- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Barclaycard Arrival Plus Review: Closed to Applicants, but Flexible if You Have It

It's no longer available, but current cardholders get a high rewards rate on all purchases, along with flexible redemption. Just be aware that you don't get the perks of a dedicated airline or hotel card.

- High rewards rate on all purchases, not just bonus categories

- Sign-up bonus

- No foreign transaction fee

- Has annual fee

- Minimum redemption required for travel

$0 intro for the first year, then $89

18.24%-25.24% Variable APR

0% intro APR on Balance Transfers for the first 12 billing cycles

Rewards rate

2 miles per dollar

Bonus offer

- Enjoy 70,000 bonus miles after spending $5,000 on purchases in the first 90 days

Ongoing APR

APR: 18.24%-25.24%, Variable

Cash Advance APR: 27.49%, Variable

Balance transfer fee

Either $5 or 3% of the amount of each transfer, whichever is greater

Foreign transaction fee

0% of each transaction in U.S. dollars

- Earn unlimited 2X miles on every purchase

- NEW - Control Your Card - Instantly secure your accounts by locking your cards with Barclays SecurHold™, plus set transaction limits and block certain purchase categories for you or your authorized users. Available only on the Barclays mobile app.

- Book travel your way—no airline, seat or hotel restrictions—and redeem your miles for travel statement credits

- Get 5% miles back to use toward your next redemption, every time you redeem

- No foreign transaction fees

- International Chip and PIN for use at self-service chip terminals around the world

- Miles don’t expire as long as your account is open, active and in good standing

Compare to Other Cards

Detailed review: Barclaycard Arrival Plus® World Elite Mastercard®

» this card is no longer available.

The Barclaycard Arrival Plus® World Elite Mastercard® is no longer accepting applications. See our best travel credit cards roundup for other options. Below is our review of the card from when it was still available.

Sometimes a solid card with fewer frills is a superior one. That's the case with the Barclaycard Arrival Plus® World Elite Mastercard® , a relatively simple travel rewards credit card with a high flat rewards rate, flexible travel redemption rules and a modest annual fee. However, as of 2019, this card is no longer taking new applications.

Existing cardholders have been able to keep and continue using it, though, and as of November 2022, the option to transfer rewards to several travel partners was introduced.

There's a no-annual-fee version of this card, with less robust perks, called the Barclaycard Arrival™ World Mastercard® . But it, too, has stopped accepting new applications.

» MORE: NerdWallet's best travel credit cards

Barclaycard Arrival Plus® World Elite Mastercard® : The basics

Card type: Travel .

Annual fee: $0 intro for the first year, then $89 .

Rewards: Unlimited 2 miles per dollar on all purchases. Each mile is worth 1 cent when redeemed for travel or 0.5 cent when redeemed for cash back.

When you redeem miles, you get 5% of those miles back toward your next redemption. You can start redeeming for travel with 10,000 miles, or 5,000 miles for cash back.

Redeem miles for almost any travel purchase of $100 or more, including airfare, hotels and cruises. Go online within 120 days of booking with your card and apply your miles for a statement credit.

Interest rate: 0% intro APR on Balance Transfers for 12 billing cycles, and then the ongoing APR of 18.24%-25.24%, Variable

Foreign transaction fees: None.

Balance transfer fee: $5 or 3% of the amount of each transfer, whichever is greater.

Other features: Chip-and-PIN capability.

Not sure whether paying the annual fee makes sense for you ? Try our calculator and see whether the rewards you earn on the Barclaycard Arrival Plus® World Elite Mastercard® will cover the fee.

Benefits and perks

G o o d ongoing rewards rate.

Earning an unlimited 2 miles per dollar spent, at a value of 1 cent per mile, is solid because it applies to all spending, not just spending in certain categories, such as travel, restaurants or supermarkets, which you find with other cards. So that means a great rewards rate whether you’re shopping online, paying for furnace maintenance or covering a doctor copay. Better yet, the 5% redemption bonus when you cash in miles — good toward a future redemption — boosts the effective rewards rate to 2.1%. This simple-but-lucrative rewards rate for all spending makes the card a candidate for top-of-wallet status.

It used to be harder to find a card that earned 2X on all purchases, no matter the category. But today, several other cards exist on the market that do just that. The Capital One Venture Rewards Credit Card earns 2X on every purchase with no limit for a similar annual fee.

» MORE: Making the most of the Barclaycard Arrival Plus® World Elite Mastercard®

Flexibility

Barclays has a liberal definition of “travel purchases,” giving you a lot of options for redeeming your miles, including spending with airlines, hotels, timeshares, campgrounds, car rental agencies, cruise lines, trains and buses, among others. And book however you want — directly with an airline or hotel, or through a travel agent or discount travel site. As long as you pay with the card, you can reimburse yourself with miles. That’s more flexible than travel credit cards that force you to book through the issuer’s travel portal to get the best rewards value. And it will appeal to budget travelers who prefer comparing travel deals from a variety of places. There are no blackout dates, restrictions or extra fees, as there can be with redeeming frequent flyer miles, for example.

Ease of use abroad

Like any good travel card, the Barclaycard Arrival Plus® World Elite Mastercard® has no foreign transaction fees. Plus, the card has chip-and-PIN capability. When traveling abroad, you may find that some kiosks and other automated payment systems require you to use a PIN to verify your identity, rather than a signature (though this requirement is not as common as it used to be ).

Transfer partners

Barclays closed the Barclaycard Arrival Plus® World Elite Mastercard® to new applicants in 2019, but as of November 2022 it added the ability to transfer miles to a host of travel partners. An odd addition to a card that is no longer open to new applications, it nevertheless gives current cardholders more options for redeeming their miles. However, the transfer ratio of Barclays points is inferior to other programs whose points largely transfer at a 1:1 ratio .

» MORE: Barclaycard credit cards mobile app review

Drawbacks and considerations

High redemption threshold.

The card has a minimum redemption for travel statement credits of 10,000 miles, or $100, which you'd have to spend $5,000 on the card in order to earn. For smaller spenders, it could be a long wait to accumulate enough miles to redeem. The minimum is 5,000 miles for other redemption options and 2,500 if used toward the card’s annual fee.

As an alternative pick, the Barclaycard Arrival Plus® World Elite Mastercard® has a doppelganger card: the Capital One Venture Rewards Credit Card . It also earns an unlimited 2 miles per dollar on most purchases, and it also allows you to redeem your miles for a statement credit against travel purchases. The a Capital One Venture Rewards Credit Card doesn’t offer the 5% redemption bonus, but it also doesn't have a minimum redemption requirement. So if you want to redeem miles for an $8 cab ride, you can.

The Capital One Venture Rewards Credit Card has an annual fee of $95 and a nice sign-up bonus: Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel. It doesn't charge a foreign transaction fee, but it also doesn't offer chip-and-PIN.

Low-value redemption alternatives

For cashing in miles, this is mostly a one-trick pony. You get a penny per mile for statement credit that offsets travel purchases, or for paying the card’s annual fee. You get half as much value — or less — if you redeem miles for cash back, gift cards or merchandise. You can now transfer miles to some travel partners, but the ratios are poor.

If you want better value when transferring points, you may be better off with a card like the Chase Sapphire Preferred® Card . It earns bonus rewards in a variety of popular spending categories, including dining and travel. Points are worth 1.25 cents apiece when used to book travel through Chase . Otherwise, points are worth a penny each. You can transfer your points to several major frequent travel programs at a 1:1 ratio. Transfer partners include United, Southwest, British Airways, Marriott and Hyatt. The Chase Sapphire Preferred® Card offers a comparable sign-up bonus: Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠. But it does have a slightly higher annual fee: $95 .

Fewer travel freebies and perks

The card’s simplicity is also a potential drawback. It doesn’t offer the perks that some travel cards do, such as airport lounge access or reimbursement for TSA Precheck or Global Entry applications. And while you can use miles to pay for checked-bag fees on airlines, airline co-branded cards often give you checked bags for free, along with early boarding. Similarly, you can use miles from this card on hotel stays, but you won’t get the automatic free nights that some co-branded hotel credit cards offer.

Get 1.5 miles per dollar on all spending, plus a sign-up bonus, for an unbeatable $0 annual fee.

How to decide if it's right for you

The Barclaycard Arrival Plus® World Elite Mastercard® isn't taking new applications. But if you're an existing cardholder who's still satisfied with its simple but valuable rewards program — which can easily make up for its annual fee — it makes sense to keep it around. You can always supplement it with a premium travel card if you want to enjoy more luxury travel perks. But for those weary of paying an annual fee, it may be time to retire the Barclaycard Arrival Plus® World Elite Mastercard® and get a good $0-annual-fee travel card instead.

- The best credit cards of 2024

- Best travel credit cards

- Best rewards credit cards

- Best cash back credit cards

Methodology

NerdWallet reviews credit cards with an eye toward both the quantitative and qualitative features of a card. Quantitative features are those that boil down to dollars and cents, such as fees, interest rates, rewards (including earning rates and redemption values) and the cash value of benefits and perks. Qualitative factors are those that affect how easy or difficult it is for a typical cardholder to get good value from the card. They include such things as the ease of application, simplicity of the rewards structure, the likelihood of using certain features, and whether a card is well-suited to everyday use or is best reserved for specific purchases. Our star ratings serve as a general gauge of how each card compares with others in its class, but star ratings are intended to be just one consideration when a consumer is choosing a credit card. Learn how NerdWallet rates credit cards.

About the author

Gregory Karp

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

Barclaycard Arrival ® Plus World Elite Mastercard ® — Full Review [2024]

Brian Graham

Former Content Contributor

10 Published Articles

Countries Visited: U.S. States Visited:

Director of Operations & Compliance

1 Published Article 1176 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Barclaycard Arrival ® Plus World Elite Mastercard ®

70,000 miles

$89 (waived first year)

18.24%, 22.24% or 25.24% variable based on your creditworthiness

With steady accumulation of points, a rewards rebate every time you redeem, and luxury travel benefits, this card will be a traveler’s dream.

You’re new to the points world, and you want a great card that makes it easy to understand and earn points while you untangle all the other “hacks.” Perhaps you want to travel the world for cheap while writing your blog and gaining new experiences.

This is the perfect starter card, and is among the most popular rewards credit cards.

Card Snapshot

Welcome bonus & info.

- Enjoy 70,000 bonus miles after spending $5,000 on purchases in the first 90 days

- Earn unlimited 2X miles on every purchase

- New – Control Your Card – Instantly secure your accounts by locking your cards with Barclays SecurHold™, plus set transaction limits and block certain purchase categories for you or your authorized users. Available only on the Barclays mobile app.

- Book travel your way-no airline, seat or hotel restrictions-and redeem your miles for travel statement credits

- Get 5% miles back to use toward your next redemption, every time you redeem

- No foreign transaction fees

- International Chip and PIN for use at self-service chip terminals around the world

- Miles don’t expire as long as your account is open, active and in good standing

Rewards Center

Redeem miles as statement credit in your account page

Customer Service Number

1-877-408-8866 (Available 24/7)

Great Card If

- Traveling is your main goal and you’re going to do it often (including internationally)

- You like simple rewards and earning options and don’t want to manage a bunch of cards

- You love to shop around for deals and have no specific airline, hotel or other travel company loyalty

- You want to take advantage of the vast array of Luxury Travel Benefits available to card holders

Don’t Get If

- You’re not much of a traveler

- You intend to redeem for many smaller purchases rather than a few bigger ones ($100 minimum redemption option)

- You want to use this card for business (Barclays restricts earning for business expenses)

Welcome Bonus and Earning Rate

Beginning with a welcome bonus after your standard purchase amount within the required months (see above), you’ll be well on your way with travel credit ready to be redeemed.

The rewards rate on this card is a solid 2 points per $1 spent, with no limits and no restricted categories.

Other cards cap out the rewards at a certain dollar amount per category, or restrict the categories in which you can earn the higher rewards rate. But here, you get a nice 2x deal everywhere!

Bottom Line: The Arrival Plus card earns 2x points for all purchases and costs $89 per year.

Card Benefits and Value

This is a travel rewards card , meaning you’ll earn the points as account credit you can apply towards travel related purchases.

Once you have enough, simply go into your account and apply the credit to your statement.

This card also gives you a 5% rebate for all redeemed points, making the value of the rewards rate equal out to 2.1 points per dollar.

Unlike some other cards, it allows you to earn miles while making your travel purchase and then apply those earned miles right back to your statement, while additionally earning a 5% rebate.

Value Compared to Other Cards

Contrast this to an airline or hotel card which deposits earned miles into the appropriate loyalty program account: when redeeming, you are taking points out but none are going back in.

Here, your redemptions are worth $0.01 per mile when redeeming for travel. This is a very standard evaluation that isn’t the worst you will find, but it also isn’t the best.

Great for Flexible Travelers

A world traveler likes flexibility, and you’ll get that with this card.

First, it has no foreign transaction fees and includes chip technology. So no matter where you are, your card will likely be accepted and continue to bring home points.

If you’re in Hong Kong and you want to travel to Thailand on a budget, you can look around for the best deals and book them all through your Arrival Plus card.

Then, redeem the miles back as statement credit, collect your rebate points, and keep going.

You won’t have to deal directly with specific airlines or hotels, but if you’re going to book through a third party it may be worth a call to confirm this will count as reimbursable.

Travel Reimbursement for Hotels, Airlines, and More … With a Caveat

Your redemption options don’t stop at airfare or hotels, either. There is a long list of items you can use your rewards for, including timeshares, cruises, discount travel sites, and most public transportation options.

Be warned though: you have to redeem for a minimum of $100 and can only apply against a purchase once , so we recommend applying your credit toward larger purchases. As always, planning is the key.

If you just aren’t traveling or using the card anymore, you do have the option to redeem for other statement credit or gift cards, but doing so cuts the value of the points in half (5000 points for $25), so we don’t recommend doing this.

Other Card Benefits

If you need a balance transfer, you can transfer to this card and enjoy 12 months of interest-free balance after the fee.

You won’t earn any points for this, so it’s not highly recommended unless you know you’ll be able to pay it off after the 12 months. Other low-interest credit cards also offer 0% APR on purchases, but no such luck with the Arrival Plus card.

Next, let’s talk about the Luxury Travel Benefits. These are actually MasterCard benefits made available to certain cardmembers.

They offer basic benefits , “World” benefits , and finally this card’s “World Elite” benefits . It basically includes all the other travel benefits in addition to some extras.

These include:

- Free business class upgrades on participating airlines with purchase of a full-price economy ticket

- Hotel room upgrades with SPG and other hotel partners

- Airline discounts up to 30%

- A complimentary companion ticket with a full-fare business class purchase

- Cruise discounts up to $500

- And many more!

Still Collect Your Loyalty Points From Your Travel Partners

It’s worth explicitly noting that you can still be a member of all the different loyalty programs and try to focus your travel on specific partners to further maximize your travel benefits.

You’ll continually be paying for everything with this card and earning card miles, but points earned through the loyalty programs still accrue into those accounts to be used later as well.

This can be an even more powerful strategy if you want to move past the beginner stage!

Best Ways To Earn Arrival Plus Rewards

Earning miles is fairly straightforward with this rewards card: buy everything on the card. Anything you could possibly pay for, try to purchase with your card as long as there are no additional fees!

You’ll get 2x points for everything plus the 5% redemption bonus back, equating to 2.1x.

Below are examples of things you could put on your card:

- Utilities and bills

- Restaurants, drinks, and entertainment

- Doctors visits

- Supplements

- Business expenses (if you don’t have a higher-earning card)

- Memberships (gym, etc.)

When earning points, plan ahead to make sure you get to a minimum 10,000 points: this is the absolute minimum value ($100) you can redeem at once. You can always redeem anything above this amount, however.

Another way you could rack up more points is to get additional cards if you have a child or spouse who spends separately. You essentially just expand your ability to earn points but get no additional benefits.

* Note : Depending on your living situation, you may be able to pay rent on a credit card without incurring extra fees. If this is the case, absolutely use your credit card to pay for your rent! If you do have a fee, then it may or may not be worth it. Typical fees range from 2% to 3%. Let’s look at the math:

Say you pay $1,200 per month in rent. If you take a 3% fee for using a credit card, but get to accrue all those points, then you would pay $1,236 for rent and get 2.1x points for it. This is assuming the fee isn’t somehow charged separately and just rolls into your rent (fees don’t earn points, and there are many other restrictions as well). That’s worth 31,147 points (at 2.1x) total! For that amount, you can redeem a $311 travel credit.

But wait! How much did you pay in fees? Well, at this rate, $36 for 12 months is equal to $432. So you’re actually losing value by using your credit card.

At a lower fee, you could potentially break even, and it turns out that sweet spot is 2.14% for this rent amount. But will you make enough for it to be worth the hassle? With $2,000 rent and 2% fee, you would come out ahead $34. Any higher of a fee, and it’s not worth it, but if you increase rent you will make a bit more. Anyone who is able to get less than a 2% fee will likely see benefit, but make sure to do your own math for your situation.

Final Note : This only applies if the fee gets charged as rent and whole thing gets counted as a retail purchase. We have not tested this, and the scenario is all in theory!

Best Way To Redeem Arrival Plus Rewards

To redeem points earned with this card, simply go into your account, navigate to Manage Rewards, and choose to redeem points for travel purchases.

We suggest planning to do this immediately after you make your travel purchase, but it must be within 120 days (so plan accordingly!).

Also, since you can only redeem for a minimum of $100, you’ll likely get one or two good redemptions per year out of your points earned.

We’d suggest saving up to pay for one larger purchase all at once, just so you don’t have to worry about the minimum spend every time.

Know that you’ll only get your 5% points back when you redeem, so you’ll have to keep on earning and redeeming to make this card worth it.

You can use your card to redeem for gift cards and other merchandise through the Barclays portal, but doing so cuts the value of your points in half ($0.005), so we don’t recommend it!

Best Way To Maximize Arrival Plus Rewards

There are no direct partnerships with this card like you would see with other cards. However, the beauty of this arrangement is the flexibility of choosing whatever travel partner you want.

Again, you can still be a member of any loyalty program you want . This card doesn’t add to those loyalty accounts, but that shouldn’t stop you from accruing any extra rewards there as well – it’s all free!

Instead, this card offers users the Luxury Travel network from MasterCard, which includes a multitude of partners.

The only trouble is finding out who the partners really are, so you’ll likely just have to call their customer service and talk about the benefits with them.

Authorized Categories for Redeeming Miles

With regards to travel, only certain categories count as travel for the redemptions. Here is the list of approved travel categories to make redemptions against ($100 min):

Airlines, hotels, motels, timeshares, campgrounds, car rental agencies, cruise lines, travel agencies, discount travel sites, trains, buses, taxis, limousines, ferries

Your annual fee also counts as redeemable, but we do NOT recommend doing this.

Because this amount is less than $100 and the minimum mile redemption is 10,000, you would have to spend that many points and waste the value of some of your points!

Alternatives to the Arrival Plus Card

The Discover it Miles Card is very similar. It also earns travel rewards that are accrued on the card just like cash-back.

But which one is better? For your first year, the Discover it Miles card is better since it earns the equivalent of 3x points which can be applied to your travel purchases.

After this first year, though, the Arrival Plus card is much more valuable, because it earns at an equivalent rate of 2.1x at all times.

That earning rate is better than other cash-back cards like the Capital One Quicksilver Cash Rewards Credit Card or the Citi Double Cash Card . The Capital One Quicksilver Cash Rewards Credit Card only earns 1.5% cash-back, while the Citi Double Cash Card earns 2% (1% at purchase with another 1% when you pay your bill).

However, this Barclays card comes with an $89 annual fee (waived the first year), so there is a minimum amount you would have to spend in order to make up for this difference in cost.

Bottom Line: The Arrival Plus card has the best earning rate of similar travel rewards and cash-back cards, but it has an $89 annual fee (waived the first year). This value must be accounted for when determining its worth.

The information regarding the Capital One Quicksilver Cash Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Barclaycard Arrival ® Plus World Elite Mastercard ® was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Discover It ® Miles Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

Is the card worth it.

This will depend on your situation, but it is a solid card for the type of person who wants a card that’s easy to use and has good rewards.

You’ll earn 2x points for all purchases, meaning you don’t have to worry about what category you’re spending in.

The card is free the first year, then costs $89/yr. So if you are spending enough to make up for this, then the card could be considered “worth it.”

One of the great benefits of this card is that for every redemption you make, you’ll get 5% of the miles spent back. This essentially means the card earns 2.1x points as long as you keep redeeming.

Additionally, you can make your travel purchases with the card to earn more points and then use those earned points to pay it off.

Other benefits include a free FICO score, access to the World Elite Concierge and Luxury Travel, as well as an array of travel and other insurances.

If these things are valuable to you, then the card is most definitely worth it.

What is the Arrival Plus card travel insurance?

Barclays travel insurance covers a few different items. First, you get rental car collision insurance. Decline the agency policy and you will be covered for the value of the car if you use your card to make the purchase.

Next, you have Travel Assistance Services. This is a concierge-type service that helps you out during travel issues. While the main service is free, any third party service must be paid for.

Finally, you also get travel accident insurance. If paying on the card, you’ll get up to $250,000 in case of accidents, baggage delays, and trip cancellation.

If your baggage is delayed, you can get $100 per day for up to three days while waiting for it, but this only covers essential items. Trip cancellation covers up to $1,500 of cancelled or interrupted trips.

What is the Arrival Plus card login?

The sign in can be found here at the typical Barclays banking login page.

What are the Arrival Plus card benefits?

First, you earn points at 2x per dollar spent on all categories. Combined with the 5% rebate earned when you redeem those points, you essentially earn 2.1x per dollar.

You have to redeem a minimum of $100 at a time, and this can only be applied against a purchase one time .

Next, you get a complimentary FICO score, World Elite Concierge, Luxury Travel benefits, price protection, purchase security, return protection, and extended warranty protection.

Finally, you get car rental and travel insurance including travel accidents, baggage delays, and trip cancellation.

What is the difference in the Barclays Arrival World Elite MasterCard (expired) vs. Arrival Plus card?

Mainly, the difference is that the Arrival Plus card has a yearly fee and earns 2x points everywhere.

The Barclays Arrival World Elite MasterCard (expired) has no annual fee and only earns 2x points on travel and dining purchases, with 1x everywhere else.

You’ll also get World Elite benefits such as the concierge and Luxury Travel program with the Barclays.

Note that the Barclays Arrival World Elite MasterCard (expired) is no longer available for new applications.

Does the Arrival Plus card have rental car insurance?

Yes, the car rental insurance covers the value of the car when using the card to book the reservation.

What is the difference in the Arrival Plus card vs Chase Sapphire Preferred Card?

Both cards earn 2x points in travel and dining, but the Arrival Plus card also earns 2x points everywhere else.

Both cards have an ongoing annual fee after the first year, but the Barclays fee is $6 cheaper than the Chase Sapphire Preferred® Card.

You’ll see a bigger difference in how the rewards are earned.

Arrival Plus rewards are like cash-back that accumulates in your Barclays account and can only be used to give you statement credit toward travel purchases (in $100 minimum redemptions).

When you redeem, you get 5% of those dollars back.

The Chase Sapphire Preferred Card earns points that go into Chase Ultimate Rewards and can be used on a variety of things, from travel to shopping to transferring into partnered loyalty accounts.

In most cases, Chase points are redeemable for a higher value than Barclays miles.

Chase’s portal also offers 20% off on flights and travel when using points, whereas the Arrival Plus card only offers the 5% rebate. Both cards offer a variety of insurances.

What is the Arrival Plus card interest rate? Is there a 0% APR?

The card typically offers an introductory APR. However, its normal purchase APR is higher once the period ends (see card summary table above).

Does the Arrival Plus card have foreign transaction fees?

There are no foreign transaction fees on the card, allowing you to use it overseas without incurring any extra costs.

About Brian Graham

Brian’s first ever airplane ride was in a private turbo-prop jet. He was merely an intern boy trying to make a good impression, but it turns out the plane made an impression on him.

It wasn’t until Brian relocated to Dallas, TX, and moved in with an American Airlines employee that he truly discovered how incredible travel could be.

Top Credit Card Content

Credit Card Reviews

- American Express Platinum Card

- American Express Gold Card

- Chase Sapphire Preferred Card

- Chase Freedom Unlimited Card

- Capital One Venture X Card

Buying Guides

- Best Credit Cards for High Limits

- Best Credit Cards for Young Adults

- Best Credit Card Combinations

- Best Credit Cards for Military

- Best Credit Card for Paying Monthly Bills

Credit Card Comparisons

- Amex Gold vs Blue Cash Preferred

- Amex vs Chase Credit Cards

- Amex Platinum vs Capital one Venture X

- Amex Platinum vs Delta Platinum Card

- Chase Sapphire Reserve vs Amex Platinum Card

Recommended Reading

- How to Pay Your Credit Card Bill

- Credit Card Marketshare Statistics

- Debit Cards vs Credit Cards

- Hard vs Soft Credit Checks

- Credit Cards Minimum Spend Requirements

Related Posts

![barclaycard arrival plus travel insurance Citi® / AAdvantage® Gold Mastercard® — Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2018/03/AAdvantage-Gold-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

We are an independent publisher. Our reporters create honest, accurate, and objective content to help you make decisions. To support our work, we are paid for providing advertising services. Many, but not all, of the offers and clickable hyperlinks (such as a “Next” button) that appear on this site are from companies that compensate us. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear. While we strive to provide a wide range of offers, our site does not include information about every product or service that may be available to you. We strive to keep our information accurate and up-to-date, but some information may not be current. So, your actual offer terms from an advertiser may be different than the offer terms on this site. And the advertised offers may be subject to additional terms and conditions of the advertiser. All information is presented without any warranty or guarantee to you.

This page may include: credit card ads that we may be paid for (“advertiser listing”); and general information about credit card products (“editorial content”). Many, but not all, of the offers and clickable hyperlinks (such as a “Apply Now” button or “Learn More” button) that appear on this site are from companies that compensate us. When you click on that hyperlink or button, you may be directed to the credit card issuer’s website where you can review the terms and conditions for your selected offer. Each advertiser is responsible for the accuracy and availability of its ad offer details, but we attempt to verify those offer details. We have partnerships with advertisers such as Brex, Capital One, Chase, Citi, Wells Fargo and Discover. We also include editorial content to educate consumers about financial products and services. Some of that content may also contain ads, including links to advertisers’ sites, and we may be paid on those ads or links.

For more information, please see How we make money .

How to Use Barclays Arrival Plus Miles for Travel: Your Full Guide

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money .

Earning miles and points for free travel is an amazing feeling. But have you ever run across a travel expense you had to pay for out of pocket because it didn’t fall under a specific airline or hotel program? Or perhaps your miles didn’t cover certain expenses, like taxes, trains or buses?

It’s time to make those scenarios a thing of the past, and earning and redeeming miles from the Barclaycard Arrival Plus® World Elite Mastercard® is one way to make that happen.

You can redeem Arrival miles toward any eligible travel expense of $100 or more made in the past 120 days. So that charge at a boutique hotel? Train tickets? Airline fee taxes? There’s a good chance your Arrival miles have got you covered.

We’ll show you how to use your Barclays Arrival Plus miles for travel!

Let’s take a look at what Barclaycard Arrival miles are, and how you can earn and redeem them.

How to Use Barclays Arrival Plus Miles

Apply Here: Barclaycard Arrival Plus® World Elite Mastercard®

Read our review of the Barclaycard Arrival Plus

With the Barclaycard Arrival Plus , you’ll earn a welcome bonus of 70,000 Arrival miles after spending $5,000 on purchases in the first 90 days of opening your account. That’s worth $700 in travel statement credits for eligible travel purchases of $100 or more.

Benefits of Barclaycard Arrival Miles

You can redeem Barclaycard Arrival miles toward a statement credit for any eligible travel purchase of $100 or more made in the past 120 days. This comes in particularly handy if you’ve made a purchase that’s otherwise not covered by any of your other travel rewards cards. For instance, what if you wanted to stay at a Marriott hotel, but you don’t happen to have any Marriott points to redeem? This is where your Arrival miles can come in handy because they can cover that expense!

Or how about this: have you ever booked an award ticket with miles and points, only to find that you still have to pay some fees in cash? You can redeem Barclaycard Arrival miles to cover the cost of a ticket AND fees, meaning you would pay nothing out of pocket.

Other travel-related expenses could include train tickets, airline ticket fees, cruises and much more. And that’s the beauty of Arrival miles: they’re incredibly flexible because they work on a variety of travel expenses.

Redeeming Barclays Arrival Miles

The best way to stretch the value of your Barclaycard Arrival miles is for statement credits for eligible travel expenses, where your miles will be worth 1 cent each.

Redeeming your Barclaycard Arrival miles for a travel statement credit can be done in just a few simple steps:

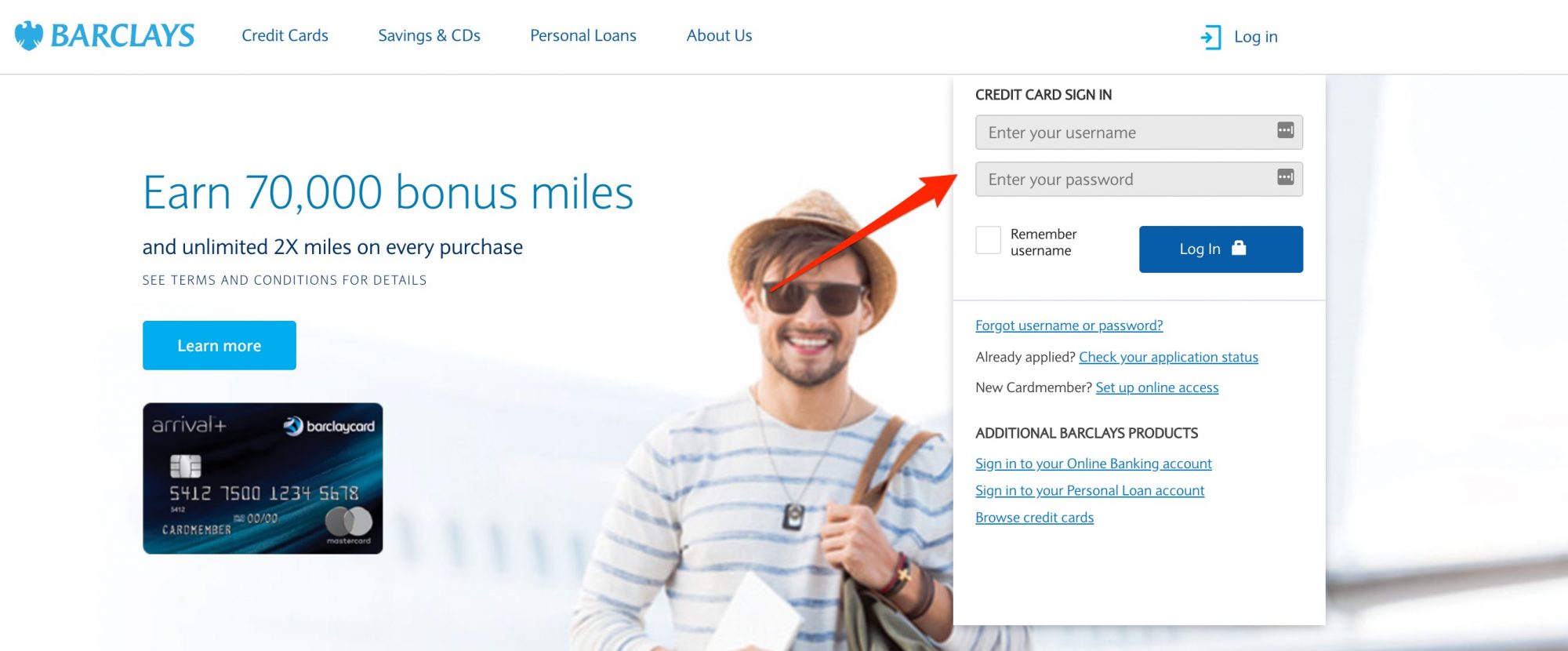

Step 1. Log in to Your Barclays Account

Navigate to the Barclays homepage and sign into your account.

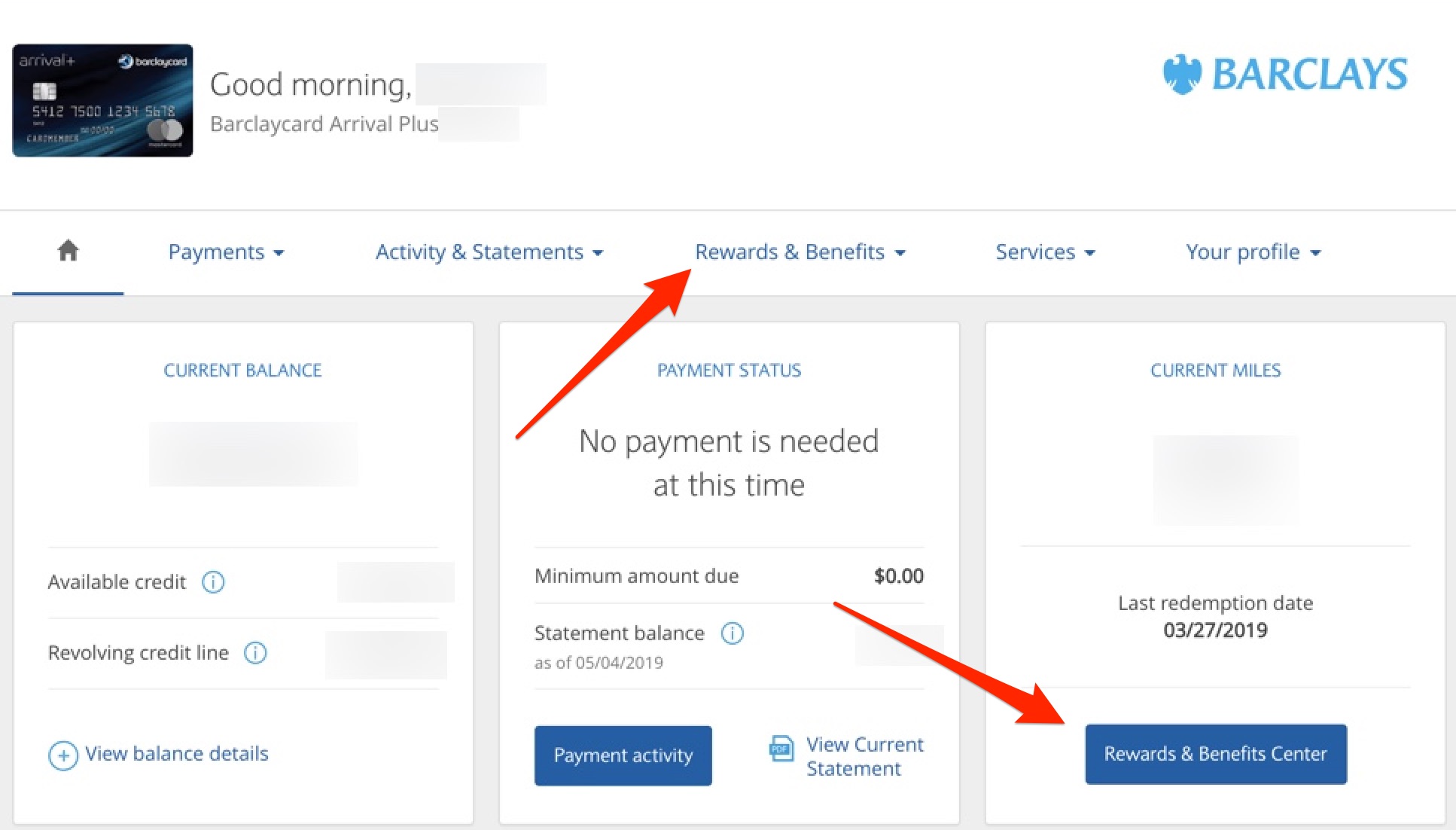

Step 2. Click on the “Rewards and Benefits” Tab and Select the Purchases You’d Like to Erase With Miles

You’ll want to navigate to the “ Rewards and Benefits Center ” from either location shown below.

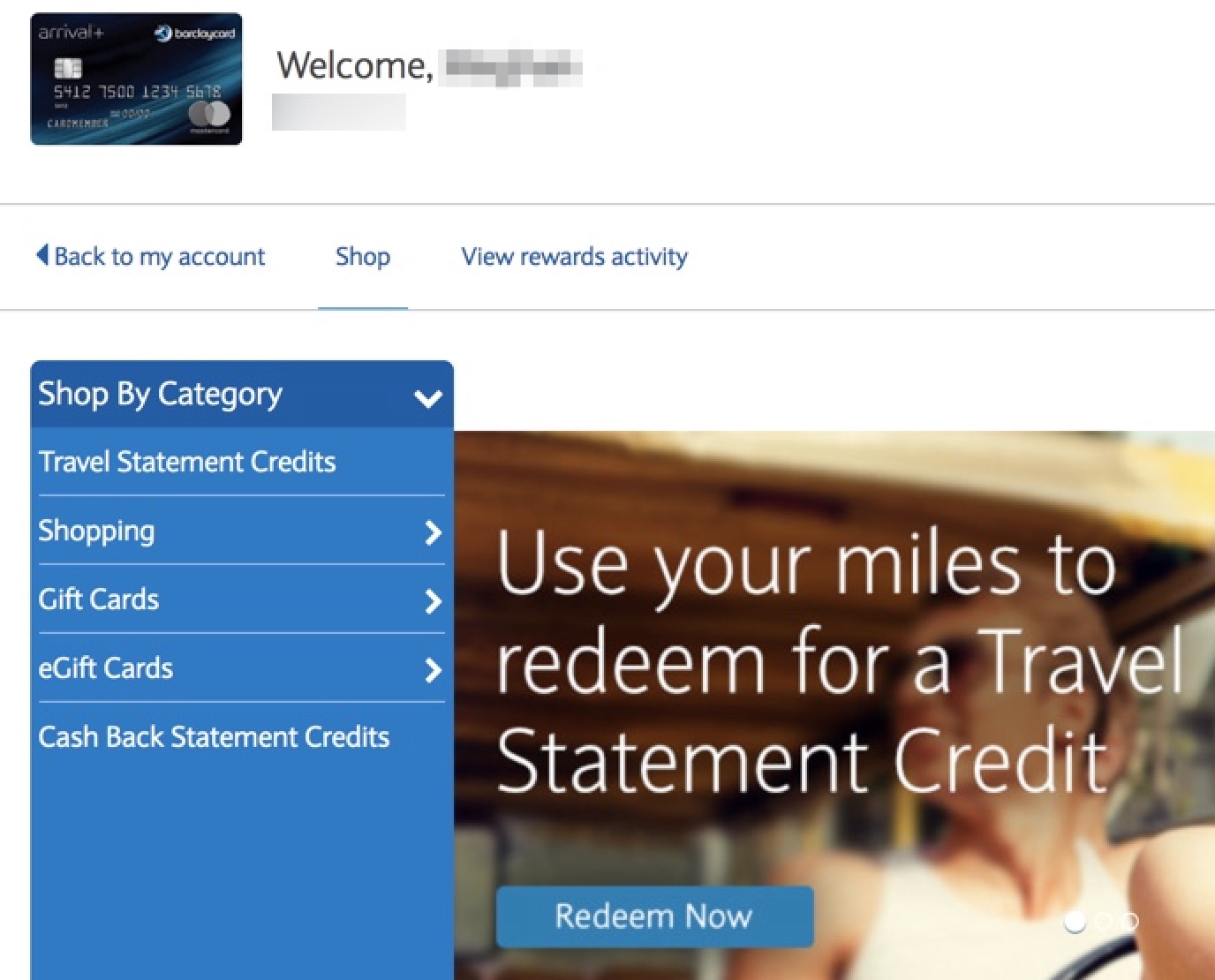

Step 3. Redeem Your Rewards

Finally, you can select exactly how to redeem your Arrival miles. You’ll get the most value out of your miles by redeeming for a travel statement credit, although you can also choose from gift cards, shopping, and cash back statement credits.

If you’re looking to make a redemption for a travel statement credit, you’ll need to start at a minimum of 10,000 Arrival miles. To redeem for annual account fees, you’ll need a minimum of 2,500 Arrival miles. And you can only redeem for travel purchases made in the past 120 days.

What Are Eligible Travel Expenses?

Barclaycard Arrival miles can be redeemed for a number of eligible travel purchases, so you’re not locked into any single merchant or travel portal. As long as a purchase codes as travel, it’ll likely be eligible for the travel statement credit.

Barclays defines travel as:

Airlines, hotels, motels, timeshares, campgrounds, car rental agencies, cruise lines, purchase and travel agencies, discount travel sites, trains, buses, taxis, limousines, ferries and the account annual fee as defined by the merchant category code.

If you’re not sure a purchase will code as travel, you can always try a small test charge first.

How to Earn Barclaycard Arrival Miles

So now that you know how to redeem Barclaycard Arrival miles and how valuable they can be, let’s talk about how you can quickly earn several hundred dollars worth!

Apply for the Barclaycard Arrival Plus World Elite Mastercard

You’ll earn a ton of miles quickly when you open the Barclaycard Arrival Plus® World Elite Mastercard® . You can earn 70,000 miles (worth $700 in travel statement credits) after you spend $5,000 on purchases within the first 90 days of opening your account. You can also continue to earn 2x Arrival miles per dollar on all purchases.

Read our review of the Barclaycard Arrival Plus for more details of the card’s benefits and perks.

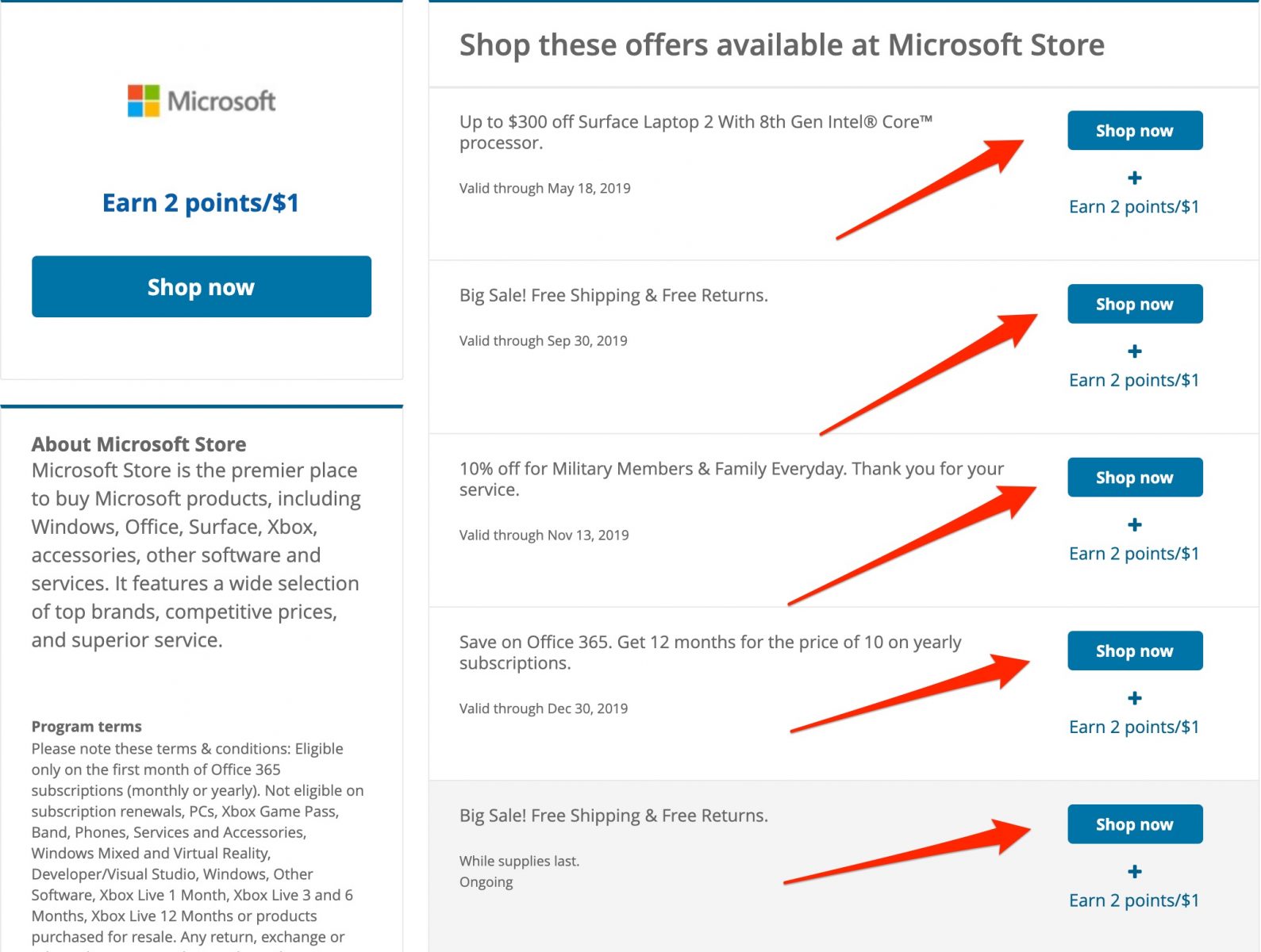

Utilize the Barclays Shopping Portal

You can also earn additional points through Barclays’ shopping portal, Barclaycard RewardsBoost .

You’ll want to log in to verify your card is eligible. Once logged in with an eligible card, all you have to do is find a retailer to shop from, click through to their website and complete your purchase. It’s simple.

Bottom Line

Barclays Arrival miles are incredibly flexible because you can redeem them for almost any eligible travel expense of $100 or more, including boutique hotels, airfare, rental cars and cruises.

You can get a jump start on your stash of Arrival miles by earning the intro bonus on the Barclaycard Arrival Plus® World Elite Mastercard® . You can earn 70,000 miles (worth $700 in travel) after spending $5,000 on purchases within the first 90 days of opening your account.

Miles earned can be redeemed for eligible travel expenses at a 1 cent per mile, although you can also redeem them for gift cards and statement credits for non-travel related items, albeit at a lower 0.5 cents per mile.

For more about Barclays Arrival miles, check out these posts:

- Our review of the Barclaycard Arrival Plus

- Barclays Miles Value

And please subscribe to our newsletter to stay up-to-date on our latest tips!

More Topics

Points and Miles

Join the Discussion!

Comments are closed.

You May Also Like

BonusTracker: Best credit card bonus offers

June 14, 2021 4

Best Hilton credit cards: Improved weekend night certificates, earning rates and more

June 12, 2021 2

Our Favorite Partner Cards

Popular posts.

Advertiser Disclosure

Bankrate.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which Bankrate.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval, also impact how and where products appear on this site. Bankrate.com does not include the entire universe of available financial or credit offers.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money and how we rate our cards . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Barclaycard Arrival Plus® World Elite Mastercard®

*The information about the Barclaycard Arrival Plus® World Elite Mastercard® has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Our writers, editors and industry experts score credit cards based on a variety of factors including card features, bonus offers and independent research. Credit card issuers have no say or influence on how we rate cards.

A FICO score/credit score is used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any financial product.

Intro offer

Enjoy 70,000 bonus miles after spending $5,000 on purchases in the first 90 days

Offer valuation

Offer valuation is not available for this credit card.

Rewards rate

Earn unlimited 2X miles on every purchase

Regular APR

On This Page

- Current offer details

- Understanding the fees

- Key cardholder perks

- Is this card worth getting?

Editor’s note: The Barclaycard Arrival Plus World Elite Mastercard is no longer available through our site.

Barclaycard Arrival Plus® World Elite Mastercard® Overview

The Barclaycard Arrival Plus World Elite Mastercard is the rare travel rewards credit card that’s uncomplicated.

You’ll earn 2X miles for every $1 spent on all purchases, which means you don’t have to mess with tracking category spending or scratch your head to remember how much the card will pay back for a nice restaurant meal.

We love the reward redemption flexibility the card champions. You can use your rewards to book travel on any airline, hotel or cruise ship. You can even pay your cab fare.

What’s more, discount travel sites are covered here, as well, letting you book your trip your preferred way.

If you’re a globetrotter, road-tripper or wanderer of any type, the Barclaycard Arrival Plus World Elite Mastercard should be in your wallet. At just $89 annual fee, waived for the first year, this card offers generous and simple rewards, along with travel protections and no foreign transaction fees — just like the flashier, more expensive travel cards, but without the big price tag for ownership.

The current sign-up bonus is pretty generous. Earn 70,000 bonus miles after spending $5,000 on purchases within the first 90 days. The mileage redemption is as easy as it gets. You can book through Barclaycard’s travel portal or just redeem your mileage as a statement credit and book your travel via any method you like.

Fees and APRs

- This card charges a variable APR of 18.24%, 22.24% or 25.24% depending on your creditworthiness.

- Enjoy an introductory 0% APR offer for 12 billing cycles for each balance transfer made within 45 days of opening the account.

- The annual fee is $89 (waived for the year).

- There’s a balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater.

- There are no foreign transaction fees on purchases made outside the United States.

- Late payments won’t affect your annual percentage rate.

- Rates and Fees

Extras, perks and using points

Miles can be redeemed for statement credits starting at 10,000 miles for $100 worth of credit. You can redeem for all or a portion of your travel charges as long as it’s within 120 days of the purchase. Here’s a nice perk: You’ll get 5% of your miles back every time you redeem. So, if you redeem 10,000 miles, you’ll automatically get 500 of those back in your account.

To redeem your miles, log into your card account online. There is no fee to redeem your miles and they never expire as long as your account is open and in good standing.

This card comes with Mastercard World Elite concierge and luxury travel benefits, which also includes some travel and auto protections.

You can receive a complimentary FICO score online and get an alert if your score has changed.

Bankrate’s Take: Is the Barclaycard Arrival Plus® World Elite Mastercard® worth it?

Anyone seeking a simple travel rewards plan with easy, breezy redemptions and without a fat annual fee can get behind the Barclaycard Arrival Plus World Elite Mastercard.

* See the online application for details about terms and conditions for these offers. Every reasonable effort has been made to maintain accurate information. However all credit card information is presented without warranty. After you click on the offer you desire you will be directed to the credit card issuer's web site where you can review the terms and conditions for your selected offer.

Editorial Disclosure: Opinions expressed here are the author's alone, and have not been reviewed or approved by any advertiser. The information, including card rates and fees, is accurate as of the publish date. All products or services are presented without warranty. Check the bank’s website for the most current information.

American Express® Gold Card Review

Capital One Venture X Rewards Credit Card Review

Capital One Venture Rewards Credit Card Review

The Platinum Card® from American Express Review

Find your odds with no impact to your credit score

Apply for a credit card with confidence.

Apply for a credit card with confidence. When you find your odds, you get:

A personalized list of cards ranked by likelihood of approval

Special card offers from top issuers in our network

No credit hits. Enjoy a safe and seamless experience that won’t affect your credit score

Tell us your name to get started

This lets us verify your credit profile

Your personal information and data are protected with 256-bit encryption.

Your personal information is secure

We use your info to run a soft credit pull which won’t impact your credit score

Here’s how we protect your safety and privacy. That means:

We only use your info to run a soft credit pull, which won’t impact your credit score

We’ll never send mail to your home

All of your personal information is protected with 256-bit encryption

What’s your mailing address?

This helps us verify your credit profile.

Why we're asking

Your financial information, like annual income and employment status, helps us better understand your credit profile and provide more accurate approval odds.

Your financial information, like annual income and employment status, helps us better understand your credit profile.

Having a clearer picture of your credit profile will help us ensure that your approval odds are as accurate as possible.

What’s your employment status?

What's your estimated annual income?

Your answer should account for all personal income, including salary, part-time pay, retirement, investments and rental properties. You do not need to include alimony, child support, or separate maintenance income unless you want to have it considerd as a basis for repaying a loan. Increase non-taxbile income or benefits included by 25%.

Knowing your rent or mortgage payments helps us calculate your debt-to-income ratio (DTI) which is your monthly debt payments divided by your pre-tax monthly income.

Why does DTI matter? Your DTI gives us a clearer picture of your credit profile, which allows us to evaluate which cards you’re likely to get approved for more accurately.

Monthly rent or mortgage payment

Put $0 if you currently don’t have a rent or mortgage payment.

Almost done!

We need the last four digits of your social security number to run a soft credit pull.

We need the last four digits of your Social Security number to run a soft credit pull. This helps us locate your profile and identify cards that you may qualify for. Your information is protected by 256-bit encryption.

A soft credit pull will not affect your credit score.

Enter the last 4 digits of your Social Security number

Last step! Once you enter your email and agree to terms:

Your approval odds will be calculated

A personalized list of cards ranked by order of approval will appear

Your odds will display on each card tile

Enter your email address

Enter your email address to activate your approval odds and get updates about future card offers.

By clicking “Agree and See Results” you acknowledge receipt of our Privacy Notice , Privacy Policy and agree to our Terms of Use . By agreeing, you are giving your written instruction to Bankrate and our lending partners (together, “Us”) to obtain a soft pull of your credit report to determine whether you may be eligible ...show more for certain targeted offers, including pre-qualified and pre-approved offers (your "CardMatch offers"), as well as display what we estimate your approval odds to be for participating offers (“Approval Odds”). You instruct Us to do this each time you return to our sites to view product offerings and up to once per month so you can be provided up-to-date results.

You understand that this is not an application for credit and CardMatch offers and Approval Odds do not guarantee you will be approved for a partner offer. To apply for a product you will need to submit an application directly with that provider. Seeing your results won't hurt your credit score. Applying for a product may impact your score. See partner for complete product terms. Show less

We’re sending you to the issuer’s site to complete your application.

Just a second... We’re matching you with personalized offers

Hold tight, we’re loading your personalized results page, sorry, we couldn't access your approval odds..

This often happens when the information that's provided is incorrect. Please try entering your full information again to view your approval odds.

Check your approval odds before you apply

Answer a few questions and see if you’re likely to be approved in less than a minute—with no impact to your credit score.

Check your approval odds on similar cards before you apply

Before you apply...

See which cards you’re likely to be approved for

In less than 60 seconds, answer some questions and we’ll estimate your odds of approval on eligible cards. You get:

A personalized list of cards ranked by likelihood of approval.

Access to special card offers from top issuers in our network.

No credit hits. Enjoy a safe and seamless experience that won’t affect your credit score.

But don’t worry! You can check out other cards that are a better fit.

Barclaycard Arrival Plus® World Elite Mastercard® review

Written by: Holly Johnson

- Balance Transfer

In a Nutshell:

One of the most generous travel cards around, the Barclaycard Arrival Plus World Elite Mastercard is a great choice for earning free travel; but it’s too expensive to carry a balance on. This card offer is no longer available.

Other Notable Features: EMV chip, no foreign transaction fees, free upgrades and discounts on business class tickets with partner airlines, discounts on luxury travel

With the highest general rewards rate on the market, the Barclaycard Arrival Plus World Elite Mastercard offers a winning combination of value, flexibility and valuable travel perks. This card offer is no longer available.

Note: This card offer is no longer available.

The Barclaycard Arrival Plus® World Elite Mastercard® is easily one of the most flexible travel credit cards on the market today. It’s so flexible, in fact, that you can use your rewards for pretty much any travel expense you can imagine. And once you start earning miles with this card, you can cash them in for travel expenses at a rate of one cent per point.

Keep reading to learn about its rewards program, its cardholder benefits and why you should sign up.

Sign-up bonus

The Arrival Plus card comes out of the gate with an especially lucrative offer for new customers. Once you sign up, you’ll earn 70,000 miles after you spend $5,000 on your card within 90 days of account opening. This is much better than the 60,000 miles we’ve seen this card offer new customers in the past.

The bonus alone is worth $735 in travel after you factor in the 5 percent travel redemption bonus you receive. You’ll need to spend at least $1,667 every 30 days for the first 90 days you have the card, however, so make sure you can reach this threshold with regular spending and bills before you sign up.

Earning points

As we mentioned already, this card gives you a flat rate of rewards – specifically 2 miles for every dollar you spend. This earning rate is easy to keep track of since there are no rotating bonus categories, and your rewards rate will never change.

What are points worth?

Generally speaking, miles earned with this card can be redeemed for 1 cent each. However, they are actually worth more than that if you redeem your miles for travel. This is due to the 5 percent redemption bonus you get when you redeem miles for travel expenses. With that bonus factored in, you wind up earning 2.10 miles for each dollar you spend.

Check out the table below to see how some other travel credit cards perform. You may notice that some cards offer a higher rate of return overall, and this is usually because cards offer a better rewards “bonus” when you redeem points for travel. Higher rewards rates are also based on the fact some cards let you transfer points to airline and hotel partners that can give more bang for your buck.

Redeeming points

Redeeming miles earned with the Barclaycard Arrival Plus card for travel is a piece of cake. All you have to do is use your credit card for a qualified travel purchase then redeem your rewards to erase that purchase from your bill. Keep in mind, however, that the Barclaycard Arrival Plus card only allows travel redemptions in increments of $100 or more. As a result, you’ll need to have at least 10,000 miles in your account to redeem for travel.

Also keep in mind that you have other options when it comes to cashing in your points, including gift cards, cash back and merchandise. These options are a lot less lucrative than redeeming for travel, as you’ll see in the chart below.

Other benefits

The Barclaycard Arrival Plus card offers a slew of important benefits that can help you save money or get more value out of this card’s annual fee. Perks to be aware of include:

- No foreign transaction fees – You won’t have to pay a fee to use your credit card for purchases outside the United States.

- Introductory 0 percent APR – Receive a 0 percent APR for 12 months on balance transfers made within 45 days of account opening, followed by a variable APR of 18.24 percent, 22.24 percent or 25.24 percent.

- Mastercard World Elite Concierge – Get 24/7 help with travel planning, dinner reservations and more.

- Cellphone insurance – Receive cellphone insurance when your phone is lost or damaged. This coverage is good for up to $800 per claim minus a $50 deductible. The annual cap is $1,000.

- Lyft credits – Get a $10 credit when you take five rides in a calendar month. The credit is applied to your next ride and you can only use one credit per month.

- Postmates discount – Get $5 off every Postmates order of $25 or more when you pay with your credit card.

- Boxed discount – Get 5 percent cash rewards on Boxed purchases, which you can use for future Boxed orders.

- Fandango rewards – Receive double Fandango VIP+ points for movie tickets when you use your credit card to pay.

- Identity theft protection – Enjoy special protection against fraud, including social security number tracking, personal information monitoring, dark web tracking and identity theft resolution services.

Approval odds

If you’re a consumer with “good credit,” or a FICO score between 670 to 739 , you are more likely to qualify for this credit card than those who have lower scores. You may be in the best position to qualify if you have a score over 740, however, since scores in that range are deemed very good or excellent.

If your credit score isn’t quite that high, you may want to wait a while before you apply. Spend a few months improving your credit score, and you may be in a better position to get approved for this card.

If you’re looking for easy ways to boost your FICO score , start by making sure all your bills are paid early or on time, paying down your debts to lower your credit utilization and refraining from opening or closing too many accounts.

Customer experience

Barclays rates fairly low in customer service with its customers, coming in ninth place in the recent J.D. Power Credit Card Customer Satisfaction survey . Barclays features 24/7 customer service and a popular mobile app. The mobile app makes it easy to monitor your bills and spending, check your account balance and notice fraudulent purchases right away.

How does the Barclaycard Arrival Plus card compare to other travel credit cards?

With the same 2x points on every purchase, the Barclaycard Arrival Plus card is a great card for earning simple, straightforward rewards, but there are more rewarding options if you’re willing to do a little extra work monitoring bonus categories:

Chase Sapphire Reserve

The Chase Sapphire Reserve is another flexible travel credit card that lets you redeem points in more than one way. Not only can you cash in your points for gift cards, statement credits and merchandise, but you get 50 percent more travel when you redeem points through the Chase Travel℠ portal. Also, you have the option to transfer your points 1:1 to popular airline and hotel partners like United MileagePlus, Southwest, Hyatt and Marriott Bonvoy.

Once you sign up, you’ll earn 75,000 points after you spend $4,000 within three months of account opening. You also get 10 points per $1 spent on hotels and car rentals when you purchase through Chase Travel℠, 5 points per $1 spent on air travel through Chase Travel℠ and 3 points per $1 spent on other travel purchases (earn elevated rewards on travel purchases after earning the $300 annual travel credit). Plus, earn 3 points per $1 spent on dining and 1 point per $1 spent on other purchases. There’s a $550 annual fee, but you get Priority Pass Select airport lounge membership, a Global Entry/TSA Precheck credit, a $300 annual travel credit and other perks.

Wells Fargo Propel American Express card

This card comes with no annual fee, yet it gives you 3 points per dollar on dining, travel and transit, gas station purchases and select streaming services and 1 point per dollar on other purchases. You also earn 20,000 points worth $200 after you spend $1,000 on your card within three months of account opening.

You can cash in your points for travel, cash back, merchandise, gift cards and more.

Capital One Venture Rewards Credit Card

The Capital One Venture card is another card that gives a flat 2 miles for each dollar you spend, except you also get the added benefit of up to $100 credit for Global Entry or TSA PreCheck. You also earn 75,000 miles if you spend $4,000 in the first 3 months.

When it comes time to redeem your miles, you can opt for travel statement credits, cash back, gift cards and more. This card also gives you the option of transferring your miles to a handful of popular airline partners.

Who should apply for the Barclaycard Arrival Plus card?

- Anyone who wants to earn a flat rate of rewards on all their spending.

- Consumers who want to earn a big sign-up bonus when they sign up for a travel credit card.

- People who prefer to redeem points for travel over other options.

- Anyone who doesn’t want to deal with complicated hotel or airline loyalty program rules.

How to use the Barclaycard Arrival Plus card

- Sign up and spend $5,000 on your card within 90 days to earn 70,000 bonus points.

- Use your card for all your regular purchases to earn 2x miles for each dollar you spend.

- Make sure to rack up at least 10,000 miles before you attempt to redeem points for travel .

- Use your card for at least five Lyft rides each month to qualify for statement credits.

- Pay your cellphone bill with this card in order to qualify for the free cellphone coverage benefit.

Is the Barclaycard Arrival Plus card worth it?

The Barclaycard Arrival Plus card is absolutely worth it if you spend money on travel each year. Not only does this card give you a big sign-up bonus, but you can redeem your miles for any purchase that codes as travel. You also earn 2 miles for each dollar you spend, which is more than you’ll get with a standard cash back credit card.

Before you sign up, however, it’s always worth checking out other travel credit cards to see how they stack up. You may find a different rewards card will leave you better off, or you may decide to pair the Barclaycard Arrival Plus card with a second card that offers different benefits.

*All information about Wells Fargo Propel American Express card has been collected independently by CreditCards.com and has not been reviewed by the issuer. The Wells Fargo Propel American Express card is no longer available.

Our reviews and best card recommendations are based on an objective rating process and are not driven by advertising dollars. However, we do receive compensation when you click on links to products from our partners. Learn more about our advertising policy

All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank’s website for the most current information.

Responses to comments in the discussion section below are not provided, reviewed, approved, endorsed or commissioned by our financial partners. It is not our partner’s responsibility to ensure all posts or questions are answered.

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Know your odds before you apply

- Enter your information

- We’ll run a soft credit pull, which won’t impact your credit score

- You’ll see your estimated approval odds near cards to help you narrow down your options

Your personal information and data are protected with 256-bit encryption.

Tell us your name to get started

We’ll use this information to to verify your credit profile.

What’s your mailing address?

What's your employment status?

Your answer should account for all personal income, including salary, part-time pay, retirement, investments and rental properties. You do not need to include alimony, child support, or separate maintenance income unless you want to have it considered as a basis for repaying a loan. Increase non-taxable income or benefits included by 25%.

Put $0 if you currently don't have a rent or mortgage payment.

Last four digits of your Social Security number

We’ll use the last four digits of your Social Security number to get your approval odds. This won’t impact your credit score.

What’s your email address?

Your email address unlocks your approval odds. Don’t worry, we won’t spam your inbox.

By clicking "See my odds" you agree to our Terms of Use (including our Prequalification Terms ) and Privacy Policy . These terms allow CreditCards.com to use your consumer report information, including credit score, for internal business purposes, such as improving the website experience and to market other products and services to you. I understand that this is not an application for credit and that, if I wish to apply for a credit card with any participating credit card issuer, I will need to click through to complete and submit an application directly with that issuer.

Calculating your approval odds

Oops something went wrong..

We’re sorry, but something went wrong and we couldn’t find your approval odds. Instead, you'll see recommended credit ranges from the issuers listed next to cards on our site.

/static-assets/statics-12566/images/financebuzz.png)

Trending Stories

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

15 Legit Ways to Make Extra Cash

/images/2019/12/06/smart_strategies_to_save_money_on_car_insurance.jpg)

6 Smart Strategies to Save Money on Car Insurance

Barclaycard arrival plus ® world elite mastercard ® review [2024]: is it worth it.

/authors/fbz-fb-profile-180x180.png)

This article was subjected to a comprehensive fact-checking process. Our professional fact-checkers verify article information against primary sources, reputable publishers, and experts in the field.

/images/2017/03/31/travel-rewards-card-review_1200x628.jpg)

We receive compensation from the products and services mentioned in this story, but the opinions are the author's own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies .

Editor's note: The Barclaycard Arrival Plus World Elite Mastercard is no longer available and this page is no longer regularly updated. If you're looking for a credit card with a high rewards rate, flexible reward options, and a generous welcome bonus, consider the Chase Sapphire Preferred ® Card instead.

A good travel rewards credit card is worth its weight in gold to its cardholders.

And, while there’s certainly a lot of competition among best credit cards, the Barclaycard Arrival Plus World Elite Mastercard remains a favorite because of its high rewards rate, flexible reward options, and awesome sign-up bonus.

Standout benefits of the Barclaycard Arrival Plus World Elite Mastercard

Why we like it

Plus, you get World Elite Mastercard benefits

Alternatives to the barclay card, bottom line.

1. It has an awesome sign-up bonus. Enjoy 70,000 bonus miles after spending $5,000 on purchases in the first 90 days.

2. The rewards add up fast. You’ll earn up to 2X miles for every dollar you spend.

3. Your rewards keep on giving. When redeeming miles, you’ll get a 5% miles rebate to use the next time (hard not to love that).

4. Reward options are super flexible. You’ll be able to redeem rewards on nearly any travel purchase, including airfare, hotels, cruises, and more in the form of a travel statement credit.

5. Miles never expire. As long as your account is open, your reward miles will never expire.

6. No foreign transaction fees. So you can travel abroad without worrying about fees.

It’s one of the most flexible travel credit cards available

When it comes to booking a trip, flexibility is key. Luckily, the Barclaycard Arrival Plus World Elite Mastercard has you covered with super flexible reward redemptions.

Once you’re ready to redeem, rewards can be booked however you’d like – whether that be directly through an airline or hotel, travel agent, or travel website. The Barclaycard Arrival Plus will then reimburse your travel expenses with the reward miles in your account.

This option is especially beneficial for budget travelers since it allows you to snag the best deals whenever they become available.

Here are a few examples of how easy the process is:

Reimbursement Example 1: Let’s say JetBlue has an incredible sale on airfare and you quickly book a $100 roundtrip ticket to San Diego using your Barclaycard Arrival Plus .

Once the purchase shows on your statement, you would simply select and submit the expense for reimbursement using your miles; when the transaction clears, you’ll be jetting off to San Diego for free thanks to your rewards program.

Reimbursement Example 2: If you’re planning a trip with a group of friends and making reservations through a travel agent, you can use your miles to be reimbursed once the trip is booked.

After using your Barclaycard Arrival Plus to pay for your travel reservations, you would simply log into your account, pull up your statement, and tag the expense for reimbursement. Once it’s been processed, you’ll see a credit on your statement for the amount covered by your reward miles.

The sign-up bonus is worth getting excited over

A generous sign-up bonus is always a factor when searching for the best travel credit card and the Barclaycard Arrival Plus World Elite Mastercard doesn’t disappoint.

Rewards add up FAST

Building a stockpile of rewards with this card is easy – you’ll earn 2 miles for every dollar spent on this card! Most credit card reward rates are 1%, so this high rate of rewards is a keeper.

Get miles back every time you redeem

Each mile is worth 1 cent, and when you redeem them, you also get a redemption bonus. You’ll get 5% bonus points back to use toward your next redemption. This essentially means you'll never run out of miles.

You're in control of your card

Using the Barclays mobile app, you can instantly secure your accounts by locking your card through Barclays SecurHold protection — a huge relief if you think your card's been compromised.

No need to worry about hidden terms and conditions

As with all rewards credit cards , worrying about blackout dates, mileage caps, and reward expirations are common. However, you won’t need to worry about that with the Barclaycard Arrival Plus .

There’s no cap on the number of award miles you can earn, no blackout dates, and as long as your account is open, miles never expire.

Another great redemption tip is you can redeem miles for your entire trip or just a portion - you decide what’s best for you.

Traveling couldn’t be easier

This card carries no foreign transaction fee, making it a must-have for traveling abroad. Also, it’s chip-enabled and PIN capabilities make it a secure choice to use while traveling abroad.

There’s a built-in support network

One of the reasons we love this card is because of the emphasis on customer experience.

When you sign-up for the card, you not only receive a powerful travel rewards card, but you also gain access to the Barclaycard Travel Community which connects travelers across the globe and rewards them with bonus miles for sharing their travel stories.

As an added benefit, this card is on the World Elite Mastercard platform, which offers cardmembers with high-end perks such as:

- Complimentary concierge service and access to travel advisors to help you plan trips

- Access to luxury hotels and resorts, plus perks such as complimentary breakfast