- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Is the Capital One Venture Credit Card Worth Its Annual Fee?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

The best perks of the Capital One Venture Rewards Credit Card

Who is this card right for, the bottom line.

If you're a frequent flyer, you likely know the pain of searching for and obtaining the best travel credit card for your travel habits and spending. There are points here, and miles there. Some cards work with specific hotel chains only. Others are a hassle. If you’re new to the world of travel credit cards , the array of options can be even more overwhelming.

Enter the Capital One Venture Rewards Credit Card . With at least 2x points on all spending across the board, an impressive roster of transfer partners and some new perks in the pipeline, this is a solid starter card if you’re looking for something high on value but low on complexity.

Of course, there’s the annual fee of $95 to consider.

To help you decide if the Capital One Venture Rewards Credit Card is the right card for you, we’ll take a look at whether the perks outweigh the annual fee.

2x miles on every purchase, plus 5x on hotels and rental cars booked through Capital One Travel

Depending on your approach to earning miles, the Venture card’s simple-as-can-be rewards rate of 2x miles can be a big draw. You don’t need to think about where you’re doing your spending or what you’re buying.

There is just one bonus spending category where you could earn even more miles. If you book hotels or rental cars through Capital One Travel, you'll earn 5 miles on every dollar.

And these points don’t expire for the lifetime of your account.

» Learn more: How to maximize the Capital One Venture rewards credit card

The welcome bonus

This card comes with a nice welcome bonus: Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Capital One Venture miles are worth 1.4 cents each according to NerdWallet's most recent analysis , which means the bonus is good for more than $1,050 worth of travel purchases if you use transfer partners. If you book in the Capital One Venture travel portal , points are worth 1 cent each.

» Learn more: How much are travel points and miles worth this year?

Redeem miles for statement credit against travel purchases

You can redeem these miles against any travel purchases on your statement at a rate of 1 cent per mile, which gives you more flexibility to redeem points than booking through a credit card issuer’s travel portal.

Capital One's definition of a travel purchase is broad, so you could redeem miles for spending on rideshare apps, car rentals, taxi cabs and Airbnb stays.

Transfer partners

Capital One cardholders can choose to spend their miles with more than 15 different hotel and airline transfer partners. Transfers can be made in 1,000-mile increments, with a handful of 1:1 partners, including Qantas , Finnair, Wyndham and Etihad .

Though most transfers will get you either 500 or 750 airline miles for every 1,000 Venture miles, if you find the right sweet spots, you could possibly get more than the 1 cent baseline value per point out of the transfer.

» Learn more: The best Capital One transfer partners — and those to avoid

TSA PreCheck or Global Entry credit

Anyone who’s ever made their way through an airport knows the ordeal of waiting in line at security. If you often find yourself muttering under your breath while the person in front of you struggles to untie their shoes, this card provides a bit of relief.

The Capital One Venture Rewards Credit Card can help you skip the line due to its $100 in statement credit toward TSA PreCheck or Global Entry application fees. Since this covers both fees in full ($78 for TSA PreCheck or $100 for Global Entry), this perk’s an easy choice at either level.

You get one statement credit per account every four years, which works out perfectly since both PreCheck and Global Entry are valid for five years. You can just keep renewing at no cost to you.

» Learn more: TSA PreCheck vs. Global Entry: Which is right for you?

No foreign transaction fees

Like many of the more basic travel cards out there, the Capital One Venture Rewards Credit Card carries no foreign transaction fees, which can save you up to 3% on transactions abroad. This benefit is the bare minimum of what you should expect from a travel credit card, and it’s especially important for people who travel internationally.

And while the simplicity of the Capital One Venture Rewards Credit Card makes it a great choice for newcomers to the world of points and miles, there are some features (with a few exciting new ones on the way) that set it apart from those more bare-bones travel cards.

» Learn more: The beginner's guide to travel points and miles

Flexible spending via PayPal Pay with Rewards and Amazon Shop with Points

Link up your Capital One Venture Rewards Credit Card with PayPal and you’ll be able to redeem your rewards at millions of online retailers through the Pay with Rewards feature .

While this gives you the flexibility to drop some points on nontravel purchases, cardholders using the Venture or any of Capital One’s other travel cards don’t get a full 1:1 redemption ratio on purchases made through PayPal.

The 1.25:1 redemption ratio means your miles are worth 0.8 cent each. And while you’re not getting the maximum value out of your miles by using Pay with Rewards, you do get the benefit of free return shipping and purchase protection that come with using PayPal.

You can likewise link your card up with your Amazon account and use your points to make purchases through the online retail giant. The same redemption ratio applies, getting you that 0.8 cent on every point.

Linking your card to PayPal or Amazon might not be the highest-value use of precious points, but if you're not planning on traveling soon, the option to use your miles on nontravel spending is nice to have.

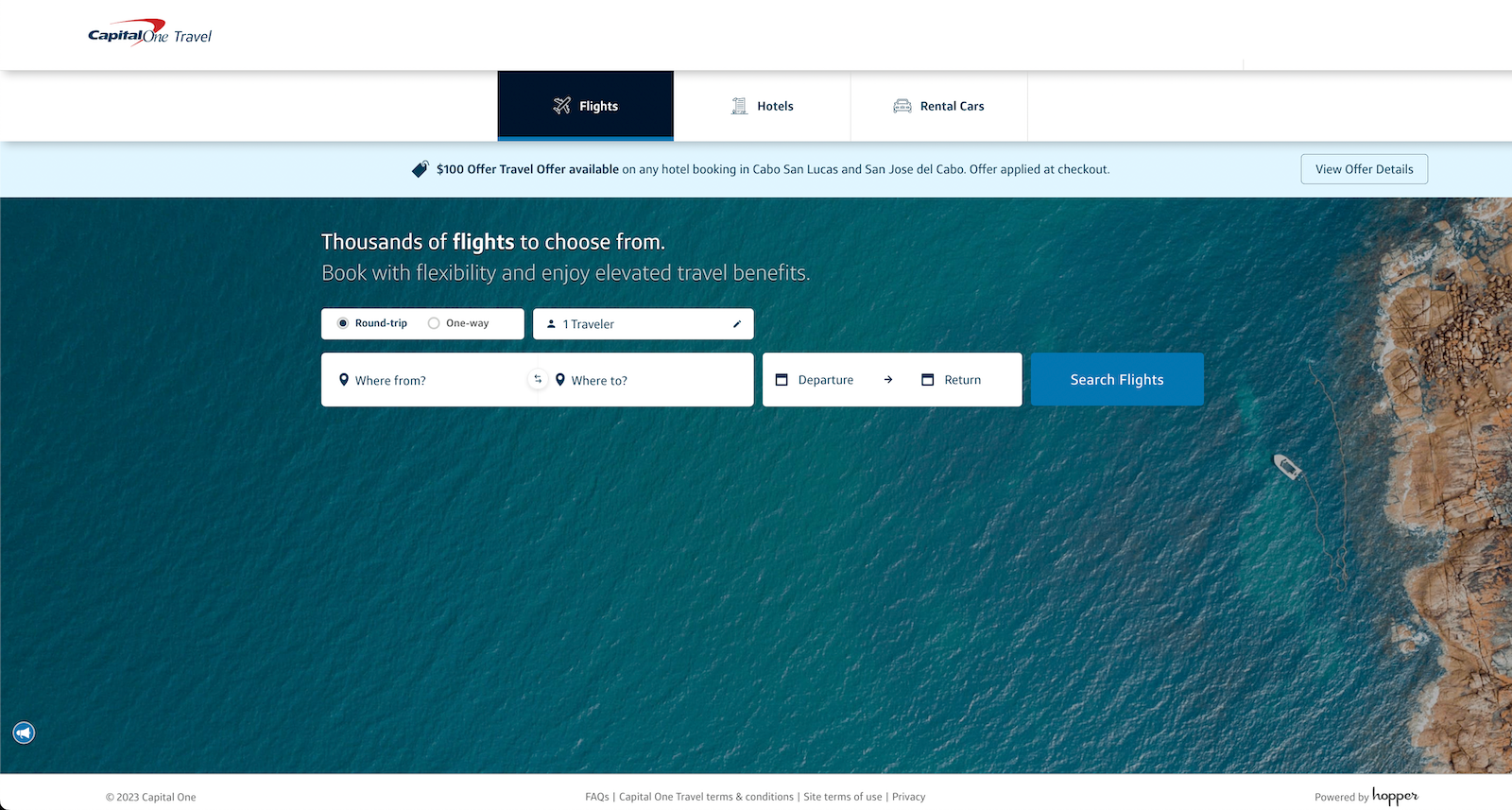

The Capital One Travel portal has been revamped

The bank’s booking portal, Capital One Travel, got an overhaul in late 2021 with new features that pit it against the likes of American Express and Chase . An enhanced rewards rate on in-portal purchases is another strong mark in Venture’s favor. The new portal includes price prediction powered by a partnership with Hopper, a travel app.

Hopper boasts up to 40% savings on travel when you make purchases based on its prediction algorithm, and removing the guesswork can take some stress out of planning your next trip.

When booking a flight through the portal, customers can also purchase Cancel For Any Reason coverage . With this benefit, you can cancel the booking for any reason whatsoever and get most of your money back as long as the cancellation is done within a specified timeframe.

If you're looking for trip coverage in general, the Capital One Venture Rewards Credit Card is one of the credit cards that provides complimentary travel insurance benefits.

Capital One Dining

Capital One teamed up with chef José Andrés, the James Beard Foundation and the Michelin Guide to compile a list of 350 restaurants in more than 10 major cities that will be a part of the Capital One Dining program. These restaurants will set aside a number of tables for Capital One Dining reservations specifically, making it a little easier for cardholders to reserve difficult-to-book tables at popular restaurants. The program will also give cardholders access to culinary events like the South Beach Wine and Food Festival.

» Learn more: The best dining rewards programs

Airport lounges

Capital One’s first branded airport lounge opened at Dallas-Fort Worth, and you can also find them at Washington-Dulles and Denver International. Some of the more enticing amenities include soundproof relaxation rooms, well-stocked private shower suites and cycling and yoga rooms.

There's private nursing rooms, and traveling families can unwind in the designated family area. Hungry? Need a pick-me-up? The lounges will also feature a coffee bar, dining stations and grab-and-go food.

With this card, you get two complimentary visits per year to Capital One lounges or to more than 100 Plaza Premium lounges.

Additional visits to Capital One lounges can be purchased for a discounted rate of $45. Meanwhile, all other travelers must pay $65 for the privilege of visiting a Capital One lounge. Although many travel cards come with lounge access , most have much higher annual fees and come with some annoying restrictions around fees for guests and limits on the number of yearly visits. As we’ve previously reported , these new Capital One lounges rival American Express’s renowned Centurion Lounges when it comes to overall value.

So if you’re someone who likes to indulge in a little luxury on your layover, this perk is definitely in the pros column for the Capital One Venture Rewards Credit Card .

A discount for Gravity Haus

Here’s one temporary benefit that might even outweigh the card’s annual fee — if you can use it. You’re entitled to a discount of up to $300 when you commit to an annual membership with Gravity Haus, which is a membership-based social club with locations primarily in popular ski areas. Each Gravity Haus location’s amenities vary, but expect to find hotel rooms, equipment rentals, a cafe, a gym, group fitness classes, spa and coworking spaces.

Membership is pricey (starting at $840 annually), so you’ll still owe a minimum of $540 even with the discount. But if you were planning to purchase an annual membership anyway, then this single benefit makes holding the card worth it.

Keep in mind that this offer is available through Jan. 19, 2024.

Even though the Venture card’s annual fee is on the lower end, there are some prospective cardholders who still might not get that much value out of the deal.

Less frequent travelers will benefit most

If you don’t plan to travel in the next year, you could skip the Capital One Venture Rewards Credit Card . But it’s important not to think of “travel” as only meaning “flights.” Though the card — like most travel cards — is certainly geared toward those who fly often, the breadth of qualifying spending means “travel” includes a fair bit more than just airline tickets.

Plus, if you take advantage of the TSA PreCheck or Global Entry credit , the annual fee could pay for itself. This card is worth it for casual travelers who want miles that are straightforward to earn and easy to redeem.

» Learn more: Why do travel points matter?

Advanced travel hackers will benefit the least

What makes this card so great for newcomers to the points and miles hobby is also what might make it lackluster for more experienced card slingers. If you live for loopholes and have spreadsheets at the ready to maximize your miles, the Capital One Venture Rewards Credit Card might be too simplistic.

You get an ongoing 2 miles for every $1 spent — that's it. This is a mostly hack-free card.

» Learn more: Things to know before getting the Capital One Venture card

The Capital One Venture Rewards Credit Card is great for those who want the benefits of a travel card without having to put too much thought into wringing every last cent of value out of it. It covers the ground that all good travel cards should, and even has a few features that set it apart from the pack .

To be certain whether the Venture card is worth it for you, use our calculator to see if the rewards you’d earn with the card will cover the fee.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

1%-10% Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases. Earn 8% cash back on Capital One Entertainment purchases. Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024. Terms apply.

$200 Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening.

2x-10x Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel, Earn unlimited 2X miles on all other purchases.

75,000 Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel.

Capital One Venture Rewards vs. Capital One Venture X: Worth the extra $300 in annual fees?

The Capital One Venture Rewards Credit Card provides great value to occasional travelers who want to maximize their miles-earning. The $95-annual-fee (see rates and fees ) card earns 2 miles per dollar on all purchases, plus offers a Global Entry/TSA PreCheck credit (up to $100).

Its flashier sibling, the $395-annual-fee Capital One Venture X Rewards Credit Card (see rates and fees ), offers an enhanced travel experience to compete with The Platinum Card® from American Express and the Chase Sapphire Reserve .

If you don't carry either card — the Venture Rewards or the Venture X — you may wonder: Should you apply for the well-established, crowd-pleasing Venture Rewards or go premium with the luxe Venture X ?

Here, we'll closely examine both cards to help travelers decide which Capital One card is the best option for themselves.

Capital One Venture Rewards vs. Capital One Venture X comparison

Capital one venture rewards vs. capital one venture x welcome bonus.

The Venture Rewards and the Venture X have identical welcome bonuses: 75,000 bonus Capital One miles after spending $4,000 in the first three months of account opening.

Those miles are worth $1,388 based on TPG's valuations , so you'll get incredible value from the bonus no matter which card you choose.

Winner: Tie

Related: How to redeem 75,000 Capital One miles for maximum value

Capital One Venture Rewards vs. Capital One Venture X benefits

With the Venture Rewards, you'll get up to a $100 credit for TSA PreCheck or Global Entry, as well as rental car and travel accident insurance, extended warranty protection, Hertz Five Star status and access to Capital One's Lifestyle Collection of hotels and Capital One Entertainment .

The Venture X , conversely, comes with a stronger list of benefits that more than justify its higher annual fee if you can maximize them.

As a cardholder, you'll get a $300 annual credit for bookings made through Capital One Travel and complimentary access to Capital One and Plaza Premium lounges for you and up to two guests. You'll also get a Priority Pass lounge membership to over 1,300 locations for you and unlimited guests (subject to capacity).

You'll get 10,000 bonus miles, worth $185 according to TPG valuations , at each cardholder anniversary along with access to Capital One's Lifestyle Collection and the luxury Premier Collection of hotels, Hertz President's Circle status *, travel protections, extended warranty and cellphone protection.

An additional benefit of the Venture X is that you can add a limited number of authorized users for no additional fee (see rates and fees ). These authorized users enjoy the same airport lounge access as the main cardholder, including complimentary access for themselves and guests.

Winner: Venture X. As the more premium card offering, it has a much more robust list of benefits than the Venture Rewards.

Related: Is the Venture X worth its annual fee?

Earning miles on the Capital One Venture Rewards vs. Capital One Venture X

Both the Venture Rewards and the Venture X earn bonus miles on travel booked through Capital One Travel and 2 miles per dollar on all other purchases.

With the Venture Rewards, you'll earn 5 miles per dollar on hotels and rental cars booked through Capital One Travel. If you have the Venture X, however, you'll earn 10 miles per dollar on hotels and rental cars booked through Capital One Travel as well as 5 miles per dollar on flights booked through Capital One Travel.

Winner: Venture X. It earns twice the miles as the Venture Rewards on hotels and rental cars booked through Capital One Travel and bonus miles on flights booked through Capital One Travel.

Related: How (and why) to earn lots of Capital One miles

Redeeming miles on the Capital One Venture Rewards vs. Capital One Venture X

Both the Venture Rewards and the Venture X earn Capital One miles and give you the same redemption options.

You'll get the most value by transferring your miles to one of Capital One's travel partners , but you can also redeem them for a statement credit to cover travel purchases or for gift cards at a flat rate of one cent per mile.

Both cards allow you to redeem your miles for cash back, but you'll get a much lower rate of 0.5 cents per mile, so we recommend avoiding this option whenever possible.

Related: Should you redeem your miles directly for travel or transfer them to partners?

Transferring miles with the Capital One Venture Rewards vs. Capital One Venture X

One of the best things about both the Venture Rewards and the Venture X is that they allow you to transfer your miles to any of Capital One's 15+ hotel and airline partners, including valuable options like Avianca LifeMiles , British Airways Executive Club and Turkish Airlines Miles&Smiles .

And if you can take advantage of a transfer bonus, you'll get even more value from your miles. For instance, TPG points and miles reporter Kyle Olsen prefers to redeem his miles by transferring them to Air France-KLM Flying Blue during a transfer bonus promotion and using them to book business-class flights to Europe.

Related: How to redeem Capital One miles for maximum value

Should I get the Capital One Venture Rewards or Capital one Venture X?

If you're focused on keeping your annual fee costs low, you'll want to choose the Venture Rewards . You'll get a strong earning rate, the ability to take advantage of Capital One's transfer partners, and some travel benefits for just a $95 annual fee (see rates and fees ). However, if you want airport lounge access and can maximize its $300 annual credit, the Venture X is better for you.

Related: Who should (and shouldn't) get the Venture X

How to upgrade from the Capital One Venture Rewards to the Capital One Venture X

If you already have the Venture Rewards and want to upgrade to the Venture X , you can call the number on the back of your card and request a product change. You won't be able to take advantage of your new card's welcome offer by going this route, but it's a good way to get more benefits without worrying about eligibility.

Related: 4 things to consider before upgrading your credit card

Bottom line

Both the Venture Rewards and the Venture X are excellent travel rewards cards that earn bonus points on Capital One Travel purchases and 2 miles per dollar on all other purchases. The Venture X is a great card for those who can take advantage of its airport lounge access and annual credit, while the Venture Rewards is a better fit for anyone who is looking to keep their annual fee costs low. You'll get some solid travel benefits and earn valuable transferable rewards regardless of which card you choose.

For more details, read our full reviews of the Venture Rewards and Venture X .

Learn more: Capital One Venture

Learn more: Capital One Venture X

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

*Upon enrollment, accessible through the Capital One website or mobile app, eligible cardholders will remain at upgraded status level through Dec. 31, 2024. Please note, enrolling through the normal Hertz Gold Plus Rewards enrollment process (e.g. at Hertz.com) will not automatically detect a cardholder as being eligible for the program and cardholders will not be automatically upgraded to the applicable status tier. Additional terms apply.

Capital One Main Navigation

- Learn & Grow

- Life Events

- Money Management

- More Than Money

- Privacy & Security

- Business Resources

Capital One miles transfer partners: A how-to guide

Learn more about transferring the miles you’ve earned to capital one’s airline and hotel loyalty program partners..

February 8, 2024 | 5 min read

Jetting off to a new place or taking a road trip? With a Capital One travel rewards card , you’ll earn miles on every purchase you make. Then you can use those miles in flexible ways like transferring them to the loyalty programs of more than 15 Capital One transfer partners . 1

Learn about how to redeem your miles with Capital One transfer partners. Plus, check out other ways to use your miles.

Key takeaways

- You can earn Capital One miles with purchases you make using travel cards from Capital One , such as Venture and Venture X .

- You can then redeem your miles with the loyalty programs of Capital One transfer partners for flights, hotel stays and more.

- Other ways to use your miles include booking trips through Capital One Travel , redeeming your miles for recent travel purchases and more.

Earn 75,000 bonus miles

Redeem your miles for flights, vacation rentals and more. Terms apply.

Capital One miles transfer partners

Check out this list of Capital One Venture transfer partners and Capital One Venture X transfer partners. You’ll also find specifics about the conversion ratio of your Capital One miles with each partner loyalty program.

Capital One airline and hotel transfer partners

When you transfer 1,000 Capital One miles to any of these transfer partners, you’ll receive 1,000 miles or points with the following travel loyalty programs:

- Aeromexico Club Premier

- Air Canada - Aeroplan®

- Cathay Pacific - Asia Miles

- Avianca LifeMiles

- British Airways Executive Club

- Choice Privileges® 2

- Emirates Skywards

- Etihad Guest

- Finnair Plus

- Flying Blue

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

- TAP Miles&Go

- Turkish Airlines Miles&Smiles

- Wyndham Rewards

When you transfer 1,000 Capital One miles to this transfer partner, you’ll receive 750 miles:

- EVA Air (Infinity MileageLands)

When you transfer 1,000 Capital One miles to this transfer partner, you’ll receive 500 points:

- ALL (Accor Live Limitless)

How to transfer miles to Capital One partners

To redeem your miles with a Capital One transfer partner, follow these general steps:

- Sign in to your account online or through the Capital One Mobile app .

- Navigate to the credit card account with the miles you would like to transfer.

- Click View rewards, where you’ll be given options for using your rewards.

- Choose the option for converting your rewards to a Capital One miles transfer partner and follow the prompts.

- Receive your confirmation code and save it for your records.

Important things to know about a Capital One miles transfer

Some loyalty programs offer miles while others offer points. And your transferred Capital One miles will convert at one of three ratios, depending on the loyalty program.

Using 1,000 Capital One miles as an example, here’s how that breaks down:

- 1:1 ratio: 1,000 Capital One miles convert to 1,000 miles or points.

- 2:1.5 ratio: 1,000 Capital One miles convert to 750 miles or points.

- 2:1 ratio: 1,000 Capital One miles convert to 500 miles.

All loyalty programs require a minimum of 1,000 Capital One miles to transfer.

Here are some additional things you’ll need to be aware of:

- You’ll need to register for an account with a loyalty program ahead of time if you want to transfer your Capital One rewards miles.

- The name of the travel loyalty program holder must match the name on your eligible Capital One account.

- Redemption rates may vary and are subject to change. It may help to review your card’s account terms and disclosures as well as the terms of the loyalty program you’re transferring your miles to.

- Once you’ve transferred your Capital One miles, they can’t be transferred back to your Capital One rewards account. And they’ll be subject to the terms and conditions of the loyalty program you’ve chosen.

Other ways to redeem Capital One miles

Using your miles with Capital One transfer partners is one way to redeem them. But there are other ways to use them, including the option to:

- Book flights, hotels and rental cars with Capital One Travel . You can also use miles to get reimbursed for past travel purchases made elsewhere.

- Redeem your miles for recent travel purchases, including flights, hotels, cruises, ride-hailing services and tolls.

- Pay for Amazon.com purchases or eligible purchases at millions of online stores through PayPal . 3

How to earn Capital One miles

You’ve read about how to redeem rewards with a Capital One travel rewards card . But how do you earn miles in the first place? Here are three examples:

- Use the Venture X card to earn unlimited double miles on every purchase. Plus, you’ll earn 10 miles per dollar on hotels and rental cars, and 5 miles per dollar on flights booked through Capital One Travel.

- Use the Venture card and earn unlimited double miles on every purchase. Plus, earn 5 miles per dollar on hotels and rental cars when you book through Capital One Travel.

- Use the VentureOne card to earn unlimited 1.25 miles per dollar on every purchase. You’ll also earn 5 miles per dollar on hotels and rental cars booked through Capital One Travel.

Keep in mind that Venture and Venture X cards have an annual fee. View important rates and disclosures .

Capital One miles transfer partners in a nutshell

Transferring your miles to a Capital One travel partner is easy. And it gives you another flexible way to make the most of your next trip.

If you don’t have a Capital One travel rewards credit card , you may want to consider one.

How to maximize your travel benefits

Who wouldn’t want to get the most out of their credit card? Here are some things to know about the perks that come with Capital One travel rewards credit cards:

- Get complimentary access to airport lounges and luxury amenities with the Capital One Venture X card .

- Earn unlimited 2X rewards miles, plus 75,000 bonus miles, and enjoy flexible redemption and transfer options with the Capital One Venture card and the Capital One Venture X card .

- Earn unlimited 1.25X miles with no annual fee with the Capital One Venture One card . View important rates and disclosures .

- Explore travel benefit card options by comparing Capital One travel rewards cards .

- Find out about flexible rewards, premium benefits, luxury perks and smart travel tools with this guide to all things Venture X .

Related Content

All about the capital one venture card.

video | October 26, 2023 | 1 min video

All about Venture X

article | February 20, 2024 | 9 min read

How do travel credit cards work?

article | February 8, 2024 | 7 min read

Is the Capital One Venture X worth the $395 annual fee?

S ince its launch in 2021, the Capital One Venture X Rewards Credit Card has disrupted the travel credit card industry and challenged titans like Chase and American Express . With its $395 annual fee (see rates and fees ), the card is priced lower than lots of its competitors in the premium credit card market.

Three years later, is the annual fee still on par with benefits to continue keeping the card open for another year? Let's look at what you get as a Venture X cardholder and whether that's enough to keep its place in your wallet.

Welcome offer

New applicants for the Venture X can earn 75,000 Capital One miles after spending $4,000 on the card within the first three months from account opening.

According to TPG's valuations , these miles are worth 1.85 cents apiece. That makes this bonus worth $1,388.

The value of these miles has increased in recent years, thanks to Capital One adding more transfer partners and improving the transfer ratio on multiple partners. There are several ways to redeem your miles for high value.

It's worth noting that Capital One can be stingy when approving credit card applications — you can only have two personal credit cards from Capital One at any time. Plus, the bank is known for being very sensitive about the information on your credit report, including your number of recent hard inquiries, new accounts and overall accounts with other issuers.

Related: Our complete guide to credit card application restrictions

$300 annual credit

Venture X cardholders receive $300 in annual credits on bookings made through Capital One Travel .

The way the $300 annual credit perk works on this card is simple. Every account year, you receive $300 in credit toward purchases made through Capital One Travel, including hotel bookings, car rentals and airfare.

However, the credit is not applicable to travel purchases made through any other channel. While that makes it more restrictive than the annual $300 travel credit available with the Chase Sapphire Reserve® , it is still relatively easy to use, and it substantially offsets the card's $395 fee (see rates and fees ) — as long as you actually take advantage of it.

There are some downsides to using a third-party booking service, though; notably, elite perks are usually not recognized for hotels and rental cars.

However, Capital One has made significant strides in improving the travel booking experience, including investing in Hopper , a booking platform, and adding customer-friendly features like price-drop prediction and a best-price guarantee.

Related: How the Capital One Venture X travel credit can save you $300 on your next trip

Anniversary bonus miles

Venture X cardholders also get access to a second annual benefit: 10,000 bonus miles on your account anniversary. This means you receive these miles one year after opening your account and each subsequent year on that date, not at the start of a new year each January.

According to the latest TPG valuations , 10,000 Capital One miles are worth $185, thanks to the potential value from airline and hotel transfer partners.

Combined with the $300 Capital One Travel portal credit, cardholders are looking at a minimum of $400 in value from their card each year.

Related: Who should (and shouldn't) get the Capital One Venture X?

Lounge access

Venture X cardholders have access to three types of lounges: Priority Pass , Plaza Premium and Capital One's own lounges for themselves and up to two guests.

Most notably, having the Venture X is the easiest way to get unlimited access to Capital One's lounges. Currently, there are three locations: Dallas Fort Worth International Airport , Dulles International Airport and Denver International Airport . Plans for a future location in Las Vegas-Harry Reid International Airport (LAS) have been announced, but we don't know the opening date yet.

Cardholders also get unlimited access to lounges in Capital One's partner network, including more than 1,300 Priority Pass lounges and over 130 Plaza Premium lounges.

A daypass to a Capital One lounge ordinarily costs $65, so this perk's value quickly adds up and can help justify the card's annual fee.

Related: Best credit cards for lounge access

Car rental perks

The Venture X has two key benefits related to rental cars: earning 10 miles per dollar on all car rentals booked through the Capital One Travel portal (instead of 2 miles per dollar when booked elsewhere) and top-tier Hertz President's Circle status .

You'll need to register for this perk with Hertz first. President's Circle status offers perks like guaranteed upgrades, the widest choice of cars when starting your rental and a free additional driver (which typically costs $13.50 per day, up to a maximum of $189 during your rental).

Upon enrollment, accessible through the Capital One website or mobile app, eligible cardholders will remain at the upgraded status level through December 31, 2024. Please note, enrolling through the normal Hertz Gold Plus Rewards enrollment process (e.g., at Hertz.com) will not automatically detect a cardholder as being eligible for the program, and cardholders will not be automatically upgraded to the applicable status tier. Additional terms apply.

Related: Stacking rental car perks with Hertz and the Venture X

Access to luxury hotel programs

Venture X cardholders can access the Capital One Premier Collection and Lifestyle Collection boutique and luxury hotel programs. Cardholders can pay cash or redeem their miles at a rate of 1 cent each to book exclusive properties and receive perks along the way.

Benefits at Premier Collection properties include room upgrades when available, free Wi-Fi during your stay, free breakfast each day for two people and a $100 on-property credit for things like spa visits or dinner at the hotel's restaurant.

Lifestyle Collection properties are mostly boutique properties with benefits such as a $50 experience credit to use toward rooftop drinks, signature hotel restaurants, room service or other activities, complimentary Wi-Fi, room upgrades (when available), as well as early check-in and late checkout, when available.

And since these bookings are made through Capital One Travel, cardholders will earn 10 miles per dollar when paying for their stay with the Venture X card.

Related: A comparison of luxury hotel programs from credit card issuers

Excellent authorized user perks

While many credit cards reserve their best perks only for the primary account holder, that's not the case with the Venture X.

Cardholders can have multiple free authorized users on their accounts. These users can receive the following perks in their own right, all without paying a fee (see rates and fees ):

- Access to Capital One lounges and Plaza Premium lounges by simply showing their Venture X card — including the ability to bring two guests of their own

- Priority Pass Select membership once they enroll online — including the ability to bring guests traveling with them

- Complimentary Hertz President's Circle elite status

- Purchase and travel protections, such as trip cancellation and interruption insurance , trip delay reimbursement and cellphone protection

When analyzing these benefits for authorized users, compare them to the perks offered to authorized users on other premium travel cards and the associated fees.

For comparison, The Platinum Card® from American Express charges $195 for each additional Amex Platinum card (see rates and fees ), and the Chase Sapphire Reserve® charges $75 per authorized user. This makes the Venture X a much more affordable option for couples or families.

Related: Why you should add authorized users on the Capital One Venture X

Other perks

Venture X cardholders can receive reimbursement for their application fee to TSA PreCheck or Global Entry . This benefit is available once every four years and is worth up to $100 in statement credits.

Cardholders also have access to several travel and shopping protections when paying with their card:

- Trip cancellation and interruption insurance

- Trip delay reimbursement: Up to $500 per person for reasonable expenses like hotel rooms, food, toiletries or clothes when your flight is delayed overnight or by six hours or more

- Lost luggage reimbursement

- Cellphone protection

- Primary rental car insurance

- Extended warranty and return protection

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Related: 6 things to do when you get the Capital One Venture X

Bottom line

The $300 annual credit and 10,000-anniversary miles provide excellent value each year and more than justify the card's $395 annual fee (see rates and fees ). And this doesn't take into account the intangibles, like the value your authorized users might achieve, the free food you consume at lounges or the money you save via purchase protections.

Of course, those benefits only provide value if you're using them. If you know you won't be able to maximize the benefits of the Venture X, you'll most likely want to opt for a different card.

For more details on the Venture X, read our full card review .

For rates and fees of the Amex Platinum, click here .

For rates and fees of the Venture X, click here .

Editorial disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

Shop for Car Insurance

Other Insurance Products

Types of mortgages

Calculators

Find & Compare Credit Cards

Cards with Rewards

Cards for a Purpose

Cards for Building Credit

Credit Card Reviews

Understanding Credit & Score

Student Loans

Paying for College

Personal Finance for College Students

Life Events

Wells Fargo Active Cash® Card

Capital one ventureone rewards credit card.

While both the Wells Fargo Active Cash Card and the Capital One VentureOne Rewards Credit Card offer $0 annual fees and introductory APRs, the former is better for cash rewards, and the latter for travel perks and customer satisfaction.

Updated: April 12, 2024

Advertising & Editorial Disclosure

On This Page:

- Which Card Is Best?

- Wells Fargo Active Cash Review

- Capital One Rewards Review

- Details Breakdown

MoneyGeek partners with leading industry experts and advertisers to help you get to your financial happy place. Our content is accurate when posted but offers may change over time. We may receive compensation for partner advertisements, but our editorial team independently reviews and ranks products. Learn more about our editorial policies .

About Doug Milnes, CFA

Doug Milnes is a CFA charter holder with over 10 years of experience in corporate finance and the Head of Credit Cards at MoneyGeek. Formerly, he performed valuations for Duff and Phelps and financial planning and analysis for various companies. His analysis has been cited by U.S. News and World Report, The Hill, the Los Angeles Times, The New York Times and many other outlets.

Milnes holds a master’s degree in data science from Northwestern University. He geeks out on helping people feel on top of their credit card use, from managing debt to optimizing rewards.

KINSELLA: Pro-Hamas protests organized and well funded

'extreme wokeness': bill maher calls canada 'a cautionary tale' for america, agar: fanatics from the left are organized — and dangerous to canada.

Brampton man, 24, charged in home invasion and two robberies

Lilley: justin trudeau says one thing in public, another at the inquiry, furlong: capital gains tax hike a blow to venture capital.

Policy change might stunt economic growth for generations

You can save this article by registering for free here . Or sign-in if you have an account.

Article content

The decision of the Trudeau government to raise capital gains taxes will impact the economy negatively.

Subscribe now to read the latest news in your city and across Canada.

- Unlimited online access to articles from across Canada with one account.

- Get exclusive access to the Toronto Sun ePaper, an electronic replica of the print edition that you can share, download and comment on.

- Enjoy insights and behind-the-scenes analysis from our award-winning journalists.

- Support local journalists and the next generation of journalists.

- Daily puzzles including the New York Times Crossword.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

Don't have an account? Create Account

FURLONG: Capital gains tax hike a blow to venture capital Back to video

For a government that says it is committed to improving economic growth, fostering innovation, improving productivity and creating jobs, this decision might just be the single most damaging policy change for Canadian entrepreneurs, stunting economic growth for generations.

A previous Liberal government, in Budget 2000, underscored the importance of a tax system that fosters innovation and supports businesses, particularly in dynamic sectors like technology. At the time, Paul Martin, then the finance minister, noted that reducing the inclusion rate of capital gains was a way to better align taxation with the goals of promoting economic growth and facilitating access to capital.

“The high-technology sector and other fast-growing industries are particularly important to Canada’s future economic growth,” Martin said. “Our tax system must be conducive to innovation and must ensure that businesses have access to the capital they need in an economy that is becoming increasingly competitive and knowledge-based.

Your noon-hour look at what's happening in Toronto and beyond.

- There was an error, please provide a valid email address.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

A welcome email is on its way. If you don't see it, please check your junk folder.

The next issue of Your Midday Sun will soon be in your inbox.

We encountered an issue signing you up. Please try again

“An examination of the taxation of capital gains in Canada suggests that this objective would be better achieved with a reduction in the inclusion rate of capital gains.”

Since then, the growth of Canada’s startup ecosystem has been exponential. The latest Scoring Tech Talent report by CRBE, a commercial real estate services firm, showed that Canada’s tech workforce grew by 15.7% (150,000 workers) between 2020 and 2022, faster than the United States growth rate of 11.4% (610,000 workers).

RECOMMENDED VIDEO

In terms of regional impact, Vancouver saw a 69% increase in tech job growth, the highest among 50 North American cities surveyed, holding its position at number 8 on the list. Ottawa and Montreal climbed up the ranks to number 11 and number 12 respectively, and Toronto remains the go-to Canadian city at number 5 on the list, second only to the San Francisco Bay Area.

The creation of Canadian jobs in venture capital-backed companies is also significant.

One source, the Work in Tech job board by Ontario-based business accelerator Communitech, shows that 98,104 jobs have been posted in Canada since 2017 by 1,418 companies. These jobs can be found across the country in our three hubs — Toronto, Montreal and Vancouver — but also in smaller cities, such as Calgary, Edmonton, Saskatoon, Quebec, Sherbrooke, Halifax and St. John’s. This sector is slowly diversifying Canada’s economy.

Venture capital has ebbed and flowed since 2000, reaching its highest point in 2021 at nearly $17 billion. It has since receded back to $6.9 billion, in line with a retrenchment seen around the globe as companies and investors adjust to higher interest rates and a number of geopolitical events impacting supply chains.

The economic headwinds have also created a tough environment for attracting capital to this risky asset class. Simply put, now is the worst possible time to signal a lack of ambition in rewarding risk-taking.

We should not be surprised when Canada is yet again labelled risk-averse, despite the many budding hubs of entrepreneurship and hard-earned innovation successes backed by committed investors in recent years.

This policy would lead to a significant reduction in domestic capital, undermining the nation’s ability to retain existing entrepreneurs and attract new talent. Canada’s investors and entrepreneurs have the ambition to scale; this government just signalled that it does not.

In addition, higher capital gains tax leads to what is known as the “lock-in” effect, which creates an incentive for people to hold on to low-performing assets.

Simply put, it leads investors and entrepreneurs to retain existing investments rather than selling them and investing in something new, such as an emerging business, just to avoid the capital gains tax. Capital gains taxes indeed influence individuals’ decisions regarding asset sales and investment choices.

While we know that policy decisions around taxation, particularly concerning capital gains, often involve balancing revenue needs with broader economic objectives, it is becoming undeniably clear that this government has not carefully considered the potential consequences of such tax changes — especially those that could impact investment incentives and entrepreneurial activity.

It’s not too late to change course and continue the remarkable progress Canada has made in future-proofing the economy. We urge the government to reverse the proposed changes to the capital gains tax.

Let’s maintain a tax system that supports innovation, attracts investment and nurtures growth, ensuring Canada remains a global leader in technology and entrepreneurship. We must keep Canada moving forward, not backward.

— Kim Furlong is Chief Executive Officer of the Canadian Venture Capital and Private Equity Association.

Postmedia is committed to maintaining a lively but civil forum for discussion. Please keep comments relevant and respectful. Comments may take up to an hour to appear on the site. You will receive an email if there is a reply to your comment, an update to a thread you follow or if a user you follow comments. Visit our Community Guidelines for more information.

This website uses cookies to personalize your content (including ads), and allows us to analyze our traffic. Read more about cookies here . By continuing to use our site, you agree to our Terms of Service and Privacy Policy .

You've reached the 20 article limit.

You can manage saved articles in your account.

and save up to 100 articles!

Looks like you've reached your saved article limit!

You can manage your saved articles in your account and clicking the X located at the bottom right of the article.

IndiGo Plans Delhi-Gurugram Electric Air Taxis By 2026. Travel Time: 7 Mins

Archer Aviation will supply 200 electric vertical takeoff and landing (eVTOL) aircraft that can carry four passengers besides a pilot and operate just like helicopters but with lesser noise and better safety.

The 200 planes, each having 12 rotters, will cost around USD 1 billion.

InterGlobe Enterprises, the parent company of IndiGo, and US-based Archer Aviation will launch an all-electric air taxi service in India in 2026, that will carry passengers from Connaught Place in the national capital to Gurugram in Haryana in just 7 minutes.

Besides Delhi, the joint venture between InterGlobe and Archer Aviation will launch similar services in Mumbai and Bengaluru to start with.

The cost of the seven-minute flight operated with the company's five-seater eVTOL (electric vertical takeoff and landing) aircraft from Connaught Place to Gurugram in Haryana could be around Rs 2,000 to 3,000, according to Archer Aviation executives.

Archer Aviation Founder and CEO Adam Goldstein on Friday said discussions are going on with the US regulator Federal Aviation Administration (FAA) and the certification process for its aircraft is at an advanced stage.

The certification is expected next year and once that is in place, the process will be initiated for the certification by the Directorate General of Civil Aviation (DGCA).

In an interview with PTI in the national capital, Goldstein said the company expects to start flights in India in 2026 and aims to have 200 of its Midnight planes for the operations.

Initially, Archer Aviation will be focusing on Delhi, Mumbai and Bengaluru. With its flight, the duration will be around 7 minutes from Connaught Place in Delhi to Gurugram and the cost could be Rs 2,000 to 3,000. In a car, for the 27-kilometre distance, it would take around 90 minutes and the cost would be about Rs 1,500, according to Goldstein.

The five-seater Midnight aircraft will be able to accommodate the pilot and four passengers. The plane, which will have six battery packs, will get fully charged in 30-40 minutes and one minute charge broadly translates to one minute of flight, its Chief Commercial Officer Nikhil Goel said.

Archer Aviation will be having a joint venture with InterGlobe Enterprises and the final contours are being worked out.

The US-based company is also in discussions with various municipalities with respect to infrastructure and other aspects of the flight operations.

Goel said it will use the full strength of InterGlobe, which is a conglomerate, and the joint venture might choose partners for the eVTOL operations in India.

Discussions are also going on with respect to the real estate space required for vertiports or the launchpads and other infrastructure for starting the flight operations.

Archer Aviation will be opening its manufacturing facility in the US this year and initially, it will have a capacity to produce up to 650 planes and the same will be enhanced to 2,000 planes.

To a query on whether the company will be looking at manufacturing the planes in India in the future, Goldstein replied in the affirmative.

Promoted Listen to the latest songs, only on JioSaavn.com

Last year, Archer Aviation entered into a Memorandum of Understanding (MoU) with InterGlobe Enterprises, an Indian travel conglomerate and the country's IndiGo is part of it.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)

Track Budget 2023 and get Latest News Live on NDTV.com.

Track Latest News Live on NDTV.com and get news updates from India and around the world .

India Elections | Read Latest News on Lok Sabha Elections 2024 Live on NDTV.com . Get Election Schedule , information on candidates, in-depth ground reports and more - #ElectionsWithNDTV

Watch Live News:

IMAGES

VIDEO

COMMENTS

Portal Hack: Book flight/hotel/rental car through travel portal. Redeem credits through travel portal. Contact flight carrier/hotel/rental car company and "cancel" in the form of a credit. You will still process the purchase through the travel portal and redeem credits.*. Rebook the flight/hotel/rental directly however you prefer.

The Capital One Venture Rewards Credit Card is an excellent antidote to the complexity of travel rewards, offering both simple earning and redemption options for beginners and high-value transfer options for the more experienced points and miles collector. You will need good to excellent credit for this card, so TPG recommends a credit score of ...

No matter which card from the Capital One Venture family you choose, all three options offer simple earnings structures, 15-plus airline and hotel transfer partners and easy-to-use rewards.. For those who like a straightforward option for earning and redeeming rewards, you can also use your miles to "pay" back travel purchases charged to your card in the past 90 days.

The cards offer bonus miles on Capital One Travel purchases, as you earn 10x miles for hotel and rental car bookings, and 5x miles on flights; I value Capital One miles at 1.7 cents each, so to me that's like an 8.5-17% return on Capital One Travel purchases, which is huge. The Venture X offers a $300 Capital One Travel credit.

Capital One's new travel portal, launched in 2021, has significantly improved since its beta release. It now allows Capital One credit cardholders, including those with the issuer's cash-back cards, to directly use their rewards for travel purchases.The portal also features updated flight search capabilities and the issuer's hotel programs: the Premier Collection and the Lifestyle Collection.

In the case of the Venture X, a $300 annual credit applied to Capital One Travel bookings significantly offsets the card's $395 annual fee (see rates and fees ), and it can be a great way to save money on travel. This also effectively reduces the cost of the annual fee to $95 once you've maxed out that $300 credit.

The Capital One Venture X exists in the premium space alongside cards like The Platinum Card® from American Express and Chase Sapphire Reserve®.Like them, it has some serious travel perks and valuable statement credits — but for a much lower annual fee of $395 (see rates and fees).. As Capital One continues opening its own airport lounges, the case for the Venture X becomes even stronger.

The Venture card is worth it if you can earn enough in rewards to outweigh the annual fee of $95 ( rates & fees ). That's easy to do in the first year of owning this card: Earn 75,000 miles once ...

This card comes with a nice welcome bonus: Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel. Capital One ...

8. Eligible cardholders must enroll through the unique Benefits Tab link found within the Capital One website or mobile app after logging in. Cardholders can find the link to enroll by visiting their eligible card's Rewards tab or Capital One Travel Benefits tab and by clicking on the Hertz benefit tile. Upon doing so, a new webpage will open ...

The Capital One Venture Rewards Credit Card provides great value to occasional travelers who want to maximize their miles-earning. The $95-annual-fee (see rates and fees) card earns 2 miles per dollar on all purchases, plus offers a Global Entry/TSA PreCheck credit (up to $100).. Its flashier sibling, the $395-annual-fee Capital One Venture X Rewards Credit Card (see rates and fees), offers an ...

Capital One venture/DECLINED. Discussion / Conversation. I'm soooo annoyed with capital one. My husband and I are planning to travel at the end of the year so we looked up travel points and decided on the capital one venture for the bonus. I applied but I made a mistake on the application. It asked me for my first, Initial and last name.

Get a one-time 75,000-mile bonus with the Capital One Venture X card and receive an additional 10,000 bonus miles every year, starting on your first anniversary. (View important rates and disclosures.) ... 6 Capital One Travel's price match guarantee is available on eligible flight, hotel and rental car purchases made through Capital One Travel ...

Plus, earn 5 miles per dollar on hotels and rental cars when you book through Capital One Travel. Use the VentureOne card to earn unlimited 1.25 miles per dollar on every purchase. You'll also earn 5 miles per dollar on hotels and rental cars booked through Capital One Travel. Keep in mind that Venture and Venture X cards have an annual fee.

Travel smarter with Capital One at every step of the journey, including booking flights, hotels and rental cars. Get more from your next journey with Capital One Travel. ... Lounges. Capital One Lounges Learn how you can relax and recharge in Capital One Lounges; Partner Lounge Network Search our network of 1,300+ lounges across the globe ...

S ince its launch in 2021, the Capital One Venture X Rewards Credit Card has disrupted the travel credit card industry and challenged titans like Chase and American Express.With its $395 annual ...

Prepare to be amazed by the outstanding features that the Capital One Venture X credit card has to offer: Welcome bonus: Embark on your travel adventures with a bang by earning an extraordinary welcome bonus of 75,000 miles! Simply spend $4,000 on purchases within the first three months after opening your account, and those miles will be yours ...

vs. Capital One VentureOne Rewards Credit Card. While both the Wells Fargo Active Cash Card and the Capital One VentureOne Rewards Credit Card offer $0 annual fees and introductory APRs, the former is better for cash rewards, and the latter for travel perks and customer satisfaction. vs.

Venture capital has ebbed and flowed since 2000, reaching its highest point in 2021 at nearly $17 billion. It has since receded back to $6.9 billion, in line with a retrenchment seen around the ...

The 200 planes, each having 12 rotters, will cost around USD 1 billion. New Delhi: InterGlobe Enterprises, the parent company of IndiGo, and US-based Archer Aviation will launch an all-electric ...