American Express Cards in the Netherlands (Complete Guide)

American Express (AMEX) is present in the Netherlands and has a number of charge cards available for Dutch residents. Whilst American Express cards are not as widely used in Europe, their acceptance has slowly been growing.

In this article we will feature all American Express cards in the Netherlands. We will broadly split them between the standard AMEX cards which earn Membership Rewards and the Flying Blue cards .

Membership Rewards is the in-house points program from American Express which can be transferred to other airline and hotel partners. Flying Blue is the frequent flyer program of Air France-KLM.

This overview may help you decide which is the best American Express card in the Netherlands for your own situation.

American Express Membership Rewards Cards in the Netherlands

The following table summarises the top 3 of the 4 classic American Express cards available in the Netherlands which earn Membership Rewards points. We will describe the benefits of all 4 cards in more detail below.

American Express Platinum Metal Card

Best Travel Benefits

This is a high-end card used by many frequent flyers and travel ‘professionals’.

It offers fully comprehensive travel insurance for the cardholder and family and all supplementary card holders. This includes baggage delay, cancellation, travel accident and full car hire insurance.

POINTS EARNING: The Platinum Card now earns the standard 1 Membership Rewards point for every €1 spent on the card. This has been recently reduced from 1.5 points per €1 spend. There are currently no bonus points on applying.

AMEX Platinum Card Lounge Access

The card comes with a raft of travel benefits. The cardholder and main supplementary cardholder will each receive a special Priority Pass membership .

This allows free entry into one of 1,300 airport lounges worldwide and 1 free guest is allowed per card (unlike the usual Priority Pass membership which you have to pay for any guests). Thus with 2 Platinum cards a group of 4 people could all get free access into a lounge.

If you were to purchase Priority Pass ‘Prestige’ membership separately it would cost €459 per person and you would pay €30 each time for any guests.

The Platinum Card will also get you direct entry into the high-end American Express Centurion lounges (mainly in the US plus Hong Kong/Sydney/Melbourne/London Heathrow T3/Stockholm).

You can also get access to Plaza Premium lounges worldwide (with 1 guest allowed) – this includes lounges at Copenhagen, Frankfurt, Geneva, Helsinki, London Heathrow, London Gatwick, Rome, Stockholm and Zurich.

Access is granted to Delta Sky Club lounges (no free guests) when flying on Delta Air Lines.

Platinum Card holders can also access select Lufthansa lounges (no free guests) if flying on LH Group airlines Lufthansa, SWISS or Austrian. Economy flyers get access to Lufthansa Business Lounge; business class flyers can access the Lufthansa Senator Lounge.

The combined lounge access possibilities with the Platinum card is valued at a minimum of €910 per year.

At Schiphol airport Amsterdam, Platinum cardholders get a light freshly prepared meal (Loungebox on the go) at the GRAB&FLY outlets on presentation of your card and boarding pass.

If travelling by Eurostar train in any class you can also enter the Eurostar Business Premier lounge at London St Pancras, Paris Nord and Brussels Zuid stations. No free guests are allowed.

A complimentary Privium Plus membership (normally €285) is given which includes fast-track security and border control (by iris scan) at Amsterdam Schiphol, business class check-in at selected airlines, use of the 3 Privium lounges and the Privium parking garage.

Supplementary cardholders can make use of a free Privium Partner membership (normally €130).

Other AMEX Platinum Card perks

The Platinum Card gives instant status in a number of hotel schemes:

Radisson Rewards Premium status Hilton Honors Gold status (which includes free continental breakfast at all Hilton hotels) MeliáRewards Gold status Marriott Bonvoy Gold Elite status

For car rentals you get Avis Preferred and Hertz Gold Plus Rewards status which gives a discount up to 15%.

You also get free room upgrades and privileges when booking 4 and 5 star hotels with the Fine Hotels & Resorts program, The Hotel Collection and The Vacation Collection.

Cardholders can get priority booking to special events and exclusive experiences.

New – You get €300 dining credit each year at a selection of the best restaurants world wide. This is €150 at some 30 restaurants in the Netherlands and a further €150 to use at more than 1,400 restaurants in 20 countries.

In addition, 1 supplementary Platinum Card and 4 supplementary Green Cards can be taken out free of charge for family or friends.

American Express quote the total value of the average annual benefits as €3,175.

You now only require a minimum gross income of €30,000 per year. This was recently reduced from €60,000 per year – which opens the card to many more people.

Though expensive, if you travel extensively and make use of the card features you could find excellent value and benefits from the card.

- Comprehensive lounge access

- Full travel and car hire insurance

- Privium Plus at Amsterdam Schiphol

- €300 Dining credit

- Relatively expensive

- No current bonus points

Platinum Card Application

American Express Gold Card

Best Mid-Range Card

It offers comprehensive travel insurance (up to age 75) for the cardholder and family if paying for your travel or stay with the card.

POINTS EARNING: You can earn 1 Membership Rewards point for every €1 spent on the card. There are currently no bonus points for applying.

AMEX Gold Card benefits

Other benefits include 4 free airport lounge passes each membership year via Priority Pass to enter into one of 1,300 airport lounges worldwide. This includes the Aspire lounges at Amsterdam Schiphol and in the UK.

At Schiphol airport Amsterdam, Gold cardholders get a light freshly prepared meal (Loungebox on the go) at the GRAB&FLY outlets on presentation of your card and boarding pass.

New – You get €100 dining credit each year at a selection of restaurants in the Netherlands, Belgium and Luxembourg.

New – You get a complimentary Amazon Prime subscription.

In addition, 4 supplementary Green Cards can be taken out free of charge for family or friends.

You do require a minimum gross income of €20,000 per year – this has been recently reduced from €36,000.

Apply for the American Express Gold Card here

If you travel every now and again this could be a worthwhile mid-range card, with its travel insurance coverage and 4 lounge passes. And if you can make use of the dining credit and Amazon Prime subscription.

- 4 Lounge passes

- Travel insurance coverage

- €100 Dining credit

- Amazon Prime subscription

Gold Card Application

American Express Green Card

It offers some basic travel insurance (accident and missed departures) if paying for your travel or stay with the card.

POINTS EARNING: It has the same earning rate as the Platinum and Gold cards, earning 1 Membership Rewards point for every €1 spent on the card. There are currently no bonus points on offer for applying.

In addition, 2 supplementary Green Cards can be taken out free of charge for family or friends.

You do require a minimum gross income of €20,000 per year. Apply for the American Express Green Card here

The points earning rate and free first year makes this a great introductory choice for an Amex card.

- Basic travel insurance

- Free first year

- 1 Membership Reward point per 1 spend

- No lounge access or dining benefits

Green Card Application

American Express Blue Card

It offers some basic travel accident insurance if paying for your travel or stay with the card.

Note, it only earns 1 Membership Rewards point for every €2 spent on the card which is half the rate of the Green and Gold Cards. If you are looking to rack up points from spending then consider one of the other cards. There are no bonus points awarded for taking the Blue card.

In addition, 2 supplementary Blue Cards can be taken out free of charge for family or friends. You do require a minimum gross income of €20,000 per year.

Since the Green card is free the first year and has a higher points earning rate we would recommend that card over the Blue card.

American Express Membership Rewards – Transfer Partners

The great feature about the Amex Membership Rewards program is the flexibility to transfer points to a number of airline and hotel transfer partners .

It is currently possible for Dutch-based Membership Rewards cardholders to transfer their MR points into points/miles of 8 frequent flyer programs and 3 hotel programs. Note, the partners and transfer rates are slightly different for Netherlands American Express cards compared to UK and US cards.

As an example, if you were to transfer 5,000 MR points to British Airways or Iberia you would receive 4,000 Avios into your account.

American Express Flying Blue Cards in Netherlands

With KLM being the national airline based in Amsterdam you may find yourself flying regularly on Air France-KLM, Delta and other Skyteam partners. The following table overviews the 4 American Express Flying Blue cards available to Dutch residents.

If you are not already a member of the Flying Blue program , applying for one of the cards will automatically enroll you.

The following table summarises the top 3 of the 4 American Express Flying Blue cards available in the Netherlands which earn Flying Blue miles. We will describe the benefits of all 4 cards in more detail below.

American Express Flying Blue Platinum Card

It offers fully comprehensive travel insurance for the cardholder and family if paying for your travel or stay with the card. This includes the car hire insurance.

POINTS EARNING: It earns 1.5 Flying Blue Miles for every €1 spent on the card. You earn 2 Flying Blue miles per €1 spent with KLM, Air France and Hertz.

There is a 10,000 Miles welcome bonus if spending €5,000 on the card in the first 3 months.

By keeping the card your Flying Blue miles will not expire, even if you are not flying for a period of time.

10000 miles is the starting rate for a return economy flight from Amsterdam to London.

You get 60 free XP points which go towards attaining elite status in the Flying Blue program. The first elite tier (Flying Blue Silver) requires 100 XP in 12 months.

In addition, up to 1 supplementary Flying Blue Platinum card and up to 4 Flying Blue Gold cards can be taken out free of charge for family or friends.

You require a gross annual income of €30,000 – like the Amex Platinum card this has recently been reduced from €60,000. You can apply for the American Express Flying Blue Platinum Card here

- Highest welcome bonus on any Dutch card

- High Flying Blue Miles earn rate

- 60XP status points

- Tied to Flying Blue, Membership Rewards cards are more flexible

Flying Blue Platinum Card Application

American Express Flying Blue Gold Card

It offers comprehensive travel insurance for the cardholder and family if paying for your travel or stay with the card.

POINTS EARNING: It earns 1 Flying Blue mile for every €1 spent on the card. You earn 1.5 Flying Blue mile per €1 spent with KLM, Air France and Hertz.

There is a 5,000 miles welcome bonus if spending €2,500 on the card in the first 3 months.

Also, by keeping the card your Flying Blue miles will not expire, even if you are not flying for a period of time.

You get 30 free XP points which go towards attaining elite status in the Flying Blue program.

In addition, up to 2 supplementary Gold cards can be taken out free of charge for family or friends.

You also require a gross annual income of €20,000. Apply for the American Express Flying Blue Gold Card here

- 5,000 welcome bonus Miles

- Solid Flying Blue Miles earn rate

- 30XP status points

Flying Blue Gold Card Application

American Express Flying Blue Silver Card

POINTS EARNING: It earns a slightly lower 0.8 Flying Blue miles for every €1 spent on the card. You earn 1 Flying Blue miles per €1 spent with KLM, Air France and Hertz.

There is a 2,500 miles welcome bonus if spending €1,500 on the card in the first 3 months. Also, by keeping the card your Flying Blue miles will not expire, even if you are not flying for a period of time.

You get 15 free XP points which go towards attaining elite status in the Flying Blue program.

In addition, up to 2 supplementary Silver cards can be taken out free of charge for family or friends.

You require a gross annual income of €20,000. Apply for the Flying Blue Silver Card here

- 2,500 welcome bonus Miles

- 15XP status points

Flying Blue Silver Card Application

American Express Flying Blue Entry Card

It only earns 1 Flying Blue miles for every €2 spent on the card.

There is a 1,000 miles welcome bonus if spending €500 on the card in the first 3 months.

In addition, 2 supplementary Entry Cards can be taken out free of charge for family or friends. You do require a gross annual income of €20,000.

Since the Flying Blue Silver Card is free the first year and has a higher points earning rate we would probably recommend that card over the Entry card.

American Express Business Cards in Netherlands

American Express offers a number of business cards to cater for business expenses. These following two cards earn Membership rewards points. You need to have been registered with the Dutch Chamber of Commerce (KvK) for at least 1 year to apply for such a card.

American Express Business Gold Card

The Business Gold Card costs €225 per year. It earns 1 Membership Rewards point for every €1 spent on the card.

The card offers business travel accident, travel inconvenience and cancellation insurance. There is also purchase and refund protection.

You require a gross annual income of €36,000.

You can apply for the American Express Business Gold Card here

American Express Business Green Card

The Business Green Card costs €85 annually. It earns 1 Membership Rewards point for every €1 spent on the card.

The card includes business travel accident and business travel inconvenience insurance.

You require a gross annual income of €23,000.

Apply for an American Express Business Green Card here

About American Express

American Express is an international financial services company with headquarters in New York, USA and offices worldwide. It specialises in payment card services and has 60,000 staff located in 110 countries.

American Express was originally established in 1850. It introduced its first charge card in 1958.

Its Dutch office is located in Amsterdam.

American Express Cards Netherlands FAQ

Is the american express netherlands website available in english.

No, generally the Amex (Netherlands) website is in Dutch. There is an exception for the Platinum Metal Card which has an English landing page. All other card pages and application pages are in Dutch.

The landing pages for the business cards are in English and Dutch, though again the application procedure is in Dutch.

How long does it take to apply for an American Express card in the Netherlands?

Applications are normally processed within 10 working days.

What are the general requirements for an American Express card in the Netherlands?

You need to be aged 18 or over and have a Dutch address.

You should have no negative records on the ‘BKR’ Dutch credit register.

You should have a Dutch bank account. You need to verify your identity using the iDIN online identification system using your bank account login credentials.

You also have to upload a copy of your identity – valid passport or ID card (driving license not accepted) – which is verified via Onfido.

What are the eligibility requirements for any welcome bonus points or first year card discounts?

To receive any welcome bonus points or get discounts on the first year of card fees you should not have held an American Express card in the Netherlands for the last 12 months.

How can I manage my American Express account?

The account can be managed online through the American Express NL website or via the American Express app.

American Express can also be contacted by phone and Dutch/English is spoken.

Does American Express offer credit cards or charge cards in the Netherlands?

American Express issues charge cards in the Netherlands. Charge cards are slightly different to credit cards as they must be paid off every month – meaning there is no ongoing balance carried over.

No registration is therefore needed with the Dutch ‘BKR’ credit register due to the issuance of the card.

American Express will give you a spending limit on the card based on your spending habits and personal profile. If you need a higher temporary limit you should contact Amex customer service.

Can I use Apple Pay with American Express Netherlands cards?

Yes, Apple Pay is available for all Membership Rewards and Flying Blue cards.

What is the fee on non-Euro payments for Dutch-based American Express cards?

American Express charges 2.5% for payments made in other (non-euro) currencies. This is pretty standard for credit cards in the Netherlands . This is less of an issue than say the UK or US based cards – since the Dutch cards can be used forex fee-free anywhere in the 19 member states of the eurozone.

Can I cancel or change my American Express card?

Yes, American Express is generally very flexible with cancellations. You usually pay the card fee monthly so effectively you get a pro-rata refund if cancelling the card. Many other card providers will charge you for the full year.

You can also easily upgrade or downgrade to other American Express cards should you satisfy all the basic requirements.

What about the American Express Centurion card in the Netherlands?

We haven’t covered the Dutch American Express Centurion card above because this is an invitation-only card product. There is a one-time €4,000 registration fee and the annual fee is also €4,000 per year. The card earns 1.5 Membership Rewards points per €1 spent.

Which retailers in the Netherlands accept American Express cards?

ALDI, Dirk van den Broek and Jumbo supermarkets, De Bijenkorf department store, HEMA, IKEA stores and major petrol stations all accept AMEX payments.

Transport companies accepting AMEX include NS (Dutch Railways), KLM and Transavia.

Note: Card names above are registered trademarks. You should pay your credit card or charge card balance in full every month. We are not offering any financial advice, we are merely describing the main card benefits and features. Always read the terms and conditions carefully before taking out any financial product.

Last update 19 June 2024 , originally published in 2019.

Links on AmsterdamTips.com may pay us an affiliate commission.

Related Articles

Netherlands Jobs: Employee Benefits

Salaries in Amsterdam, Netherlands (2024)

OV Fiets – Dutch Bike Rental Scheme

How To Buy Dutch Train Tickets

Everything you need to know about Amex Travel

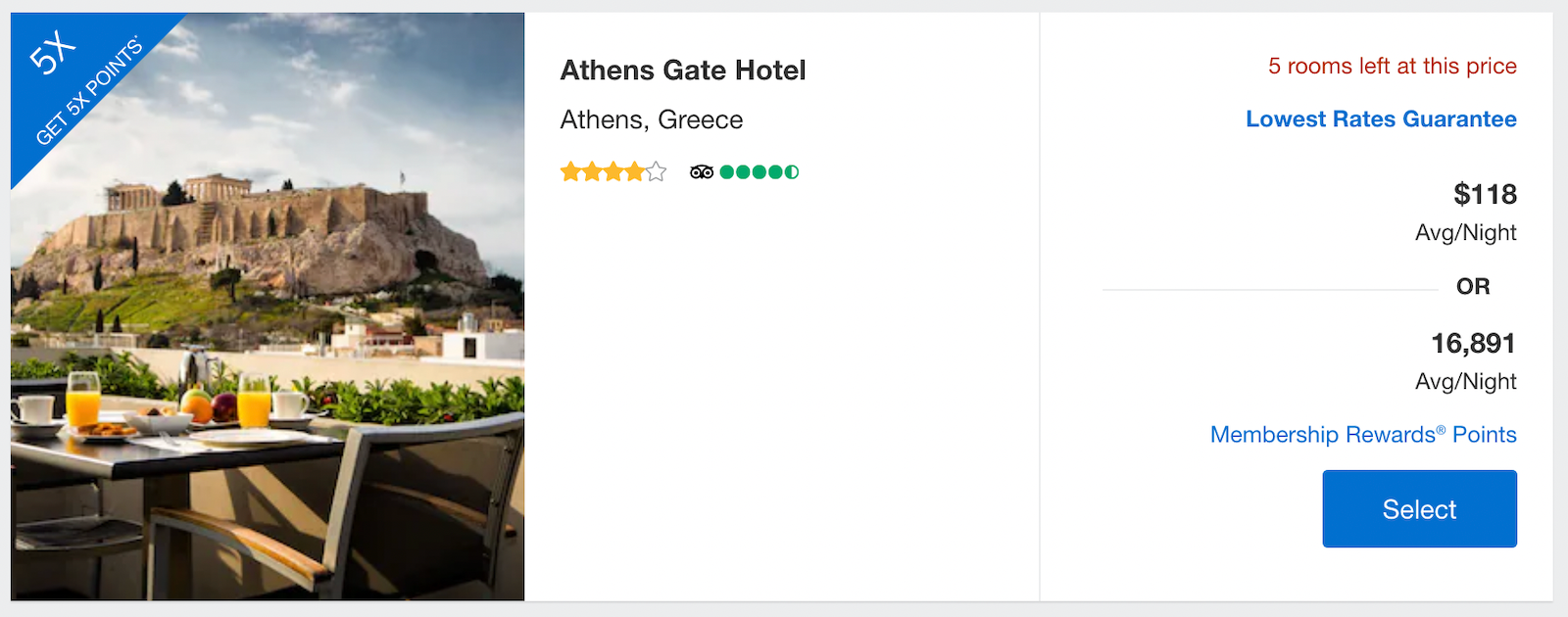

The American Express Travel portal allows you to redeem Membership Rewards points directly for travel reservations and activities rather than transfer your rewards to airline or hotel partners like Delta Air Lines SkyMiles and Marriott Bonvoy .

You also can book discounted premium tickets, use benefits like a 35% points rebate on certain bookings and even book premium hotels with additional perks through Amex Travel.

Let's explore this booking portal to uncover all its benefits and potential disadvantages.

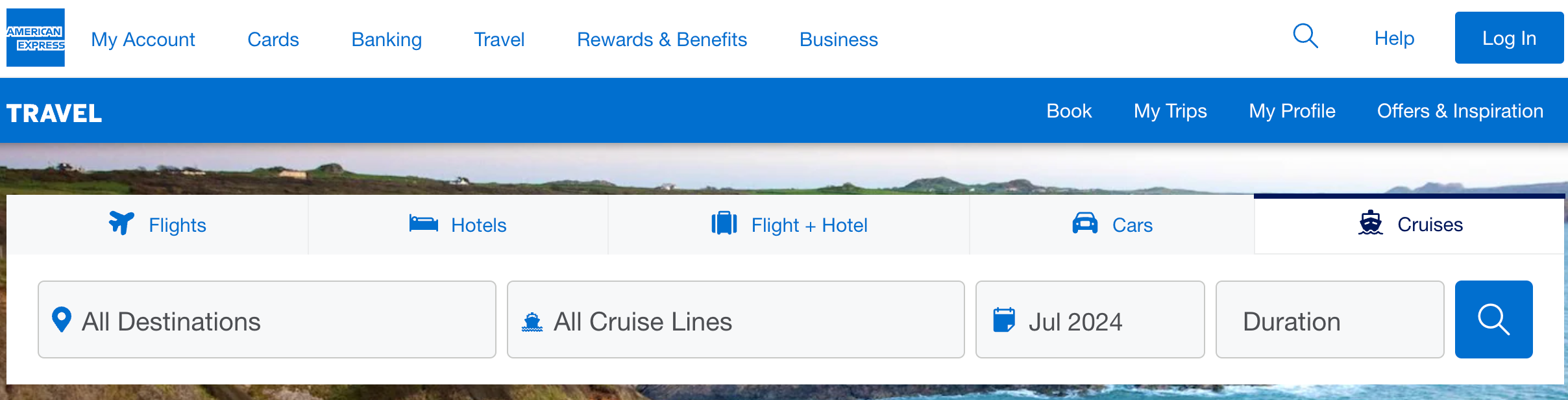

What is the American Express Travel portal?

Amex Travel is the booking portal for most American Express cards . You can book flights, hotels, rental cars and cruises through the site, and you can pay with points, cash or a combination of the two.

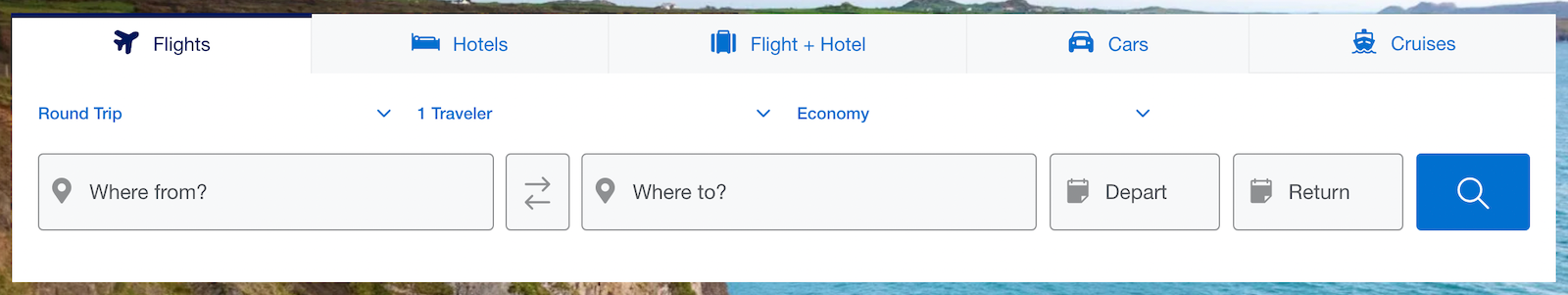

How to book flights on the Amex Travel portal

To find flights on American Express Travel, visit this webpage . The flight booking process on the Amex Travel portal is similar to other popular sites like Kayak and Orbitz. You'll find a search box where you can enter your departure and destination cities.

If you're flexible with your departure airport, you can choose an entire city, such as New York, which has multiple airports. Additionally, you can customize your booking by selecting your preferred class and the number of travelers, and choosing between one-way and round-trip flights.

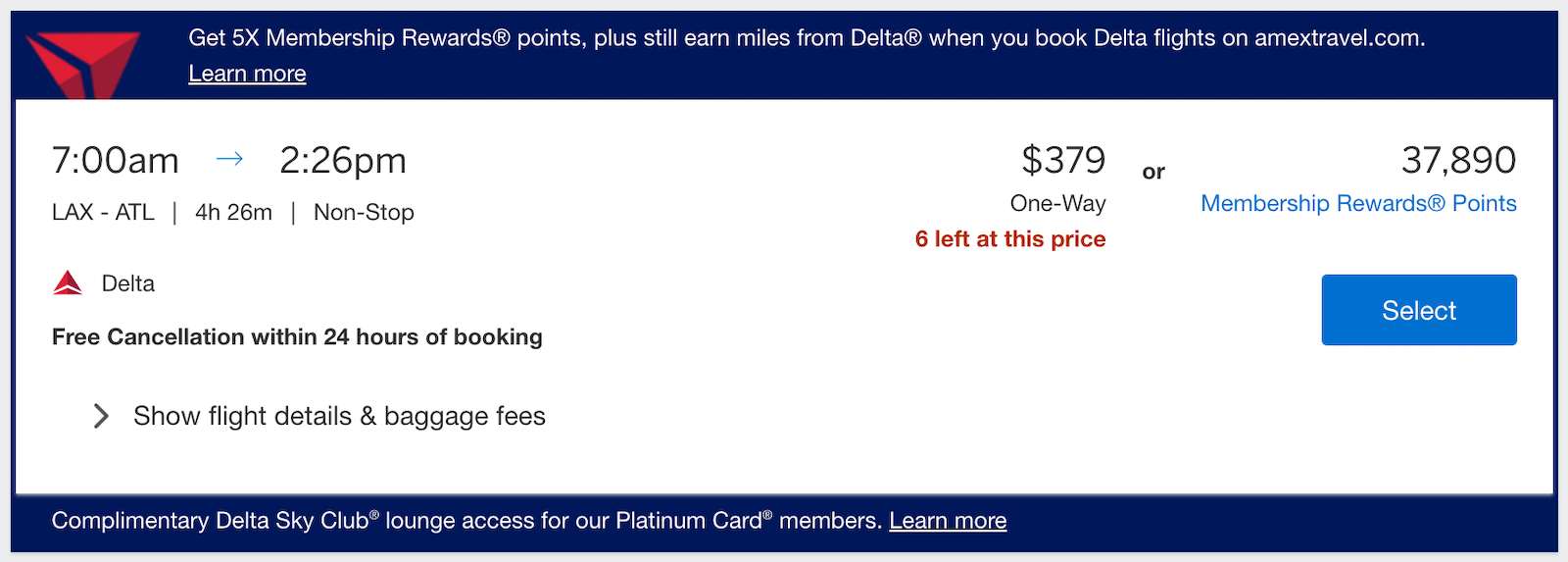

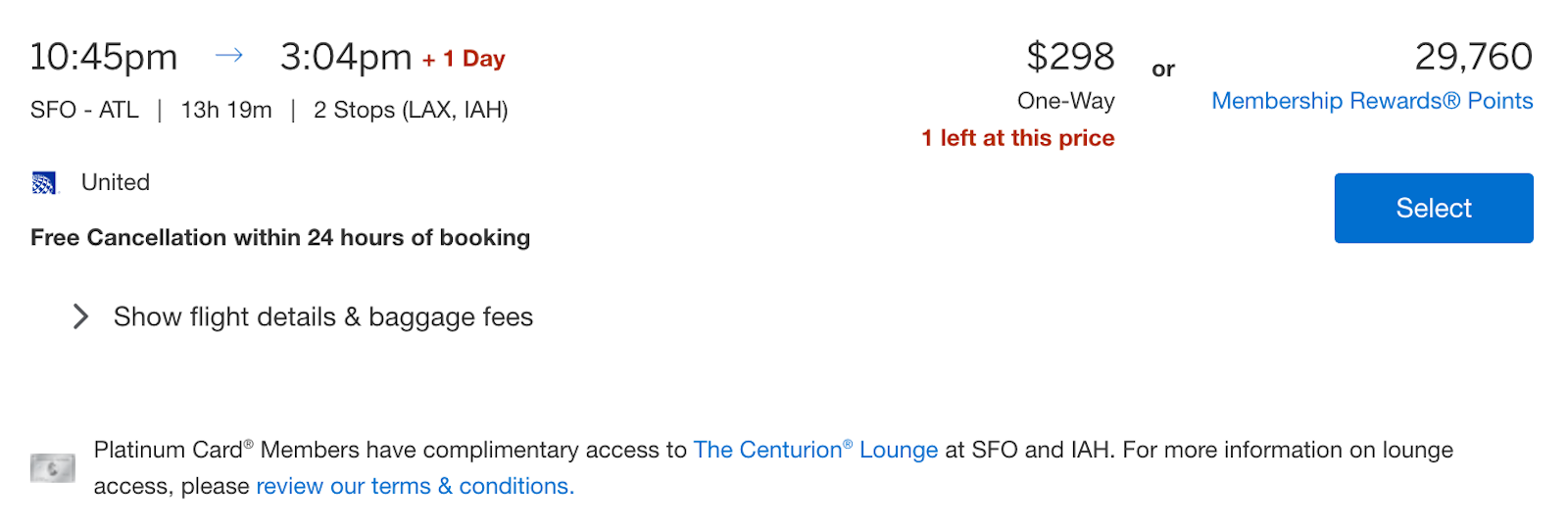

You'll see the price listed in dollars and the number of Amex Membership Rewards points during the booking process.

You can also use the options on the left-hand side to filter flights by number of stops, departure and arrival times, flight duration and airline.

Delta Air Lines is a featured airline in the Amex Travel portal. Sometimes, Delta flights appear at the top of your results, listed as "recommended," but this doesn't mean those flights are always the cheapest.

Additionally, if you have The Platinum Card® from American Express or The Business Platinum Card® from American Express and are flying from an airport with a Centurion Lounge , you'll see an indicator that a lounge is available.

Points vs. cash

When paying for your flights on Amex Travel, several American Express cards offer elevated earning rates:

You can also pay with Amex Membership Rewards points to cover the cost of your flight.

You'll see the number of points required next to the cash price of a flight. You can expect a value of 1 cent per point when using Pay with Points . However, TPG values Membership Rewards points at 2 cents apiece when you maximize Amex's transfer partners.

Related: How to redeem American Express Membership Rewards for maximum value

It's important to compare the number of points required for bookings on Amex Travel with the points you'd need to transfer to an airline program . If you can't book a flight through transfer partners and prefer to use your points, Amex Travel remains an option.

There's an additional benefit for Amex Business Platinum cardmembers: You can get 35% of your points back when paying with points on Amex Travel. This applies to first- and business-class flights on any airline plus tickets in any class on your preferred airline (the same one used for your airline incidental credits ; enrollment is required in advance). This 35% points rebate can provide a value of 1.54 cents per point, which may influence your decision to pay with cash or points.

Similarly, the Business Centurion® Card from American Express offers a 50% Pay with Points rebate on eligible flights. Note that Centurion cards are available by invitation only.

The information for the Business Centurion Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

More details about flights through Amex Travel

During the payment process, you can use points, your credit card or a combination of both. The minimum number of points you can use is 5,000, and each point is valued at 1 cent.

You can upgrade your flights using cash or points in the Amex Travel portal. This generally gives you a return of 1 cent each, and you can book using your Amex card, points or a combination of both.

During your flight search, you might come across "Insider Fares" that offer a discounted price. But to benefit from the discount, you must redeem points to cover the full fare amount.

Amex Platinum and Amex Business Platinum cardmembers have another benefit: discounted premium tickets through Amex Travel's International Airline Program . This program offers discounts on first-class, business-class and premium economy tickets from over 20 participating airlines.

To book a premium ticket using the IAP, go to the Amex Travel portal and pay with cash or points, including the Business Platinum card's 35% airline rebate. Keep in mind that not all flights are eligible and there are restrictions:

- The cardmember must travel on the itinerary.

- A maximum of eight tickets can be booked per itinerary; travel must begin and end in the U.S. or Canadian international airports.

- Tickets are nonrefundable unless stated otherwise.

- Name changes for passengers are not allowed.

Finally, note that flights booked through Amex Travel are typically treated as normal paid tickets, meaning you're eligible to earn points or miles with participating airline loyalty programs.

Related: Why I love the Amex Business Platinum's Pay with Points perk

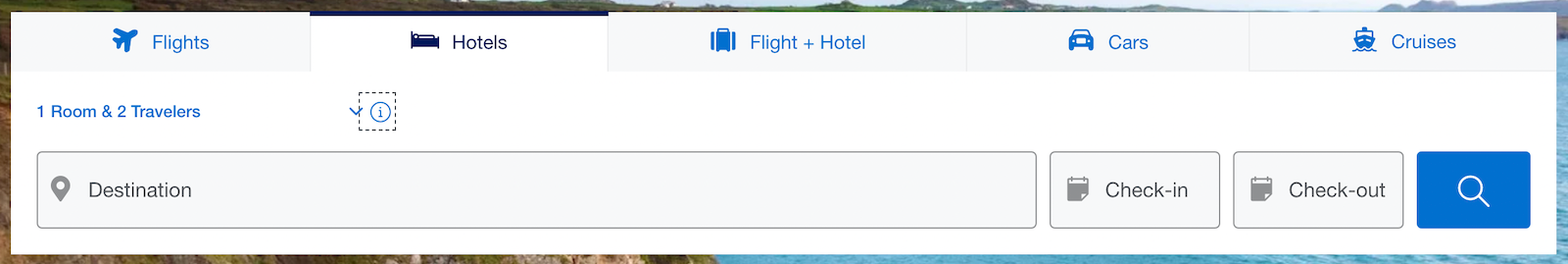

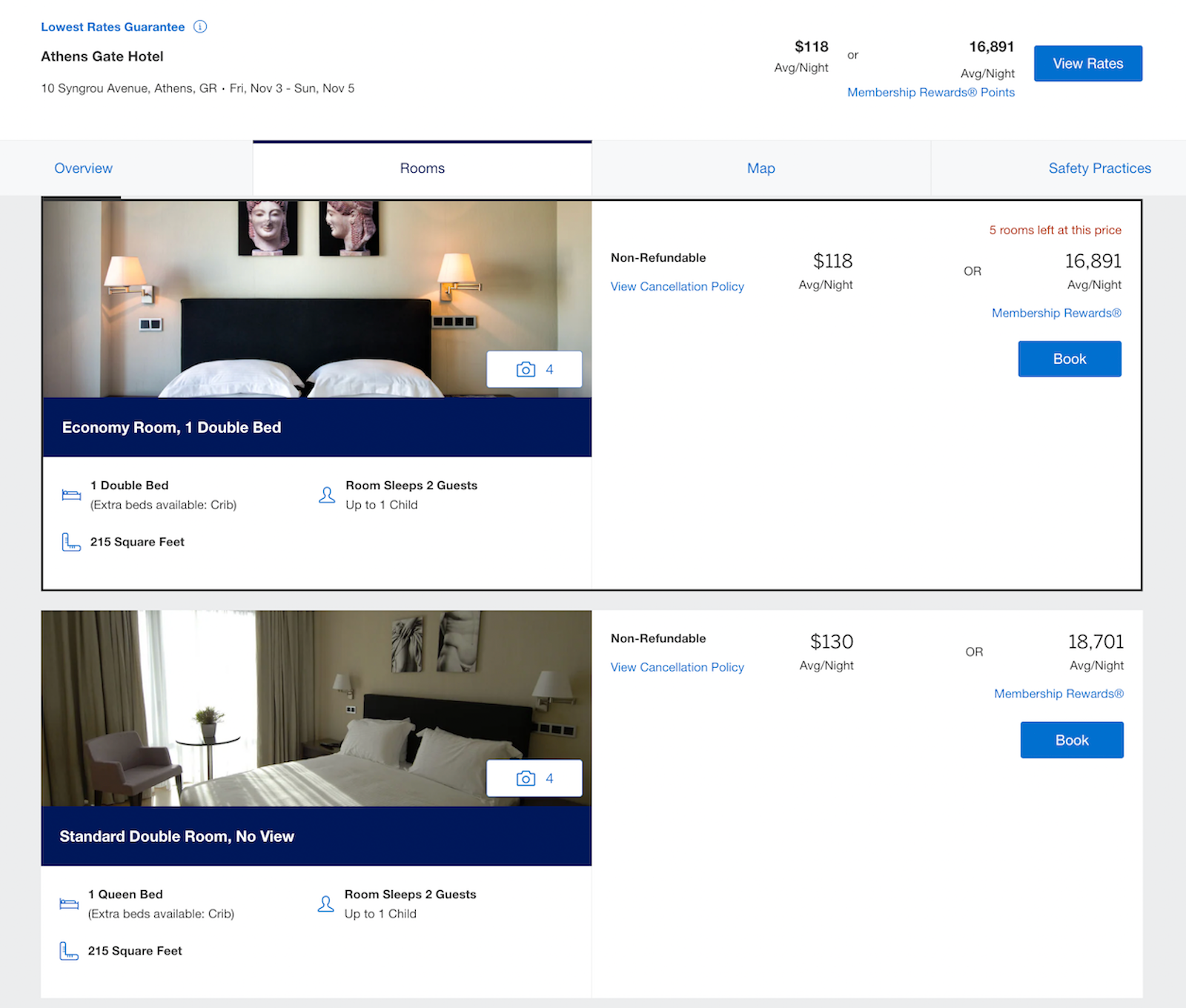

How to book hotels on the Amex Travel portal

You can book hotels through American Express Travel with a Gold, Platinum or Centurion card. As with other travel portals, you can input your destination, dates, number of rooms and number of guests (with separate input fields for adults and children).

Platinum and Business Platinum cardmembers earn 5 points per dollar on prepaid hotel reservations.

After selecting your hotel, you'll choose your preferred room and pay with points or cash. If you pay with points, you'll only get a value of 0.7 cents per point (compared to 1 cent when you book flights).

Note that these are considered third-party bookings, so you likely won't earn hotel points or elite credits for your stay . While there are reports of people receiving stay credits with Marriott Bonvoy or Hilton Honors on rooms booked through Amex Travel, the hotel is not guaranteed to recognize your elite status in these programs or provide status-qualifying stay credits.

Related: 9 things to consider when choosing to book via a portal vs. booking directly

Amex Fine Hotels + Resorts

Platinum and Centurion cardholders also have access to the Fine Hotels + Resorts program through Amex Travel. This can add some great benefits to your hotel stays — and may not cost much more than booking directly with the hotel.

Here are the perks you'll receive with every FHR booking, regardless of the length of your stay:

- Room upgrade upon arrival (when available): Some room types may be excluded, but you could receive an upgrade to preferred rooms with better views or a better location in the hotel.

- Daily breakfast for two people: The provided breakfast must be, at a minimum, a continental breakfast.

- Guaranteed 4 p.m. late checkout

- Noon check-in when available

- Complimentary Wi-Fi

- Unique property amenity: The amenity varies by hotel but should be valued at $100 or more and usually consists of a property credit, dining credit, spa credit, private airport transfer or similar amenity.

You'll need to book these stays through Amex Travel, but note that FHR is considered a separate program from Amex Travel.

In addition, if you have the personal Amex Platinum , you can also get up to $200 in statement credits every year for prepaid reservations through Fine Hotels + Resorts or The Hotel Collection — which we'll discuss next. Enrollment is required.

Related: A comparison of luxury hotel programs from credit card issuers: Amex, Capital One, Chase and Citi

The Hotel Collection

A lesser-known American Express benefit is The Hotel Collection , which allows you to book in cash or with points. Those with Amex Gold, Platinum and Centurion cards have access to this program, which offers the following benefits:

- A room upgrade at check-in (if available)

- $100 on-property credit for qualifying dining, spa and resort activities

Note that The Hotel Collection bookings require a minimum stay of two nights, though they too are eligible for the $200 hotel credit on the Amex Platinum.

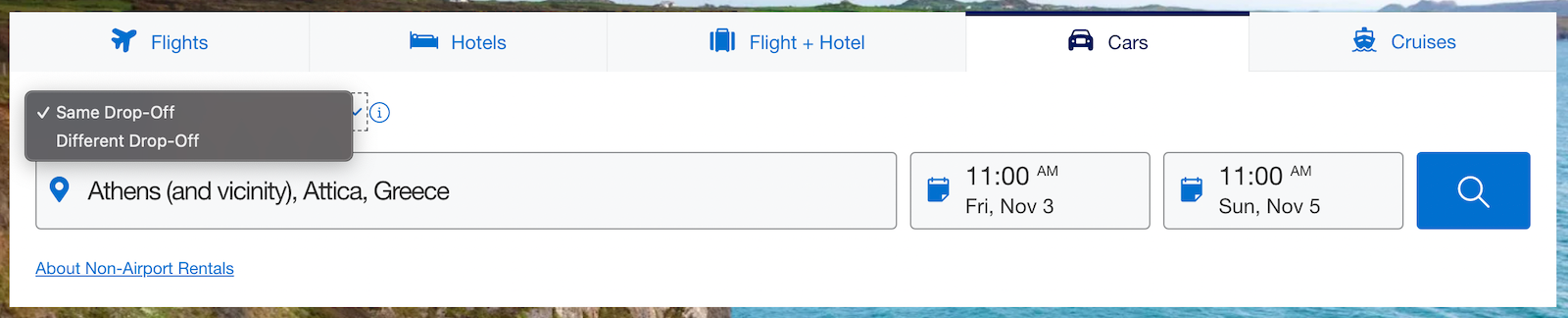

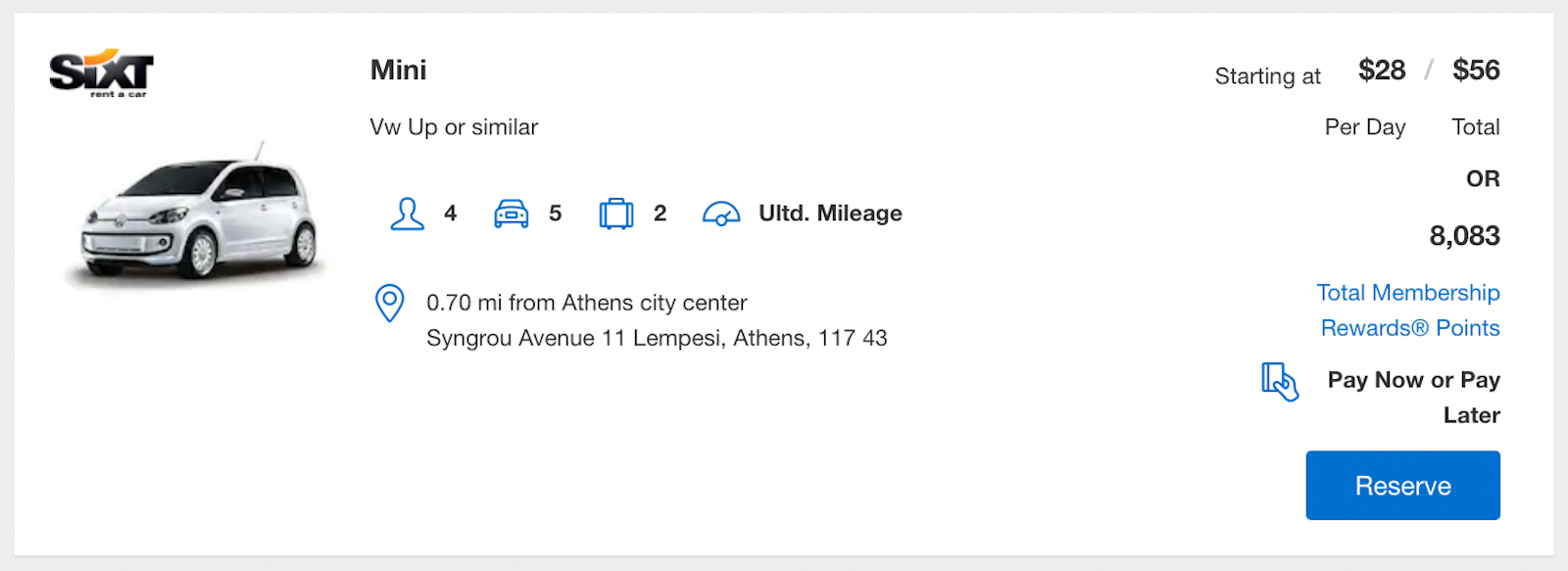

How to book rental cars and cruises on the Amex Travel portal

Reserving a car in the Amex portal is relatively simple. You'll input your pickup and drop-off times and location.

You'll see rental car prices listed in cash and points. When using Pay with Points , your points are worth 0.7 cents — just over a third of TPG's valuation of Amex Membership Rewards points.

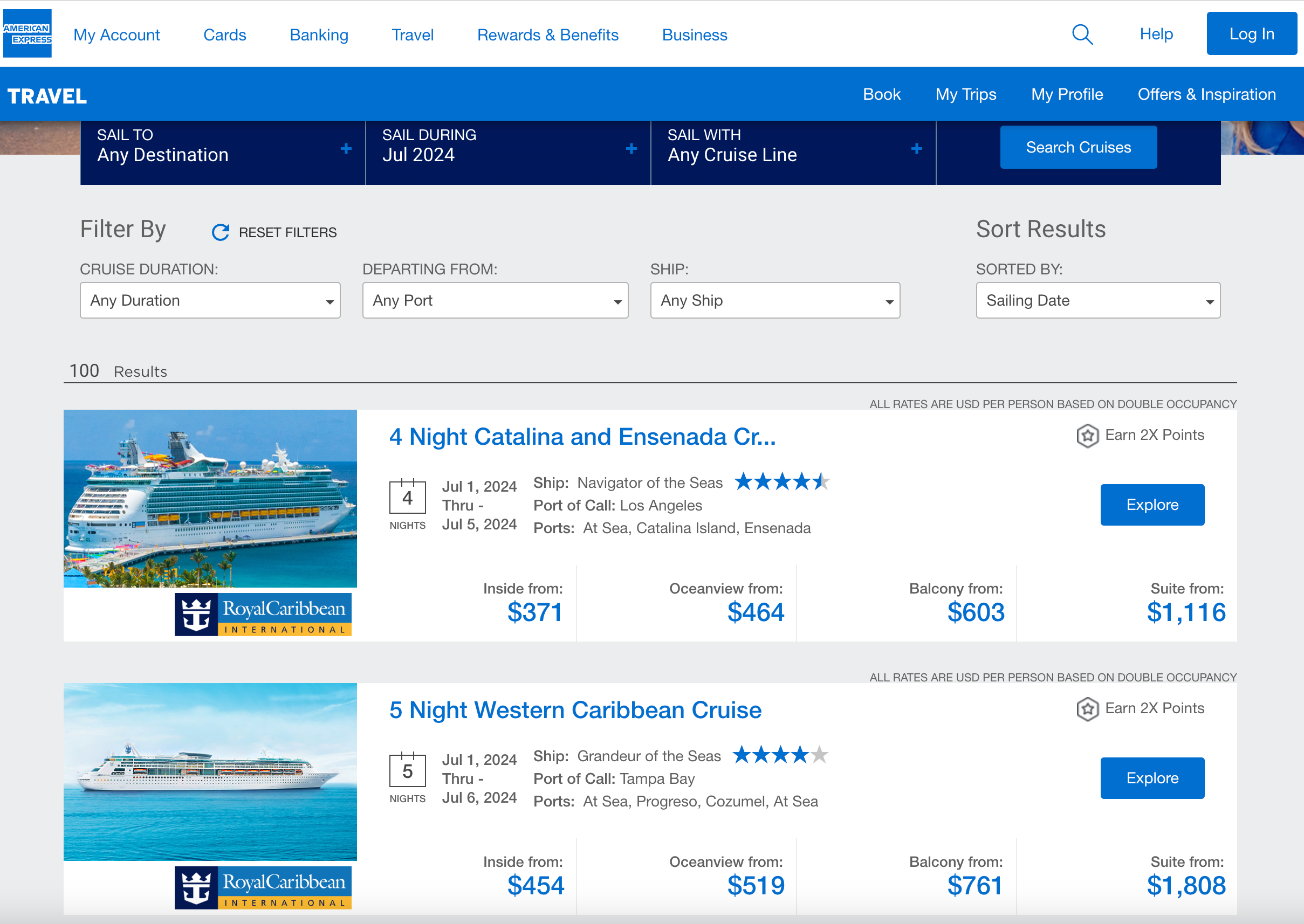

Although the format differs, you can also search for cruises on Amex Travel.

Rather than typing specific dates and numbers of passengers, you'll see four drop-down menus. These allow you to choose a destination (by region), filter by cruise lines and choose a month for travel — though not specific dates — on this first page. You can also select your desired cruise duration.

From here, you can filter by cruise duration, departure port and ship. You can sort your results by sailing date, value, price or ship rating.

On the final payment page, you can use your card or redeem points, ranging from 1 point to enough to cover the entire cost. Using points for a cruise will result in a low valuation of 0.7 cents per point, but it can be a money-saving option if you prefer not to spend cash.

There's another benefit available if you're a Platinum or Centurion cardholder (including personal and business versions of these cards): the Cruise Privileges Program .

This is available on cruises of five nights or more with select cruise lines, and it offers the following perks:

- $100-$500 in onboard ship credit (note that this cannot be used for casino or gratuity charges)

- Additional onboard amenities vary by line, such as spa vouchers, a bottle of Champagne, shore excursion credits or a private ship tour

Note that the Platinum cardmember must be one of the travelers on the cruise to enjoy these benefits.

Related: How to book a cruise using points and miles

Further things to consider about Amex Travel

When booking through the Amex Travel portal, there are a few factors to consider.

First, using Amex Membership Rewards points on Amex Travel may not provide the best value compared to transferring points to airline or hotel loyalty programs. The Pay with Points feature typically values points at 0.7 to 1 cent per point, which is far lower than our 2-cent valuation .

Additionally, the prices on Amex Travel may not always be the most competitive, so we recommend checking other platforms like Google Flights before booking your travel. Also, booking directly with hotels is advised for those seeking to utilize elite status benefits.

When you need to change your upcoming trips booked through Amex Travel, it can get complicated. You may encounter change and cancellation fees, often around $75, and making a change requires a phone call. Flight credit vouchers from cancellations can only be used for rebooking through Amex Travel via phone.

On the positive side, Amex Travel allows a 24-hour cancellation window for most reservations, and booking flights through the site generally still qualifies for earning miles and status with airline loyalty programs.

Related: Redeeming American Express Membership Rewards for maximum value

Bottom line

American Express Travel offers an array of booking options, including the ability to earn bonus Membership Rewards points on select purchases. Although you can use your points to book hotels, flights, rental cars and cruises through Amex Travel, you can get more from your points when you transfer them to Amex's airline and hotel partners .

However, there are exceptions, such as when there is no award availability for last-minute travel. In addition, Amex Travel offers perks like discounted premium flights, added benefits with Amex Fine Hotels + Resorts and a user-friendly interface. And with a simple redemption scheme that doesn't involve complicated loyalty programs and transfer partners, many Amex cardholders prefer it when planning their trips.

Additional reporting by Ryan Patterson and Kyle Olsen.

Select your Country

AMERICAN EXPRESS EXPERIENCES access to limited-time experiences all across the world.

Terms Apply.*

Makani Luxury Wanderlust

Cartagena, Colombia

El Dorado Park

Dominican Republic

American Express Snow House

Villa La Angostura, Argentina

Relive the most memorable experiences

American Express Beach Club

Punta del Este, Uruguay

American Express Experiences - Pop Up Bar

American Express Bar

Johannesburg, South Africa

American Express Color Oasis

Bodrum, Turkey

American Express Platinum Bar

Seoul, South Korea

American Express Fine Dining

Tel Aviv, Israel

Credit cards

Earn Miles on your everyday purchases with your Flying Blue credit card. Learn which cards are available and how to request one.

Flying Blue – American Express Cards

With a Flying Blue – American Express Card, you earn Miles each time you make a purchase. Choose from 4 credit cards: Entry, Silver, Gold, or Platinum. You can request a Flying Blue – American Express Card regardless of your Flying Blue membership level.

Mijn Account

Zelf Direct Regelen

Kaartvoordelen

American Express Kaarten

Flying Blue kaarten

Zakelijke kaarten

Reis Boeken

Zakelijk Reizen

MKB-segment en ZZP-ers

Grote bedrijven en multinationals

Kaartacceptatie

Explore What Inspires You

Voorwaarden

Fine Hotels + Resorts

Deze aanbieding geldt alleen voor nieuwe boekingen voor Fine Hotels + Resorts die zijn gedaan via The Centurion Travel Service of online op americanexpress.nl/travel . Betaling dient te geschieden met een American Express kaart op naam van de Platinum Cardmember of Centurion member. De kaarthouder moet boeken op zijn eigen naam en zelf verblijven in de accommodatie om van de beschreven privileges te kunnen profiteren.De kamer upgrade en de check-in vanaf 12.00 uur gelden op basis van beschikbaarheid bij check-in. Het ontbijt kan variëren per accommodatie maar is minimaal een continentaal ontbijt. Gratis Wi-Fi geldt in de kamer. Indien de kosten voor WiFi bij de accommodatie standaard zit inbegrepen in de prijs, ontvangt de cardmember een dagelijks tegoed van de accommodatie ter waarde van het bedrag dat de accommodatie rekent voor Wi-Fi. Het tegoed wordt verrekend bij check-out. De privilege-voorwaarden variëren per Fine Hotels + Resorts accommodatie; de voordelen kunnen niet worden ingewisseld voor contant geld en de aanbieding kan niet worden gecombineerd met andere aanbiedingen, tenzij anders aangegeven. Wij adviseren u vooraf reserveringen te maken voor services zoals de spa, restaurants of golf om er zeker van te zijn dat u tijdens uw verblijf gebruik kunt maken van uw Fine Hotels + Resorts extra. De privileges en andere extra’s van Fine Hotels + Resorts worden uitsluitend toegepast bij check-out en vervallen bij check-out. Er geldt een limiet van 3 kamers per kaarthouder per verblijf. De voordelen gelden eenmalig per kamer per verblijf. Aaneengesloten verblijfsperioden binnen 24 uur bij dezelfde accommodatie gelden als één verblijf. Deelnemende Fine Hotels + Resorts accommodaties en privileges kunnen wijzigen.

The Hotel Collection

Deze aanbieding geldt voor nieuwe The Hotel Collection boekingen bij deelnemende hotels van tenminste 2 aaneengesloten nachten geboekt via americanexpress.nl/travel of The Centurion Travel Service. Betaling dient te geschieden met een American Express kaart op naam van de American Express Gold kaarthouder, American Express Platinum kaarthouder of Centurion member. De kaarthouder moet zelf verblijven in de accommodatie om van de beschreven privileges te kunnen profiteren. 1. De kaarthouder ontvangt een hoteltegoed bij check-out van $1 voor elke uitgegeven dollar. Tot een maximum van $100 zal gecrediteerd worden bij check-out, gebaseerd op geldige transacties exclusief belasting, fooi en de kamerprijs. Additionele uitsluitingen kunnen van toepassing zijn bij specifieke hotels (zoals aankopen die worden gedaan in het hotel, maar die worden verkocht door derde partijen) - Informeer bij de hotel receptie naar de details. Het tegoed kan niet worden overgeheveld naar een ander verblijf, is niet inwisselbaar voor contant geld en verloopt op het moment van check-out. Tegoed is niet inwisselbaar en wordt toegekend in US Dollars of de lokale munteenheid, gebaseerd op de wisselkoers van de dag van aankomst. Deze aanbieding kan niet worden gecombineerd met andere aanbiedingen, tenzij anders aangegeven Maximaal 1 tegoed per kamer, per verblijf. Maximaal 3 kamers per in aanmerking komende kaarthouder per verblijf. Aaneengesloten verblijfsperioden binnen 24 uur bij dezelfde accommodatie gelden als één verblijf. Hoteltarieven verschillen per accommodatie, datum, kamercategorie en beschikbaarheid. Deelnemende accommodaties en privileges kunnen wijzigen. 2. Een kamercategorie upgrade op basis van beschikbaarheid bij check-in.

IMAGES

COMMENTS

Op alle boekingen zijn de Algemene Voorwaarden van American Express Travel website. Boek vluchten, hotels, auto's en pakketten met American Express Reizen. Bekijk onze gidsen, vind goede deals, beheer uw boeking en check online in.

When you book a Fine Hotels + Resorts®️ or The Hotel Collection stay through American Express Travel®️ you'll earn Membership Rewards®️ points. Plus, you still earn loyalty points with hotels1. Explore Benefits. †The Hotel Collection requires a minimum two-night stay. 1Hotel brands with loyalty or rewards programs and the terms and ...

Hyatt | American Express Travel NL. Our Brands. Hyatt. Hyatt Ziva Cap Cana. Hyatt is a global hospitality brand with one driving purpose: to care for people so they can be their best. Their commitment to this purpose is evidenced by their 60-year history of high standards and quality, their thoughtful and deliberate offerings for both business ...

American Express Cookie-voorkeuren. Ons gebruik van cookies American Express gebruikt cookies op deze website voor niet-essentiële doeleinden. Ze helpen ons te begrijpen hoe u onze website gebruikt, content te personaliseren en onze online marketing te verbeteren.

Boek The Hotel Collection met American Express Travel voor een stijlvol verblijf en speciale extra's op locaties dichtbij en ver weg. Verblijf in hotels met een eigen persoonlijkheid; wij hebben ze al nagelopen dus u kunt met een gerust hart binnenlopen. W Amsterdam, Amsterdam, Nederlands.

You are being redirected.

Bookings must be made using an eligible Card and must be paid using that Card, or another American Express® Card, in the eligible Card Member's name, and that Card Member must be traveling on the itinerary booked. The average total value of the program benefits is based on prior-year bookings for stays of two nights; the actual value varies.

The Green Card. The American Express Green card. The Green Card has that classic American Express retro design and is arguably the most recognisable of the portfolio. Its lower monthly fee means you give up quite a few benefits of the Gold and Platinum. It costs €5.50 per month, although the first year is free.

American Express was founded in 1850. A pioneer of prepaid travel, American Express issued the first traveler's cheque in 1891. It created the first credit "card"- out of paper- in 1958. Today American Express is one of the best-known financial service providers in the world with coverage across the globe.

American Express charges 2.5% for payments made in other (non-euro) currencies. This is pretty standard for credit cards in the Netherlands. This is less of an issue than say the UK or US based cards - since the Dutch cards can be used forex fee-free anywhere in the 19 member states of the eurozone.

To modify a reservation, you can cancel and rebook your reservation on amextravel.com or by calling a representative of amextravel.com at 1-800-297-2977. To be eligible for the 3X Membership Rewards® points, any changes to an existing reservation must be made through the same method as your original booking.

The American Express Travel portal allows you to redeem Membership Rewards points directly for travel reservations and activities rather than transfer your rewards to airline or hotel partners like Delta Air Lines SkyMiles and Marriott Bonvoy.. You also can book discounted premium tickets, use benefits like a 35% points rebate on certain bookings and even book premium hotels with additional ...

If you've had an American Express Card in the past 12 months, you will not receive bonus Miles. See terms and conditions for insurance policies at americanexpress.nl ; ... Join over 20 million Flying Blue members and get rewarded whenever you shop or travel. Earn Miles in whichever way you want, from booking tickets or hotel stays to shopping ...

American Express was founded in 1850. A pioneer of prepaid travel, American Express issued the first traveler's cheque in 1891. It created the first credit "card"- out of paper- in 1958. Today American Express is one of the best-known financial service providers in the world with coverage across the globe.

If Amsterdam or Ranstad then you are in luck. Dirk and Aldi both accept Amex. Most restaurants, too, especially if they see any high-end or tourist traffic. Online 100% and their response to card fraud is borderline anal. They are pretty good. If you fly a lot, it is worth it, IMHO . Reply reply.

Eligible travel purchases are limited to: (i) purchases of air tickets on scheduled flights, of up to $500,000 in charges per calendar year, booked directly with passenger airlines or through American Express Travel (by calling 1-800-525-3355 or through AmexTravel.com); (ii) purchases of prepaid hotel reservations booked through American ...

With the official American Express® Mobile App for Android, you can access your account from anywhere. Pay your bill and take advantage of features only available in the Amex Netherlands App. Log in securely with the same login name and password that you use online. • Check your balance, pending transactions and view previous PDF statements.

Dominican Republic. American Express Snow House. Villa La Angostura, Argentina. Relive the most memorable experiences. Select your Experience. American Express. Beach Club. Punta del Este, Uruguay. American Express Experiences - Pop Up Bar.

Explore the Suite of Benefits that Card Members are Eligible for at Over 2,200+ Luxury Hotels with American Express Travel Premium Hotel Programs. ... boekingen voor Fine Hotels + Resorts die zijn gedaan via The Centurion Travel Service of online op americanexpress.nl/travel. Betaling dient te geschieden met een American Express kaart op naam ...

The insurance is provided under group insurance policies that American Express Europe S.A. holds with insurers for the benefit of its Cardmembers. Learn more If you have been impacted by any travel disruption, please seek reimbursement or alternative travel arrangements with your provider before approaching AXA Travel Insurance or American Express.

Flying Blue - American Express Cards. With a Flying Blue - American Express Card, you earn Miles each time you make a purchase. Choose from 4 credit cards: Entry, Silver, Gold, or Platinum. You can request a Flying Blue - American Express Card regardless of your Flying Blue membership level.

Deze aanbieding geldt alleen voor nieuwe boekingen voor Fine Hotels + Resorts die zijn gedaan via The Centurion Travel Service of online op . Betaling dient te geschieden met een American Express kaart op naam van de Platinum Cardmember of Centurion member. De kaarthouder moet boeken op zijn eigen naam en zelf verblijven in de accommodatie om ...

Netherlands. Change Country. Voorwaarden. Fine Hotels + Resorts. Deze aanbieding geldt alleen voor nieuwe boekingen voor Fine Hotels + Resorts die zijn gedaan via The Centurion Travel Service of online op americanexpress.nl/travel. Betaling dient te geschieden met een American Express kaart op naam van de Platinum Cardmember of Centurion member.