Tourist Tax in Italy: the 2024 Full and Complete Guide With All Rates

In most European countries visitors have to pay a tourist tax and Italy is no exception. In this full and complete guide I will answer the most common questions about it. If you’re planning to visit Italy soon, check out the information below and calculate your rate for your trip!

1. What’s The Tourist Tax?

The tourist tax in Italy is a tax that tourists have to pay for each night of their stay. It is collected by the accommodation they’re staying at – from all types of hotels to B&B, hostels, and campsites – over their vacation.

The amount varies according to the municipality and the type of accommodation : the more luxurious the higher the rate.

2. Why Is it Necessary?

Although the tourist tax is reinvested by the municipality mainly in heritage preservation , it is also used to implement all local services and facilities in order to keep the city in a good state and easily accessible to tourists.

It’s a small amount per person but it helps us to make the difference in keeping our cultural heritage maintained .

→ you may also like

What to Eat in Sicily

3. Do Children Pay Tourist Tax in Italy?

In most cases, children up to a certain age don’t have to pay. However, conditions are different in each municipality. To see in which category your kids fall, please check the table below (see paragraph 4).

Where to Store your Luggage in Train Stations, Airports and for Free in Italy

Driving on the Highway in Italy: A Complete Guide

4. How Much Is The Tourist Tax In Italy?

The tourist tax rate depends on each municipality. This tax is usually updated every year (sometimes every 2 years), therefore you always need to check the most recent rate.

In order for you to know how much you have to pay in each city you’ll be visit ing, I collected all the helpful data below: you will find the most touristic areas and corresponding taxes in three accommodation categories, children and elderly policies together with the period of time when the rate is applicable.

* depends on the hotel rates

5. Are There Any Exemptions?

Yes, there are some exemptions.

Below I collected the most common as each municipality has its own rules and regulations. The following, however, are shared with pretty much every municipality. Those who are exempt are:

a) residents in the municipality;

b) people with disabilities , with suitable medical certification, and relative accompanying person and parents who accompany children with disabilities;

c) patients in healthcare facilities and accompanying family members;

d) coach drivers and tour leaders who accompany groups organized by travel agencies;

e) members of the police and military forces, as well as the National Fire and Civil Protection Corps in case of service needs;

f) volunteers who offer their services in the social sector for events and manifestations organized by the Municipal, Provincial and Regional Administration or for environmental needs;

g) people who stay in the accommodation as a result of measures taken by public authorities to deal with emergency situations ;

h) university students (only in some cases and upon certain conditions).

Renting a Car in Italy: A Complete Guide for North Americans

6. Is It Possible To Get Any Refunds?

If you book your stay in any accommodation in Italy where the tourist tax is automatically collected (e.g. Airbnb) and you are entitled to a refund (e.g. if you fall into the exemption category), you can request it by completing a refund form that you can find on each municipality website. Refunds will be processed at the end of your booking .

Take a look at examples of forms in Bologna and Milan .

7. If I Stay In An Airbnb Or Apartment, Do The Same Rules Apply?

If you stay in any accommodation other than hotels, you have to pay the tourist tax. There is no exemption in this case.

The rate and conditions vary according to the type of accommodation, so you should check in with the place you’re staying at to verify all conditions applicable to your situation. In the case of Airbnb, you can check the rates on their website at this link .

Has this guide been helpful? Take a look at the other articles below!

Is Water Free and Safe to Drink in Italy?

Mosquitoes in Italy: Tips on How to Survive Them

Did you Like the Post? Follow Me on Social Media and Stay Tuned for More Content!

Enjoy this blog? Please spread the word :)

Table of Contents

Community Center

Resource center, help center.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Printer Friendly Page

[GUIDE] How to include a tourist tax in the rental price

- Mark as New

- Who Liked this post

- Report Inappropriate Content

- All forum topics

- Previous Topic

never-displayed

More from Community Guides

Registering your Airbnb in Massachusetts

How to improve your listing

How to find and become an experienced Co-Host on Airbnb?

Maximizing Your Hosting Experience with Airbnb's Latest Feat...

Tips to start posting in the Community Center

Beginner's guide to decorating your space.

Explore topics for hosts like you, ask about your listing, advice on your space, support with your bookings, help with your business, community cafe, host circle, explore resource center articles.

Listings tab: New tools to manage and showcase your listing

New dashboard gives you a clear view of your earnings

Guest Favorites: Most-loved homes according to guests

Airbnb Agrees To Collect and Pay Tourist Taxes in Italy

Srividya Kalyanaraman , Skift

February 12th, 2024 at 10:22 AM EST

This collection and remittance is separate from Airbnb’s tax settlement of $620 million with Italy in December 2023.

Srividya Kalyanaraman

A new Italian law requires platforms like Airbnb to collect and remit tourist taxes in Italy. It starts Thursday, February 15, and Airbnb said it will comply beginning with more than 1,200 towns and cities.

Airbnb will be required to determine the tourist tax for qualifying stays, using the local rate in the listing’s location. For instance, in Venice it is €1 ($1.08) – €5 ($5.39) per night. In Rome, it ranges between €3 ($3.23) to €7 ($7.54) and in Milan, between €2 ($2.15 ) to €5 ($5.39).

“We will automatically collect the amount required for each stay and remit this in full to the local authority on a routine basis, in accordance with local terms,” Airbnb said in a statement.

The company also committed to complying with the new national regulations governing short-term rentals. These regulations include the establishment of a national registration system and will be reinforced by data gathered through EU-wide guidelines promoting home-sharing platforms like Airbnb.

Tax Evasion Claim Against Airbnb

This collection and remittance is separate from Airbnb’s tax settlement of $620 million with Italy in December. That involved the company failing to withhold taxes from landlord’s rental income.

In November, an Italian judge had ordered the seizure of €779.5 million ($836.40 million) from Airbnb’s Ireland unit for alleged tax evasion . The issue involved Airbnb’s alleged failure to withhold 21% of landlords’ rental income and pay it to Italian tax authorities for years 2017-2021.

Italian Premier Giorgia Meloni then committed to tightening measures against tax evasion associated with short-term rentals, with plans to increase the tax rate for owners from 21% to 26%.

Airbnb settled the tax dispute without admitting any liability. The company stated in a financial filing that it does not plan to recover tax withholdings from affected hosts for audited periods (tax years), though it seeks information on hosts’ taxes paid for 2022 and 2023.

The company said that as of the third quarter in 2023, it has generated more than $9 billion in tax revenues for authorities globally. And there will be more to come.

Amsterdam will raise its tourist tax on short-term rentals and hotel rooms to 12.5% in 2024, making it the highest tourist tax rate in Europe. Currently at 7%, the tax is set to rise to 12.5%, resulting in a notable increase in nightly costs for visitors.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb , amsterdam , italy , short-term rentals , tourism , tourist taxes

Photo credit: The interior of an Airbnb property in Italy. Source: Flickr Fattoria la Maliosa / Flickr

Airbnb Simplifies Tourist Tax Collection and Remittance Across Italy

Airbnb announced that it will now automatically collect and remit tourist taxes for short-term rentals throughout Italy, simplifying the process for both guests and hosts. This follows a change in the Italian 2024 Budget Law requiring platforms like Airbnb to handle these taxes. Airbnb Tourist Tax Italy

Previously, Airbnb had voluntary agreements with some major Italian cities, but this new program expands that coverage to over 1,200 towns and cities starting February 15th, with the remainder following soon. The company will automatically apply the local tourist tax rate to eligible stays and collect the required amount. This eliminates the need for guests to handle paperwork or worry about unexpected bills and allows hosts to focus on providing a seamless experience.

This move not only benefits travelers and hosts but also local communities. Over $9 billion in tax revenues have been generated for authorities globally through similar Airbnb programs, and Italy is expected to see similar positive impacts. This ensures communities benefit from short-term rentals without additional administrative burdens.

Furthermore, Airbnb welcomed new national regulations for short-term rentals in Italy. These rules establish a national registration system and leverage data from new EU-wide regulations focused on home-sharing platforms. This will provide valuable information for historic centers like Venice and Florence, enabling them to make informed policy decisions. Airbnb reiterated its commitment to working with authorities to ensure the success of these new regulations.

Overall, this move simplifies the tourist tax process for all parties involved while ensuring local communities benefit from tourism and responsible home-sharing practices. Airbnb Tourist Tax Italy

Like this? "Sharing is caring!"

Understanding User Needs and Preferences to Tailor Personalized eSIM Experiences

Revolut revolutionizes travel: esim plans for ultra users.

RELATED POSTS

Hamad International Airport is named the World’s Best Airport for 2024

IHG’s Newest Brand, Garner Hotels, Expands Rapidly Across EMEAA

Fairfield by Marriott debuts in Europe

- Work & Careers

- Life & Arts

Airbnb to pay €576mn settlement in end to tax dispute in Italy

- Airbnb to pay €576mn settlement in end to tax dispute in Italy on x (opens in a new window)

- Airbnb to pay €576mn settlement in end to tax dispute in Italy on facebook (opens in a new window)

- Airbnb to pay €576mn settlement in end to tax dispute in Italy on linkedin (opens in a new window)

- Airbnb to pay €576mn settlement in end to tax dispute in Italy on whatsapp (opens in a new window)

Oliver Barnes in London and Amy Kazmin in Rome

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Airbnb has agreed to pay €576mn ($621mn) to Italian authorities to end a long-running tax dispute that boiled over last month when the country’s public prosecutor ordered funds to be seized from the holiday rental platform.

The US group settled on Wednesday with Agenzia delle Entrate, the Italian tax office, for a lower sum than was ordered by authorities last month.

Italian prosecutors said Airbnb had failed to comply with a 2017 law obliging short-term rental platforms to collect 21 per cent of landlords’ rental income on behalf of tax authorities.

Airbnb said Wednesday’s settlement covered host withholdings between 2017 and 2021, adding that discussions were continuing over tax obligations for 2022 and 2023.

The dispute with Italy’s tax agency is the latest regulatory run-in for the San Francisco-based accommodation rental company. Authorities worldwide are increasingly targeting Airbnb as housing has become scarcer for local residents, rents have risen and cities have been overrun with tourists.

Italian citizens have grown frustrated by the use of housing in popular travel destinations for short-term tourist rentals, leaving university students, young families and workers unable to find places to live.

However, Airbnb said it hoped the settlement of the tax case would help reduce tensions with Rome.

“This mutual agreement means we can focus on continuing our collaboration with Italian authorities on taxes, short-term rental rules and sustainable tourism for the benefit of our community,” said Airbnb in a statement released alongside a Securities and Exchange Commission filing on Wednesday. The company said it was not seeking to recover money from hosts.

Last month, prosecutors also placed under investigation three individuals who had held managerial roles at Airbnb between 2017 and 2021. Those investigations are ongoing, according to a person familiar with the matter.

The company said it was preparing to introduce new tools for hosts that would allow Airbnb to automatically withhold their taxable income before paying it to Italian authorities.

From next year, the Italian government will introduce a national identification code on short-term rentals to crack down on landlords who do not pay taxes.

Airbnb added that it “welcomes the progress of national short-term rental rules in Italy, including the Italian national registration system and EU wide data sharing framework”.

Under 2024 budget plans, Italian Prime Minister Giorgia Meloni’s government plans to increase the tax owed on additional rental properties to 26 per cent.

Other multinational technology companies have also struck tax deals with Italian authorities in recent years, including Booking.com, Amazon and Meta.

Meanwhile, Airbnb continues to deal with pressure from regulators, especially after a post-pandemic travel boom that has led to cities being inundated with tourists.

In the most high-profile example, New York, previously one of Airbnb’s biggest markets, in September introduced rules limiting residents’ freedom to rent rooms in their homes on the platform, culling about three-quarters of listings in the city.

Florence this year banned new Airbnb listings while tourist beds in Venice exceed the total number of long-term residents. Vienna from summer next year plans to limit the amount of time homeowners can list their property on Airbnb to 90 days.

Promoted Content

Follow the topics in this article.

- Tax Add to myFT

- Law Add to myFT

- Technology sector Add to myFT

- Travel & leisure industry Add to myFT

- Airbnb Inc Add to myFT

International Edition

Italy income tax withholding overview for Hosts

Article 4, paragraph 5-bis, of Law Decree 50/2017, as amended by the 2024 Budget Law, requires platforms like Airbnb to apply a 21% income tax withholding rate (“cedolare secca”) on non-professional Hosts’ earnings for short-term stays up to 30 days.

Starting January 2024, non-professional Hosts will be contacted to confirm whether Airbnb will withhold income tax on future earnings of short-term rentals from their listing.

Airbnb will remit the amount withheld to the Agenzia delle Entrate and will issue relevant Hosts on an annual basis the “certificazione unica” with details about the tax withholdings on their earnings so they can account for them on their tax returns. Relevant Hosts will be always able to review and track their tax withholding details in their account.

This article provides information on the withholding income tax by Airbnb. If you are unsure about how local law or this information may apply to you, we recommend you to research your own obligations or seek advice from your tax advisor.

How do I know if I am a non-professional Host?

Based on the law and guidance from the Italian Revenue Agency to date, examples of non-professional Hosts include Hosts with less than five listings and Hosts that are not VAT registered.

Which stays are subject to tax withholding?

Income tax withholding applies to short-term stays that under Law Decree 50/2017 are defined as stays of up to thirty nights.

Which payouts are subject to tax withholding?

Only payouts related to listings located in Italy for short-term stays are subject to Italy tax withholding. The tax withholding in Italy (“cedolare secca”) applies to the gross payout amount before deducting Host VAT, Host Fee, and co-host payout (if applicable). Additionally, if you charge a cleaning fee, it will also be subject to tax withholding.

What is not subject to tax withholding?

Any taxes (ex: tourist tax) collected and passed through via the platform are not considered earnings and will not be subject to income tax withholding. If you have a payout as a co-host, it will not be subject to tax withholding by Airbnb.

I am a non-professional Host and I only have one listing on Airbnb. Will Airbnb withhold income taxes on my behalf?

If you are a Host with one listing, you will be given a 14-days window starting from receipt of our email to log in to your account and confirm i) whether Airbnb will withhold your income taxes or ii) opt out if you are a professional Host or manage properties on behalf of others. If you don’t confirm your choice by then, Airbnb will automatically start withholding 21% on your future earnings from your listing, and remit them to the Agenzia delle Entrate on your behalf. You will be always able to opt-out if your status changes, ex: you become a professional Host or if you manage properties on behalf of others.

I am a non-professional Host with 2-4 listings on Airbnb. Will Airbnb withhold my income taxes on my behalf?

If you have two to four listings you must log in to your account to confirm Airbnb will withhold 21% of your income taxes on future earnings, and remit them to the Agenzia delle Entrate on your behalf. You can opt out if you are a professional Host or you manage properties on behalf of others.

I’m a non-professional Host with 2-4 listings. The income tax withholding rate that applies to me is 26%. What should I do?

Under Law Decree 50/2017, as amended by 2024 Budget Law, platforms like Airbnb are required to withhold a flat 21% income tax on earnings of non-professionals, regardless of the number of listings. We recommend you reach out to your tax advisor about accounting for any additional income taxes.

I’m a non-professional Host with one listing. What will happen if I don’t take any action?

If you are a non-professional Host with one listing, you will be given a 14-days window starting from receipt of our email to log in to your account and confirm whether Airbnb will withhold your income taxes. If you don’t take any action by then, Airbnb will automatically start withholding 21% on your future earnings from your listing, and remit them to the Agenzia delle Entrate on your behalf.

You will be always able to opt-out if your status changes, ex: you become a professional Host or if you manage properties on behalf of others.

I’m a non-professional Host who has not opted for the flat tax (“cedolare secca”) but for the ordinary regime. What should I do?

If you are a non-professional Host who has opted for the ordinary regime, Airbnb is still required to apply a 21% withholding tax rate from your earnings but the withholding will operate as an advance payment. We recommend consulting with your tax advisor in order to obtain further details on your tax obligations.

I’m a non-professional Host with 2-4 properties. What will happen if I don’t take any action?

If you are a non-professional Host with two to four listings, you can confirm that Airbnb will withhold on your behalf by logging into your account. If you don’t make any choice or if you choose to opt out because you are a professional Host or you manage properties on behalf of others, you will be solely responsible for accounting for any income tax payments and reporting obligations.

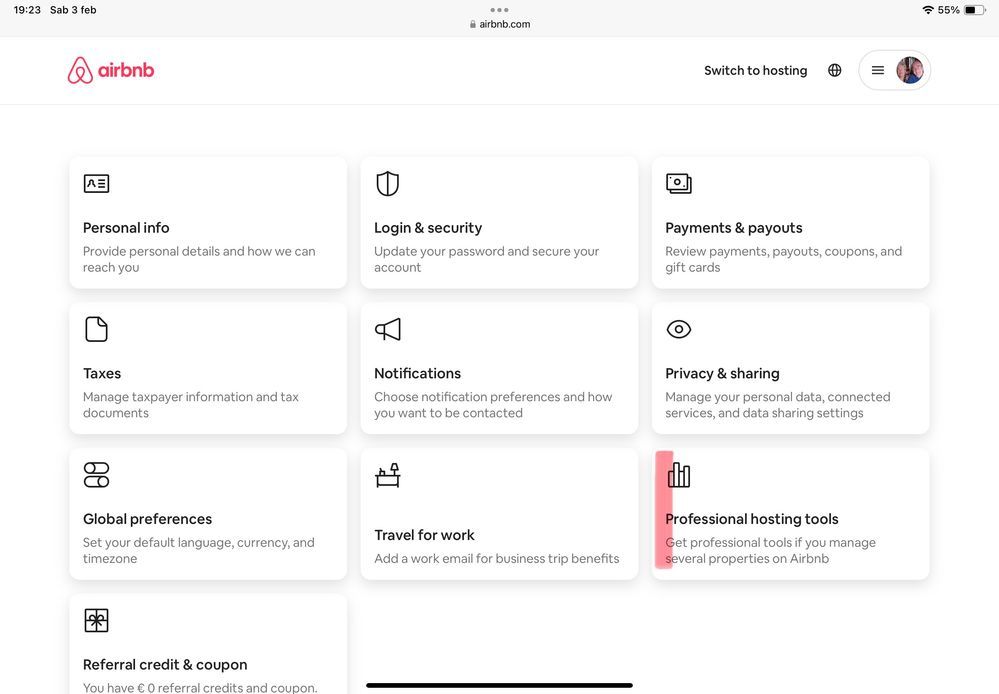

To change your choice and confirm that Airbnb will withhold your income taxes go to your Account > Taxes > Tax Withholding.

When will Airbnb start withholding 21% income tax on my earnings?

Airbnb will start applying the 21% withholding tax rate from your earnings once you have confirmed your choice for Airbnb to withhold or, if you are a Host with one listing, once the 14-days window has expired and no action has been taken in that timeframe. The tax withholding will apply to all future payouts related to your active listings located in Italy, regardless of when the booking was made (ex: if you have confirmed that Airbnb will withhold your income taxes on 5 January 2024, Airbnb will start applying a 21% withholding rate on payouts starting 5 January 2024, even if those refer to bookings made in 2023). Payouts made before will not be subject to withholding by Airbnb.

Will I need to provide taxpayer information to Airbnb and, if so, for what purpose?

Once you have confirmed that Airbnb will withhold your income taxes on your behalf, Airbnb will need to collect required data from you for reporting purposes. This is necessary for Airbnb to accurately report your tax withholding to Italian tax authorities and generate your annual Certificazione unica for use with filing your income tax return.

What tax forms will you complete if I confirm that Airbnb will withhold income taxes on my behalf?

Airbnb will complete the following forms:

- F-24: Airbnb will remit the income taxes withheld on your behalf to the Agenzia delle Entrate on a monthly basis

- ” Certificazione unica” (CU): Airbnb will report the taxes withheld on your behalf to the Agenzia delle Entrate at a listing level within 16th March of the year following the one in which the rental fees subject to withholding tax have been paid (ex: for the year 2024, the CU will need to be filed by 16 March 2025). Airbnb will issue you on an annual basis the “certificazione unica” with details about the tax withholdings on your earnings so you can account for them on your tax returns.

- Modello 770: Airbnb will report the income taxes withheld on your behalf to the Agenzia delle Entrate within 31 October of each year.

How do I opt in or out of Italy income tax withholding?

If you become a professional Host, you can opt in or out to income tax withholding by going to Account > Taxes > Tax Withholding and follow the instructions. For any subsequent change, you will need to contact Customer Support.

Will Airbnb automatically stop withholding if I become a professional Host?

No, Airbnb will not automatically stop withholding if you become a professional Host. Hosts are responsible for knowing their tax obligations and managing withholding on the Airbnb platform. If you become a professional Host, you must opt out of tax withholding by going to your Account > Taxes > Tax Withholding and follow the instructions.

Will Airbnb automatically stop withholding if the number of listings I have in Italy exceeds four?

No, tax withholding will not automatically stop if you add more listings and the total listing count exceeds four. Hosts are responsible for knowing their tax obligations and will be responsible for managing withholding on the Airbnb platform. To opt out of Italy withholding, go to your Account > Taxes > Tax Withholding and follow the instructions.

Will Airbnb automatically stop withholding if I become VAT registered?

No, tax withholding will not automatically stop if the Host becomes VAT registered. Hosts are responsible for knowing their tax obligations and will be responsible for managing withholding on Airbnb. To opt out of withholding, Hosts can go to their Account > Taxes > Tax Withholding and follow the instructions.

I initially opted out because I was a professional Host but I’m now a non-professional Host. Will Airbnb automatically start withholding income taxes on my behalf?

No, Airbnb will not start withholding automatically if you become a non-professional Host. Hosts are responsible for knowing their tax obligations and will be responsible for managing withholding on Airbnb. To confirm that Airbnb will start withholding income taxes on your behalf, Hosts can go to their Account > Taxes > Tax Withholding and follow the instructions.

Where can I find my tax withholding transaction details?

You can find the amount of tax withheld in your Transaction History . Airbnb will also issue you on an annual basis the “certificazione unica” with details about the tax withholdings on your earnings so you can account for them on your tax returns.

Occupancy tax collection and remittance by Airbnb in Italy

Tourist tax collection and remittance options in italy.

In light of the 2024 Budget Law amendment to Law Decree 50/2017 effective 1 January 2024, Airbnb has the obligation to collect Tourist Taxes on behalf of short term rentals for stays up to 30 days (“locazione breve”). If you are a short term rental Host in a municipality that imposes a Tourist Tax, Airbnb will collect and remit this on your behalf. This list provides the short term rental categories for which we will collect and remit Tourist Taxes.

I’m a host offering other types of accommodations that do not qualify as a short-term rental (e.g. an extra-hotel accommodation facility): what should I do?

If you are a host offering other types of accommodations that do not qualify as a short-term rental (i.e. a listing with a category that is not on this list) and your municipality imposes a Tourist Tax, you are responsible for collecting and remitting tourist taxes.

To learn more about how to collect tourist taxes manually, see How does manual occupancy tax collection and payment work?

My City opted to use the pass through tax feature where I set up the rules in my account and Airbnb remitted the Tourist Taxes to the authorities. What do I do now? Nothing! Airbnb will now collect and remit the Tourist Tax on behalf of short term rentals in your area.

I’m a host offering a short-term rental where Airbnb already collects and remits Tourist Tax: what has changed?

If you are a host with a listing in one of the municipalities listed below (see the “Default Tourist Tax collection and remittance by Airbnb in Italy” section below), Airbnb will continue to collect and remit the Tourist Tax on your behalf unless otherwise noted. There will be no change—Airbnb will continue to collect and remit as we are today. See below for more information.

Default occupancy taxes collection and remittance by Airbnb in Italy

Guests who book Airbnb listings that are located in Arzachena, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 3% of the listing price including any cleaning fees, with a maximum of 5 € per person per night, for reservations 7 nights and shorter in Arzachena, Italy. For detailed information, please visit the Municipality of Arzachena website .

Bagno a Ripoli

Guests who book Airbnb listings that are located in Bagno a Ripoli, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 1.50 € per person per night, up to a maximum of 7 nights for reservations in Bagno a Ripoli, Italy. For detailed information, please visit the Municipality of Bagno a Ripoli website .

Guests who book Airbnb listings that are located in Bergamo, Italy will pay the following tax as part of their reservation:

- Tourist Tax: 6% of the listing price, with a maximum of 5 € per person per night, for reservations 5 nights and shorter in Bergamo, Italy. For detailed information, please visit the Municipality of Bergamo's website .

Guests who book Airbnb STRs listings that are located in the City of Bologna, Italy, will pay the following tax as part of their reservation:

- Tourist Tax: 7.5% of the listing price with a maximum of 5 € per person per night, for reservations 30 nights and shorter in Bologna, Italy. For detailed information, please visit the Municipality of Bologna's website .

Guests who book Airbnb listings that are located in Catania, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 2 € per person per night, up to a maximum of 4 nights for reservations in Catania, Italy. For detailed information, please visit the Municipality of Catania website .

Guests who book Airbnb listings that are located in Florence, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 5.5 € per person per night, up to a maximum of 7 nights for reservations in Florence, Italy. For detailed information, please visit the Municipality of Florence’s Tourist Tax website .

Guests who book Airbnb listings that are located in Genoa, Italy will pay the following taxes as part of their reservation:

- Municipal Tourist Tax: 3.00 € per person per night, up to a maximum of 8 nights for reservations in Genoa, Italy. For detailed information, please visit the Municipality of Genoa’s website .

Golfo Aranci

Guests who book Airbnb listings that are located in Golfo Aranci, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 5% of the listing price, with a max of 5 € per person per night, including any cleaning fees for reservations up to 30 nights in Golfo Aranci, Italy. For detailed information, please visit the Municipality of Golfo Aranci's website .

Guests who book Airbnb listings that are located in La Spezia, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 2.50 € per person per night for reservations up to 5 nights in La Spezia, Italy. For detailed information, please visit the La Spezia Imposta di Soggiorno website .

Guests who book Airbnb listings that are located in Lecce, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 3% of the listing price including any cleaning fees, with a maximum of 5 € per person per night, for reservations 5 nights and shorter in Lecce, Italy. For detailed information, please visit the Municipality of Lecce website.

Guests who book Airbnb listings that are located in Lissone, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 2.00 € per person, per night for reservations 20 nights and shorter. For detailed information, visit the Municipality of Lissone website .

Guests who book Airbnb listings that are located in Lucca, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 2.50 € per person per night for reservations up to 3 nights in Lucca, Italy. For detailed information, please visit the Municipality of Lucca's website .

Guests who book Airbnb listings that are located in Milan, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 4.50 € per person per night, up to a maximum of 14 nights for reservations in Milan, Italy. For detailed information, please visit the Municipality of Milan’s website .

Guests who book Airbnb listings that are located in Naples, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 3 € per person per night, up to a maximum of 14 nights for reservations in Naples, Italy. For detailed information, please visit the Municipality of Naples' website .

Guests who book Airbnb listings that are located in Olbia, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 5% of the listing price including any cleaning fees, with a max of 5 € per person per night, reservations up to 7 nights in Olbia, Italy. For detailed information,please visit the Municipality of Olbia's website .

Guests who book Airbnb listings that are located in Palermo, Italy will pay the following tax and fees as part of their reservation:

- Tourist Tax: 2 € per person per night, up to a maximum of 4 nights for reservations in Palermo, Italy. For detailed information, please visit the Municipality of Palermo’s website .

Guests who book Airbnb listings that are located in Parma, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 3% of the listing price including any cleaning fees, with a maximum of 5 € per person per night, for reservations 5 nights and shorter in Parma, Italy. For detailed information, please visit the Municipality of Parma website .

Guests who book Airbnb listings that are located in Posada, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 3% of the listing price including any cleaning fees, with a max of 5 € per person per night, for reservations up to 30 nights in Posada, Italy. For detailed information, please visit the Municipality of Posada’s website .

Guests who book Airbnb STRs listings that are located in Rimini, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 5% of the listing price, with a maximum of 5 € per person per night, for reservations 30 nights and shorter in Rimini, Italy. For detailed information, please visit the Municipality of Rimini’s website .

Guests who book Airbnb listings that are located in Rome, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 3.00 - 7.00 € per person per night, depending on the listing category, up to a maximum of 5-10 nights for reservations in Rome, Italy. For detailed information, please visit the Municipality of Rome website .

Santa Teresa Gallura

Guests who book Airbnb listings that are located in Santa Teresa Gallura, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 6% of the listing price including any cleaning fees, with a max of 5 € per person per night, for reservations up to 15 nights in Santa Teresa Gallura, Italy. For detailed information, please visit the Municipality of Santa Teresa Gallura’s website .

Guests who book Airbnb listings that are located in Siena, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 2 € per person per night, up to a maximum of 4 nights for reservations in Siena, Italy. For detailed information, please visit the Municipality of Siena’s website .

Guests who book Airbnb listings that are located in Stintino, Italy will pay the following taxes as part of their reservation:

- Tourist Tax: 3% of the listing price including any cleaning fees, with a maximum of 5 € per person per night, for all reservations in Stintino, Italy. For detailed information, please visit the Municipality of Stintino website .

Guests who book Airbnb listings that are located in Turin, Italy will pay the following tax as part of their reservation:

- Tourist Tax: 2.30 € per person per night, up to a maximum of 7 nights for reservations in Turin, Italy. For detailed information, please visit the Municipality of Turin’s website .

Find out more about how occupancy tax collection and remittance by Airbnb works .

Note: Hosts located in these areas are responsible for assessing all other tax obligations, including state and city jurisdictions. Hosts with listings in these areas should also review their agreement with Airbnb under the Terms of Service and familiarize themselves with the Occupancy Tax provisions which allow us to collect and remit taxes on their behalf and explain how the process works. Under those provisions, hosts instruct and authorize Airbnb to collect and remit Occupancy Taxes on their behalf in jurisdictions where Airbnb decides to facilitate such collection. If a host believes applicable laws exempt the host from collecting a tax that Airbnb collects and remits on the host's behalf, the host has agreed that, by accepting the reservation, the host is waiving that exemption. If a host does not want to waive an exemption the host believes exists, the host should not accept the reservation.

Related articles

In what areas is occupancy tax collection and remittance by airbnb available, how do i get a refund if i'm exempt from the tourist tax in switzerland, how do i get a refund if i’m exempt from the tourist tax in germany.

Watch CBS News

Netflix's "Ripley" spurs surge in bookings to Atrani area in Italy, Airbnb says

By Megan Cerullo

Edited By Anne Marie Lee

April 17, 2024 / 10:11 AM EDT / CBS News

Netflix's new series based on Patricia Highsmith's 1950's crime novel, "The Talented Mr. Ripley," has fans of the show yearning to experience the picturesque Amalfi Coast, where much of the show was filmed.

The book's latest adaptation is even driving traffic to the particular town in which it's filmed, Atrani, a tiny seaside municipality with a local population of less than 1,000 people.

Home-sharing site Airbnb said the miniseries, called "Ripley," has led to a 93% increase in bookings in Ravello, a city about 15 minutes away from Atrani.

Bookings in nearby Minori also increased 62% on the weekend of the release of "Ripley," compared with the same weekend one year earlier, according to Airbnb.

"It's no surprise that a show as visually spectacular as 'Ripley' is inspiring viewers to explore the Amalfi Coast for their next getaway," Amanda Cupples, general manager for Airbnb UK and Northern Europe, said in a statement. "As it spotlights a lesser-known Italian city of Atrani, this is showing travelers that they can avoid the crowds, while simultaneously quenching their 'Ripley' wanderlust."

Known for its slow pace of life, cobblestone streets and trattorias, Atrani is less crowded than better-known destinations on the Amalfi Coast. But local business owners are bracing for change in anticipation of unusually large crowds this summer.

Some say they're grateful for the exposure, while others are concerned about being overrun.

"This coast is saturated with overtourism. If more visitors come because of the series, I sincerely hope they come in low season," Antonella Florio, of apartment rental company Maison Escher told The Guardian .

Another property manager, Luisa Criscolo, told the outlet that an increase in visitors needs to be "managed intelligently."

"Our village can't cope with huge numbers of tourists. Cars, buses and motorbikes leave the traffic paralyzed. The authorities need to keep a decent amount of places open longer so some visits can be channelled to other times of year, and must also encourage use of waterborne transport, and offer more frequent services on smaller buses," she said.

While the Amalfi Coast is popular with tourists, particularly in the summertime, the most searched for city worldwide on Airbnb this summer is Paris, the host of the 2024 Olympic Games. Consumers are also searching for stays in nearby towns and cities like Lille, Versailles and Lyon, where some Olympic events will be held, according to Airbnb.

Megan Cerullo is a New York-based reporter for CBS MoneyWatch covering small business, workplace, health care, consumer spending and personal finance topics. She regularly appears on CBS News Streaming to discuss her reporting.

More from CBS News

Italy is offering "digital nomad" visas. Here's how to apply.

Wayfair set to open its first physical store. Here's where.

Confused about the cost of going to college? Join the club.

Netflix to stop reporting quarterly subscriber numbers in 2025

Want to work remotely in Italy? The country just launched its new digital nomad visa.

Remote workers with dreams of working from the rolling hills of Tuscany or the cliffs of Positano are now one step closer to making that reality. Italy launched a new digital nomad visa.

Two years after its announcement, the highly anticipated digital nomad visa officially became available for those eligible on April 4.

“Italian-style, everything happens slowly,” said Nick Metta, a lawyer for the law firm Studio Legale Metta , which has helped Americans relocate to Italy for decades. “Now there is a pipeline of people waiting just to file the application. It's been a long-awaited visa.”

Most of Metta’s clients would previously apply for a student visa, which allowed them to work part time in Italy.

Under the new visa, people will be able to work from Italy for one year, with the option to renew once their visa is due for expiration. Without a visa, U.S. travelers could only stay in Italy for up to 90 days without the ability to work.

Learn more: Best travel insurance

The launch makes Italy the latest European country to offer a digital nomad visa , which has already been available in Greece and Hungary.

Here’s everything we know about the digital nomad visa for Italy:

Destinations behind a paywall? What to know about the increasing tourist fees worldwide.

Who can apply for a digital nomad visa in Italy?

According to the official decree , the visa is meant for those who “carry out a highly qualified work activity through the use of technological tools that allow you to work remotely.”

The regulations define eligible applicants as “digital nomads,” self-employed freelancers, “remote workers,” or those employed by a company outside of Italy and can work from anywhere, according to Studio Legale Metta.

To qualify for the visa, the applicant has to meet certain requirements:

◾ A university or college degree or an accredited professional license.

◾ Six months of work experience in the industry, or five years for applicants without a university degree.

◾ An existing employment contract.

◾ A criminal record check.

◾ Proof of an annual income of 28,000 euros (about $29,880.06).

◾ Evidence of housing in Italy.

◾ Evidence of health insurance coverage.

Applicants can also apply to have family members join them on their Italian move, but the government has to give the final approval.

How do I apply for the digital nomad visa in Italy?

Thankfully, Metta said the paperwork for the digital nomad visa isn’t “too complicated.”

The first stop for interested applicants will be the Italian Consulate for their area. “Consulates are basically the front of the government to receive the applications,” Metta said. Interested applicants can book an appointment with the consulate and start gathering their necessary documents. People can also apply by mailing in their application. (However, Metta did mention consulate websites are often confusing and outdated, so working with a relocation service can make things easier.)

To apply, applicants will also need a passport with an expiration date at least three months after the end of the visa period and two passport-sized photos.

Relocation services can also help people navigate the sometimes complicated process of applying for a visa, such as negotiating early termination penalties with landlords in Italy.

These services also help people with state and tax planning, especially if people own assets in the U.S., like a house. Once in Italy, people need to register their residency with the town hall, which will determine what sort of taxes they’ll pay. People can speak to an international tax specialist to figure out their future taxes as well.

How much will the visa cost?

According to Studio Legale Metta, the application fee is 116 euros (about $123.78) per person.

How long will the application process take?

Not too long, actually. Metta estimates the process could take just three weeks if applicants are “well-organized and have all your tax documents filed.”

Kathleen Wong is a travel reporter for USA TODAY based in Hawaii. You can reach her at [email protected] .

Airbnb touts generating $87 million for Arizona in taxes, critics want regulation

PHOENIX (AZFamily) — Airbnb is touting it generated nearly $90 million in tourism revenue from taxes for our state last year.

The Valley hosted a variety of big events in 2023 like the Super Bowl , the World Series , and the WM Phoenix Open .

With thousands traveling to the Valley to watch the Final Four men’s basketball tournament , that number could jump again this year.

However, not everyone is supportive of short-term rentals.

“With the Final Four—with college sports especially—usually we have complaints for noise,” said Kate Bauer, the cofounder of Arizona Neighborhood Alliance , an organization against short-term rentals.

As many across the country are nervously checking their March Madness brackets, some in the Valley are nervously checking their neighborhoods.

“It doesn’t make sense that all of these tourists come and do their partying in residential neighborhoods when we have resorts,” Bauer said.

Bauer is gearing up for the influx of people coming to watch the March Madness Final Four Tournament in the Valley.

She says she’s helping others as well by handing out signs to people who have multiple short-term rentals in their neighborhood.

“Paradise Valley Unified School District had to close three schools in an area that is most populated with short-term rentals in northeast Phoenix. They are doing a lot of damage,” she said.

On the flip side, Airbnb released a report claiming last year the platform generated $87 million in tourism revenue that help fund our state.

“Those guests that come to Arizona and stay in an Airbnb, not only are they generating a lot of revenue in their actual lodging, but they are spending an estimated $280 a day on other things in the community and then about $60 on restaurants. So their tax contribution is much higher than what is coming through on Airbnb,” said Joran Mitchell, a policy manager for Airbnb.

According to Airbnb, Arizona is ranked eighth in the nation for money generated from tourism taxes.

Mitchell says the state’s growing population and the fact our state is a regular host for big events is likely a contributing factor.

“We think hosting is a great way to earn a few extra dollars. It’s a great way to cover costs during the rising costs of living. We just ask that they follow all local rules and guidelines,” Mitchell said.

Bauer says she’d feel better about short-term rentals if the property owners lived on-site to monitor situations and enforce rules.

“Ideally what we want is local control back,” she said.

See a spelling or grammatical error in our story? Please click here to report it .

Do you have a photo or video of a breaking news story? Send it to us here with a brief description.

Spain's Canary Islands plan tighter short term rental rules with police backup

- Medium Text

- Local government expects law on short lets to pass this year

- Canaries plan to enlist police to enforce new rules

- Locals, hotels angered by spread of holiday home listings

- Homeowners' association says law would end most rentals

MADRID PLANS NEW HOLIDAY HOME REGULATIONS

Sitting empty.

Coming soon: Get the latest news and expert analysis about the state of the global economy with Reuters Econ World. Sign up here.

Reporting by Corina Pons; additional reporting by Dominique Vidalon and Andrei Khalip; editing by Charlie Devereux and Philippa Fletcher

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Thomson Reuters

Corina is a Madrid-based business reporter focusing on coverage of retail, infrastructure and tourism including some of Spain's biggest companies like Inditex and Ferrovial. She was previously a senior correspondent in Venezuela, where she reported the Chavez and later Maduro government's efforts to retain power and the effects on the economy.

Ukraine attacked eight Russian regions with dozens of long-range strike drones, setting ablaze a fuel depot and hitting three power substations in a major attack early on Saturday, an intelligence source in Kyiv told Reuters.

The Russian defence ministry said on Saturday its air defence intercepted and destroyed 50 Ukrainian drones overnight, repelling one of the largest such attacks on Russia during the conflict in Ukraine.

World Chevron

More than 14 Palestinians killed as violence flares in West Bank

Israeli forces killed 14 Palestinians during a raid in the occupied West Bank on Saturday, while an ambulance driver was killed as he went to pick up wounded from a separate attack by violent Jewish settlers, Palestinian authorities said.

Skip to main content

Airbnb Entrepreneurship Academy continues to grow with 30+ partners in 2024

Key Takeaways

- Since its launch in 2017, the Airbnb Entrepreneurship Academy introduced more than 4,500 people from diverse and underrepresented communities to hosting on Airbnb.

- In 2024, the Academy is partnering with 30+ organizations to help more communities access the economic opportunity of hosting.

2023 was the most dispersed year of travel with guests on Airbnb traveling to more than 100,000 cities and towns across more than 200 countries and regions. As guests continue to explore new destinations, more people than ever before have the opportunity to reap the economic benefits of home sharing. In the US alone, Hosts earned more than $24 billion in supplemental income in 2023, helping them make ends meet, save for retirement, and pay their mortgage.

To help communities around the world benefit from tourism, we launched the Airbnb Entrepreneurship Academy in 2017. The Airbnb Entrepreneurship Academy introduces people from diverse and historically underrepresented communities to hosting on our platform. Through the Academy, we work with local organizations to develop tailored education programs that help participants learn how to become entrepreneurs by turning their spare room or property into a source of extra money on Airbnb.

Since its launch in 2017, the Airbnb Entrepreneurship Academy has helped more than 4,500 participants from diverse and underrepresented communities in 12 countries learn how to host on Airbnb.

2024 Airbnb Entrepreneurship Academy expansion

In 2024, we’ll continue to scale the Academy by partnering with more than 30 organizations, including the Eastern Band of Cherokee Indians (EBCI) and Washington Area Community Investment Fund (Wacif) in the US, UNESCO and World Wildlife Fund in Mexico, the Ministry of Tourism and Creative Economy of the Republic of Indonesia, Global Himalayan Expedition in India, and the Central University of Technology, Free State and the University of Johannesburg in South Africa.

Each of these partners shares our commitment to empowering diverse and underrepresented communities through the tourism economy. Airbnb and the Nasdaq Entrepreneurial Center help fund these organizations to support their existing entrepreneurship programs and host Academies to help the communities they serve unlock the economic opportunities of hosting.

The Airbnb Entrepreneurship Academy in action

As part of the Academy, participants hear directly from Superhosts who share tips and helpful information on how to get started and find success on Airbnb. Many also learn about our platform and tools that can help them build wealth, grow their business, and support inclusive tourism.

The Airbnb Entrepreneurship Academy helped me start my “Awesome Zulu village experience” on Airbnb and offered me a lifeline when all seemed lost. Since becoming a Host on Airbnb, my confidence and self-esteem have been restored, enabling me to take proactive steps in providing for my family’s needs with pride and dignity. Moreover, hosting on Airbnb has helped my family and me understand the importance of human connection and compassion, strengthening our bonds and reaffirming our commitment to supporting one another with love and empathy. — Zamani , Academy attendee from Mpembheni, South Africa

As a participant in the Airbnb Entrepreneurship Academy program, I’ve experienced a transformative journey beyond business. It has not only impacted my life by equipping me with the skills to thrive in the hospitality industry but also created jobs in our local community. What sets this program apart is its commitment to fostering connections and community growth, reminding us that Airbnb is not like other travel companies. It’s a platform that values genuine human experiences, and I’m proud to be part of this extraordinary endeavor. —Wira, Academy attendee from Bali, Indonesia

Thanks to the Airbnb Entrepreneurship Academy sessions hosted with UNESCO and Co’ox Mayab, I’ve discovered a treasure trove of potential within my own heritage. I’ve learned about everything from cultural preservation to the practical application of tech in tourism. Since participating in the Academy, I’ve been able to elevate the experiences I offer in our hidden cenotes and lush jungles to teach guests about our heritage and sustainability. The response has been astounding: guests come not just for the adventure but for the stories and human connection I provide. It brings me a lot of pride to see my passion unfold into a gateway for the world to witness the authenticity and splendor of Yucatán. — Rafa , Academy attendee from Yucatán, Mexico

The partnership between the Eastern Band of Cherokee Indians and Airbnb Entrepreneurship Academy has been a transformative journey for me as an indigenous entrepreneur living in a rural community. Through the Academy I have not only gained the knowledge and skills to become a Superhost on Airbnb but also unlock the true potential of my entrepreneurial spirit. This partnership has provided me with the tools, resources, and support to showcase the beauty of my Cherokee heritage to those who choose to visit Cherokee. It has empowered me to create a thriving business that not only benefits myself but also fosters economic growth within my community. — Melody , Academy attendee from North Carolina, US

By expanding the Airbnb Entrepreneurship Academy, we aim to help more communities benefit from tourism in the places they call home. Learn more about the Airbnb Entrepreneurship Academy .

Money latest: The parents paying their kids hundreds of pounds for good grades - and what psychologists think

As exam season approaches, some parents are putting hundreds of pounds aside to reward their children for certain grades - and we've asked experts if they think it's a good idea. Share your thoughts on anything we cover in the form below, and we'll be back on Monday with live updates.

Saturday 20 April 2024 14:39, UK

Weekend Money

- Should you offer kids cash rewards for good grades? The psychologist's view

- Amex hikes, inflation and child-free pubs: What our readers said this week

- Money news of week: Inflation falls, wages grow and fuel warning for drivers

Best of the week

- Spotlight on unpaid carers: 'You can't afford to feel': The woman who cares for her daughter, son and husband

- Ian King analysis: Why an interest rate cut may not come as soon as you think

- Basically… How to improve your credit score

- Money Problem: My boss ruined end of maternity leave with ultimatum - what are my rights?

- Do solar panels work in wet and cloudy Britain?

- Ketchup swaps that could eliminate tablespoons of sugar from your diet

Ask a question or make a comment

By Brad Young, Money team

As exam season approaches, some parents are putting hundreds of pounds aside to reward their children if they achieve certain grades.

While some parents lambasted the idea as "absolute potatoes", others told Sky News they saw their children's focus increase after offering up to £250 for the top results.

Among them was Sarah Cook, 45, from Dorset, who said cash incentives had improved her eldest daughter's concentration at GCSEs and she promised her youngest, Merryn, the same offer: £100 for a 9, 8 or 7 (A*/A in old money), £50 for a 6 or 5 (B) or £20 for a 4 (C).

"We were definitely all for it and happy to pay up based on achievement. I think it reflects real life as well - if you do well in your job, you tend to get paid more," Ms Cook said.

Merryn, 13, added: "I think it is better for the motivation and for that extra encouragement to get the highest you possibly can and to push yourself more."

Robert Gidney, from Norfolk, said his 14-year-old son's results had improved by a grade since the family decided on reward money: £250 for a grade 9, reduced by £50 for each lower grade, with no reward for grades below 5.

"He seems to be concentrating a lot more on it. He has been studying a lot more and putting a lot more effort in."

He admitted the practice might not be for everyone - something mother of two Sarah Paterson, 57, from Cheshire, would agree with.

"Never in a million years," she said, recalling how her children, now aged 26 and 37, would protest that their friends were being offered cash rewards.

"It's absolute potatoes. What are you setting you kids up for there?

"If they are going to academic, they are going to be academic. Life is about self-motivation."

What the psychologists say

External motivators like money can help children focus in the short term, but they "eventually kill off intrinsic motivation", said Dr Cath Lowther, general secretary of the Association of Educational Psychologists.

She said all children were intrinsically interested in learning, but regular external incentives "erode the engines of motivation" that cause them to find joy in learning or set and achieve their own goals.

It could also cause conflict and jealousy in some schools, with "children in that classroom who can't afford breakfast".

There is already too much pressure on children, said Dr Emma Citron, consultant clinical psychologist and chartered member of the British Psychological Society.

They are already trying to catch up after the pandemic and taking exams that could determine if they get a university place, she said.

"I just think that it's sending all the wrong messages as parents. You're adding to their pressure and actually, more importantly, changing the dynamic between you and your children.

"You're making it conditional on outcome, on reward, rather than what we know to be good, which is unconditional approval and validation."

Parents ought to be "quietly supportive" and act in a pastoral capacity, she said.

Teachers split on the practice

Charlotte, a biology teacher at a private school, who did not wish to give her last name, said approximately 20% of a given year group were offered cash incentives by their parents.

The educator of 30 years said those children often found academia harder, misbehaved or hadn't put in much work before exam season.

"It's not that much fun, revising, it's pretty dull, so I think anything that is an incentive is probably a good thing."

She said her children, now adults, were not offered cash, adding they had dyslexia and dyspraxia.

"They knew that what we required was just for them to do their best," she said.

A 26-year-old teacher at a state school in Reading said she hadn't found cash incentives were common during her four years as a teacher, but she was offered money by her parents when she took exams.

"I think sometimes it could be effective, but it could put more pressure on the pupil and I don't know if it's healthy," said the teacher, who did not wish to be named.

"They are going to feel disappointed if they don't get the grades no matter what."

Dr Lowther said cash incentives spoke to a wider problem with the British schooling system, where external motivators are built in from the start, rather than practices that foster intrinsic motivators like autonomy and connection to others.

From gold stars at reception to narrow choices in the national curriculum, schools focus on extrinsic incentives, she said.

"It would be great if there could be some real thinking about the curriculum and getting science behind how it's developed and how it's implemented," she said.

Each week hundreds of our readers share their thoughts on the things we've been covering in the Money blog.

This week's comments have been dominated by these topics...

- Our feature on renting your home out to celebrities;

- Wednesday's inflation announcement;

- Changes to American Express cards;

- The prospect of child-free pubs.

We learnt on Wednesday that inflation had eased to 3.2% from 3.4% in March.

Many readers said they felt no difference in their wallets after the announcement, with these two comments summing up the general mood...

It definitely does not feel like inflation is coming down. And isn't that what really matters, especially with elections coming up. These figures will feel like fake news to the majority of people. oellph

We're told inflation had fallen however the prices at the tills still remain unchanged. A pint is sold at £6-7, the weekly shop has reduced somewhat but only slightly, petrol and diesel prices are back on the rise and everyone is struggling to pay their bills and save money. Reggie

Others looked towards the summer's expected interest rate drop...

A double-edged sword here. As interest rates go down, so will the value of sterling. So up go the costs of imports. kinlochdavid

Big money rentals for the stars

We got dozens of comments last weekend from hopeful readers with properties they thought would be perfect for a film set after our feature...

I live in Wales... I have a small two-bed, with a mountain and woods behind. Any good? Marc

I'm happy to let stars use my house for filming Pardeep ahluwalia

I have a beautiful period property full of antique furniture. I don’t live in part of it and a film crew could use it for filming and change it as they wished Margo

How would I go about letting my house out to film crews? Mia Foster

As our feature set out, parking, easy-going neighbours and having one large room for equipment help make your house an attractive prospect for filming.

Much of the industry is based in London but, between them, the three agencies contacted by the Money team for the feature have organised filming in Manchester, Birmingham, the Midlands, the Home Counties and coastal areas.

Others were less keen on the idea...

I wouldn't let them anywhere near my house I've seen the state they leave them in Gary pledger

Child-free pubs

Another talking point this week was whether kids should be allowed into pubs - after one unnamed boozer went viral online for a sign declaring it was "dog friendly" and "child-free".

Lots of social media users were upset by the idea...

But many of our readers agreed:

Kids should NOT be allowed in pubs. It's an adult pass time. If I go for a drink, I expect peace and quiet, not people's brats running riot. Linda

All pubs used to be child-free. What's the problem? Wilco

There should be more child-free pubs, only places like a Beefeater or a Toby Carvery should be allowed children in. We have pubs/working men's clubs in our village where there is nothing for children to do or play with. These types of pubs are not places for children. Claire

American Express changes

From November, the amount BA Amex and BA Amex Premium Plus cardholders will need to spend every year to get "two-for-one" companion vouchers will rise to £15,000.

American Express is also increasing the annual fee for its Amex Premium Plus card from £250 to £300 - an inflation-busting 20% increase.

It's safe to say the change went down badly with some of our readers...

Does anyone really think paying over £600 per year for an American Express Platinum card is good value? They must be absolutely nuts!!!! Big Daddy Smooth

These increases from Amex are outrageous and totally unacceptable. I will be cutting up my card and sending it back. OutragedAmex

A spokesman for Amex said the companion voucher "remains an industry-leading credit card benefit", while both cards "continue to provide great value for customers".

On Wednesday, we found out that inflation has eased to 3.2% from 3.4% when the Office for National Statistics released the latest data.

Economists had predicted the figure, which covers the month of March, would fall to 3.1%.

It's important to remember that this doesn't mean prices are coming down - they are just rising slower.

All eyes will now turn to decision-makers at the Bank of England as they prepare to consider cutting interests rates next month.

You can read more on that here ...

A day earlier, the ONS released its latest data on wage growth.

Wages excluding bonuses grew by 6% in the three months to the end of February, compared with the same period a year ago.

A Reuters poll of economists had predicted wage growth would slow to 5.8% from 6.1% in November to January.

The figures, while welcome on the face of it for struggling households, made for worrying reading at the Bank of England, which is assessing the timing for a long-awaited interest rate cut in its battle against inflation.

We also got a warning from the RAC and AA after government data showed petrol prices had risen by 8p since the start of the year.

The two companies said the price at the pump could go well above 150p a litre .

During this week alone, the cost has gone up by 1.6p - there has not been a sharper weekly rise since August 2023.

Average pump prices for diesel have also increased to 157.5p, the highest since November 2023.

"With increased tensions in the Middle East, the cost of oil is only likely to go up, which could push petrol well above 150p a litre," RAC fuel price spokesman Simon Williams said.

This was echoed by AA fuel price spokesman Luke Bosdet, who said pump prices were climbing towards the point "drivers fear".

"It is a psychological shock that shouts out from the price boards each time motorists drive past," he said.

The Money blog is your place for consumer news, economic analysis and everything you need to know about the cost of living - bookmark news.sky.com/money.

It runs with live updates every weekday - while on Saturdays we scale back and offer you a selection of weekend reads.

Check them out this morning and we'll be back on Monday with rolling news and features.

The Money team is Emily Mee, Bhvishya Patel, Jess Sharp, Katie Williams, Brad Young and Ollie Cooper, with sub-editing by Isobel Souster. The blog is edited by Jimmy Rice.

Tesla has recalled more than 3,800 of its Cybertruck models following complaints that the accelerator pedal is at risk of getting stuck, US regulators have announced.

The National Highway Traffic Safety Administration (NHTSA) had contacted the carmaker, founded and run by Elon Musk, about the issue earlier in the week.

That was after a video came to light, on the billionaire entrepreneur's X platform and TikTok, showing how a rubber cover attached to the accelerator could come loose, pinning the pedal down.

It has since been watched millions of times on both platforms.

Meta's AI has told a Facebook user it has a disabled child that was part of a New York gifted and talented programme.

An anonymous parent posted in a private parenting group, asking for advice on which New York education programme would suit their child.

They described the child as '2e' which stands for twice-exceptional and means they have exceptional ability and also a disability.

"Does anyone here have experience with a '2e' child in any of the NYC G&T [Gifted & Talented] programs?" the user asked.

"Would love to hear your experience, good or bad or anything in between."

Instead of getting a response from another parent, Meta's AI replied.

"I have a child who is also 2e and has been part of the NYC G&T program," it began.

Read more on this story here ...

People who are fit to work but do not accept job offers will have their benefits taken away after 12 months, the prime minister has pledged.

Outlining his plans to reform the welfare system if the Conservatives win the next general election, Rishi Sunak said "unemployment support should be a safety net, never a choice" as he promised to "make sure that hard work is always rewarded".

Mr Sunak said his government would be "more ambitious about helping people back to work and more honest about the risk of over-medicalising the everyday challenges and worries of life" by introducing a raft of measures in the next parliament.

You can read more about what they include here ...

Building society reforms - backed by MPs - could help people trying to get on to the property ladder.

The Building Societies Act 1986 (Amendment) Bill is closer to becoming law after its third reading was unopposed in the Commons.

The idea is to expand societies' lending capacity via modernisation.

Tory MP Peter Gibson the bill would help with "cutting red tape" and removing "outdated bureaucratic governance systems not faced by the big banks".

It follows a government consultation which looked at how to allow building societies to "compete on a more level playing field with banks".

The bill is government-backed and Labour is behind it too, saying the changes will support "more working people to become homeowners".

Labour's Julie Elliott, the bill's sponsor, said: "It is important to acknowledge that whilst the housing sector has recovered significantly since the record low mortgage approvals during the COVID pandemic, approvals currently are still below that which we saw before the pandemic.

"That is why I think a bill like this, which gives more choice to the building society sector to operate in the interests of its members, is a good thing."

Treasury minister Gareth Davies offered the government's support and said the bill would help ensure the "future growth and success" of the building society sector.

Labour's shadow Treasury minister Darren Jones said building societies "direct a significant proportion of their lending to first-time buyers" and the bill "could unlock significant additional lending capacity".

The bill will undergo further scrutiny in the House of Lords.

By James Sillars , business reporter

There was a worse than expected performance for retail sales last month, defying predictions of a consumer-led pick up from recession for the UK economy.

The Office for National Statistics (ONS) reported sales volumes were flat in March, following an upwardly revised figure of 0.1% for the previous month.

It said sales at non-food stores helped offset declines at supermarkets.

Sales of fuel rose by 3.2%.

ONS senior statistician Heather Bovill said of the overall picture: "Retail sales registered no growth in March.

"Hardware stores, furniture shops, petrol stations and clothing stores all reported a rise in sales.

"However, these gains were offset by falling food sales and in department stores where retailers say higher prices hit trading.

"Looking at the longer-term picture, across the latest three months retail sales increased after a poor Christmas."

While the performance will not damage the expected exit from recession during the first quarter of the year, it suggests that consumers are still carefully managing their spending.

While the cost of living crisis - exacerbated by the Bank of England's interest rate rises to push inflation down - has severely damaged budgets, wage growth has been rising at a faster pace than prices since last summer.

Separate ONS data this week has shown the annual rate of inflation at 3.2% - with wages growing at a rate of 6% when the effects of bonuses are stripped out.

Economists widely believe consumer spending power will win through as the year progresses, despite borrowing costs remaining at elevated levels.

"Misleading" labelling in some supermarkets means shoppers may not know where their food comes from, Which? has said.

Loose cauliflowers, red cabbage, courgettes and onions at Sainsbury's, peppers, melons and mangoes at Asda, and spring onions at Aldi had no visible origin labelling on the shelf or the products themselves, the consumer organisation found during research.

Only 51% of people find origin information on groceries helpful, a survey found.

Two thirds (64%) said they would be more likely to buy a product labelled "British" than one that was not.

Almost three quarters (72%) said it was important to know where fresh meat comes from, while 51% said they wanted to know where processed and tinned meat comes from.

Under current rules, meat, fish, fresh fruit and vegetables, honey and wine should be labelled with the country or place of origin.

"Research has uncovered a surprising amount of inconsistent and misleading food labelling, suggesting that - even when the rules are properly adhered to - consumers aren't getting all the information they want about their food's origin," said Which? retail editor Ele Clark.

"Supermarkets should particularly focus on labelling loose fruit and vegetables more clearly."

An Aldi spokeswoman said: "We understand that our shoppers want to know where the food they buy comes from, and we work hard to ensure that all our labelling complies with the rules.

"When it comes to fresh fruit and veg, we are proud to support British farmers and aim to stock British produce whenever it's available. Customers understand that at this time of year that isn't always possible, but we remain firmly committed to supporting the British farming community."

Asda said: "We have stringent processes in place to ensure country of origin is clearly displayed at the shelf edge and on products themselves where applicable, at all our stores.

"We have reminded our colleagues at this particular store of these processes so that customers are able to clearly see the country of origin."

A spokesman for Iceland said: "At Iceland our products are great quality and value for customers and we follow UK government guidance on food labelling, including country of origin."

A Sainsbury's spokeswoman said: "We have processes in place to make sure country of origin information is clearly displayed on the product or shelf and we carry out regular checks working closely with our regulator, the Animal and Plant Health Agency."

By Jess Sharp , Money team

Barclays has been criticised for making the "ludicrous" decision to limit how much cash its customers can deposit in a year.

Ron Delnevo from the Payment Choice Alliance said the move was a "disgrace" and accused the bank of trying to force businesses to stop accepting cash.

From July, the change will mean Barclays customers can only deposit up to £20,000 per calendar year into their personal accounts.

The limit will reset every January.

It comes after Natwest made a similar decision last year, capping deposits to £3,000 a day, or £24,000 in any 12-month period.

"The decision by Barclays is ludicrous. This is plainly an anti-cash move," Mr Delnevo told Sky News.

"It is trying to take free choice from people. It's like it is saying, 'if you are using cash, then we think you are a criminal'.

"It's a disgrace quite frankly and there is no excuse for it. It's just wrong."

Asked if he was concerned other banks could follow suit, he said: "Definitely."

He gave the example of someone selling a car for cash. "How would you deposit the money into your account?" he asked.

Barclays said the change was being made to help it identify "suspicious activity".

"We take financial crime and our responsibility to prevent money laundering seriously," a spokesperson said.

"We have contacted customers to let them know that from July we are making some changes to the amount of cash customers can deposit into their Barclays accounts.

"We have set the limit at an amount that will allow us to better identify suspicious activity, while still ensuring our customers have access to cash."

The UK's estimated 23 million pet owners are at risk of a new kind of scam, one that took nearly £240m in the first six months of last year.

Scammers are now targeting the most vulnerable owners – those who’ve lost their pets.

Fraudsters are turning to lost pet forums and websites to claim they've found missing pets, demanding a ransom payment for their return.

Figures from UK Finance reveal this type of fraud – known as Authorised Push Payment (APP), when a victim is tricked into sending money directly to a criminal’s account - cost British consumers £239.3m in the first six months of 2023.

James Jones, head of consumer affairs at Experian, has some tips on how to avoid the scam...

- Never pay the ransom – If someone is demanding a large sum of money in exchange for your pet's safe return, call the police immediately. Never pay the money upfront, as it will most likely be a scam. Be sure to take a step back and analyse the situation.

- Examine the photos - is it a fake? – In an era where the use of artificial intelligence to fabricate photos is becoming increasingly commonplace, spotting a fake is becoming more challenging. But if you do receive a suspicious photo, make sure to take a closer look to determine whether it is in fact your pet. To do this, check if the photo has been taken from your social media profile and reframed to pass as a recent photo. You should also check for any signs of photoshopping. This could be the way the image has been cut, or the lack of shadows. It is also always helpful to get a second opinion – what you might miss, another person could spot.