- English (UK)

- English (CA)

- Deutsch (DE)

- Deutsch (CH)

The 8 best travel & expense management software platforms in 2024

What is travel and expense management software.

?)

Want to know more about automating your travel expense management? Check out our ebook!

The best travel and expense management solutions, 1. travelperk.

- Access to multiple user profiles for booking travel

- Centralized invoicing , so you can say goodbye to multiple invoices and even opt to let TravelPerk handle invoice collection for you

- Company policy compliance when offering booking options

- Third-party integrations with popular tools like Expensify , Payhawk , and BambooHR

- Excellent 24/7 customer support with a target 15-second response time

- Advanced reporting and insights for a comprehensive overview of spending

- Quick VAT recovery solutions —find out how much you could be saving with TravelPerk’s VAT recovery calculator

- G2 rating : 4.6 / 5, based on 1,533 ratings

- Capterra rating : 4.8 / 5, based on 403 ratings

?)

Start saving money on business travel for your company today!

2. spendesk.

?)

- Unlimited virtual cards for frictionless subscription management and online payments

- Built-in budgets and spending rules to eliminate rogue spending

- Automatic receipt capture with OCR technology

- Smoother month-end closing every month thanks to automated bookkeeping and streamlined processes

- Faster, smarter spending decisions

- G2 rating : 4.7 / 5, based on 399 reviews

- Capterra rating : 4.8 / 5, based on 215 ratings

3. BILL Spend & Expense

?)

- Unlimited, customizable virtual cards for your business expenses

- In-depth reporting and insights to give you complete control over business expenses

- Travel reimbursement software to measure expense claims and mileage reimbursements against specific budgets for added spend visibility

- Rewards program based on your payoff schedule, with rewards on restaurants, hotels, subscriptions, and more

- G2 rating : 4.5 / 5, based on 1,258 ratings

- Capterra rating : 4.7 / 5, based on 412 ratings

?)

- Accounting automation to eliminate tedious, time-consuming accounting tasks (when integrated with an accounting solution)

- Easy to set up spending approval and pre-paid cards with custom budgets

- AI-powered receipt matching that learns from previous receipt submissions

- Cards with your company branding for that extra personalized touch

- G2 rating: 4.8 / 5, based on 1,907 ratings

- Capterra rating: 4.9 / 5, based on 178 ratings

?)

- Easily manage receipts and business travel details

- Save or submit digital expense reports through a centralized dashboard

- Ensure travel compliance with set business travel expense reimbursement policies

- Access credit card management software, which is useful for monitoring and processing company credit cards

- G2 rating : 4.6 / 5, based on 1,251 ratings

- Capterra rating : 4.5 / 5, based on 146 ratings

6. SAP Concur

?)

- Reduce overall costs with control over your travel and expense management

- Improve your compliance and help mitigate risks

- Simple implementations with cloud solutions

- A scalability solution for growing businesses

- Mobile optimized for those looking for mobile app capabilities

- A larger inventory means TravelPerk offers deals from a wider variety of travel providers, including deals on flights, accommodation, and car hire.

- SAP Concur’s pricing can be difficult to estimate , and many features are optional additions. With TravelPerk, you pay when you travel —no unexpected fees or add-ons.

- TravelPerk’s platform is easy to implement and use, whereas SAP Concur users often report the tool being “ clunky and not easy to use ”.

- G2 rating : 4 / 5, based on 5,999 ratings

- Capterra rating : 4.3 / 5 stars, based on 2,013 reviews

Click below to compare both platforms’ features and benefits

7. zoho expense.

?)

- Streamlined corporate travel with automated expense reporting for each trip

- Notifications to alert team members of updates and changes

- Real-time spend visibility for an up-to-date overview of any expense data

- Analytics that can highlight changes required for better travel and expense management

- High quality 24/7 customer support with a target response time of 15 seconds

- An industry-leading inventory that offers TravelPerk’s negotiated rates

- Key features like carbon offsetting and VAT recovery

- An easy-to-use interface and workflow

- G2 rating : 4.5 / 5, based on 1,127 ratings

- Capterra rating : 4.6 / 5, based on 971 ratings

8. Emburse Certify

?)

- Workflows for efficient, reliable, and data-rich employee expense management

- Policy compliance with built-in policy controls

- Automate the accounts payable process and gain insights into business spend

- G2 rating : 4.5 / 5, based on 2,014 ratings

- Capterra rating : 4.7 / 5, based on 1,279 ratings

When is it the right time to find a travel and expense management solution?

- Identify where you could be saving on your travel budget

- Find better deals on travel and accommodation with negotiated rates

- Lower your overall travel spending

- Make life easier for your corporate travel manager(s)

- Enable employees to easily self-book travel within your organization’s company policy

What should you look out for in T&E software?

A user-friendly travel management platform, multiple user profiles, travel policy integration and compliance, a seamless reimbursement process, automated approval workflows and reporting, need an easier way to manage expenses for business travel, integrations with existing tools.

- Accounting software

- Travel management software

- Time-tracking tools

- Team management software

- Calendar software

Travel and expense management software for your business

?)

Make business travel simpler. Forever.

- See our platform in action . Trusted by thousands of companies worldwide, TravelPerk makes business travel simpler to manage with more flexibility, full control of spending with easy reporting, and options to offset your carbon footprint.

- Find hundreds of resources on all things business travel, from tips on traveling more sustainably, to advice on setting up a business travel policy, and managing your expenses. Our latest e-books and blog posts have you covered.

- Never miss another update. Stay in touch with us on social for the latest product releases, upcoming events, and articles fresh off the press.

?)

Top 14 European trade shows in 2024 & beyond

?)

5 best business travel management companies in San Francisco

?)

6 best business travel management companies in Los Angeles

- Business Travel Management

- Offset Carbon Footprint

- Flexible travel

- Corporate Travel Resources

- Corporate Travel Glossary

- For Travel Managers

- For Finance Teams

- For Travelers

- Thoughts from TravelPerk

- Careers Hiring

- User Reviews

- Integrations

- Privacy Center

- Help Center

- Privacy Policy

- Cookies Policy

- Modern Slavery Act | Statement

- Supplier Code of Conduct

Filter by Keywords

10 Best Travel & Expense Software to Use in 2024

Praburam Srinivasan

Growth Marketing Manager

June 2, 2024

Start using ClickUp today

- Manage all your work in one place

- Collaborate with your team

- Use ClickUp for FREE—forever

Manual travel and expense reimbursement is tedious. You have to maintain spreadsheets, gather all travel expense receipts from employees, verify them, record the data, and approve the reimbursement. It also leaves room for errors.

Why go through this whole expense data hassle when you can automate this process with travel and expense management software?

Instead of maintaining a record of hundreds of physical receipts and large rows of employee expenses, you can simply scan the receipts to record expenses and automate the approval processes through defined workflows, making corporate travel management as easy as ever.

Let’s explore the top 10 travel and expense management software to support your business travel needs, their key features, and pricing.

What Should You Look for in Travel and Expense Software?

1. travelperk, 3. wegopro (formerly travelstop), 4. expensify, 7. emburse certify, 8. sap concur, 9. travelbank, 10. zoho expense.

A travel and expense software should simplify bookings, invoicing, and reimbursements. Here are some capabilities that enable a streamlined reimbursement process:

- Intuitive dashboard : An intuitive dashboard helps you easily monitor each employee’s travel expenses when they submit digital expense reports. Look for customizable views, app integrations, and real-time tracking

- Automation : The software should auto-fill transaction details from corporate cards and calculate expense reimbursements

- Digital receipts capturing : It should be able to extract data from digital receipts and fill in expense fields, eliminating the need for manual data entry

- Advanced analytics: Best expense management platforms offer in-depth reporting and analytics features to help businesses analyze and manage travel expenses

- Cost-effectiveness : The software should offer custom and reasonable pricing as per your business needs

The 10 Best Travel and Expense Software to Use in 2024

Here are the 10 best travel and expense software that can manage your end-to-end business travel needs—from travel booking to expense management, budget tracking, and receipt management.

TravelPerk is a platform that offers seamless travel and expense reporting management. It supports multiple use cases, such as group travel bookings for offsites, travel management, expense management, and centralized invoicing.

With its in-built travel tracker, HR managers can monitor employee trips in real time and check whether they are adhering to travel expense policies and compliances.

TravelPerk best features

- Control your travel budget with real-time information from the interactive TravelPerk dashboard

- Add powerful integrations in one click to manage all your expenses from one place

- Modify your bookings anytime with Flexi Perk, a one-tap solution to book airline tickets and hotels at any rate and cancel them at any time

- View real-time travel status with an interactive map

- Get top insights on travel carbon footprints for introducing sustainable traveling solutions

TravelPerk limitations

- It has limited travel booking options

- Needs potential UI improvements for travel bookings. For example, you cannot search for hotels directly and will have to scroll through the entire list

TravelPerk pricing

- Starter : Free

- Premium : $99/month+3% booking

- Pro : $299/month+3% booking

- Enterprise : Custom pricing

TravelPerk ratings and reviews

- G2 : 4.6/5 (1500+ reviews)

- Capterra : 4.8/5 (404 reviews)

Fyle is an expense management solution that automates your expense and reimbursement process, which includes reconciling corporate card expenses and processing employee expense reimbursements. Connect it with your accounting software to track vendor, project, and department expenses.

You can integrate Fyle with NetSuite, Xero, Sage Intact, BambooHR, and QuickBooks. While it does not offer travel management features, it can be integrated with TravelPerk to analyze and report employee travel expenses.

Fyle best features

- Leverage conversational AI to collect digital expense reports and match them to the credit card transaction

- Automate expense form filling, report submissions, and sync expenses to your accounting software like Quickbooks, Sage, and Xero

- Get real-time actionable insights into your spending data through the powerful and advanced analytics dashboard

Fyle limitations

- Fyle’s limited expense categories make it difficult to accurately record all types of expenses

- It has a steep learning curve

Fyle pricing

- Standard : $6.99 per month per user, billed annually

- Business : $11.99 per month per user, billed annually

- Enterprise : Custom pricing

Fyle ratings and reviews

- G2 : 4.6/5 (1300+ reviews)

- Capterra : 4.5/5 (146 reviews)

WeGoPro is a travel booking and management plus expense tracking software. It has over 800 airlines and 600,000 hotels listed to make travel booking and control easier for businesses.

With WeGoPro, you can track company-wide expenses on a single dashboard in real time. It also allows you to maintain a record of frequent travel policy and compliance violators.

WeGoPro best features

- Saves hours of manual paperwork and accelerates reimbursement with automated expense reporting

- Manage multi-currency expenses with instant exchange rates to manage global business expenses without any delay

- Get data-driven insights through a consolidated view of your spending by either expense category or department in one single place

- Track real-time business traveler’s data and ensure safety and instant support through interactive maps

WeGoPro limitations

- It offers limited accommodation options as compared to other travel management platforms

- Higher prices per booking can impact travel budget, especially for small businesses

WeGoPro pricing

- Standard : $10/booking

- Premium : Contact for pricing

- Expenses : $5/month per user

WeGoPro ratings and reviews

- G2 : 4.4 /5 (12 reviews)

- Capterra : 4.3/ 5 (18 reviews)

Expensify is an expense management app with unlimited receipt tracking management. Its SmartScan feature scans all receipts in one click and automatically uploads them on the dashboard.

You can sync Expensify with business accounting, HR, and travel software to bring all data together, making financial audit processes easier.

Expensify best features

- Capture all receipts in one click with SmartScan to automatically import your expenses for rapid reimbursements

- Earn up to 2% cashback on Expensify cards on transactions above $250,000

- Create expense rules to categorize recurring payments automatically

Expensify limitations

- Submitting separate expense reports for personal and business cards can be overwhelming for employees

- Frequent glitches in the receipt scanning process require manual effort to submit expense bills

Expensify pricing

- Collect : $5/month per user, billed annually

- Control : $9/month per user, billed annually

Expensify ratings and reviews

- G2 : 4.5/5 (5100+ reviews)

- Capterra : 4.5/5 (1000+ reviews)

Navan is an expense management automation software that collects details of business spend from employee receipts and business card expenses. Businesses can limit card usage to avoid overspending by employees.

You can use Navan to reimburse out-of-pocket expenses of business travelers across 45 countries and 25 currencies. Moreover, Navan Rewards allows employees to earn rewards on their travel.

Navan best features

- Track employee travel spending with advanced expense reporting and analytics

- Get real-time carbon emission data to keep track of your sustainable travel goals

Navan limitations

- Customer support team might take longer time than usual to answer your support tickets

- Lack of offline GPS support makes it difficult to record travel when employees are traveling to another country without an international SIM card

Navan pricing

- Growth : Free

- Professional : Custom pricing

Navan ratings and reviews

- G2 : 4.7/5 (7500+ reviews)

- Capterra : 4.6/5 (176 reviews)

Happay is a comprehensive platform for travel and expense management. It offers different expense management solutions for various use cases, such as a Self Booking Tool (SBT) to book travel tickets and hotels for business purposes, and Xpendite to track expenses from over six sources automatically.

Its smart audit solution helps managers identify and flag travel policy violations by employees. Happay’s intelligent analytics offer valuable insights into employee spending patterns, enabling greater control over the business spend.

Plus, its seamless integration with accounting systems makes it the ultimate solution for efficient financial management.

Happay best features

- Achieve 100% accurate expense reporting from 6+ sources with Happay Xpendite

- Detect duplicate receipts and policy violations using SmartAudit to ensure compliance

- Manage your travel and expenses from anywhere with the Happay mobile app with all the web features

- Get real-time travel and expense insights with DeepAnalyze for making well-informed decisions

Happay limitations

- Can be time-consuming and lead to erroneous reports

- It can be difficult to manage expenses that involve multiple expense categories, projects, and currencies

Happay pricing

- Custom pricing

Happay ratings and reviews

- G2 : 4.5/5 (305 reviews)

- Capterra : 4.6/5 (829 reviews)

Emburse is another popular expense management software for creating, submitting, and approving expenses. It also provides a travel and expense management system that streamlines travel planning, policy compliance, expense recording, and collection of visa and health information of travelers.

You can set pre-approvals for travel expenses for better cost control. It also eliminates manual tasks like submitting an expense report or a physical receipt.

Emburse Certify best features

- Schedule an automatic expense report creation with ReportExecutive to avoid the tedious job of manual reporting

- Catch violations and duplicates using Embrace Audit for a transparent, reimbursement and expense management process

- Eliminates cash flow bottlenecks by providing pre-approval on travel programs

- Improve financial decision-making by analyzing expenses and spending patterns

Emburse Certify limitations

- Its complex UI makes it difficult for users to navigate through the app

- It offers limited integration features

Emburse Certify pricing

- Certify Now: $12/month per user

- Professional: Custom pricing

Embrace Certify ratings and reviews

- G2 : 4.5/5 (2035 reviews)

- Capterra :4.7/5 (1279 reviews)

SAP Concur offers a bundled solution for expense, travel, and invoice management. It connects employees’ travel expenses and invoicing into a single system to offer greater visibility into transactions and ensure compliance.

SAP Concur’s best features

- Automate spend management system with Concur expense and process reimbursements faster

- Analyze data and insights from business expenses and invoice clearance timelines with comprehensive dashboards

- Streamline business travel details by connecting trips, travelers, and itineraries all in one place with Concur Travel

- Automate accounts payable processing to mitigate potential fraud and compliance risks

SAP Concur limitations

- Inability to show expense reports which are older than 90 days

- It has a high turnaround time for support tickets

SAP Concur pricing

Sap concur ratings and reviews.

- G2 : 4.0/5 (6000+reviews)

- Capterra : 4.3/5 (2030 reviews)

TravelBank is another comprehensive solution for card management, expense tracking, and travel management. You can submit digital expense reports, automate approvals, optimize travel spending, reconcile corporate card transactions, and get better data visibility with TravelBank.

TravelBank best features

- Monitor the allocation and spending of funds to control business expenses

- Predict future expenses and plan travel budget accordingly

- Integrate all virtual corporate travel cards and automatically sync the transaction into the TravelBank expense management platform

TravelBank limitations

- It can be difficult to modify your bookings

- The scanning tool captures wrong information from receipt uploads sometimes

TravelBank pricing

- Travel : $25/month per user

- Expense : $10/month per user

- Travel and Expense : Custom pricing

TravelBank ratings and reviews

- G2 : 4.5/5 (333 reviews)

- Capterra : 4.7/5 (226 reviews)

Zoho Expense is a travel and expense management tool for businesses to automate expense reporting and simplify business travel booking. It also autoscans credit and corporate card transactions with receipts for better reconciliation. You can also set per diem allowances for employees in different regions.

Zoho Expense’s best features

- Get a comprehensive view of your employees’ travel requests with instant analytics and intuitive dashboards

- Automate mileage tracking without compromising on data security

- Enhance expense auditing and fraud control so you don’t have to review every transaction manually

- Simplify business receipt tracking through advanced auto-scan in more than 14 languages

Zoho Expense’s limitations

- Minor discrepancies in the receipt recognition feature lead to ineffective expense reporting

- It has limited integrations

Zoho Expense’s pricing

- Standard : $4/month per user, billed annually

- Premium : $6/month per user, billed annually

- Custom : Custom pricing

Zoho Expense’s ratings and reviews

- G2 : 4.5/5 (1100+ reviews)

- Capterra : 4.6/5 (900+ reviews)

Other Travel Management Tools

Travel and expense management software can help you track travel overspends and policy violations. However, to avoid overspending, you need strategic travel planning. Try ClickUp, an all-in-one platform to create smart travel plans.

With ClickUp, you can create detailed personal or business travel plans at low costs. It is an all-in-one travel tool for travel managers and individuals. Start with budget planning . For this, you don’t need an AI-powered accounting tool . Use ClickUp’s Docs to collaborate with the travel team, discuss budgets, and create itineraries.

With ClickUp for Finance , you and your finance team can track the organization’s financial goals and set a travel budget accordingly.

Next, you need itinerary templates to plan a smooth business trip.

ClickUp offers several itinerary templates to suit your different travel needs. These templates help you plan more effectively and handle last-minute changes in the plan.

You can also simplify business or personal travel planning with ClickUp’s Travel Planner Template. The template helps you track flights and hotel bookings and share your travel plans with friends, family or colleagues.

Now that you’ve planned your trip and the budget, it’s time to create a schedule for your travel program with ClickUp’s Calendar View . You can plan all trip activities, including rest days and travel time.

Make Travel Planning and Management Easy with ClickUp

Choosing the right travel and expense management software is essential to ensure compliance, maintain cash flow, and process reimbursements quickly.

However, they often lack travel planning features and have expensive booking options.

ClickUp is the best solution to bridge this gap. Combine your travel and expense management processes with ClickUp to simplify business travel planning and execution, which in turn results in better expense management.

Sign up on ClickUp for free to organize travel plans and track business travel costs effortlessly!

Questions? Comments? Visit our Help Center for support.

Receive the latest WriteClick Newsletter updates.

Thanks for subscribing to our blog!

Please enter a valid email

- Free training & 24-hour support

- Serious about security & privacy

- 99.99% uptime the last 12 months

Company News

Hear why sap concur solutions are g2 leaders for travel, expense, and invoice management.

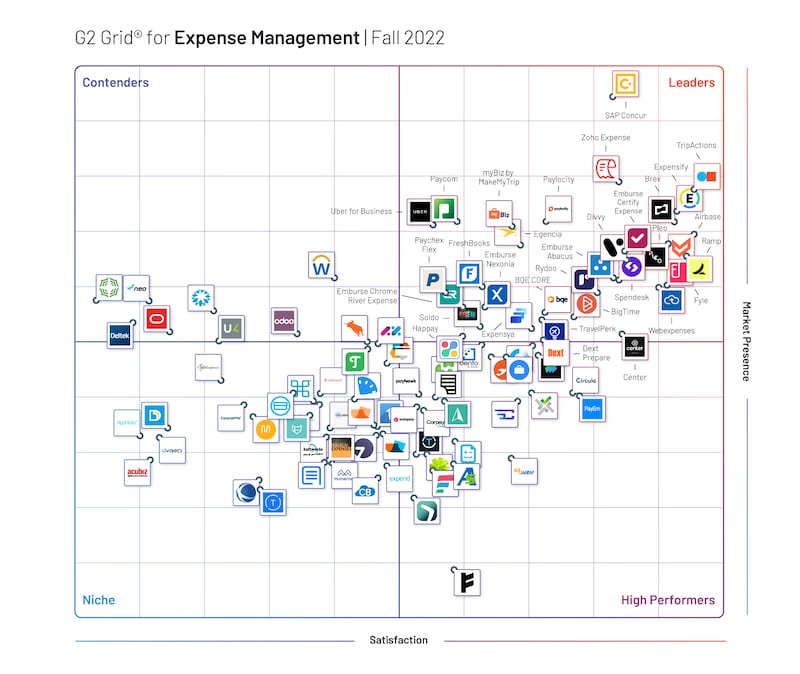

Our users have spoken (more than 5,000 of them!) and they have ranked us #1 in the Expense Management , Travel and Expense Management, and Invoice Management categories.

“SAP Concur is ranked #1 overall in both Expense and Invoice Management categories, and has been ranked a Leader in the following G2's Fall 2022 Grid® Reports: Travel Management, Expense Management, and Invoice Management”, said Nathan Calabrese, Senior Research Analyst at G2. “These top rankings are due to SAP Concur’s high market presence and strong satisfaction ratings from its users. In reviews, users especially appreciated SAP Concur’s approval process and invoice management features.”

What do our users love about SAP Concur solutions? Here are just some of the things they're saying:

"SAP Concur totally streamlined our employee expense report process." - Read full review

"We reduced the outstanding expense timeframe from 64 days to 23 days by going from a manual solution to Concur." - Read full review

"SAP Concur has allowed us to improve company spending visibility by offering real-time reporting." - Read full review

"User-friendly, straightforward to use, with minimal training required." - Read full review

Want to learn more? Visit G2 to read more SAP Concur reviews and see how we stack up against competitors. Then, take our tools for a spin in our self-guided Concur Invoice and Concur Expense demos.

Nice to meet you.

Enter your email to receive our weekly G2 Tea newsletter with the hottest marketing news, trends, and expert opinions.

Expense Management 101: Your Guide to Expense Reporting

May 17, 2024

Expense management is a process that is often described as time-consuming, laborious, error-prone, and frustrating. Yet it plays a crucial role in maintaining your company's bottom line.

By definition, expense management is a system of organization deployed for processing expense reports , approvals, and employee reimbursements.

However, further into the read, you will see how the nitty grits of expense management could make or break businesses of any size if left unattended. This article talks about why companies must pay closer heed to expense management and its benefits.

Why is expense management important?

Expense management has different implications for different stakeholders. For finance teams, the main focus is to maintain accurate records and financial planning. For employees, it is to get reimbursed faster and with minimal friction. For owners or management, it is about growth, productivity, risk management, cost-saving, and employee satisfaction.

Here are some perks of paying heed to expense management:

- When the expense management process flows smoothly, it gives accurate insights into the organization’s financial health. This helps management identify cost-saving opportunities and potential risks.

- Next, when expense employee reimbursement cycles are shorter, it results in higher employee satisfaction and trust. This plays a crucial role in determining your employee and financial productivity.

- Lastly, when you put in the effort to stay compliant and maintain detailed records, you are rewarded with tax benefits. A well thought out and implemented expense management system, hence, has benefits both tangible and intangible.

What does the expense management process look like?

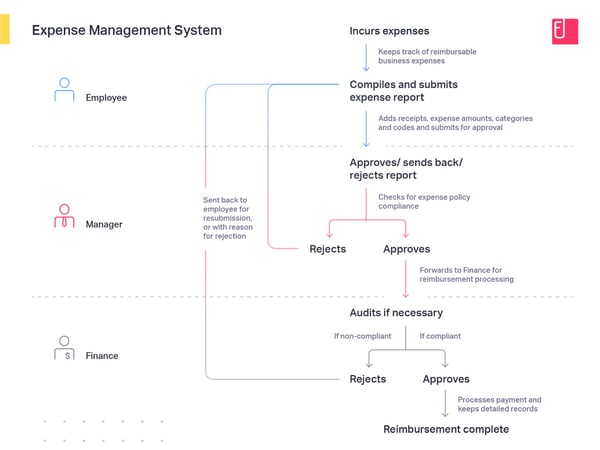

The expense management process involves the following:

- Reporting of business expenses by employees

- Verification and validation of reports by managers/approvers

- Audit of expense reports for compliance by accountants/finance teams

- Processing of payments for employee expense reimbursements

- Safe-keeping of expenses, sales receipts , and records for external audits

Here’s a flowchart to help you visualize the process:

It looks quite simple, but in reality, there are challenges at each step of the process that pose severe threats to the business’s stability and growth if not done right. Thus, it is essential to understand these challenges to build an efficient expense management system.

Challenges in the travel and expense management process

Added to being time-consuming and labor-intensive, the expense management process is riddled with challenges right from when you set up policies till reimbursements are processed. And then some more. Here are the three most common challenges in expense management.

1. Unclear travel and expense policies

The cycle of expense reporting starts from the employees, and with unclear expense policies, the first step is where the trouble begins. Especially because expense reporting is always a last-minute job, and it is dreaded by all.

Problems employees face with unclear travel and expense policies:

- It becomes difficult to remember expense policies and categories.

- This results in employees claiming for out-of-policy expenses.

- Reports are sent back to employees for resubmission, resulting in delayed payouts.

- Non-compliant expenses, if reimbursed, count as expense report fraud.

- Employees might try repeating unchecked violations as they might not be fully aware of the repercussions of committing expense report fraud.

2. Ineffective expense approval workflows

As in the case of travel and expense policies, if the approval workflow is not well defined, the expense report might just not reach the right person and in the right time frame. This causes frustration, confusion, and delays in reimbursing employees for the money they spent from their pockets for your business.

Problems employees and finance teams face with inefficient approval workflows:

- Employees and approvers aren’t aware of the entire reimbursement process.

- They waste productive hours in understanding which reports go to whom.

- There is a high chance that an approver misses an expense report email.

- Fraudulent or out-of-policy claims might go unchecked.

- As a result of the constant and long back and forths, reimbursements are delayed.

- There is no one place where all activity on an expense report is tracked.

- It becomes difficult for Finance teams to keep track of bottlenecks and compliance.

- Inevitably, without a detailed audit trail, the business opens itself up to audits.

3. Delayed employee expense reimbursements

Expense reimbursements are a lengthy and tiresome process. Be it the multiple back and forths between employees and finance teams or the colossal amount of manual data entry, verification, and processing – nobody likes expense reporting.

Additionally, delayed employee expense reimbursements lead to:

- Employee dissatisfaction and reduced morale.

- Employees lose out on the money that they spent on the company.

- Don't have enough time to focus on things that are actually important.

- Last-minute approvals might result in out-of-policy claims being approved.

- Finance teams cannot close books on time.

Delays, errors, frauds, and painful audits are characteristic of traditional expense management. This is businesses, small and large, turn to more effective methods of managing expenses.

What is traditional expense management?

Traditional expense management processes rely on paper-based receipts and records. To paint a picture, this is what a traditional expense management system looks like:

- Employees are tasked with keeping all business receipts safe to claim expense reimbursements at the beginning of every reimbursement cycle.

- Approvers need to manually verify expense claims and ensure they comply with the company’s travel and expense policy.

- Finance teams are tasked with auditing all approved expense receipts with paper trails before processing.

- Finance teams then have to save all receipts and records in an organized manner for future internal/external audits.

Challenges with traditional expense management

An upgrade from paper-based accounting was Excel-based accounting. However, both systems are time and labor-intensive, relying solely on manual data entry and verification. Here are some challenges and limitations of traditional expense management:

- High probability of data entry errors: Traditional expense management relies on manual data entry for expense reporting, approvals, and even record-keeping. An additional zero or a missing one could skew your books and open you up to audits.

- High risk of expense report frauds: It is very much possible for policy nuances to slip through the cracks and create expense report frauds. This costs businesses a lot of money and may block your calendars for an unpleasant inquiry with tax authorities.

- Lack of visibility into employee spending: Finance teams have no way to know how much employees are spending on different projects until they’ve turned in expense reports at the end of the month. This handicaps financial productivity and can cause a serious threat to your company’s bottom line.

What is automated expense management?

Automated expense management software use features designed specially to eliminate all mundane tasks involved in financial reporting. This helps remove the frustration behind manual expense reporting.

Besides making expense reporting and tracking a breeze, here are some other benefits automated expense management brings with it:

- Offers easy ways for employees to track and report expenses from any device of their choice.

- Runs real-time policy checks on every expense claim even before it is reported to ensure policy compliance.

- Enables customization and automation of approval workflows and bank and corporate credit card reconciliations.

- Integrates with other accounting, ERP , and HRMS software to ensure all employee and travel and expense management data are centralized.

Benefits of switching to automated expense management

A switch from paper and Excel-based expense reporting to digital can be a significant transformation for businesses. Here are a few benefits automated expense management offers over traditional expense management.

- Employees spend less time compiling and submitting expense reports.

- Approvers spend less time verifying and approving expense reports.

- Compliance is taken care of by the expense management software.

- Audit-readiness is ensured without any extra manual effort.

- Finance teams get continuous visibility into employee expenses.

Switching to automated expense management takes over manual, error-prone, and time-consuming tasks and helps businesses boost financial performance, employee productivity, and optimize their budget management .

What is expense management software?

Expense management software is designed to automate travel and expense management-related processes, including expense reporting, approvals, reimbursements, and travel bookings. An automated expense management process minimizes risks that are usually characteristic of traditional expense management. Here are a few advantages of using an expense management software organized by stakeholders.

For employees, it offers:

Efficient receipt tracking and reporting

Most expense management software offer easy business receipt tracking options to reduce the time and effort employees invest in expense reporting. The most salient expense reporting feature is the Optical Character Recognition (OCR) scanner found in almost all expense management mobile applications.

This feature allows employees to simply take a picture of the paper receipt using the OCR scanner. The software then auto-populates expenses details from the captured image, all ready to report. This ensures that a truly one-click experience replaces the otherwise tedious manual expense reporting process.

Faster expense reimbursements

An automated travel and expense management software makes it easy for employees to submit compliant expense reports. It also eliminates the need for constant back and forths between stakeholders to ensure timely expense report submissions, approvals, and employee expense reimbursements.

For approvers, it offers:

Custom automated approval workflows

With an expense management software, there’s no need for managers or approvers to respond to “could you please point me to the right person” emails. Once the workflow is fed into the system and policies set, you could even set automatic report submission reminders and auto-approve reports and eliminate bottlenecks in the expense approval process altogether.

Effective expense policy enforcement

As managers, department heads, or the finance department, there are better and more important things you have to do than verifying expense claims against policies. An expense management software automates policy checks and alerts you about any violations. This enables you to take appropriate action and without wasting productive hours on verification.

For finance teams, it offers:

Automatic corporate credit card reconciliation

A while ago, when corporate cards were all the rage, they felt like the ultimate solution to managing business expenses. Only finance teams know the pain of matching credit card statements to bills and then auditing them for compliance. An expense management software can be a real boon when it comes to credit card reconciliation . The software automatically matches expenses, receipts, and transactions, erasing manual intervention from the equation. It also integrates with credit card providers to get direct feeds on the expense management dashboard. This helps finance teams get real-time insight into where exactly the spend is happening instead of just the information that spend is happening.

Digital audit trails for continuous compliance

Expense management software maintains detailed digital audit trails for each expense and all stakeholders’ corresponding actions. This makes it easy for Finance teams to audit expense reports before processing reimbursements. This also eliminates the need for storing stacks of paper receipts and worrying about their safekeeping.

Faster payment processing

An expense management software integrates your existing ERP, accounting, HRMS system, and bank portals. This allows you to bring all employee and expense data to a single platform and initiate payments right from your expense management dashboard. Further, it will enable you to track payment progress, ensuring you are always in-the-know of things.

Secure cloud storage for expense receipts

All expense receipts attached to expense claims are stored in a secure and searchable cloud. This makes it easy for finance teams to search for any expense, receipt, or report using filters. The next time you sit for an audit, there won’t be an hour of awkward silence between you and the auditor while you sort through heaps of reports to find the one the auditor asked for.

Real-time insight into expense data analytics

An expense management software offers real-time visibility and insight into employee spending across the organization or multiple organizations. These insights are made available on your expense management dashboard, where you can view spend by departments, projects, categories, and more.

Real-time expense data insights will help you optimize spends whenever and wherever necessary. It also ensures you’re sticking to the predicted/allocated budgets. Additionally, insight into historical data enables you to analyze your organization’s financial needs better to make data-driven decisions.

Data security

Data security is a massive concern with anything that involves software. A good business expense management software adheres to industry-standard security measures to ensure your data is always safe. They also offer features like role-based access, IP based access, and auditor-access to ensure different stakeholders with different roles only have access to data you decide to let them see.

An expense management software helps you automate the entire expense management system, save time and costs. It also helps reduce risks and frauds while boosting employee morale and overall profitability. If you’d like to check, strictly in terms of money, the RoI of an expense management software, here’s a free ROI calculator you can use.

How to pick expense management software for your business

If you used the ROI calculator we were just talking about, you’re probably convinced that an expense management software is worth the investment.

But automating your expense reporting is more than just ROI. You must pick an expense report software that suits your business needs. To help you through the process, we've compiled a handy checklist to help you select the best expense software options for your business:

Check for must-have expense management features

Your chosen expense management software vendor should offer the following capabilities to ensure that you can automate every single step of the expense management process:

- A mobile app with easy expense tracking options for employees.

- Fully customizable expense approval workflows.

- A robust business rules engine (travel and expense policy automation.)

- Automatic bank and credit card reconciliation capability.

- In-depth and real-time expense data analytics.

- A comprehensive expense management dashboard.

- Integrations with travel desks, ERP, accounting, and HRMS software.

- Powerful and easy to implement ERP systems with API integrations .

Understand your customer support requirements

You must understand your organization's customer support requirements before you shortlist vendors. If you have frequent traveling employees, you might need a highly rated vendor with quick responses, active live chats, and timely customer support.

If you prefer having detailed how-to videos, documents, and other resources, ensure that your vendor can make such resources easily accessible for your team. This ensures quicker and easier adoption of newer technology.

Check for user reviews on trusted platforms

Reviews from customers who use a software provide insight into their experiences post-implementation. These reviews play a crucial role in understanding whether a particular software is a viable product or not for your business.

Software review platforms like G2 simplify and fasten the process by rating software based on real user reviews across various platforms. They rate software based on different criteria such as ease of use, quality of support, ease of implementation, and more. This provides a trusted shortcut to getting your hands on the best expense report software to achieve your desired business goals.

Future-proof your bottom line

The main ingredients for an organization's success are a seamless collaboration between teams with a constant rise in financial and employee productivity. This can be achieved by streamlining your expense management process to save time, effort, ensure accuracy and security, and provide valuable expense data insights.

Manaswini Rao Kaki is a Content Marketer at Fyle, a B2B expense management software company. When she’s not building brands, she’s off exploring pretty places and vibrant cultures or brewing a perfect cup of coffee. Reach her at [email protected]

Recommended Articles

What Are Business Expenses? How to Fuel Smart Tax Savings

You can’t run a business without knowing what makes you money and what drains it. Every...

by Rob Browne

Creating an Effective Expense Reimbursement Policy

It’s no secret that running a business is expensive.

Understanding How to Create an Expense Report in 9 Steps

Conducting business can lead to a load of ancillary costs. From travel to meals to...

Get this exclusive AI content editing guide.

By downloading this guide, you are also subscribing to the weekly G2 Tea newsletter to receive marketing news and trends. You can learn more about G2's privacy policy here .

Deem is #1 on G2

Fast, seamless setup. Above-and-beyond usability.

Deem's mission is to transform corporate travel with a powerhouse platform that’s a delight to use.

Travel Management Software Usability Score

Deem leads in multiple categories like ease of use, administration, and adoption data.

Learn how Etta ranks in multiple categories like ease of use, administration, and adoption data.

Travel Management Relationship Score

Deem scored 9.59 on the G2 Travel Management Relationship index, leading in ease of doing business, high quality support, and other factors.

Customer Reviews

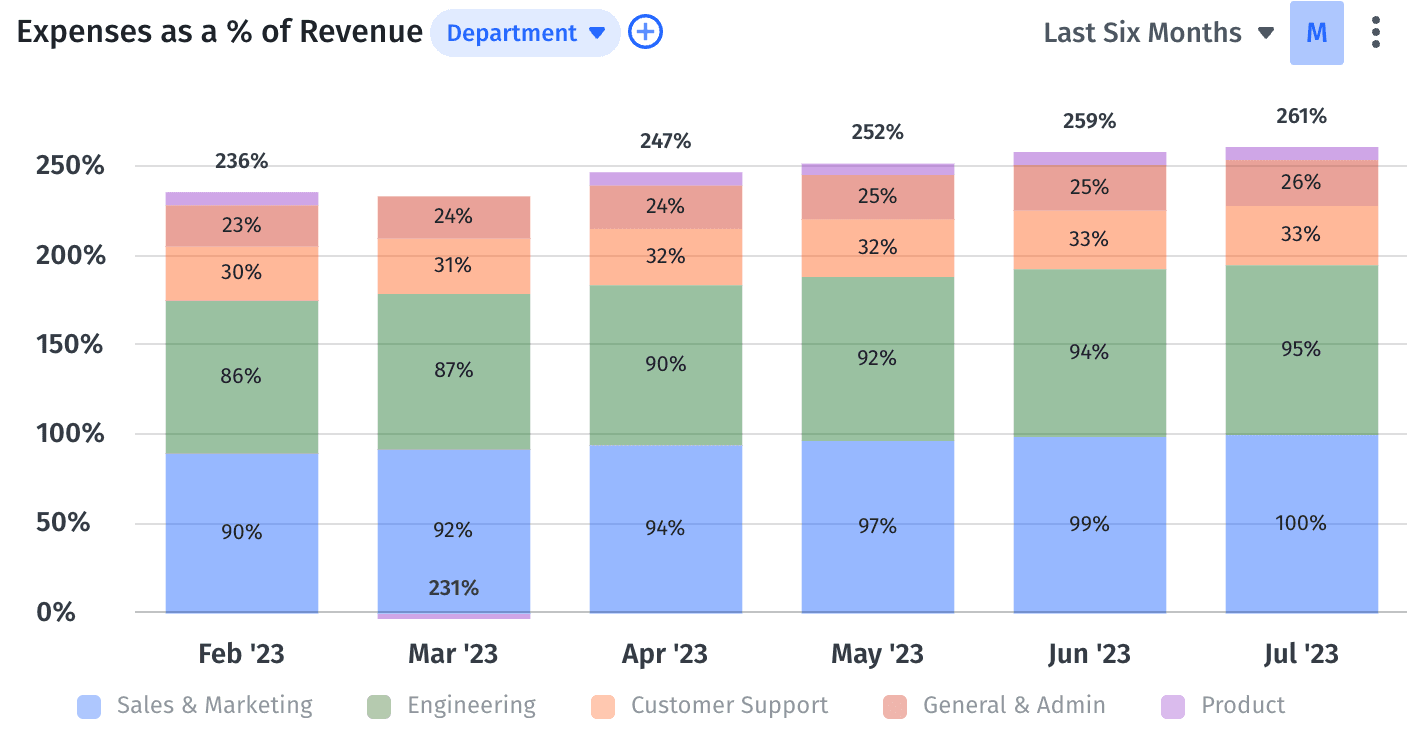

The SaaS Guide to General and Administrative Expenses in 2024

Joe Michalowski

Director of Content

The 2024 Financial Planning Blueprint

SaaS companies, especially small businesses that are scaling quickly, often have general and administrative (G&A) expenses that shoot through the roof. Sometimes, the number is as high as 30% of operational costs, often because of rapid growth and continuous investments in the business.

These companies are either not spending wisely or not allocating their funds properly to match the growth rate. But when you consider economies of scale, as a SaaS business rakes in more revenue, its G&A expense should ideally take up a smaller piece of the revenue.

Here’s the problem: When you’re unclear about categorizing expenses in your P&L, it’s like trying to complete a jigsaw puzzle without looking at the picture on the box. You’re trying to fit pieces together based on vague assumptions rather than the actual design.

The best strategic finance functions act as a compass for the business, and the only way to do that is to have a clear view of each piece of the financial planning and analysis ( FP&A ) puzzle. Get started by cleaning up your G&A expense categorization and tracking.

Table of Contents

What Are General & Administrative Expenses?

General and administrative (G&A) expenses include those from back-office functions like accounting, finance, HR, and legal as well as overhead costs, fixed and semi-variable, that don’t directly fall under a specific business function. Properly categorizing G&A expenses in SaaS is crucial because it affects your bottom line, especially as the business grows.

Aside from the headcount-related costs for accounting, legal, finance, and HR, G&A covers indirect costs and business expenses like rent, utilities, non-department-specific payroll, insurance, travel, professional services like accounting and legal fees, and expenses related to maintaining business licenses.

On the flip side, expenditures tied to direct operations or front-office business functions aren’t considered G&A. For example, research and development (R&D), hosting services, selling expenses, marketing costs, and customer success aren’t included in this category.

G&A Expense Categories

Some parts of your G&A are fixed costs, while others are semi-variable. This mix gives you flexibility, making G&A a prime area to explore when aiming for financial efficiency . By closely examining these costs, you can pinpoint where to save and ensure you’re using your resources best.

Fixed Expenses

As mentioned above, some general and administrative costs are fixed, meaning you’ll incur these costs even if you’ve paused business activities, acquiring new sales or customers. For example, say you don’t sign any new accounts in November. You’d still need to cover the office rent and utilities, plus continue offering services for existing customers.

Semi-Variable Expenses

Some G&A expenses fluctuate based on your company’s specific needs, such as changes in business activity — these are semi-variable expenses. However, these costs don’t necessarily have linear changes based on business activity. Instead, they fluctuate based on the investments you choose to make.

For instance, acquiring a state-of-the-art projector might enhance in-house meetings or client presentations. Still, it’s unrelated to the functionality or efficiency of your software solution. Starting with these costs is a good idea if you want to trim expenses and improve cash flow.

Start Using Our Chart of Accounts Template

Why g&a expenses are important for saas businesses to deeply understand.

In SaaS finance , accounting poses unique challenges compared to traditional businesses, mainly because of the subscription-based model. If you throw in miscategorized G&A expenses, you risk overlooking chances to cut unnecessary costs or preserve revenue, especially during growth phases when budgets are tight.

Moreover, the quality of your insights hinges on your data’s accuracy. So, if you’re not clear about where your expenses belong, including G&A, your data analysis could lead you astray, potentially guiding your business off course.

In simple terms, G&A expenses are crucial for CFOs and finance teams to understand the financial health of your SaaS startup. They help manage funds, reduce costs, and sustain revenue throughout growth.

How to Calculate G&A Costs

Calculating G&A costs begins with identifying the types of expenses it covers. Once you’ve identified the expenses that belong under this category, you can gather the data for a specified timeframe, such as monthly or annually, and add them up to get the total G&A costs.

For instance, let’s say your company had a total revenue of $500,000 for August. Your G&A expenses included rent, non-departmental salaries for executives or admin, utilities, office supplies, insurance premiums, and travel expenses unrelated to sales.

So, your total G&A expenses were as follows:

G&A Costs = Rent ($10,000) + G&A Salaries ($100,000) + Utilities ($2,500) + Office Equipment ($1,500) + Insurance Premiums ($2,000) + Travel Expenses ($3,000) = $119,000

You can also view your G&A expenses as a percentage to track variations over time or compare the percentage to industry benchmarks — divide the total G&A expenses by total revenue (or operational expenses) for the specified period and multiply the number by 100. For August, your G&A percentage would be as follows:

G&A % = Total G&A Costs ($119,000) / Total Revenue ($500,000) x 100 = 23.8%

4 Ways to Reduce G&A Costs

Trimming G&A costs is highly beneficial for SaaS companies; it frees up funds that can be channeled into crucial areas like product development or customer acquisition. Plus, fine-tuning these expenses enhances operational efficiency , leading to better profitability. Here’s how you can reduce your G&A costs:

1. Track Your G&A Costs Closely

As mentioned earlier, once you’ve rightly categorized your G&A costs, pay attention to the numbers — it might reveal patterns, such as seasonal expenses or significant variations that need a closer look. When you have your G&A percentage, you can compare the number with other SaaS companies or track progress toward an internal benchmark.

2. Audit Your Costs Over Time to See Where Your Money Goes

Regularly checking G&A expenses can highlight areas of waste or overlap in your day-to-day operations. By spotting these unnecessary line items, you can streamline the company’s operations and improve its bottom line. Additionally, a clear grasp of G&A expenses ensures that your financial choices are grounded in comprehensive and precise data.

3. Use FP&A Software to Highlight & Eliminate Financial Redundancies

A common FP&A best practice is to use FP&A software like Mosaic, which can automate much of the categorization process, and make it easier to track expenses over time and even create visualizations to spot patterns or outliers. Mosaic was made with SaaS businesses in mind, so you can track your G&A expenses and other key metrics in real time.

4. Implement Spend Controls

Before you can control spending, you need to understand where the money is currently going. Once you’ve reviewed your G&A expenses, take measures to control spending. Some methods include setting transparent budgets, introducing approval workflows for costs exceeding a certain cap, limiting unnecessary travel and entertainment expenses, and negotiating with vendors for better terms or discounts.

Gain Complete G&A Expenses Visibility With Mosaic

SaaS business owners and finance teams understand the urgency of immediate financial insights, especially in a market where products evolve rapidly. This is where Mosaic steps in, with real-time G&A expense tracking and financial analysis.

If you’re wrestling with the intricate maze of SaaS finance, look no further: Mosaic is the comprehensive financial analytics solution you need. It nails down precise financial projections and gives users a clear view of how changes in G&A expenses have a direct impact on the bottom line.

Mosaic comes packed with easy-to-use templates you can whip up in no time to peek at your G&A expenses in handy financial dashboards , as well as gain deeper insight into other financial statements. Ready to turn your insights into collaborative reports that rally the whole team? Mosaic helps ensure everyone’s on track to meet those growth targets. Dive into the reason behind the numbers with user-friendly, clear visuals.

If you’re excited to shape your company’s financial story in minutes, request a personalized demo of Mosaic .

G&A Expense FAQs

What does g&a stand for.

G&A stands for general and administrative expenses in financial planning and analysis (FP&A). Typically, G&A includes day-to-day costs for back-office functions like human resources, accounting, finance, and legal as well as other expenses like rent, utilities, non-departmental payroll, business licenses, etc.

Are wages and salaries included in G&A costs?

Wages and salaries are included in G&A costs when they’re associated with G&A functions. For example, the accounting team would fall under the G&A umbrella, so wages and salaries for all full-time hires in the accounting department would be included.

What is the difference between G&A and operating expenses?

G&A expenses cover overheads that don’t directly align with specific company functions such as production costs, selling costs, or research and development. Instead, they back the company’s overall operations.

Conversely, operating expenses encompass all direct costs of a company’s primary activities. This involves not only the costs of producing goods or services (referred to as “cost of goods sold,” known as COGS , or, in SaaS, “cost of services”) but also the general operational costs, which include G&A expenses.

Is G&A a fixed or variable cost?

G&A includes both fixed and semi-variable costs. Examples of fixed G&A costs include office space, and utilities, whereas office equipment that is purchased based on new business needs is considered semi-variable.

What is the difference between G&A and SG&A?

Selling, general, and administrative (SG&A) expenses include G&A expenses plus any expenses related to selling the product, such as sales and marketing expenses or advertising.

Related Content

- 11 Software Solutions to Improve Your SaaS Accounting Processes

- What Is Spend Forecasting and How Can It Benefit Your Business?

- What Is Financial Reporting and How Can You Use It to Tell the Right Narrative

Never miss new content

Subscribe to keep up with the latest strategic finance content.

The latest Mosaic Insights, straight to your inbox

Own the of your business..

- Grand Rapids/Muskegon

- Saginaw/Bay City

- All Michigan

Equity officer investigated for travel expenses resigns in Washtenaw County

- Published: Aug. 27, 2024, 11:01 a.m.

(Ryan Stanton | MLive file photo)

- Jennifer Eberbach | [email protected]

WASHTENAW COUNTY, MI — A top Washtenaw County official who has been on unpaid leave as her travel expenses were investigated has resigned.

County Racial Equity Officer Alize Asberry Payne resigned effective Friday, Aug. 16, County Administrator Gregory Dill confirmed.

“I accepted her resignation, and she is moving on,” Dill said.

There is a separation agreement with Asberry Payne, but Dill declined to make it public.

Payne directed a request for comment to her attorney Robert Burton-Harris. He confirmed Tuesday, Aug. 27, that she had resigned from the county and declined further comment.

Earlier this year, it was revealed Payne had spent thousands of dollars on travel using her county-issued credit card.

“We did look into all of her travel expenses,” Dill said, “And I was satisfied that while the judgement was not the best, there was no major policy violation.”

Records received by MLive/The Ann Arbor News through a Freedom of Information Act request show Asberry Payne requested the leave under the Family and Medical Leave Act and that leave was approved starting on May 3.

She was granted 450 hours of leave as part of her FMLA request. She was able to cash in 404 hours of paid time off and sick time, records show.

Eleven days after requesting leave, MLive/The Ann Arbor News reported Asberry Payne had spent at least 80 days traveling to conferences and events in 2022 and 2023. Records showed that among those trips were visits to Germany, a wellness retreat on the Caribbean coast, and multiple four- and five-star hotel stays exceeding $600 a night.

“She didn’t violate the policy, per se,” Dill said.

“She did, I believe, exercise poor judgement in terms of where she chose to seek professional development opportunities. There are likely some better choices than some of the places that she chose. Overseas travel is not a violation in and of itself of county policy.”

Hired in 2019 to lead the county’s newly-created Racial Equity Office, Asberry Payne sought out training and conference opportunities across the country, travel records show.

MLive/The Ann Arbor News reviewed more than two years of Mastercard statements and hundreds of pages of receipts associated with spending by Asberry Payne, all obtained through FOIA requests.

The trips were for professional conferences or meetings, many with direct links to Asberry Payne’s job responsibilities, addressing racial and socioeconomic disparities within county government, the records show.

The county’s Board of Commissioners in early August amended the county’s travel policy for employees in an effort to improve transparency in spending by county employees, while placing limits on how much travel employees can take and how much money they can use for those functions.

While Asberry Payne was on leave, responsibilities of the Racial Equity Office were divided among Dill and other county employees.

“We’ll likely make some decisions,” he said. “There has not been a job posting as of yet. The ink has just become dry on her resignation.”

Want more Ann Arbor-area news? Bookmark the local Ann Arbor news page or sign up for the free “ 3@3 Ann Arbor ” daily newsletter.

More from The Ann Arbor News

- Jack White to play at 400-person venue in Ann Arbor

- Man accused of burying grandmother in shallow grave to undergo psychiatric exam

- Art installation celebrating diversity vandalized with pro-Palestine messages

- Virtual teachers are district backup plan for hard-to-fill special education, language jobs

- $1M grant to help Ann Arbor explore starting city tree nursery, enhance urban forest

If you purchase a product or register for an account through a link on our site, we may receive compensation. By using this site, you consent to our User Agreement and agree that your clicks, interactions, and personal information may be collected, recorded, and/or stored by us and social media and other third-party partners in accordance with our Privacy Policy.

Middle East and Africa

Asia Pacific

- Try for free

- Concur Expense

- Company Bill Statements

- Bank Card Feeds

- Concur Detect

- Concur Benefits Assurance

- Concur Event Management

- Concur Request

- Concur Tax Assurance

- Intelligent Audit

- All products

- Concur Travel

- Concur TripLink

- Concur Invoice

- Payment providers

- Payment solutions

- Purchase Request

- Three-Way Match

- Consultative Intelligence

- Data Delivery Service

- Intelligence

- Concur Advanced Care

- Concur Essential Care

- Concur Select Care

- Concur User Assistant

- Managed Rate Administration

- User Support Desk

- Learn about integrations

- Invoice integrations

- Concur Compleat

- TMC solutions

- Traveler self-service

- TravPay Hotel

- Trip Approval

- Sustainable travel

- Business expansion

- Compliance and risk

- Control company costs

- Duty of care

- Employee experience

- Global tax management

- Intelligent Spend Management

- Travel and expense

- Travel in China

- Energy & utilities

- Financial services

- Government contracting

- Legal/professional services

- Life sciences

- Manufacturing

- Non profits

- Oil, mine, and gas

- State & local governments

- Technology companies

- Enterprise finance leader

- Small business finance leader

- Travel manager

- Getting started

- Premium Assistant

- Service Assistant

- All solutions

- Intelligent spend management

- Travel and Expense

- REQUEST PRICING

- About SAP Concur

- CONTACT SALES

- Resource center

- Case studies

- Customer experience

- Mobile apps

- SAP Concur Community

- Expense demo

- Invoice demo

Concur Drupal Menu - Mobile

Hear why sap concur solutions are g2 leaders for travel and expense management.

Infographics

Tackling Travel Tension in Higher Education: Insights from the...

Busting the Biggest AP Automation Myths: What You Need to Know

2024 Business Spending Trends

- SERVICE STATUS

- REQUEST A QUOTE

- REQUEST A DEMO

- VISIT SAP.COM

- Terms of Use

City Politics | Virginia Beach’s ex-economic development…

Share this:.

- Click to share on Facebook (Opens in new window)

- Click to share on X (Opens in new window)

e-Pilot Evening Edition

- Latest Headlines

- Environment

City Politics

City politics | virginia beach’s ex-economic development director responds as records reveal $47,000 in travel expenses.

But former Virginia Beach Director of Economic Development Chuck Rigney may have overstepped. His travel expenses are under review as the city has opened an investigation into department travel expenses that did not adhere to city policies. Over the course of roughly 12 months, Rigney expensed roughly $47,000 in travel and other spending, according to expense reports obtained by The Virginian-Pilot.

City officials have not explicitly said what prompted the review. Rigney resigned July 24 .

For the first time since leaving his position, Rigney spoke publicly about the city’s investigation and his departure.

“I’m certainly not trying to hide anything,” Rigney said in an exclusive interview Saturday with The Pilot.

Rigney said he asked for a review by the auditor when he was confronted with concerns. When asked why he resigned, Rigney said, “As the events unfolded, it was the way it had to be done. On that day, it just kind of came down to I was leaving — that was just it.”

While updating City Council on Aug. 13 about Rigney’s departure, City Manager Patrick Duhaney said a comprehensive review of department financial records found “some travel expenses do not align with our policies.” Duhaney explained he requested an investigation .

“Any abuse by city staff of the privilege to travel and represent the city of Virginia Beach will not be tolerated, and we have checks and balances in place so we are grateful that we were able to catch this before it got out of hand,” he said.

The Pilot obtained copies of Rigney’s city credit card charges and expense reimbursements spanning from when he began working for the city in March 2023 to the end of July, through a Freedom of Information Act request. The Pilot also obtained copies of Rigney’s receipts for the same time period.

Some of the biggest expenses outlined in 232 pages of receipts include airline travel for business trips to Germany, Brazil, Spain and Italy.

While the receipts shed light on how much taxpayer money was spent on Rigney’s travel, the documents do not flag whether charges were deemed inappropriate or violated city travel policy.

City spokesperson Tiffany Russell declined to divulge which specific expense or expenses triggered the investigation.

“We have provided documents responsive to FOIA requests as required by law, but this matter remains under investigation by the city auditor, and it would be inappropriate to respond further until this investigation is complete,” Russell wrote in a text Thursday.

As the leader of the city’s economic development, Rigney’s role was to network with international companies interested in establishing in Virginia Beach. The department is a single point of contact for site location assistance, demographic reports, incentives and a variety of research, according to the city.

Since resigning, Rigney said he hasn’t heard from the city about the matter.

“I’m waiting to see what they (city officials) have as it relates to questions and I’ll answer,” Rigney said.

International travel

Most of Rigney’s receipts stemmed from his hefty travel schedule. He drank coffee at an airport Starbucks and ate fried calamari at a restaurant in Germany.

During his time with the city, Rigney attended several organized events overseas. He also traveled abroad for discussions about business proposals identified only by code names in city documents.

On the frequency of his travel, Rigney said he would have traveled more but was dealing with a personal matter that kept him closer to home.

“I wanted to help elevate the beach to the next level,” he said.

Rigney traveled to Germany three times. In July 2023, he flew to Stuttgart with Mayor Bobby Dyer for a workforce development meeting . The Delta flight for that trip cost $4,745.35. Rigney and Dyer stayed at Le Meridien in the center of the city for five nights. The cost of their hotel stay was roughly $2,300, according to business receipts provided.

Additional travel included a three-day trip to Frankfurt to meet with “Project Dust to promote foreign direct investment in Virginia Beach,” according to an interoffice memo signed by Duhaney. Airline tickets cost $3,675.55. A January 2024 flight to Stuttgart to discuss “Project Zeus” and to meet with other businesses that have expanded in Virginia Beach cost $3,007.80.

In March, Rigney attended a Select USA event in Milan and Padua, Italy, involving state-level economic development officers, local companies, major business and industrial associations and banks. Select USA is a program run by the U.S. Department of Commerce’s International Trade Administration that promotes and facilitates business investment in the United States.

The Delta flight to Italy cost $3,894.90, which receipts show was paid through an ecredit. The hotel and food receipts added up to roughly $1,700, according to the trip receipts.

Rigney also traveled to Spain to meet with a business prospect in June of 2023 and stayed at the Hotel Arts Barcelona, a 5-star hotel on the city’s waterfront that billed between 530 and 645 euros (about $590-$720) a night during his five-night stay.

City policy states that international travel requires approval from a deputy city manager.

“Any international travel was approved by the city manager,” Rigney said.

‘A valid business case’

Other expenses stem from local outings or domestic destinations.

Among Rigney’s list of expe nses was a last-minute flight purchased May 10 for the International Council of Shopping Centers convention that month in Las Vegas. The American Airlines ticket with a stopover in Charlotte, North Carolina, cost $2,060.51. That, along with a $722 credit from American Airlines were flagged on the spreadsheet as “pending expense auditor approval.”

Upgrades costing $1,541.25 were made for the same trip two days before the flight , but the airline receipt provided by the city doesn’t specify what those upgrades entailed. Rigney declined to discuss details of the trip.

It’s unclear if the flight arrangements fell in line with the city’s travel expense policy. The policy states, “when pre-authorized by the Deputy City Managers for the department they are responsible for overseeing, upgraded Coach Class fares are permissible for official City of Virginia Beach domestic and international air travel when scheduled flight time, including stopovers and change of planes, is less than 12 hours in one day.”

The policy goes on to say, “upgraded coach class fares, which may be pre-authorized by a Deputy City Manager, include upgrades to business class, upgraded coach class seats, prem ium seats, exit row seating, early bird check in and other conveniences and upgrades, except that first class fares are not allowed.”

“The City carefully reviews all expenses to ens ure each travel charge is justified by a valid business case in accordance with city policy,” city spokesperson Ali Weatherton-Shook wrote in an email this week.

The nature of Rigney’s job entailed more travel expenses as compared with Virginia Beach City Council members, for example. Council members and the mayor incurred about $20,000 in expenses last year. The bulk of the money paid for a Hampton Roads Chamber of Commerce’s Leadership Exchange Conference in Charleston, South Carolina.

Time as director

Rigney, 68, resigned less than six months after the city manager appointed him in February.

Rigney had replaced Taylor Adams, who left for another job in 2023. Before coming to Virginia Beach, Rigney worked in economic development for several Hampton Roa ds cities, including Hampton, Norfolk and Portsmouth.

Duhaney wrote a glowing review of Rigney when he appointed him as director.

“In his short time as interim, he has demonstrated his ability to lead the City’s department and successfully stepped in to manage major projects with critical deadlines, which include the Amazon facility, re-evaluation of Corporate Landing and Innovation Business Parks, and ongoing efforts to attract national and international businesses,” Duhaney was quoted in a February release.

The city auditor is investigating the economic development department, including Rigney’s travel expenses, and the findings will be presented publicly, Duhaney said.

Directors submit their expense reports for approval to the deputy city manager who oversees their department.

After Adams resigned at the end of June of 2023, Duhaney oversaw economic development until Deputy City Manager Amanda Jarratt was hired March 27. Jarratt was t hen responsible for approving Rigney’s travel expenses, according to the city.

Jarratt is serving in the interim economic development director role now.

Among the receipts provided by the city is an email which states that Jarratt asked Rigney to provide further information on the June expense submission for a $329 food and drink tab during the Dave Matthews Band concert at the Veterans United Home Loans Amphitheater.

Rigney wrote in the email that he was trying to persuade the managing partner at one of Hampton Roads’ largest law firms to open a Virginia Beach office. The charge was not listed among the approved expenses in the expense report spreadsheet.

The city’s Development Authority renewed its amphitheater box for the season, and Rigney told the Pilot he and his staff were allowed to bring clients to shows to encourage business retention and expansion opportunities. He’s not concerned about an expense related to the concert and just wants to move on.

“I’m certainly hoping we can resolve this matter as quickly as possible,” Rigney said. “I’m not one to dwell on spilled milk. I’ve got more to do.”

Stacy Parker, 757-222-5125, [email protected]

More in City Politics

City Politics | Aquarium foundation wants to collaborate with Virginia Beach, pause search for private operator

SUBSCRIBER ONLY

Transportation | lions bridge reopens in newport news, but iconic statues remain hidden.

Inside Business | Virginia Beach homeowners affected by 2023 tornado voice concerns dealing with insurance companies

City Politics | New city manager hopes to bring stability to Portsmouth through ‘level-headed’ leadership

Trending nationally.

- An epidemic of adult children killing their parents in NYC raises troubling issues

- Hiker left behind on mountain by coworkers during office retreat, stranded overnight amid freezing rain, high winds

- More free COVID-19 tests can soon be ordered through the mail

- I know what you stole last summer: Beg that national park for forgiveness and send it back. Better yet, write a letter.

- Study looks deeper into olive oil’s health benefits

City Commissioner Jack Porter faces election-year ethics complaint, calls it 'frivolous'

A local businessman, citing stories in the conservative media outlet Tallahassee Reports, filed a state ethics complaint against City Commissioner Jack Porter — though she called it a “frivolous” filing timed not far from the Aug. 20 primary.

T. Michael Hines filed the complaint last week with the Florida Commission on Ethics alleging that Porter failed to disclose “gifts” in the form of travel expenses related to her membership in Local Progress, a network of local elected officials working to advance progressive causes. Though ethics complaints are considered confidential in the early stages, Hines emailed copies of it to all five city commissioners and several news outlets.

Hines named “media reports” as the source of his information for the complaint but didn’t specifically mention TR, a publication once scorned by City Hall that now receives city funding in the form of advertising. Steve Stewart, TR’s editor and a former three-time City Commission candidate, has been writing about Porter’s affiliation with Local Progress, her travel and her refusal to answer his questions for months.

“City Commissioner Jack Porter — as required by state law — has failed to disclose gifts received from a third party in the form of travel expenses,” Hines wrote in the complaint. He added, “Repeated efforts to determine who paid for the trips have been met with silence. Media reports indicate Commissioner Porter will not answer questions.”

Porter said in a text message on Monday that she expects the complaint to be dismissed.

“Elections are coming and the mudslinging is starting early,” she said. “This is a frivolous complaint being pushed by fringe right wing media."

Weeks before the ethics complaint was filed, Porter provided documents to the Democrat showing she has sought legal advice about Local Progress from the city attorney and her own lawyer dating back several years.

In March, City Attorney Amy Toman advised Porter that accepting travel expenses for an upcoming Local Progress event did not constitute a gift and did not have to be reported because of an exemption in the gift law.

Under Florida law, public officials can’t accept gifts given to influence their vote or gifts over $100 from certain individuals and entities, including lobbyists and vendors doing business with their agency.

Officials can, however, accept certain things of value — statutes specify what constitutes a gift and what doesn’t — provided they report any that meet the definition and are worth more than $100. State Commission on Ethics records show that Porter hasn’t reported any gifts on a quarterly Form 9 since at least 2021.

Local Progress, founded in 2012 and active in 48 states, says on its website that it works on "a broad intersectional progressive agenda driven by a vision of racial and economic justice." Among other things, it advocates for immigrants, public school funding, home rule and affordable housing.

Porter's lawyer: Travel expenses paid by Local Progress 'not required' to be reported

On Nov. 2, 2021, Porter asked then-City Attorney Cassandra Jackson whether it would violate city or state ethics law if she accepted payment of travel expenses to attend a meeting of Local Progress. Jackson said it wouldn’t, though she added Porter would have to disclose the gift unless the city paid her expenses up front and Local Progress reimbursed the city.

It wasn’t immediately clear whether that happened. Porter, asked by the Democrat about that, said she couldn't discuss details until the ethics complaint is resolved.

Jackson added that her analysis "assumes a public purpose for the travel as seems reasonable based on the purpose for the organization and conference."

The city routinely covers travel expenses for city commissioners and their aides to participate in numerous events, including annual conferences hosted by the Chamber of Commerce and the National and Florida League of Cities. In Porter's case, the city has also covered some of her expenses involving Local Progress events.

In a March 6 letter supplied by Porter, her attorney, Ron Meyer of Tallahassee, wrote that Local Progress paid her travel expenses to attend its meetings but that she wasn’t otherwise paid by the group.