Processing...

Click here to proceed with citi bank, login via internet banking, login as guest user.

A world of rewards awaits you.

- Citi PremierMiles® Credit Cardholder

CUSTOMER ID

Enter Email ID or Mobile Number

- Forgot your password? -->

You are not connected to the internet.

You can search here.

- About EDGE REWARDS

- Terms & Conditions

- Privacy Policy

- Best Credit Cards

- Lifetime Free

- Forex Credit Cards

- RuPay Credit Cards

- International Travel

- Railway Lounge

- Credit Card Guides

- Credit Card News

- Offers & Rewards

- Credit Score Guide

- Credit Card Limit

- Lounge Access

Axis Bank Magnus Credit Card

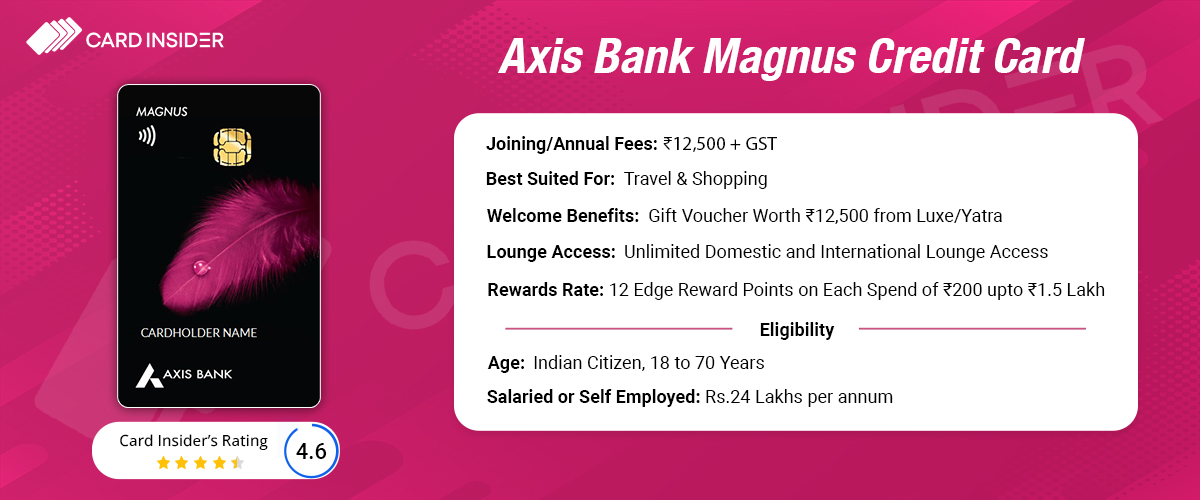

The Magnus Credit Card is one of the most rewarding and sought-after cards in Axis Bank’s portfolio. This super-premium card issued by the bank targets high-income individuals who want to enjoy the privilege of a luxurious lifestyle. It has a joining fee of Rs. 12,500 but offers many premium travel, lifestyle, dining, and insurance benefits.

Cardholders get domestic and international lounge access at airports along with a 24*7 concierge service. Premium customers can also make international transactions at a relatively low 2% Forex Markup fee. Also, there are no cash withdrawal charges on the card (Interest charges applicable). Although the annual fee of the card is relatively high, you can get it waived by spending 25 lakhs or above in the previous anniversary year and save Rs. 12,500.

Keep reading our review of the super-premium Magnus credit card to learn about its features and benefits.

Joining Fee

Renewal fee, best suited for.

Movies | Travel | Dining | Shopping |

Reward Type

Reward Points

Welcome Benefits

Movie & dining.

Buy one and get up to Rs. 500 off on the next movie/non-movie ticket on BookMyShow (max 5 times a month), 20% discount at 4,000+ restaurants across India under the Axis Bank Dining Delights program.

Rewards Rate

12 Axis EDGE REWARDS Points for every Rs. 200 spent with the card, 5X EDGE REWARDS on travel spends via TRAVEL EDGE.

Reward Redemption

Axis EDGE REWARDS Points can be redeemed on the EDGE REWARDS portal at a value of 1 Edge Reward = Re. 0.20 or Transfer to Partner Airlines/Hotels Rewards Program.

Complimentary international as well as domestic airport lounge access, airport concierge services and discounted stays at Oberoi Hotels.

Domestic Lounge Access

Unlimited Free Domestic Airport Lounge Access

International Lounge Access

Unlimited complimentary international airport lounge access for primary cardholders and 8 complimentary visits for the guests every year with Priority Pass

Insurance Benefits

Credit shield protection worth Rs. 5 lakh (in case the card is lost) and a purchase protection worth Rs. 2 lakh.

Zero Liability Protection

Credit shield cover worth Rs. 5 lakh, liability protection up to the card's credit limit.

Spend Based Waiver

Annual fee waived off on an expenditure of Rs. 25 lakhs in the preceding year.

Rewards Redemption Fee

Foreign currency markup.

2% of the transaction plus GST

Interest Rates

3.0% per month (42.58% annually)

Fuel Surcharge

1% fuel surcharge waived off at all fuel stations across India

Cash Advance Charges

Add-on card fee.

- Rs. 12,500 worth gift voucher from Luxe, Postcard Hotels, or Yatra as welcome benefit

- 12 Axis EDGE REWARDS Points for every Rs. 200 spent on retail purchases up to Rs. 1.5 Lakhs. Earn 35 RPs per Rs. 200 after exceeding the monthly spend of Rs. 1.5 Lakhs

- Earn 60 Axis EDGE REWARDS Points for every Rs. 200 spent on Travel Edge portal Rs. 2 Lakhs. Earn 35 RPs per Rs. 200 after exceeding the monthly spend of Rs. 2 Lakhs

- Unlimited domestic airport lounge access every year.

- Unlimited complimentary international lounge visits every year with Priority Pass.

- Discounted stays at Oberoi Hotels.

- Buy one and get up to Rs. 500 off on the next BookMyShow ticket (max 5 times a month).

- 40% discount upto Rs 1,000 via Eazydiner at 4,000+ restaurants across India under the Axis Bank Dining Delights program.

- Credit Shield cover (against misuse of the card) worth Rs. 5 lakh and purchase protection worth Rs. 2 lakh with Axis Bank Magnus Card.

- Medical benefits include a medical concierge, second medical opinion, preventive healthcare diagnostic programs, and global travel and medical assistance.

- Lower interest rate (2.5% pm) and foreign currency mark-up (2%) and zero cash withdrawal fee.

- 24×7 dedicated concierge service for assistance regarding flight or hotel reservations, gift deliveries, etc.

- There are no cash withdrawal charges with this card.

- Unlimited international and domestic lounge access with the Magnus Credit Card.

- You can avail “BOGO” on movies and get discounts on dining with this card.

- The annual income required to be eligible for the Axis Bank Magnus Credit Card is very high, at Rs. 24 lakh.

- There are no golf benefits with this card.

- To qualify for the New Magnus Card for Burgundy, you must maintain the Total Relationship Value associated with the account.

Axis Bank Magnus Credit Card Features and Benefits

The Magnus Credit Card offered by Axis Bank is one of its most popular and premium credit cards that comes with exciting benefits across various categories, including travel, rewards, and many more.

Welcome Benefits:

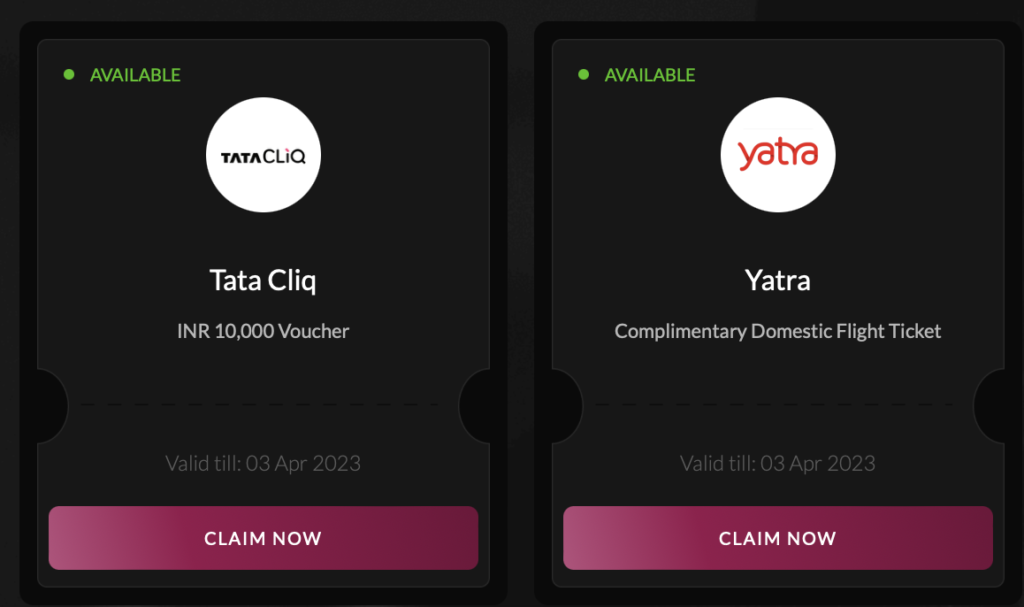

The welcome benefit has been updated and the option to choose the Tata Cliq voucher has been discontinued on the Magnus credit card. Cardholders have the option to choose a Rs. 12,500 worth gift vouchers from Luxe, Postcard Hotels, or Yatra gift voucher.

Travel Benefits:

Unlimited domestic lounge access at select airports across India for primary as well as supplementary cardholders using the Magnus Credit Card. Additionally, the following is the list of lounges accessible through the Priority Pass in India-

- Agartala – Primus Lounge

- Allahabad and Prayagraj – Zesto Executive Lounge

- Amritsar – Costa Coffee

- Bhopal – Primus Lounge

- Cochin – Earth Lounge

- Dibrugrah – Primus Lounge

- Guwahati – The Lounge

- Kannur – Pearl Domestic Lounge

- Madurai – Primus Lounge

- Varanasi – Take Off Bar

Unlimited complimentary international airport lounge access with Priority Pass membership for the primary cardholders. Along with free visits for primary cardholders, you also get an additional 8 complimentary visits for the guests per year.

Airport Concierge and VIP Meet & Greet

Airport meet & greet, concierge service with 8 complimentary VIP assistance services for assistance regarding airport processes, including check-in, security check, immigration processes, and porter services.

For example, at the Delhi airport, you get the complimentary Atithya Silver service that costs Rs. 2000 per adult for both departure and arrival at select airports. Get a warm welcome at the aerobridge gate, porter assistance, golf cart gate transfers, and other privileges. The airport Meet & Greet service can also be used for the guests travelling with you.

Movie & Dining Benefits:

- BookMyShow Benefit – Buy one movie/non-movie ticket from BookMyShow and get Rs. 500 off on the next ticket. This discount can be availed for a maximum of 5 times a month.

- Dining Delights Program -Enjoy up to 40% off at partner restaurants, up to a maximum of Rs. 1000. With the Birthday Offer, get 50% at partner restaurants, up to Rs. 3000.

Insurance Benefits:

24×7 dedicated concierge service:.

You may call the 24×7 dedicated concierge service at 1800 103 4962 for assistance regarding flight bookings, restaurant table reservations, exclusive events/shows, gift deliveries, and more.

Fuel Surcharge Waiver

1% fuel surcharge waived off for transactions between Rs. 400 and Rs. 4,000 at all fuel stations across India. The maximum waiver is capped at Rs. 400 per month. You do not earn reward points on fuel spends for which you get the surcharge waiver.

Spends Based Waiver:

The annual membership fee of the card is waived off on an expenditure of Rs. 25 lakhs in the preceding anniversary year. This threshold does not include wallet reload and rent transactions.

Axis Bank Magnus Credit Card Reward Points

- Earn 12 EDGE Reward Points for every INR 200 on cumulative monthly spends up to Rs. 1.5 Lakhs. Further, earn 35 EDGE Reward Points per Rs. 200 on cumulative monthly spends above Rs. 1.5 Lakhs

- You can earn 60 EDGE Reward Points for every Rs. 200 spent on Travel Edge portal, up to cumulative transactions of Rs. 2 Lakhs per month. Earn 35 EDGE Reward Points per Rs. 200 spent on cumulative transactions of Rs. 2 Lakhs per month.

- Edge Rewards for rental transactions accrue only up to transactions of Rs. 50,000 per month and you have to pay rental transaction charges of 1% of the total amount.

- You can get up to 5x Reward Points on purchases from various brands at the Axis Bank Grab Deals website. Maximum 5,000 EDGE Reward Points, and maximum cashback of Rs. 1000 can be earned per customer per month.

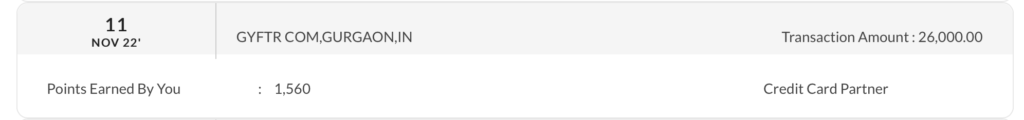

- You can get up to 5x Reward Points along with great discounts on Gyftr . There is no capping on the maximum number of reward points you can earn through the Gyftr portal. Cardholders can purchase only Rs. 20,000 worth of Amazon Pay gift cards and Rs. 10,000 worth of Amazon and Flipkart shopping gift vouchers per month from the Gyftr portal.

After the calendar month is completed, accelerated reward points are credited within 45 days from the evaluation month’s end. Accelerated reward points are calculated as [Eligible Spends = (Total spends in the month – Rs. 1.5 Lakhs – Spends in the exclusion list – Spends on Travel Edge up to Rs. 2 Lakhs – Rent payments) x 23 reward points.

Categories Excluded from earning reward points –

- Wallet reloads/payments

- Incremental spends on rent payments above Rs. 50,000 in a month

- Spends on utilities and government institutions

- Refunded/reversed/cancelled transactions

- Credit card fees and charges

- Cash withdrawals

- Spends made on Travel Edge up to Rs. 2 Lakhs in a month, Gyftr, and Grab Deals portal

Reward Redemption:

You can redeem the Axis EDGE REWARDS Points for instant vouchers, gifts, gadgets, fashion accessories, etc. on the Axis EDGE REWARDS redemption portal . 1 Edge Reward = Re. 0.20.

You can also Transfer EDGE REWARDS Points earned to Partner Airlines/Hotels Rewards Program including Club ITC, Marriott Bonvoy, Etihad Guest, KrisFlyer, United, Turkish Miles&Smiles, and much more at a ratio of 5:2. The new ratio is applicable from 1st September 2023 based on the new terms and conditions of the Miles Transfer program on the Magnus credit card.

- The EDGE RPs earned by you can be transferred to domestic as well international partner hotel and airline loyalty program points. The revised transfer ratio is 5:2, where 5 EDGE RPs = 2 Partner Miles/Points

- The total number of reward points you can convert in a calendar year is capped at 5,00,000 RPs for a single Customer ID. In 2023, cardholder can convert 5,00,000 reward points from 1 st September to 31 st December 2023.

- You can just link one Customer ID to a partner program loyalty membership at a given time. If you want to link another ID, you will first have to delink the existing primary ID and add the new one.

- The cardholder must wait at least 60 days to update their partner program Customer ID at the Travel EDGE portal.

To continue with the current Miles Conversion ratio of 5:4 on the Magnus credit card, you will have to maintain the Burgundy Private account relationship and get the Burgundy Private credit card. The bank does not charge any extra fee for this special offering on the credit card.

New Magnus Credit Card for Burgundy

Recently, Axis Bank has started taking in applications for the New Magnus Credit Card for Burgundy. Customers have been notified regarding the same by Axis Bank via email. With the New Axis Bank Magnus Credit Card, you can earn four partner miles/points for every 5 EDGE Reward Points, which is an upgrade from the previous card.

Joining Fees

The joining and renewal fees for the Axis Bank Magnus Burgundy Credit Card are Rs. 30,000 + GST. Till 31st January 2024, there was no joining fee for the new Magnus Credit Card for Burgundy account holders.

The reward structure is the same as the Magnus Credit Card, except with the new card, you can-

- Earn 4 Partner Miles Against 5 EDGE Reward Points,

- Up to 10 Lakh EDGE Reward Points.

How to Apply for the New Axis Bank Magnus Burgundy Credit Card?

Existing Burgundy account holders who fulfill the eligibility criteria for the new Magnus Credit Card can ask for an upgrade on their card by calling 1800 419 0065. Once your consent is given, your new card shall be dispatched.

Popular Credit Cards Comparison With Axis Bank Magnus

When it comes to super-premium credit cards, the Axis Bank Magnus card faces competition from the HDFC Infinia and Diners Club Black Credit Cards.

However, there are quite a few differences between the three cards, and we will highlight those in the below table.

Axis Bank Magnus Credit Card Fees and Charges

There are several fees and charges associated with a credit card, of which some of the most important ones are as follows:

- The joining and annual fee of the Axis Magnus Credit Card is Rs. 12,500. The renewal fee of Rs. 12,500 is waived off on spending Rs. 25 lakhs or more in the previous year. Existing cardholders who got the card before 1st September 2023 can continue using the card at the old fee of Rs. 10,000 plus taxes.

- The interest rate on this credit card is 3.0% per month (42.58% annually).

- The foreign currency markup fee on this credit card is 2% of the total transaction amount.

- The cash advance fee on the Magnus credit card is zero, i.e., you don’t need to pay any cash withdrawal charges with this card (interest charges are applicable).

Axis Bank Magnus Credit Card Eligibility Criteria

Every credit card has some specific eligibility criteria that need to be fulfilled by the applicants in order to get approved for that particular card. The eligibility requirements for the Magnus Credit Card are as follows:

- Your age must be between 21 years and 70 years for primary cardholders, and above 18 years for add-on cardholders.

- Your annual income must be at least Rs. 18 lakh (for both salaried and self-employed applicants).

- If you have a credit limit of Rs. 3 Lakhs or more on an Axis Bank or any other bank credit card, then you are eligible to apply for the Magnus credit card.

How to Apply for the Axis Magnus Credit Card?

You can apply for Axis Bank Magnus credit cards online as well as offline at your convenience. To apply offline, You will have to visit your nearest Axis Bank branch with all the required documents in order for your application to be processed. To apply online, you can proceed as follows:

- Click on the Apply Now button at the top of the page,

- Fill in your details and apply for the Magnus Credit Card.

Customer Care

For any queries/assistance regarding the credit card, you may dial Axis Bank’s retail phone banking numbers- 1860 419 5555 or 1860 500 5555. To block your card, you may contact the 24×7 helpline at +91 22 67987700.

Axis Bank Magnus Credit Card Review

Even though the annual joining fee for the Axis Bank Magnus credit card is high, it is an excellent option for high-net-worth individuals who prefer a premium lifestyle. It offers great benefits for both domestic and international travel, exclusive dining, low-interest rates, and a relatively low foreign currency markup fee.

The card is similar to HDFC’s Infinia and ICICI’s Emeralde cards. One feature that differentiates this card from the other two is the extra medical benefits that it offers. What do you think of this super-premium credit card by Axis Bank? And how does it stack up against the competition from HDFC and ICICI? Please let us know in the comments below. If you’re an existing customer, feel free to share your experience for the benefit of others.

38 Comments

wrong info about international lounge access unlimited for card holders and 8 guest pass per year.

Hi, thanks for pointing this out. The card was recently updated with new features.

Are you aware of any limitations on maximum of 6000 edge reward points per transaction on this card? That means transaction limit of ₹1,00,000. I have this card and made a transaction of more than 1L, but received only 6K points. Axis customer service being as useless as ever where front-end support opens a SR saying you should get for entire value but back-end support closes it saying 6000 is the limit without citing any T&C.

I have done a transaction of more than 1 lac and have got more than 6000 points on that transaction.

HEY, just applied and got approved for the card, waiting for the delivery, I was wondering if this is a metal card? if yes, then is the quality of metal comparable to HDFC Infinia metal card?

Yes, the Magnus card is a Metal card and the quality is similar to Infinia.

Some users are saying it’s quality is not similar to infinia, is that right?

We have both Infinia Metal and Magnus Metal. The Magnus metal is lighter than Infinia Metal, but overall both cards are solid.

received the card few days back. just wanna clarify one thing; do I need to show priority pass to access the domestic lounges or just my Magnus card?

Dont use priority pass for domestic, if u use priority pass they will charge 27$ plus taxes in India, priority pass is only for international, i mean outside country.

I have a couple of questions? Would you prefer it on Visa or Mastercard? What’s the difference? Is there any chance to get it LTF? Can I transfer my balance from other credit card to Axis Credit Cards? If yes then what are the charges?

Thank you so much

What is the maximum rewards point on can earn on Axis Grab Deal, Axis Travel Edge and Axis GIft Edge portal?

Hey Bhargav! We would like to inform you that you can earn up to 10X EDGE REWARD Points on Brand voucher purchased on http://www.gyftr.com/edgerewards/ with Axis Bank Credit and Debit Cards. Buy Gift Vouchers of 160+ Brands and Get Exclusive Offers & Discounts. Not only this, each customer would also get Up to 10X EDGE REWARD Points on all Credit & Debit Cards (*T&C apply). The EDGE REWARD Points (Accelerated Points) will be posted within 120 days from the date of transaction. For more details we request you to please click on https://www.gyftr.com/edgerewards/terms-and-conditions Team GyFTR

Domestic lounges have become too crowded these days. They queue for entry is also never ending. Can the Priority Pass be used to access “The Exclusive Lounges” like the one in Hyderabad which is just opposite the regular domestic lounge. Is International Travel boarding pass mandatory to use this lounge or can the same be availed with domestic boarding pass as well. Thanks

i dont see ITC club while converting the points. Is it still available?

If I link my HDFC infinia credit card to Google-pay, and pay for govt transactions, will I get reward points? or will I atleast bypass the additional credit card gateway fees?

Hello, Sir. Only RuPay Credit Cards can be linked to UPI.

I am doing a calculation. I buy Reliance Digital Gift Cards for ₹249900 as I want to buy a MacBook Pro. I will also get the 5X RP mean of 75000 RP So basically I will get 75000RP*0.8*1.8=108000 worth in ACCOR. This means my MacBook Pro will cost me Rs.250000-108000=Rs.142000/-

Am I right on the calculation?

and you get extra 25000 points as monthly milestone benefit as well.

On website it says that milestone benefits are applicable from the month of card issuance itself . However you have mentioned that it is applicable from the next month. Please clarify

It’s from the 1st month itself. Updated the article.

You mentioned insurance premium amount is not counted for milestone benefit. Are you sure? Because the following article doesn’t say so: https://www.axisbank.com/docs/default-source/default-document-library/25k-edge-rewards-tnc.pdf

Hi Sandy, thanks updated the article. Rent and wallet is excluded.

I have card and used it multiple times to book flights via travel edge. However, the bonus points have not been credited. Is there a wait time for travel edge 5x bonus points to get credited, or should I reach out to someone?

Isn’t there a limit of 10k points, per month per customer? Total points is 35000. And with Accor, a reduction of 50k.

limit is only on grabdeals.

I have salary of 10lacs per annum…. And I hav citi bank credit card (2lac limit) and axis bank ace(1lac limit) Can I apply for magnus credit card

Here are the easiest way to get Magnus without huge ITR or huge Limit, I have help almost all my friend circle. 1) Use your Citi card statement and mail to axis with your salary slips to increase limit and match as citi for your Axis Ace. or 1) Apple Card 2 Card any random low variant cc so via bank offline or agent so that you get 2Lac Limit 2) Wait for 3 Month or sometime even less. 3) Open Axis Mobile App, Credit Cards > Scroll Bottom, do not select any card > there would be new a button “Apply Now’ Click there 4) Fill the details and go next, Now if your coll down period ie. step 2 is over then you will get a credit card list which are pre-approved. 5) For magus you need at least 2Lac on existing axis card, and Voila you will see Magnus in that list. 6) Thank me later, New Year Gift hehe 😛

Hi, I’ve a couple of questions. 1. What’s the difference between Magnus VISA & Magnus Master card on usage / restrictions and please suggest the best. 2. Regarding International Airport Lounge Program, whether the guest of the card holder (like wife travelling along with the card holder) can also avail the offer.? If so, what’s the limitation ?

I was travelling internationally in last 3 weeks. Whichever airport lounges I asked, none of them accept this card (Canada, Germany, France, Dubai). can anyone share which airports and which lounges accept this cad?

are jewellery purchase counted in magnus 1 lac spends per month cretiria and if yes also can i buy kalyan jeweller gift card from gift edge at 5x and take benefit??

Anyone has got the 25000 point for the month of march 23?

hi…will I get any edge reward points if I pay my electricity & other utility bills through Magnus CC?

Bonus of 25000 points on spending of 1 lakh and more has been withdrawn by axis on magnus card. now it is making magnus less attractive

25K points on 1L spend has been withdrawn.. besides a lot of other degradations on the card. There’s a spectacular degradation on this card which makes the WORST card among all premium cards. Stay away from this card (Unless you are a Burgundy account holder)

Ankur One Point to change. AXIS is now Offering Magnus in MasterCard World from Dec 20th, So we can avail Gold benefits via Master Card.

World Mastercard cardholders can enjoy the following privileges: – 4 complimentary rounds of green fees per calendar year (not more than 1 round in a single calendar month) – 12 complimentary golf lessons per calendar year (1 lesson per calendar month) – Discounted golf services at 50% of the green fee beyond complimentary sessions

This card is just hyped way too much. After devaluation the return rate is just 1.2 to 2% max. 1 edge point is 0.2 rs vs 1 point =1 inr for HDFC Infinia and Diners black. Don’t be fooled, I have cancelled my card after devaluation( removal of 25000 point on 1 lakh spends). Even when this offer was there the return rate was about 5% max.. 25000*0.2 rs =5000 rs for every 1L spend.

Write A Comment Cancel Reply

Save my name, email, and website in this browser for the next time I comment.

Find the perfect credit card in India by comparing the most rewarding options in one place!

- Privacy Policy

- Terms & Conditions

Contact Info

© Copyright 2024 Card Insider

Made With ❤ in India.

Type above and press Enter to search. Press Esc to cancel.

Add cards to start comparing

Axis Magnus Credit Card gets a NEW milestone benefit and more

For detailed review & latest updates please refer to Axis Magnus Review

Axis Bank has recently added new benefits to the MAGNUS credit card after about ~2 months of onboarding customers on Visa Infinite Platform.

Here’s everything you need to know about the new benefits that’s going live for all Magnus credit cards from 1st Feb 2022 .

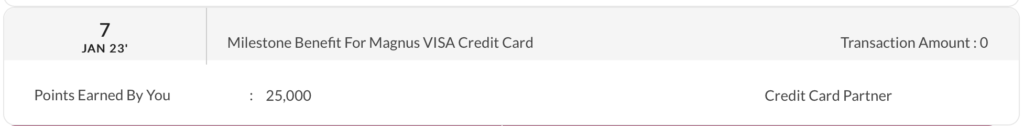

- Monthly Milestone Benefit: 25k points on 1L spend (5000 INR value, which is +5% return)

- Accelerated Rewards: 5X on travel spends via Travel Edge (6% Value)

- International lounge access: Unlimited via Priority Pass (guests limited to 8, same as before)

The monthly milestone reward points benefit is a MIND-BLOWING addition to Magnus with which one can now earn 6.2% worth of rewards on 1L spend (excluding wallet loads), every calendar month. That’s a massive benefit to have as a standard feature on the card.

So it now helps to compete with HDFC Super Premium cards as far as the reward rate (on regular spend) is concerned.

If Axis does another addition by making 5X to 10X or even 20X Rewards on travel as they did a while ago, then Magnus has everything one needs with better redemptions and no 70% restriction as with HDFC.

Note : For New customers, the monthly milestone benefit will be applicable from the 1st of the upcoming month post the card issuance date

Magnus is an amazing card and is the first mover when it comes to Domestic Airport Concierge services and seems it attracts high quality customers that they’re now able to give even more to them.

That said, I wish Axis adds something similar to Axis Reserve Credit Card as well to boost the reward rate, maybe something like 25K rewards on 1L & 2L spends each. Let’s see what they do!

Sign up for Weekly Newsletter

Get curated emails every week, so you don't miss any rewards.

Related Posts

189 thoughts on “ Axis Magnus Credit Card gets a NEW milestone benefit and more ”

Few other good to know conditions: 1. Wallet loads are not considered for the monthly milestone. 2. 2X benefit on MMT, Goibibo and yatra will be discontinued from 10March. 3. Bonus 25K RPs will be credited within 90 days from monthend. 4. Monthly milestone is calculated calendar month wise and not billing cycle wise.

Hi Sid, Now Axis Magnus comes with Visa Infinite platform?

I have the reserve card taken in end October and still sending email to PNO/Nodal as my CLUB ITC membership has still not been processed. I am not sure if I would even get the 50K edge points…and this after being a Burgundy customer and holding 4 axis cards. I have stopped spending on my reserve card and now fighting for a refund as well let’s see..

How did you get four axis cards? Please share your experience

Got select card free from my Burgundy account…was anyway holding Axis Flipkart earlier…in the new promotion in Oct applied for Vistara Infinite and Reserve and got both approved. Thus holding these 4 axis cards

There is discalimer stating the benefit will be discontinued from 10th March REWARDS PROGRAM 25,000 EDGE REWARDS Points worth Rs. 5,000 on monthly spends of Rs. 1Lakh. 5X EDGE REWARDS on travel spends via TRAVEL EDGE. 12 Axis EDGE REWARDS Points on every Rs.200 that you spend. 2X Axis EDGE REWARDS Points on purchases at MakeMyTrip, Yatra, Goibibo and more. *This benefit will be discontinued w.e.f 10th march 2022

That’s only for 2X.

Is Unlimited International lounge access for old card holders also.( Master card)? I checked with Axis call center and they are not aware of this new feature.

Hoping HDFC takes note of this and improves on Infinia / DCB..i personally plan on taking this card now and routing all non Smartbuy spends on this and keep my DCB for Smartbuy spends only

The issue is that even though it is generous 25000 edge rewards on 1 lac monthly spend, the edge rewards cannot be converted to cash statement credit. The edge rewards can be redeemed only for vouchers like amazon gift, etc.

Applied for this. Will shift spends from infinia to this

Lucky are those who opted for FYF for Axis Magnus when the offer was live!

Is there any minimum limit required for existing axis bank card holders to apply via ‘card upgrade’ for this card?

Yes , 3lacs. I upgraded my existing credit card to Magnus card through upgrade option.

From Customer Care I was told that existing limit on card of axis bank should be 50000. I applied through the bank by submitting a new application on C2C basis. I submitted Regalia Statement with credit limit of 3.9 lakhs. The care was approved on 14 Jan and now reflecting in app. Not dispatched yet

What is a limit shows of magnus credit card ?

Hello shoyaib, i also want to apply for magnus card, as c2c from business regalia card. I want to know as you applied, with regalia card, how much limit you got ?? How did you apply form branch or individual agent?? Kindly reply asap.thanks in advance

I got number of an agent of axis bank. I applied C2C with regalia. I got limit of 3 lakhs on magnus card

is this a metal card? and is it better than business regalia which I am currently using?

@shreyansh. Yes.minimum limit is 3lakh required for upgrade the card

Minimum 3 Lacs on your existing Axis Card.

Since it’s Visa Infinite, will the unlimited domestic Lounge access continue for AddOn card holders? Traditionally have only seen Master card allowing Addon Card holders to Swipe at Lounges.

How easy or possible is it to upgrade from Select card with 2.5L limit to Magnus? Any tips/suggestions for it?

If you have any other card with 3 lakhs + limit then file a fresh application through bank agent on C2C basis.

I have privilege credit card with 2.65L limit but was rejected as the limit is less than 3L.

For 2nd year onwards also will we get either voucher or air ticket after paying annual fee of Rs 10K + GST

For a monthly spend of approx 1-2L, this card is more rewarding than the Reserve, Select, Ace, Flipkart cards and is the most rewarding card in Axis for that spend range. Please correct me if I am wrong.

Is rent pay considered for the 1L milestone benefit?

Is NPS investment considered for the 1 lakh milestone?

The T&C doc states, “All spends are considered except wallet loads” – fuel/insurance/bill payment/NPS/all should be considered

I applied for the card 2 days ago and got a application id number but thats it. Does anyone know how to track or check the status. The usual links after google search dont bring up anything.

Used the airport concierge service today domestic bookes using Magnus card at Mumbai airport … was disappointed to know that the service booked via axis bank partnership only includes porter service and VIP lane security, service ends when they put you into the VIP lane .. no golf cart provided … i wont value this service more than 1000rs per visit

If you value it even Rs. 1000 then I think they are doing a good job for a card with 10k fee.

Lucky you atleast you are getting the service. I am shocked to see service is not available in Delhi region. I applied for the card for this service only.

Not surprised at all , i think there is some problem with VIP services at delhi T3 , for Amex pmat charge holders, i was informed that the meet and greet is indefinitely on hold when i tried to book tickets for using the service

Axis Magnus card applied as a new customer (hold ACE and FK) from website on 27Jan Physical verification done on 29Jan Approval SMS received on 31Jan and could see partial card number in Axis mobile app without any details such as limit, etc and they have added 11800 to the existing outstanding amount

More details as it progresses..

02 Feb: Received an SMS saying that Dineout Plus membership number and Priority pass card are enclosed in the credit card kit 03 Feb: Card is shipped 04 Feb: Card received along with PP

This becomes more attractive particularly post the devaluation of DCB/Infinia

@MT The bank website says this “With airport concierge services, Axis Bank brings you a seamless air travel experience with any airline of your choice. Get greeted at the airport by our authorized agents, fast-track yourself through the check-in, security and immigration processes and travel care-free with our porter and buggy services. Book your services now!”

By buggy services I believe they mean the golf card. You could probably raise a complaint with your RM/Bank.

Do you have a referral link for this card? I hold a LTF DCB(5.9L limit) and a LTF Yes First Exclusive(4.9L limit) and the Citi rewards card(9.7L limit). Do you think it makes sense for me to apply for this card?

I got my card today(1st February). So I would.be eligible for the offer this month or its going to start next month?

For New customers, the monthly milestone benefit will be applicable from the 1st of the upcoming month post the card issuance date.

– Written in T&C

That’s my trouble and confusion in my case. According to terms and conditions, For New customers, the monthly milestone benefit will be applicable from the 1st of the upcoming month post the card issuance date.

I received my card on 1st February and got activated same day. So obviously my card issuance date would be somewhere in Jan end.

Even I spoke to premium customer and sent email to their premium customer service, they have no idea about it. I wish they had delivered my card in January only or somewhere in the middle of February 🤣🤣

Got Magnus card today. Limit 3 lakhs. Applied C2C based on regalia with limit 3.9 lakhs. Took more than 21 days to get approved. I was holding Flipkart axis Bank card with limit 40000

How many days after receiving the SMS on ‘Dineout Plus membership number and Priority pass’ did the card get delivered?

Is their any offer to get this card on LTF basis ?

Applied for Magnus credit card and in 2 hours card got approved ,saw the card number also in mobile app and received the card in 4 days. Super fast process by Axis bank. I already have Vistara Infinite card with 6.15L limit so this card was kind of pre approved one

Hi Mouli, You applied for Axis card online or through the branch?

I applied through online,in Netbanking

This new Infinite Variant is made of Plastic or Mettalic?

But it’s not as good as Infinia or Onecard

Now that DB is further devalued for voucher purchase and daily cap of 2500 points, mathematically, is there card better than DB?

Till a couple of days back I was keen on applying for the new metallic infinia, what do you suggest? Infinia or magnus?

This 1 lakh monthly spend milestone reward a feature of this card or a temporary offer? Planning to apply if it won’t be revoked immediately. Has anyone confirmed insurance premium is not excluded in Axis rewards?

Axis confirmed that they are not issuing Add on card for any Axis credit cards so whoever applies for this card don’t consider add on card benefits

From what I know, it can still be applied if applied along with the primary card application. Still, Add-on’s with Axis is full of bugs as reported earlier. So better to avoid.

Holding vistara infinite and Fk card with 75k limit each… Applied for magnus online and got a confirmation call asking for full name and mail id.

Card is now approved with a limit of 1.8 lakh and dispatched..

Seems many comments above about 3 lakh min limit but seems that they are issuing even with less limit..

How do they even expect you to spend 15L p.a with a CL like 1.8 lakh?

Can you please share the details of the online application?

Could you please let us know applied for Magnus online means through axis bank website as existing customer or new application ?

What are the bugs with add on Sid ?

Hi all, I want to have Magnus. I can spend easily 1 lakh for month. But, I’m not eligible with the ITR. I’ve Vistara Infinite, ACE and Flipkart cards from Axis with the shared limit of Rs.3 lakhs. I also have HDFC card with 12 lakhs limit. 1) Is there a way to get the Magnus? 2) Is it possible to have the 4th card from Axis?3)Is it a good idea to upgrade the Vistara to Magnus?

Yes, you can firsttly, provided you have limit of 3,00,000 INR in existing card. Please note that you can only hold 3 cards that means you need to close on card and then apply magnus. I cannot answer your second question , as i dont hold vistara.

hope i was able to answer you.

vistara to magnus is purely upon your priorities , if you cant get value through cv points or dont rate business class tickets or not in delhi/mumbai to maximise then you may consider magnus, even it has its own shortfalls. 3 lakhs shared limit is enough to call and swap any of your existing axis cards , afaik axis allows only 3 cards. if you want to try for more limit try to apply through c2c route , heard a lot have got good limits through this way

You can easily get Magnus Card with your Credit Card Statement of HDFC. Apply it offline with biometric authentication. Axis may ask you to close one of the existing card. But in few cases axis allowed holding 4 cards.

@Sid Axis is launching a new credit card. Atlas Credit Card. Annual fees Rs 5000 +gst

Hi.. I had applied for Magnus card on 31st Jan and got the approval sms on 04th Feb but after that no communication. If I check the application status, nothing is showing there. So I want to know if this is the normal practice of Axis Bank.. Thanks in advance.

Yes it is a normal practice by the bank. Many times even customer care will not be able to track it. Better to get in touch with any bank employee and ask them the status saying there is no communication. I got approved sms and after that it took 14 days for the card to reflect in app.

Are the welcome benefits recurring after I pay renewal fee? I just got the Magnus card, its in Metal form factor.

Hi Sid, used Magnus card for rent , Rewards point are generating for Redgirraffe transaction through payzap bill payment . And also did transaction in CRED.

Did transaction on 5th current month.

Does rent payment through redgiraffe/payzapp still working for magnus card? and this will include part of 1L/month milestone?

Mumbai arrival experience is must better at T2 , booked VIP service via concierge, had a person waiting with a porter and a reserved golf cart (5seater) , quickly escorted to baggage hall , pointed out my bags to porter , promptly picked up , exited via staff exit (for vaccine cert check) no waiting in line with normal passengers, porter loaded all bags into car … on pranaam website its 2,000 rs per person , guess it fits the valuation

Hi Siddharth , i regularly visit your website. I am following your website for last three years. Thank you so much for investing your time and your effort . I recently upgrade my My Axis bank privilege to magnus after reading your post. I received the card within a week. But i Cant able to use it TNEB website. I am getting otp but after submitting the OTP , no message from bank side and Transaction getting declined for no reason. I dont even get declined transaction message. Do you or anyone from your website face issues like this. . Can bank block Transaction on Certain Mearchant ?.. Please share your inputs Regarding this.Will be very useful. Thank you

Check if you have enabled transaction at control Center

i enabled ecom transaction online on control center. i can make payment on other website, but i cant make payment on TNEB only. Thank you Abhishek

I may sound little odd to your ears. Did you checked your online transactions? if that enabled or not.?

Is there a way to get axis magnus card life time free.

No, it’s not. May be you can keep this card foe first year and see how is the cost-benefit and then may be Axis would convert to LTF as part of retention process. Don’t forget this card is par with Infinia & Diners. It’s worth the cost.

Wondering the same. Is everyone paying 10K+GST or getting it waived off? I hold a Burgandy and have not availed any credit card from Axis so far. They offer select for free but I am not interested.

I am trying to use my Magnus card on the Axis Gyftr Edge Instant voucher platform to buy Amazon vouchers but the transaction is failing (just received today and enabled for Ecom transaction through the app – working fine on big basket). Tried using my Axis Select card and it is going through (though I cancelled on OTP page as I want to use Magnus). I also don’t see a mention of Magnus on the Gyftr Edge benefits illustration page – it starts from Select. Does it mean one can’t use Magnus on this platform?

I too faced the same issue with the magnus card. Raised a complaint with Gyftr team. Will update, once the issue is resolved.

Have been unable to use magnus card on Giftedge portal. It says Transaction failed. Axis bank is clueless and so is the gyftr team.

After one month of Axis Magnus I have realised that AXIS bank’s whole system is convoluted – they have grabdeals (which has vouchers and cashback links and few offers), they have travel edge (to redeem and book – earlier with 10x, 20x offers) and they have GIFT Edge where one can purchase vouchers.

Very silly system. I am now moving actively from Diners Black to Magnus but they are making the shift difficult with such complexities. Hope they fix their internal co-ordination issues and make the experience simple. The customer care folks also need better training and understanding of the whole eco-system.

Same issue with me, unable to buy on gyftr.com/edgerewards and raised a complaint about 15 days back and finally, Gyftr team came back today saying the issue is with the card and need to reach out to the bank. Reached out via Twitter, no reply so far.

I did not get any reward points including regular points after statement. I have asked customer care ,they are saying need to wait for next month statement generated for regular points as well because it is new card. Is it true?

Do Magnus add on card holders also get a separate priority pass membership? Their website mentions complimentary domestic lounge access for add on cards but there is no reference to international lounges.

Also, any idea when Axis will allow add on card applications?

Received my Magnus card today – pathetic credit limit given of 27K – the application was on card to card basis with my infinia card having limits of 15Lacs….

Any ideas about how to get the limit enhanced immediately. Otherwise paying 10K+gst joining fees makes no point. The main purpose to apply this card was the monthly milestone – have monthly expenses to the tune of almost 2lacs per month.

hi sid, do you see the FYF offers coming back for Axis in March, since the LTF offers are already back for lower cards. I’m thinking of applying for Magnus but was thinking if I should wait a bit. Hoping the offers come back , even though I’m sure Axis is meeting more than its targets for Magnus after the devaluation by HDFC 🙂

I applied for Magnus Credit card on 14/02/2022 thorugh online and the respresentative who came to do KYC (As i am not a bank account holder), didnt ask for any document, but still i gave my existing INFINIA Statement with limit of 7.37 lakh. The card was in pending status for 9 days and got approved today with limit of 1.5 lakh.

Hi Vikram, I’m unable to track my card. Says AppID invalid. Which webpage are you using?

Received the card today with 8 lacs limit. Had applied on C2C basis l and it took good 21 days to get the approval. The card comes in metal now. Off topic, SBI Aurum is the only good looking metal card in india. Rest all including Amex Plat Charge, Infinia, and Magnus have that ugly square EMV chip. It’s kind of gross 😬

I’ve applied for this card online on Feb 8, physical verification (seriously!?) happened in a couple of days and the guy who came for the same says the application I raised initially is not valid for whatever reason and asked me to follow a set of instructions (which according to him is the only way of getting the card approved, with some ridiculous rules). Once physical verification is done, I was expecting to atleast track the application through my axis app but I don’t see anything. It’s been two weeks and I get a message today that card is declined. I hold cards premium to this (from other companies) and I also have an axis account since a while and I’m pretty sure I’ve brought them good business from my end but this is very disappointing experience with Axis.

I already had flipkart and ace credit card with them with shared limit of 3 lacs. Applied online for magnus and got it approved yesterday. Took around a week to get it approved. Also received an IVR call for confirmation of the application 2 days back. Sadly the limit is still same shared between 3 cards.

Seshu please apply card to card basis, same thing happened to me got card now

I got an Axis magnus, last month but when I applied for a LTF flipkart card from axis , it got denied. Has it happened to anyone else? I have a credit score upwards of 800 and this is the first time a card got rejected.

There must be 3 months gap between two applications in Axis

Hey sid I got this card around 15 days back and to my surprise the sale discounts on amazon and flipkart for axis credit cards are not getting applied on this card The same card discounts are getting applied on my flipkart and ace card without any issue I initially thought this of some technical issue but after complaining till the nodal officer i was informed today that the card discounts on merchant’s like amazon, flipkart and others won’t apply on this card as this card is excluded from those offers I have checked all the terms and conditions on amazon and flipkart (During the sale period) and there was only one exclusion on flipkart for flipkart axis card of 5% discount instead of 10% which is fine Can you please confirm whether anyone else is facing this issue or is it just some technical issue with my card? And if it’s true then this will be a major downside for this card

Seems like all rent payments through sites like CRED, Paytm, NoBroker is being blocked.

Can anyone else confirm?

Hi Rohan, I don’t make payments on Rent websites, But i tried to pay my utility Bill . But i cant do it . I think they intentionally blocked it as well. Thanks to Shreyansh Soni and Siddharth about the Visa Bin issue. i reported my issue to nodal office , i don’t get any reply so far.

Update: Tried booking a flight today (2nd March) at makemytrip using axis’s discount code MMTWEDCREDIT After entering the magnus card number and clicking on continue the page shows ‘The offer is only valid on Axis Credit Cards’ I think axis has not shared the card’s bin number with merchants either inadvertently or this is how they have designed this card

Yes, they likely missed to update the Visa bin numbers it seems. Will check on it.

Yes – same problem with Cred Axis 10x Edge rewards offer and guess same issue with Gyftr Edge rewards as well

Well, this is true. Furthermore, if you try and make payments for this Visa variants of Magnus cards through Axis’s Billdesk portal or HDFC’s billpay portal, you won’t be able to because of the same reason.

This bin issue of Magnus card is finally resolved😅 Sent many mails to axis @pno, premium.experience etc, got no resolution. Finally just raised one simple complaint at the BO, and voila I was assigned a dedicated complaint resolver from Axis’s pno desk. He said that all these issues persist as this Visa Variant of Magnus card is not WHITE-LISTED for any customer. I was surprised to see his response; he was resolving one issue, then calling me back to check and confirm, then next, and so on. He has confirmed that now all offers will apply on Magnus card, apart from a few, which are likely to get resolved in a day or two. I also have checked the same, and it’s working for sure now. He further stated that, many of these issues have been resolved for all customers along with me ( I dunno how true that is)

Hey Gaurav Can you please tell us how did you get a dedicated complaint resolver? Axis told me on 15th the gyftr transactions issue would be resolved in next 3 days and now they have resolved it 👍 However i checked on cred and the 10x offer is still not getting applied

Thanks Gaurav for the effort – I can see the card is now working on Gyftr Edge rewards portal.

Cred offer will be resolved on 1st April 2022 – got confirmation from their Twitter team. However, I have another issue on this card. I am not getting even the regular reward points on the card as of now – 2 statements have generated. Raised the issue with customer care and they have escalated.

Were you able to find any update on this?

Any update sid?

Update 2: The 10% discount on the ongoing amazon super value days also not getting applied Also its been a week i made a complaint to the nodal officer. Still no reply other than the automated mail Pathetic service by axis 🤦

Applied online, received this card today with a limit of 71k. Just for comparison, my DCB has 7 lakh limit. I don’t know how can I achieve the milestone with this limit. This is my first Axis card, does axis normally give such a low limit or this is a special case?

The bin bumber of Axis Magnus Visa Infinite card is also not there in bookmyshow visa infinite offer. So not being bale to avail the offer of Visa Infinite on Book My show

Is this issue resolved yet?

You don’t need a visa infinite offer for this card.. there is an Axis Magnus offer separately – go and apply that offer.. I booked tickets twice already without any hassle.

Yes i have also availed the normal Magnus offer, but i was talking about the Visa Infinite offer which i am not being able to avail. there is a seperate offer for Visa Infinite cards.

yes got it.. visa infinite allows you to get snacks as well.. maybe because the Magnus offer is generous they aren’t providing this

No use, as most of the times the Quota is over and no T&C mention when the quote refreshes.

Error Message: “Sorry, the quota for the offer you are trying has been exhausted. Please try again later. Please check offer terms and conditions for details or check the support section…..”

Were these offers honoured with the MasterCard variant earlier or this is specific to the Visa variant only?

Here is my experience with Magnus, I already own Infinia but cannot ignore 5% on Magnus – Applied online after reading this article on 28th Jan. Agent came to house on 29th Jan. He didn’t ask for any income proof (I already have Vistara Signature with 2.8L limit). Didn’t receive any communication until 15th Feb. Received card on 18th Feb. Now I couldn’t use this card for any online transactions, used to say “Your mobile number is not updated with us.” in spite of receiving SMS on doing offline transactions. Called customer care multiple times on different days, no one could give proper solution. Then one care person asked to visit branch and update the email ID again. Did it on 4th March. Filled KYC form. One care person asked to update email ID using mobile app. Did it on 4th March only. He asked me to try transaction after 4 hours. Still couldn’t. Now on 7th March, I am finally able to use the card for online transaction. Oof.. Paid rent of 49999 on Cred, went smoothly. Cheers.

I went to purchase a samsung refrigerator today in which there was disocunt of Rs 7000 on axis cards, used my magnus visa infinite card to pay, the transaction was declined saying some rule error, i think this card is a real headache, how can axis do such a mistake of not sharing the bin range. If we cannot even use the axis card at places, then what is the use of such a premium card. i made a complain on the axis phone banknig, but they have not replied anything as such

So I applied for this card and got it as well. I already had two Axis bank credit cards – the select miles and more and vistara infinite, with separate limits of 3.7 lakhs and 4.8 lakhs respectively. Once I got the Magnus, it had a limit of 4.7 lakhs. On the app, it showed that there are separate limits. I tried to swipe the Magnus for a hefty amount, and it got declined. On calling customer care, I was told that it is a combined limit amongst all cards! Till date it shows as separate limits on the app. Immediately cancelled all 3 cards as I can’t deal with such erratic and arbitrary things done on their own without intimation. Waiting for their “rentention” team for the last 10 days to call me to discuss what to do about the Magnus joining fees as I am not willing to pay it for sure!

Having the same problem with Magnus – GyFTR/axisrewards as Amazon Voucher purchases are going for failed transactions – Amazon instant discounts offers are also not being extended. – Kind of repenting the idea of going for Magnus after having read the ga-ga review and paying the hefty fees (though the issues are not something Siddharth’s knew beforehand). – Just to add in – had applied for Add-on card during primary application only but that also did not come through. – the customer care (including Twitter DM) is absolutely below par.

Better to stay away from Magnus is nothing that’s been promised of.

Does anyone know how to check whether the transaction has tracked on grabdeals or not. Recently i did a transaction through grabdeals, it has almost been around 10 days but i have not reeived any message from Axis Bank whtehter the transaction has been recorded on Grabdeals or not. This is the first time i am using an Axis card and have no idea about these. Please can anybody help me how to check whether the transaction has been recorded on Grabdeals or not. I called customer care multiple times, none of the executive were able to help. Using HDFC is way way way way simpler. HDFC Smartbuy transactions shows as smartbuy in the statement and even at the time of making payment.

You generally get a message within 24-48 hours stating that your grabdeals transaction has been recorded.

Here is my experience with Magnus, I already own Infinia but cannot ignore 6.2% on Magnus – Applied online after reading this article on 28th Jan. Agent came to house on 29th Jan. He didn’t ask for any income proof (I already have Vistara Signature with 2.8L limit). Didn’t receive any communication until 15th Feb. Received card on 18th Feb. Now I couldn’t use this card for any online transactions, used to say “Your mobile number is not updated with us.” in spite of receiving SMS on doing offline transactions. Called customer care multiple times on different days, no one could give proper solution. Then one care person asked to visit branch and update the email ID again. Did it on 4th March. Filled KYC form. One care person asked to update email ID using mobile app. Did it on 4th March only. He asked me to try transaction after 4 hours. Still couldn’t. Now on 7th March, I am finally able to use the card for online transaction. Oof.. Paid rent of 49999 on Cred, went smoothly. Cheers.

Axis Magnus is giving unlimited BOGO on BOOK MY SHOW

Also, no upper cap on ticket price

Hi Gaurav, Is the Magnus bin issue resolved completely ? What is the way to reach out to BO contact ?

Tried adding Magnus to Samsung pay but failed I guess bin issue still present

Same won’t able to add in samsung pay

Hello, do we get accelerated 5x rewards for buying Amazon or other vouchers through GYFTR-edge rewards portal while buying through Magnus CC? Thanks.

Hi , I have the magnus since February and so far no reward points added for any transaction. How long does it take for the reward points to reflect?

Never, unless you follow-up rigorously

Hi all my Samsung pay issue persists, so I went to BookMyShow to see if card accepted. And it’s now accepted got in both Magnus section and visa infinite. Went to FAQ in both and now 451460 bin range is added in both sections also a 5 series is present in Magnus which I guess is original MasterCard.

Very slow in dispatching the card after approval. It is approved state from March 16, and still they did not generate card and not dispatched, is this usual with this bank ?

It shouldn’t take more than 7 days ideally.

Hi Guys. Can anyone confirm if the rental payments are still getting considered for the Rs 1 Lakh monthly spend.

Hello folks, Despite paying the joining fees on my Magnus last month itself, neither have I received the option of selecting Tata Cliq or so… Not am I enrolled on the Edge Rewards.cannot see any points (forget accelerated, not even normal) even after 60 days of spends. Is this normal?

Sorry, asking a similar question as above because it wasn’t answered.

You will get it after generation of first statement post payment of joining fee. Axis concierge team would call you.

Yes – it is usual 🙂 Reward points: I have followed up vigorously and credited one fine day. Joining benefit: One call to the Magnus concierge did the job.

Who / which department did you follow up for credit of normal reward points. My reward points for May after 4th May are not credited at all. Is anyone else also facing similar issues?

Hi Deepak, This is happening for all.. no reward points credited to me after 7th May.. There may be some sort of system issue and need to wait for few more days

Thanks Raghu. Lets wait and watch!

Q 1: Magnus card has no cash widthdraw charges? Does this count towards 1L transaction for 25k edge reward? Also what are disadvantages of cash widthdraw?

Q2: any one tried with NPS T2 account for completing 1L limit?

Finally my card is approved today. But bank taking long time like 10 working days to approve. Slow process.

Is the above 1lac milestone of 25k edge reward points separate then the routine 12 points per 200?

The website mentions 25,000 EDGE REWARDS Points worth Rs. 5,000 on monthly spends of Rs. 1Lakh – but doesn’t explicitly mentions that this reward is over & above the routine 1.2% rewards.

Can others who have received the milestone rewards of 25K plz confirm the same…

Hi can I use axis Magnus priority pass in domestic lounges, I want to use in 080 bengaluru

No. Not allowed.

Please confirm monthly milestone benefit is based on total spend in one full month or one billing cycle.

Hey can someone please confirm this?

Its calendar month.

I’ve made total transactions north of Rs 50000 on Zomato using Axis grab deals and none of the transaction is recorded. Is there any way I can get it fixed? I’ve added my number and last 4 digits of my card on the portal. TIA.

How do you know that the transaction has not been recorded? Has it already been 120 days?

By the way, I have noticed some people getting confirmation SMS that grabdeal transactions have been tracked. I dont seem to be getting any for my Amazon purchases I made over the last month or so. Customer care is useless and dont even reply.

No I think its been 60-70 days but someone here mentioned that you get a message if a transaction is recorded.

Anyone has any customer care escalation numbers / mail IDs

Been three months and didn’t get the joining voucher or the monthly spend rewards

Were you able to solve for this? Or still waiting?

Anyone here, got the 25K reward points? Was it automatic or needed followup.

Good question. I am too seeking for this?

I don’t have any relation with Axis bank right now. I applied for Magnus card on their website. 30 days have passed and no response. Does it mean Axis bank will give card only to existing customers? Please advise.

Hi Sid, All. Is anyone aware of any limitations of maximum of 6000 edge reward points per transaction on this card? That means transaction limit of ₹1,00,000. I got this card in Mar and made a transaction of more than 120K in Apr, but received only 6K points (instead of 7200). Axis customer service being as useless as ever where front-end support opens a SR saying you should get for entire value but back-end support closes it saying 6000 is the limit without citing any T&C. Yet to receive the 25K bonus.

Vin I did transaction through Magnus of Rs. 1,51,327.50 on 19.04.2022 and I have received 9,027 points on 21.04.2022

I have neither gotten the 25K reward points for last 2 months neither the welcome bonus (Tata Cliq). Customer care was clueless, they asked me to write an email to some “affluent cards” id for Axis. Any one else faced this?

Welcome voucher – Need to ask Concierge to issue the voucher 25K – within 90 days from end of the month, so should start coming in from this month end onwards.

Hi Guys, Need a clarification. Is there any cap on edge reward points for Magnus? In one page it mentions monthly cap of 10k points and on another it says no monthly cap. Tried calling Axis customer care multiple times. They have no idea of grabdeals concept and are absolutely useless. Thank you

Can some.pls help with above query?

Hi I was getting reward points correctly till date but 1 transaction done on 24 April was pending. Finally got points on 27 may. I did send an email to PNO. Has anyone got 25000 till now. I have stopped using the card till some clarity comes in reward point issuing. I got my Tata cliq voucher last week. Can someone explain how it works do we add to cliq app cash from gift voucher section. Can we use in parts.

It seems they’re facing issues as always.

– So yes, I can also see points credited on 27th for the spends done in the past few weeks. – No one got 25K points as far as I know and their deadline has crossed as well.

Will update if I see any progress on the same.

I got 25k points for feb on 27th may , along with points for all tx between 27th april and 27th may… very hard to understand their logic of crediting points for normal transactions

I got 25k points (27th May)for the spend that I made in FEB

Hi Sid, I have received the 25,000 milestone points for February on 24th May.

I have received 25000 points for both Feb and March month in last 7 days

You can add in cliq cash and can be used in parts.

what are the exclusions for calculating monthly milestone for axis magnus credit card.will appreciate clarity on this for avoiding any confusion in this regards.thanks in advance.

i recd today 25000 milestone points against march spends.

Hi all good news got 25000 points on 2 June. “ Milestone Benefit For Magnus Visa Credit Card” 25000 edge rewards. Now will restart using card. Can someon please explain Tata cliq voucher usage in app

Where to check reward point balance?

Hi Sid , If you are aware, could you please help with following queries.

1. On Grabdeal, Axis is running an offer of 20X reward points (Max 20K points) or 10% cashback (Max 3K) from 17th-26th June. Can we avail both by selecting Points for one transaction and Cashback in another transaction?

2. For most of the partners on grabdeal, it has mentioned max cap of 10K points/1K cashback per month for 5x/10x/5%CB/10%CB. It this limit cumulative across all partners in a month or is this per partner? Does this 10K includes even the regular 1X reward points?

3. It’s not showing either cashback or points for amazon gift vouchers purchase on gyftr. Is it stopped now?

Anyone received the April month’s milestone benefit yet?

I am still waiting for March

Yes received. For those not receiving the points regularly despite spending said amount… please write an email to the ceo

Anyone received 25k milestone points of June month?

Not yet. Seems that one is bit delayed.

Received 25k milestone points today of June.

I don’t see the option to transfer the points to ITC club, is it removed?

Purchases made on GYftr / GiftEdge portal (like amazon gift card/ Croma Gift Card or Swiggy money ) will be counted for the milestone benefit?

Received 25k milestone points today of July month.

Why only Kalyan jeweler being given benefits. Is it safe to buy Kalyan jeweler in terms of purity?

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Don't subscribe All new comments Replies to my comments Notify me of followup comments via e-mail. You can also subscribe without commenting.

About Contact Contribute

Terms of Use

Terms of Use Privacy Policy Advertising Policy

Subscribe to Emails

Love Credit Card Rewards? Then you would love the email newsletters too!

Axis Bank Magnus Credit Card Review (2023)

January 7, 2023 by Ajay 50 Comments

Axis Bank launched a slew of upgrades to its credit card portfolio, and one of the best additions to the portfolio from that list was the Magnus Credit Card , which was launched in 2019 . Unfortunately for the bank, just like many of their peers, they could not cash out on the potential of this launch with Covid hitting us in 2020, and the world saw a shutdown.

However, as Covid-19 ebbed, Axis Bank renewed its focus on this credit card and made it even sharper to appeal to the affluent/HNI category. I signed up for the card last year, and in this post, I wanted to shed some light on the finer details of the card and my experience with it.

One of the first things to note about the card is the metallic form factor, which is more akin to the Amex Platinum than the other metallic cards in India. The card feels solid in your hand and is a conversation starter. Also, no risk of the digits erasing over time since they are etched on the metal. The card used to be issued on the MasterCard platform but is now issued as a Visa Infinite Credit Card.

Axis Bank Magnus Credit Card Overview

Axis Bank’s Magnus Credit Card targets affluent/HNI customers. The card was curated to offer lifestyle benefits across travel, dining, movies and wellness to those who sign up for it. In 2022, Axis Bank added a new kicker to the card, offering 25,000 bonus EDGE Rewards points to those who spent INR 100K (INR 1 Lakh) on their card in a calendar month. Then, they added transfer partners as well. The overall combination made it one of the best cards for putting your spending on in India.

Axis Bank Magnus Credit Card Eligibility and Application

The Axis Bank Magnus Credit Card can be applied online /offline. Eligibility for the card is at an annual income level of INR 18 Lakh, both for salaried and self-employed folks. You can also apply for it on a card-to-card basis, providing another credit card statement where the minimum approved limit on your card is INR 5 Lakhs. The card is available to customers already holding a Banking Relationship with Axis Bank and those new to the Bank. To get started on your application, Apply Here .

On completion of INR 15 Lakhs spending during a membership year, the fee is waived for the following membership year.

Axis Bank Magnus Credit Card Joining and Annual Benefits

The Axis Bank Magnus Credit Card comes at a joining/renewal fee of INR 10,000 + GST (net INR 11,860). In exchange, the Bank provides the option between one complimentary domestic flight ticket with a value of up to INR 10,000 (including taxes) or a TataCLIQ voucher worth INR 10,000. The link to redeem is sent to you after your first transaction is registered on the card in every membership year cycle. You can claim your benefit up to 6 months after you receive the text message.

The TataCLIQ voucher converts into TataCLIQ cash, is valid for one year and sits in your account after you add it there. For your free ticket, you get one for Economy or Premium Economy, and you need to make the booking on Yatra.com. The ticket can be any amount, but the balance must be charged to your card for tickets more than INR 10,000.

Axis Bank Magnus Credit Card points earning

Magnus provides 12 EDGE Rewards/INR 200 spent on the card. Like everything else on Axis Bank Credit Cards, the spends are rounded down to the nearest INR 200, and you will be credited reward points for that. For instance, if you spend INR 1448, the points credited will be 84 EDGE Rewards. These points are usually credited as soon as the transaction settles or within a day or two. You can check the number of points earned using your customer ID with the bank here .

However, if you make INR 1,00,000 spend in a calendar month, Axis Bank also provides you with 25,000 bonus points (EDGE Rewards), which are credited to your account usually within 90 days of the closure of the month for which the spend was achieved. For instance, I made the first whole month of spending in October 2022, and the points arrived like clockwork in January 2023. Points for November 2022 also were credited in February 2023.

The 25,000 points monthly bonus is not a promotion but a full benefit of the card. The only spends that do not count for this benefit are wallet loads, and in the coming days, rent paid via credit card will also not count . Many people have an issue with the 90 days timeline. However, the bank is within its right to dictate the timelines for such a generous benefit. They might want to account for fraudulent practitioners doing all kinds of stuff to generate spending.

Apart from this, Axis Bank has a few other kickers in store as well where you can earn bonus points on your Magnus Credit Card :

- When you book travel from the Axis Bank TravelEDGE portal, you get 5X points for your travel spends. The base points post as the transaction settles, and the 4X Bonus points also get in quickly (it does not take 90 days).

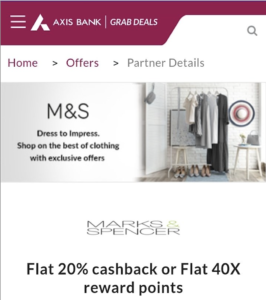

- You can also buy using the GrabDeals website, a white-labelled website offering all the deals and discounts on online purchases from Axis Bank. The bonus points earned from GrabDeals are limited to 10,000 per month. One of the sub-sections of this website offers vouchers as well from a different vendor called WooHoo. GrabDeals has some fantastic deals going on at times. For example, at the end of January 2023, they had 40X EDGE Rewards on offer for Marks & Spencers.

Remember, EDGE Rewards expire three years after accrual if not redeemed or transferred out.

Axis Bank Magnus Credit Card points burning

You can use your Axis Bank Magnus Credit Card EDGE Rewards towards many different use cases. The most basic one, offered for a long time, was to use them at a value of INR 0.20 per EDGE Rewards point. But I also mentioned that Axis Bank added transfer partners recently, and here is a list of the 19 transfer partners along with the transfer ratios:

- AirAsia Rewards: 5 EDGE Rewards transfer to 4 AirAsia Rewards

- Club Vistara : 5 EDGE Rewards transfer to 4 Club Vistara Points

- Etihad Guest: 5 EDGE Rewards transfer to 4 Etihad Guest Miles

- SpiceClub: 5 EDGE Rewards transfer to 4 SpiceClub Points

- Ethiopian Airlines ShebaMiles : 5 EDGE Rewards transfer to 4 ShebaMiles

- Singapore Airlines KrisFlyer: 5 EDGE Rewards transfer to 4 KrisFlyer Miles

- United Mileage Plus: 5 EDGE Rewards transfer to 4 MileagePlus Miles

- Turkish Airlines Miles & Smiles: 5 EDGE Rewards transfer to 4 Miles & Smiles Miles

- Air Canada’s Aeroplan: 5 EDGE Rewards transfer to 4 Miles

- Thai Airways Royal Orchid Plus: 5 EDGE Rewards transfer to 4 Miles

- Qatar Airways: 5 EDGE Rewards transfer to 4 Avios

- Japan Airlines JAL Mileage Bank: 5 EDGE Rewards transfer to 4 Miles

- Qantas Frequent Flyer: 5 EDGE Rewards transfer to 4 Miles

- AirFrance KLM Flying Blue: 5 EDGE Rewards transfer to 4 FlyingBlue Miles

- IHG One Rewards : 5 EDGE Rewards transfer to 4 IHG One Rewards

- Club ITC: 5 EDGE Rewards transfer to 4 ClubITC points

- Marriott Bonvoy : 5 EDGE Rewards transfer to 4 Marriott Bonvoy Points

- Accor ALL: 5 EDGE Rewards transfer to 4 ALL Points

- Wyndham Rewards: 5 EDGE Rewards transfer to 4 Wyndham Rewards Points

As you can see, Axis Bank has covered all alliances, domestic carriers and international hotel chains with a pretty lucrative transfer ratio, which makes it possible for Magnus to keep happy those who like to use miles and points to make their life comfortable as well. 5 of these programmes have an instant transfer. At the same time, the rest could take up to 10 working days for transfer.

Axis Bank Magnus Credit Card Travel Benefits

While the Axis Bank Magnus Credit Card intends to have you spend across the board, the niche it really specialises in is Travel. The Bank provides the primary and add-on card holders with unlimited lounge access on swiping the card across India. Not just that, the card comes with an unlimited-use Priority Pass in the box, which you can use for lounge access outside of India. On this Priority Pass, you also get free visits for eight guests in a membership year. This means you can have a +1 join you at the lounge eight times a year or have eight friends join you once a year.

Apart from these two benefits, Axis Bank also offers eight complimentary meet-and-greet services across Indian airports in a calendar year. You can use this Meet and Greet Service for Arrival or Departure at 29 Indian airports. The service needs to be booked at least 48 hours before departure online. You can also bring co-passengers, although you need to declare it upfront, and it gets deducted from your quota of 8 services per annum.

Delhi Meet-and-Greet by Encalm Hospitality

I recommend that you book the Meet and Greet a day or two before the final closure of the timeline because placing your request too far also means it goes very low on the priority of Aspire Lifestyle. These folks run the concierge service for Axis Bank. They confirm the service usually on the day of travel or, at best, one day prior. In a recent case, when I was flying out from Delhi Airport in December 2022 , I’d placed a request about 15 days earlier, and I did not get a message confirming the service until 5 hours before departure. At this point, I had to call them, and they missed the request, though they did not admit to it.

Other lifestyle benefits offered by Magnus

Some other benefits offered on the Magnus Credit Card are in the entertainment and wellness category. In partnership with Bookmyshow, Magnus cardmembers are offered 5 Buy-One-Get-One-Free tickets every month on their card for both movies and non-movies categories, up to a limit of INR 500 for the free ticket. Axis Bank also tied up with EazyDiner , where you can get up to 40% discount on your meals twice a month and up to 3000 off once a year on your meals.

Fuel pump spends are not granted reward points on the Magnus. However, they are instead given a 1% rebate on the fuel surcharge. They still count for the milestone spending monthly and annually as well. Further, Insurance spends are capped at INR 100K for granting points for now per transaction. Rent transactions have been excluded from milestone coverage effective March 5, 2023 . Forex Charges are at 2%+GST, which is lower than some of the other players in the market.

Overall, the Axis Bank Magnus Credit Card , with its very lucrative rewards structure, is an excellent card for those who routinely spend over INR 100,000 in a billing cycle. The card comes with INR 10,000 worth of annual vouchers, which recoup the cost of the card every year. In addition, you get 12 EDGE Rewards/INR 200 spent, apart from the potential of earning 300K Bonus points just by spending INR 12 Lakhs on the card in a year (INR 100K per month gets you 25K Bonus points). Add that up with the handsome list of transfer partners, and you have a card grabbing all the right eyeballs these days. You also get an unlimited use Priority Pass, domestic lounge trips and meet and greet services.

Do you already hold the Axis Bank Magnus Credit Card? What has been your experience with the card?

Apply Here for the Axis Bank Magnus Credit Card

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction. )

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

+ 25K Bonus Points per month on minimum spend + Unlimited Lounge Access + Metal Form Factor + Meet and Greet Services

- Tracking GrabDeals might be a problem sometimes

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on X (Opens in new window)

More from Live from a Lounge

Ajay Awtaney is the Founder and Editor of Live From A Lounge (LFAL), a pioneering digital platform renowned for publishing news and views about aviation, hotels, passenger experience, loyalty programs, travel trends and frequent travel tips for the Global Indian. He is considered the Indian authority on business travel, luxury travel, frequent flyer miles, loyalty credit cards and travel for Indians around the globe. Ajay is a frequent contributor and commentator on the media as well, including ET Now, BBC, CNBC TV18, NDTV, Conde Nast Traveller and many other outlets.

More articles by Ajay »