Request Brochure

Speak to an expert - 020 7593 2288

Scroll Down

to discover more

SHORT BREAKS & TAILOR-MADE HOLIDAYS

Since 1986, Kirker's team of experts has been creating holidays to Europe's great cultural cities as well as the finest coast, countryside, island and lakeside locations. Speak to a Kirker expert for first-hand advice, bespoke quotation and our unique Concierge service.

Kirker Holidays - For Discerning Travellers

Meet the team.

Learn more about Kirker's team of experts and read our latest destination reviews.

Mark Harwood

Team Leader and Senior Reservations Consultant

William Blackburn

Reservations Consultant

Thomas Brown

Amanda Boccolini

Senior Reservations Consultant

Michael Brewin

Katherine Wales

David White

Kirker Concierge

Dominic Rossi

Reservations Manager

Joshua Gibson

Managing Director

Alice Boyle

Sarah Barton

Graphic Designer & Marketing Executive

Casey Williams

Lucy Ayling

Cultural Tours, Sales & Operations Executive

Andrew Layard

Product & Commercial Director

Kathryn Irons

Enrique Novella

Product Manager

Pat Bellieni

Patrick Millar

Senior Manager & Head of Marketing

Ignacio Foley

Hannah Morris

Francesca Camplani

Marcus Freeman

Georgina Henderson

Barry Cheeseman

Cultural Tours Senior Executive

Samuel Wolff

Our expert reservations team regularly travel to a wide range of destinations to explore new cities, visit hotels and to research museums, galleries and restaurants so that we can offer the most up-to-date advice and recommendations.

Join our mailing list to receive the latest updates and travel inspiration.

By clicking Sign Up you're confirming that you agree with our Terms and Conditions .

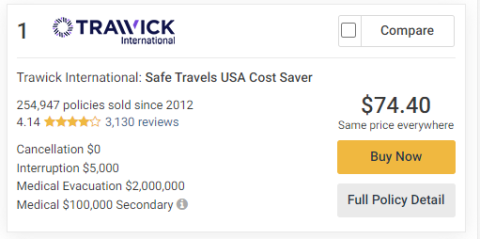

Find the Best Travel Insurance & Avoid Costly Surprises

- 22 Top-Rated Providers

- Side-by-Side Comparison

- 3 Million+ Travelers Insured

Standard Single Trip Policies

- The most popular and comprehensive travel insurance plan

- Covers cancellations, medical emergencies, delays, and luggage

- Protection from the time you purchase to the date you return

Annual / Multi Trip Policies

- Cost-effective option for travelers taking multiple trips a year

- Includes common medical, delay, and luggage benefits

- May require add-ons from trip cancellation or interruption

Cruise Insurance Policies

- Offers comprehensive trip protection on land and at sea

- Includes high travel medical insurance coverage limits

- Protects against hurricanes, inclement weather, and more

Adventure & Sports Policies

- Essential for travelers partaking in high-risk activities

- Provides protection for lost or delayed sports equipment

- Strong coverage for cancellations and medical emergencies

Compare and Save in Minutes

Whether you’re heading abroad or staying local, we make it easy to find the best travel insurance plan for your next adventure. No bias. No hidden fees. Just the best trip protection quotes from the country’s leading providers.

Tell us some basic information about your next trip. We’ll use these details to help narrow your search and show the plans that best fit your needs.

Easily see how plans from the best travel insurance providers compete on cost and coverage. Use filters and sort results to uncover the right plan for you.

Get peace of mind at the lowest possible price. We partner with leading providers to offer you the best policies at the best value, guaranteed.

Why Trust Squaremouth?

When selecting a travel insurance provider, it's crucial to compare options. Obtain quotes from three to five insurers to ensure the best coverage and value. While it may seem time-consuming, this process can result in significant savings.

That's why we're here – over the past two decades, our industry-leading comparison engine has helped millions of travelers find highly-rated insurance plans and protect their trip expenses.

Our industry-leading comparison platform , enriched by customer reviews, displays unbiased results based on your specific trip details. If you run into any trouble, our multi-award-winning customer service team is just a phone call away.

- Helped more than 3 million travelers

- 20+ years serving the travel community

- Intuitive & user-friendly comparison engine

- More plans and top-rated providers than the competition

- Prices are regulated by law; you won't find a lower price anywhere else

- Multi award-winning customer service team

- 140,000+ customer reviews

Save With Squaremouth

Squaremouth has helped more than 3 million travelers find the best policy for their trip.

Key Travel Insurance Benefits

Most trip insurance policies are comprehensive, including coverage for cancellations, medical emergencies, travel delays, and lost luggage, among other benefits.

What Coverage is the Most Important?

Squaremouth customer reviews.

More than 99% of customers would recommend Squaremouth to others. Read what a few of them had to say about their recent experience buying travel insurance.

Great Experience!

"The Squaremouth website is fantastic! It was very easy to select coverage and find and compare policies. Will recommend it to others."

Savannah from NC 03/26/2024

Great Coverage and Price

"Getting a travel insurance quote online was easy. We have used Squaremouth before and have been pleased each time. It's peace of mind for our travel needs."

Rhonda from IN 03/20/2024

Easy to Use!

"I always use Squaremouth simply because it is so easy to use and offers plans that are affordable to me."

Emily from AZ 03/08/2024

Very pleased!

"They give great service, and the website is so easy to navigate to find just the right insurance plan. I always appreciate working with them."

Don from UT 03/07/2024

The Squaremouth website is fantastic! It was very easy to select coverage and find and compare policies. Will recommend it to others.

Featured Articles

Our topic experts keep a constant pulse on the travel industry so we can provide the most current information and recommendations based on today's traveler needs.

What Type of Insurance Do I Need?

Plans can range in terms of cost and coverage, so it’s important to identify your specific needs before comparing options. Discover the different types of travel insurance policies you should consider for your upcoming trip.

How to Buy Travel Insurance on Squaremouth

If you’re new to Squaremouth, this quick guide can help you identify your needs, start your first quote, and compare your results. If you need additional help, our customer service team is just a phone call away.

Travel Insurance FAQs

Here are some of the most frequently asked questions from travelers like you.

Is Travel Insurance Mandatory for International Travel?

While rare, some countries or organized tours may require proof of travel insurance that lasts for the duration of your trip. Our Destination Center is a good starting point to learn about entry requirements and travel insurance recommendations.

While it is typically not mandatory, travelers should consider buying insurance if they want to protect themselves financially from unforeseen events that may impact their travel plans. Many Americans and U.S. residents purchase travel insurance when planning international or high cost trips. View our list of the top international travel insurance providers .

What Does Travel Insurance Cover?

Comprehensive travel insurance is designed to cover common disruptions that may impact a trip. Most policies will provide coverage for trip cancellations , medical emergencies , travel delays , missed connections , accidental death and dismemberment , and lost luggage . Travelers that experience financial loss as a result of a covered disruption may be eligible for reimbursement through their insurance policy.

How Much Does Travel Insurance Cost?

In general, a comprehensive policy with Trip Cancellation typically costs between 5% and 10% of the total trip cost. The cost of a policy depends on four primary factors: trip cost, traveler age, trip length, and coverage amounts. A policy without an insured trip cost will be significantly less expensive. We recommend comparing plans from multiple providers to find the best priced plan for your trip.

What Should I Look for When Comparing Travel Insurance?

There’s no one-size-fits-all policy when it comes to travel insurance. When comparing plans, you should consider the following:

- Benefits: Travel insurance benefits outline what situations are covered under each plan. Make sure each plan you’re considering includes coverage for what’s important to you.

- Coverage Limits: Plans will set limits to how much reimbursement you’re eligible for, and can vary significantly. Higher coverage limits can result in less out of pocket expenses in the event of a claim.

- Exclusions: Travel insurance companies will list specific activities, equipment, and scenarios that are not covered by their plans in the event of a claim.

- Premium: Higher priced insurance products do not always equate to better coverage. We recommend choosing the most affordable plan that offers the travel protection you need.

- Provider Reputation: All providers on Squaremouth have been carefully vetted and offer 24-Hour Assistance services. Customers are also encouraged to share honest reviews about their experience before, during, and after their trips.

Does Travel Medical Insurance Cover International Trips?

In many cases, primary health care plans, such as Medicare or a policy you have through your employer, are not accepted overseas. If you’re not covered, you may be responsible for unforeseen medical expenses if you get sick or injured while traveling.

To avoid out-of-pocket expenses if you need medical care in the event of an emergency, many travelers opt for travel medical insurance. These plans can cover the cost of treating unexpected medical conditions incurred during your international trip.

Are Pre-Existing Conditions Covered by Travel Insurance?

Coverage for pre-existing conditions varies among travel insurance policies. While many plans won’t offer coverage for existing injuries or illnesses, some plans may offer Pre-Existing Condition waivers if certain conditions are met, such as purchasing the policy within a specified time frame from booking the trip.

Will My Policy Cover Trip Cancellations?

Yes, many comprehensive travel insurance policies cover trip cancellations under specified circumstances, such as sudden illness, injury, or death of the insured or a family member, natural disasters, or unexpected work obligations. Most policies that include the Trip Cancellation benefit offer 100% reimbursement for all prepaid, non-refundable trip costs.

What’s the Difference Between Single-Trip and Annual Travel Insurance?

Single-trip travel insurance covers a specific journey for a set duration, offering protection for that trip only. This is the most popular type of travel insurance among Squaremouth users. In contrast, Annual Travel Insurance provides coverage for multiple trips within a year. Annual plans can be cost-effective for frequent travelers and less of a hassle than purchasing multiple single-trip plans.

What's the Process for Filing a Travel Insurance Claim?

To file a trip insurance claim, follow these steps:

- Contact your insurer: Notify them as soon as possible about the incident.

- Gather documentation: Collect relevant documents, such as police reports, medical records, or receipts for expenses incurred.

- Complete the claim form: Fill out the insurer's claim form with accurate details.

- Submit supporting documents: Attach all required documents to substantiate your claim.

- Keep records: Maintain copies of all submissions and correspondence for your records.

- Follow up: Stay in touch with the insurer for updates on your claim status.

- Be honest and thorough: Provide clear and truthful information to expedite the process.

Remember, the process may vary by insurer, so review your policy or contact your insurance provider for specific instructions. Learn more about what can be covered and how to file a travel insurance claim .

Where Can I Buy Travel Insurance?

Travelers can purchase travel insurance directly from providers, through a comparison site like Squaremouth, or directly through a travel supplier when booking. Credit cards and travel agents are other sources to consider. Travel insurance prices are regulated by law, meaning the price of one specific policy must be the same regardless of where it is sold, whether it’s purchased from Squaremouth or directly from the provider.

A Practical Guide to Buying Travel Insurance

Travel insurance could be the difference between a huge medical bill or a modest copay. use these tips to find the best policy for your trip..

- Copy Link copied

It’s far better to buy travel insurance and never use it than to not be covered in an emergency.

Courtesy of Shutterstock

For many, travel insurance seems like an unnecessary additional expense. But if you get stuck in a costly situation—a medical emergency, a canceled trip due to a pandemic , a stolen camera—it suddenly becomes a totally worthwhile investment that saves, not costs, you money.

This was the case for writer Chris Ciolli. After years of traveling without a safety net, she invested in travel insurance on a recent trip during which she was rushed to the hospital at 3 a.m. for a slew of just-in-case tests. She ended up with an underwhelming diagnosis of gastritis, but also a slow trickle of medical bills—a few hundred dollars here, a thousand there—that totaled nearly $6,000. Fortunately, her monthlong $185 World Nomads policy covered everything after an initial $80 copay.

But even if you understand the benefits and you’re committed to buying travel insurance, choosing the right policy for your needs—and even knowing what those needs are—can be tricky. To help you choose the best travel insurance for your trip, we’ve consulted a number of travel agents, insurance industry professionals, and lifelong travelers for advice. In this guide, you’ll find everything you need to know, from travel insurance reviews and comparisons to common questions answered, to pick the best policy for your next trip.

What is travel insurance?

Travel insurance is a plan, similar to health or auto insurance, that protects you from expenses incurred during unforeseen mishaps while traveling, such as lost luggage, trip cancellations, or medical emergencies.

Although your current homeowner’s, renter’s, auto, or health insurance may cover you for certain things while traveling, it usually doesn’t cover everything—especially on international trips. A good travel insurance plan will cover the gaps.

Where do you get travel insurance?

Some very basic forms of travel insurance are included if you booked your trip with a credit card such as World MasterCard, Capital One Venture Rewards, and Chase Ink and Sapphire cards. With these plans, you may be protected regarding some delay, luggage, and travel accident expenses, but the coverage is usually pretty basic.

You can also purchase it as an add-on while booking flights, cruises, or hotels. These plans are also limited and will only cover you in the event of an unavoidable cancellation due to events such as a natural disaster or a death in your family. “While it may seem less expensive, it may not cover all of the components of your trip,” says Andrew David Harris, vice president and COO of Harris Travel Service . While both of these are better than nothing, the most comprehensive and best travel insurance policies are sold by providers such as World Nomads, Allianz Global Assistance, Seven Corners, or TravelEx. You can purchase these plans through your travel agent, but it’s often less expensive to book directly with the travel insurance provider or through a comparison website, like SquareMouth .

What does travel insurance cover?

Every traveler and trip is different, which is reflected by the variety of travel insurance plans on the market. No matter what plan or provider you choose, below are some common things travel insurance covers. Experts agree that before you buy, you should absolutely look for specific exclusions in the fine print on potential policies. If you’re unsure about something, reach out. A good insurance company will be responsive and willing to clarify your questions.

Trip cancellation and interruption

Most travel insurance policies will include some form of trip cancellation and interruption coverage to reimburse you for nonrefundable expenses, like a prepaid hotel or plane ticket. Unless you add cancel for any reason (CFAR) insurance to your plan, there will be a limited set of acceptable reasons to claim this. Illness, death of an immediate family member, and weather are commonly accepted reasons.

Trip delays and missed connections

Also common is reimbursement for additional expenses incurred if a trip is delayed and meets criteria set out by the provider. With World Nomads, your flight must be delayed by at least six hours to qualify.

Baggage and personal effects

Most plans will cover the cost of lost or damaged luggage and personal belongings as well as the cost of purchasing additional items if your luggage is delayed.

Emergency medical and dental care

This covers the cost of medical care when you get sick or have an accident in another country and usually includes medical evacuation. However, travel insurance isn’t a substitute for regular health insurance so nonemergency medical expenses (physicals, anything cosmetic, eye exams) aren’t covered. Childbirth isn’t covered either, even for pregnant travelers who go into labor prematurely.

Shannon O’Donnell, 2013 National Geographic Traveler of the Year and blogger at A Little Adrift , mentions another coverage gap travelers miss: “You’re only covered for what you’re licensed to do back home—if you don’t have a permit for a motorbike and you drive one in Southeast Asia, you might not be covered in an accident.”

Emergency medical evacuation

This covers the cost of an emergency transfer (in an ambulance or helicopter, for example) from an area with inadequate medical care to the nearest medical center with the services you need. It’s costlier but essential in isolated and politically unstable parts of the world.

Accidental death and dismemberment and repatriation

Experts say that “truckloads of coverage for hospital costs and medical repatriation home” are the most important things to look for. “The rest is just window dressing.” A lot of basic plans won’t include this in their coverage, but you can easily add this on with an upgrade to a more premium tier.

Concierge and 24/7 service

Daniel Durazo, director of Marketing and Communications for Allianz Global Assistance , says that “a good policy includes a 24/7 contact line for both medical and travel emergencies.”

Common travel insurance add-ons to consider

A basic plan is usually enough for most travelers, but it may not cover everything you need if you’re older, have pre-existing medical conditions, participate in sports while traveling, book an expensive trip, or travel with expensive gear (such as a high-end camera). If you fall into any of these categories, consider an add-on or upgrade.

Upgrade lost luggage, trip delay, and cancellation amounts

“Standard travel insurance levels cover more modest belongings and lodging,” advises Annette Stellhorn, president and Group Luxury Travel designer at Accent on Travel . If you’re traveling with expensive gear or spending a lot on your trip, consider upgrading to a tier that covers your costs adequately.

Additional coverage for adventure and high-risk travel

Stellhorn also notes that adventure and high-risk travel “require higher benefit amounts for medical evacuation, which can run more than $250,000.” And Judy Perl at Judy Perl Worldwide Travel says that “most insurance companies will not insure high-risk travel at all, with the exception of big companies like First Allied and Travelex .” Even fewer risky activities and sports may only be covered to a limit: that is, climbing to certain heights and diving to certain depths.

Most sports are covered up to a certain level of intensity; any higher and you may have to purchase a different tier of insurance. World Nomads, for example, will cover a slew of adventure travel activities and sports, but at an additional cost on top of its basic insurance.

Cancel for any reason (CFAR) insurance

It’s important to read the fine print of any insurance plan because, even if it includes trip cancellation coverage, this often only kicks in under certain circumstances. As many travelers found out recently, trips canceled due to the recent coronavirus pandemic were not covered unless they had a CFAR add-on .

Jennifer Wilson-Buttigieg, co-owner and copresident at Valerie Wilson Travel , explains that these plans “only cover 75 percent of trip expenses [and only] if travelers cancel their trips at least 48 hours in advance.”

Does travel insurance cover pandemics?

No. “Once actual events have unfolded, such as the coronavirus outbreak, they are considered known or foreseeable events and are no longer covered by most travel insurance policies,” says Afar’s Michelle Baran . The exception is if you chose to upgrade your plan to include a CFAR add-on.

What are the best travel insurance policies?

The best travel insurance policy will depend on you and your trip. You’ll want to make sure you have a plan that covers the cost of your entire trip and the activities you want to do and won’t leave you in the dark if you have preexisting conditions. The following are some of the best travel insurance partners to consider:

Best for: Older travelers and those with preexisting conditions.

While Allianz provides great travel insurance for any traveler, it’s especially appropriate for those with pre-existing conditions, since those are covered in every one of its plans. However, its basic coverage only covers up to $500 in lost or damaged baggage, so consider an upgrade if you’re traveling with more expensive equipment.

Get a quote: allianztravelinsurance.com

Best for: Medical coverage only

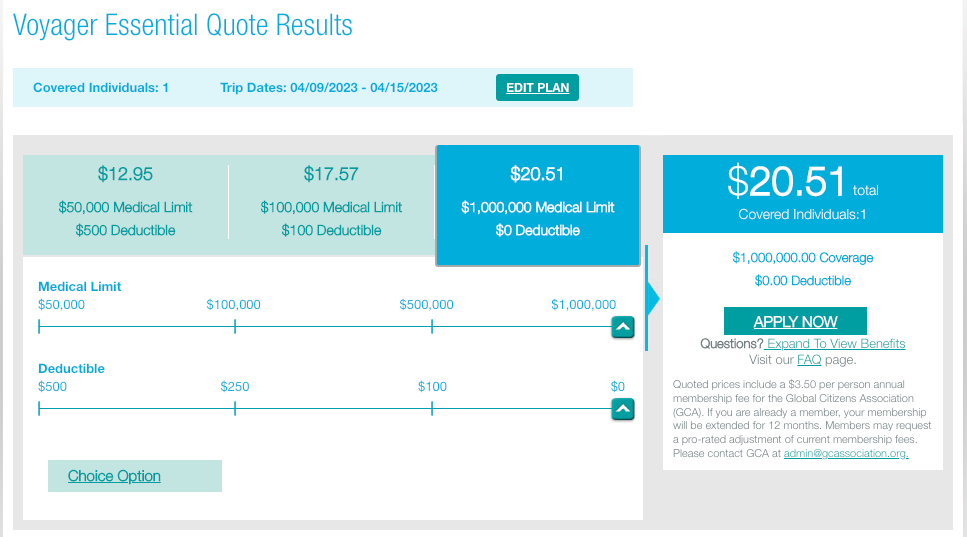

GeoBlue’s Voyager basic medical coverage is not a comprehensive travel insurance plan that covers a slew of scenarios; rather it provides travelers with basic medical travel insurance. The deductible is a high $500, but at $19 to $35 per trip, it’s an inexpensive way to protect yourself in case something catastrophic happens. If you’re adequately covered for travel mishaps like lost luggage or stolen goods by other insurance (like your credit card or homeowner’s insurance), this might be the plan for you.

Get a quote: geobluetravelinsurance.com

Best for: Traveling with kids

With TravelEx, travelers can choose between a basic or select travel insurance package with options to customize it according to their needs. Both plans cover standard things like trip cancellation and emergency medical services and are an all-around comprehensive option. However, its Travel Select plan also includes free coverage for any children under 17 traveling with you. For families, TravelEx Select is a great money-saving option.

Get a quote: travelexinsurance.com

How much does travel insurance cost?

Complete travel insurance packages can cost as little as $8 per day but vary depending on the length of the trip, destination(s), and the tier of travel insurance you choose. Some, but not all, travel insurance may also cost more for travelers with pre-existing conditions or older adults.

As a comparison, here are some examples of travel insurance costs for a 45-year-old traveler on a $5,000, one-week trip to Mexico:

- $138 for an explorer plan with World Nomads

- $179 for a basic plan with Allianz

- $248 for an essential plan with AIG

- $261 for a basic plan with Travelex

While some of these plans may seem expensive, keep in mind that if they provide you the coverage you need, they can be a huge money saver. Insurer World Nomads says that its average claim amount for 2017 was $1,634, and its most expensive claim—a medical evacuation of a child from Sitka, Alaska, to Seattle—was nearly $200,000. Suddenly, that $8 per day makes travel insurance worth it . But, as Michael Holtz, founder and CEO of the travel agency SmartFlyer , says, “People don’t think they need it until they need it.”

How do I buy travel insurance?

You should always buy travel insurance from an official, reputable provider or website, such as purchasing directly through the insurance provider, a travel agent, or a comparison website; these “offer a way to search, compare, and purchase from a wide array of plans,” says Stan Sandberg, cofounder of TravelInsurance.com .

Comparison sites to buy travel insurance include:

- Travelinsurance.com

- SquareMouth

- Insuremytrip

Sandberg strongly recommends consumers speak with a licensed agent when they are unsure about benefits. The website Elliott Report is another good resource and features a list of reputable travel insurance companies compiled by consumer advocate Christopher Elliott.

When to buy travel insurance

Generally, you should book your travel insurance as soon as you can after booking your flights and hotels. If you’re traveling to a destination affected by hurricanes , book sooner rather than later, because you can’t buy insurance to cover delays or cancellations related to a storm that already has a name.

People with preexisting conditions need to consider other factors. Most insurers will cover only expenses related to prior illnesses in very specific circumstances; travelers with preexisting conditions must book coverage within a specific time frame, usually between 14 and 21 days, following their initial trip reservation, and they must be medically able to travel on the date they purchase the insurance.

Your travel insurance policy period should be for the duration of your trip from door to door (no gaps or shortcuts, please) and cover you for every place you plan to visit, whether it’s in-state, out-of-state, or international. Some destinations are at higher risk than others, so insurers don’t offer the same coverage for the same price everywhere.

What does your existing insurance cover while traveling?

While your existing health, auto, renter’s, or homeowner’s insurance may cover a few things while you’re traveling, it likely doesn’t cover everything.

- Health insurance: Many U.S. health-care policies, including Medicare, don’t cover travelers on international trips. Some plans will cover you abroad, so check with your provider. If your health insurance only covers you domestically, both the Centers for Disease Control and the U.S. State Department recommend purchasing medical travel insurance.

- Travel insurance: Credit cards can provide limited coverage of some delay, luggage, and travel accident expenses, as well as part of your rental car insurance.

- Homeowner’s and renter’s insurance: Home contents or rental insurance may cover some lost, stolen, or damaged valuables or even offer a reasonably priced floater policy (an add-on to your regular policy that covers easily moveable property) if you travel with expensive equipment.

- Auto insurance: Within the United States, your primary auto insurance will almost always cover rental vehicles. There are a few exceptions for domestic rentals, like if your current auto insurance has low coverage limits. International car rentals are a different story. In Mexico, for example, rental car insurance is mandatory , even if you have insurance at home. Always be sure to check local rules before you reserve a rental car.

Tips for filing claims and getting reimbursed

Unlike most domestic health insurance policies, travel insurance doesn’t typically have a deductible. Some inexpensive policies will require you to pay a small, nonrefundable, initial policy excess amount before further costs up to the benefit limit are covered. Many policies work on a reimbursement plan: You pay upfront, save your receipts, and file a claim, then after processing, your insurance company pays you back for covered expenses.

Most policies require you pay non-emergency expenses out of pocket and submit your claim for reimbursement afterward. In a non-life-threatening emergency, call your insurer for instruction if you’re able; it will make the claims process easier, and the insurer may be able to direct you to a hospital or medical center where your care can be billed directly to it.

Hannah Logan, of the blog Eat Sleep Breathe Travel , says this step is especially important because the small print on many policies “reads that calling the contact number [may be] a requirement for coverage.”

No matter what, document everything. Whether it’s lost baggage, a medical expense, or damage to your rental car, gather and keep anything that can help your claims case: your original rental car agreement, receipts, photos, medical paperwork, a copy of your boarding pass.

Buying travel insurance is a little like packing a suitcase: It can seem overwhelming at first, but eventually it becomes routine and a necessary part of every trip. Once it does, you can travel worry-free, secure in the knowledge that you’ve saved yourself from a possible $6,000 mistake.

This article originally appeared online in 2018; it was updated on June 19, 2020, and on May 15, 2024, to include current information.

World Nomads provides travel insurance for travelers in over 100 countries. As an affiliate, we receive a fee when you get a quote from World Nomads using this link. We do not represent World Nomads. This is information only and not a recommendation to buy travel insurance.

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

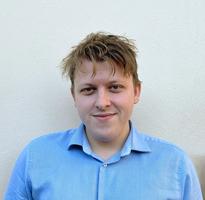

AIG Travel Guard

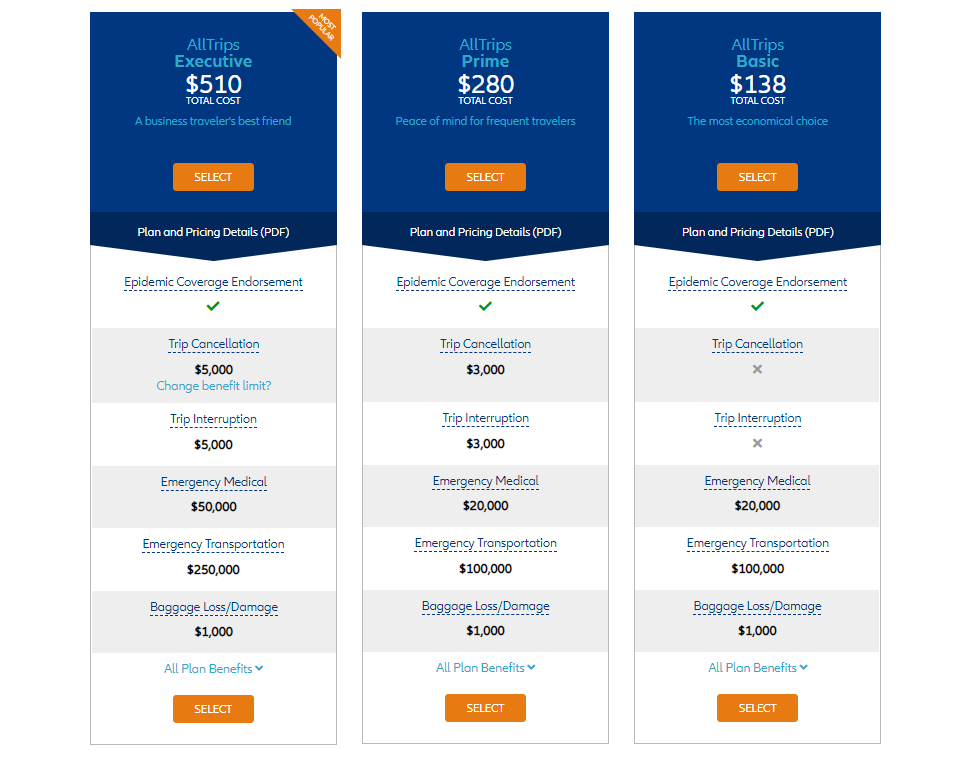

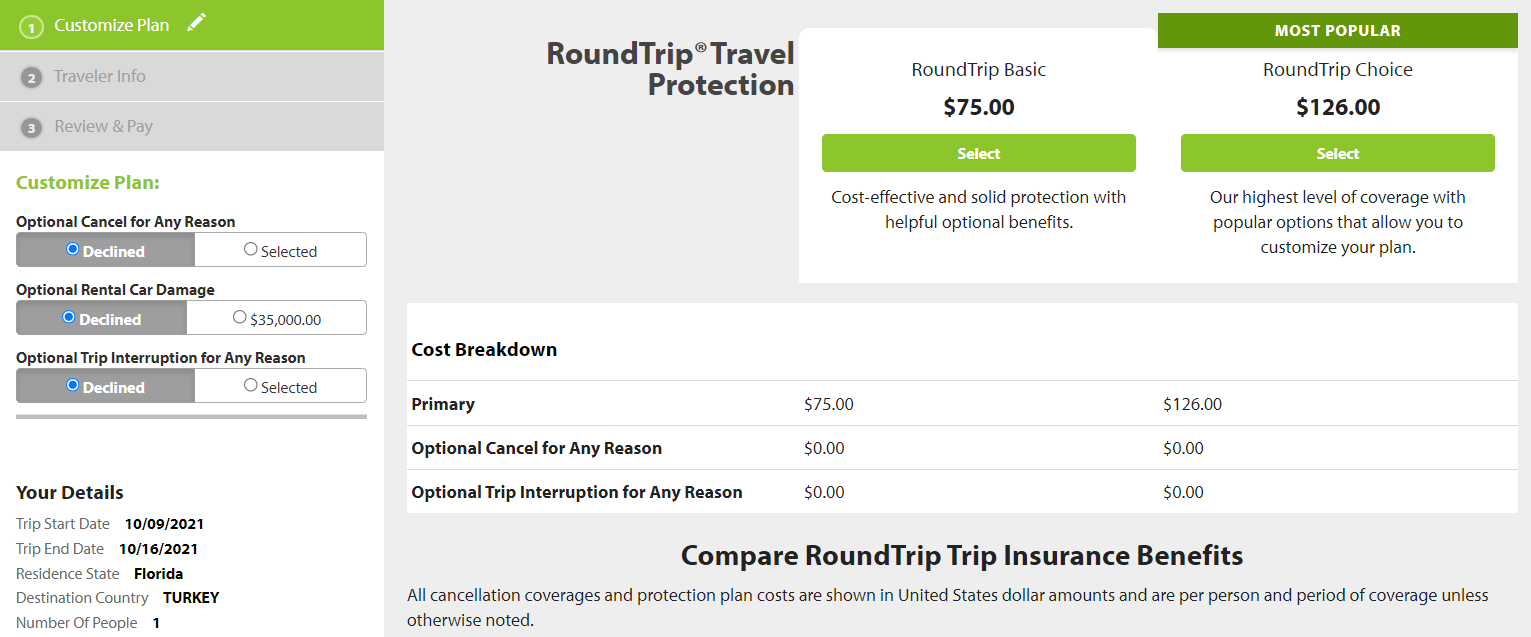

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

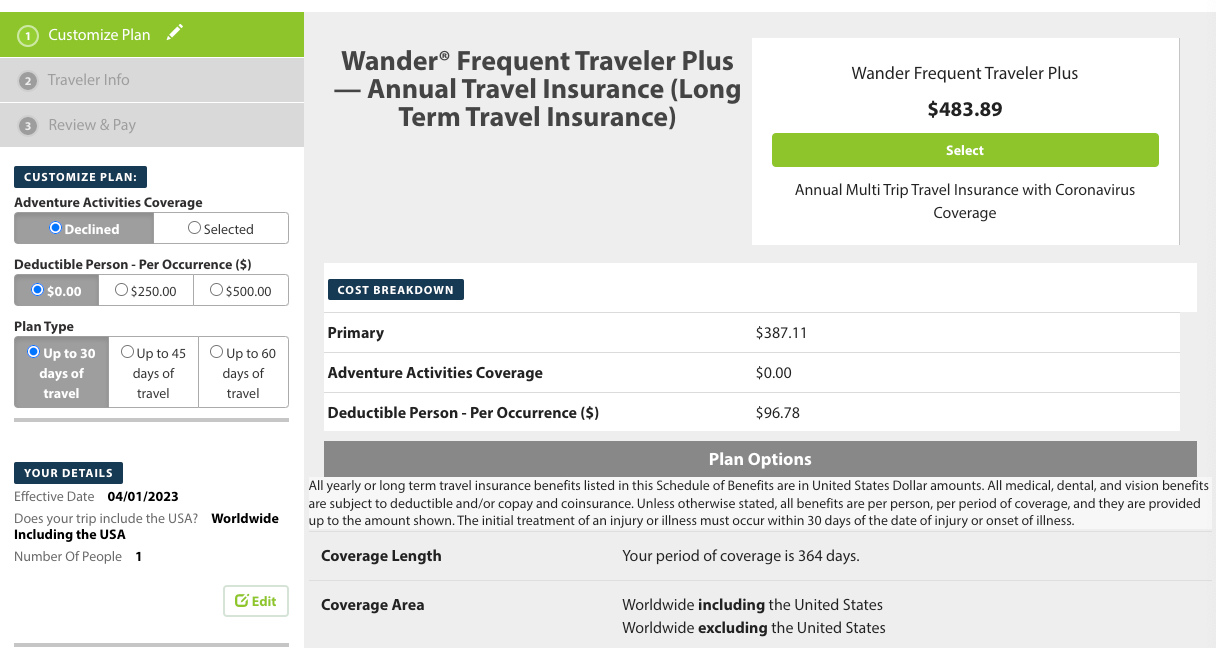

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

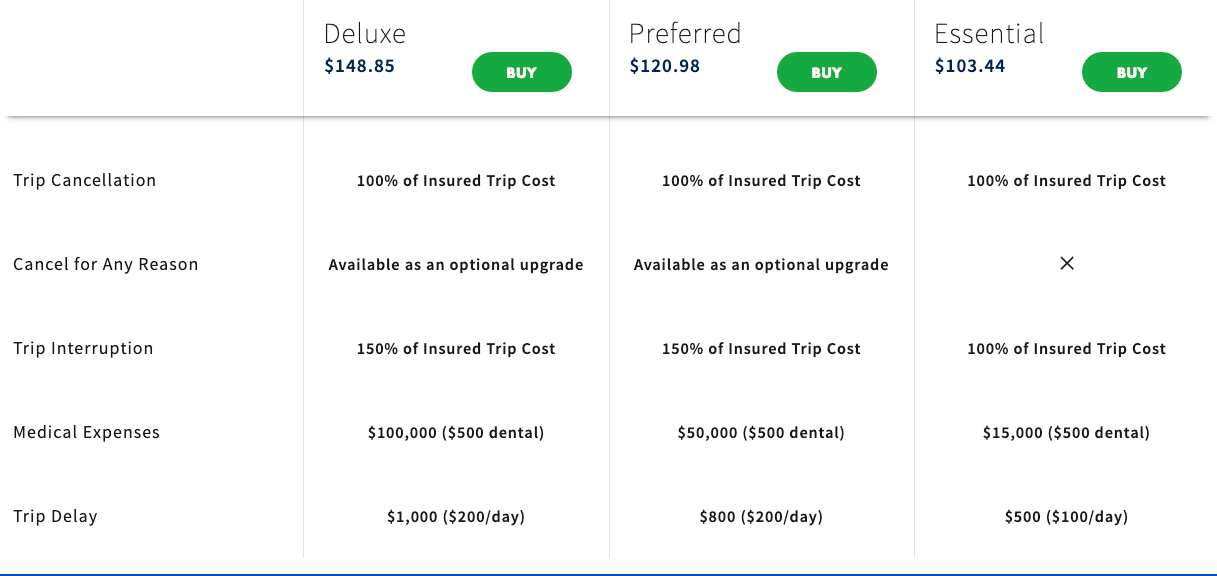

Allianz Travel Insurance

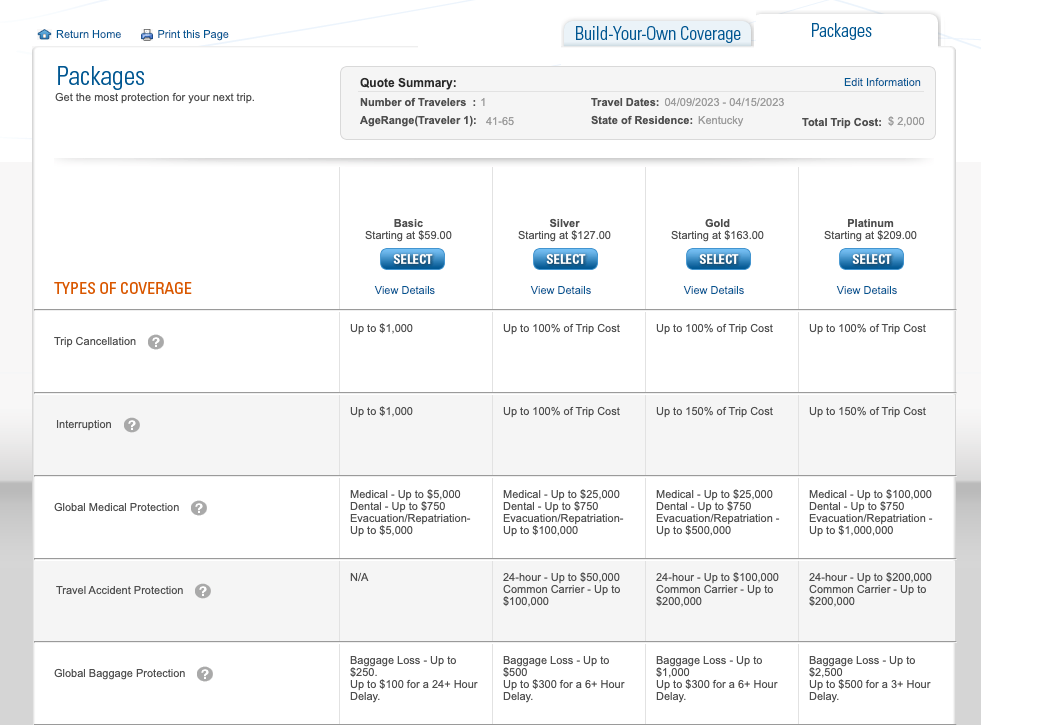

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

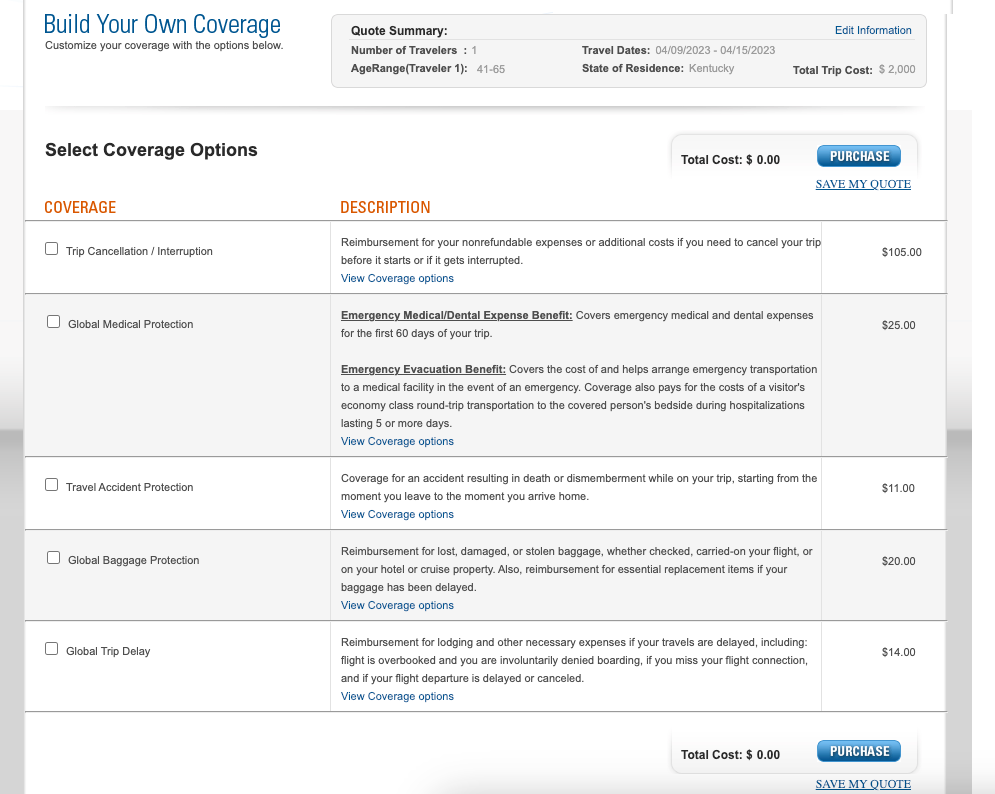

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

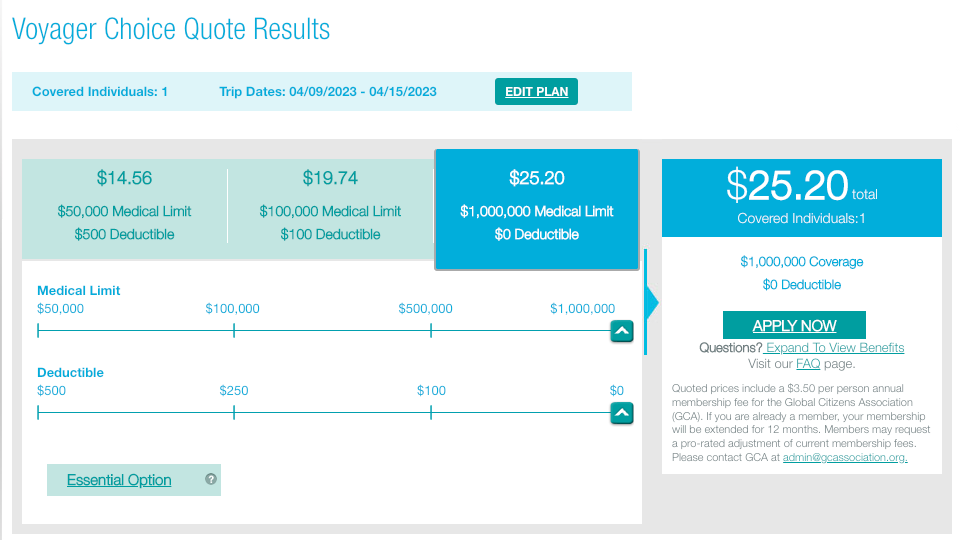

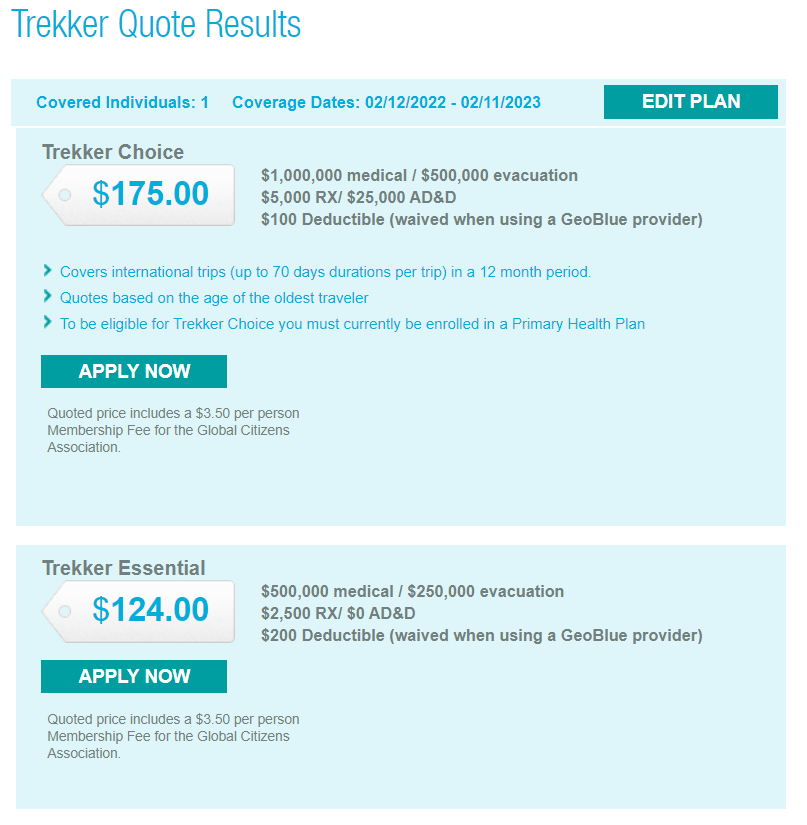

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

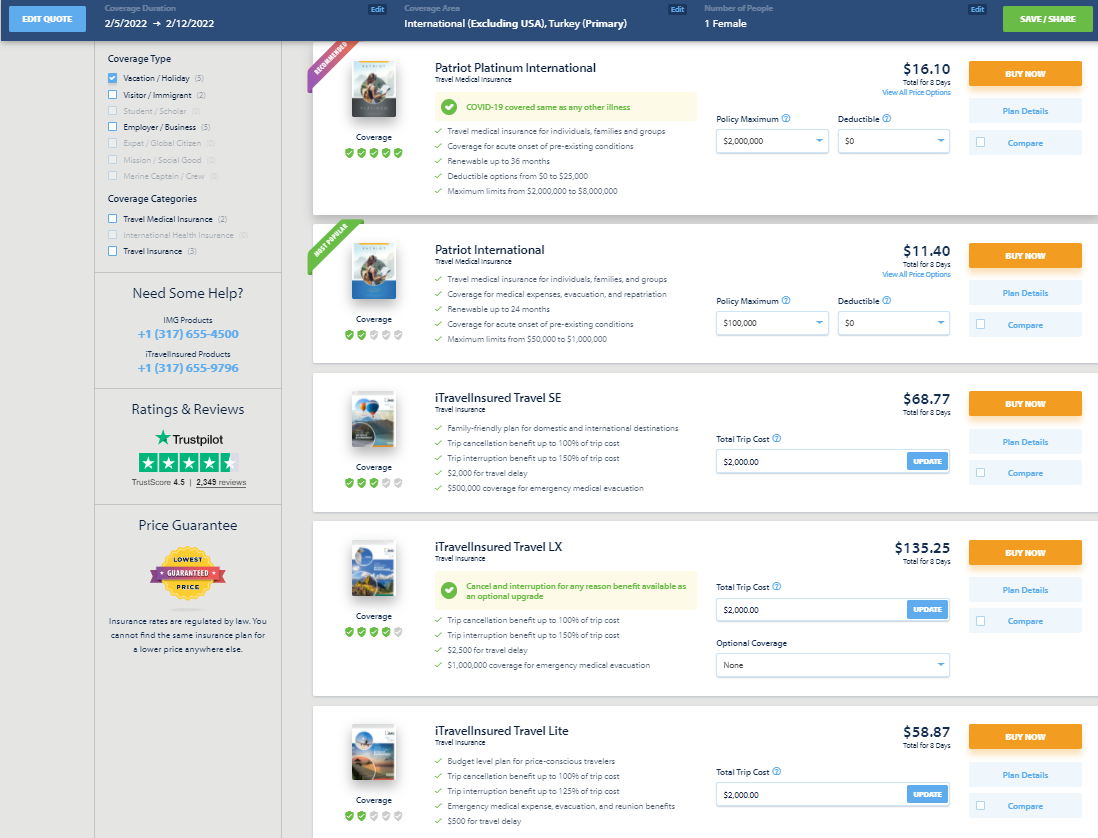

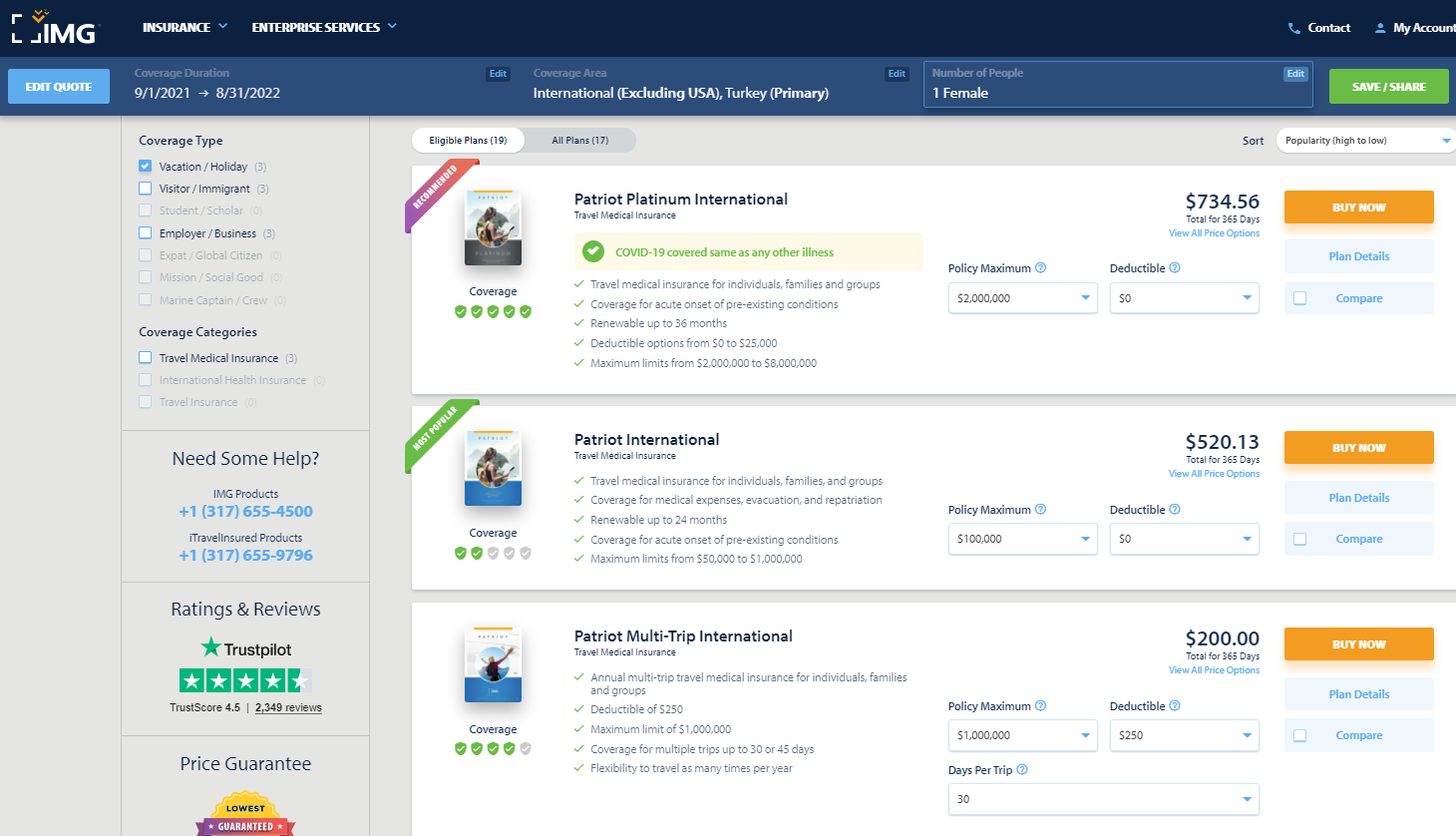

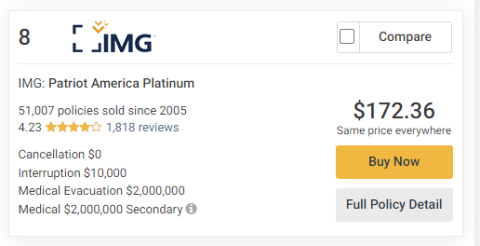

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

Travelex Insurance

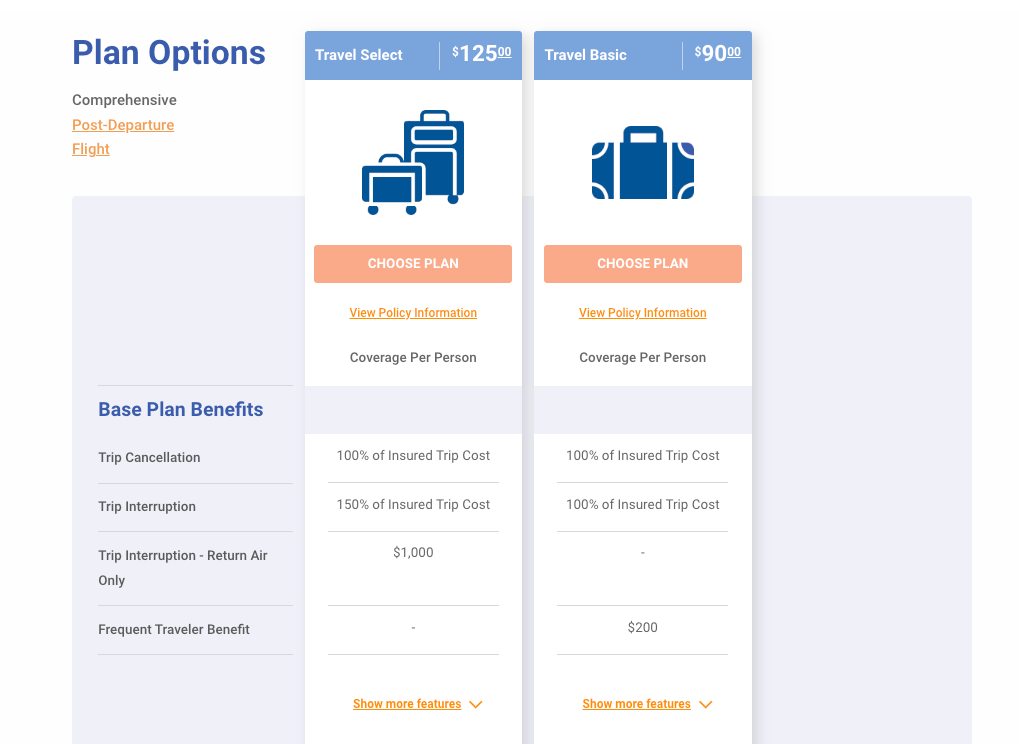

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

Seven Corners

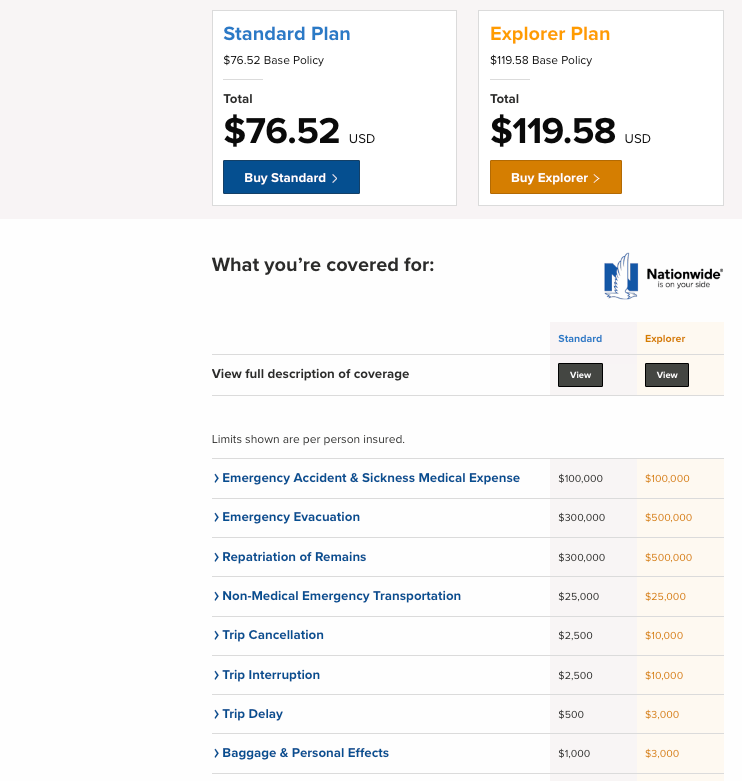

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Best travel insurance companies of May 2024

Amy Fontinelle

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 6:28 a.m. UTC May 2, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

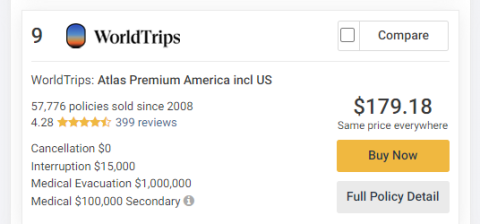

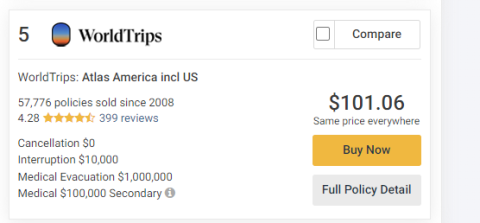

WorldTrips is the best travel insurance company of 2024 , based on our in-depth analysis of travel insurance policies. Its Atlas Journey Preferred and Atlas Journey Premier plans get 5 stars in our rating because of the extensive coverage they provide for the price. Both plans come with high limits for important benefits such as emergency medical and evacuation, travel delay and missed connections. WorldTrips travel insurance also offers a pre-existing medical condition exclusion waiver if you buy a plan within 21 days of making your first trip deposit.

Best travel insurance of 2024

Why trust our travel insurance experts

Our travel insurance experts evaluate hundreds of insurance products and analyze thousands of data points to help you find the best trip insurance for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content . You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Travel insurance quotes comparison

Best travel insurance companies, best travel insurance.

Top travel insurance plans

Average cost, medical limit per person, why it’s the best.

If you’re looking for the best travel insurance for international travel, WorldTrips has two top-rated travel insurance plans in our rating:

- Atlas Journey Preferred provides $100,000 per person in emergency medical benefits as secondary coverage, with the option to upgrade to primary coverage. Primary coverage means you don’t have to first file a medical claim with your health insurance company. Atlas Journey Preferred is also the best travel insurance for cruises with $1 million in coverage for emergency evacuation.

- Atlas Journey Premier costs more but gives you $150,000 in travel medical insurance with primary coverage. This plan is a good option if health insurance for international travel is a priority. It also has $1 million in emergency evacuation coverage.

Pros and cons

- Atlas Journey Preferred is the cheapest of our 5-star travel insurance plans.

- Atlas Journey Premier has $150,000 in primary medical coverage.

- Both plans have top-notch $1 million per person in medical evacuation coverage.

- Each plan includes travel inconvenience coverage of $750 per person.

- 12 optional upgrades, including destination wedding and rental car damage and theft.

- No non-medical evacuation coverage.

Customer reviews

WorldTrips has a rating of 4.27 stars out of 5 on Squaremouth, based on 411 reviews of policies purchased through the travel insurance comparison site since 2008.

Best travel insurance for emergency evacuation

Travel insured international.

Top travel insurance plan

If you’re traveling to a remote area, consider Travel Insured International’s Worldwide Trip Protector. It has the best travel insurance for emergency evacuation of travel insurance policies in our rating. This top travel insurance plan provides up to $1 million in emergency evacuation coverage per person and $150,000 in non-medical evacuation per person. It also has primary coverage for travel medical insurance benefits.

- Only plan in our rating that offers $150,000 in non-medical evacuation coverage.

- $500 per person baggage delay benefit only requires a 3-hour delay.

- Optional rental car damage benefit up to $50,000.

- Missed connection benefit of $500 per person is only available for cruises and tours.

Travel Insured International has a rating of 4.39 stars out of 5 on Squaremouth, based on 3,402 reviews of policies purchased on the travel insurance comparison site since 2004.

Best travel insurance for missed connections

If you’re looking for good travel insurance for missed connections , it’s worth considering TravelSafe. Its Classic plan includes $2,500 in missed connection coverage for each person on the plan. Some travel insurance companies only provide missed connection coverage for cruises and tours, but TravelSafe doesn’t impose that restriction.

- Best-in-class $2,500 per person in missed connection coverage.

- $1 million per person in medical evacuation and $25,000 in non-medical evacuation coverage.

- Generous $2,500 per person baggage and personal items loss benefit.

- Most expensive of our best-rated travel insurance plans.

- No “interruption for any reason” coverage option.

- Weak baggage delay coverage of $250 per person after 12 hours.

TravelSafe has a rating of 4.3 stars out of 5 on Squaremouth, based on 1,506 reviews of policies purchased on the travel insurance comparison site since 2004.

Best trip insurance for traveling with a pet

Go Ready Choice by Aegis has the most affordable travel insurance of the best-rated travel insurance companies in our rating. It’s also the best trip insurance for pet parents , with an optional Pet Bundle add-on that includes pet medical, pet kennel and pet return benefits.

- Cheapest of our best trip insurance plans.

- Optional pet bundle adds pet medical expense and pet return benefits.

- Low emergency medical and evacuation limits.

- Low missed connection benefit of $500 per person for cruises and tours only.

- Low baggage and personal items loss benefit of $500 per person.

Aegis has a rating of 4.06 stars out of 5 on Squaremouth, based on 1,111 reviews of policies purchased on the travel insurance comparison site since 2013.

Best travel insurance for families

Top-scoring plan

Travelex Insurance Services has the best travel insurance for families because you can add kids aged 17 and younger to your Travel Select plan at no additional charge.

- Free coverage for children 17 and under on the same policy.

- Robust travel delay coverage of $2,000 per person ($250 per day) after 5 hours.

- Hurricane and weather coverage after a common carrier delay of any amount of time.

- Low emergency medical coverage of $50,000 per person.

- Non-medical evacuation is not included.

- Low baggage delay coverage of $200 requires a 12-hour delay.

Travelex has a rating of 4.43 stars out of 5 on Squaremouth, based on 2,048 reviews of policies purchased on the travel insurance comparison site since 2004.

Best travel insurance for add-on coverage options

Travel Guard Preferred from AIG allows you to customize your policy with a host of available upgrades, making it the best traveler insurance for add-on options . These include “cancel for any reason” (CFAR) coverage , rental vehicle damage coverage and bundles that offer additional benefits for adventure sports, travel inconvenience, quarantine, pets, security and weddings.

There’s also a medical bundle that increases the travel medical benefit to $100,000 and emergency evacuation to $1 million. This is a good option if you’re looking for foreign travel health insurance.

See our full AIG travel insurance review

- Bundle upgrades allow you to customize your travel insurance policy.

- Emergency medical and evacuation limits can be doubled with optional upgrade.

- Base travel insurance policy has relatively low medical limits.

- $300 baggage delay benefit requires a 12-hour delay.

- Optional CFAR upgrade only reimburses up to 50% of trip cost.

Best travel insurance for cruise itinerary changes

Nationwide’s Cruise Choice plan is good travel insurance for cruises . It has a $500 per person benefit if a cruise itinerary change causes you to miss a prepaid excursion.

Cruise Choice also has a missed connections benefit of $1,500 per person after only a 3-hour delay when you’re taking a cruise or tour. But note that this coverage is secondary coverage to any compensation provided by a common carrier.

- Benefits for cruise itinerary changes, ship-based mechanical breakdowns and covered shipboard service disruptions.

- Non-medical evacuation benefit of $25,000 per person.

- Missed connection coverage of $1,500 per person for tours and cruises, after a 3-hour delay.

- Baggage loss benefits of $2,500 per person.

- Travel medical coverage is secondary.

- Trip cancellation benefit for losing your job requires three years of continuous employment.

- No “cancel for any reason” upgrade available.

Nationwide has a rating of 4.02 stars out of 5 on Squaremouth, based on 570 reviews of policies purchased on the travel insurance comparison site since 2018.

What is the best travel insurance?

The best travel insurance for international travel is sold by WorldTrips, according to our in-depth trip insurance comparison.

The best travel insurance plan for you will depend on the trip you are planning and the coverage areas that are most important to you.

- Best cruise travel insurance

- Best COVID travel insurance

- Best “Cancel for any reason” travel insurance

- Best senior travel insurance

Best travel insurance for cruises

The best cruise travel insurance is Atlas Journey Preferred sold by WorldTrips . This plan offers solid travel insurance for cruises for a low rate.

Via TravelInsurance.com’s website

Best travel insurance for COVID-19

The best COVID travel insurance is the Trip Protection Basic plan sold by Seven Corners . It is a relatively low cost travel insurance plan with optional “cancel for any reason” coverage that reimburses up to 75% of your prepaid, nonrefundable trip expenses.

Best travel insurance for “cancel for any reason”

The best “cancel for any reason” (CFAR) travel insurance is Seven Corners’ Trip Protection Basic. Adding CFAR coverage to a RoundTrip Basic plan only increases the cost by about 40%, which is lower than other plans we analyzed. For the extra cost, you get coverage of 75% of your prepaid, nonrefundable trip expenses, as long as you cancel at least 48 hours before your scheduled departure.

Best travel insurance for seniors

The best senior travel insurance is the Gold plan sold by Tin Leg . It is an affordable travel insurance plan with travel medical primary coverage of $500,000 and a pre-existing conditions waiver if you insure the full amount of your trip within 14 days of your first trip deposit.

How much is travel insurance?

The average cost of travel insurance is 5% to 6% of your prepaid, nonrefundable trip costs .

How much you pay for travel insurance will depend on:

- The cost of your trip.

- Your destination.

- The length of your trip.

- The ages of travelers being insured.

- Your state of residence.

- The travel insurance policy you choose.

- The total coverage amounts in your policy.

- Any travel insurance add-ons you select.

Here are average travel insurance rates for a 30-year-old female who is insuring a 14-day trip to Mexico.

Looking to save? Discover cheap travel insurance options.

How much travel insurance should I buy?

Travel insurance companies typically offer several plans with varying maximum limits. The higher the coverage limits, the more you’ll pay for travel insurance.

Squaremouth, a travel insurance comparison site, recommends the following coverage limits for international travel:

- Emergency medical coverage: At least $50,000.

- Medical evacuation coverage: At least $100,000.

If you’re going on a cruise, or to a remote location, Squaremouth recommends:

- Emergency medical coverage: At least $100,000.

- Medical evacuation coverage: At least $250,000.

When evaluating travel insurance plans, our team of insurance analysts considered the best medical travel insurance policies to have at least $250,000 in emergency medical coverage and at least $500,000 in medical evacuation coverage.

When should I buy travel insurance?

The best time to buy travel insurance is within two weeks of making your first nonrefundable travel payment, whether it’s for a plane ticket, hotel stay, cruise or excursion.

Travel insurance costs the same whether you buy it early or last minute, and buying it early has added benefits:

- You may be able to add on “ cancel for any reason” (CFAR) coverage , an upgrade that is typically only available for a limited time after you’ve started paying for your trip.

- You may qualify for a pre-existing medical conditions exclusion waiver, meaning your pre-existing conditions will be covered by travel insurance. This waiver is generally added to your policy automatically, provided you buy the travel insurance within a certain window after your first trip deposit.

- You will be covered over a longer period of time for unforeseen events that could cause you to cancel your trip, such as medical emergencies, inclement weather and natural disasters.

Expert tip: You can buy travel insurance up to the day before you leave on your trip, but waiting may cost you the opportunity to qualify for a pre-existing conditions exclusion waiver or to buy a “cancel for any reason” upgrade.