle-boarding, but not all plans cover overnight or remote expeditions, trekking, climbing, mountaineering or skiing on Antarctica peaks. It may be possible to upgrade your plan or activities cover if you want to scuba dive, snorkel, hike or climb so check your policy carefully when you buy it. For full details, contact World Nomads as coverage, conditions and exclusions will vary, depending on your country of residence.

Baggage Loss, Theft and Delay

Another important element to any Antarctica travel insurance policy is your baggage cover. This is often particularly important to Antarctica travelers as many of us carry expensive camera gear!

No one wants to turn up for their long-awaited Antarctica journey to find their expensive equipment has been stolen, lost or broken. Luckily, nearly all standard Antarctica insurance policies cover for this, however, it’s important to understand how much your covered for.

A standard amount for lost or stolen baggage is US$1,000. If like us, you’re carrying expensive camera gear, this amount won’t really cut it! We suggest therefore getting a premium plan or the ‘Explorer’ plan with World Nomads that covers you up to US$3,000 for lost and stolen baggage and US$750 for delayed baggage (over 12 hours).

An important note here is that many Antarctica travel insurance policies will state that they cover you for millions and that you’ll get thousands and thousands back for your lost, damaged or stolen gear , however, this is not entirely true. This is why the wording of the policy is key. Most policies will not actually cover you for optic gear or any electronic gear! Most policies will also not cover you for any items bought second-hand.

We always recommend to travelers to bring a small lock to secure your baggage. Although theft is certainly not a problem in Antarctica or on any Antarctica cruises , Ushuaia is a busy city in which crime does happen.

Please also remember that you will be travelling in several countries, not just Antarctica and that you’ll need to take out insurance for these places also. If you are leaving from Ushuaia for example, you’ll need a Antarctica travel insurance policy that covers you for both Antarctica and Argentina.

World Nomads Insurance Calculator

Below is a very quick calculator by World Nomads which you can use to get your Antarctica travel insurance quote.

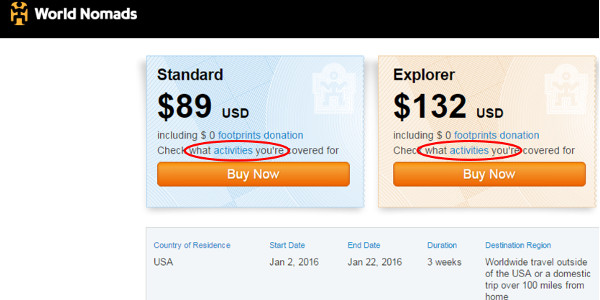

The quote that will initially be provided to you will be for World Nomad’s ‘standard’ policy option. However, depending on your country of residence, you may see both the ‘Standard’ and ‘Explorer’ options on your screen.

If you just wish to purchase the standard option then all you need to do is fill out the form and then follow the instructions. If you wish to purchase the advanced ‘Explorer’ policy, then just follow the instructions below.

STEP 1: FILL OUT THE FIELDS IN THE CALCULATOR BELOW AND CLICK ‘GET A PRICE’ (REMEMBER TO PUT IN BOTH ANTARCTICA AND ANY OTHER COUNTRY YOU VISIT)

STEP 2: CLICK ON THE ACTIVITIES LIST TO MAKE SURE YOU ARE COVERED FOR THE ACTIVITIES YOU ARE PLANNING

Depending on your country of residence, the activities you are covered for on a standard policy will change. For example, a standard policy for a US citizen will not cover snorkeling, however, for a UK or Australian citizen, snorkeling is covered as standard.

The activities button is located just above the ‘Buy It Now’ button on each policy option. See Image below marked in red:

When you click the activities option you’ll be greeted with a blue page that has every activity World Nomads cover.

Activities with the number 1 after them are covered in your particular policy as standard whereas the activities with a number 2 after them are only covered if you select the ‘Explorer’ option. See Image below:

For non US citizens, there will also be the chance to ‘upgrade’ your policy. This means you can add certain activities onto your policy and also take out higher coverage for your personal items and gear.

If you would like to know more about Antarctica travel insurance please leave a comment below and we will endeavor to get back to you within 24 hours! Alternatively, please see our FAQ page here . If you would like to get a cruise quote, please use this form.

Thank you - AntarcticaGuide Team

Tags: Antarctica travel insurance, do you need travel insurance for Antarctica, travel insurance Antarctica

You may also like...

What penguins will I see on my Antarctic cruise?

What have we learnt from the historic discovery of Sir Ernest Shackleton's ship - Endurance?

South Georgia Explorer: The new South Georgia focused itinerary

Understanding Citizen Science in Antarctica

A day in South Georgia: A personal account

Visiting the Falkland Islands on my Antarctic itinerary: A personal account

What will you see on an Antarctic cruise?

A typical day in Antarctica

Zodiacs in Antarctica: What to expect

If you found this article useful please share it...

Louise Milligan says

4 years ago

Burnham Arlidge says

C S Leaman says

6 Best Antarctica Travel Insurance Plans for US Citizens in 2024

Updated on January 10, 2024 by Matthew H. Nash – Licensed Insurance Agent

- SwiftScore Our SwiftScore is a unique and proprietary insurance ranking system objectively comparing key metrics which are most important to Antarctica travelers. Learn more at the end of this page.

STARTING PRICE FOR 2-WEEK TRIP TO THE ANTARCTICA

CAN YOU CANCEL YOUR TRIP FOR ANY REASON?

BEST WEBSITE FOR

Comparing Policies

- Compare dozens of the best Antarctica travel insurance policies from all the major providers in one place

- Easily filter for the features you want and get support from their award-winning customer service team

- Founded in 2013, TravelInsurance.com has helped hundreds of thousands of travelers find affordable insurance coverage

BEST POLICY FOR

Fastest Claims

- Super fast claims via their 100% digital platform with a helpful mobile app

- Faye makes it easy to add-on coverage for vacation rentals, adventure/extreme sports, pet emergencies, and “cancel for any reason” at competitive prices

- Underwritten by Crum & Forster, Faye is known for its exceptional customer support, with 4.8/5 stars on Trustpilot

- SwiftScore Our SwiftScore is a unique and proprietary insurance ranking system objectively comparing key metrics which are most important to travelers. Learn more at the end of this page.

BEST POLICY FOR

Travelers Aged 55+

- Pre-existing medical conditions are covered for a reasonable fee and they offer “cancel for any reason” as an add-on

- $2,000 COVID quarantine coverage available w/ Safe Travels Voyager plan

- Founded in 1998 and underwritten by Nationwide and GBG Insurance

BEST WEBSITE FOR

Filtering Plans

- This comparison website has the most comprehensive filters especially for Covid-19 which helps you search for the specific benefits you need

- They have “Zero Complaint Guarantee” which promises a fair claims process

- Established in 2003, Squaremouth has consistently been recognized for it’s exceptional customer service

BEST POLICY FROM

An Established Brand

- Well rounded, inexpensive travel insurance plans from an established and top rated global insurance company

- AXA has plans that cover pre-existing conditions and their “Platinum” plan covers “cancel for any reason” with an optional add-on. They also offer helpful 24/7 Worldwide Travel Assistance Services

- Founded in 1959 and underwritten by Nationwide

Long-term Travel

- Ideal for digital nomads and long-term travel, available to anyone anywhere

- Scored lower because short-term travel coverage isn’t as robust as competitors

- Founded in 2018 and is underwritten by Lloyds of London

CAN YOU CANCEL YOUR TRIP FOR ANY REASON?

Antarctica travel insurance FAQs

Is antarctica travel insurance worth it.

Antarctica travel insurance is worthwhile because it shields you against the financial costs that come with trip interruption, cancellation, damaged or lost luggage, medical emergencies, and evacuations. It also covers you for reasons beyond the scope of your policy’s standard benefits if you purchased an optional “Cancel for Any Reason” (CFAR) upgrade. Travel insurance plays a crucial role in assisting you and your travel companions through medical emergencies by arranging airlifts or other means of evacuation and that you receive top-level care. My experiences have shown that travel insurance gives travelers peace of mind that they wouldn’t otherwise have, making it beneficial for a destination like Antarctica, where you confront the harshest climate. It is worth mentioning that travel insurance is highly affordable, usually costing only 2-3% of your overall trip cost (differs by age).

What qualifies as a trip interruption?

Trip Interruption is when an unforeseen emergency forces you to cut your trip short and fly home. Events that often fall under coverage include terrorist attacks, extreme weather, and the injury, death, or illness of a traveler insured on your policy. Since coverage kicks in once your trip starts, Trip-Interruption is considered a post-departure benefit.

When should I purchase Antarctica travel insurance?

I recommend buying your Antarctica travel insurance as soon as you book your trip. Once you have a policy in place, your Trip Cancellation benefits go into effect, protecting you and any other insured travelers on your policy from the financial loss that may result from unexpected events before or during your vacation. Keep in mind that should you wish to purchase a “Cancel for Any Reason” (CFAR) add-on plan or a Pre-Existing Condition package, you can only do so within 14-21 days of when you paid your trip deposit. This window differs between providers, so check your policy’s full details for more information.

How can I find the cheapest Antarctica travel insurance plan?

I recommend that travelers search for travel insurance plans on a comparison site. You can filter through policies based on your specific needs and sort them from cheapest to most expensive. My preferred comparison site for travel insurance is WithFaye.com .

How can I file a claim with my insurance provider?

Travel insurance companies have claim portals on their website, usually linked in the footer. It will say something along the lines of “Make a claim,” “Submit a claim,” or “Claims.” Click the link, and follow the steps as instructed. You will be asked for several pieces of information and upload all relevant documentation. Most companies will also allow you to submit claims via mail as well.

How long does the claim process take?

After you file a claim and submit all of the requisite documentation, expect it to take 6 to 8 weeks to be processed, with reimbursement to follow shortly after that. Of course, this varies from one provider to the next.

Do I have any recourse if my travel insurance claim is rejected?

If your claim gets rejected, it’s always important to review the following criteria to ensure it is valid. Did you follow the required procedures for claim submissions? Did you fail to disclose a pre-existing medical condition for you or one of your insured travel companions? Did you forget to state trip costs accurately when you purchased your travel insurance plan? Does the claim you are filing fall under the provisions of your policy? If, after reviewing these criteria, you still feel your claim is valid, the insurance company will give you potential follow-up steps that you can take.

How is “total trip cost” defined when it comes to buying travel insurance?

Total trip cost is essential in determining Trip Interruption and Trip Cancellation benefits, so you must calculate this accurately. Total trip cost is defined as the full cost of all non-refundable costs you prepaid. These include cruises, plane tickets, hotel or accommodation packages, retreats, event tickets, tours, and more. Always include everything you have prepaid that you would not be able to get a full refund for should you have to cancel your trip. Also, you will need to add any penalties you would be required to pay if you cancel your trip, even if you did not have to prepay anything. Remember, to qualify for the benefits in your policy, round your total trip cost up to the nearest dollar. And more importantly, never list your trip as being cheaper than it is just to secure a cheaper policy. Doing so will automatically disqualify you from receiving benefits.

Common problems tourists experience in Antarctica and how to avoid them:

Seeing as almost all tourists visit Antarctica via cruise or research boat, you will face the typical illnesses that come with living in such close quarters with hundreds or thousands of people. Another concern is the cold and potentially harsh weather conditions. Follow your tour operator’s packing instructions to the letter. Many tour operators will also provide each traveler with the essential dry gear. All ships have their own dynamic medical staff living aboard.

Aside from sightseeing, Antarctica’s most common tourist activity is sea kayaking. Of course, accidents may result, but the ship/boat you’re aboard has a highly trained medical team to take care of you. Keep in mind that severe injuries may require air evacuations, which can be costly. A good travel insurance plan can shield you against such expenses and ensure you get the best care possible.

Since Antarctica has no public infrastructure, you will be keeping your most valuable possessions on the boat. To protect your belongings, keep your cabin locked at all times. Beyond this, theft most likely will not be an issue on your trip.

Emergency resources for Antarctica

Phone numbers.

Most emergencies, particularly medical ones, can be handled by your tour operator as they all have highly-skilled medical teams. However, on the rare occasion, they are not equipped to handle something, dial 911. Your call will run through the United States’ McMurdo Station’s fire and emergency dispatch. Help will come from the nearest island or country with the necessary resources.

US embassy or consulate details

Since Antarctica does not have a government or permanent residents, there is no embassy or consulate on the continent. Any matters pertaining to citizen services will have to be dealt with once you return to Argentina or Chile after your cruise around Antarctica.

Additional information to help travelers have a better experience in Antarctica:

The Antarctic dollar is merely a collectible item and not used as legal tender. If you are fortunate enough to be on a boat with less than 500 passengers, you’ll be able to go on land in Antarctica and even buy some postcards and souvenirs at one of the major research stations. An ATM at the United States’ McMurdo Station dispenses dollars, and Euros or British Pounds are also used at other stations.

Etiquette & Local Customs

Antarctica may not be a country with its own people and culture, but there is undoubtedly a “wilderness etiquette” that you will be expected to follow. Every species has a specific distance you must keep from them. Please adhere to these distances strictly; they are not only for the safety of the wildlife but you too! Another expectation is that you take no natural souvenirs with you, including rocks, eggs, bones or other pieces of nature. A third rule is to leave no trace. Do not disturb the natural environment by making too much noise, leaving behind litter, altering any sites or smoking. Last but equally as important is that you wash and sterilize all of your gear before leaving for Antarctica. If you don’t, you may unwittingly bring pests from home that can adversely affect the White Continent’s fragile ecosystem. Your tour operator will spell out all rules and expectations before you disembark from the ship.

Food & Drink

Your meals will be limited to whatever is available on the ship you’re living aboard for this vacation. How many dining venues and styles of food will vary depending upon the cruise line you’re traveling with and the size of your ship. That said, most cruises offer a vast and delicious selection of meals, allowing you to never eat the same thing each time you sit down during your Antarctica cruise. They also have an array of menu items to suit most preferences, and you are free to eat until your heart’s content. The same usually goes for drinks, but you might want to take it easy on the alcohol or hydrated and ill, especially after a long day of being outdoors.

Getting Around

While you will spend much time sightseeing aboard your cruise ship or research boat, your excursions will usually occur via zodiacs or sea kayaks.

Immigration

Since Antarctica is not a country or a territory of another country, you do not need a visa. That said, the US was one of forty signers of the Antarctic Treaty’s Protocol on Environment Protection, meaning that all Americans are required to get permission to visit the White Continent. The good news is that your tour operator almost always takes care of this.

Antarctica has no permanent residents, but it has approximately 1,000 temporary residents from all over the world for scientific research purposes. While English is the de facto language of science, the most represented populations are from the US, UK, France, Germany, Spain, Italy, China and Japan. Most staff members will speak English and possibly other languages regarding your cruise ship.

All services that require tipping will be on your cruise ship or organized by your tour operator. Tip $6-7/person/day for cabin attendants and waiters, $4-5/person/day for assistant waiters, 15-18% of the bill for bartenders and deck stewards and $5-$10 for the maitre d’ should they provide you with any special services, a $5 to $10 tip is adequate.

Packing advice for Antarctica

Apart from Travel Insurance, we recommend you bring the following items for maximum health, safety, and enjoyment of your trip to Antarctica.

A final note about travel insurance for the Antarctica

I have spent dozens of hours researching travel insurance, including getting quotes and comparing coverage from all the most popular brands. Regardless of where you’re going I am confident that you will also find that WithFaye.com offers the best way to compare policies with the ideal combo of coverage and price.

I wish you and yours an incredible journey.

SwiftScore Ranking Methodology

- Average price for a 2-week vacation based on a 35-year-old California resident traveling to the Antarctica with a $3,500 trip cost

- Coronavirus coverage

- Cancel for any reason (CFAR)

- AM Best rating of the underwriter

- Key policy details including cancellation, interruption, emergency medical evacuation, and baggage & personal effects

- Ease of sign up

- Policy language clarity

- User reviews

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- All Credit Card Guides

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Make Money

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- E&O Professional Liability Insurance

- Best Savings Accounts & Interest Rates

- All Insurance Guides

- Antarctica Travel Insurance

On This Page

- Key takeaways

What to consider when taking a trip to Antarctica

What antarctica travel insurance coverage do i need, what isn’t covered by travel insurance for antarctica, how much does travel insurance for antarctica cost, tips for getting the best antarctica travel insurance, faq: antarctica travel insurance, related topics.

Antarctica Travel Insurance: Tips & Requirements for US Visitors

- There are no major medical facilities in Antarctica , so medical emergencies require medical evacuation to another country.

- Medical evacuations from Antarctica are expensive and require a huge effort, so tour operators typically require you to have at least $100,000 in travel medical and at least $250,000 in medical evacuation coverage .

- In addition to medical coverage, more comprehensive travel insurance plans will also include trip cancellation and interruption coverage, baggage insurance and more .

- According to our research, the top travel insurance plans come from AXA, Tin Leg and IMG ( skip ahead to view these plans ).

- Our sales data shows that travel insurance costs around $19 per day .

- We recommend using our online comparison tool to view multiple plans at once and find the best coverage to suit your needs.

Our top picks for the best antarctica travel insurance

- AXA Assistance USA: Best Value on a Budget

- Tin Leg: Top Customer Satisfaction Ratings

- IMG: Best for Premium Inclusions

Our top picks for travel insurance for Antarctica

Axa assistance usa.

Due to its isolated location and harsh natural environment, Antarctica is unlike any other travel destination.

If you plan to visit, keep the following in mind.

Antarctica medical insurance is a legal requirement

According to the U.S. Department of State , Antarctica doesn’t have a single public hospital, so the only way to get medical treatment is to evacuate to Argentina, Australia or another country with modern health care facilities.

Medical evacuation is extremely expensive, so all tour operators require travelers to maintain Antarctica travel insurance. Your insurance plan must include emergency medical care and medical evacuation services.

Trips to Antarctica are expensive

Because it’s so remote and is vulnerable to damage caused by human activity, Antarctica is one of the most expensive destinations in the world. Only certain companies are allowed to operate tours and this limited competition drives up prices and makes even a short expedition much more expensive than the average vacation. It’s important to have Antarctica travel insurance to protect your investment.

Traveling to Antarctica

Another factor to consider is that you can’t travel to Antarctica directly from the United States. Most tours depart from Ushuaia in southern Argentina. Several also leave from Punta Arenas in southern Chile.

Tours from Ushuaia leave via boat, while tours from Punta Arenas depart via flight. Therefore, it’s important to purchase a robust travel insurance policy instead of a bare-bones policy with limited coverage.

Antarctica cruises

In many cases, the best way to see Antarctica is to take a cruise. The best travel insurance for an Antarctica cruise includes higher limits for missed connections and medical emergencies. Cruise insurance may also protect you against unexpected delays and cancellations.

A comprehensive travel insurance policy combines several types of coverage to give you the greatest amount of protection available.

Consider getting these types of coverage for your trip.

Emergency medical insurance

U.S. health insurance doesn’t cover medical expenses incurred in Antarctica. This includes Medicaid, Medicare and other government health insurance programs. Due to the lack of medical infrastructure in Antarctica, you should aim for at least $100,000 in emergency medical coverage .

Medical evacuation insurance

This is one of the most important components of an Antarctica travel insurance plan. Because Antarctica is extremely remote and has no medical infrastructure, it costs a significant amount of money to evacuate in the event of a medical emergency.

Aim for at least $250,000 worth of medical evacuation (medevac) coverage . Some policies include up to $1 million in medevac coverage.

Trip delay insurance

You can’t just get on a plane and land in Antarctica a few hours later. You may have to take multiple flights, board a cruise ship or hop on a boat to get to your destination. From your initial flight to South America to the 48-hour boat ride to Antarctica, trip delay insurance protects you in the event of an airline or boat delay.

Trip cancellation insurance

The Southern Ocean is known for its volatile weather conditions. It’s not unusual for tour operators to cancel with little notice due to inclement weather or other safety issues. Many tour operators also require nonrefundable deposits, making it even more important to protect your investment.

If you cancel for a covered reason , your insurance provider will reimburse your prepaid, nonrefundable costs. Covered reasons include sudden illness, the death of a travel companion and natural disasters.

Cancel-for-any-reason insurance

Cancel-for-any-reason coverage is more flexible than standard trip cancellation insurance. Many providers will reimburse up to 75% of your prepaid, nonrefundable trip costs, regardless of your reason for cancellation.

Baggage insurance

If you’re visiting Antarctica, you can’t get away with a tiny suitcase filled with a few essentials. You’ll need a heavy jacket, thermal underwear, expedition gear and other items to protect your body from the elements. Many people also bring expensive camera equipment to capture the penguins, leopard seals and whales in all their glory.

Baggage insurance reimburses you for losses related to lost, stolen and damaged luggage. For example, if one of your bags goes missing between Argentina and Antarctica, your insurance provider may reimburse you accordingly. Note that this type of insurance usually has a limit of a few hundred to a few thousand dollars. Your insurer probably won’t reimburse you for $10,000 in specialized photography equipment, so pack accordingly.

Baggage delay insurance protects you in the event of unexpected delays. To qualify for reimbursement, you must be traveling via a common carrier. If you arrive before your baggage, your insurer may cover the cost of purchasing clothing, toiletries and other items to tide you over until your suitcase arrives.

Typically, a delay must last for several hours before your baggage delay insurance kicks in. For example, some insurers don’t reimburse travelers unless a delay lasts for at least 12 hours.

Adventure insurance

If trekking to an ice-covered continent doesn’t satisfy your appetite for adventure, you’re in luck. Antarctica offers plenty of opportunities for kayaking, skiing and sledding. If you plan to participate in an adventure activity, consider upgrading your Antarctica travel insurance policy to cover any resulting emergencies.

Even the most comprehensive policies typically exclude the following.

- Foreseeable events: To qualify for coverage, an event must be unforeseeable. That means you don’t know about it ahead of time. Travel insurance doesn’t cover foreseeable events, which are events that a reasonable person traveling to your destination would know about. For example, if the Air Line Pilots Association announces a strike, you have reasonable knowledge that your flight is likely to be grounded.

- Natural disasters that occur before you purchase travel insurance: If an earthquake hits after you’ve already purchased a travel insurance policy, your insurer should reimburse you for your prepaid, nonrefundable expenses. If it hits before you purchase insurance, however, you won’t be covered.

- Preexisting medical conditions: A preexisting medical condition is a condition that you had before you purchased travel insurance. For example, if you’ve had diabetes for years, you have a preexisting condition. Travel insurance typically doesn’t cover any medical costs associated with these health issues. However, you may be able to purchase a preexisting condition waiver , giving you extra coverage during your trip.

- Normal pregnancy: If you’re pregnant on your trip , your insurance plan won’t cover routine obstetric care. Some insurers cover the cost of treating pregnancy-related complications, but it depends on the terms of your policy.

- Risky/illegal activities: Travel insurance doesn’t cover losses associated with criminal activity, alcohol consumption or the use of illicit substances. Standard plans also exclude adventure sports. If you plan to participate in adventure activities, consider purchasing an add-on. A travel insurance add-on augments the coverage bundled into your original policy.

- Claims without adequate documentation: If you can’t prove that you suffered a covered loss, your insurance company may deny your claim. Therefore, it’s important to keep receipts, medical records and other documents. For example, if you have a medical emergency requiring evacuation, you should keep copies of your medical bills.

Based on our sales data, visitors who purchased travel insurance through our website paid an average of $324 for a 17-day trip to Antarctica. Therefore, we can assume that a plan costs around $19 per day .

To give you more insight into how much travel insurance costs for a trip to Antarctica, we got quotes from some of the top providers. All of our quotes follow the guidelines of having at least $100,000 in emergency medical and at least $250,000 in medical evacuation coverage.

We used these parameters for our quotes:

- Age: 50 years old

- State of residency: California

- Destination: Antarctica

- Trip Length: 14 days

- Time of trip: November 2024

- Trip cost: $8,000

In this first example below, we’ve displayed quotes for basic travel insurance coverage. These plans cost around $3 to $5 per day.

Example Where Plan Doesn’t Reimburse the Full Antarctica Trip Cost

This next example shows our quotes for more comprehensive travel insurance that include trip cancellation and interruption coverage. These plans range from around $26 to $58 per day .

Example Where Plan Does Reimburse the Full Antarctica Trip Cost

Factors that impact the cost include:

- Age . Older people have an increased risk of chronic health conditions. Therefore, it’s more expensive to insure an older person than it is to insure someone in their 20s or 30s.

- Trip length . Long trips cost more than short trips, so you need additional coverage to ensure you have the right amount of protection.

- Add-ons . If you purchase add-ons, your plan will cost more than a basic insurance plan.

- Number of travelers . It costs more to cover multiple people than it does to cover one person.

- Coverage limits . If you choose a plan with high coverage limits, you’ll pay more than someone who selected a plan with low limits. For example, it costs less to insure 75% of your trip than it does to insure 100% of your trip.

Follow these tips to find the best travel insurance for Antarctica.

Think about how you’re getting there.

Antarctica is a remote destination, so each trip includes multiple legs. The more complicated your itinerary, the more likely it is that something will go wrong, whether it’s a baggage delay or a medical emergency.

Make a list of the activities you plan to do.

If any of them qualify as adventure activities, you may need to purchase an add-on. Otherwise, your standard plan won’t cover any expenses arising from your participation in adventure sports.

Buy insurance as soon as possible after you book your trip.

The longer you wait, the more likely it is that something will happen, rendering you unable to get coverage for certain events. For example, if a landslide occurs before you buy a policy, you won’t be eligible for reimbursement if you have to cancel due to landslide damage.

Request quotes from multiple companies.

Our online comparison tool makes it easy to compare cost and coverage details.

Is travel insurance required for Antarctica?

Yes. Because it costs so much money to get there, all tour operators require travelers to carry medical insurance. We recommend purchasing additional coverage to ensure you don’t lose a significant amount of money due to unforeseen events.

What is the average cost of a cruise to Antarctica?

A standard cruise to Antarctica costs anywhere from $3,000 to $20,000. It may cost much more if you book a luxury cruise. This doesn’t include transportation to the departure port or activities that aren’t part of the cruise package.

Can tourists fly to Antarctica?

No commercial airline offers flights to Antarctica. To get to your destination, you need to fly from Punta Arenas or take a boat from southern Chile.

Can you take a private trip to Antarctica?

Yes, it’s possible to take a private expedition to Antarctica. However, we advise you to use a reputable tour operator instead, as tour professionals know the area and understand how to navigate the rough waters.

How much does medical evacuation from Antarctica cost?

It depends on what type of transportation you use and where you need to go. However, Squaremouth advises travelers to purchase at least $100,000 in medevac coverage. This seems like overkill, but it’s extremely expensive to evacuate via helicopter or boat.

Leigh Morgan is a seasoned personal finance contributor with over 15 years of experience writing on a diverse range of professional legal and financial topics. She specializes in subjects like navigating the complexities of insurance, savings, zero-based budgeting and emergency fund development.

In the last five years, she’s authored over 300 articles for credit unions, digital banks, and financial professionals. Morgan is also the author of “77 Tips for Preventing Elder Financial Abuse,” a book focused on helping caregivers protect the elderly from financial scams.

In addition to her writing skills, she brings real-world financial acumen thanks to her previous experience managing rental properties as part of a $34 million real estate portfolio.

Explore related articles by topic

- All Travel Insurance Articles

- Learn the Basics

- Health & Medical

- Insurance Provider Reviews

- Insurance by Destination

- Trip Planning & Ideas

Best Travel Insurance Companies & Plans in 2024

Best Medical Evacuation Insurance Plans 2024

Best Travel Insurance for Seniors

Best Cruise Insurance Plans for 2024

Best COVID-19 Travel Insurance Plans for 2024

Best Cheap Travel Insurance Companies - Top Plans 2024

Best Cancel for Any Reason (CFAR) Travel Insurance

Best Annual Travel Insurance: Multi-Trip Coverage

Best Travel Medical Insurance - Top Plans & Providers 2024

- Is Travel Insurance Worth It?

Is Flight Insurance Worth It? | Airlines' Limited Coverage Explained

Guide to Traveling While Pregnant: Pregnancy Travel Insurance

10 Romantic Anniversary Getaway Ideas for 2023

Best Travel Insurance for Pre-Existing Medical Conditions April 2024

22 Places to Travel Without a Passport in 2024

Costa Rica Travel Insurance: Requirements, Tips & Safety Info

Best Spain Travel Insurance: Top Plans & Cost

Best Italy Travel Insurance: Plans, Cost, & Tips

Best Travel Insurance for your Vacation to Disney World

Chase Sapphire Travel Insurance Coverage: What To Know & How It Works

2024 Complete Guide to American Express Travel Insurance

Schengen Travel Insurance: Coverage for your Schengen Visa Application

Mexico Travel Insurance: Top Plans in 2024

Best Places to Spend Christmas in Mexico this December

Travel Insurance to Canada: Tips & Quotes for US Visitors

Best Travel Insurance for France Vacations in 2024

Travel Insurance for Germany: Top Plans 2024

Best UK Travel Insurance: Coverage Tips & Plans April 2024

Best Travel Insurance for Trips to the Bahamas

Europe Travel Insurance: Your Essential Coverage Guide

Best Trip Cancellation Insurance Plans for 2024

What Countries Require Travel Insurance for Entry?

Philippines Travel Insurance: Coverage Requirements & Costs

Travel Insurance for the Dominican Republic: Requirements & Tips

Travel Insurance for Trips Cuba: Tips & Safety Info

AXA Travel Insurance Review April 2024

Best Travel Insurance for Thailand in 2024

Travel Insurance for a Trip to Ireland: Compare Plans & Prices

Travel Insurance for a Japan Vacation: Tips & Safety Info

Faye Travel Insurance Review April 2024

Travel Insurance for Brazil: Visitor Tips & Safety Info

Travel Insurance for Bali: US Visitor Requirements & Quotes

Travel Insurance for Turkey: U.S. Visitor Quotes & Requirements

Travel Insurance for India: U.S. Visitor Requirements & Quotes

Australia Travel Insurance: Trip Info & Quotes for U.S. Visitors

Generali Travel Insurance Review April 2024

Travelex Travel Insurance Review for 2024

Tin Leg Insurance Review for April 2024

Travel Insured International Review for 2024

Seven Corners Travel Insurance Review April 2024

HTH WorldWide Travel Insurance Review 2024: Is It Worth It?

Medjet Travel Insurance Review 2024: What You Need To Know

Travel Insurance for Kenya: Recommendations & Requirements

Travel Insurance for Botswana: Compare Your Coverage Options

Travel Insurance for Tanzania: Compare Your Coverage Options

Travel Insurance for an African Safari: Coverage Options & Costs

Nationwide Cruise Insurance Review 2024: Is It Worth It?

- Travel Insurance

- Travel Insurance for Seniors

- Cheap Travel Insurance

- Cancel for Any Reason Travel Insurance

- Travel Health Insurance

- How Much is Travel Insurance?

- Is Flight Insurance Worth It?

- Anniversary Trip Ideas

- Travel Insurance for Pre-Existing Conditions

- Places to Travel Without a Passport

- Christmas In Mexico

- Europe Travel Insurance

- Compulsory Insurance Destinations

- Philippines Travel Insurance

- Dominican Republic Travel Insurance

- Cuba Travel Insurance

- AXA Travel Insurance Review

- Travel Insurance for Thailand

- Ireland Travel Insurance

- Japan Travel Insurance

- Faye Travel Insurance Review

- Brazil Travel Insurance

- Travel Insurance Bali

- Travel Insurance Turkey

- India Travel Insurance

- Australia Travel Insurance

- Generali Travel Insurance Review

- Travelex Travel Insurance Review

- Tin Leg Travel Insurance Review

- Travel Insured International Travel Insurance Review

- Seven Corners Travel Insurance Review

- HTH WorldWide Travel Insurance Review

- Medjet Travel Insurance Review

- Kenya Travel Insurance

- Botswana Travel Insurance

- Tanzania Travel Insurance

- Safari Travel Insurance

- Nationwide Cruise Insurance Review

Policy Details

LA Times Compare is committed to helping you compare products and services in a safe and helpful manner. It’s our goal to help you make sound financial decisions and choose financial products with confidence. Although we don’t feature all of the products and services available on the market, we are confident in our ability to sound advice and guidance.

We work to ensure that the information and advice we offer on our website is objective, unbiased, verifiable, easy to understand for all audiences, and free of charge to our users.

We are able to offer this and our services thanks to partners that compensate us. This may affect which products we write about as well as where and how product offers appear on our website – such as the order in which they appear. This does not affect our ability to offer unbiased reviews and information about these products and all partner offers are clearly marked. Given our collaboration with top providers, it’s important to note that our partners are not involved in deciding the order in which brands and products appear. We leave this to our editorial team who reviews and rates each product independently.

At LA Times Compare, our mission is to help our readers reach their financial goals by making smarter choices. As such, we follow stringent editorial guidelines to ensure we offer accurate, fact-checked and unbiased information that aligns with the needs of the Los Angeles Times audience. Learn how we are compensated by our partners.

Travel Insurance

Antarctica travel insurance can help cover trip cancellation, curtailment, or interruption. These plans can also cover expenses that might arise as a result of loss, damage, injury, and delay, or other inconvenience occurring to or otherwise involving a passenger (e.g. assistance if your luggage is lost). Many Antarctic travel insurance policies include medical coverage during travel.

Medical Insurance

In most cases, trips to Antarctica require proof of out-of-country medical coverage. Your insurance plan must cover personal injury, medical expenses, repatriation expenses, evacuation expenses, and pre-existing medical conditions.

Medical Evacuation Insurance

Antarctic Cruise companies often require a policy that will cover air evacuation from Antarctica (King George Island) to Punta Arenas, Chile. Several companies offer medical evacuation insurance for Antarctica. Evacuation from Antarctica can cost more than US$150,000 per person, prompting some cruise operators to set that amount as their policy minimum.

Antarctic medical evacuation policies usually cover the cost of any medical care needed during transportation (e.g. doctor, medical supplies, etc). When the patient is delivered to the closest hospital, the coverage provided by an Antarctic medical evacuation insurance policy ends. Any further medical costs are not covered by Antarctic medical evacuation policies. Therefore, additional medical coverage is needed/required.

As these three types of policies can overlap or leave gaps when purchased separated, most cruise operators recommend their passengers purchase comprehensive Antarctic medical travel insurance.

Comprehensive Medical Travel Insurance

Comprehensive Antarctic Medical Travel Insurance policies typically include:

- Medical Evacuation and Repatriation in remote areas, including Antarctica.

- Evacuation travel insurance coverage of $150,000 per person (limits vary by cruise operator)