- Share full article

Advertisement

Supported by

No Nation in the World Is Buying More Planes Than India. Here’s Why.

While most Indians travel by road or rail, the country is engaged in a major expansion of its aviation industry to serve the needs of its middle class.

By Alex Travelli and Hari Kumar

Reporting from New Delhi and Darbhanga, India

No nation in the world is buying as many airplanes as India. Its largest airlines have ordered nearly 1,000 jets this year, committing tens of billions of dollars to a spending spree that is unparalleled in aviation. In New Delhi, Indira Gandhi International Airport will be ready for 109 million passengers next year, as it prepares to become the world’s second busiest, behind Hartsfield-Jackson Atlanta International Airport in the United States.

And this is happening in a vast country still heavily reliant on trains — with 20 journeys by rail for every one by air.

The enormous aviation build-out, with a surge of investment behind it, has pride of place in India’s case for a greater standing on the world stage. As it moves up the ranks of the world’s biggest economies, India is scrambling to meet the expanding ambitions of its ascendant middle class. Its airports present highly visible achievements.

Air travel remains out of the financial reach of most Indians. An estimated 3 percent of the country’s population flies on a regular basis. But in a nation of 1.4 billion people, that percentage represents 42 million — executives, students and engineers who yearn to get quickly from here to there inside India’s borders, and to gain easier access to destinations beyond, for both business and vacation.

Kapil Kaul, the chief executive of CAPA India, an advisory firm focused on aviation, calls “the next two to three years critical for achieving the quality of growth that India desires and deserves.” Growth has so far been profitless. Now Indian aviation must prove it can make money.

The effects of the spending spree should redound across India’s economy. Cargo comes with passenger traffic, and foreign investment tends to follow closely behind, Mr. Kaul said.

Arrivals to the international terminal at Indira Gandhi Airport are greeted by a wall of giant sculptural hands, their fingers and palms folded into gestures used by the Buddha, looking both ancient and futuristic. In 2012, when they were installed, 30 million passengers passed through the airport. By the time the airport has expanded to its new capacity, another one will have been built from scratch on the other side of the city.

Indira Gandhi Airport is racing to get bigger. In July it added a fourth runway and opened an elevated taxiway. The company that operates it, GMR Airports, took over in 2006, a time when all arrivals walked past cows lazing in the dust to reach a taxi stand. By 2018 the facility was rated as India’s most valuable infrastructural asset. To spare the use of jet fuel, a battery-powered TaxiBot lugs idling planes around the tarmac. An automated luggage-handling system can sort 6,000 bags an hour.

Two beneficiaries of India’s expanding aviation market are the world’s largest airplane makers: Boeing in America and Airbus in Europe. In February, Air India, which the Tata Group took private last year, agreed to buy 250 planes from Airbus and 220 from Boeing, worth a combined $70 billion. In June, IndiGo, the country’s biggest carrier by passengers and flights, ordered 500 new Airbus A320s.

The bulk of the growth of Indian aviation has been among homegrown airlines, which have clocked a 36 percent increase in passengers since 2022. Foreign tourist arrivals are rebounding since the pandemic, but are still relatively scarce, barely topping 10 million in a good year (about the same as Romania). So low-cost carriers are adding new countries to their destinations in order to accommodate India’s demand for foreign tourism. Azerbaijan, Kenya and Vietnam are all a direct flight from Delhi or Mumbai, India’s financial capital, for less than 21,000 rupees, or $250, one way.

The air corridor between Delhi and Mumbai was already one of the world’s 10 busiest. Like Delhi, Mumbai has new airport terminals that would be the envy of any city in America, not to mention the glorious new all-bamboo Terminal 2 at Kempegowda International Airport in Bengaluru, a city in southern India. But the expansion in infrastructure is not limited to the country’s premier metropolitan areas.

Prime Minister Narendra Modi’s government likes to point out that the number of airports has doubled in the nine years since he took office, to 148 from 74. Jyotiraditya Scindia, Mr. Modi’s aviation minister, said there would be at least 230 by 2030. The government has invested more than $11 billion in airports over the past decade, and Mr. Scindia has promised another $15 billion.

That means that sleepy towns like Darbhanga, a former principality in the impoverished state of Bihar in eastern India, now have nonstop access to Delhi, Bengaluru and beyond. For many of the 900 travelers a day who fill its flights, including plenty from nearby Nepal, the new airport has transformed the journey.

Prasanna Kumar Jha, 52, was born in Darbhanga but works in Delhi as a tax consultant. “Who ever expected that Darbhanga would be on the air map?” he asked. Flying to his hometown on short notice to see his ailing mother cost him 10,500 rupees ($126), which pinched.

“But if you calculate the alternative — by train from Delhi and then taxi to Darbhanga — it will take at least 30 hours,” he said. “The plane journey is no longer a luxury but a necessity.”

Darbhanga’s airport is a far cry from New Delhi’s. There is no parking lot. Passengers walk from the edge of a highway past a checkpoint to wait on benches outside the terminal. Then they wait on another set of outdoor benches after clearing the security check. But it works.

Another passenger on the same flight at Darbhanga, Ajay Jha, was cradling his 1-year-old daughter, Saranya, as he stood near the rudimentary baggage claim. His family was on the last leg of a trip that started in Bellevue, Wash., where he works as an engineer for Amazon, to a family reunion in the Bihari countryside. Traveling halfway around the world took less time than Mr. Jha used to spend getting home from his school in Bengaluru.

Yet a vast majority of Indians cannot afford such conveniences. The annual mean income is still less than a single economy-class fare from the United States, and, in this top-heavy economy, most Indians earn much less than that. Middle class, in Indian parlance, indicates somewhere close to the top of the pyramid.

A report by CAPA India, the aviation analysis firm, counted just 0.13 passenger seats per capita in 2019 for Indians, compared with 0.52 for Chinese and 3.03 for Americans. But aviation companies and India’s elected officials look at the low penetration and see opportunity.

A scarcity of competition, in the face of an emerging duopoly between IndiGo and the Tata-led airlines, is one of the new landscape’s most striking features. Smaller competitors keep going bust, most recently Go First, which declared bankruptcy in May. A shortage of pilots, after dozens were poached by bigger companies, forced Akasa Air, a promising upstart, to cancel flights in August.

But supply shortages are not the worst kind of problem to have in today’s global economy. With aviation’s growth in the decade before the pandemic steady at about 15 percent a year, the Indian boom seems all but guaranteed to change the future of aviation worldwide. If the benefits accruing to the winners in India’s economy can be coaxed into trickling outward and downward, the same could go for many other sectors.

An earlier version of this article misidentified the Airbus planes ordered by IndiGo. They are A320s, not A230s.

How we handle corrections

Alex Travelli is a correspondent for The Times based in New Delhi, covering business and economic matters in India and the rest of South Asia. He previously worked as an editor and correspondent for The Economist. More about Alex Travelli

Hari Kumar is a reporter in the New Delhi bureau. He joined The Times in 1997. More about Hari Kumar

- Screen Reader

- Skip to main content

- Text Size A

- Language: English

- Case Studies

- EXIM Procedure

Media & Events

- Image Gallery

- Media Coverage

Other Links

- GI of India

- Experience India

- Indian Trend Fair 2022

- India Organic Biofach 2022

- Gulfood Dubai 2023

Rise of the Indian Aviation Market

Recent case studies.

India has become the third-largest domestic aviation market in the world and is expected to overtake the UK to become the third-largest air passenger market by 2024. Indian aviation also contributed 5% of the GDP, creating a total of 4 million jobs. In addition to it, there is a US$ 72 billion gross value-added contribution to GDP by this industry.

The advantages and significance of the aviation sector can be highlighted by the following ideas:

- The aviation sector offers global connection, which is crucial for advancing international trade and business. Further, it greatly influences how a nation's economy is shaped by linking it to other nations and continents.

- It also plays a crucial role in promoting tourism by offering a robust transportation network. The promotion of the tourism industry also helps the economy and employment sector both domestically and globally. Everyone is aware of how the pandemic affected our social lives as well as how the global economy suffered. People get familiar with other people's religions, practices, and cultures as a result of travel. In addition, it also fosters a sense of integrity and cohesion among people.

- The aviation sector has played an important role in natural catastrophes or even in conflicts. During times of famine, supplies, human transport, and food are all handled by the aviation sector. In addition, a specially outfitted plane responds to forest fires and even protects crops by spraying pesticides and fertilizer on them.

- The aviation industry not only transports passengers from place to place but also greatly contributes to the transportation of all types of cargo around the world.

India has a vast history in the field of aviation. During the initial years of the Indian aviation industry, the operations of air transport were entrusted to three public undertakings, namely:

- Air India for international services

- Indian Airlines for domestic services and services to neighbouring countries

The improved connectivity across the globe has contributed to the growth of the aviation sector at a faster rate. There have been a lot of changes since the inception of the sector, but despite all these, it has always proved its value and considerable power. These values continue to increase because of the vast geographical coverage of the country and the continuous industrial growth. Economic growth, along with the rising working class of the Indian middle class, also contributes to the industry and as a result, the Indian government is planning to set up new airports 220 by 2025.

The government is focussing on building infrastructure with the support of the private sector to make it more feasible with collaboration. Nearly US$ 11.8 billion (INR 98,000 crores) over a four-year period would be spent by the Ministry of Civil Aviation on the construction of new greenfield airports and the development of existing brownfield airports. Out of this, the private sector will contribute US$ 7.5 billion (INR 62,000 crores), while the Indian government will invest US$ 4.3 billion (INR 36,000 crores) through AAI.

Growth of Aviation Sector in India In India, remarkable growth has been noticed in the sphere of civil aviation. The speed and carrying capacity of modern aircraft are providing commendable and far beyond what we used to experience decades ago. India is already among the top 10 aviation markets, serving over 83 million domestic passengers annually, and the volume of air traffic, both in terms of passengers and goods, is growing at a good pace. During April-September 2022, domestic freight traffic increased by 19.9% as compared to the same period of last year.

Here are some of the key facts explaining the growth of Indian aviation:

- During the month of September 2022:

- A total of 197.25 thousand aircraft movements (domestic & international) were reported, registering a growth of 34.3% from the previous year

- Passenger traffic was registered at 24.94 thousand, an increase of 61.6% from the previous year

- India’s airport capacity is expected to handle 1 billion trips annually by 2023

- India’s domestic traffic makes up 69% of the total airline traffic in South Asia. Total passenger traffic across the country during April- September 2022 was 150 million.

- There has been a growth of over 33% in the number of passengers carried by Indian domestic carriers in 2021 as compared to 2020. (838.14 lakh passengers in 2021 while 630.11 lakh passengers in 2020).

- The country now has about 140 airports, up from 74 in 2013-2014 (including Heliports and water domes). By 2024-2025, the number is expected to reach 220.

- In 2013-14, there were 400 aircraft in the nation and currently, there are 710 aircraft with more than 100 planes expected to join each year.

- The Ministry of Civil Aviation (MoCA) stated that it is likely to employ 1 lakh more people by 2024, which shows an increase in direct employment from 2.5 lakhs to 3.5 lakhs.

Some of the key factors which will drive the growth of the aviation sector are mentioned below:

1) Higher Household Income As the GDP of India grew 8.7% in FY 2022 after a contraction of 6.6% during the previous fiscal year, there has been more business travel by professionals and greater leisure travel by individuals due to increasing income groups which drive the consumption pattern in India and primarily based out of urban areas, contributing more to the aviation industry.

2) Entry of Low-cost Carriers (LCC) This is the model which has made air travel affordable for the common man and has been operating in the domestic market since 2004. The market suggests that this model is driving domestic traffic and thus, has shown strong operational performance over the years.

3) Increased FDI Inflows The inflow of FDI contributes to the better development of the infrastructure of the aviation industry.

- Up to 100% FDI in civil aviation in India is permitted in Non-scheduled air transport services under the automatic route

- Up to 100% FDI is permitted in helicopter services and seaplanes under the automatic route

- Up to 100% FDI is permitted in MRO for maintenance and repair organizations; flying training institutes; and technical training institutes under the automatic route

- Up to 100% FDI in the aviation sector is permitted in Ground Handling Services subject to sectoral regulations & security clearance under the automatic route

4) Increased Tourist Inflows With the increase in the tourism industry, air travel growth has also increased over the years. For Foreign Tourist Arrivals (FTA), air travel is the most chosen mode of transportation. In 2021, out of 1.52 million FTAs in India, 87.5% of individuals entered via air routes, 11.8% via land routes, and 0.7% via sea routes. Around 53.6% of FTAs arrived in India through the Delhi and Mumbai airports. In 2021, tourism's foreign exchange earnings (FEE) were US$ 8.7 billion compared to US$ 6.958 billion in 2020, registering a growth of 26.4%.

5) Development of Modern Airports with New Technologies Modern airports come up with developed infrastructure in terms of speed, capacity, sustainability goals, etc, and hence contribute more to the aviation industry. One of the examples is the newly opened greenfield international airport at Mopa in the state of Goa. It has been developed with an investment of US$ 348 million, the first phase of Mopa International Airport will handle around 4.4 million passengers per annum which can be extended to a saturation capacity of 33 million passengers per annum. This airport has been developed with several sustainable infrastructure plans, including a solar power plant, green buildings, LED lights on the runway, rainwater harvesting, and a modern sewage treatment plant with recycling facilities.

6) Supporting Government Policies Government interventions play a major role in the development of the aviation industry in India. One of the schemes launched by the government in support of the growth of aviation was the UDAN (Ude Desh Ka Aam Nagrik) scheme which was released in June 2016 with the motive of offering half of the flights at subsidized fares and is expected to be in process for a period of 10 years (till 2026).

Click here for more information.

Not a member

Growth of 42.85% in Passengers Carried by Domestic Airlines

monthly growth rate in last one year stands at 22.18% the overall cancellation rate of flights has been only 0.47%.

Remarkable growth in the number of passengers carried by domestic airlines has been noticed. According to the traffic data submitted by various domestic airlines, the number of passengers reached a record-breaking 503.92 lakhs, marking a substantial annual growth of 42.85% compared to the corresponding period of the previous year which was 352.75 lakhs passengers.

This remarkable surge in passenger number reflects the robustness and resilience of India's aviation industry, showcasing the ongoing efforts to enhance connectivity and provide convenient travel options to the citizens of our nation. The increased passenger figures indicate a growing demand for air travel and highlight the positive trajectory of the aviation sector.

Furthermore, the MoM growth rate between April 2022 and April 2023 has increased by 22.18%, underscoring the sustained momentum of the domestic airline industry. This consistent growth is a testament to the collective efforts of airlines, airports, and the Ministry of Civil Aviation in fostering a safe, efficient, and customer-centric aviation ecosystem.

In addition to the commendable growth in passenger numbers, the overall cancellation rate of scheduled domestic flights for the month of April 2023 remained at an impressively low rate of 0.47%. Also, the number of complaints per 10,000 passengers carried for the month of April 2023 has been at a low of around 0.28. This achievement is a result of the meticulous planning, operational efficiency, and proactive measures taken by the Ministry of Civil Aviation and airlines also who have ramped up their operations despite the two-year COVID-19 slowdown to ensure a seamless travel experience for passengers.

According to Shri Jyotiraditya M. Scindia, Union Minister of Civil Aviation and Steel, "The efforts of all involved have been instrumental in driving the growth of the aviation sector and positioning India as a global aviation hub. We are delighted to witness the steady expansion of the domestic airline industry, which not only strengthens our economy but also connects people across the country. The Ministry remains dedicated to fostering a conducive environment for the aviation industry to thrive and will continue to collaborate with stakeholders to facilitate sustainable growth and ensure the highest standards of safety, efficiency, and passenger satisfaction”.

Subscribe Now! Get features like

- Latest News

- Entertainment

- Real Estate

- Solar Eclipse Live Updates

- MI vs DC Live Score

- Election Schedule 2024

- Win iPhone 15

- IPL 2024 Schedule

- IPL Points Table

- IPL Purple Cap

- IPL Orange Cap

- Bihar Board Results

- The Interview

- Web Stories

- Virat Kohli

- Mumbai News

- Bengaluru News

- Daily Digest

India's air travel expected to double in next decade: Report

India's passenger market is the world's third-largest. Its economy is predicted to grow at 5 per cent annually through the forecast period, the highest of any emerging market.

Aerospace major Boeing on Wednesday forecast strong aviation growth in India due to the country's growing economy and an expanding middle class, fueling demand for more than 2,200 new jets valued at nearly 320 billion dollars over the next 20 years.

Boeing shared its India forecast as part of its annual Commercial Market Outlook (CMO) which anticipates resilient long-term demand for commercial airplanes and services.

Although the Covid-19 pandemic sharply reduced Indian air travel last year, the country's domestic passenger traffic is recovering more rapidly than in most other countries and regions, recently reaching 76 per cent of pre-pandemic levels.

While Covid-19 remains a near-term challenge, the country's passenger traffic is forecast to outpace global growth, doubling from pre-pandemic levels by 2030, according to the CMO.

India air cargo growth is expected to average 6.3 per cent annually over the next 20 years, driven by India's manufacturing and e-commerce sectors. The 'Make in India' initiative is expected to support the above-global average cargo traffic growth in the Indian domestic market.

Boeing Managing Director of regional marketing David Schulte said Indian carriers have opportunities for growth in international markets.

"Several airlines have started or plan to start non-stop routes between India and North America to serve a passenger preference for direct service flights" he added.

India's civil aviation industry will require nearly 90,000 new pilots, technicians and cabin crew personnel during the 20-year forecast period, with a growing number of women choosing to pursue aviation careers.

"India's burgeoning manufacturing and services business means the region is uniquely positioned to become a major aerospace hub," said Salil Gupte, President of Boeing India.

"We remain committed to partnering across India to develop the nation's aerospace ecosystem, as continued investment in the civil aviation infrastructure and talent will enable sustained growth" he added.

Globally, Boeing projects the need for 43,110 new commercial airplanes and demand for aftermarket services to be equivalent to 9 trillion dollars over the next two decades.

- Covid-19 Pandemic

Join Hindustan Times

Create free account and unlock exciting features like.

- Terms of use

- Privacy policy

- Weather Today

- HT Newsletters

- Subscription

- Print Ad Rates

- Code of Ethics

- Elections 2024

- India vs England

- T20 World Cup 2024 Schedule

- IPL Live Score

- IPL 2024 Auctions

- T20 World Cup 2024

- Cricket Players

- ICC Rankings

- Cricket Schedule

- Other Cities

- Income Tax Calculator

- Budget 2024

- Petrol Prices

- Diesel Prices

- Silver Rate

- Relationships

- Art and Culture

- Telugu Cinema

- Tamil Cinema

- Exam Results

- Competitive Exams

- Board Exams

- BBA Colleges

- Engineering Colleges

- Medical Colleges

- BCA Colleges

- Medical Exams

- Engineering Exams

- Horoscope 2024

- Festive Calendar 2024

- Compatibility Calculator

- The Economist Articles

- Explainer Video

- On The Record

- Vikram Chandra Daily Wrap

- PBKS vs DC Live Score

- KKR vs SRH Live Score

- EPL 2023-24

- ISL 2023-24

- Asian Games 2023

- Public Health

- Economic Policy

- International Affairs

- Climate Change

- Gender Equality

- future tech

- Daily Sudoku

- Daily Crossword

- Daily Word Jumble

- HT Friday Finance

- Explore Hindustan Times

- Privacy Policy

- Terms of Use

- Subscription - Terms of Use

- The Sky’s the Limit: India's Growing Aviation Industry

- Team India Blogs

India's aviation industry has undergone significant growth and transformation over the past decade. In the early 2000s, air travel in India was a luxury, only accessible to the affluent few. Today, India has become the third-largest domestic market in the world, behind only the United States and China, with more people choosing to travel by air than ever before. The domestic air traffic has again picked up pace during FY22-23 and is expected to reach around 97 percent of the pre-covid level.

In the past eight years, the number of operational airports in the country has risen from 74 to 140. The government plans to develop and operationalise 220 airports in the next five years. India is currently the seventh largest civil aviation market in the world and is expected to become the third-largest civil aviation market within the next 10 years.

The growth of the Indian aviation industry has been driven by a combination of factors, including liberalisation of the sector, increased competition, and government initiatives to boost air connectivity. One of the primary drivers of growth in the Indian aviation industry has been the liberalisation of the sector. In the 1990s, the Indian government opened up the aviation industry to private players, which led to the entry of several new airlines. Today, there are several major players in the Indian aviation industry, including IndiGo, SpiceJet, Air India, and Vistara. Another factor that has contributed to the growth of the Indian aviation industry is increased competition. The entry of low-cost carriers like IndiGo and SpiceJet has made air travel more affordable for a larger portion of the population. This has led to an increase in passenger traffic, particularly on domestic routes. In addition, airlines have introduced various incentives and loyalty programs to attract and retain customers.

The Indian Government is proactively supporting the aviation sector by providing a stable policy environment and incentivising competition-led growth. The Government has approved the 'Revival of unserved and under-served airports' scheme for the revival and development of 100 unserved and under-served airports, helipads, and water aerodromes by 2024. KrishiUdan 2.0 is a scheme that focuses on transporting perishable food products from hilly areas, north-eastern states, tribal areas, and other areas. 58 airports have been identified under this scheme to incentivize movement of air cargo. The Airports Authority of India (AAI) and other airport developers have taken up the development of new and existing airports with a projected capital expenditure of approximately INR 98,000 crore in the next five years. The Union Budget 2023-24 allocated an amount of INR 1,244.07 crore for Regional Connectivity Scheme (UDAN). The National Civil Aviation Policy is another initiative aimed at promoting growth in the aviation sector by providing incentives for the development of airport infrastructure, reducing taxes, and simplifying regulations. With up to 100 percent FDI permitted in Greenfield and existing airport projects and for MRO (maintenance and repair organisations) under the automatic route, India is attracting investors to the sector.

Air India made a historic announcement on 14 February 2023 by signing a deal with Boeing and Airbus to buy 470 aircraft worth $ 70 billion, marking the largest order in aviation history. This is also Air India's first order since 2005, and comes at a time when the Indian aviation industry is seeing a surge in passenger traffic.

Looking ahead, the future of the Indian aviation industry is bright. The sector is expected to see significant growth in the coming years, particularly in the areas of international travel and cargo. The government's continued efforts to boost air connectivity and infrastructure development are expected to further drive the growth of the sector. Additionally, technological advancements, such as the use of artificial intelligence and automation, are expected to bring greater efficiency and cost savings to the industry.

- https://www.business-standard.com/article/current-affairs/number-of-operational-airports-in-country-rises-to-140-from-74-in-2014-122121000351_1.html

- https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1895744

- https://www.financialexpress.com/budget/budget-to-civil-aviation-ministry-reduced-to-rs-3113-36-crore-in-fy-2023-24-a-look-at-details-of-fund-allocation-2969329/

- https://pib.gov.in/PressReleasePage.aspx?PRID=1776087

- https://www.cnbctv18.com/aviation/explained-air-india-boeing-deal-impact-on-india-aviation-industry-15948831.htm

We are India's national investment facilitation agency.

For further queries on this subject, please get in touch with us @Invest India. Raise your query

What are you looking for?

Most popular topics.

- Sustainability

- Flight Operations Solutions

- Flight Hour Services (FHS)

24 March 2022

India aircraft demand seen at 2,210 over next 20 years.

- Passenger traffic to grow at 6.2% annually over the next two decades

- Fleet will need 1,770 new small* and 440 medium and large** aircraft

- India will need additional 34,000 pilots; 45,000 technicians by 2040

Hyderabad, March 24, 2022: India will require 2,210 new aircraft over the next 20 years, according to Airbus’ latest India Market Forecast. That fleet could comprise 1,770 new small and 440 medium and large aircraft.

Over the next decade, India will grow to have the largest population in the world, its economy will grow the fastest among the G20 nations, and a burgeoning middle class will spend more on air travel. As a result, passenger traffic in India will grow at 6.2% per annum by 2040 , the fastest among the major economies and well above the global average of 3.9%.

India has witnessed an upward trend in the growth of air traffic over the last ten years – with domestic traffic growing almost threefold and international traffic more than doubling. On international routes, India has only about 1/10th of the widebody fleet installed in similar markets, depriving homegrown carriers of a larger share of the profitable long-haul routes now dominated by foreign airlines.

“We have seen India’s domestic market develop strongly with our flagship A320 aircraft. It is time now for Indian carriers to unlock the potential of international travel in and out of India, leveraging the country’s demographic, economic and geographic dividends,” said Rémi Maillard, President and MD, Airbus India & South Asia.

“Whether it is expanding existing airlines or supporting new airlines, there must now be a re-fleeting and rethinking about future-oriented solutions with technology that paves the way for sustainable long-range travel. The A350 is the perfect solution for that,” Maillard said, announcing the India Market Forecast on the opening day of the Wings India air show being held at Hyderabad from March 24 to 27, 2022.

To serve its growing aviation industry, India will require an additional 34,000 pilots and 45,000 technicians by 2040.

The complete Airbus product line comprises the only aircraft specifically designed for the small single-aisle market, the A220, the world’s best-selling A320 Family, the mid-size widebody A330/330neo and the Long-Range Leader, the A350. In the freight market, Airbus aircraft are available with the A320/321P2F (Passenger to Freighter), the A330-200F and A330P2F as well as the world's newest freighter, the A350F .

Airbus India highlights:

- New aircraft needs: 1,770 small, 440 medium and large

- 6.2% annual growth in passenger traffic (global average 3.9%)

- New pilot needs: 34,000; New technician needs: 45,000

- About 64% backlog order share; 74% of in-service fleet

- Airbus will deliver more than one aircraft to India every week for the next 10 years

- Airbus supports 7,000 jobs, including about 1,650 engineers in India

- Annual sourcing from India at more than US$650 million

*Small: Domestic-type operation

**Medium and Large: Regional international and long haul operation

Your contact

Krittivas Mukherjee

Head of Communications - Airbus India & South Asia

Manager Communications - Airbus India

Justin Dubon

External Communications - Airbus Commercial Aircraft

- Global Market Forecast

- Wings India

Related news

GlobalX chooses Airbus’ Skywise Health Monitoring Services for its Growing All-Airbus Fleet

Getting ready for A350 cabin retrofits

Korean Air finalises order for 33 A350s

The Economic Times daily newspaper is available online now.

India is flying high again: domestic numbers touching pre-pandemic levels.

In terms of passenger revenue kilometres, the domestic aviation market was a mere 2.2 per cent shy of reaching pre-pandemic levels, shows a report by an industry body. Revenue Passenger Kilometers (RPK) is a key metric in the aviation industry that measures the demand for air transport. ICRA estimated domestic passenger traffic growth at 8-13 per cent next fiscal, post the 55-60 per cent expansion in FY2023, to reach 145-150 million, which is much higher than the pre-Covid levels.

Read More News on

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Turnaround Trouble: Why Thierry Delaporte is the third CEO to fail at turning around Wipro

Pernod Ricard sips Indian single malts with Longitude 77. Can it overtake Indri, Amrut?

Much ado about localisation proof: Why the flagship PLI scheme failed to benefit auto companies

Use these 6 Daniel Kahneman principles to avoid losing money

Will Delhi government’s EV drive send IGL on a bumpy ride?

Abandoned Clubhouse: Why users vacated the drop-in social-audio platform in post-pandemic era.

Find this comment offensive?

Choose your reason below and click on the Report button. This will alert our moderators to take action

Reason for reporting:

Your Reason has been Reported to the admin.

To post this comment you must

Log In/Connect with:

Fill in your details:

Will be displayed

Will not be displayed

Share this Comment:

Uh-oh this is an exclusive story available for selected readers only..

Worry not. You’re just a step away.

Prime Account Detected!

It seems like you're already an ETPrime member with

Login using your ET Prime credentials to enjoy all member benefits

Log out of your current logged-in account and log in again using your ET Prime credentials to enjoy all member benefits.

To read full story, subscribe to ET Prime

₹34 per week

Billed annually at ₹2499 ₹1749

Super Saver Sale - Flat 30% Off

On ET Prime Membership

Unlock this story and enjoy all members-only benefits.

Offer Exclusively For You

Save up to Rs. 700/-

ON ET PRIME MEMBERSHIP

Get 1 Year Free

With 1 and 2-Year ET prime membership

Get Flat 40% Off

Then ₹ 1749 for 1 year

ET Prime at ₹ 49 for 1 month

Stay Ahead in the New Financial Year

Get flat 20% off on ETPrime

90 Days Prime access worth Rs999 unlocked for you

Exclusive Economic Times Stories, Editorials & Expert opinion across 20+ sectors

Stock analysis. Market Research. Industry Trends on 4000+ Stocks

Get 1 Year Complimentary Subscription of TOI+ worth Rs.799/-

Stories you might be interested in

Giant markets, giant potential – how does India’s air travel development compare with China’s?

India has become one of the hottest markets for aircraft manufacturers as airlines place hundreds of new orders to support growth plans based on India 's vast untapped demand for air travel. The country will soon have the world's largest population, yet it is also relatively underserved in terms of airline capacity.

Lured by this dynamic, India 's airlines have collectively placed significantly more orders than the current fleet size.

Comparing India with China is an interesting exercise, as they now have very similar population sizes, and are both fast growing aviation markets. But China currently has a far greater air service market penetration, which highlights the scope of the potential in India .

This analysis examines some of the similarities and differences between the world's two largest markets. China has more passenger traffic, but India 's rate of growth has been at least as high over the past decade. And while China also has a much larger fleet, order numbers are fairly similar.

- India 's population is only just behind China 's, at 1.4 billion, and it will soon be higher.

- India lags China in terms of GDP and per-capita GDP, and also has much less airline capacity.

- Long train journeys are common in India , but the country does not yet have true high-speed lines.

- India and China were both seeing double digit growth rates for most of the decade before the pandemic.

- China 's fleet size is far greater than India 's, although they have similar numbers of aircraft orders.

India 's population will surpass China 's, although its economy is still smaller

The United Nations projects that India will overtake China in 2023 to become the most populous country, with an estimated total of more than 1.4 billion. A higher projected growth rate indicates that India 's lead will continue to grow, according to United Nations studies.

The CIA World Factbook also estimates that India has the second largest population in 2023, just behind China . The Factbook lists India 's estimated annual growth rate at 0.7%, versus 0.18% for China . This supports the premise that India will overtake China at some point in the near future.

However, India 's real GDP of USD9.3 trillion is significantly behind China 's USD24.9 trillion, according to the Factbook. China is first on the rankings and India third, behind the United States of America .

In terms of GDP per capita, China is 99 th in the world, with USD17,600 based on 2021 estimates, and India is 159 th , at USD6,600.

China 's system seat capacity is currently 3.5 times higher than India 's

So what does this mean for air travel demand?

Despite China and India having similar population sizes, India has far less airline capacity than China . The higher per-capita GDP likely counts in China 's favour in this regard.

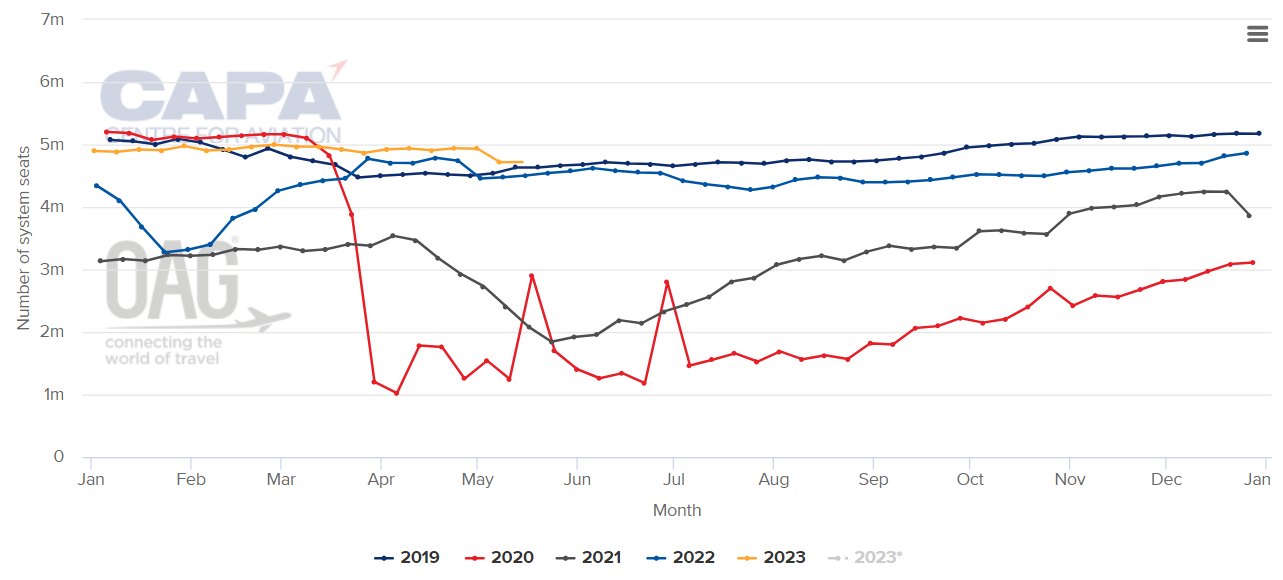

The chart below shows that India 's weekly system seat capacity has recovered to 4.9 million, as of 1-May-2023. This includes all airlines, based in India as well as overseas.

The current capacity total is slightly below the 5.1 million seats that were in this market in Feb-2020, just before the COVID-19 pandemic hit.

India 's systemwide capacity, as measured in weekly seats, 2019-2023

Source: CAPA - Centre for Aviation and OAG

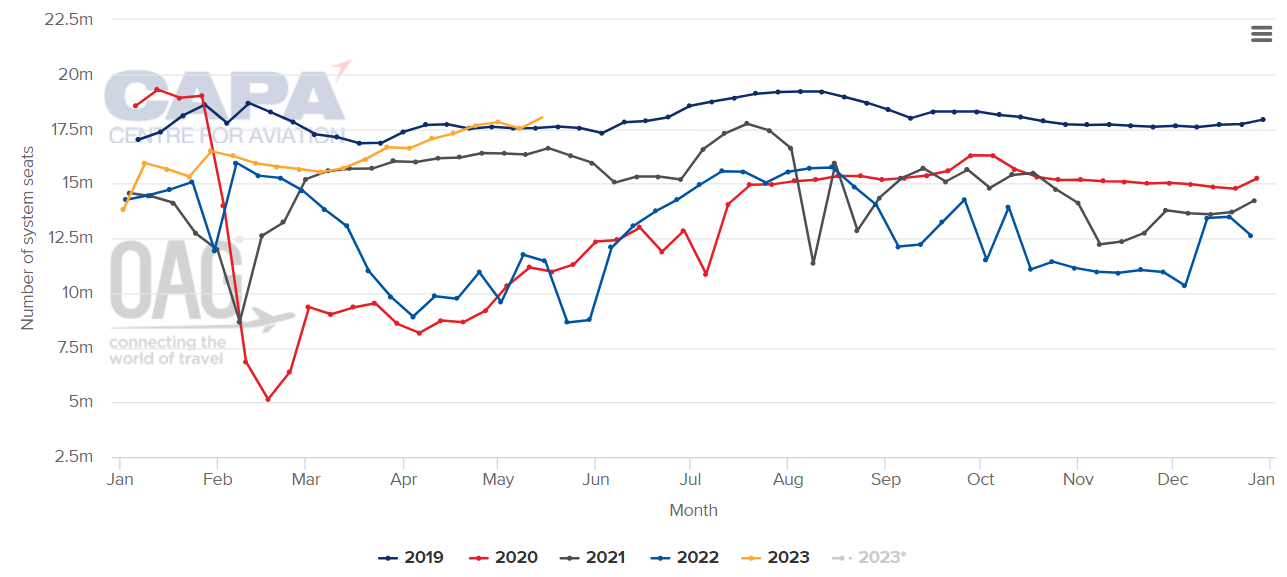

In contrast, mainland China 's systemwide seats were at 17.8 million for the week of 1-May-2023 - this is still down from around 19 million in Jan-2020.

Clearly, China has far greater air service relative to its population than India .

Mainland China 's systemwide capacity, as measured in weekly seats, 2019-2023

CAPA lists India as having 44 airlines and 171 airports.

Mainland China has 84 airlines and 270 airports. Both countries have major airport-building programmes under way.

In India , the construction of new airports in the Mumbai and Delhi markets is particularly important.

Naturally, there are other factors to consider when comparing the two countries. For example, China has a much larger geographic area, making air travel more important on many routes.

The CIA Factbook lists China 's area as fifth in the world, at 9.6 million square kilometres, and India eighth, at 3.3 million square kilometres.

India 's high levels of long-distance train travel represent an opportunity for airlines

One important aspect that boosts the potential for air travel growth in India is the huge numbers of people who travel long distances on the country's vast rail network.

Analyst Craig Jenks, of Airline/Aircraft Projects Inc, notes that rail journey times of 18-36 hours are fairly common in the country.

India has some trains classified as semi-high-speed, but the average speed is still relatively low.

While there is a project under way to start building true high-speed links, the completion of these is still some years away. China 's high-speed rail development is far more advanced.

As in other countries that are heavily reliant on slow-speed ground transport for long domestic trips, this presents an opportunity for India 's LCCs in particular.

Passenger traffic was rising quickly in both India and China in the pre-COVID decade

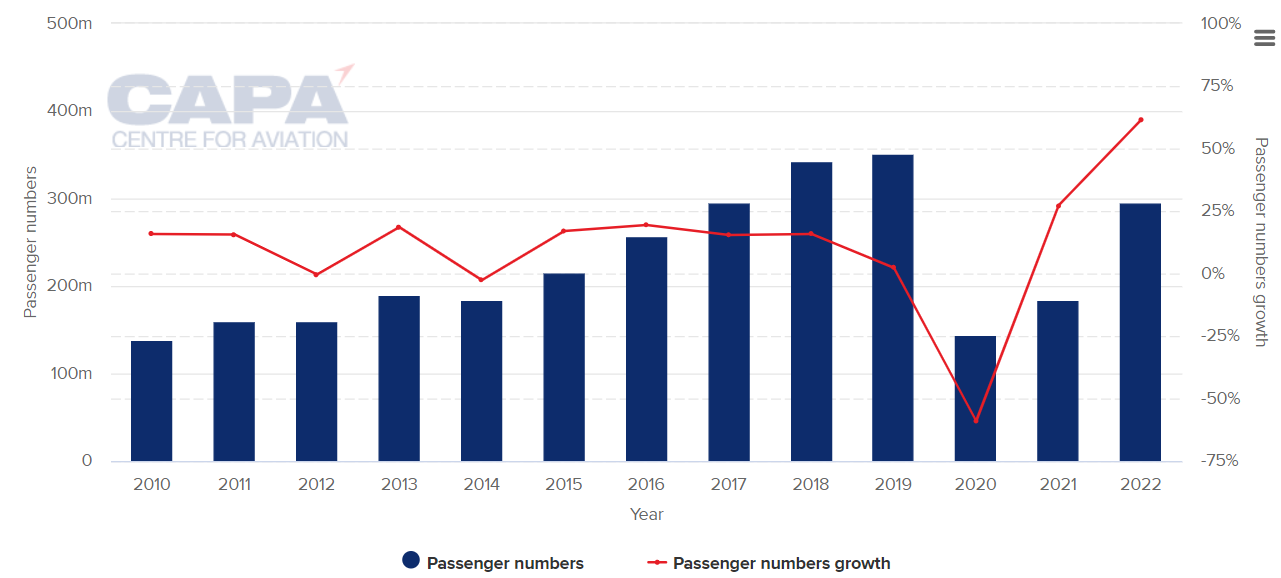

The chart below shows that India 's passenger traffic was growing rapidly before the COVID-19 pandemic.

Annual growth was at least 15% in seven out of the 10 years from 2010. The growth rate in the other three years was much lower, however.

According to data from the Airports Authority of India , the systemwide - international and domestic - passenger total reached 349.3 million in 2019. This was followed by the drop-off in 2020 and the start of the rebound in 2021 and 2022.

Airports Authority of India : annual passenger totals, with annual growth rate, 2010 to 2022

Source: CAPA - Centre for Aviation and Airports Authority of India

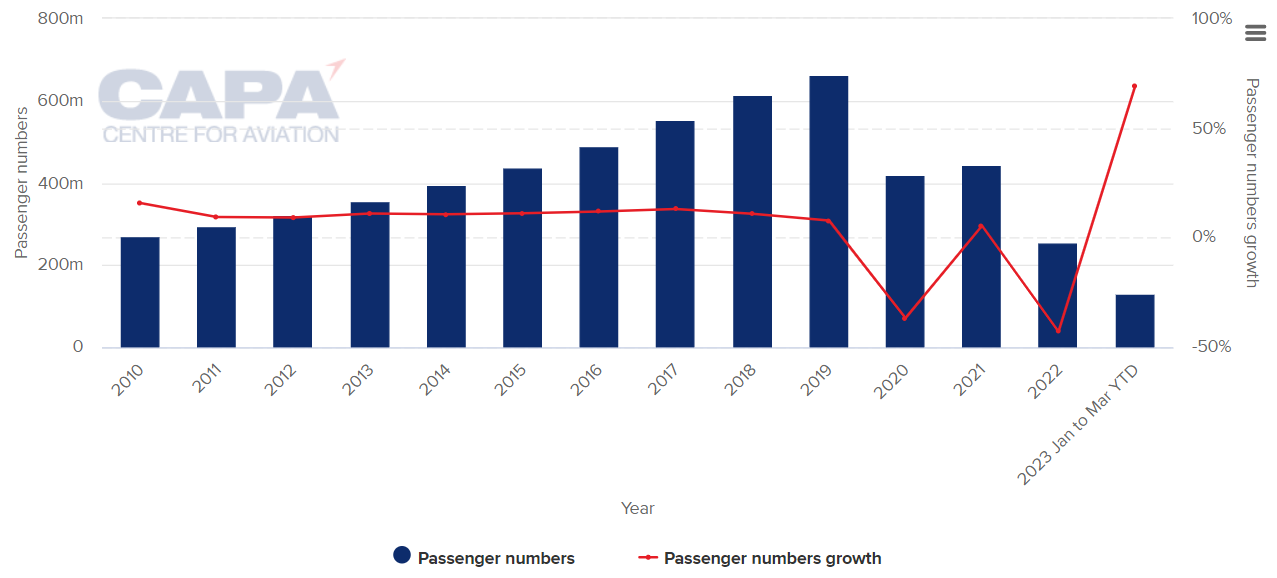

In China there was also strong passenger growth in the decade through 2019, as indicated by data for Chinese airlines from the Civil Aviation Administration of China ( CAAC ).

Annual increases from 2011 through 2018 were in the range of 9-13%, and passenger numbers were up by almost the same proportion as India 's for the whole period.

The passenger total in 2019 (for Chinese airlines) reached 659.9 million - nearly double India 's total for that year.

CAAC : annual systemwide traffic, with annual growth rate, 2010 to 2023 YTD

Source: CAPA - Centre for Aviation and CAAC

China 's fleet is far larger, but order numbers are broadly similar in China and India

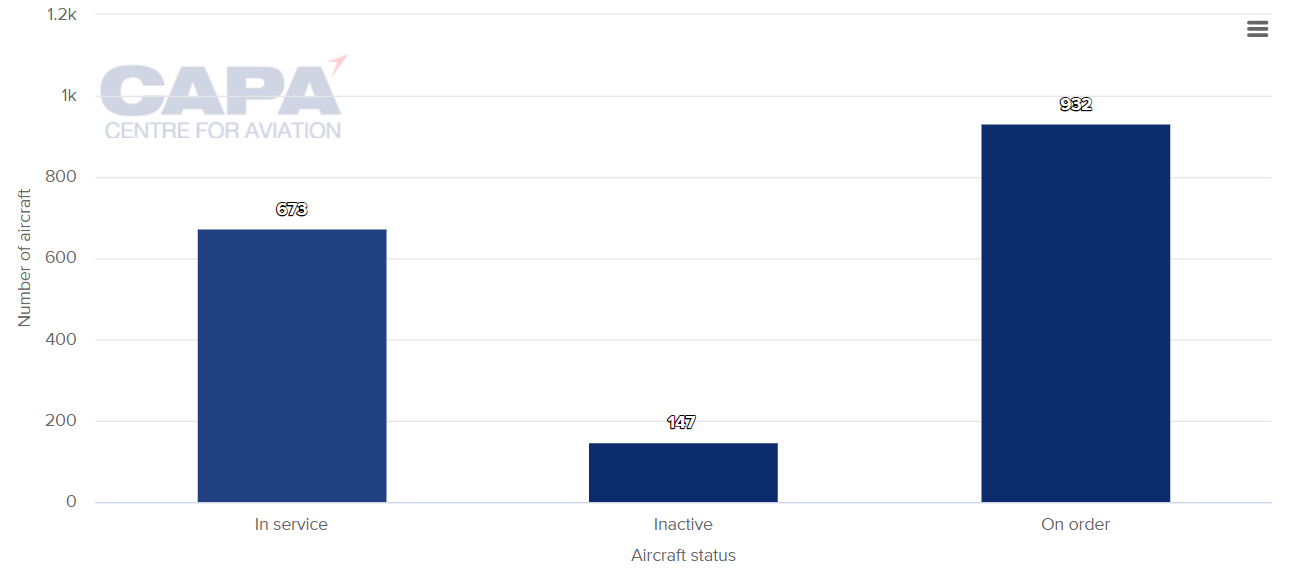

There is considerable disparity in fleet sizes. India currently has 701 aircraft in service, with another 120 inactive.

Indian airlines also have 932 aircraft on order. The total does not include the 470 orders placed recently by Air India , and more large orders are expected later in 2023.

However, India 's total also includes 88 aircraft on order by Go First , which has recently filed for bankruptcy protection.

And the fate of 132 orders attributed to Jet Airways is uncertain, since the airline has been grounded since 2019 and its new owners have yet to set a date for its relaunch.

India 's aircraft fleet status and orders, as of 15-May-2023

Source: CAPA - Centre for Aviation Fleet Database

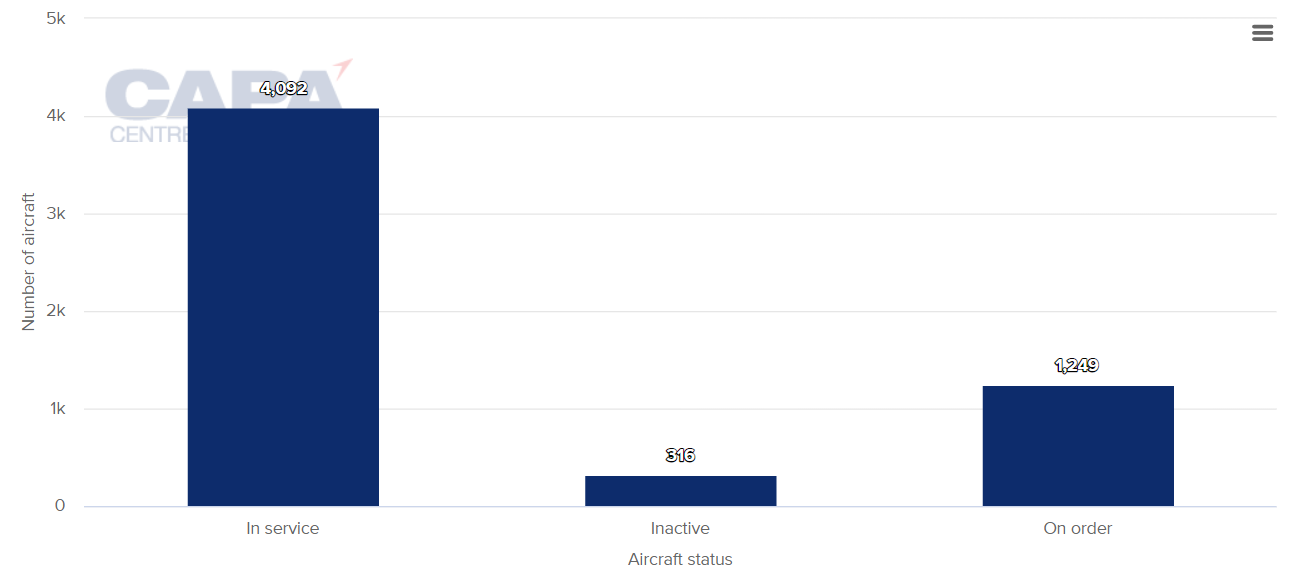

In contrast, China has more than 4,000 aircraft in service. While this dwarfs India 's active fleet, the order numbers are not too far apart when the Air India orders are included.

China 's aircraft fleet status and orders, as of 15-May-2023

India 's potential justifies massive orders, although growth challenges cannot be ignored

There is no question that India has huge potential for air travel growth - both domestic and international. The combination of the soon-to-be world's largest population, relatively low air service levels for its size, and lack of high-speed rail provide a good environment for local airlines.

In the international arena, Indian airlines aim to capture a greater share of the market from the overseas airlines that collectively carry 57% of Indian international traffic.

The country is currently well behind China on the growth curve in terms of airline service and fleet. However, for this reason India likely has the greater scope for expansion. A rapidly expanding backlog of aircraft orders shows that India 's fleet, while smaller now, is destined for at least as much growth as China 's. India has a far greater ratio of orders to active aircraft.

The market's growth potential indicates that the hundreds of aircraft orders placed - and planned - by Indian airlines are justified.

An important caveat is that the rate of expansion must keep pace with the acceleration in demand. In previous years, capacity has outstripped demand growth, depressing yields and causing airlines to struggle financially.

Aviation infrastructure improvement and workforce development must also be a focus, otherwise they could impede air service growth - even if demand is booming.

Significant infrastructure investment is under way, most notably in the airport sector, but workforce could be a tougher problem to solve.

NOTE: A condensed version of this article first appeared in the Jun-2023 edition of our sister publication Air Transport World. This issue includes the features:

Whereto china - boeing 's prospects for aircraft sales in china remain stronger than might be apparent, elevating the experience - some major airlines are ramping up plans to adopt air taxi service, top flight - demand for long-haul first class has picked up. is it a sustainable trend, want more analysis like this.

- Business News

- India Business News

Passenger demand up 21 % in February: IATA report

Visual Stories

PPF Calculator

This financial tool allows one to resolve their queries related to Public Provident Fund account.

FD Calculator

When investing in a fixed deposit, the amount you deposit earns interest as per the prevailing...

NPS Calculator

The National Pension System or NPS is a measure to introduce a degree of financial stability...

Mutual Fund Calculator

Mutual Funds are one of the most incredible investment strategies that offer better returns...

Other Times Group News Sites

Popular categories, hot on the web, trending topics, living and entertainment, latest news.

Virgin Atlantic Bets Big On India, Reveals New Flights and Local Cabin Crew Hires

Gordon Smith , Skift

April 3rd, 2024 at 11:59 AM EDT

Virgin Atlantic has been serving India for almost 25 years. Today's developments suggest its presence in the country will grow even further.

Gordon Smith

Virgin Atlantic is best known for linking Britain with the United States , but there’s another market that is increasingly important for the carrier.

India now represents the airline’s largest growth area outside of the U.S., and there’s even more expansion to come.

On Wednesday, the company announced plans to double the number of flights between London Heathrow and Mumbai. A second daily service is due to begin on October 27 and will be operated by Virgin’s flagship Airbus A350-1000.

The carrier also serves Delhi double-daily and last week added the southern city of Bengaluru to its network. All existing routes are typically served by the Boeing 787 Dreamliner.

Virgin’s International Partners

To provide extra feeder traffic for its nonstop services from India, Virgin Atlantic codeshares with IndiGo to provide 36 connections at its Indian hubs.

On the London side, it also partners with Delta Air Lines for transit options to and from North America. Roughly a third of Virgin Atlantic’s total passengers, or about 3,000 people a day, connect at Heathrow.

Virgin said the addition of another Mumbai flight “signaled its continued commitment to the region.” By next year, the airline will offer more than a million seats to and from India annually, which it describes as “a key strategic market.” It says this marks a 350% increase compared to 2019.

As well as passenger traffic, the larger aircraft and enhanced frequencies allow for more goods to be carried by Virgin Atlantic Cargo. Once the fifth daily flight to India launches in October, freight capacity will be up 336% versus 2019.

Additional Indian Cabin Crew

To better accommodate the increasing number of Indian passengers on its services, Virgin is also ramping up local recruitment.

The airline is quadrupling the number of Indian-based cabin crew operating on its India routes for the coming summer season. An average flight will now have four Indian flight attendants “to deliver a more personalized service.”

Juha Jarvinen, Chief Commercial Officer at Virgin Atlantic has described India as “a huge opportunity” for the airline, adding that the company is “anticipating a huge growth in demand for international travel from the region.”

Jarvinen’s comments echo those of Air India CEO, Campbell Wilson. Speaking at the Skift India Summit in Delhi last month, he described “the wonder of India” , and suggested the market is now on par with Continental Europe and North America.

Despite the country’s rapid aviation growth, it remains relatively underserved according to Indian aviation minister Jyotiraditya Scindia .

“Even if, as per projections, the number of domestic passengers reaches 635 million by fiscal year 2030, India will still be one of the least penetrated of the 20 largest markets,” he said in January.

Airlines Sector Stock Index Performance Year-to-Date

What am I looking at? The performance of airline sector stocks within the ST200 . The index includes companies publicly traded across global markets including network carriers, low-cost carriers, and other related companies.

The Skift Travel 200 (ST200) combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more airlines sector financial performance .

Read the full methodology behind the Skift Travel 200.

Skift India Report

The Skift India Report is your go-to newsletter for all news related to travel, tourism, airlines, and hospitality in India.

Have a confidential tip for Skift? Get in touch

Tags: air india , delhi , Heathrow Airport , india , indigo airlines , mumbai , skift india summit , virgin atlantic

Photo credit: Airbus/A Doumenjou/Master Films Airbus

- Personal Finance

- Today's Paper

- Partner Content

- Entertainment

- Social Viral

- Pro Kabaddi League

MakeMyTrip expands global reach, now available in over 150 countries

India's online travel firm has expanded its reach to major travel markets like the uk, germany, japan, italy, france, and others.

)

Listen to This Article

Makemytrip logs highest-ever quarterly gross bookings at $2.08 billion, asus rog phone 8 pro gaming-focused smartphone now available on vijay sales, ind vs afg: rohit sharma becomes first player to feature in 150 t20is, 'india our 911 call', says former maldives minister amid row. top points, as india-maldives row heats up, all you need to know about lakshadweep, realme eyes top spot in rs 15-25k segment with launch of p series in 2024, jsw steel posts record output at 26.43 in fy24, sees yoy growth of 9%, keystone realtors sales up 41% to rs 2,266 cr on strong housing demand, edtech firm aakash educational services appoints deepak mehrotra as new ceo, air india appoints jayaraj shanmugam as head of global airport operations.

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Apr 08 2024 | 12:25 PM IST

Explore News

- Suzlon Energy Share Price Adani Enterprises Share Price Adani Power Share Price IRFC Share Price Tata Motors Share Price Tata Steel Share Price Yes Bank Share Price Infosys Share Price SBI Share Price Tata Power Share Price HDFC Bank Share Price

- Latest News Company News Market News India News Politics News Cricket News Personal Finance Technology News World News Industry News Education News Opinion Shows Economy News Lifestyle News Health News

- Today's Paper About Us T&C Privacy Policy Cookie Policy Disclaimer Investor Communication GST registration number List Compliance Contact Us Advertise with Us Sitemap Subscribe Careers BS Apps

- Budget 2024 Lok Sabha Election 2024 IPL 2024 Pro Kabaddi League IPL Points Table 2024

- Transportation & Logistics ›

- Domestic market share of airlines across India FY 2023, by passengers carried

IndiGo - the market leader

A flight for the budget airline market, domestic market share of airlines across india in financial year 2023, by passengers carried.

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

India's financial year starts in April and ends in March. For example, FY 2019 started in March 2018 and ended in April 2019.

Other statistics on the topic Air transportation in India

- Busiest Indian airports FY 2023, by number of passengers handled

- Leading Indian airports FY 2023, by volume of freight

- Leading airports in India FY 2023, based on aircraft movements

- Number of aviation employees in Indian scheduled airlines FY 2022, by employee type

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

You only have access to basic statistics.

- Instant access to 1m statistics

- Download in XLS, PDF & PNG format

- Detailed references

Business Solutions including all features.

Statistics on " Air transportation in India "

- Aircraft movements at airports India FY 2014-2022, by type

- Number of RCS-UDAN routes operationalized 2024, by stage

- Total aircraft fleet of scheduled Indian operators FY 2015-2022

- Fleet size of the aviation market in India 2021-2033, by aircraft type

- Number of Indian aircraft in service 2022, by airline

- Fleet composition of airlines in India 2022, by aircraft type

- Domestic passenger kilometers for scheduled Indian airlines FY 2014-2023

- Passenger traffic at Indian airports FY 2014-2023, by type

- Passenger traffic from India FY 2023, by leading destination

- Passengers traveling from and to India FY 2023, by domestic carriers

- Leading Indian airports FY 2023, by number of domestic passengers

- Air freight traffic at Indian airports FY 2014-2022, by sector

- Volume of domestic freight carried by Indian airlines FY 2013-2023

- Leading international cargo carriers in India FY 2023, by air freight arrival volume

- Leading international cargo carriers in India FY 2023, by freight volume departures

- Leading airlines in India 2023, by international traffic

- Number of employees in scheduled Indian airlines FY 2022, by operator

- Financial performance for IndiGo FY 2015-2023

- Revenue from operations for SpiceJet FY 2014-2023

- Key financial figures for Air India FY 2016-2023

Other statistics that may interest you Air transportation in India

Market overview

- Premium Statistic Aircraft movements at airports India FY 2014-2022, by type

- Basic Statistic Domestic market share of airlines across India FY 2023, by passengers carried

- Premium Statistic Number of aviation employees in Indian scheduled airlines FY 2022, by employee type

- Premium Statistic Leading airports in India FY 2023, based on aircraft movements

- Premium Statistic Number of RCS-UDAN routes operationalized 2024, by stage

- Premium Statistic Total aircraft fleet of scheduled Indian operators FY 2015-2022

- Premium Statistic Fleet size of the aviation market in India 2021-2033, by aircraft type

- Premium Statistic Number of Indian aircraft in service 2022, by airline

- Premium Statistic Fleet composition of airlines in India 2022, by aircraft type

Passenger transport

- Premium Statistic Domestic passenger kilometers for scheduled Indian airlines FY 2014-2023

- Premium Statistic Passenger traffic at Indian airports FY 2014-2023, by type

- Premium Statistic Passenger traffic from India FY 2023, by leading destination

- Premium Statistic Passengers traveling from and to India FY 2023, by domestic carriers

- Premium Statistic Busiest Indian airports FY 2023, by number of passengers handled

- Premium Statistic Leading Indian airports FY 2023, by number of domestic passengers

Freight transport

- Premium Statistic Air freight traffic at Indian airports FY 2014-2022, by sector

- Premium Statistic Volume of domestic freight carried by Indian airlines FY 2013-2023

- Premium Statistic Leading Indian airports FY 2023, by volume of freight

- Premium Statistic Leading international cargo carriers in India FY 2023, by air freight arrival volume

- Premium Statistic Leading international cargo carriers in India FY 2023, by freight volume departures

Market players

- Premium Statistic Leading airlines in India 2023, by international traffic

- Premium Statistic Number of employees in scheduled Indian airlines FY 2022, by operator

- Premium Statistic Financial performance for IndiGo FY 2015-2023

- Premium Statistic Revenue from operations for SpiceJet FY 2014-2023

- Premium Statistic Key financial figures for Air India FY 2016-2023

Further related statistics

- Premium Statistic Largest registered airlines in the CEE region 2019, by supply of airline seats

- Premium Statistic Most important destinations of LOT Polish Airlines 2019, by supply of airline seats

- Premium Statistic Largest airlines flying from the CEE region 2019, by supply of airline seats

- Premium Statistic Main airlines in Iran - by passenger market share 2014

- Premium Statistic Main airlines in Africa ranked by fleet size 2016

- Premium Statistic Latin American domestic air traffic market by business model 2016

- Premium Statistic Air carrier market share in South Asia - international traffic 2016

- Premium Statistic Main airlines in Iran - based on passenger numbers 2014

- Premium Statistic Seat distribution of Latin America's air carrier market by country 2016

- Premium Statistic Weekly seat capacity: North American domestic airlines by carrier 2016

- Premium Statistic Main domestic airlines in Latin America, ranked by weekly seat capacity 2016

- Premium Statistic African international air traffic market by business model 2016

- Premium Statistic Bookings - international traffic Africa-Asia Pacific 2016

- Premium Statistic Air carrier market share in Latin America - international traffic 2016

- Premium Statistic Weekly seat capacity of domestic airlines in South Asia by carrier 2016

- Premium Statistic Leading travel airlines in Latin America in 2017

- Basic Statistic Airlines with the best business class cabins in the Americas 2015

- Premium Statistic Leading airline brands ranked by Buzz score in the United Kingdom 2019

- Premium Statistic Flight bookings by airline brand in Australia 2023

Further Content: You might find this interesting as well

- Largest registered airlines in the CEE region 2019, by supply of airline seats

- Most important destinations of LOT Polish Airlines 2019, by supply of airline seats

- Largest airlines flying from the CEE region 2019, by supply of airline seats

- Main airlines in Iran - by passenger market share 2014

- Main airlines in Africa ranked by fleet size 2016

- Latin American domestic air traffic market by business model 2016

- Air carrier market share in South Asia - international traffic 2016

- Main airlines in Iran - based on passenger numbers 2014

- Seat distribution of Latin America's air carrier market by country 2016

- Weekly seat capacity: North American domestic airlines by carrier 2016

- Main domestic airlines in Latin America, ranked by weekly seat capacity 2016

- African international air traffic market by business model 2016

- Bookings - international traffic Africa-Asia Pacific 2016

- Air carrier market share in Latin America - international traffic 2016

- Weekly seat capacity of domestic airlines in South Asia by carrier 2016

- Leading travel airlines in Latin America in 2017

- Airlines with the best business class cabins in the Americas 2015

- Leading airline brands ranked by Buzz score in the United Kingdom 2019

- Flight bookings by airline brand in Australia 2023

IMAGES

COMMENTS

Experts say India's is seeing a travel boom post the pandemic. India's domestic air traffic has hit a record high, with 456,082 passengers flying on a single day. ... This marked a 51.7% growth ...

Domestic air travel in India was suspended for several months in 2020. Meanwhile, regular international travel came to a halt for over two years, starting from March 2020. ... Annual growth in ...

Increased aviation tends to boost growth, according to a paper in Transport Reviews, a journal. And India is a vast country, with patchy road and rail links and far-spaced industrial and business ...

Two beneficiaries of India's expanding aviation market are the world's largest airplane makers: Boeing in America and Airbus in Europe. In February, Air India, which the Tata Group took ...

With the increase in the tourism ...

The increased passenger figures indicate a growing demand for air travel and highlight the positive trajectory of the aviation sector. Furthermore, the MoM growth rate between April 2022 and April 2023 has increased by 22.18%, underscoring the sustained momentum of the domestic airline industry.

Domestic traffic growth over 2019 levels stabilized at 4.8% with an annual growth rate at 33.7%. International passenger traffic reached 94.4% of pre-pandemic levels with a 29.7% growth YoY. Air ticket sales trended close to 2019 levels, indicating resilient demand for air travel despite the economic challenges faced by consumers.

While Covid-19 remains a near-term challenge, the country's passenger traffic is forecast to outpace global growth, doubling from pre-pandemic levels by 2030, according to the CMO. India air cargo ...

India is on track to record a fourth straight year of double-digit passenger growth. Figure 1: Total air passenger journeys to, from & within India (annual)2 Source: IATA 2 Unless stated otherwise, all data in this report are calculated on an origin-destination (O-D) basis. Figure 2: Annual growth in India's O-D air passenger journeys

A notable increase in both international and domestic air travel reflects positive trends in the country's aviation industry. ... This represents an annual growth rate of 27%, with a monthly ...

This is also Air India's first order since 2005, and comes at a time when the Indian aviation industry is seeing a surge in passenger traffic. Looking ahead, the future of the Indian aviation industry is bright. The sector is expected to see significant growth in the coming years, particularly in the areas of international travel and cargo.

Air transportation in India - statistics & facts. In a densely globalized economy, air transport is a key element in the country's transport infrastructure. The Indian aviation industry has ...

As a result, passenger traffic in India will grow at 6.2% per annum by 2040, the fastest among the major economies and well above the global average of 3.9%. India has witnessed an upward trend in the growth of air traffic over the last ten years - with domestic traffic growing almost threefold and international traffic more than doubling. On ...

Mar 4, 2024. In financial year 2023, the total air passenger traffic in India reached more than 190 million passengers. It was a huge increase comparing to the previous year. The domestic ...

Aircraft maker Boeing on Thursday said India's air traffic is projected to see a nearly 7 per cent annual growth through 2040. Strong recovery is gaining further momentum in Indian aviation and it is one of the fastest growing markets, Boeing Managing Director (Marketing) David Schulte said here. According to him, India's airlines will lead air traffic growth through 2040, growing at a rate of ...

India is fast emerging as a key global aviation market, according to the latest market analysis report of the International Air Transport Association ( ATA). India's domestic air travel has continued to grow robustly and as of February, it was a mere 2.2 per cent shy of reaching pre-pandemic levels measured by passenger revenue kilometres (PRK).

In terms of passenger revenue kilometres, the domestic aviation market was a mere 2.2 per cent shy of reaching pre-pandemic levels, shows a report by an industry body. Revenue Passenger Kilometers (RPK) is a key metric in the aviation industry that measures the demand for air transport. ICRA estimated domestic passenger traffic growth at 8-13 per cent next fiscal, post the 55-60 per cent ...

Global air traffic surpasses pre-pandemic levels in February. In February 2024, the airline industry achieved full recovery in total passenger traffic, surpassing the 2019 threshold by 5.7%. Annual growth in Revenue Passenger-Kilometers (RPK) reached 21.5% year-on-year (YoY). Passenger load factors (PLF) improved in comparison to the previous ...

To better understand the current paradoxical state of India's aviation industry, we need to go back a few years. In 2014, a relatively young Indian low-cost airline, IndiGo, made headlines by ...

India has become one of the hottest markets for aircraft manufacturers as airlines place hundreds of new orders to support growth plans based on India's vast untapped demand for air travel. The country will soon have the world's largest population, yet it is also relatively underserved in terms of airline capacity. Lured by this dynamic, India's airlines have collectively placed significantly ...

As the growth is now picking up, the Indian aviation industry is on its way to recovery and expects an increase in demand for leased aircraft in comparison to the rest of the world. As per the Oliver Wyman report,25 released in January 2021, India's air fleet expects the growth to double or more by 2031.

In India, there were over 400 airports and airstrips, while 136 were operational. Passenger traffic amounted to over 327 million at airports across India in financial year 2023, out of which close ...

Mar 24, 2024,06:00am EDT. India's surging middle class is projected to spend as much as $144 billion a year on international travel by 2030. And hotels, airlines and cities are spending millions ...

India Business News: Global air travel demand surged by 21.5% in February 2024, with international demand up by 26.3% and domestic demand by 15.0%. The industry remains op

By November 2023, IndiGo held the dominant position in India's aviation market in terms of passenger numbers, with a market share of 61.8%. Throughout 2023, IndiGo transported 56.2% of India's air travellers, whereas Air India accounted for 25.1%.

It says this marks a 350% increase compared to 2019. As well as passenger traffic, the larger aircraft and enhanced frequencies allow for more goods to be carried by Virgin Atlantic Cargo. Once ...

Previously operational in India, the United States (US), and the United Arab Emirates (UAE), MakeMyTrip has now expanded its reach to over 150 countries, including major travel markets such as the United Kingdom (UK), US, Germany, Japan, Italy, France, and others, allowing travelers to benefit from its services globally.

Domestic market share of airlines across India FY 2023, by passengers carried. India's aviation sector had increasingly emerged as a fast-growing industry. The sector had established itself as ...

India's air transport industry; a global perspective • The Indian air transport has shown very strong growth in recent years sector particularly on the - domestic market segment. • In October 2018, the domestic India market recorded its 50th consecutive months of double-digit year-