Liberty Travel Insurance

Your safety may not be your top priority as you go through life. Work, family, and responsibilities all take precedence; however, have you ever considered the ramifications for your loved ones and co-workers if you become incapacitated without warning? If that’s the case, you’ve come to the right place. At Liberty Insurance, they have a variety of travel and personal accident insurance products to fit your needs.

About Liberty Insurance

Liberty Insurance are firm believers that progress occurs when people feel safe. They are dedicated to assisting their customers and employees on a daily basis so that they can protect their families, grow their businesses, and invest in their future. They vow to protect you in those unanticipated situations, and they’ll provide it with care. Liberty Insurance is a name you can trust, with over 44 years of experience in delivering comprehensive insurance solutions to Malaysians. They prioritise customer experience and are constantly working to give you the strength to face today’s challenges while confidently pursuing tomorrow’s goals.

Why should I choose Liberty travel insurance?

You should choose Liberty travel insurance because they have various benefits such as:

- Medical Payments

- Comprehensive Protection

- Liability Cover

- Additional Benefits

- 24-Hour Travel Worldwide Assistance

How do I contact Liberty Insurance for further informations?

- Customer Service Hotline

1 300 888 990 OR 03 2619 9000

customercare@ libertyinsurance.com.my

What are the types of products they have for travel insurance?

Their TravelStar Insurance Plan Policy is high in demand!

What is the period of the coverage?

TravelStar Insurance begins on the issue date of the Certificate of Insurance and ends when the intended trip begins, according to Section 3 (Benefit 11). The Period of Insurance begins when the insured leaves his or her home territory (provided the cover does not begin more than 24 hours prior to the scheduled departure time or ends more than 24 hours after the scheduled arrival at his or her home territory) and ends when he or she returns to his or her home or business in his or her home territory, whichever comes first.

This does not apply to one-way coverage, which ends 72 hours after your scheduled arrival time at your ultimate destination overseas or when the Period of Insurance expires, whichever comes first. Unless the delay is beyond your control, any stopover should not exceed 30 days.

If I’m holding a one-way ticket, am I eligible to purchase this plan?

Yes. The one-way cover is a trip that begins when you leave your house and ends when your specified arrival time at your final destination or the Period of Insurance expires, whichever comes first. Unless the delay is beyond your control, any stopover should not exceed 30 days.

What is the procedure for cancelling my coverage and receiving a refund of the premium paid?

You may cancel your coverage by notifying their company in writing. There will be no premium refund if you cancel.

Who do I contact for an emergency assistance or if I need to be admitted to a hospital while overseas?

They have 24-Hour Travel Worldwide Assistance. For worldwide emergency assistance, medical or travel advice, please contact: Asia Assistance Network(M) Sdn Bhd via (603)-7965 3977 .

What does TravelStar cover?

TravelStar provide coverage for:

- Personal Accident

- Medical and Other Expenses

- Losses and Inconveniences

- Emergency Services

You can click here for more information.

What are some of the policy’s general exclusions?

This policy does not cover for death or injury caused by the following events:

- Suicide and insanity;

- Self-inflicted injury;

- AIDS or any related diseases or tested on an HIV/ AIDS related blood test;

- Provoked murder or assault; and

- Hazardous sports

For further information, you can click here .

How much do I have to pay for TravelStar plan?

TravelStar Premium Table *6% Service Tax (SST) is not applicable for Travel Star Insurance (Overseas)

Asia includes Brunei, Cambodia, China, Hong Kong, India, Indonesia, Japan, Korea, Laos, Macau, Maldives, Myanmar, Nepal, Pakistan, Philippines, Singapore, Sri Lanka, Taiwan, Thailand and Vietnam.

Worldwide means all countries including Asia but excluding USA and Canada.

Worldwide means all countries including Asia, USA and Canada

What are the fees and charges that I have to pay?

How are my policies delivered.

The policies will be delivered to you via email.

- Car Insurance

- Berjaya Sompo

- Great Eastern

- Pacific & Orient

- Takaful Malaysia

- Tokio Marine

- Medical Insurance

- Motorcycle Insurance

- Travel Insurance

- Unit D-3A-06, Menara Suezcap 1 KL Gateway, No. 2, Jalan Kerinchi, Gerbang Kerinchi Lestari, 59200 Kuala Lumpur, Malaysia

- +6011-1684 2590

- [email protected]

- Damage Protection

- Riders Protection

- Employee Benefits

- Insurance Solutions

Our Company

- Terms of Business

- Privacy Policy

- Personal Data Protection Act

PolicyStreet is approved and licensed by Labuan Financial Services Authority under Polisea Labuan Ltd. (Company No. LL17429), Bank Negara Malaysia under Polisea Sdn. Bhd. (Company No. 201601041144 (1212085-T)), and Australian Securities & Investments Commission under Polisea Pty Ltd (ABN: 99655193016)

COPYRIGHT © 2017-2024 POLISEA GROUP OF COMPANIES. ALL RIGHTS RESERVED.

Hamdan Liberty Agency you can count on

You can purchase liberty insurance and roadtax in the comfort of your own home, 24 hours a day. renew liberty insurance with 3 simple steps now, dear valued customer of liberty msia ins berhad, at time after you have filled the form in "get a quote" link and error message prompt , do not worry. the error is an indication that your vehicle failed to go through the underwriting control checking. proceed with filling in the form above and we shall contact you at the earliest. #libertyjagakita, want to earn extra cash refers your friends, and earn rm10 when your friends renew their insurance with us whatsapp us now, @2022 hm falah sdn. bhd. all right reserved, privacy policy.

Buy Travel Insurance For Your Next Trip

- EN English Bahasa Malaysia 中文

- Login / Register

- Products All Insurance Products All Travel Insurances Compare Auto Insurance Compare Travel Insurance Compare Umrah Travel Insurance Compare Personal Accident Insurance Compare SME Business Loan Office All Risk Insurance Car Extended Warranty Auto Repair Loan Gadget Insurance Maid Insurance Golfer Insurance Phone Extended Warranty Medical Malpractice Insurance -->

- Free Financial Tools

Compare The Market

- Fincrew Blog •

- Claim Submission

- Alliance Bank Business Current Account

Where are you travelling to?

Foreigner Wanted To Visit Malaysia? Click Here

Please ensure your travel countries are cover within the Region

When are you travelling?

Who are you travelling with?

Travelling Party

No. of Traveller(s)

Age 1 month - 65 yrs old

The personal data you provide us within these questions will be retained to provide you with details of our insurance services. If at any time you want your data removed from our systems please let us know. Our privacy notice lets you know how we look after your data.

*A Verification Code will be sent via SMS for verification purposes.

Enter the verification code you received.

*All Travel Insurances are Eligible for Malaysians, Permanent Residents, Employment Pass/Work Permit Holders and Dependant(s) of Pass Holders, excluding overseas secondment & students studying overseas.

Trip cancellation is when something happens that prevents you from going on a previously planned trip, such as an unforeseen medical problem. Trip interruption is when you are part way through your journey and something happens that cuts it short, such as a family member’s medical emergency back home or a workers’ strike at an airport.

These cover the cost of moving you to a location where you can get necessary and appropriate treatment in the event of a medical emergency. Evacuation costs are generally not covered by your regular home-based health insurance.

This coverage provides reimbursement for lost, stolen, or damaged baggage and other personal items. It’s usually offered for your entire trip, not just flight-related activities.

This add-in covers Hospitalization & Benefits related to COVID-19.

Pays for emergency medical expenses during a trip. If you are traveling and have an unexpected illness, injury or medical condition that’s covered by your travel medical insurance, the plan will reimburse you, up to the plan limits.

Coverage for a quick getaway. Protection that stays with you all the way. Protects you against accidental bodily injury, even on short-term journeys.

Choose From Single Or Annual Trip

Enter Your Trip Details To Get Quotation

Pay Through Our secure And Simple Online Payment System

Fincrew have the biggest insurance and financial articles library online.

View All Articles

- Why do I need travel insurance? It is important to have travel insurance while you are travelling in case of accident, illness or loss of personal belongings. You may compare and get the comprehensive coverage from different insurance companies at Fincrew.

- What does travel insurance cover? Travel insurance provide accidental cover, illness or loss of personal belongings etc. Some insurance company provide additional benefits such as trip cancellation, pandemic cover or sports equipment.

- What is a pre-existing medical condition? A medical condition that started before a person’s insurance went into effect.

- When should I buy travel insurance? You should buy your travel insurance before your trip start and it is advisable to start 1 day or earlier before your trip.

- Does travel insurance cover natural disasters? Most of the travel insurance cover natural disasters and subject to the terms of the policy. It is important to compare your travel insurance at Fincrew.

- How long does travel insurance Last? Some of the insurance company cover up to 190 days for single trip and 90 days for annual trip cover. It is important to consult Fincrew Customer Service or refer to Product Brochure or Policy Wording from the respective insurance companies.

- What is the use of trip cancellation insurance? This benefit compensates you for irrecoverable travel and accommodation expenses as a result of trip cancellation due to serious injury or illness.

- Can I cancel travel insurance if I cancel my trip? You may terminate the policy at any time by giving a written notice to the company within fourteen (14) days or contact our Customer Service Centre here . Such termination shall become effective on the date the notice is received by the Company or the date specified in the notice, whichever is earlier. No premium will be refunded upon cancellation of cover.

Compare & Buy Travel Insurance

The risks of traveling and how to prevent them.

Traveling is a relaxing and enjoyable exercise. Whether domestic travel or an international tour, there’s a lot to gain from partaking in this age-old pastime. To make the most of any trip, you usually have to invest significant time and research into planning and implementing your travel itinerary. But just as with various other facets of life, your travel plans aren’t impervious to sudden and unexpected changes. While no one certainly hopes for it, it isn’t unusual for people to fall sick while on a trip away. Also, your flight could get canceled; you can lose your valued possessions somewhere along the way, or you could get involved in an accident. It is where we at Fincrew Travel Insurance come in! We go the extra lengths to make sure that you are financially stable, no matter the event. Travel comprises various things from transportation to accommodation and feeding. Fincrew Travel Insurance provides that you have a partner who can step in effortlessly and protect you from loss if anything goes wrong.

The Best Travel Insurance in Malaysia

Traveling is fun. However, it can also be a delicate affair. Sometimes, all it takes to ruin a carefully laid out travel plan is for you to miss one flight due to bad weather. You could have covered all the details of your trip only for an emergency to come up less than 24 hours before you move. We are your one-stop solution to ensure that you don’t lose any money due to trip cancelations. At Fincrew Travel Insurance, we understand more than most the value of reasonable travel assistance. That is why we have all the logistics support and backup you need to succeed in your trip. Even if you’re making a single trip for your domestic travel, our travel insurance plans give you comfortable options so you can efficiently work. From submitting a claim to getting the support you need in time, we work hand-in-hand with you to provide a policy you can truly depend. Still not sure if we’re right for you, here are a few reasons to compare and buy travel insurance from our team!

Why Use Fincrew Travel Insurance

There are a lot of companies where you can buy travel insurance. What makes Fincrew the best option for you when you want to compare and purchase travel insurance in Malaysia today? Setting aside that we have one of the best travel insurance Malaysia reviews around, we don’t rest on our laurels. Our team has been pushing boundaries and finding innovative and proactive ways of protecting your precious travel plans. When you get any of our travel insurance plans, you are assured;

Top-Tier Customer Service

Even when it’s a domestic travel adventure right here in Malaysia, an unexpected hiccup with your plans can leave you feeling lost and confused. We account for this possibility and afford you the most convenient solution under any circumstance. Our customer service channel is available 24 hours a day to ensure that we get on top of any problem you might have from the second you report it in. We take the task of safeguarding your financial security very seriously, so we ensure that you always have a fast and accessible point of contact at all times. The Fincrew customer service team is specially trained and equipped to provide you with immediate solutions to help you ease any discomfort you might feel until it is a resolved issue.

Fast Intervention With Travel Interruptions

Be it a single trip or a tour that spans multiple continents; we have a seamless system and network in place that ensures that no unfavorable traveling conditions catch you ill-prepared. No matter what time of the year you plan on traveling or what the weather presents during your trip, we have a rapid response policy that covers trip cancellations and speedily delivers on all valid travel claims. Count on us to save the day fast and without fuss from missed connections to set up new reservations.

Extensive Medical Expenses Coverage For Emergencies

Some travel adventures tend to demand more physical activity than others. For example, if you plan on hiking or going on a safari adventure, there’s a relatively high chance that you could hurt yourself. In other instances, the local cuisine mightn’t agree with you, and you end up falling sick. Whatever the case may be, our travel insurance plans offer some of the most comprehensive personal accident protection you’ll see around today! You don’t have to think about emergency medical expenses. A few things you can expect rapid financial recovery for after submitting a claim includes;

- Medical evacuations

- Medical transport

- All prescriptions

Comprehensive Personal Liability Coverage

A big part of the traveling experience includes renting accommodation spaces and, in many cases, cars to facilitate smoother transportation. Sometimes, unexpected things happen and end up damaging these items to varying degrees. Once you file travel claims with us, we make this go away quickly and quietly. Our comprehensive coverage sees to it that you avoid out-of-pocket costs if you unknowingly damage any property or injure a third party. What’s more, we let you know just what each of our travel insurance plans covers you for clearly in the terms and conditions section of the policy. As the best travel insurance in Malaysia, each review from our long list of clients attests to our true experts in our field. When you compare and buy travel insurance with Fincrew, you effectively secure your trip financially. So, if you’re ready to give your next international or domestic trip the best protection possible in the country today, check out the list of travel insurance plans we have to offer below!

You plan to shop online for the best auto insurance policy when you get home. After that, you’ve also got to start shopping for a provider with the best interest rate as you plan on applying for a personal loan or SME loan soon. And oh, your medical insurance will be lapsing soon, and you need to renew it before it expires. It reminds you of the home insurance you’ve been putting off for so long! How will you ever manage with so many financial services to attend to at once? How will you ever manage?! We are introducing the new and improved FinCrew! You don’t have to dash from one tab on your browser to the next anymore! With our newly optimized user interface, you now have all the financial products and services you could need.

Tower A Level 1-05 Vertical Business Suite Avenue 3 Bangsar South No 8 Jalan Kerinchi 59200 Kuala Lumpur Malaysia +60182288606

SO-31-02 Menara 1 Strata Office No 3 Jalan Bangsar 59200 Kuala Lumpur +60133322455

About Fincrew

Insurance Products

Loan Products

Other Products

Financial Tools & Calculators

Policy & Legals

Featured Partners

Featured Articles In Automotive

Featured Articles In Travel

Featured Articles In Personal Finance

Featured Articles In Loan

If you had renewed your insurances with us before, our system will auto setup an account for you. Check your mailbox and login again to view your purchase history.

Signing up only take you 3 minutes and you can have access to all your saved vehicles, purchase history and make fast renewal.

Join Fincrew Mailing List

I agree to receive your newsletters and accept the data privacy statement.

- Advertise with us

- Best Car Insurance

- Best Life Insurance & Family Takaful

- How it works

- FAQ for Motor Award

- Car Insurance

- Car Takaful

- Travel Insurance

- Travel Takaful

- Life Insurance

- Insurance Agents

- Insurance Companies

- Repair Workshops

- Dental Clinics

Best Travel Insurance in Malaysia – 2022 Ultimate Guide Travel Insurance Best Travel Insurance in Malaysia – 2022 Ultimate Guide Best Travel Insurance in Malaysia – 2022 Ultimate Guide

- May 31, 2022

In this Ultimate Travel Insurance Guide, we will take a closer look at eight insurance companies to find the Best Travel Insurance in Malaysia.

Travel Insurance is a great way to protect you from unfortunate events that can cost you a lot of money. In Malaysia, we have 12 insurance companies that offer travel insurance, and it is not easy to compare them and find out which is the Best Travel Insurance for you.

The benefit of buying online is that it is fast and you can even do it on your way to the airport when you have forgotten to buy it. The other benefit is that many insurance companies offer an additional discount when you buy online.

Quick Links to Content

- 7 Malaysian companies that sell Travel Insurance Online

- 5 Malaysian companies that sell Travel Insurance Offline

Which travel insurance is the cheapest?

- Which Travel Insurance is the Best for me?

- – Step 1: What is the biggest worry when travelling?

- – Step 2: How much protection do we need?

- The BEST Travel Insurance for you only

Wait? Why is Personal Accident insurance not important?

- Best Travel Insurance for Single Traveler:Allianz

- Best Travel Insurance for Trips with Travel Agent: Tokio Marine

7 Malaysian Insurance companies where you can buy Travel Insurance Online

Source: Rating and Review counts are from http://review.ibanding.my dated 16.05.2022

5 Malaysian Insurance companies that sell Travel Insurance Offline

Buying travel insurance online is easy.

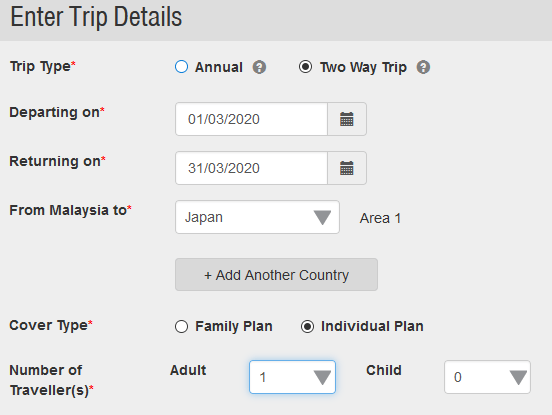

We took a closer look at the webpages from all the seven insurance companies that offer travel insurance online and surprisingly, all of them are Easy to Very Easy to use. For most webpages, all you need to provide is the below information, and you can get a price on your travel insurance:

- Who is travelling? Single, Family or Group

- Where are you going to?

- From when to when are you travelling?

- Do you want to buy a single trip or an annual plan?

If you compare it to buying car insurance online , buying travel insurance is much easier even if you do not know much about insurance. And if you are still unsure? Keep on reading; we will show you how we found the Best Travel Insurance for us.

Many people like us, when it comes to buying anything, we look at the price and ask, which is the cheapest travel insurance ? It is a typical question to ask because when we buy something, we do not want to pay more money if we can get it more affordable. We took a quick look at the prices for a sample trip of 7 nights to Japan for a single 30-year-old traveller . You might say that you are not travelling to Japan and it does not help you. But our example will give you a rough idea of how big the difference is between the insurance companies. You can then select a few companies to do your research and find the right insurance for you. Here are the results:

What a difference in prices!

The price range for travel insurance goes from the cheapest RM 27 up to RM 54. The excellent news, Travel Insurance, is cheap. So Travel Insurance is something that everyone can afford. Especially if you consider that not having travel insurance can cost you up to RM 250,000 in medical expenses if you fall sick in another country.

If you look at the products, there are 7 possible Malaysian Travel Insurances that you can buy online. Some companies like AIG offer different product levels so that there are more travel products than insurance companies.

Our question “What is the cheapest travel insurance?” is easy to answer. In our case, it is AIG Malaysia Starter that only costs us RM 27.00. It is so much cheaper than a 5-piece Chicken combo at KFC.

But Wait !! Is Cheaper = Better?

The obvious answer is No . When it comes to insurance, the cheapest insurance is not always the Best Travel Insurance for you . The better question to ask is “Which Travel Insurance is the BEST for me? “. If we look at the cover for Medical Expenses and Travel Delay, we immediately notice that AIG Malaysia Starter only covers Medical Expenses for RM 100,000 compared to Allianz Travel Easy that includes Medical Expenses of up to RM 200,000 . That difference is huge! In addition, Allianz also covers Travel Cancellation up to RM25,000 while AIG does not offer this.

Which Travel Insurance is the Best for me?

So if the price is not the right way to find the Best Travel Insurance, how do you find it? Many professional agents will agree that the answer is “It depends on you” . How many insurances do you already have? Are you married or single? Do you have a house loan that needs to be paid or you live with your parents. So yes, it might be worth talking to someone who is an insurance agent or someone who works for an insurance company to get their advice and opinion.

Once you learn more about Travel Insurance and how it protects you during your vacation, you can then decide for yourself. Below, we will give you a general step-by-step guide on how you can find which travel insurance is the Best for you . Legal disclaimer here, we are not a licenses insurance agent or financial advisor, and we do not sell insurance. So, the guide is our opinion, and you should talk to many people to get their views before buying insurance.

Step 1: What is the biggest worry when travelling?

In the first step, you need to brainstorm what would be something that you think could happen to you and cost a lot of money, when it happens during your travel. For example, the following three events occur most often to people when they fly to another country for vacation.

1. The flight delays more than six hours

The number one things that can happen during your trip is a flight delay. A flight delay of a few hours is inconvenient, but the world does not end, and you can still enjoy your vacation. If a flight is delayed more than six hours, then very often a lot of additional costs pop-up. You will miss your connecting flight. You have to stay for one more night in a foreign country without any hotel bookings. Many things that you did not plan for and cost extra money. If your flight is cancelled or delayed overnight and you need to spend another unplanned night => DISASTER. iBanding CEO Luke Roho described his experience of a cancelled flight with AirAsia in this article What I Did When My AirAsia Flight Was Cancelled and How I Received RM 700 for It

Flight delay is the most essential protection we are looking for.

2. Luggage is delayed or lost

You arrive at your vacation destination, and your luggage is missing. Your warm jacket on your winter trip to Japan is in the bags, and now you are freezing outside in Tokyo. Your business suit or dress for the meeting is missing. If your checked-in luggage is missing for more than a day, you most likely will need to buy extra clothes, toothbrush, soap and many more things to enjoy your vacation still. You do not waste time waiting in your hotel room for your luggage to arrive. You want to make the most of the limited time you have to enjoy your vacation. If your baggage is delayed or missing, then you need to spend a lot more money to enjoy your vacation still. A lot of money that you might not have or planned to use for tours, food, etc. instead of clothing.

Luggage delay is the second important protection we are looking for in a Travel Insurance.

3. You get sick during your vacation

Another worry, when travelling in countries where the living costs are much higher than Malaysia is Medical Expenses. Many Malaysians, when they go to another country for the first time, get sick, because they are not used to the different temperatures and environment. We are just not used to the different seasons like spring, fall and winter. In Malaysia, it is always summer. Hot dry or hot rainy.

You like to eat out and adventure on a food journey Makan-Makan? If you are this kind of person, then food poisoning is no stranger to you. If you get sick on your vacation, you might not be able to wait until you get home to see a doctor. Then going to the doctor or the hospital abroad is not cheap. A doctor visit as a foreigner in Japan can cost you about RM 220 – 730 because as a foreigner you pay even more than locals. The low ringgit and the high exchange rate makes a doctor or hospital visits in developed countries like Japan, Korea, Australia or the US cost a fortune. The worst part is if you have an accident or need to get admitted to the hospital. Then the cost can go quickly into the hundred thousands of ringgit.

Medical Expenses is the third most crucial protection when we look for Travel Insurance.

So in our example cases, those are the three things that worry us the most: Flight delay, Delayed Luggage and Medical Expenses. You might ask, what about all the rest like Personal Accident, Permanent Disablement, Hospital Income, Funeral Expenses and more more more?

Many of the other protections might be more critical for you, so you need to look into those in more detail and compare those between the different insurance products. In our example, we decided that the three possible events, we worry the most for our vacation are Flight Delay, Delayed Luggage and Medical Expenses.

Many insurance companies especially highlight the Personal Accident Benefit of Travel Insurance. This means that if you die during an accident, then your surviving loved ones will get the Sum Insured. For example, Berjaya Sompo Basic the cheapest insurance will pay RM 100,000 and AIG the most expensive travel insurance will pay RM 300,000.

Travel Insurance is terrible to cover your death

The reason why Personal Accident is not our priority is that Travel insurance is terrible to cover you for your death. If you do want to have money for your loved ones, you should have protection not only during your vacation. YOU WANT TO HAVE PROTECTION ALL THE TIME. It just does not make sense to insure yourself for accidental death only for vacation. Out of 365 days a year, how many days are you on vacation? Why do you think that you will only have an accident during your vacation?

Travel Insurance is not Life Insurance

If you worry about your death and want to make sure that your parents, spouse and children have enough money when you die, then get Life Insurance or buy Personal Accident insurance is the better choice. The protection is then not only for the trip but for a whole year or longer. This is the main reason why we do not consider the sum insured for Personal Accident essential and worth looking at when reviewing travel insurance. When we buy Travel Insurance, we only want to look at the things we want to protect ourselves from during the vacation. Death from an accident is not one of them, because we want to be protected against accidents all the time . Not only on holidays.

Step 2: How much protection do we need?

In the 2nd step, we need to look at how much protection do we need for those three things that we worry the most?

1. Flight delays more than six hours

Insurance companies offer a fixed amount after a set number of hours of flight delay. For example, Berjaya Sompo gives RM 200, if your flight is delayed for six hours. If the flight is delayed for another 6 hours, so in total 12 hours, then you get another RM 200.

Etiqa is unique among the insurance companies because it pays RM 100 already after a flight delay of 2 hours. A 2-hour delay can happen quite often, especially during international flights.

Selection Criteria: When we look at the amount, we want the highest possible. The higher the amount, the better.

Here, we take the same approach as a flight delay. Instead of looking at how much the maximum payout is for delay or lost luggage, we look at the amount that is paid out after 6 hours of flight delay. Berjaya Sompo, for example, pays RM200 for every 6 hours your luggage is delayed up to an amount of RM 800. To get RM 800 your luggage needs to be delayed for 24 hours.

Selection Criteria: We prefer the insurance company that pays the most out after 6 hours. The higher the amount, the better.

The most significant difference between insurance companies is medical expenses. To recap, AXA Affin has the lowest amount of RM 50,000, and Tune has the highest of RM 300,000. The more we need, the more we pay for the Travel Insurance. This is why Berjaya Sompo is also among the expensive travel insurance. Here again, to find the Best Insurance for you, you need to decide for yourself, what medical expense amount makes sense. We are no experts for medical expenses in other countries, so we take the best approach possible, which is to go with the most popular amount. RM 200,000 is the coverage that most travel insurance companies provide, so we believe it is good choice to say that the insurance we want must provide at least RM 200,000. It can have more, but it should not have less than RM 200,000 in protection against medical expenses during the vacation.

Selection Criteria: The medical expenses coverage must be RM 200,000 or higher.

The BEST Travel Insurance in Malaysia for you only

Just by taking two simple steps, (1) Setting what protection is most important to you and (2) Setting what is the amount of protection you need, we have reduced the number of possible Travel Insurance products from 11 products to 8 products and are now able to put them into a ranking that you see below. At the top is the insurance that matches our criteria the most. At the bottom is the travel insurance that matches our needs the least.

3 Travel Insurance Products that can be the BEST for you

The current ranking shows Berjaya Sompo travel insurance as the BEST because it pays the highest after 6 hours of travel delay (RM 200), a high RM 800 for Luggage Delay after 6 hours and a high medical coverage at RM250,000. This also fulfils our requirement of RM 200,000 for medical expenses.

Berjaya Sompo travel insurance costs RM 37.00 and is just RM4.50 extra than AXA Affin Classic, but the medical coverage from Berjaya Sompo is 5 times higher. Also, AXA Affin Classic does not pay you any support when there is a Travel Delay. Berjaya Sompo pays you RM200 for every 6 hours of the delay. If you look for value for money, then Berjaya Sompo is clearly the value for money winner.

On second place we have Tune. It pays RM200 after 6 hours of travel delay, pays up to RM1,000 for Luggage Delay and a medical coverage of RM300,000

Best Travel Insurance for Single Traveler:

Berjaya sompo.

Buy Now at Berjaya Sompo

The insurance that fulfils our needs and is the best is Berjaya Sompo Travel Safe . Berjaya Sompo’s Travel insurance provides RM 200 after 6 hours of flight delay. Berjaya Sompo Travel Safe also covers medical expenses up to RM 250,000, which is the highest and fulfils the minimum amount we require. Berjaya Sompo Travel Safe costs RM 37.00 for our trip.

Best Travel Insurance Malaysia has to offer is:

- Berjaya Sompo – Travel Safe Elite C

- Tune – Travel Easy Basic

- Allianz – Travel Easy

15% Discount on Motor Insurance From Berjaya Sompo

Discount 15% on Medical Insurance From Berjaya Sompo

Do you agree with our list? In your opinion, which insurance company provides the best travel insurance in Malaysia?

Leave a comment cancel comment.

WhatsApp us

- FOR INDIVIDUAL

- PERSONAL BANKING

- WEALTH BANKING

- PRIVILEGE BANKING

- PRIVATE BANK

- UOB REFERRAL

- FOR COMPANIES

- BUSINESS BANKING

- WHOLESALE BANKING

- FOREIGN DIRECT INVESTMENT

- UOB ASEAN INSIGHTS

- INDUSTRY INSIGHTS

- ABOUT IBOR TRANSITION

- CHANGES TO BENCHMARK RATES

- UOB ISLAMIC BANKING

- Islamic Banking

- CORPORATE PROFILE

- STAKEHOLDER RELATIONS

- UOB Digitalisation

- UOB MALAYSIA

- UOB SINGAPORE

- UOB HONG KONG

- UOB INDONESIA

- UOB PHILIPPINES

- UOB THAILAND

- UOB VIETNAM

- UOB PERSONAL INTERNET BANKING

- UOB INFINITY

- Credit Card

- Savings Account

- UOB Chat Assist

- General Insurance

- Travel Insurance

UOB Traveller’s Insurance Plus

From short local trips to overseas holidays, enjoy every journey with the peace of mind you deserve when you and your loved ones are protected with Enhanced UOB Traveller’s Plus Insurance.

*This product is exclusively for UOB customers only.

Eligibility

Enhanced UOB Traveller’s Plus Insurance provides the peace of mind you deserve. Extend your coverage protection with important add-on protection such as Covid’19 extension, Extreme Sports and Dengue Coverage.

- Protection from as low as RM35 per coverage

- 31 comprehensive benefit coverage, e.g. Medical Expenses, Trip Cancellation, Trip Curtailment, Travel Delay and many more

- Additional add-on benefits such as Covid19, Extreme Sports and Dengue coverage.

Geographical Areas

- Domestic shall means anywhere within Malaysia only.

- Asia includes as Brunei, Cambodia, China, Hong Kong, India, Indonesia, Japan, Laos, Macau, Malaysia (East to West or vice-versa), Myanmar (Burma), Nepal, Singapore, Philippines, South Korea, Thailand, Taiwan, Vietnam, Pakistan, Maldives, Sri Lanka, etc.

- Worldwide is defined as all countries including Asia (as defined above) except Excluded Countries such as Iran, Yemen, Syria, North Korea, Russia, Cuba, Israel, Venezuela, Ukraine and Belarus and all other sanctioned and war declared countries.

Section 1: Personal Accident

Overseas (Outbound)

Domestic (Inbound)

Section 2: Medical and Other Expenses

Section 3: Emergency Medical Evacuation & Repatriation

Section 4: Travel Inconveniences

For optional add-on benefits, please refer here .

- All Malaysians, Malaysian permanent residents, valid work permit holders or individuals legally employed in Malaysia, and his/ her spouse and child/children who are legally residing in Malaysia.

- Individual and/or Spouse plan above 18 years old to 85 years old

- Insured and Child plan include you and your children within 30 days and below 18 years old

- Family Plan include you, your spouse and child(ren) within 30 days and below 18 years old.

- Each trip must begin or end in Malaysia except for One Way Cover.

- The above premium rates apply for both one-way and two-way cover.

- Maximum period of cover for one-way and two-way is 90 days and 185 days respectively.

Note: * Dependant below the age of 18 must be accompanied by an adult.

Apply Now and complete the application through our partner Liberty Insurance’s website

- Obtaining the form at any of our branches .

Underwritten by:

This is for your general information only. You are advised to visit any of our UOB Malaysia branches for the detailed terms, conditions and exclusions of coverage. The above plans are underwritten by Liberty General Insurance Berhad 197801007153 (44191-P), formerly known as AmGeneral Insurance Berhad . All claims and liabilities arising from the policies should be made with the company.

Leave us your contact details and we will contact you.

Find the nearest branch and speak to us.

Liberty Insurance Travel Star Travel Insurance

Underwritten by:

LIBERTY INSURANCE BERHAD Ground Floor, Menara Liberty, 1008, Jalan Sultan Ismail, 50250 Kuala Lumpur.

- +603-2619 9000

- 1-300-888-990 (Toll-Free Line)

Agent Details:

GB Risk Management Consultancy

(Agent No: BCAN002)

Premiums & Estimates

*prices are subject to the number of days of your trip, worldwide (excluding us and canada), worldwide (including us and canada), why travel star insurance, hospital allowance.

Daily hospital cash allowance for every 24 hours of hospitalisation as a result of accidental injury or sickness whilst overseas. RM250 per day per adult and RM125 per day per child.

Tour Fare Protection

Reimbursement for irrecoverable deposits or full payments paid for air tickets/tour packages in the event of insolvency of the registered travel agent in Malaysia.

24hr Travel Assist

24 hours hotline services include Visa, Passport and Inoculation Requirements Service Provider referrals, Location of Loss Items, Emergency Message Relay and more.

Personal Accident

Covers against accidental death and permanent total disablement while outside Malaysia, insured at RM250,000/adult and RM75,000/child.

Medical Expenses

RM300,000 sum insured for medical expenses, follow up treatment in home country insured at RM30,000/adult and RM3,000/child within 14 days.

Baggage, Document Losses

RM500/article or item insured for Loss of Personal Baggage and Effects, RM2,500 sum insured for loss of Travel Document (Silver plan).

Travel Inconveniences

Reimbursement for up to RM15,000 sum insured for Trip Curtailment, RM250 for Travel Overbooked (at least 8 hours), RM250 for each consecutive 8 hours Travel Delay.

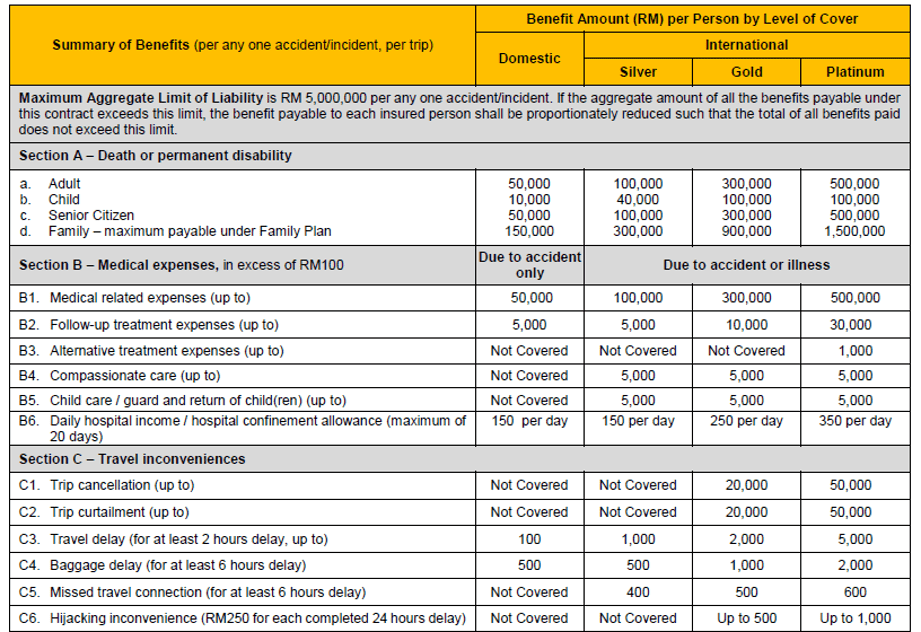

Summary of Benefits

Check out the benefits and coverages offered by this insurer, or download the Product Disclosure Sheet here.

Benefit amounts displayed will vary depending on insurance plan and travel destination. For baseline, only lower tier plans will be used as example.

Like what you're seeing?

Gabungan Baiduri Sdn Bhd (532042-M) 111, Tingkat 1, TTDI Adina Jalan Judo 13/45, Seksyen 13, 40675 Shah Alam, Selangor

Tel : +603 5031 3933 Fax : +603 5031 3934 Email: [email protected]

Supported Insurers

Info & Resources

MyArRehlah © All rights reserved

frugalavish

Money for Memories

Comparison of Travel Insurance in Malaysia

I highly recommend travel insurance when you go traveling. I used to skip purchasing travel insurance until I fell and injured myself in Sydney . Ever since then, I purchase travel insurance for myself and my girlfriend everytime we go traveling. And we were lucky to have bought it when we went to Thailand as our luggage was lost in transit. You can read about it here which teaches you the process of reporting and claiming lost luggage.

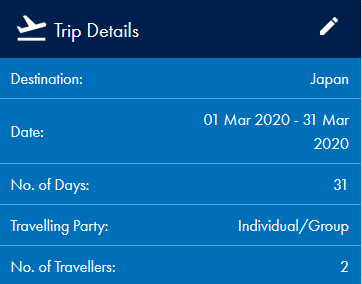

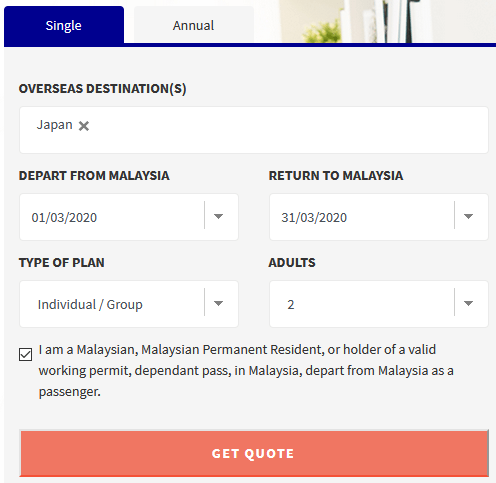

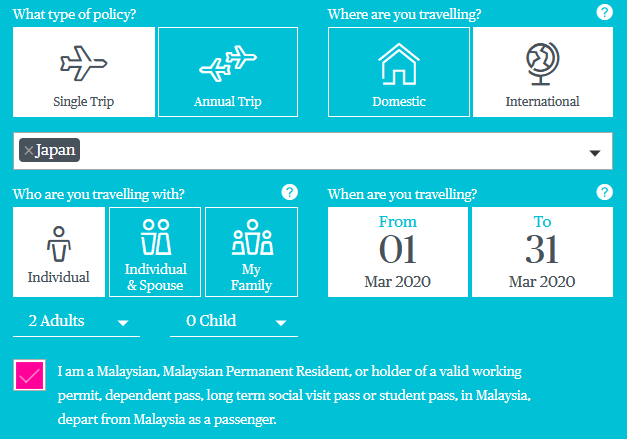

In this article, I would like to compare the different travel insurance plans in Malaysia that can be purchased online. To compare apple to apple, below are the details I put in to search for the quotations:

- Single trip

- Mar 1 to Mar 31

You can click on the links below to jump straight to the specific insurance provider.

Takaful Malaysia

Tokio marine.

- Tune Protect

TL;DR – skip to Conclusion

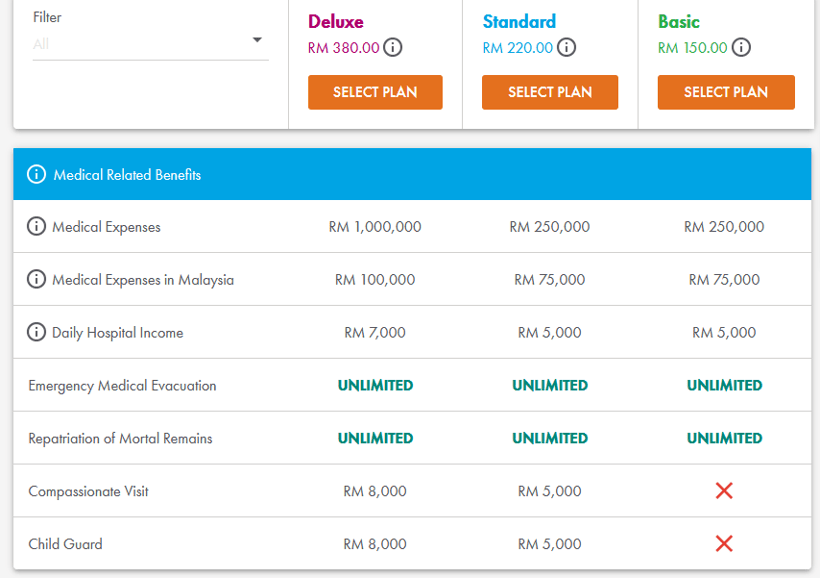

AIG (American International Group) has 3 travel insurance plans which are Basic, Standard, and Deluxe.

Even though Basic is the cheapest, it does not cover travel cancellation, delay (travel nor baggage), and personal effects.

You can also scroll here to have an overview of the differences between the 3 packages. You can also switch the button at the top to switch to the comparison for family plans.

Website / Product Disclosure Sheet / Brochure

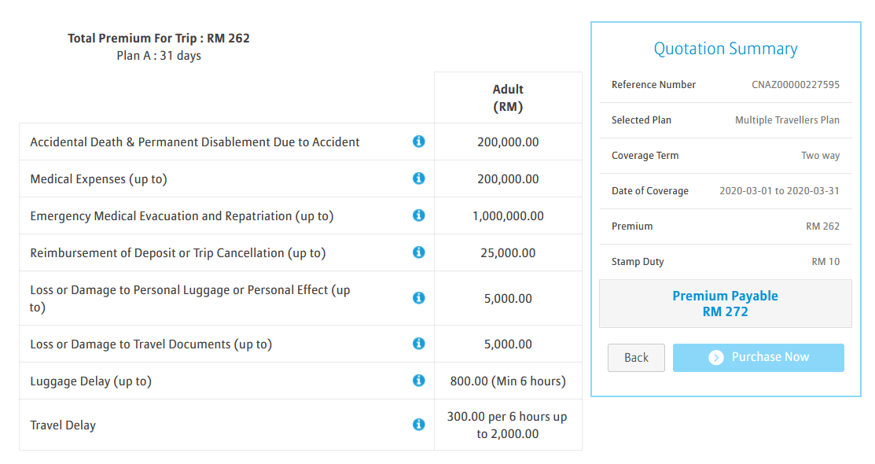

For Allianz it is very straightforward as you don’t need to choose any plans after keying in the required info.

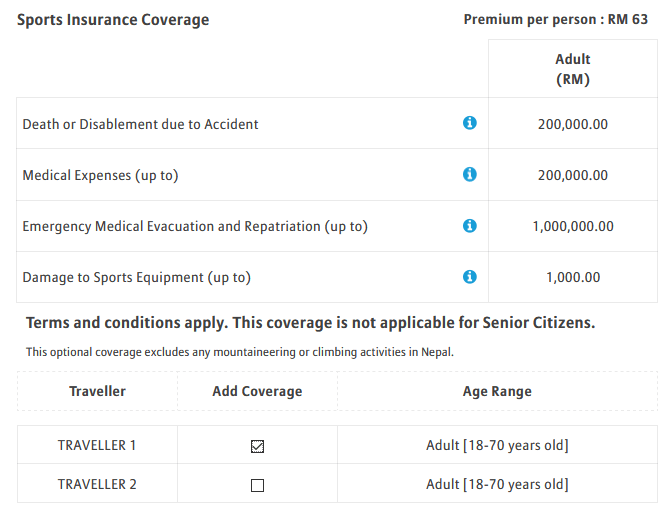

The price is RM272 for 2 person and you can choose to add on the following:

- Sports insurance coverage ( RM63 per person )

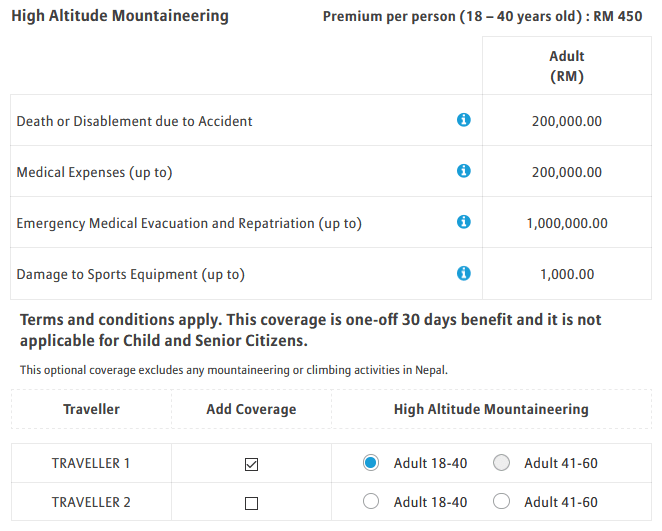

- High altitude mountaineering ( RM450 per person for adult between 18-40, RM900 per person for adult between 41-60 )

- Domestic coverage ( RM27 per person )

For sports insurance coverage, you might want to add on if you are doing any high risk sports which includes mountaineering up to 3500 meters. You will be insured with the following:

For mountaineering above 3,500m and up to 5,500m, you will need to choose this instead of the add on above.

Lastly, for Worldwide or Asia plans, Malaysia (domestic) is not included so you might want to add on this.

Although Allianz Travel Easy travel insurance has only 1 option, it has a wide coverage with reasonable insured amount. Besides that, the add on options are especially good for those doing high risk sports.

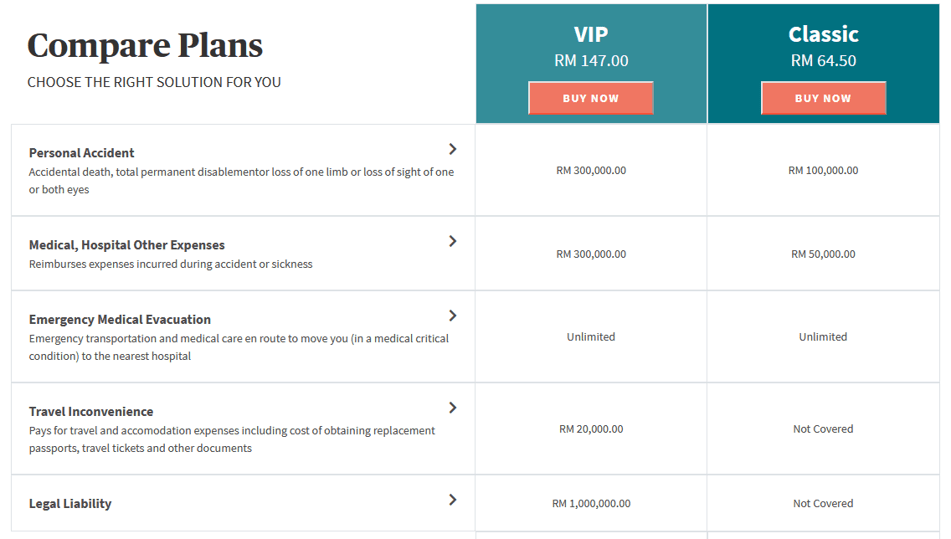

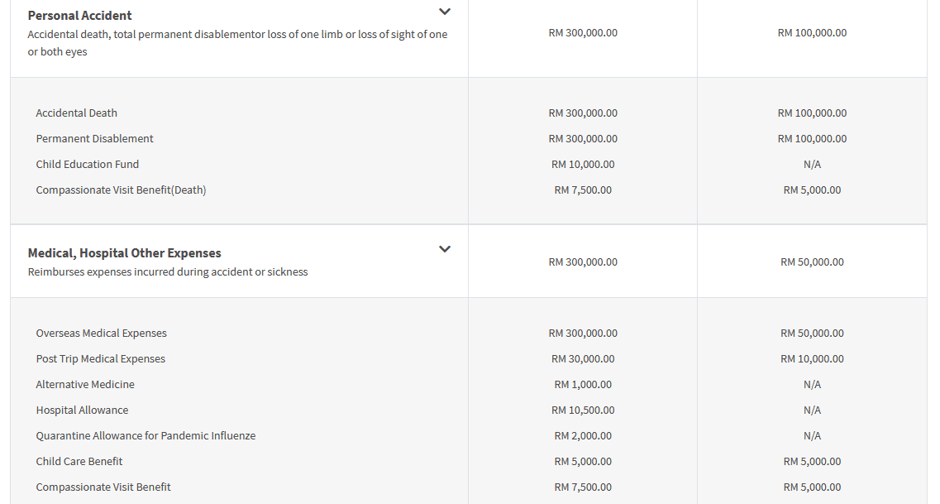

AXA has only 2 options – classic and VIP. If you have been reading from the top, classic is similar to AIG’s basic where it doesn’t cover travel delay/cancellation and personal effects. Therefore, VIP is the recommended option here.

In a nutshell comparison:

By breakdowns:

Website / Product Disclosure Sheet

Chubb (formerly ACE Jerneh) has 3 options for their travel insurance which are – Premium, Executive, and First.

The company has a comprehensive page which lists down all the coverage in details which helps to compare the 3 travel insurance plans which you can visit here .

For Chubb, even the basic Premium has an extensive coverage. Besides that, you have the option to add on coverage for cruise at a minimal cost. If you are playing golfs during your travel, do take First as it also covers for golfs.

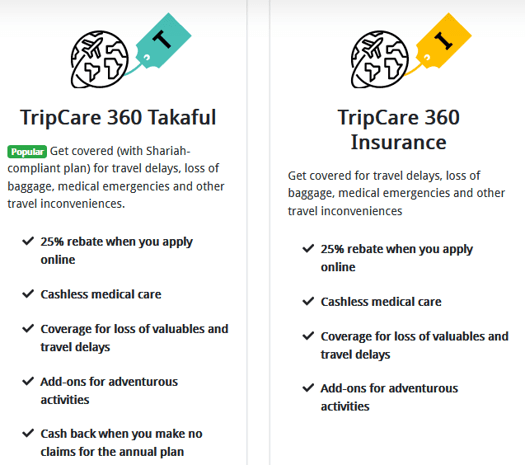

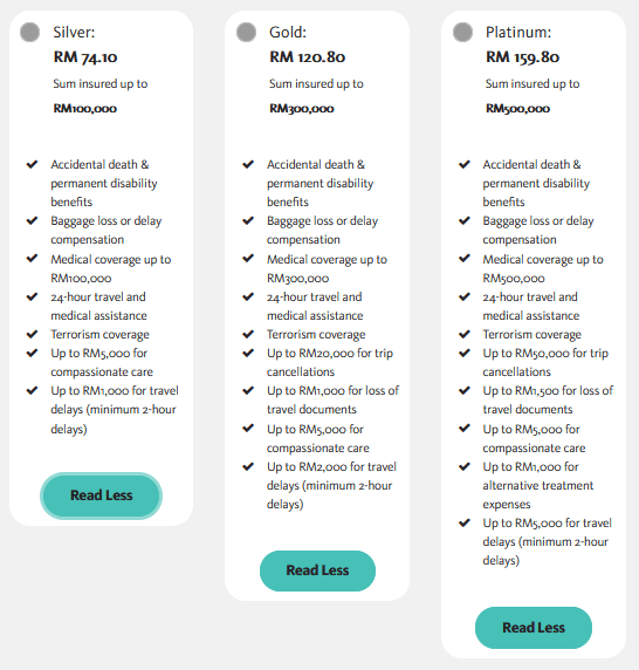

Etiqa offers 2 travel insurance plans which are TripCare 360 Takaful and TripCare 360 Insurance. The 2 plans can be further categorized into Silver, Gold, and Platinum options.

Both plans have the same options and costs as below. The price is before 25% discount and is for 1 individual.

The summary of benefits for each options as below:

The basic silver has a good coverage but it lacks trip cancellation and curtailment. In addition, it also does not cover personal money and travel documents. Depending on your need, it can be sufficient or you can choose Gold instead for the mentioned items.

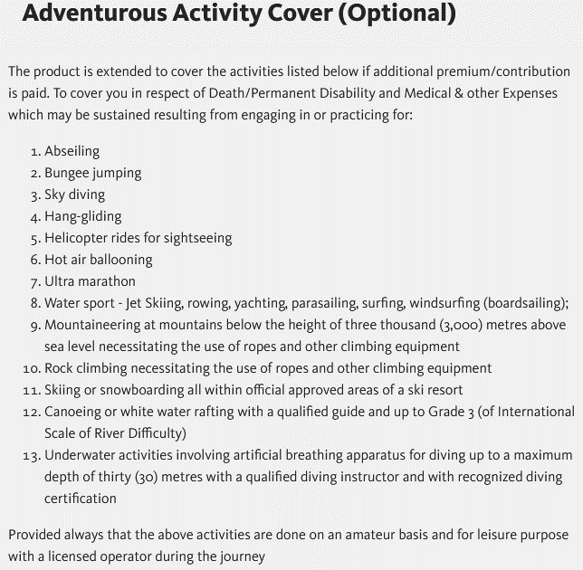

Besides that, you can also add on Adventurous activity cover to your travel insurance with a minimal premium which covers the following sports.

Website / Product Disclosure Sheet (TripCare 360 Takaful) / Product Disclosure Sheet (TripCare 360 Insurance)

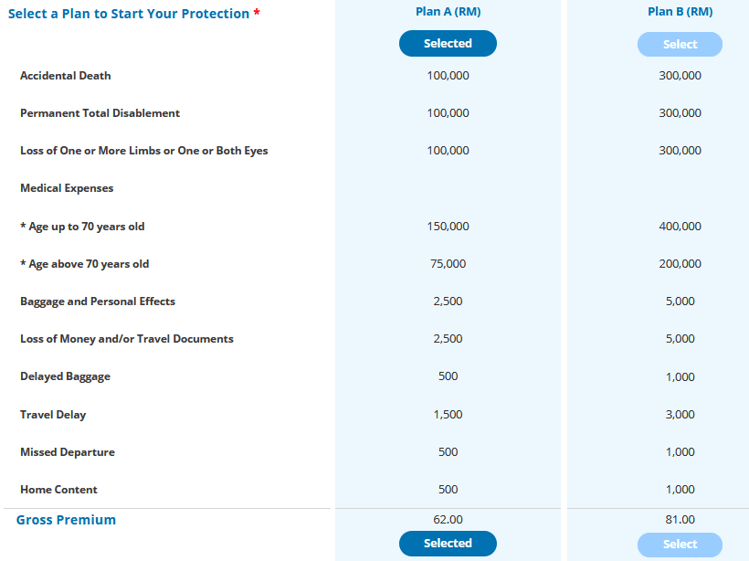

Kurnia’s Travel Supreme plan has 2 options which are Plan A and Plan B. Perhaps the team wants to be different than the other competitors thus no fancy names were given to the options.

Anyways, below is the price for 1 individual.

For the full itemized benefits, you may refer to Plan A or Plan B .

Despite the non fancy name, the basic Plan A has a wide coverage which is sufficient for most travelers. With just an additional top up of RM19 to Plan B, you can get more higher coverage which seems to worth the price.

However, do take note that the plans offered by Kurnia are underwritten by AmGeneral Insurance Berhad.

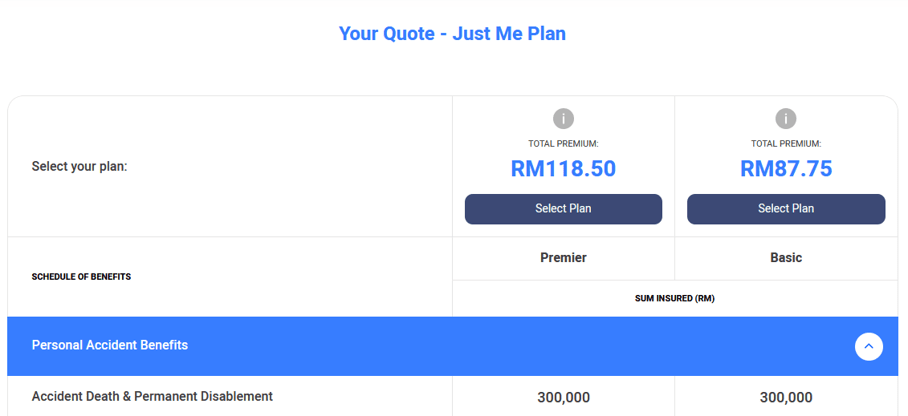

Lonpac has 2 options for their Travel ezSecure travel insurance which are Basic and Premier. The price below shows for 1 individual only.

The Basic option only covers for Personal Accident, Medical, Emergency Medical, and Personal Liability. Therefore, the Premier option seems to be the better choice with just an additional of RM30.75.

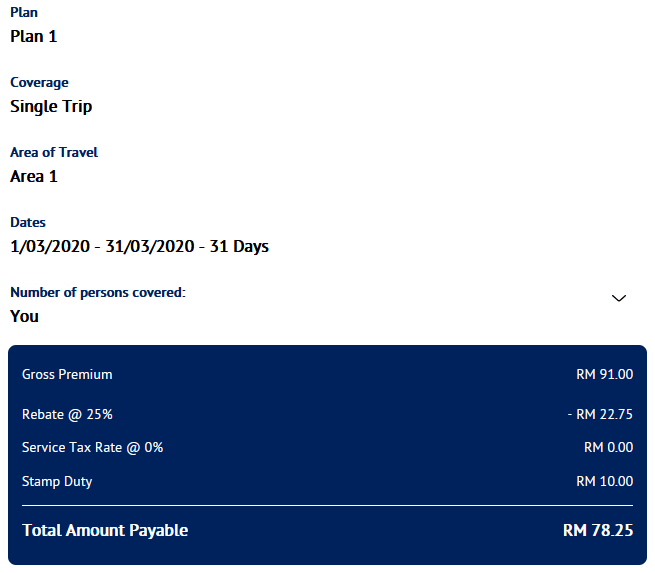

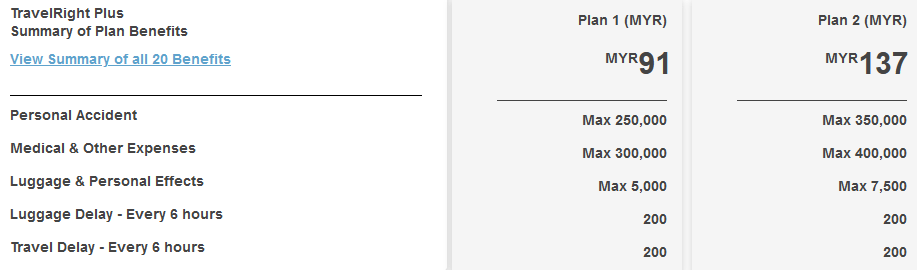

MSIG (Mitsui Sumimoto Insurance Group) offers 2 travel insurance plans with simple name just like Kurnia which are Plan 1 and Plan 2.

The plans below are for 1 individual only.

And once again, even though the name is plain, but both plans have wide coverage. The only difference between the 2 plans is that Plan 2 covers higher amount than Plan 1. Besides that, both MSIG travel insurance plans also covers for high-risk activities as stated in Section 19.

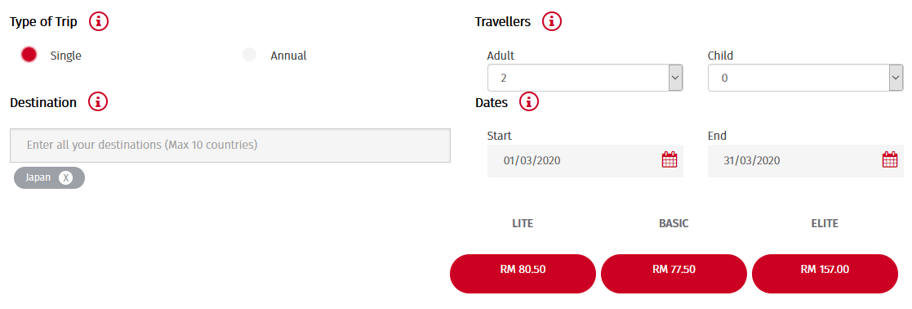

Sompo offers 3 options for their travel insurance which are Lite, Basic, and Elite.

Although Lite seems to cover less items compared to Basic, but it has a higher price tag. The only 2 things that Lite covers but is not covered by Basic are Hospital Allowance and Travel Delay. However, both Lite and Basic do not cover the items in Section D – Travel Inconveniences (except Travel Delay for Lite). Therefore, I would suggest to go for Elite although it comes with a higher price tag.

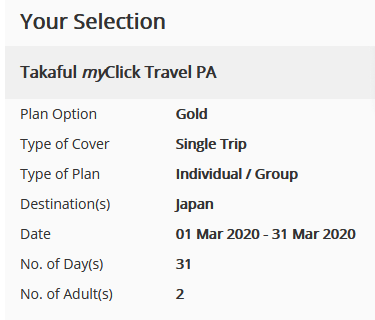

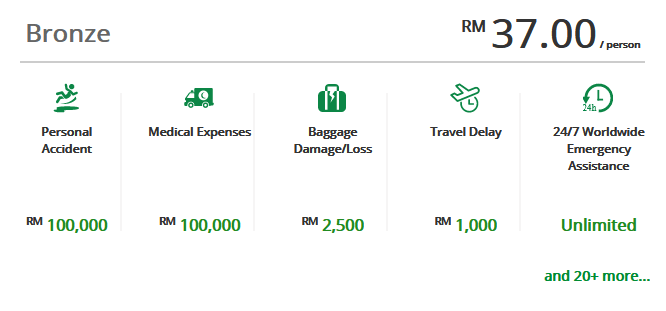

Takaful Malaysia offers 3 plans for their Takaful myClick Travel PA travel insurance which are Bronze, Silver, and Gold.

The prices below are for 1 person only.

The above screenshots are basic overview of their coverage and amount. They have the comprehensive table for comparison here . The basic Bronze covers extensive items which is sufficient for most travelers. However, it is recommended to go for Silver which covers higher amount with just an additional RM22. If you rent a car or plays golf during your travel, Silver and Gold also covers for these as well.

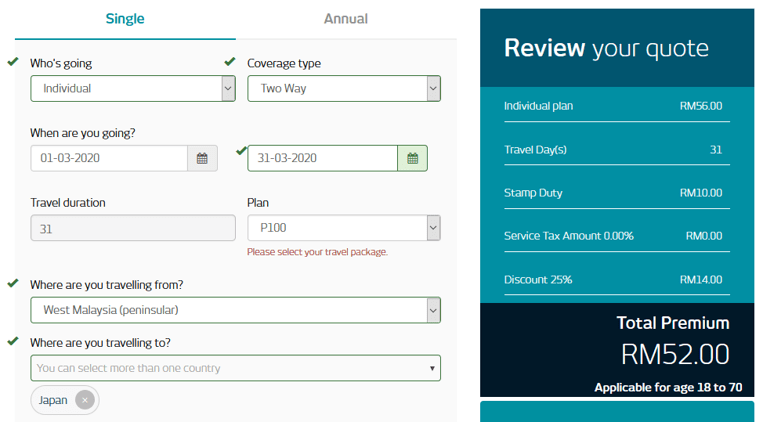

Tokio Marine provide 2 plans for their Tokio Marine Explorer travel insurance which are P100 (basic plan) and P325 (standard plan).

The price below is for 1 individual.

Tokio Marine has a table for easy comparison between the plans here . In the fact sheet there is a P500 plan but is not offered under the drop down button in the selection of plans phase. The P100 basic plan does not cover a lot of items that P325 does which includes hospital allowances and travel cancellation/curtailment. However, surprisingly even the P100 covers for golf equipment as well.

I would recommend going for the P325 standard plan by topping up RM33. Besides that, this plan covers for car rental as well. In addition, you can add on premium for extreme activities. However, I can’t find this option in the selection phase.

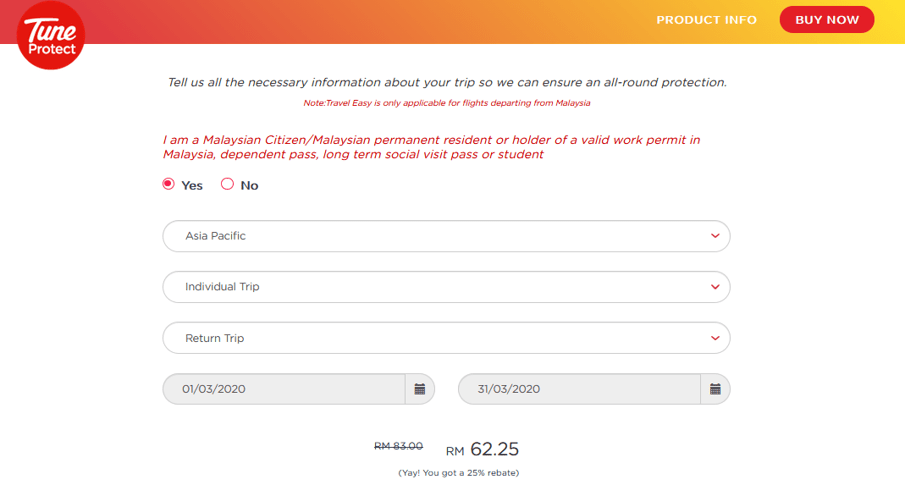

Tune Protect also offers 1 plan only for their travel insurance which is similar to Allianz .

The price below is for 1 individual only.

Tune Protect has a full list of items that is covered by their travel insurance here in table format. It covers most, if not all of the basic items which includes trip cancellation and curtailment.

More options for travel insurance

There are several companies that provide travel insurance as well such as QBE , Prudential , and Great Eastern etc. However, you cannot buy via online for the mentioned companies (for Great Eastern it can be done via online but after I key in the info it keeps showing error and I can’t proceed). Therefore, if you have an agent that is servicing you for these companies, you can check with them. However, buying online is generally cheaper as the insurance companies usually rebate the agency commission to you.

Banks offer travel insurance as well

Besides the insurance providers as above, banks also offers travel insurance. However, most of them leads back to the insurance providers above. For example, if you go to Maybank website to get quotation, you will end up at Etiqa website with the same price and options. Same goes to Bank Simpanan Nasional (BSN) which goes back to AIG’s website.

However, some banks give you special promo or discount by purchasing through them.

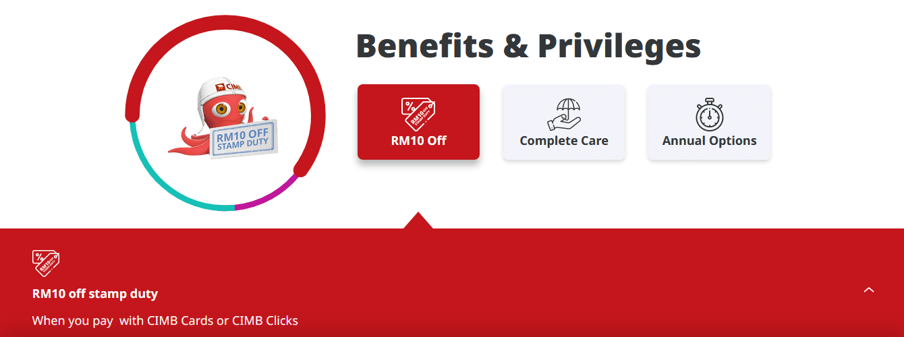

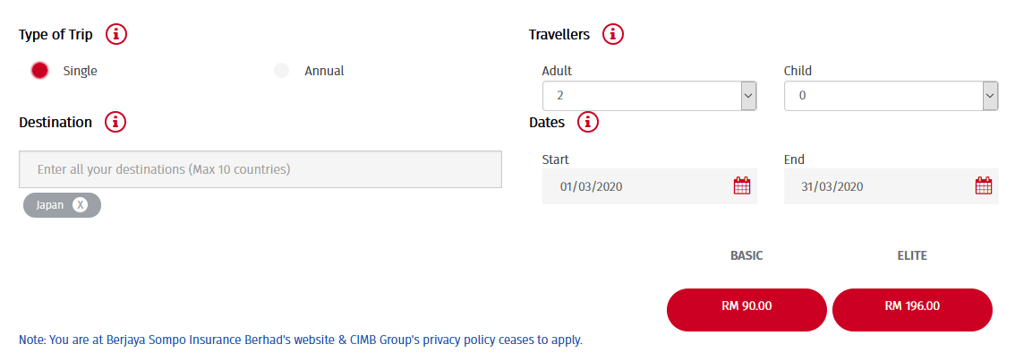

CIMB x Sompo

CIMB gives you RM10 off the stamp duty when you pay with CIMB cards or CIMB Clicks.

However, if you key in the same details, the results come out differently. Firstly, the Lite option is not there if you compared to purchasing directly from Sompo website. Besides that, Basic costs RM90 instead of RM77.50 while Elite costs RM196 instead of RM157. However, the product disclosure sheet is the same as Sompo meaning the benefits are the same.

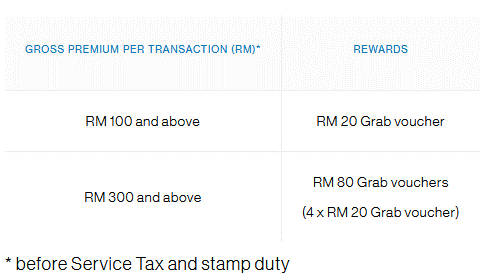

Besides CIMB, Standard Chartered also has promotion as below where you can get Grab vouchers if you purchase the travel insurance from them.

Standard Chartered x Allianz

However, if you key in the same details as Allianz , you will find that the cost is RM300 instead of RM272. But for the price difference of RM28, you will get RM80 Grab vouchers which is a good deal.

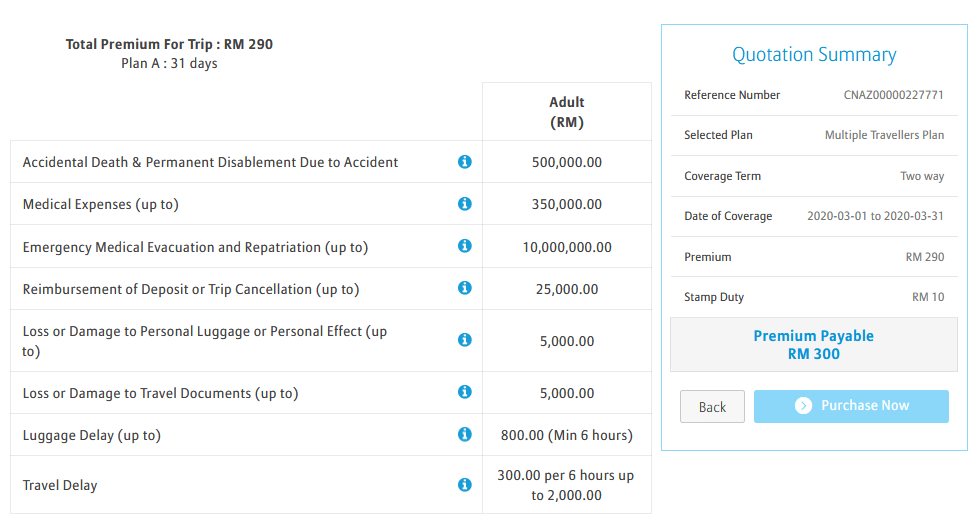

- UOB x Liberty Insurance

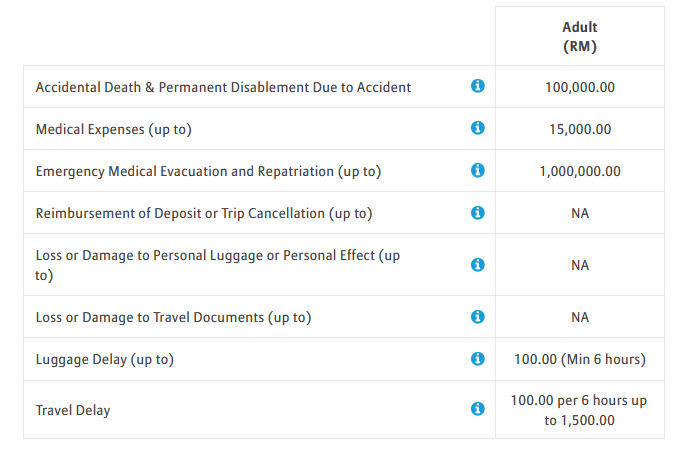

UOB’s travel insurance is underwritten by Liberty Insurance. It has only 1 option like Allianz and Tune Protect . The price below is for 1 individual only.

It has a wide coverage which includes travel cancellation and curtailment.

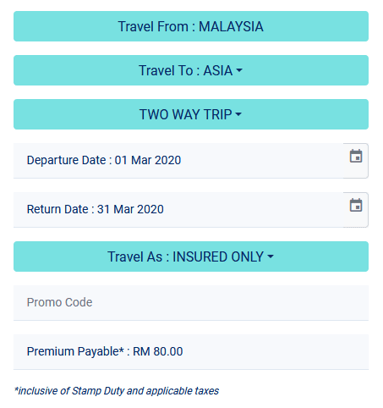

OCBC x Great Eastern

Although I had trouble getting quotation directly from Great Eastern website, but I have no trouble getting it via OCBC. However, do take note that OCBC’s plan is TravelMate while the one I tried to access via Great Eastern website is Great Voyager travel insurance.

Great Eastern offers 2 plans for their travel insurance which are Value Plan and Signature Plan. The price below is for 1 person only.

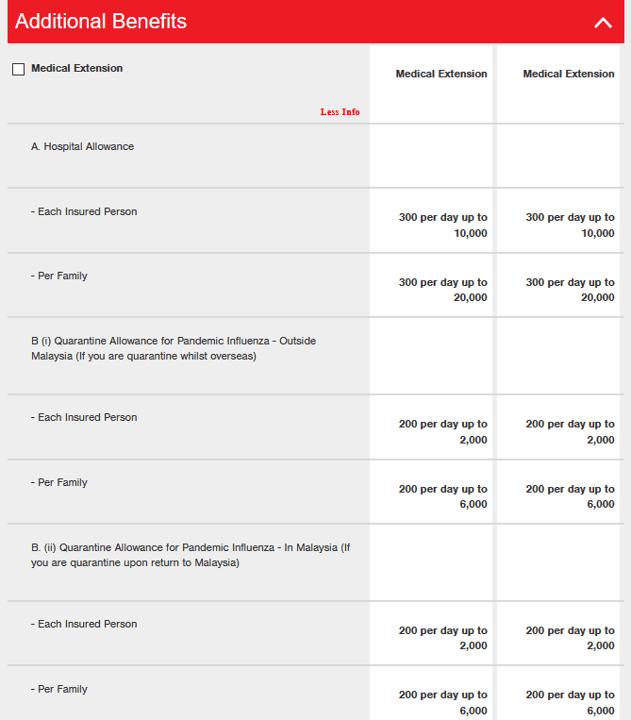

Both travel insurance plans cover extensively but with just an additional RM20, you get insured for a higher sum which is worthy. In addition, you can add on 5 benefits to your insurance plan if needed:

- Medical extension ( RM10 for both plans )

- Golfer’s cover ( RM100 for Value, RM60.50 for Signature . Same coverage amount but not sure why Value is more expensive)

- Adventurous activities cover ( RM75.50 for both plans )

- Personal liability & rental car excess cover ( RM12 for both plans )

- Home contents benefit ( RM29 for both plans )

Hong Leong Bank x MSIG

For Hong Leong Bank, it has the same travel insurance plans and benefits as per MSIG. Here is the summary table on HLB website. Besides that, it has the same product disclosure sheet . However, compared to the other banks, you get the quotation and purchase directly from HLB website so you would need to have their account.

The price above is for 1 individual only. Just like the other banks, the price is higher (the price is actually the same for MSIG and HLB, but MSIG has 25% rebate).

RHB Insurance

RHB Group has their own insurance arm but it cannot be purchased online. For more info, you may visit here .

Citibank x AXA

You will be landed to AXA website to get quotation for the travel insurance. However, I’ve been having trouble getting the quotation but if I go directly to AXA website it is ok. You may try it here . However, both AXA and Citibank have the same plans and coverage which you can refer here .

Affin Bank x AXA

Just like Citibank, I have trouble getting quotation from this link . However, the plans are the same with AXA.

Alliance Bank x Zurich

Both cannot be purchased online. However, you may read about it here .

Airlines also offer travel insurance

When you purchase flight tickets, there are usually options to add on insurance. Below are some of the samples and their underwriting insurance provider.

- Malaysia Airlines x Etiqa

- Firefly x AIG

- Airasia x Tune Protect

- Singapore Airlines x AIG

- Scoot x AXA

- Emirates x AIG

- Qantas x Lloyd

Now that we have gone through all the travel insurance plans, it’s the headache moment to pick the one that is suitable. Let’s take a look at the prices based on the details below:

Do take note that the prices above are gross prices, meaning it does not take into consideration of 25% discount (if applicable) and RM10 stamp duty.

Based on the table above, UOB x Liberty Insurance has the cheapest Extensive plan followed by Kurnia and Tune Protect. Therefore, if we were to rank solely based on price, then below are the options:

- Cheapest of all plans – AXA Classic plan (Basic)

- Standard plan – Sompo Basic plan

- Extensive plan – UOB x Liberty Insurance

However, we should also take into consideration of the things that are being insured. I have shortlisted the 3 most important items:

- Medical expenses in overseas + follow-up treatment in Malaysia

- Travel cancellation and curtailment

- Loss of luggage/money/travel documents/credit card

Based on the criteria above, all 3 of the cheapest Extension plans do include the above with the only Exception that UOB x Liberty Insurance does not cover the follow-up treatment in Malaysia. Therefore, in terms of pricing and coverage, the ranking would be as follow:

- Kurnia Plan B

However, claiming process is also an important consideration. The easier and faster you can get a claim when something happens the better. But, let’s hope there is no need to claim it though. I’ve tried claiming from AXA once and the claiming process is not a pleasant experience. You can read about it here .

In addition, here are some notable mentions:

- Chubb is the only company that has Cruise add-on

- Allianz , Etiqa , MSIG , OCBC x Great Eastern , Tokio Marine covers/add on for extreme activities

- AXA , Kurnia , MSIG , Takaful Malaysia , Tokio Marine covers for car rental

- Chubb , OCBC x Great Eastern , Takaful Malaysia , Tokio Marine , Tune Protect covers/add on for golf equipments

If you have any pleasant/unpleasant experience getting a claim, please feel free to share in the comments section below.

You may also like...

Review of Plaza Premium Lounge, Gateway@klia2

New Zealand – North & South Islands Self-Drive Adventure

Seafood Feast and Adorable Corgi in Bangkok

Popular posts.

Japan 7D6N Self-Drive Trip

Reviews of P2P Platforms in Malaysia

A Trip to the States – Work and Travel USA

Melbourne Has The World’s Best Croissant And Pie

Europe Trip Part 3 – Paris + London + Singapore

Aloha Ubud Swing Review

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Malaysia Travel Insurance

Travel insurance for malaysia.

In the beautiful country of Malaysia, Batu Caves is a sight to behold with its many temples and shrines, not to mention the gigantic statue of the Hindu God. Along with the Petronas Twin Towers and other tourist attractions, travelers are sure to enjoy a trip to breathtaking Malaysia. As you plan your incredible itinerary, it is important to remember travel insurance as it can help aid and support you on your travels. Let’s dive in!

- What should your Travel insurance cover for a trip to Malaysia?

How Does Travel Insurance for Malaysia Work?

- Do I need Travel Insurance for Malaysia?

- How much does Travel Insurance cost for Malaysia?

Our Suggested AXA Travel Protection Plan

- What types of medical coverage does AXA Travel Protection plans offer?

Are There Any COVID-19 Restrictions for Travelers to Malaysia?

Traveling with pre-existing medical conditions , what should your travel insurance cover for a trip to malaysia.

At a minimum, your travel insurance should cover trip cancellation, trip interruption and emergency medical expenses. When it comes to international travel, the US Department of State outlines key components that should be included in your travel insurance coverage. AXA Travel Protection plans are designed with these minimum recommended coverages in mind.

- Medical Coverage – The top priority is making sure your health is in order. With AXA Travel Protection, you can have access to quality healthcare during your trip overseas in the event of unexpected medical emergencies.

- Trip Cancellation & Interruptions – Assistance against unexpected trip disruptions can dampen the mood, AXA Travel Protection offers coverage against unforeseen events.

- Emergency Evacuations and Repatriation – In situations where transportation is dire, AXA Travel Protection offers provisions for emergency evacuation and repatriation.

- Coverage for Personal Belongings – AXA offers coverage for your belongings with assistance against lost or delayed baggage.

- Optional Cancel for Any Reason – For added flexibility, AXA offers optional Cancel for Any Reason coverage, allowing you to cancel your trip for non-traditional reasons. Exclusive to Platinum Plan holders.

In just a few seconds, you can get a free quote and purchase the best travel insurance for Malaysia.

Malaysia has a reputation for being a fairly safe place to visit. However, it is important to learn which areas to avoid and practice safe traveling habits to prevent issues like pickpocketing and theft even in the safest areas. If a thief steals luggage from the baggage area, a travel insurance plan can help replace your bags and the contents inside them. Here is how travelers can benefit from an AXA Travel Protection Plan:

Baggage Benefits:

- Luggage Delay: If the airline delays your checked baggage, your policy might offer reimbursement for essential items like clothing and toiletries.

- Lost or Stolen Luggage: In the unfortunate event of permanent loss or theft of your luggage, your policy may offer reimbursement for its value, assisting you in replacing your belongings.

Medical Benefits:

- Emergency Medical Expenses: Should you fall ill or have an accident during your trip, your policy may offer coverage for medical expenses, including hospital stays and doctor's fees.

- Emergency Evacuation & Repatriation: In case of a serious medical emergency, your policy may include provisions for evacuation to the nearest appropriate medical facility or repatriation.

- Non-Emergency Evacuation & Repatriation : In non-medical crises (e.g., political unrest), your policy may cover evacuation or repatriation, subject to policy terms.

Pre-Departure Travel Benefits:

- Trip Cancellation: You may be eligible for reimbursement if you cancel your trip due to a sudden illness or injury.

- COVID-19 Travel Insurance: Coverage is available for trip cancellation and medical expenses related to COVID-19, subject to policy terms and conditions.

- Trip Delay: If your flight faces delays due to unforeseen circumstances, you may have coverage for additional expenses such as meals and accommodations.

Post-Departure Travel Benefits

- Trip Interruption: In case of an unexpected event, you could be eligible for reimbursement for the unused portion of your trip.

- Missed Connection: If you miss a connecting flight due to delays or cancellations, this coverage may help with expenses like rebooking fees and accommodations.

Additional Optional Travel Benefits

- Rental Car (Collision Damage Waiver): Exclusive to Gold & Platinum plan policy holders, this optional benefit gives travelers extra coverage on their rental car against damage and theft.

- Cancel for Any Reason: Exclusive to Platinum plan policy holders; this optional benefit gives travelers more flexibility to cancel their trip for any reason outside of their standard policy.

- Loss Skier Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate some costs associated with pre-paid ski tickets that you or your traveling companion cannot use due to specified slope closures.

- Loss Golf Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate the expenses linked to prepaid golf arrangements that you or your travel companion are unable to utilize due to specified golf closures.

Do I Need Travel Insurance for Malaysia?

While the Malaysian government does not require travelers to purchase travel insurance , it offers valuable protection in an unfamiliar area where you may not speak the language or be able to find helpful resources.

You can breathe a sigh of relief knowing that your travel insurance plan backs you up if your travel plans go awry. Why? There are several reasons:

Trip Cancellation: You may not be able to control circumstances such as bad weather, a personal emergency, or an illness that prevents you from traveling. Travel insurance may reimburse you for 100% of the cost of your trip for eligible expenses.

Lost Baggage: Airlines sometimes mishandle baggage, and the last thing you want is to be without your essentials in an unfamiliar place. Travel insurance offers to cover the cost of replacing necessary items, allowing you to continue on.

Trip Interruption: Travel insurance may reimburse you for unexpected expenses due to an unexpected change of plans.

How Much Does Travel Insurance Cost for Malaysia?

In general, travel insurance costs about 3 – 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans:

- Total Trip cost: The total non-prepaid and non-refundable costs you have already paid for your upcoming trip. This includes prepaid excursions, plane tickets, cruise costs, etc.

- Age: Like any other insurance type, the correlation is rooted in increased health risks associated with older individuals. It's important to note that this doesn't make travel insurance unattainable for older individuals.

With AXA Travel Protection, travelers to Malaysia will be offered three tiers of insurance: Silver, Gold and Platinum . Each provides varying levels of coverage to cater to individual's preferences and travel needs.

AXA presents travelers with three travel plans – the Silver Plan , Gold Plan , and Platinum Plan , each offering different levels of coverage to suit individual needs. Given that United Kingdom hospitals often do not accept U.S. health insurance or Medicare, we genuinely recommend travelers consider purchasing any of these plans, particularly for the crucial coverage they offer for emergency accident and sickness medical expenses.

The Platinum Plan is a good choice for Malaysian travelers who want the benefit of extra coverage. For example, " Cancel for Any Reason " is an optional coverage that offers greater flexibility for those who have concerns have concerns about an unexpected cancellation. The Collision Damage Waiver coverage is also available as an option. This coverage pays for damage to a rental car being used during your Malaysia trip.

Golf enthusiasts may be disappointed if their golf game gets rained out or you cannot play for some other reason at one of Malaysia’s fine golf courses or country clubs. Nonetheless, coverage is available on the Platinum Plan for Lost Golf Rounds to reimburse your fees.

What Types of Medical Coverage Do AXA Travel Protection Plans Offer?

AXA covers three types of medical expenses:

- Emergency medical

- Emergency evacuation & repatriation

- Non-medical emergency evacuation & repatriation

Emergency medical: Can cover illnesses such as dengue fever, tuberculosis, or food poisoning. It may also cover injuries such as a broken appendage, injury due to a fall or other injury. Emergency evacuation and repatriation: Can cover your immediate transportation home in the event of an accidental injury or illness. Non-medical emergency evacuation and repatriation: Can cover evacuation or repatriation expenses due to a non-medical event such as an earthquake, typhoon or volcanic eruption.

The Malaysian government has lifted all COVID-19 restrictions for travelers entering the country. They recommend travelers take normal precautions.

Traveling with pre-existing medical conditions can complicate your plans, but with AXA Travel Protection, we're here to support you during your trip.

Our Gold and Platinum plans offer coverage for pre-existing medical conditions. The Platinum plan, in particular, is our highest-offered choice for travelers who want our highest coverage limits and optional add-ons,

What does this mean for you? If you've got a medical condition that's been hanging around, you can qualify for coverage under our Gold and Platinum plans with a pre-existing medical condition , so long as it’s within 14 days of placing your initial trip deposit and in our 60-day look-back period. We're here to ensure you travel easily, no matter your health situation.

1.Can you buy travel insurance after booking a flight?

You can buy travel insurance even after your flight is booked.

2.When should I buy Travel Insurance to Malaysia?

It is advisable to purchase travel insurance for your trip as soon as you have made your initial trip deposit (prepaid and non-refundable trip costs.) AXA Travel Protection offers coverage as soon as you purchase your protection plan. We can give coverage against unforeseen events before you leave for your trip. Additionally, our policies offer coverage for preexisting medical conditions and Cancel for Any Reason if you purchase your protection within 14 days of making your initial trip deposit.

3.Do Americans need travel insurance in Malaysia?

No, travel insurance is not currently required to visit Malaysia, although you may find it valuable.

4.What is needed to visit Malaysia from the USA?

If you are visiting Malaysia from the USA, all you need is a passport that is valid for at least six months. The government also requires you to have at least one full page in your passport that is blank.

5.What happens if a tourist gets sick in Malaysia?

If you become sick in Malaysia, travelers with AXA Travel protection can contact the AXA Assistance hotline 855-327-1442 . Contact information is typically provided within the insurance documentation. Please ensure to read through your policy details and information.

Disclaimer: It is important to note that Destination articles are for editorial purposes only and are not intended to replace the advice of a qualified professional. Specifics of travel coverage for your destination will depend on the plan selected, the date of purchase, and the state of residency. Customers are advised to carefully review the terms and conditions of their policy. Contact AXA Travel Insurance if you have any questions. AXA Assistance USA, Inc.© 2023 All Rights Reserved.

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

Get AXA Travel Insurance and travel worry free!

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip.

Subscribe to my newsletter jom🤗

No products in the basket.

Subscribe to my newsletter 🤗

Everything You Want to Know About Buying Travel Insurance, Answered [SPONSORED]

Table of Contents

Flight tickets, check. Accommodation, check. List of things to do and places to go, check. What else? Oh yeah, need to buy travel insurance too. You know, just in case. Also it’s not like the pandemic is over.

But which travel insurance to buy? Which one is the best?

Spoiler alert, this article is sponsored by Tune Protect, but they specifically reached out to me so I can create educational content about travel insurance. Here’s what I will cover:

Part 1: What you MUST include in your travel insurance (non-negotiable)

Part 2: what travel insurance does not cover (just how it’s designed), part 3: where and how to buy travel insurance (how much coverage is enough).

- Part 4: How to buy travel insurance for cheap(er)

Part 5: How to claim travel insurance

Of course the answer is ‘it depends’, but to me, there are 4 non-negotiable things I need before I buy travel insurance. I won’t even look at the product if they don’t include good coverage for:

- Trip Cancellation/Curtailment – in case trip is cancelled or cut short – the higher the better

- Personal Accident – in case accidents happen – the higher the better

- Medical Expenses – in case accidents happen – the higher the better

- Covid-19 – in case get infected – the more comprehensive the better

Only after these are satisfied, I’ll look at the ‘nice-to-haves’, like:

- Price – I don’t look for cheap, I look for value for money, discounts and contests, if any

- Home Care Benefit – if house got burglary or fire while away

- Travel Delay – if flight is delayed without enough notice. Tip: get a written confirmation by the flight operator

- Baggage Damage/Delay – If luggage lost/destroyed

Don’t get me wrong, it’s not like Travel Delay and Baggage Damage/Delay isn’t important to me, it is. In fact, according to Tune Protect, these two alone make up a combined 90% of claims .

But inconveniences and loss of items are temporary problems – I’ll forget about it in a month, maybe two, while the consequences of an unfortunate accident are more long-lasting. So I highly suggest you prioritise health-related coverages first before travel inconveniences.

Your travel insurance will NOT reimburse your claim if it does not satisfy its T&C as stated in the Policy Wording document.

Each travel insurance provider will word their policies a bit differently, but the Trip Cancellation clause under Travel Easy by Tune Protect states the following (bold my own addition):

We will reimburse for loss of irrecoverable deposits or charges paid in advance for the Trip only in the event of unavoidable cancellation of all or one of the following: Air ticket hotel/accommodation expense local tour package admission tickets In the following situations: if you are tested positive for COVID-19 within 14 days prior to your departure date (Note: only under Covid Plus Plan) Insured event ( Death, Permanent Total Disablement or an admission as an in-patient in a Hospital where such admission is Medically Necessary; occurring to You, Your Immediate Family Members or Travel Companion within 14 days prior to Your original scheduled departure date a fire or natural disaster resulting in serious damage to Your Home or destination of planned trip. natural disasters such volcanic eruption, flood, earthquake, tsunami, hurricane or wildfire occurring at destination of planned trip.

Therefore, you WON’T be reimbursed for Trip Cancellation if:

- a second cousin is admitted to the hospital (not You, Your Immediate Family Members or Travel Companion), or

- due to a fire at your workplace (not Your Home or destination), and

- you certainly can’t make a claim if you just cancel your trip for funsies

But if you paid a hefty sum for, say Hajj or Pilgrimage package and tested positive for Covid-19 days before departure, then this counts – Tune Protect will reimburse you for Trip Cancellation (subject to other clauses).

Other standard exclusions

In addition, most (if not all) travel insurance products apply many standard exclusions, including:

- Any illegal or unlawful intention act by You

- Any Pre-Existing Condition

- Death or injury directly or indirectly occasioned by war

The full coverages and exclusions will be covered under a document called Policy Wording document, and it is generally quite long and legalese (it has to be – precision of word matters). Open the Travel Easy Policy Wording Document by Tune Protect to see how it looks.

Don’t be too overwhelmed by the document. After all, you have already listed your priorities (see #1 again). You just need to skim 3-5 sections, not every single thing.

Now comes the next questions: Where to buy travel insurance in Malaysia? How to buy travel insurance?

Where to buy travel insurance in Malaysia?

Hint: I wouldn’t worry too much about ‘bad’ travel insurance providers or avoiding that one particular company because that one time your cousin/friend didn’t get the claim they asked for.

The thing is, if the travel insurance provider is licensed by Bank Negara Malaysia and you have a valid claim, you WILL get your money . If not, you can:

- Submit a complaint at BNM Financial Consumers Inquiries and Complaints

- Lodge a dispute at the Ombudsman of Financial Services

So go ahead and buy your travel insurance from any of companies listed on the Financial Sector Participants Directory in BNM website. These companies are regulated under strict and comprehensive legal frameworks :

- Financial Services Act 2013

- Islamic Financial Services Act 2013, and

- Insurance Act 1996

How to buy travel insurance?

As for how to buy travel insurance in Malaysia, generally speaking you can get them via 2 ways:

- Via agent, or

Personally, I prefer online because it is easier to learn more about the products and compare prices. There are also discounts via online purchase – you know me, I like saving money!

Bonus question from RoR audience: How much coverage is enough?

How much coverage should you get for your travel insurance? You might see various travel insurance products offering Medical Expenses and Personal Accident coverage from RM100,000 all the way up to RM1,000,000!

For me, I am personally comfortable with the RM300,000 in Medical Expenses and RM300,000 in Personal Accident coverage offered under all plans from Travel Easy by Tune Protect . You might want to get higher coverage if the country you are traveling to is known to have super expensive healthcare .

However, I wouldn’t worry excessively to the point of paranoia. Tune Protect informed me that the highest amount of claim they have paid out for Medical Expenses is RM30,000. Not a small amount, but not six or seven-figures either.

Part 4: How to buy travel insurance for cheap(er)

First, I should share with you the 4 factors that decide the price of travel insurance in Malaysia:

- Destination – The further away the location from Malaysia, the higher the price. Note: If you are going to a couple of destinations, the furthest location will be used in the quotation

- Type of plan – Basic plans are cheaper, extensive plans with better sum coverage are more expensive

- No of pax – Individual plans are cheaper than family or group plans

- Duration – The longer your trip, the higher the price

Like buying other types of protection products, I believe in getting a few quotations. Here’s what you can do:

- Step 1: Get 3 or so travel insurance quotation online

- Step 2: Look at what each of them offers for your non-negotiables (see #1)

- Step 3: Make your purchase

How the process of buying travel insurance looks like

It is easy to get a travel insurance quotation online. Just go to travel insurance providers of your choice and fill in your trip information, and they will spit out the quotations. My suggestion is to include Travel Easy by Tune Protect as price benchmark.

Note that each travel insurance provider usually offers a few types of plans, and not all will apply to you so take them out of consideration. For example, there are 3 plans under Travel Easy by Tune Protect , but I know I will only consider the Covid Plus plan because Travel Cancellation due to Covid-19 is non-negotiable to me .

(Thanks to my preference for cheap but non-refundable flights, it’s too much money to potentially lose if I go without it)

For a 1-week hypothetical trip to Australia, the Covid Plus plan from Travel Easy by Tune Protect will cost me RM58.65. I will repeat this process and get quotations from at least 2 other companies.

Now that I have 3 quotations, I will look at price. I mentioned that I look for value for money rather than cheap. I look for discounts, promos and contests.

In this case, Travel Easy by Tune Protect is running a Buy early, save 15% + 25% promo – you’ll get 15% discount for buying at least a month early PLUS 25% discount for buying online.

Here’s an idea of how much you’ll save, depending on where you’re going.

Will all these information, and factoring in coverage and price, I will compare the 3 plans and make my travel insurance selection.

Bonus question from RoR audience: Does travel insurance work on Cashless admission or pay first claim later?

Generally speaking,

- (1) unless stated otherwise, many travel insurance works on pay first, claim later basis, and

- (2) cashless admission is more expensive

I wouldn’t mind no (2) if the difference is a little bit, but it can be a lot.