Simple Flying

5 ways to access airport lounges for free.

Enjoy all the perks without breaking the bank

Airport lounges offer a haven of comfort, convenience, and relaxation amid the bustling terminals of airports around the world. Before we dive in, it’s worth noting that the terms 'airline lounges' and 'airport lounges' may sound similar, but they refer to distinct concepts.

Airline lounges are private lounges operated and exclusively accessible to passengers flying with a specific airline. These lounges often carry the airline's branding and reflect its service standards. For example, the Emirates Business Class Lounge in Dubai International Airport is exclusively available to passengers traveling on Emirates.

On the other hand, airport lounges, sometimes referred to as independent or third-party lounges, are not affiliated with any specific airline. These lounges are open to a broader range of travelers, including passengers from multiple airlines. For instance, the American Express Centurion Lounge at various airports around the world is accessible to American Express cardholders, regardless of their airline choice.

We take a look at some of the easiest ways to get into these luxurious and comfortable waiting areas when on your next trip.

1 Hold the credit card that unlocks doors

Complementary lounge access is just part of the perks.

Several credit cards come with complimentary lounge access as part of the perks. Cardholders and often a limited number of guests can enjoy these lounges, making it a valuable benefit for those seeking some rest and relaxation at the airport.

For example, the Citi® / AAdvantage® Executive World Elite Mastercard®* provides cardholders with complimentary Admirals Club membership , with an estimated annual value of up to $650. Similarly, premium credit cards, such as the American Express Platinum Card or the Chase Sapphire Reserve, offer access to various lounge networks like Priority Pass, which allows access to over 1,300 airline lounges and airport restaurants worldwide.

Read more: Which lounges does the AMEX Platinum get you into?

2 Bank on your bank account getting you in

Some packaged accounts will open doors.

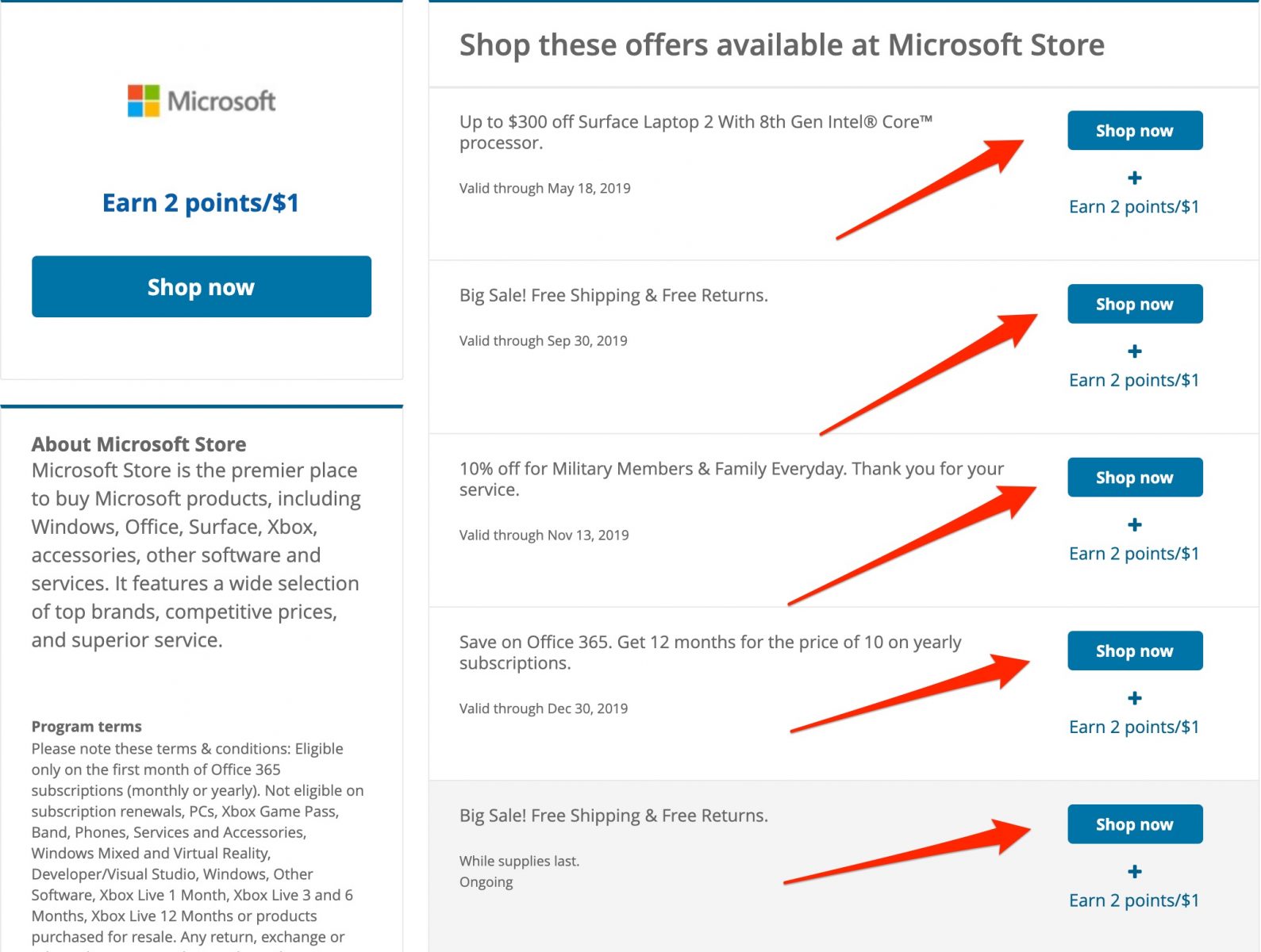

Packaged bank accounts typically involve a monthly charge, but they offer a range of advantages that can be highly cost-effective. These accounts commonly include benefits like travel insurance, mobile device coverage, and roadside assistance. However, certain bank accounts go a step further by including additional perks, such as access to airport lounges.

In the UK, £18 ($21.84) a month will get you the Barclays Travel Plus Pack, which provides access to airport lounges six times per year. Similarly, the NatWest Reward Black account offers access to over 1,100 different airport lounges. In the USA, this type of offer is normally linked with Private Banking and some of the more exclusive accounts, but is much more readily available via credit cards.

3 Leverage your loyalty to open the door

Frequent flyers can earn their way in.

If you are a loyal traveler with an airline and have achieved elite status, you may be entitled to free lounge access. Many airlines extend this privilege to their top-tier frequent flyers, providing a serene space to relax and unwind before your flight.

Delta Air Lines, through its SkyMiles program , offers complimentary Sky Club access to Delta Gold, Platinum, and Diamond Medallion members. Most of the US majors offer similar benefits, and many international airlines do the same. Check with your airline to see if your status qualifies you for lounge access. Otherwise, you could also redeem miles for either day passes or lounge memberships, depending on whether your airline offers this service.

4 Get in faster with airline alliances

Earning with partners in the 'big three' can see status achieved rapidly.

If you are not just any frequent flyer, but a frequent flyer with a member airline of an alliance, you’re in for a treat! Being a part of a global airline alliance can open the doors to lounges across the world. Here are the lounge access requirements of the big three:

- Star Alliance: First, business class and Star Alliance Gold

- oneworld: First, business class and oneworld Emerald or Sapphire

- SkyTeam : International first, international business and SkyTeam Elite Plus

If you're embedded with an airline alliance and have high status, the doors of some lounges are open to you. But if you're flying a route that is not served by one of the airlines allied with your usual points partners, all is not lost. In the US particularly, airlines frequently offer 'status challenges,' where they'll offer you a limited period of time to access their status benefits to get the taste of something different. This is a great way to get lounge access for a one-off trip, and if you clock up enough miles during your temporary status period, you could secure it for a full year.

5 If all else fails, phone a friend

There's no shame in being the plus-one.

Ever heard the saying “Your network is your net worth”? This is true when it comes to lounge access. Some credit cards and lounge memberships offer complimentary access to not only the entitled person, but also a limited number of guests. This means that if you're traveling with someone who has the necessary access, you may be able to enter the lounge for free as their guest. This can be a cost-effective way for both you and your companion to enjoy lounge benefits.

For Star Alliance Gold customers in any class of travel or international and domestic first class customers, you are entitled to bring one guest traveling on the same flight. Some airlines, such as Cathay Pacific, also offer complimentary lounge access to members’ guests:

“Available in all tiers, the Lounge Pass is a mid-tier benefit that enables members, or their family members and friends, to enjoy our world-class lounges when they reach a certain number of club points.”

If you’re unable to get free access, you can still enjoy an airport lounge without breaking the bank. Occasionally, airlines and lounge networks run promotions that allow passengers to purchase discounted day passes or access them at a reduced fee. Keep an eye on your airline's website, third-party booking platforms, or social media channels for special offers, as this can be a budget-friendly way to enjoy all the lounge amenities.

Sources: Forbes , Money.co.uk , Oneworld , Star Allliance , Cathay Pacific

An expert’s guide to the best Barclays credit cards

Update : Some offers mentioned below are no longer available. View the current offers here .

Over the past several years, Barclays has made big changes to its lineup of credit cards on offer. The biggest shift is how the United Kingdom-based company is now focusing on cobranded cards, with partners like American Airlines, JetBlue and Wyndham.

For consumers, that means the end of Barclays' own flexible card products like the now-departed Barclays Arrival Plus World Elite Mastercard. The company is relying on the strength of travel and retail partners to get in front of cardholders.

If you're looking to get a credit card that earns rewards with some of your go-to brands, here are our top picks for the best Barclays credit cards.

The best Barclays credit cards of 2022

- AAdvantage Aviator Red World Elite Mastercard : Best for American Airlines flyers

- JetBlue Plus Card: Best for JetBlue flyers

- Hawaiian Airlines World Elite Mastercard: Best for Hawaiian Airlines flyers

- Wyndham Rewards Earner® Card: Best for no-annual-fee hotel card

- Wyndham Rewards Earner® Plus Card : Best for mid-tier hotel card

- Miles & More World Elite Mastercard : Best for international and premium awards

The information for the AAdvantage Aviator Red World Elite Mastercard, JetBlue Plus Card, Hawaiian Airlines World Elite Mastercard, and Miles & More World Elite Mastercard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

This is a diverse list of cards, so let's take a closer look at some of the top Barclays' offerings to decide if any of these cards make sense for you.

New to The Points Guy? Sign up for our daily newsletter and check out our beginner's guide .

Comparing the best Barclays credit cards

Here's a quick snapshot of how these Barclays cards stack up against each other:

A closer look at these Barclays credit cards

Now let's take a deeper look into each of these cards to see if any of them deserve a spot in your wallet.

AAdvantage Aviator Red World Elite Mastercard

Sign-up bonus: Earn 50,000 AAdvantage bonus miles after making your first purchase and paying the $99 annual fee in full within the first 90 days. This bonus is worth $1,062 based on TPG's latest valuations .

Rewards: You'll earn 2 miles per dollar on American Airlines purchases with this card (which is fairly standard across cobranded airline credit cards). Get 1 mile per dollar on everything else.

Annual fee: $99.

Benefits: One of the best perks of this AAdvantage card is that you don't need to hit a minimum spending requirement in order to earn the welcome bonus of 60,000 miles. Buying anything at all will trigger the sign-up bonus, as long as you also pay the $99 annual fee.

Other benefits include:

- Inflight food and beverage discount: Receive a 25% discount in the form of statement credit for inflight food and beverage purchases

- Inflight Wi-Fi credit: You'll get up to $25 in statement credits annually for inflight Wi-Fi purchases.

- Anniversary companion certificate: $99 companion fare (plus taxes and fees) after you spend at least $20,000 on your card in a year.

- First checked bag free: You and up to four traveling companions will get your first checked bags free when flying domestic itineraries.

- Preferred boarding: You'll be allowed to board after Priority and before the rest of economy (which means you won't have to worry about overhead bin space).

- Travel Protections: Receive travel accident insurance, auto rental collision damage waiver, baggage delay insurance, 24/7 travel assistance services, trip cancellation and interruption coverage and more.

For more details, see our full review of the AAdvantage Aviator Red World Elite Mastercard

JetBlue Plus Card

Sign-up bonus: New cardholders receive 60,000 bonus points after spending $1,000 on purchases and paying the annual fee in full, both within the first 90 days. That's worth $780 based on our valuations .

Rewards: You'll earn 6 points per dollar on JetBlue purchases, 2 points per dollar at restaurants and grocery stores, and 1 point per dollar on all other purchases. As a point of comparison, the no-annual-fee version of this card, simply called the JetBlue card, offers half as many points on JetBlue purchases.

Benefits: The JetBlue Plus card is one of the most rewarding cobranded airline cards with an annual fee less than $100. Why? Well, for starters, you receive a 5,000-point bonus on every account anniversary. These points are worth about $65, according to TPG valuations .

In addition, you'll automatically receive a 10% points rebate on all awards booked out of the primary cardholder's TrueBlue account. There's no limit to the number of points you get back, and this even holds true when the cardholder is the head of a family pool — which is a key way TPG's Nick Ewen makes the most of his JetBlue Plus card every year.

Then, you get a $100 statement credit every year with your purchase of a JetBlue Vacations package of $100 or more with your card. You also receive 50% off inflight purchases, including alcoholic drinks and snack boxes, and you'll pay no foreign transaction fees outside the U.S. Other notable perks include:

- Fast-track to Mosaic status: Get automatic Mosaic status after spending $50,000 on the card in a calendar year.

- Free checked bags: You and up to three travel companions on the same reservation will enjoy one free checked bag on JetBlue-operated itineraries.

For more details, see our full review of the JetBlue Plus card .

Hawaiian Airlines World Elite Mastercard

Sign-up bonus: Earn 60,000 bonus miles after spending $2,000 on purchases in the first 90 days. That's worth $540 based on TPG's valuations . Additionally, you'll receive a one-time 50% companion travel discount.

Rewards: The card offers 3 miles per dollar on Hawaiian Airlines purchases. Although not industry-leading, the card has a decent return on select everyday spending categories : 2 miles per dollar on gas, dining and grocery spending and 1 mile per dollar on everything else

Benefits: One unique feature of this Hawaiian Airlines card is that it lets you transfer HawaiianMiles miles between accounts.

Other perks include:

- Annual $100 companion discount for round-trip travel between Hawaii and the mainland after each account anniversary

- Free checked bag for the primary cardmember when you use your card to purchase eligible tickets directly from Hawaiian Airlines

- Discounted award flights

- No foreign transaction fees

- World Elite Mastercard benefits

For more details, see our full review of the Hawaiian Airlines World Elite Mastercard .

Wyndham Rewards Earner® Card

Sign-up bonus: Earn 30,000 bonus points, enough for up to four free nights at participating properties, after spending $1,000 on purchases in the first 90 days. That's worth $330 based on TPG's valuations .

Rewards: Earn 5 points per dollar on eligible hotels by Wyndham and gas station purchases, 2 points per dollar on dining and grocery store purchases (excluding Target and Walmart), 2 points per dollar on eligible purchases made at Wyndham Timeshare properties (including maintenance fees and loan payments), and 1 point per dollar on all other purchases.

Annual fee: $0.

Benefits: This card offers automatic Wyndham Rewards Gold status, which includes free Wi-Fi, preferred room selection and late checkout. You'll also have the opportunity to earn 7,500 bonus points each anniversary year after you spend $15,000 on eligible purchases. Cardholders also enjoy a 10% points discount on redemptions for free nights and pay no foreign transaction fees.

Wyndham has over 9,000 properties worldwide, and while its Rewards program might not be the most popular, there are many unique hotels to choose from.

For more details and to apply, see our link here for the Wyndham Rewards Earner® Card.

Wyndham Rewards Earner® Plus Card

Sign-up bonus: Earn 45,000 bonus points, enough for up to four free nights at participating properties, after spending $1,000 on purchases in the first 90 days. That's worth $495 based on TPG's valuations .

Earning rate: Earn 6 points per dollar on eligible hotels by Wyndham purchases and gas station purchases, 4 points per dollar on dining and grocery store purchases (excluding Target and Walmart), 4 points per dollar on eligible purchases made at Wyndham Timeshare properties (including maintenance fees and loan payments), and 1 point per dollar on all other purchases.

Annual fee: $75.

Benefits: Wyndham Rewards Platinum status is an automatic perk on the card, which includes all the same perks of Gold status plus early check-in, car rental upgrades with Avis and Budget, and a Caesars Rewards status match . Cardholders receive 7,500 bonus points each anniversary year with no spending requirement.

If you routinely stay at Wyndham hotel brands such as Wyndham, Hawthorn Suites, Days Inn and La Quinta, the Wyndham Rewards Earner Plus Card may be a valuable addition to your stays. The automatic Platinum status alone can be valuable, and the 7,500 points on your anniversary can more than offset the $75 annual fee.

For more details and to apply, see our link here for the Wyndham Rewards Earner® Plus Card.

Miles & More World Elite Mastercard

Sign-up bonus: Earn 50,000 award miles after spending $3,000 in purchases within the first 90 days and payment of the annual fee. That's worth $700 based on TPG's valuations .

Rewards: You'll get 2 award miles per dollar on ticket purchases with Miles & More "integrated airline partners." This includes AirDolomiti, Austrian Airlines Group, Brussels Airlines, Croatia Airlines, Eurowings, LOT Polish Airlines, Lufthansa, Luxair and SWISS. Unfortunately, there are no other bonus categories, so you'll earn 1 award miles per dollar on everything else.

Annual fee: $89.

Benefits: The Miles & More card is an intriguing option for those that are invested in any of the airlines that comprise the Lufthansa Group. You can redeem miles for Star Alliance flights at favorable rates . You'll also receive two complimentary Lufthansa Business Lounge Vouchers after each account anniversary, a companion ticket and the ability to convert award miles into status miles once each calendar year.

Bottom line

Barclays has several solid options when it comes to potential credit cards to add to your wallet. Since the issuer no longer offers its own cards to new applicants and instead works with brand partners, it's important to select a card that aligns with your lifestyle.

If you care about any of Barclays' cobranded partners, then go for one of these cards. But if you're looking for something a bit more versatile, look beyond Barclays to card options that allow you to transfer points or to receive straight cash back .

Featured photo by Chris Ratcliffe/Bloomberg/Getty Images.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

Barclaycard Arrival ® Plus World Elite Mastercard ® — Full Review [2024]

Brian Graham

Former Content Contributor

10 Published Articles

Countries Visited: U.S. States Visited:

Director of Operations & Compliance

1 Published Article 1171 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Barclaycard Arrival ® Plus World Elite Mastercard ®

70,000 miles

$89 (waived first year)

18.24%, 22.24% or 25.24% variable based on your creditworthiness

With steady accumulation of points, a rewards rebate every time you redeem, and luxury travel benefits, this card will be a traveler’s dream.

You’re new to the points world, and you want a great card that makes it easy to understand and earn points while you untangle all the other “hacks.” Perhaps you want to travel the world for cheap while writing your blog and gaining new experiences.

This is the perfect starter card, and is among the most popular rewards credit cards.

Card Snapshot

Welcome bonus & info.

- Enjoy 70,000 bonus miles after spending $5,000 on purchases in the first 90 days

- Earn unlimited 2X miles on every purchase

- New – Control Your Card – Instantly secure your accounts by locking your cards with Barclays SecurHold™, plus set transaction limits and block certain purchase categories for you or your authorized users. Available only on the Barclays mobile app.

- Book travel your way-no airline, seat or hotel restrictions-and redeem your miles for travel statement credits

- Get 5% miles back to use toward your next redemption, every time you redeem

- No foreign transaction fees

- International Chip and PIN for use at self-service chip terminals around the world

- Miles don’t expire as long as your account is open, active and in good standing

Rewards Center

Redeem miles as statement credit in your account page

Customer Service Number

1-877-408-8866 (Available 24/7)

Great Card If

- Traveling is your main goal and you’re going to do it often (including internationally)

- You like simple rewards and earning options and don’t want to manage a bunch of cards

- You love to shop around for deals and have no specific airline, hotel or other travel company loyalty

- You want to take advantage of the vast array of Luxury Travel Benefits available to card holders

Don’t Get If

- You’re not much of a traveler

- You intend to redeem for many smaller purchases rather than a few bigger ones ($100 minimum redemption option)

- You want to use this card for business (Barclays restricts earning for business expenses)

Welcome Bonus and Earning Rate

Beginning with a welcome bonus after your standard purchase amount within the required months (see above), you’ll be well on your way with travel credit ready to be redeemed.

The rewards rate on this card is a solid 2 points per $1 spent, with no limits and no restricted categories.

Other cards cap out the rewards at a certain dollar amount per category, or restrict the categories in which you can earn the higher rewards rate. But here, you get a nice 2x deal everywhere!

Bottom Line: The Arrival Plus card earns 2x points for all purchases and costs $89 per year.

Card Benefits and Value

This is a travel rewards card , meaning you’ll earn the points as account credit you can apply towards travel related purchases.

Once you have enough, simply go into your account and apply the credit to your statement.

This card also gives you a 5% rebate for all redeemed points, making the value of the rewards rate equal out to 2.1 points per dollar.

Unlike some other cards, it allows you to earn miles while making your travel purchase and then apply those earned miles right back to your statement, while additionally earning a 5% rebate.

Value Compared to Other Cards

Contrast this to an airline or hotel card which deposits earned miles into the appropriate loyalty program account: when redeeming, you are taking points out but none are going back in.

Here, your redemptions are worth $0.01 per mile when redeeming for travel. This is a very standard evaluation that isn’t the worst you will find, but it also isn’t the best.

Great for Flexible Travelers

A world traveler likes flexibility, and you’ll get that with this card.

First, it has no foreign transaction fees and includes chip technology. So no matter where you are, your card will likely be accepted and continue to bring home points.

If you’re in Hong Kong and you want to travel to Thailand on a budget, you can look around for the best deals and book them all through your Arrival Plus card.

Then, redeem the miles back as statement credit, collect your rebate points, and keep going.

You won’t have to deal directly with specific airlines or hotels, but if you’re going to book through a third party it may be worth a call to confirm this will count as reimbursable.

Travel Reimbursement for Hotels, Airlines, and More … With a Caveat

Your redemption options don’t stop at airfare or hotels, either. There is a long list of items you can use your rewards for, including timeshares, cruises, discount travel sites, and most public transportation options.

Be warned though: you have to redeem for a minimum of $100 and can only apply against a purchase once , so we recommend applying your credit toward larger purchases. As always, planning is the key.

If you just aren’t traveling or using the card anymore, you do have the option to redeem for other statement credit or gift cards, but doing so cuts the value of the points in half (5000 points for $25), so we don’t recommend doing this.

Other Card Benefits

If you need a balance transfer, you can transfer to this card and enjoy 12 months of interest-free balance after the fee.

You won’t earn any points for this, so it’s not highly recommended unless you know you’ll be able to pay it off after the 12 months. Other low-interest credit cards also offer 0% APR on purchases, but no such luck with the Arrival Plus card.

Next, let’s talk about the Luxury Travel Benefits. These are actually MasterCard benefits made available to certain cardmembers.

They offer basic benefits , “World” benefits , and finally this card’s “World Elite” benefits . It basically includes all the other travel benefits in addition to some extras.

These include:

- Free business class upgrades on participating airlines with purchase of a full-price economy ticket

- Hotel room upgrades with SPG and other hotel partners

- Airline discounts up to 30%

- A complimentary companion ticket with a full-fare business class purchase

- Cruise discounts up to $500

- And many more!

Still Collect Your Loyalty Points From Your Travel Partners

It’s worth explicitly noting that you can still be a member of all the different loyalty programs and try to focus your travel on specific partners to further maximize your travel benefits.

You’ll continually be paying for everything with this card and earning card miles, but points earned through the loyalty programs still accrue into those accounts to be used later as well.

This can be an even more powerful strategy if you want to move past the beginner stage!

Best Ways To Earn Arrival Plus Rewards

Earning miles is fairly straightforward with this rewards card: buy everything on the card. Anything you could possibly pay for, try to purchase with your card as long as there are no additional fees!

You’ll get 2x points for everything plus the 5% redemption bonus back, equating to 2.1x.

Below are examples of things you could put on your card:

- Utilities and bills

- Restaurants, drinks, and entertainment

- Doctors visits

- Supplements

- Business expenses (if you don’t have a higher-earning card)

- Memberships (gym, etc.)

When earning points, plan ahead to make sure you get to a minimum 10,000 points: this is the absolute minimum value ($100) you can redeem at once. You can always redeem anything above this amount, however.

Another way you could rack up more points is to get additional cards if you have a child or spouse who spends separately. You essentially just expand your ability to earn points but get no additional benefits.

* Note : Depending on your living situation, you may be able to pay rent on a credit card without incurring extra fees. If this is the case, absolutely use your credit card to pay for your rent! If you do have a fee, then it may or may not be worth it. Typical fees range from 2% to 3%. Let’s look at the math:

Say you pay $1,200 per month in rent. If you take a 3% fee for using a credit card, but get to accrue all those points, then you would pay $1,236 for rent and get 2.1x points for it. This is assuming the fee isn’t somehow charged separately and just rolls into your rent (fees don’t earn points, and there are many other restrictions as well). That’s worth 31,147 points (at 2.1x) total! For that amount, you can redeem a $311 travel credit.

But wait! How much did you pay in fees? Well, at this rate, $36 for 12 months is equal to $432. So you’re actually losing value by using your credit card.

At a lower fee, you could potentially break even, and it turns out that sweet spot is 2.14% for this rent amount. But will you make enough for it to be worth the hassle? With $2,000 rent and 2% fee, you would come out ahead $34. Any higher of a fee, and it’s not worth it, but if you increase rent you will make a bit more. Anyone who is able to get less than a 2% fee will likely see benefit, but make sure to do your own math for your situation.

Final Note : This only applies if the fee gets charged as rent and whole thing gets counted as a retail purchase. We have not tested this, and the scenario is all in theory!

Best Way To Redeem Arrival Plus Rewards

To redeem points earned with this card, simply go into your account, navigate to Manage Rewards, and choose to redeem points for travel purchases.

We suggest planning to do this immediately after you make your travel purchase, but it must be within 120 days (so plan accordingly!).

Also, since you can only redeem for a minimum of $100, you’ll likely get one or two good redemptions per year out of your points earned.

We’d suggest saving up to pay for one larger purchase all at once, just so you don’t have to worry about the minimum spend every time.

Know that you’ll only get your 5% points back when you redeem, so you’ll have to keep on earning and redeeming to make this card worth it.

You can use your card to redeem for gift cards and other merchandise through the Barclays portal, but doing so cuts the value of your points in half ($0.005), so we don’t recommend it!

Best Way To Maximize Arrival Plus Rewards

There are no direct partnerships with this card like you would see with other cards. However, the beauty of this arrangement is the flexibility of choosing whatever travel partner you want.

Again, you can still be a member of any loyalty program you want . This card doesn’t add to those loyalty accounts, but that shouldn’t stop you from accruing any extra rewards there as well – it’s all free!

Instead, this card offers users the Luxury Travel network from MasterCard, which includes a multitude of partners.

The only trouble is finding out who the partners really are, so you’ll likely just have to call their customer service and talk about the benefits with them.

Authorized Categories for Redeeming Miles

With regards to travel, only certain categories count as travel for the redemptions. Here is the list of approved travel categories to make redemptions against ($100 min):

Airlines, hotels, motels, timeshares, campgrounds, car rental agencies, cruise lines, travel agencies, discount travel sites, trains, buses, taxis, limousines, ferries

Your annual fee also counts as redeemable, but we do NOT recommend doing this.

Because this amount is less than $100 and the minimum mile redemption is 10,000, you would have to spend that many points and waste the value of some of your points!

Alternatives to the Arrival Plus Card

The Discover it Miles Card is very similar. It also earns travel rewards that are accrued on the card just like cash-back.

But which one is better? For your first year, the Discover it Miles card is better since it earns the equivalent of 3x points which can be applied to your travel purchases.

After this first year, though, the Arrival Plus card is much more valuable, because it earns at an equivalent rate of 2.1x at all times.

That earning rate is better than other cash-back cards like the Capital One Quicksilver Cash Rewards Credit Card or the Citi Double Cash Card . The Capital One Quicksilver Cash Rewards Credit Card only earns 1.5% cash-back, while the Citi Double Cash Card earns 2% (1% at purchase with another 1% when you pay your bill).

However, this Barclays card comes with an $89 annual fee (waived the first year), so there is a minimum amount you would have to spend in order to make up for this difference in cost.

Bottom Line: The Arrival Plus card has the best earning rate of similar travel rewards and cash-back cards, but it has an $89 annual fee (waived the first year). This value must be accounted for when determining its worth.

The information regarding the Capital One Quicksilver Cash Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Barclaycard Arrival ® Plus World Elite Mastercard ® was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Discover It ® Miles Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

Is the card worth it.

This will depend on your situation, but it is a solid card for the type of person who wants a card that’s easy to use and has good rewards.

You’ll earn 2x points for all purchases, meaning you don’t have to worry about what category you’re spending in.

The card is free the first year, then costs $89/yr. So if you are spending enough to make up for this, then the card could be considered “worth it.”

One of the great benefits of this card is that for every redemption you make, you’ll get 5% of the miles spent back. This essentially means the card earns 2.1x points as long as you keep redeeming.

Additionally, you can make your travel purchases with the card to earn more points and then use those earned points to pay it off.

Other benefits include a free FICO score, access to the World Elite Concierge and Luxury Travel, as well as an array of travel and other insurances.

If these things are valuable to you, then the card is most definitely worth it.

What is the Arrival Plus card travel insurance?

Barclays travel insurance covers a few different items. First, you get rental car collision insurance. Decline the agency policy and you will be covered for the value of the car if you use your card to make the purchase.

Next, you have Travel Assistance Services. This is a concierge-type service that helps you out during travel issues. While the main service is free, any third party service must be paid for.

Finally, you also get travel accident insurance. If paying on the card, you’ll get up to $250,000 in case of accidents, baggage delays, and trip cancellation.

If your baggage is delayed, you can get $100 per day for up to three days while waiting for it, but this only covers essential items. Trip cancellation covers up to $1,500 of cancelled or interrupted trips.

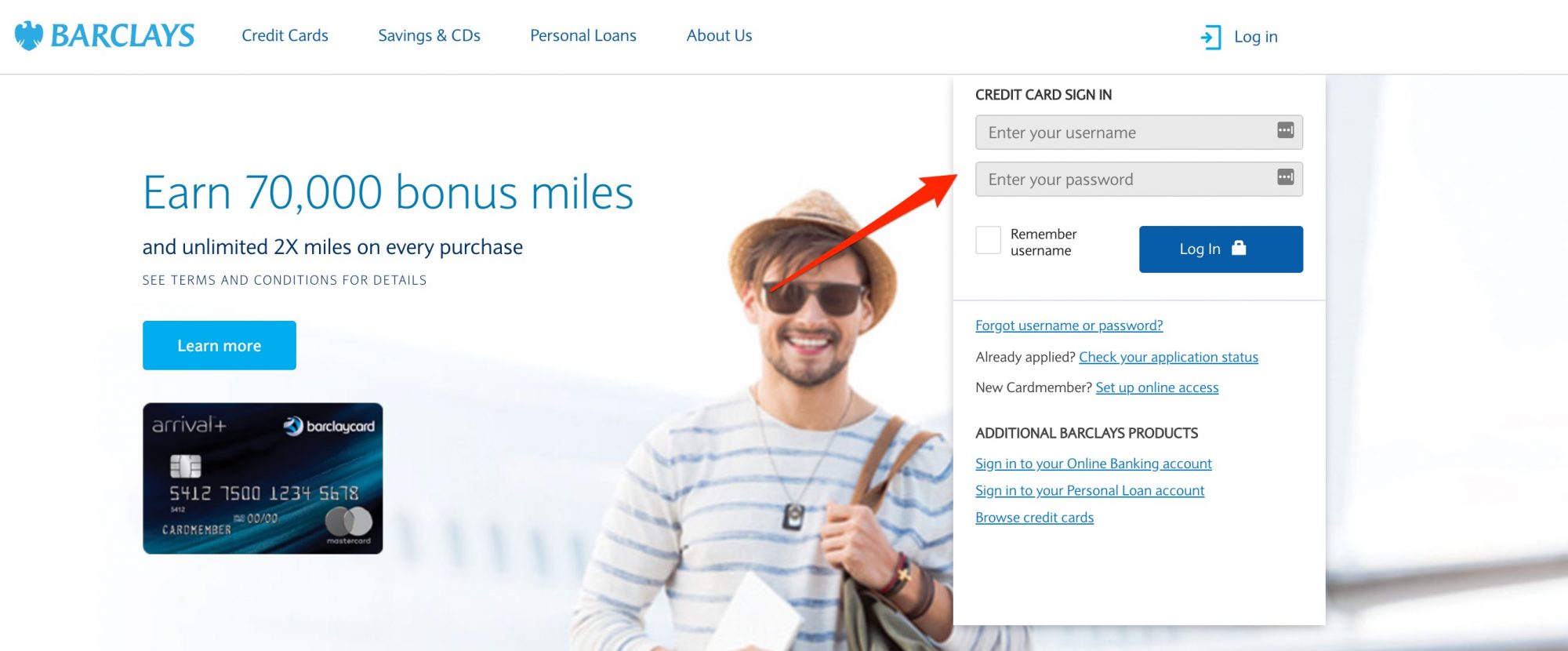

What is the Arrival Plus card login?

The sign in can be found here at the typical Barclays banking login page.

What are the Arrival Plus card benefits?

First, you earn points at 2x per dollar spent on all categories. Combined with the 5% rebate earned when you redeem those points, you essentially earn 2.1x per dollar.

You have to redeem a minimum of $100 at a time, and this can only be applied against a purchase one time .

Next, you get a complimentary FICO score, World Elite Concierge, Luxury Travel benefits, price protection, purchase security, return protection, and extended warranty protection.

Finally, you get car rental and travel insurance including travel accidents, baggage delays, and trip cancellation.

What is the difference in the Barclays Arrival World Elite MasterCard (expired) vs. Arrival Plus card?

Mainly, the difference is that the Arrival Plus card has a yearly fee and earns 2x points everywhere.

The Barclays Arrival World Elite MasterCard (expired) has no annual fee and only earns 2x points on travel and dining purchases, with 1x everywhere else.

You’ll also get World Elite benefits such as the concierge and Luxury Travel program with the Barclays.

Note that the Barclays Arrival World Elite MasterCard (expired) is no longer available for new applications.

Does the Arrival Plus card have rental car insurance?

Yes, the car rental insurance covers the value of the car when using the card to book the reservation.

What is the difference in the Arrival Plus card vs Chase Sapphire Preferred Card?

Both cards earn 2x points in travel and dining, but the Arrival Plus card also earns 2x points everywhere else.

Both cards have an ongoing annual fee after the first year, but the Barclays fee is $6 cheaper than the Chase Sapphire Preferred® Card.

You’ll see a bigger difference in how the rewards are earned.

Arrival Plus rewards are like cash-back that accumulates in your Barclays account and can only be used to give you statement credit toward travel purchases (in $100 minimum redemptions).

When you redeem, you get 5% of those dollars back.

The Chase Sapphire Preferred Card earns points that go into Chase Ultimate Rewards and can be used on a variety of things, from travel to shopping to transferring into partnered loyalty accounts.

In most cases, Chase points are redeemable for a higher value than Barclays miles.

Chase’s portal also offers 20% off on flights and travel when using points, whereas the Arrival Plus card only offers the 5% rebate. Both cards offer a variety of insurances.

What is the Arrival Plus card interest rate? Is there a 0% APR?

The card typically offers an introductory APR. However, its normal purchase APR is higher once the period ends (see card summary table above).

Does the Arrival Plus card have foreign transaction fees?

There are no foreign transaction fees on the card, allowing you to use it overseas without incurring any extra costs.

About Brian Graham

Brian’s first ever airplane ride was in a private turbo-prop jet. He was merely an intern boy trying to make a good impression, but it turns out the plane made an impression on him.

It wasn’t until Brian relocated to Dallas, TX, and moved in with an American Airlines employee that he truly discovered how incredible travel could be.

Top Credit Card Content

Credit Card Reviews

- American Express Platinum Card

- American Express Gold Card

- Chase Sapphire Preferred Card

- Chase Freedom Unlimited Card

- Capital One Venture X Card

Buying Guides

- Best Credit Cards for High Limits

- Best Credit Cards for Young Adults

- Best Credit Card Combinations

- Best Credit Cards for Military

- Best Credit Card for Paying Monthly Bills

Credit Card Comparisons

- Amex Gold vs Blue Cash Preferred

- Amex vs Chase Credit Cards

- Amex Platinum vs Capital one Venture X

- Amex Platinum vs Delta Platinum Card

- Chase Sapphire Reserve vs Amex Platinum Card

Recommended Reading

- How to Pay Your Credit Card Bill

- Credit Card Marketshare Statistics

- Debit Cards vs Credit Cards

- Hard vs Soft Credit Checks

- Credit Cards Minimum Spend Requirements

Related Posts

![barclays travel plus Citi® / AAdvantage® Gold Mastercard® — Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2018/03/AAdvantage-Gold-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Barclaycard Arrival Plus Review: Closed to Applicants, but Flexible if You Have It

It's no longer available, but current cardholders get a high rewards rate on all purchases, along with flexible redemption. Just be aware that you don't get the perks of a dedicated airline or hotel card.

- High rewards rate on all purchases, not just bonus categories

- Sign-up bonus

- No foreign transaction fee

- Has annual fee

- Minimum redemption required for travel

$0 intro for the first year, then $89

18.24%-25.24% Variable APR

0% intro APR on Balance Transfers for the first 12 billing cycles

Rewards rate

2 miles per dollar

Bonus offer

- Enjoy 70,000 bonus miles after spending $5,000 on purchases in the first 90 days

Ongoing APR

APR: 18.24%-25.24%, Variable

Cash Advance APR: 27.49%, Variable

Balance transfer fee

Either $5 or 3% of the amount of each transfer, whichever is greater

Foreign transaction fee

0% of each transaction in U.S. dollars

- Earn unlimited 2X miles on every purchase

- NEW - Control Your Card - Instantly secure your accounts by locking your cards with Barclays SecurHold™, plus set transaction limits and block certain purchase categories for you or your authorized users. Available only on the Barclays mobile app.

- Book travel your way—no airline, seat or hotel restrictions—and redeem your miles for travel statement credits

- Get 5% miles back to use toward your next redemption, every time you redeem

- No foreign transaction fees

- International Chip and PIN for use at self-service chip terminals around the world

- Miles don’t expire as long as your account is open, active and in good standing

Compare to Other Cards

Detailed review: Barclaycard Arrival Plus® World Elite Mastercard®

» this card is no longer available.

The Barclaycard Arrival Plus® World Elite Mastercard® is no longer accepting applications. See our best travel credit cards roundup for other options. Below is our review of the card from when it was still available.

Sometimes a solid card with fewer frills is a superior one. That's the case with the Barclaycard Arrival Plus® World Elite Mastercard® , a relatively simple travel rewards credit card with a high flat rewards rate, flexible travel redemption rules and a modest annual fee. However, as of 2019, this card is no longer taking new applications.

Existing cardholders have been able to keep and continue using it, though, and as of November 2022, the option to transfer rewards to several travel partners was introduced.

There's a no-annual-fee version of this card, with less robust perks, called the Barclaycard Arrival™ World Mastercard® . But it, too, has stopped accepting new applications.

» MORE: NerdWallet's best travel credit cards

Barclaycard Arrival Plus® World Elite Mastercard® : The basics

Card type: Travel .

Annual fee: $0 intro for the first year, then $89 .

Rewards: Unlimited 2 miles per dollar on all purchases. Each mile is worth 1 cent when redeemed for travel or 0.5 cent when redeemed for cash back.

When you redeem miles, you get 5% of those miles back toward your next redemption. You can start redeeming for travel with 10,000 miles, or 5,000 miles for cash back.

Redeem miles for almost any travel purchase of $100 or more, including airfare, hotels and cruises. Go online within 120 days of booking with your card and apply your miles for a statement credit.

Interest rate: 0% intro APR on Balance Transfers for 12 billing cycles, and then the ongoing APR of 18.24%-25.24%, Variable

Foreign transaction fees: None.

Balance transfer fee: $5 or 3% of the amount of each transfer, whichever is greater.

Other features: Chip-and-PIN capability.

Not sure whether paying the annual fee makes sense for you ? Try our calculator and see whether the rewards you earn on the Barclaycard Arrival Plus® World Elite Mastercard® will cover the fee.

Benefits and perks

G o o d ongoing rewards rate.

Earning an unlimited 2 miles per dollar spent, at a value of 1 cent per mile, is solid because it applies to all spending, not just spending in certain categories, such as travel, restaurants or supermarkets, which you find with other cards. So that means a great rewards rate whether you’re shopping online, paying for furnace maintenance or covering a doctor copay. Better yet, the 5% redemption bonus when you cash in miles — good toward a future redemption — boosts the effective rewards rate to 2.1%. This simple-but-lucrative rewards rate for all spending makes the card a candidate for top-of-wallet status.

It used to be harder to find a card that earned 2X on all purchases, no matter the category. But today, several other cards exist on the market that do just that. The Capital One Venture Rewards Credit Card earns 2X on every purchase with no limit for a similar annual fee.

» MORE: Making the most of the Barclaycard Arrival Plus® World Elite Mastercard®

Flexibility

Barclays has a liberal definition of “travel purchases,” giving you a lot of options for redeeming your miles, including spending with airlines, hotels, timeshares, campgrounds, car rental agencies, cruise lines, trains and buses, among others. And book however you want — directly with an airline or hotel, or through a travel agent or discount travel site. As long as you pay with the card, you can reimburse yourself with miles. That’s more flexible than travel credit cards that force you to book through the issuer’s travel portal to get the best rewards value. And it will appeal to budget travelers who prefer comparing travel deals from a variety of places. There are no blackout dates, restrictions or extra fees, as there can be with redeeming frequent flyer miles, for example.

Ease of use abroad

Like any good travel card, the Barclaycard Arrival Plus® World Elite Mastercard® has no foreign transaction fees. Plus, the card has chip-and-PIN capability. When traveling abroad, you may find that some kiosks and other automated payment systems require you to use a PIN to verify your identity, rather than a signature (though this requirement is not as common as it used to be ).

Transfer partners

Barclays closed the Barclaycard Arrival Plus® World Elite Mastercard® to new applicants in 2019, but as of November 2022 it added the ability to transfer miles to a host of travel partners. An odd addition to a card that is no longer open to new applications, it nevertheless gives current cardholders more options for redeeming their miles. However, the transfer ratio of Barclays points is inferior to other programs whose points largely transfer at a 1:1 ratio .

» MORE: Barclaycard credit cards mobile app review

Drawbacks and considerations

High redemption threshold.

The card has a minimum redemption for travel statement credits of 10,000 miles, or $100, which you'd have to spend $5,000 on the card in order to earn. For smaller spenders, it could be a long wait to accumulate enough miles to redeem. The minimum is 5,000 miles for other redemption options and 2,500 if used toward the card’s annual fee.

As an alternative pick, the Barclaycard Arrival Plus® World Elite Mastercard® has a doppelganger card: the Capital One Venture Rewards Credit Card . It also earns an unlimited 2 miles per dollar on most purchases, and it also allows you to redeem your miles for a statement credit against travel purchases. The a Capital One Venture Rewards Credit Card doesn’t offer the 5% redemption bonus, but it also doesn't have a minimum redemption requirement. So if you want to redeem miles for an $8 cab ride, you can.

The Capital One Venture Rewards Credit Card has an annual fee of $95 and a nice sign-up bonus: Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel. It doesn't charge a foreign transaction fee, but it also doesn't offer chip-and-PIN.

Low-value redemption alternatives

For cashing in miles, this is mostly a one-trick pony. You get a penny per mile for statement credit that offsets travel purchases, or for paying the card’s annual fee. You get half as much value — or less — if you redeem miles for cash back, gift cards or merchandise. You can now transfer miles to some travel partners, but the ratios are poor.

If you want better value when transferring points, you may be better off with a card like the Chase Sapphire Preferred® Card . It earns bonus rewards in a variety of popular spending categories, including dining and travel. Points are worth 1.25 cents apiece when used to book travel through Chase . Otherwise, points are worth a penny each. You can transfer your points to several major frequent travel programs at a 1:1 ratio. Transfer partners include United, Southwest, British Airways, Marriott and Hyatt. The Chase Sapphire Preferred® Card offers a comparable sign-up bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠. But it does have a slightly higher annual fee: $95 .

Fewer travel freebies and perks

The card’s simplicity is also a potential drawback. It doesn’t offer the perks that some travel cards do, such as airport lounge access or reimbursement for TSA Precheck or Global Entry applications. And while you can use miles to pay for checked-bag fees on airlines, airline co-branded cards often give you checked bags for free, along with early boarding. Similarly, you can use miles from this card on hotel stays, but you won’t get the automatic free nights that some co-branded hotel credit cards offer.

Get 1.5 miles per dollar on all spending, plus a sign-up bonus, for an unbeatable $0 annual fee.

How to decide if it's right for you

The Barclaycard Arrival Plus® World Elite Mastercard® isn't taking new applications. But if you're an existing cardholder who's still satisfied with its simple but valuable rewards program — which can easily make up for its annual fee — it makes sense to keep it around. You can always supplement it with a premium travel card if you want to enjoy more luxury travel perks. But for those weary of paying an annual fee, it may be time to retire the Barclaycard Arrival Plus® World Elite Mastercard® and get a good $0-annual-fee travel card instead.

- The best credit cards of 2024

- Best travel credit cards

- Best rewards credit cards

- Best cash back credit cards

Methodology

NerdWallet reviews credit cards with an eye toward both the quantitative and qualitative features of a card. Quantitative features are those that boil down to dollars and cents, such as fees, interest rates, rewards (including earning rates and redemption values) and the cash value of benefits and perks. Qualitative factors are those that affect how easy or difficult it is for a typical cardholder to get good value from the card. They include such things as the ease of application, simplicity of the rewards structure, the likelihood of using certain features, and whether a card is well-suited to everyday use or is best reserved for specific purchases. Our star ratings serve as a general gauge of how each card compares with others in its class, but star ratings are intended to be just one consideration when a consumer is choosing a credit card. Learn how NerdWallet rates credit cards.

About the author

Gregory Karp

Please upgrade your browser

To have the best experience using our site, please upgrade to one of the latest browsers.

- Barclays insurance

- Barclays travel and breakdown insurance

Travel Pack

Get cover for £14.50 a month

In partnership with Aviva and RAC. Protect your trips from the unexpected with cover for cancellations, breakdowns, lost baggage and more.

Six-month minimum term – terms and conditions apply.

Worldwide and UK multi-trip cover

Cover for you and your family, with optional cover for medical conditions.

Complete breakdown cover in UK and Europe

Unlimited callouts in UK, plus cover for you as a driver or passenger when travelling.

What does our Travel Pack cover?

Eligibility criteria

To apply for cover, you’ll need to:

- Live in the UK for at least 183 days a year

- Be registered with a UK doctor.

Who’s covered

If you’re eligible for travel insurance, Aviva will cover:

- You and your partner who lives with you up to the age of 79 at the start of your trip

- Your children (including step- and foster children) who travel with you and are under 23.

If you’re eligible for RAC breakdown cover, our providers will cover:

- You, as the pack holder

- Anyone who lives at the same address as you, if you add them to your cover when you buy your pack.

Travel insurance by Aviva

We made some changes to our Travel Plus Pack terms and conditions on 24 April 2023. If you bought your pack before this date, your terms and conditions haven’t changed and you can find them in ‘Statements and documents’ in the Barclays app.

What’s covered

Multi-trip travel insurance underwritten by Aviva Insurance Limited. You’ll get:

Trips abroad and in the UK for up to 31 days. For UK trips, you’ll need to be away from home for at least two consecutive nights in pre-booked holiday accommodation

Winter sports, cruises and business trips outside the UK for non-manual work, like meetings and conferences

Up to £10 million worth of emergency medical treatment for sudden illness or injuries

Up to £10,000 per person for cancelled trips if you need to come home early

Unexpected travel costs – up to £10,000 for additional travel and accommodation costs if your plans are disrupted, and up to £250 if your pre-booked transport is delayed for longer than 12 hours

Protection for your belongings – up to £1,500 if your personal belongings are lost, stolen or damaged during your trip.

What’s not covered

Travel delays where your travel is delayed by less than 12 hours

Costs you can recover from your travel or accommodation provider, your debit or credit card company, PayPal, ABTA, ATOL or similar organisations

Any incident that happens after 31 days of your holiday, unless you have a longer trip upgrade

Anything that already happened before you bought this pack or booked your trip (whichever is later). For example, an airport strike that's been reported in the media

Any claim if you don’t follow the advice of local authorities

Claims if you travel against the advice of a doctor

Travels to get medical advice or treatment

Trips if you’re travelling with a terminal prognosis

Claims for cancellation or coming home early if you travel against advice or measures that were already announced when you bought your pack or booked your trip (whichever is later).

Optional 12-month upgrades

For an extra one-off fee, you could get a:

Longer trip upgrade

Designed for trips longer than 31 days. This covers the entire trip for up to 120 days. You’ll need to buy this as soon as you book the trip.

Pre-existing conditions upgrade

We now cover more pre-existing medical conditions, some for free. You can add cover for other family members too. If you have a valid upgrade, you’ll be covered automatically for any new conditions that occur over 12 months. We’ll give you an upgrade quote when you buy your pack. This will be valid for 30 days, so you can decide if you want to buy the upgrade.

RAC breakdown cover in the UK and Europe

Get roadside assistance, national recovery and onward travel to anywhere in the UK, plus cover if your vehicle won’t start at home.

Personal vehicles, whether you’re the driver or the passenger

Electric cars

Unlimited callouts in the UK

Support on the myRAC app, where you can report your breakdown in 30 seconds

Transport to the nearest garage within 10 miles if we can’t repair your vehicle at the side of the road

A hire vehicle, alternative transport (for example, a train or plane) or overnight accommodation to help you complete your journey

Access to RAC Rewards for discounts and offers on all things motoring, plus discounts on days out, dining, holidays and gym memberships.

Terms and conditions apply for the myRAC app and RAC Rewards. For more information, register for the myRAC app or visit rewards.rac.co.uk/barclays/terms-and-conditions

Anyone other than your nominated partner or any other family members, such as your children

Vehicles used for business purposes

Company cars

Any breakdowns or accidents that happened before you bought this pack

Costs of any vehicle parts or repairs completed in a garage.

Terms and conditions

Just need UK breakdown cover for roadside and at home?

Our Breakdown Cover Pack offers UK roadside and at home rescue for £9 a month.

How to get our Travel Pack

It takes a few minutes to apply for our Travel Pack in the Barclays app or Online Banking.

To apply for a pack, you’ll need to have an eligible current account with us.

Download the Barclays app to get our Travel Pack

Tap the logo you need, and it’ll take you straight to the app in your app store.

Important Information

Travel Pack Insurance Product Information Document (Travel IPID)

Travel Pack Insurance Product Information Document (Breakdown Cover IPID)

Travel Pack terms and conditions

Changes to terms and conditions

- Important information

Our products

- Current accounts

- Credit cards

- Help & FAQs

- Money worries

- Report fraud or a scam

- Report card lost or stolen

Site information

- Accessibility

- Privacy policy

- Cookies policy

- Find Barclays

- Service status

Barclays Bank UK PLC and Barclays Bank PLC are each authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Barclays Insurance Services Company Limited and Barclays Investment Solutions Limited are each authorised and regulated by the Financial Conduct Authority.

Registered office for all: 1 Churchill Place, London E14 5HP

404 Not found

We are an independent publisher. Our reporters create honest, accurate, and objective content to help you make decisions. To support our work, we are paid for providing advertising services. Many, but not all, of the offers and clickable hyperlinks (such as a “Next” button) that appear on this site are from companies that compensate us. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear. While we strive to provide a wide range of offers, our site does not include information about every product or service that may be available to you. We strive to keep our information accurate and up-to-date, but some information may not be current. So, your actual offer terms from an advertiser may be different than the offer terms on this site. And the advertised offers may be subject to additional terms and conditions of the advertiser. All information is presented without any warranty or guarantee to you.

This page may include: credit card ads that we may be paid for (“advertiser listing”); and general information about credit card products (“editorial content”). Many, but not all, of the offers and clickable hyperlinks (such as a “Apply Now” button or “Learn More” button) that appear on this site are from companies that compensate us. When you click on that hyperlink or button, you may be directed to the credit card issuer’s website where you can review the terms and conditions for your selected offer. Each advertiser is responsible for the accuracy and availability of its ad offer details, but we attempt to verify those offer details. We have partnerships with advertisers such as Brex, Capital One, Chase, Citi, Wells Fargo and Discover. We also include editorial content to educate consumers about financial products and services. Some of that content may also contain ads, including links to advertisers’ sites, and we may be paid on those ads or links.

For more information, please see How we make money .

How to Use Barclays Arrival Plus Miles for Travel: Your Full Guide

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money .

Earning miles and points for free travel is an amazing feeling. But have you ever run across a travel expense you had to pay for out of pocket because it didn’t fall under a specific airline or hotel program? Or perhaps your miles didn’t cover certain expenses, like taxes, trains or buses?

It’s time to make those scenarios a thing of the past, and earning and redeeming miles from the Barclaycard Arrival Plus® World Elite Mastercard® is one way to make that happen.

You can redeem Arrival miles toward any eligible travel expense of $100 or more made in the past 120 days. So that charge at a boutique hotel? Train tickets? Airline fee taxes? There’s a good chance your Arrival miles have got you covered.

We’ll show you how to use your Barclays Arrival Plus miles for travel!

Let’s take a look at what Barclaycard Arrival miles are, and how you can earn and redeem them.

How to Use Barclays Arrival Plus Miles

Apply Here: Barclaycard Arrival Plus® World Elite Mastercard®

Read our review of the Barclaycard Arrival Plus

With the Barclaycard Arrival Plus , you’ll earn a welcome bonus of 70,000 Arrival miles after spending $5,000 on purchases in the first 90 days of opening your account. That’s worth $700 in travel statement credits for eligible travel purchases of $100 or more.

Benefits of Barclaycard Arrival Miles

You can redeem Barclaycard Arrival miles toward a statement credit for any eligible travel purchase of $100 or more made in the past 120 days. This comes in particularly handy if you’ve made a purchase that’s otherwise not covered by any of your other travel rewards cards. For instance, what if you wanted to stay at a Marriott hotel, but you don’t happen to have any Marriott points to redeem? This is where your Arrival miles can come in handy because they can cover that expense!

Or how about this: have you ever booked an award ticket with miles and points, only to find that you still have to pay some fees in cash? You can redeem Barclaycard Arrival miles to cover the cost of a ticket AND fees, meaning you would pay nothing out of pocket.

Other travel-related expenses could include train tickets, airline ticket fees, cruises and much more. And that’s the beauty of Arrival miles: they’re incredibly flexible because they work on a variety of travel expenses.

Redeeming Barclays Arrival Miles

The best way to stretch the value of your Barclaycard Arrival miles is for statement credits for eligible travel expenses, where your miles will be worth 1 cent each.

Redeeming your Barclaycard Arrival miles for a travel statement credit can be done in just a few simple steps:

Step 1. Log in to Your Barclays Account

Navigate to the Barclays homepage and sign into your account.

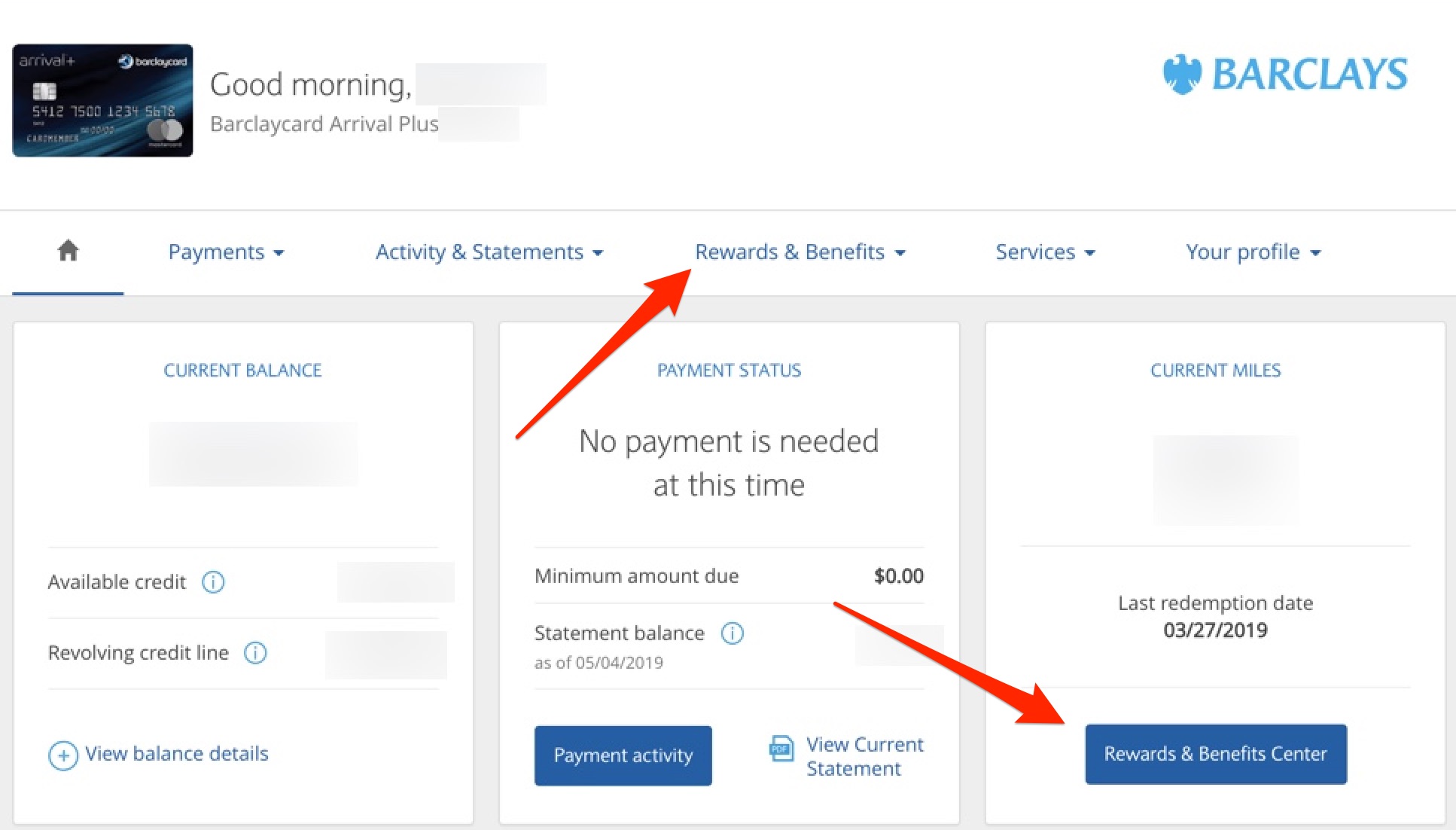

Step 2. Click on the “Rewards and Benefits” Tab and Select the Purchases You’d Like to Erase With Miles

You’ll want to navigate to the “ Rewards and Benefits Center ” from either location shown below.

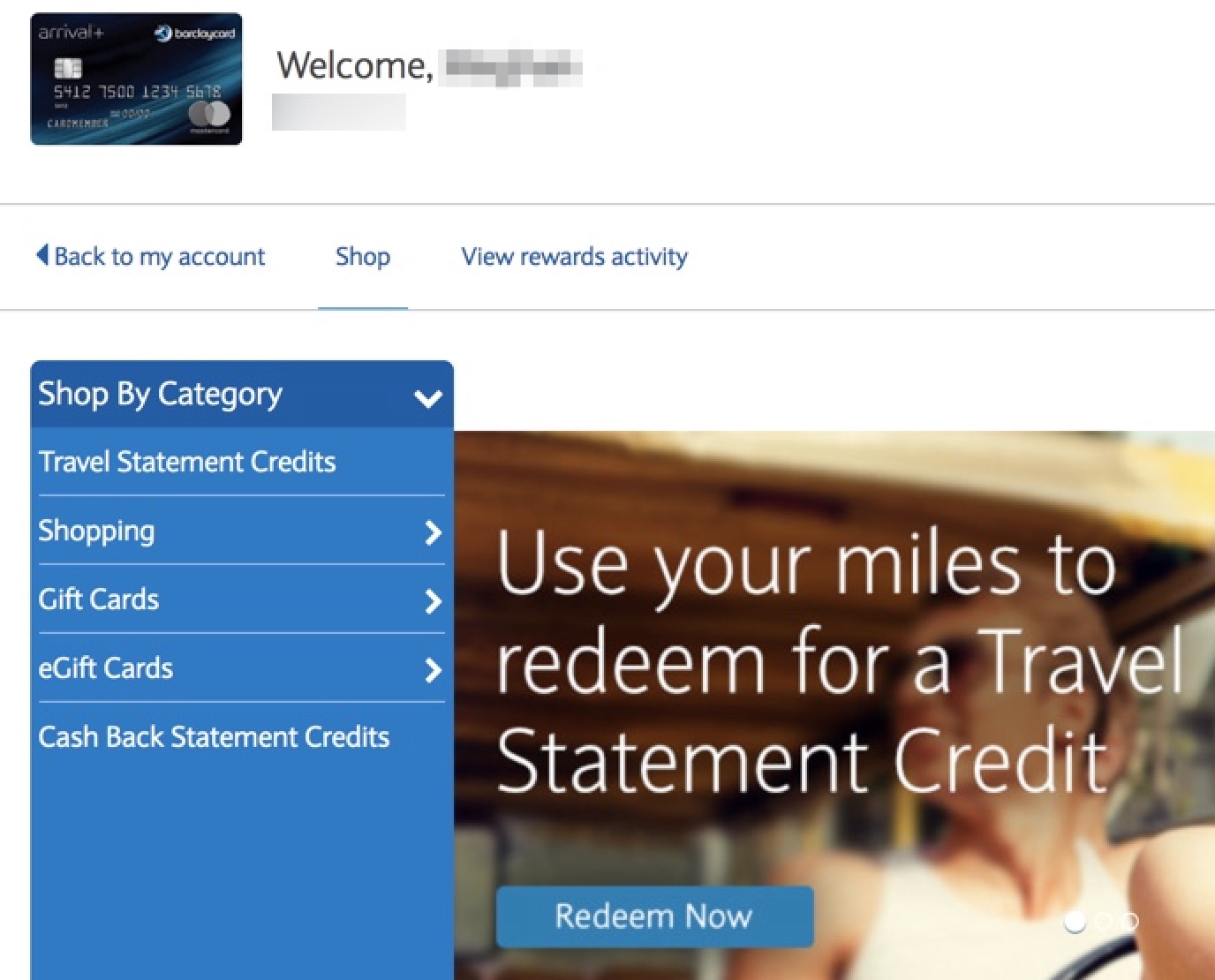

Step 3. Redeem Your Rewards

Finally, you can select exactly how to redeem your Arrival miles. You’ll get the most value out of your miles by redeeming for a travel statement credit, although you can also choose from gift cards, shopping, and cash back statement credits.

If you’re looking to make a redemption for a travel statement credit, you’ll need to start at a minimum of 10,000 Arrival miles. To redeem for annual account fees, you’ll need a minimum of 2,500 Arrival miles. And you can only redeem for travel purchases made in the past 120 days.

What Are Eligible Travel Expenses?

Barclaycard Arrival miles can be redeemed for a number of eligible travel purchases, so you’re not locked into any single merchant or travel portal. As long as a purchase codes as travel, it’ll likely be eligible for the travel statement credit.

Barclays defines travel as:

Airlines, hotels, motels, timeshares, campgrounds, car rental agencies, cruise lines, purchase and travel agencies, discount travel sites, trains, buses, taxis, limousines, ferries and the account annual fee as defined by the merchant category code.

If you’re not sure a purchase will code as travel, you can always try a small test charge first.

How to Earn Barclaycard Arrival Miles

So now that you know how to redeem Barclaycard Arrival miles and how valuable they can be, let’s talk about how you can quickly earn several hundred dollars worth!

Apply for the Barclaycard Arrival Plus World Elite Mastercard

You’ll earn a ton of miles quickly when you open the Barclaycard Arrival Plus® World Elite Mastercard® . You can earn 70,000 miles (worth $700 in travel statement credits) after you spend $5,000 on purchases within the first 90 days of opening your account. You can also continue to earn 2x Arrival miles per dollar on all purchases.

Read our review of the Barclaycard Arrival Plus for more details of the card’s benefits and perks.

Utilize the Barclays Shopping Portal

You can also earn additional points through Barclays’ shopping portal, Barclaycard RewardsBoost .

You’ll want to log in to verify your card is eligible. Once logged in with an eligible card, all you have to do is find a retailer to shop from, click through to their website and complete your purchase. It’s simple.

Bottom Line

Barclays Arrival miles are incredibly flexible because you can redeem them for almost any eligible travel expense of $100 or more, including boutique hotels, airfare, rental cars and cruises.

You can get a jump start on your stash of Arrival miles by earning the intro bonus on the Barclaycard Arrival Plus® World Elite Mastercard® . You can earn 70,000 miles (worth $700 in travel) after spending $5,000 on purchases within the first 90 days of opening your account.

Miles earned can be redeemed for eligible travel expenses at a 1 cent per mile, although you can also redeem them for gift cards and statement credits for non-travel related items, albeit at a lower 0.5 cents per mile.

For more about Barclays Arrival miles, check out these posts:

- Our review of the Barclaycard Arrival Plus

- Barclays Miles Value

And please subscribe to our newsletter to stay up-to-date on our latest tips!

More Topics

Points and Miles

Join the Discussion!

Comments are closed.

You May Also Like

BonusTracker: Best credit card bonus offers

June 14, 2021 4

Best Hilton credit cards: Improved weekend night certificates, earning rates and more

June 12, 2021 2

Our Favorite Partner Cards

Popular posts.

It's time for an update.

To continue accessing and managing your account, please update your browser.

JetBlue Plus Card

Earn 60,000 bonus points

after qualifying account activity 2

on eligible JetBlue purchases 2

at restaurants and eligible grocery stores 2

annual fee 1

after spending $1,000 on purchases and paying the annual fee in full, both within the first 90 days 2

2X points at restaurants and eligible grocery stores

and 1X points on all other purchases 2

Free first checked bag

for you and up to 3 eligible travel companions on JetBlue-operated flights 2,4

Mosaic status faster

Earn toward Mosaic with every purchase 2,3

No blackout dates

That’s any seat, any time, on JetBlue-operated flights 3

Redeem for any seat, any time on JetBlue-operated flights

Points required for an Award flight will vary based on the published base fare at the time of booking 3

Points never expire

Your points will be ready whenever you are 3

Points pooling

Earn & share points with family and friends 3

Cash + Points

Short on points (or cash) for that trip? Pay for your flight with almost any combination of dollars and TrueBlue points – starting with as few as 500 points 3

50% savings

on eligible inflight purchases on JetBlue-operated flights 2,4

Get 10% of your points back

after you redeem for and travel on a JetBlue-operated Award Flight 2

Receive a $100 statement credit

after you purchase a JetBlue Vacations package of $100 or more with your JetBlue Plus Card. Limit one statement credit per year 2

$0 Fraud Liability protection

Means you’re not responsible for unauthorized charges

Points Payback

Points Payback allows you to redeem points for a statement credit, up to $1,000 annually 2

No foreign transaction fees

on international purchases 1

Earn 5,000 points bonus

each year after your JetBlue Plus Card account anniversary 2

Interest Rates and Charges Summary

Fee summary.

See Terms and Conditions for a complete listing of rates and fees

Important Information

Offer subject to credit approval. This offer is available through this advertisement and may not be accessible elsewhere. Other offers may be available. For complete pricing and other details, please see the Terms and Conditions .

This offer is valid for approved applicants. Any bonus associated with this offer may only be earned once. You may not be eligible for this offer if you currently have or previously had an account with us in this program. In addition, you may not be eligible for this offer if, at any time during our relationship with you, we have cause, as determined by us in our sole discretion, to suspect that the account is being obtained or will be used for abusive or gaming activity (such as, but not limited to, obtaining or using the account to maximize rewards earned in a manner that is not consistent with typical consumer activity and/or multiple credit card account applications/openings). Please see the About This Offer section of the Terms and Conditions for important information.

Annual Fee is $99. 0% introductory APR on balance transfers made within 45 days of account opening is applicable for the first 12 billing cycles that immediately follow each balance transfer. This introductory APR offer does not apply to purchases and cash advances. For new and outstanding balance transfers after the introductory period and all purchases, the variable APR is 21.24% to 29.99%, depending upon our review of your application, your credit history at account opening, and other factors. The variable APR for cash advances is 29.99%. The APRs on your account will vary with the market based on the Prime Rate and are subject to change. The minimum monthly interest charge will be $0.50. Balance transfer fee: 5% (min. $5). Cash advance and fee: 5% (min. $10). Foreign transaction fee: $0. See Terms and Conditions for updated and more information about the terms of this offer, including the "About the Variable APRs on Your Account" section for the current Prime Rate information.

Conditions and limitations apply. Please refer to the Introductory Bonus Offer section of the Terms and Conditions for more information about the introductory offer. Please refer to the Reward Rules within the Terms and Conditions for additional information about the rewards program.

Refer to TrueBlue Terms and Conditions for details, including information on fares eligible for award flights.

JetBlue-operated flights only. Codeshare flights and flights operated by a partner airline are not eligible for free checked bag or inflight purchase savings.

JetBlue and TrueBlue are registered trademarks of JetBlue Airways Corporation.

The JetBlue Plus World Elite Mastercard (JetBlue Plus Card) is issued by Barclays Bank Delaware pursuant to a license from Mastercard International Incorporated. Mastercard, World Mastercard, World Elite Mastercard, and the circles design are registered trademarks of Mastercard International Incorporated.

© 2024 Barclays Bank Delaware, PO Box 8801, Wilmington, DE 19801, Member FDIC.

FC Arsenal Tula

Spartak Moscow

- Evgeni Lutsenko ( 90'+4' )

- Daniil Lesovoy ( 90'+9' )

- Aleksandr Sobolev ( 44' )

- Nikolai Rasskazov ( 66' )

- Ezequiel Ponce ( 79' )

Match Formations

Game information, match timeline, russian premier league standings, russian premier news, prosecutors seek nine year prison sentence for quincy promes, ex-netherlands forward promes sentenced to 18 months in jail, top russian clubs appeal to cas to return to uefa competitions.

- Terms of Use

- Privacy Policy

- Your US State Privacy Rights

- Children's Online Privacy Policy

- Interest-Based Ads

- About Nielsen Measurement

- Do Not Sell or Share My Personal Information

- Disney Ad Sales Site

- Work for ESPN

- Corrections

Explore Zelenograd

Plan Your Trip to Zelenograd: Best of Zelenograd Tourism

Essential zelenograd.

Zelenograd Is Great For

Eat & drink

- Benedict Hotel&Spa

- Xenia City Hotel Zelenograd

- Record Hotel

- Sak Mini Hotel

- Sergio Pizza

- Shokoladnitsa

- Goodson Bar

- Bolshoi Gorodskoi Prud

- Central Square

- Vedogon Theatre

- Bali Spa Lux

IMAGES

COMMENTS

Stress-free travels with DragonPass Premier+ app. Relax in a lounge, skip security queues or make use of dining discounts with the DragonPass Premier+ app. If you've got a Barclaycard Avios Plus credit card, you can access airport lounges around the world for £18.50 per person. To compare the full features and benefits of our Travel Plus ...

2 Your Travel Plus Pack Welcome to your Travel Plus Pack Enjoy more comfort and reassurance while you're away with Worldwide Travel Insurance¹, Comprehensive UK and European RAC Cover, access to airport lounges around the world as well as discounts on airport parking and airport hotels. All for £18.00 a month.

4 Your Travel Plus Pack Your Travel Plus Pack 5 Barclays Pack terms and conditions In these terms and conditions: • 'we', 'us' and 'our' refers to Barclays Bank UK PLC and Barclays Insurance Services Company Limited, unless stated. • 'Pack holder' is the person who made the application to purchase the Pack.

If you benefit from the £100 fee-free overdraft, you'll keep your overdraft but you'll start paying interest on the £100 if you use your overdraft once you cancel your pack. If you bought your Travel Pack on or after 19 January 2021, or if you bought your Travel Plus Pack on or after 16 June 2021, you'll get a refund for the days you ...

Barclays claims that the travel insurance in the Travel Plus Pack has been awarded a 5-star rating by Defaqto, however, so it may well be all you need. Feedback from readers confirms that the insurance is good and does cover many pre-existing conditions. This is very rare with 'free' policies. Note that each account holder and their ...

Travel Pack. Get cover for £14.50 a month. Stay protected with worldwide family travel insurance by Aviva, plus RAC complete breakdown cover in the UK and Europe, roadside and at home. Six-month minimum term - terms and conditions apply. View Travel Pack.

If you have a Travel Pack or Travel Plus Pack, you can manage your travel insurance online by visiting the Aviva website. You can also view frequently asked questions, make a claim, request a call back from Aviva or get proof of travel insurance.

Barclays Travel Plus Pack - Frequently Asked Questions. Important: Reference throughout this Frequently Asked Questions (FAQ) document to Qualifying Account means Barclays Bank Account, Barclays Basic Current Account, Student Additions, Higher Education Account or Premier Current Account to which Travel Plus Pack has been added.

But, Barclays recently announced that Arrival Plus travel statement credit redemptions now start at 5,000 miles for $50 toward a travel charge of $100 or more. And, through Jan. 31, 2021, you can offset qualifying gas, grocery and restaurant purchases. ... After all, Barclays usually classifies online travel agencies in the travel merchant ...

The Barclays Travel Plus Pack costs £18 a month (rising to £22.50 a month from 1 Feb 2024) and gives you six free airport lounge passes a year from a choice of 1,000 lounges, but you'll need to register to get them. You can do this via phone or online banking. You also get family travel insurance, and UK and European breakdown cover.

In the UK, £18 ($21.84) a month will get you the Barclays Travel Plus Pack, which provides access to airport lounges six times per year. Similarly, the NatWest Reward Black account offers access to over 1,100 different airport lounges. In the USA, this type of offer is normally linked with Private Banking and some of the more exclusive ...

The best Barclays credit cards of 2022. AAdvantage Aviator Red World Elite Mastercard: Best for American Airlines flyers. JetBlue Plus Card: Best for JetBlue flyers. Hawaiian Airlines World Elite Mastercard: Best for Hawaiian Airlines flyers. Wyndham Rewards Earner® Card: Best for no-annual-fee hotel card. Wyndham Rewards Earner® Plus Card ...

Mainly, the difference is that the Arrival Plus card has a yearly fee and earns 2x points everywhere. The Barclays Arrival World Elite MasterCard (expired) has no annual fee and only earns 2x points on travel and dining purchases, with 1x everywhere else. You'll also get World Elite benefits such as the concierge and Luxury Travel program ...

Barclaycard Arrival Plus® World Elite Mastercard®: The basics. Card type: Travel. Annual fee: $0 intro for the first year, then $89. Rewards: Unlimited 2 miles per dollar on all purchases. Each ...

If you're eligible for travel insurance, Aviva will cover: You and your partner who lives with you up to the age of 79 at the start of your trip. Your children (including step- and foster children) who travel with you and are under 23. If you're eligible for RAC breakdown cover, our providers will cover: You, as the pack holder.

If you've got a Barclaycard Avios Plus loan card, thou can einstieg airport lounges about the world since £18.50 per person. Please consider and liken who full perks and features of the Barclays Travel Plus Pack and Barclaycard Avios Plus credit card. Find out more.

Barclays Arrival miles are incredibly flexible because you can redeem them for almost any eligible travel expense of $100 or more, including boutique hotels, airfare, rental cars and cruises. You can get a jump start on your stash of Arrival miles by earning the intro bonus on the Barclaycard Arrival Plus® World Elite Mastercard® .