WORLD TRADE ORGANIZATION

Home | About WTO | News & events | Trade topics | WTO membership | Documents & resources | External relations

Contact us | Site map | A-Z | Search

español français

- trade topics

- sector-by-sector

- tourism and travel-related services

SERVICES: SECTOR BY SECTOR

Tourism and travel-related services

Tourism plays an important role for nearly all WTO members, especially in terms of its contribution to employment, GDP, and the generation of foreign exchange. Tourism-related services are typically labour-intensive, with numerous links to other major segments of the economy, such as transport, cultural and creative services, or financial and insurance services.

Tourism and travel-related services include services provided by hotels and restaurants (including catering), travel agencies and tour operator services, tourist guide services and other related services.

A crucial aspect of trade in tourism services is the cross-border movement of consumers (mode 2). This permits a variety of workers, including those in remote areas, to become services exporters — for instance, by guiding tourists, performing in local events, or working in tourist accommodation. While digitalisation offers great potential for many aspects of tourism services, the sector continues to depend highly on the cross-border movement of both customers and employees, and remains strongly linked to transport services.

Current commitments and exemptions

Tourism commitments have been undertaken by over 133 WTO members, more than in any other service sector. This indicates the desire of most members to expand their tourism sectors and to increase inward foreign direct investment (FDI) as part of their efforts to promote economic growth.

The level of commitments by sub-sector varies widely for tourism and travel-related services. Commitments on services provided by hotels and restaurants are the most frequent, with a significantly smaller number of WTO members making commitments on travel agencies and tour operator services. Only about half of members with commitments on tourism have included tourist guide services, and only a few members have made commitments for the “other” tourism services category.

- Schedules of WTO Members with Specific Commitments on Tourism Services

Treatment of the sector in negotiations

Tourism services, like other services covered by the General Agreement on Trade in Services (GATS), were included in the services negotiations that began in 2000.

One of the earliest documents was a proposal for a GATS Annex on Tourism, originally sponsored by the Dominican Republic, El Salvador and Honduras ( S/C/W/127 and S/C/W/127/Corr.1 ). The proposal had two main aspects: more comprehensive treatment of the tourism sector (with respect to classification issues), and the prevention of anti-competitive practices. As part of the plurilateral process, a joint request was made by a group of developing countries, asking for improved tourism commitments for all modes of supply.

- Proposals and related negotiating documents on tourism services

Additional information

Search Documents Online These links open a new window: allow a moment for the results to appear.

- Secretariat background notes on tourism services (Document code S/C/W/* and keyword “tourism and Background Note”) > search > help

- Tourism services (Document code S/CSS/W/* or TN/S/W/* and Title Tourism) > search

You can perform more sophisticated searches from the Documents Online search facility by defining multiple search criteria such as document symbol (i.e. code number), full text search or document date.

Some useful links

- World Tourism Organization (UNWTO)

- World Travel and Tourism Council (WTTC)

- OECD Tourism Unit (Centre for Entrepreneurship, SMEs, Regions and Cities)

Problems viewing this page? If so, please contact [email protected] giving details of the operating system and web browser you are using.

The future of tourism: Bridging the labor gap, enhancing customer experience

As travel resumes and builds momentum, it’s becoming clear that tourism is resilient—there is an enduring desire to travel. Against all odds, international tourism rebounded in 2022: visitor numbers to Europe and the Middle East climbed to around 80 percent of 2019 levels, and the Americas recovered about 65 percent of prepandemic visitors 1 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. —a number made more significant because it was reached without travelers from China, which had the world’s largest outbound travel market before the pandemic. 2 “ Outlook for China tourism 2023: Light at the end of the tunnel ,” McKinsey, May 9, 2023.

Recovery and growth are likely to continue. According to estimates from the World Tourism Organization (UNWTO) for 2023, international tourist arrivals could reach 80 to 95 percent of prepandemic levels depending on the extent of the economic slowdown, travel recovery in Asia–Pacific, and geopolitical tensions, among other factors. 3 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. Similarly, the World Travel & Tourism Council (WTTC) forecasts that by the end of 2023, nearly half of the 185 countries in which the organization conducts research will have either recovered to prepandemic levels or be within 95 percent of full recovery. 4 “Global travel and tourism catapults into 2023 says WTTC,” World Travel & Tourism Council (WTTC), April 26, 2023.

Longer-term forecasts also point to optimism for the decade ahead. Travel and tourism GDP is predicted to grow, on average, at 5.8 percent a year between 2022 and 2032, outpacing the growth of the overall economy at an expected 2.7 percent a year. 5 Travel & Tourism economic impact 2022 , WTTC, August 2022.

So, is it all systems go for travel and tourism? Not really. The industry continues to face a prolonged and widespread labor shortage. After losing 62 million travel and tourism jobs in 2020, labor supply and demand remain out of balance. 6 “WTTC research reveals Travel & Tourism’s slow recovery is hitting jobs and growth worldwide,” World Travel & Tourism Council, October 6, 2021. Today, in the European Union, 11 percent of tourism jobs are likely to go unfilled; in the United States, that figure is 7 percent. 7 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022.

There has been an exodus of tourism staff, particularly from customer-facing roles, to other sectors, and there is no sign that the industry will be able to bring all these people back. 8 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022. Hotels, restaurants, cruises, airports, and airlines face staff shortages that can translate into operational, reputational, and financial difficulties. If unaddressed, these shortages may constrain the industry’s growth trajectory.

The current labor shortage may have its roots in factors related to the nature of work in the industry. Chronic workplace challenges, coupled with the effects of COVID-19, have culminated in an industry struggling to rebuild its workforce. Generally, tourism-related jobs are largely informal, partly due to high seasonality and weak regulation. And conditions such as excessively long working hours, low wages, a high turnover rate, and a lack of social protection tend to be most pronounced in an informal economy. Additionally, shift work, night work, and temporary or part-time employment are common in tourism.

The industry may need to revisit some fundamentals to build a far more sustainable future: either make the industry more attractive to talent (and put conditions in place to retain staff for longer periods) or improve products, services, and processes so that they complement existing staffing needs or solve existing pain points.

One solution could be to build a workforce with the mix of digital and interpersonal skills needed to keep up with travelers’ fast-changing requirements. The industry could make the most of available technology to provide customers with a digitally enhanced experience, resolve staff shortages, and improve working conditions.

Would you like to learn more about our Travel, Logistics & Infrastructure Practice ?

Complementing concierges with chatbots.

The pace of technological change has redefined customer expectations. Technology-driven services are often at customers’ fingertips, with no queues or waiting times. By contrast, the airport and airline disruption widely reported in the press over the summer of 2022 points to customers not receiving this same level of digital innovation when traveling.

Imagine the following travel experience: it’s 2035 and you start your long-awaited honeymoon to a tropical island. A virtual tour operator and a destination travel specialist booked your trip for you; you connected via videoconference to make your plans. Your itinerary was chosen with the support of generative AI , which analyzed your preferences, recommended personalized travel packages, and made real-time adjustments based on your feedback.

Before leaving home, you check in online and QR code your luggage. You travel to the airport by self-driving cab. After dropping off your luggage at the self-service counter, you pass through security and the biometric check. You access the premier lounge with the QR code on the airline’s loyalty card and help yourself to a glass of wine and a sandwich. After your flight, a prebooked, self-driving cab takes you to the resort. No need to check in—that was completed online ahead of time (including picking your room and making sure that the hotel’s virtual concierge arranged for red roses and a bottle of champagne to be delivered).

While your luggage is brought to the room by a baggage robot, your personal digital concierge presents the honeymoon itinerary with all the requested bookings. For the romantic dinner on the first night, you order your food via the restaurant app on the table and settle the bill likewise. So far, you’ve had very little human interaction. But at dinner, the sommelier chats with you in person about the wine. The next day, your sightseeing is made easier by the hotel app and digital guide—and you don’t get lost! With the aid of holographic technology, the virtual tour guide brings historical figures to life and takes your sightseeing experience to a whole new level. Then, as arranged, a local citizen meets you and takes you to their home to enjoy a local family dinner. The trip is seamless, there are no holdups or snags.

This scenario features less human interaction than a traditional trip—but it flows smoothly due to the underlying technology. The human interactions that do take place are authentic, meaningful, and add a special touch to the experience. This may be a far-fetched example, but the essence of the scenario is clear: use technology to ease typical travel pain points such as queues, misunderstandings, or misinformation, and elevate the quality of human interaction.

Travel with less human interaction may be considered a disruptive idea, as many travelers rely on and enjoy the human connection, the “service with a smile.” This will always be the case, but perhaps the time is right to think about bringing a digital experience into the mix. The industry may not need to depend exclusively on human beings to serve its customers. Perhaps the future of travel is physical, but digitally enhanced (and with a smile!).

Digital solutions are on the rise and can help bridge the labor gap

Digital innovation is improving customer experience across multiple industries. Car-sharing apps have overcome service-counter waiting times and endless paperwork that travelers traditionally had to cope with when renting a car. The same applies to time-consuming hotel check-in, check-out, and payment processes that can annoy weary customers. These pain points can be removed. For instance, in China, the Huazhu Hotels Group installed self-check-in kiosks that enable guests to check in or out in under 30 seconds. 9 “Huazhu Group targets lifestyle market opportunities,” ChinaTravelNews, May 27, 2021.

Technology meets hospitality

In 2019, Alibaba opened its FlyZoo Hotel in Huangzhou, described as a “290-room ultra-modern boutique, where technology meets hospitality.” 1 “Chinese e-commerce giant Alibaba has a hotel run almost entirely by robots that can serve food and fetch toiletries—take a look inside,” Business Insider, October 21, 2019; “FlyZoo Hotel: The hotel of the future or just more technology hype?,” Hotel Technology News, March 2019. The hotel was the first of its kind that instead of relying on traditional check-in and key card processes, allowed guests to manage reservations and make payments entirely from a mobile app, to check-in using self-service kiosks, and enter their rooms using facial-recognition technology.

The hotel is run almost entirely by robots that serve food and fetch toiletries and other sundries as needed. Each guest room has a voice-activated smart assistant to help guests with a variety of tasks, from adjusting the temperature, lights, curtains, and the TV to playing music and answering simple questions about the hotel and surroundings.

The hotel was developed by the company’s online travel platform, Fliggy, in tandem with Alibaba’s AI Labs and Alibaba Cloud technology with the goal of “leveraging cutting-edge tech to help transform the hospitality industry, one that keeps the sector current with the digital era we’re living in,” according to the company.

Adoption of some digitally enhanced services was accelerated during the pandemic in the quest for safer, contactless solutions. During the Winter Olympics in Beijing, a restaurant designed to keep physical contact to a minimum used a track system on the ceiling to deliver meals directly from the kitchen to the table. 10 “This Beijing Winter Games restaurant uses ceiling-based tracks,” Trendhunter, January 26, 2022. Customers around the world have become familiar with restaurants using apps to display menus, take orders, and accept payment, as well as hotels using robots to deliver luggage and room service (see sidebar “Technology meets hospitality”). Similarly, theme parks, cinemas, stadiums, and concert halls are deploying digital solutions such as facial recognition to optimize entrance control. Shanghai Disneyland, for example, offers annual pass holders the option to choose facial recognition to facilitate park entry. 11 “Facial recognition park entry,” Shanghai Disney Resort website.

Automation and digitization can also free up staff from attending to repetitive functions that could be handled more efficiently via an app and instead reserve the human touch for roles where staff can add the most value. For instance, technology can help customer-facing staff to provide a more personalized service. By accessing data analytics, frontline staff can have guests’ details and preferences at their fingertips. A trainee can become an experienced concierge in a short time, with the help of technology.

Apps and in-room tech: Unused market potential

According to Skift Research calculations, total revenue generated by guest apps and in-room technology in 2019 was approximately $293 million, including proprietary apps by hotel brands as well as third-party vendors. 1 “Hotel tech benchmark: Guest-facing technology 2022,” Skift Research, November 2022. The relatively low market penetration rate of this kind of tech points to around $2.4 billion in untapped revenue potential (exhibit).

Even though guest-facing technology is available—the kind that can facilitate contactless interactions and offer travelers convenience and personalized service—the industry is only beginning to explore its potential. A report by Skift Research shows that the hotel industry, in particular, has not tapped into tech’s potential. Only 11 percent of hotels and 25 percent of hotel rooms worldwide are supported by a hotel app or use in-room technology, and only 3 percent of hotels offer keyless entry. 12 “Hotel tech benchmark: Guest-facing technology 2022,” Skift Research, November 2022. Of the five types of technology examined (guest apps and in-room tech; virtual concierge; guest messaging and chatbots; digital check-in and kiosks; and keyless entry), all have relatively low market-penetration rates (see sidebar “Apps and in-room tech: Unused market potential”).

While apps, digitization, and new technology may be the answer to offering better customer experience, there is also the possibility that tourism may face competition from technological advances, particularly virtual experiences. Museums, attractions, and historical sites can be made interactive and, in some cases, more lifelike, through AR/VR technology that can enhance the physical travel experience by reconstructing historical places or events.

Up until now, tourism, arguably, was one of a few sectors that could not easily be replaced by tech. It was not possible to replicate the physical experience of traveling to another place. With the emerging metaverse , this might change. Travelers could potentially enjoy an event or experience from their sofa without any logistical snags, and without the commitment to traveling to another country for any length of time. For example, Google offers virtual tours of the Pyramids of Meroë in Sudan via an immersive online experience available in a range of languages. 13 Mariam Khaled Dabboussi, “Step into the Meroë pyramids with Google,” Google, May 17, 2022. And a crypto banking group, The BCB Group, has created a metaverse city that includes representations of some of the most visited destinations in the world, such as the Great Wall of China and the Statue of Liberty. According to BCB, the total cost of flights, transfers, and entry for all these landmarks would come to $7,600—while a virtual trip would cost just over $2. 14 “What impact can the Metaverse have on the travel industry?,” Middle East Economy, July 29, 2022.

The metaverse holds potential for business travel, too—the meeting, incentives, conferences, and exhibitions (MICE) sector in particular. Participants could take part in activities in the same immersive space while connecting from anywhere, dramatically reducing travel, venue, catering, and other costs. 15 “ Tourism in the metaverse: Can travel go virtual? ,” McKinsey, May 4, 2023.

The allure and convenience of such digital experiences make offering seamless, customer-centric travel and tourism in the real world all the more pressing.

Three innovations to solve hotel staffing shortages

Is the future contactless.

Given the advances in technology, and the many digital innovations and applications that already exist, there is potential for businesses across the travel and tourism spectrum to cope with labor shortages while improving customer experience. Process automation and digitization can also add to process efficiency. Taken together, a combination of outsourcing, remote work, and digital solutions can help to retain existing staff and reduce dependency on roles that employers are struggling to fill (exhibit).

Depending on the customer service approach and direct contact need, we estimate that the travel and tourism industry would be able to cope with a structural labor shortage of around 10 to 15 percent in the long run by operating more flexibly and increasing digital and automated efficiency—while offering the remaining staff an improved total work package.

Outsourcing and remote work could also help resolve the labor shortage

While COVID-19 pushed organizations in a wide variety of sectors to embrace remote work, there are many hospitality roles that rely on direct physical services that cannot be performed remotely, such as laundry, cleaning, maintenance, and facility management. If faced with staff shortages, these roles could be outsourced to third-party professional service providers, and existing staff could be reskilled to take up new positions.

In McKinsey’s experience, the total service cost of this type of work in a typical hotel can make up 10 percent of total operating costs. Most often, these roles are not guest facing. A professional and digital-based solution might become an integrated part of a third-party service for hotels looking to outsource this type of work.

One of the lessons learned in the aftermath of COVID-19 is that many tourism employees moved to similar positions in other sectors because they were disillusioned by working conditions in the industry . Specialist multisector companies have been able to shuffle their staff away from tourism to other sectors that offer steady employment or more regular working hours compared with the long hours and seasonal nature of work in tourism.

The remaining travel and tourism staff may be looking for more flexibility or the option to work from home. This can be an effective solution for retaining employees. For example, a travel agent with specific destination expertise could work from home or be consulted on an needs basis.

In instances where remote work or outsourcing is not viable, there are other solutions that the hospitality industry can explore to improve operational effectiveness as well as employee satisfaction. A more agile staffing model can better match available labor with peaks and troughs in daily, or even hourly, demand. This could involve combining similar roles or cross-training staff so that they can switch roles. Redesigned roles could potentially improve employee satisfaction by empowering staff to explore new career paths within the hotel’s operations. Combined roles build skills across disciplines—for example, supporting a housekeeper to train and become proficient in other maintenance areas, or a front-desk associate to build managerial skills.

Where management or ownership is shared across properties, roles could be staffed to cover a network of sites, rather than individual hotels. By applying a combination of these approaches, hotels could reduce the number of staff hours needed to keep operations running at the same standard. 16 “ Three innovations to solve hotel staffing shortages ,” McKinsey, April 3, 2023.

Taken together, operational adjustments combined with greater use of technology could provide the tourism industry with a way of overcoming staffing challenges and giving customers the seamless digitally enhanced experiences they expect in other aspects of daily life.

In an industry facing a labor shortage, there are opportunities for tech innovations that can help travel and tourism businesses do more with less, while ensuring that remaining staff are engaged and motivated to stay in the industry. For travelers, this could mean fewer friendly faces, but more meaningful experiences and interactions.

Urs Binggeli is a senior expert in McKinsey’s Zurich office, Zi Chen is a capabilities and insights specialist in the Shanghai office, Steffen Köpke is a capabilities and insights expert in the Düsseldorf office, and Jackey Yu is a partner in the Hong Kong office.

Explore a career with us

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

U.S. Department of Commerce

- Fact Sheets

Was this page helpful?

Fact sheet: 2022 national travel and tourism strategy, office of public affairs.

The 2022 National Travel and Tourism Strategy was released on June 6, 2022, by U.S. Secretary of Commerce Gina M. Raimondo on behalf of the Tourism Policy Council (TPC). The new strategy focuses the full efforts of the federal government to promote the United States as a premier destination grounded in the breadth and diversity of our communities, and to foster a sector that drives economic growth, creates good jobs, and bolsters conservation and sustainability. Drawing on engagement and capabilities from across the federal government, the strategy aims to support broad-based economic growth in travel and tourism across the United States, its territories, and the District of Columbia.

The federal government will work to implement the strategy under the leadership of the TPC and in partnership with the private sector, aiming toward an ambitious five-year goal of increasing American jobs by attracting and welcoming 90 million international visitors, who we estimate will spend $279 billion, annually by 2027.

The new National Travel and Tourism Strategy supports growth and competitiveness for an industry that, prior to the COVID-19 pandemic, generated $1.9 trillion in economic output and supported 9.5 million American jobs. Also, in 2019, nearly 80 million international travelers visited the United States and contributed nearly $240 billion to the U.S. economy, making the United States the global leader in revenue from international travel and tourism. As the top services export for the United States that year, travel and tourism generated a $53.4 billion trade surplus and supported 1 million jobs in the United States.

The strategy follows a four-point approach:

- Promoting the United States as a Travel Destination Goal : Leverage existing programs and assets to promote the United States to international visitors and broaden marketing efforts to encourage visitation to underserved communities.

- Facilitating Travel to and Within the United States Goal : Reduce barriers to trade in travel services and make it safer and more efficient for visitors to enter and travel within the United States.

- Ensuring Diverse, Inclusive, and Accessible Tourism Experiences Goal : Extend the benefits of travel and tourism by supporting the development of diverse tourism products, focusing on under-served communities and populations. Address the financial and workplace needs of travel and tourism businesses, supporting destination communities as they grow their tourism economies. Deliver world-class experiences and customer service at federal lands and waters that showcase the nation’s assets while protecting them for future generations.

- Fostering Resilient and Sustainable Travel and Tourism Goal : Reduce travel and tourism’s contributions to climate change and build a travel and tourism sector that is resilient to natural disasters, public health threats, and the impacts of climate change. Build a sustainable sector that integrates protecting natural resources, supporting the tourism economy, and ensuring equitable development.

Travel and Tourism Fast Facts

- The travel and tourism industry supported 9.5 million American jobs through $1.9 trillion of economic activity in 2019. In fact, 1 in every 20 jobs in the United States was either directly or indirectly supported by travel and tourism. These jobs can be found in industries like lodging, food services, arts, entertainment, recreation, transportation, and education.

- Travel and tourism was the top services export for the United States in 2019, generating a $53.4 billion trade surplus.

- The travel and tourism industry was one of the U.S. business sectors hardest hit by the COVID-19 pandemic and subsequent health and travel restrictions, with travel exports decreasing nearly 65% from 2019 to 2020.

- The decline in travel and tourism contributed heavily to unemployment; leisure and hospitality lost 8.2 million jobs between February and April 2020 alone, accounting for 37% of the decline in overall nonfarm employment during that time.

- By 2021, the rollout of vaccines and lifting of international and domestic restrictions allowed travel and tourism to begin its recovery. International arrivals to the United States grew to 22.1 million in 2021, up from 19.2 million in 2020. Spending by international visitors also grew, reaching $81.0 billion, or 34 percent of 2019’s total.

More about the Tourism Policy Council and the 2022 National Travel and Tourism Strategy

Created by Congress and chaired by Secretary Raimondo, the Tourism Policy Council (TPC) is the interagency council charged with coordinating national policies and programs relating to travel and tourism. At the direction of Secretary Raimondo, the TPC created a new five-year strategy to focus U.S. government efforts in support of the travel and tourism sector which has been deeply and disproportionately affected by the COVID-19 pandemic.

Read the full strategy here

Share this page

Travel and Tourism

As the travel and tourism industry emerges from the shock of the pandemic, companies have a clear opportunity to reset their business model and ways of working. Our tourism consulting experts help companies craft the right strategy for success.

COVID-19 challenged travel and tourism companies to think more boldly than ever. As these companies navigate continued changes to the industry, those that remain flexible and adaptive stand to gain significant market share and security. And fundamentals—like managing pricing and customer relationships—coupled with innovation will be key to a strong post-crisis performance.

Our Travel and Tourism Services

Airline Industry

Digital Transformation

Business Transformation

Social Impact and Sustainability

How BCG Helps Travel and Tourism Companies

We currently work with the top travel and tourism companies across the globe.

Copy Shareable Link

Over the past five years, we have collaborated on more than 1,100 travel and tourism initiatives, working closely with airlines, railways, the hotel industry, the cruise industry, theme parks, gaming and casinos, government tourism organizations, and more.

We treat travel and tourism as its own unique entity, not an offshoot of adjacent industry topics. Airlines and railroads look very different when seen through a travel and tourism lens versus a logistics and transportation lens. The difference is stark—and now more than ever, travel and tourism needs a highly customized approach. That’s what we offer at BCG.

Our Client Work in Travel and Tourism

Our travel and tourism consulting teams work with clients on a wide variety of topics, including strategy , people and organization , sales and distribution, post-merger integration , travel operations, digital operations, business transformation , digital transformation , pricing and revenue management, and social impact and sustainability . Here are just a few examples of our impact in travel and tourism and the hospitality industry.

A low-cost carrier with 75% to 80% load factor had a 45% improvement in their forecasting accuracy, using BCG’s state-of-the-art Machine Learning demand forecasting approach.

While working with BCG to identify and eliminate hidden costs, a US airline reduced expenses by $750 million , with no layoffs or involuntary moves.

A multibillion-dollar global hotel chain needed to enhance its loyalty program. After working with BCG to redesign the loyalty program and build up marketing capabilities, the organization achieved a 20 to 25 times return on investment over five years.

Our travel and tourism consulting team worked with an underperforming online travel agency to define a profitable growth strategy focused on specific consumer segments, creating a plan to improve profits by 20% to 25% .

SPOTLIGHT ON ORBITZ AND JOURNERA

In 2000, during a period of slow growth for airlines, five major US carriers—American, Continental, Delta, Northwest, and United —joined forces to create the travel portal Orbitz. BCG was involved in designing, building, and launching the startup from the beginning. Five managers from BCG oversaw operations, finance, IT, corporate development, and HR, and helped build a company that sold in 2004 for $1.25 billion. More recently, in partnership with Jeff Katz, the founding CEO of Orbitz Worldwide, BCG cofounded Journera , an industry-wide platform that provides secure, real-time data exchange to help companies create more seamless travel journeys. When it comes to big ideas, we don’t simply consult. We co-create.

BCG on Consumer

Follow us on LinkedIn for the latest insights and news on consumer products, retail, fashion, and travel.

Meet Our Travel and Tourism Consultants

Learn more about travel and tourism.

Can Rising Borrowing Costs Create Unexpected Opportunity for Hotels?

Uncertainty, inflationary fears, and elevated interest rates have a chilling effect on investment. But strong demand for rooms makes hotels one of the few sectors that enjoy pricing flexibility in a broader economic downturn.

To Uncertainty and Beyond in the Travel Industry

In this episode of The So What from BCG, Jason Guggenheim, BCG’s global leader of travel and tourism, explains how companies can sharpen their ability to sense shifts in demand.

Subscribe to read our latest insights on Travel and Tourism.

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

Chapter 7. Travel Services

7.3 Tourism Services

Many organizations can have a hand in tourism development. These include:

- Sector-specific associations

- Tourism and hospitality human resources organizations

- Training providers

- Educational institutions

- Government branches and ministries in land use, planning, development, environmental, transportation, consumer protection, and other related fields

- Economic development and city planning offices

Consultants

The rest of this section describes Canadian and BC-based examples of these.

Sector-Specific Associations

Numerous not-for-profit and arm’s-length organizations drive the growth of specific segments of our industry. Examples of these associations can be found throughout this textbook in the Spotlight On features, and include groups like:

- BC Hotel Association

- Sea Kayak Guides Alliance of BC

- Restaurants Canada

These can serve as regulatory bodies, advocacy agencies, certification providers, and information sources.

Tourism and Hospitality Human Resource Support

Tourism HR Canada — formally the Canadian Tourism Human Resource Council (CTHRC) — is a national sector council responsible for best practice research, training, and other professional development support on behalf of the 174,000 tourism businesses and the 1.75 million people employed in tourism-related occupations across the country. In BC, an organization called go2HR serves to educate employers on attracting, training, and retaining employees, as well as hosts a tourism job board to match prospective employees with job options in tourism around the province.

Training Providers

Throughout this textbook, you’ll see examples of not-for-profit industry associations that provide training and certification for industry professionals. For example, the Association of Canadian Travel Agents offers a full-time and distance program to train for the occupation of certified travel counsellor. Closer to home, an organization called WorldHost, a division of Destination BC, offers world-class customer service training.

You’ll learn more about training providers and tourism human resources development in Chapter 9 .

Educational Institutions

British Columbia is home to a number of high-quality public and private colleges and universities that offer tourism-related educational options. Training options at these colleges and universities include certificates, diplomas, degrees and masters-level programs in adventure tourism, outdoor recreation, hospitality management, and tourism management. For example, whether students are learning how to manage a restaurant at Camosun College, gaining mountain adventure skills at College of the Rockies, or exploring the world of outdoor recreation and tourism management at the University of Northern BC, tomorrow’s workforce is being prepared by skilled instructors with solid industry experience.

Spotlight On: Emerit

Emerit is Canada’s award winning training resource developed by Tourism HR Canada in collaboration with tourism industry professionals from across Canada. For more information on Emerit, visit the go2HR website .

Government Departments

At the time this chapter was written, there were at least eight distinct provincial government ministries that had influence on tourism and hospitality development in British Columbia. These are:

- Tourism, Arts, and Culture

- Advanced Education, Skills, and Training

- Transportation and Infrastructure

- Environment & Climate Change Strategy

- Forests, Lands, Natural Resource Operations & Rural Development

- Indigenous Relations & Reconciliation

- Jobs, Economic Development, & Competitiveness

- Public Safety & Solicitor General

Ministry names and responsibilities may change over time, but the functions performed by provincial ministries are critical to tourism operators and communities, as are the functions of similar departments at the federal level.

At the community level, tourism functions are often performed by planning officers, economic development officers, and chambers of commerce.

A final, hidden layer to the travel services sector is that of independent consultants and consulting firms. These people and companies offer services to the industry in a business-to-business format, and they vary from individuals to small-scale firms to international companies. In BC, tourism-based consulting firms include:

- IntraVISTAS: specializing in aviation and transportation logistics advising

- Chemistry Consulting: specializing in human relations and labour market development

- Beattie Tartan: a public-relations and reputation management firm

For many people trained in specific industry fields, consulting offers the opportunity to give back to the industry while maintaining workload flexibility.

Introduction to Tourism and Hospitality in BC - 2nd Edition Copyright © 2015, 2020, 2021 by Morgan Westcott and Wendy Anderson, Eds is licensed under a Creative Commons Attribution 4.0 International License , except where otherwise noted.

Share This Book

If you build it, they will come: Why infrastructure is crucial to tourism growth and competitiveness

Tourism is expanding globally, but can infrastructure keep up?

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Maksim Soshkin

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} Travel and Tourism is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:, travel and tourism.

With international tourist arrivals reaching 1.4 billion in 2018— two years ahead of initial projections —the travel and tourism industry will continue to drive global connectivity. The World Economic Forum’s 2019 Travel and Tourism Competitiveness Report shows this growth is backed by improving global travel and tourism competitiveness, which stems, in part, from growing aviation capacity, increased international openness, and declining travel costs.

However, the report also shows the need for developing infrastructure, which may not be able to keep up with the additional 400 million arrivals forecasted by 2030 . While infrastructure challenges differ for various regions and levels of economic development, failure to address these challenges may reduce competitiveness, hurting the travel and tourism industry.

Infrastructure—including air, ground, port, and tourism services like hotel rooms and car rental services—plays a vital role in travel and tourism competitiveness, serving as the arteries of the industry. And from a global perspective, infrastructure continues to improve.

Since 2017 , air transport infrastructure is one of the most improved components in the index, with strong growth in scores across most regions, subregions and economic development levels. However, much of this performance has come from growing route capacity and the number of carriers operating. Perceptions of the quality of air transport infrastructure, while better since 2017, have grown more slowly, while most recent airport density figures indicate slightly reduced airport access than before. These results potentially indicate that travel demand and airline growth may eventually outstrip hard-infrastructure capacity. By 2037, the International Air Transport Association projects the number of air passengers could double to 8.2 billion.

The report also shows that global perspectives on the quality and efficiency of ground transport infrastructure and services have remained, on average, near stagnant. Given the projected growth in travel as well as the need for infrastructure to accommodate more tourism-related needs, significant work will be required to bridge multi-trillion dollar investment deficits for airports, ports, rail and roads.

The results could be used to assess the infrastructure readiness of economies by looking at their scores for infrastructure and tourist arrival trends. The figure above compares country subregion and income-level groupings against their growth in international tourist arrivals from 2013 to 2017. It is clear tourism is growing in most subregions and among all income groups, with many above the global rate of growth.

Most of the regions on the right side of the figure above are relatively advanced countries with well-developed infrastructure. As a result, they may have more capacity to handle tourism growth. Moreover, it is also apparent that, despite market maturity, such countries are still welcoming more and more tourists each year. As the figure shows, high-income economies had the largest increase in arrivals, growing faster than the global rate. But while these economies have strong infrastructure, their share of arrivals and growth rates reveals the pressure on their infrastructure.

High-income economies analysed accounted for nearly 65% of arrivals in 2017 and 74.3% of growth in arrivals between 2013 and 2017. Subregions like Southern Europe and Eastern Asia-Pacific have seen rapid growth in arrivals, putting pressure on their more developed infrastructure. Arrivals in Western European countries, which on average, have the best infrastructure in the ranking, might seem to be below the global rate of growth but accounted for nearly one-fifth of global arrivals in 2017, and nearly 14% of the increase globally since 2013.

Northern Europe has experienced some of the fastest growth in arrivals in recent years and had the third-largest improvement in scores for air transport infrastructure since 2017. But its well-developed infrastructure may still come under strain, with this year’s report showing the region’s growth in ground, port and tourist infrastructure was below the global average.

South-East Asia has also experienced strong growth in tourism in recent years, but its near-average infrastructure scores indicate it might lack the capacity to continue accepting tourists. Countries like Vietnam, Indonesia and the Philippines have recently seen a surge in tourism, but, despite improvement in scores, all rank below average for infrastructure.

The regions on the left side of the figure mostly consist of lower-income countries. While these economies do not account for the same volume of arrivals as the more developed regions and countries, they still face capacity issues because their infrastructure is less developed. Nevertheless, due to higher price competitiveness, economic growth and declining travel barriers, many of these countries have also seen some of the biggest percentage increases in arrivals.

Countries in subregions on the upper left-hand quadrant may be at greatest risk of strain due to rapid visitor growth and underdeveloped infrastructure. In particular, this is an issue for South Asia, Western Africa, South America and the Balkans and Eastern Europe. On the other hand, nations on the bottom left-hand quadrant have less tourism growth, though this might be due to their limited infrastructure capacity, among other factors.

How countries deal with their infrastructure will be a crucial factor in their long-term travel and tourism competitiveness. Even nations with developed airports and roads may face strain under growing utilization, which may lead to issues related to quality.

Have you read?

These islands are using tourists to help offset the effects of tourism, why china will soon be the world's top destination for tourists, in the age of the tourism backlash, we need 'destination stewards', tourism is damaging the ocean. here’s what we can do to protect it.

However, it is also important to note competitiveness relies on far more than just infrastructure. Emerging economies also have more work to do when it comes to improving business environments, addressing safety and security concerns and reducing travel barriers. Natural assets, which attract a significant number of visitors internationally, also need to be better protected. For example, South America and South-East Asia outscore the global average for natural resources by about 27% and 11%, respectively, but score below average for environmental sustainability. Consequently, many countries in these subregions may be at risk of damaging the very assets that make great travel destinations.

In some cases, improvements in one area of competitiveness without progress elsewhere can also lead to issues. For instance, Iceland’s improvement in air connectivity and surging visitor volumes was not matched by price competitiveness and overall tourism capacity, potentially explaining its recent slowdown .

Handling all these issues cannot be the purview of only travel and tourism stakeholders. Improving competitiveness, especially as it relates to travel and tourism, requires a holistic, multistakeholder approach.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} Weekly

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Travel and Tourism .chakra .wef-17xejub{-webkit-flex:1;-ms-flex:1;flex:1;justify-self:stretch;-webkit-align-self:stretch;-ms-flex-item-align:stretch;align-self:stretch;} .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

How Japan is attracting digital nomads to shape local economies and innovation

Naoko Tochibayashi and Naoko Kutty

March 28, 2024

Turning tourism into development: Mitigating risks and leveraging heritage assets

Abeer Al Akel and Maimunah Mohd Sharif

February 15, 2024

Buses are key to fuelling Indian women's economic success. Here's why

Priya Singh

February 8, 2024

These are the world’s most powerful passports to have in 2024

Thea de Gallier

January 31, 2024

These are the world’s 9 most powerful passports in 2024

South Korea is launching a special visa for K-pop lovers

- Discovery Platform

- Innovation Scouting

- Startup Scouting

- Technology Scouting

- Tech Supplier Scouting

- Startup Program

- Trend Intelligence

- Business Intelligence

- All Industries

- Industry 4.0

- Manufacturing

- Case Studies

- Research & Development

- Corporate Strategy

- Corporate Innovation

- Open Innovation

- New Business Development

- Product Development

- Agriculture

- Construction

- Sustainability

- All Startups

- Circularity

- All Innovation

- Business Trends

- Emerging Tech

- Innovation Intelligence

- New Companies

- Scouting Trends

- Startup Programs

- Supplier Scouting

- Tech Scouting

- Top AI Tools

- Trend Tracking

- All Reports [PDF]

- Circular Economy

- Engineering

- Oil & Gas

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

Top 9 Travel Trends & Innovations in 2024

How are the latest trends in the travel industry reshaping trip planning and enhancing tourist experiences in 2024? Explore our in-depth industry research on the top 9 travel trends based on our analysis of 3500+ companies worldwide. These trends include AI, immersive tourism, IoT, contactless travel & more!

Technological advancements in the travel industry meet the growing demand for personalized experiences, safety, and sustainability. Post the COVID-19 pandemic, emerging travel trends mark a shift towards contactless travel through digital payments, self-check-ins, and more. Additionally, artificial intelligence (AI), the Internet of Things (IoT), and blockchain are automating various hospitality and travel-related operations.

For instance, smart hotels make use of internet-connected devices to remotely control rooms. Further, businesses offer virtual tours by adopting extended reality (XR) technologies like virtual reality (VR) and augmented reality (AR). Travel companies also leverage data analytics to personalize marketing. At the same time, traveler assisting solutions like chatbots and voice technology aid them in booking accommodation and optimizing journeys. These travel trends improve the overall profitability of the tourism industry and enable it to make operations more sustainable and safe.

This article was published in July 2022 and updated in February 2024.

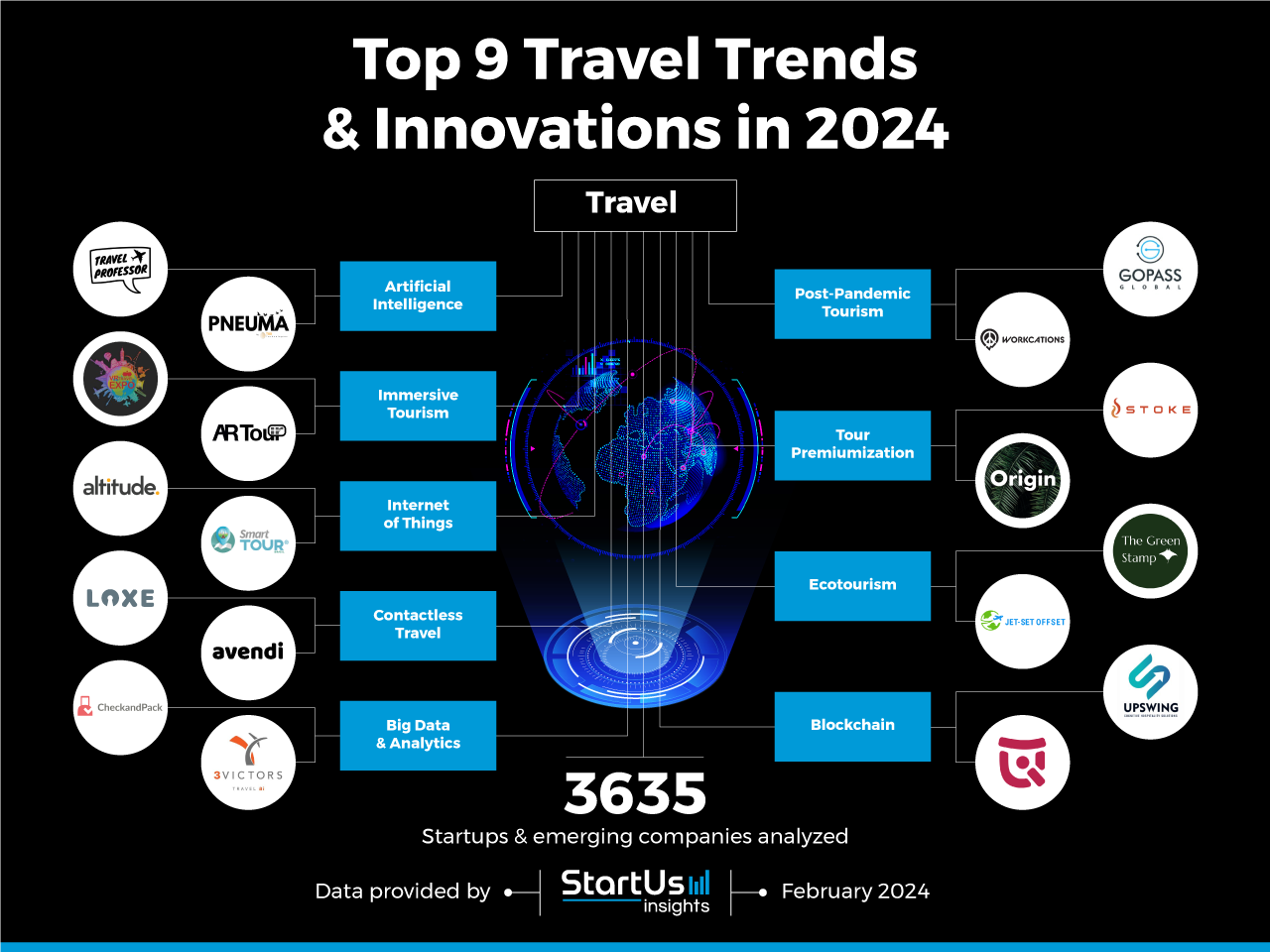

Innovation Map outlines the Top 9 Travel Trends & 18 Promising Startups

For this in-depth research on the Top 9 Trends & Startups, we analyzed a sample of 18 global startups and scaleups. The result of this research is data-driven innovation intelligence that improves strategic decision-making by giving you an overview of emerging technologies & startups in the travel industry. These insights are derived by working with our Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform , covering 2 500 000+ startups & scaleups globally. As the world’s largest resource for data on emerging companies, the SaaS platform enables you to identify relevant startups, emerging technologies & future industry trends quickly & exhaustively.

In the Innovation Map below, you get an overview of the Top 9 Travel Trends & Innovations that impact travel & tourism companies worldwide. Moreover, the Travel Innovation Map reveals 3 500+ hand-picked startups, all working on emerging technologies that advance their field.

Top 9 Travel Trends

- Artificial Intelligence

- Immersive Tourism

- Internet of Things

- Contactless Travel

- Big Data & Analytics

- Post-Pandemic Tourism

- Tour Premiumization

Click to download

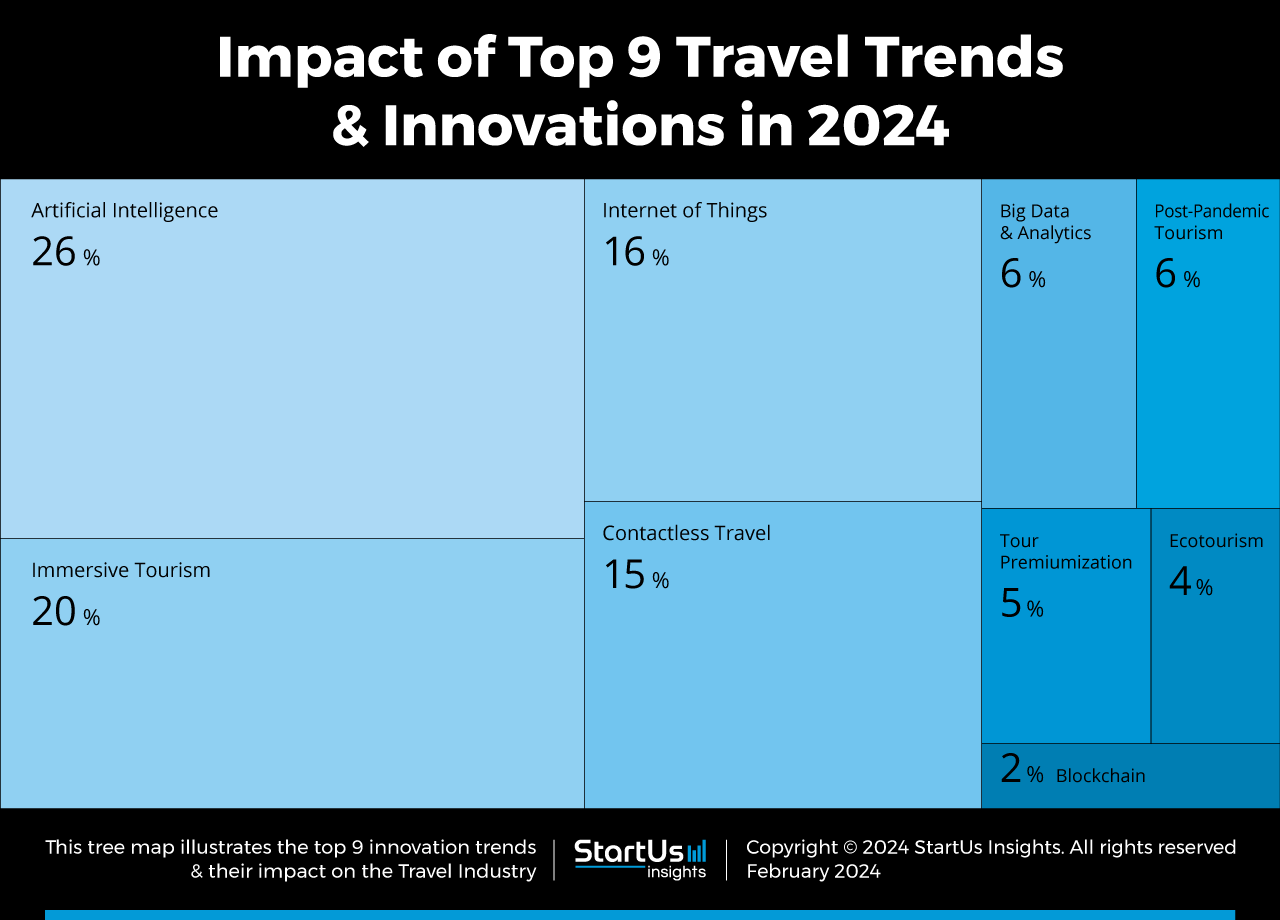

Tree Map reveals the Impact of the Top 9 Travel Trends

Based on the Travel Innovation Map, the Tree Map below illustrates the impact of the Top 9 Travel Industry Trends in 2024. Startups and scaleups are enabling contactless travel using technologies like biometrics, radio-frequency identification (RFID), and near-field communication (NFC). This is due to increasing health and hygiene concerns post the pandemic. The use of AI in tourism ensures hassle-free trip planning while AR and VR allow tourists to virtually visit various locations and excursions. IoT increases visibility into tourism industry operations and allows passengers to track their luggage more efficiently. Further, the demand for personalized and luxurious travel is rising. Several startups enable recreational space travel as well as offer sustainable travel options to passengers.

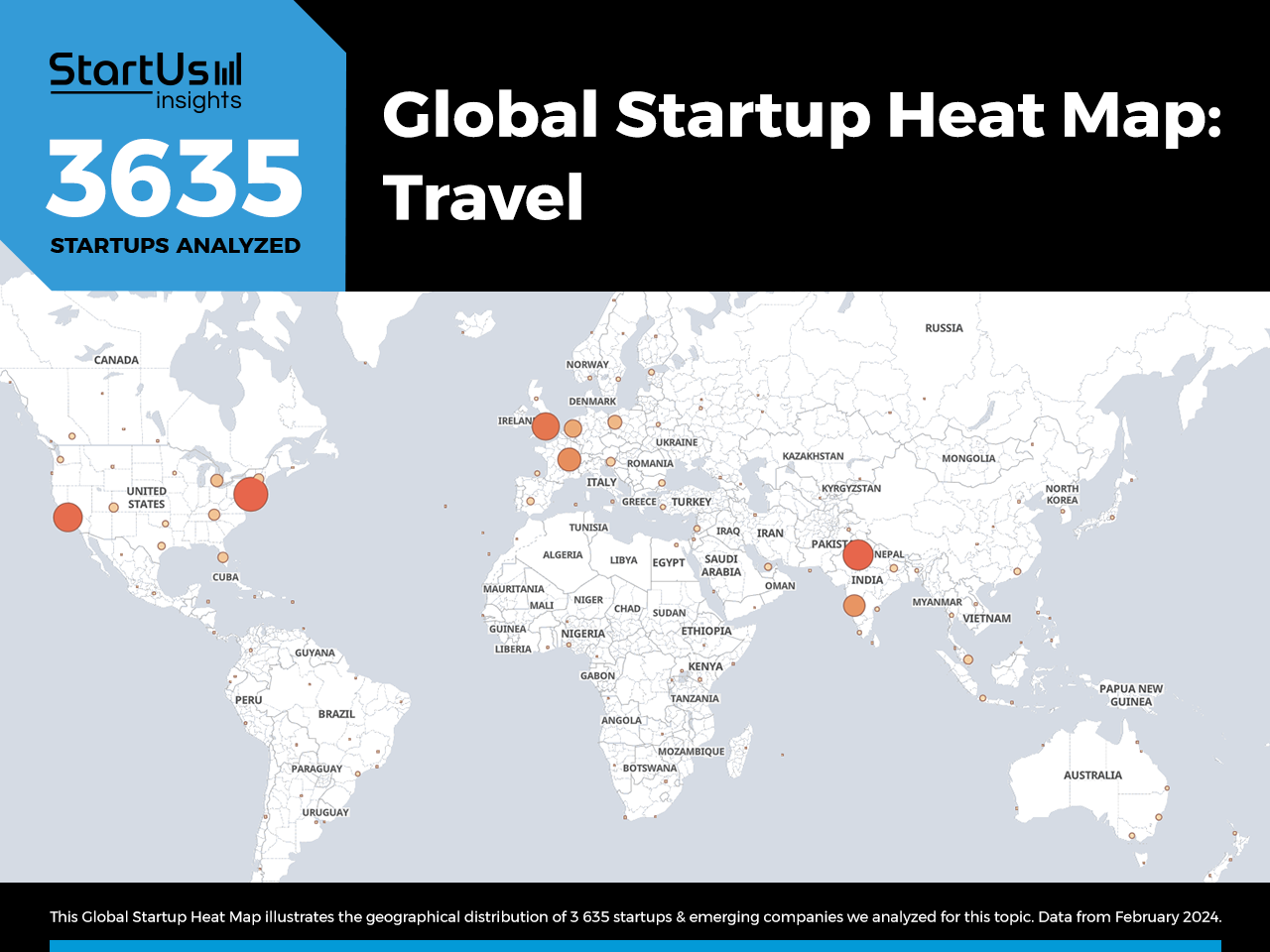

Global Startup Heat Map covers 3 635 Travel Startups & Scaleups

The Global Startup Heat Map below highlights the global distribution of the 3 635 exemplary startups & scaleups that we analyzed for this research. Created through the StartUs Insights Discovery Platform, the Heat Map reveals that the US, Europe, and India see the most activity.

Below, you get to meet 18 out of these 3 635 promising startups & scaleups as well as the solutions they develop. These 18 startups are hand-picked based on criteria such as founding year, location, funding raised, and more. Depending on your specific needs, your top picks might look entirely different.

Interested in exploring all 3500+ travel startups & scaleups?

Top 9 Travel Trends in 2024

1. artificial intelligence.

Hotels employ intelligent chatbots, powered by AI, to provide quick and personalized responses to traveler inquiries. These chatbots simplify the booking process and gather customer reviews, aiding potential travelers in making informed decisions. Moreover, AI-based robots enhance the customer experience by automating hotel disinfection and delivering room service.

At airports, these robots guide travelers and assist with luggage handling. Facial recognition technology, driven by AI, expedites identity verification at airports, enhancing security and offering a swift alternative to traditional methods. Startups are developing AI-powered trip planning solutions, optimizing journeys, and personalizing travel experiences.

Travel Professor develops a Travel Chatbot

UK-based startup Travel Professor offers an AI-enabled chatbot for travelers. The startup’s chat widget software monitors multiple flight deals and notifies users when their preferences match. It also provides travel destination recommendations and flight price alerts. This allows travelers to book economical flights and have a budget-friendly tourism experience.

Pneuma Travel facilitates Travel Planning

US startup Pneuma Travel develops a voice-assisted digital agent, Sarah , to streamline the process of travel planning. This assistant, powered by AI, excels in arranging flight and accommodation bookings and assists travelers in discovering a variety of activities. Sarah , available round the clock, provides continuous support for all travel-related inquiries.

Moreover, Sarah customizes travel options according to individual preferences and budgetary constraints. The agent further enhances the travel experience by providing insights into local attractions in unfamiliar cities. Importantly, Sarah enables real-time modifications to travel plans, in compliance with specific airline policies, thereby minimizing waiting times for users.

2. Immersive Tourism

Immersive tourism caters to the growing demand for meaningful experiences among travelers, leveraging AR, VR, and mixed reality (MR). VR simulates original locations through a computer-generated environment, allowing tourists to virtually explore destinations. It provides travelers with a comprehensive 360-degree tour of points of interest.

AR enhances the travel experience with interactive elements such as navigation maps and ads. Travel companies employ AR and VR-based gamification to heighten tourist attractions. Moreover, these technologies enable hotels and resorts to present amenities and rooms in an engaging, interactive manner.

VR Travel Expo offers VR-based Travel Plans

US startup VR Travel Expo develops a VR travel application to transform the way people research and book travel. The application enables users to plan their vacations more efficiently. It provides an engaging platform for users to explore and expand their knowledge of the world. Moreover, it employs 3D geospatial technology that creates real-time digital twins of the world. This further enhances the travel planning experience.

AR Tour makes AR Glasses

Italian startup AR Tour offers AR-powered tours. The startup’s AR glasses superimpose reconstructed images of archaeological ruins to show how the site originally was. Its tour informs the tourists about the site’s history and significance via an audio-visual package. Moreover, the startup designs lightweight AR glasses to prevent motion sickness among tourists, improving convenience.

3. Internet of Things

IoT generates ample data that tourism companies leverage to personalize services in their subsequent visits. Hotels use IoT sensors to enable smart rooms that automate room lighting, temperature, and ambiance control, enhancing guest comfort. These sensors adjust appliances in vacant rooms, conserving energy and reducing the building’s carbon footprint.

Startups harness IoT to deliver location-specific information to customers, including real-time luggage tracking via IoT tags, minimizing lost items. Airlines also incorporate IoT-based solutions into seats, monitoring passenger temperature and heart rate for proactive health management.

Altitude enables Smart Hotels

New Zealand-based startup Altitude creates an IoT-based hotel software and hardware to develop smart hotels. The startup makes self-service kiosks to automate reservations, room up-gradation, payments, as well as check-in and check-out. Its hotel management platform further enables contactless engagement with guests. Additionally, Altitude’s mobile keys allow guests to open doors using mobile phones, providing convenience and saving time for travelers.

Smart Tour provides Smart Itineraries

Brazilian startup Smart Tour offers smart itineraries using IoT and quick response (QR) codes. The startup recommends travel routes and destinations based on the user’s preference in real-time. This facilitates a seamless experience for travelers. Besides, the user-generated data enables tourism managers to better understand consumer behavior and indulge in proximity marketing. The startup also offers a contact tracing solution to monitor COVID-19 infected travelers and ensure public safety.

4. Contactless Travel

Travelers benefit from contactless recognition technologies like retina scanning, which replace traditional travel documents, speeding up passenger identification and reducing airport queues. QR codes offered by travel companies allow tourists to access relevant information on their mobile devices, enhancing engagement.

Hotels have introduced contactless self-check-ins, enabling visitors to arrange services before arrival. Additionally, contactless payment modes are available in hotels and restaurants for swift and secure transactions. Moreover, wearable devices are transforming the travel experience by providing real-time notifications and touch-free access to services and information.

Loxe designs Smart Hotel Keys

US-based startup Loxe makes smart mobile keys for hotels. The startup’s smartphone app replaces key cards with contactless mobile keys that allow users to unlock doors using smartphones. It also reduces operational costs incurred in the manufacturing of conventional keys or plastic cards. Moreover, the startup designs a Bluetooth retrofit module that converts normal door locks into mobile-ready door locks. This allows hotel owners to easily convert their existing locks into smart ones without additional expenses while improving guest safety and convenience.

Avendi provides Contactless Payment

Singaporean startup Avendi offers contactless and cashless payments for travelers. The startup allows tourists to accumulate expenses throughout their trip and pay at the end of the journey. Avendi’s app utilizes QR codes to add all the billed expenses and shown through its dashboard. The user settles the tab amount in the preferred currency, preventing the inconvenience of cash withdrawal or credit card payments.

5. Big Data & Analytics

Big data empowers travel companies with customer trends for strategic marketing. Analyzing traveler behavior, they offer tailored recommendations for hotel bookings, cab hires, flight reservations, and ticket purchases.

Predicting future demand is another advantage of big data and analytics, helping hotels and airlines identify peak periods to optimize revenue. Advanced analysis of transactional data aids in detecting cyber fraud, and safeguarding sensitive customer information such as credit card details and biometric data.

CheckandPack creates a Travel Platform

Dutch startup CheckandPack offers a big data travel platform. It runs marketing campaigns to gather traveler data and understand tourism trends. Based on these insights, the platform enables businesses to approach travelers with a customized appeal. It also provides travelers with holiday planning.

3Victors provides Travel Data Analytics

US-based startup 3Victors offers travel data analytics. The startup’s product, PriceEye Suite , proactively monitors the prices of numerous airlines to provide insights into competitor prices. It creates a dashboard to display travelers’ location of interest, allowing travel airlines to better manage their revenue and pricing strategy.

6. Post-Pandemic Tourism

Post-pandemic tourism focuses on safe, sustainable, and flexible travel options, responding to evolving traveler preferences and health guidelines. Enhanced health and safety protocols, including regular sanitization and contactless services, become standard in airlines and hotels, ensuring traveler confidence.

Destinations and operators emphasize outdoor and less crowded experiences, catering to a heightened demand for nature-based and wellness travel. Flexible booking policies and trip insurance gain prominence, offering peace of mind amid uncertainties. Sustainable travel gains traction, with tourists and businesses prioritizing environmental impact and community well-being.

GOPASS Global enables Pre-travel Risk Management

Singaporean startup GOPASS Global provides a travel risk analytics platform against COVID-19. It analyzes the biosecurity risk elements involved in a trip, such as border restrictions, quarantine requirements, airport type, and airline transit points or seating in real-time. This allows travelers to assess risk factors and plan their trips accordingly.

Moreover, the startup creates world maps displaying information regarding COVID-prone areas, testing areas, and vaccine coverage. This provides travelers with a preview of the current situation, allowing them to ensure safety during business and leisure travel.

Workcations enables Work from Anywhere

Indian startup Workcations provides properties at tourist destinations for remote-working individuals. It offers amenities like internet connectivity, food, and a quiet ambiance, allowing tourists to work in a peaceful environment without hindrance. This increases employee productivity, motivation, and retention.

7. Tour Premiumization

Hyper-personalization in travel experiences is on the rise, with tourists eager to immerse themselves in diverse cultures. Luxury travelers enjoy tailored experiences and intuitive services through tour premiumization. Health and wellness packages offered by travel startups help tourists unwind.

These retreats enhance health and offer detoxifying food options. Space tourism is another exciting development, offering leisure or research trips to space. Lastly, travel startups are fostering customer loyalty and building strong relationships through membership or subscription models.

STOKE provides Space Tour

US-based startup STOKE facilitates space travel using everyday-operable rockets. The startup’s rockets are reusable and deliver satellites to any desired orbit. This enables on-demand access to space, paving way for space tours for exploration, recreation, and research. The startup also emphasizes the economical and rapid development of its hardware for feasible spacecraft launches, advancing space tourism.

Origin offers Travel Personalization

Dutch startup Origin provides premium travel personalization to tourists. The startup utilizes machine learning and travel curators to plan creative vacations. It also arranges flights and accommodation for travelers. Further, the startup measures the carbon output of itineraries and offers sustainable tourism options.

8. Ecotourism

Traveling responsibly minimizes tourism’s environmental impact and supports local communities’ well-being. Ecotourists strive to reduce their carbon footprint during their journeys. Startups contribute by developing sustainable transport, ecolodges, and solar-powered resorts.

Airline passengers have the option to offset carbon emissions during flight bookings. Local tourism stimulates small businesses economically and creates job opportunities. It also emphasizes minimum littering, which lowers pollution and the time spent on cleanups.

Jet-Set Offset simplifies Flight Carbon Offset

US-based startup Jet-Set Offset creates a carbon-offsetting platform for air travel. The startup partners with non-profit organizations working against climate change and connects them with travelers. Each time travelers book flight tickets via the startup’s platform, Jet-Set Offset contributes a certain amount per mile for their journey to environmental organizations. This way, the passenger’s journey promotes mileage-based donations to offset carbon emissions.

The Green Stamp facilitates Ethical Wildlife Tour

Dutch startup The Green Stamp provides a platform to book ethical wildlife tours. It curates tours based on the tourists’ inclinations toward certain locations or wildlife. Exploration of these projects allows travelers to indirectly contribute to their cause as these wildlife projects donate to the welfare of local communities and the environment.

9. Blockchain

Blockchain provides the travel industry with operational transparency and security. Traceable payments, particularly for international travel, are a key application, that fosters trust among parties involved in transactions.

Automation and enforcement of agreements in travel insurance and supplier contracts are achieved through smart contracts. This strengthens reliability and cuts administrative costs. Travel firms establish customer loyalty programs where points are exchanged for cryptocurrency. Lastly, blockchain increases data storage security, reducing the risk of information leaks.

Upswing facilitates Guest Profiling

Indian startup Upswing creates AURA , a blockchain-powered platform for guest profiling. It provides a holistic view of guests, their preferences, and purchase patterns. The platform associates a score with each guest and suggests improvements in their service. This facilitates hotels to provide a personalized experience to their guests and, in turn, increase sales.

UIQ Travel develops a Solo Traveling App

US-based startup UIQ Travel develops a blockchain-based app to connect solo travelers. It discovers people with shared interests and suggests tours or attractions. Such hyper-personalized recommendations assist in experience discovery and also increase traveler engagement.

Discover all Travel Trends, Technologies & Startups

Tourism, although severely impacted by the pandemic, now continues to rapidly grow across the globe. Post-pandemic trends indicate an increasing emphasis on hygiene and safety during travel. The industry is witnessing the widespread adoption of disruptive technologies like AI, XR, IoT, and blockchain. The travel industry utilizes big data to understand traveler trends for targeted marketing. The transition to ecotourism is accelerating as businesses integrate zero-emission transit and carbon offset programs to reduce their carbon footprint.

The Travel Trends & Startups outlined in this report only scratch the surface of trends that we identified during our data-driven innovation and startup scouting process. Among others, personalization, decarbonization, and travel safety will transform the sector as we know it today. Identifying new opportunities and emerging technologies to implement into your business goes a long way in gaining a competitive advantage. Get in touch to easily and exhaustively scout startups, technologies & trends that matter to you!

Your Name Business Email Company

Get our free newsletter on technology and startups.

Protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Discover our Free Travel Report

Book a call today!

Mobility 22 pages report

Railway 22 pages report, cleantech 19 pages report.

Leverage our unparalleled data advantage to quickly and easily find hidden gems among 4.7M+ startups, scaleups. Access the world's most comprehensive innovation intelligence and stay ahead with AI-powered precision.

Get started

Your Name Business Email Company How can we support you? (optional)

Business Email

Protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Agoda to Promote Tourism in Goa Under New Deal – India Report

Bulbul Dhawan , Skift

April 8th, 2024 at 11:00 PM EDT

Goa is seeking to reinvent itself as a year-round destination. Its partnership first with MakeMyTrip and now Agoda is a step towards being known for more than just its beaches.

Bulbul Dhawan

The Skift India Newsletter is your go-to platform for all news related to travel, tourism, airlines, and hospitality in India.

Online travel platform Agoda has signed an agreement with Goa Tourism to promote the coastal state. The collaboration aims to highlight various experiences that the state can offer to different travelers.

As part of the partnership, Agoda will be creating custom pages and travel guides that would highlight Goa and its hidden gems. It will also be using its social media platforms for the promotion of the destination.

Goa beyond beaches: In February this year, the government of Goa partnered with online travel agency MakeMyTrip . As part of the agreement, MakeMyTrip will focus on the inland offerings of the state, promoting it as a year-round destination.

Goa has been focusing on promoting itself beyond its beaches as part of its regenerative tourism initiative and ‘Goa Beyond Beaches’ vision.

Ooty Most-Searched Leisure Destination for Domestic Summer Travel

Travel insights by online booking platform Booking.com has revealed that Ooty is the most-searched domestic leisure destination this year among Indian travelers. Booking.com Travel Predictions 2024 have revealed that 57% of the Indian travelers are looking to undertake long domestic trips between April 15 and July 15 this year.

Dubai continues to be the most-favored international destination for summer, followed by Singapore, London, Paris, and Bangkok.

Santosh Kumar, country manager for India, Sri Lanka, Maldives and Indonesia at Booking.com said that there has been a significant change in the way Indians are approaching summer travel in recent years. “While Indians are exploring both domestic and overseas destinations, we are seeing travelers gravitating towards culturally significant or leisure-oriented destinations with a growing desire for immersive experiences,” he added.

IndiGo Announces Three Routes in Kerala, Lakshadweep

Budget airline IndiGo has announced three new routes that are set to be operational from May this year. The new routes will connect Kozhikode with Kochi in Kerala; Kochi in Kerala with Agatti in the Lakshadweep archipelago; and Kozhikode with Agatti via Kochi, the airline has said.

Agatti is the latest destination to be added in IndiGo’s network, after the carrier began operating daily flights there from Bengaluru on March 31 . Vinay Malhotra, head of global sales, IndiGo, said that these new flights would contribute to travel, tourism, and trade in the region.

The airline’s move is in line with the government of India’s push to tourism in Lakshadweep recently.

Jayaraj Shanmugam Appointed Head of Global Airport Operations at Air India

Air India has appointed Jayaraj Shanmugam as its head of global airport operations, and the appointment is set to come into effect on April 15. Shanmugam is set to join the carrier from Bangalore International Airport Limited (BIAL), where he is the Chief Operating Officer.

He has previously worked with airlines such as Singapore Airlines, Qatar Airways, and Jet Airways. At Air India, he will oversee the airline’s airport operations worldwide and ensure coordination and efficiency to make the passenger journey smooth.

RCI Launches First-Ever Cruise Exchange Program in India

Timeshare exchange company RCI has launched its first-ever cruise exchange program in India on the occasion of its 50th anniversary. The program will allow members to use their timeshare ownerships in order to access discounted rates on cruise bookings worldwide.

As part of the program, active members of RCI would be able to book from a range of cruise options, including different destinations, cruise lengths, and cabin categories, RCI said in a statement.

Air India Express Launches Bag Track and Protect Services

Air India Express has launched ‘Bag Track and Protect’ services that would let passengers track their baggage. The services have been launched in partnership with Blue Ribbon Bag and would need to be pre-booked by passengers as add-ons.

This service would also facilitate expedited return of delayed baggage and allow passengers to get compensation in case of delayed baggage not being delivered within 96 hours of landing at the destination.

Skift India Report

The Skift India Report is your go-to newsletter for all news related to travel, tourism, airlines, and hospitality in India.

Have a confidential tip for Skift? Get in touch

Tags: agoda , air india , Air India Express , airlines , aviation , aviation industry , aviation news , booking.com , cruise , domestic leisure travel , dubai , goa tourism , hotels , india , india outbound , india travel , indian airlines , indigo , indigo airlines , Leisure , leisure travel , leisure travelers , makemytrip , online , online booking , online travel , online travel agencies , online travel companies , skift india report , tourism , Travel Trends

Photo credit: Goa has been a popular Indian destination for a long time, known mostly for its beaches. Incredible India website

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

Popular destination for British holiday makers 'collapsing socially and environmentally'

The sunny getaway spot sees huge numbers of tourists every year - but locals say it is too much and warned they are 'living in their cars and even in caves'.

Tuesday 9 April 2024 13:30, UK

A popular sunny British holiday destination is "collapsing socially and environmentally" due to the huge numbers of tourists, residents say.

Locals on the Canary Islands are "living in their cars or even in caves" due to soaring housing prices. Now they are gearing up to protest.

The group of Spanish islands, located off the coast of Africa , are hugely popular with Britons, with nearly five million jetting out last year.

But now local groups are mobilising and protests are planned for 20 April.

Organisers claim one of the islands "is collapsing socially and environmentally" because it cannot cope with the numbers of tourists.

A recent report from environmental group Ecologists in Action warned of "unsustainable tourism" to the Canary Islands.

Despite the new tourism records being set year after year, generating millions of euros for the industry, almost 34% of the local population, nearly 800,000 people, are at risk of poverty or social exclusion, the report said.

More on Canary Islands

Tourist dies after falling into sea in Tenerife - as footage shows extreme waves battering coast

British baby dies and family members injured in Lanzarote crash

Spain says more than 1,000 migrants reach Canary Islands in three days after record crossings in 2023