Winter is here! Check out the winter wonderlands at these 5 amazing winter destinations in Montana

- Plan Your Trip

- Safety & Insurance

What Is Excess In Travel Insurance

Published: December 18, 2023

Modified: December 28, 2023

by Kalie Scofield

- Sustainability

Introduction

Travel insurance is a crucial aspect of trip planning, offering financial protection and peace of mind in the face of unexpected events. However, understanding the various components of travel insurance, such as excess, is essential for making informed decisions when purchasing a policy. In this comprehensive guide, we will delve into the concept of excess in travel insurance, exploring its significance, functionality, and implications for travelers.

Excess, often referred to as a deductible in other insurance contexts, is a fundamental feature of travel insurance policies. It represents the portion of a claim that the policyholder is responsible for covering out of pocket. While the concept of excess may seem straightforward, its nuances and impact on insurance coverage merit a closer examination.

By gaining a deeper understanding of excess in travel insurance, travelers can navigate the intricacies of policy terms and conditions with confidence, ensuring that they select a plan that aligns with their unique needs and preferences. Throughout this article, we will unravel the intricacies of excess, shedding light on its mechanics, advantages, and potential drawbacks. Additionally, we will provide practical tips for effectively managing excess within the context of travel insurance, empowering travelers to make informed and strategic decisions when safeguarding their journeys.

Join us on this insightful journey as we demystify the concept of excess in travel insurance, equipping you with the knowledge and insights needed to optimize your insurance coverage and embark on your travels with confidence.

Understanding Excess in Travel Insurance

Excess in travel insurance represents the amount of money that a policyholder must contribute towards a claim before the insurance coverage comes into effect. It serves as a form of self-insurance, requiring travelers to share a portion of the financial risk with the insurer. When purchasing a travel insurance policy, individuals can typically choose the level of excess they are comfortable with, balancing higher excess amounts against lower premiums.

It is important to note that excess applies to each separate claim made, meaning that if multiple claims arise from a single incident, the excess will be applicable to each claim. Understanding the implications of excess is essential for travelers, as it directly influences the out-of-pocket expenses they may incur when seeking coverage for unforeseen events during their trips.

Moreover, excess can vary based on the type of claim. For instance, some policies may have different excess amounts for medical expenses, trip cancellations, or baggage loss. This nuanced approach underscores the importance of carefully reviewing policy details to ascertain the specific excess conditions for different claim categories.

By comprehending the role of excess in travel insurance, individuals can make informed decisions when comparing policy options and assessing their risk tolerance. While a higher excess may result in lower premium costs, it also entails a greater financial responsibility in the event of a claim. Conversely, a lower excess may lead to higher premiums but can offer more comprehensive coverage with reduced out-of-pocket expenses at the time of a claim.

As we delve deeper into the mechanics of excess in travel insurance, we will explore how this component interacts with various aspects of insurance coverage, shedding light on its implications for travelers seeking to protect their journeys and mitigate financial risks.

How Excess Works

Understanding how excess works in the context of travel insurance is essential for travelers aiming to grasp the practical implications of this component. When a covered event occurs during a trip, such as medical treatment abroad or the need to cancel travel plans due to unforeseen circumstances, the policyholder is required to pay the excess amount before the insurance coverage takes effect.

For instance, if a travel insurance policy has an excess of $200 and the traveler incurs medical expenses totaling $1,500, the policyholder would be responsible for paying the first $200, with the insurer covering the remaining $1,300. It is important to note that the excess is deducted from the total claim amount, and the insurance coverage applies to the remaining costs, up to the policy’s specified limits and coverage terms.

It is crucial for travelers to be mindful of the excess amount specified in their insurance policies, as this factor directly impacts the financial responsibility they assume when making a claim. By carefully evaluating their risk exposure and financial capabilities, individuals can select an excess level that aligns with their preferences and budget, striking a balance between upfront costs and potential claim expenses.

Furthermore, the application of excess may vary based on the nature of the claim. Different types of incidents, such as trip cancellations, medical emergencies, or baggage loss, may have distinct excess amounts outlined in the policy. This nuanced approach underscores the importance of reviewing policy details to gain clarity on the specific excess conditions for various claim categories.

As we unravel the intricacies of how excess operates within travel insurance, we will delve into real-world scenarios and practical examples to illustrate its impact on travelers and the dynamics of insurance claims. By gaining a comprehensive understanding of how excess functions, individuals can navigate the complexities of travel insurance with confidence, ensuring that they are well-prepared to manage potential claim situations during their journeys.

Pros and Cons of Excess in Travel Insurance

Excess in travel insurance presents both advantages and considerations that travelers should carefully weigh when evaluating insurance policies. By examining the pros and cons of excess, individuals can make informed decisions that align with their unique needs and risk tolerance.

- Lower Premiums: Opting for a travel insurance policy with a higher excess can lead to reduced premium costs, making comprehensive coverage more affordable for travelers, especially those on a budget.

- Customized Coverage: The ability to choose the excess amount allows travelers to tailor their insurance policies to suit their financial preferences and risk tolerance, providing a sense of control over their coverage.

- Financial Flexibility: Incurring a higher excess in the event of a claim may be manageable for individuals with sufficient emergency funds or those willing to absorb a larger portion of the financial risk in exchange for lower ongoing insurance expenses.

- Upfront Costs: A higher excess requires travelers to allocate more funds upfront in the event of a claim, potentially impacting their immediate cash flow during an already stressful situation.

- Risk Exposure: While lower premiums may be appealing, a higher excess places a greater financial burden on the policyholder in the event of a claim, necessitating careful consideration of one’s ability to cover the excess amount when needed.

- Claim Limitations: Depending on the excess amount selected, travelers may find that certain smaller claims fall below the excess threshold, rendering them ineligible for coverage, which could impact the overall value of the insurance policy.

By weighing these factors, travelers can assess the trade-offs associated with excess in travel insurance and make informed choices that align with their financial circumstances and risk management preferences. Understanding the pros and cons of excess empowers individuals to select insurance policies that strike a balance between cost-effectiveness and comprehensive coverage, ensuring that they are adequately protected during their travels.

Tips for Managing Excess in Travel Insurance

Effectively managing excess in travel insurance is essential for travelers seeking to optimize their coverage while balancing financial considerations. By implementing strategic approaches to navigate the nuances of excess, individuals can make informed decisions and mitigate potential financial risks during their journeys.

Tip 1: Evaluate Your Risk Tolerance

Assess your comfort level with assuming financial responsibility in the event of a claim. Consider your ability to cover the excess amount and strike a balance between upfront costs and potential claim expenses based on your risk tolerance and financial circumstances.

Tip 2: Compare Excess Options

When exploring travel insurance policies, compare the excess amounts offered by different providers. Evaluate how varying excess levels impact premium costs and coverage terms to identify a balance that aligns with your preferences and budget.

Tip 3: Consider Your Travel Plans

Take into account the nature of your trip and potential risks associated with your destination. Assess the likelihood of needing to make a claim and tailor the excess amount based on the specific travel scenarios you anticipate.

Tip 4: Review Policy Inclusions

Thoroughly review the policy’s coverage inclusions and exclusions to understand how excess applies to different types of claims. Ensure that the excess amounts align with the potential expenses you may encounter during your travels.

Tip 5: Build an Emergency Fund

Consider setting aside an emergency fund to cover the excess amount in the event of a claim. Having a financial safety net can provide peace of mind and ensure that you are prepared to manage unexpected expenses without undue stress.

Tip 6: Seek Professional Advice

If you are uncertain about the appropriate excess level for your travel insurance, consider consulting with insurance professionals or financial advisors. Their expertise can help you navigate the decision-making process and select a policy that meets your needs.

By implementing these tips, travelers can proactively manage excess in their travel insurance, optimizing their coverage while aligning with their financial capabilities and risk management preferences. Strategic decision-making and thoughtful planning empower individuals to embark on their journeys with confidence, knowing that they are well-prepared to handle unexpected events while safeguarding their financial well-being.

As we conclude our exploration of excess in travel insurance, it becomes evident that this component plays a significant role in shaping the financial dynamics of insurance coverage for travelers. By understanding the intricacies of excess and its implications, individuals can make informed decisions when selecting travel insurance policies, ensuring that they strike a balance between cost-effectiveness and comprehensive protection.

Excess empowers travelers to customize their insurance coverage based on their risk tolerance and financial circumstances. The ability to choose an excess level that aligns with one’s preferences provides a sense of control and flexibility, allowing individuals to manage potential claim situations with confidence.

However, it is crucial for travelers to carefully evaluate the pros and cons of excess, weighing the trade-offs associated with higher or lower excess amounts. By doing so, individuals can align their insurance policies with their unique needs, travel plans, and budgetary considerations, optimizing their coverage while effectively managing financial risks.

Ultimately, the strategic management of excess in travel insurance involves thoughtful planning, thorough policy review, and an awareness of one’s risk exposure. By implementing the tips provided in this guide and seeking professional advice when needed, travelers can navigate the complexities of excess with confidence, ensuring that they are well-prepared to safeguard their journeys and financial well-being.

As you embark on your future travels, may this comprehensive understanding of excess in travel insurance serve as a valuable resource, empowering you to make informed decisions and embark on your journeys with peace of mind and financial security.

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

Direct Line Travel Insurance Review

Everything you need to know before you buy travel insurance from Direct Line!

The experts say:

If you're looking for a no-nonsense travel insurance option, Direct Line's Single Trip policy is an obvious choice. With a Which? ranking of 17 out of 71 providers and a Policy score of 76%, it stands out as one of the top picks on the market. Its Covid Cover rating is Complete, meaning it covers 10000000 in medical expenses and also includes baggage cover up to 1500 and cancellation cover up to 5000 as standard. Plus, with just an excess payble of 75 on medical claims, you can rest assured that there won't be any nasty surprises. And with their Fairer Finance Rating of 4 stars, you can trust that Direct Line is the way to go!

What Direct Line customers are saying right now:

- 😃Efficient dealing with customers, timely and helpful.

- 😇Waived fees and gave refunds without any trouble.

- 🤩Faultless dealings with repair garages and courtesy cars.

- 😊Threats of increase in policy price or cancellation of policy avoided.

- 👍Highly customer orientated business.

- 😡 Awful customer service, long wait times and no response to complaints.

- 😠 Refusing to pay claims and pressuring customers to drop them.

- 🤬 Obstructive in helping pensioners, moving the goalposts and making threats of increasing policy prices or cancelling them.

Direct Line customer reviews summary

Direct Line travel insurance has been receiving mixed reviews, with some people praising their customer service and others finding them to be unhelpful. Many customers have found the company to be slow in responding to queries, while others have noted that they were quick to make refunds after cancelling policies. Prices appear to be rather steep and some people have faced obstacles when attempting to claim. On the whole, Direct Line travel insurance scores a 6/10 for its customer service and promptness in dealing with enquiries, though the cost of premiums may put some off.

AllClear Travel Insurance Review

Everything you need to know before you buy travel insurance from AllClear!

Co-op Insurance Services Travel Insurance Review

Everything you need to know before you buy travel insurance from Co-op Insurance Services!

Covered2Go Travel Insurance Review

Everything you need to know before you buy travel insurance from Covered2Go!

Reviewed: 100+ UK travel insurance providers

- Privacy Policy

- Car Insurance Reviews

- Pet Insurance Reviews

- Home Insurance Reviews

Copyright © 2023 TravelInsuranceReview.co.uk

Suggested companies

Admiral insurance, hastings direct.

Direct Line Reviews

In the Insurance company category

Visit this website

Company activity See all

Write a review

Reviews 3.9.

21,872 total

Most relevant

Re-newed both cars & home insurance…

Re-newed both cars & home insurance with direct line after many years. Price has increased rather a lot but could have moved to another company for a little less but stayed as we are happy with direct line what is included and more contactable than most other companies. Call out with home insurance came next day.

Date of experience : 16 August 2024

I have multiple policy's with them

I have multiple policy's with them and because of this i get a discount on the very competitive price when it comes to renewing. They are always very helpful when you call. Their product knowledge is great, the call handlers are always friendly and chatty, there's nothing not to like. The only time I made a claim they were extremely efficient, supportive, helpful and quick to get everything sorted out. Very loyal customer!! 👏

The woman was so helpful my 5 stars…

The woman was so helpful my 5 stars rating is a for her the Customer Service she gave me. Not for the price Direct line charges now been with them a long time they put up the prices on house and my car so high I have stopped my car insurance with them. So being a loyal customer means nothing, you are just a number.

I absolutely hate the fact you…

I absolutely hate the fact you increased my proposed premium significantly but as soon as I queried it you immediately discounted it! This happened last year also. As I have 2 cars insured with you I expect better treatment in future otherwise I shall leave next year. Be warned

Date of experience : 15 August 2024

You can always easily contact them …

You can always easily contact them and they answer promptly. They always explain things clearly. Recently renewed car insurance, Managed to reduce quote by about £100 by showing I had visited comparison websites. Shame insurance companies cant give you the lower price in first place.

Date of experience : 31 July 2024

Reply from Direct Line

We appreciate your kind words and are glad to hear you find our customer service helpful and responsive. We strive to provide clear and concise explanations to ensure our customers understand their policies and options. Christy

My car was damaged at a school when the…

My car was damaged at a school when the electric gates closed without warning. DL repaired my car without it affecting my NCB due to a very good addition to the policy called ‘fair claim commitment’ as the accident wasn’t my fault. In a time where insurance companies are taking advantage, DL are excellent and nothing like the rest. 1st class job!!

Date of experience : 13 August 2024

We’re happy to see your amazing comments about your recent claim, Antony. Thanks for sharing.

Trouble free claim.

Not a major accident but still needed to make a claim. The process was so easy with no long complicated forms to fill in, no long phone calls just a short online form. The rest was taken care of by Direct Line and within two weeks both cars involved, mine and the third party’s, were delivered back completely without any fuss. Totally recommended.

Date of experience : 14 July 2024

We're delighted to hear about your positive experience with our claims process. It's great to know that you found it straightforward and efficient. We strive to make the claims process as smooth as possible for our customers.

Fantastic customer service

Fantastic customer service and product knowledge. Explained all the options so I could decide which was best foe me. Thank you

Third party claim experience

I'm not with Direct Line, but my car was hit by someone who is. Their teams have handled everything brilliantly - really quick to take responsibility (called me within 60 mins) and every single person (call centre, auto repairs, etc.) has been super helpful and friendly. They really have made things as easy as possible for me as the third party. I will now be considering switching to DL when my renewal comes up.

Date of experience : 01 August 2024

We appreciate your kind words and are delighted to hear about the positive experience you've had with our team. It's wonderful to know that our commitment to providing excellent customer service has been recognized. We're glad that we were able to make a difficult situation easier for you.

Great customer service

I've always liked dealing with Direct Line. Their telephone service is excellent and their staff always go the extra distance to make sure I'm 100% satisfied with the outcome of any enquiry.

Excellent claim experience

Just made my first claim and service received was excellent throughout. All staff were very helpful and repairs arranged very quickly. Even the hire car was arranged for me. I also had regular progress updates and my repairs were completed quicker than the original estimate. Very pleased

We are thrilled to hear about your positive experience with our claims process. It's wonderful to know that our team was able to provide you with such excellent service and support. We appreciate your kind words about the helpfulness of our staff, the promptness of the repairs, and the convenient arrangement of a hire car. We're also glad to hear that you received regular updates and that your repairs were completed ahead of schedule. We strive to provide our customers with the best possible experience, and your feedback is a testament to our commitment to excellence.

Modern Highway Bandits

I had the misfortune of being hit by a Dutch registered HGV on the M4 last October 2023. Not being at fault my claim was for excess refund and expenses incurred to new insurer for increased premiums having reported the incident as per the law. Case finally closed in my favour as non fault last month, I was refunded £100 excess from a total claim recovery of over £4000. They failed to refund my expenses!! Bandits!!!

Date of experience : 16 October 2023

Tried to increase my premium by 60%…

Tried to increase my premium by 60% over last year when no changes to my situation had occurred. I think this is unjustified and unacceptable as I also have Home Insurance with them and have made no claim on either. I have, however, always found them easy to contact and helpful to deal with..

More respect for customers

I received my renewal notice which was significantly higher than the previous 12 months. I carried out a comparison search the contacted Direct Line with my findings to see if the would match my comparison price. The agent did reduce my premium but not as low as my comparison price. I advised the agent that they were still higher but I would go away and think about it. I phoned again the next day and spoke with a different agent who reduced it even further to within £2.00 of my comparison price. Why can't Direct Line just provide there lowest premium initially to save the so called "valued customer" all this agrovation?

The staff and attention to detail when you make requests, anything is possible you just have to ask, and feel comfortable to be able to ask.

initial price HIKE of thirty percent

initial price HIKE of thirty percent my cost phone call to discuss - 15-20 minutes, too many questions before reaching a HUMAN being impossible to contact Direct Line by email - hopeless

Direct Line & Auger, unprofessional and unsafe.

Direct Line uses Auger as their claim company. Their engineer does not follow health and safety procedures. Avoid at all costs. Engineer on site checking manholes leaving them uncovered, being a potential risk of falling for myself as the property owner and also for members of the contractors team, all video recorded as evidence. Complaint made through Auger that has no effect, no managers assuming responsibilities or liability. The report os not signed by anybody, and bases the facts on "likely to have happened". Totally unprofessional. Since this is the company used by Direct Line to manage claims, I would recommend avoiding both. My case reference - 090351438 (Direct Line ref), Client: Direct Line, Auger ref: 174239.1.UCC - FA

Date of experience : 12 August 2024

I’ve left a link to our website below, where you can raise this as a complaint and find more information about our complaints processes. We have several ways to raise this, including an online complaint form available on the site. Once we’ve received your complaint, one of the team will be in touch to try and resolve this with you. https://www.directline.com/complaints

Ease of renewing insurance policy. My policy price increased which I expected but it wasn’t too drastic so I decided to renew

We're pleased to see we made it easy for you Jackie, thanks for your review and renewing with us. Christy

People on the phone are fine but

People on the phone are fine; they are dealt a poor hand when their bosses keep hiking the prices up by hundreds of pounds. It’s not their fault they can’t justify the price increases imposed from above.

Thanks for taking the time to leave us a review, David. Alex

Totally straight forward and speedily delivered

Totally straight forwards, speedily got a good quote for my house insurance, all done and dusted in minutes

Find out what you really need to know, plus easily compare prices from hundreds of deals, no matter what insurance you need.

Our Top Picks

- Cheap Car Insurance

- Best, Largest Car Insurance Companies

- Cheap Motorcycle Insurance

- Cheap Home Insurance

- Cheap Moped Insurance

- Best Cheap Cruise Insurance

- Best Pet Insurance

- Best Insurance for Bulldogs

- Best Travel Insurance

- Pet Insurance

- Home Insurance

- Travel Insurance

- Car Insurance

- Motorcycle Insurance

- Caravan & Motorhome Insurance

- Campervan Insurance

- Health Insurance

- Van Insurance

Solar Panels

Get solar panels for your home.

- Best Solar Panels

- Solar Panel Installers

- Solar Panels for Home

- Solar Panel Comparison

- Solar Panel Installation

- Solar Panel Battery

The Financial Aspects

- Solar Panel Costs

- Solar Panel Grants

- Solar Panel Quotes

- Solar Panel Tariffs

Business Insurance

Find the best insurance deals for you and discover what you need to know, whatever your business.

Popular Types of Cover

- Public Liability Insurance

- Employers' Liability Insurance

- Professional Indemnity

- Directors and Officers

- Fleet Insurance

- Best Business Insurance Companies

- Guide to Small Business Insurance

- How Much Does Business Insurance Cost?

- Business Loans

By Type of Business

- Limited Company Insurance

- Self Employed Insurance

By Occupation

- Click for insurance by occupation!

Credit Cards

Read reviews and guides to get clarity over credit cards and see which is best for you.

Credit Card Categories

- Credit Builder Cards for Bad Credit

- Rewards Credit Cards

- Travel Credit Cards

- 0% Interest Credit Cards

- No Foreign Transaction Fee Credit Cards

- Balance Transfer Credit Cards

- Cashback Credit Cards

- Credit Cards with No Annual Fee

- Student Credit Cards

Helping you make the most of your money with our in-depth research on the topics that matter to you.

Stay up to date with the latest news that affects you.

Come say hi!

Connect with NimbleFins

- Follow NimbleFins on LinkedIn

The guidance on this site is based on our own analysis and is meant to help you identify options and narrow down your choices. We do not advise or tell you which product to buy; undertake your own due diligence before entering into any agreement. Read our full disclosure here .

What Does Travel Insurance Excess Mean?

Compare Cheap Insurance

Get quick quotes from dozens of insurance companies today.

The excess on a travel insurance policy is not always as straightforward as it seems. For instance, the excess may differ according to the type of claim (e.g., lost baggage vs. delayed baggage ) and you may be required to pay more than one excess in some situations. We'll explain the nuances of a travel insurance excess so you understand how much risk you're taking when you sign up.

- The Excess is Different for Some Claims

- How Many Excesses Will I Pay?

An "excess" on travel insurance is defined as the amount you are responsible for paying toward each travel insurance claim you submit. For example, if the stated policy excess is £100 then you would pay the first £100 in the event of a valid trip cancellation claim and your insurance company would pay the rest, up to the Cancellation limit.

While this example is relatively straightforward, in some situations you may pay more than one excess or the excess may differ from the stated excess.

Paying A Different Excess for Some Types of Claims

Travel insurance policyholders pay a different excess for different types of claims. The stated excess on your policy is the amount you'll typically contribute towards cancellation, baggage and emergency medical claims.

However, for claims where the benefit is determined on a per hour or per day basis (e.g., delayed departure, delayed baggage, hospital benefit, etc.), there is typically no excess payment required. Personal accident, personal liability and legal assistance also usually have no excess. Similarly, if you've purchased a winter sports add on then claims for piste closure and avalanche often have no excess.

Additionally, there may be special situations where the excess is higher or lower than the stated excess. These fine print changes to the excess are sometimes to the benefit of the policyholder, and other times to the detriment. To give you an idea of these exceptions, here are some examples we've come across in the Policy Wording of various plans:

Lower Excess on a Lost Deposit: You may pay a lower excess if you are only claiming for a lost deposit in the event of trip cancellation. For example, Direct Line charges a £10 excess for each insured person claiming for a lost deposit (where they otherwise charge a £50 excess for annual, multi-trip cover and a £75 excess for single trip cover).

Higher Excess on Medical Claims for Volunteer Work: Those insured with Insure & Go or Travelinsurance.co.uk who injure themselves doing volunteer work will have their excess on emergency medical claims increased to £100, even if they've purchased an excess waiver.

Higher Excess on Riskier Activities: Those engaging in riskier activities such as skiing or glacier walking could be subject to a higher medical excess—be sure to check your policy details.

Lower Excess on Medical Claims with GHIC: Most travel insurers will waive the excess on emergency medical claims if you have presented a valid Global Health Insurance Card (GHIC) or any other reciprocal healthcare arrangement to reduce the cost of your treatment while abroad. Terms vary by insurer but if you're travelling to Europe, this is yet another reason to carry your GHIC card with you.

How Many Excesses Will You Pay?

If something goes wrong on your holiday, you might get another bit of not-so-good news—depending on the circumstances, you might need to pay more than one excess when it comes time to claim.

Typically, travel insurance companies will apply the excess in one of two ways: one excess per insured person per incident, or one excess per insured person per incident per each section of the policy you claim under. For policies utilizing the second option (i.e., an excess per person, per incident, per section), you may pay more excesses and therefore receive less back from the insurance company for a valid claim.

For example, the theft of a rucksack containing a jacket, camera and cash would trigger claims under two sections of your policy: Personal Belongings and Baggage (for the bag, jacket and camera) and Personal Money (for the cash). If your policy imposes an excess per section then you'll pay two excesses—one for the Personal Belongings and Baggage claim and another for the Personal Money claim—even though it was just one incident. Assuming a standard excess of £50, here's what you'd pay in excess(es) under the two scenarios:

For another example of paying multiple excesses, take a family of four whose trip is cancelled due to unexpected emergency. As most policies apply an excess per person for cancellation, there would be four excesses applied—a family of four whose standard excess is £50 would therefore be required to pay the first £200 (4 x £50) of the cancellation claim.

By understanding how the excess works, you'll be better prepared to check the accuracy of insurance payouts should you ever need to claim.

Lower Excess on Premium Travel Insurance

Many travel insurance companies offer a range of plans, from budget to premium. You'll find that in many cases the premium plans have a lower excess, or no excess at all. When there is no excess, then the insurance company will compensate you for a valid claim up to the limit, without you having to contribute anything.

Those who don't want to pay an excess in the event of a claim might prefer the simplicity of a premium plan, despite the higher premium. Premium plans will typically sport higher limits and better features as well, all else equal.

What is an Excess Waiver on Travel Insurance?

By paying an extra premium, some plans include an excess waiver which will remove the excess from your policy. That means you won't need to pay an excess should you need to claim. An excess waiver can be handy for someone who wants a policy with no excess, but who doesn't want to pay up for a premium travel insurance plan.

Whether or not the excess waiver is worth it depends on the size of the extra premium required. Compare the extra premium to the size of the excess to help you decide—for instance, if an excess waiver costs almost as much as the excess to be waived, it may not be worth it, especially if you're a single traveller who won't get caught out on multiple, per-person excesses.

Changing the Excess to Increase or Decrease the Premium

Some travel insurance providers give you an option to choose your excess. When this option is available, choosing a higher excess should lower your premium. This is because a higher excess means you are taking on more risk, and the insurance company consequently has less risk exposure. Before going down that route, however, be sure you'd be comfortable paying the higher excess (per person, per incident, and possibly per section you claim under) and consider the amount you're saving in premium.

In contrast, some people prefer to choose a lower excess so they are better covered by the insurance company in the event of a claim—whether or not a lower excess is worth the inevitable higher premium is also a personal decision.

Final Thoughts

It's also worth noting that the excess on a travel insurance plan might be higher when purchased from a comparison site than direct from the insurer's website—a higher excess is one of the ways a comparison site is able to offer lower prices. Also, you might find a slightly lower excess on annual policies

Most travellers don't think much about how travel insurance works , until they claim. By understanding the nuances of a travel insurance excess you can better choose a travel insurance plan suited to your risk profile. Plus you'll be better prepared to understand the reimbursements in the event of a claim.

'No excess' travel insurance means you won't pay an excess if you need to claim (i.e., you won't be out of pocket, so long as your claim is valid and within the policy limits). Opting for a no excess travel insurance policy is typically more expensive so be sure to compare prices as a 'no excess' policy might not be worth the additional upfront cost. And read the fine print as there still may be an excess applied to certain claims.

An excess waiver on travel insurance is when you pay an upfront fee to waive the excess on a policy—essentially it means paying a fee or higher premium to get a 'zero excess' policy. With a zero excess policy, you aren't out of pocket if you need to claim. However there can be exceptions, that is circumstances in which you still need to pay an excess—so be sure to read the fine print. For example, the excess may still be payable on a medical screening.

- 4.8 out of 5 stars**

- Quotes from 20 providers

Our Top Insurance Picks

- Cheap Travel Insurance

Cheap Travel Insurance by Destination

- Travel Insurance to Australia

- Travel Insurance to Ireland

- Travel Insurance to Canada

- Travel Insurance to Turkey

- Travel Insurance to India

Articles on Travel Insurance Costs

- Average Cost of Travel Insurance

- Average Cost of Travel Insurance to USA

- Cost of Travel Insurance with Pre-Existing Medical Conditions

- Average Cost of Travel Insurance to India

- Average Cost of Travel Insurance to Ireland

Recent Articles on Travel Insurance

- Travel Insurance with Optional Gadget Cover

- Top Tips for Travel Insurance with Medical Conditions

- Can Travel Insurance Help if Natural Disaster Strikes?

- Should You Buy Travel Insurance from a Comparison Site?

- Should You Buy Single-Trip or Annual Multi-Trip Travel Insurance?

Travel Insurance Guides

- Do I Need Travel Insurance? 3 Key Questions

- Will Your Travel Insurance Claim be Rejected? Boost Your Odds with These Tips

- 7 Things Your Travel Insurance May Not Cover

- Travel Insurance Guide

Travel Insurance Reviews

- AA Travel Insurance Review

- Admiral Travel Insurance Review

- Aviva Travel Insurance Review

- AXA Travel Insurance Review

- Cedar Tree Travel Insurance Review

- CoverForYou Travel Insurance Review

- Coverwise Travel Insurance Review

- Debenhams Travel Insurance Review

- Direct Line Travel Insurance Review

- Holidaysafe Travel Insurance Review

- Insure & Go Travel Insurance Review

- Sainsbury's Bank Travel Insurance Review

- Tesco Travel Insurance Review

- Travelinsurance.co.uk Travel Insurance Review

- Zurich Travel Insurance Review

Reviews of Travel Insurance for Pre-Existing Conditions

- Fit2Travel Travel Insurance Review

- Free Spirit Travel Insurance Review

- goodtogoinsurance.com Review

- JustTravelcover.com Insurance Review

- OK To Travel Insurance Review

- Saga Travel Insurance Review

- Virgin Money Travel Insurance Review

- Privacy Policy

- Terms & Conditions

- Editorial Guidelines

- How This Site Works

- Cookie Policy

- Copyright © 2024 NimbleFins

Advertiser Disclosure : NimbleFins is authorised and regulated by the Financial Conduct Authority (FCA), FCA FRN 797621. NimbleFins is a research and data-driven personal finance site. Reviews that appear on this site are based on our own analysis and opinion, with a focus on product features and prices, not service. Some offers that appear on this website are from companies from which NimbleFins receives compensation. This compensation may impact how and where offers appear on this site (for example, the order in which they appear). For more information please see our Advertiser Disclosure . The site may not review or include all companies or all available products. While we use our best endeavours to be comprehensive and up to date with product info, prices and terms may change after we publish, so always check details with the provider. Consumers should ensure they undertake their own due diligence before entering into any agreement.

Note regarding savings figures: *For information on the latest saving figures, pay-less-than figures, and pay-from figures used for promotional purposes, please click here .

**4.8 out of 5 stars on Reviews.co.uk is the rating for our insurance comparison partner, QuoteZone.

Direct Line Travel Insurance: Your Key to Secure and Seamless Journeys

Direct Line Travel Insurance is a trusted name in the industry, renowned for its commitment to providing comprehensive coverage and exceptional customer service. With a history of reliability, Direct Line has become a go-to choice for travellers seeking peace of mind during their journeys.

Table of Contents

Read also: https://traveltouk.site/exploring-the-wonders-of-mountain-view-park/

Read more: Xcover Travel Insurance: Your Ultimate Safety Net

Importance of Travel Insurance

Travel insurance is not just an optional expense; it’s a safeguard against unexpected events that can turn a dream vacation into a nightmare. From medical emergencies to trip cancellations, having the right insurance ensures you’re protected financially and can focus on enjoying your travels.

1. Features of Direct Line Travel Insurance:

Coverage options:.

Medical Expenses

Direct Line covers a spectrum of medical expenses, including hospitalization, emergency medical evacuation, and outpatient care. This ensures you receive necessary healthcare without worrying about excessive costs.

Trip Cancellation

Life is unpredictable, and so are travel plans. Direct Line’s trip cancellation coverage reimburses non-refundable expenses if you need to cancel your trip due to unforeseen events such as illness, injury, or family emergencies.

Lost or Stolen Belongings

Protect your belongings with Direct Line’s coverage for lost or stolen items. This includes valuable items such as passports, electronics, and luggage, providing reimbursement for the inconvenience caused.

Emergency Assistance

Direct Line goes beyond insurance by offering 24/7 emergency assistance. Whether you need medical advice, travel assistance, or emergency evacuation, their dedicated support team is just a call away.

Policy Customization:

Tailoring Coverage to Specific Travel Needs

Every traveller is unique, and so are their needs. Direct Line allows you to customize your coverage, ensuring you pay for what matters most to you, whether it’s adventure sports coverage or additional protection for valuable items.

Add-Ons and Extras:

Enhance your protection with optional add-ons and extras. These may include coverage for pre-existing medical conditions, rental car protection, or even coverage for activities like scuba diving. Direct Line’s flexibility caters to the diverse needs of travellers.

2. Benefits of Choosing Direct Line:

Reputation and reliability.

Direct Line has earned its reputation through years of providing reliable and trustworthy services. Their commitment to transparency and fair dealings has made them a trusted choice for countless travellers.

Customer Reviews and Testimonials

Real experiences speak louder than promises. Positive customer reviews highlight Direct Line’s efficiency in handling claims, prompt customer support, and overall satisfaction. Hearing from other travellers can instil confidence in your choice.

Awards and Recognition

Direct Line’s excellence hasn’t gone unnoticed. Multiple awards and industry recognition underscore their commitment to delivering top-notch travel insurance services. Recognition can serve as a testament to the company’s dedication to quality.

3. How to Purchase Direct Line Travel Insurance:

Online purchase process.

Direct Line’s online platform simplifies the purchase process. The user-friendly interface allows you to input your travel details, customize your coverage, and receive a quote promptly. The straightforward process ensures you get the protection you need without unnecessary hassle.

Customer Support and Assistance

For those who prefer a more hands-on approach, Direct Line’s customer support is readily available. Whether you need clarification on coverage details or assistance with the application, their knowledgeable support team is just a phone call away.

4. Comparison with Other Travel Insurance Providers:

Highlighting unique selling points.

Direct Line stands out in the crowded travel insurance market. Unique selling points include their transparent pricing, customer-centric approach, and the ability to tailor coverage. Understanding these distinctions helps you make an informed decision.

Price Comparison

While price shouldn’t be the sole factor in choosing insurance, it’s a crucial consideration. Direct Line’s competitive pricing, coupled with its comprehensive coverage, positions it as a valuable choice for budget-conscious travellers.

Customer Satisfaction Ratings

Explore customer satisfaction ratings to gauge the overall experience of travellers with Direct Line. High satisfaction ratings indicate not just affordability but also the reliability and effectiveness of their services.

5. Tips for Making a Claim:

Step-by-step guide.

Filing a claim can be intimidating, but Direct Line provides a step-by-step guide to simplify the process. From documenting the incident to submitting necessary forms, the guide ensures you navigate the claims process with ease.

Document Requirements

Understanding what documents are required when making a claim is essential. Direct Line provides clarity on the necessary paperwork, ensuring you’re well-prepared and speeding up the claims approval process.

Customer Support during the Claim Process

Direct Line’s commitment to customer support extends to the claims process. Their dedicated team is there to assist you throughout, providing updates and guidance to alleviate any concerns during a stressful time.

6. Travel Insurance Industry Trends:

Overview of trends in travel insurance.

Stay informed about the latest trends in travel insurance. From evolving coverage options to advancements in digital services, Direct Line adapts to industry changes to offer cutting-edge solutions.

Direct Line’s Response to Industry Changes

Direct Line doesn’t just follow trends; it sets them. Discover how the company responds to industry changes, implementing innovations to stay ahead and provide enhanced services to its customers.

Clearing Up Misconceptions

Are there any hidden fees not mentioned in the pricing breakdown?

Direct Line is committed to transparency, and there are no hidden fees. All costs are clearly outlined.

Is travel insurance only for international trips?

No, Direct Line provides coverage for both domestic and international trips, ensuring comprehensive protection.

Is Direct Line Travel Insurance only for international trips?

Can I customize my coverage based on my specific travel requirements?

Yes, Direct Line provides flexibility, allowing you to tailor your coverage to match your unique circumstances.

What types of medical expenses are covered by Direct Line Travel Insurance?

Direct Line covers a range of medical expenses, including hospitalization, emergency medical evacuation, and outpatient care.

How does Direct Line handle trip cancellations?

Direct Line’s trip cancellation coverage reimburses non-refundable expenses in case of unforeseen events such as illness, injury, or family emergencies.

What belongings are covered in case of loss or theft?

Direct Line’s coverage extends to lost or stolen items, including valuable items such as passports, electronics, and luggage.

How does Direct Line provide emergency assistance during travels?

Direct Line offers 24/7 emergency assistance, providing support for medical emergencies, travel assistance, and emergency evacuations.

Can I add coverage for specific activities, such as adventure sports?

Yes, Direct Line allows you to customize your coverage, including options for specific activities like adventure sports.

Is travel insurance necessary for short domestic trips?

Direct Line offers plans for various travel needs, including short domestic trips, ensuring comprehensive protection.

How quickly can I expect a response when filing a claim?

Direct Line aims for a swift and efficient claims process, with many customers reporting timely resolutions.

What additional services or add-ons does Direct Line offer?

Direct Line provides optional add-ons and extras, allowing you to tailor your policy with services like coverage for pre-existing medical conditions or rental car protection.

Can I purchase Direct Line Travel Insurance for a group of travellers?

Yes, Direct Line offers options for group travel insurance, ensuring all members are covered during their journey.

Are there discounts available for frequent travellers?

Direct Line may offer discounts for frequent travellers or specific promotions. Check their website or contact customer support for current offerings.

What sets Direct Line apart from other travel insurance providers?

Direct Line stands out with transparent pricing, a customer-centric approach, and the ability to tailor coverage to individual needs.

Is Direct Line Travel Insurance suitable for business trips?

Yes, Direct Line provides plans suitable for business trips, addressing specific needs such as trip cancellations or emergency medical coverage.

Direct Line Travel Insurance offers a comprehensive and flexible solution for your travel protection needs, backed by a stellar reputation, customer satisfaction, and industry recognition. As you plan your next adventure, consider the security and peace of mind that come with Direct Line Travel Insurance. Choose a partner that understands your unique needs and is committed to ensuring your journeys are memorable for all the right reasons.

For in-depth policy details and to explore coverage options, visit Direct Line’s official website.

Related Posts

Importance of Travel Insurance | Ultimate Guide

STA Travel Insurance: Your Ultimate Protection

What cover do Direct Line travel insurance policies provide?

Direct Line is a relatively young company, having started in 1985 and began what became an online insurance revolution. While the company's travel insurance policies are not focused wholly on the over 50s, they offer a wide range of travel cover. Single trip, annual multi-trip cover and even backpack cover are available to different age groups. But do the policies provide value for money?

Direct Line travel insurance: FAQs

Does direct line travel insurance have additional cover for covid-19.

Yes. Overall, the travel insurance industry has been relatively quick in adapting both policies and premiums to consider Covid-19 and future pandemics. There is a separate section for Covid-19 cover on the Direct Line insurance website.

Do I need to declare any medical conditions?

Yes. If a policyholder fails to declare any medical conditions, this may result in curtailment of cover or the policy being cancelled and cover withdrawn. The vast majority of medical conditions are covered by Direct Line travel insurance , but the company need to be aware of specific conditions.

How much does it cost to insure children?

If children travel with an insured person (an adult), who has a Direct Line travel insurance policy , they will be covered at no extra cost. This relates to children under the age of 18.

How is Direct Line travel insurance protected?

As a financial services provider, Direct Line's and its parent group UK Insurance Limited are regulated by the Financial Conduct Authority and Prudential Regulation Authority.

While the history of some established insurance companies goes back hundreds of years, Direct Line was born in 1985. Originally part of the Royal Bank of Scotland Group, the company was sold off and floated on the stock market as a stand-alone operation. As well as travel insurance , traditional home insurance and car insurance , Direct Line offers insurance for pets, businesses and landlords. Servicing more than 10 million customers, Direct Line insurance is the leading online insurance company. The group now includes an array of other companies such as Churchill Insurance.

There are several factors to consider and a certain degree of flexibility when it comes to Direct Line travel insurance policies . We will now look at the detail you can expect to find in your policy documents, and the level of travel insurance� cover offered.

Whether you're looking for single-trip, multi-trip, or specialist cover, or need assurance about pre-existing medical conditions, our panel of travel insurance providers has you covered. Click on your chosen provider below to get started.

- Some restrictions based on age

Am I eligible for Direct Line travel insurance cover?

Unlike travel insurance companies focused on the over 50s market, like Saga , there are various conditions for Direct Line travel insurance. For example, there are some age restrictions , and the level of insurance cover available varies with different policies.

The standard conditions when applying for Direct Line travel insurance are as follows:

- You must make the company aware of any pre-existing medical conditions

- Cover is only available to permanent residents of the UK

- Your trips must start and end in the UK

- Trips within the UK must be for at least two consecutive nights, pre-booked with commercial accommodation

- Cancellation cover will not be available if you suspect the trip might be cancelled at the time of booking

There are also some age-related conditions when looking to acquire Direct Line travel insurance:

- Those looking to take out an annual multi-trip policy must be under 75 years of age

- You must be less than 54 years of age for the backpack cover

- The single trip cover is reduced from the standard 90 days to 42 days for those aged 60 and above

Consequently, when comparing and contrasting travel insurance for the over 50s , it is crucial to be aware of curtailment on some elements of cover. What might seem good value on the surface may look slightly different on further investigation!

Different types of Direct Line travel insurance

Three main types of travel insurance are available through Direct Line instead of the traditional annual multi-trip and single trip cover. In addition, travellers under 54 can apply for backpack cover when travelling the world. It is also important to note that you can add additional people to your travel insurance policy. Children travelling with an adult are covered as standard. Let's look at the three types of Direct Line travel insurance policies available, what they have to offer, and any restrictions or conditions to be aware of.

Annual multi-trip cover

Direct Line annual multi-trip cover is perfect for frequent travellers. Under this type of insurance policy, you will be afforded annual cover for trips up to 42 days in duration. Unfortunately, yearly multi-trip cover is only available to those under 75 years of age.

Annual multi-trip insurance policies offer comprehensive cover that includes:

In the event of end supplier failure, you will be covered for additional expenses not protected elsewhere in the policy documents. For example, children under 18 will be covered when travelling with an adult insured under a Direct Line travel insurance policy .

It is also essential to be aware of specific exclusions not covered by the standard Direct Line travel insurance policy. Annual multi-trip cover includes:

- Personal belongings (optional extra)

While not standard, you can add personal belongings insurance to your policy to cover your bags and their contents. The maximum payout is £1,500 for valuables lost, stolen or damaged while travelling.

- Winter sports cover (optional extra)

You can take out additional winter sports insurance, which will cover your skiing or snowboarding equipment for theft and damage. You will also be covered for injuries and piste closures.

- One night UK trips

Annual multi-trip insurance only covers UK trips for a minimum of two consecutive nights, pre-booked in commercial accommodation.

- Non-UK residents

Direct Line travel insurance is only available to those permanently resident in the UK.

- One-way trips

This type of travel insurance does not cover one-way trips; they must be return trips, starting and ending in the UK.

- Undeclared pre-existing medical conditions

Only declared pre-existing medical conditions will be covered as part of your travel insurance policy. Any claim made on an undeclared medical condition will be rejected.

Single trip cover

Single trip insurance cover offers standard protection for one-off trips lasting up to 90 days anywhere in the world. If you're over 60, the duration of your trip is reduced to 42 days anywhere in the world.

The level of cover provided by a Direct Line single trip insurance policy is the same as that for annual multi-trip policies.

Backpack cover

Sometimes referred to as "Discoverer Trip" cover, Direct Line backpack travel insurance cover is available to those under 54 for trips lasting 3 to 18 months. The specifics of backpack travel insurance cover are as follows:

You are also covered for end supplier failure, where costs have not been protected elsewhere under your policy. Children travelling with an adult insured under a Direct Line travel insurance policy will also be covered.

There are also some additional exemptions. Due to the nature of "backpacking trips", you will not be covered for an early end to your trip. Consequently, you will not be able to claim if you are forced to abandon your journey or change your travel arrangements for whatever reason.

Am I covered for Covid-19 with Direct Line travel insurance?

Unfortunately, we are likely to experience many Covid-19 spikes in different areas of the world in the short to medium-term. Consequently, Direct Line has made several changes to its policies. From 5 October 2021, all Direct Line travel insurance policies cover Covid-19 and other pandemics related to bookings made but yet to take and future trips.

There is cover in place for trips cancelled as a consequence of:

- You, a party in your travelling group, or person you're planning to stay with, having to quarantine or self-isolate either in the UK or abroad

- You, or any insured person, travelling companion or a close relative being diagnosed with Covid-19 or another pandemic disease

- The Foreign, Commonwealth and Development Office (FCDO) advising against all but essential travel to your holiday destination within 28 days of departure - however, this advice must not have been in place when the holiday was booked or Direct Line travel insurance was acquired

- Covid-19 or another pandemic diseases, resulting in pre-booked/prepaid accommodation not being available or restrictions in the surrounding area

You will also be covered if forced to cut your trip short due to:

- A change in the FCDO advice, which you were not aware of when you travelled

- A change in circumstances, such as a lockdown, affecting your pre-booked accommodation because of Covid-19 or a pandemic - you must not have been aware of this advice when you travelled

Last but not least, there is also emergency medical cover for overseas expenses when diagnosed with coronavirus or another pandemic disease while on your trip.

While consumer attention is on Covid-19, Direct Line is referencing pandemics, in general, in its policy documents. We will all need to consider potential pandemics in the future concerning travel plans and life in general.

Standard features of Direct Line travel insurance policies

While Direct Line travel insurance policies are relatively flexible and can be tailored to your specific requirements, there are some standard features. Therefore, it is essential to check with each type of policy to see which features are included:

Cancellation cover

There is cancellation cover up to a maximum of £5,000 per trip. Valid if you are forced to cancel due to illness, unemployment or another unexpected issue.

Medical emergency cover

While the headline figure of £10 million for medical expenses insurance has caught the attention of many consumers, there is more to consider. In addition, medical emergency cover will pay up to £2,500 for a loved one or friend to travel and stay with you while undergoing treatment. There is also a daily allowance of £25 for phone calls, transport and food.

Personal liability cover

Suppose you're found legally liable for an incident resulting in physical injury, death, accidental loss or damage to property. In that case, there is personal liability cover up to a maximum of £2 million. This is crucial as the associated costs can vary widely in different countries.

Legal expenses and a 24-hour helpline

While there is advice available 24/7, the legal cost cover up to £50,000 can prove helpful. This may be used to claim damages or compensation for injury, illness, death or a dispute about an agreement relating to your journey.

If you are arrested overseas, there is cover of up to £250 for the first meeting with a local solicitor.

Abandoned journeys

If you experience a delay of at least 12 hours and have to abandon your journey, you will be paid up to a maximum of £5,000.

Delayed or missed departure

If your departure is delayed, you will receive up to £200 per person or up to £600 for a missed departure. This element is reduced to a maximum of £200 for UK-only trips.

Children's insurance cover

All children under 18 will be covered if travelling with an adult insured under a Direct Line travel insurance policy. This will also take in organised activities such as snorkelling, beach games, swimming, and other events supervised by adults.

Personal accident

If you are injured due to an accident, where no third party is liable, there is a maximum of £10,000 payment if this results in your death. The figure is reduced to £1,500 for those under 18 travelling with an adult with a Direct Line travel insurance policy. Loss of sight or loss of a limb will lead to a maximum £10,000 payout and up to £25,000 if you cannot work after two years.

Lost or stolen passport

Losing your passport, for whatever reason, can be extremely daunting, more so when in a foreign land. Consequently, Direct Line travel insurance includes up to £500 for any extra travel/accommodation expenses incurred while waiting for replacement documentation.

Disaster cover

If pre-booked accommodation, or the surrounding area, has been impacted by a natural disaster, you are covered for extra travel and additional accommodation expenses up to £1,000. This is because you may decide to continue your trip or return to the UK. Natural disasters could include fires, explosions, earthquakes, tidal waves, avalanches, hurricanes, medical epidemics or a pandemic, and more.

Delayed personal belongings

There's nothing worse than losing your belongings, be it via your airline or a third-party travel provider. If the return of your belongings is delayed by more than 12 hours, you would be eligible for up to £200 to replace any personal belongings you need to buy.

Cost of Direct Line travel insurance policies

It is difficult to calculate an "average" Direct Line travel insurance premium because there are so many variables, including:

- Destination

- Type of policy

- Additional extras

- Medical conditions

- Excess payments

As detailed above, some of the policies have age restrictions, while Saga , focusing specifically on over 50s, have no such conditions. On the plus side, you will see introductory offers on the Direct Line insurance website from time to time. One of the more common offers is a 25% discount off annual multi-trip travel insurance cover, which is certainly worth considering!

Does Direct Line travel insurance offer value for money?

It isn't easy to compare Direct Line travel insurance with the likes of Saga , which is focused solely on the over 50s market. That said, there are several options available to reduce your Direct Line travel insurance premiums, such as reducing the excess and taking advantage of online offers. In addition, the standard cover on Direct Line travel insurance policies is both flexible and comprehensive. The key is to ensure that the travel insurance package you purchase is moulded around your particular requirements.

There may also be options to buy pet insurance, home insurance and other Direct Line products alongside your travel insurance, which may provide a discount.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

11 Best Travel Insurance Companies in August 2024

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If the past few years have shown us anything, it’s that travelers need to be prepared for the unexpected — from a pandemic to flight troubles to the crowded airport terminals so many of us have encountered.

If you don't have sufficient travel insurance coverage via your credit card , you can supplement your policies with third-party plans.

Whether you’re looking for an international travel insurance plan, emergency medical care or a policy that includes extreme sports, these are the best travel insurance providers to get you covered.

How we found the best travel insurance

We looked at quotes from various companies for a 10-day trip to Mexico in September 2024. The traveler was a 55-year-old woman from Florida who spent $3,000 total on the trip, including airfare.

On average, the price of each company’s most basic coverage plan was $126.53. The costs displayed below do not include optional add-ons, such as Cancel For Any Reason coverage or pre-existing medical condition coverage.

Read our full analysis about the average cost of travel insurance so you can budget better for your next trip.

However, depending on the plan, you may be able to customize at an added cost.

As we continue to evaluate more travel insurance companies and receive fresh market data, this collection of best travel insurance companies is likely to change. See our full methodology for more details.

Best insurance companies

Types of travel insurance

What does travel insurance cover, what’s not covered, how much does it cost, do i need travel insurance, how to choose the best travel insurance policy, what are the top travel destinations in 2024, more resources for travel insurance shoppers.

Top credit cards with travel insurance

Methodology

Best travel insurance overall: berkshire hathaway travel protection.

Berkshire Hathaway Travel Protection

- ExactCare Value (basic) plan is among the least expensive we surveyed.

- Speciality plans available for road trips, luxury travel, adventure activities, flights and cruises.

- Company may reimburse claimants faster than average, including possible same-day compensation.

- Multiple "Trip Delay" coverage types might make claims confusing.

- Cheapest plan only includes fixed amounts for its coverage.

Under the direction of chair and CEO Warren Buffett, Berkshire Hathaway Travel Protection has been around since 2014. Its plans provide numerous opportunities for travelers to customize coverage to their needs.

At $135 for our sample trip, the ExactCare Value (basic) plan from Berkshire Hathaway Travel Protection offers protection roughly $10 above the average price.

Want something cheaper? Air travelers looking for inexpensive, less comprehensive protections might opt for a basic AirCare plan that includes fixed amounts for its coverage .

Read our full review of Berkshire Hathaway .

What else makes Berkshire Hathaway Travel Protection great:

Pre-existing medical condition exclusion waivers available at nearly all plan levels.

Plans available for travelers going on a cruise, participating in extreme sports or taking a luxury trip.

ExactCare Value (basic) plan was among the least expensive we surveyed.

Best for emergency medical coverage: Allianz Global Assistance

Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Global Assistance is a reputable travel insurance company offering plans for over 25 years. Customers can choose from a variety of single and annual policies to fit their needs. On top of comprehensive coverage, some travelers might opt for the more affordable OneTrip Cancellation Plus, which is geared toward domestic travelers looking for trip protections but don’t need post-departure benefits like emergency medical or baggage lost.

For our test trip, Allianz Global Assistance’s basic coverage cost $149, about $22 above average.

What else makes Allianz Global Assistance great:

Annual and single-trip plans.

Plans are available for international and domestic trips.

Stand-alone and add-on rental car damage product available.

Read our full review of Allianz Global Assistance .

Best for travelers with pre-existing medical conditions: Travel Guard by AIG

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

Travel Guard by AIG offers a variety of plans and coverages to fit travelers’ needs. On top of more standard trip protections like trip cancellation, interruption, baggage and medical coverage, the Cancel For Any Reason upgrade is available on certain Travel Guard plans, which allows you to cancel a trip for any reason and get 50% of your nonrefundable deposit back as long as the trip is canceled at least two days before the scheduled departure date.

At $107 for our sample trip, the Essential plan was below average, saving roughly $20.

What else makes Travel Guard by AIG great:

Three comprehensive plans and a Pack N' Go plan for last-minute travelers who don't need cancellation benefits.

Flight protection, car rental, and medical evacuation coverage, as well as annual plans available.

Pre-existing medical conditions exclusion waiver available on all plan levels, as long as it's purchased within 15 days.

Read our full review of Travel Guard by AIG .

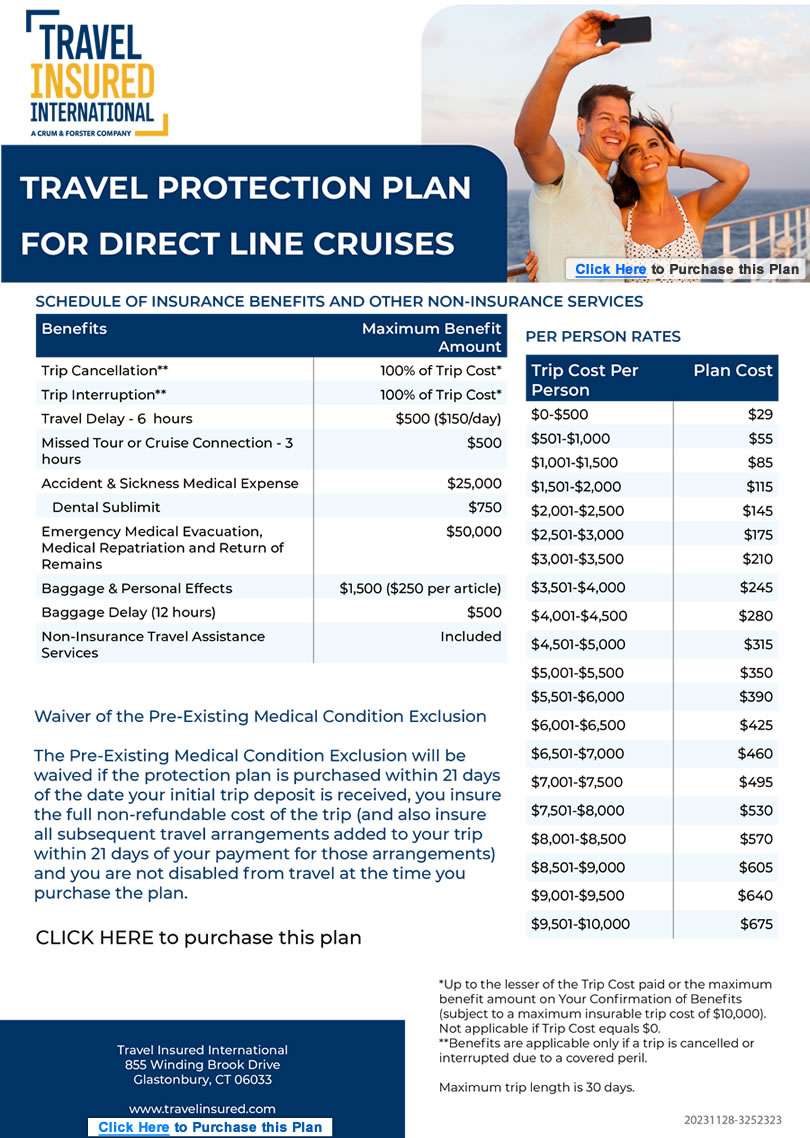

Best for those who pack expensive equipment: Travel Insured International

Travel Insured International

- Higher-level plan include optional add-ons for event tickets and for electronic equipment

- Rental car protection add-on for just $8 per day, even on lower-level plan.

- Many of the customizations are only available on the higher-tier plan.

- Coverage cost comes in above average in our latest analysis.

Travel Insured International offers several customization options. For instance, those going to see a show may want to add on event ticket registration fee protection. Traveling with expensive gear?Consider adding on coverage for electronic equipment for up to $2,000 in coverage.

Be sure to check which policies are available in your state. You will need to input your destination, residence, trip dates and the number of travelers to get a quote and see coverages.

What else makes Travel Insured International great:

Comprehensive plans include medical expense reimbursement accidents, sickness, evacuation and pre-existing conditions, depending on the plan.

Flight plans include coverage for missed and canceled flights and lost or stolen baggage.

Read our full review of Travel Insured International .

Best for adventurous travelers: World Nomads

World Nomads

- Travelers can extend coverage mid-trip.

- The standard plan covers up to $300,000 in emergency evacuation costs.

- Plans automatically cover 200+ adventurous activities.

- No Cancel For Any Reason upgrades are available.

- No pre-existing medical condition waivers are available.

Many travel insurance plans contain exclusions for adventure sports activities. If you plan to ski, bungee jump, windsurf or parasail, this might be a plan to consider.

Note that the Standard plan ($72 for our sample trip), while the most affordable, provides less coverage than other plans. But it can be a good choice for travelers who are satisfied with trip cancellation and interruption coverage of $2,500 or less, do not need rental car damage protection, find the limits to be sufficient and do not need coverage for certain more adventurous activities.

What else makes World Nomads great:

Comprehensive international travel insurance plans.

Coverage available for adventure activities, such as trekking, mountain biking and scuba diving.

Read our full review of World Nomads .

Best for medical coverage: Travelex Insurance Services

Travelex Insurance Services

- Top-tier plan doesn’t break the bank and provides more customization opportunities.

- Offers a plan specifically for domestic travel.

- Sells a post-departure medical coverage plan.

- Fewer customization opportunities on the Basic plan.

- Though perhaps a plus for domestic travelers, keep in mind the Travel America plan only covers domestic trips.

For starters, basic coverage from Travelex Insurance Services came in at $125, almost exactly average for our sample trip.

Travelex’s plans focus heavily on providing protections that are personalized to your travel style and trip type.

While the company does offer comprehensive plans that include medical benefits, you can also choose between cheaper plans that don’t provide cancellation coverage but do offer protections during your travels.

Read our full review of Travelex Insurance Services .

What else makes Travelex Insurance Services great:

Three comprehensive plans available, two of which cover international trips.

Offers a post-departure plan geared exclusively toward disruptions after you leave home.

Two flight insurance plans available.

Best if you have travel credit card coverage: Seven Corners

Seven Corners

- Annual, medical-only and backpacker plans are available.

- Cancel For Any Reason upgrade is available for the cheapest plan.

- Cheapest plan also features a much less costly Interruption for Any Reason add-on.

- Offers only one annual policy option.

Each Seven Corners plan offers several optional add-ons. Among the more unique is a Trip Interruption for Any Reason, which allows you to interrupt a trip 48 hours after the scheduled departure date (for any reason) and receive a refund of up to 75% of your unused nonrefundable deposits.

» Jump to the best cards with travel insurance

The basic coverage plan for our trip to Mexico costs $124 — right around the average.

What else makes Seven Corners great:

Comprehensive plans for U.S. residents and foreigners, including travelers visiting the U.S.

Cheap add-ons for rental car damage, sporting equipment rental or trip interruption for any reason.

Read our full review of Seven Corners .

Best for long-term travelers: IMG

- Coverage available for adventure travelers.

- Offers direct billing.

- Claim approval can be lengthy.

While some travel insurance companies offer just a handful of plans, with IMG, you’ll really have your pick. Though this requires a bit more research, it allows you to search for coverage that fits your travel needs.

However, travelers will want to be aware that IMG’s iTravelInsured Travel Lite is expensive. Coming in at $149.85, it’s the costliest plan on our list.

Read our full review of IMG .

What else makes IMG great:

More affordable than average.

Many plans to choose from to fit your needs.

Best for travelers with unpredictable work demands: Tin Leg

- In addition Cancel For Any Reason, some plans offer cancel for work reason coverage.

- Adventure sports-specific coverage is available.

- Plans have overlap that can be hard to distinguish.

- Only one plan includes Rental Car Damage coverage available as an add-on.

Tin Leg’s Basic plan came in at $134 for our sample trip, adding about $8 onto the average basic policy cost. Note that you’ll pay a lot more if you shop for the most comprehensive coverage, and there are eight plans to choose from for trips abroad.

The multitude of plans can help you find coverage that fits your needs, but with so many to choose from, deciding can be daunting.

The only real way to figure out your ideal plan is to compare them all, look at the plan details and decide which features and coverage suit you and your travel style best.

Read our full Tin Leg review .

Best for booking travel with points and miles: TravelSafe

- Covers up to $300 redepositing points and miles on eligible canceled award flights.

- Optional add-on protection for business equipment or sports rentals.

- Multi-trip or year-long plans aren’t available.

Selecting your travel insurance plan with TravelSafe is a fairly straightforward process. The company’s website also makes it easy to visualize how optional add-on elements influence the total cost, displaying the final price as soon as you click the coverage.

However, at $136, the Basic plan was among the more expensive for our trip to Mexico.

What else makes TravelSafe great: