The Egyptian Tourism Authority (ETA) was established in 1981—by Presidential Decree No. 134—as a regulatory body affiliated with the Ministry of Tourism. ETA’s mission is to boost international tourism by promoting Egypt’s rich history and civilization and highlighting the country’s abundance of diverse tourist attractions. Part of ETA’s mandate is to also address any obstacles that may stand in the way of growth in Egypt’s tourism sector. It also aims to promote domestic tourism, raise tourism awareness throughout the country, and strengthen the connection between Egyptians and their heritage.

ETA works to achieve its objectives by:

- • Highlighting the diversity and variety of Egypt’s tourist attractions and destinations

- • Developing marketing strategies and programs to promote international and domestic tourism

- • Providing technical and marketing support in coordination with relevant entities for the promotion of tourism

ETA also organizes and sponsors tourism, sports, social, cultural, entertainment, and educational events held at tourist attractions, archaeological sites, and museums across Egypt. These activities shed light on Egypt’s diversity of experiences and highlight the country’s competitive edge as a destination for international travelers.

The ETA Board of Directors is chaired by the Minister of Tourism. Its members include the ETA’s CEO and representatives from relevant entities, such as the Chairman of the Egyptian Tourism Federation (ETF), the Egyptian Travel Agents Association, and the Egyptian Hotel Association; the Chairman of the Egyptian Civil Aviation Authority; the Secretary-General of the Supreme Council of Antiquities; the Director General of the Grand Egyptian Museum; and four additional tourism sector experts. The ETA Board of Directors is responsible for setting ETA’s general policies and making the necessary decisions to help achieve its goals and objectives.

Arts & Culture

Our magazine, haya karima.

Our magazine

Egypt's initiative to promote domestic tourism extended to may 15.

Egypt Today staff

Sun, 28 Feb 2021 - 11:44 GMT

Egypt extends initiative to support domestic tourism to May 15 - Min. of Tourism & Antiquities

CAIRO – 28 February 2020: According to the directives of Egypt’s Prime Minister Mostafa Madbouly, the Ministries of Tourism and Antiquities and Civil Aviation decided to extend the initiative to support domestic tourism in Egypt until May15, instead of February 28.

This comes with a commitment to 50 percent of the hotel’s capacity and implementing hygiene safety regulations in airports, museums, archaeological sites, restaurants, cafeterias, hotels and tourist buses.

This decision comes in accordance with the package of incentive measures launched by the government to support the tourism and aviation sectors and their workers, based on the directions of Egypt’s President Abdel Fattah el-Sisi, to support the two sectors and their workers and stimulate tourism.

The decision to extend the activation of the initiative came in response to the demands of a large number of Egyptians as well as members of the House of Representatives and Senate whom the Ministers of Tourism and Antiquities and Civil Aviation met during their visits in Egyptian cities.

The two ministers visited the cities of Hurghada and Marsa Alam in the Red Sea, as well as Luxor and Sohag in Upper Egypt.

The initiative aims to reduce domestic airline prices that connect tourist cities within Egypt by organizing flights from Cairo to Luxor, Aswan, Sharm El Sheikh, Taba, Hurghada and Marsa Alam, and from Alexandria to Luxor and Aswan.

It was decided that airline ticket prices for Egyptians and foreigners will continue to be fixed at a flat rate that includes taxes for arrival and departure from Cairo and Alexandria to Luxor for EGP 1500 and to Aswan for EGP 1800.

Also the ticket prices from Cairo or Alexandria to Sharm El-Sheikh, Hurghada and Taba will be a fixed rate of EGP 1800 and EGP 2000 to Marsa Alam.

The Board of Directors of the Supreme Council of Antiquities also agreed to grant a reduction on the prices of tickets for Egyptians and Arabs visiting archaeological areas and museums open for visits in Egypt, where an agreed price will be applied, which is the price of tickets for Egyptian students, until mid-May 2021.

It should be noted that the initiative was launched by the Ministries of Tourism and Antiquities and Civil Aviation last January in accordance with the recommendations of the Ministerial Committee for Tourism and Antiquities during the meeting held under the chairmanship of the Prime Minister during the month of December 2020.

Sharm el Sheikh

Mostafa madbouly, egyptian museums, egyptian tourism, abdel fattah el sisi, supreme council of antiquities, ministry of tourism & antiquities, egyptian domestic tourism, archaeological areas in egypt.

Leave a Comment

Infrastructure investment positions Egypt's tourism industry for growth

Egypt | Tourism

In the years leading up to the Covid-19 pandemic, the tourism sector was a key contributor to economic growth and foreign exchange. Egypt was expecting significant growth in tourism going into 2020 with the opening of new flight routes and museums, as well as investment in antiquities. The pandemic’s impact on the tourism sector in markets around the world was significant, as travel restrictions were implemented and borders closed to contain the spread of the virus. Nonetheless, public investment in the sector and concerted marketing campaigns aimed at fuelling engagement laid the groundwork for a rebound. Indeed, in 2021 and the early months of 2022 international arrivals began to pick up pace, as new source markets materialised.

Structure & Oversight

The Ministry of Tourism and Antiquities (MoTA) is responsible for implementing government policies related to the sector, as well as for providing oversight of industry players such as travel administrators and tour guides. The ministry was created in 2019 after a reshuffle merged the Ministry of Antiquities and the Ministry of Tourism. The merger was meant to bring emphasis to not only traditional sun-and-sand beach offerings such as Sharm El Sheikh and Hurghada, but also antiquities tourism. The MoTA has invested heavily in cultural tourism through the restoration and promotion of monuments, museums and archaeological sites in the years since its establishment.

As part of Egypt Vision 2030, designed in line with the UN Sustainable Development Goals, the MoTA is working with the Egyptian Tourism Federation to develop a national strategy for sustainable tourism. Moreover, the ministry intends to carry out a digital transformation of the sector through a three-pillar strategy that involves building websites, developing infrastructure and creating databases.

After travel restrictions were imposed during the early months of the pandemic, the MoTA worked with other government offices to implement several programmes aimed at reinvigorating the tourism industry and ensuring that it continued to build upon post-2017 sectoral growth. First, the government prioritised vaccinations for tourism workers, particularly in the Sinai and the Red Sea governorates – home to some of the country’s most-visited resorts – to support the reopening of tourist destinations. Second, it extended two pandemic-support initiatives implemented by the Central Bank of Egypt (CBE) through the end of 2022. Specifically, these were rescheduling of debts and arrears, and postponing of fees owed to the government. The government also continued its scheme to reduce aviation fuel prices through April 2022, and provided workers in affected industries with a monthly subsidy for a three-month period. Third, the government eased access for tourists, requiring only a negative PCR test upon arrival. The government also waived entry visa fees for tourists at the beginning of 2021.

Performance & Size

Tourism contributes substantially to Egypt’s economy. After a fall in tourism revenue following the Arab Spring in 2011, tourist expenditure increased to Egypt’s highest level in 2019 before falling due to the disruption of the pandemic in 2020. According to The World Travel & Tourism Council (WTTC), international arrival spending totalled LE261.6bn ($16.6bn) in 2019. This figure decreased by 70% to LE79.6bn ($5.1bn) in 2020 but rose to LE108.6bn ($6.9bn) in 2021.

Domestic tourism spending saw a similar trend, falling by 32.3% from $11.1bn in 2019 to $7.5bn in 2020. In 2019 domestic tourism spending accounted for 41% of total tourism spending, while in 2020 this figure increased to 65% due to restrictions on international arrivals and concerted efforts by tourism officials to attract Egyptians to the country’s cultural and destination offerings. That year also saw a 55% decrease in the total contribution of tourism to GDP, from $32bn – or 8.8% of GDP – in 2019 to $14.4bn – or 3.8% of GDP – in 2020.

In November 2019 the MoTA introduced the Tourism Reform Programme, known as E-TRP. The programme included a number of objectives, including increasing the number of individuals employed in the sector and encouraging sustainable practices throughout the industry value chain. It was based on five pillars: institutional reform; legislative reform; promotion and marketing; infrastructure and tourism development; and global tourism trends. The pandemic, however, put pressure on employment in the sector. In 2019, 9.2% of the workforce was employed in tourism, or around 2.4m people. By 2020 this figure dropped to 6.2%, or 1.6m workers. This reflected a global trend in tourism, in which the number of jobs in the sector in 2020 fell by 18.5% worldwide.

In FY 2019/20 the government invested LE15.2m ($965,800) in the sector, with economic authorities and public companies contributing an additional LE43.5m ($2.8m) and LE260.1m ($16.5m), respectively, according to the CBE. The following fiscal year these entities invested LE11.7m ($743,400), LE2.8m ($177,900) and LE393.5m ($25m), respectively. The private sector accounted for the bulk of investment over this period, or LE5bn ($315.9m) in FY 2019/20 and LE6bn ($379m) in FY 2020/21.

Visitors & Source Markets

In 2019 there were just over 13m international visitor arrivals, an increase from 11.3m the previous year and 5.4m in 2016. The pandemic had a sharp effect on the number of international visitors, which fell to 3.7m in 2020. The principal inbound source markets that year were Germany (14%), Saudi Arabia (9%), Libya (6%), Italy (5%) and Poland (4%). Arrivals from the rest of the world accounted for 62% of the total, suggesting a diversity in source markets. Leisure tourists accounted for the bulk of tourist spending, or $10bn of the $11.5bn spent in 2020.

Another major source market for Egypt is Russia. However, the February 2022 invasion by Russia of Ukraine – another key source market – is expected to have a significant impact on Egypt’s tourism sector. Indeed, visitors from the two countries typically account for 40% of the beach holidaymakers who visit Egypt each year. In March 2022 Moataz Sedky, vice-chairman of the tourism committee of the American Chamber of Commerce in Egypt, told local media that he expected tourist arrivals to fall by 35% over the course of the year.

Despite the payment impediments posed by international sanctions, by April 2022 Egypt was able to welcome its first group of tourists from Russia after such trips were stopped the previous month. The excursions are managed by Biblio-Globus, a Russia-based tourism operator, which will manage flights to Hurghada and Sharm El Sheikh.

Air Developments

Several new and resumed flight links have opened up in recent years, as did new domestic routes linking tourist destinations. In August 2021 Russia resumed flights to Sharm El Sheikh and Hurghada following a six-year hiatus. The flights were previously halted following the crash of a Russian airliner in the Sinai Peninsula.

In October 2021 flights between London and Sharm El Sheikh resumed after they were halted in March 2020 due to pandemic travel restrictions. Germany also resumed flights between Frankfurt and Hurghada in 2021. New international flight routes include the June 2021 launch of Air Canada’s first direct route between Montreal and Cairo, and Fly Dubai’s link between Dubai and Sharm El Sheikh, announced the same month.

Egypt also inaugurated several domestic flight routes. In 2021 the MoTA launched an initiative to merge beach and leisure tourism with cultural tourism by offering flights between the Nile Valley and coastal cities. In October of that year Egypt Air opened a new route between Sharm El Sheikh and Luxor. The flight was part of a wider incentive programme implemented by the Ministry of Civil Aviation to facilitate flights between cities in the Red Sea and Upper Egypt. In addition to boosting domestic tourism, the link offers international travellers the opportunity to see Egypt beyond its beaches.

After welcoming its first international flight in 2020, the LE300m ($19m) Sphinx International Airport in western Cairo closed for renovations in 2021. The reopening of the expanded airport is expected to coincide with the November 2022 opening of the Grand Egyptian Museum, which is in proximity to the site. The Red Sea governorate’s LE2.3bn ($145.3m) Berenice International Airport welcomed its first flight in September 2021. The airport, which has the capacity to handle 600 passengers an hour, is expected to boost tourism in the region thanks to its link with the Wadi El Gemal National Park, and to attract greater levels of investment.

Hotel Infrastructure

After shutting down at the beginning of the pandemic, hotels were permitted to open at 25% capacity in May 2020, a percentage that gradually rose before hotels were permitted to operate at full capacity in October 2021. Occupancy rates were low during the initial months of the pandemic, at 28.4% for the first 10 months of 2020 compared to 67.8% for the same period the previous year. Several hoteliers used the drop in arrivals to refurbish their hotels.

In February 2021 the National Bank of Egypt and AlSharif Holding Group signed a LE978.2m ($61.8m) long-term financing agreement for the modernisation and development of the 260-room Shepheard Hotel in Downtown Cairo. The developer aims to renovate the property and increase the number of rooms to 316 by the end of 2024. Foreign investors were also involved in hospitality renovations: in September 2020 the Abu Dhabi Tourism Investment Company announced that it would implement a series of hotel renovations in 2021, and refurbished three facilities in Cairo, Hurghada and Sharm El Sheikh.

In May 2021 the CBE amended an initiative to make it easier for hoteliers to afford renovations, financing a maximum of 90% of the costs of replacement and renewal, up from the previous 75% rate. It also increased its credit risk guarantee for facilities granted from 60% to 70%, with commercial banks responsible for the remaining disbursement.

In addition to renovation projects, 19 new hotels were opened in 2021. These added 3000 new rooms to the total, which measured in at 205,000 in February of that year. There are several new hotels and resorts in the pipeline that are set to further boost the number of rooms in the market: 14 projects with 3570 rooms are set to be completed in 2022, followed by 12 properties with 2990 rooms in 2023.

Niche Markets

In recent years the MoTA has prioritised expanding Egypt’s reputation for tourism offerings beyond sun, sea and antiquities. The ministry and the Egyptian Tourism Authority are working to promote cultural and historical sites, Nile cruises, ecotourism and museums, as well as adventure, spiritual and therapeutic tourism. Moreover, the MoTA is working with the Ministry of Youth and Sport in the planning of several upcoming international sporting events, including diving, high diving and artistic swimming events that are scheduled to be held between 2023 and 2026. Egypt is also aiming to become a top destination for golf, with over 25 golf courses across the country.

The country is working to leverage its vast ecological offerings across three deserts, two seas and the Nile Delta to develop its nature and adventure sport segments. Indeed, ecotourism plays a central role in Egypt Vision 2030’s framework for sustainable economic development. It has many strengths in the segment: the Red Sea’s Elphinstone Reef is considered one of the world’s best for snorkelling, and Egypt was ranked second in 2021 in the annual ranking of diving destinations published by DIVE international arrivals and traditional tourism revenue, but also docking fees, taxes, fuel sales and maintenance fees. This initiative builds on previous efforts to facilitate yacht tourism, especially in light of its potential in terms of luxury travel spending. In August 2021 local real estate developer Emaar Misr inaugurated Egypt’s first international yacht port, Marassi Marina Yacht Club, on the North Coast. The new port features 3300 hotel keys and 23 residential neighbourhoods, as well as beaches and golf clubs.

Digital Offerings

Another opportunity will be for Egypt to promote itself as a remote working destination. Worldwide pandemic restrictions have led many companies to move their workforces online, allowing their employees to work anywhere. This has driven an influx of digital nomads to tourist destinations around the world. Towns such as El Gouna on the Red Sea have began to promote themselves as a digital nomad destinations. These efforts have been supported by a wider drive to boost connectivity across the country, including a $360m plan to bring fibre-to-the-home internet to populations across 4500 villages (see ICT & Innovation chapter).

The government has also worked to digitalise tourist services. In 2021 the MoTA launched an e-ticketing system across 32 archaeological sites and museums, and installed smart electronic gates at a number of sites. The same year the authorities began a programme in which tourists receive an SMS upon arrival with the ministry’s hotline and emergency numbers.

E-TRP aims to modernise Egypt’s tourism promotion activities. It targets three main goals: the establishment of international marketing and promotion partnerships; the adoption of modern promotion approaches; and the diversification of revenue streams. The MoTA has also prioritised attracting additional tourist inflows, especially in light of the reopening of borders in key source markets. To that end, the MoTA hosted Egypt’s pavilion at the Dubai Expo 2020, which was held from October 2021 to March 2022. The government has also invited journalists, travel bloggers and influencers on guided tours to enhance its profile as a tourist destination in both traditional and social media outlets.

In December 2021 the MoTA launched a “Sunny Christmas” online campaign to attract tourists during Christmas and the New Year, as well as those looking to escape cold weather in the northern hemisphere for Egypt’s warm beaches. In addition to domestic tourists, the campaign targeted visitors from France, Germany, Italy, the UK, Russia, Ukraine and the US.

The winter initiative followed previous campaigns that aimed at boosting domestic tourism during the pandemic, when restrictions limited international arrivals. In 2021 the MoTA promoted the “Enjoy your Winter in Egypt” initiative, working with the Supreme Council of Antiquities to offer Egyptians reduced prices at museums and archaeological sites. The government also introduced fixed-rate internal flight prices in 2020 and 2021 to encourage travel. Cheaper flights connecting Cairo and Alexandria to destinations such as Luxor, Aswan, Sharm El Sheikh, Taba, Hurghada and Marsa Alam allowed both nationals and foreigners to travel within Egypt more easily. The campaigns appeared to be successful, with Egypt seeing a 26% increase in internet searches related to domestic tourism and a 53% rise in searches for domestic flights during the summer of 2020, according to a 2020 report from US consulting firm BCG.

In 2022 the MoTA is using the 100-year anniversary of the discovery of King Tutankhamen’s tomb and the 200th anniversary of the decipherment of the Rosetta Stone – the latter of which led to the understanding of ancient Egyptian hieroglyphs – to further promote the antiquities tourism. The government hopes the restoration of several historical sites and the reopening of museums after pandemic-related closures will encourage cultural tourism. To kick off these efforts, in November 2021 the government reinaugurated the Avenue of the Sphinxes, a 2400-year-old ancient walkway in Luxor deemed the largest open-air museum in the world. Moreover, the upcoming opening of the Grand Egyptian Museum is expected to further boost the segment. The museum will be home to around 100,000 artefacts – 3500 of which belonged to King Tutankhamen – making it a centre for Egyptology, with easy access for tourists due to its proximity to the Great Pyramids of Giza.

Through investment in tourist sites and antiquities, as well as private spending on hotel renovations during the pandemic, Egypt has reopened its doors to international tourists. The government has also sought to bolster the domestic tourism market, encouraging Egyptians to take their holidays in both beach and cultural destinations. In 2020, when international arrivals and tourism operations were affected by the pandemic, there was a worry that the tourism industry would lose its post-2017 momentum. However, new flight routes and marketing campaigns are set to maintain the upwards trend.

Request Reuse or Reprint of Article

Read More from OBG

Focus Report: How Special Economic Zones are shaping Africa's industrial landscape En Français As Africa embraces the transformative power of the African Continental Free Trade Area (AfCFTA), Special Economic Zones (SEZs) emerge as pivotal catalysts for regional economic growth.The impact of AfCFTA on SEZs on the continent is a key part of Africa’s growth, through improved market access, reduced trade barriers, and participation in regional value chains, which all enhance overall competitiveness. ESG considerations take centre stage, highlighting the imperative for …

Khalid Jasim Al Midfa, Chairman, Sharjah Commerce and Tourism Development Authority (SCTDA) In this Global Platform video, Oxford Business Group speaks with Khalid Jasim Al Midfa, Chairman, Sharjah Commerce and Tourism Development Authority (SCTDA) about Sharjah’s strategies for fostering tourism growth by striking a balance between cultural appreciation and sustainability. In 2022 tourism constituted over 9% of the UAE's GDP and contributed around 10% to non-oil GDP in the emirate of Sharjah, which is positioning itself as a family and environmentally friendly destination. Sharjah, …

How Saudi Arabia is empowering MSMEs to support economic growth The Kafalah programme is playing a critical role in empowering micro-, small and medium-sized enterprises (MSMEs) in Saudi Arabia’s non-oil sector as the Kingdom works towards its Vision 2030 goals. The upcoming report “MSME Empowerment in Saudi Arabia”, produced by Oxford Business Group in partnership with Kafalah, details the factors that are shaping the future of the MSME segment and driving sustainable economic development in Saudi Arabia. …

Register for free Economic News Updates on Africa

“high-level discussions are under way to identify how we can restructure funding for health care services”, related content.

Featured Sectors in Egypt

- Africa Agriculture

- Africa Banking

- Africa Construction

- Africa Cybersecurity

- Africa Digital Economy

- Africa Economy

- Africa Education

- Africa Energy

- Africa Environment

- Africa Financial Services

- Africa Health

- Africa Industry

- Africa Insurance

- Africa Legal Framework

- Africa Logistics

- Africa Media & Advertising

- Africa Real Estate

- Africa Retail

- Africa Safety and Security

- Africa Saftey and ecurity

- Africa Tourism

- Africa Transport

Featured Countries in Tourism

- Algeria Tourism

- Cote d'Ivoire Tourism

- Djibouti Tourism

- Egypt Tourism

Popular Sectors in Egypt

- Egypt Construction

- Egypt Economy

- Egypt Energy

- Egypt Financial Services

- Egypt Industry

Popular Countries in Tourism

- Indonesia Tourism

- Malaysia Tourism

- The Philippines Tourism

- Thailand Tourism

- Oman Tourism

Featured Reports in Egypt

Recent Reports in Egypt

- The Report: Egypt 2022

- The Report: Egypt 2020

- The Report: Egypt 2019

- The Report: Egypt 2018

- The Report: Egypt 2017

Privacy Overview

- International

- Art & Design

- Health & Wellness

- Life & Society

- Sustainability

- Entrepreneurship

- Film & TV

- Pop Culture

Quality Journalism relies on your support

Subscribe now and enjoy unlimited access to the stories that matter.

Don’t have an account?

Username or Email Address

Remember Me

Forgot Password?

Quality Journalism relies on your support.

Already have an account?

Egyptian Streets

Independent Media

Locals Struggle as Tourists Have Egypt All to Themselves

By Gregory Holyoke

Last year in late 2020, I, along with a group of friends, travelled to Luxor in the south of Egypt for a Nile Cruise. While the train to Luxor from Alexandria was packed full of people, the cruise was comparably empty. Each day, we would disembark the cruise and visit some of the ancient world’s most reputed sights with few other travellers in sight. Save for the odd scattered Egyptian groups and sometimes a few foreigners, we would wander around uninterrupted. No queue for a photo in front of an obelisk, sphinx or tomb, and, apart from our phones, no clicking and flashing of cameras anywhere.

Our local guide, in between effortlessly reading hieroglyphs straight from the walls, tried to convey to us how lucky we were.

“It is normally so filled with people,” he said, “I have never seen it so empty.”

We were extremely lucky indeed. However, in reality, our good fortune was a very stark sign of the great misfortune that has beset the entire tourism industry in Egypt since the spread of COVID-19 in early 2020.

In 2019, Egypt attracted over 13 million foreign visitors, the highest number in Africa and the third highest in the Middle East. In real terms, this contributed over USD 13 billion in revenue, or 4.2 percent of Egypt’s overall Gross Domestic Product (GDP). At the time, the industry employed 2.4 million Egyptians, making it a lifeline for millions of families across the country.

Then came COVID-19. In the space of a year, almost 850,000 people lost their jobs and the sector’s contribution to Egypt’s GDP more than halved. The industry was devastated.

Problems, at home and abroad

I first met Joe Samy, co-founder of iEgypt, in October 2020. With an entrepreneurial spark and high energy, Joe was juggling a full-time job in a Cairo hostel, co-running a tourism start-up, and finishing his business and commerce degree in Zamalek.

During a recent Zoom interview with Egyptian Streets, Joe and the co-founder iEgypt Mohammed Ali, explained—after much reminiscing and minor disagreements—how they started working together on a plan to start running tours after they had met through an online community for hosting foreign travellers called ‘CouchSurfing’ a few years ago.

For a while they spoke about starting to run tours around Egypt for both international and local travellers and sightseers for a year until last year they decided to put their plans in motion.

“So, we met again in April 2020,” Joe started explaining, “we met, and the streets were empty, no cafes, no humans, nothing.”

Ali, who is much calmer and quieter than his namesake suggests, nods and, smiling, says “Yes, we were sitting on a car.”

“That is where we founded iEgypt,” concluded Joe.

Across the world, everything was shut down and borders were starting to close; , the entire tourism industry was looking on in horror, but Ali and Joe (along with a third co-founder Mou Sobhy) pressed on unfazed with their launch of iEgypt as Egypt opened up from a strict curfew and lockdown in early summer, 2020. Since then, they have run dozens of tours, mostly for domestic travellers.

Ahmed Abdullah, a director at Rhapsody Travel in Alexandria, was less positive about the pandemic.

“We incurred very large losses during the period of the [pandemic],” said Abdullah, who has worked in tourism since 2001. “[The] pandemic has greatly affected the numbers of tourists coming from outside Egypt, as well as local customers.”

While the effects of COVID-19 on international tourism could easily be predicted, there has also been a painful tailing off of domestic customers, which has only rubbed salt into a very open wound for the industry. In 2017, domestic tourists accounted for 48 percent of the industry’s income, and, while it is easier for domestic tourists to travel around the country without the international travel restrictions, numbers are still down overall. Abdullah blames a “constant fear that still exists so far in Egypt,” and its population, about the ongoing pandemic. People are also spending less, whether that means spending less when on holidays, or forgoing holidays altogether.

Effects of the wider economy

With tourism representing such a significant portion of Egypt’s economy, this sudden hit has reverberated throughout the wider economy and society. According to one report by the International Food Policy Research Institute (IFPRI), the losses from the collapse of tourism, when combined with the reduction in traffic through the Suez Canal and remittance (money sent home by Egyptians abroad) could cause the Egyptian economy to contract by up to 4.8 percent.

This is having a real term impact on lives across Egypt, especially disadvantaged communities across Egypt. Apart from the effects of hundreds of thousands of job losses in the industry, the contraction in the economy could lead to a significant reduction in the average household income over the course of the pandemic.

As Egypt was in a rebuilding process following the economic chaos caused by the 2011 and 2013 uprisings, which also disproportionately affected the tourism industry, the pandemic has tested the industry to its limits, but perhaps also showed its resilience.

The ‘bounce back’

In 2010, Egypt welcomed more foreign tourists than any other year in history. In 2011, when the revolution erupted, foreign travel collapsed and revenues (in USD billions) stayed in single figures throughout the following years of uncertainty. However, as stability slowly came back in the eyes of the world, so did international travellers. And they did so with wallets more open than ever. In fact, despite there being over a million fewer travellers in 2019 than in 2010, their total spending was up by half a billion.

Although total spending by tourists for 2021 is not expected to surpass USD seven billion, Khaled Al-Anani, Egypt’s Minister of Tourism and Antiquities, recently stated that the government expects to return to ‘pre-COVID-19 levels’ by the end of 2022, much faster than it did after the revolution. This could be driven by a post-pandemic economic ‘boom’, which many economists are predicting, combined with the ‘cabin fever’ many people are feeling having been denied international trips over the last year and a half, this boom could work strongly in the favour of Egypt’s tourism industry.

Egypt has also very publicly poised itself as open for tourism recently, with the planned opening of the new Grand Egyptian Museum–the largest archaeological museum in the world–later in 2021. In April of 2021 Egypt held the internationally covered, multimillion dollar Pharaohs’ Golden Parade , transporting mummies from the old Egyptian Museum to their new home in the National Museum of Egyptian Civilisation in Fustat , with President Abdel Fattah El Sisi making several appearances himself throughout the event.

The government is also acting to vaccinate hospitality staff in resorts around the red sea, which attract a wealth of foreign visitors each year.

In Alexandria, Rhapsody Travel’s Ahmed Abdullah is cautious.

“I hope that the situation will improve by the end of this year and at the beginning of next year.”

Joe and Ali are more optimistic. Now that he has finished university, Joe is hoping to devote more time to the business, and wants to expand it. He envisions moving into more permanent offices with “departments for [domestic] travellers, and departments for foreigners,” and foreign travel. He also put forward the idea of a central hostel or hotel as a hub for clients. As we came to the end of our call and we started to say our goodbyes, another task came up in Joe’s incredibly busy day, this one more domestic.

“I need to go,” he waved, “I said I’d make my mum lunch.”

Comments (3)

Cancel reply.

You must be logged in to post a comment.

[…] أن العديد من القطاعات خاصة السياحة والطيران المدني ، عانى خسائر كبيرة على مدى العامين […]

[…] further emphasized that many sectors, particularly tourism and civil aviation, suffered significant losses over the past two […]

Related Articles

Recommended for you

Suez Canal Revenues Drop 60% Due to Regional Tensions: Sisi

New Livestock Plan to Revitalize Egypt’s Industry

Egypt’s New Gov’t 3-Year Program: Explainer

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- My Account Login

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Open access

- Published: 04 March 2024

The impact of push-pull motives on internal tourists’ visit and revisit intentions to Egyptian domestic destinations: the mediating role of country image

- Doaa Ayoub ORCID: orcid.org/0000-0002-2275-0510 1 na1 &

- Dina Nasser Hassan Sayed Mohamed 1 na1

Humanities and Social Sciences Communications volume 11 , Article number: 358 ( 2024 ) Cite this article

4402 Accesses

2 Altmetric

Metrics details

- Business and management

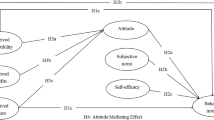

Purpose -The purpose of this study is to investigate the impact of the push motivational factors (rest & relaxation, enhancing the ego, and novelty & knowledge-seeking) and pull motivational factors (tourism facilities, environment & safety, and cultural & historical attraction) on internal tourists’ visit and revisit intentions to a domestic destination in Egypt. It also tested the mediation role of the country image in the relationship between the independent variables (push & pull motives) and the dependent variables (visit & revisit intentions). This study provides novelty for the context of travel motivation, especially in a global crisis like Corona and highlight the limited literature regarding the Arab context, especially Egypt. Data were collected using an online survey of internal tourists to test the proposed model empirically using structured questions. Structural equation model (SEM) was developed to test the research hypotheses with a sample of 349. The findings indicate that all the research hypotheses were statistically supported, except for the associations between rest-and-relaxation, tourism facilities and the internal tourists’ visit intention to a destination in Egypt.

Similar content being viewed by others

Exploring the impact of functional, symbolic, and experiential image on approach behaviors among state-park tourists from India, Korea, and the USA

Comparative analysis of the behavioral intention of potential wellness tourists in China and South Korea

How to improve tourists’ trust in official tourism destination websites in China—an empirical research based on CV and PASP

Introduction.

The academics of tourism have shown considerable interest in travel motivation, and how travel motivation is considered a useful approach to comprehend tourists’ needs and motives. They even propositioned the complexity of investigating why tourists intend to travel and what they want to indulge or enjoy (Yoon and Uysal, 2005 ). Many disciplines have been considered to explain the travel motivation phenomena, and accordingly it has been investigated by many academics from various fields, namely anthropology, sociology, and psychology fields (Mohammad and Som, 2010 ; Yoon and Uysal, 2005 ; Gnoth, 1997 ; Dann, 1977 ). Maslow’s hierarchy of human needs have been highly utilised as the most famous and well-known theory within the travel motivation literature, displaying the basic human needs at the bottom of the pyramid to its way up to the least pressing needs (Negrusa and Yolal, 2012 ). Therefore, the hierarchy of Maslow can be seen as the theoretical basis and background for travel motivation studies.

Travel motivation theory has been examined and investigated till it is generally accepted, which is the push and pull motives (Dann, 1981 ; 1977 ). Previously, different studies have addressed and utilised the push and pull motives in the context of tourism motivation, and hence they were seen as relevant independents or predictors to be used for comprehending why tourists intend to travel, and integrating their behaviours (Correia et al., 2013 ; Jarvis and Blank, 2011 ; Mohammad and Som, 2010 ). Yousefi and Marzuki ( 2015 ), Negrusa and Yolal ( 2012 ), Mohammad and Som ( 2010 ), and Yoon and Uysal ( 2005 ) identified the push factors as the forces that motivate and induce individuals to go away from their home; while the pull factors are the externalities of a specific place/destination that pull individuals to visit this destination. Furthermore, Seebaluck et al. ( 2015 ) supported that push-pull motivational factors can integrate well with the hierarchy of Maslow. Thus, such an integration between the most well-known theory (Maslow’s theory) and the generally accepted theory (push-pull motives) will help to better comprehend the travel motivation and behaviours of tourists.

The dimensions that this paper focuses on and investigates for the push motives are: rest and relaxation, enhancing the ego, and novelty and knowledge-seeking. While the pull motives are the following dimensions: tourism facilities, environment and safety, and cultural and historical attractions. These dimensions were mentioned by and taken from Yousefi and Marzuki ( 2015 ). Moreover, this study concentrates on internal tourism, meaning that it considers the travel activities of those who are resident in the country of reference and non-residents visitors to the country of reference, as part of either their domestic or international tourism trips, respectively. In the same vein, it is also because many studies were focusing on either investigating residents visiting an outbound country only or investigating international tourists visiting a country of reference only (Baniya and Paudel, 2016 ; Yousefi and Marzuki, 2015 ; Mohammad and Som, 2010 ; Huang, 2010 ; Jang and Cai, 2002 ). Thus, this research paper provides novelty to the travel motivation context especially in global crisis such as Corona.

Country image plays an essential role in getting the interest and attention of travellers to visit a city of reference. It is considered the sum of impressions collected by a person about a specific destination or place (Gallarza et al. 2002 ). Doosti et al. ( 2016 ) highlighted the fact that country image is not only a good predictor in determining traveller’s visit intention but also their re-visit intention, because it influences travellers’ decision-making process for both, namely the visit and re-visit intentions. Therefore, this paper utilises the country image role as a mediator between the first relationship of the push-pull motivational factors and visit intention, and between the second association of the push-pull motives and re-visit intention. Hence, adding contribution to the tourism context.

Although studies regarding the travel motivation context have been covered excessively, focusing on the overseas countries like: Japan, Australia, North America, Canada, West Germany, France, the UK, and many regions across Asia (Hsu et al., 2009 ; Rittichainuwat, 2008 ; Kim and Prideaux, 2005 ; Oh et al., 1995 ; Uysal and Jurowski, 1994 ; Yuan and McDonald, 1990 ), Mohammad and Som ( 2010 ) highlighted the lack of information and limited literature regarding the Arab context that is why they studied Jordon as one of the Arabic countries. As a result, this research concentrates on Egypt in specific as a very promising country when it comes to tourism. Tourism in Egypt is considered a very crucial factor from the many essential factors that takes an extremely huge role in the growth of the economic development, and accordingly if tourism recovers, Egypt will recover in return (World Tourism Organisation UNWTO, 2016 ). Egypt is considered one of the top safest countries, according to Gallup’s 2018 Global Law and Order Report, coming in the 10th place for being safe for not only the local residents, but also for international tourists visiting Egypt. This survey showed that Egypt is being tied up with Denmark, Slovenia, Luxembourg, Austria, China, and Netherlands by scoring 88 out of 100, indicating its low crime rate (CNN Travel, 2018 ). A year later, Egypt escalated up to the 8th place, outranking multiple European countries, the USA, and the UK by scoring 92 out of 100, indicating its sense of personal safety and faith in law enforcement according to Gallup’s 2019 Global Law and Order Report (GALLUP, 2019 , P.12; Egyptian Streets, 2019 ).

Egypt is considered one of the countries that attracts many tourists to visit annually. The number of international tourists arriving to Egypt annually from the period ranges from (2007) to (2019) has escalated as reported by The World Bank ( 2023 ). Even during the pandemic (Covid-19) that disrupted the economy so hard worldwide, Egypt was regarded as one of the few emerging countries that showed resilience towards the pandemic, experiencing growth in 2020, and maintaining a positive GDP growth in 2021 (International Monetary Fund, 2021 ). Although such a pandemic influenced the entire world in 2020, but Egypt was able to hold onto its position as a top destination for tourists, this is due to the Egyptian government’s active response and short-period lockdown. As a result, Egypt led Africa in terms of tourists’ arrivals, reporting around 3.7 million tourists visited Egypt in 2020 (Statista, 2022a ). In 2021, Egypt ranked the first to have the largest number of tourists visiting the country among the rest of the African countries, reporting 3.67 million tourists (Statista, 2022b ). Ultimately, Egypt ranked the highest in the 2021 Competitiveness Index of Travel and Tourism among the African Countries, scoring 4.2 (Statista, 2022c ). Thus, showing such a high score of resilience will contribute to Egypt’s development (World Economic Forum, 2022 ).

This paper aims to investigate the impact of push motives (rest and relaxation, enhancing the ego, and novelty and knowledge-seeking) and pull motives (tourism facilities, environment and safety, and cultural and historical attractions) on internal tourists’ visit and revisit intentions to a domestic destination in Egypt. It also tests the country image and its mediation role in the relationship between the independent variables (push-pull motives) and the dependent variables (visit and revisit intentions). This study provides novelty for the context of travel motivation, especially in a global crisis like Corona. Afterwards, the study’s objective is to assess the impact of the push and pull motivational factors on internal tourists’ visit and revisit intentions to a domestic destination in Egypt. On that basis, the following section presents the literature related to this study.

Literature review

Tourism, internal tourism, and tourists.

Caldito et al. ( 2015 ) identified tourism as a global and universal economic activity, which advocates and supports the socio-economic developments and processes within the countries, territories, or provinces where they are developed. The United Nations ( 2010 , P.1) and the World Tourism Organisation UNWTO ( n.d. ) considered tourism in different phenomena such as social, cultural, as well as economical. Tourism entails the transfer and movement of individuals to different places or countries that are regarded to be outside the individuals’ own usual and normal environment for one purpose or more purposes (World Tourism Organisation UNWTO, n.d. ), including professional purposes, leisure purposes, or even personal ones (United Nations, 2010 , P.10). On that basis, internal tourism is the comprising of both, namely the domestic and in-bound tourism (World Tourism Organisation UNWTO, n.d. ). The internal tourism is considered the activities of both, resident as well as non-resident visitors, as part of either domestic tourism trips or international tourism trips within the country of reference (United Nations, 2010 , P.15). Accordingly, tourists are those individuals who leave voluntarily their usual environment and go-to surroundings where they used to live and work, integrating and participating in various activities despite of the destination being close or far-away, as conformed by Camilleri ( 2017 ).

Travel motivation

Travel motivation has gained the attention and interest of many researchers in various research, studies, and fields. It has also showed its importance in different contexts of comprehending well travellers’ behaviours and intentions (Baniya and Paudel, 2016 ). Motivation can stimulate an action, and in that sense, it is considered the person’s psychological as well as internal forces which in sequence can spur that action (Armstrong and Kotler, 2013 ). Due to this action that is being stimulated, then it can satisfy a specific need (Li et al., 2015 ). This elucidates that for these actions to be stimulated, the person must have from the beginning some psychological or what is so called biological needs and wants. The existence of these needs and wants will start directly and immediately to motivate the person, and in return some behaviours and activities will be integrated (Negrusa and Yolal, 2012 ). Indeed, individual’s motivation is like a collection of driving forces that in return can conciliate performing and carrying out specific actions that can be induced by the person who is being motivated (Sandybayev et al., 2018 ). In line with that, Chang et al. ( 2014 ) clarified that tourists will tend to participate, engage, and integrate in a specific behaviour, however that integration or participation is due to being motivated based on some reasons, forces, or even goals. Jarvis and Blank ( 2011 ) challenged that it is not necessary that all tourists will be motivated by the same motives or forces, as that way might cause many problems if tourists to be treated the same exact way. Understanding and comprehending well individual’s motives is the most important key for designing offerings and tailoring them to suit the targeted markets (Negrusa and Yolal, 2012 ; Park et al., 2008 ).

Negrusa and Yolal ( 2012 ) defined motivation as an initiator for the everyday individual’s decision-making process. It is considered what affects people’s choices through internal and psychological influences. This agrees with Banner and Himmelfarb (1985 as cited in Jarvis and Blank, 2011 ), supporting that tourism is solely based on the voluntary motivation (intrinsic force), leaving behind the extrinsic motivation. Getz ( 2008 ) agreed to some extent with what addressed earlier regarding the voluntary motivation, supporting that it is well-established compared to the extrinsic motivation. Hence, this clarifies the lack of support towards the extrinsic force that requires more comprehension and understanding when it comes to the tourism motivation (Jarvis and Blank, 2011 ). However, other researchers argued the above and addressed a different perspective, Seebaluck et al. ( 2015 ) stated that travel motivation is a combination of both, namely intrinsic and extrinsic factors, and accordingly these factors can stimulate the desire for travelling and visiting a specific destination in mind and that tourists can satisfy concurrently many distinctive needs and wants, instead of pleasing/delighting one need only. This agrees with what has been addressed by Mohammad and Som ( 2010 ), that the forces/factors of travel motivation can be seen as a multi-dimensional concept. Nevertheless, travel motivation does not only look very interesting topic for marketers to better understand tourist’s motives/forces as stated earlier, but according to Chang et al. ( 2014 ), they addressed that it can also explore and understand the reasons behind why an individual intends to travel. Due to this perplexity on how to define or even describe travel motivation, then it is being referred to as a “Fuzzy Set” according to Kay ( 2003 as cited in Jarvis and Blank, 2011 ). To put it differently, despite that travel motivation may appear as a very interesting topic for many researchers, however it is a hard and dynamic concept in the tourism field/context (Chang et al., 2014 ; Mohammad and Som, 2010 ).

Travel motivation theories

By reviewing the previous literatures regarding the travel motivation, many well-known theories and frameworks were presented. These frameworks were widely used as a guide to many research studies of tourism motivation, explaining and identifying the behaviour of tourists (Sandybayev et al., 2018 ; Li et al., 2015 ; Negrusa and Yolal, 2012 ). These theories are Maslow’s Hierarchy of Human Needs (Maslow, 1943 ; 1954 , P.2), Travel Career Pattern (Pearce, 1988 , P.31), and Escape-Seeking Model (Ross and Iso-Ahola, 1991 ). They are followed then by the Push and Pull Motives (Dann, 1981 ; 1977 ), which are considered the focus of this paper.

First, Maslow’s Hierarchy of Human Needs, which is arranged in a hierarchical-composure from tackling first the most essential human-being needs to the least pressing needs. Simply put, when a person tends to fulfil and satisfy one need, then he/she will be motivated to satisfy and delight the next upcoming need (Sandybayev et al., 2018 ; Pearce and Packer, 2013 ; Negrusa and Yolal, 2012 ; Maslow, 1943 ). According to Pearce and Packer ( 2013 ) and Mohammad and Som ( 2010 ), the hierarchy of Maslow is considered the most applied framework to contribute to studying, exploring, and identifying travel motivation. Second is the Travel Career Pattern or what is merely known by Sandybayev et al. ( 2018 ) and Li et al. ( 2015 ) as the Travel Career Ladder. Travel Career Pattern showed pivotal contribution into the travel motivation literature, identifying the existence of the multiplicity of forces. In other words, it means that tourists will not be motivated by one dominant motive only, but by multiple forces, and accordingly this shows that travel motivation can be identified in patterns of multiple forces all together (Pearce and Packer, 2013 ; Jarvis and Blank, 2011 ). Additionally, a dynamic approach can be recommended to this framework. This is because of its multiplicity of forces that can be recognised in not only tourists in the tourism context, but also in people in any social ones, confirming that this framework can be effective in any motivation context (Jarvis and Blank, 2011 ).

Third is the Escapism-Seeking Model. It showed a great influence on the leisure behaviour of an individual, suggesting that escaping and seeking are the two leading and master motives that affects simultaneously individuals’ motives for leisure activities (Ross and Iso-Ahola, 1991 ). Negrusa and Yolal ( 2012 ) also explained that seeking activities are sought in trying and discovering novel and new things or places; and mainly for fulfilling the self and acquiring psychological rewards. While for the escape, it refers to the fleeing from the daily stressful environment, difficulties, and the tedious routine of life. The last theory that this study will tackle is the Push-Pull Framework. This is not the last theory when it comes to the travel motivation theories and context, it is considered the main focus of this paper.

Push and pull motives

Push and Pull motives are considered the main constructs of this study. Sandybayev et al. ( 2018 ), Li et al. ( 2015 ), and Negrusa and Yolal ( 2012 ) identified the push motives as the forces that induce individuals to go away from home. While the pull motives are the forces that pull individuals to visit a specific destination, it is the destination’s external attractions. Push and Pull motives were addressed before in various research studies, and they were seen as relevant and effective constructs to be used as a starting point for explaining why tourists intend to travel, alongside identifying their behaviours. Many researchers showed their agreement regarding these factors due to their utilisation in several tourism motivation literatures, and accordingly this concept is considered generally accepted (Dean and Suhartanto, 2019 ; Correia et al., 2013 ; Jarvis and Blank, 2011 ). Apart from this, Seebaluck et al. ( 2015 ) encouraged that the Push and Pull motives can integrate well with the above addressed theory, which is Maslow’s Hierarchy of Human Needs. Likewise, Jarvis and Blank ( 2011 ) supported that the Push-Pull motives can be adjusted by its integration with the Escapism-Seeking Model. Therefore, this shows the integration between the theories with each other to better understanding the travel motivation and behaviours.

Push motives

Push factors are considered the factors or forces that can prompt, motivate, and encourage tourists to go to a specific destination. It has also been referred to as the socio-psychological needs (Seebaluck et al., 2015 ), intangible elements or intrinsic factors (Isa and Ramli, 2014 ). These factors push tourists to travel as a way of escapism from the home-surrounding environment, daily tedious routine, and the hassle of everyday life. Hence, tourists consider that these forces can spur them to travel as a way of recharging their batteries once again; and to relax (Dunne et al., 2011 ). Ultimately, push factors are what push tourists to escape, have social interactions, and to be novelty-seekers and adventurous (Yousefi and Marzuki, 2015 ; Seebaluck et al., 2015 ; Isa and Ramli, 2014 ; Mohammad and Som, 2010 ). Several researchers also suggested other push factors that can stimulate tourists to travel and visit a specific place in mind which are: psychological health and fitness (Sandybayev et al., 2018 ; Isa and Ramli, 2014 ), knowledge (Yousefi and Marzuki, 2015 ), ego-enhancement (Seebaluck et al., 2015 ), and self-exploratory (Negrusa and Yolal, 2012 ; Mohammad and Som, 2010 ).

Jang and Cai ( 2002 ) studied the push-pull motives of British travellers and identified that knowledge-seeking was perceived as the most important push motive. Correspondingly, novelty-seeking was perceived as the core travel motivation factor that pushed Chinese visitors to travel to Hong Kong (Huang, 2010 ). This also agrees with the findings of Sangpikul ( 2009 ), discovering that the most perceived push dimensions to push Asians and Europeans to Thailand were novelty-seeking and escape and relaxation. This is similar to the results of Chen et al. ( 2023 ) study and Teng et al. ( 2023 ) study. Based on the above, this research will concentrate on the following push dimensions mentioned by Yousefi and Marzuki ( 2015 ), namely rest and relaxation, enhancing the ego, and novelty and knowledge seeking. Thus, the below hypotheses are formulated:

H1 : The push-dimension impacts internal tourists’ visit intention to a domestic destination in Egypt.

H1-1: Rest and relaxation impact internal tourists’ visit intention to a domestic destination in Egypt.

H1-2: Enhancing the ego impacts internal tourists’ visit intention to a domestic destination in Egypt.

H1-3: Novelty and knowledge seeking impact internal tourists’ visit intention to a domestic destination in Egypt.

Pull motives

Pull factors are considered the externalities of a destination that can attract tourists to travel and contribute to their desire of visiting this place. Simply speaking, pull factors come from the destination itself, what is external to tourists (Seebaluck et al., 2015 ). Pull factors are related and linked to the cognitive or situational aspects of motivation, as a way of example, destination’s landscape, hospitality, image, publicity, facilities, branding, climate, features, promotions, and marketing (Seebaluck et al., 2015 ; Correia et al., 2013 ). According to Dunne et al. ( 2011 ), the allure and fascinating attraction of the triple S or what is so called the 3’S (Sea, Sun, and Sand) are the most relevant when it comes to vacation decision-making. Some intangible and tangible elements are also included in the pull motives, for instance, biodiversity (the variety of life that has existence on earth), rivers, as well as beaches (Seebaluck et al., 2015 ). Yousefi and Marzuki ( 2015 ) argued that other factors like: destination’s heritage and historical sites, cultural appeal and charms, destination’s security, natural reserves, and safety and cleanliness of the place are regarded as externalities of a destination that can pull and attract tourists. Similarly, Seebaluck et al. ( 2015 ) added that flexibility, resilience of travelling, and travel costs are also externalities of a destination that can contribute to the traveller’s desire of visiting the destination in mind.

Jang and Cai ( 2002 ) studied the push-pull motives of British travellers and identified that cleanliness and safety were perceived as the most important pull motives. Conversely, another study found that touristic activities, attractions, and travel costs were the most considered pull factors by Asian travellers visiting Thailand, whereas European travellers were pulled by the cultural, historical attractions, touristic activities and attractions (Sangpikul, 2009 ). Based on the above, this research will concentrate on the following pull dimensions mentioned by Yousefi and Marzuki ( 2015 ), namely tourism facilities, environment and safety, and cultural and historical attractions. Therefore, the below hypotheses are formulated:

H2 : The pull-dimension impacts internal tourists’ visit intention to a domestic destination in Egypt.

H2-1: Tourism facilities impact internal tourists’ visit intention to a domestic destination in Egypt.

H2-2: Environment and safety impact internal tourists’ visit intention to a domestic destination in Egypt.

H2-3: Cultural and historical attraction impact internal tourists’ visit intention to a domestic destination in Egypt.

Mediation role: Country image

Seaton and Benett (1996 as cited in Doosti et al., 2016 ) and Fakeye and Crompton ( 1991 ) defined country image as the mental construction of city portrayal. Doosti et al. ( 2016 ) also added that country image is being constructed based on the understanding of the characteristics of the country/city. Ultimately, it is how tourists perceive the city and the overall set of impressions and beliefs of the country/city, which is mainly developed from the collection of information from multiple sources formed over the time, as a way of example, through tourists’ exposure to the TV, magazines, any non-tourism information, and touristic sources from advertisements to posters. Destination image is considered the visitors representation of the destination in their own minds, and such representation might include the climate, people of the city, or even the surrounding natural environment (Fakeye and Crompton, 1991 ).

Country’s image is very essential in attracting and getting the attention of tourists to visit the city (Kim and Lee, 2015 ). Avraham ( 2004 ) added that it also plays an essential role in improving and enhancing how people perceive this destination and its image. This agrees with Doosti et al. ( 2016 ) that improving the country’s image is affecting visitors’ visit intention positively as well as their decision-making process for a re-visit (future visitation intention). Stepchenkova and Morrison ( 2008 ) found that when US travellers had more willingness and intention to visit Russia, they had less negative image of Russia as the host country, and vice versa. This elucidates that enhancing the positive image of a destination can influence tourists’ visitation intentions. Likewise, Doosti et al. ( 2016 ) confirmed that city image is a significant predictor of visitors’ visitation intention when studying foreign visitors to Iran. Multiple studies also showed that positive country image can lead to revisit intentions too (Beerli and Martin, 2004 ; Gallarza et al., 2002 ). For instance, Kim and Lee ( 2015 ) showed that city image influenced positively the revisit intention of South Korean tourists to international cities.

H3 : Country image will mediate the relationship between travel motivation factors and visit/revisit intentions.

H3-1: Country image will mediate the relationship between travel push motivation factors and visit intention.

H3-2: Country image will mediate the relationship between travel pull motivation factors and visit intention.

H3-3: Country image will mediate the relationship between travel push motivation factors and revisit intention.

H3-4: Country image will mediate the relationship between travel pull motivation factors and revisit intention.

Visit intention and revisit intentions

Intention as a concept is considered a very broad subject and an interesting topic in consumer behaviour (Chekima et al., 2015 ). This triggered the interest of many marketers to study people’s intentions in different contexts (Goh et al., 2017 ; Chekima et al., 2015 ; Dunne et al., 2011 ; Han et al., 2010 ). In the tourism context, tourists’ visit intention is considered their subjective likelihood to engage in a certain behaviour (Chang et al., 2014 ). Additionally, visit intention is one of the steps of the travel/vacation decision-making process (Doosti et al., 2016 ), and accordingly it showed great significance in the recent years (Dunne et al., 2011 ). Martin and Woodside ( 2012 ) clarified that the travel decision making process is like a fickle and dynamic process, and it is characterised by having a series of unique and solitary, yet unstructured decisions. These decisions may be based on some unplanned or even unexpected events, including some decisions that can be inter-related that can drive an individual to the destination’s choice/selection and visitation intention. Accordingly, it is really hard to be able to predict or even explain the decision of a tourist/traveller, it is a complex phenomenon that still stimulates scholar’s curiosity and interest back in the old decades till nowadays (Dunne et al., 2011 ).

Chang et al. ( 2014 ) emphasised that tourists tend to participate and integrate in a specific behaviour after being motivated based on multiple and different reasons or even goals that need to be satisfied. This confirms that these behaviours are still hard for tourists to be explained. In line with that, Martin and Woodside ( 2012 ) stressed on keeping a sharp eye on the unconscious mind of tourists, because it can assist in interpreting the causal and associative processes that result in the selection, conclusions, and intentions/actions of tourists. Ultimately, intention is a good predictor of individuals’ behaviour, where it stimulates a person for a real commitment (Chekima et al., 2015 ). Ajzen ( 1991 ) also emphasised that intention is the best predictor when it comes to the actual commitment, since it can indicate the behaviour even if it is not deliberated or considered. On that basis, it is essential to comprehend the visit intention of tourists for the selected destination (Martin and Woodside, 2012 ), which will leave a room in the future to create successful touristic destination’s campaigns and businesses (Dunne et al., 2011 ).

As previously mentioned in the mediating role of the country image part, the relationship between city image and tourists’ visit intentions is significant, and according to Stepchenkova and Morrison ( 2008 ), they showed that enhancing the favourable image of a destination can impact tourists’ visit intention. This means that city image is a significant predictor of tourists’ visit intention (Doosti et al., 2016 ).

H4: There is significant positive relationship between country image and visit intention.

Repeating the visit to a specific place that an individual visited before is considered an essential phenomenon that needs to be considered in the tourism context (Wang, 2004 ). This is because it is more effective, in terms of the cost, to attract repeat travellers than new visitors (Chang et al., 2014 ). That is why many destinations might rely extensively on repeat travellers as emphasised by Um et al. ( 2006 ), clarifying that the cost to retain back the former group (e.g., repeat tourists) is less expensive compared with the new visitors. Additionally, it has been illustrated that repeat travellers tend to spend more, in terms of money, than first-time visitors (Chang et al., 2014 ; Lehto et al., 2004 ). For instance, when studying U.S. travellers to Canada, Meis, Joyal, and Trites ( 1995 ) showed that repeat travellers spend more across the whole duration of their travel-life cycle. Chang et al. ( 2014 ) also revealed that repeat tourists tend to stay longer compared to first-time ones. This is confirmed by Wang ( 2004 ) when he studied repeat visitation of Chinese travellers to Hong Kong. Intention is a good predictor of individuals’ behaviour, and accordingly it can promote for a real commitment. Likewise, traveller’s revisit intention is considered a good predictor of traveller’s future travel behaviour to a specific destination (Chang et al., 2014 ). Accordingly, this helps marketers and scholars to understand and predict tourist’s future commitment and behaviour (Ajzen and Driver, 1992 ).

As addressed earlier in the country image section, many research studies showed positive and significant relationship between city image and re-visit intentions (Beerli and Martin, 2004 ; Gallarza et al., 2002 ). Kim and Lee ( 2015 ) also agreed on this, showing that city image is significant in predicting the re-visit intention of South Korean visitors to international destinations/cities.

H5: There is significant relationship between country image and revisit intentions.

H6: Push-Pull motives have a positive influence on tourists’ revisit intentions.

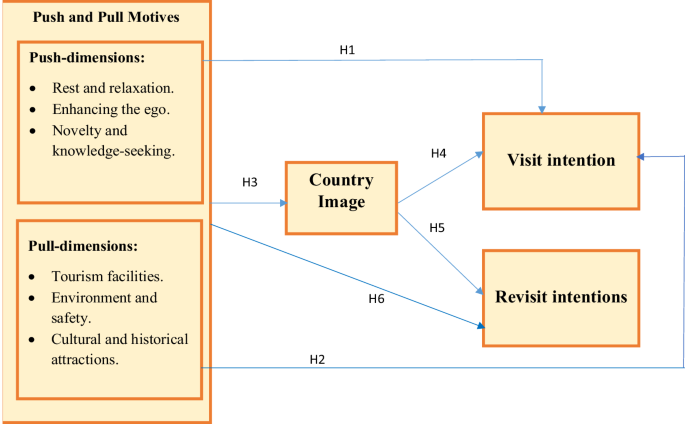

The study analytical model

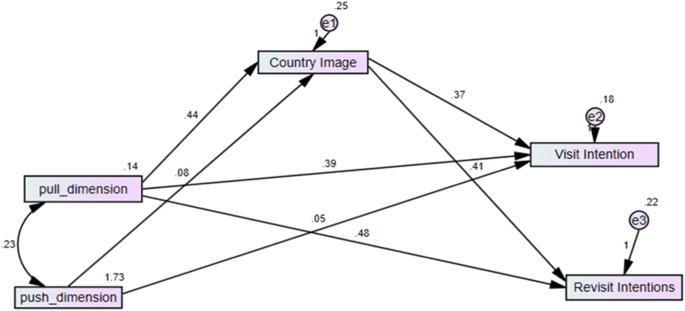

Based on the above literature reviewed, the relationships between the independent and dependent variables are presented in the below conceptual model (Fig. 1 ) of this research. This conceptual framework is going to discover which is the most push-dimension and the most pull-dimension, from the listed dimensions that this paper will tackle, that have a great influence on the visit intention of internal tourists to a domestic destination in Egypt (H1 and H2). It will also figure out the impact of the push-pull motives on the revisit intention of internal tourists to a domestic destination in Egypt (H6). In addition to the country image that positively mediates the relationship between push-pull dimensions and visit and re-visit intentions (H3, H4, and H5).

The figure shows the relationships between the push motivational factors (rest & relaxation, enhancing the ego, and novelty & knowledge-seeking) and pull motivational factors (tourism facilities, environment & safety, and cultural & historical attraction) on internal tourists’ visit and revisit intentions; the mediation role of the country image in the relationship between the independent variables (push & pull motives) and the dependent variables (visit & revisit intentions).

Methodology

The measurement of constructs.

The items’ relevance to measuring the variable was confirmed through a pilot study involving three experts. Subsequently, the study instruments underwent pretesting consisting of 30 participants to modify and refine items clarity of words and sentences, no changes were recommended based on the results. In March 2022, a self-administered questionnaire was disseminated in Cairo -capital city of Egypt. It included multiple sections to measure the independent, dependent, and mediator variable used in this research (Push-Pull motivational factors, visit and revisit intentions, and country image). In addition to the socio-demographic data collected to provide more information on the respondents’ profile.

The survey consisted of close-ended questions, and the Egyptian internal tourists (respondents of this study) were exposed to six sections: the first section designed to obtain general information on travel characteristics. The second section identified the push and pull travel motivations, where 19 push and 18 pull motivational items were presented. Questions were developed based on a comprehensive review of travel motivation past studies, where the items got selected and adapted from Yousefi and Marzuki ( 2015 ), Hsu and Huang ( 2008 ), Sangpikul ( 2009 ), Jang and Wu ( 2006 ), and Hanqin and Lam ( 1999 ). The third section obtained data on the country image, that was measured by four items adopted from Chi and Qu ( 2008 ), following the studies of Jalilvand and Samiei ( 2012 ) and Jalilvand et al. ( 2013 ). The fourth section obtained data on the visit intentions that was measured by four items scale adopted from Usakli and Baloglu ( 2011 ). These sections were presented in a statement format and assessed on a five-point Likert scale, ranging from 1 (means strongly disagree) to 5 (means strongly agree). Respondents were also exposed to the last two sections: the fifth section obtained data on the re-visit intentions, where respondents got asked to rate their revisit intentions to different destinations in Egypt. Three items were selected from Deslandes ( 2003 ) for their reliability and adapted to fit the context of this research. The sixth and last section obtained data on the socio-demographics, where respondents required to provide some personal details regarding their profile (like gender, age, marital status, income, occupation, educational level, travel companion, accommodation, and nationality).

Sampling and data collection

This study tests the hypotheses and research framework by means of questionnaire survey with an extensive literature review. The research object of this study is Egyptian internal tourists. The questionnaire was sent to the randomly selected consumers.

Due to the fact that the tourists’ segment in Egypt exceeds 1 million according to the Central Agency for Public Mobilisation and Statistics -CAPMAS ( 2021 ); therefore, the sample size will be 384 respondents according to the Uma Sekaran table (Sekaran, 2003 ). In total, 385 responses were received, (70.2%) females and (29.8%) males. In total, 36 cases were deleted because of incomplete answers, which generated 349 usable responses to proceed for analysis, around (7.2%) are aged between 18 and 24 years, almost (31.2%) between 25 and 34, (36.7%) between 35 and 44, (20.9%) between 45 and 54, (3.4%) between 55 and 64, and (0.6%) above 64 years. This shows that younger generation are more involved in domestic tourism. In terms of education, around (4.9%) from Secondary/Diploma, (2.6%) earned High School degree, (33.8%) had an Undergraduate degree, and (58.7%) had a graduate degree. In terms of Job level, around (18.3%) were businessperson, (47.2%) were employees, (31%) were unemployed, and (3.5%) retired. In terms of travel companion, almost (62.5%) travel with family, around (24.9%) travel with friends, (4.6%) travel for work, around (4.9%) travel alone, and around (3.2%) travel with other companions. Regarding the marital status (7.2%) were single, (85.4%) were married, (6.6%) are widowed, and (0.9%) were divorced.

Statistical analysis and results

Table 1 indicates that the questionnaire is reliable as the Cronbach’s alpha and average inter-item correlation coefficient for all items greater than (0.7), ranging from 0.732 (ego-enhancement) to 0.811 (novelty and knowledge seeking), emphasising a good level of internal consistency (Nunnally and Bernstein, 1994 ). AVE value for all items greater than 0.5, ranging from 0.600 (revisit intention) to 6.83 (country image). AVE values above 0.50 are considered to be adequate (Hair et al., 2006 ).

Descriptive statistics of variables

From Table 2 , the average of all variables is between 3 and 4 which mean that respondents are tend to neutrally and agree to most of the statement that measure these variables. The variable with highest agreement is the novelty and knowledge seeking and country image while the variable with least agreement is the tourism facilities and environment and safety. As overall push dimensions have higher agreement than pull dimensions.

Correlation analysis

In this subsection the correlation analysis between the variables of the study is presented. From Table 3 below, it is clear that with confident (95%) that there is positive significant correlation between country image, visit intention, revisit intentions and each of push dimensions and pull dimensions, as the p value associated with them less than (5%). However, the correlation with push dimension is higher than the correlation with pull dimension.

ANOVA test results

The p value equals 0.000 which is significant (less than 0.05)as shown in Table 4 . This means that the proposed model predicts the dependent variable better than the intercept-only model (model with no predictors).

Coefficients summary

The following table (Table 5 ) summarise the included and excluded variables listed with significance and coefficients. The significance of the included variables is less than (0.05) which indicates that 4 variables out of 6 have significant influence on the visit intention, this with confident (95%). The significance of the excluded variables is greater than (0.05) which indicates that 2 variables out of 6 have no influence on the visit intention, with confident (95%).

Novelty and knowledge have significant positive impact on visit intention, this with confident (95%). The p value is 0.000 (less than 0.05) and β coefficient equals 0.393, which accept the alternative hypothesis (H1-3). Thus, novelty and knowledge have significant positive impact on visit intention, this with confident (95%), and controlling for other variables.

Ego-enhancement has significant positive impact on visit intention, this with confident (95%). The p value is 0.029 (less than 0.05) and β coefficient equals 0.153, which accept the alternative hypothesis (H1-2). Thus, Ego-enhancement has significant positive impact on visit intention, this with confident (95%), and controlling for other variables.

Rest and relaxation have insignificant impact on visit intention, this with confident (95%). The p value is 0.107 (larger than 0.05). Thus, rest and relaxation have insignificant impact on visit intention, this with confident (95%), and controlling for other variables which reject the alternative hypothesis (H1-1).

Cultural and historical attraction have significant positive impact on visit intention, this with confident (95%). The p value is 0.000 (less than 0.05) and βcoefficient equals 0.248, which accept the alternative hypothesis (H2-3). Thus, Cultural and historical attraction have significant positive impact on visit intention, this with confident (95%), and controlling for other variables.

Environment and safety have significant positive impact on visit intention, this with confident (95%). The p value is 0.048 (less than 0.05) and β coefficient equals 0.108, which accept the alternative hypothesis (H2-2). Thus, Environment and safety have significant positive impact on visit intention, this with confident (95%), and controlling for other variables.

Tourism facilities has insignificant impact on visit intention, this with confident (95%). The p value is 0.139 (larger than 0.05). Thus, tourism facilities have insignificant impact on visit intention, this with confident (95%), and controlling for other variables which reject the alternative hypothesis (H2-1).

From the standardised coefficient, the variable with highest effect on visit intention is Novelty and knowledge seeking.

Regression model summary

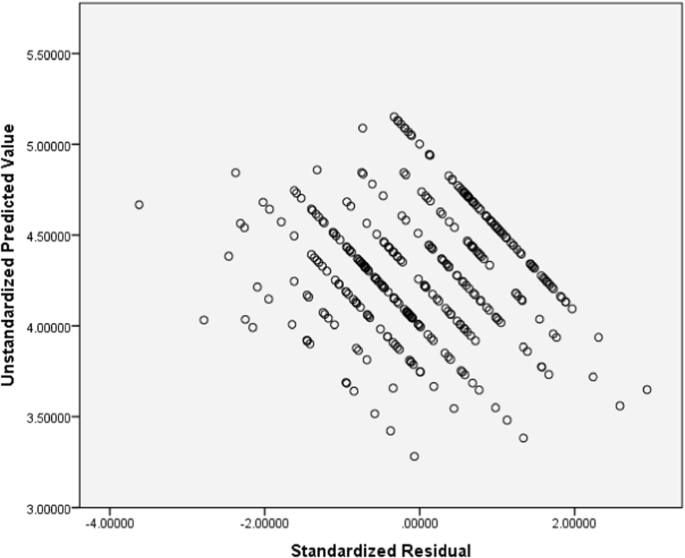

Table 6 shows that the Adjusted R 2 value of 0.989 indicates the fit of the model. The proposed model could infer 98.9% of the total variance in the visit intention.

From the value of Durbin Watson, there is no serial autocorrelation between residuals, as the value is near to 2. No serial auto correlation is one of the assumptions of the regression model.

Linearity assumption was checked to ensure that model results are reliable, from the graph below (Fig. 2 ) points are random then linearity satisfied.

The figure represents the linearity assumption. The linearity was checked to ensure that model results are reliable. The graph shows that points are random then linearity satisfied.

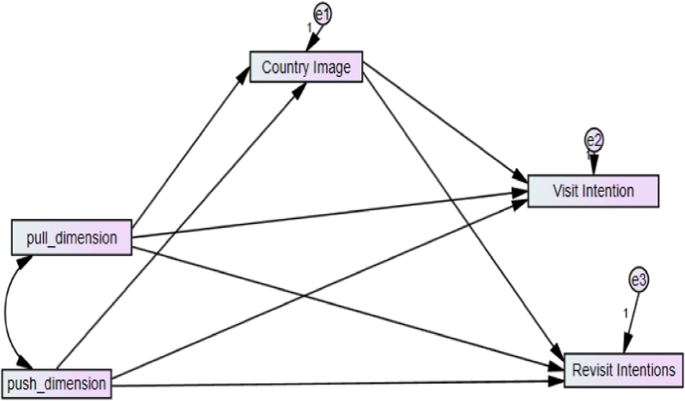

The H3, H4, H5, H6 hypotheses are answered using SEM and path analysis, then the following path model will be estimated as in Fig. 3 .

SEM is used to assess hierarchical relationship between some variables, as testing for mediating effect in a model.

From Table 7 , we can conclude that push dimension has insignificant effect on revisit intentions this with confident (95%) as p-value larger than (5%), then this path is removed, and the model will be estimated again.

Second and final step

The following table (Table 8 ) and path model (Fig. 4 ) present the results of the final estimated path model, and from it we can conclude that:

The results show that pull dimension and push dimension has direct positive impact on country image and this effect = 0.444, 0.078 respectively and this with confident (95%) as the p value associated with them is less than (5%).