Wise Travel Debit Card Review: Fees, Exchange Rates, Limits and How to Use It

There are many things you need to keep track of as a digital nomad, such as visas , travel documents, and accommodation , to name a few.

But one of the most important things to work out is your finances. As a digital nomad, you are likely constantly moving between countries and switching currencies, so having a travel debit card is imperative .

The Wise debit card is an easy financial solution for frequent travelers, digital nomads, and expats . So, what is the fuss about this Wise travel card? How does it work? And most importantly, should you hop on the bandwagon and sign up for it?

I have been using the Wise Travel Card for quite some time now and, in this article, I will give you my honest opinion about it.

What is a Wise Travel Debit Card?

If you travel often, you have probably used or at least heard of Wise (formerly Transfer Wise) .

This UK-based tech company was founded in 2011 by Estonian businessmen Kristo Käärmann and Taavet Hinrikus on the principle of providing fast and fair exchange rates for international transfers without any sneaky fees or below-par exchange rates.

I have been personally using their Wise multi-currency account for years now, and it is still the primary way I transfer money abroad. But, I recently started using the Wise travel card , which added an entirely new dimension to my travels.

Can I Use The Wise Card For Traveling Abroad?

The Wise travel card it's not a credit card and functions pretty much like a regular debit card. You simply add funds to the account and insert, swipe, or tap to pay for items.

The main difference? With Wise, you can hold money in more than 40 different currencies and pay like a local for items in more than 160 countries worldwide without having to worry about hefty fees or markups on conversion rates.

Your Wise Travel Card is connected directly to your Wise account, so you can spend funds from your balances.

Who is the Wise Travel Card for?

Obviously, this is a “travel” card, so its primary purpose is for spending abroad while traveling . That said, you could totally use this for your day-to-day expenses. Traditional banks aren’t really designed to cater to frequent travelers or digital nomads , and the Wise Travel Card fills this gap.

For example, my wages are paid from the US, but I live abroad permanently, so I can easily transfer from my US-based bank to Wise and then simply use my Wise card for most of my daily expenses.

You should consider using the Wise Travel Card if one or more of the following applies to you:

- You frequently transfer funds from another country that uses a different currency.

- You travel internationally often and need a card with low currency conversion fees.

- You often shop online with international retailers that sell their products in a foreign currency.

- You own a business and need a card for international expenses.

- Your current bank card has high currency conversion fees and you want to get away from a traditional bank account

- Your current bank card has high fees for using international ATMs.

Wise Card Features for Traveling Abroad

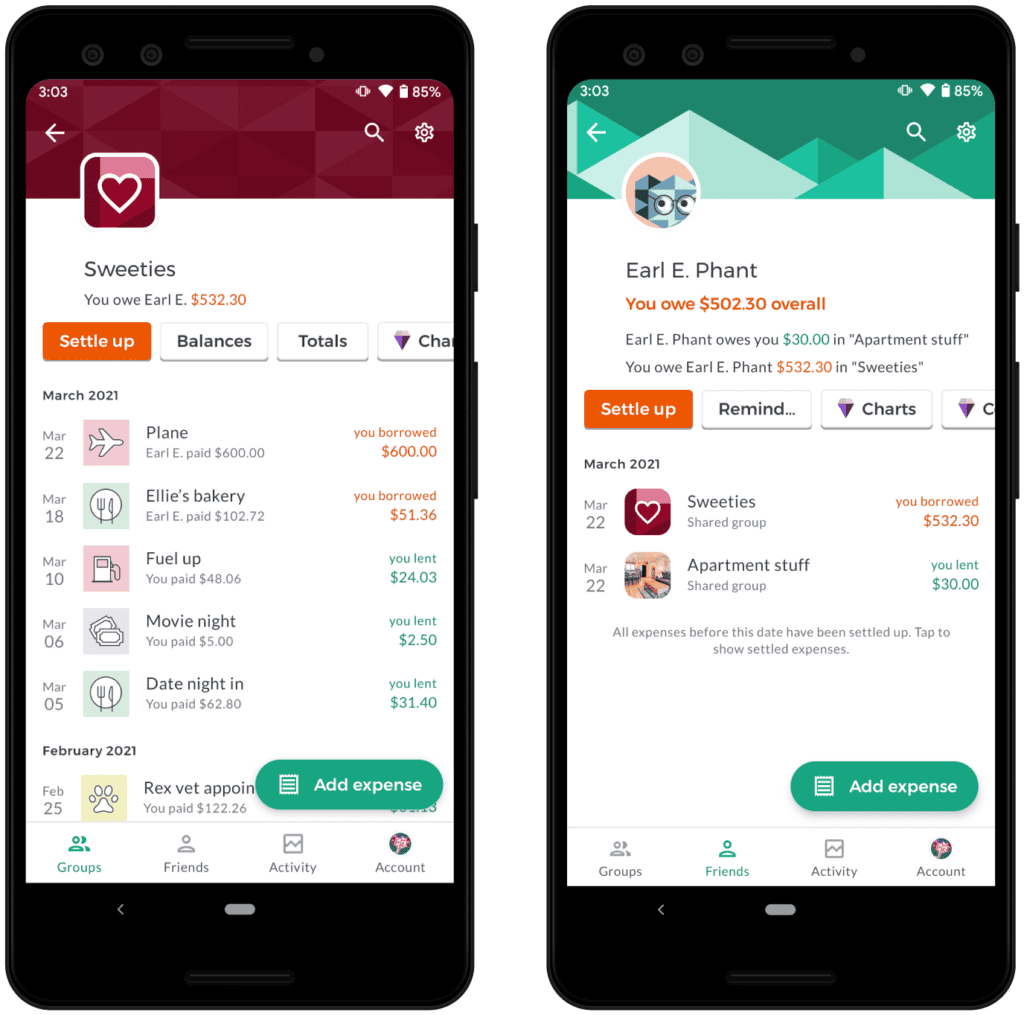

If you have used a travel prepaid card like Revolut , Chime , or Monzo in the past, you can expect similar features from the Wise Travel Card. Let's see which ones are those:

- Low fees on conversions with the mid-market exchange rate

- Hold, spend, and exchange more than 40 different currencies in your Wise account

- Available to citizens and residents of more than 30 countries , including the UK, Canada, EU, USA, and Australia

- Manage, top up, freeze, and view your card balance in the Wise App

- Use at over 2 million ATMs with free monthly withdrawals up to certain limits.

- Create up to 3 digital virtual cards for free

- Auto currency convert feature to automatically convert your funds at your set rate

- Ability to make Contactless payments

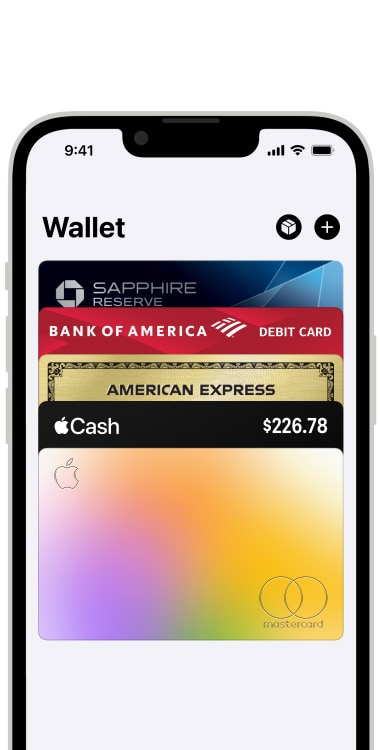

- Connect to most popular eWallets like Google Pay, Apple Pay, and more

- Free spending of any currency you hold in your Wise account

- Biodegradable and eco-friendly card design

Pros and Cons of the Wise Debit Card for Travel

When I first started my digital nomad journey, I quickly came to a rude awakening when I found that my bank was charging exorbitant markups on foreign exchange and fees for ATM withdrawals .

If the same is happening to you, you’ll want to get your hands on this gem of a travel card . But before you sign up, let’s go over some of the upsides and downsides of the Wise Travel Card.

Pros and cons:

What to love about the wise debit card.

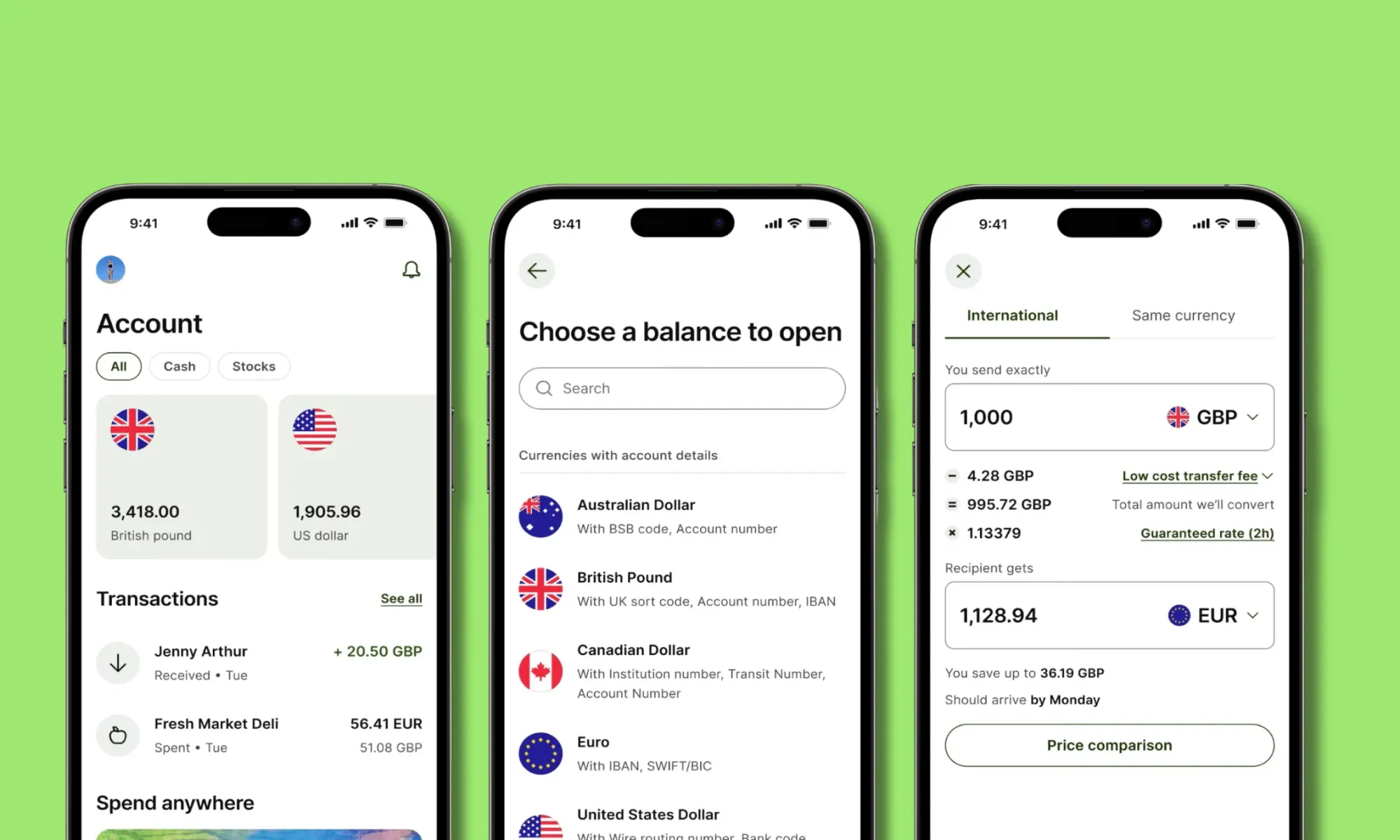

For me, the Wise card's standout features are the app's user-friendliness , the multi-currency account , and the low markup on exchange rates .

Being able to hold more than 40 currencies is a game changer. Transferring funds to different currencies in their app when I travel abroad is super easy. To give you an example, I spend quite a bit of time in Europe, the USA, and New Zealand. And with Wise , I can have separate accounts for USD, EUR, and NZD, which makes my life SO much more manageable when traveling to these countries!

On top of that, while there is a small markup fee on currency exchange, it is extremely minimal compared to other banks I have used .

What Could Be Improved About the Wise Debit Card?

The obvious downsides of the Wise Travel Card lie with ATM withdrawal limits , longer card delivery timeframes , and the lack of a premium option .

I am based in the USA, and my card took more than 2 weeks to arrive. Most digital nomads don’t spend too much time in each place, so this can make it difficult to receive your card initially if you are a frequent traveler .

Also, while card transactions are becoming the norm in many countries, cash is still king in several countries I have traveled to in the past few years. The Wise card is NOT exactly the ideal card for withdrawing cash . You’ll only get two transactions for free , and then you’ll be paying a usage fee as well as a 1.75% to 2% markup . This definitely isn’t a dealbreaker, but I hope Wise will improve this in the future.

What Currencies Can You Use With the Wise Travel Card?

One of the main reasons Wise has kept me on board as a customer all these years is their multi-currency account . This is truly the crown jewel of all of Wise’s features.

You can store 40+ currencies in various wallets in your Wise account , but this doesn’t mean you are limited to spending in those currencies. In fact, you can use the Wise debit card in more than 160+ countries ! If the currency you are spending in doesn’t have a wallet option, the Wise card will simply exchange the money into the payment currency at the time of your purchase .

For example, I was recently in Guatemala, and, unfortunately, I was not able to store Quetzal (the local currency) in my multi-currency account. But when I bought something, my funds were automatically converted from USD to Quetzal at the mid-market rate (plus 0.5%).

There are also 11 currencies for which you get account details to make bank transfers . This means you can transfer funds in the following currency balances directly from your Wise account to another bank account.

This is a feature of Wise that I use often. If I need to transfer funds from my US bank account to one in another country, I almost always use Wise as a “middleman” in order to avoid unexpected transfer fees .

While you won’t be able to make bank transfers in other currencies, you can hold them in your Wise account and spend with your travel card.

How Does the Wise Card Exactly Work?

As you can see, the Wise Travel Card is a wise decision for any traveler (see what I did there?), but how does it exactly work?

As with any new bank account or credit card, there is a bit of a learning curve when first using your Wise travel card . That said, using this card isn’t rocket science, so you’ll be saving money on exchange fees in no time!

How to Use the Wise Travel Card Abroad

The Wise travel card is specifically designed for spending money outside of your home country, so as you would expect, it is pretty easy to use abroad.

All you need to do is order your card , activate it, create a PIN, add money to your account, and you will be all set to use the card in a different country!

The Wise App

There is nothing more annoying than an app that is built for developers and not for the general public. Your banking and financial app should be easy to navigate and access.

I personally find the Wise app to be extremely user-friendly and intuitive . All features are easy to find, and when navigating through the app, I rarely got stuck or failed to find a setting.

I was easily able to change personal settings, connect bank accounts, exchange money, and send transfers from the app.

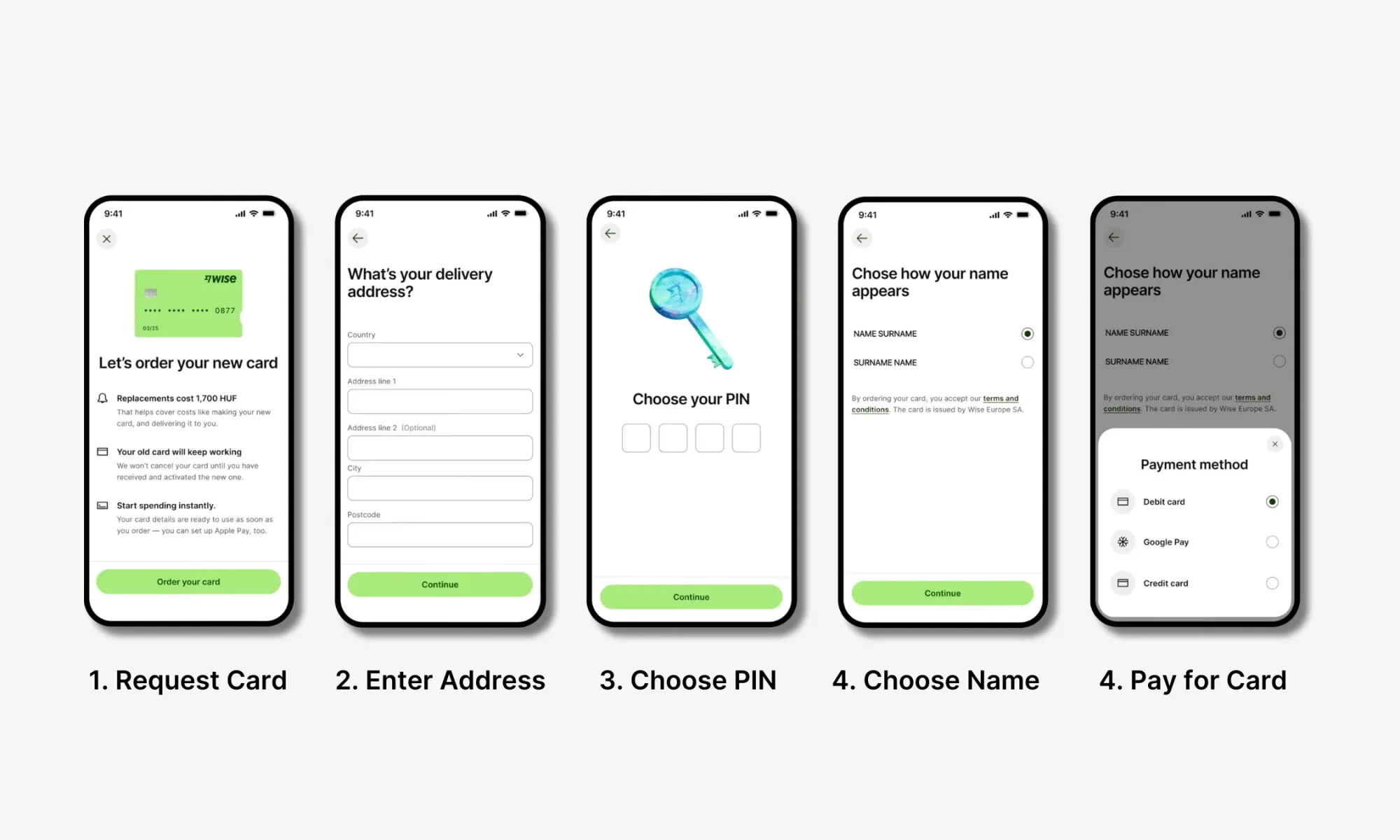

How to Order Your Wise Travel Card

Ordering your Wise Travel Card can take some time (mine took more than 2 weeks to arrive), so I recommend getting on this as soon as possible to ensure you have the card for your next trip!

These are the 3 simple steps you will need to go through:

Step 1: Create a Multi-Currency Account

If you don’t have one already, your first step will be to sign up for a Multi-Currency Account with Wise

Step 2: Start Using Your Virtual Card Immediately

After making an account and verifying your details, you will then be directed to choose a digital/virtual card or a physical card . Digital cards are free and can be added to Google/Apple Pay or used for online payments immediately!

Step 3: Order a Wise Debit Card (Recommended)

If you want instead a physical card, you can do so by clicking on the “Card” tab on the main page and then click on “ Order a Debit Card ”. Physical cards cost a one-off fee of 7 GBP/7 EUR/10 USD , and it will take 7 to 21 business days for the card to arrive, based on your location.

If you'd like to visualise the entire process, watch the instructional video below:

How to Activate Your Wise Card

Once your Wise travel card arrives, it is time to activate it and start spending ! Luckily, for most Wise account holders, you won’t need to take any steps to activate the card, simply make a chip and PIN payment, and the card is ready to go !

Activate Your Wise Card (for US and Japan Customers Only)

As I mentioned above, Wise customers in the USA or Japan must activate the card separately . This isn’t too much of a headache, just don’t forget you need to be in your home country .

Here is a step-by-step breakdown of activating your card if you are a US and Japan customer.

- Log into the Wise app and tap on “ Card ”.

- Then tap on “ Activate Card ”.

- You’ll then be prompted to enter a 6-digit code that you’ll find on your card.

- After entering the code, you’ll create your PIN .

If you'd like to visualise the steps to activate your Wise card for your region, watch the instructional video below:

How to Change the PIN for Your Wise Card

Did you forget your PIN? Don’t worry, it happens to the best of us!

Luckily, if you are a US card holder, you can easily change your PIN in the Wise app :

- Tap on “ Card ” in the Wise app

- Select “ Change PIN ”

- Enter your new PIN 2 times, and you are all set!

If you are a non-US Wise card holder , you cannot change your PIN in the app , unfortunately. Instead, you’ll need to change it using an ATM that supports PIN changes .

My best advice? Choose a PIN you’ll never forget, or keep it written down somewhere secure.

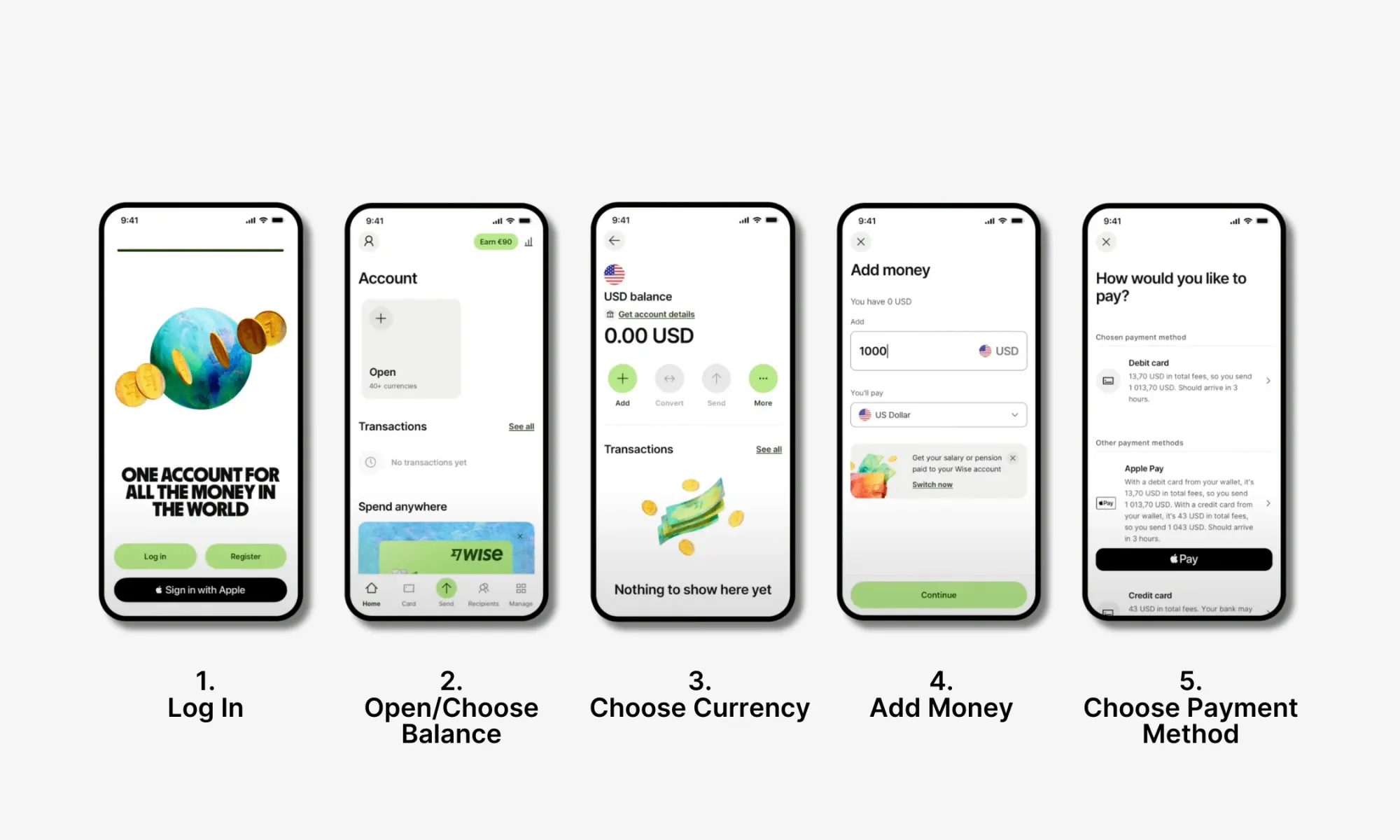

How to Add Money to Your Wise Travel Card

Your Wise travel card is linked to your Wise Multi-Currency account , so you’ll need to top up your Wise account with funds before using the card.

This is a pretty straightforward process:

- Logging into your account

- Choose which currency balance you want to add money to.

- Click “ Add ”.

- Choose which currency you want to use to top up the account.

- Type in the amount of money you want to add.

- Choose your payment method (bank transfer, debit card)

- Confirm the top-up and verify the money arrives in your balance.

Watch the instructional video below to visualise how to top up your Wise balance:

How to Freeze/Unfreeze Your Wise Card

One of the downsides of constant travel is that you put yourself at risk of fraud or losing your card. If you notice potential fraudulent transactions from your Wise card, or you believe your card is lost/stolen, you should freeze your card immediately . This way, you’ll avoid more fraud on your account.

Here are the steps to take to freeze your Wise Travel Card.

- After logging in to your Wise account, tap on “ Card .”

- Then simply click “ Freeze Card ”, or if you want to unfreeze, “ Unfreeze Card .”

- Fill out this transaction dispute form and contact customer support right away. They will be able to help you determine what to do next.

How to Replace a Lost or Stolen Wise Card

If you can confirm that your card has been lost or stolen, you’ll want to cancel the card and then order a new one.

- Log in to your Wise account and click on “ Card .”

- Tap “ Replace Card .”

- You’ll then be prompted to answer why you need a replacement card.

- Wait for the new card to arrive.

How to Use an ATM with Your Wise Travel Card

As mentioned above, ATM withdrawal is not the strongest feature with the Wise card, but you can definitely still use the card to take out cash. Spending with your Wise card is simple since the card can make contactless, chip, and swipe payments and is eligible for Google, Apple, Fitbit, and Garmin Pay. But how do you use an ATM with the Wise card?

Using an ATM with the Wise Travel Card is the same as using any other bank card. Simply insert your card into the machine, enter your PIN, determine how much cash you want to withdraw, and take your cash. Don’t forget to take your card back when you are done (I have made this mistake too many times…).

Wise Card ATM Limits

One of the biggest downsides with the Wise card is that you’ll have limited free ATM withdrawals. For all accounts, you’ll have 2 free ATM withdrawals each month, after which you will be charged an ATM usage fee and a percentage markup on the amount of cash you withdraw.

I use the Wise Travel Card for many of my day-to-day travel expenses, but I use my Charles Schwab Investor Checking account for ATMs. This card not only has a 0% ATM markup, but it also refunds any fees the ATM provider charges. This includes international withdrawals!

Wise Card Delivery Timeframe

Once you order your Wise Travel Card, you can expect it to take between 3 and 21 days to arrive, depending on your location. If you live in Singapore, you’ll get your card SUPER fast. Unfortunately for Americans like me, this isn’t the case.

Wise Travel Card Fees and Exchange Rates

One thing I really love is that using Wise itself is free, and you won’t have to pay an ongoing fee to Wise to use the card. In fact, there isn’t even a Premium account feature, so all users get 100% of the features for free. All this said, there are some charges and exchange rates you should know about before you start using the Wise Travel Card.

Comparison: How Does the Wise Card Holds Up Against Other Travel Cards?

Wise is a leader in the travel account realm, but it still has some major competitors. While all of these different companies vary, they all cater to digital nomads and frequent travelers. The table below will compare some key factors with Wise, Revolut, N26, and Chime.

You may also be interested in:

So, What Travel Card is the Best?

This is a close call and pretty dependent on where you are located. For example, N26 and Chime are awesome choices if you live in the EU or USA (respectively). But, with these options, you can’t hold different currencies like with Revolut and Wise.

For most digital nomads, Wise or Revolut will be the best option. You can hold a huge number of currencies, and they are available to many different nationalities. I have personally used both Wise and Revolut and can say they are both excellent options.

Spending Limits for the Wise Travel Card

The Wise Travel Card has set daily and monthly spending limits for all types of transactions. While these limits won’t be a deal breaker for the vast majority of users, they are still worth noting.

Keep in mind the above limits are for US Wise customers. The amounts will differ slightly for customers based in different regions.

Is It Safe to Use the Wise Travel Card?

Wise is a trusted and safe travel card provider, so you can rest assured that your funds will be protected when using the Wise Travel Card. A licensed and regulated financial institution, your funds are safeguarded in Wise. It is, however, worth noting that since Wise is not considered a bank, it is not FDIC insured. FDIC insures up to $250,000 of bank customer's money, but Wise works a bit differently. Wise safeguards users’ money and is required to ensure all customers have access to all of their funds.

So, is Wise safe to use? Yes, absolutely! We don’t recommend keeping all of your money in Wise, but in general, it is a perfectly secure financial institution.

Additionally, the company uses several security features to protect your data, including HTTPS encryption, a two-step login process, and 24/7 fraud prevention.

What to Do If Your Wise Card Is Lost, Stolen, or Compromised

If you lose your Wise card or suspect it to be stolen or compromised, you’ll need to act quickly to prevent any further fraud. Below, we will go over a step-by-step process for what to do if your card is lost, stolen, or compromised.

- Freeze your card in the Wise app.

- Contact Wise support if you suspect the card to be compromised.

- Cancel the card in the app if you confirm the card is lost or stolen or if fraud charges have been made.

- Order a new card.

- Wait for the new Wise card to arrive.

Bottom Line: Is the Wise Travel Card Worth it?

Time for the 1 million dollar question: Should you get the Wise Travel Card?

If you are a frequent traveler like me and you don’t already have a solid travel card with fair exchange rates, low ATM fees the answer is a resounding yes !

The Wise Travel Card is one of the best cards for digital nomads and expats, as it allows you to seamlessly spend money, withdraw cash, and transfer funds from anywhere around the globe without having to worry about excessive fees. The best part? After paying a one-time card order fee, your Wise account is completely free to use!

Ready To Save Money Abroad with Wise?

If you want more digital nomad guides like these, sign up for our free newsletter and get upcoming articles straight to your inbox!

Sign up for our Newsletter

Receive nomad stories, tips, news, and resources every week!

100% free. No spam. Unsubscribe anytime.

You can also follow us on Instagram and join our Facebook Group if you want to get in touch with other members of our growing digital nomad community!

We'll see you there, Freaking Nomads!

Disclosure: Hey, just a heads up that some of the links in this article are affiliate links. This means that, if you buy through our links, we may earn a small commission that helps us create helpful content for the community. We only recommend products if we think they will add value, so thanks for supporting us!

How To Create a Healthy Work-Life Balance While Working Remotely

How to set up and manage an esim on iphone, digital nomad internet: best wifi options for remote work anywhere.

Wise for Travel: my review of the awesome multi-currency account

Wise (formerly TransferWise) has improved the way we travel in a radical way. In this post, you will learn how Wise works, why the Wise debit card (formerly TransferWise Borderless card) is the best card to travel, and how to sign up and start saving money!

We have been using the Wise debit card to travel since 2018. To say we are huge fans is an understatement: as soon as we start planning a new trip, I open a new currency balance on the Wise App. We are sure you will love it too!

Help me run my blog! This post contains some affiliate links: the small commission I may earn if you click through and make a purchase/booking (at no extra cost to you) will go towards supporting the site and our travels. That means more posts and useful info for you! We only recommend products we use ourselves and believe in. Thank you for supporting Travelling Sunglasses! Click here to read our full disclosure .

Why you will like Wise

Does this sound familiar?

- You withdraw cash from an ATM abroad, and days later you find an unexpected fee on your balance.

- You withdraw cash from an ATM abroad and the exchange rate is ridiculous! Thieves! You even calculate what you could eat or drink with the money you are losing to these buffoons.

- You try to pay with your card abroad, but the card is blocked for security reasons. Even though you told the bank you were going to travel.

- You pay with your card abroad, and the waiter/shop assistant informs you of the fees and commissions due to the different currency . What you were going to buy suddenly becomes more expensive.

- As you prepare the budget for your trip, you know that you will spend also on fees and commissions from your bank … And this breaks your heart.

- You are scared that your bank card will be cloned or stolen . It’s connected to your main bank account!

If you work hard to save money for your travels, the Wise multi-currency account is the service for you. All your money problems will be fixed , thanks to a simple service with low and transparent fees.

What is Wise and how does it work?

Let’s start with the basics: with a Wise account , you can send and receive money from abroad, as well as spend it in different currencies around the world, with lower fees compared to traditional banks, and with the official mid-market exchange rate .

If you send or receive money from abroad through Wise , they keep it cheap because the money does not actually cross the border: my Euros go to the Wise central account in EUR, and then the Wise central account in USD releases the equivalent in American Dollars to my friend. No international fees! During the process, you will read clearly the official exchange rate used and the commission they apply.

The Wise multi-currency account , (formerly TransferWise Borderless account ), allows you to open balances in 50+ different currencies. This means that in just one debit card, for example, you can have balances in Euros, US Dollars, Polish Zloty and Japanese Yen. Some of them, like Euro, British Pound, US Dollar, Australian Dollar, New Zealand Dollar and Singapore Dollar even come with a bank number for bank transfers. Just like with transferring money, when you exchange money within your account from a currency to another you can read clearly the official rate and the fee. And the exchange is immediate.

Do you see how amazing this is? Banks and exchange offices always have different rates for selling and buying currencies, as well as more fees and commissions (even when they advertise 0% commission fee!). It is extremely complicated to figure this out before exchanging the money, so you usually realize only afterwards how much you spent (or better said, lost).

Wise makes exchanging and sending money super fast, cheap and clear.

Wise for travel: the multi-currency account and debit card

As travellers, the Wise multi-currency debit card changed our lives.

Let’s get practical: without Wise , we would pay our accommodation, food and tickets with the normal debit card, withdraw cash from ATMs, or bring cash with us to exchange on spot. Each of these transactions would cost us a fee and the exchange rate difference. Even on a short city break, we would waste 20-30 EUR this way!

Instead, travelling with Wise is so much easier.

We usually prepare for a trip abroad like this:

- We calculate a first budget of how much we will spend of accommodation, transportation, entrance tickets, and some food.

- If we are being very meticulous (like for our honeymoon in Japan), we monitor the exchange rate for a few days and convert our money into the travel currency when it looks like a good deal.

- If we are in a rush, e.g. we are already booking the hotel, we just convert it there and then on the Wise app.

- Done! We exchanged a big amount of money with the best exchange rate and a small, fair commission. Now we can continue paying by card without any other fees, or we can withdraw cash from a local ATM.

What if you finish the local currency on your card during your trip? Just convert some more, it takes a second from the Wise app! If you have any left at the end, exchange it back to your home currency (and in this case, why not monitor the exchange rates and try to get the best deal.) If you don’t exchange it, your payments will use the first currency you have available (for me, Euro).

What if you finish all the money on your Wise card during your trip? I usually add money through the app from my traditional debit card. This takes a few seconds, and then a few more to exchange it into a new currency. You can also do a traditional bank transfer from your online banking system.

Don’t believe us? Here are our real stories of using Wise for travel !

Why is Wise useful for travellers?

Need more insight? As travellers, we use Wise because:

- It is transparent : I’m too shy or I don’t have time to ask for commissions and fees in advance at a shop or restaurant, so I would just end up losing money. I love that Wise shows upfront all details of my conversion or transfer.

- It is fast : it’s really easy to become familiar with the app, and then converting and transferring money is super fast.

- It holds different currencies : with fewer and lower fees, I worry less and I feel more like a local! It is also easier to keep track of all expenses during the trip, because the history and balances are always visible.

- The Wise app is great: since there are no offices to walk into, they made the App intuitive, easy to use, and safe.

- The customer service is helpful: I had a couple of unclear situations during these 3 years, and the customer service team was very fast and competent in solving them, even though they were not even Wise’s fault.

Looking for more? Here are all our efficient travel tips !

How to request the Wise multi-currency debit card

Signing up with Wise and requesting the card is easy, but it may take 2-3 weeks. Plan this before you travel.

These are the steps (which may change slightly as Wise update and improve their website):

- Click here to go over to Wise (and I will receive a small commission after your first transaction. Thank you!)

- Click on GET AN ACCOUNT IN MINUTES and insert all your data. Your country of residence will be requested. Opening an account is free, and you get a bank account immediately.

- Once your account has been created, request the card (as of March 2021, it is available for Wise account-holder residents in the UK, US, Australia, New Zealand, Singapore, Switzerland and EEA; the cost is 5 GBP or 7 EUR or a similar amount ). This is a Mastercard debit card. You have to provide an ID, a picture of you holding the ID, and proof of address. Regulations, availability and prices may change and be updated from country to country; read more here .

- If I remember correctly (I helped Darek and my father request theirs), an initial payment may be required to start the process, and you will find it in your balance.

- Wait a couple of weeks to receive your card in the mail , and then do a happy dance 🙂

How to add and convert money on the Wise app

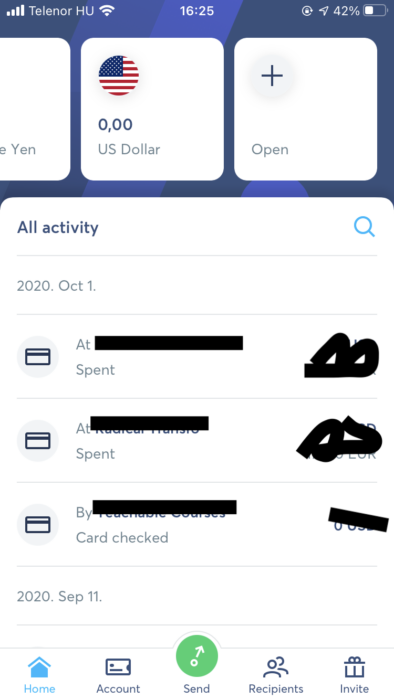

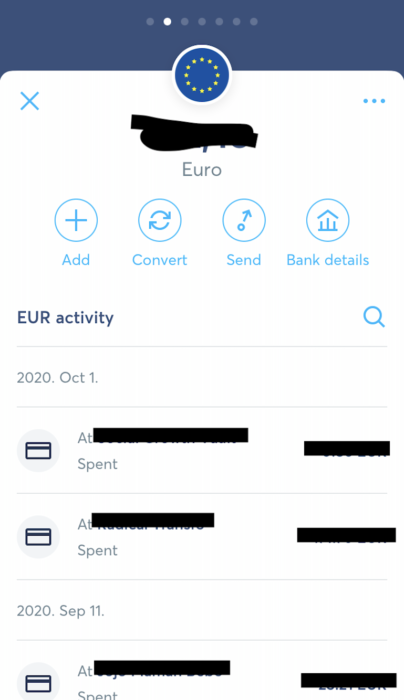

This is also incredibly straightforward. Check out the screenshots below I made from the app on iPhone.

First of all, download the Wise app from your store, and log in.

To open a new balance in a new currency , scroll to the right and tap the “+” sign. Choose the new currency. Done!

To add money to an existing balance , tap on it and then tap on the “+” sign. Choose how much money to add and from which currency it originates. Continue and you will be able to choose how to add money: by debit card, or credit card, or bank transfer… You will also read how long it will take, between seconds and a day. Done!

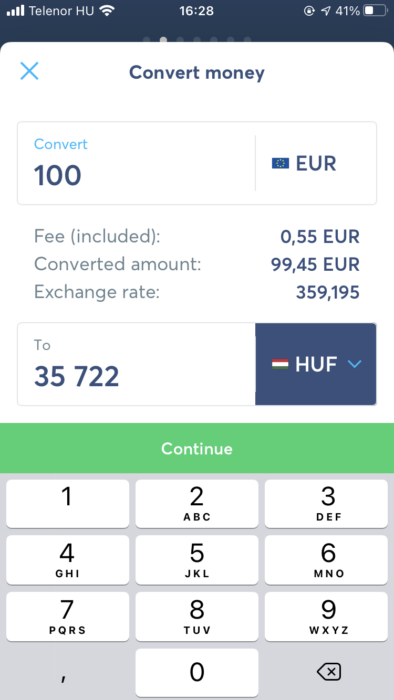

To convert money from a currency into another, start by tapping on the original currency. Here I’m exchanging Euro into Hungarian Forints. Choose how much money you want to convert. The app shows the fee, the exchange rate, and the final result. It’s guaranteed to be the same mid-market exchange rate you see on Google. Tap “Continue” and done!

Find here more useful and practical Wise travel tips .

Are there any fees?

Lately, some fees for withdrawing money have been introduced. Dependent on where your card was issued, the first 200 GBP, 250 USD, 350 AUD, 350 NZD, or 350 SGD that you withdraw every month is free. If your card was issued to you in Europe, the home currency is GBP. After, the charge on withdrawals is 2%.

Be careful, ATMs may charge fees too . For example, EURONET ATMs always charge extra fees, so just avoid them altogether. Wise suggests using this Mastercard locator tool by selecting “View more options” and then “No access fee (within country)” to find ATMs. If the ATM offers to convert money for you, they will cheat with a bad exchange rate!

Is Wise safe?

Yes. Wise (formerly TransferWise) is an authorised Electronic Money Institution independently regulated by the Financial Conduct Authority (FCA) in the UK.

The Wise debit Mastercard® is issued by Wise Ltd under license by Mastercard International Inc. Mastercard is a registered trademark, and the circles design on the card is a trademark of Mastercard International Incorporated. Find out more here .

Should you get the multi-currency Wise debit card?

Of course! Wasn’t this beaming review enough? Get it now by clicking here .

You may also be interested in real-life stories of how we use Wise , and some Wise travel tips we learned over the years.

Do yourself a favour and start saving money while you travel! Think of me when you enjoy that extra croissant or glass of wine, which would have been wasted on bank commissions.

Let us know below what you think!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Winter is here! Check out the winter wonderlands at these 5 amazing winter destinations in Montana

- Travel Tips

How To Use Wise For CHEAPER Travel Money & Spending

Published: September 7, 2023

Modified: December 27, 2023

by Robbi Tedder

- Budget Travel

- Hotel Reviews

- Travel Essentials & Accessories

- Travel Guide

Introduction

When it comes to traveling, one of the most important things to consider is how to handle your money. Whether it’s exchanging currency, sending money abroad, or simply using your card for everyday expenses, finding an efficient and cost-effective solution can make a big difference. This is where Wise comes in.

Wise, formerly known as TransferWise, is an online platform that offers a range of financial services, including international money transfers, multi-currency accounts, and prepaid debit cards. What sets Wise apart from traditional banks is its focus on transparency, convenience, and low fees. By using Wise for your travel money needs, you can save significant amounts of money and have more control over your finances.

In this article, we will explore the benefits of using Wise for travel money and provide you with a step-by-step guide on how to set up a Wise account, verify your identity, add money, convert currency, send money abroad, and use the Wise card for your expenses. We will also compare Wise with traditional banks to help you make an informed decision.

So, whether you’re a frequent traveler or planning your next vacation, read on to discover how Wise can make your travel money management simpler, cheaper, and more convenient.

What is Wise?

Wise is an online platform that aims to revolutionize the way people handle their money internationally. It was founded in 2011 by two friends, Taavet Hinrikus and Kristo Käärmann, who experienced the frustrations and hefty fees associated with traditional banks for international money transfers.

Wise operates on a peer-to-peer model, matching individuals and businesses looking to exchange currencies at mid-market rates, which are the real exchange rates, without any hidden markups. This allows users to avoid the high fees charged by banks and traditional currency exchange services.

One of the key features of Wise is its multi-currency account. With this account, you can hold and manage money in multiple currencies, allowing you to effortlessly switch between currencies at the real exchange rate. This feature is particularly beneficial for travelers who often need to convert their money into different currencies as they move from one country to another.

Wise also offers a prepaid debit card, known as the Wise card, which can be used worldwide for payments and ATM withdrawals. The card is linked to your Wise account, giving you full control and transparency over your spending. Additionally, the Wise card is accepted at millions of locations worldwide, making it a convenient option for your travel expenses.

Overall, Wise provides a modern and user-friendly platform for managing and transferring money internationally, with a strong emphasis on transparency, convenience, and cost-effectiveness.

Why use Wise for travel money?

Wise offers several advantages that make it an ideal choice for handling your travel money:

- Transparent and low fees: Unlike traditional banks, Wise charges low and transparent fees for its services. You’ll always know exactly how much you’re being charged, and you can save significantly compared to banks that often have hidden fees and unfavorable exchange rates.

- Real exchange rates: Wise uses the mid-market exchange rate for currency conversions, which means you get the same rate you see on Google or financial news websites. There are no markups or hidden fees, ensuring you get the most value for your money.

- Multi-currency account: With a Wise multi-currency account, you can hold and manage money in different currencies all in one place. This eliminates the need to open multiple bank accounts or carry large amounts of cash when traveling to different countries.

- Convenient currency conversion: Wise allows you to convert currency easily and conveniently within your account. You can convert funds at any time, whether you’re preparing for a trip or need to switch currencies while on the go.

- Fast and secure transfers: Transfer money internationally with ease using Wise. The platform ensures fast and secure transfers, so your funds reach their destination quickly and safely.

- Wise card for spending: The Wise prepaid debit card makes it easy to access your money while traveling. Accepted at millions of locations worldwide, it offers competitive exchange rates and low fees for international transactions and ATM withdrawals.

- User-friendly interface: Wise provides an intuitive and user-friendly online platform and mobile app, making it simple to manage your money, track transactions, and stay in control of your finances while on the go.

- 24/7 customer support: If you encounter any issues or have questions, Wise offers reliable customer support around the clock to assist you with your travel money needs.

By choosing Wise for your travel money, you can save money on fees, enjoy transparent currency conversions, and have greater control and convenience while managing your finances abroad.

How to set up a Wise account

Setting up a Wise account is a straightforward process that can be completed in a few simple steps:

- Visit the Wise website: Start by visiting the Wise website or downloading the Wise mobile app from your device’s app store.

- Create a new account: Click on the “Sign up” or “Get started” button to create a new account. You will need to provide your email address and create a password to secure your account.

- Select your account type: Choose the account type that suits your needs. If you’re an individual, select “Personal.” If you’re a business, select “Business.”

- Provide personal information: Enter your personal details, including your full name, date of birth, and country of residence. This information is required to verify your identity and comply with regulatory requirements.

- Verify your email address: Check your email inbox for a verification link sent by Wise. Click on the link to verify your email address and activate your account.

- Set up two-factor authentication: To enhance the security of your account, Wise offers two-factor authentication. You can set this up by linking your account to your mobile phone number or by using an authenticator app.

- Choose your primary currency: Select the currency that you will primarily use for your transactions. This will be the default currency of your Wise account.

- Agree to the terms and conditions: Read through the terms and conditions, privacy policy, and any other applicable agreements, and agree to them to proceed.

- Complete additional verification: Depending on your country of residence and the regulations in place, you may be required to provide additional documentation to verify your identity. This typically involves uploading a copy of your identification document, such as a passport or driver’s license.

- Account activation: Once you’ve completed all the necessary steps and your identity has been verified, your Wise account will be activated, and you can start using it for your travel money needs.

It’s important to note that the specific steps and requirements may vary depending on your country of residence and the type of account you’re creating. The Wise website and app will guide you through the process, providing clear instructions along the way.

After setting up your Wise account, you’ll have access to a range of features and services to help you manage your travel money conveniently and efficiently.

Verifying your identity

Verifying your identity is an essential step in setting up your Wise account, as it helps ensure the security and compliance of the platform. The process may vary slightly depending on your country of residence, but generally involves the following steps:

- Initial identity verification: When you sign up for a Wise account, you’ll need to provide your personal details, such as your full name, date of birth, and country of residence. This information is used to initiate the identity verification process.

- Uploading identification documents: In most cases, you’ll be required to upload a scanned copy or clear photo of a valid identification document, such as a passport, national ID card, or driver’s license. Ensure the document is valid and not expired.

- Additional documentation: Depending on your country of residence and the regulations in place, you may be asked to provide additional documentation to support your identity verification. This could include proof of address, such as a utility bill or bank statement, or additional identification documents.

- Verification review: Once you’ve submitted your identification documents, they will be reviewed by the Wise verification team. This process typically takes a few hours to a few days, depending on the volume of verification requests.

- Identity confirmation: If the verification team determines that your documents are satisfactory and valid, your identity will be confirmed, and you will receive a notification that your account is verified.

- Additional steps for business accounts: If you’re setting up a Wise business account, you may be required to provide additional documentation, such as proof of business registration, tax identification numbers, and ownership information.

It’s important to provide accurate and up-to-date information during the identity verification process. Any discrepancies or inconsistencies may lead to delays or even the rejection of your account verification. If you encounter any issues or have questions during the process, Wise provides customer support to assist you.

Wise takes privacy and security seriously, and all personal information and identification documents are handled with strict confidentiality and in accordance with applicable data protection laws.

Once your identity is verified, you can enjoy the full range of services and features provided by Wise for your travel money needs.

Adding money to your Wise account

Once you have set up your Wise account, you will need to add money to it before you can start using it for your travel expenses. Wise provides several convenient methods to add funds to your account:

- Bank transfer: One of the most common ways to add money to your Wise account is through a bank transfer. You can initiate a transfer from your personal bank account to your Wise account by using the provided bank details. Wise supports transfers in various currencies, making it easy to add funds from different accounts.

- Debit/credit card: You can also add money to your Wise account using a debit or credit card. Simply link your card to your Wise account and initiate a transfer. It’s important to note that some issuers may classify this transaction as a cash advance, so be aware of any associated fees or interest charges.

- Direct deposit: If you’re receiving a salary, pension, or other regular payments, you can opt to have them directly deposited into your Wise account. This eliminates the need for manual transfers and ensures a seamless flow of funds.

- PayPal: In certain countries, you may have the option to add money to your Wise account using PayPal. This can be a convenient method if you already have funds available in your PayPal account.

- Other local payment methods: Depending on your country of residence, Wise may offer additional local payment methods, such as Apple Pay or Google Pay, to add funds to your account. These methods can provide added convenience and faster transfer times.

It’s important to note that when adding money to your Wise account, you will need to consider any associated fees and currency conversion rates. Wise provides transparency in its fee structure, and you will be able to see the exact amount you’ll receive in your chosen currency before initiating the transfer.

Once the funds are added to your Wise account, you can easily manage and convert them into different currencies, send money abroad, or use the Wise card for your travel expenses.

Add funds to your Wise account hassle-free and take advantage of the competitive exchange rates and low fees offered by the platform for your travel money needs.

Converting currency with Wise

One of the key features that sets Wise apart is its ability to convert currency at the mid-market rate, also known as the real exchange rate. Converting your currency with Wise is a simple and cost-effective process:

- Select the currencies: Start by logging into your Wise account and navigating to the “Holdings” or “Balances” section. From there, choose the currency you wish to convert from and the currency you want to convert to.

- Enter the amount: Specify the amount of currency you want to convert. You can either enter the amount manually or choose from preset options, depending on the currency pair and available balance.

- Confirm the exchange rate: Before confirming the conversion, you will be shown the exchange rate, along with the total amount you will receive in the converted currency, including any applicable fees.

- Approve the conversion: Once you are satisfied with the exchange rate and total amount, click the “Convert” or “Exchange” button to initiate the currency conversion.

- Conversion completion: The currency conversion will be processed instantly, and the funds will be available in your Wise account in the new currency. You will also receive a confirmation of the transaction.

- Hold multiple currencies: With a Wise multi-currency account, you can hold and manage funds in multiple currencies simultaneously. This allows you to conveniently convert currencies at your desired time or when favorable exchange rates are available.

- Track your conversion: You can view your transaction history and track your currency conversions within your Wise account. This helps you keep track of your expenses and conversions during your travels.

It’s important to remember that Wise uses the mid-market exchange rate for currency conversions, which is the real exchange rate without any hidden markups. This means you get a fair rate with no added fees or surcharges, often resulting in significant savings compared to traditional banks and currency exchange services.

By converting your currency with Wise, you can have peace of mind knowing that you are getting the best exchange rate available and avoiding unnecessary fees and charges.

Take advantage of Wise’s convenient currency conversion feature to efficiently manage your travel money and get the most out of your funds.

Sending money abroad with Wise

Wise is renowned for its international money transfer service, allowing you to send money abroad quickly, securely, and at a fraction of the cost charged by traditional banks. Here’s how you can send money abroad using Wise:

- Choose the recipient’s country and currency: Start by selecting the country where you want to send money to. Wise operates in numerous countries and supports a wide range of currencies.

- Enter the recipient’s details: Provide the recipient’s name and bank account details, including the International Bank Account Number (IBAN) or local bank account number, depending on the recipient’s country.

- Specify the amount to send: Enter the amount of money you wish to transfer. Wise will display the exact amount that the recipient will receive in their local currency, along with any applicable fees.

- Review the transaction: Before confirming the transfer, Wise will show you the exchange rate, fees, and estimated delivery time. You’ll have a clear view of the fees and the total cost of the transfer.

- Choose the funding source: Select the source of funds for the transfer. You can use your Wise balance or link your bank account or debit/credit card to fund the transaction.

- Verify the transaction: Review all the details once again to ensure accuracy. If everything looks good, confirm the transaction to initiate the transfer.

- Monitor the transfer: You can track the progress of your transfer within your Wise account. Wise provides real-time updates, keeping you informed about the status of your transaction.

- Delivery to the recipient: The funds will be transferred to the recipient’s bank account in their local currency. The exact delivery time depends on the recipient’s country and the corresponding banking system.

Wise’s international money transfer service offers several advantages over traditional methods. You can save on high fees and unfair exchange rates, as Wise uses the mid-market rate for currency conversion. Additionally, Wise provides transparency throughout the process, ensuring that both you and the recipient know the exact amount being sent and received.

With Wise, sending money abroad is a hassle-free experience, allowing you to support family and friends, pay bills, make investments, or handle other financial obligations in a cost-effective and efficient manner.

Spending money with your Wise card

The Wise card is a prepaid debit card that offers a convenient and cost-effective way to spend money while traveling. Here’s how you can use your Wise card:

- Activate your Wise card: Once your Wise card arrives, activate it by following the instructions provided. This typically involves accessing your Wise account and confirming the receipt of the card.

- Load money onto your card: Before you can start using your Wise card, you need to load funds onto it. You can transfer money from your Wise account to your card using the online platform or mobile app. The loading process is quick and straightforward.

- Choose your spending currency: With a Wise card, you have the option to choose the currency in which you want to make your transactions. This can be beneficial if you’re traveling to a country with a different currency than your card’s default currency.

- Make purchases: Your Wise card can be used for both online and in-person purchases. Simply present your card or enter the card details at the point of sale. The card is accepted at millions of locations worldwide, wherever Mastercard is accepted.

- Withdraw cash: If you need cash while traveling, you can use your Wise card to withdraw money from ATMs. Look for ATMs displaying the Mastercard logo and follow the instructions to complete the withdrawal. Remember to be mindful of any applicable ATM fees.

- Monitor your spending: Keep track of your transactions and balance through your Wise account. The online platform and mobile app provide detailed transaction history, enabling you to monitor your expenses and manage your budget effectively.

- Enjoy competitive exchange rates: When using your Wise card for purchases or withdrawals in a different currency, you’ll benefit from competitive exchange rates. Wise aims to provide fair and transparent rates, eliminating hidden fees and markups.

- Manage your card settings: Through your Wise account, you can manage various card settings, such as enabling or disabling contactless payments, setting spending limits, and even freezing or canceling the card if needed.

- Top up your card on the go: If your card balance runs low while traveling, you can easily top it up using the Wise app. This ensures that you have access to funds whenever you need them, without the hassle of visiting a bank or currency exchange.

With the Wise card, you can enjoy the convenience and security of a prepaid debit card while also benefiting from competitive exchange rates and low fees. It’s a reliable companion for managing your travel expenses and ensuring easy access to your funds wherever you go.

Travel with peace of mind and manage your spending efficiently with the Wise card.

Wise fees and charges

Wise is known for its transparent fee structure, offering competitive rates compared to traditional banks and currency exchange services. Here are some fees and charges to consider when using Wise:

- Currency conversion fees: When you convert currency within your Wise account, there is a small fee involved. The fee is typically a percentage of the amount being converted and varies depending on the currencies involved.

- Sending money fees: When you send money abroad using Wise, there is a fee associated with the transfer. The fee is usually a percentage of the amount being sent and can vary based on the currency pairs and the recipient’s country.

- Wise card fees: While there are no fees to obtain a Wise card, certain fees may apply when using it. For example, there might be charges for ATM withdrawals, card replacements, or inactivity. It’s important to review the fee schedule specific to your region to understand the costs associated with the Wise card.

- Bank transfer fees: If you choose to add money to your Wise account through a bank transfer, your bank may charge fees for the transfer. These fees are not controlled by Wise and vary from bank to bank. It’s recommended to check with your bank for any applicable charges.

- Inactivity fees: If you have a Wise account but do not use it for an extended period, an inactivity fee may be charged. This fee is to cover the maintenance costs of your account and can be avoided by regularly transacting or using your Wise account.

It’s important to note that the specific fees and charges can vary depending on your country of residence, account type, and the services you use. Wise provides a transparent breakdown of fees on their website, allowing you to review and understand the costs associated with their services.

Despite the fees, Wise is typically more cost-effective compared to traditional banks when it comes to currency conversion, international money transfers, and travel-related expenses. The transparency and lower fees make Wise an attractive option for managing your travel money with ease.

Before using any Wise services, it’s advisable to review the fee schedule applicable to your account and familiarize yourself with the costs associated with specific transactions.

Wise vs traditional banks for travel money

When it comes to managing your travel money, Wise offers several advantages over traditional banks. Here’s a comparison of Wise and traditional banks for travel money:

- Transparency: Wise provides transparency in its fee structure, clearly displaying the fees associated with currency conversion, international money transfers, and card usage. In contrast, traditional banks often have hidden fees and markups, making it challenging to determine the true cost of your transactions.

- Exchange rates: Wise uses the mid-market exchange rate, which is the real exchange rate without any markups or hidden fees. This means you get a fair and transparent rate for your currency conversions. Traditional banks, on the other hand, offer their own exchange rates, which often include a margin that results in unfavorable rates for customers.

- Low fees: Wise’s fees are typically significantly lower compared to traditional banks. Whether it’s for currency conversion, international transfers, or card usage, Wise aims to keep fees competitive and transparent. Traditional banks, on the other hand, often charge high fees for these services, leading to unnecessary costs for travelers.

- Convenience: Wise offers a user-friendly online platform and mobile app, allowing you to manage your travel money anytime and anywhere. You can easily convert currencies, send money abroad, or access your funds with the Wise card. Traditional banks may have limited opening hours and require in-person visits, which can be inconvenient, especially when traveling overseas.

- Multi-currency accounts: With Wise, you can hold and manage funds in multiple currencies within a single account. This eliminates the need to open multiple bank accounts or carry large amounts of cash when traveling to different countries. Traditional banks often require separate accounts for different currencies, adding complexity and inconvenience.

- Speed of transfers: Wise offers fast and secure international money transfers, with most transfers typically processed within one to two business days. In contrast, traditional bank transfers can take several business days, resulting in delays and uncertainty for those who need to send or receive money quickly.

- Accessibility: The Wise card can be used globally, providing convenient access to your funds for purchases and ATM withdrawals. Traditional bank cards may have limited acceptance or charge high fees for international transactions.

Overall, Wise provides an innovative and cost-effective solution for managing your travel money. With its transparent fees, competitive exchange rates, convenience, and multi-currency capabilities, Wise offers a superior alternative to traditional banks for handling your finances while traveling.

By utilizing Wise’s services, you can save money on fees, benefit from fair exchange rates, and have greater control over your travel budget.

Managing your travel money can be a daunting task, but with Wise, you have a reliable and cost-effective solution at your fingertips. Whether you’re exchanging currency, sending money abroad, or using a prepaid card for your expenses, Wise offers transparency, convenience, and competitive rates that traditional banks struggle to match.

With Wise, you can enjoy the benefits of the mid-market exchange rate, avoiding hidden fees and unfavorable exchange rates. Their user-friendly platform and mobile app make it easy to set up an account, convert currencies, send money abroad, and track your transactions. The Wise card adds an extra layer of convenience, providing an accessible and secure way to spend your money worldwide.

Compared to traditional banks, Wise stands out with its low fees, transparency, and speed of transactions. By choosing Wise, you can save money, have greater control over your finances, and eliminate the hassle of dealing with multiple accounts or carrying large amounts of cash.

Whether you’re a frequent traveler or planning your next vacation, using Wise for your travel money needs is a smart choice. You’ll have peace of mind knowing that you’re getting the best rates, avoiding excessive fees, and managing your finances with ease.

So, next time you’re planning your trip, consider Wise as your trusted companion for all your travel money requirements. With Wise by your side, you can embark on your journey with confidence, knowing that your finances are in good hands.

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

- Find Itineraries

- Generate Itineraries

- About Travel-Wise

- Country Guides

- Help Guides

The FASTEST tri p planner for travel. Create the perfect adventure in minutes.

Join Our Community

Find A Template

Trip Planning

Take The Quiz

Create your next trip plan in minutes., s hare it, collaborate on it, use it as a journal., create a trip plan.

Trip plans are an overall view of the experiences you want. Think of it as a general list of places of interest. Create your own or use someone else's template itinerary and edit as needed. Then, add your friends and family to the trip and collaborate on the plan!

Create an itinerary

A templated itinerary is a detailed outline of a region's locations, events, and experiences. It creates segmented suggested templates that anyone on Travel-Wise can use and stitch together with other templates to outline their perfect trip. Then, when you finish your grand adventures, you can create templated itineraries to share with others from your trip plans.

Share and collaborate

Invite everyone you are traveling with to your trip plan to collaborate and plan together. After the trip, share your journal and trip plan outline, complete with a map of everywhere you've been. Share on social media, your website, and over email. The options are limitless.

Journal on your trip

Add your personal notes, pictures, and experiences to our trip plan's journal as you travel. Journaling supports offline and online modes. You can also share with friends and family and they can see your live updates on your trip! Your journal becomes a day-to-day log of your experiences.

Top Features

Click on the boxes below to see a short demo of the feature.

Ready-made temp late itineraries

Access an ever-growing list of ready-made templated itineraries to make plans within seconds.

Easy trip planning

Create a new plan for a trip from scratch pulling from pre-made itineraries and using the tools to customize the plan to your liking.

A trip journal

Log all your trip highlights in your trip journal at any time during your trip, with or without the need for internet access.

Share anywhere

Share your content from Travel-Wise on social media and your website, send it to friends and family, or share it with the Travel-Wise community!

Collaborative planning

Invite your travel partner(s) to your trips and do planning and journaling a collaborative affair! Make new friends from the community and use the planner to put things in motion.

A vibrant community

Share and interact with a community of like-minded travelers always looking for the next adventure.

Travel-Wise singular goal is to make trip planning quick, easy, and fun. Here, you can find itineraries created by the community members, select one that reflects your travel wishes, add it to your trip as a template, and edit it to your liking. No need to stop at one, either! There's no easier way to create your travel plans. Once done, you can share it however you want. For example, invite your travel partners to make their edits, contribute to journaling, post to social media, and eventually post it publicly on Travel-Wise as its itinerary template for others to view and use.

Community-Driven Trip Planning

© 2024 Travel-Wise ®

- Get The App

- Privacy policy

- Terms & Conditions

Looking for expert help? Call us on:

Request a call back:

- Sun Holidays

- Camping Holidays

- Golf Holidays

- Sports Travel

- Gift Vouchers

- Family Holidays

- Solo Travel

- Adventure Tours

- Special Offers

- Something Different

- Active Holidays

- City Breaks

- Luxury Travel

- All Holiday Types

- All Destinations

- Cruise Newsletter Sign Up Link

- Travel Blog

- Flexible Payments

- NEW: No-fly cruises 2025

- Disneyland Paris

- Last Minute Deals

- SAYIT J1 Visa: Applications Closed

- Solo Cruises

- Christmas Markets

- Cruise Special Offers

- Over 50's Holidays

- Christmas Sun

- European City Breaks

- Flights- worldwide deals

- Flights: Great Fares

- Harry Potter Tours

- Sports: VIP Packages

- USA City Breaks

- New: Greece direct from Cork

- Marella Cruises

- Virgin Voyages

- Football Tickets

- Camino de Santiago

- Holiday Types

- Airport Services

- West Cork Travel

Start your search

- TravelWise App

Compiled by the Department Of Foreign Affairs, the TravelWise app brings you user-friendly, trusted and comprehensive travel advice straight to your phone.

Any citizen travelling to a higher risk destination can register with the nearest Embassy, using the App. Registering means that in the event of an unforeseen crisis such as a natural disaster or civil unrest, the Department can proactively contact the citizen, ensure they are safe, update them on developments and provide assistance as necessary.

TravelWise provides security ratings for over 200 countries- a clear way to show you how safe or unsafe they believe a country may be to visit, and to help you to make informed decisions about overseas travel.

There are four colour-coded levels to the security ratings:

- Normal Precautions (Green)

- High Degree of Caution (Yellow)

- Avoid Non-Essential Travel (Amber)

- Do Not Travel (Red)

In addition to security ratings, the app also provides detailed information about visas, health, safety, local laws and customs and other information we think you might find useful.

Topical Articles includes practical information on major events abroad. A “Know before you go” section provides cross-cutting information relevant to multiple travel types and destinations.

This includes passport information, travel insurance information and the consular role of our embassies network.

The “My Trip” checklist is a handy tool to help travellers ensure that they are well prepared for an upcoming journey.

To download TravelWise visit the App Store or Google Play .

- The TravelWise app is free.

- There is no limit to the number of countries that can be favourited, but users must have a data connection (3G, 4G or wifi) in order to receive a push notification.

- When installed and downloaded, the entire app content is available offline, and in your pocket.

- Initial download 4MB. Secondary background download of global travel advice and guides 11MB.

Call our travel hotline for expert advice or to book your trip.

Join Our Mailing List

We are moving home after 20 years!

Yes, we are excited to let you know that Sayit Travel is being incorporated in to its parent company Shandon Travel. Nothing has changed! We're still your one stop shop for all your travel needs.

10 Apps That Will Make The Most Of Your Vacation In 2024

I f you've ever spent time at a networking event, made small talk at your kids' soccer games, or scrolled through a dating app, you'll know that "travel" is something almost everyone will tell you they enjoy. Couple that with an attachment to our smartphones that borders on co-dependent, and it's no surprise to learn that travel apps are a hot commodity. Some of the best innovations in travel come in the form of apps. Staying in touch with people at home, travel planning, staying organized on the road, or connecting with other travelers? Not only is there an app for that, there are many apps for that.

To help you sort through the plethora of what's out there, here are some travel-ready apps to make your vacation a blast. We've sourced suggestions from people who travel for a living and those who leave their local area only rarely, so no matter how often you jet-set, there is an app for you.

Read more: 12 Smart Gadgets You Didn't Know Existed

If your cell plan doesn't include international roaming, you can get slammed with steep fees for using mobile data outside your own country.

There are a few ways to get around roaming charges, including buying a local SIM card for the country you are traveling in, using a Wi-Fi stick , or investing in a dual SIM phone, like those from Samsung, Apple, or Google. One of the easiest and cheapest options though, is an eSIM app like Airalo . Airalo was one of the first in the eSIM game and continues to be popular with travelers. Fans of the app point to how easy it is to download and get started quickly, and how much it saves in fees. On the other hand, some users have noticed a discrepancy in how well it works in different countries. One reviewer on TrustPilot states "We do NOT recommend this plan given the extremely poor performance in Vietnam" despite noting excellent service in Hong Kong.

Airalo is a paid service, available on the App Store and on Google Play.

Google Maps is often the default app travelers reach for when navigating new territory. It's a trusted resource for a lot of reasons, including the ease of finding reviews and info for even very small businesses. But it's not the only map app out there, nor is it the best in every situation. The main advantage of Maps.me over Google Maps is that it is based on user-generated information. Particularly for folks who are getting around on foot, this "boots on the ground" approach is excellent and more direct than reporting problems to Google Maps . It also means that if you find a cool place on your travels and want to make sure other travelers can find it, you can add it to a map.

Like Google Maps and other useful way-finding apps, you can download maps and bookmark points of interest for offline use, although the background information on locations is not as robust as on Google Maps. Maps.me also allows you to access various modes of transportation while offline, which Google doesn't.

Maps.me is free to download and available from the App Store and from Google Play.

Cash's position as king is increasingly precarious. On your travels, you'll find cashless options in places you might not expect. The mass availability of mobile payment platforms like Square means you may be able to whip out your phone or card at Swiss coffee carts or Mexican street vendors. Wise (formerly Transferwise) lets you move between currencies seamlessly. Wise lets you operate in 40 currencies, which is particularly handy if you are traveling to several different countries. They advertise charges that are less than the major banks. However, some users have complained about complications with money transfers, so be forewarned if you intend to use this app for sending money.

Of note to travelers is the option to get an actual bank card that can function as an international debit card with a nominal conversion fee (not all bank cards can pay by debit in countries other than your home base.) Or, save a step and scan your phone to pay from your Wise account.

Wise is available on the App Store and from Google Play. There is no charge to download the app, but fees are charged for some banking activities.

If you are going to be traveling from place to place on your vacation, you will want the Rome2Rio app on your phone. Enter your destination and departure location, and the app spits out the options and approximate costs for each leg of your journey. For instance, if you are in Edmonton, Canada, and want to get to the Thai island of Ko Yao Yai, the app will suggest six options, labeling the best, cheapest, and fastest combination of flight, minibus, and ferry. You can't purchase tickets through the app, although there are links to book accommodation that take you to Booking.com. Being able to purchase travel fares through the app would make things easier, especially if they were offered in a package, but the absence of that feature means you can investigate and compare prices from different booking operators , so we are putting it in the win column.

Rome2Rio is free to download and available from the App Store and from Google Play.

Rick Steves Audio Europe

Rick Steves is recognized as a top voice in travel guides. His down-to-earth approach to travel has endeared multitudes of followers to him, spawning an industry of books, television shows, and a sprawling web presence that features how-to guides, articles, and an active travelers' forum. On top of all that, he has a free app for self-guided walking tours through many of Europe's top sights called Rick Steves Audio Europe . Reviewers of the app give it a high rating (4.7 on Google Play and 4.3 on the App Store) using superlatives like "This app is GOLD," and comparing the quality of the tours to paid audio tours. On the downside, it is difficult to sync the app on multiple devices, so if you are in a group you may all be at slightly different parts of the tour, which can be mildly annoying. There are a bunch of tour sites, with more added periodically.

The audio tours and accompanying maps are downloadable, so you don't need to worry about burning through mobile data or needing to rely on Wi-Fi. Rick Steve Audio Europe is free to download and available from the App Store and from Google Play.

How many trips come vividly back to life in your mind just by thinking about that one excellent bowl of Cacio e Pepe pasta or sun-drenched sip of a Paloma? Exploring a place through its flavors and discovering new spots to eat is a beloved part of travel. In Europe, TheFork (the French version is called LaForchette) is the go-to app for crowd-sourced restaurant reviews. Previously, the app also covered Australia, but at the start of 2024, it was announced they will be pulling out of Oz.

You can find Michelin-starred restaurants with months-long wait lists or little hole-in-the-wall spots by searching the name of the eating establishment, the city or neighborhood you want to eat in, or the kind of cuisine you are craving.

The app is worthy of its space on your phone just for the restaurant listings and reviews, but if you want to explore more of the capabilities, there are ways to expand its usefulness. You can make reservations, register to collect points, access discounts and specials at select spots, and pay through the app. TheFork is free to download and available from the App Store and from Google Play.

Looking for a little love on the road? The Fairytrail app might be the ticket to romance (or ROAMance) you are looking for. Aimed at digital nomads and van life devotees, the app is a nice addition to the dating lives of travelers of all stripes. Members are evaluated and assigned a fairytale character similar to enneagram-slash-Myers-Briggs personality types, which is a new and novel approach compared with other iPhone dating apps or Android dating apps .

Because the app is focused on people with nomadic lifestyles, matches are location-independent. The idea is that users of the app will be willing to travel to each other to meet and date. There is a setting that allows an extra layer of matching: dream places to visit. If you so choose, before chatting with a match you need to have an overlapping "bucket-list" destination. Previously, this was an unavoidable step but became an optional setting after it was changed in response to frustration expressed by reviewers. The app is being redesigned in 2024 and soliciting feedback from users. Stay tuned, it seems more happy endings are in store! Fairytrails is free to download with in-app purchases and is available from the App Store and from Google Play.

Price Scanner And Converter

A very unpleasant aspect of vacationing in another country is coming home to a shocking credit card bill. Part of the problem is the tendency of holidaymakers to spend like money isn't real, but the other problem is how difficult it is to calculate prices into your own currency. Sure, you can come up with shortcuts to do quick math, but that gives you an estimate rather than an exact cost. To help, there are many different currency converter apps out there, with features like real-time rate calculation and offline capability. The somewhat clunky-named Price Scanner and Converter takes it one step further by using your phone's camera to scan prices and display them automatically in your preferred currency (out of 150 global currencies.) New iPhone cameras also have a similar capability, but it isn't as seamless a process as using this app.

This price scanning app isn't presently available on Google Play, although there are similar apps to be found. The reviews are pretty overwhelmingly mediocre, so if you are on team Android, your best bet may be to download a regular currency converter and enter in prices the old-fashioned way.

Downloading the Price Scanner and Converter is free from the App Store.

Searching through your emails for confirmations and itineraries isn't an efficient way to access your travel information. And good luck if you have used your work email for some of your planning and your personal email for others. What if you are offline when you need to find your tour details? Nightmare fuel. Tripit has created a simple user experience, allowing you to forward all those endless travel planning emails to be arranged into an easily accessible itinerary in a single spot, which you can access from any of your devices.

Other features of this include the ability to load PDFs, QR codes, and other travel documents to your Tripit travel folder. There are helpful navigation tools, like airport maps, neighborhood safety ratings, and nearby places. You can share your travel plans and sync them to your calendar. For $49 a year (or a free 30-day trial) you can upgrade to Tripit Pro for enhanced travel aid, including notifications to help keep you on track and on time.

Tripit is free to download from the App Store and from Google Play, and you can upgrade to the premium Tripit Pro on the Tripit website or in the app.

Mobile Passport Control

The latest app from U.S. Customs and Border Patrol goes by the wildly creative name, " Mobile Passport Control ." It's a no-nonsense app with a no-nonsense name that allows users to streamline the customs experience. Rather than filling out declarations forms, users enter their information into the app and send it to border officials so they can access it as soon as they get to customs. You can do this immediately upon arrival, say as your plane is taxiing to the gate.

The app is for United States citizens and Canadians with a B-1 or B-2 visitor visa who are entering the USA at one of 33 American airports, 11 preclearance sites, and four seaports. It works in tandem with your passport, but it doesn't replace it.

As a bonus, some sites allow those with the Mobile Passport Control app to use their own (almost always shorter!) line or expedited Global Entry lines at passport control. You can enter family members on the same app and there is no approval process, just download and go.

A previous iteration of the app had a premium, paid version, but this is no longer the case. The app is free on the App Store and Google Play.

Read the original article on SlashGear .

Track Wise Live 4+

Gps tracking app, designed for iphone, iphone screenshots, description.