Tour Detail

Signature food tour of pike place market.

- 8+ Tastings

- Family-Friendly

- 10:00am and 10:30am | 10:00am and 10:30am

- Pike St & 1st Ave, Seattle, WA 98101, USA

- Insider’s look at 8 Market vendors

- Yummy tastes from some of Yelp’s Top 10 best Seattle restaurants and eateries

- Entertaining stories of the Market’s rich history and culture

- Why throwing fish is legitimately good for business

- The secret behind the “first” Starbucks store

Join us for Seattle’s original food and cultural tour of Pike Place Market!

Become a market insider on this behind-the-scenes adventure to experience the sights, sounds, and flavors of this historic 100+ year old landmark. Meet the Market’s lively characters and hear their memorable stories. See fish fly, cheese being made, and the “original” Starbucks store. By the end, you will know the best places to eat at Pike Place Market….. Read More

Others tours you might like

Savor Seattle Nominated as Best Food Tour in the Nation

☂️ VOTE HERE!☂️ Savor Seattle Tours is proud to announce that USA Today has nominated us as The Best Food Tour in the nation. Nominees

The Return of Savor Seattle Tours!

Hello! We’re Matthew and Heather! If you have taken a Savor Seattle Tour before, you may recognize us; we’re former managers and tour guides Matthew

Meyer Lemon & Thyme Roasted Sunchokes

Secret ingredient of the day: sunchokes! Also known as Jerusalem artichokes, sunchokes are a root vegetable related to the sunflower. They are a kind of

Savor Seattle Jambalaya

This recipe was created for us by Chef Michaela Skloven and was featured in our “Mardi Gras” theme box in February 2021. It features products

Sign up for our newsletter.

Stay up to date on new tours and local food news and events!

Enter your email address:

- Culinary Getaways

- Private Tours

- Our Partners

- Press & Reviews

- Newsletters

EXTRA HELPINGS

- Food Tours: 206-633-2489

- Send Email ” target=”_self”>Food Boxes: [email protected]

- View Our Calendar

Connect with us

©2022 Savor Seattle Food Tours. All Rights Reserved.

Privacy Policy Terms of Use Waiver Notice

THE ORIGINAL FOOD AND CULTURE TOUR

INSIDER’S BREAKFAST AND CULTURE TOUR

PRIVATE TOURS

WHY CHOOSE SAVOR SEATTLE FOOD TOURS?

PRESS & REVIEWS

FOOD TOURS: 206-338-1841

FOOD BOXES: [email protected]

CONNECT WITH US

©2023 Savor Seattle Food Tours. All Rights Reserved Savor Seattle is permitted and licensed by the Pike Place Market Preservation and Development Authority (PDA) to operate tours in the Pike Place Market Historical District. The PDA requires any business or person conducting paid tours within its properties and in the public areas of the historical district to be pre-approved and to have a license for this activity.

PRIVACY POLICY

TERMS OF USE

WAIVER NOTICE

NEED A LAST MINUTE GIFT?!?

Enjoy 10% off tour bookings and gift certificates! Use the code: SAVORHOLIDAY23 at check out (valid through Monday, December 25th). Not valid for the Gourmet Kayak Expedition.

BLACK FRIDAY SALE!

Enjoy 10% off tour bookings and gift certificates! Use the code: BLACKFRIDAY2023 at check out (valid through Monday, November 27th). Not valid for the Gourmet Kayak Expedition.

- Skift Research

- Airline Weekly

- Skift Meetings

- Daily Lodging Report

The Last Outpost of Travel: A Deep Dive into Tours, Activities and Experiences 2023

Executive summary, introduction, the tours, activities and experiences industry could be a $1 trillion market , tours, activities and experiences remains one of the most opportunistic markets in travel, the industry is backed by huge amounts of investor funding, a fragmented industry with a long tail of suppliers, the industry is rapidly shifting from offline to online, online intermediaries have gained share from online direct sites .

- Google’s 'Things To Do Platform' Prioritizes Direct Sites

A Flurry of B2B Activity

Opportunity for otas to consolidate market share, many otas focus on revenue growth and market share gains, related reports.

- India’s Travel Booking Landscape March 2024

- The Past, Present, and Future of Online Travel March 2024

- Skift Research Global Travel Outlook 2024 January 2024

- A Deep Dive into Google Travel Part II: U.S. vs Europe in 20 Charts November 2023

Report Overview

The market for tours, activities & experiences represents one of the most opportunistic and untapped prospects within the travel industry: it is highly fragmented with a long tail of small suppliers and is rapidly shifting online, making it an attractive space for online intermediaries to consolidate market share from small offline players as they onboard online.

However, Google, not one to miss the party, has also entered the space with its ‘Things To Do’ tool and similar to its role within other verticals in the travel industry, acts as both friend and foe to the online travel agents (OTAs). Skift Research’s proprietary web scraping analysis of Google’s ‘Things To Do’ shows that whilst many OTAs list on Google, taking advantage of its vast scale and power as a search engine, Google persistently prioritizes the direct option over third party OTA sites. Could Google potentially dis-intermediate the OTAs and give power to the direct sites, similar to the practices conducted by Google Hotels? Or does the highly fragmented and largely un-sophisticated nature of the industry demand a strong aggregator, with direct bookings less likely to gain traction?

We look to answer these questions in this report, as well as provide an overview of the tours, activities & experiences market, comparing it to other verticals within the travel industry – showing how it is the last outpost of travel in today’s distribution landscape.

Executives Interviewed

- Chris Atkin, CEO of Rezdy

- Claudio Bellinzona, Chief Supply Officer and Co-Founder of TUI Musement

- Susan DeBottis, Chief Growth Officer at Rezdy

- Eric Gnock Fah, Chief Operating Officer & Co-Founder of Klook

- Nishank Gopalkrishnan, Chief Business Officer of TUI Musement

- Laurens Leurink, CEO of Tiqets

- Blanca Menchaca, CEO of BeMyGuest

- Ankur Thakuria, Regional Director Asia Pacific & Middle East at Tiqets

- Spokesperson from Groupon

The selling of tours, activities & experiences is one of the most attractive parts of the travel industry for an online aggregator. There are three key reasons behind this: first, there is a huge addressable market up for grabs; second, bookings are rapidly shifting from offline to online; and third, the market is very fragmented and thus demands a strong aggregator.

The market is ripe with opportunity and many of the largest players have entered the space, either as a pure-play OTA or through B2B partnerships, with the online intermediaries gaining share from offline, direct sites. Google too has forayed into the space with its Things To Do tool. Whilst Google’s entrance into the hotel industry through Google Hotels arguably hinders rather than aids the efforts of leading OTAs such as Booking Holdings and Expedia; in the tours, activities & experiences space, we expect Google to be more friend than foe. Though Google acts as a dis-intermediary in the hotel space, aiding in the shift back to direct bookings, in the vastly fragmented experiences market, we expect that direct bookings are less likely to gain traction and instead that the OTAs will continue to gain share.

However, to say which OTA will emerge as market leader is difficult, with no one player currently owning more than 5-6% of market share currently. There is a lot to play for with a long tail of small OTAs presenting an attractive opportunity for consolidation. The tours, activities & experiences market is therefore one of the most opportunistic and untapped parts of the travel industry.

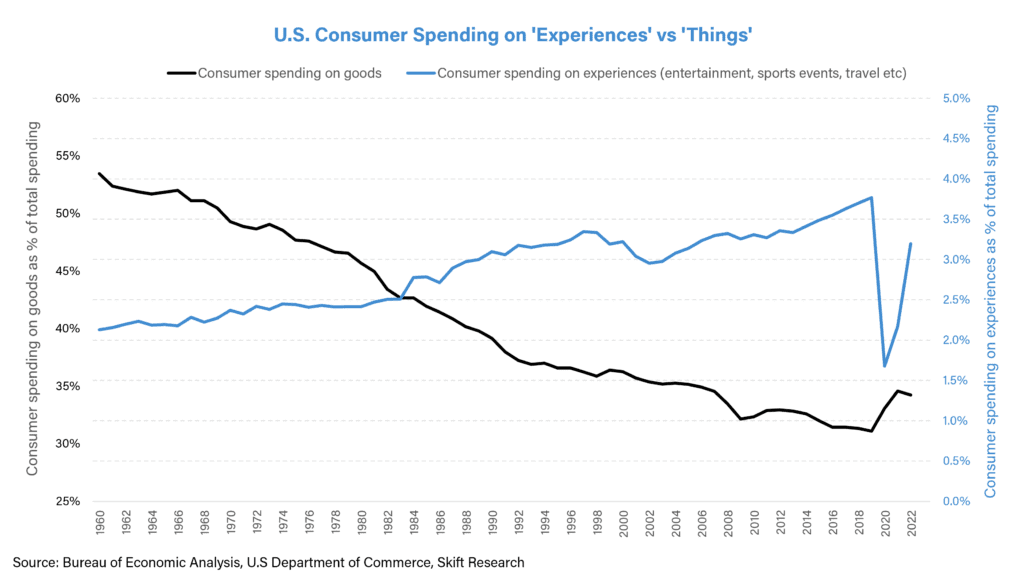

The shift in consumer spending from goods to services has long been a trend observed by economists. In affluent countries such as the U.S., this shift has been defined by changing consumer preferences and behaviors, with a greater emphasis placed on convenience and efficiency, and further facilitated by the rise of digital marketplaces, allowing consumers to easily seek and engage with a wide range of services.

Moreover, consumers, particularly younger generations such as Millennials and Gen-Z, are increasingly prioritizing spending on ‘experiences’ over ‘things’, reflecting a growing recognition of the value derived from memorable memories rather than material possessions. The rise of social media has also contributed to this shift, with consumers seeking experiences that are worth sharing on social platforms.

The chart below shows that whilst consumer spend on goods as a percentage of total spending has decreased from 53% in 1960 to 35% by 2022, spend on experiences (such as tickets to live entertainment, sporting events, museums or spend on travel and package tours) has nearly doubled from 2% of total spending in 1960 to nearly 4% by 2019. During Covid, consumer spending naturally shifted back towards goods, with few opportunities available for live events and travel in a time of global lockdowns. However, post Covid, we have seen this quickly reverse back, with spending on travel booming even in the face of a looming recession and travel seemingly venturing higher up in psychologist Abraham Maslow’s hierarchy of needs, being a powerful tool for self-discovery and finding purpose in life.

As we wrote in our deep dive from 2018 The Post Experience Economy: Travel in an Age of Sameness , “travel has always been an experience, facilitated by the services provided by travel companies” and is in a prime position to benefit from consumers who are looking to spend money on memorable experiences.

However, there is still much work to be done in order for travel brands to fully deliver on the emotionally meaningful experiences craved by consumers – a desire that often clashes with the commercial objectives of major travel companies. For example, as we wrote in 2018, “ a vacation mediated by a la carte ordering via mobile phone is antithetical to our vision of travel’s future”. By prioritizing differentiation, based on the quality of service rather than an over-reliance on technological add-ons or lower prices, brands which serve the tours, activities & experiences market have a real opportunity to tap into this vastly under-served segment of the travel industry.

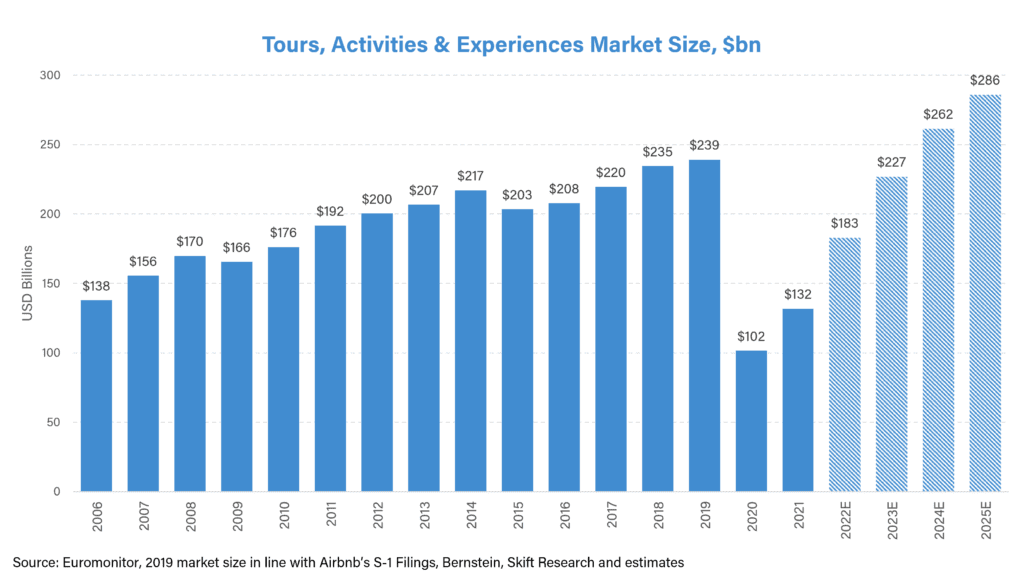

Tours, Activities and Experiences Market Sizing

The selling of tours, activities and experiences is a $239 billion market, as of 2019, and we estimate that after recovering to pre-Covid levels by 2024, it can grow to nearly $300bn by 2025.

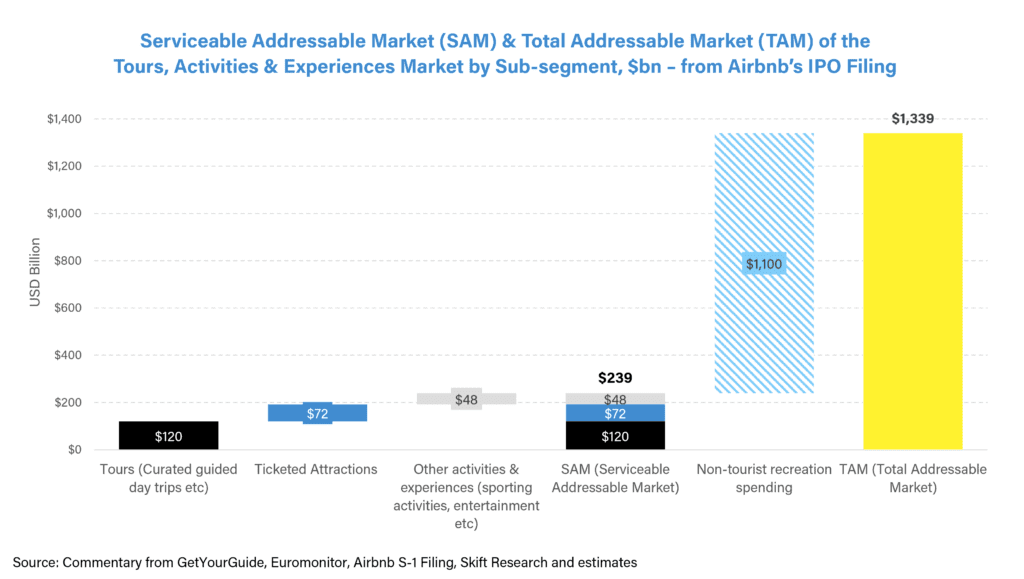

We estimate that tours (such as guided tours and day trips) consist of 50% of the market, ticketed attractions (to major tourist sites) consist of 30% of the market and other activities and experiences (such as sporting events, shows and entertainment) the rest 20%.

Interestingly, in addition to a currently serviceable market size of $239bn (as of 2019), Airbnb in their S-1 registration form released prior to their IPO identified a further $1.1 trillion of spend on recreational and cultural experiences by local residents, saying that “we believe we can continue to expand our platform use cases to enable people to discover and explore their own cities through Airbnb”. This would present the tours, activities & experiences industry as having a huge $1.4 trillion total addressable market (TAM).

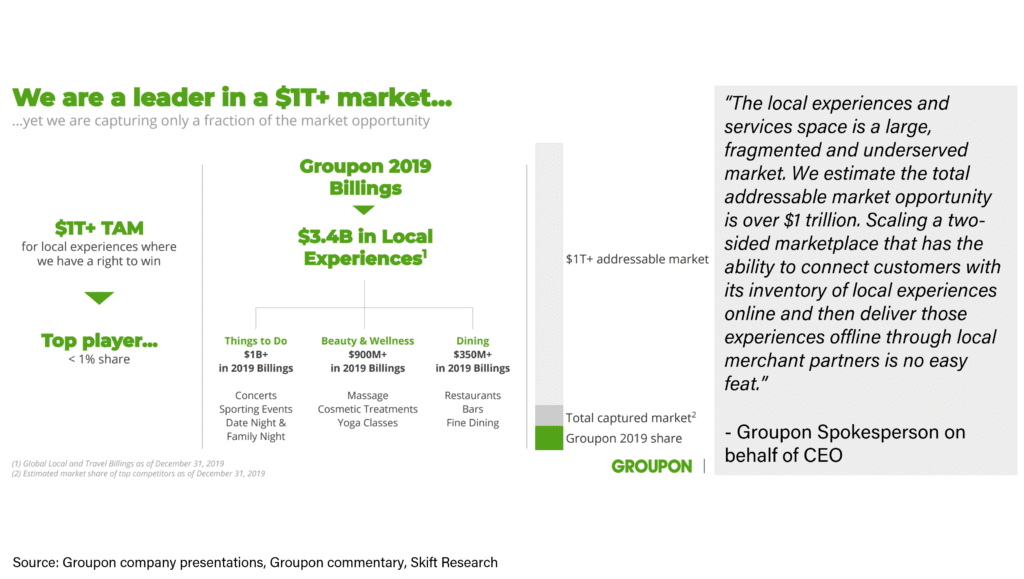

Whilst local leisure activities (such as swimming pools, movie theaters, etc.) have not yet been incorporated into the strategies of travel businesses such as the major OTAs, Groupon is one company that has singled out the local experiences market as its main focus, also citing a large and fragmented market with a >$1trillion TAM of which Groupon has less than 1% market share.

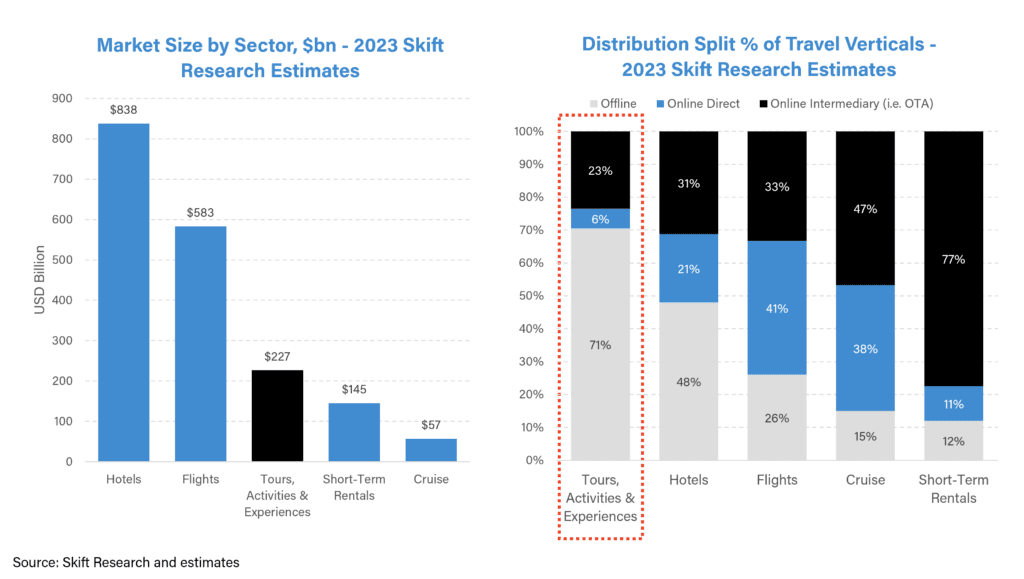

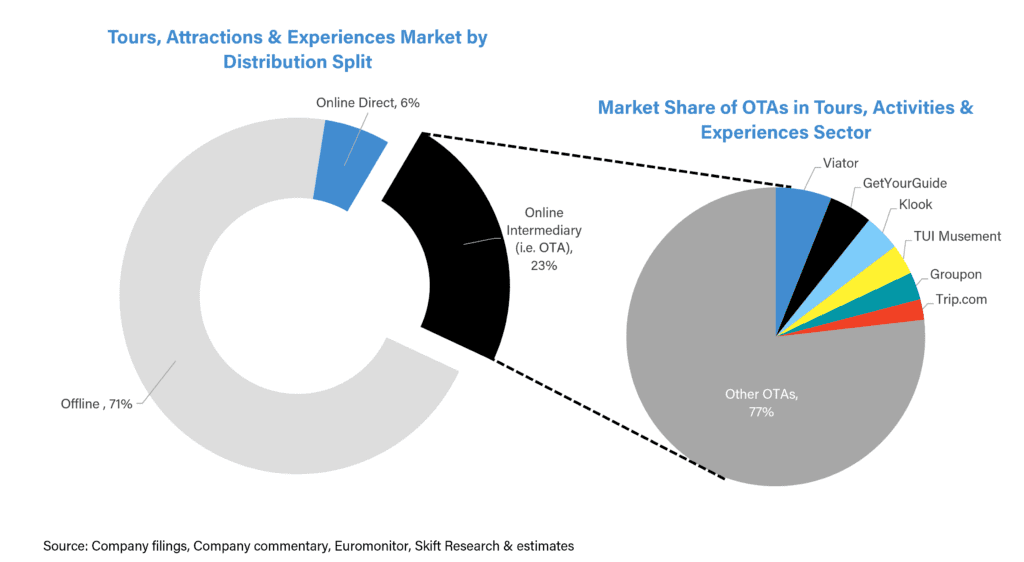

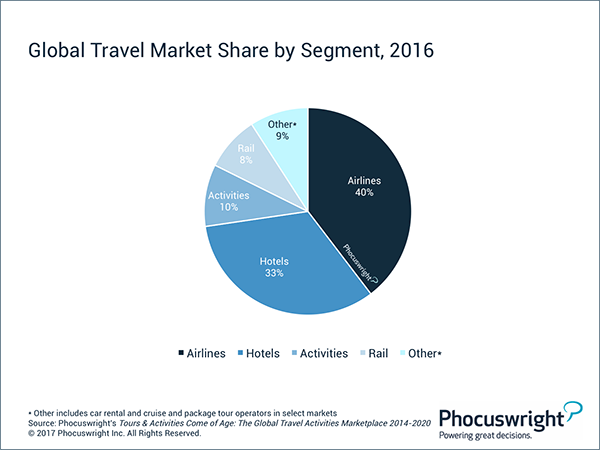

Unlike other verticals in the travel industry, the booking of tours, activities & experiences is still predominantly done offline – 70% offline, versus 48% offline for hotels, 26% for airlines and only 12% for short-term rentals, as shown in the chart below.

Nishank Gopalkrishnan, Chief Business Officer of TUI Musement explained that: “the digitization of the tourism activity space has lagged the other parts of travel due to the propensity of the customer to book experiences much later than other parts of travel. 70% of the time, a consumer would book excursions or attractions in-destinations, based on a variety of factors, such as the weather, your mood, how much time you have at the destination etc. However, a flight or hotel gets booked earlier because you need to have a place to sleep and a way of getting there. So [online penetration within the tours, activities & experiences space] was the last thing to be solved because it was also one of the last things to be booked.”

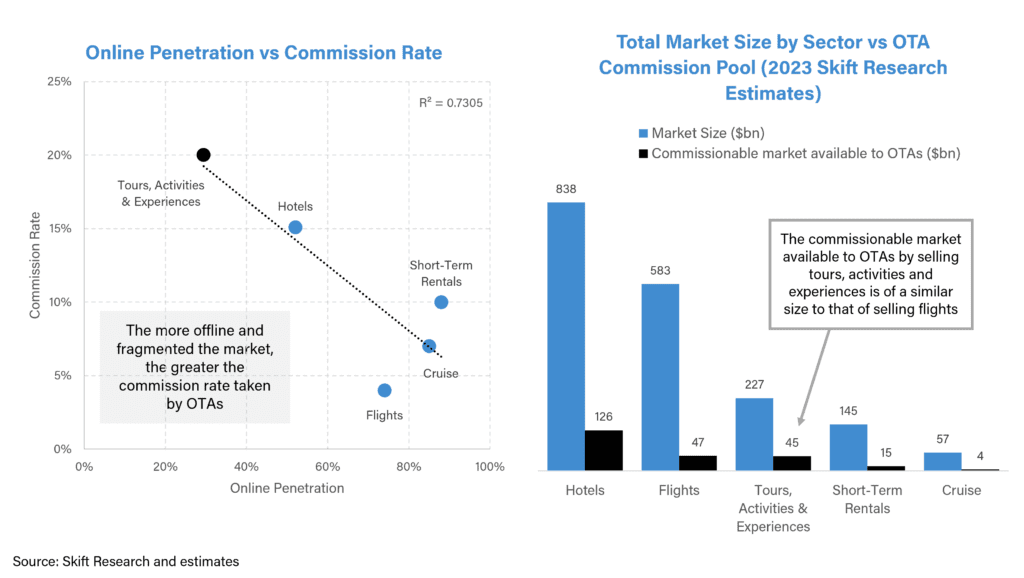

Additionally, as shown in the chart below, we have noticed a correlation between online penetration and commission rates, with the more offline and fragmented the market, the greater the commission rate commanded from OTAs. We estimate that the OTAs command a ~20% take rate from the selling of tours, activities & experiences, compared to only low single digit take rates for flight OTAs.

Therefore, despite the total market size of the airlines industry being more than double the size of tours, activities & experiences, the actual commissionable market available to OTAs by selling experience is actually of a similar size to that of selling flights. Whilst the airline OTAs serve an underlying industry that has largely matured and been consolidated over time, the experience sector will inherently remain a more fragmented part of the travel landscape, being made up of a unique and diverse supply set versus the more commoditized products of flight tickets and hotel rooms. Even though there exists an attractive opportunity for consolidation in the space, there will always be sections of the market that are led by tailored players in the field.

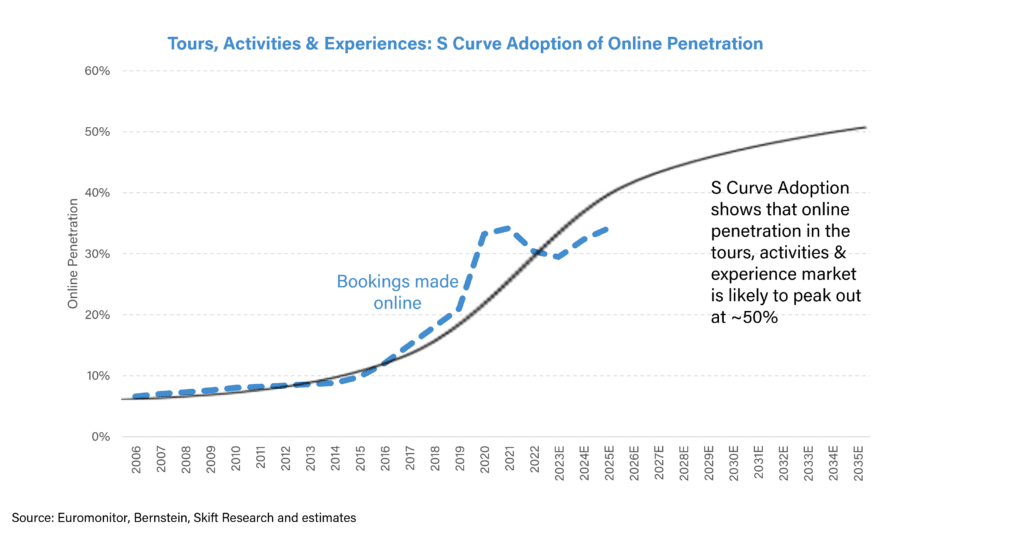

Online penetration too might not ever reach the levels seen in other parts of travel, with the inherent nature of the market meaning that there will always be walk-ins and last minute offline bookings. Chris Atkin, CEO of Rezdy commented that “even before the age of the internet, for hotel bookings there has always been a fax number or a telephone number in order for you to communicate ahead of time and secure a reservation. The hotels have nearly always had that pre-booking because there’s an obvious constraint around availability in every hotel. Whereas in the experiences space, you don’t ever see the zoo, for example, selling out”.

Based on the S-curve adoption model, as shown in the chart below, we estimate that online penetration is likely to peak out at roughly 50%-55%. Though there is a ceiling that will eventually be hit, given the current online penetration levels we are at currently and how quickly the shift is occurring, there is still plenty of upside to be reaped.

Post Covid, many operators of tours, activities and experiences have noticed that more tourists are pre-planning and booking activities in advance, likely due to the scarcity of tours coupled with the huge amounts of consumer pent up demand. Atkin of Rezdy commented that “we’re seeing more and more that people are pre-planning their activities. Lots of really great things to do are going to be sold out because we are still in recovery from the pandemic.”

Eric Gnock Fah, COO and co-founder of Klook , an Asian based OTA in the tours, activities and experiences sector, commented that “[online penetration] for tours and activities which require pre-booking will likely edge closer to that of the car rentals or flights business, whereby for attractions there is usually an option to purchase tickets offline because generally speaking the attractions market is large enough to allow last minute walk-ins.” This is because the market for selling tickets to major attractions, though larger in size, is also more homogenous, whilst specialized tours and activities are more unique and can sell out in advance.

Many of the OTAs we interviewed spoke of the potential to add significant value by selling curated or bundled tours rather than just the traditional offering of individual tickets to attractions. By bundling attractions, activities, transportation, and even accommodation, OTAs can differentiate themselves by offering a unique experience that can cater to specific themes and interests, as well as simplifying the booking process for consumers. The offering of tailored tours allows OTAs to enhance personalization and foster loyalty, with Nishank Gopalkrishnan of Musement further commenting that “typically attraction tickets have lower margins and tours have higher margins.”

Laurens Leurink, CEO of Tiqets, sees the bundling of attraction tickets as a key differentiating factor between booking with an intermediary such as Tiqets versus booking directly through a venue. He commented that “when I’m visiting Paris, I probably want to do a river cruise and also visit the Louvre. Tiqets offers a combination which is pre-bookable.” By bundling tickets together, companies such as Tiqets also offer discounts to consumers, based on “deep integration with core supply partners”, with Leurink noting that “for the people looking for a good value proposition, there’s good value in there, but there’s also a lot of pre planners that just like to have the boxes ticked and their agenda planned. So we’re helping them to fully plan their trip in advance without being overloaded by so many options.”

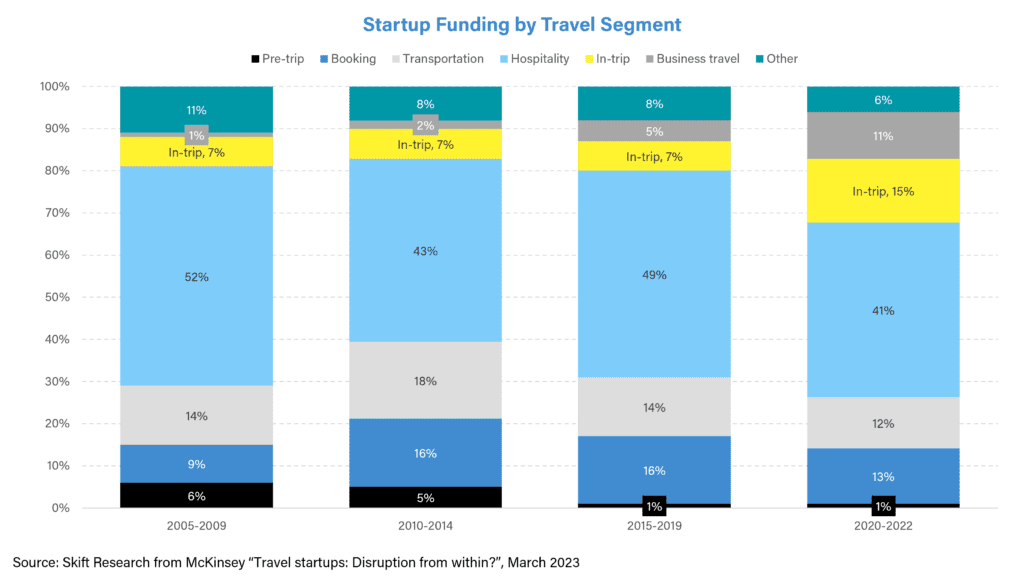

The tours, activities & experiences industry has garnered huge amounts of investor interest, with the largest – and fastest growing – private companies in the space backed by vast amounts of funding. Companies like Klook and GetYourGuide are valued at more than $1bn, making them ‘unicorns’ in the venture capital space. In fact, recent funding news shows that GetYourGuide is actually close to being valued at $2bn, with more than $1bn of investor funding.

Interest in the space has only increased through the pandemic, with investment into in-trip tours & activities companies as a percentage of total travel funding more than doubling through Covid.

The Distribution Landscape

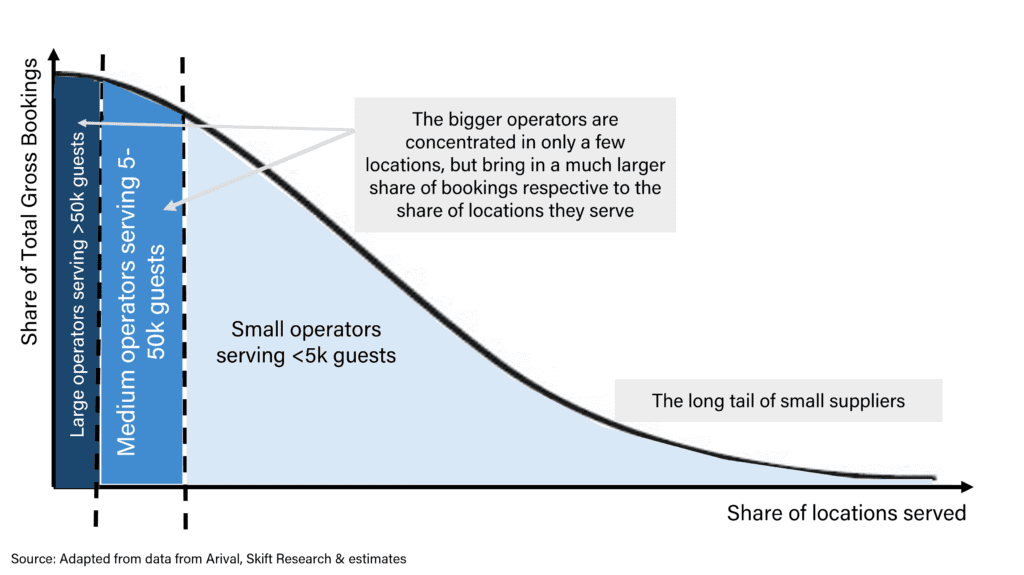

The tours, activities & experiences market is highly fragmented, defined by a long tail of small operators. These small operators tend to work independently, selling activities focused on regional experiences – such as a small company led by one or two people selling short kayaking tours, or a family selling cooking classes. This results in a vast and varied range of supply in the market. For example data and commentary from GetYourGuide suggests that of the ~850k suppliers in the market, “as of year end 2022, we had about 16k suppliers on the platform, meaning that we are only scratching the surface so far”.

The highly fragmented nature of the industry presents an attractive opportunity for consolidation. Unlike other markets in the travel industry which have been consolidated by the leading OTAs – such as Booking.com and Expedia in the hotel industry and Airbnb in short-term rentals – the tours, activities and experiences sector currently operates without a dominant market leader or standardized booking platform.

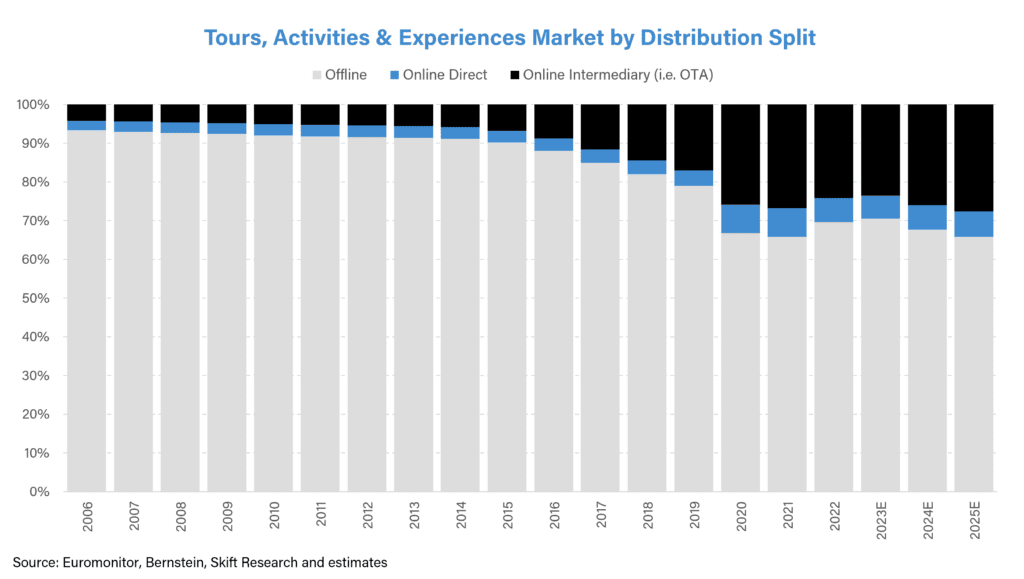

In recent years, the tours, activities & experiences market has rapidly shifted online, from 7% online in 2006 to 30% online by 2022. In 2020, during the Covid pandemic, online penetration increased more than 10% year-on-year from 21% in 2019 to 33% in 2020 – with lockdowns limiting spontaneous walk-ins and offline bookings, suppliers were forced to adopt an online presence that offered consumers real-time updates, flexible booking options, and easy cancellations.

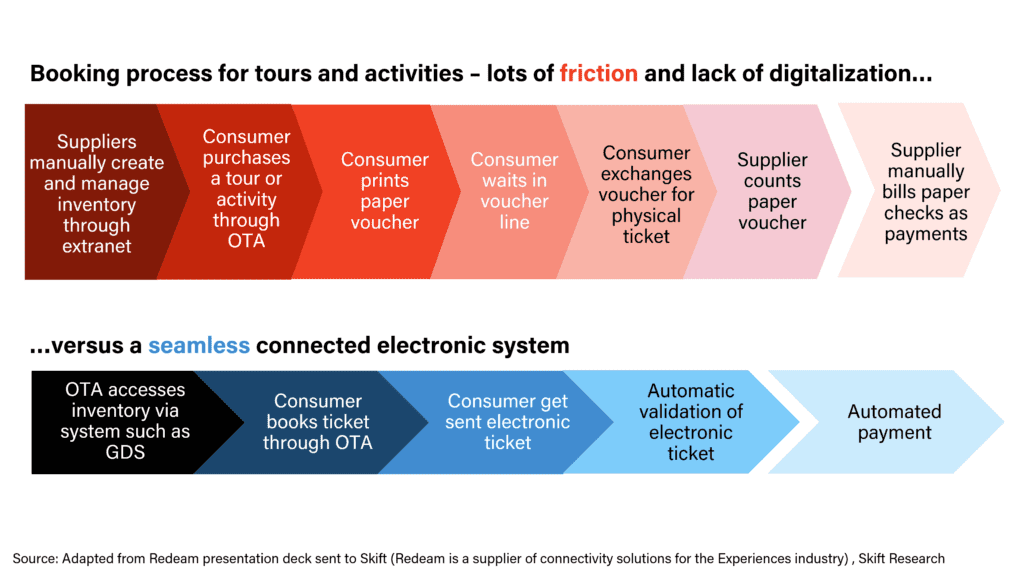

Despite the surge in the percentage of bookings being done online during the pandemic, 70% of the industry is still offline in 2022, dominated by small operators who conduct much of their business on pen and paper or on outdated pieces of software that don’t integrate with OTAs. This lack of digitization creates friction in the booking process, increases operating costs and creates a low-quality consumer experience.

Even when a supplier decides to onboard online, it can face a myriad of problems in setting up a booking platform and having to separately integrate with the various OTAs and distribution channels. The lack of technological uniformity in the sector has led to the emergence of B2B reservation technology providers, such as Rezdy which allow suppliers to manage their online bookings in one place and connect to a marketplace of resellers through a single connection.

However, distribution technology still has a long way to go before it can support the rapid rise in online bookings. Chris Atkin, CEO of Rezdy, said that: “even the biggest players, the most connected players that have close to 200 API integrations [with the various resellers] are still in a situation where only 50% of their products that are available for you to book can get live availability,” with Susan DeBottis, Chief Growth Officer of Rezdy adding that “the tours, activities and experiences space is about 15 or more years behind other sectors from a technological and advancement perspective around distribution.”

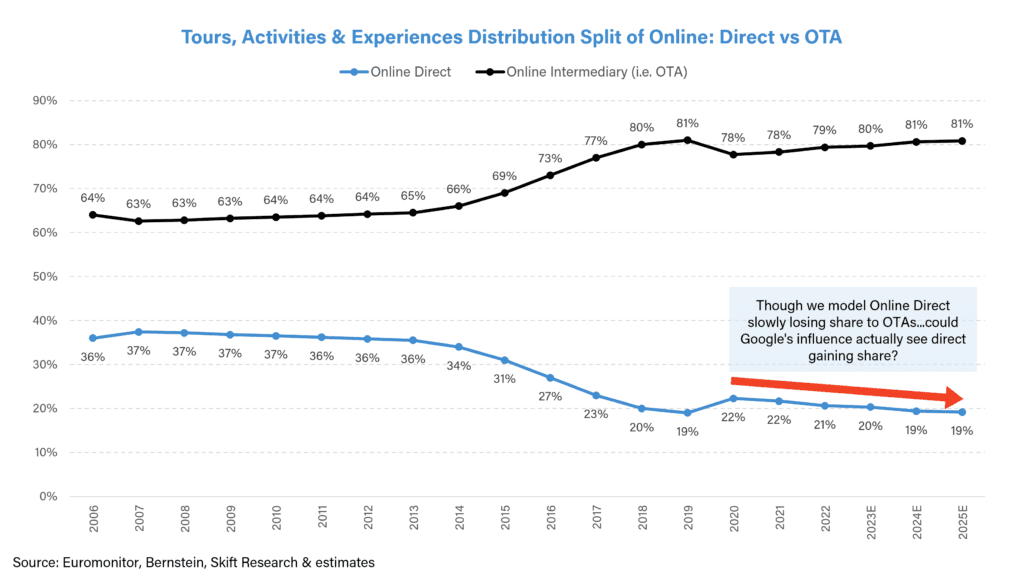

The fragmented nature of the industry lends itself to intermediaries. Of the bookings made online in 2022, 78% were made through an OTA vs 21% through a direct online site. The OTAs have continuously taken share from online direct sites – from 64% of bookings made through an OTA in 2006 to 78% in 2022, as shown in the chart below.

The tours, activities & experiences sector is made up of a long tail of small, diversified providers who offer a wide range of services in different areas, from local tour operators to larger companies that design original and curated tours. As a result, it is a difficult effort for any particular online direct site to combine all these disparate offers onto a single platform. On the other hand, online intermediaries serve as aggregators, giving consumers looking for a variety of experiences a one-stop shop, thus providing more convenience and choice. Additionally, due to economies of scale and large marketing budgets, the large OTAs can negotiate better terms and higher commissions with suppliers and thus provide lower prices for consumers.

We model that the OTAs will continue to gain share from online direct. However, as we discuss in the next section, Google has recently entered the space with its Things To Do tool which prioritizes direct sites over third party booking channels – potentially giving some power back to the direct site.

Google’s ‘Things To Do Platform’ Prioritizes Direct Sites

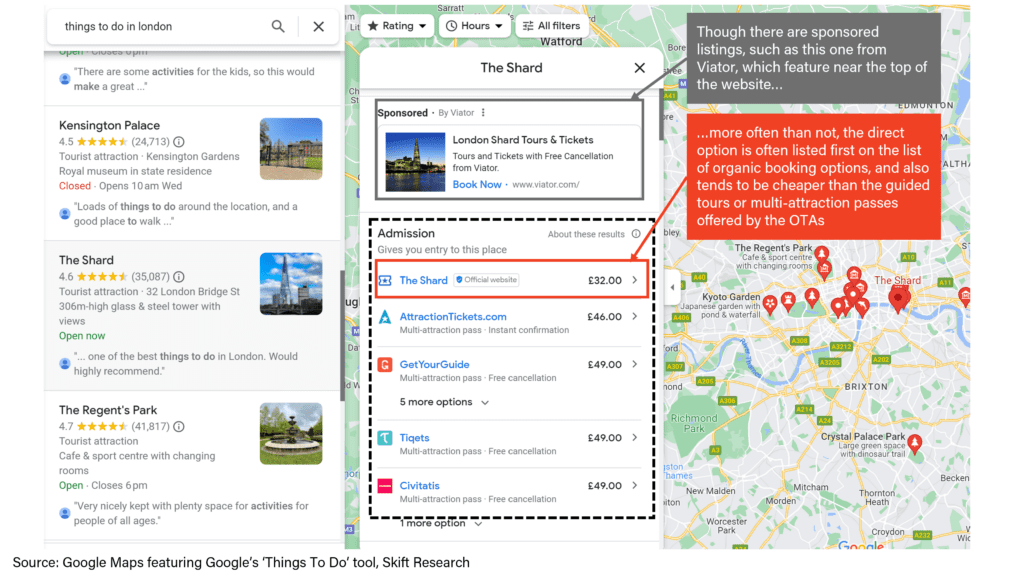

In September 2021, Google launched an advertising product called “Google Things To Do”, which lists not only the top attractions in a city but also options to book tickets via a list of predominantly OTAs. As we show in the screenshot below, though Google displays paid sponsored listings near the top of the site, its main organic booking list prioritizes the direct website over the sites of aggregators such as Viator, GetYourGuide and Musement, to name a few.

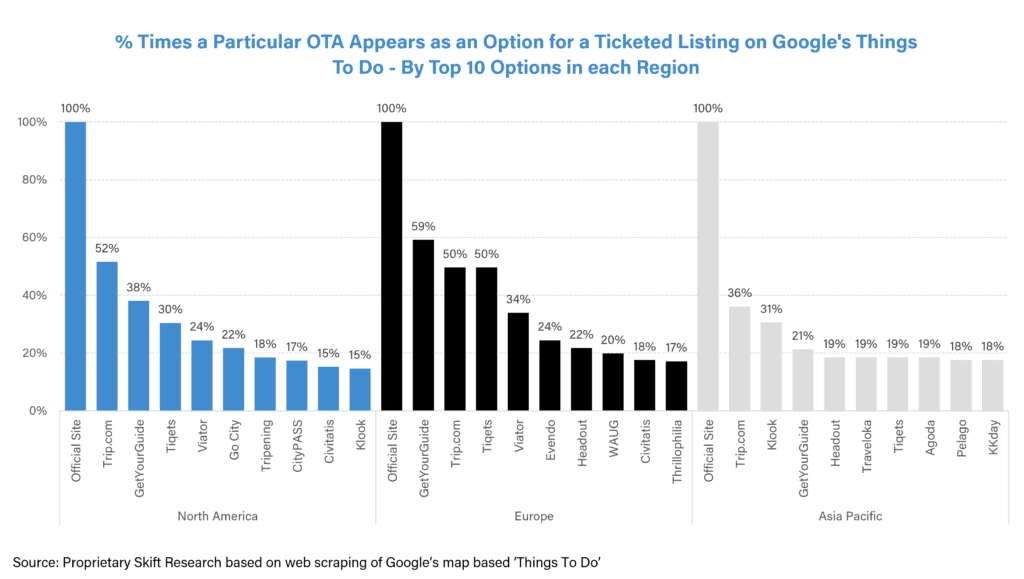

As an exercise to test how often the direct site does appear top of the list, and also to understand which OTAs are listing on Google’s Things To Do tool, using browse.ai we ran a web scraping analysis across 40 cities in each global region, looking at top 10 booking options listed for the top 20 attractions in each city. As we show in the chart below, the direct site appeared on a 100% of attractions, followed by a long list of OTAs, with the top 4-5 positions below the direct option primarily being the large players such as Trip.com, GetYourGuide, Klook, Tiqets etc. Though there are regional leaders, such as GetYourGuide in Europe and Trip.com and Klook in Asia, there was no one dominant player – with even the current leaders only listing on ~50% of attractions, going to show how fragmented the booking landscape is today.

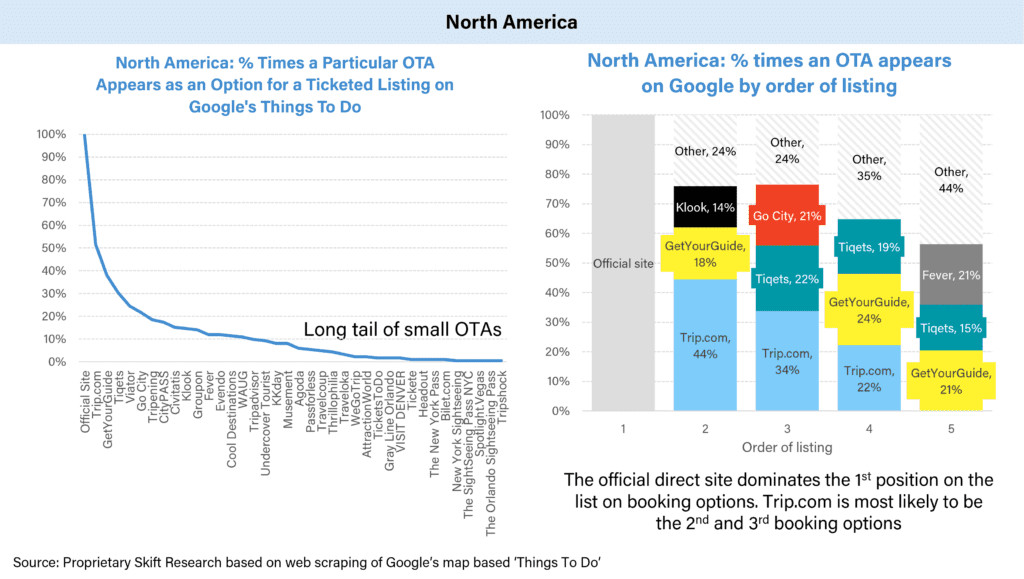

As shown in the charts by region below, we collected listing information from hundreds of OTAs, with there being a long tail of small OTAs listing on specific attractions. The first option was always the direct website, with the 2nd-5th options getting progressively more fragmented as more niche players attempt to (organically) bid on a booking. Google is very clear on its ranking system with its website noting that: ‘tickets are ranked based on several factors, but mainly by price. Official tickets are given preference in the ranking. Ticket suppliers don’t pay Google to appear in these search results and can’t pay to influence their ranking’. It is perhaps of no surprise to see Trip.com often come top of the booking list, being well known to discount prices (by giving up a share of their take rate) as a way to undercut competitors. We also note that neither Booking.com or Expedia featured in any of the booking options.

Google’s entrance into the space has been met with both trepidation and excitement: whilst Google Hotels – and its practice to prioritize direct bookings over the OTAs – has proved to be a formidable competitor to the likes of Booking and Expedia in the hotels industry, in the experiences market we expect Google to be more friend than foe. This is inherently due to the vastly fragmented nature of tours, activities & experiences which demands a strong aggregator, with direct options less likely to gain traction. For example, Leurink of Tiqets commented: “I think Google is still hugely challenged in finding the right interface. Because if you want to compete with every provider of museum attractions, tours, a whole diverse range of experience etc. through one user interface, that’s quite challenging.”

Though still in early phases of developing Things To Do to the same scale as Google Hotels or Google Flights, the fragmented nature of the experiences market means that Google is likely to focus primarily on the large headline attractions for which there will be a direct website in addition to several OTA booking options. However a vast portion of the experiences market doesn’t have its own website, and instead relies on reservation technology providers or the OTAs as a predominant distribution channel. Small operators who do wish to list directly on Google will have to also partner with an OTA or reservation technology companies in order to integrate with Google’s systems. Therefore, whilst Google is certainly aiding in the industry wide shift from offline to online, we ultimately expect the online intermediaries to continue gaining share of bookings.

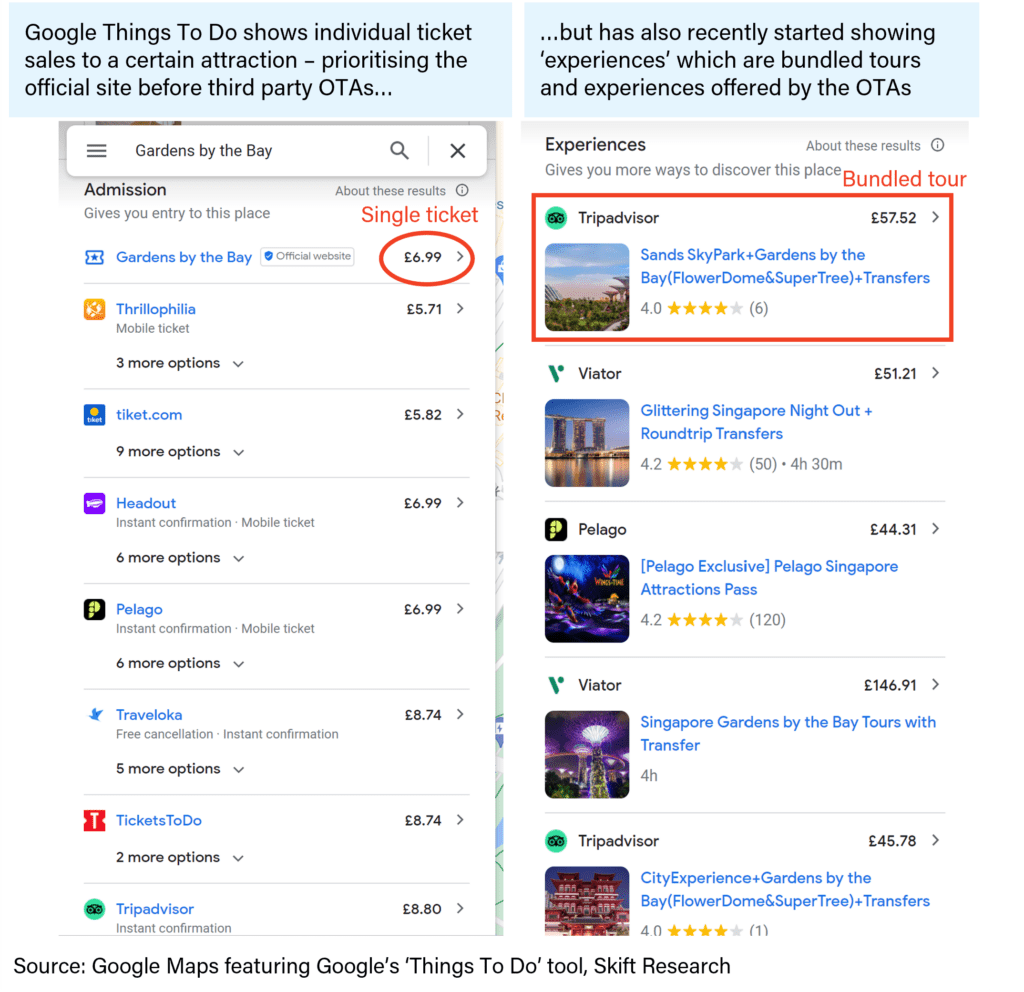

Additionally, as we show in the screenshots below, though Google might push users to the official website of major attractions, it also provides a space for OTAs to list their own original bundled tours which, as we have written about in earlier sections, has proved to be a valuable way for OTAs to differentiate themselves among their competitors.

The spotlight has been turned onto the tours, activities & experiences industry as a highly opportunistic part of travel ripe for consolidation. Every travel company wants a piece of the pie and in recent years we have seen a flurry of B2B partnerships which has allowed the large OTAs such as Expedia and Booking to source inventory from other players, even rival OTAs, in order to power their own tours, activities & experiences business. Gnock Fah of Klook commented: “I think for the category of experiences, there’s a lot of dirty work that needs to be done to consolidate the supply. Booking [Holdings] has demonstrated that though they decided to do it themselves pre-Covid, they have now realized that maybe it’s not in their DNA or maybe it’s just not in their focus today. So that has given rise to B2B partnerships”.

Gopalkrishnan of Musement further commented that “Booking are operating in just one part of the value chain when it comes to experiences – they are focussed on the digital sales element of it, whereas we are also on the ground selling tours and activities. This is the value of omni-channel sales – if you really want to sell experiences, you need to be available when the customer wants to buy it. So, both short-term and long-term, we see [B2B partnerships] as an opportunity to be part of their success and help them scale. And as a function of that, help us scale as a business.”

Notable B2B deals include Booking sourcing inventory from TUI Musement and Tripadvisor’s Viator . For companies like Musement, partnerships with the likes of Booking allows greater distribution and access to a wider pool of consumers in different source markets. Gopalkrishnan of Musement noted that a sizable 50% of their top line is from B2B channels, where Musement shares a portion of its commission and margin with its partners, sometimes marking up the commission that it receives from suppliers and then passing this onto its partners.

Though the birth of the B2B model has certainly aided in the growth of the industry as a whole, it has arguably also reduced the barrier to entry for online aggregators to near zero – fuelling more fragmentation in the market. For example Ankur Thakuria, Regional Director Asia Pacific & Middle East at Tiqets said that “it’s very easy for a company to tap into the market of selling tickets and experience and literally pull the supply overnight.” Though the fragmented nature of the industry and the rapid shift from offline to online still presents plenty of opportunity, especially for the emergence of regional market leaders – with Thakuria noting that “most of our biggest B2B partners have their unique source markets which are not necessarily overlapping with us” – in order to differentiate themselves OTAs will now have to rely not just on the amount of inventory and scale they have, but on providing products that are focused on personalization and high levels of service. As we wrote in 2018 , ultimately “digital experience marketplaces will fall prey to the paradox of choice. Fragmentation means brands competing on price instead of service have the most to lose.”

Largest Players and Market Shares

Of the industry that is booked on online intermediary platforms, we estimate that only about a fifth of this is dominated by the largest and most well known OTAs, with the rest spread across a wide range of smaller OTAs. We estimate that the biggest OTAs – namely Viator (owned by Tripadvisor) and GetYourGuide– only have a 5-6% market share of all online intermediaries. We also note that prominent OTAs like Booking, Expedia and Airbnb have negligible market share, with Airbnb Experiences recently removing tours and activities from its app and website. The lack of a dominant player presents a very attractive opportunity for the consolidation of market share.

We expect to see further M&A (Mergers and Acquisitions) activity in the future, with plenty of inorganic growth opportunities available in the space. However, it is difficult to predict whether the industry will see a dominant market leader, such as the market leading positions held by the duopoly of Booking and Expedia in the hotels space. This is largely due to the vastly more fragmented supply base of tours, activities & experiences and the differences in consumer behavior such that last minute walk-in offline bookings are much more prevalent.

Laurens Leurink of Tiqets doesn’t see one player monopolizing the market, saying: “Is this a winner takes all market? I don’t think so. The online visibility of all the things to do is so wide and diverse that I don’t think one party can be able to combine all this and be relevant. So I think there’s space for a lot of players. If you look at the playing fields, I see clear identity differences between the players, with plenty of space for more tailored players in the field. Google is trying to get a universal interface and then cover the whole industry, which I think is quite challenging, and they’re discovering that themselves as well.

Secondly, the space that we’re playing in has a huge diversity of very commercial players like Merlin Group for example, but you also have huge museums that are government owned or region owned that have much different dynamics. It’s not around profit optimization. It’s around having a fair share of people being able to see the art or whatever is being displayed. So that is hugely different from the dynamics in the airline and the hotels and lodging industry. The experiences vertical within travel and within leisure has so many different dynamics that I don’t see there being even two or three parties owning it all.”

In a highly competitive and fragmented industry so ripe with opportunity, many OTAs are pursuing expansion strategies and prioritizing market share gains over positive EBITDA margins. They are heavily investing in acquiring unique supply and building original tours and experiences, as well as marketing and technology in order to attract more users and enhance transaction volumes. While this strategy may result in top-line growth and increased market penetration, it comes at the sacrifice of short-term profitability. For example, Leurink of Tiqets commented that “there’s always a balance between growth and margin,” further saying that “our margins could be four or five fold [of current levels] if we decide to grow a bit less.”

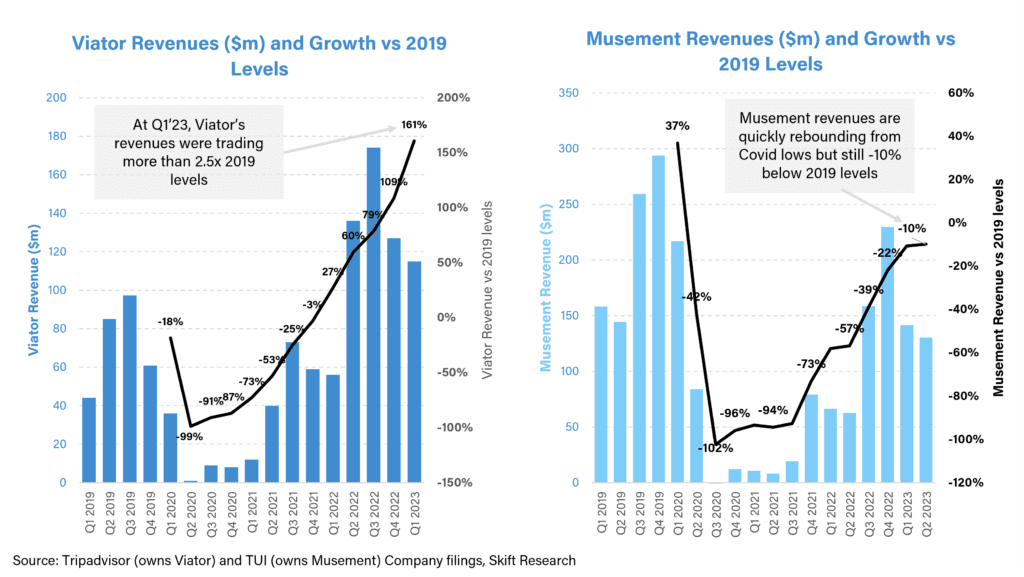

The charts below show that whilst Viator and Musement – two of the only public OTAs in the space – have rapidly grown their top line above pre-Covid levels, with Viator’s revenues at Q1 2023 more than 2.5x greater than 2019 levels, they are still operating at either negative or low single digit EBITDA margins.

However this is not to say that profitability is not on the cards. At Q2 2022 earnings, Tripadvisor said that “ although currently not yet demonstrating their profit potential as we invest in growth, we believe longer term, Viator can reach EBITDA margins of 25% to 30% given its strong gross margin profiles and potential for scale given the large TAMs and attractive unit economics.”

OTAs will continue to gain share . The tours, activities & experiences market represents a highly opportunistic part of the travel industry for online aggregators: the inherent fragmented nature of the market coupled with the rapid shift from offline to online necessitates a strong online aggregator. Major players have already entered the market – often backed with huge amounts of investor funding – with online intermediaries gaining share from their offline counterparts.

There will be a greater emphasis on service and personalization. There is all to play for, with no one OTA owning more than 5-6% market share of the online intermediaries. The long tail of small OTAs presents an attractive opportunity for consolidation by the larger players. However, given the rise in popularity of the B2B model – which essentially reduces the barrier to entry for online aggregators to near zero – we might see more fragmentation than consolidation in the market. This places a greater impetus on OTAs to differentiate themselves in meaningful ways such as providing high levels of personalized service.

Google’s ‘Things To Do’ is more friend than foe to the OTAs. Google’s foray into the space with its Things To Do tool has been met with both trepidation and excitement. Whilst Google’s entrance into the hotel industry through Google Hotels arguably hinders rather than aids the efforts of leading OTAs such as Booking Holdings and Expedia; in the tours, activities & experiences space, we expect Google to be more friend than foe. We expect that Google will benefit the online intermediaries, expediting the industry wide shift from offline to online and giving prominence to the OTAs. Additionally, though Google acts as a dis-intermediary in the hotel space, aiding in the shift back to direct bookings, in the vastly fragmented experiences market, we expect that direct bookings are less likely to gain traction and instead that the OTAs will continue to gain share.

Industry Verticals »

- Chemicals And Materials

- Consumer Goods

- Electronics and Semiconductors

- Energy and Natural Resources

- Factory Automation

- Food and Beverages

- Heavy Engineering Equipment

- IT and Telecom

- Pharmaceutical

- Latest Reports

- Forthcoming Reports

- Top Industry Reports

Press Releases »

About tmr ».

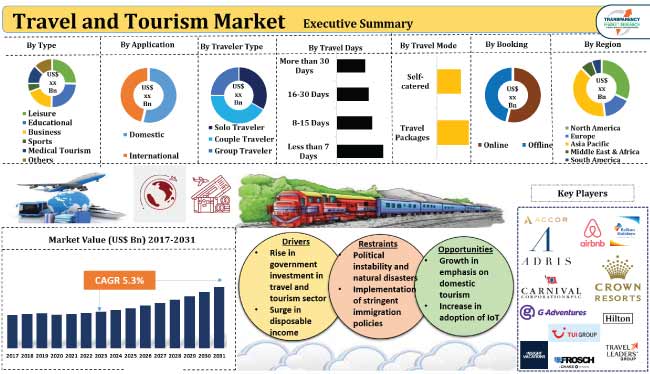

Travel and Tourism Market

Travel and Tourism Market (Type: Leisure, Educational, Business, Sports, Medical Tourism, and Others; and Application: Domestic and International) - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2023-2031

- Report Preview

- Table of Content

- Request Brochure

Global Travel and Tourism Market Outlook 2031

- The global industry was valued at US$ 615.2 Bn in 2022

- It is estimated to grow at a CAGR of 5.3% from 2023 to 2031 and reach US$ 972.5 Bn by the end of 2031

Analysts’ Viewpoint on Market Scenario Growth in disposable income, affordable commutes, easy accessibility of remote locations, and emerging travel trends are major factors boosting the travel and tourism market growth during the forecast period. Rise in government investment in the tourism sector is also projected to drive demand for travel and tourism in the next few years. Surge in adoption of IoT is likely to offer lucrative opportunities to players in the global travel and tourism industry. However, political instability, natural disasters, and implementation of stringent immigration policies are estimated to limit the travel and tourism market progress in the near future.

Market Introduction

Travel and tourism refers to the movement of people from one place to another due to various reasons such as leisure, education, business, and sports. It can be domestic, overseas, short distance, or long distance. The tourism sector is witnessing immense growth opportunities around the globe owing to rise in discretionary income, governmental support, infrastructural development, and technical integration to facilitate easy commutes.

Online booking platforms, mobile apps , and travel websites are gaining traction among travelers. Rapid globalization has led to a more interconnected world through trade, social media networks, business, and culture. Thus, people are traveling within and out of their borders with ease. These scenarios and travel trends are expected to augment the travel and tourism market value in the next few years.

Social media platforms and online websites are being used widely to promote various tourist destinations and hospitality and leisure facilities. They are attracting travelers through influencer marketing , travel blogs, articles, and user-generated content. This, in turn, is projected to spur growth of the travel and tourism industry. Moreover, increase in investment in infrastructural development and emergence of new travel trends among millennials are boosting the travel and tourism market size.

Tourism is becoming one of the major sectors driving a country’s revenue. Thus, governments across the globe are promoting and investing heavily in the sector, which is leading to improvements in public transportation, tourist destinations, and accommodation facilities. According to the latest travel and tourism market trends, travel and tourism is gaining traction among the middle-class population due to surge in disposable income.

In 2019, an average household in the U.S. spent around US$ 2,100 on travel. Security and health concerns play a major role in the tourism sector. This average dropped to US$ 926 post the emergence of the COVID-19 pandemic in 2020. Thus, travelers prefer safe and secure destinations.

Rise in Government Investment in Travel and Tourism Sector

The tourism sector across the globe is growing at a rapid pace, especially after COVID-19 lockdowns were lifted. Major governments are focusing on promoting and enhancing tourist traffic. In India, the Ministry of Tourism, under the CSSS Scheme of ‘Incentive to Tour Operators for Enhancing Tourist Arrivals to India’ is extending financial incentives to foreign tour operators, approved by the government. These promotional activities are contributing to the market size of travel and tourism.

Accessibility to remote yet beautiful tourist places and increase in popularity of travel destinations through online platforms has resulted in the tourist industry emerging as one of the key sectors in many countries. According to the U.S. Department of Commerce, International arrivals to the U.S. grew from 19.2 million in 2020 to 22.1 million in 2021. Moreover, the U.S. government is focusing on attracting around 90 million international visitors who are expected to spend approximately US$ 279 Bn annually by 2027. Hence, rise in number of international visitors is estimated to fuel the travel and tourism market.

Surge in Disposable Income

Rise in digital transformation and growth in penetration of the internet are offering emerging opportunities in the travel and tourism market. Online resources provide convenience in booking flight tickets and hotels and searching for places to plan trips.

Increase in disposable income provides a sense of economic stability, in which people tend to spend on leisure activities such as travel. Families are more likely to plan vacations, leading to surge in demand for trips and tourism. The gross national disposable income in India reached US$ 3,182.4 Bn in the financial year 2021-2022, recording a growth of 17.4% compared to the previous year. In the U.S., personal income increased US$ 45.0 billion (0.2% at a monthly rate) in July 2023, according to the Bureau of Economic Analysis. Hence, rise in disposable income is projected to boost the travel and tourism market revenue during the forecast period.

Regional Outlook

According to the latest travel and tourism market forecast, Asia Pacific is anticipated to hold largest share from 2023 to 2031. Rise in disposable income and growth in government investment are fueling the market dynamics of the region. Geographical advantages, increase in number of international travelers, and presence of a well-established tourism sector are driving the travel and tourism market statistics in North America.

Analysis of Key Players

Most travel and tourism service providers are offering lucrative tour packages to attract more travelers. They are also investing heavily in promotional activities to increase their travel and tourism market share.

Accor, Adris Grupa d.d., Airbnb, Inc., Balkan Holidays Ltd., Carnival Corporation & plc, Crown Resorts Ltd., G Adventures, Hilton Worldwide Holdings Inc., TUI Group, Travel Leaders Group, LLC, Insight Vacations, and Frosch International Travel, Inc. are key players in the travel and tourism market.

Key Developments

- In August 2023 , G Adventures added two new National Geographic Family Journeys in Italy and Tanzania. The eight-day Tanzania Family Journey is expected to take families on game drives in the Serengeti throughout the tour and include a visit to a community tourism project.

- In July 2023 , TUI Group released a ChatGPT-powered chatbot on its U.K. app, the first of what is expected to be a wave of rollouts that incorporates generative AI into the company’s tech, to help consumers search through its own portfolio of products

- In February 2023 , Adris announced plans to invest US$ 511 Mn in its tourism arm Maistra until 2025 with an aim to boost its luxury segment

Travel and Tourism Market Snapshot

Frequently asked questions, how big was the travel and tourism market in 2022.

It was valued at US$ 615.2 Bn in 2022

What would be the CAGR of the travel and tourism industry during the forecast period?

It is estimated to be 5.3% from 2023 to 2031

How big will the travel and tourism business be in 2031?

It is projected to reach US$ 972.5 Bn by the end of 2031

What are the prominent factors driving demand for travel and tourism?

Rise in government investment in travel and tourism sector and surge in disposable income

Which region is likely to record the highest demand for travel and tourism?

Asia Pacific is anticipated to record the highest demand from 2023 to 2031

Who are the prominent travel and tourism service providers?

Accor, Adris Grupa d.d., Airbnb, Inc., Balkan Holidays Ltd., Carnival Corporation & plc, Crown Resorts Ltd., G Adventures, Hilton Worldwide Holdings Inc., TUI Group, Travel Leaders Group, LLC, Insight Vacations, and Frosch International Travel, Inc.

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Entertainment Market Overview

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Service Provider Analysis

5.8. Global Travel and Tourism Market Analysis and Forecast, 2017 - 2031

5.8.1. Market Value Projection (US$ Bn)

6. Global Travel and Tourism Market Analysis and Forecast, By Type

6.1. Travel and Tourism Market (US$ Bn), By Type, 2017 - 2031

6.1.1. Leisure

6.1.2. Educational

6.1.3. Business

6.1.4. Sports

6.1.5. Medical Tourism

6.1.6. Others (Event Travel, Volunteer Travel, etc.)

6.2. Incremental Opportunity, By Type

7. Global Travel and Tourism Market Analysis and Forecast, By Application

7.1. Travel and Tourism Market (US$ Bn), By Application, 2017 - 2031

7.1.1. Domestic

7.1.2. International

7.2. Incremental Opportunity, By Application

8. Global Travel and Tourism Market Analysis and Forecast, By Traveler Type

8.1. Travel and Tourism Market (US$ Bn), By Traveler Type, 2017 - 2031

8.1.1. Solo Traveler

8.1.2. Couple Traveler

8.1.3. Group Traveler

8.2. Incremental Opportunity, By Traveler Type

9. Global Travel and Tourism Market Analysis and Forecast, By Travel Days

9.1. Travel and Tourism Market (US$ Bn), By Travel Days, 2017 - 2031

9.1.1. Less than 7 Days

9.1.2. 8-15 Days

9.1.3. 16-30 Days

9.1.4. More than 30 Days

9.2. Incremental Opportunity, By Travel Days

10. Global Travel and Tourism Market Analysis and Forecast, By Travel Mode

10.1. Travel and Tourism Market (US$ Bn), By Travel Mode, 2017 - 2031

10.1.1. Travel Packages

10.1.2. Self-catered

10.2. Incremental Opportunity, By Travel Mode

11. Global Travel and Tourism Market Analysis and Forecast, By Booking

11.1. Travel and Tourism Market (US$ Bn), By Booking, 2017 - 2031

11.1.1. Online

11.1.2. Offline

11.2. Incremental Opportunity, By Booking

12. Global Travel and Tourism Market Analysis and Forecast, by Region

12.1. Travel and Tourism Market (US$ Bn), by Region, 2017 - 2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Incremental Opportunity, by Region

13. North America Travel and Tourism Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Demographic Overview

13.4. Key Brand Analysis

13.5. Key Trends Analysis

13.5.1. Demand Side Analysis

13.5.2. Supply Side Analysis

13.6. Consumer Buying Behavior Analysis

13.7. Travel and Tourism Market (US$ Bn), By Type, 2017 - 2031

13.7.1. Leisure

13.7.2. Educational

13.7.3. Business

13.7.4. Sports

13.7.5. Medical Tourism

13.7.6. Others (Event Travel, Volunteer Travel, etc.)

13.8. Travel and Tourism Market (US$ Bn), By Application, 2017 - 2031

13.8.1. Domestic

13.8.2. International

13.9. Travel and Tourism Market (US$ Bn), By Traveler Type, 2017 - 2031

13.9.1. Solo Traveler

13.9.2. Couple Traveler

13.9.3. Group Traveler

13.10. Travel and Tourism Market (US$ Bn), By Travel Days, 2017 - 2031

13.10.1. Less than 7 Days

13.10.2. 8-15 Days

13.10.3. 16-30 Days

13.10.4. More than 30 Days

13.11. Travel and Tourism Market (US$ Bn), By Travel Mode, 2017 - 2031

13.11.1. Travel Packages

13.11.2. Self-catered

13.12. Travel and Tourism Market (US$ Bn), By Booking, 2017 - 2031

13.12.1. Online

13.12.2. Offline

13.13. Travel and Tourism Market (US$ Bn) Forecast, By Country, 2017 - 2031

13.13.1. U.S.

13.13.2. Canada

13.13.3. Rest of North America

13.14. Incremental Opportunity Analysis

14. Europe Travel and Tourism Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Demographic Overview

14.4. Key Brand Analysis

14.5. Key Trends Analysis

14.5.1. Demand Side Analysis

14.5.2. Supply Side Analysis

14.6. Consumer Buying Behavior Analysis

14.7. Travel and Tourism Market (US$ Bn), By Type, 2017 - 2031

14.7.1. Leisure

14.7.2. Educational

14.7.3. Business

14.7.4. Sports

14.7.5. Medical Tourism

14.7.6. Others (Event Travel, Volunteer Travel, etc.)

14.8. Travel and Tourism Market (US$ Bn), By Application, 2017 - 2031

14.8.1. Domestic

14.8.2. International

14.9. Travel and Tourism Market (US$ Bn), By Traveler Type, 2017 - 2031

14.9.1. Solo Traveler

14.9.2. Couple Traveler

14.9.3. Group Traveler

14.10. Travel and Tourism Market (US$ Bn), By Travel Days, 2017 - 2031

14.10.1. Less than 7 Days

14.10.2. 8-15 Days

14.10.3. 16-30 Days

14.10.4. More than 30 Days

14.11. Travel and Tourism Market (US$ Bn), By Travel Mode, 2017 - 2031

14.11.1. Travel Packages

14.11.2. Self-catered

14.12. Travel and Tourism Market (US$ Bn), By Booking, 2017 - 2031

14.12.1. Online

14.12.2. Offline

14.13. Travel and Tourism Market (US$ Bn) Forecast, By Country, 2017 - 2031

14.13.1. U.K.

14.13.2. Germany

14.13.3. France

14.13.4. Rest of Europe

14.14. Incremental Opportunity Analysis

15. Asia Pacific Travel and Tourism Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price (US$)

15.3. Demographic Overview

15.4. Key Brand Analysis

15.5. Key Trends Analysis

15.5.1. Demand Side Analysis

15.5.2. Supply Side Analysis

15.6. Consumer Buying Behavior Analysis

15.7. Travel and Tourism Market (US$ Bn), By Type, 2017 - 2031

15.7.1. Leisure

15.7.2. Educational

15.7.3. Business

15.7.4. Sports

15.7.5. Medical Tourism

15.7.6. Others (Event Travel, Volunteer Travel, etc.)

15.8. Travel and Tourism Market (US$ Bn), By Application, 2017 - 2031

15.8.1. Domestic

15.8.2. International

15.9. Travel and Tourism Market (US$ Bn), By Traveler Type, 2017 - 2031

15.9.1. Solo Traveler

15.9.2. Couple Traveler

15.9.3. Group Traveler

15.10. Travel and Tourism Market (US$ Bn), By Travel Days, 2017 - 2031

15.10.1. Less than 7 Days

15.10.2. 8-15 Days

15.10.3. 16-30 Days

15.10.4. More than 30 Days

15.11. Travel and Tourism Market (US$ Bn), By Travel Mode, 2017 - 2031

15.11.1. Travel Packages

15.11.2. Self-catered

15.12. Travel and Tourism Market (US$ Bn), By Booking, 2017 - 2031

15.12.1. Online

15.12.2. Offline

15.13. Travel and Tourism Market (US$ Bn) Forecast, By Country, 2017 - 2031

15.13.1. China

15.13.2. India

15.13.3. Japan

15.13.4. Rest of Asia Pacific

15.14. Incremental Opportunity Analysis

16. Middle East & Africa Travel and Tourism Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Price Trend Analysis

16.2.1. Weighted Average Selling Price (US$)

16.3. Demographic Overview

16.4. Key Brand Analysis

16.5. Key Trends Analysis

16.5.1. Demand Side Analysis

16.5.2. Supply Side Analysis

16.6. Consumer Buying Behavior Analysis

16.7. Travel and Tourism Market (US$ Bn), By Type, 2017 - 2031

16.7.1. Leisure

16.7.2. Educational

16.7.3. Business

16.7.4. Sports

16.7.5. Medical Tourism

16.7.6. Others (Event Travel, Volunteer Travel, etc.)

16.8. Travel and Tourism Market (US$ Bn), By Application, 2017 - 2031

16.8.1. Domestic

16.8.2. International

16.9. Travel and Tourism Market (US$ Bn), By Traveler Type, 2017 - 2031

16.9.1. Solo Traveler

16.9.2. Couple Traveler

16.9.3. Group Traveler

16.10. Travel and Tourism Market (US$ Bn), By Travel Days, 2017 - 2031

16.10.1. Less than 7 Days

16.10.2. 8-15 Days

16.10.3. 16-30 Days

16.10.4. More than 30 Days

16.11. Travel and Tourism Market (US$ Bn), By Travel Mode, 2017 - 2031

16.11.1. Travel Packages

16.11.2. Self-catered

16.12. Travel and Tourism Market (US$ Bn), By Booking, 2017 - 2031

16.12.1. Online

16.12.2. Offline

16.13. Travel and Tourism Market (US$ Bn) Forecast, By Country, 2017 - 2031

16.13.1. GCC

16.13.2. South Africa

16.13.3. Rest of Middle East & Africa

16.14. Incremental Opportunity Analysis

17. South America Travel and Tourism Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Price Trend Analysis

17.2.1. Weighted Average Selling Price (US$)

17.3. Demographic Overview

17.4. Key Brand Analysis

17.5. Key Trends Analysis

17.5.1. Demand Side Analysis

17.5.2. Supply Side Analysis

17.6. Consumer Buying Behavior Analysis

17.7. Travel and Tourism Market (US$ Bn), By Type, 2017 - 2031

17.7.1. Leisure

17.7.2. Educational

17.7.3. Business

17.7.4. Sports

17.7.5. Medical Tourism

17.7.6. Others (Event Travel, Volunteer Travel, etc.)

17.8. Travel and Tourism Market (US$ Bn), By Application, 2017 - 2031

17.8.1. Domestic

17.8.2. International

17.9. Travel and Tourism Market (US$ Bn), By Traveler Type, 2017 - 2031

17.9.1. Solo Traveler

17.9.2. Couple Traveler

17.9.3. Group Traveler

17.10. Travel and Tourism Market (US$ Bn), By Travel Days, 2017 - 2031

17.10.1. Less than 7 Days

17.10.2. 8-15 Days

17.10.3. 16-30 Days

17.10.4. More than 30 Days

17.11. Travel and Tourism Market (US$ Bn), By Travel Mode, 2017 - 2031

17.11.1. Travel Packages

17.11.2. Self-catered

17.12. Travel and Tourism Market (US$ Bn), By Booking, 2017 - 2031

17.12.1. Online

17.12.2. Offline

17.13. Travel and Tourism Market (US$ Bn) Forecast, By Country, 2017 - 2031

17.13.1. Brazil

17.13.2. Rest of South America

17.14. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Market Player - Competition Dashboard

18.2. Market Revenue Share Analysis (%), (2022)

18.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

18.3.1. Accor

18.3.1.1. Company Overview

18.3.1.2. Sales Area/Geographical Presence

18.3.1.3. Revenue

18.3.1.4. Strategy & Business Overview

18.3.2. Adris Grupa d.d.

18.3.2.1. Company Overview

18.3.2.2. Sales Area/Geographical Presence

18.3.2.3. Revenue

18.3.2.4. Strategy & Business Overview

18.3.3. Airbnb, Inc.

18.3.3.1. Company Overview

18.3.3.2. Sales Area/Geographical Presence

18.3.3.3. Revenue

18.3.3.4. Strategy & Business Overview

18.3.4. Balkan Holidays Ltd.

18.3.4.1. Company Overview

18.3.4.2. Sales Area/Geographical Presence

18.3.4.3. Revenue

18.3.4.4. Strategy & Business Overview

18.3.5. Carnival Corporation & plc

18.3.5.1. Company Overview

18.3.5.2. Sales Area/Geographical Presence

18.3.5.3. Revenue

18.3.5.4. Strategy & Business Overview

18.3.6. Crown Resorts Ltd.

18.3.6.1. Company Overview

18.3.6.2. Sales Area/Geographical Presence

18.3.6.3. Revenue

18.3.6.4. Strategy & Business Overview

18.3.7. G Adventures

18.3.7.1. Company Overview

18.3.7.2. Sales Area/Geographical Presence

18.3.7.3. Revenue

18.3.7.4. Strategy & Business Overview

18.3.8. Hilton Worldwide Holdings Inc.

18.3.8.1. Company Overview

18.3.8.2. Sales Area/Geographical Presence

18.3.8.3. Revenue

18.3.8.4. Strategy & Business Overview

18.3.9. TUI Group

18.3.9.1. Company Overview

18.3.9.2. Sales Area/Geographical Presence

18.3.9.3. Revenue

18.3.9.4. Strategy & Business Overview

18.3.10. Travel Leaders Group, LLC

18.3.10.1. Company Overview

18.3.10.2. Sales Area/Geographical Presence

18.3.10.3. Revenue

18.3.10.4. Strategy & Business Overview

18.3.11. Insight Vacations

18.3.11.1. Company Overview

18.3.11.2. Sales Area/Geographical Presence

18.3.11.3. Revenue

18.3.11.4. Strategy & Business Overview

18.3.12. Frosch International Travel, Inc.

18.3.12.1. Company Overview

18.3.12.2. Sales Area/Geographical Presence

18.3.12.3. Revenue

18.3.12.4. Strategy & Business Overview

18.3.13. Other Key Players

18.3.13.1. Company Overview

18.3.13.2. Sales Area/Geographical Presence

18.3.13.3. Revenue

18.3.13.4. Strategy & Business Overview

19. Go To Market Strategy

19.1. Identification of Potential Market Spaces

19.2. Understanding Procurement Process of Customers

19.3. Preferred Sales & Marketing Strategy

19.4. Prevailing Market Risks

List of Tables

Table 1: Global Travel and Tourism Market Value (US$ Bn) Projection By Type 2017-2031

Table 2: Global Travel and Tourism Market Value (US$ Bn) Projection By Application 2017-2031

Table 3: Global Travel and Tourism Market Value (US$ Bn) Projection By Traveler Type 2017-2031

Table 4: Global Travel and Tourism Market Value (US$ Bn) Projection By Travel Days 2017-2031

Table 5: Global Travel and Tourism Market Value (US$ Bn) Projection By Travel Mode 2017-2031

Table 6: Global Travel and Tourism Market Value (US$ Bn) Projection By Booking 2017-2031

Table 7: Global Travel and Tourism Market Value (US$ Bn) Projection By Region 2017-2031

Table 8: North America Travel and Tourism Market Value (US$ Bn) Projection By Type 2017-2031

Table 9: North America Travel and Tourism Market Value (US$ Bn) Projection By Application 2017-2031

Table 10: North America Travel and Tourism Market Value (US$ Bn) Projection By Traveler Type 2017-2031

Table 11: North America Travel and Tourism Market Value (US$ Bn) Projection By Travel Days 2017-2031

Table 12: North America Travel and Tourism Market Value (US$ Bn) Projection By Travel Mode 2017-2031

Table 13: North America Travel and Tourism Market Value (US$ Bn) Projection By Booking 2017-2031

Table 14: North America Travel and Tourism Market Value (US$ Bn) Projection By Country 2017-2031

Table 15: Europe Travel and Tourism Market Value (US$ Bn) Projection By Type 2017-2031

Table 16: Europe Travel and Tourism Market Value (US$ Bn) Projection By Application 2017-2031

Table 17: Europe Travel and Tourism Market Value (US$ Bn) Projection By Traveler Type 2017-2031

Table 18: Europe Travel and Tourism Market Value (US$ Bn) Projection By Travel Days 2017-2031

Table 19: Europe Travel and Tourism Market Value (US$ Bn) Projection By Travel Mode 2017-2031

Table 20: Europe Travel and Tourism Market Value (US$ Bn) Projection By Booking 2017-2031

Table 21: Europe Travel and Tourism Market Value (US$ Bn) Projection By Country 2017-2031

Table 22: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection By Type 2017-2031

Table 23: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection By Application 2017-2031

Table 24: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection By Traveler Type 2017-2031

Table 25: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection By Travel Days 2017-2031

Table 26: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection By Travel Mode 2017-2031

Table 27: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection By Booking 2017-2031

Table 28: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection By Country 2017-2031

Table 29: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection By Type 2017-2031

Table 30: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection By Application 2017-2031

Table 31: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection By Traveler Type 2017-2031

Table 32: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection By Travel Days 2017-2031

Table 33: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection By Travel Mode 2017-2031

Table 34: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection By Booking 2017-2031

Table 35: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection By Country 2017-2031

Table 36: South America Travel and Tourism Market Value (US$ Bn) Projection By Type 2017-2031

Table 37: South America Travel and Tourism Market Value (US$ Bn) Projection By Application 2017-2031

Table 38: South America Travel and Tourism Market Value (US$ Bn) Projection By Traveler Type 2017-2031

Table 39: South America Travel and Tourism Market Value (US$ Bn) Projection By Travel Days 2017-2031

Table 40: South America Travel and Tourism Market Value (US$ Bn) Projection By Travel Mode 2017-2031

Table 41: South America Travel and Tourism Market Value (US$ Bn) Projection By Booking 2017-2031

Table 42: South America Travel and Tourism Market Value (US$ Bn) Projection By Country 2017-2031

List of Figures

Figure 1: Global Travel and Tourism Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 2: Global Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 3: Global Travel and Tourism Market Value (US$ Bn) Projection, By Application 2017-2031

Figure 4: Global Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Application 2023-2031

Figure 5: Global Travel and Tourism Market Value (US$ Bn) Projection, By Traveler Type 2017-2031

Figure 6: Global Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Traveler Type 2023-2031

Figure 7: Global Travel and Tourism Market Value (US$ Bn) Projection, By Travel Days 2017-2031

Figure 8: Global Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Days 2023-2031

Figure 9: Global Travel and Tourism Market Value (US$ Bn) Projection, By Travel Mode 2017-2031

Figure 10: Global Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Mode 2023-2031

Figure 11: Global Travel and Tourism Market Value (US$ Bn) Projection, By Booking 2017-2031

Figure 12: Global Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Booking 2023-2031

Figure 13: Global Travel and Tourism Market Value (US$ Bn) Projection, By Region 2017-2031

Figure 14: Global Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Region 2023-2031

Figure 15: North America Travel and Tourism Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 16: North America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 17: North America Travel and Tourism Market Value (US$ Bn) Projection, By Application 2017-2031

Figure 18: North America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Application 2023-2031

Figure 19: North America Travel and Tourism Market Value (US$ Bn) Projection, By Traveler Type 2017-2031

Figure 20: North America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Traveler Type 2023-2031

Figure 21: North America Travel and Tourism Market Value (US$ Bn) Projection, By Travel Days 2017-2031

Figure 22: North America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Days 2023-2031

Figure 23: North America Travel and Tourism Market Value (US$ Bn) Projection, By Travel Mode 2017-2031

Figure 24: North America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Mode 2023-2031

Figure 25: North America Travel and Tourism Market Value (US$ Bn) Projection, By Booking 2017-2031

Figure 26: North America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Booking 2023-2031

Figure 27: North America Travel and Tourism Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 28: North America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 29: Europe Travel and Tourism Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 30: Europe Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 31: Europe Travel and Tourism Market Value (US$ Bn) Projection, By Application 2017-2031

Figure 32: Europe Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Application 2023-2031

Figure 33: Europe Travel and Tourism Market Value (US$ Bn) Projection, By Traveler Type 2017-2031

Figure 34: Europe Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Traveler Type 2023-2031

Figure 35: Europe Travel and Tourism Market Value (US$ Bn) Projection, By Travel Days 2017-2031

Figure 36: Europe Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Days 2023-2031

Figure 37: Europe Travel and Tourism Market Value (US$ Bn) Projection, By Travel Mode 2017-2031

Figure 38: Europe Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Mode 2023-2031

Figure 39: Europe Travel and Tourism Market Value (US$ Bn) Projection, By Booking 2017-2031

Figure 40: Europe Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Booking 2023-2031

Figure 41: Europe Travel and Tourism Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 42: Europe Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 43: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 44: Asia Pacific Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 45: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection, By Application 2017-2031

Figure 46: Asia Pacific Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Application 2023-2031

Figure 47: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection, By Traveler Type 2017-2031

Figure 48: Asia Pacific Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Traveler Type 2023-2031

Figure 49: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection, By Travel Days 2017-2031

Figure 50: Asia Pacific Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Days 2023-2031

Figure 51: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection, By Travel Mode 2017-2031

Figure 52: Asia Pacific Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Mode 2023-2031

Figure 53: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection, By Booking 2017-2031

Figure 54: Asia Pacific Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Booking 2023-2031

Figure 55: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 56: Asia Pacific Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 57: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 58: Middle East & Africa Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 59: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection, By Application 2017-2031

Figure 60: Middle East & Africa Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Application 2023-2031

Figure 61: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection, By Traveler Type 2017-2031

Figure 62: Middle East & Africa Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Traveler Type 2023-2031

Figure 63: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection, By Travel Days 2017-2031

Figure 64: Middle East & Africa Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Days 2023-2031

Figure 65: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection, By Travel Mode 2017-2031

Figure 66: Middle East & Africa Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Mode 2023-2031

Figure 67: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection, By Booking 2017-2031

Figure 68: Middle East & Africa Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Booking 2023-2031

Figure 69: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 70: Middle East & Africa Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 71: South America Travel and Tourism Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 72: South America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 73: South America Travel and Tourism Market Value (US$ Bn) Projection, By Application 2017-2031

Figure 74: South America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Application 2023-2031

Figure 75: South America Travel and Tourism Market Value (US$ Bn) Projection, By Traveler Type 2017-2031

Figure 76: South America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Traveler Type 2023-2031

Figure 77: South America Travel and Tourism Market Value (US$ Bn) Projection, By Travel Days 2017-2031

Figure 78: South America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Days 2023-2031

Figure 79: South America Travel and Tourism Market Value (US$ Bn) Projection, By Travel Mode 2017-2031

Figure 80: South America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Mode 2023-2031

Figure 81: South America Travel and Tourism Market Value (US$ Bn) Projection, By Booking 2017-2031

Figure 82: South America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Booking 2023-2031

Figure 83: South America Travel and Tourism Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 84: South America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Download FREE Sample!

Get a sample copy of this report

Your personal details are safe with us. Privacy Policy*

Get a copy of Brochure!

Copyright © Transparency Market Research, Inc. All Rights reserved

Trust Online

The Global Tours & Activities Market

Delivered june 7th, 2022 . contributors: kej a., key takeaways.

- The global size of the tours and activities reservations market in the year 2020 is $158.5 trillion .

- The global domestic tourism market, as of 2020, had a market size of $1.22 trillion .

- The global travel activities market has an estimated size of $66.84 billion.

Introduction

Global tours and activities reservations market.

- The global tours and activities reservations market was estimated at $158.5 trillion in 2020.

- The market is expected to grow at a CAGR of 7.7% from 2020 to 2027. At this rate, the market will reach an estimated size of $266.7 trillion by 2027.

- The US alone represents about 27% of the global figure, with an annual size of $42.8 trillion .

- China holds the second position, with an estimated market size of $27.6 trillion in 2020. It is expected to continue at a CAGR of 11.7% and reach $59.9 trillion by 2027.

- The following are other key markets and their f o r e c a s t e d CAGR from 2020 to 2027;

- Japan: 4.2%

- Germany: 5%

- Canada: 6.9%

Calculations

Local experiences market (domestic tourism).

- The market size of the global domestic tourism market as of 2020 is $1.22 trillion .

- At a projected CAGR of 13.4% , the market is expected to reach $6.73 trillion by 2030.

- The Asia-Pacific region accounts for the largest share of the domestic tourism market with a 40% market share and is projected to hold this position until 2030.

- Latin America, the Middle East, and Africa (LAMEA) is the fastest-growing region and is expected to grow at a CAGR of 15.7% from 2021 to 2030.

Travel Activities Market

- According to a 2021 report by Research and Markets, the global travel market is expected to grow by $451.19 billion during the forecast period of 2022-2026 at a CAGR of 13.86% .

- Based on these figures , the 2022 market size of the global travel market is estimated to be $668.4 billion.

- In 2016, the travel activities market accounted for 10% of the global travel market.

- Assuming that the 10% market share remains constant, the travel activities market has a current size of $66.84 billion.

- The Global Travel Activities Report by Market Reports World is a 126-page p a y w a l l e d research report on the travel activities market, including key players, demographic profile, size, other quantitative information, and distribution by activity and geography.

- Market size 2022 = 1

- Market size 2023 = (1 + 13.86/100) =1.1386

- Market size 2024 = 1.1386 * (1+13.86/100) = 1.296

- Market size 2025 = 1.296 * (1+13.86/100) = 1.473

- Market size 2026 = 1.473 * (1+13.86/100) = 1.675

Research Strategy

Did this report spark your curiosity, global tours and activities reservations industry (2020 to 2027) - market trajectory & analytics, global domestic tourism market to reach $6.73 trillion by 2030: allied market research, global travel market growth outlook 2022-2026: compound annual growth of 13% is forecast during 2022-2026 - researchandmarkets.com, travel activities market to reach $183 billion by 2020: phocuswright.

- Private Tours

- Dine Arounds

- Culinary Trips (Coming Soon)

- Coming Soon

North End(Little Italy) & Boston Public Market Tour

- 3 1/2 Hours

- 10:30 a.m. or noon departure 11:30 a.m. on Sundays

A walking food tour in Boston’s North End

Note: Please be aware that the tour does not run on major holidays when the Boston Public Market is closed. Tour stops are subject to change based on our partners’ daily opening and closing schedules. We advise guests to leave one hour between the end of the tour and subsequent plans, and we recommend that all guests bring a bottle of water to stay hydrated.

Join us on a culinary journey through Boston’s vibrant food scene, starting in the historic North End, also known as Boston’s Little Italy. We’ll begin with award-winning pizza included on the country’s “Top 100 Pizzas” list, followed by a visit to historic North Square.

Next, we’ll indulge in an iconic cannoli, and visit two hidden gems that offer unique culinary experiences. At one stop, you’ll enjoy a bread tasting from a three-time Old World Best of Boston Bread Bakery. At another, you’ll savor balsamic vinegars, and house-made mozzarella tastings from a salumeria featured on the Food Network’s “Best Thing That I Ever Ate.”

Explore the Boston Public Market

On Fridays and Saturdays, our tour route will take us through the nearly-200-year-old historic Haymarket Market, the oldest open-air market in the country, where we’ll meet with vendors.

Moving indoors, we’ll visit the Boston Public Market, recognized in 2022 as one of the top four public markets in the country by USA Today readers. Here, you’ll enjoy representative tastings from up to 30 local and regional vendors, including a regional specialty doughnut, Best of Boston-winning ice cream, and addictive flavored nuts.

Our finale is both historical and delicious! Just a block away from the market, we’ll experience the longest continuously-running restaurant in the country, ranked by Forbes as one of the top ten classic restaurants in the world. Here, we’ll savor its iconic chowder and cornbread, and beer drinkers can enjoy an exclusive Sam Adams beer on tap.

Join us for an unforgettable culinary adventure through Boston’s rich history and diverse food culture. If you have any questions, get in touch .

Tony DeMarco statue, at the corner of Cross and Hanover Streets, next to Mother Anna’s restaurant.

Availability

Fridays and Saturdays; up to (6) days weekly as season progresses. Does not run on major holidays, when the Boston Public Market is closed.

Already A Member?

Username or E-mail

Forget Password?

Don't have an account? Create one.

Or continue as guest, adding item to wishlist requires an account.

1-617-461-5772 [email protected]

Related Tours

North End (Little Italy) Neighborhood Tour

- Market Segmentation in Tourism (What It Is & Why It Matters)

Pete Sherwood , Director of Content Strategy

Pete Sherwood

Director of content strategy.