Top Travel Insurances for South Africa You Should Know in 2024

Byron Mühlberg

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

At the very bottom of Africa, South Africa is a famous tourist destination that's known for its diverse landscapes, Table Mountain, the Kruger National Park with its Big Five, and rich cultural heritage such as traditional music and dance. Although travelling to South Africa can be an accessible holiday destination for many people, out-the-pocket healthcare costs in the country tend to be expensive, so it's a very good idea to arrive there with travel insurance under your belt.

Luckily, online global insurances (known as 'insurtechs') specialize in cost-savvy travel insurance to South Africa and other countries worldwide. Our list below explores the four services we believe provide the best deals for young travellers, adventurers, everyday holidaymakers looking for comprehensive but affordable coverage, and longer-term expats.

South Africa Insurance Profile

Here are a few of the many factors influencing the scope and cost of travel insurances for South Africa:

Best Travel Insurances for South Africa

- 01. Should I get travel insurance for South Africa? scroll down

- 02. Best medical coverage: VisitorsCoverage scroll down

- 03. Best trip insurance: Insured Nomads scroll down

- 04. Best mix for youth and digitial nomads: SafetyWing scroll down

- 05. FAQ about travel insurance to South Africa scroll down

Heading to South Africa soon? Don't forget to check the following list before you travel:

- 💳 Eager to dodge high FX fees? See our picks for the best travel cards in 2024.

- 🛂 Need a visa? Let iVisa take care of it for you.

- ✈ Looking for flights? Compare on Skyscanner !

- 💬 Want to learn the local language? Babbel and italki are two excellent apps to think about.

- 💻 Want a VPN? ExpressVPN is the market leader for anonymous and secure browsing.

Do I Need Travel Insurance for South Africa?

No, there's currently no legal requirement to take out travel insurance for travel to or through South Africa.

However, regardless of whether or not it's legally required, it's always a good idea to take our health insurance before you travel — whether to SA or anywhere else. For what's usually an affordable cost , taking out travel insurance will mitigate most or all of the risk of financial damage if you run into any unexpected troubles during your trip abroad. Take a look at the top five reasons to get travel insurance to learn more.

With that said, here are the top three travel insurances for South Africa:

VisitorsCoverage: Best Medical Coverage

Among the internet's best-known insurance platforms, VisitorsCoverage is a pioneering Silicon Valley insurtech company that offers comprehensive medical coverage for travellers going abroad to South Africa. It lets you choose between various plans tailored to meet the specific needs of your trip to South Africa, including coverage for medical emergencies, trip cancellations, and travel disruptions. With its easy online purchase process and 24/7 live chat support, VisitorsCoverage is a reliable and convenient option if you want good value and peace of mind while travelling abroad.

- Coverage 9.0

- Quality of Service 9.0

- Pricing 7.6

- Credibility 9.5

VisitorsCoverage offers a large variety of policies and depending on your needs and preferences, you'll need to compare and explore their full catalogue of plans for yourself. However, we've chosen a few highlights for their travel insurance for South Africa:

- Policy names: Varies

- Medical coverage: Very good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, mental health-related conditions, and many others.

- Trip coverage: Excellent - but only available for US residents.

- Customer support: FAQ, live chat and phone support

- Pricing range: USD 25 to USD 150 /traveller /month

- Insurance underwriter: Lloyd's, Petersen, and others

- Best for: Value for money and overall medical coverage

Insured Nomads: Best Trip Coverage

Insured Nomads is another very good travel insurance option, especially if you're adventurous or frequently on the go and are looking for solid trip insurance with some coverage for medical incidents too. With Insured Nomads, you can choose the level of protection that best suits your needs and enjoy a wide range of benefits, including 24/7 assistance, coverage for risky activities and adventure sports, and the ability to add or remove coverage as needed. In addition, Insured Nomads has a reputation for providing fast and efficient claims service, making it an excellent choice if you want peace of mind while exploring the world.

- Coverage 7.8

- Quality of Service 8.5

- Pricing 7.4

- Credibility 8.8

Insured Nomads offers three travel insurance policies depending on your needs and preferences. We go through them below:

- Policy names: World Explorer, World Explorer Multi, World Explorer Guardian

- Medical coverage: Good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, and many others.

- Trip coverage: Good. Includes coverage for trip cancellation and interruption, lost or stolen luggage (with limits), adventure and sports activities, and many others.

- Customer support: FAQ, live chat, phone support

- Pricing range: USD 80 to USD 420 /traveller /month

- Insurance underwriter: David Shield Insurance Company Ltd.

- Best for: Adventure seekers wanting comprehensive trip insurance

SafetyWing: Best Combination For Youth

SafetyWing is a good insurance option for younger travellers or digital nomads because it offers flexible but comprehensive coverage at a famously affordable price. With SafetyWing, you can enjoy peace of mind knowing you're covered for unexpected medical expenses, trip cancellations, lost or stolen luggage, and more. In addition, SafetyWing's user-friendly website lets you manage your policy, file a claim, and access 24/7 assistance from anywhere in the world, and, unlike VisitorsCoverage, you can even purchase a policy retroactively (e.g. during a holiday)!

- Coverage 7.0

- Quality of Service 8.0

- Pricing 6.3

- Credibility 7.3

SafetyWing offers two travel insurance policies depending on your needs and preferences, which we've highlighted below:

- Policy names: Nomad Insurance, Remote Health

- Medical coverage: Decent. Includes coverage for doctor and hospital visits, repatriation, and many others.

- Trip coverage: Decent. Includes attractive coverage for lost or stolen belongings, adventure and sports activities, transport cancellation, and many others.

- Pricing range: USD 45 to USD 160 /traveller /month

- Insurance underwriter: Tokyo Marine HCC

- Best for: Digital nomads, youth, long-term travellers

How Do They Compare?

Interested to see how VisitorsCoverage, SafetyWing, and Insured Nomads compare as travel insurances to South Africa? Take a look at the side-by-side chart below:

Data correct as of 4/1/2024

FAQ About Travel Insurance to SA

Travel insurance typically covers trip cancellation, trip interruption, lost or stolen luggage, travel delay, and emergency evacuation. Some travel insurance packages also cover medical-related incidents too. However, remember that the exact coverage depends on the insurance policy.

No, you'll not be required to take out travel insurance for South Africa. However, we strongly encourage you to do so anyway, because the cost of healthcare in South Africa can be high, and taking out travel insurance will mitigate some or all of the risk of covering those costs yourself if you need medical attention during your stay.

Yes, medical travel insurance is almost always worth it, and we recommend taking out travel insurance whenever visiting a foreign country. Taking out travel insurance will mitigate some or all of the risk of covering those costs yourself in case you need medical attention during your stay. In general, we recommend VisitorsCoverage to travellers worldwide because it offers excellent value for money and well-rounded travel and medical benefits in its large catalogue of plans.

Health insurance doesn't cover normal holiday expenses, such as coverage for missed flights and hotels, but in case you run into medical trouble while abroad, it may cover some or all of your doctor or hospital expenses while overseas. However, not all health insurance providers and plans offer coverage to customers while abroad, and that's why it's generally best to take out travel insurance whenever you travel.

Although there's overlap, health and travel insurance are not exactly the same. Health insurance covers some or all of the cost of medical expenses (e.g. emergency treatment, doctor's visits, etc.) while travel insurance covers non-medical costs that are commonly associated with travelling (e.g. coverage for missed flights, stolen or lost personal belongings, etc.).

The cost of travel insurance depends on several factors, such as the length of the trip, the destination, the age of the traveller, and the level of coverage desired. On average, travel insurance can cost anywhere between 3% and 10% of the total cost of the trip.

A single-trip travel insurance policy covers a specific trip, while an annual one covers multiple trips taken within a one-year period. An annual policy may be more cost-effective for frequent travellers.

Yes, you can sometimes purchase travel insurance after starting your trip, but it is best to buy it before the trip begins to ensure maximum coverage. If you do need to buy insurance after you've started your trip, we recommend VisitorsCoverage , which offers a wide catalogue of online trip and medical insurance policies, most of which can be booked with immediate effect. Check out our guide to buying travel insurance late to learn more.

Yes, you can most certainly purchase travel insurance for a trip that has already been booked, although we recommend purchasing insurance as soon as possible aftwerwards to ensure all coverage is in place before your journey begins. Check out our guide to buying travel insurance late to learn more.

See Our Other Travel Insurance Guides

Looking for Travel Insurance to Another Country?

See our recommendations for travel insurance to other countries worldwide:

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

- Schengen Product

- Travel Global

- Annual Multi-trip

- TravelSmart

- Travel Senior

- Policy Document

- Travel Tips

- Insurance Glossary

- Privacy Policy

- Health Declaration and Exclusions

- GET A QUOTE

Travel Insurance

Travel insurance for the whole family

Whilst you are traveling, Allianz Travel provides travel insurance to safeguard you and your family. Our wide range of travel insurance options extends from simple Schengen visa coverage to exclusive annual multi-trip covers.

Total Coverage!

Allianz travel insurance covers you and your family when traveling. We provide several types of coverage, including accident, illness, injury, sickness, trip interruption, baggage loss or damage, delays, and so much more.

Allianz Travel offers you the freedom to explore the world with confidence, knowing that Allianz Travel has one of the following travel insurance plans to protect you:

Popular Products

Schengen travel.

If you are travelling to the Schengen Zone, then this policy enables you to obtain your Visa, in addition to offering emergency medical cover, whilst you are travelling.

From R 147*

Single trip insurance.

Perfect for individuals or families travelling worldwide for a single trip. Protect you or your family as well as your holiday with our great value Single Trip Travel Insurance.

From R 233**

Annual trip insurance.

Planning on going away more than once this year, then an Annual Trip Policy offers you great value cover for all of your trips, the best cost effective solution all year long.

From R 1887***

Sports Cover

* Schengen Travel - Price based on a 30 year old travelling up to 3 days within a Schengen Destination.

**Travel Standard - Price based on a 30 year old travelling up to 3 days within Worldwide excluding USA & Canada geographical zone.

***Travel Schengen Annual multi-trip - Price based on a 30 year travelling to the Schengen space

****Travel Standard with Sport Cover - Price based on a 30 year old travelling up to 3 days within Worldwide excluding USA & Canada geographical zone

For more information about our optional products prices please refer to the products page.

The Travel Insurance Experts

When you are insured with AGCS SA, you have access to a global network of travel experts. Our travel insurance underwriters have a vast amount of experience and local knowledge about the destinations, cultures and risks of many different countries. This means that we can design a comprehensive cover for your specific needs while understanding the unique challenges faced by people traveling to more remote or exotic locations around the world.

- Introducing the new Chubb Travel Insurance

- What is covered?

- What is not covered?

- When am I covered?

- Where can I travel?

- Who is covered?

- Preparing to Travel

- At Your Destination

- When the Unexpected Happens

- Planning your Travel

- Top Travel Tips

- Chubb Assistance

- Product Features

- Overseas Medical Assistance And Claims

- Luggage And Travel Documents

- Sports Equipment

Personalise your travel insurance coverage

Travel visa.

Our most affordable international travel cover option. A range of benefits with reduced cover benefits. Some basic domestic cover available.

Travel Plus

Quality travel insurance coverage with a range of benefits to meet your travel needs. With lower limits than the Travel Superior plan, the Chubb Travel Plus Plan is our extensive coverage international travel plan that will give you wide cover limits on your travels abroad at a competitive price. Choose between Single Trip or Annual Multi-Trip plans based on your travel schedule.

Travel Superior

If you are after our most comprehensive travel insurance plan, the Chubb Travel Superior Plan should be considered. Superior is our carefully designed and broad coverage international travel plan that will give you extensive cover on your travels abroad with high benefit limits.

Quality travel cover at an affordable price

With more than 50 years of insurance experience and many millions of travellers served, Chubb Travel Insurance offers high-quality insurance to South African travellers. We have plan options for all types of travellers, from frequent flyers and families, to holidaymakers on a budget.

Access to a global team of travel experts

Purchasing travel insurance from Chubb means access to a truly global network. In addition to our wealth of global expertise, Chubb’s operation in South Africa is backed by our extensive travel network and breadth of resources to serve your every need.

Fast, fair and efficient handling of claims

Experience has taught us the importance of being proactive when handling claims. Chubb understands that a fast, fair and efficient approach to claims handling will bring about an expedited outcome, and can help to deliver an improved result.

24 hour emergency assistance

When you purchase Chubb Travel Insurance, you are instantly covered by Chubb Assistance, our 24-hour emergency hotline that provides the support that you expect in your time of need, anywhere, anytime.

You may contact us via email or telephone.

Chubb Insurance South Africa Limited

Ground Floor, The Bridle, Hunts End Office Park 38 Wierda Road West, Wierda Valley, Sandton

Chubb Travel Insurance Customer Service

For general enquiries and claims, call

0800 467 467

(Mon-Fri: 9am to 5pm only)

For 24-hour emergency, call

+27 (0) 11 722 5757

Chubb Worldwide Offices

For the mailing address, telephone number and email address of any Chubb office in our global network,

Please use our office locator

Chubb. Insured. ™

- About Chubb

- Cookie Policy

Chubb Travel Insurance is issued and underwritten by Chubb Insurance South Africa Limited, a (Re)Insurer licensed to conduct non-life insurance and reinsurance business. Chubb is an authorised Financial Services Provider (FSP: 27176). The policy wording will take precedence over all the guidance contained in the website and in all instances the terms and conditions of the policy wording apply. Chubb only provides general guidance and does not consider your objectives, financial situation or needs; therefore this guidance cannot be considered as financial advice. Chubb can be contacted on 0800 467 467 or e-mailed at [email protected] .

We use personal information which you supply to us or, where applicable, to your insurance broker for underwriting, policy administration, claims management and other insurance purposes, as further described in our Master Privacy Policy, available here: https://www.chubb.com/za-en/privacy-policy.html . You can ask us for a paper copy of the Privacy Policy at any time, by contacting us at mailto: [email protected] .

We use cookies to optimise the user experience. Tell me more

Please take note

You are about to leave the Absa website. The content of the website you are visiting is not controlled by Absa. This link is being offered for your convenience and Absa is not responsible for accuracy or security of the information provided. We recommend that you read the privacy policies and terms of the other website. The requested site will open in a new window.

- Private & Wealth

- Absa Online

- Online Share Trading

Wealth and Investment Management

- Business Online Banking

- Electronic Mailbox

- International Trade Finance

- International Cash Management

- iMX Extranet

- Business Integrator Online

- Absa Investments

- Cash Self Service

- Data Security Manager

- ISO Merchant Onboarding

- Commercial Online Banking

- Fleet Management System

Absa Travel Insurance

Relax and enjoy the journey knowing you’re covered for any eventuality.

Call me

Holidays should be stress-free

We’ll cover you for unexpected incidents that may affect your travel, from a cancelled flight to a lost suitcase or a sudden illness. Absa Travel Insurance options will ensure that you relax and enjoy every journey. Choose the travel insurance option that suits you best.

Stress-free travel

Your top-up cover will cover you for the loss of baggage, money or bank cards, the rejection or delay of your visa, missing a connecting flight or cancelling or delaying your trip.

Discounted rates for couples, families and groups travelling together.

Frequent travellers

Unlimited number of trips (maximum trip duration is 90 days) done within 12 months are covered by our annual multi-trip option.

What you need to know

Already an absa customer.

As a holder of a qualifying Absa Visa card, you automatically get up to 90 days’ Basic Travel Insurance for international journeys when purchasing your return travel ticket(s) with your card. Automatic Basic Travel Insurance is available for travellers between three months and 74 years old.

Top-up cover

If you need more cover you can easily add more benefits to your Automatic Basic Cover.

War is a general exclusion on all Bryte policies. Due to sanctions as well as the prevailing conditions please note that cover on all policies (Basic Travel Insurance as well as Top-up cover) for travel to Russia, Ukraine and Belarus and associated airspace has been suspended until further notice.

Choose the insurance solution you need

We’ll call you with a personalized quote.

Automatic Basic Travel Insurance

Get 90 days’ Automatic Basic Travel Insurance for international trips. You also get medical cover for expenses and personal accidents, plus selected travel-assisted services.

Tell me more

Optional top-up cover

Supplement your Automatic Basic Travel Insurance with a range of benefits that cater for trips up to 184 days.

Top-up Cover for seniors

If you're between 75 and 85 years old, this cover gives you travel insurance for 90, 120 or 184 days or an annual multi-trip.

Tell me more

Exclusive seniors

Get exclusive cover for 31 days if you are between 86 and 89 years old. Specific terms and conditions apply.

- Basic Travel Insurance

- Optional Top-up Cover

- Top-up Cover for Seniors

- Exclusive Seniors

- As a cardholder of a qualifying Absa card, you qualify for up to 90 days’ Automatic Basic Travel Insurance for international journeys when purchasing your return travel ticket(s) with your credit card.

- Available for travellers between the ages of three months and 74 years.

- Basic Travel Insurance does not cover pre-existing medical conditions and may not include cover for certain hazardous activities. A pre-existing medical condition includes any doctor’s consultation or medical advice or treatment (including prescription medication) that you may have received for any chronic or recurring illness or injury in the year before the insurance under this policy started.

- You have a choice of three optional top-up plans to supplement the Automatic Basic Travel Insurance available to you. Please refer to the optional top-up schedules of benefits in the policy for detailed information on the benefits and limits offered.

- Your card must be used for payment at a point of sale (POS), or you can pay for your public transport carrier ticket by using an online purchase facility (Card Not Present transaction). EFT transactions (payment from the credit card account) do not qualify.

- You only qualify for automatic basic cover benefits when your insured journey begins and ends in South Africa.

Get certificate OR Call me back

View our top-up rates Read your Travel Insurance Policy

Visit the Bryte website get your Automatic Basic Cover confirmation, an Absa quote or buy your Absa Top Up Travel Insurance.

Absa Travel Insurance is underwritten by Bryte Insurance Company Limited, a licensed insurer and an authorised FSP (17703).

automatic-basic-travel-insurance

With Optional Top-up Cover, you can add more benefits to your Automatic Basic Cover.

Rates are calculated according to the following age groups:

- Three months to 59 years (inclusive)

- 60 to 69 years (inclusive)

- 70 to 74 years (inclusive)

You can choose from the following trip duration options:

- One to 90 days

- 91 to 120 days

- 121 to 184 days

- Annual multi-trip

The comprehensive offer covers:

- Hijacking of a public transport carrier

- Legal expenses

- Lost or stolen baggage

- Wrongful detention

- Personal Accident Insurance

- Trip cancellation/Cutting your insured journey short

- Additional cover for emergency medical and associated expenses

- Personal loss of money or your passport, as outlined in the policy document.

The standard optional top-up plans may not include certain hazardous activities. Please refer to the hazardous activities listed in the policy wording to ensure that you have cover for your planned activities. If your activity does not appear on our list, please call the Bryte Customer Care Centre on 0861 227 284 or email [email protected] to ensure that you have the appropriate cover in place.

Cover for cardiac, cardiovascular, vascular or cerebrovascular conditions If you are 70 years or older, we do not pay for claims caused by or resulting from any cardiac, cardiovascular, vascular or cerebrovascular illness or consequences or complications that can reasonably be related to these conditions.

This exclusion will not apply if you bought the Optional Additional Cardiac, Cardiovascular, Vascular or Cerebrovascular Cover before the insured journey started. This optional extra cover is only available to travellers between the ages of 70 and 74, including when they buy Optional Top-up Plan 1.

Cancellation Cover

Cardholders of a qualifying Absa card have two Cancellation Cover options available to them, namely: Cancellation for a named reason and Cancellation for an unnamed reason.

- The standard Cancellation Cover for a named reason is explained on pages 69 and 70 of the policy wording document and lists specific named events for which a policyholder can claim.

- Cancelling an insured journey for an unnamed reason is an optional benefit that can be purchased by paying an additional premium. It waives specific exclusions and allows you to potentially claim for an event that is not specifically mentioned on pages 69 and 70, as described above. This Optional Additional Cover is only available on Top-up Option 1 and carries specific conditions as outlined in the policy wording. The Travel Insurance Policy must be bought within 24 hours after making the first (full or part) payment against your travel and accommodation booking. This benefit cannot be used in conjunction with Cancellation for a named reason.

- The specific exclusions applicable to cancellation, both named and unnamed cover, are listed on pages 75 to 76 of the policy wording. When you buy the optional cancellation cover for an unnamed reason, there are a number of exclusions that no longer apply. However, if you do not buy the optional cover for cancellation for an unnamed reason, the exclusions will apply as stated.

View our top-up rates Read your Travel Insurance Policy

Visit the Bryte website get your Automatic Basic Cover confirmation, an Absa quote or buy your Absa Top Up Travel Insurance.

optional-top-up-cover

This cover is specifically for travellers between the ages of 75 and 85 and is valid for 90, 120 or 184 days or an annual multi-trip.

The cover includes:

- Baggage loss/theft

- Personal accident insurance

- Wrongful detention and personal loss of money or your passport

- Comprehensive Travel Insurance Cover for emergency medical and associated expenses.

Get certificate OR Call me back

top-up-cover-for-seniors

Absa also offers Exclusive Cover for Senior Travellers between the ages of 86 and 89 years. The maximum period of insurance is 31 days.

- Before purchasing this plan, you are required to provide proof of your medical aid and a medical clearance form completed by your local treating medical practitioner. Cover is subject to pre-approval by Bryte.

- Please refer to the Exclusive Senior Schedule of Benefits in the policy document for detailed information on the applicable benefits, benefit limits and terms and conditions.

Visit the Bryte website get your Automatic Basic Cover confirmation, an Absa quote or buy your Absa Top Up Travel Insurance. Absa Travel Insurance is underwritten by Bryte Insurance Company Limited, a licensed insurer and an authorised FSP (17703).

exclusive-seniors

Cover has to be bought for each traveller, including children. Quoted premiums are for each insured traveller.

Discounted rates apply for couples, family/friends and groups travelling together.

Refer to the rates table below.

Find out more about our insurance solutions

Need to submit a claim.

We will give you all the support you need when you have to submit a travel insurance claim.

Call Bryte on 0860 222 446 or +27 (0) 10 498 7866 Monday to Friday between 08:00 and 16:30 Closed on weekends and public holidays Email [email protected]

Register and submit your claim here .

For emergencies

Call us on +1 416 977 9288 (Reverse call charges accepted)

For any medical claims over R10 000, contact the Emergency Assistance Helpline for approval. If you do not get approval, your benefit will be limited to R10 000.

Ensure that you have the following documents available in emergencies:

- Travel Insurance Policy number (if Optional Top-up Cover has been bought) or the credit card number used to purchase the airline ticket

- Current location

- Your telephone number

- Nature of the emergency

- Type of assistance required

Need more help?

Speak to one of Bryte Insurance consultants to get the best insurance for your needs

Call Bryte on 0861 227 284 or +27 (0) 10 498 7856 Monday to Thursday: between 08:00 and 18:00 Fridays: between 08:00 and 17:00 Saturdays: between 08:00 and 13:00

Closed on Sundays and public holidays

Email: [email protected]

Download the Absa Banking App today

Latest offers

Find a branch

Safety and security

Market Indices

Self servicing and help guides

App, Online and other banking

Exchange rates

Banking rates and fees

Investor Relations

Citizenship

Media Centre

Sponsorship

Personal Banking

Business Banking

Corporate and Investment Banking

Legal and compliance

Terms of use

Banking regulations

Privacy Statement

Switch to Absa

Business debit order switching

Send your feedback

011 501 5050

or 0800 11 11 55

Absa Head Office: Absa Towers West, 15 Troye Street, Johannesburg, Gauteng, South Africa, 2000

Terms Of Use | Banking Regulations | Privacy Statement | Security Centre | � Copyright. Absa Bank Limited, Registration number 1986/004794/06. All rights reserved | Authorised Financial Services Provider and a registered credit provider (NCRCP7)

We use cookies to optimise the user experience. Tell me more

Please take note

You are about to leave the Absa website. The content of the website you are visiting is not controlled by Absa. This link is being offered for your convenience and Absa is not responsible for accuracy or security of the information provided. We recommend that you read the privacy policies and terms of the other website. The requested site will open in a new window.

- Private & Wealth

- Absa Online

- Online Share Trading

Wealth and Investment Management

- Business Online Banking

- Electronic Mailbox

- International Trade Finance

- International Cash Management

- iMX Extranet

- Business Integrator Online

- Absa Investments

- Cash Self Service

- Data Security Manager

- ISO Merchant Onboarding

- Commercial Online Banking

- Fleet Management System

Explore our available travel insurance options

SCROLL TO DISCOVER

With cover for anything from a cancelled flight, lost suitcase to a sudden unexpected illness, Absa travel insurance allows you to relax and enjoy your journey. Choose from our travel insurance options below to ensure that you and your loved ones travel with peace of mind.

Basic travel insurance

Get emergency medical cover and up to 90 days automatic basic travel insurance for international trips. You are covered for emergency medical expenses, personal accident and selected travel assisted services

Optional top-up cover

This cover will supplement your automatic basic cover by providing a wider range of benefits and also caters for trips up to a maximum of 184 days as well as a cardio buy back option.

Stress-free travel

Top-up cover caters for all kinds of travel scenarios from the loss of baggage, money or bank cards, the rejection or delay of your Visa to having missed a connection or having to cancel or delay your trip.

Discounted premiums

Couples, families and groups travelling together get discounted rates.

Frequent travellers

Our annual multi-trip option covers you for an unlimited number of trips in a 12-month period.

Top-up cover for seniors

Provides cover for travelers who are 74 years of age while also offering an exclusive senior top-up option up to age 89.

Get your automatic basic travel cover certificate or purchase additional top up cover

Click here to get your automatic basic travel cover certificate or purchase top-up cover online

Complete this form if you would prefer to be contacted by a Bryte agent

Please contact me

Automatic basic cover

As an Absa credit cardholder you qualify for up to 90 days automatic basic travel insurance for international journeys when you purchase your return travel ticket(s) with your credit card*. Automatic basic travel insurance is available for travelers between the age of 3 months and 74 years.

Automatic basic travel insurance does not include cover for any pre-existing medical conditions and may not include certain hazardous activities. A pre-existing medical condition includes any doctor’s consultation or medical advice, treatment, including prescription medication, you may have received from a medical practitioner for any chronic or recurring illness or injury during the year before the insurance under this policy started.

You have a choice of three optional top up plans to supplement the automatic basic cover available to you. Please refer to the optional top up schedules of benefits in the policy for detailed information on the benefits and benefit limits offered.

You only qualify for automatic basic cover benefits when your insured journey begins and ends in South Africa.

* Your card must be used for payment at point of sale (POS), or you can pay for your public transport carrier ticket by using an online purchase facility (“card not present” transaction). EFT transactions (payment from the credit card account) do not qualify.

Optional top-up cover will supplement your automatic basic cover.

Rates are calculated according to the following age bands:

- 3 months to 69 years of age (inclusive)

- 70 years to 74 years (inclusive)

You can select from the following trip duration options:

- 1 – 90 days

- 91 – 120 days

- 121 – 184 days

- Annual Multi Trip

The comprehensive offer includes:

- Legal expenses

- Baggage loss/theft

- Wrongful detention

- Personal accident insurance

- Trip cancellation/curtailment

- Additional cover for emergency medical and associated expenses

- Personal loss of money or passport, as outlined in the policy document

The standard optional top up plans may not include certain hazardous activities. Please refer to the hazardous activities listed in the policy wording to ensure that you have cover for your planned activities. Should your activity not appear on our list, please contact the Bryte Customer Care Centre on 0861 227 284 to ensure that you have the appropriate cover in place.

Cardiac or cardio vascular or vascular or cerebro-vascular conditions cover If you are 70 years or older, we do not pay for claims caused by or resulting from any cardiac or cardio vascular or vascular or cerebro-vascular illness or consequences or complications that can reasonably be related to these conditions. This exclusion will not apply if you bought the optional additional cardiac or cardio vascular or vascular or cerebo-vascular cover before the insured journey started. This optional additional cover is only available to travelers between the ages of 70 and 74 years inclusive when they buy optional top up plan 1.

Cancellation Cover

Absa credit cardholders have two cancellation cover options available to them, namely : cancellation for a named reason and cancellation for an unnamed reason

- the standard cancellation cover, for a named reason , is explained on pages 66 to 67 of the policy wording document and lists specific named events for which a policyholder can claim.

- cancelling an insured journey for an unnamed reason is an optional benefit that can be purchased by paying additional premium. It waives specific exclusions and allows you to potentially claim for an event that is not specifically mentioned on pages 66 to 67, as described above. This optional additional cover is only available on Top Up Option 1 and carries specific conditions as outlined in the policy wording. The travel insurance policy must be bought within 24 hours after making the first (full or part) payment against your travel and accommodation booking. This benefit cannot be used in conjunction with cancellation for a named reason.

The specific exclusions applicable to cancellation, both named and unnamed cover, are listed on pages 71 to 72 of the policy wording. When you buy the optional cancellation cover for an unnamed reason, there are a number of exclusions that no longer apply. However, if you do not buy the optional cover for cancellation for an unnamed reason, the exclusions will apply as stated.

Cover for seniors

This cover is specifically for travelers aged 75 to 85 and is valid for 90, 120, 184 days or an Annual Multi Trip.

The cover includes:

- Wrongful detention and personal loss of money or passport

- Comprehensive travel insurance cover for emergency medical and associated expenses.

Exclusive Seniors: Absa also offers exclusive seniors’ cover for travelers from 86 up to and including 89 years. The maximum period of insurance is 31 days.

Please refer to the senior schedule of benefits in the policy document for detailed information on the senior’s benefits, benefit limits offered and terms and conditions.

Top-up rates

How to claim.

We will give you all the support you need when you have to submit a travel insurance claim.

Contact Bryte:

For medical out-patient and inconvenience benefit claims, e.g. cancellation, loss of baggage, etc.

011 370 9205

Email: [email protected]

Detailed Policy Information

Ensure that you are covered in the event of any emergency that requires medical assistance.

Click here to read your travel insurance policy wording

War is a general exclusion on all Bryte policies and is also an industry standard. Due to sanctions as well as the prevailing conditions please note that cover on all policies (Basic Travel Insurance as well as Top-up cover) for travel to Russia, Ukraine and Belarus and associated airspace has been suspended until further notice.

*Absa Travel Insurance is underwritten by Bryte Insurance Company Limited.

Emergency contact details

In the event of a medical emergency please contact the Emergency Assistance Helpline on:

+1 416 977 9288

Please ensure you have the following information at hand:

- Travel Insurance policy number (if Optional Top-Up Cover has been bought) or the credit card number used to buy the airline tickets

- Current location

- Contact telephone number where you can be reached

- Nature of the emergency

- Type of assistance required

*Please note that if the insured person named in the schedule does not contact the Emergency Assistance Helpline before incurring any expenses they may want to claim for our liability which will be limited to a maximum of R2 000.

Here's what you can expect

Need more help.

Let one of our consultants help you get the best insurance for your needs.

To speak to an adviser call:

0861 227 284

Email us at:

[email protected]

Visit your nearest branch

Download the Absa Banking App today

Latest offers

Find a branch

Safety and security

Market Indices

Guides to help you bank

App, Online and other banking

Exchange rates

Banking rates and fees

Investor Relations

Citizenship

Media Centre

Sponsorship

Personal Banking

Business Banking

Corporate and Investment Banking

Legal and compliance

Terms of use

Banking regulations

Privacy Statement

Switch to Absa

Business debit order switching

Send your feedback

011 501 5050

or 0800 11 11 55

Absa Head Office: Absa Towers West, 15 Troye Street, Johannesburg, Gauteng, South Africa, 2000

Terms Of Use | Banking Regulations | Privacy Statement | Security Centre | � Copyright. Absa Bank Limited, Registration number 1986/004794/06. All rights reserved | Authorised Financial Services Provider and a registered credit provider (NCRCP7)

- Travel Insurance

Travel insurance in South Africa: Complete Guide 2022

With the advent of COVID-19, one thing has become abundantly clear, that insurance is no longer optional but a strategic necessity, particularly when travelling. It follows that the demand for travel insurance in South Africa is skyrocketing. We have received a number of questions around travel insurance, people have been asking us, “Rateweb, should I buy travel insurance? Should I insure my next trip? Is it right for me? Do you guys buy travel insurance? Who sells the best travel insurance?”

Those are some of the questions we will address in this article

What is Travel Insurance?

Travel Insurance is a range of insurance offerings covering unforeseen losses while travelling, either international or domestic. Travel insurance generally covers including but not limited to medical emergencies, trip cancellation, trip interruption, delays, medical evacuation, and lost, damaged, or stolen luggage.

6 things to know before you buy travel insurance in South Africa

Travel insurance isn’t for everyone.

The first thing you need to know is that travel insurance doesn’t make sense for everyone. To determine whether it makes sense for you, you have to decide how willing you are to take financial risks related to travel.

Travel insurance exists to minimize financial risk when travelling. So you have to look at the trip you are taking, how much money did it cost? If for unforeseen reasons you can’t go or something happens, how much money will you lose? Do you lose a few hundred rands in airfare or is it an R150,000 once in a lifetime trip?

Those are things you have to look at to decide whether you want to buy travel insurance or not. You also have to ask yourself, how much is peace of mind worth to you? If you’re someone who worries a lot, peace of mind might actually be worth quite a bit.

Types of travel insurance

- Trip cancellation coverage If you have a policy that has trip cancellation coverage, then your insurance will refund you the price of your trip provided that the reason you’re cancelling is one of the covered reasons.

- Trip interruption coverage Trip interruption coverage insurance comes into play if you have to interrupt and stop your trip halfway through because something happened and you have to go home. In that case, the insurance would refund you the rest of the price of your vacation that you didn’t get to enjoy.

- Trip delay coverage Trip delay coverage kicks in if there is a delay during the trip. A good example is a flight delay while you are at a transit airport. Say you are flying from Port Elizabeth to Thailand, and you get stuck at OR Tambo or Cape Town International Airport or even London Heathrow for 6 to 12 to 18 hours, you might have to stay in a hotel overnight, that’s what trip delay coverage is for.

- Medical coverage Medical coverage as part of a travel insurance policy will reimburse medical expenses incurred at your travel location. You might also want to look at an emergency evacuation or transport coverage so that if you have to go to a hospital if you are in a third world country, you get medical transport or emergency evacuation due to a medical situation. The insurance company will pay for transporting you to a better country that has better health facilities.

- Death or dismemberment coverage Death or dismemberment coverage insurance is a depressing one, but if the covered person dies, or is dismembered, loses limbs, then their next of kin or in the case that they were dismembered will receive the money associated with that part of the policy.

- Baggage coverage insurance Baggage coverage insurance provides for reimbursement of expenses due to loss, damaged, delayed, or stolen baggage.

- Rental car coverage Rental car coverage covers your rental car on a trip.

- Change coverage Change coverage insurance will cover you if you have to make changes to your airlines reservations, cruise ships, whatever the change comes from

- Political evacuation coverage If there’s something like an uprising or a coup in your host country, Political evacuation coverage insurance will provide for your transport out of that country during that situation.

- Annual travel coverage If you travel a lot, then you actually might want to look at getting an annual policy, which would cover you on all the trips you take in a year. This is best for travel junks and business people who manage numerous offices around the world.

Travel insurance is not a one-size-fits-all thing. And every travel insurance plan covers different areas and different conditions. These are the most common types you might be interested in and looking for in a travel insurance policy.

If you see a policy labelled as a comprehensive policy, that’s typically one that covers almost all of the things that we have talked about. If you are looking at a policy that says it’s reimbursement only, then the way that policy works is you pay first and then you get reimbursed.

Price of Travel Insurance

Travel insurance generally costs 5% to 12% of the total costs of the trip. The biggest determining factor in the cost of insurance is the age of the people being insured. If you are above the age of 50 years, then the cost generally considerably goes up.

Children under the age of 17 might be covered for free or discounted provided that there are some adults on the policy already. The prices of travel insurance can range widely, so it is important to shop around policies.

You may be interested in checking our article on what you need to know before signing up for insurance in South Africa. Don’t just buy the travel insurance company that your airline or cruise company is pushing on you when you book directly with them, do your own research.

When to buy travel insurance

Many people think that you have to buy travel insurance at the same time that you book your tickets or flights or cruise, but that’s actually not the case. Typically, you don’t have to buy many types of travel insurance until just before you go. However, if you are buying something like trip cancellation coverage you are better off buying early, it tends to be cheaper that way and gives you more value.

If you buy it later on, well, you might not be reaping the benefits, cause something might already have happened, and you had to cancel the trip. There are some policies that do require you to purchase within 7, 14, 21 days of booking your trip.

So you should research the policies and try to book it around the same time, but you don’t have to.

Medical Insurance in detail

The fifth thing to know is a bit more detail about medical insurance coverage. This is one of the most important areas of travel insurance and so it is paramount that we dive into it a little deeper than we did earlier.

First of all, if you already have health insurance, your existing health insurance plan or policy might cover you when you go on travel. Read the details, call your insurance company, figure that out before you buy travel insurance so that you don’t spend money twice on something you’re already covered for.

You need to dive into the details a little bit because if your insurance company says they cover you, well, they might actually be billing those coverage things out of network rates, which could actually lead to some really expensive medical bills if something happens to you while you are on travel.

We mentioned earlier, but we will say it again, If you are going to someplace kind of sketchy, you might really want to look into a policy that gives you an emergency airlift service to take you to a civilized hospital.

This type of coverage becomes more important the more adventures and the more remote places you go. For example, if you are hiking Mount Kilimanjaro and something happens to you upon the mountain, well, you are first going to need a helicopter. And then after the helicopter, you will need an airplane to actually take you someplace civilized.

So that can get expensive really quick.

Credit Cards

So a lot of people ask us, “Rateweb, do I need travel insurance if I already have a credit card that comes with some premium benefits?” Well, it depends on the card that you have. Our favourite card for travel is the Capitec Global One Card .

If you are below the age of 75 years and you buy your air tickets through the Capitec Global One Card you automatically qualify for basic travel insurance. You may also opt for the comprehensive travel insurance cover. The basic cover covers emergency medical and related expenses of up to R10 million.

Best credit cards for travel insurance in South Africa

- Capitec Global One Card

- FNB Black Card

- Discovery Bank Black Card

- Nedbank Classic Credit Card

- Standard Bank Platinum Credit Card

- F NB Platinum Credit Card

- ABSA Private Banking Credit Card

- Nedbank Platinum Credit Card

- Standard Bank Titanium Credit Card

- Nedbank Gold Credit Card

Start trading with a free $30 bonus

Unleash your trading potential with XM —your gateway to the electric world of financial markets! Get a staggering $30 trading bonus right off the bat, with no deposit required . Dive into a sea of opportunities with access to over 1000 instruments on the most cutting-edge XM platforms. Trade with zest, at your own pace, anytime, anywhere. Don't wait, your trading journey begins now! Click here to ignite your trading spirit!

Shephard Dube is the Co-Founder of Rateweb. He is a web software developer with a passion for personal finance, economics, stock market, blockchain and cryptocurrencies. He spends most of his time figuring out how organizations and governments can make the environment conducive for business owners and consumers. He can be contacted on: [email protected]

Related Post

- Tragic Tree Accident Claims Security Guard in Paarl Storm

- Inquiry Delayed: Pursuit of Truth for Enyobeni Tavern Tragedy

- Urgent Eyecare Advisory: Pink Eye Surge Hits South Africa

- SABC Salary Stagnation Sparks COSATU’s Urgent Advocacy Efforts

- Battle Against Bullying: A Mother’s Cry for Justice

- Western Cape Braces for Devastating Weather

- Unveiling the Future: AI’s Impact on Jobs and Opportunities

- Rand Water: Debunking Water Crisis Fears with Infrastructure Upgrades

- Family’s Fight: Justice for Assaulted 13-Year-Old Victim

- South Africa Condemns Diplomatic Building Attack in Syria

Recent Posts

- Forex Market

The Art of Making Money through Forex Trading

Fnb freezes ex-president zuma’s accounts ahead of elections.

- International

Apple Removes WhatsApp, Threads from China’s App Store

World bank aims to connect 250 million africans by 2030, meta unveils smarter ai assistant powered by llama 3, fatal shoot-out: three suspects killed in johannesburg confrontation, roodepoort murder case: bail postponed as accused await trial, former us president trump faces unprecedented criminal trial, ff+ warns: land expropriation threatens south africa’s economy.

- Business News

- Capital Markets

- Finance News

- Investing News

- Stock Market

Regulatory Probe Unveils Ascendis Health Limited’s Corporate Transaction Challenges

This website uses cookies.

Comprehensive Travel Insurance

Embark on your next adventure worry-free with VisaRequest

We offer Trave Insurance at the best price, covering a wide range of incidents in most countries of the world and underwritten by one of the biggest international insurance providers

Schengen Visa Compliant

Protects travelers from unforeseen eventualities that can threaten their trip.

Our travel insurance meets the Embassy requirement. Get the certificate you need for your Schengen Visa Application

Easy, Quick and Affordable

Get an instant quote and purchase your travel insurance online.

Our easy online facility offers a step-by-step quotation and purchase facility so you can be protected from unforeseen eventualities that can threaten their trip

Covers up to R 500,000 in emergency medical expenses in case of accident, sickness, illness or injury

Policy is designed for Europe, but it covers most countries in the world for up to 3 months

Call the 24/7 emergency help line for immediate support or claim from the online portal

Benefits of Our Travel Insurance

Quick Online Quote and Processing

Instant Insurance Certificate

Schengen Visa compliant

Emergency Medical Transportation

Coverage including COVID-19

100% Refund in case of visa refusal

Cheapest Travel Insurance in SA

Underwritten by Allianz for peace of mind

What Can Happen?

Don't let unforeseen circumstances ruin your trip

Medical Emergency

Chronic illness, fracture, sprain, bruise, food poisoning or other reasons to be hospitalized

Loss or Damage

Lost luggage, damage to your bags or damage to your work equipment or sport gear

Unable to Enter

Flight cancellation, forced observation or other reasons for being denied entry into a country

Three Simple Steps To Get Travel Insurance

Complete the form.

Fill out our user-friendly form, provide essential details about your trip

Select a Payment Method

Easily make a secure online payment, choose from various payment options

Receive the Certificate

Get your insurance coverage and the required document for your travel visa

Get Your Travel Insurance Pay 50% To Start Now

Euismod risus auctor egestas augue mauri viverra euismod tortor eugiat a mauris placerat.

Fringilla risus nec, luctus mauris orci auctor purus euismod and pretium purus at pretium ligula rutrum viverra tortor sapien sodales and primis ligula risus auctor egestas augue mauri viverra tortor in iaculis placerat eugiat mauris ipsum viverra tortor gravida

Request Form

www.travel-insurance.co.za

Visa Applications

Other Services Offered by VisaRequest

Travel visas, long stay visas, passport renewal, evisa for south africa, visarequest: sa's market leader.

Assisting Travelers Since 2008

Years’ Experience

Clients Assisted

Successful Visas

Corporate Clients

Some of the corporate clients who used the services of VisaRequest

Aerial Concepts

Bigen Africa

Boniswa Group

Bank of Eswatini

Congo Industrial Supplies

Mobi Hunter

Quad Africa

Thaba Tholo

New Forest Company

Turbo Direct

University of Pretoria

What is covered.

The policy covers up to R 500,000 in emergency expenses

Medical Expenses

Medical treatment, hospitalization and medical evacuation in case of illness or injury

Repatriation

Costs associated with repatriating the remains of a person who pass away to their home country

Medical Evacuation

Transport to the nearest suitable medical facility in case of a medical emergency

Travel Assistance

Support services with lost passport, emergency cash transfers or legal assistance

Trip Cancellation

Coverage for trip cancellation or interruption due to unexpected events

Personal Liability

Legal expenses and damages in case the person is held legally responsible for injury or damage

Frequently Asked Questions

Questions answered about travel insurance

What Is Schengen Travel Insurance?

Schengen travel insurance is mandatory travel insurance required for getting a Schengen Visa

Why do you need Schengen travel insurance?

It is mandatory for travelling to the Schengen countries to secure yourself and your finances from anything that could go wrong during your trip

Does Schengen travel insurance cover countries outside Europe?

Yes, the travel insurance covers most countries in the world

What amount is covered with Schengen travel insurance

The insurance covers medical expenses and repatriation for up to €30,000

Which incidents are covered with Schengen travel insurance?

Schengen travel insurance provides coverage for medical emergencies, accidents and other unexpected events during your trip

Are natural disasters covered by the travel insurance?

Yes, coverage includes unexpected events like natural disasters

Can I purchase an insurance policy while staying abroad?

Yes, you can purchase our travel insurance online from anywhere in the world

Can I get travel insurance when I'm already travelling abroad?

Unfortunately, coverage must be purchased before the start of your trip

When does the insurance policy take effect?

The policy takes effect from the date of travel for which your policy has been purchased

Which country should be indicated in the policy if I plan to travel to more countries?

Indicate the primary destination or the country of the longest duration of stay in your policy

How long does it take to receive the insurance policy after payment?

You will receive your insurance certificate within 2-6 office hours

How will I receive my policy document?

Your insurance certificate and coverage policy/brochure will be sent to you electronically by email

What should I do if an insured event occurs?

Contact the 24/7 assistance hotline to be guided through the claims process

How is monetary compensation after an insured event carried out?

Upon approval, monetary compensation is reimbursed through the chosen payment method

Can I get holiday insurance that covers COVID-19?

Yes, our travel insurance includes coverage for COVID-19 related illness

Who is the underwriter of the Travel Insurance?

It is underwritten by Allience, a well-known global insurer

Still have a question? Ask your question here

Travel insurance news.

Read More About Travel Insurance For South Africans

Schengen Insurance Reading time - 2 min read

The Role of Travel Insurance in Securing a Schengen Visa

Planning a trip Europe? Ensure a seamless journey by understanding why travel insurance is not just a choice but a necessity when applying for a Schengen visa. From comprehensive health coverage to financial protection and compliance with visa requirements, discover the reasons to purchase travel insurance. This article sheds light on the significance of obtaining the right policy

by VR_AdminPR - July 21, 2023

Travel Insurance Reading time - 2 min read

How my travel insurance saved my life during my recent holiday disaster

This gripping personal account narrates a traveller’s real-life experience of facing a holiday disaster and how their travel insurance from VisaRequest played a crucial role in mitigating the challenges

by VR_AdminPR - May 11, 2023

The Unbeatable Case for Travel Insurance: Your Ultimate Safeguard Abroad

Explore the multitude of reasons why having travel insurance is a non-negotiable aspect of trip planning. From unexpected medical emergencies to trip cancellations, this article outlines the various scenarios where travel insurance becomes your reliable safeguard for financial protection during your travels

by VR_AdminPR - February 9, 2023

Our Location

648 Jan Shoba Street,

Hillcrest, Pretoria

Phone : 087 550 5282

Cell : 082 733 5236

Office Hours

8:00 AM - 4:30 PM

Drop a Line

www.VisaRequest.co.za

Passport Type Passport Type New Renewal

Passport Type Normal Thik

include ID Card

This will close in 0 seconds

Working Holiday Visa Study Abroad Digital Nomads

- Luxury Comprehensive

- Business Comprehensive

- Schengen Visa

- Africa, Asia, Indian Ocean & Middle East Regional Cover

- Youth – For Casual Work and Study

- Credit Card Top Up Cover

- Senior (Over 71-80 years)

- Senior (Pensioners) over 80

- Inbound – For tourists visiting South Africa

- Cover for South African Residents traveling locally

- How to get the right travel insurance

- International Medical Emergency Help and advice

- Tailor your International travel Protection

- 6 Policies that have Annual Multi-Trip (For frequent travelers)

Buy International Travel Insurance Online – South Africa

It is easy to get an instant quote and buy travel insurance online with our step-by-step quotation and purchase facility. It is safe, secure, and fully underwritten by Genric Insurance Company (Ltd) to give you peace of mind. Enjoy traveling knowing you are well covered for any medical emergency.

International Travel Insurance from South Africa

See our selections of cover for South African residents travelling internationally.

Local Travel Insurance in South Africa

Cover for residents and non-residents visiting South Africa.

Which cover should I choose?

A guide to purchasing the best and most suitable cover fit for where you are traveling at the best price.

Information about Travelinsure and what you should do in a medical emergency. Who underwrites our policies?

Six Easy Steps to Buying Travel Insurance Online

1. click buy now button.

This will take you to our online Quotation and purchase system.

2. Trip Details

Quickly Fill in information on age, business or leisure travel, destination & dates of travel.

3. Quote & Policy Choice

Select policy choice based on suitable cover presented showing price and schedule of medical & travel protection benefits. See our range of International policies.

4. Tailor Extra Cover (Optional)

Tailor your cover by adding a choice of Extra benefits. You can read more about it here.

5. Personal Details

Complete personal (Confidential) details on our quick and easy form.

6. Completion

Pay with a card using our secure online payment gateway. Your policy will be emailed and you can relax and look forward to a covered trip.

Why Buy Travel Insurance Online With Travelinsure?

Convenience and professionalism.

Information & Guidance

Terms and Conditions

Copyright Essential World Travel (Pty) Ltd Trading as Travelinsure

Hollard Travel Insurance

Plan your next international holiday with peace of mind

Got the wanderlust? The world is calling!

It’s time to start ticking those items off your bucket list again.

International travel has opened up and it couldn’t have come a moment too soon! Our itchy feet want to get moving again, but let’s just make sure you have the right travel insurance to cover you for unexpected eventualities.

Need to get in touch with us?

Call Customer Care on 0861 455 738 or email [email protected] or fax 0866 43 44 36

Call 24-hour Medical Assistance and Expense Authorisation on 011 991 8610

Customer service operating hours

Mon - Fri: 08:00 – 16:30

Get your travel cover quote now and choose from one of our tailor-made international Travel Insurance products:

Maximum period of travel, overseas medical.

R100,000,000

Cannot travel

R50,000,000

SilverVoyage

R10,000,000

Travel Insurance product benefits

Whether you’re going hiking in Peru or snowboarding in France, you plan the itinerary, and we’ll make sure you’re covered for it.

Just put us in your backpack and we’ll cover you for the following:

- Approved Pre-existing medical conditions (if unsure declare them to us).

- Approved sporting activities.

- Winter sports and cruise travel insurance.

- Holiday and business travel insurance.

- Senior travel insurance, up to 81 years.

- Cancelling your trip before departure.

- Your flight or cruise departs later than scheduled.

- Your flight or cruise arrives later than scheduled and you miss your connecting flight or cruise.

- Theft or damage to personal belongings.

- Your bags are delayed.

There are a few additional advantages

Below is a quick summary of our products:.

- Hollard Gold = Top of the range / most comprehensive cover.

- Hollard Orange = Medical benefits only / can be used for Schengen visa applications/travellers that only want to cover medical expenses.

- Hollard Purple = Standard benefits and rates @ a lower premium than Gold.

- Medi+ = Medical top-up cover when you already have free bank or credit card or medical aid cover.

- BizMICE = Our new Business product, with a whole lot more! Meetings, Incentives, Conferences, Exhibitions and Sports Events.

- SilverVoyage = Our improved 71+ years travellers’ product: more cover, more benefits.

With the Hollard Travel colour range comes exciting new benefits:

- Hollard Gold = No excess for medical claims.

- CFAR benefit effective 15 days after the policy issue date.

- Checked-in baggage cover.

- Baggage: Named Reasons cover.

- Rental vehicle excess: New benefit.

Travel with peace of mind.

Get our comprehensive international Travel Insurance in minutes.

I would like a travel insurance quote now.

Call us or submit your claim online through our Hollard Travel claims website.

Please remember to:

- Keep your original bills and receipts until your claim has been finalised.

- Once the claim has been submitted, you will receive an email as proof of submission with your claim number.

- Please save all documents in PDF format for you to upload successfully.

If you have any questions contact us by email at [email protected] or call us on +27 11 351 4531 .

Submit a new claim here.

Update an existing claim here.

Covid-19 Travel Insurance information

Covid-19 travel insurance.

Hollard is proud to lead the way as the first insurance provider in South Africa to launch COVID-19 travel insurance and Cancel for Any Reason benefits. Our international travel insurance products meet the demands of the current travel landscape. Our products meet the European Union and other embassies’ requirements when you apply for a visa and require evidence of medical and COVID-specific cover. Give yourself the freedom to travel with peace of mind.

Travel cover in a COVID world

Contracting COVID is a reality we could all face, so, we have designed an overseas medical cover that considers this:

- Inpatient treatment cover.

- Fully vaccinated? Great, we have no restrictions for fully vaccinated travellers. Remember to declare your vaccine status to us.

- Not fully vaccinated? Restrictions apply to the Overseas Medical Benefit for high-risk travellers. For example, if your BMI is 35 or above or you have a combination of certain pre-existing medical conditions.

- We will book your medical quarantine at an approved facility when you test positive on your trip.

- We will cover the cost of the test when you test positive.

- Event cancellation resulting in a cancelled trip.

- Cancel for any reason (when you cancel 48hrs or more before departure date).

See what else it is you need to know

Buy your travel insurance policy when you pay for your trip.

Protect your financial investment. Make sure you are covered for absolutely any reason! Yes, you can even be covered if you have to cancel because your wedding has been cancelled and therefore the honeymoon is off.

Report theft to the police or airline immediately

You must report the theft of personal belongings to the police within 24 hours, be it from your room or on your person. We will need a copy of the police report when you submit your claim.

Similarly, if your baggage is damaged or items have been removed, obtain a report from the airline before you leave the baggage collection area and claim from the airline first.

Alcohol-related claims are not covered

Yes, we know that most people enjoy a drink while on holiday but you aren't covered for any claim where alcohol is a factor.

Get written confirmation

So your baggage is delayed for 2 days. You buy clothing and toiletries (keep the receipts) and now you want to claim for the extra costs. Please ask the airline for a letter to confirm how long your baggage was delayed for. This is proof that your baggage was delayed and we can finalise your claim immediately.

Similarly, if your flight was delayed, we must know the reason for the delay. If the flight was delayed due to a technical problem you are covered. We do not cover delays due to operational reasons as this is deemed to be “in the control of the airline”, such as crew shortages.

You have to cancel your trip. Contact your airline and accommodation provider IMMEDIATELY and ask for a letter confirming their cancellation policy. We want to pay your claim as soon as possible, however, without this letter we do not know how much we should pay you.

You receive medical treatment whilst on your trip, OR you need to cancel your trip due to a medical reason. We are not a medical aid and do not have access to your medical records. Make sure you obtain a written diagnosis from your doctor. If your claim is related to illness we will also need your medical history. We are not trying to delay the process, however, we need to determine whether your claim is related to a pre-existing medical condition.

You need a motorcycle/driver’s license

We know it looks like fun. If you have absolutely no training and no experience at handling a two-wheeled machine at home, what makes you think you'll magically acquire those skills in a foreign country?

While thousands of visitors each year rent a motorcycle or scooter and ride around Southeast Asia unlicensed, if you don't have a valid license and have a crash it's pretty straightforward: you're riding illegally and you're not covered.

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

- Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

What we know about unauthorized immigrants living in the U.S.

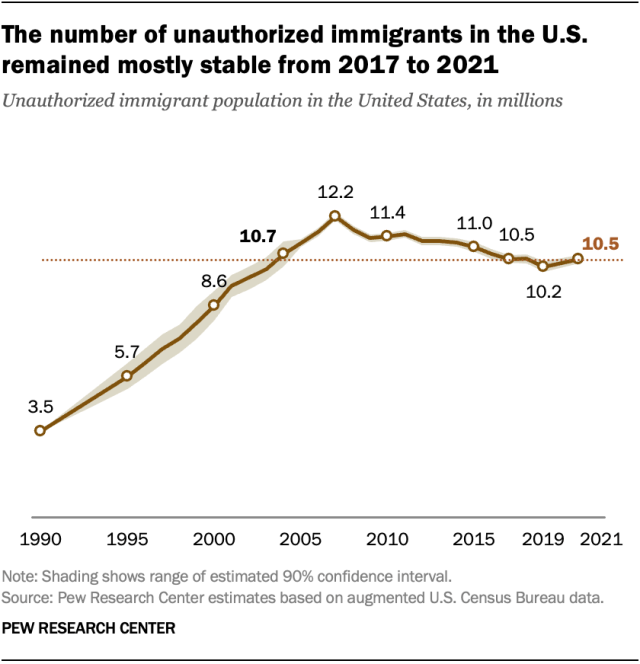

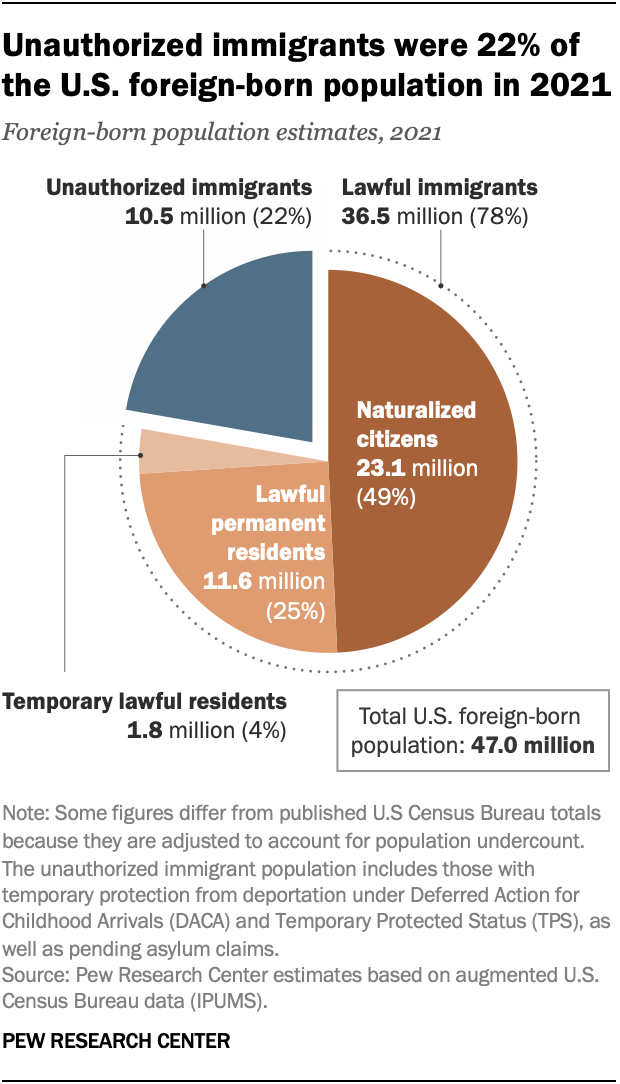

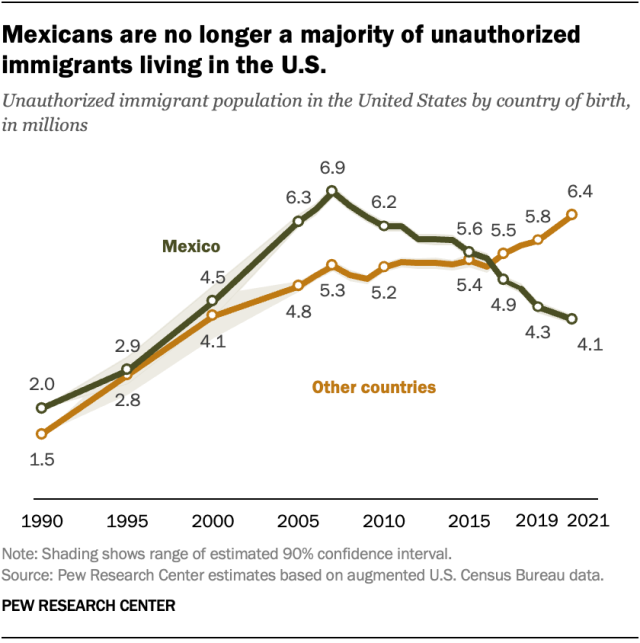

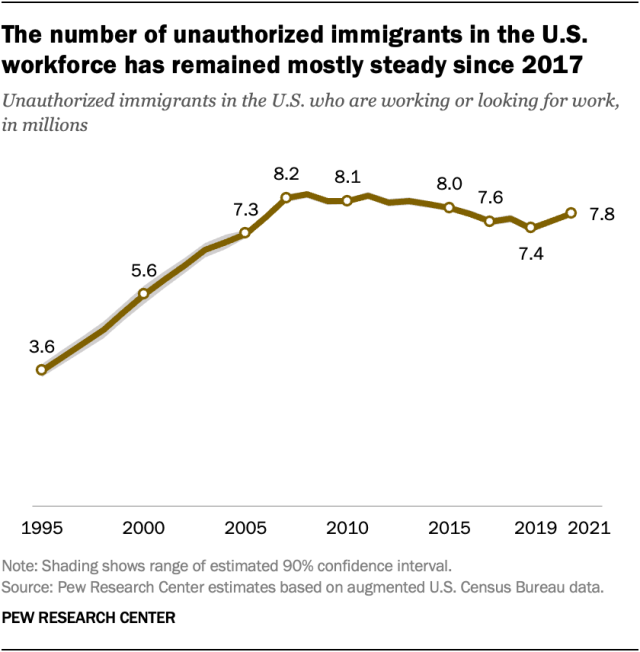

The unauthorized immigrant population in the United States reached 10.5 million in 2021, according to new Pew Research Center estimates. That was a modest increase over 2019 but nearly identical to 2017.

The number of unauthorized immigrants living in the U.S. in 2021 remained below its peak of 12.2 million in 2007. It was about the same size as in 2004 and lower than every year from 2005 to 2015.

The new estimates do not reflect changes that have occurred since apprehensions and expulsions of migrants along the U.S.-Mexico border started increasing in March 2021 . Migrant encounters at the border have since reached historic highs .

Pew Research Center undertook this research to understand ongoing changes in the size and characteristics of the unauthorized immigrant population in the United States. The Center has published estimates of the U.S. unauthorized immigrant population for more than two decades. The estimates presented in this research are the Center’s latest, adding new and updated annual estimates for 2017 through 2021.

Center estimates of the unauthorized immigrant population use a “residual method.” It is similar to methods used by the U.S. Department of Homeland Security’s Office of Immigration Statistics and nongovernmental organizations, including the Center for Migration Studies and the Migration Policy Institute . Those organizations’ estimates are generally consistent with ours. Our estimates also align with official U.S. data sources, including birth records, school enrollment figures and tax data, as well as Mexican censuses and surveys.

Our “residual” method for estimating the nation’s unauthorized immigrant population includes these steps:

- Estimate the total number of immigrants living in the country in a particular year using data from U.S. censuses and government surveys such as the American Community Survey and the Current Population Survey.

- Estimate the number of immigrants living in the U.S. legally using official counts of immigrant and refugee admissions together with other demographic data (for example, death and out-migration rates).

- Subtract our estimate of lawful immigrants from our estimate of the total immigrant population . This provides an initial estimate of the unauthorized immigrant population .

Our final estimate of the U.S. unauthorized immigrant population, as well as estimates for lawful immigrants, includes an upward adjustment. We do this because censuses and surveys tend to miss some people . Undercounts for immigrants, especially unauthorized immigrants, tend to be higher than for other groups. (Our 1990 estimate comes from work by Robert Warren and John Robert Warren; details can be found here .)

The term “unauthorized immigrant” reflects standard and customary usage by many academic researchers and policy analysts. The U.S. Department of Homeland Security’s Office of Immigration Statistics also generally uses it. The term means the same thing as undocumented immigrants, illegal immigrants and illegal aliens.

For more details on how we produced our estimates, read the Methodology section of our November 2018 report on unauthorized immigrants.

The unauthorized immigrant population includes any immigrants not in the following groups:

- Immigrants admitted for lawful residence (i.e., green card admissions)

- People admitted formally as refugees

- People granted asylum

- Former unauthorized immigrants granted legal residence under the 1985 Immigration Reform and Control Act

- Immigrants admitted under any of categories 1-4 who have become naturalized U.S. citizens

- Individuals admitted as lawful temporary residents under specific visa categories

Read the Methodology section of our November 2018 report on unauthorized immigrants for more details.

Pew Research Center’s estimate of unauthorized immigrants includes more than 2 million immigrants who have temporary permission to be in the United States. (Some also have permission to work in the country.) These immigrants account for about 20% of our national estimate of 10.5 million unauthorized immigrants for 2021.

Although these immigrants have permission to be in the country, they could be subject to deportation if government policy changes. Other organizations and the federal government also include these immigrants in their estimates of the U.S. unauthorized immigrant population.

Immigrants can receive temporary permission to be in the U.S. through the following ways:

Temporary Protected Status (TPS)

In 2021, there were about 500,000 unauthorized immigrants with Temporary Protected Status . This status provides protection from removal or deportation to individuals who cannot safely return to their country because of civil unrest, violence or natural disaster.

Deferred Enforced Departure (DED) is a similar program that grants protection from removal. The number of immigrants with DED is much smaller than the number with TPS.

Deferred Action for Childhood Arrivals (DACA)

Deferred Action for Childhood Arrivals is a program that offers protection from deportation to individuals who were brought to the U.S. as children before June 15, 2007. As of the end of 2021, there were slightly more than 600,000 DACA beneficiaries , largely immigrants from Mexico.

Asylum applicants

Individuals who have applied for asylum but are awaiting a ruling are not legal residents yet but cannot be deported. There are two types of asylum claims, defensive and affirmative .

Defensive asylum applications are generally filed by individuals facing deportation or removal from the U.S. These are processed by the Department of Justice’s Executive Office for Immigration Review. At the end of 2021, there were almost 600,000 applications pending.

Affirmative asylum claims are made by individuals already in the U.S. who are not in the process of being deported or removed. These claims are handled by the U.S. Department of Homeland Security’s Citizenship and Immigration Services (USCIS). At the end of 2021, more than 400,000 applications for affirmative asylum were pending, some covering more than one applicant.

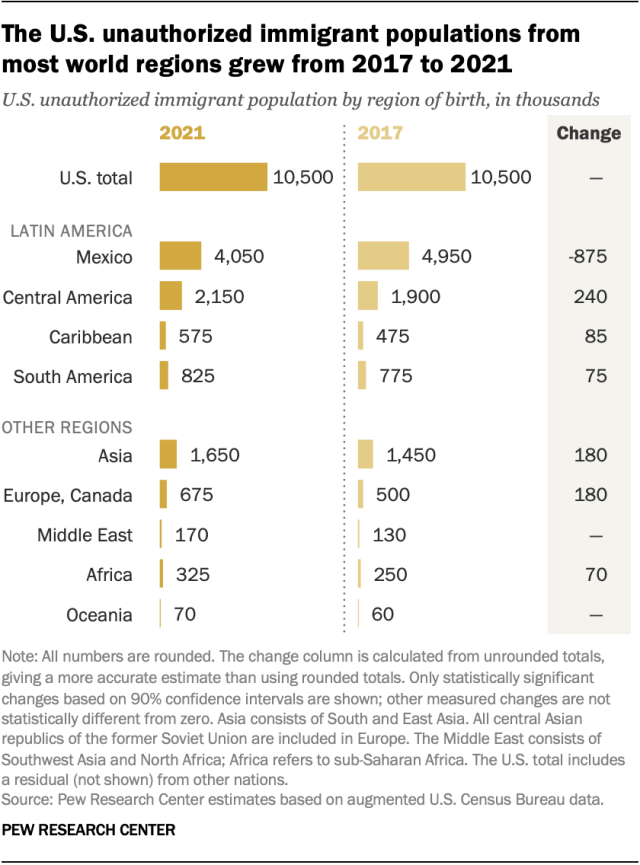

Here are key findings about how the U.S. unauthorized immigrant population changed from 2017 to 2021:

- The most common country of birth for unauthorized immigrants is Mexico. However, the population of unauthorized immigrants from Mexico dropped by 900,000 from 2017 to 2021 , to 4.1 million.

- There were increases in unauthorized immigrants from nearly every other region of the world – Central America, the Caribbean, South America, Asia, Europe and sub-Saharan Africa.