The smarter way to travel

Multi-currency Cash Passport™. One Card, Ten Currencies.

Get your card Get the app

Multi-currency Cash Passport

10 currencies, locked in rates.

Lock in exchange rates each time you load and top up. Load up to 10 different currencies on one card. Pound Sterling, Euros, US Dollars, Australian Dollars, Canadian Dollars, New Zealand Dollars, South African Rand, Turkish Lira, Swiss Francs and Emirati Dirhams.

Stay in control

Manage and track your Cash Passport on the go via your mobile, tablet, laptop or PC. Login to My Account and stay in control of your money.

Accepted at millions of locations

Preload your Cash Passport and use like you would a credit or debit card in-store, online or to withdraw local currency at ATMs.

Global assistance

Help is only a call away. If your card is lost, stolen or damaged, we can replace it quickly or provide you with emergency cash up to the available balance on your card (subject to availability).

Today's exchange rates*

Running low on travel money.

Multi-currency Cash Passport is reloadable, allowing you to top up any of your currencies, anywhere, anytime.

You can top up in 5 ways:

- Bank transfer (via phone or internet banking)

- Via the mobile app

- Over the phone

- In participating branches

Learn more about your top up options.

Keep track of your travel money

You can use your mobile, tablet, laptop or PC to login to My Account and stay in control of your travel money.

Register for My Account , so you can:

- Track your spending

- Top up your card

- Transfer between currencies

- Retrieve your PIN number

- Suspend your card temporarily

You can also download the Cash Passport mobile app, available for iOS and Android devices.

Travel with confidence

Safe and secure access to your money

Cash Passport uses Chip and PIN technology which means you can rest assured you have additional security making your card safer than carrying cash. Accepted at millions of locations and cash machines worldwide.

Looking for a back-up card for safe keeping? Simply purchase an additional card when ordering online or in-store.

We're here to help

We're only a call or email away at all times. Our global assistance team will help you if your card is lost, stolen or damaged.

We can replace your card quickly or provide you with access to emergency cash up to the available balance on your card (subject to availability), so you can keep enjoying your holiday.

Need further help?

View our frequently asked questions or feel free to contact us .

Cash Passport™ app

The new Cash Passport app has an improved design that makes managing your travel money faster and easier.

Start travelling smarter in just a couple of taps. Activate your Cash Passport card from your mobile, download the app from the iOS or Android store, log-in, and load up with your preferred currency. Simple!

Now you can securely store your payment card details in the Cash Passport app, so whenever and wherever you are, you can top up with up to 10 currencies, including Euros, US, Australian and Canadian Dollars and British Pounds at the touch of a button.

Stay in control the smart way. The new message centre feature lets you stay on top of tailored notifications, including low balance and transaction alerts. Keeping you up to date with your own personal need to know information.

Move money between your currencies with just a couple of taps – it’s that simple! Quickly move money between 10 currencies and spend more time enjoying your holiday.

Priceless Cities

Priceless Cities is a program available exclusively to Cash Passport cardholders and provides access to unforgettable experiences in the cities where you live and travel.

There’s a world of possibilities waiting for you to explore, so why not break free from your routine for a moment, a night, or even a weekend? Fuel your passions. Make memories to last a lifetime. Start Something Priceless.

Find out more

Multi-currency Cash Passport is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

*Foreign exchange rates can fluctuate and the rate that applies one day will not necessarily be the same on any other day. The exchange rates set out on this website apply to top-ups that are made via this website only and that are applied to your card account within four hours. We will provide you with the applicable exchange rate at the time you top up.

Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. App Store is a service of Apple Inc. registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC.

Today’s exchange rates*

MASTERCARD BENEFIT INQUIRIES

Within the U.S.: 1-800-Mastercard (1-800-627-8372) | Outside the U.S.: Mastercard Global Service Phone Numbers

Availability of insurance benefits on your card may vary by card issuer. Please refer to your issuing financial institution for complete insurance benefit coverage terms, conditions and exclusions.

*Card registration required. Certain exceptions apply. Click here for terms and conditions .

†Requirements may vary. See card packaging for details or contact card issuer.

Accessibility Quick Links

- Skip to Online Banking

- Skip to Content

- Skip to Navigation

Are you sure you want to delete this saved card number?

AC conversion™ Visa* Prepaid Card

The best travel companion. Safely carry up to 10 currencies in one card.

Get the card for $0 and have the currencies you need ready to go.

Make touchless payments a breeze in over 40 countries with a single card

Travel like a local. Easily load up to 10 currencies on one card and avoid conversion fees. Whether you’re train hopping through Europe or hanging ten in Australia, exact fare is a tap away.

One card to carry on trips to more than 40 countries around the globe.

There’s no fee to order the card, no fee to load it and no conversion fees when you make a purchase.

Use the app to load up to 10 currencies at a time on the go. Shop wherever Visa is accepted.

Carry less cash. Load up to 10 currencies.

Lock in a great exchange rate each time you load. That means you don’t have to worry about exchange rate fluctuations. Plus, there’s no extra conversion fee.

How does it work?

- No minimum load required.

Activate it

- Register your account and retrieve your PIN from the Manage My Card page Opens in a new window. .

- Or, to activate by phone, call 1-800-482-8347 Opens your phone app. .

- Load from the app or sign on from your web browser Opens in a new window. .

- Choose from up to 10 currencies for 45 countries.

Load on the go with the AC conversion App

Manage your card from the palm of your hand. Reload as you go so you never run out of currency on your trip.

- Check your balance

- Keep track of your spending

- Transfer money from one currency to another

- Retrieve your PIN

Manage your card online Opens a new window in your browser.

Get the prepaid travel card that takes your money further

- Save money on conversion fees

- Make travelling more convenient with 10 currencies on 1 card

- Advanced chip and pin technology keeps your money safe

- Shop with foreign currency on global e-commerce sites 1

Frequently asked questions

To load funds onto your card, use your mobile app or sign onto your account at acconversion.cibc.com Opens in a new window. . The website also works on your phone or tablet on the go.

There is no minimum amount you have to load.

The maximum the card can hold is the equivalent of $20,000 CA in your choice of currencies.

The maximum load amount in any 24-hour period is the equivalent of $3,000 CA.

It’s easy to check your balance. Simply choose one of the following options:

- Sign onto your account at acconversion.cibc.com Opens in a new window.

- Use the mobile app. You can download the app for both Apple and Android operating systems

- Call the number shown on the back of your card and follow the automated prompts to speak with a live agent

Yes. However, you should be aware that many restaurants and hotels factor in an automatic tip or other incidental expenses when authorizing your purchase transaction.

Advance bookings — Hotels and car rental agencies can place a hold on funds that may exceed your balance. However, use of your card for settlement of a final amount will be treated as a normal purchase.

Places that could require a tip or extra charge — Certain merchants, including restaurants and hair salons, may add an additional 20% to the purchase amount prior to authorization of the transaction. This puts a hold on the full amount of the transaction. Although this is normal, it means you will not have use of the funds until the hold is released or it may exceed the balance available on your card and lead to a decline of the transaction.

The CIBC Air Canada AC conversion Visa Prepaid Card is protected by advanced chip and PIN technology to minimize fraud and theft. It also comes with Emergency Card Replacement Service, Emergency Cash Service and Protection from unauthorized use of cards or account information.

All fees related to your card are provided to you in the terms and conditions.

- English United States English. Opens in a new window.

Please note: Multilanguage sites do not provide full access to all content on CIBC.com. The full CIBC website is available in English and French.

- Destinations

- Travel Tips

- Community Trips

- TTIFridays (Community Events)

- SG Travel Insider (Telegram Grp)

The Best Multi-currency Travel Card For Travellers — YouTrip vs Revolut vs InstaReM vs TransferWise Review

Which multi-currency travel card to get? YouTrip, Revolut, InstaReM, or TransferWise?

Correct as of: 9 Nov 2019 The views in this article represent the opinions of the writer only.

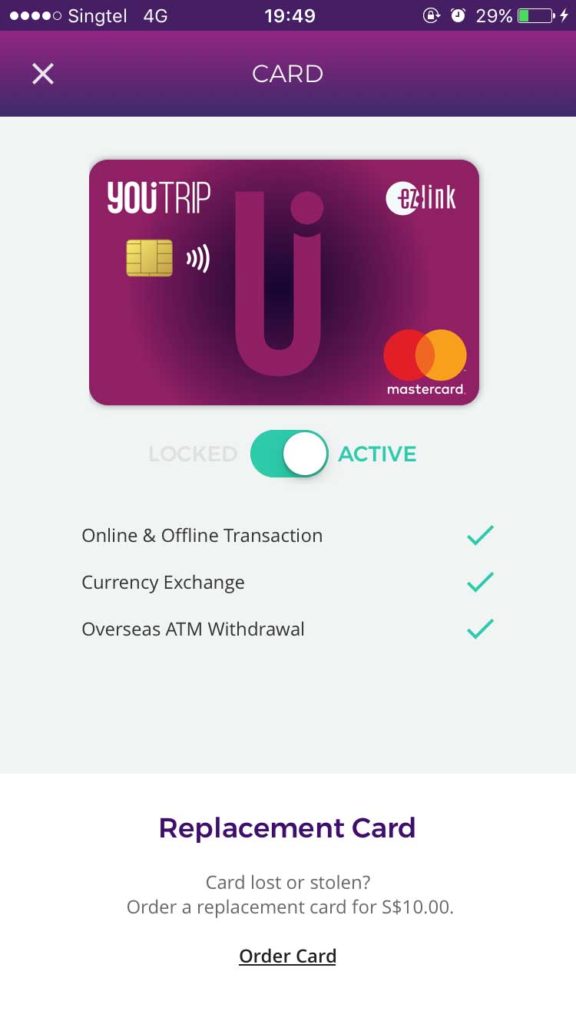

As a frequent traveller, I’ve been a big fan of digital multi-currency travel cards since YouTrip launched the first digital multi-currency travel card in Singapore (2018).

While they’re not a replacement for credit cards that collect miles, they’re an alternative everyday card for spending overseas.

With so many “travel” related cards popping up recently, I’ve taken up the task of pitting the main players — YouTrip, Revolut, TransferWise, and InstaReM — up against each other. Hopefully at the end of this digital multi-currency travel card review, we’ll all have a better idea of which multi-currency card best fits our needs.

Here’s a handy TL;DR summary table if you can’t wait:

Some key features and considerations — costs, exchange rates, security, application process .

Key Features of the different digital Multi-Currency Travel Cards

The basic premise of a digital multi-currency travel card is that they all promise preferential exchange rates with little to no fees. So what sets them apart?

If you’re already familiar with these cards, scroll down to the next section on costs & exchange rate differences.

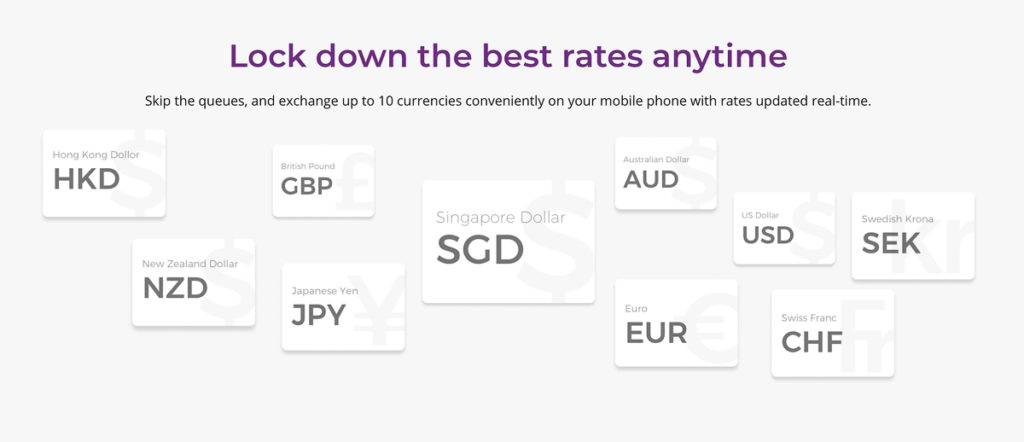

For savvy Singaporean travellers, you should be familiar with the first digital multi-currency travel card player that started here in August 2018. Developed by You Technologies Group Limited, the company is based in both Hong Kong and Singapore. They recently secured the principal licence to be a direct Mastercard issuer.

YouTrip allows you to pay overseas with no fees in 150+ currencies. Having used YouTrip for a year, I really loved how fuss-free and convenient it was. It works really well as an overseas debit card + multi-currency wallet, and have already saved me hundreds of dollars.

Read also: YouTrip Review

Founded in the UK back in July 2015, Revolut just made its way to Singapore, and is the first neobank to partner with Visa here. More than just a multi-currency travel card, Revolut has plenty of features that seems to position itself as an all purpose debit card as well. It’s the only player that offers three different cards with a subscription plan .

The paid tiers allow you higher limits for ATM withdrawals, a lower currency exchange fee (see section below), priority customer support, nicer physical cards, and LoungeKey Pass access. The Metal Card also offers 1% cashback on overseas spending.

What’s interesting to note is that other than acting as a multi-currency wallet and overseas debit card, Revolut also allows you to transfer money abroad. They have an in App budgeting/analytics tool, and a feature called Vault that can automatically round up your purchases to the nearest dollar and save it in your account.

If you are new to travel wallets and multi-currency cards, I’d suggest taking your time to explore the different features.

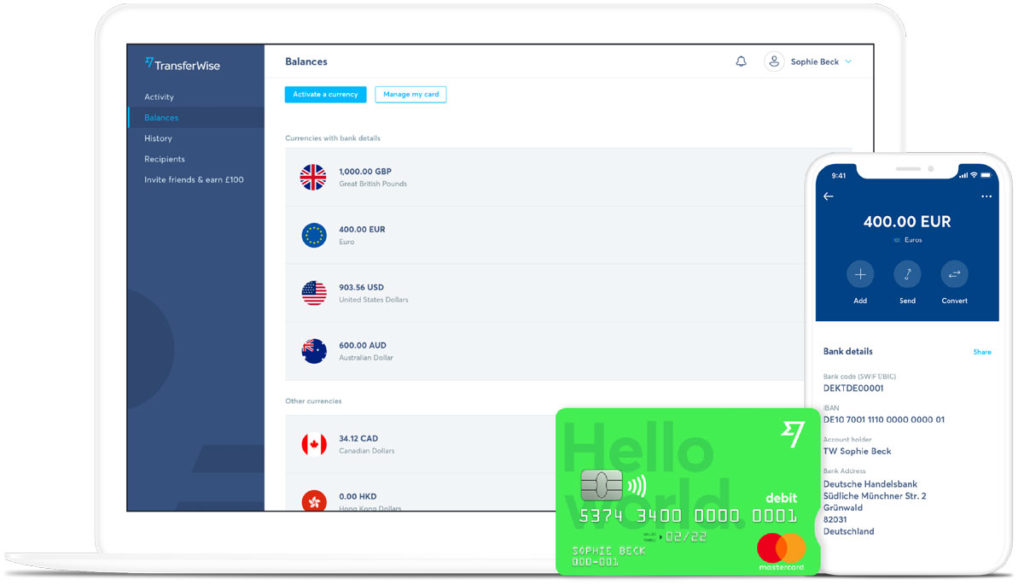

TransferWise — Platinum Debit Card

Another UK based company, TransferWise started in 2011 as a fuss-free and low-cost way to remit money overseas online. Their trademark neon green debit card is supported by Mastercard and also allows you to spend overseas at preferential exchange rates.

The amazing thing about TransferWise, is that you can get access to your own account in multiple countries. This currently includes: – an Australian account number and BSB code – a British account number and sort code – an European IBAN – a New Zealand account number – a US account number and routing number

You can also store up to 40+ different currencies in your account, the most amongst all the multi-currency wallets.

InstaReM — AMAZE Card

Founded in Singapore in 2015, InstaReM is a digital cross-border remittance company focussed on making it easier and cheaper to send money globally. Their new AMAZE Card allows you to link up to 5 debit or credit cards and continue earning cashbacks, reward points and air miles. The AMAZE card is currently only available in Singapore and will be launching in December 2019.

Costs & Exchange Rates of YouTrip, Revolut, TransferWise & InstaReM

Probably the section most people care about.

Basic Cost : Free Exchange Rates : Real-Time Interbank Mid-Market Rate Currency Exchange Fees : No Commission Overseas ATM Withdrawal : SGD5 per withdrawal

– YouTrip is free to use and does not charge any commission – The interbank mid-market rates is typically much better than the ones credit companies use — which is very close to the physical money changer or google interbank rates. As of 4th Nov 2019, YouTrip also offered to match the exchange rates on other multi-currency wallets. – For overseas ATM withdrawal, there’s a S$5 charge per withdrawal, so it’s best to plan ahead and draw enough if required.

Basic Cost : $0 to S$19.99/month Exchange Rates : Real-Time Interbank Mid-Market Rate Currency Exchange Fees : 0-2.5% depending on membership and market hours Overseas ATM Withdrawal : Free up to SGD350 (Standard), SGD700 (Premium), SGD1050 (Metal) every month. 2% Fair Usage Fee after.

– A currency exchange fee is charged based on a few factors — your membership level (standard, premium or metal card), amount you exchange each month, and London’s market hours. With Revolut, you are split into either a “Regular” or “High Frequency Standard” customer.

*High Frequency Standard rates are charged to standard users (free membership) who have exchanged more than S$9,000 or equivalent in any rolling month.

To protect themselves against currency fluctuations, Revolut also locks in the closing rate for the weekend (UTC) and charges more currency exchange fees. Here’s the breakdown:

Exchange Fees during market hours (UTC, Mon-Fri)

Exchange Fees after market hours (UTC, Sat-Sun, trading holidays)

*Pro-Tip : Do your money changed from Monday to Friday (UTC).

– ATM withdrawal is free up to certain amounts depending on your membership level. Standard: S$350/month Premium: S$700/month Metal Card: S$1050

A 2% usage fee is charged for amounts exceeding your limit but that shouldn’t be an issue when travelling in places where card payment is widely accepted.

TransferWise — Platinum Debit Card (Borderless Account)

Basic Cost : Free Exchange Rates : Real-Time Interbank Mid-Market Rate Currency Exchange Fees : 0.35-2% Overseas ATM Withdrawal : Free up to SGD350 per 30 rolling days. 2% fee after limit is hit

– Like YouTrip, TransferWise is totally free to use and also uses the real-time interbank mid market rates. – Uses a fixed percentage fee, depending on the currencies exchanged. The fee is clearly shown at the point of exchange and you can test it for yourself on the TransferWise pricing and fee converter .

Here are some common currency conversion fees for TransferWise Platinum Debit Card holders):

– Similar to Revolut, there is a cap on the overseas ATM withdrawal limit for TransferWise. The main difference is that there are no Premium Plans/Cards to increase your limit.

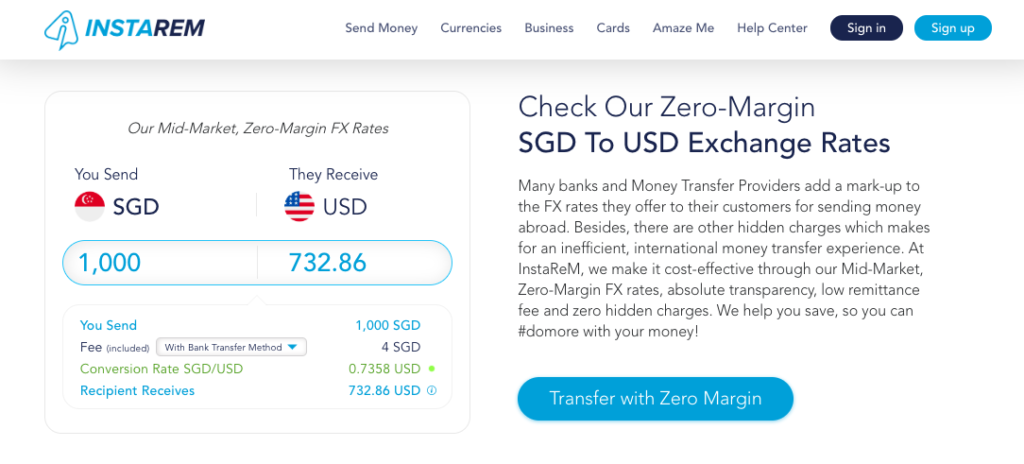

Basic Cost : Free Exchange Rates : Real-Time Interbank Mid-Market Rate Currency Exchange Fees : 0.25-1% (assuming it’s the same as their transfer fees) Overseas ATM Withdrawal : N/A

Launching in December, we are eagerly waiting for details of the InstaReM AMAZE Card to see how it compares to the rest. However, we can use their current zero-margin exchange rates as a benchmark. You can test the various exchange rates and fees using the InstaRem Currency Converter .

Here are some common currency exchange fees for InstaRem:

At a glance, the fees are slightly better than TransferWise. However interbank mid-market exchange rates might differ. They don’t make it easy for us to compare, but I compared anyway (see below).

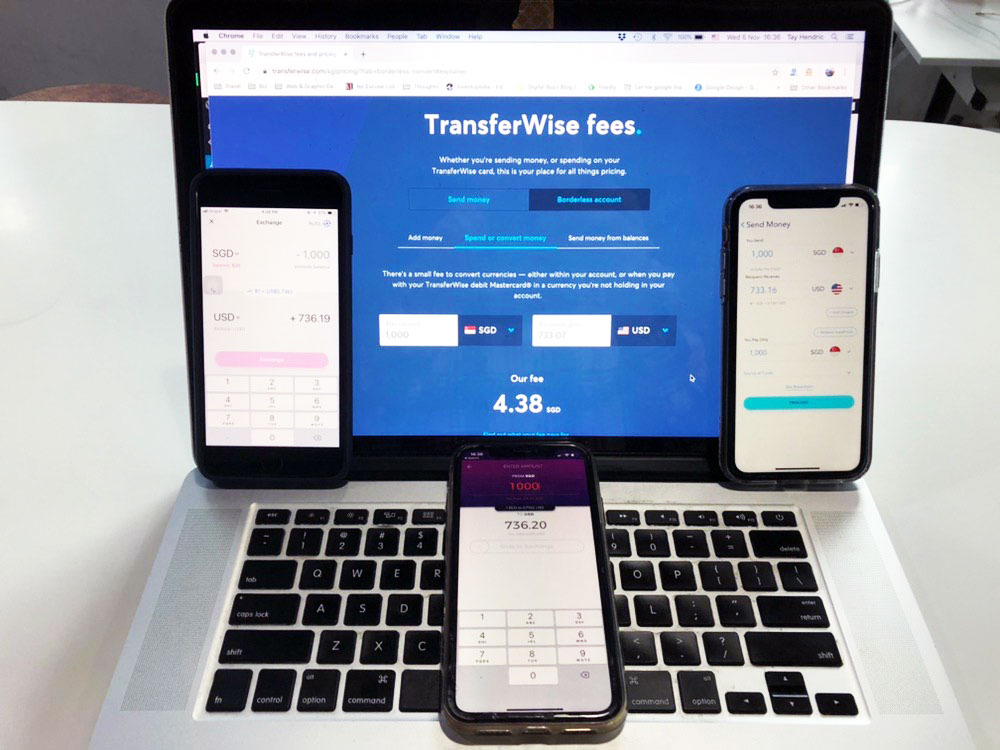

Exchange Rate Comparison — YouTrip vs Revolut vs InstaReM vs TransferWise

Here’s a comparison of exchanging SGD1,000 to USD at the point of writing. As the currency exchange rate was changing constantly, I refreshed the rates at the same time so the gap within each is probably about 3 seconds. It’s as fast as I can manage using 3 phones and a laptop. 😛

1 The test was conducted on a weekday, so I do expect the fees to rise over the weekend. 2 InstaReM’s rate is based off their remittance service, while YouTrip, Revolut, and TransferWise was based off the money exchange feature on the respective multi-currency wallet.

Note : It’s probably best to do your own tests if you are exchanging large amounts of money as I’m pretty sure the exchange rates will fluctuate more as the competition heats up.

Security Features of YouTrip, Revolut, TransferWise & InstaReM

If you misplaced your card, YouTrip allows you to deactivate it temporarily by toggling a button on the YouTrip App. If you find it again in-between the couch, you can easily activate it again. Compared to the traditional way of calling the banks to deactivate your debit/credit card permanently, this is much more convenient and fuss-free.

Revolut has the ability to freeze (deactivate) the card temporarily too.

What I found interesting is function to create Disposable Virtual Cards — perfect for times when you have to make an online payment through a dodgy looking website.

According to Revolut, the Disposable Virtual Card will automatically be destroyed and a new one is generated each time an online payment is made. This reduces the risk of online credit card fraud since it can only be used once. However, this feature is only available for Premium & Metal Card users. You can also control other security features from the Revolut App directly, like turning on location-based security, or disabling contactless payments, ATM withdrawals, online payments, or magnetic stripe payments based on your needs.

Similar to YouTrip and Revolut, you can easily freeze or cancel your card. An additional feature is the implementation of 2FA for desktop logins. This can be done via SMS, a phone call, or the TransferWise App. You can also set monthly spending limits

InstaReM – AMAZE Card

To be updated.

Which Multi-Currency Travel Card is better for me?

While there are plenty of overlaps, I do think that the strengths of each card suits different types of travellers.

For the Fuss-free Traveller: YouTrip

Probably the simplest and easiest card to understand and use, YouTrip does as it says — it saves you money for spending overseas. There are no frills or additional features (currently). If you don’t want to worry too much about when to exchange currencies, nor have a need to remit money overseas, this is a great alternative to carrying lots of cash around.

For those who want a multi-purpose spending card: Revolut

The most sophisticated of the lot, Revolut has a lot of useful features for the global citizen. More than just a travel card, you can also use it like a global everyday spending card, and to transfer money overseas.

For those who have a need to remit money: TransferWise

With the ability to store up to 40+ different currencies, TransferWise is definitely ahead if you travel to many non mainstream countries or need to send money abroad. The ability to have local bank account numbers is a huge plus.

For those who have multiple debit/credit cards: InstaReM

While we wait for the card to launch, it’s current premise looks really promising — consolidate all your cards and rewards while having better exchange rates for overseas spending.

Hope you found this review useful. Do let us know if there are other things we might have missed out on in the comments section below!

For more travel inspiration, follow us on Instagram , YouTube , and Facebook !

View this post on Instagram A post shared by The Travel Intern (@thetravelintern) on Aug 27, 2019 at 6:23am PDT

RELATED ARTICLES MORE FROM AUTHOR

Gem at the fringe of town — One Farrer Hotel Staycation Review

2D1N Southern Islands Staycation — St John Island, Lazarus Island, Kusu Island on a Yacht

Protected: How this Travel App Became An Essential for All My Trips in 2019 — Klook App Review

Revolut Review: The pros, the cons, what it does, and what it’s not

The Best-Kept Secret to Staying Warm During Winter — Uniqlo HEATTECH Review

Why do airport lounges exist when we have a world-class airport — Marhaba Lounge review (Changi Airport T3)

Leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Terms Of Use

- Privacy Policy

- Customer Care Number

Internet banking

- NRI Banking

- Money2World

- Money2India

Offers especially for you!

Open an Insta Save Account.

No Paperwork, No Branch Visits, No Hassle!

ICICI Bank Credit Cards

Save more on your everyday expenses.

ICICI Bank Personal Loans

For your safe, comfortable, and convenient travel needs

ICICI Bank Home Loans

The key to your Dream Home, within easy reach

Campus Power - from a dream to a degree, with you at every step.

Solutions for student, parents and institutes.

Just getting returns on your investment?

Save Tax too, while you build your corpus!

Manage all your utility bills, smartly.

Pay bills easily, using Internet Banking.

ICICI Bank Two-Wheeler Loan

Get your dream bike now!

ICICI Bank FD

Choose certainity during uncertain times.

ICICI Bank PPF Account

A blessing for wealth creation is here for you!

Your guide to Personal Finance

A refreshing way to learn all about Personal Finance.

All it takes is 5 minutes!

Instant payout on selling shares, with the ICICIdirect Prime Account.

ICICI Bank Car Loan

Experience a seamless Car Loan process!

- Personal Banking

- Multicurrency Contactless Forex Prepaid Card

Want us to help you with anything? Request a Call back

Thank you for your request..

Your reference number is CRM

Our executive will contact you shortly

Your reference number is CRM 786578956

Sorry! Please check back in a few minutes as an error has occurred.

Welcome to the world of Speed, Security and Convenience.

Now you can make your international trips more convenient and secured. How? Just get started with ICICI Bank Contactless Multicurrency Forex Prepaid Card. This Card comes with an in-built technology which enables you to make contactless payments# at merchant terminals.

Be it transit, shopping or dining, just load the Contactless Forex Prepaid Card and explore the world endlessly.

If you are an existing ICICI Bank customer, login to apply .

New to ICICI Bank? Click below to apply.

Joining Benefits:

15 Wallets of different currencies in a single Card

Get a free international sim card for your travel abroad

Lost Card/Counter Card liability coverage of INR 5,00,000.

- Joining fee - NIL

- Annual fee - NIL

How to avail a free international SIM?

To avail a complimentary international SIM on ICICI Bank Visa Forex Prepaid Card, you need to first log in to vsim.webaccess.dreamfolks.in/ using your registered mobile number and follow the below steps:

After logging in, you will be prompted to enter the card number and your name

Click on ‘Register’

Upon successful validation, you will be redirected to a page displaying the complimentary SIM access benefits linked to the card

You can then choose between a physical SIM or an eSIM and proceed by following the instructions

An executive from the service provider's vendor team will reach out to you for the KYC verification process

In case of any issues, you can contact the helpdesk on 18001234109 or send an e-mail to [email protected] . This service is available 24x7.

Click here for more details.

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

A safe-to-use, prepaid, reloadable, multi-currency card that’s not linked to your bank account

No charges when you spend abroad*

Make contactless, Apple Pay and Google Pay™ payments

Manage your account and top up or freeze your card easily with our Travel app

*No charges when you spend abroad using an available balance of a local currency supported by the card.

Win £5000 with Post Office Travel Money Card

A chance to win £5000 when you top up a new or existing Travel Money Card*. Offer ends 12 May

*Exclusive to travel money cards. Promotion runs 4 March to 12 May 2024. 1 x £5,000 prize available to be won each week. Minimum equivalent spend of £50 applies.

Why get a Travel Money Card?

Carry up to 22 currencies safely.

Take one secure, prepaid Mastercard® away with you that holds multiple currencies (see ‘common questions’ for which).

Accepted in over 36 million locations worldwide

Use it wherever you see the Mastercard Acceptance Mark – millions of shops, restaurants and bars in more than 200 countries.

Manage your card with our travel app

Top up, manage or freeze your card, transfer funds between currencies, view your PIN and more all in our free Travel app .

It’s simple to get started

No need to carry lots of cash abroad. Order a Travel Money Card today for smart, secure holiday spending.

Order your card

Order online, via the app or pick one up in branch and load it with any of the 22 currencies it holds.

Activate it

Cards ordered online and in-app should arrive within 2-3 working days. Activate it by following the instructions in your welcome letter.

It’s ready to use

Spend in 36 million locations worldwide, and top up and manage your card in the app or online.

Stay in control

Manage your holiday essentials together in one place on the move, from your Travel Money Card and travel insurance to extras like airport parking.

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

Order a Travel Money Card

Order your card online – or through the Post Office travel app – and we'll deliver it within 2-3 days. Just activate it and go.

Need it quick? Visit a branch

Pick up a Travel Money Card instantly at your local Post Office. Bring a valid passport, UK driving licence or valid EEA card as ID.

Need some help?

We’re here to help you make the most of your Travel Money Card – or put your mind at ease if it’s been lost or stolen

Lost or stolen card?

Please immediately call: 020 7937 0280

Available 24/7

To read our FAQs, manage your card or contact us about using it:

Visit our Travel Money Card support page

Common questions

How can i order my card.

There are three ways that you able to obtain a Travel Money Card, each very simple.

Please note, you must be a UK resident over the age of 18 to obtain a Travel Monday Card.

- Via our travel app: you can order and store up to three Travel Money Cards in our free travel app . Delivery will take 2-3 working days.

- Online: follow our application process to order your card online. Your card will take 2-3 working days to be delivered. Once it arrives you can link it to our Travel app to manage on the go.

- In branch: simply find a nearby Post Office branch and pop in to get your Travel Money Card there. Please remember to take a valid passport, UK driving licence or a valid EEA card in order to obtain your card, and you can take it away the same day.

Whichever way you choose to order your card, don't forget to activate it once it arrives. Full details of how to activate your card will be provided in your welcome letter, to which your card will be attached if it’s been sent in the post.

How do I use my card?

Travel Money Card is enabled with both chip & PIN and contactless, so you can make larger and lower-value value payments with it respectively. For convenience, you can also add it to Apple Pay and Google Wallet.

You can load it with between £50 and £5,000 (see more on load limits below). You can use it to pay wherever the Mastercard Acceptance Mark is displayed. And you can withdraw cash with it at over 2 million ATMs worldwide (charges and fees apply, see 'Are there top-up limits?' below).

Your Travel Money Card is completely separate from your bank account so it’s a safe and secure way to pay while you’re abroad.

How can I manage my card?

After you've activated your card, you can manage it using our travel app or via a web browser. You can check your recent transactions, view your PIN, transfer funds between different currency ‘wallets’, top up your card, freeze your card and more.

Our travel app brings together travel essentials including holiday money, travel insurance and more together in one place. As well as managing your Travel Money Card you can buy cover for your trip, access your policy documents on the move, book extras such as airport parking and hotels, and find your nearest ATM while overseas or Post Office branches here in the UK.

Which currencies can I use?

The Post Office Travel Money Card can be loaded with up to 22 currencies at any one time. You can top up funds on the card and transfer currencies between different ‘wallets’ for these currencies easily in our travel app or online.

Currencies available:

- EUR – euro

- USD – US dollar

- AUD – Australian dollar

- AED - UAE dirham

- CAD – Canadian dollar

- CHF – Swiss franc

- CNY – Chinese yuan

- CZK – Czech koruna

- DKK – Danish krone

- GBP – pound sterling

- HKD – Hong Kong dollar

- HUF – Hungarian forint

- JPY – Japanese yen

- NOK – Norwegian krone

- NZD – New Zealand dollar

- PLN – Polish zloty

- SAR – Saudi riyal

- SEK – Swedish Krona

- SGD – Singapore dollar

- THB – Thai baht

- TRY – Turkish lira

- ZAR – South African rand

What are the charges and fees?

Full details of our charges and fees can be found in our Travel Money Card terms and conditions .

The Post Office Travel Money Card is intended for use in the countries where the national currency is the same as the currencies on your card. If the currency falls outside of any of the 22 we offer on your card, you’ll be charged a cross-border fee. For example, using your card in Brazil will incur a cross-border fee because we do not offer the Brazilian real as a currency.

Cross border fees are set at 3% and are only applicable when you use your currency in a country other than the ones we offer.

For more information on cross border fees, please visit our cross border payment page.

There are no charges when using your card in retailers in the country of the currency on the card. This means that a €20 purchase in Spain would cost you €20 and will be deducted from your euro balance.

To avoid unnecessary charges to your card, wherever asked, you should always choose to pay for goods or withdraw cash in the currencies of your card. For example, if you are using the card in Spain you should always choose to pay in euro if offered a choice; choosing to pay in sterling (GBP) in this example would allow the merchant to exchange your transaction from euro to sterling. This would mean your transaction has gone through two exchange rate conversions, which will increase the total cost of your transaction.

For loads in Great British pounds, a load commission fee of 1.5% will apply (min £3, max £50). A monthly maintenance fee of £2 will be deducted from your balance 12 months after your card expires. Expiration dates can be found on your TMC; all cards are valid for up to 3 years.

A cash withdrawal fee will be charged when withdrawing cash from a UK Post Office branch or from any ATM globally that accepts Mastercard.

We have listed all available currencies and their associated withdrawal limits and charges below:

EUR – euro Max daily cash withdrawal: 450 EUR Withdrawal charge: 2 EUR

USD – US dollar Max daily cash withdrawal: 500 USD Withdrawal charge: 2.5 USD

AED – UAE dirham Max daily cash withdrawal: 1,700 AED Withdrawal charge: 8.5 AED

AUD – Australian dollar Max daily cash withdrawal: 700 AUD Withdrawal charge: 3 AUD

CAD – Canadian dollar Max daily cash withdrawal: 600 CAD Withdrawal charge: 3 CAD

CHF – Swiss franc Max daily cash withdrawal: 500 CHF Withdrawal charge: 2.5 CHF

CNY – Chinese yuan Max daily cash withdrawal: 2,500 CNY Withdrawal charge: 15 CNY

CZK – Czech koruna Max daily cash withdrawal: 9,000 CZK Withdrawal charge: 50 CZK

DKK – Danish krone Max daily cash withdrawal: 2,500 DKK Withdrawal charge: 12.50 DKK

GBP – Great British pound Max daily cash withdrawal: 300 GBP Withdrawal charge: 1.5 GBP

HKD – Hong Kong dollar Max daily cash withdrawal: 3,000 HKD Withdrawal charge: 15 HKD

HUF – Hungarian forint Max daily cash withdrawal: 110,000 HUF Withdrawal charge: 600 HUF

JPY – Japanese yen Max daily cash withdrawal: 40,000 JPY Withdrawal charge: 200 JPY

NOK – Norwegian krone Max daily cash withdrawal: 3,250 NOK Withdrawal charge: 20 NOK

NZD – New Zealand dollar Max daily cash withdrawal: 750 NZD Withdrawal charge: 3.5 NZD

PLN – Polish zloty Max daily cash withdrawal: 1,700 PLN Withdrawal charge: 8.5 PLN

SAR – Saudi riyal Max daily cash withdrawal: 1,500 SAR Withdrawal charge: 7.50 SAR

SEK – Swedish Krona Max daily cash withdrawal: 3,500 SEK Withdrawal charge: 20 SEK

SGD – Singapore dollar Max daily cash withdrawal: 500 SGD Withdrawal charge: 3 SGD

THB – Thai baht Max daily cash withdrawal: 17,000 THB Withdrawal charge: 80 THB

TRY – Turkish lira Max daily cash withdrawal: 1,500 TRY Withdrawal charge: 7 TRY

ZAR – South African rand Max daily cash withdrawal: 6,500 ZAR Withdrawal charge: 30 ZAR

Are there top-up limits?

Yes, all currencies have top-up limits and balances. See full information below, which is applicable to all currencies available on the Travel Money Card.

- Top-up limit: minimum £50 – maximum £5,000

- Maximum balance: £10,000 at any time, with a maximum annual balance of £30,000

- Read more Travel Money Card FAQs

Other related services

Hoi An in Vietnam is still the best-value long haul destination for UK ...

Travelling abroad? These tips will help you get sorted with your foreign ...

We all look forward to our holidays. Unfortunately, though, more and more ...

The nation needs a holiday, and Brits look set to flock abroad this year. The ...

Our annual survey of European ski resorts compares local prices for adults and ...

The nation needs a holiday. And, with the summer season already underway, new ...

If you’re driving in Europe this year, Andorra’s your best bet for the cheapest ...

One of the joys of summer are the many music festivals playing across the ...

Prepaid currency cards are a secure way to make purchases on trips abroad. They ...

For the first time in 16 years of our reports, Lisbon is not only the cheapest ...

Thinking of heading off to Europe for a quick city break, but don’t want to ...

Knowing how much to tip in a café, restaurant, taxi or for another service can ...

Post Office Travel Money unveils the first Islands in the Sun Holiday Barometer ...

To avoid currency conversion fees abroad, always choose ‘local currency’ ...

Long-haul destinations offer the best value for UK holidaymakers this year, ...

Kickstarting your festive prep with a short getaway this year? The Post Office ...

Find out more information by reading the Post Office Travel Money Card's terms and conditions .

Post Office Travel Money Card is an electronic money product issued by First Rate Exchange Services Ltd pursuant to license by Mastercard International. First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW8 9DF, (Financial Services Register No. 900412). Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Post Office and the Post Office logo are registered trademarks of Post Office Limited.

Post Office Limited is registered in England and Wales. Registered number 2154540. Registered office: 100 Wood Street, London, EC2V 7ER.

These details can be checked on the Financial Services Register by visiting the Financial Conduct Authority website and searching by Firm Reference Number (FRN).

- Personal Finance Accounts Best Credit Cards Best Financial Advisors Best Savings Accounts Apps Best Banking Apps Best Stock Trading Software Robinhood Alternatives TurboTax Alternatives Brokers Brokerage Account Taxes Brokers for Bonds Brokers for Index Funds Brokers for Options Trading Brokers for Short Selling Compare Online Brokers Forex Brokers Futures Brokers High-Leverage Forex Brokers MetaTrader 5 Brokers Stock Brokers Stock Brokers For Beginners

- Insurance Car Best Car Insurance Rental Car Insurance Motorcycle Best Motorcycle Insurance Seasonal Insurance Vision Best Vision Insurance Types of Vision Insurance Vision Insurance For Kids Vision Insurance For Seniors Health Affordable Health Insurance Best Health Insurance Companies Individual Health Insurance Self-employed Health Insurance House Earthquake Insurance Flood Insurance Homeowners Insurance Mobile Homes Moving Insurance Renters Insurance Sewer Line Dental Affordable Dental Insurance Best Dental Insurance Dental Insurance With No Annual Maximum Dental Insurance With No Waiting Period Kids Dental Insurance Medicare Compare Medicare Plans Cost of Hospital Stays Life Term Life Insurance Business Best Business Insurance Pet Best Pet Insurance

- Investing Penny Stocks Best EV Penny Stocks Best Penny Stocks Penny Stocks Under 10 Cents Penny Stocks With Dividends Futures Best Futures Trading Software Futures to Trade Futures Trading Courses Strategies Trading Platforms for E-Mini Futures Stocks Best Stock Charts Best Stocks Under $50 Best Stocks Under $100 Best Swing Trade Stocks Best Time to Trade Cash App Stocks How to Invest Stock Market Scanners Stock Market Simulators Stocks to Day Trade Forex Forex Demo Accounts Forex Robots Forex Signals Forex Trading Apps Forex Trading Software How to Trade Forex Making Money Trading Forex Trading Courses Trading Strategies Options Options to Buy Options Trading Apps Options Trading Books Options Trading Courses Paper Trading Swing Trading Options Trading Examples Trading Simulators Trading Software Trading Day Trading Apps Day Trading Books Day Trading Courses Day Trading Software Day Trading Taxes Prop Trading Firms Trading Chat Rooms Trading Strategies Alternative investing Alternative Investment Platforms Best REITs Best Alternative Investments Best Cards to Collect Best Gold IRAs Investing in Precious Metals Investing in Startups Real Estate Crowdfunding ETFs Commercial Real Estate ETFs International ETFs Monthly Dividing ETFs

- Mortgage Best Mortgage Companies FHA Lenders First Time Buyers HELOC & Refinancing Lenders for Self-Employed People Lenders That Do Not Require Tax Returns Online Mortgage Lenders

- Crypto Best Crypto Apps Business Crypto Accounts Crypto Day Trading Crypto Exchanges Crypto Scanners Crypto Screeners Earning Interest on Crypto Get Free Crypto How to Trade Crypto Is Bitcoin a Good Investment?

Best Forex Card for International Travel

A forex card is one of the most convenient and safe ways to carry cash and exchange money for your travels abroad. It's a widely accepted payment and is simple to use, like a credit or debit card. When selecting a type of forex card, you need to consider the countries you are traveling to. Find out more about the best forex card for international travel, their benefits and how to use them.

5 Best Forex Cards for International Travel

Wise travel card, axis bank forex card, indusind bank multi-currency forex card, travelex money card, hsbc everyday global travel card, what is a forex card, how to choose a forex card for international travel, low exchange rates, ability to hold multi-currency, ability to reload online.

- EVM Chip-enabled

Special Perks

Cut down on international travel expenses using forex cards.

- Frequently Asked Questions

Quick look: Best Forex Cards

- Best for Exchange Rate: Wise Travel Card

- Best for Discounts and Exclusive Rewards: Axis Bank Forex Card

- Best for Low Fees: Travelex Money Card

- Best for Convenience: IndusInd Bank Multi-Currency Forex Card

- Best for No International Transaction Fees: HSBC Everyday Global Travel Card

The following are among the best five forex cards and their features:

With the Wise Travel forex card, you can enjoy a better exchange rate and lower fees than your bank. The Wise Travel Card is ideal for purchasing goods online from other countries, and it charges no transaction fees. The Wise card is accepted across the MasterCard network.

Best for: Frequent travelers

Card Validity: The validity of your card is stated on the front of the card. Wise will notify you when it's time to order a new one.

Number of Currencies : 50+

Fees and Charges:

- After making two withdrawals of up to $100 each month for free, you'll be charged $1.50 per withdrawal.

- There's a 2% fee on any amount you withdraw above $100.

- Wise charges a fee of $9 when you order a card.

- Best exchange rates globally

- One of the lowest conversion fees on the market

- No international transaction fees

- No annual or monthly fees

- Extremely low costs to send money overseas

Cons:

- If you require a replacement card, it may take up to two to three weeks to arrive.

- You can only top up your account online or in the app.

- There are no cash or check payment options.

- There are no credit facilities.

Axis Bank provides four different types of forex cards. Each card has unique perks and disadvantages, so you can select which suits your requirements. The Axis Bank forex card offers emergency assistance and a miles program. Using Mastercard's contactless technology, the card offers quick and secure payments.

Best for: Students

Card Validity: 5 years

Number of Currencies : 16

- Issuance Fee – 300 Indian rupees (INR)

- Reload Fee – 100 INR

- Add-on Card Fee – 100 INR

- Cash withdrawal: $2.25

- Balance inquiry: $0.5

- Replacement card fee (Domestic): $3

- Replacement card fee (International): $15

- Cross Currency Fee – 3.5%

- 24-hour emergency assistance

- Locked exchange rate: Your money on the card is unaffected by the fluctuation in the dollar exchange rate.

- The Axis Bank Forex Card is widely accepted in all retail outlets and online retailers that accept MasterCard or Visa credit and debit cards.

- Charges fees for signing up, reloading and cash withdrawals from ATMs other than those operated by Axis Bank.

- If the card is not used for longer than 36 months, there is an inactivity fee of $5 or the indicated fee for each currency.

- Axis bank forex cards only support a limited amount of currencies.

The IndusInd Bank multi-currency forex card has an embedded chip, which makes transactions secure and simple. Indusind forex card provides currency withdrawals from all VISA ATMs and currency fluctuation protection. IndusInd Multi Currency Forex card also provides add-on features, such as zero foreign markup rates.

Best for: Frequent international travelers

Card Validity: 3 years

Number of Currencies : 14

Fees and Charges:

- Issuance fee – 300 INR

- Cross currency fee – 3.5% markup

- Re-issuance of card fee – 100 INR

- ATM cash withdrawal fee- $2

- Reload fee – 100 INR

- Inactivity fee – $3 per quarter after 18 months of inactivity

- Two free ATM withdrawals each month per currency

- There is no extra charge on International bookings and payments for hotels, restaurants, flights, retailers and gas stations made with the travel card.

- It offers protection given against currency fluctuations.

- You cannot reload the card at foreign locations.

The Travelex Money Card is a contactless prepaid forex card. Pre-loading your Travelex Money Card before a trip allows you to manage your travel budget better. You can pay for goods and services online and at physical stores worldwide. Travelex Money Card does not charge fees for international ATMs withdrawal or purchases.

Card Validity: The validity of your card is stated on the front of the card.

Number of Currencies : 10

- Currency transfer fee - Foreign exchange rate applies; varies each day.

- Foreign exchange fee - If you use your card for a transaction in a currency that is not listed on it you will be charged a 5.75% fee. This fee also applies if there is not enough money on the card to cover the transaction in the local currency, and the rest is taken from another currency.

- Individuals can use it anywhere Mastercard is accepted.

- Travelex doesn't charge ATM fees.

- If your card is lost or stolen, you can withdraw funds from your account through Western Union or Moneygram agents.

- The currency rates are less favorable than those offered by other international travel forex cards.

- It only supports a limited amount of currencies.

The HSBC Everyday Global Travel Card provides an excellent conversion rate for U.S. dollars. When you use HSBC ATMs, you can withdraw cash without paying the 10% withdrawal fee. HSBC forex card does not charge a foreign transaction fee. When you tap and pay with payWave, Apple Pay or Google Pay, you can receive 2% cash back for transactions under $100.

Best for: Individuals traveling to or within the United States and Australia, and transferring overseas.

Card Validity: The validity of your card is stated on the front of the card. HSBC will notify you when it's time to order a new one.

- HSBC does not charge ATM fees, but local operators may charge additional fees or set limits.

- Foreign currency conversion fees are calculated in different scenarios based on HSBC real-time or VISA exchange rates.

- Excellent USD exchange rate.

- There are no ATM fees, foreign transactions, currency conversion costs or monthly fees.

- Multiple currencies can be managed in a single account online or via the HSBC mobile banking app.

A forex card is a prepaid travel card that you can preload with the foreign currency of your choice before embarking on your trip. A forex card can be used to pay for shopping and lodging expenses or to get cash from an ATM in your travel destination's local currency.

When you use a forex card, you do not have to pay a conversion fee every time you swipe the card. Forex cards provide better exchange rates than cash purchases of foreign currency. Currency fluctuations do not impact forex cards because they are preloaded at fixed exchange rates. It is a secure and simple means of holding and transacting foreign currencies.

The following are factors to consider when selecting a forex card for international travel.

When you purchase a forex card and load it with the currency of your choice, it is not affected by currency fluctuations. When selecting a forex card, find out about its exchange rate and fees, as these might significantly increase your expenses. Read the exchange rate fees listed for each forex card and choose the most affordable ones that meet your requirements.

A multi-currency forex card is a card that can hold several currencies. This feature is essential if you plan to visit several countries during your trip. Choose a forex card that supports the currencies of the countries you visit. This way, you won't need to plan for cash each time you pass a border or worry about exchange rate changes.

The forex card you select should have an online reload feature, allowing you to instantly transfer funds from your bank account. This function may come in handy if you run out of money while traveling and cannot visit a bank or wait for a fund transfer.

EVM Chip-enabled

The most important factor to consider when getting a forex card is its security features. Magnetic-stripe cards are vulnerable to card skimming, which allows hackers to clone and abuse them. Ensure that your currency card has an EVM chip for security. The chip's encryptions prevent attackers from using data-reading devices and technology to obtain your card information.

Some forex card issuers provide you with special perks, like discounts, cash back, miles and access to airport services. Find out if a forex card offers additional benefits before choosing one because doing so could help you save money and cut down on travel costs.

Most forex card issuers have mobile apps that allow you to monitor your transactions online and easily reload your card when your funds run out. Forex Cards are one of the most efficient, safe and cost-effective ways to carry money when traveling internationally. Select one of the best forex cards and get easy access to making international transactions at affordable rates.

Frequently Asked Questions

Is a forex card worth it.

Forex cards offer better exchange rates, discounts and additional features that make financing international travel easy.

Do forex cards work?

Yes. After signing up and activating your forex card, you can use it to make purchases and payments.

Is a forex card better than a debit card?

For international travel, a forex card is recommended because they have a better exchange rate and do not charge a conversion fee on every international transaction.

Get a Forex Pro on Your Side

FOREX.com , registered with the Commodity Futures Trading Commission (CFTC), lets you trade a wide range of forex markets with low pricing and fast, quality execution on every trade.

You can also tap into:

- EUR/USD as low as 0.2 with fixed $5 commissions per 100,000

- Powerful, purpose-built currency trading platforms

- Monthly cash rebates of up to $9 per million dollars traded with FOREX.com’s Active Trader Program

Learn more about FOREX.com ’s low pricing and how you can get started trading with FOREX.com.

Here Are the Four Best Travel Money Cards in 2024

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Jarrod Suda

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

From the multitude of bank fees and ATM charges to hidden currency conversion fees, there's no question that spending your money abroad while travelling can be costly — and that's saying nothing about the cost of the holiday itself!

As you prepare for your trip abroad, the golden rule is that you'll save the most money by using the local currency of your destination. This means withdrawing local cash at foreign ATMs and using a debit card to pay directly in the local currency. For example, if you're from the UK, using your bank's debit card that accesses your British pounds will likely lose you money to hidden fees at ATMs abroad and at local merchants.

In general, we rate Revolut as the best travel card all around. Its versatile account and card can be used to spend like a local pretty much anywhere in the world. ✨ Get 3 months of free Revolut Premium as a Monito reader with our exclusive link .

If you're from the EU, UK, or US, here are a few more specific recommendations to explore:

- Best for travelling from the UK: Chase

- Best for travelling from the US: Chime ®

- Best for travelling from the Eurozone: N26

If it's not possible for you to spend in the local currency when travelling abroad, then spending in your home currency while using a card that doesn't charge any hidden exchange rate markups from your bank (e.g. only the VISA or Mastercard exchange rates to convert currency) is still a good bet for most people.

In this guide, we explore cards that waive or lower ATM fees and that hold multiple currencies. Spend on your holiday like a local and enjoy peace of mind after each tap and swipe!

Best Travel Cards (And More!) at a Glance

Best travel money cards.

- 01. What is the best best multi currency card? scroll down

- 02. Are prepaid currency cards really it? scroll down

- 03. Monito's best travel money card tips scroll down

- 04. FAQ about the best travel cards scroll down

Revolut: Best All-Rounder

Revolut is one of the most well-known fintechs in the world because it offers services across Europe, the Americas, Asia, and Oceania.

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

Revolut is available in many countries. You can double-check if it's available in yours below:

Here's an overview of Revolut's plans:

Revolut Ultra is currently only available in the UK and EU.

Like Wise, Revolut converts your currency to the local currency of your travel destination at an excellent exchange rate (called the 'Revolut Rate', which, on weekdays, is basically on par with the rate you see on Google), making it a good way to buy foreign currency before travelling abroad. As always though, bear in mind that Revolut's exchange rates might be subject to change.

Revolut's Standard Plan only allows currency exchange at the base mid-market exchange rate for transfers worth £1,000 per month. ATM withdrawals are also free for the first €200 (although third-party providers may charge a withdrawal fee, and weekend surcharges may also apply). These allowances can be waived by upgrading memberships.

N26: Good Bank For EU Travellers

One of the most well-known neobanks in Europe, N26 and its debit card operate in euros only. However, N26 is a partner with Wise and has fully integrated Wise's technology so that you never have to pay foreign transaction fees on your purchases outside of the eurozone. While N26 does not have multi-currency functionality, N26 will apply the real exchange rate on all your foreign purchases and will never charge a commission fee — making N26's card a powerful card for EU/EEA residents who travel across the globe.

- Trust & Credibility 7.9

- Service & Quality 8.0

- Fees & Exchange Rates 9.3

- Customer Satisfaction 8.1

These are the countries in which you can register for an N26 account:

And here is an overview of the various plans and account:

This low-fee option for banking is also ideal for travellers who do not belong to a European bank but frequent the Eurozone. For example, N26 is available for residents and citizens of Switzerland, Norway, and other European Economic Area countries that do not run on the Euro.

These citizens, who are in close proximity to the Eurozone, will save each time they spend with an N26 card while in Europe. N26 provides three free ATM withdrawals per month in euros but does charge a 1.7% fee per ATM withdrawal outside of Europe.

Take a look at our guide to the best travel cards for Europe to learn more.

Wise: Best For Multi-Currency Balances

Load up to 54 currencies onto this card at the real exchange rate, giving you access to truly global travel.

- Trust & Credibility 9.3

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.6

These are the countries in which you can order a Wise debit card:

Unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your home currency into up to 54 currencies. The live rate you see on Google or XE.com is the one you get with Wise.

An industry-low commission fee per transaction will range from 0.35% to 2.85%, depending on the currency.

Chase: Great UK Bank For Travel

A recent arrival from the USA, Chase is one of the UK’s newest digital challenger banks and comes with a rock-solid reputation and no monthly charges, no currency conversion charges, no withdrawal fees, and no other charges for everyday banking from Chase. It’s a simple, streamlined bank account with an excellent mobile banking app and a great cashback offer. However, it doesn’t yet offer more advanced features like international money transfers, joint accounts, business banking, overdrafts and loans, and teen or child accounts.

- Trust & Credibility 10

- Fees & Exchange Rates 10

- Customer Satisfaction 8.7

Chime: Great Account For US Travelers

Chime is a good debit card for international travel thanks to its no foreign transaction fees¹. Unlike multi-currency accounts like Revolut (which let you hold local currency), Chime uses the live exchange rate applied by VISA. This rate is close to the mid-market rate, and Chime does not add any extra markup to your purchases, although out-of-network ATM withdrawal and over-the-counter advance fees may still apply.

- Trust & Credibility 9.5

- Service & Quality 8.8

- Fees & Exchange Rates 9.8

While Chime waives ATM fees at all MoneyPass, AllPoint, and VISA Plus Alliance ATMs within the United States, this fee waiver does not extend to withdrawals made outside the country. For withdrawals abroad, Chime applies a $2.50 fee per transaction, with a daily withdrawal limit of $515 or its equivalent. This is in addition to any fees charged by the ATM owner. Therefore, we recommend Chime primarily for card purchases rather than relying on it for withdrawing cash while traveling internationally.

- No foreign transaction fees ¹;

- Uses VISA's exchange rate ( monitor here ):

- A $2.50 fee per ATM withdrawal made outside of the United States;

- More info: Read our Chime review or visit their website .

Best Travel Money Cards in 2024 Compared by Country

In the table below, see our comparison summary of the four best travel cards for 2024 by country:

Last updated: 8 January 2024

What's The Best Prepaid Card to Use Abroad?

Travel cards come in many varieties, such as standard credit cards or debit cards with no foreign transaction fees or cards that waive all foreign ATM withdrawal fees.

What is a Multi-Currency Card?

Multi-currency cards are a specific type of travel card that allows you to own all kinds of foreign currencies, which you can instantly access when you pay with your card abroad. By spending the local currency in the region of travel , you bypass poor foreign exchange rates. ATMs and cashless payment machines will treat your card like a local card.

We have already mentioned a few multi-currency cards in this review, but we will also introduce Travelex . Travelex's Money Card also allows you to top up several foreign currencies — albeit at exchange rates slightly poorer than the real mid-market rate .

Wise Account

Wise has one of the best multi-currency cards available on the market.

Read our full review for more details.

Revolut is impressive for its vast options in currencies and its additional services.

Our in-depth review explores Revolut's services in detail.

Travelex offers a prepaid travel money card that supports 10 currencies and waives all ATM withdrawal fees abroad.

- Trust & Credibility 9.0

- Service & Quality 5.8

- Fees & Exchange Rates 7.1

- Customer Satisfaction 9.3

Travelex charges fees, which fluctuate according to the exchange rates of the day, in order to convert your home currency into the currencies that it supports. But once the currency is on the card, you'll be able to spend like a local. Learn more with our full review .

Don’t Let Banks, Bureaux de Change, and ATMs Eat Your Lunch 🍕!

Are you withdrawing cash at an ATM in the streets of Paris? Exchanging currencies at Gatwick airport? Paying for a pizza with your card during a holiday in Milano? Every time you exchange currencies, you could lose between 2% to 20% of your money in hidden fees . Keep reading below to make sure you recognize and avoid them.

Currency Exchange Fees Eating My Lunch? What’s That?

You’re often charged a hidden fee in the form of an alarming exchange rate.

At any given time, there is a so-called “ mid-market exchange rate ” — this is the real exchange rate you can see on Google . However, the money transfer provider or bank you use to exchange currencies rarely offers this exchange rate. Instead, you will get a much worse exchange rate. They pocket this margin between the actual rate and the poor exchange rate they apply, allowing the bank or money transfer provider to profit from the currency exchange.

In other words, you or your recipient will receive less foreign currency for each unit of currency you exchange. All the while, the provider will claim that they charge zero commission or zero fees.

So the question now is… how can you avoid them? Thankfully, the best travel money cards will allow you to hold the local currency, which you can access instantly with a tap or swipe. Carrying the local currency avoids exchange rate margins on every purchase.

Top Travel Money Tips

- Avoid bureaux de change. They charge between 2.15% and 16.6% of the money exchanged.

- Always pay in the local currency and never accept the dynamic currency conversion .

- Don't use your ordinary debit or credit card unless it's specifically geared toward international use. Doing this will typically cost you between 1.75% and 4.25% per transaction. Instead, use one of the innovative travel money cards below.

By opting for a travel card without FX fees, you can freely swipe your card abroad without worrying about additional charges. However, saving money doesn't stop there. To make the most out of your travel budget, consider using Skyscanner , one of the most powerful flight search engines available that allows you to compare prices from various airlines and find the best deals.

With Skyscanner's user-friendly interface and comprehensive search options, you can discover cheap flights and enjoy your holidays with peace of mind and more money in your pocket.

Best Travel Money Card Tips

When you convert your home currency into a foreign currency, foreign exchange service providers will charge you two kinds of fees :

- Exchange Rate Margin: Providers apply an exchange rate that is poorer than the true "mid-market" exchange rate . They keep the difference, called an exchange rate margin .

- Commission Fee: This fee is usually a percentage of the amount converted, which is charged for the service provided.

With these facts in mind, let's see what practices are useful to avoid ATM fees, foreign transaction fees, and other charges you may encounter while on your travels.

Tip 1: While Traveling, Avoid Bureaux de Change At All Costs

Have you ever wondered how bureaux de change and currency exchange desks are able to secure prime real estate in tourist locations like the Champs-Élysées in Paris or Covent Carden in London while claiming to take no commission? It’s easy: they make (plenty of) money through hidden fees on the exchange rates they give you.

Our study shows that Bureaux de Change in Paris charges a margin ranging from 2.15% at CEN Change Dollar Boulevard de Strasbourg to 16.6% (!!) at Travelex Champs-Élysées when exchanging 500 US dollars into euros for example.

If you really want cash and can’t wait to withdraw it with a card at an ATM at your destination, ordering currencies online before your trip is usually cheaper than exchanging currencies at a bureau de change, but it’s still a very expensive way to get foreign currency which we, therefore, would not recommend.

Tip 2: Always Choose To Pay In the Local Currency

Don’t fall for the dynamic currency conversion trap! When using your card abroad to pay at a terminal or withdraw cash at an ATM, you’ve probably been asked whether you’d prefer to pay in your home currency instead of the local currency of the foreign country. This little trick is called dynamic currency conversion , and the right answer to this sneaky question will help you save big on currency exchange fees.

As a general rule, you always want to pay in the local currency (euros in Europe, sterling in the UK, kroner in Denmark, bahts in Thailand, etc.) when using your card abroad, instead of accepting the currency exchange and paying in your home currency.

This seems like a trick question - why not opt to pay in your home currency? On the plus side, you would know exactly what amount you would be paying in your home currency instead of accepting the unknown exchange rate determined by your card issuer a few days later.

What is a Dynamic Currency Conversion?

However, when choosing to pay in your home currency instead of the local one, you will carry out what’s called a “dynamic currency conversion”. This is just a complicated way of saying that you’re exchanging between the foreign currency and your home currency at the exact time you use your card to pay or withdraw cash in a foreign currency, and not a few days later. For this privilege, the local payment terminal or ATM will apply an exchange rate that is often significantly worse than even a traditional bank’s exchange rate (we’ve seen margins of up to 8%!), and of course, much worse than the exchange rate you would get by using an innovative multi-currency card (see tip #3).

In the vast majority of times, knowing with complete certainty what amount you will pay in your home currency is not worth the additional steep cost of the dynamic currency conversion, hence why we recommend always choosing to pay in the local currency.

Tip 3: Don't Use a Traditional Card To Pay in Foreign Currency/Withdraw Cash Abroad

As mentioned before, providers make money on foreign currency conversions by charging poor exchange rates — and pocketing the difference between that and the true mid-market rate. They also make money by charging commission fees, which can either come as flat fees or as a percentage of the transaction.

Have a look at traditional bank cards to see how much you can be charged in fees for spending or withdrawing $500 while on your holiday.

These fees can very quickly add up. For example, take a couple and a child travelling to the US on a two-week mid-range holiday. According to this study , the total cost of their holiday would amount to around $4200. If you withdraw $200 in cash four times and spend the rest with your card, you would pay $123 in hidden currency exchange and ATM withdrawal fees with HSBC or $110 with La Banque Postale. With this money, our travellers could pay for a nice dinner, the entrance fee to Yosemite Park, or many other priceless memories.

Thankfully, new innovative multi-currency cards will help you save a lot of money while travelling. Opening an N26 Classic account and using the N26 card during the same US holidays would only cost $13.60.

Need Foreign Cash Anyway?

In many countries, carrying a wad of banknotes is not only useful but necessary to pay your way since not every shop, market stall, or street vendor will accept card payments. In these cases you'll have two options to exchange foreign currency cheaply:

1. Withraw at an ATM

As we've explored in great depth in this article, withdrawing money from a foreign ATM will almost always come with fees — at the very least from the ATM itself, and so it's therefore the best strategy to use a travel debit card that doesn't charge in specific ATM withdraw fees on its own to add insult to injury. That said, if you need cash, we recommend making one large withdrawal rather than multiple smaller ones . This way, you'll be able to dodge the fees being incurred multiple times.

2. Buy Banknotes (at a Reasonable Rate!)

As we've also seen, buying foreign currency at the airport, at foreign bank branches, or in bureaux de change in tourist hotspots can be surprisingly expensive. Still, not all exchange offices are equally pricey . If you're looking for a well-priced way to exchange your cash into foreign currency banknotes before you travel, Change Group will let you order foreign currency online and pick them up at the airport, train station, or a Change Group branch just before you leave for your holiday. A few pick-up locations in the UK include:

- London centre (multiple locations),

- Glasgow centre,

- Oxford centre,

- Luton Airport,

- Gatwick Airport,

- St. Pancras Station.

(Note that Change Group also has locations in the USA, Australia, Germany, Spain, Sweden, Austria, and Finland!)

Although its exchange rates aren't quite as good as using a low-fee debit card like Revolut, Change Group's exchange rates between popular currencies tend to be between 2% to 3%, which is still a lot better than you'll get at the bank or at a touristy bureau de change in the middle or Paris or Prague!

FAQ About the Best Travel Money Cards

Having reviewed and compared several of the industry's leading neobanks, experts at Monito have found the Wise Account to offer the best multi-currency card in 2024.

In general, yes! You can get a much better deal with new innovative travel cards than traditional banks' debit/credit cards. However, not all cards are made equal, so make sure to compare the fees to withdraw cash abroad, the exchange rates and monthly fees to make sure you're getting the best deal possible.

- Sign up for a multi-currency account;

- Link your bank to the account and add your home currency;

- Convert amount to the local currency of holiday destination ( Wise and Revolut convert at the actual mid-market rate);

- Tap and swipe like a local when you pay at vendors.

Yes, the Wise Multi-Currency Card is uniquely worthwhile because it actually converts your home currency into foreign currency at the real mid-market exchange rate . Wise charges a transparent and industry-low commission fee for the service instead.

More traditional currency cards like the Travelex Money Card are good alternatives, but they will apply an exchange rate that is weaker than the mid-market rate.

The Wise Multi-Currency Card is the best money card for euros because unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your local currency into euros with them.

The live rate you see on Google or XE.com is the one you get with Wise . An industry-low commission fee will range from 0.35% to 2.85%. USD to EUR transfers generally incur a 1.6% fee.

Learn more about how to buy euros in the United States before your trip.

There are usually three types of travel cards, prepaid travel cards, debit travel cards and credit travel cards. Each have pros and cons, here's a short summary:

- Prepaid travel cards: You usually need to load cards with your home currency via a bank wire or credit/debit card top-up. You're then able to manage the balance from an attached mobile app and can use it to pay in foreign currencies or withdraw cash at an ATM abroad tapping into your home currency prepaid balance. With prepaid travel cards, as the name indicates, you can't spend more than what you've loaded before hand. Some prepaid card providers will provide ways to "auto top-up" when your balance reaches a certain level that you can customize. On Revolut for example, you can decide to top-up £100/£200/£500 from your debit card each time your balance reaches below £50.

- Debit travel cards: Some innovative digital banks, like N26 or Monzo, offer travel debit cards that have the same advantages than a Prepaid Travel Cards, except that they're debit card directly tapping into your current account balance. Like a Prepaid travel card, you can't spend more than the balance you have in your current account with N26 or Monzo, but you can activate an overdraft (between €1,000 or €10,000 for N26 or £1,000 for Monzo) if you need it, for a fee though.

Note that even if they're Prepaid or Debit cards, you can use them for Internet payments like a normal credit card.

- Credit travel cards: You can find credit cards made for international payments offering good exchange rates and low fees to withdraw money abroad, but you'll need to pay interests in your international payment if you don't pay in FULL at the end of every month and interest on your ATM withdrawals each day until you pay them back.

Why You Can Trust Monito

Our recommendations are built on rock-solid experience.

- We've reviewed 70+ digital finance apps and online banks

- We've made 100's of card transactions

- Our writers have been testing providers since 2013

Other Monito Guides and Reviews on Top Multi Currency Cards

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

- Home ›

- Currency Cards ›

- Multi Currency Cards

Compare multi-currency cards

Multi-currency cards are a low-fee, prepaid alternative to cash and traditional bank cards that are designed to be used abroad

Mutli-currency prepaid travel money cards

Mutli-currency prepaid travel money cards are a unique kind of payment method which are designed to be more cost-effective than a standard UK credit or debit card when used abroad. They are intended to be a modern replacement to Travellers Cheques as they are more secure, more widely accepted and can be used anywhere in the world that accepts VISA or MasterCard.