Quick Quote

- Airline Travel Insurance Review

- Country Travel Health Insurance

- Country Traveler Information

- Cruise Company Insurance Review

- Insurance Carrier Review

- Travel Company Insurance Review

- City Guides

Royal Caribbean Travel Insurance - 2024 Review

Royal caribbean travel insurance - review.

- Strong Insurance Partner

- Available at Check-Out

- Weak Medical Cover

- Weak Evacuation Cover

- No Pre-Existing Medical Waiver

Sharing is caring!

Despite what the name would imply, Royal Caribbean doesn’t only sail in the Caribbean. This premiere cruise line will take you across the seas to dream destinations from Alaska to the Amalfi Coast. With so many places to explore far from home, Royal Caribbean understands the importance of travel insurance. That is why they offer their own travel insurance package whenever a customer books a cruise with Royal Caribbean.

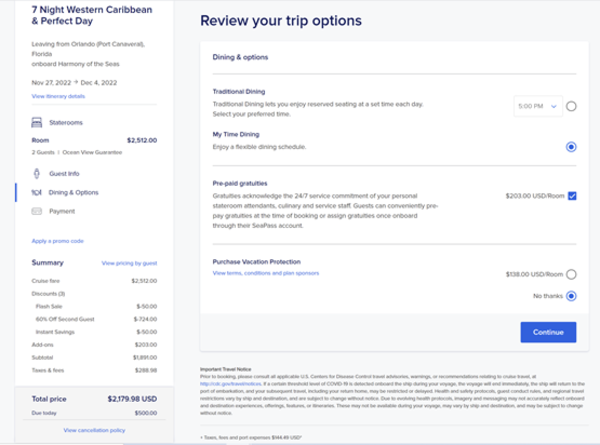

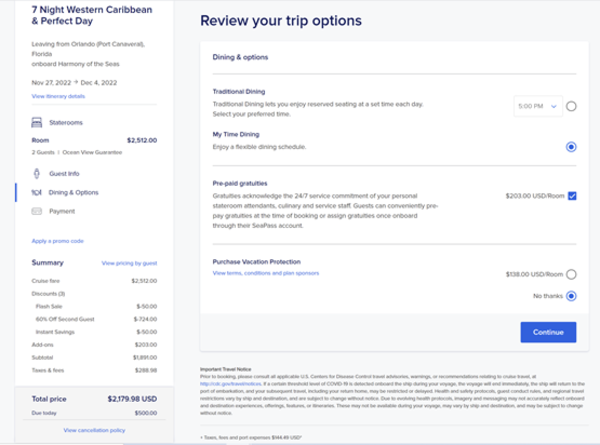

Sample Cruise Itinerary

For comparison purposes, we chose the example of a Royal Caribbean 7-Night Western Caribbean & Perfect Day cruise that begins and ends in Orlando, Florida. Cruise dates chosen were 11/27/2022 – 12/4/2022. Travelers are two adults aged 59. The cruise price is $2,179.98.

As airfare is purchased separately and pricing can greatly vary, this review includes only the cost of the cruise, instead of total trip cost including airfare.

Royal Caribbean only offers one comprehensive policy, and it’s a simple “check yes or no” situation as you’re selecting your additional options on their website before checking out.

Our $2,179.98 cruise has an insurance cost of $138 if bought through Royal Caribbean. The plan offered is called the Royal Caribbean Travel Protection Program, and it provides the following coverage:

- $25k Emergency Travel Medical Insurance

- $50k Emergency Medical Evacuation Insurance

- 90% refund of cruise credits if you Cancel for Any Reason

In our opinion, this medical coverage is generally not enough for someone who is travelling internationally. To understand it another way, this would be like insuring your car to the state minimum required limits. It’s enough to get you on the road, but will it be enough if you need to use it? In our experience, it is not.

Moreover, we have an issue with the Cancel For Any Reason benefit that is offered. We feel that if you cancel, you should get your money back. What if you decide you don’t want to cruise after all? To us, a refund of cruise credit is not a true refund. We recommend a policy that gives you cash back — a true refund — if you cancel your trip.

Comparison Quotes

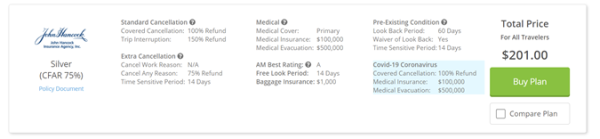

Based on our sample couple, ages 59 and 59, we created comparison quotes using Cruise Insurance 101’s travel insurance marketplace engine. The trip cost used for the comparison is the cruise cost for both travelers of $2179.

When traveling outside the United States, we recommend a minimum coverage of $100,000 in Medical Insurance, $250,000 in Medical Evacuation, and a Pre-existing Medical Condition Waiver. We used these criteria to choose the selected quotes. Since the Royal Caribbean Travel Protection Program includes their Cancel For Any Reason benefit as standard, we compared their policy to our Cancel For Any Reason (CFAR) plans.

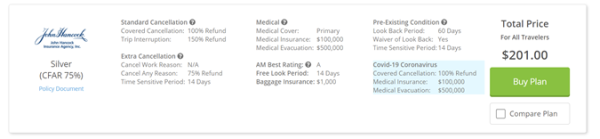

The least expensive Cancel For Any Reason plan with adequate coverage on our quote from Cruise Insurance 101 is the John Hancock Silver (CFAR 75%).

Next, we broke down the benefits of each policy in a side-by-side comparison.

Cost Comparison

Overall, the Royal Caribbean Travel Protection Program has minimal coverage. Their CFAR benefit only provides a cruise credit valid for one year.

By shopping for cruise insurance through Cruise Insurance 101 our two travelers can have 4 times the Medical Insurance, double their Emergency Medical Evacuation insurance, and receive actual cash back if they choose to cancel for a reason not specified in the policy. We feel it’s important for travelers to know that a policy with more appropriate coverage limits is available for only $31.50 more per person.

In the following sections, we discuss know what to look for when shopping for travel insurance for your Royal Caribbean cruise.

Trip Cancellation

A significant concern for travelers is Trip Cancellation . If you became ill or had an accidental injury prior to your departure date, you may have to cancel your travel arrangements, resulting in financial losses. While disappointing, Trip Cancellation is doubly painful without cancellation insurance.

Royal Caribbean Travel Protection Program permits cancellation for the following reasons:

- Unexpected injury, illness, or death of traveler or family member.

- Involvement of a traffic accident that causes you to miss your cruise

- Residence uninhabitable by natural disaster, fire, flood, burglary

- Revocation of military leave

- Subpoena or being called to serve jury duty

Unfortunately, Royal Caribbean’s list of cancellation reasons lacks some important coverages.

We recommend policies that also include:

- Default or bankruptcy of the common carrier or travel supplier

- Cancel For Work Reason (traveler required to work during the trip)

- Employer-initiated transfer of 250 miles or more

- Destination uninhabitable or unreachable by fire, flood or natural disaster

- Mechanical breakdown of a common carrier

- Mandatory evacuation

- Inclement weather

- Documented theft of passports or visas.

The Royal Caribbean Travel Protection Program also does not cover any travel arrangements booked outside Royal Caribbean.

The John Hancock Silver (CFAR 75%) policy can cover all travel arrangements, regardless of where you booked them. In addition, this plan offers a broad list of covered reasons, including cancelling due to contracting COVID.

Trip Interruption

A Trip Interruption is a situation during your trip that causes you to miss some or the rest of your vacation. It’s like Trip Cancellation but happens during your travels.

The most common trip interruption is the injury or illness of a traveler. If you had an injury or illness on your vacation but can continue traveling after treatment, trip interruption reimburses the unused portion of the trip, and the cost to rejoin the trip in progress.

Trip interruption also includes a family member who had a sudden grave illness or passed away. If your covered situation requires curtailing the trip and going home early, Trip Interruption also reimburses for the unused portion of the trip, plus the added cost of going home early.

In the Royal Caribbean Travel Protection Program, Trip Interruption benefits share the same short list of covered reasons as Trip Cancellation.

Cancel For Any Reason

Cancel For Any Reason cruise insurance provides the highest level of flexibility and reimbursement if you must cancel your trip for any reason not covered by the policy.

If you cancel your Royal Caribbean cruise for a reason not listed in their travel policy, they grant future credits for 90% of the prepaid, non-refundable cancellation fees paid to them. Credits expire after one year, are non-transferrable and not redeemable for cash. Royal Caribbean, not their insurance policy, provides this part of the Travel Protection Program. When it comes to refunds, we always prefer cash since future credits may not be used.

Alternatively, travel insurance policies like John Hancock Silver (CFAR 75%) pay a 75% cash refund of all prepaid, non-refundable trip costs including arrangements made outside of Royal Caribbean. This could include flights, hotels, rental cars, excursions and transfers.

Cancel For Any Reason policies have several stipulations:

- Purchase the policy within 10 - 21 days (depending on policy), of your initial payment or deposit date and

- Insure 100% of the prepaid trip costs subject to cancellation penalties or restrictions. For additional prepaid non-refundable payments made after the purchase of the policy, insure within 10-21 days (depending on policy), of each subsequent payment added to your trip, and

- Cancel your trip 2 days or more before your scheduled departure date.

Medical Insurance for Emergency Treatment

One of the most important factors in selecting trip insurance is having adequate Medical Insurance when you travel. Anything can happen, including accidental injuries or sudden illness.

If you have a medical emergency when traveling and don’t have proper medical insurance coverage while overseas, you could find yourself with huge, unexpected hospital bills. Many Americans mistakenly believe countries with universal health care will treat them for free. Unfortunately, this is not the case.

Instead, Americans receive treatment at private hospitals, not public, and must pay like anyone else. Admission for inpatient care can cost $3,000-$4,000 per day, plus the cost of treatment, x-rays, surgeries, and specialists.

A common misconception is that Medicare will pay for hospitalization overseas. Unfortunately, they won’t. Medicare does not pay providers outside the US. Some Medicare supplements do cover overseas, but have lifetime limits or reduced benefits, and pay for emergencies only. They can still require you to pay 20% of the costs. As a result, you could go on vacation and end up with medical bills in the thousands.

Cruise Insurance 101 urges overseas travelers to take travel medical insurance of at least $100,000 per person. In a medical emergency, $100,000 provides ample health care and helps protect your retirement savings from unexpected financial burdens.

Royal Caribbean provides a $25,000 benefit for Medical Insurance. John Hancock’s Silver (CFAR 75%) policy includes $100,000 per person of Medical Insurance, so you can receive proper treatment without ending up in debt.

Emergency Medical Evacuation

Medical Insurance isn’t the only potentially expensive part of a trip. Emergency Medical Evacuation transports you from the place of injury or illness to the closest hospital. Once you’re stable enough for transport, Medical Evacuation brings you home via commercial flight or, if necessary, private medical jet.

Medical flights can cost up to $25,000 per hour and regular health insurance does not cover it. In addition, the US State Department does not offer any medical treatment or evacuation assistance for US citizens. Cruise Insurance 101 advises travelers to get at least $250,000 Medical Evacuation to assure there’s enough coverage to get them back home from almost anywhere if they experience a serious medical event. However, if traveling to Asia or Africa or beyond, we recommend a minimum of $500,000 for Emergency Medical Evacuation due to the distance from the US.

The Royal Caribbean Travel Protection Program includes Medical Evacuation up to $50,000 per person.The John Hancock Silver (CFAR 75%) offers $500,000 per person for Medical Evacuation, so you can feel secure knowing you have adequate coverage to transport you back home if needed.

Pre-existing Medical Conditions

A significant concern for senior travelers can be pre-existing medical conditions. A Pre-Existing Medical Condition is one in which you’ve received medical treatment, testing, medication changes, added new medications, or received a recommendation for a treatment or test that hasn’t happened yet. Most travel insurance policies exclude pre-existing conditions unless you purchase the policy within the required time period from your initial trip deposit date (called the Time Sensitive Period). Otherwise, the insurer will look backward 60, 90, or 180 days (depending on the policy) from the date you purchased the insurance to see if there are any pre-existing medical conditions they won’t cover. This is called the Look Back Period. Any medical conditions older than this Look Back Period, unchanged or stabilized with no medication dosage changes are covered, as are any new conditions that arise after you purchase the policy.

If you must cancel, interrupt, or seek medical treatment for a medical condition while traveling, travel insurance policies typically exclude claims related to Pre-existing Medical Conditions. However, if you purchase the policy within a few days of your Initial Trip Payment or Deposit date, many policies add a Waiver to the policy that covers Pre-existing Conditions. As a result, there is no Look Back Period and Pre-existing Conditions are covered.

The Royal Caribbean Travel Protection Program does not cover Pre-Existing Conditions inside the Look Back Period of 60 days.

The John Hancock Silver (CFAR 75%) covers Pre-existing Medical Conditions if you purchase within the 14-day Time Sensitive Period.

Price and Value

The Royal Caribbean Travel Protection Program offers minimal coverage for a relatively similar price as other available options. The medical insurance coverage is only $25,000, and only $50,000 medical evacuation, which may not be adequate for a serious illness or injury. It does not offer a Pre-Existing Condition Exclusion Waiver. Cancellation reasons are limited, and the Cancel For Any Reason option only grants future cruise credits that expire after a year. Overall, the Royal Caribbean Travel Protection Program offers limited value for the price.

In contrast, by comparison shopping, we found the John Hancock Silver (CFAR 75%) policy comes in at $201 (only $63 more than the Royal Caribbean plan!) It includes superior medical and evacuation benefits, a pre-existing medical condition waiver if purchased within a Time Sensitive Period of 14 days from the deposit date, and a robust list of cancellation reasons. Plus, it includes a Cancel For Any Reason provision that refunds 75% of trip costs back in cash, rather than future credit. It has superior coverage over Royal Caribbean’s policy at minimal additional cost.

Royal Caribbean Travel Protection Program cruise insurance provides travelers with a minimal insurance policy and could leave travelers unpleasantly surprised during an emergency. Medical coverage and medical evacuation limits are low, and there are a limited number of covered cancellation and interruption reasons. Overall, we rate it a 7 out of 10.

Travelers planning a Royal Caribbean cruise vacation will find the best value for their money and peace of mind when they shop for travel insurance at Cruise Insurance 101 Travel Insurance Marketplace. There, you can review dozens of options and select the best policy to fit your needs.

To help you find the best policy, Cruise Insurance 101 recommends having at least $100,000 in travel medical coverage and $250,000 emergency medical evacuation when traveling outside the US. And, if you purchase the policy within the 14-21 days of initial trip payment, please consider a travel insurance policy with the pre-existing condition waiver included to ensure the most coverage for your money.

If you are planning a Royal Caribbean cruise in 2022, be sure to pack insurance before you travel. You never know when you may need it.

Have questions? Chat with us online, send us an email at [email protected] or alternatively call us at +1(786) 751-2984 . We would love to hear from you.

Safe Travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Helpful and knowledgeable customer service

I was not able to narrow down the specifics of my travel insurance needs just utilizing the website; but with the help of a customer service agent I was very satisfied and completed my purchase for my trip.

Purchase was easy

Amanda and Denise were both helpful to explain in detail the options and the cost. The purchase was simple and easy.

On line chat and telephone contact was great

Both Nicole (on line chat) and Felicia (telephone agent) answered all my questions and there was no pressure, or even a hint of it, to purchase right now.

- Privacy Policy

Sea France Holidays Best French Holiday Destinations Honest Guide

- The Best Private Student Loans for Community College Students

- Best Health Insurance for International Students in the USA

- The Best 2-Year Nursing Programs in the USA for International Students

- Sallie Mae International Student Loans – Everything You Need to Know

- Student Loans for International Students in the USA Without a Cosigner

- Vermont Student Loan Forgiveness Programs: A Complete Guide

- Halal Islamic Student Loans – Everything You Need to Know

- Top 5 French Porcelain Brands: History, Luxury, and Elegance

- French Consulate New Orleans – Services, Contact Info, and More

- Atlanta to Paris Flight Time – What to Expect

Comprehensive Royal Caribbean Travel Protection: Cost, Coverage, and Benefits – Ensure Peace of Mind for Your RCCL Vacation

Travel Insurance

- Stumbleupon

Picture this: you’re planning your dream vacation aboard a Royal Caribbean cruise. You’ve picked out your itinerary, your excursions, and what activities you want to do onboard. But there’s one thing left to consider: what happens if your plans fall through? No one likes the idea of cancelling a trip, but unforeseen circumstances can arise. That’s where Royal Caribbean’s Travel Protection program comes in. In this blog post, we’ll explore what the program entails, the cost, and whether it’s worth it for your peace of mind and financial security. So, let’s dive into the details of Royal Caribbean’s protection plans and how they can benefit you.

Table of Contents

1. Royal Caribbean Travel Protection Cost

Royal Caribbean Travel Protection Cost: Honest Reviews

When planning a vacation, buying travel insurance can be a smart choice that provides peace of mind. The Royal Caribbean Travel Protection Program offers coverage for trip cancellation, interruption, emergency medical and dental expenses, baggage loss or delay, and more. But is it worth the cost?

The price of the Royal Caribbean Travel Protection Plan varies depending on the total cost of your cruise and the level of coverage you choose. For example, a cruise that costs $1,500 per person can have a travel protection plan that costs $119 per person for standard coverage, or $199 per person for the higher “Cancel for Any Reason” option.

The cost of the Royal Caribbean Travel Protection Plan may seem steep, but it can be worth it if you consider the potential financial losses. If you have to cancel your trip due to a covered reason, such as illness or injury, the travel protection plan can reimburse you for the non-refundable expenses you’ve already paid for, such as airfare and hotel stays.

One downside of the Royal Caribbean Travel Protection Plan is that it doesn’t cover pre-existing medical conditions unless you purchase the plan within a certain number of days after your initial deposit. Additionally, the “Cancel for Any Reason” option only reimburses up to 75% of the cruise fare.

When comparing the Royal Caribbean Travel Protection Plan to other travel insurance options, it’s essential to read the fine print and compare the benefits and exclusions. Some credit cards, for example, offer primary rental car coverage, eliminating the need for car rental insurance.

Overall, the Royal Caribbean Travel Protection Plan can be a good investment for peace of mind and financial protection. However, it’s crucial to understand the coverage details and compare it to other insurance options to decide whether it’s worth the cost for your needs.

2. RCCL Vacation Protection Plan

Travelling is an exciting experience, but it can also be stressful. Uncertainties in life can disrupt even the most well-planned vacation. Royal Caribbean, one of the most trusted names in the cruise industry, offers its own version of travel insurance- the RCCL Vacation Protection Plan. This plan is designed to give passengers peace of mind and security in case of any unforeseen circumstances during their vacation.

The RCCL Vacation Protection Plan offers different levels of coverage, including trip cancellation/interruption insurance, medical coverage, emergency medical transportation, baggage protection, and travel accident protection. The cost of the plan is based on the total amount of your trip, and the coverage level you choose. The average cost for the plan is around 7% to 10% of the total trip cost. The plan can be purchased up to 30 days before the departure date.

The RCCL Vacation Protection Plan’s primary advantage is its inclusive coverage. The trip cancellation/interruption insurance offers protection in case of emergencies or unforeseen events that can cause trip cancellation or interruption. Medical coverage pays for medical treatment such as hospitalization and doctor visits. The plan also covers emergency medical transportation, providing assistance to travelers who require medical attention while on vacation. The baggage protection covers the loss, theft, and damage of luggage and personal items. Travel accident protection offers coverage for accidental injuries and death.

While the cost of the plan may seem steep, it is a reasonable investment considering the uncertainties that could arise during a vacation. The coverage provided by the RCCL Vacation Protection Plan is specifically designed to protect travelers from unexpected occurrences that can disrupt their trip or cause financial loss. It gives passengers peace of mind to know that they are covered in the event of any emergency. Overall, the RCCL Vacation Protection Plan is worth considering when planning your next cruise vacation.

3. Canceling Royal Caribbean Cruise with Insurance

When it comes to traveling, canceling a trip can be a stressful and expensive situation. That’s why having travel insurance can give peace of mind and financial protection. Royal Caribbean offers a travel protection program for their customers to purchase. This plan can reimburse customers for non-refundable expenses if they have to cancel their trip for a covered reason, such as injury or illness.

The cost of Royal Caribbean’s travel protection plan varies based on the price of the trip and the age of the traveler. It typically ranges from $49 to $149 per person. While this may seem like an added expense, it can save a lot of money if something unexpected comes up. However, it’s important to note that not all reasons for canceling are covered, such as changing your mind about the trip or missing the ship due to your own negligence.

In addition to cancellation coverage, Royal Caribbean’s plan also includes benefits such as emergency medical and dental coverage, baggage protection, trip interruption coverage, and 24/7 emergency assistance. However, it’s important to carefully read the terms and conditions of the plan to understand what is and isn’t covered.

While having travel insurance can provide a safety net, some travelers may wonder if it’s truly worth the cost. It ultimately depends on the individual and their specific circumstances. If you’re booking a costly vacation with non-refundable expenses and have concerns about canceling, then purchasing travel insurance could be a smart investment. On the other hand, if you’re booking a less expensive trip and have flexibility with your travel plans, you may not need to purchase insurance at all.

Overall, Royal Caribbean’s travel protection plan can provide valuable coverage for travelers who are worried about canceling their trip. It’s important to carefully consider the cost and benefits of the plan before making a decision to purchase. Whether or not you choose to purchase travel insurance, it’s always a good idea to have a plan in place for unexpected situations that may arise during your travels.

4. Royal Caribbean Travel Protection Insurance

Royal Caribbean is a popular cruise line that offers travel protection insurance to its customers. The Royal Caribbean Travel Protection Insurance provides coverage for trip cancellation, interruption, delay and baggage loss, among other things. The cost of the insurance varies based on several factors, such as the length of the trip and the number of travelers. The insurance can be purchased online during the booking process or added later by contacting customer service. While the price of the insurance may seem steep, it can provide peace of mind and financial protection in case of unforeseen circumstances.

One of the advantages of the Royal Caribbean Travel Protection Insurance is that it can cover a wide range of scenarios. For instance, if a traveler falls ill and cannot embark on their cruise, the insurance can offer reimbursement for non-refundable trip costs. Additionally, if a traveler has to interrupt their trip due to an emergency or unforeseen circumstance, the insurance can reimburse them for the unused portion of the trip. Importantly, the insurance can also provide medical coverage in case of an accident or illness during the trip. For these reasons, purchasing the Royal Caribbean Travel Protection Insurance can be a smart investment for those who want to travel with peace of mind.

However, it is important to note that the insurance may not cover every situation. For example, if a traveler cancels their trip due to a pre-existing medical condition, the insurance may not offer coverage. Additionally, the insurance may not cover cancellations or interruptions due to natural disasters or political unrest. As such, it is essential to read the policy carefully and understand the limitations of the coverage before purchasing the insurance.

Ultimately, whether or not the Royal Caribbean Travel Protection Insurance is worth the cost depends on the individual traveler’s circumstances and risk tolerance. Travelers who are concerned about unforeseen events or who are planning an expensive trip may find that the insurance provides valuable protection. On the other hand, those who are comfortable taking on more risk and who have flexible travel plans may opt to forego the insurance. In any case, it is important to carefully consider one’s options and make an informed decision when it comes to travel insurance.

5. Royal Caribbean Protection Plan

Royal Caribbean Protection Plan is a travel insurance program offered by the cruise line. The cost of this program varies based on the vacation package selected and the traveler’s age. The program is known for offering several benefits, including trip cancellation, trip interruption, trip delay, emergency medical and dental, emergency medical evacuation and repatriation, and baggage and personal effects coverage. These benefits typically are not covered by most health insurance plans.

However, the decision to purchase the Royal Caribbean Protection Plan may depend on the traveler’s preferences and needs. Some vacation packages may already include certain insurance coverage, which can make buying additional insurance unnecessary. Furthermore, some travelers may have health insurance plans that offer international coverage or the coverage they need for their trip. Overall, the Royal Caribbean Protection Plan can provide peace of mind while traveling, but it is up to the individual to determine whether it is worth the cost.

Another important aspect to consider is the plan’s cancellation policy. The Royal Caribbean Protection Plan typically allows travelers to cancel their trip for any reason, with reimbursement up to 75% of the non-refundable trip cost. However, there may be limitations and exclusions to this coverage. For example, the cancellation must be made before the trip departure date, and some circumstances, such as pre-existing medical conditions, may not be covered.

Travelers who have purchased the Royal Caribbean Protection Plan and need to make a claim can contact the plan’s insurance provider to request assistance. In some cases, the insurance provider may require documentation or proof of loss, such as medical bills or receipts. It is important to note that the Royal Caribbean Protection Plan is not a guarantee of coverage and that the insurance provider makes all final determinations on claims.

In summary, the Royal Caribbean Protection Plan can provide valuable insurance coverage for travelers who want to protect their vacation investment. The plan can help cover expenses related to cancellations, medical emergencies, and other unforeseen circumstances. However, travelers should carefully review the plan details and assess their own needs before making the decision to purchase it. In addition, they should be aware of the plan’s limitations and exclusions to fully understand the extent of their coverage.

6. The Royal Caribbean Travel Protection Program

The Caribbean Travel Protection Program is an insurance product offered to passengers who have booked a cruise with Royal Caribbean. This program provides coverage for trip cancellations, trip interruptions, medical emergencies, baggage loss and delay, and more. Travelers can opt for one of the three plans based on their needs and budget: the basic plan, the essential plan, and the deluxe plan.

The basic plan is the most affordable option and offers limited coverage. It includes trip cancellation and interruption coverage, medical expense coverage, and emergency medical evacuation coverage. However, it does not cover pre-existing medical conditions, trip delays, or baggage loss or damage.

The essential plan is the mid-tier option and provides more comprehensive coverage than the basic plan. Along with trip cancellation and interruption coverage, medical expense coverage, and emergency medical evacuation coverage, it also covers pre-existing medical conditions and trip delays. Additionally, it provides baggage loss or damage coverage and has higher coverage limits compared to the basic plan.

The deluxe plan is the most expensive option and provides the most comprehensive coverage. It includes all the benefits of the essential plan plus accidental death and dismemberment coverage, trip interruption for any reason coverage, and up to $500 in sports equipment rental coverage. It also has the highest limits on coverage and provides a cancel for any reason benefit.

One important thing to note is that the Royal Caribbean Travel Protection Program only offers coverage for certain situations. For example, it does not cover cancellations due to work-related reasons or changes in personal circumstances. It also does not cover losses or damages caused by the passenger’s own negligence or illegal actions.

In terms of pricing, the cost of the Royal Caribbean Travel Protection Program varies based on the plan chosen and the cost of the cruise. Generally, the basic plan costs around 5% of the total trip cost, the essential plan costs around 7-9% of the total trip cost, and the deluxe plan costs around 10% of the total trip cost.

Overall, the Royal Caribbean Travel Protection Program can provide peace of mind for travelers and protect them from unexpected expenses and situations. However, it is important for passengers to carefully review the coverage and limitations of each plan before purchasing to ensure they are getting the best value for the premium paid.

7. RCCL Travel Protection

RC Travel Protection is an optional insurance plan offered by Royal Caribbean for its cruise passengers. The plan covers trip cancellation, trip interruption, and other travel type expenses. The cost of the plan varies depending on the price and duration of the cruise, as well as the age of the travelers. Royal Caribbean’s website provides a chart that lists the exact cost of the plan based on these factors. The plan can be added to the booking at any time but must be purchased before the final payment date.

The plan offers trip cancellation coverage for reasons such as illness, injury, or death of a family member, and weather-related issues. Additionally, it includes trip interruption coverage for reasons such as illness or injury and covers the extra expenses incurred by the traveler due to a trip delay or a missed connection. The plan also includes coverage for medical expenses incurred during the trip, up to a certain limit, and emergency medical transportation. Additionally, the plan offers baggage protection, which covers the cost of lost or stolen baggage and other personal belongings.

While the RCCL Travel Protection plan does provide many benefits for the traveler, it may not be necessary for everyone. Some travelers may already have coverage through their credit card or other insurance policies. Additionally, the cost of the plan can add up, especially for longer and more expensive cruises. However, for travelers who are concerned about potential travel-related mishaps, the peace of mind provided by the plan may be worth the additional expense.

In the event that a traveler needs to cancel their cruise and has purchased the RCCL Travel Protection plan, they can file a claim for reimbursement of any eligible expenses. The claims process can be completed online or over the phone, and the traveler will need to provide documentation to support their claim. The claim will then be reviewed by the insurance company, and a decision will be made regarding reimbursement.

Overall, the RCCL Travel Protection plan can be a valuable option for travelers who want additional coverage and peace of mind during their cruise. While the plan does come at an additional cost, it may be worth it for those who want to protect themselves against potential travel-related issues. However, travelers should carefully consider their individual needs and consult with their insurance provider before purchasing the plan.

8. Royal Caribbean Insurance Coverage

Royal Caribbean Cruise Line offers a Travel Protection Program to its passengers. The program is designed to give travelers peace of mind by providing a range of coverage options. The cost of the program varies depending on the length of the cruise and the type of package selected. For example, a seven-night cruise may cost around $100-$150 per person. However, it is important to note that the program does not cover pre-existing medical conditions or any conditions that occur after the final payment for the trip has been made.

The Royal Caribbean Travel Protection Program includes coverage for trip cancellation and trip interruption. The plan will reimburse passengers for non-refundable prepaid trip costs in case of unforeseen events such as illness, injury, or death of a traveler, or a family member. Coverage is also provided for trip interruption if a traveler needs to return home due to an unexpected event such as illness or injury. The program also covers trip delay, missed connection, and emergency medical and dental expenses.

Passengers who purchase the Royal Caribbean Travel Protection Program have access to a 24-hour emergency hotline for assistance with medical and travel-related issues. Additionally, the program provides coverage for lost, stolen, or damaged baggage, as well as travel accident insurance. However, it is important for travelers to carefully review the policy to understand its limitations and exclusions.

Overall, the Royal Caribbean Travel Protection Program can provide valuable protection for cruise passengers. However, travelers should weigh the cost of the program against their individual needs and risk tolerance. For those who are concerned about unexpected events causing financial loss, the program may be worth the investment. It is also important for travelers to read the fine print and understand what is and is not covered by the policy.

9. Royal Caribbean Travel Protection Price

Royal Caribbean is a well-known cruise line with many loyal customers. However, accidents and unforeseeable circumstances can happen, which is why the cruise line offers the Royal Caribbean Travel Protection Program. This program provides travelers with a sense of security and peace of mind while on vacation.

When it comes to selecting the right travel protection plan, price is often a significant factor. In terms of Royal Caribbean’s Travel Protection Program, the cost varies based on several factors, such as the length of the trip and the total cost of the vacation package. On average, the cost is typically between 7-10% of the total cost of the trip.

Some may question whether or not the cost of the program is worth it. The answer to that question depends on the individual traveler’s needs and preferences. For those who prioritize peace of mind, the cost may be worth it. The Travel Protection Program offers reimbursement for medical expenses, trip cancellations or interruptions, and baggage loss or delay. For those who may face unexpected financial setbacks, this program could potentially save a significant amount of money in the long run.

It’s important to note that the Travel Protection Program does have its limitations and exclusions. It’s essential to review the terms and conditions of the program to understand the exact coverage and limitations. Travelers should also consider any pre-existing medical conditions, as they may not be covered under the program.

Overall, the Royal Caribbean Travel Protection Program is an option for travelers who want additional peace of mind while on vacation. The cost may be a factor for some, but for those who prioritize security and are willing to pay for it, the program may be worth it. It’s important to thoroughly review the terms and conditions of the program to fully understand the coverage and exclusions.

10. Royal Caribbean Cruise Line Insurance

Royal Caribbean Cruise Line Insurance provides coverage for unexpected events that may occur before, during or after a trip. The insurance coverage is offered to protect travelers against trip cancellation or interruption, medical emergencies, lost or delayed baggage, and other potential risks. The insurance plan is offered through Aon Affinity Travel Practice and is available for purchase when booking a cruise. The cost depends on the number of travelers and the length of the trip, but it is generally affordable and can provide peace of mind for travelers.

Travelers who purchase Royal Caribbean Cruise Line Insurance can cancel their trip for covered reasons and receive a full refund of the trip cost. Covered reasons include illness, injury, weather, and other unforeseen events. In addition, if travelers need to interrupt their trip due to a covered reason, such as a family emergency or health issue, they can be reimbursed for the unused portion of their trip. This type of coverage can be especially valuable for travelers who are planning a costly or lengthy cruise.

Another important benefit of Royal Caribbean Cruise Line Insurance is the medical coverage it offers. If a traveler becomes ill or injured during the trip, the insurance can cover medical expenses and emergency medical evacuation. This can be crucial for travelers who are visiting unfamiliar places where healthcare may be expensive or difficult to access. Additionally, the insurance can provide coverage for lost or delayed baggage, travel delays or missed connections, as well as emergency travel assistance services.

Overall, Royal Caribbean Cruise Line Insurance can be a wise investment for travelers who want to protect their trip and ensure a stress-free vacation. While the insurance coverage may not be necessary for every traveler, it can provide valuable benefits for those who want to minimize their financial risk and protect themselves from unexpected events. Travelers should carefully review the terms and conditions of the insurance plan and determine if it is the right choice for their particular situation.

Related Articles

USAA Travel Insurance Deals: Save on Hotels, Flights, and More

September 24, 2023

AMEX American Express Travel Services – Insurance, Lifestyle & More

September 10, 2023

MoneySupermarket Best Travel Insurance As Reccommended in 2023

July 20, 2023

MoneySavingExpert Martin Lewis RecommendsThe Best Travel Insurance for 2023

Are you planning a perfect vacation, but worried about the unexpected expenses you might incur …

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Is Royal Caribbean Travel Protection Worth It?

Doesn’t matter how expensive the Royal Caribbean cruise you booked. The truth is that bad travel experiences can happen to all. And that’s the point where travel insurance can help you.

Spending on Royal Caribbean travel protection is worth it. Their travel insurance plans will help you cover the cost of various foreseen. E.g., trip cancellation, interruption, and emergency evacuation. Further, you can also get medical insurance coverage.

In today’s guide, we will discuss all the necessary facilities in travel insurance so that you can easily decide whether it’s worth spending.

So, without further ado, let’s jump in.

Table of Contents

What is the Travel Protection Program of the Royal Caribbean Cruise?

The travel insurance program of Royal Caribbean has multiple facilities, just like it covers medical issues, evacuation, baggage, and many others to help you get a pleasant, safer journey without any worries.

For example, if you want to cancel your cruise line due to any specific reason, you will be worried about all those expenses you have made.

So, here the travel insurance program helps you out by providing a 100% refund of your amount.

However, this amount could vary depending on the situation, but you will be eligible for the insurance company refund only if your cancelation is due to the specified reason.

Further, it doesn’t matter whether you buy an insurance check from the Royal Caribbean or any other resource. So, it all depends on you because all you need is protection against any foreseen event.

Related Post: Royal Caribbean The Key: Is It Worth It?

What is Included in the Travel Insurance of Royal Caribbean?

To clearly understand whether you should buy the travel insurance program, you must be aware of what is included in it.

So, here are some of the common benefits included in Royal Caribbean travel insurance.

- Cancel for any reason: Suppose you want to cancel your trip for any specified reason in the contract. In that case, the travel insurance company will refund you depending on the circumstances and policy.

- Travel insurance is generally realistic: If you are not complying with the trip cancellation policies mentioned in the contract, you can still receive a portion of your cost as a return. However, it will only be possible if you are eligible for all other requirements.

- Medical condition: Travel medical coverage is also included in the travel insurance. So, if you get sick or get any injury, they will compensate you up to a limit.

- Travel delays: There are always several hours to wait for the cruise. However, if it exceeds the travel insurance will help you to protect the expenses.

- An emergency evacuation can sometimes occur, and you may suffer the necessary transport costs. Meanwhile, if you have travel protection, you won’t have to worry as travel insurance cover your cost to an extent.

- Baggage protection is the most exquisite opportunity. Which is your luggage gets lost, stolen, or damaged due to the specified reason, the cost will be recovered.

All these were some common benefits included in the Royal Caribbean travel protection program. With that, while getting any of the policies, you must read all those policies under which they will provide compensation.

However, we suggest you keep the pricing the same because the lowest price options may not include the needed coverage.

What is Not Included in the Travel Insurance of Royal Caribbean?

Here are some of the most common things that should be included in the travel insurance of Royal Caribbean.

Meanwhile, you might get these basic facilities if you get travel insurance from other sources.

- You will not get compensation for bad weather.

- Royal Caribbean Travel Protection program will not cover the cost if you want to cancel your cruise. However, this is something additional you can get by connecting with your travel agent or simply by calling 1-888-722-2195.

- Further, the reimbursement of expenses is not possible due to invasion and any unwanted act of foreign enemies.

- With that, the policy will not cover the loss due to pre-existing conditions or arising from that condition.

Among all, if you have taken any controlled substance (just like drugs or any other thing that influences the mind), the travel policy wills not reimburse you.

However, if the physician prescribed it, then there might be some chances to compensate for the cost or get a refund up to an extent.

Above are some of the most common losses not included in the Royal Caribbean travel protection program.

That’s why we highly suggest you read the fine print to clearly understand what’s included in the travel insurance policy and what’s not.

How Much is the Cost of Travel Insurance on Royal Caribbean?

The ultimate cost of travel insurance in the Royal Caribbean depends on multiple factors.

For example, the cost varies depending on how long the trip will be, who is being covered, activities you had planned, trip cost, and the destination.

However, as an estimation, it can cost you up to 10% of your total cruise cost.

Before making any decision, read the policy carefully to clearly understand which areas it will cover and whether it will justify the price.

Should you Buy Royal Caribbean Travel Protection?

Now you know what is and is not included in the policy.

So, we are confident you have decided whether to buy travel insurance.

However, here are certain pros and cons to help you get a clear and wider understanding.

So, let’s jump in.

- Any trip cancellation before the departure will be covered.

- Laid off or being fired.

- Loss in losing or damaging your luggage will help you cover the cost.

- Any emergency medical coverage or dental coverage.

- Coverage in the damage of rental car even if it gets theft.

- Compensation for travel accidents.

- Loss due to any epidemic or pandemic.

- Coverage for any interruption or delay in the trip.

- Pregnancy or birth of a child.

- Additional cost for trip cancelation due to any reason.

- No compensation for bad weather.

- Needs critical thinking to understand the policy requirements clearly.

- Zero protection against anything bad happening due to existing conditions.

So, is it worth spending – what Do We Suggest?

To wrap up today’s discussion – we must say it’s never a good idea to cruise without travel insurance.

Nobody wants a bad experience, but it is also a part of it. That’s why you must prepare yourself by getting a travel insurance policy.

With that, the long list of ultimate advantages of Royal Caribbean cruise insurance will help you stay more protected against anything happening.

I am Zoe Grace, a passionate enthusiast of cruise ships. With a decade of firsthand experience in the cruising industry, I have developed a deep understanding of the intricacies and wonders that these majestic vessels hold.

Now, I am excited to embark on a new journey as an author, sharing my knowledge and insights with readers who share my fascination for the world of cruising.

Join me as we explore the captivating world of cruise ships together.

Similar Posts

Royal Caribbean The Key: Is It Worth It?

![cost of royal caribbean travel insurance Royal Caribbean Refreshment Package – [Ultimate Drink Cost]](https://cruiseshipmania.com/wp-content/uploads/2023/07/Health-1200-×-628px-5-768x402.jpg)

Royal Caribbean Refreshment Package – [Ultimate Drink Cost]

Everything You Need to Know About Royal Caribbean Junior Suites & Its Perks!

How To Make Dining Reservations on Royal Caribbean?

Royal Caribbean Gratuity: How To Pay?

How Long Does it Take to Disembark Royal Caribbean?

Leave a reply cancel reply.

You must be logged in to post a comment.

Royal Caribbean Travel Insurance – Every Information About Royal Cruise

In today’s world, traveling has become more accessible due to more frequent flights, new routes, and transportation improvements. However, there are still many people who chose not to add travel insurance on their tickets due to the uncertainty of its real benefits.

This is why, in this article, we are going to talk about Royal Caribbean travel insurance and everything that you need to know about it.

About Royal Caribbean Cruise Line

Royal Caribbean is a luxury cruise company. They are famous for their grand ships that are equipped with all the facilities that hotels on land have.

Aside from that, they transport people from one beautiful port to another. The guest then has the opportunity to go off the ship and explore the cities and towns where they are docked.

The RCCL has departures from Orlando, For Lauderdale, Miami, and North America ports such as Cape Town, Seattle, Vancouver, Anchorage, and Galveston. Aside from that, they operate in over 250 ports around the world. This includes Asia, Australia, and the Middle East as well. They also now operate around China.

Availing a Royal Caribbean Cruise can be quickly done online. They have several packages with different destination and duration. Moreover, the cost can be paid full or through a down payment. In terms of facilities, their ships have several onboard restaurants.

These restaurants have a variety of themes. Indoor activities, such as mini-golf and wall climbing, are also offered. They also offer amenities such as pools, spas, and fitness centers are also provided.

They have been one of the number one choices when it comes to European cruise gaining a lot of positive reviews from guests. Due to the nature of their services, they also offer their guest travel protection. This can be availed upon checkout of their tickets during books.

The Coverage of Royal Caribbean Travel Insurance

Everybody is aware that we do not know what the future holds, which is why it is essential to buy protection against unfortunate events.

With Royal Caribbean travel insurance, you are protected not only during your trip but also after the moment that you made your booking. What does that mean? Well, check out the coverage you can get before departure when you avail of this insurance:

Trip Cancellation Benefit

Cruise vacation packages can be costly. In an event where there is a cancellation due to weather conditions, natural calamities, or anything that threatens the security of guests and staff, the trip can be canceled.

As a result, some tickets can be forfeited and left unrefunded. However, with Royal Caribbean travel insurance, you are confident that you will not be throwing money as it will be refunded 100% back to you.

Trip Cancellation For Any Reason Benefit.

This benefit allows you to be refunded 75% in an event where you decide to cancel your trip due to personal reasons. The 75% refund will come in the form of credit, which you can use in your future bookings for another date.

However, take note that this credit must be used within a year. It is also non-transferable. This means that if you do not use it, it will be equivalent to being gone.

The most important feature of travel insurance is the protection that you can avail of during the actual trip. This is essential and convenient, especially when you are traveling from one country to another. Here are the protections you can avail in the duration of your trip:

Trip Interruption

If you cannot finish the duration of your trip due to valid reason such as illness, injury, or someone died in your family, then you will have the same coverage as the trip cancellation.

In an event where your air transfer is delayed due to reason you cannot control, you will be provided with up $500 to catch up with the cruise.

Sickness and Accident Benefit

If you encounter sickness or injuries during the cruise trip, you can have up to $10,000 of coverage.

Emergency Medical Evacuation

In severe cases where you need to evacuate from the cruise due to medical conditions immediately, you can have up to $25,000 of coverage for emergency transport.

Baggage protection

Many travelers have encountered issues when it comes to their baggage. In more severe cases, they can be lost or damaged. Royal Caribbean Travel insurance offers up to $1,500 coverage against this.

Another nightmare when it comes to baggage is delayed. If this happens to you, the insurance covers up to $500 so that you can purchase personal items while waiting for your bags.

The Benefits of Royal Caribbean Travel Insurance

Now that we have discussed the coverage included in the Royal Caribbean travel insurance let us take a closer look at the benefits that you can get from it.

Easy Reservation

Many people do not like the idea of going to physical offices to get insured. With this insurance, there is no need to do that.

In order for you to avail, all you have to do is fill up a few forms and click several buttons. Your insurance certificate will then be emailed to you.

24/7 Support

This insurance program offers 24/7 support. This means no matter where you are or what time it is; you can immediately contact somebody for assistance. This can help you feel at ease during your vacations.

Luggage Protection

As mention above, this insurance offers luggage protection for lost, damaged, and delayed bags.

Medical Protection

This is one of the biggest reasons why a guest should avail of travel insurance. The specifics of the coverage are already mentioned above.

Customers Reviews of Royal Caribbean Travel Insurance

Notably, several customers have positive things to say about this insurance. However, there are some criticisms, as well. Let us first look at the negative things that clients have to say about it:

Medical benefits are too small

Some customers noted that coverage for medical benefits is too small, mainly because these cruises are done internationally.

Quite expensive

Some also noted that this travel insurance is a bit expensive. However, you have to understand that travel insurance is often costly, especially when it involves international travel.

Moreover, the cost of your travel insurance varies depending on the duration of your trip and its locations.

With that said, here are the commendable things about this insurance:

Cancellation Benefit

According to statistics , this is the second main reason why travelers avail of insurance. Many customers appreciate the cancellation benefits under the circumstances of weather, medical condition, etc. They like the fact that they will refund in cash instead of credit.

Cancellation for no Reason

This is one of the reasons why many customers opt for this insurance.

Convenience

Many customers also appreciate the comfort of this travel insurance program, mainly because they only have to click a few buttons to avail it. They like how it is easy to avail.

Many also commend the 24/7 support, which answers inquiries and guide you through the steps of filing a claim.

Frequently Asked Question about Royal Caribbean travel insurance

Q: how much does the royal caribbean travel insurance cost.

A: The cost of this travel insurance program differs from the port of origin and the destinations that you choose.

The benefits, coverage, and length of the trip will also be a factor in its overall cost. However, its general estimate of it can be around $150- $300.

Q: Where to avail of this royal Caribbean travel insurance program?

A: You can avail of this insurance program upon check out of your cruise ticket. There you can check the option for the travel insurance program. The cost will then be added to your total bill.

Another way to avail of it is to purchase it directly with Aon Affinity. They are the ones who administer those insurance benefits.

Q: Does the cancelation benefit still apply for non-refundable tickets?

A: Yes, if you have travel insurance, that benefit still applies, given that it falls under the specified reason in your policies. For example, canceling your vacation due to emergency surgery or being in an accident. However, the amount refunded will depend on the specifics included in your coverage.

Final Thoughts

Overall, availing Royal Caribbean travel insurance can be considered worth it. It has all the essential benefits that you will need. At the same time, you also have the option to purchase add-ons for other things.

However, you have to take note that travel insurance programs can be a little complicated. Some benefits may not apply to several destinations. There are also necessary conditions to be met in order to file for a claim.

This is why in getting travel insurance, it pays to read the fine prints of the policies. Doing this will give you a general idea of what benefits applies to you and your trip.

Royal Caribbean says that vacation should be for peace of mind, and one obvious way of doing that is to get travel insurance. Hopefully, the benefits mentioned above have encouraged travelers to avail of travel insurance.

Related Articles

Read Travel Insurance for Parents here

Easy Trip Guides

Recent Posts

Solar Power Calculator (100% free)

Solar Power Calculator Overview Solar Power Calculator Solar Power Calculator Adjustable Variables Solar Panel Wattage Average Daily Sunlight...

Weight Conversion Calculator (100% free)

Weight Conversion Calculator Overview Weight Converter Kilograms Pounds Ounces Grams Kilograms Pounds Ounces Grams Convert Use a...

Royal Caribbean vs. Carnival: Quick Comparison Chart

T rying to choose between Royal Caribbean and Carnival for your next cruise? Check out the comparison chart below, then read on for more details.

Winner: Royal Caribbean

When it comes to fleet size as well as the features available on cruise ships, Royal Caribbean has an edge over Carnival Cruise Line. That's because Royal Caribbean already has 28 ships in operation, including its incredible Oasis Class, Quantum Class and Quantum Ultra Class ships. Oasis Class vessels like Allure of the Seas , Symphony of the Seas , Wonder of the Seas and Utopia of the Seas are some of the largest in the world – and Royal Caribbean Group is constantly rolling out new, even bigger cruise ships with better amenities and new features. For example, the new Icon of the Seas (scheduled to debut in 2024) plans to have the largest water park at sea, the largest swimming pool at sea, and a range of over-the-top cabins and suites for families of all sizes.

Meanwhile, Carnival currently operates 25 different vessels with a few more on the way. Newer ships like Carnival Celebration and Carnival Venezia aren't as large and grand as Royal Caribbean ships, nor are the brand-new vessels the company is planning for late 2023 and 2024. For example, the new Carnival Jubilee that is set to begin sailing later in 2023 will have 15 passenger decks and capacity for up to 6,631 guests, compared to 18 guest decks and 7,600 passengers on Icon of the Seas.

Read: The Largest Cruise Ships in the World

Comparing cabins across cruise lines as a whole isn't an easy feat, mostly because companies tend to offer larger suites and cabins with a better layout on their newer ships . You'll therefore likely have a nicer cabin on one of Carnival's newest vessels compared to an older ship from Royal Caribbean, and of course the opposite is also true. Cabin sizes and layouts also vary widely across the vessels of both brands, and that's true even for basic interior, ocean view and balcony cabins.

That said, Royal Caribbean still comes out ahead in this category, since the line boasts more square footage in some of the most basic cabins as well as more over-the-top luxury accommodations, especially for families.

As an example, most inside cabins on Allure of the Seas feature 172 square feet of space, whereas Carnival Celebration's inside cabins are slightly smaller at 158 square feet. Meanwhile, the largest suites on Celebration are the Carnival Excel Presidential Suite, with 1,120 square feet of space including the balcony, and the Carnival Excel Aft Suite, which has 861 square feet of interior and balcony space. Compare those options to the Sky Loft Suites on Allure of the Seas, which feature 1,132 square feet across the room and balcony, and the spacious two-bedroom AquaTheater Suites with 1,595 square feet including the balcony.

Book a cruise on GoToSea , a service of U.S. News.

Winner: Tie

Food options vary widely across vessels within any cruise brand, and this is especially true with Royal Caribbean and Carnival. For example, older ships from both cruise lines offer fewer specialty dining options overall along with the main dining rooms and buffet options cruisers come to expect, whereas newer ships from both lines feature a lot more unique and innovative options.

When you view the cruise dining options from both lines, you'll quickly find that both Carnival and Royal Caribbean pull out all the stops when it comes to food. For example, Carnival ships include a range of eateries from large and expansive buffets to main dining rooms to unique offerings like Big Chicken, Guy's Burger Joint and BlueIguana Cantina. Meanwhile, specialty dining on Carnival vessels features options like teppanyaki, Emeril's Bistros at Sea and Guy's Pig & Anchor Smokehouse.

Royal Caribbean ships feature convenient buffets and main dining room experiences, as well as included options like pizza kitchens, noodle bars and casual fast food. Specialty dining on Royal Caribbean ranges from the brand's Chef's Table experience to Johnny Rockets' burgers and shakes to innovative fine dining at Wonderland.

Drink packages

Both Carnival and Royal Caribbean offer drink packages that cruisers can purchase as part of their vacation to get a more all-inclusive feel . Then again, the value of these packages depends on how much you drink over the course of your trip. Also note that the cost of drink packages across all cruise lines can vary depending on the ship, itinerary, travel dates, length of trip and more.

Royal Caribbean comes out slightly ahead in this category because the line offers three tiers of drink packages for guests with different needs. Choose from the Classic Soda Package; the Refreshment Package, which includes soda along with coffees, juices and even milkshakes at Johnny Rockets; and the Deluxe Beverage Package, which adds in beer, cocktails and wine by the glass. Meanwhile, Carnival offers just two different drink packages: the Bottomless Bubbles package, which covers soft drinks and juice, and the Cheers! drink package, which adds in spirits and cocktails, beer, wine by the glass, specialty coffee, energy drinks and more.

Read: Cruise Drink Packages: Your Options by Cruise Line

Onboard activities

Analyzing onboard activities across cruise lines isn't always easy – you really have to break down this category by ship for a true comparison. When you do that with Carnival and Royal Caribbean, you'll find that both lines offer fun activities for all ages, from onboard water parks to hosted games, casinos and more.

That said, Royal Caribbean does take things up a notch in this category, especially on the line's newer ships. Some Royal Caribbean vessels offer escape rooms, surf simulators, zip lines, game shows and over-the-top water parks with incredible slides for thrill-seekers. For example, Freedom of the Seas boasts huge onboard waterslides, glow-in-the-dark laser tag, mini-golf and more. Don't forget about Icon of the Seas with its massive water park and pool offerings in the works. Meanwhile, standout activities on Carnival ships include Family Feud Live, onboard water parks and the thrilling SkyRide.

Compare Royal Caribbean cruises on GoToSea .

Live entertainment

The quality of cruise ship entertainment varies widely based on the quality of the talent booked for individual ships. Both Carnival and Royal Caribbean offer their share of live music and entertainment, including performances by bands and singers, karaoke, and piano bars. Meanwhile, both lines also boast their own theaters on every vessel, which often feature Broadway-style shows, singing and dancing, comedy acts, and more.

Royal Caribbean comes out ahead in this category since its vessels feature award-winning musicals like "Hairspray," "Mamma Mia!" and "Cats." The open-air AquaTheater on Oasis Class ships also wows guests with incredible diving feats, stunts and aerial acrobatics. Some Royal Caribbean ships even have onboard ice skating performances and ice games.

Explore cruise deals on GoToSea .

Raw HTML : Tips on Trips and Expert Picks

Kids programming

Winner: Carnival

Both cruise lines have kids clubs that cater to younger guests of all ages, with each one offering supervised care so parents can drop the kids off for some alone time or a quiet dinner on the ship. However, Carnival stands out slightly in this category due to the six different clubs offered across the fleet for children and teens between 6 months and 17 years old. Carnival also offers supervised Night Owls services for kids 11 and younger, which lets parents get out and have some late-night fun for an extra charge.

Royal Caribbean offers four kids clubs for children ages six months to 12, along with a separate club for tweens and teens . Supervised child care is available for free during the day, and you can opt for paid care after hours as well.

Read: The Top Cruises for Babies and Toddlers

Adults-only offerings

Both cruise lines offer their share of adults-only spaces and things to do, from onboard casinos to luxurious spas to bars that offer cocktails and live entertainment at all hours of the day and night. Carnival and Royal Caribbean also offer adults-only areas on some of their ships.

On Carnival, for example, cruisers will find the Serenity Adults-Only Retreat for sailors 21 and older with extra space and comfortable chairs for relaxation, along with its own bar nearby. On many Royal Caribbean vessels, on the other hand, the onboard Solarium for ages 16-plus has its own pool and extra space to find peace and quiet.

Carnival's Serenity relaxation area is included for guests. While Royal Caribbean's Solarium is typically also included, on certain sailings there is restricted access by fare class.

Read: The Top Adults-Only Cruises

Shore excursions

Shore excursions offered by cruise lines are largely operated by third-party companies and are often the same across brands. Both Carnival and Royal Caribbean boast a broad selection of excursions in destinations around the world, from snorkeling and scuba tours in the Caribbean to city tours, horseback riding, cooking classes and more.

Both cruise lines offer private and custom tours you can book through your ship as well.

Compare cruises on GoToSea .

Private island experiences

Royal Caribbean and Carnival each have their own private island in the Bahamas , which is included in most itineraries to this part of the world. These private islands provide a fun beach escape for families to enjoy, whether you want to relax in the sun or take part in some of the available activities.

Royal Caribbean's private island, called Perfect Day at CocoCay, is the more impressive option due to everything it includes: a heart-thumping water park, its own wave pool, a zip line, a hot air balloon experience and overwater bungalows you can book for the day, among other offerings. Meanwhile, Carnival's Half Moon Cay has a unique beached pirate ship to explore – but fewer amenities overall.

Note that both private islands have plenty of beach space for guests to spread out and relax, as well as restaurants and bars. You can also book excursions on both private islands, which include activities like snorkeling and water sports.

Read: The Top Cruise Line Private Islands

Comparing costs across cruise lines can be tricky since fares and available sales vary throughout the year, as well as based on the vessel booked, the cruise itinerary, the number and age of travelers, and more. To get an idea of who wins on price, we looked for two similar cruises on comparable ships from Carnival and Royal Caribbean, then priced out an option for a family of four with two children ages 8 and 10. For the purpose of this comparison, we used seven-night eastern Caribbean cruises on Carnival Celebration and Royal Caribbean's Wonder of the Seas, both of which began sailing in 2022.

The Carnival Celebration itinerary from Miami stops in Amber Cove, Dominican Republic; San Juan, Puerto Rico ; and St. Thomas, U.S. Virgin Islands . By comparison, the Wonder of the Seas sailing leaves from Port Canaveral, Florida, with stops in Philipsburg, St. Maarten ; San Juan; and Perfect Day at CocoCay in the Bahamas.

The chart below shows the total cost (including taxes and fees) for a family of four in January 2024 in both an ocean view and a typical balcony cabin across both cruise lines. Note that, for the purpose of this comparison, we selected the least expensive room option in each category.

Read: How Much Does a Cruise Cost?

Why Trust U.S. News Travel

Holly Johnson is a professional travel writer who has covered cruises and other family travel for more than a decade. She has cruised more than 30 times across most of the major cruise lines and has ventured on itineraries around the world. Johnson used her personal experience and research expertise to curate this cruise line comparison.

You might also be interested in:

- Cruise Packing List: Essentials for Your Cruise

- The Best Cruise Insurance Plans

- The Top Cruise Lines for Solo Travelers

- How to Find Last-Minute Cruise Deals

- The Top Kids Sail Free Cruises

Copyright 2023 U.S. News & World Report

- Favorites & Watchlist Find a Cruise Cruise Deals Cruise Ships Destinations Manage My Cruise FAQ Perfect Day at CocoCay Weekend Cruises Crown & Anchor Society Cruising Guides Gift Cards Contact Us Royal Caribbean Group

- Back to Main Menu

- Search Cruises " id="rciHeaderSideNavSubmenu-2-1" class="headerSidenav__link" href="/cruises" target="_self"> Search Cruises

- Cruise Deals

- Weekend Cruises

- Last Minute Cruises

- Family Cruises

- 2024-2025 Cruises

- All Cruise Ships " id="rciHeaderSideNavSubmenu-4-1" class="headerSidenav__link" href="/cruise-ships" target="_self"> All Cruise Ships

- Cruise Dining

- Onboard Activities

- Cruise Rooms

- The Cruise Experience

- All Cruise Destinations " id="rciHeaderSideNavSubmenu-5-1" class="headerSidenav__link" href="/cruise-destinations" target="_self"> All Cruise Destinations

- Cruise Ports

- Shore Excursions

- Perfect Day at CocoCay

- Caribbean Cruises

- Bahamas Cruises

- Alaska Cruises

- European Cruises

- Mediterranean Cruises

- Cruise Planner

- Book a Flight

- Book a Hotel

- Check-In for My Cruise

- Required Travel Documents

- Make a Payment

- Redeem Cruise Credit

- Update Guest Information

- Beverage Packages

- Dining Packages

- Shore Excursions

- Transportation

- Royal Gifts

- All FAQs " id="rciHeaderSideNavSubmenu-7-1" class="headerSidenav__link" href="/faq" target="_self"> All FAQs

- Boarding Requirements

- Future Cruise Credit

- Travel Documents

- Check-in & Boarding Pass

- Transportation

- Perfect Day at CocoCay

- Post-Cruise Inquiries

- Royal Caribbean

- Celebrity Cruises

Will I require travel insurance for my cruise departing from Australia?

For all sailings departing from Australia

We strongly recommend that all guests have travel insurance and international guests travelling from overseas ensure their travel insurance policy includes cover for COVID-19 related costs and medical care . Ongoing costs for medical treatment post disembarkation remains the responsibility of the guest.

Still need help? Contact Us

Get support by phone or email.

Email Your Questions

Locate a Travel Agent

Previewing: Promo Dashboard Campaigns

My Personas

Code: ∅.

- LIVE DISCOURSE

- BLOG / OPINION

- SUBMIT PRESS RELEASE

- Advertisement

- Knowledge Partnership

- Media Partnership

Importance of Travel Insurance: Royal Sundaram

Heres help decoding this crucial decision.common coverage types - trip cancellationinterruption reimbursement if events derail travel plans.- emergency medical covers overseas hospitalization and treatment.- travel delay compensates for costs from delayed journeys.- baggage protection guards belongings against damage, theft, or temporary loss.- travel assistance support navigating troubles abroad.- emergency evacuation transport to advanced healthcare facilities.- accidental deathdismemberment financial protection for families in tragedy.adventure activities daring travelers must ensure activities like scuba diving or bungee jumping are covered, often by purchasing add-ons.pre-existing conditions some providers limit or deny coverage for pre-existing illnesses..

Chennai, Tamil Nadu, India – Business Wire India Travel opens up new horizons, but unexpected events can ruin even the best trips. That's where travel insurance comes in - it's an essential ally that protects you financially and guides you to safety when things go wrong. This guide explains the must-knows about travel insurance for those seeking protection for their adventures.

The Benefits of Travel Insurance Insurance shields travelers from costly incidents beyond their control. Why spend extra money on it? For travelers venturing abroad, international travel insurance is a small price for financial security and peace of mind.

An Umbrella in Difficult Situations In unfamiliar places, small problems can become big issues. With proper coverage, you can weather storms like flight delays, medical emergencies, or lost luggage. Comprehensive plans cover emergency hospital bills or last-minute accommodation costs.

A Helping Hand When You Need It Top providers offer travel assistance services - a lifeline for stranded travelers overseas. They coordinate medical care, help with passport issues, or arrange emergency travel home, turning potential disasters into mere inconveniences.

Tailored Protection for Your Needs Different travelers have different needs. Some want adventure, while others prefer relaxation. Whether solo backpacking or a family ski trip, there's niche protection for every travel style. Evaluate your risks and customize coverage - your passport to fully enjoy each culture and adventure.

Understanding Policy Details Choosing adequate protection amidst the fine print can be confusing. Here's help decoding this crucial decision.

Common Coverage Types: - Trip Cancellation/Interruption: Reimbursement if events derail travel plans.

- Emergency Medical: Covers overseas hospitalization and treatment.

- Travel Delay: Compensates for costs from delayed journeys.

- Baggage Protection: Guards belongings against damage, theft, or temporary loss.

- Travel Assistance: Support navigating troubles abroad.

- Emergency Evacuation: Transport to advanced healthcare facilities.

- Accidental Death/Dismemberment: Financial protection for families in tragedy.

Adventure Activities Daring travelers must ensure activities like scuba diving or bungee jumping are covered, often by purchasing add-ons.

Pre-Existing Conditions Some providers limit or deny coverage for pre-existing illnesses. Scrutinize this aspect when choosing a plan if you have health conditions.

Real-World Reviews See verified customer reviews to understand how responsive the provider is in real situations.

Choosing the Right Policy The cheapest insurance offers little to no value if it doesn't match your trip requirement. Stay focused on key details to find a tailored match.

Match Coverage to Trip Costs Don't over- or under-insure. Set coverage limits based on total vacation expenses.

Consider Medical Needs Exotic destinations may require more medical coverage, especially for extended treatments.

Weigh Cancellation Coverage Consider cancellation reimbursements against overall trip costs when deciding coverage.

Why Royal Sundaram For tailored policies for Indian travelers, Royal Sundaram stands out. With coverage spanning overseas medical, assistance services, and even home burglary insurance, they accompany globetrotters to 150 countries worldwide.

Their expertise crafts nuanced products like single trip & multi trip, overseas student or senior citizen policies. With a stellar claim settlement record, Royal Sundaram translates to travel insurance worthy of even the most adventurous spirit.

So let your global adventures begin. With financial risks secured and dedicated helpers abroad, jet setters can chase their dreams unfettered - the world is their oyster. Travel insurance done right is the ultimate passport to a safe trip.

(This story has not been edited by Devdiscourse staff and is auto-generated from a syndicated feed.)

- READ MORE ON:

- Medical Needs Exotic

- Royal Sundaram

- Accidental Death/Dismemberment: Financial

- Match Coverage

- The Benefits of Travel Insurance Insurance

- Real-World Reviews See

- A Helping Hand

Reuters Health News Summary

Soccer-The week in Asian football

Pakistan President, PM wish people on Holi

US STOCKS-Futures slip at start of holiday-shortened week